Attached files

| file | filename |

|---|---|

| EX-5.1 - Balincan USA, Inc. | v199151_ex5-1.htm |

| EX-23.1 - Balincan USA, Inc. | v199151_ex23-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-1

Pre

Effective Amendment No. 2

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MOQIZONE

HOLDING CORPORATION

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

95-4217605

|

|||

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification

Number)

|

7A-D

Hong Kong Industrial Building

444-452

Des Voeux Road West

Hong

Kong

+852

34434384

(Address

and telephone number of principal executive offices

and

principal place of business)

Moqizone

Holding Corporation

7A-D

Hong Kong Industrial Building

444-452

Des Voeux Road West

Hong

Kong

+852

34434384

(Name,

address and telephone number of agent for service)

Copies

to:

Leser,

Hunter, Taubman & Taubman

17

State Street, Flr. 20

New

York, NY 10004

Tel:

(212) 732-7184

Approximate date of commencement of

proposed sale to the public: From time to time after this Registration

Statement becomes effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ¨

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer”, “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

(Do

not check if a smaller reporting

company)

|

|||

CALCULATION

OF REGISTRATION FEE

|

Title of each class of securities

to be registered

|

Amount to be

Registered (1)

|

Proposed

maximum

offering

price per

share (2)

|

Proposed

maximum

aggregate

offering

price

|

Amount of

registration fee (5)

|

||||||||||||

|

Common

Stock, $0.001 par value

|

$ | $ | $ | |||||||||||||

|

Common

Stock underlying Series C preferred (3)

|

869,422 | 9.50 | 8,259,509 | 588.90 | ||||||||||||

|

Common

Stock underlying Warrants (4)

|

869,422 | 9.50 | 8,259,509 | 588.90 | ||||||||||||

|

Common

Stock underlying Placement Agent Warrants

|

173,884 | 9.50 | 1,651,898 | 117.78 | ||||||||||||

|

Total

|

1,912,728 | $ | 18,170,916 | $ | 1,295.58 | |||||||||||

|

(1)

|

Pursuant to Rule 416 of the

Securities Act of 1933, as amended, the shares of common stock offered

hereby also include such presently indeterminate number of shares of our

common stock as shall be issued by us to the selling shareholders as a

result of stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated solely for purposes of

calculating the registration fee in accordance with Rule 457(c) under the

Securities Act of 1933, as amended based upon the average of the bid and

asked price of the Registrant’s common stock as quoted on the

Over-the-Counter Bulletin Board on May 13, 2010. Accordingly, the

closing bid price on May 13, 2010 was $4.00 and the asked price was

$15.00.

|

|

(3)

|

The shares of common stock

registered hereunder are being registered for resale by selling

stockholders named in the prospectus upon conversion of 869,422 shares of

series C convertible preferred

stock.

|

|

(4)

|

The shares of common stock

registered hereunder are being registered for resale by selling

stockholders named in the prospectus upon exercise of outstanding warrants

to purchase common stock.

|

|

(5)

|

The registration fee has been

calculated in accordance with Rule

457(g).

|

The

registrant is filing a single prospectus in this Registration Statement on Form

S-1 pursuant to Rule 429 under the Securities Act of 1933, as amended, in order

to satisfy the requirements of the Securities Act and the rules and regulations

thereunder for this offering.

We are

filing this amendment to include our responses to the Securities & Exchange

Commission’s (“SEC”) Comment letter dated July 16, 2010 after its

review of the S-1 Amendment No. 1 filed on June 18, 2010, file number

333-166839. This amendment is also being filed to conform the

disclosure contained herein to our Quarterly Report on Form 10-Q for the quarter

ending June 30, 2010, which we filed on August 16, 2010.

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to

Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling

stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and is not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not

permitted.

SUBJECT

TO COMPLETION, DATED

PROSPECTUS

MOQIZONE

HOLDING CORPORATION.

1,912,728

Shares

Common

Stock

This

prospectus relates to the resale of up to 1,912,728 shares of our common stock,

$0.001 par value. The selling stockholders named herein may sell common stock

from time to time in the principal market on which the stock is traded at the

prevailing market price, at prices related to such prevailing market price, in

negotiated transactions or a combination of such methods of sale. We will not

receive any proceeds from the sales by the selling stockholders.

Our

shares of common stock are quoted on OTC Bulletin Board under the symbol

“MOQZ.” The closing bid price and asked price of our common stock

on October 13, 2010 was $0.55 and $2.25 respectively.

THIS

INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY

IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS”

BEGINNING ON PAGE 8 FOR A DISCUSSION OF RISKS APPLICABLE TO US AND AN INVESTMENT

IN OUR COMMON STOCK.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS

TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The

date of this prospectus is October 14, 2010

1

TABLE

OF CONTENTS

|

Item

3. Summary

|

3

|

|

|

Item

4. Use of Proceeds

|

19

|

|

|

Item

5. Determination of Offering Price

|

19

|

|

|

Item

6. Dilution

|

20

|

|

|

Item

7. Selling Security Holders

|

20

|

|

|

Item

8. Plan of Distribution

|

23

|

|

|

Item

9. Description of Securities

|

24

|

|

|

Item

10. Interests of Named Experts and Counsel

|

26

|

|

|

Item

11. Information with respect to the Registrant

|

27

|

|

|

Item

11A. Material Changes

|

64

|

|

|

Item

12. Incorporation of Certain Information by Reference

|

64

|

|

|

Item

12A. Disclosure of Commission Position on Indemnification for Securities

Act Liabilities

|

64

|

|

|

Part

II

|

65

|

|

|

Item

13. Other Expenses of Issuances and Distribution

|

65

|

|

|

Item

14. Indemnification of Directors and Officers

|

65

|

|

|

Item

15. Recent Sales of Unregistered Securities

|

65

|

|

|

Item

16. Exhibits and Financial Statement Schedule

|

66

|

|

|

Item

17. Undertakings

|

68

|

We have

not authorized any person to give you any supplemental information or to make

any representations for us. You should not rely upon any information about us

that is not contained in this prospectus or in one of our public reports filed

with the Securities and Exchange Commission (“SEC”) and incorporated into this

prospectus. Information contained in this prospectus or in our public

reports may become stale. You should not assume that the information contained

in this prospectus, any prospectus supplement or the documents incorporated

by reference are accurate as of any date other than their respective dates,

regardless of the time of delivery of this prospectus or of any sale of the

shares. Our business, financial condition, results of operations and prospects

may have changed since those dates. The selling stockholders are offering to

sell, and seeking offers to buy, shares of our common stock only in

jurisdictions where offers and sales are permitted.

In this

prospectus the “company,” “we,” “us,” and “our” refer to MOQIZONE HOLDING

CORPORATION, a Delaware corporation and its subsidiaries.

Until

[ ], all dealers that effect transactions in these securities, whether or

not participating in this offering, may be required to deliver a

prospectus. This is in addition to the dealers’ obligation to deliver a

prospectus when acting as underwriters.

