Attached files

| file | filename |

|---|---|

| 8-K - DYNEGY INC 8-K 10-19-2010 - DYNEGY HOLDINGS, LLC | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - DYNEGY HOLDINGS, LLC | ex99_1.htm |

Exhibit 99.2

Setting the Record Straight:

The Truth About Asset Sales, Dividends and Debt Facilities

The Truth About Asset Sales, Dividends and Debt Facilities

Investor Presentation

October 2010

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward looking statements.”

Discussion of risks and uncertainties that could cause actual results to differ materially from current projections, forecasts, estimates and expectations of Dynegy Inc. (“Dynegy”) is contained in

Dynegy’s filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference to, and incorporates herein by reference, the section entitled “Risk Factors” in

its most recent Form 10-K and subsequent reports on Form 10-Q, and the section entitled “Cautionary Statement Regarding Forward-Looking Statements” in its most recent definitive proxy

statement filed with the SEC on October 4, 2010. In addition to the risks and uncertainties set forth in Dynegy’s SEC filings, the forward-looking statements described in this presentation

could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through Dynegy’s 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions

relating to liquidity, available borrowing capacity and capital resources generally; (iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy

of emission credits, and the impact of ongoing proceedings and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water

intake structures, coal combustion byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricing and generation volumes; (v)

anticipated liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial market

conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and costs associated with coal,

fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity and regional supply and demand characteristics of

the wholesale power generation market, including the potential for a market recovery over the longer term; (viii) the effectiveness of Dynegy’s strategies to capture opportunities presented

by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs and assumptions about weather and general economic conditions; (x) beliefs regarding the

U.S. economy, its trajectory and its impacts, as well as Dynegy’s stock price; (xi) projected operating or financial results, including anticipated cash flows from operations, revenues and

profitability; (xii) beliefs and expectations regarding the Plum Point Project; (xiii) expectations regarding Dynegy’s revolver capacity, credit facility compliance, collateral demands, capital

expenditures, interest expense and other payments; (xiv) Dynegy’s focus on safety and its ability to efficiently operate its assets so as to maximize its revenue generating opportunities and

operating margins; (xv) beliefs about the outcome of legal, regulatory, administrative and legislative matters; (xvi) expectations and estimates regarding capital and maintenance

expenditures, including the Midwest Consent Decree and its associated costs; and (xvii) uncertainties associated with the proposed transaction between Dynegy and an affiliate of Blackstone

(the “Merger”), including uncertainties relating to the anticipated timing of filings and approvals relating to the Merger and the sale by an affiliate of Blackstone of certain assets to NRG

Energy, Inc. (the “NRG Sale”), the outcome of legal proceedings that have been or may be instituted against Dynegy and/or others relating to the merger agreement and/or the NRG Sale, the

expected timing of completion of the Merger, the satisfaction of the conditions to the consummation of the Merger with an affiliate of Blackstone and the NRG Sale and the ability to

complete the Merger. Any or all of Dynegy’s forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks,

uncertainties and other factors, many of which are beyond Dynegy’s control.

Dynegy’s filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference to, and incorporates herein by reference, the section entitled “Risk Factors” in

its most recent Form 10-K and subsequent reports on Form 10-Q, and the section entitled “Cautionary Statement Regarding Forward-Looking Statements” in its most recent definitive proxy

statement filed with the SEC on October 4, 2010. In addition to the risks and uncertainties set forth in Dynegy’s SEC filings, the forward-looking statements described in this presentation

could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through Dynegy’s 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions

relating to liquidity, available borrowing capacity and capital resources generally; (iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy

of emission credits, and the impact of ongoing proceedings and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water

intake structures, coal combustion byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricing and generation volumes; (v)

anticipated liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial market

conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and costs associated with coal,

fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity and regional supply and demand characteristics of

the wholesale power generation market, including the potential for a market recovery over the longer term; (viii) the effectiveness of Dynegy’s strategies to capture opportunities presented

by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs and assumptions about weather and general economic conditions; (x) beliefs regarding the

