Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Local Insight Regatta Holdings, Inc. | d8k.htm |

OCTOBER 18, 2010

P U B L I C - S I D E L E N D E R P R E S E N T A T I O N

Disclaimer

Safe Harbor for Forward-Looking Statements; Cautionary Statements

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “assumption” or the negative of these terms or other comparable terminology. Regardless of any identifying phrases, these statements relate to future events or future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although Local Insight Media Holdings, Inc. (together with its subsidiaries, the “Company”) believes that the expectations reflected in these forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. The Company cautions that these forward-looking statements are based on assumptions that are subject to a wide range of risks and uncertainties. These and other risks and uncertainties are described in detail in Local Insight Regatta Holdings, Inc.’s (“Regatta”) Annual Report on Form 10-K for the year ended December 31, 2009, Regatta’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2010 and Regatta’s other periodic filings with the SEC, which are available on the SEC’s internet site (http://www.sec.gov). Recipients are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this presentation, and the Company undertakes no obligation to publicly revise or update such forward-looking statements to reflect events or circumstances that occur after the date of this presentation or to reflect the occurrence of any unanticipated event

| 1 |

|

Table of Contents

I

INTRODUCTION

2

II

INDUSTRY OVERVIEW

10

III

BUSINESS STRATEGY / BERRY LEADS

13

IV

FINANCIAL PERFORMANCE

20

APPENDIX

I Introduction

I I N T R O D U C T I O N

Executive Summary

Industry is in flux due to changing consumer behavior, creating both risks and opportunity Small and Medium Businesses’ (“SMBs”) needs are changing and we are adapting

Duration of cyclical pressures gives rise to trade-offs and accelerating secular changes

Advertising is often viewed as discretionary – SMBs must make choices

We believe our investment thesis holds – LIM markets were insulated, not isolated Challenges unique to us: system conversion and rolling out Berry Leads These business decisions have both intentional and unintentional costs to the business Having the right business model is critical in this environment

A channel strategy that is advertiser-focused

We believe we have the right model; need the runway to prove it Preliminary results from Berry Leads are promising Financial results reflect the cyclical and secular pressures

Print revenue declines and increased bad debt and claims and adjustments

2010 revenue and EBITDA are expected to be significantly below prior expectations

We are likely to breach the financial covenants under Regatta’s credit facilities at September 30, 2010 and December 31, 2010

Lazard has been engaged as financial advisor to assist in the evaluation of our capital structure, including balance sheet restructuring options Bank lenders and bondholders have retained advisors; we have engaged with them

| 2 |

|

I I N T R O D U C T I O N

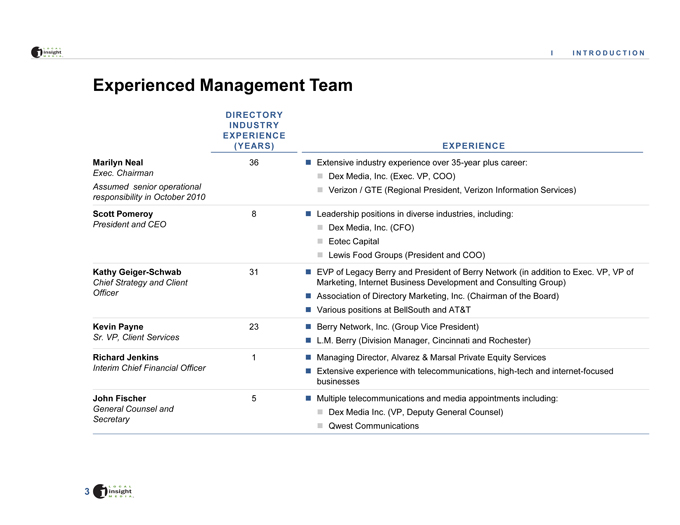

Experienced Management Team

DIRECTORY

INDUSTRY

EXPERIENCE

(YEARS)

EXPERIENCE

Marilyn Neal

36

Extensive industry experience over 35-year plus career:

Exec. Chairman

Dex Media, Inc. (Exec. VP, COO)

Assumed senior operational

Verizon / GTE (Regional President, Verizon Information Services)

responsibility in October 2010

Scott Pomeroy

8

Leadership positions in diverse industries, including:

President and CEO

Dex Media, Inc. (CFO)

Eotec Capital

Lewis Food Groups (President and COO)

Kathy Geiger-Schwab

31

EVP of Legacy Berry and President of Berry Network (in addition to Exec. VP, VP of

Chief Strategy and Client

Marketing, Internet Business Development and Consulting Group)

Officer

Association of Directory Marketing, Inc. (Chairman of the Board)

Various positions at BellSouth and AT&T

Kevin Payne

23

Berry Network, Inc. (Group Vice President)

Sr. VP, Client Services

L.M. Berry (Division Manager, Cincinnati and Rochester)

Richard Jenkins

1

Managing Director, Alvarez & Marsal Private Equity Services

Interim Chief Financial Officer

Extensive experience with telecommunications, high-tech and internet-focused

businesses

John Fischer

5

Multiple telecommunications and media appointments including:

General Counsel and

Dex Media Inc. (VP, Deputy General Counsel)

Secretary

Qwest Communications

| 3 |

|

I I N T R O D U C T I O N

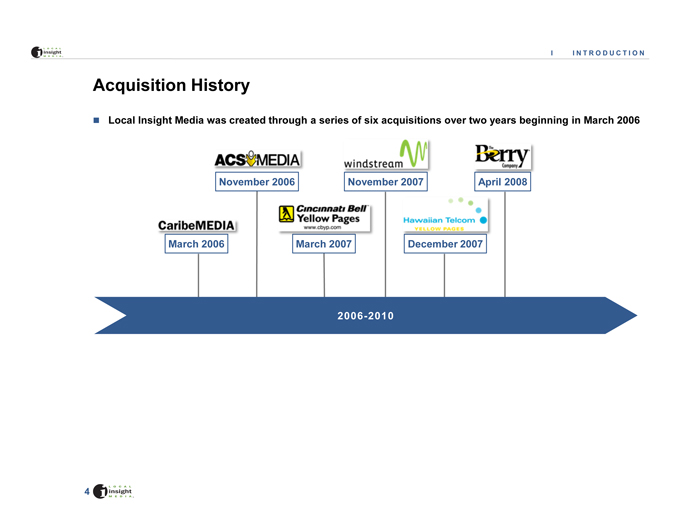

Acquisition History

Local Insight Media was created through a series of six acquisitions over two years beginning in March 2006 November 2006