2

ITEM

3. SUMMARY INFORMATION, RISK FACTORS AND RATIO OF EARNINGS TO FIXED

CHANGES

This

summary highlights selected information appearing elsewhere in this prospectus.

While this summary highlights what we consider to be the most important

information about us, you should carefully read this prospectus and the

registration statement of which this prospectus is a part in their entirety

before investing in our common stock, especially the risks of investing in our

common stock, which we discuss later in “Risk Factors,” and our financial

statements and related notes beginning on page s 8, F-1 and F-7,

respectively . Unless the context requires otherwise, the words “we,” “us” and

“our” refer to MOQIZONE HOLDING CORPORATION and our subsidiaries.

Our

Company

Through

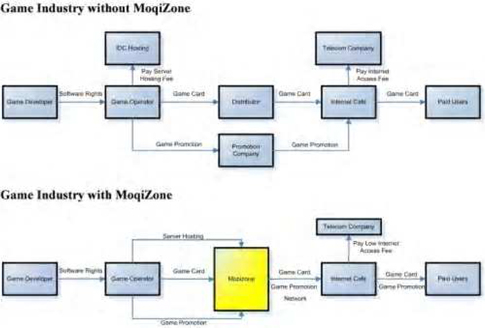

our Shanghai MoqiZone subsidiary, our primary business focus is to provide an

online game delivery platform delivering contents of online games that are

hosted by us to internet cafes which have installed Netcafe Farmer and/or our

WiMAX equipment in China via our Netcafe Farmer software or our proprietary

MoqiZone WiMAX Network. Our MoqiZone WiMAX Network is a wireless virtual

proprietary network. Netcafe Farmer is an online game client software

auto-update distribution system which enables internet cafés to automatically

update their game client software on real time basis for all the PCs in their

cafés. The combination of MoqiZone WiMAX Network and Netcafe Farmer form the

backbone of our distribution channel for our online games to our targeted

market, which are licensed Internet cafes in cities where the internet cafés

business is more developed. Please see further discussion at page 47 under

“Business – Key Corporate Objectives”. Since November 2009, we have connected

approximately 30 Internet cafes in Chengdu and 3 Internet cafes in Suzhou. We

have not generated any revenue from MoqiZone WiMAX Network and little revenue

was generated from the license fee of Netcafe Farmer as of December 31, 2009 as

we are providing our WiMAX installation to the internet cafes free of charge.

Once a substantial number of WiMAX installed internet cafes are participating in

our business (expected to be approximately 700 internet cafes), we plan to

commence our charged services to the internet cafes.

Netcafe

Farmer is currently servicing approximately 700 internet cafés mainly in Henan,

Hebei, Zhejiang, and Northeast of China with a nominal annual subscription fees

and has also established a strong network with major content suppliers to help

them to promote games in internet cafés.

Our

key business development objectives over the next two years are to grow and

expand our business penetration servicing Internet cafes throughout selected

targeted cities in China. These business objectives will require the build out

of our MoqiZone WiMAX Network, continuous technological development of our

portals including but not limited to www.moqizone.com and

www.53mq.com (“53MQ”), and also aggregation of online digital entertainment

contents (meaning online gaming, videos, movies, music and other online

contents). We will not be able to generate significant revenue until we have a

basic foundation of all these components. Please see further discussion at page

(44) under “Business – Key Operating Objectives”.

Our

principal executive offices are located at Hong Kong and Shanghai, and our

telephone number is +852 34434383.

Our

Independent Auditors Have Expressed Their Concern As To Our Ability to Continue

As A Going Concern

Our

independent auditors, Paritz & Company, P.A., have expressed substantial

doubt concerning our ability to continue as a going concern. As of March 31,

2010, we had a stockholders’ deficiency of approximately $3,800,000 and a

accumulated deficit of roughly $6,100,000. We will continue incurring additional

expenses as we implement our growth in the fiscal year of 2010, which will

reduce our net income in 2010. If we are not able to achieve profit or continue

to raise capital from additional financings to fund our operation, then we

likely will be forced to cease operations and investors will likely lose their

entire investment.

Our

History

Moqizone

Holding Corporation, formerly called Trestle Holdings, Inc., was previously a

non-operating public company which was seeking out suitable candidates for a

business combination with a private company. Trestle originally developed

and sold digital tissue imaging and telemedicine applications linking dispersed

users and data primarily in the healthcare and pharmaceutical

markets.

The

common stock of MoqiZone currently trades on the OTCBB under the symbol

“MOQZ.”

Acquisition

of our Operating Business

On March

15, 2009, Trestle entered into a Share Exchange Agreement with MoqiZone Cayman,

Lawrence Cheung, the principal shareholder of MoqiZone Cayman, and, MKM, our

former principal stockholder (the “Agreement”). MoqiZone Cayman is the

record and beneficial owner of 100% of the share capital of MoqiZone Hong Kong

and MoqiZone Hong Kong is the record and beneficial owner of 100% of the share

capital of Shanghai MoqiZone. On June 1, 2009, pursuant to the Agreement,

and as a result of MoqiZone Hong Kong’s receipt of approximately $4,345,000 in

gross proceeds from our private financing, Trestle became the record and

beneficial owner of 100% of the share capital of MoqiZone Cayman and therefore

own 100% of the share capital of MoqiZone Hong Kong directly and Shanghai

MoqiZone indirectly in exchange for the issuance to Lawrence Cheung and the

other shareholders of MoqiZone Cayman of 10,743 shares of our sought to be

created Series B convertible preferred stock. and such Series B preferred stock

will be automatically converted (on the basis of 1,000 shares of common

stock for each share of Series B preferred stock) into an aggregate of

10,743,000 shares of our common stock, representing approximately 95% of our

issued and outstanding shares of common stock, on a fully-diluted basis, as at

the time of conversion (but prior to the issuance of any other equity or equity

type securities). The remaining 5% of the then outstanding shares of the

Company’s common stock are publicly traded and are owned by approximately 83

shareholders on record (see Reverse Stock Split below at Page 6).

3

Pursuant

to the terms of the Agreement, Eric Stoppenhagen resigned as our Interim

President, effective immediately. Additionally, each of our directors

tendered their resignation as one of our directors, which was on June 19, 2009

to our stockholders. Our Board of Directors appointed Lawrence Cheung to

serve as our Chief Executive Officer, effective June 19, 2009.

Additionally, commencing on that same date, Benjamin Chan was elected to serve

as a director as well.

Recent

Developments

Appointment

of New Director

On

November 3, 2009, we announced that Mr. Paul Lu has been appointed as a director

of our board.

Acquisition

of Netcafe Farmer

On

December 21, 2009, we acquired a client-end software called “Netcafe Farmer”

which was originally developed by Mr. Liu Qian in 2006. It is a client-end

software available in the market that provides an automatic content update

distribution system in internet cafés allowing internet cafés to automatically

update their client-end software on a real time basis for all their computers.