U.S. economy, its trajectory and its impacts, as well as Dynegy’s stock price; (xi) projected operating or financial results, including anticipated cash flows from operations, revenues and

profitability; (xii) beliefs and expectations regarding the Plum Point Project; (xiii) expectations regarding Dynegy’s revolver capacity, credit facility compliance, collateral demands, capital

expenditures, interest expense and other payments; (xiv) Dynegy’s focus on safety and its ability to efficiently operate its assets so as to maximize its revenue generating opportunities and

operating margins; (xv) beliefs about the outcome of legal, regulatory, administrative and legislative matters; (xvi) expectations and estimates regarding capital and maintenance

expenditures, including the Midwest Consent Decree and its associated costs; and (xvii) uncertainties associated with the proposed transaction between Dynegy and an affiliate of Blackstone

(the “Merger”), including uncertainties relating to the anticipated timing of filings and approvals relating to the Merger and the sale by an affiliate of Blackstone of certain assets to NRG

Energy, Inc. (the “NRG Sale”), the outcome of legal proceedings that have been or may be instituted against Dynegy and/or others relating to the merger agreement and/or the NRG Sale, the

expected timing of completion of the Merger, the satisfaction of the conditions to the consummation of the Merger with an affiliate of Blackstone and the NRG Sale and the ability to

complete the Merger. Any or all of Dynegy’s forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks,

uncertainties and other factors, many of which are beyond Dynegy’s control.

Non-GAAP Financial Measures: This presentation contains non-GAAP financial measures including EBITDA, Adjusted EBITDA, EBITDAR, Adjusted EBITDAR and Adjusted Debt. Reconciliations of

these measures to the most directly comparable GAAP measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the

definitions of such non-GAAP financial measures are included herein.

these measures to the most directly comparable GAAP measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the

definitions of such non-GAAP financial measures are included herein.

WHERE YOU CAN FIND MORE INFORMATION

In connection with the Merger, Dynegy filed a definitive proxy statement with the SEC on October 4, 2010 and commenced mailing the definitive proxy statement and form of proxy to the

stockholders of Dynegy. BEFORE MAKING ANY VOTING DECISION, DYNEGY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS

ENTIRETY BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Dynegy’s stockholders are able to obtain, without charge, a copy of the definitive proxy

statement and other relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. Dynegy’s stockholders are also able to obtain, without charge, a copy of the

definitive proxy statement and other relevant documents by directing a request by mail or telephone to Dynegy Inc., Attn: Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston,

Texas 77002, telephone: (713) 507-6400, or from the Dynegy’s website, http://www.dynegy.com.

stockholders of Dynegy. BEFORE MAKING ANY VOTING DECISION, DYNEGY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS

ENTIRETY BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Dynegy’s stockholders are able to obtain, without charge, a copy of the definitive proxy

statement and other relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. Dynegy’s stockholders are also able to obtain, without charge, a copy of the

definitive proxy statement and other relevant documents by directing a request by mail or telephone to Dynegy Inc., Attn: Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston,

Texas 77002, telephone: (713) 507-6400, or from the Dynegy’s website, http://www.dynegy.com.

PARTICIPANTS IN THE SOLICITATION

Dynegy and its directors and officers may be deemed to be participants in the solicitation of proxies from Dynegy’s stockholders with respect to the Merger. Information about Dynegy’s directors

and executive officers and their ownership of Dynegy’s common stock is set forth in the proxy statement for Dynegy’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on

April 2, 2010. Stockholders may obtain additional information regarding the interests of Dynegy and its directors and executive officers in the Merger, which may be different than those of

Dynegy’s stockholders generally, by reading the definitive proxy statement and other relevant documents regarding the Merger.

and executive officers and their ownership of Dynegy’s common stock is set forth in the proxy statement for Dynegy’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on

April 2, 2010. Stockholders may obtain additional information regarding the interests of Dynegy and its directors and executive officers in the Merger, which may be different than those of

Dynegy’s stockholders generally, by reading the definitive proxy statement and other relevant documents regarding the Merger.