November 2007

April 2008

March 2006

March 2007

December 2007 2006-2010

| 4 |

|

I I N T R O D U C T I O N

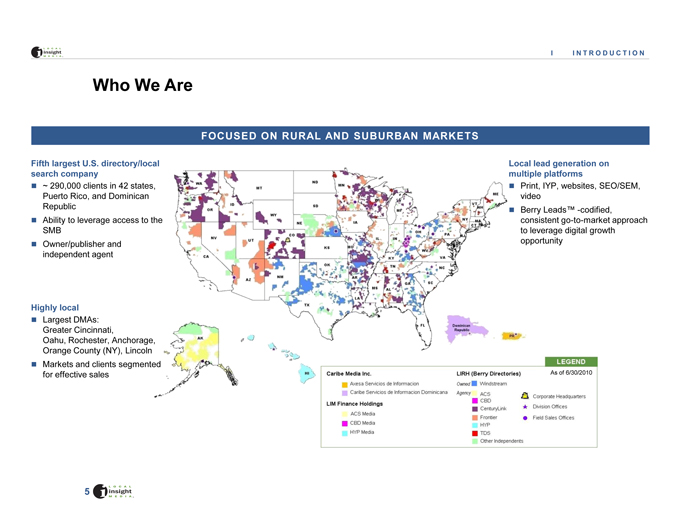

Who We Are

Fifth largest U.S. directory/local search company

~ 290,000 clients in 42 states, Puerto Rico, and Dominican Republic Ability to leverage access to the SMB

Owner/publisher and independent agent

Highly local

Largest DMAs: Greater Cincinnati,

Oahu, Rochester, Anchorage, Orange County (NY), Lincoln Markets and clients segmented for effective sales

FOCUSED ON RURAL AND SUBURBAN MARKETS

Local lead generation on multiple platforms

Print, IYP, websites, SEO/SEM, video

Berry Leads™ -codified, consistent go-to-market approach to leverage digital growth opportunity

As of 6/30/2010

| 5 |

|

I I N T R O D U C T I O N

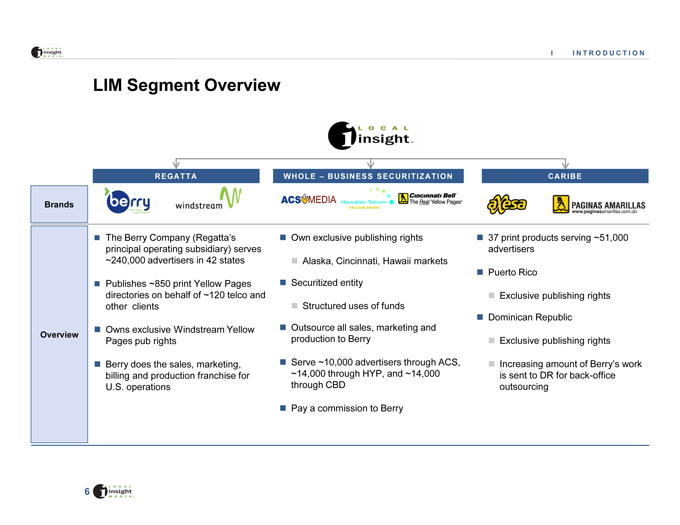

LIM Segment Overview

Brands

Overview

REGATTA

The Berry Company (Regatta’s principal operating subsidiary) serves ~240,000 advertisers in 42 states

Publishes ~850 print Yellow Pages directories on behalf of ~120 telco and other clients

Owns exclusive Windstream Yellow Pages pub rights

Berry does the sales, marketing, billing and production franchise for U.S. operations

WHOLE –BUSINESS SECURITIZATION

(Regatta’sOwn exclusive publishing rights Alaska, Cincinnati, Hawaii markets Securitized entity Structured uses of funds

Outsource all sales, marketing and production to Berry

Serve ~10,000 advertisers through ACS, ~14,000 through HYP, and ~14,000 through CBD

Pay a commission to Berry

CARIBE

37 print products serving ~51,000 advertisers

Puerto Rico

Exclusive publishing rights Dominican Republic Exclusive publishing rights

Increasing amount of Berry’s work is sent to DR for back-office outsourcing

| 6 |

|

I I N T R O D U C T I O N

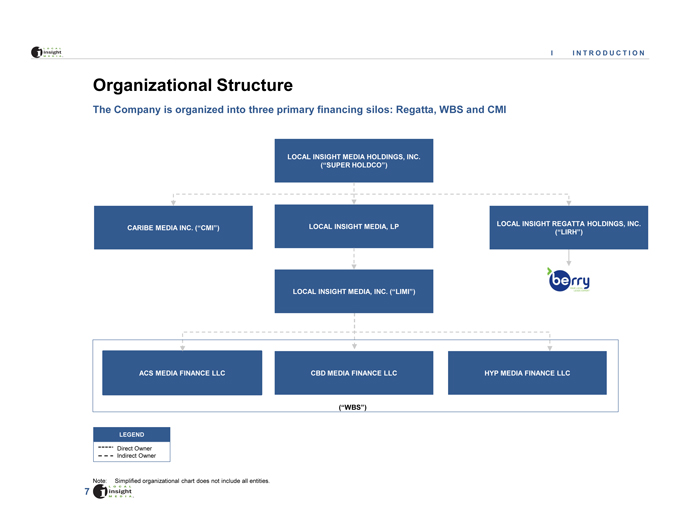

Organizational Structure

The Company is organized into three primary financing silos: Regatta, WBS and CMI

LOCAL INSIGHT MEDIA HOLDINGS, INC.