Pursuant to the Agreement, we acquired the ownership of the software “Netcafe

Farmer” from Mr. Liu Qian, including all the intellectual property and all its

existing business has been transferred to Shanghai MoqiZone. The total

consideration paid was RMB650,000 (or approximately US$95,000). By acquiring

Netcafe Farmer, the Company also recruited Mr. Liu Qian and his development team

of 4 people. The incremental salary is approximately $75,500 (RMB516,000) per

annum. It is expected that the income generated from existing Netcafe Farmer

business will substantially subsidize the monthly additional salary

expenses. Under the guidance in FASB ASC 805, the purchase price was allocated

to intangible assets and amortized over its estimated life. No liability was

assumed in this acquisition. “Netcafe Farmer” has operated for approximately 18

months and earned less than 20,000 RMB (or approximately US$3,000) per month.

The total income in the most recentfiscal year was approximately US$36,000. Mr.

Liu Qian has the obligation to transfer all the intellectual property, including

source codes of Netcafe Farmer to the Company.

Netcafe

Farmer is currently servicing approximately 700 internet cafés mainly in Henan,

Hebei, Zhejiang, and Northeast of China and has also established a strong

network with major content suppliers to help them to promote games in internet

cafés. As a result of the foregoing, we will be able to bring tremendous synergy

to the Moqizone online game platform business and improve our services to

internet café operators. The existing brand name “Netcafe Farmer” will be

retained and a new version will be developed to support the Moqizone WiMAX

Network. The acquisition of Netcafe Farmer will also allow us

to cover internet café s, which due to physical limitation cannot install our

WiMAX equipment, via fixed line network. Internet cafe s installed with Netcafe

Farmer will be able to enjoy the same products and services as those that are

installed with WiMAX equipment except the revenue sharing would be different.

For Netcafe Farmer connected internet cafés, they will be sharing less revenue

because the company will have to subcontract fixed line connectivity from major

Telco providers and as a result the cost to the company to deploy such system

will be higher.

Management

has adopted FASB ASC 805-10-25-1 to determine which accounting method should be

used for this acquisition. According to FASB ASC 805-10-25-1, entity shall

determine whether a transaction or other event is a business combination by

applying the definition, which requires that the assets acquired and liabilities

assumed constitute a business. If the assets acquired are not a business, the

reporting entity shall account for the transaction or other event as an asset

acquisition. An entity shall account for each business combination by applying

the acquisition method. Management has also adopted FASB ASC 805-10-55-4, which

declares that a business consists of inputs and processes applied to those

inputs that have the ability to create outputs. Since Netcafe Farmer has all

three elements, management believes that it constitutes a business and we

accounted for it under the acquisition method.

According

to rule 11-01 of Regulation S-X, financial information and pro forma financial

information of an acquired business may be required depending on the level of

significance in accordance with Rule 1-02(w) of Regulation S-X. Pursuant to Rule

11-01(b) and Rule 1-02(w), the significance test, (1) The total net income of

Netcafe Farmer in the most resent fiscal year was approximately US$36,000, which

didn’t exceed 20 percent of the net loss of the company and its subsidiaries

consolidated for the most recently completed fiscal year, which was

approximately US$913,000 for the year ended December 31, 2008; (2) the

company’s investment in “Netcafe Farmer” was approximately US$95,000 which was

about 20 percent of the total assets of the company and its subsidiaries

consolidated as of the end of the most recently completed fiscal year and we

believe the effect is immaterial; and (3) the total asset of “Netcafe Farmer”

didn’t exceed 20 percent of the total assets of the company as of the end of the

most recently completed fiscal year. As a result, the business combination was

not considered to be significant and we were not required to file pro forma

financial information.

Agreements

with Win’s Entertainment Ltd.

We have

recently established partnership with Win’s Entertainment Limited (“Win’s”), a

major motion picture producing company in Hong Kong through a series of

proprietary content agreements. In November 2009, we were contracted to develop

the online game for Win’s movie, Tiger Tang 2

(“Tiger Tang 2 Game”) and we also acquired the exclusive rights from Win’s for

publishing Tiger Tang 2 Game. We are also currently in discussion with Win’s to

develop online games for Win’s other movies as well as publish those

games.

4

The

2010 Financing

We

completed a private equity financing of $1,956,200 on March 29, 2010, with 7

accredited investors. Net proceeds from the offering are approximately

$1,760,400. Pursuant to the financing, we issued a total of 869,422 units of our

securities at $2.25 per unit. Each Unit consists of (i) one (1) share of the

Company’s Series C Convertible Preferred Stock, par value $0.001 per share (the

“Preferred Shares”), convertible into one share of the Company’s common stock,

par value $0.001 per share (the “Common Stock”), and (ii) a Series C Warrant

(the “Series C Warrant”) and Series D Warrant (the “Series D Warrant”),

collectively the “Warrants”), with the total amount of Warrants of each Series

exercisable to purchase that number of shares of Common Stock as shall be equal

to fifty percent (50%) of the number of Units purchased in the Offering. Each of

the Warrants has a term of three (3) years.

In

connection with this financing, we paid cash compensation to a placement agent

in the amount of $195,620. Additionally, in connection with this financing, we

granted warrants to purchase up to 86,942 shares of common stock, Series C

Warrants to purchase up to 43,471 shares of common stock and Series D Warrants

to purchase 43,471 shares of common stock to the placement agent or its

designees. These warrants have the same terms as the warrants issued to

Investors that are included in the Units.

The

MobiZone Hong Kong Financing

On June

1, 2009, we completed a private financing of $4,345,000, with 10 accredited

investors (the “June 1 Financing”), which initially included $300,000 that we

received in October 2008 pursuant to a Convertible Loan Agreement with two

accredited investors (the “Convertible Notes”), however, in accordance with the

terms of the Convertible Notes, on August 20, 2009, the holders of the

Convertible Notes elected to be repaid the principal of the Notes rather than

convert the Convertible Notes into the same securities issued to the investors

pursuant to the June 1 Financing. The net proceeds from the June 1 Financing

were approximately $3,337,000 after taking into account the fees and expenses of

the Offering as well as the repayment of the Convertible Notes.

Consummation of the June 1 Financing was a condition to the completion of

the Share Exchange. The securities offered in the June 1 Financing was

sold pursuant to a Securities Purchase Agreement (the “Purchase Agreement”) by

and among the Company, MoqiZone Cayman, Cheung, MKM and each of the purchasers

thereto (the “Investors”). Pursuant to the Purchase Agreement, we issued a

total of approximately 405 Units of securities consisting of (a) $10,000 of 8%

exchangeable convertible notes of MobiZone Hong Kong due March 31, 2011 (the

“Notes”), (b) three year Class A callable warrants (the “Class A Warrants”) to

purchase 2,778 shares of common stock of Trestle, at an exercise price of $2.50

per share, and (c) three year Class B non-callable warrants (the “Class B

Warrants”) to purchase 2,778 shares of common stock of the Company at an

exercise price of $3.00 per share. The exercise prices of the Warrants are

subject to weighted average and other anti-dilution adjustments. Pursuant

to the sale of approximately 405 Units, we issued an aggregate of approximately

$4,045,000 of Notes, Class A Warrants to purchase up to 1,123,614 shares of

common stock and Class B Warrants to purchase up to 1,123,614 shares of common

stock will be issued. The Notes were and will be issued by MobiZone Hong

Kong and the Warrants will be issued by Trestle (now Moqizone Holding

Corporation).