Forward-Looking Statements/Additional Information/

Participants in Solicitation

Participants in Solicitation

2

• Under no scenario as a public company would Dynegy’s Board be able to issue a dividend to

stockholders

stockholders

– No meaningful dividend would be permitted by Dynegy’s credit agreement

– Dividends would not be prudent given Dynegy’s current projected sources and uses of cash

– Dividends would not be permitted as a public company under Delaware law given Dynegy’s current financial forecasts(1)

• Dynegy’s Board considered several strategic alternatives, including various asset sale packages,

and determined not to pursue them

and determined not to pursue them

– Significant asset sales are not permitted by Dynegy’s credit agreement and would result in a loss of Dynegy’s existing

$1.9 billion credit facility

$1.9 billion credit facility

– Asset sales would exacerbate already significant negative cash flow forecasts and increase debt to EBITDA ratio

• Sell-side analyst reports reflect a deep understanding of Dynegy’s financial condition and the

power generation industry and their analyses appear to support the Board’s conclusion that

the Blackstone transaction is the best alternative for Dynegy’s stockholders

power generation industry and their analyses appear to support the Board’s conclusion that

the Blackstone transaction is the best alternative for Dynegy’s stockholders

– Significant risk associated with a stand-alone strategy

– Goldman, Sachs & Co. and Greenhill & Co., LLC each provided fairness opinions(2)

– “Go-shop” process validated Blackstone’s $4.50 per share offer - no other offer was received

The Blackstone Transaction is the Best

Alternative for Dynegy’s Stockholders

Alternative for Dynegy’s Stockholders

3

Dynegy’s Board believes the Blackstone offer provides certainty and fair value

Unrealistic and unsubstantiated market speculation will significantly harm stockholder

value if the Blackstone transaction is not completed

value if the Blackstone transaction is not completed

(1) Based on Dynegy’s current financial condition and forecasts, Dynegy does not believe it presently has sufficient statutory surplus to support a dividend.

(2) See definitive proxy statement for the assumptions made, procedures followed, matters considered and limitations on the review undertaken by Goldman, Sachs & Co. and

Greenhill & Co. in connection with their respective opinions.

Greenhill & Co. in connection with their respective opinions.

• As a public company, Dynegy’s current financial condition simply would not support paying

a dividend

a dividend

– No meaningful dividend would be permitted by Dynegy’s credit agreement

– Current high fixed-cost structure, projected negative cash flow and substantial debt obligations

make issuing a dividend imprudent at best

make issuing a dividend imprudent at best

– Dividends would not be permitted as a public company under Delaware law given Dynegy’s

current financial forecasts

current financial forecasts

– Given Dynegy’s currently projected negative cash flow forecasts through 2015, Dynegy will be

required to raise new capital to satisfy its obligations and operate its business as a going concern

required to raise new capital to satisfy its obligations and operate its business as a going concern

– Dynegy’s leverage is ~10 x, compared to peer group leverage of ~3.5 x-6.5 x

– Dynegy is rated CCC by Moody’s

Dynegy is Not in a Position to Pay a Dividend

to Stockholders…

to Stockholders…

4

No public company in Dynegy’s condition should issue a dividend

5

Asset Sales Would Not Create Stockholder Value

& Would Result in a Loss of $1.9 B in Credit Facilities

& Would Result in a Loss of $1.9 B in Credit Facilities

• Dynegy’s Board previously considered various asset sale

packages and concluded that the Blackstone transaction is

the best alternative for stockholders

packages and concluded that the Blackstone transaction is

the best alternative for stockholders

– An asset sale similar to Blackstone’s agreed sale of assets to NRG

Energy is not permitted, and would result in a loss of Dynegy’s

existing $1.9 billion credit facility

Energy is not permitted, and would result in a loss of Dynegy’s

existing $1.9 billion credit facility

– Proceeds of the asset sale would be needed to support existing

collateral needs AND help fund ~$1.5 billion of currently

projected negative cash flows over the next five years

collateral needs AND help fund ~$1.5 billion of currently

projected negative cash flows over the next five years

§ Lost cash flow from assets sold, net of interest expense savings, would

result in additional negative cash flow of ~$365 million above the ~$1.1

billion, for a total negative cash flow of ~$1.5 billion over the next five

years

result in additional negative cash flow of ~$365 million above the ~$1.1

billion, for a total negative cash flow of ~$1.5 billion over the next five

years

– Any asset sales would increase Dynegy’s leverage and further

limit future access to capital markets

limit future access to capital markets

– Sale of assets would also increase Dynegy’s exposure to Midwest

coal market, especially in terms of regulatory and environmental

uncertainties and sensitivity to delivered coal costs

coal market, especially in terms of regulatory and environmental

uncertainties and sensitivity to delivered coal costs

Under current market conditions, any assets sold today would add

significant risk and worsen Dynegy’s financial condition

significant risk and worsen Dynegy’s financial condition

Note: Calculation of liquidity sources assumes asset sale proceeds from the sale of the same asset package, including sales price, that is being sold by Blackstone to NRG Energy. Liquidity cushion needed