(“SUPER HOLDCO”)

LOCAL INSIGHT MEDIA, LP LOCAL INSIGHT REGATTA HOLDINGS, INC. (“LIRH”)

CARIBE MEDIA INC. (“CMI”)

LOCAL INSIGHT MEDIA, INC. (“LIMI”)

ACS MEDIA FINANCE LLC CBD MEDIA FINANCE LLC HYP MEDIA FINANCE LLC

(“WBS”)

LEGEND

Direct Owner Indirect Owner

Note: Simplified organizational chart does not include all entities.

| 7 |

|

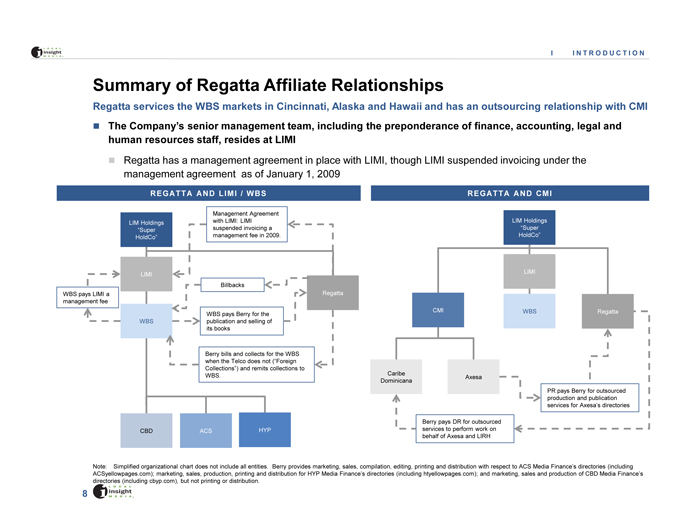

I I N T R O D U C T I O N

Summary of Regatta Affiliate Relationships

Regatta services the WBS markets in Cincinnati, Alaska and Hawaii and has an outsourcing relationship with CMI

The Company’s senior management team, including the preponderance of finance, accounting, legal and human resources staff, resides at LIMI

Regatta has a management agreement in place with LIMI, though LIMI suspended invoicing under the management agreement as of January 1, 2009

REGATTA AND LIMI / WBS REGATTA AND CMI

Management Agreement

LIM Holdings with LIMI: LIMI LIM Holdings “Super suspended invoicing a “Super HoldCo” management fee in 2009. HoldCo”

LIMI LIMI

Billbacks

WBS pays LIMI a Regatta management fee

CMI WBS Regatta WBS pays Berry for the WBS publication and selling of its books

Berry bills and collects for the WBS when the Telco does not (“Foreign

Collections”) and remits collections Caribe to

WBS. Dominicana Axesa

PR pays Berry for outsourced production and publication services for Axesa’s directories

Berry pays DR for outsourced CBD ACS HYP services to perform work on behalf of Axesa and LIRH

Note: Simplified organizational chart does not include all entities. Berry provides marketing, sales, compilation, editing, printing and distribution with respect to ACS Media Finance’s directories (including ACSyellowpages.com); marketing, sales, production, printing and distribution for HYP Media Finance’s directories (including htyellowpages.com); and marketing, sales and production of CBD Media Finance’s directories (including cbyp.com), but not printing or distribution.

| 8 |

|

II Industry Overview

I N D U S T R Y O V E R V I E W

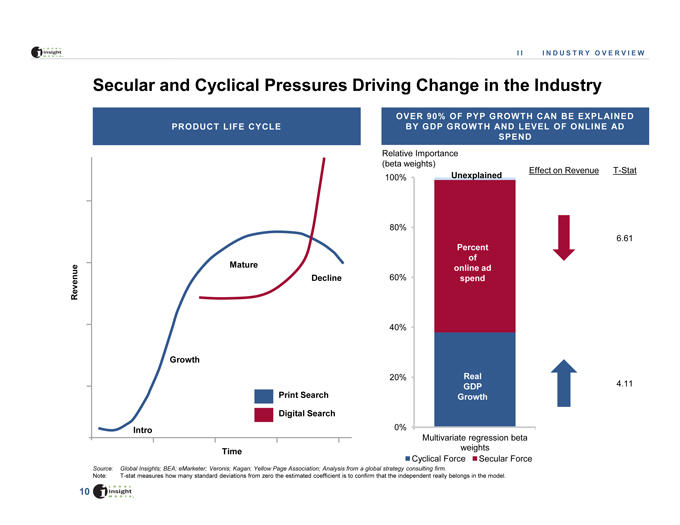

Secular and Cyclical Pressures Driving Change in the Industry

OVER 90% OF PYP GROWTH CAN BE EXPLAINED PRODUCT LIFE CYCLE BY GDP GROWTH AND LEVEL OF ONLINE AD

SPEND

Relative Importance (beta weights)

Effect on Revenue T-Stat 100% Unexplained

80%

6.61

Percent Mature of online ad Revenue Decline 60% spend

40%

Growth

20% Real 4.11

GDP Print Search Growth Digital Search Intro 0%

Multivariate regression beta weights Time Cyclical Force Secular Force

Source: Global Insights; BEA; eMarketer; Veronis; Kagan; Yellow Page Association; Analysis from a global strategy consulting firm.

Note: T-stat measures how many standard deviations from zero the estimated coefficient is to confirm that the independent really belongs in the model.

10

I I I N D U S T R Y O V E R V I E W

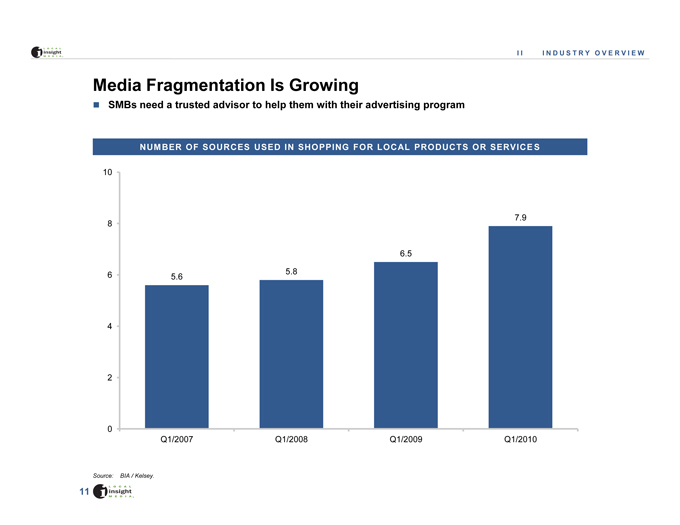

Media Fragmentation Is Growing

SMBs need a trusted advisor to help them with their advertising program

NUMBER OF SOURCES USED IN SHOPPING FOR LOCAL PRODUCTS OR SERVICE S

10

7.9 8

6.5

| 6 |

|

5.8 |

5.6 4 2

0

Q1/2007 Q1/2008 Q1/2009 Q1/2010

Source: BIA / Kelsey.