On August

11, 2009, we completed a further private equity financing of $900,000 with 3

accredited investors (the “August 11 Financing”). Net proceeds from the

August 11 Financing are approximately $800,000. Pursuant to the August 11

Financing, we issued a total of approximately 90 Units of securities each

consisting of (a) $10,000 of 8% exchangeable convertible notes of MobiZone Hong

Kong due March 31, 2011 (the “Notes”), (b) three year Class A callable

warrants (the “Class A Warrants”) to purchase 2,778 shares of common stock of

Moqizone, at an exercise price of $2.50 per share, and (c) three year Class B

non-callable warrants (the “Class B Warrants”) to purchase 2,778 shares of

common stock of Moqizone at an exercise price of $3.00 per share. The

exercise prices of the Warrants are subject to weighted average and other

anti-dilution adjustments. Pursuant to the sale of approximately 90 Units,

we issued an aggregate of approximately $900,000 of Notes, Class A Warrants

to purchase up to 250,000 shares of common stock and Class B Warrants to

purchase up to 250,000 shares of common stock will be issued. All of the

securities issued in the August 11 Financing contain the same terms and

conditions as the securities issued to the investors of the June 1 Financing

(the “August 11 Financing”; and together with the June 1 Financing, the

“Financings”).

We raised

a total of $4,945,000 from 11 accredited investors from the Financings

after repayment of the Convertible Notes. As a result of the Financings,

we issued a total of approximately 494.5 Units of securities each consisting of

(a) the Notes, (b) the Class A Warrants, and (c) the Class B Warrants.

Pursuant to the sale of approximately 494.5 Units, we issued an aggregate of

approximately $4,945,000 of Notes, Class A Warrants to purchase up to 1,373,614

shares of common stock and Class B Warrants to purchase up to 1,373,614 of

common stock will be issued. The net proceeds from the Financings are

to be used for working capital and general corporate purposes. We are

obligated to file a registration statement within 150 days of the second

closing, providing for the resale of the shares of common stock underlying the

securities issued pursuant to the Financings.

In

connection with the June 1 Financing and August 11 Financing, we granted

warrants to purchase up to 582,779 shares of common stock respectively to

Tripoint Global Equities, LLC, the placement agent or its designees. These

warrants have the same terms as the warrants issued to Investors and included in

the Units. The placement agent received a total of 582,779 warrants to

purchase up to 582,779 shares of our common stock from the Financing. These

warrants have the same terms as the warrants issued to Investors and

included in the Units.

We

completed the initial closing of a private equity financing of approximately

$247,000 on August 27, 2010 with 2 accredited investors pursuant to a Securities

Purchase Agreement. Net proceeds from the offering, are approximately

$207,000. Pursuant to the financing, we issued a total of 11 units of

our securities at $22,500 per unit. Each Unit consists of (i) an 8%

Convertible Note, convertible into shares of the Common Stock, (ii) a Series E

Warrant, and (iii) a Series F Warrant, each such warrant gives the holder the

right to purchase up to that number of shares of our common stock as shall be

equal to fifty percent (50%) of the number of shares of common stock underlying

the Convertible Note. Each of the Warrants has a term of three (3)

years.

In

connection with this financing, we paid cash compensation to a placement agent

in the amount of $24,650. We also issued, to the placement agent or its

designees, in connection with this financing, warrants to purchase up to that

number of shares of our common stock as shall be equal to ten percent (10%) of

the total number of shares underlying the Units. These warrants have the

same terms as the warrants issued to Investors that are included in the

Units.

5

|

(a)

|

all of the issued and outstanding

Notes were cancelled;

|

|

|

(b)

|

all interest accrued on the Notes

(at the rate of 8% per annum) from the date of issuance to the date of

cancellation was paid, at the Company’s option, in shares of Trestle

common stock valued at $1.80 per

share;

|

|

|

(c)

|

each $1,000 principal amount of

cancelled MoqiZone Hong Kong Note was exchanged for one share of Series A

Preferred Stock, $0.001 par value per share. The Series A Preferred

Stock (i) has a liquidation value of $1,000 per share, (ii) votes,

together with the Trestle common stock, on an “as converted basis”, and

(iii) is convertible, at any time after issuance, at the option of the

holder, into shares of Trestle common stock at a conversion price of $1.80

per share, subject to customary adjustments, including weighted average

anti-dilution protection.

|

Our

Corporate Structure

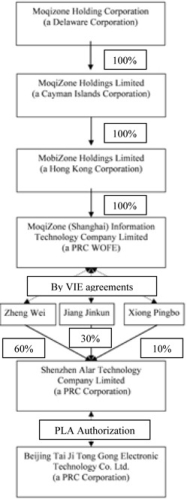

The

following table sets forth our corporate structure, after giving effect to

consummation of the transactions contemplated by the Share Exchange Agreement

described below, assuming the termination of the SZ Mellow

Agreements.

6

THE

OFFERING

|

Common

stock being offered by Selling Stockholders

|

Up

to 1,912,728 shares of common stock (1)

|

|

|

OTCBB

Symbol

|

MOQZ

|

|

|

Risk

Factors

|

The

securities offered by this prospectus are speculative and involve a high

degree of risk and investors purchasing securities should not purchase the

securities unless they can afford the loss of their entire investment. See

“Risk Factors” beginning on page

13.

|

(1)

Pursuant to Rule 416 of the Securities Act of 1933, as amended, the shares of

common stock offered hereby also include such presently indeterminate number of

shares of our common stock as shall be issued by us to the selling shareholders

as a result of stock splits, stock dividends or similar

transactions.

SUMMARY

FINANCIAL DATA

The

following table summarizes the relevant financial data for our business and

should be read in conjunction with our financial statements which are included elsewhere in

this prospectus. Our historical financial data reflect only the financial

statements of the Company which, as a result of the Share Exchange transaction,

is deemed for accounting purposes to have acquired Moqizone. The summary

set forth below should be read together with our consolidated financial

statements and the notes thereto, as well as “Selected Consolidated Financial

Data” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” included elsewhere in this prospectus.