for working capital, collateral spikes, etc. “Lost cash flow on assets sold (2011-2015), net of interest expense savings” includes ~$830 million of cash flow associated with the four assets that are being sold

by Blackstone to NRG Energy and ~$465 million consisting primarily of interest expense savings due to no credit facility in place and less debt. Cash outflow of $1.1 billion is based on the financial forecasts

prepared by management of Dynegy in connection with the Board’s consideration of the Blackstone transaction and is based on June 7, 2010, pricing. See appendix for additional information.

for working capital, collateral spikes, etc. “Lost cash flow on assets sold (2011-2015), net of interest expense savings” includes ~$830 million of cash flow associated with the four assets that are being sold

by Blackstone to NRG Energy and ~$465 million consisting primarily of interest expense savings due to no credit facility in place and less debt. Cash outflow of $1.1 billion is based on the financial forecasts

prepared by management of Dynegy in connection with the Board’s consideration of the Blackstone transaction and is based on June 7, 2010, pricing. See appendix for additional information.

Recovery in commodity prices needs to be higher and sooner than

forecasted if a meaningful amount of assets are to be sold in today’s market

Future Financial Position Could be even Worse

than Forecasted as Markets Continue to Deteriorate

than Forecasted as Markets Continue to Deteriorate

6

Pricing:

Commodity prices continue to decline with absence of any recovery in sight

– Summary Financial Forecasts based on June 7, 2010, pricing

– Dynegy’s forecasted negative cash flow of $1.1 billion from 2011-2015 should therefore worsen

– Based on updated commodity curves as of September 7, 2010, forecasted negative cash flow would be $1.6 billion,

reflecting a deterioration due to pricing declines (1)

reflecting a deterioration due to pricing declines (1)

Coal & Rail Transportation Contracts:

If coal & rail transportation contracts are priced more in-line with today’s market pricing, there will be a negative impact on

EBITDA

EBITDA

– Summary Financial Forecasts assumed rail transportation contracts are negotiated at rates more favorable than today’s

market pricing, when the current below-market contracts expire at the end of 2013

market pricing, when the current below-market contracts expire at the end of 2013

– If coal & rail transportation contracts are priced more in-line with today’s market pricing, EBITDA would be reduced an

average of $135 million in both 2014 and 2015 (2)

average of $135 million in both 2014 and 2015 (2)

Asset Retirements:

Asset retirements in the market may not materialize as assumed; therefore, supply may continue to outstrip demand

– Summary Financial Forecasts assumed industry asset retirements beginning in 2013, which resulted in reduced reserve

margins. Lower reserve margins improve the economics of Dynegy’s portfolio, particularly in the Midwest

margins. Lower reserve margins improve the economics of Dynegy’s portfolio, particularly in the Midwest

– If assumed industry asset retirements are delayed, current excess capacity will persist

– If asset retirements do not materialize, EBITDA would be reduced by an average of $85 million each year from 2013-

2015

2015

Based on current gas prices, coal & rail transportation pricing and supply &

demand factors, Dynegy’s forecasted negative cash flow could be materially worse

(1) In updating the cash flow estimates related to the June 7, 2010 pricing, the only assumption changed pertained to pricing impacts on gross margin. All other assumptions are the same.

(2) Combination of increase in absolute rail transportation pricing and less dispatch due to assets being less economic.