11

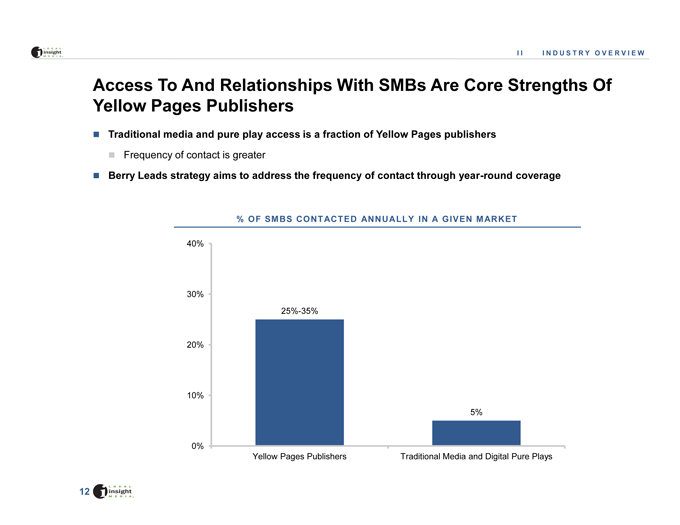

I I I N D U S T R Y O V E R V I E W

Access To And Relationships With SMBs Are Core Strengths Of Yellow Pages Publishers

Traditional media and pure play access is a fraction of Yellow Pages publishers

Frequency of contact is greater

Berry Leads strategy aims to address the frequency of contact through year-round coverage

% OF SMBS CONTACTED ANNUALLY IN A GIVEN MARKET

40%

30%

25%-35%

20%

10%

5%

0%

Yellow Pages Publishers

Traditional Media and Digital Pure Plays

12

III Business Strategy / Berry Leads

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

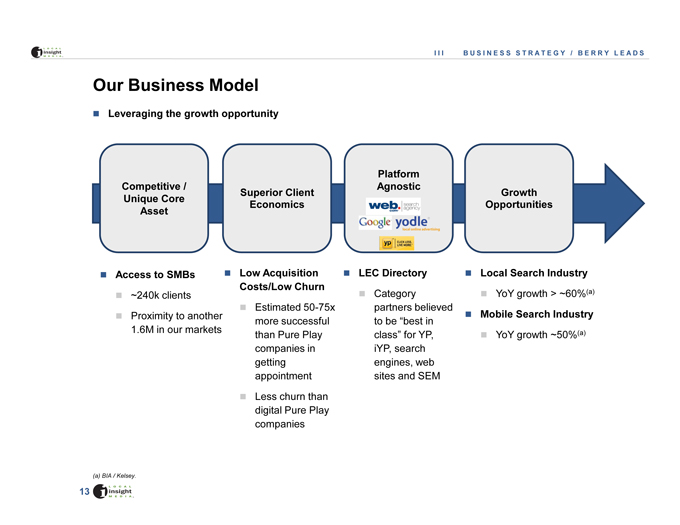

Our Business Model

Leveraging the growth opportunity

Competitive /

Unique Core

Asset

Access to SMBs

~240k clients

Proximity to another

1.6M in our markets

| (a) |

|

BIA / Kelsey. |

Superior Client Economics

Low Acquisition Costs/Low Churn

Estimated 50-75x more successful than Pure Play companies in getting appointment

Less churn than digital Pure Play companies

Platform

Agnostic

Growth

Opportunities

LEC Directory

Category partners believed to be “best in class” for YP, iYP, search engines, web sites and SEM

Local Search Industry

YoY growth > ~60%(a)

Mobile Search Industry

YoY growth ~50%(a)

13

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

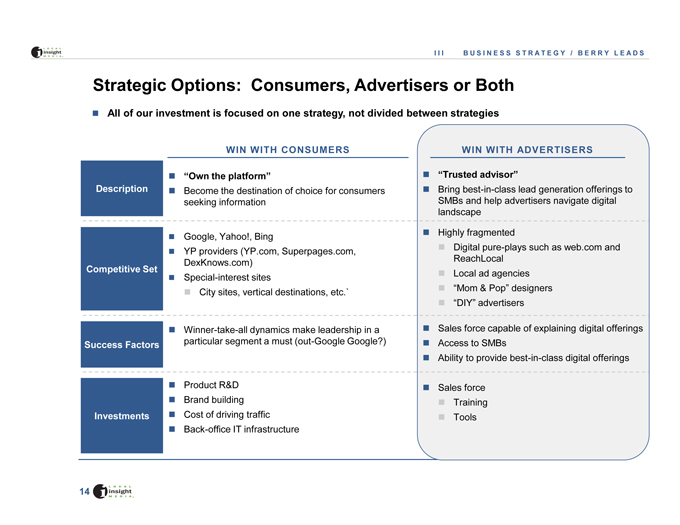

Strategic Options: Consumers, Advertisers or Both

All of our investment is focused on one strategy, not divided between strategies

WIN WITH CONSUMERS

“Own the platform”

Description Become the destination of choice for consumers seeking information

WIN WITH ADVERTISERS

“Trusted advisor”

Bring best-in-class lead generation offerings to SMBs and help advertisers navigate digital landscape

Highly fragmented

Digital pure-plays such as web.com and ReachLocal Local ad agencies

“Mom & Pop” designers “DIY” advertisers

Sales force capable of explaining digital offerings Access to SMBs Ability to provide best-in-class digital offerings

Sales force Training Tools

Google, Yahoo!, Bing

YP providers (YP.com, Superpages.com, DexKnows.com)

Competitive Set

Special-interest sites

City sites, vertical destinations, etc.`

Winner-take-all dynamics make leadership in a Success Factors particular segment a must (out-Google Google?)