Consolidated Statement of Operations

Data :

Consolidated Statement of Operations

Data (in Thousands):

|

Three months

ended

June

30,

|

Years

ended

December

31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

Revenues

|

$ | 58 | $ | - | $ | 1 | $ | - | ||||||||

|

Gross

profit

|

5 | - | 1 | - | ||||||||||||

|

Net profit

(Loss)

|

1,217

|

(598

|

) | (23,441 | ) | (913 | ) | |||||||||

|

Foreign

adjustment

|

58 | 2 | 4 | (6 | ) | |||||||||||

|

Comprehensive income

(Loss)

|

1,275

|

(596

|

) | (23,550 | ) | (919 | ) | |||||||||

|

Six months

ended

June

30,

|

Years

ended

December

31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

Revenues

|

$ | 59 | $ | - | $ | 1 | $ | - | ||||||||

|

Gross

profit

|

7 | - | 1 | - | ||||||||||||

|

Net profit

(Loss)

|

19,882 |

(1,003

|

) |

(23,441

|

) |

(913

|

) | |||||||||

|

Foreign

adjustment

|

89 | (3 | ) | 4 | (6 | ) | ||||||||||

|

Comprehensive income

(Loss)

|

19,971 |

(1,006

|

) |

(23,550

|

) |

(919

|

) | |||||||||

Consolidated Balance Sheet

Data :

|

As of June 30,

|

As of December 31,

|

|||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Balance Sheet

Data:

|

||||||||||||

|

Current

Assets

|

$ |

1,106

|

$ | 666 | $ | 18 | ||||||

|

Total

assets

|

1,926 | 1,565 | 466 | |||||||||

|

Total Current

Liabilities

|

4,478 | 25,889 | 1,187 | |||||||||

|

Total

Liabilities

|

4,478 | 25,889 | 1,187 | |||||||||

|

Total

Stockholders’ Deficiency

|

$ |

(2,552

|

) | $ | (24,324 | ) | $ | (721 | ) | |||

RISK

FACTORS

Investment

in our securities involves risk. You should carefully consider the risks we

describe below before deciding to invest. The market price of our securities

could decline due to any of these risks, in which case you could lose all or

part of your investment. In assessing these risks, you should also refer to the

other information included in this Memorandum. You should pay particular

attention to the fact that a substantial amount of our operations in China are

subject to legal and regulatory environments that in many respects differ from

that of the United States. Our business, financial condition or results of

operations could be affected materially and adversely by any of the risks

discussed below and any others not foreseen. This discussion contains

forward-looking statements.

7

Risks

Related to Our Business and Industry

We

depend on the People’s Liberation Army’s or PLA’s s approval and our cooperation

relationship with Tai Ji as low cost WiMAX network provider. The

termination or alteration of the PLA’s approval or the termination of our

cooperation relationship with Tai Ji would materially and adversely impact our

business operations and financial conditions.

Tai Ji

was authorized to exclusively use the 3.5GHz radio frequency resources by an

approval letter issued by the PLA Resource Office dated October 31, 2007 (“PLA

Approval Letter”). However, we cannot assure you that (i) the PLA Resource

Office or its higher authority will not revoke their approval by issuing another

letter; (ii) whether the PLA Resource Office has the authority to grant an

“exclusive” right to Tai Ji to use the 3.5GHz radio frequency resources; (iii)

whether the 3.5GHz radio frequency resources authorized by the PLA Approval

Letter can be widely used for commercial purpose. If the PLA Approval Letter is

revoked, the Company may be forced to purchase T1 ADSL bandwidth from the

incumbent telecom carriers, which will increase our operational cost and

materially and adversely impact our business operations and financial

conditions.

Notwithstanding

the Cooperation Agreement (see further below the discussion of “VIE” at Page 44)

among Tai Ji, SZ Alar and Shanghai MoqiZone and the fact that there are

common members among the management teams of the Company and Tai Ji, we cannot

assure you that (i) the cooperation relationship between Shanghai MoqiZone and

Tai Ji will be maintained, and (ii) the Cooperation Agreement will be fully

performed. In the event that Tai Ji breaches the Cooperation

Agreement, or we cannot get a renewal of the cooperation relationship

after it expires, we will not be able to use the 3.5GHz radio

frequency resources, which could cause significant disruptions to our

business operations or may materially adversely affect our business,

financial condition and results of operations.

Significant

changes in policies or guidelines of the PLA may result in lower revenue or

additional costs for us and materially adversely affect our financial condition

or results of operations.

It is

possible that the PLA will from time to time issue policies or guidelines,

requesting or stating its preference for certain actions to be taken by Tai Ji

using its networks, including changing the usable frequency from 3400-3430 MHz

and 3500-3530 MHz to other range. Due to our reliance on the PLA as low-cost

network resources provider, a significant change in its policies or guidelines

may have a material effect on us. Such change in policies or guidelines may

result in lower revenues or additional operating costs for us, and we cannot

assure you that our financial condition and results of operation will not be

materially adversely affected by any policy or guideline change by the PLA in

the future.

If

the PRC government believes that the agreements that establish the structure for

operating our business do not comply with PRC government restrictions on foreign

investment in the value-added telecommunications industry, we could be subject

to severe penalties.

In

December 2001, in order to comply with China’s commitments with respect to its

entry into the World Trade Organization, or WTO, the State Council promulgated

the Administrative Rules for Foreign Investments in Telecommunications

Enterprises, or the Telecom FIE Rules. The Telecom FIE Rules set forth detailed

requirements with respect to capitalization, investor qualifications and

application procedures in connection with the establishment of a

foreign-invested telecommunications enterprise. Pursuant to the Telecom FIE

Rules, the ultimate ownership interest of a foreign investor in a foreign-funded

telecommunications enterprise that provides value-added telecommunication

services, shall not exceed 50%.

We

(including Shanghai MoqiZone), are considered as foreign persons or

foreign-invested enterprises under PRC laws. As a result, we operate our

wireless value-added services in China through the VIE, which is owned by PRC

citizens. We do not have any direct equity interest in the operating company but

instead, the Company will only share its economic benefits derived through

contractual arrangements, including agreements on provision of services, license

of intellectual property, and certain corporate governance and shareholder

rights matters. The VIE conducts portion of our operations and generates portion

of our revenues. It also holds the licenses (including the Content Provider

License) and approvals that are essential to our business.

There are

substantial uncertainties regarding the interpretation and application of

current or future PRC laws and regulations, including but not limited to the

laws and regulations governing the validity and enforcement of our contractual

arrangements. Accordingly, we cannot assure you that PRC regulatory authorities

will not determine that our contractual arrangements with the VIE violate PRC

laws or regulations.

If we or

our operating company were found to violate any existing or future PRC laws or

regulations, the relevant regulatory authorities would have broad discretion in

dealing with such violation, including, without limitation, the

following:

|

|

(a)

|

levying

fines;

|

|

|

(b)

|

confiscating our or our operating

company’s income;

|

|

|

(c)

|

revoking our or our operating

company’s business licenses and other operating

licenses;

|

|

|

(d)

|

shutting down the servers or

blocking our or our operating company’s web

sites;

|

8

|

(e)

|

restricting or prohibiting our

use of the proceeds from this offering to finance our business and

operations in China;

|

|

(f)

|

requiring us to restructure our

ownership structure or operations;

and/or

|

|

(g)

|

requiring us or our operating

company to discontinue our wireless value-added services

business.

|

Any of

these or similar actions could cause significant disruptions to our business

operations or render us unable to conduct our business operations and may

materially adversely affect our business, financial condition and results of

operations.