Significant Risk of Negative Impact on Dynegy’s

Stock Price if Transaction is not Completed

Stock Price if Transaction is not Completed

• Dynegy’s pre-announcement stock price was $2.78 per share

on August 12, when Blackstone confirmed its $4.50 per share

offer

on August 12, when Blackstone confirmed its $4.50 per share

offer

– Average peer stock prices have fallen ~3% since August 12,

implying a potential 60% loss in value compared to

Blackstone’s offer

implying a potential 60% loss in value compared to

Blackstone’s offer

– Dynegy’s higher leverage tends to amplify changes in its

equity value

equity value

– Natural gas prices have continued to fall and shale gas

appears to be a long term driver of prices

appears to be a long term driver of prices

– Given these trends, and assuming the correlation between

natural gas prices and Dynegy’s stock price returns,

Dynegy’s stock price could trade at or below the pre-

announcement price if the Blackstone transaction is not

completed

natural gas prices and Dynegy’s stock price returns,

Dynegy’s stock price could trade at or below the pre-

announcement price if the Blackstone transaction is not

completed

• Cumulative cash outflows included in the Summary Financial

Forecasts will decrease the company’s financial flexibility and

reduce its access to traditional capital markets

Forecasts will decrease the company’s financial flexibility and

reduce its access to traditional capital markets

• The company expects to restructure the balance sheet to

reduce debt and thereby reduce fixed costs, which actions

would be dilutive to stockholders

reduce debt and thereby reduce fixed costs, which actions

would be dilutive to stockholders

– Issuance of equity, equity linked securities, debt for equity

swaps or combination of these

swaps or combination of these

– Further asset sales at depressed and dilutive prices

If the Blackstone transaction does not close, the stock price could trade

down to or below the pre-announcement price of $2.78 per share and

stockholders could lose significant value

down to or below the pre-announcement price of $2.78 per share and

stockholders could lose significant value

Indexed Stock Performance Since Transaction Announcement

Merchant Power Peers reflect market-capitalization-weighted index which includes Calpine, Mirant,

NRG Energy and RRI Energy performance as of September 27, 2010.

NRG Energy and RRI Energy performance as of September 27, 2010.

80%

100%

120%

140%

160%

180%

200%

Dynegy

+72.7%

Merchant

Power

Peers

-2.9%

Blackstone's $4.50 Cash Offer for Dynegy

Sell-Side Analyst & Rating Agency Commentary

8

Challenging Financial Profile

• “Based on our assessment of these public filings, Dynegy's financial profile is expected to be quite fragile,

particularly during 2011 and 2012, when the company is projected to generate both negative operating cash

flow and negative free cash flow due to weak operating margins and the required funding of their capital

investment programs.” - Moody's, 10.01.10

particularly during 2011 and 2012, when the company is projected to generate both negative operating cash

flow and negative free cash flow due to weak operating margins and the required funding of their capital

investment programs.” - Moody's, 10.01.10

• “We understand that the company's ability to remain compliant with the EBITDA to interest covenant in the

current DHI revolver will become more challenging given that the covenant test gradually increases over

time during the next twelve months.” - Moody's, 10.01.10

current DHI revolver will become more challenging given that the covenant test gradually increases over

time during the next twelve months.” - Moody's, 10.01.10

Extensive and Lengthy Process

• “Go-shop period likely long enough for competing bidder to emerge. The 40-day go-shop provision in the

Blackstone bid for Dynegy expired at midnight last night. We believe the go-shop period was long enough

that a competing bidder would likely be known by now.” - Andrew Smith, JP Morgan, 09.23.10

Blackstone bid for Dynegy expired at midnight last night. We believe the go-shop period was long enough

that a competing bidder would likely be known by now.” - Andrew Smith, JP Morgan, 09.23.10

• “Fair to say no rock left unturned over the years in the search to find a buyer for DYN. The company has

been quietly marketed for ~5 years, aggressively so for the last two with few interested parties getting

beyond initial due diligence.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

been quietly marketed for ~5 years, aggressively so for the last two with few interested parties getting

beyond initial due diligence.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

Note: The research analyst materials in this presentation were taken from published research analyst reports. The research analysts and their respective organizations have not consented to the inclusion of

materials from their research reports in these materials, and the use of materials from these research reports does not represent any recommendation by the analysts or their respective organizations as to how

to vote in respect of the Merger.

materials from their research reports in these materials, and the use of materials from these research reports does not represent any recommendation by the analysts or their respective organizations as to how

to vote in respect of the Merger.

Sell-Side Analyst & Rating Agency

Commentary (cont’d)

Commentary (cont’d)

9

Full, Fair and Immediate Value

• “Current $4.50/sh offer appears reasonable as market outlook remains challenging for the next few years.