Product R&D Brand building Investments Cost of driving traffic Back-office IT infrastructure

14

III BUSINESS STRATEGY / BERRY LEADS

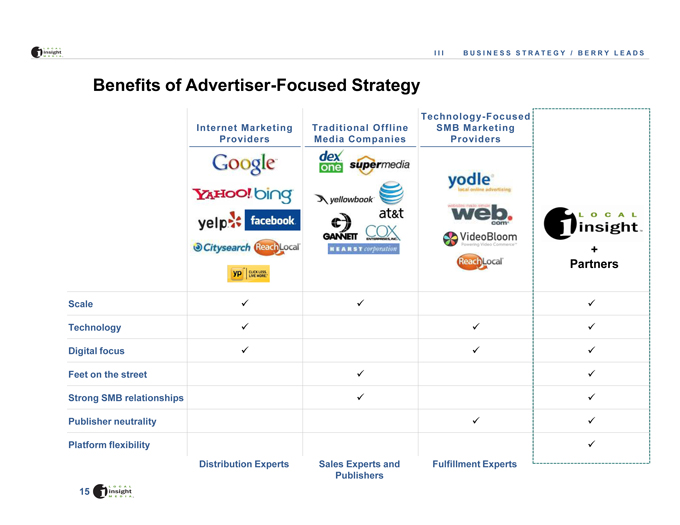

Benefits of Advertiser-Focused Strategy

Technology - Focused

Internet Marketing

Traditional Offline

SMB Marketing

Providers

Media Companies

Providers

Partners

Scale

Technology

Digital focus

Feet on the street

Strong SMB relationships

Publisher neutrality

Platform flexibility

Distribution Experts

Sales Experts and Publishers

Fulfillment Experts

15

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

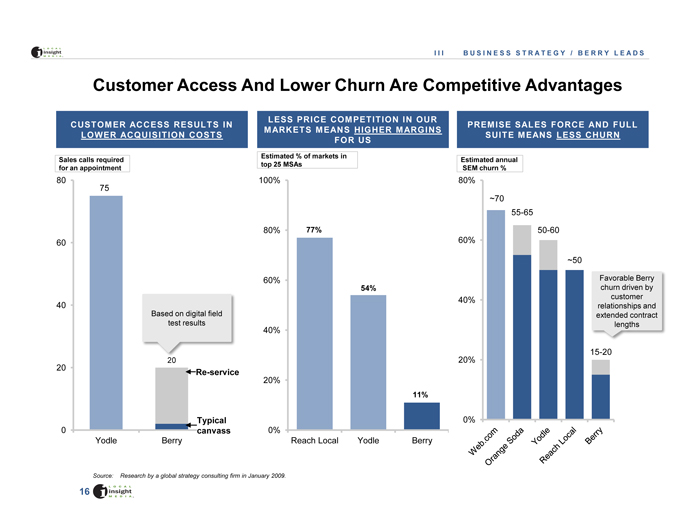

Customer Access And Lower Churn Are Competitive Advantages

CUSTOMER ACCESS RESULTS IN LOWER ACQUISITION COSTS

Sales calls required for an appointment

80 75 60

40

Based on digital field test results

20 20

Re-service

Typical canvass

Yodle Berry

LESS PRICE COMPETITION IN OUR MARKETS MEANS HIGHER MARGINS

FOR US

Estimated % of markets in top 25 MSAs

100%

80% 77%

60%

54%

40%

20%

11%

0%

Reach Local Yodle Berry

PREMISE SALES FORCE AND FULL SUITE MEANS LESS CHURN

Estimated annual SEM churn %

80% 40%

~70

55-65

50-60 60%

~50

Favorable Berry churn driven by customer relationships and extended contract lengths

20% 15-20

0%

Source: Research by a global strategy consulting firm in January 2009.

16

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

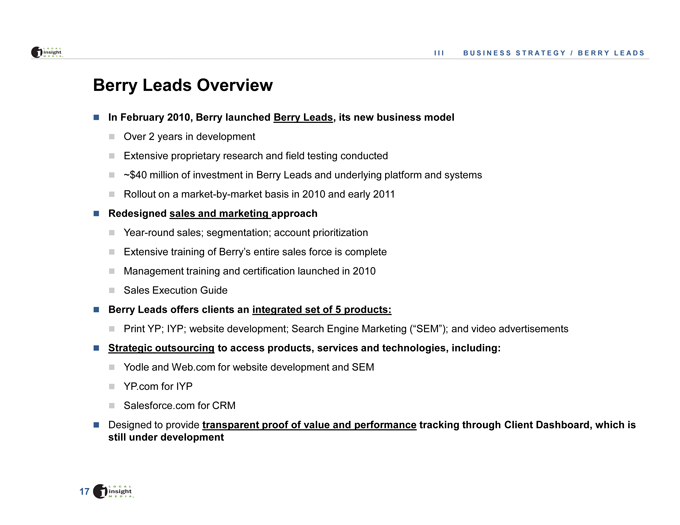

Berry Leads Overview

In February 2010, Berry launched Berry Leads, its new business model

Over 2 years in development

Extensive proprietary research and field testing conducted

~$40 million of investment in Berry Leads and underlying platform and systems Rollout on a market-by-market basis in 2010 and early 2011

Redesigned sales and marketing approach

Year-round sales; segmentation; account prioritization

Extensive training of Berry’s entire sales force is complete

Management training and certification launched in 2010 Sales Execution Guide

Berry Leads offers clients an integrated set of 5 products:

Print YP; IYP; website development; Search Engine Marketing (“SEM”); and video advertisements

Strategic outsourcing to access products, services and technologies, including:

Yodle and Web.com for website development and SEM YP.com for IYP

Salesforce.com for CRM

Designed to provide transparent proof of value and performance tracking through Client Dashboard, which is still under development