Our

contractual arrangement with the VIE and their shareholders may not be as

effective in providing operational control as direct ownership of these

businesses and may be difficult to enforce. We were not able to establish

operations control of SZ Mellow under prior agreements.

PRC laws

and regulations currently restrict foreign ownership of companies that provide

value-added telecommunication services, which include wireless value-added

services and Internet content services. As a result, we conduct a portion of our

operations and could generate revenues through the VIE pursuant to a series of

contractual arrangements with it and its respective shareholders. These

agreements may not be as effective in providing control over our operations as

direct ownership of these businesses. Direct ownership would allow us, for

example, to directly exercise our rights as a shareholder to effect changes in

the board of the VIE, which, in turn, could affect changes, subject to any

applicable fiduciary obligations, at the management level. However, under

the current contractual arrangements, as a legal matter, if the VIE or its

shareholders fail to perform their respective obligations under these

contractual arrangements, we may have to incur substantial costs and expend

significant resources to enforce those arrangements, and rely on legal remedies

under PRC law. These remedies may include seeking specific performance or

injunctive relief, and claiming damages, any of which may not be effective. For

example, if the VIE’s shareholders refuse to transfer their equity interest in

the VIE to us or our designee when we exercise the purchase option pursuant to

these contractual arrangements, or if any of those individuals otherwise act in

bad faith towards us, we may have to take legal action to compel them to fulfill

their contractual obligations. This was the case with regard to the

shareholders of SZ Mellow. When these persons refused to cooperate with

our management with regard to the use and operation of SZ Mellow’s

ISP license, we were forced to hire PRC litigation counsel to terminate the

agreements with SZ Mellow. Additionally, we were forced to seek out a new

VIE company in order to continue to operate our business as planned.

Although we were able to enter into new agreements with SZ Alar and, as a

result, our dispute with the owners of SZ Mellow did not materially disrupt our

business, we cannot guarantee that we will not have similar problems with SZ

Alar in the future or that we will be able to prevent further disruption to our

business and operations as a result.

Additionally,

all of these contractual arrangements are governed by PRC laws and provide for

the resolution of disputes through arbitration in the PRC. Accordingly, these

contracts would be interpreted in accordance with PRC laws and any disputes

would be resolved in accordance with PRC legal procedures. The legal environment

in the PRC is not as developed as in other jurisdictions, such as the United

States. As a result, uncertainties in the PRC legal system could limit our

ability to enforce these contractual arrangements. In the event we are unable to

enforce these contractual arrangements, which relate to critical aspects of our

operations, we may be unable to exert effective control over the VIE

and our ability to conduct our business may be negatively

affected.

If we are unable to get additional

online games that are attractive to players and result in overall revenue

growth, our business, financial condition and results of operations may be

materia lly and

adversely affected and our ability to recover related costs may become

limited .

In order

to maintain our long-term profitability and financial and operational success,

we must continually get new online games that are attractive to players. To

date, we have signed up 4 online game companies with approximately 30 games.

These games may or may not attract players away from other games companies and

may or may not be profitable or popular among the online game players in China.

If these games fail to attract new players and fail to drive our online game

revenues, our business, financial condition and results of operations may be

materially and adversely affected.

Our

ability to purchase or license successful online games will depend on their

availability at acceptable terms, including price, our ability to compete

effectively against other potential purchasers or licensees to attract the

developers of these games, and our ability to obtain government approvals

required for the purchase or licensing and operation of these

games.

The games

that we purchase or license may not be attractive to players, may be viewed by

the regulatory authorities as not complying with content restrictions, may not

be launched as scheduled or may not compete effectively with our competitors’

games. Additionally, new technologies in our competitors’ online game

programming or operations could render our games obsolete or unattractive to

players, thereby limiting our ability to recover related product development

costs, purchase costs and licensing fees. If we are not able to develop,

purchase or license successfully online games appealing to players, our future

profitability and growth prospects will decline.

9

Our operating results may be impacted

materially by the valuation of our warrants.

The

warrants that each investor received as a result of our June 1 and August 11

Financings and the conversion of the convertible notes contained a down round

protection that allows the price of the Warrants to be reduced in the event the

Company issues any additional shares of common stock at a price per share less

than the then-applicable warrant price. As such and in accordance with the

accounting guidelines, we valued the warrants as a derivative financial

instrument and the corresponding liabilities were entered onto our consolidated

balance sheet, measured at fair value (at issuance date) and re-measured at fair

value (at each reporting period) with changes in fair value recorded in earnings

at each reporting period. The Company used a Black-Scholes option

pricing model, which uses the underlying price of our common stock as one of the

inputs, to determine the fair value at issuance date and each subsequent

reporting period. As a result, the fair value of the warrants is

impacted by changes in the market price of our common stock. The

market price of our Common Stock can be volatile and is subject to factors

beyond our control. These factors include, but are not limited to,

changes in financial estimates by industry and securities analysts, conditions

or trends in the industry in which we operate, the market of OTC Bulletin Board

quoted stocks in general and/or sales of our common stock. As a

result, the value of our common stock may change from measurement date to

measurement date thereby resulting in fluctuations in the fair value of the

warrants that can materially impact our operating

results.

Our

limited operating history and the unproven long-term potential of our business

model make evaluating our business and prospects difficult.

We were

incorporated in August 29, 2007. As our operating history is limited, the

revenue and income potential of our business and markets are yet to be fully

proven. In addition, we are exposed to risks, uncertainties, expenses and

difficulties frequently encountered by companies at an early stage of

development. Some of these risks and uncertainties relate to our ability

to:

|

|

a.

|

maintain our current, and

develop new, cooperation

arrangements;

|

|

|

b.

|

increase the number of our

users by expanding the type, scope and technical sophistication of the

content and services we

offer;

|

|

|

c.

|

respond effectively to

competitive pressures;

|

|

|

d.

|

respond in a timely manner to

technological changes or resolve unexpected network

interruptions;

|

|

|

e.

|

comply with changes to

regulatory requirements;

|

|

|

f.

|

maintain adequate control of

our costs and expenses;

|

|

|

g.

|

increase awareness of our

brand and continue to build user loyalty;

and

|

|

|

h.

|

attract and retain qualified

management and

employees.

|

We cannot

predict whether we will meet internal or external expectations of our future

performance. If we are not successful in addressing these risks and

uncertainties, our business, financial condition and results of operations may

be materially adversely affected.

Our

success depends on attracting and retaining qualified personnel.

We depend

on a core management and key executives. In particular, we rely on the

expertise and experience of our founders and senior officers, in our business

operations, and their personal relationships with our other significant

shareholders, employees, the regulatory authorities, our clients, our suppliers

and the PLA. If any of them, become unable or unwilling to continue in their

present positions, or if they join a competitor or form a competing company in

contravention of their employment agreements, we may not be able to identify a

replacement easily, our business may be significantly disrupted and our

financial condition and results of operations may be materially adversely

affected. We do not currently maintain key-man life insurance for any of our key

personnel.