We continue to believe Blackstone's offer price remains a reasonable deal for current shareholders,

especially as natural gas pricing has maintained its downward trend... We believe the $4.50/sh offer is a

reasonable value given current market conditions and EV/EBITDA trading multiples of the independent

power producer group.” - Daniel W. Scott, Dahlman Rose & Co., 10.06.10

We continue to believe Blackstone's offer price remains a reasonable deal for current shareholders,

especially as natural gas pricing has maintained its downward trend... We believe the $4.50/sh offer is a

reasonable value given current market conditions and EV/EBITDA trading multiples of the independent

power producer group.” - Daniel W. Scott, Dahlman Rose & Co., 10.06.10

• “DYN value is very sensitive to assumptions. Time to return to a balanced supply demand power market is

one of two big drivers for our IPP NAVs (the other being nat gas prices). Our base DYN assumption is a

weighted average of 6 years to reach market equilibrium resulting in a $3.25/sh NAV, ~25% below BX’s take

out offer.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

one of two big drivers for our IPP NAVs (the other being nat gas prices). Our base DYN assumption is a

weighted average of 6 years to reach market equilibrium resulting in a $3.25/sh NAV, ~25% below BX’s take

out offer.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

• “DYN/BX deal less certain, but still too risky to play for upside. Despite DYN stock occasionally trading above

$5.00 in recent past, we were not willing to bite on the “better bid in the wings” hypothesis post BX’s

$4.50/sh offer. Now, post the go shop period, an IPP experienced, activist fund has shown up on the scene

with the likely goal of undermining shareholder support for the BX transaction. While we continue to

believe that the path of least resistance is Blackstone’s $4.50/sh takeout, this activist entering the picture

makes the transaction less certain. However, still not a game we’d play as we see downside risk at current

DYN price level still outweighing any near-term upside.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

$5.00 in recent past, we were not willing to bite on the “better bid in the wings” hypothesis post BX’s

$4.50/sh offer. Now, post the go shop period, an IPP experienced, activist fund has shown up on the scene

with the likely goal of undermining shareholder support for the BX transaction. While we continue to

believe that the path of least resistance is Blackstone’s $4.50/sh takeout, this activist entering the picture

makes the transaction less certain. However, still not a game we’d play as we see downside risk at current

DYN price level still outweighing any near-term upside.” - Brandon Blossman, Tudor Pickering Holt, 10.11.10

Sell-Side Analyst & Rating Agency

Commentary (cont’d)

Commentary (cont’d)

10

Natural Gas Prices Continue to Fall

• “For another bidder to step in, they would be paying anywhere from 17% - 28% more (premium and

termination fee) for a depreciating option. In addition, if looking to replicate the NRG deal with another

party (NRG is locked in exclusivity), with the fall in Nat Gas prices and the depressed coal and gas units for

sale in the market, those assets are unlikely to fetch the $1.36B NRG is paying for them. All said, there are

significant financial hurdles for an interloping bid.”- Stephen Grahling, Jefferies & Co., 10.05.10

termination fee) for a depreciating option. In addition, if looking to replicate the NRG deal with another

party (NRG is locked in exclusivity), with the fall in Nat Gas prices and the depressed coal and gas units for

sale in the market, those assets are unlikely to fetch the $1.36B NRG is paying for them. All said, there are

significant financial hurdles for an interloping bid.”- Stephen Grahling, Jefferies & Co., 10.05.10

• “Dynegy’s fundamentals have been deteriorating since the deal was struck. Nat Gas prices, which set the

price for power, have fallen 9% at the 2011 end of the pricing curve. Dynegy’s operating cash flow is

decreasing — their cash needs are increasing. Dynegy will have $1.6B in excess liquidity on completing the

transaction (including Blackstone’s equity contribution). However, after adjusting for the NRG sale,

significantly more than $1.1B will be needed to support Dynegy’s cash needs for the next five years.

Blackstone’s $543M equity cushion is declining.” - Stephen Grahling, Jefferies & Co., 10.05.10

price for power, have fallen 9% at the 2011 end of the pricing curve. Dynegy’s operating cash flow is

decreasing — their cash needs are increasing. Dynegy will have $1.6B in excess liquidity on completing the

transaction (including Blackstone’s equity contribution). However, after adjusting for the NRG sale,

significantly more than $1.1B will be needed to support Dynegy’s cash needs for the next five years.

Blackstone’s $543M equity cushion is declining.” - Stephen Grahling, Jefferies & Co., 10.05.10

Note: Emphasis added.