17

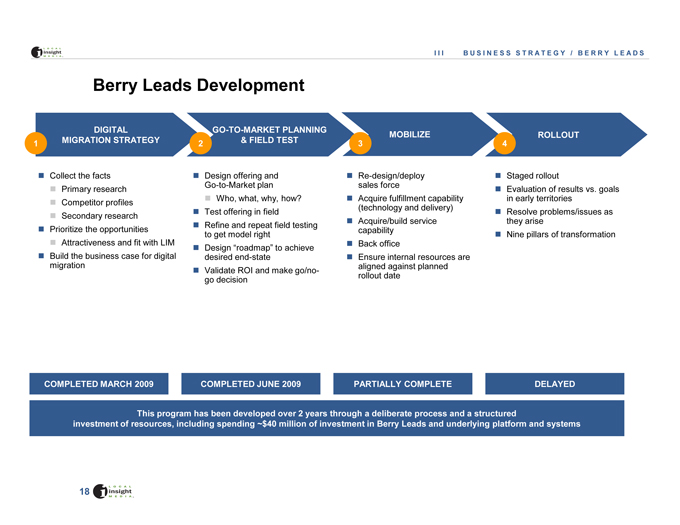

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

Berry Leads Development

DIGITAL

| 1 |

|

MIGRATION STRATEGY |

Collect the facts Primary research Competitor profiles Secondary research Prioritize the opportunities Attractiveness and fit with LIM Build the business case for digital migration

GO-TO-MARKET PLANNING

2

& FIELD TEST

Design offering and Go-to-Market plan Who, what, why, how? Test offering in field Refine and repeat field testing to get model right

Design “roadmap” to achieve desired end-stateValidate ROI and make go/no-go decision

3 MOBILIZE

Re-design/deploy sales force

Acquire fulfillment capability (technology and delivery) Acquire/build service capability Back office

Ensure internal resources are aligned against planned rollout date

4 ROLLOUT

Staged rollout

Evaluation of results vs. goals in early territories Resolve problems/issues as they arise Nine pillars of transformation

COMPLETED MARCH 2009 COMPLETED JUNE 2009 PARTIALLY COMPLETE DELAYED

This program has been developed over 2 years through a deliberate process and a structured investment of resources, including spending ~$40 million of investment in Berry Leads and underlying platform and systems

18

I I I B U S I N E S S S T R A T E G Y / B E R R Y L E A D S

Berry Leads: Preliminary Results

Key Highlights

Preliminary results for Berry Leads are promising

NPS scores continue to show significantly higher client loyalty over business-as-usual (“BAU”)

NPS scores for clients who buy websites and SEM fulfilled by our partners are showing significant increases

Reps who consult/sell to the “gold standard” have increased performance and NPS scores

Systems issues are impacting productivity

Early results are showing improvement in the renewal rate trend

19

IV Financial Performance

I V F I N A N C I A L P E R F O R M A N C E

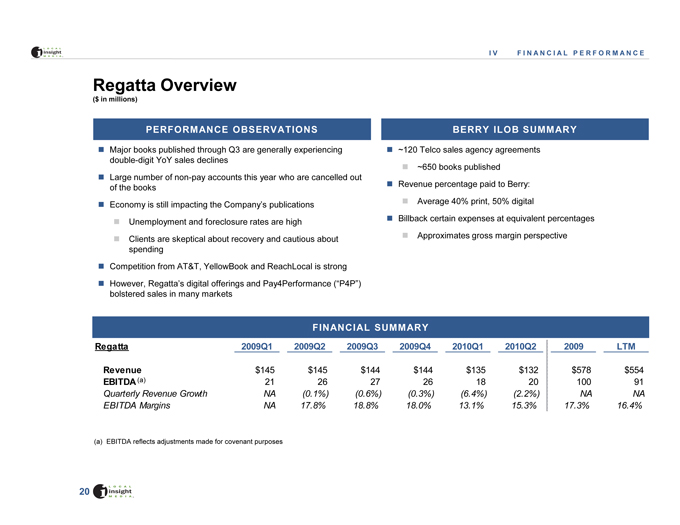

Regatta Overview

($ in millions)

PERFORMANCE OBSERVATIONS

Major books published through Q3 are generally experiencing double-digit YoY sales declines

Large number of non-pay accounts this year who are cancelled out

of the books

Economy is still impacting the Company’s Publications

Unemployment and foreclosure rates are high

Clients are skeptical about recovery and cautious about spending

BERRY ILOB SUMMARY

~120 Telco sales agency agreements ~650 books published Revenue percentage paid to Berry:

Average 40% print, 50% digital

Billback certain expenses at equivalent percentages Approximates gross margin perspective

Competition from AT&T, YellowBook and ReachLocal is strong

However, Regatta’s digital offerings and Pay4Performance (“P4P”) bolstered sales in many markets

FINANCIAL SUMMARY

Regatta

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2009

LTM

Revenue

$145

$145

$144 $144

$135 $132

$578 $554

EBITDA(a)

21 26

27 26

18 20

100 91

Quarterly Revenue Growth NA

(0.1%)

(0.6%) (0.3%)

(6.4%) (2.2%)

NA

NA

EBITDA Margins

NA

17.8% 18.8% 18.0% 13.1% 15.3% 17.3% 16.4%

(a) EBITDA reflects adjustments made for covenant purposes

20

I V F I N A N C I A L P E R F O R M A N C E

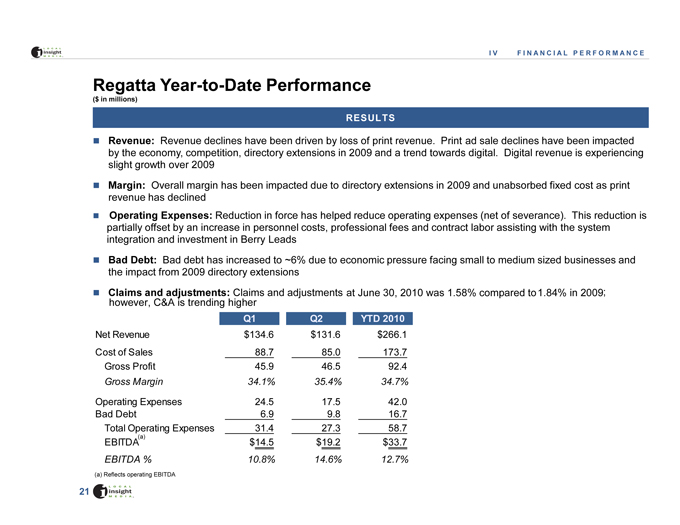

Regatta Year-to-Date Performance

($ in millions)