We

may not be able to continue as a going concern because it’s not clear that they

will be able to indefinitely raise enough resources to stay

operational

Our

accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. We have sustained a loss since inception of

approximately US$4,947,000 and, as of June 30, 2010, have only generated a

nominal amount of revenue from Netcafe Farmer software license fee. In addition,

the Company had cash or cash equivalents of approximately US$901,000 as of June

30, 2010. On March 29, 2010, we completed a private equity financing of

$1,956,200, with 7 accredited investors. Net proceeds from the offering, are

approximately $1,760,400. Although we expect that the net proceeds of the

private placement described above, together with our available funds and funds

generated from our operations will be sufficient to meet our anticipated needs

for 12 months, we will need to obtain additional capital to continue to grow our

business. We currently estimate that we will need an additional $12,000,000 in

order to completely deploy our online game delivery platform in our targeted

cities by 2013. Our cash requirements may vary materially from those currently

anticipated due to changes in our operations, including our marketing and

distribution activities, product development, and expansion of our personnel and

the timing of our receipt of revenues. Our ability to obtain additional

financing in the future will depend in part upon the prevailing capital market

conditions, as well as our business performance. There can be no assurance that

we will be successful in our efforts to arrange additional financing on terms

satisfactory to us or at all.If we do not receive additional financing, we may

have to restrict or discontinue our business. Our success is dependent on future

financings. These factors, among others, raise substantial doubt about our

ability to continue as a going concern. In addition, our independent auditors,

Paritz & Company, P.A., have expressed substantial doubt concerning our

ability to continue as a going concern. As of June 30, 2010, we had a

stockholders’ deficiency of approximately $2,552,000. We will continue incurring

additional expenses as we implement our growth in the fiscal year of 2010, which

will reduce our net income in 2010. If we are not able to achieve profit or

continue to raise capital from additional financings to fund our operation, then

we likely will be forced to cease operations and investors will likely lose

their entire investment.

10

We

may not be able to continue to operate our business if we are unable to attract

additional operating capital.

On

March 29, 2010, we completed a private equity financing whereby the net proceeds

were approximately $1,760,400.00. In addition to this financing, we estimate

that we will need at least $1.5 million of general working capital to

fund our basic operations until October 2011. Based on our current

business development plans and in addition to our general working capital needs,

we estimate that we will need approximately US$2 million of additional financing

to fund our WiMAX deployment to the point where our cash flow from operating

activities will be positive, a further US$1 million to aggregate and license

contents and $1 million to develop the Viva Red mobile game platform. These

factors, among others, raise substantial doubt about our ability to continue as

a going concern. The accompanying financial statements do not include any

adjustments that might result from the outcome of this uncertainty. Although we

expect that the net proceeds of the private placement together with

approximately $5.5 million of additional funding as described above will be

sufficient to fund our working capital needs, develop Viva Red and allow

deployment of WiMAX until it becomes cash flow positive, we will need to obtain

additional capital to execute our overall business. We currently estimate that

we will need an additional US$10 million in order to completely deploy our

online game delivery platform in all targeted cities by 2014. Our cash

requirements may vary materially from those currently anticipated due to changes

in our operations, including our marketing and distribution activities, product

development, and expansion of our personnel and the timing of our receipt of

revenues.

Although

we expect that the net proceeds of the private placement together with $3

million of additional funding as described above will be sufficient to fund our

WiMAX deployment until it becomes cash flow positive, we will need to obtain

additional capital to execute overall business. We currently estimate that we

will need an additional $9,000,000 in order to completely deploy our online game

delivery platform in all targeted cities by 2013. Our cash requirements may vary

materially from those currently anticipated due to changes in our operations,

including our marketing and distribution activities, product development, and

expansion of our personnel and the timing of our receipt of revenues. Our

ability to obtain additional financing in the future will depend in part upon

the prevailing capital market conditions, as well as our business performance.

There can be no assurance that we will be successful in our efforts to arrange

additional financing on terms satisfactory to us or at all Accordingly, our

business and operations are substantially dependent on our ability to raise

additional capital to: (i) supply working capital for the expansion of sales and

the costs of marketing of new and existing products; and (ii) fund ongoing

selling, general and administrative expenses of our business. If we do not

receive additional financing prior to December 2010, we may have to restrict or

discontinue our business. Our success is dependent on future

financings.

Accordingly,

our current level of our revenues is not sufficient to finance all of our

operations on a long-term basis. We continue to attempt to raise additional debt

or equity financing as our operations do not produce sufficient cash to offset

the cash drain of our general operating and administrative expenses.

Accordingly, our business and operations are substantially dependent on our

ability to raise additional capital to: (i) supply working capital for the

expansion of sales and the costs of marketing of new and existing products; and

(ii) fund ongoing selling, general and administrative expenses of our business.

Our ability to obtain additional financing in the future will depend in part

upon the prevailing capital market conditions, as well as our business

performance. There can be no assurance that we will be successful in our efforts

to arrange additional financing on terms satisfactory to us or at all. If we do

not receive additional financing prior to December 2010, we may have to restrict

or discontinue our business, including reducing the name of target internet

cafes, eliminating some proposed online gaming software and /or reducing

staffing. Our success is dependent on future financings.

We

may not be able to adequately protect our intellectual property, and we may be

exposed to infringement claims by third parties.

We

believe the copyrights, service marks, trademarks, trade secrets and other

intellectual property we use are important to our business, and any unauthorized

use of such intellectual property by third parties may adversely affect our

business and reputation. We rely on the intellectual property laws and

contractual arrangements with our employees, clients, business partners and

others to protect such intellectual property rights. Third parties may be able

to obtain and use such intellectual property without authorization. Furthermore,

the validity, enforceability and scope of protection of intellectual property in

the Internet and wireless value-added related industries in China is uncertain

and still evolving, and these laws may not protect intellectual property

rights to the same extent as the laws of some other jurisdictions, such as the

United States. Moreover, litigation may be necessary in the future to enforce

our intellectual property rights, which could result in substantial costs

and diversion of our resources, and have a material adverse effect on our

business, financial condition and results of operations.

The

laws and regulations governing the value-added telecommunications and Internet

industry in China are developing and subject to future changes. Substantial

uncertainties exist as to the interpretation and implementation of those laws

and regulations.

Our

digital entertainment services are subject to general regulation regarding

telecommunication services. In recent years, the PRC government has begun to

promulgate laws and regulations applicable to Internet-related services and

activities, many of which are relatively new and untested and subject to future

changes. In addition, various regulatory authorities of the central PRC

government, such as the State Council, the MIIT (formerly known as the

Ministry of Information Industry, or MII), the State Administration of Industry

and Commerce, or SAIC, and the Ministry of Public Security, are empowered to

issue and implement rules to regulate certain aspects of Internet-related

services and activities. Furthermore, some local governments have also

promulgated local rules applicable to Internet companies operating within their

respective jurisdictions. As the Internet industry itself is at an early stage

of development in China, there will likely be new laws and regulations

promulgated in the future to address issues that may arise from time to time. As

a result, uncertainties exist regarding the interpretation

and implementation of current and future PRC Internet laws and

regulations.