Appendix

• EBITDA Measures. We believe that EBITDA and Adjusted EBITDA provide a meaningful representation of our operating performance. We

consider EBITDA as a way to measure financial performance on an ongoing basis. Adjusted EBITDA is meant to reflect the true operating

performance of our power generation fleet; consequently, it excludes the impact of mark-to-market accounting and other items that

could be considered “non-operating” or “non-core” in nature, and includes the contributions of those plants classified as discontinued

operations. Because EBITDA and Adjusted EBITDA are two of the financial measures that management uses to allocate resources,

determine Dynegy’s ability to fund capital expenditures, assess performance against its peers and evaluate overall financial performance,

we believe they provide useful information for our investors. In addition, many analysts, fund managers and other stakeholders that

communicate with us typically request our financial results in an EBITDA and Adjusted EBITDA format.

consider EBITDA as a way to measure financial performance on an ongoing basis. Adjusted EBITDA is meant to reflect the true operating

performance of our power generation fleet; consequently, it excludes the impact of mark-to-market accounting and other items that

could be considered “non-operating” or “non-core” in nature, and includes the contributions of those plants classified as discontinued

operations. Because EBITDA and Adjusted EBITDA are two of the financial measures that management uses to allocate resources,

determine Dynegy’s ability to fund capital expenditures, assess performance against its peers and evaluate overall financial performance,

we believe they provide useful information for our investors. In addition, many analysts, fund managers and other stakeholders that

communicate with us typically request our financial results in an EBITDA and Adjusted EBITDA format.

– “EBITDA” - We define “EBITDA” as earnings (loss) before interest, taxes, depreciation and amortization.

– “Adjusted EBITDA” - We define “Adjusted EBITDA” as EBITDA adjusted to exclude (1) gains or losses on the sale of assets, (2) the impacts of mark-to-market

changes and (3) impairment charges.

changes and (3) impairment charges.

– “Adjusted EBITDAR” - We define “Adjusted EBITDAR” as Adjusted EBITDA adjusted to exclude operating lease commitments.

• Debt Measures. We believe that our debt measures are useful because we consider these measures as a way to re-evaluate our progress

toward our strategic corporate objective of reducing our overall indebtedness. In addition, many analysts and investors use these

measures for valuation analysis purposes. The most directly comparable GAAP financial measure to the below measures is GAAP debt.

toward our strategic corporate objective of reducing our overall indebtedness. In addition, many analysts and investors use these

measures for valuation analysis purposes. The most directly comparable GAAP financial measure to the below measures is GAAP debt.

– “Net Debt” - We define “Net Debt” as total GAAP debt less cash and cash equivalents and restricted cash. Restricted cash in this case consists only of collateral

posted for the credit facility at the end of each period, and the Sithe debt reserve, at the end of each period where applicable.

posted for the credit facility at the end of each period, and the Sithe debt reserve, at the end of each period where applicable.

– “Net Debt and Other Obligations” or “Adjusted Net Debt”- We define “Net Debt and Other Obligations” or “Adjusted Net Debt” as total GAAP debt plus

certain operating lease commitments less cash and cash equivalents and restricted cash. Restricted cash in this case consists only of collateral posted for the

credit facility at the end of each period.

certain operating lease commitments less cash and cash equivalents and restricted cash. Restricted cash in this case consists only of collateral posted for the

credit facility at the end of each period.

– “Adjusted Debt” - We define “Adjusted Debt” as total GAAP debt plus certain operating lease commitments.

Definitions

12

Reg G Reconciliation

13

Note: The above is a summary of the financial forecasts prepared by management of Dynegy in connection with Board’s consideration of the Blackstone transaction. For additional information about

these summary financial forecasts, including the assumptions Dynegy management made in preparing them, see the “Summary Financial Forecasts” section of the definitive proxy statement. (1)

Forecasted values. (2) Commodity pricing assumptions through 2012 were based upon June 7, 2010 price curves and commodity pricing assumptions after 2012 were based upon June 7, 2010 price curves

and adjusted based upon management’s fundamental outlook, which included the assumption of asset retirements by which Dynegy would benefit. (3) Adjusted EBITDA means EBITDA plus other

adjustments related to mark-to-market changes.

these summary financial forecasts, including the assumptions Dynegy management made in preparing them, see the “Summary Financial Forecasts” section of the definitive proxy statement. (1)

Forecasted values. (2) Commodity pricing assumptions through 2012 were based upon June 7, 2010 price curves and commodity pricing assumptions after 2012 were based upon June 7, 2010 price curves

and adjusted based upon management’s fundamental outlook, which included the assumption of asset retirements by which Dynegy would benefit. (3) Adjusted EBITDA means EBITDA plus other

adjustments related to mark-to-market changes.