RESULTS

Revenue: Revenue declines have been driven by loss of print revenue. Print ad sale declines have been impacted by the economy, competition, directory extensions in 2009 and a trend towards digital. Digital revenue is experiencing slight growth over 2009

Margin: Overall margin has been impacted due to directory extensions in 2009 and unabsorbed fixed cost as print revenue has declined Operating Expenses: Reduction in force has helped reduce operating expenses (net of severance). This reduction is partially offset by an increase in personnel costs, professional fees and contract labor assisting with the system integration and investment in Berry Leads

Bad Debt: Bad debt has increased to ~6% due to economic pressure facing small to medium sized businesses and the impact from 2009 directory extensions

Claims and adjustments: Claims and adjustments at June 30, 2010 was 1.58% compared to 1.84% in 2009; however, C&A is trending higher

Q1

Q2

YTD 2010

Net Revenue

$134.6

$131.6

$266.1

Cost of Sales

88.7

85.0

173.7

Gross Profit

45.9

46.5

92.4

Gross Margin

34.1%

35.4%

34.7%

Operating Expenses

24.5

17.5

42.0

Bad Debt

6.9

9.8

16.7

Total Operating Expenses

31.4

27.3

58.7

EBITDA(a)

$14.5

$19.2

$33.7

EBITDA %

10.8%

14.6%

12.7%

(a) Reflects opening EBITDA

21

I V F I N A N C I A L P E R F O R M A N C E

Print, P4P and Digital Detail

Ad sales decline higher than expected; impacted by the following: Economy Competition Directory extensions in 2009 Secular trends Regatta has lost some Telco contracts

P4P

Leads-based pricing program that enables advertisers to pay for calls received from print and digital advertising

By reducing risk for advertisers through a pay per call pricing model we have generated incremental revenue

by “selling more to more”

and retaining advertising revenues from “at risk” customers

As a new program without full data visibility at inception, we have encountered forecasting issues but have tightened our forecasting methodology

The result was a general overstatement of expected call volumes for these non-core headings Since call volumes have been lower than anticipated, AVO per customer is lower than expected

Digital

Training under the Berry Leads program has been completed

YoY increase in Digital revenue reflects the roll-out of Berry Leads. This growth has been driven by the SEM and Website product offerings as SMBs continue to utilize online services to promote their businesses. The increase in cost is due to higher cost associated with the delivery of the new product set

22

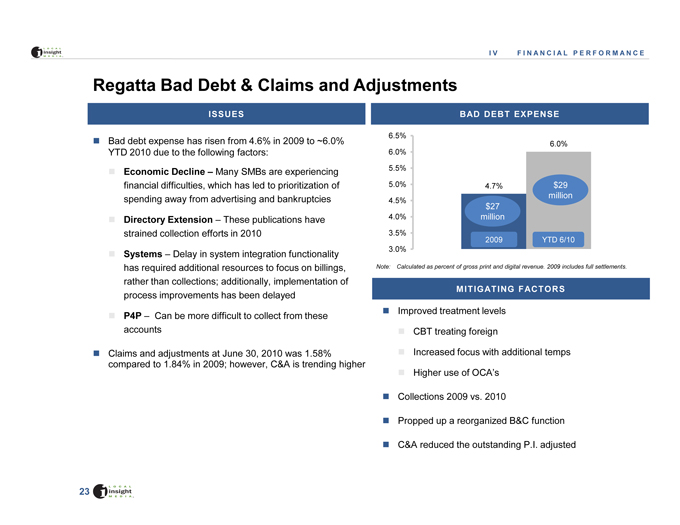

I V F I N A N C I A L P E R F O R M A N C E

Regatta Bad Debt & Claims and Adjustments

ISSUES

Bad debt expense has risen from 4.6% in 2009 to ~6.0% YTD 2010 due to the following factors:

Economic Decline – Many SMBs are experiencing financial difficulties, which has led to prioritization of spending away from advertising and bankruptcies

Directory Extension – These publications have strained collection efforts in 2010

Systems – Delay in system integration functionality has required additional resources to focus on billings, rather than collections; additionally, implementation of process improvements has been delayed

P4P – Can be more difficult to collect from these accounts

Claims and adjustments at June 30, 2010 was 1.58% compared to 1.84% in 2009; however, C&A is trending higher

BAD DEBT EXPENSE

6.5%

6.0%

6.0%

5.5%

5.0% 4.7% $29 million

4.5% $27 million

4.0%

3.5% 2009 YTD 6/10

3.0%

Note: Calculated as percent of gross print and digital revenue. 2009 includes full settlements.

MITIGATING FACTORS

Improved treatment levels

CBT treating foreign

Increased focus with additional temps

Higher use of OCA’s

Collections 2009 vs. 2010

Propped up a reorganized B&C function

C&A reduced the outstanding P.I. adjusted

23

I V F I N A N C I A L P E R F O R M A N C E

Regatta Cost Saving Initiatives

Prior year cost saving initiatives (since the Berry acquisition in Q2 2008)

Four office closures (Birmingham, Alabama; Macedonia, Ohio; Lincoln, Nebraska and Monroeville, Pennsylvania) The elimination of approximately 290 positions A majority of finished graphics work in print directories has also been outsourced to Macmillan India Ltd.