The VIE

has obtained various value-added telecommunication service licenses from the

MIIT or its local branches, and Tai Ji has obtained PLA Authorization, for the

provisions of their services in relation to the usage of 3.5GHz. Tai Ji will

apply for licenses for each and all WiMAX base stations when they are built up.

These licenses will be held by Tai Ji and Tai Ji will license these stations to

the VIE. We cannot assure you that we will be able to obtain or maintain

these licenses or that the regulatory authorities will not take any action

against us if we fail to obtain or maintain them. If the VIE and/or Tai Ji fails

to obtain or maintain any of the required licenses or permits respectively, it

may be subject to various penalties, including redressing the

violations, confiscation of income, imposition of fines or even suspension

of its operations. Any of these measures could materially disrupt our operations

and materially and adversely affect our financial condition and results of

operations.

The

MIIT issued regulations that regulate and limit ownership and investment in

internet and other value-added telecommunications businesses in the PRC which

may limit the type of businesses we will be able to acquire.

On July

13, 2006, the MII issued a notice with the purpose of increasing the regulation

of foreign investment in and operations of value added telecom services which

include internet and telecommunication businesses in the PRC. The regulations

require Chinese entities to own and control the following: (i)

internet domain names, (ii) registered trademarks, and (iii) servers and

other infrastructure equipment used to host and operate web-sites and conduct

businesses. The ownership requirements functionally limit foreign direct

and indirect ownership and control of the intellectual property of these

businesses even when attempted through various parallel control, licensing, use

and management agreements. It is anticipated that these regulations will be

strictly enforced, and the government has provided that the new regulations

apply retroactively and provide for audit procedures. The failure to comply may

cause the MIIT to terminate a telecommunication license or otherwise modify

existing agreements or require the disposition of the assets by the foreign

entity. Any anticipated foreign investment in such businesses will be subject to

prior approval by the MIIT, and it is expected that approval for investment may

not be easily obtained for foreign investment in these businesses unless in

strict compliance. Therefore, investment by us in this sector may not be

actively pursued because certain assets may not be acquirable and accounting

consolidation may be restricted or not permitted as a result of an unfavorable

but permitted transaction structure.

11

The

PRC government may prevent us from distributing, and we may be subject to

liability for content that any of them believes is inappropriate.

China has

promulgated regulations governing telecommunication service providers, Internet

access and the distribution of online games and other information. In the past,

the PRC government has stopped the distribution of information over the Internet

that it believes to violate Chinese law, including content that is obscene,

incites violence, endangers national security, is contrary to the national

interest or is defamatory.

The

growth of our business may be adversely affected due to public concerns over the

security and privacy of confidential user information.

The

growth of our business may be inhibited if the public concern over the security

and privacy of confidential user information transmitted over the Internet and

wireless networks is not adequately addressed. Our service quality may

decline and our business may be adversely affected if significant breaches of

network security or user privacy occur.

We

could be liable for breaches of security of our website and third-party online

payment system, which may have a material adverse effect on our reputation and

business.

Secure

transmission of confidential information, such as customers’ debit and credit

card numbers and expiration dates, personal information and billing addresses,

over public networks, including our official game website, is essential for

maintaining consumer confidence. We currently provide password protection, IP

address verification and hardware verification for all of player accounts. While

we have not experienced any breach of our security measures to date, such

current security measures may be inadequate. In addition, we expect that an

increasing number of our sales will be conducted over the Internet as result of

the growing use of online payment systems. We also expect that associated online

crime will likely increase accordingly. We must therefore be prepared to

increase our security measures and efforts so that our customers have confidence

in the reliability of the online payment system that we use. We do not have

control over the security measures of our third-party online payment operator,

and its security measures may not be adequate at present or may not be

adequate with the expected increased usage of online payment systems. We could

be exposed to litigation and possible liability if we fail to secure

confidential customer information, which could harm our reputation, ability to

attract customers and ability to encourage players to purchase our game

points.

Unexpected

network interruptions, security breaches or computer virus attacks could have a

material adverse effect on our business, financial condition and results of

operations.

Any

failure to maintain the satisfactory performance, reliability, security and

availability of our network infrastructure may cause significant harm to our

reputation and our ability to attract and maintain players. All our game servers

and all of the servers which handle log-in, billing and data back-up matters are

hosted and maintained by third party service providers. Major risks involved in

such network infrastructure include any break-downs or system failures resulting

in a sustained shutdown of all or a material portion of our servers,

including failures which may be attributable to sustained power shutdowns, or

efforts to gain unauthorized access to our systems causing loss or corruption of

data or malfunctions of software or hardware.

Our

network systems are also vulnerable to damage from fire, flood, power loss,

telecommunications failures, computer viruses, hacking and similar events. Any

network interruption, virus or other inadequacy that causes interruptions in the

availability of the online games or deterioration in the quality of access

to the online games could reduce our players’ satisfaction and ultimately harm

our business, financial condition and results of operations. In addition, any

security breach caused by hackings, which involve efforts to gain unauthorized

access to information or systems, or to cause intentional malfunctions or loss

or corruption of data, software, hardware or other computer equipment, and the

inadvertent transmission of computer viruses could have a material adverse

effect on our business, financial condition and results of operations. We do not

maintain insurance policies covering losses relating to our network systems and

we do not have business interruption insurance.

Future

acquisitions may have an adverse effect on our ability to manage our

business.

Selective

acquisitions form part of our strategy to expand our business. We do not,

however, have any prior experience integrating any new companies into ours, and

we believe that integration of a new company’s operation and personnel will

require significant management attention. The diversion of our management’s

attention from our business and any difficulties encountered in the integration

process could have an adverse effect on our ability to manage our

business.

We may

pursue acquisitions of companies, technologies and personnel that are

complementary to our existing business. However, our ability to grow through

future acquisitions or investments or hiring will depend on the availability of

suitable acquisition and investment candidates at an acceptable cost, our

ability to compete effectively to attract these candidates, and the availability

of financing to complete larger acquisitions. We may face significant

competition in executing our growth strategy. Future acquisitions

or investments could result in potential dilutive issuances of equity

securities or incurrence of debt, contingent liabilities or impairment of

goodwill and other intangible assets, any of which could adversely affect our

financial condition and results of operations. The benefits of an acquisition or

investment may also take considerable time to develop and any particular

acquisition or investment may not produce the intended benefits.

12

Future

acquisitions would also expose us to potential risks, including risks associated

with the assimilation of new operations, technologies and personnel, unforeseen

or hidden liabilities, the diversion of resources from our existing businesses,

sites and technologies, the inability to generate sufficient revenue to offset

the costs and expenses of acquisitions, and potential loss of, or harm to, our

relationships with employees, customers, licensors and other suppliers as a

result of the integration of new businesses.

We

may be subject to infringement and misappropriation claims in the future, which

may cause us to incur significant expenses, pay substantial damages and be

prevented from providing our services or technologies.

Our