14

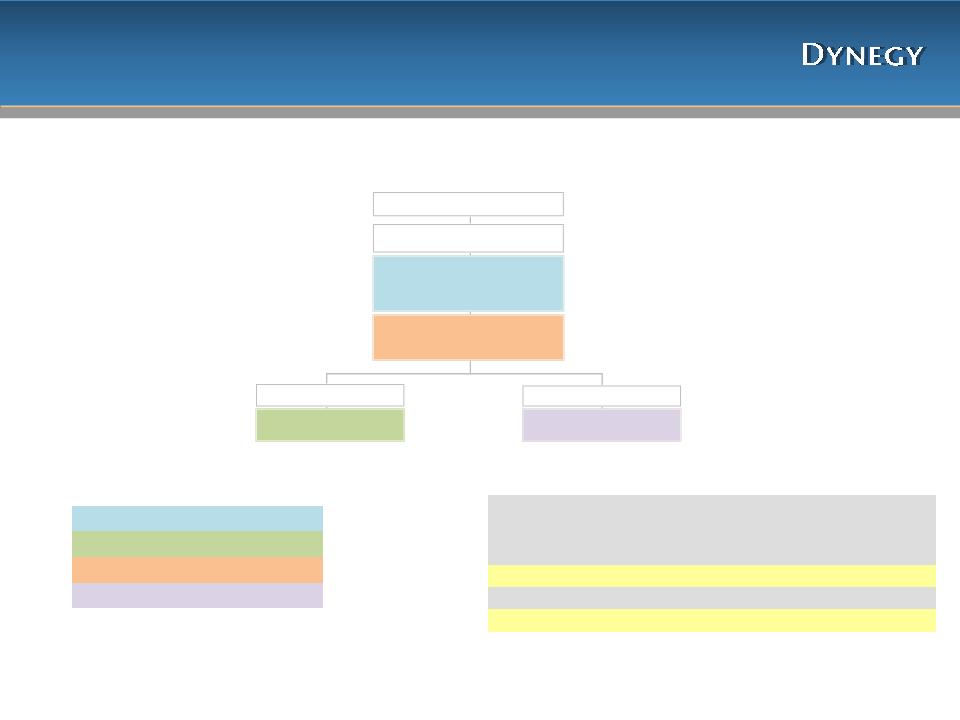

Capital Structure

Debt & Other Obligations as of 6/30/2010

Dynegy Power Corp.

Central Hudson(2) $633

Dynegy Holdings Inc.

$1,080 Million Revolver(1) $0

Term L/C Facility $850

Tranche B Term $68

Sr. Unsec. Notes/Debentures $3,450

Sub.Cap.Inc.Sec (“SKIS”) $200

Dynegy Inc.

Senior Debentures $257

Sithe Energies

|

TOTALS ($ Million)

|

6/30/2010

|

|

Secured

|

$918

|

|

Secured Non-Recourse

|

$257

|

|

Unsecured

|

$3,650

|

|

Lease Obligation

|

$633

|

|

($ Million)

|

6/30/2010

|

|

Total Obligations

|

$5,458

|

|

Less: Cash & short-term investments

|

501

|

|

Less: Restricted cash(3)

|

850

|

|

Net Debt & Other Obligations

|

$4,107

|

|

Less: Central Hudson Lease Obligation

|

633

|

|

Net Debt

|

$3,474

|

(1) Represents drawn amounts under the revolver; actual amount of revolver was $1.08 Billion as of 6/30/2010;

(2) Represents PV (10%) of future lease payments. Central Hudson lease payments are unsecured obligations of

Dynegy Inc., but are a secured obligation of an unrelated third party (“lessor”) under the lease. DHI has

guaranteed the lease payments on a senior unsecured basis; (3) Restricted cash includes $850MM related to the

Synthetic Letter of Credit facility

(2) Represents PV (10%) of future lease payments. Central Hudson lease payments are unsecured obligations of

Dynegy Inc., but are a secured obligation of an unrelated third party (“lessor”) under the lease. DHI has

guaranteed the lease payments on a senior unsecured basis; (3) Restricted cash includes $850MM related to the

Synthetic Letter of Credit facility