2010 cost saving initiatives: Initial Plan

Three office closures contemplated (Matthews, North Carolina; Hudson, Ohio and Erie, Pennsylvania) The elimination of 320 headcount, primarily in the areas of operations, sales and field marketing, information technology and marketing

2010 cost saving initiatives: Progress-to-Date

The closing of Hudson, Ohio has been postponed pending resolution of operational challenges

Through June 2010, ~$3.2 million in severance and related costs was incurred in connection with the 2010 Restructuring Plan. Accrual will be evaluated in light of need to reduce RIF

Approximately 460 headcount departures to date, through the planned reduction in force and attrition Approximately 225 headcount additions related to Berry Leads, backfilling open positions and to address operational impacts Approximately 235 net headcount reductions year-to-date

24

I V F I N A N C I A L P E R F O R M A N C E

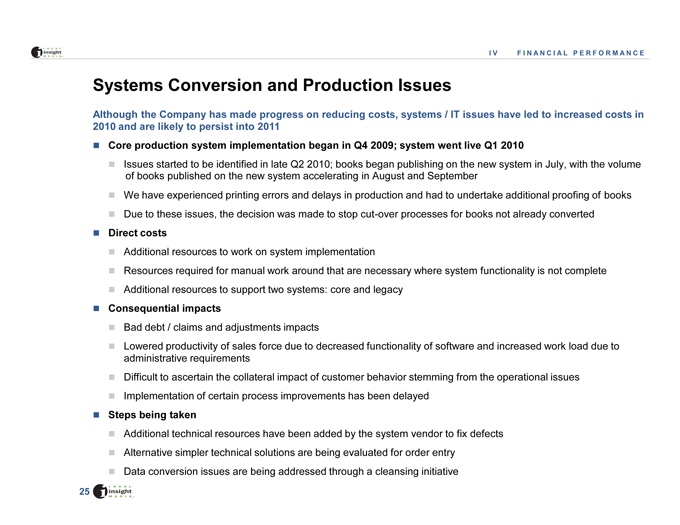

Systems Conversion and Production Issues

Although the Company has made progress on reducing costs, systems / IT issues have led to increased costs in 2010 and are likely to persist into 2011

Core production system implementation began in Q4 2009; system went live Q1 2010

Issues started to be identified in late Q2 2010; books began publishing on the new system in July, with the volume of books published on the new system accelerating in August and September

We have experienced printing errors and delays in production and had to undertake additional proofing of books Due to these issues, the decision was made to stop cut-over processes for books not already converted

Direct costs

Additional resources to work on system implementation

Resources required for manual work around that are necessary where system functionality is not complete Additional resources to support two systems: core and legacy

Consequential impacts

Bad debt / claims and adjustments impacts

Lowered productivity of sales force due to decreased functionality of software and increased work load due to administrative requirements Difficult to ascertain the collateral impact of customer behavior stemming from the operational issues Implementation of certain process improvements has been delayed

Steps being taken

Additional technical resources have been added by the system vendor to fix defects Alternative simpler technical solutions are being evaluated for order entry Data conversion issues are being addressed through a cleansing initiative

25

I V F I N A N C I A L P E R F O R M A N C E

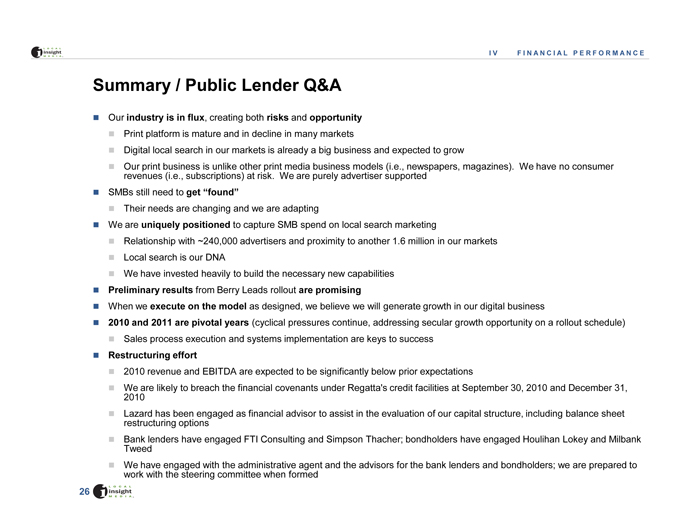

Summary / Public Lender Q&A

Our industry is in flux, creating both risks and opportunity

Print platform is mature and in decline in many markets

Digital local search in our markets is already a big business and expected to grow

Our print business is unlike other print media business models (i.e., newspapers, magazines). We have no consumer revenues (i.e., subscriptions) at risk. We are purely advertiser supported

SMBs still need to get “found” Their needs are changing and we are adapting

We are uniquely positioned to capture SMB spend on local search marketing

Relationship with ~240,000 advertisers and proximity to another 1.6 million in our markets Local search is our DNA

We have invested heavily to build the necessary new capabilities

Preliminary results from Berry Leads rollout are promising

When we execute on the model as designed, we believe we will generate growth in our digital business

2010 and 2011 are pivotal years (cyclical pressures continue, addressing secular growth opportunity on a rollout schedule) Sales process execution and systems implementation are keys to success

Restructuring effort

2010 revenue and EBITDA are expected to be significantly below prior expectations

We are likely to breach the financial covenants under Regatta’s credit facilities at September 30, 2010 and December 31, 2010 Lazard has been engaged as financial advisor to assist in the evaluation of our capital structure, including balance sheet restructuring options Bank lenders have engaged FTI Consulting and Simpson Thacher; bondholders have engaged Houlihan Lokey and Milbank Tweed We have engaged with the administrative agent and the advisors for the bank lenders and bondholders; we are prepared to work with the steering committee when formed

26

Appendix

A P P E N D I X

List of Defined Terms

Term

Meaning

ACS

ACS Media Finance LLC

B&C

Billing and Collections

BAU

Business as Usual

C&A

Claims and Adjustments

CBD

CBD Media Finance LLC

CMI

Caribe Media, Inc.

CRM

Customer Relationship Management

HYP

HYP Media Finance LLC

ILOB

Independent Line of Business

IYP

Internet Yellow Pages

LEC

Local Exchange Carrier

OCA

Outside Collection Agency

P4P

Pay for Performance

PI

Previous Issue

Premise Sales

Face-to-face sales representative

PYP

Print Yellow Pages

SEM

Search Engine Marketing

SEO

Search Engine Optimization

SMB

Small to Medium-Sized Business

WBS

Whole-Business-Securitization

27