Attached files

| file | filename |

|---|---|

| EX-5 - China Electronics Holdings, Inc. | v199084_ex5.htm |

| EX-4.4 - China Electronics Holdings, Inc. | v199084_ex4-4.htm |

| EX-23.2 - China Electronics Holdings, Inc. | v199084_ex23-2.htm |

| EX-23.1 - China Electronics Holdings, Inc. | v199084_ex23-1.htm |

As

filed with the Securities and Exchange Commission on October 15,

2010

Registration

No. 333-

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

CHINA

ELECTRONICS HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

0273

|

98-0550385

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Building

3, Binhe District, Longhe East Road, Lu’an City, Anhui Province, PRC

237000

011-86-564-3224888

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Vcorp

Services, LLC

20

Robert Pitt Drive, Suite 214

Monsey,

New York 10952

(845)425-0077

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

Copies

to:

Darren

Ofsink, Esq.

Guzov

Ofsink, LLC

600

Madison Avenue 14th Floor

New

York, New York 10022

(212)

371-8008

Approximate

date of commencement of proposed sale to public: as soon as practicable after

this Registration Statement is declared effective.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o __________

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o_________

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier registration statement for the same

offering. o __________

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated

filer

|

¨

|

Accelerated

filer

|

¨

|

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

|

(Do

not check if a smaller reporting company)

|

CALCULATION

OF REGISTRATION FEE

|

Title of each class of

securities to be

registered

|

Amount to be

registered (1)

|

Proposed maximum

offering price per

unit

|

Proposed

maximum

aggregate offering

price

|

Amount of

registration fee

(2)

|

||||||||||||

|

Common

Stock, par value $.0001 per share

|

2,767,246 | $ | 3.80 | (3) | $ | 10,515,535 | $ | 750 | ||||||||

|

Common

Stock, par value $.0001 per share, underlying Series A

Warrants

|

314,286 | (4) | $ | 2.19 | $ | 688,286 | $ | 49 | ||||||||

|

Common

Stock, par value $.0001 per share, underlying Series B

Warrants

|

314,286 | (5) | $ | 2.63 | $ | 826,572 | $ | 59 | ||||||||

|

Common

Stock, par value $.0001 per share, underlying Series C

Warrants

|

497,303 | (6) | $ | 3.70 | $ | 1,840,021 | $ | 131 | ||||||||

|

Common

Stock, par value $.0001 per share, underlying Series D

Warrants

|

497,303 | (7) | $ | 4.75 | $ | 2,362,189 | $ | 168 | ||||||||

|

Common

Stock, par value $.0001 per share, underlying Series E

Warrants

|

1,000,000 | (8) | $ | 0.25 | $ | 250,000 | $ | 18 | ||||||||

|

Total

|

$ | 1,175 | ||||||||||||||

|

(1)

|

Pursuant to Rule 416 promulgated

under the Securities Act of 1933, as amended, there are also registered

hereunder such indeterminate number of additional shares as may be issued

to the selling stockholders to prevent dilution resulting from stock

splits, stock dividends or similar

transactions.

|

|

(2)

|

The registration fee is

calculated pursuant to Rule

457(g).

|

|

(3)

|

The

registration fee is calculated pursuant to Rule 457(c). As of the date of

this prospectus, our Common Stock is quoted under the symbol "CEHD.OB" on

the Over-the-Counter Bulletin Board (“OTCBB”). The last reported sale

price of our Common Stock as of October 14, 2010 was

$3.80.

|

|

(4)

|

Consists of shares of Common

Stock underlying three year Series A warrants to purchase an aggregate of

314,286 shares of Common Stock with an

exercise price of $2.19 per

share.

|

|

(5)

|

Consists of shares of Common

Stock underlying three year Series B warrants to purchase an aggregate of

314,286 shares of Common Stock with an

exercise price of $2.63 per

share.

|

|

(6)

|

Consists

of shares of Common Stock underlying three year Series C warrants to

purchase an aggregate of 497,303 shares of Common Stock with an exercise

price of $3.70 per share.

|

|

(7)

|

Consists

of shares of Common Stock underlying three year Series D warrants to

purchase an aggregate of 497,303 shares of Common Stock with an exercise

price of $4.75 per share.

|

|

(8)

|

Consists

of shares of Common Stock underlying five year Series E warrants to

purchase an aggregate of 1,000,000 shares of Common Stock with an exercise

price of $0.25 per share.

|

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to Section 8(a), may

determine.

5,390,424

Shares of Common Stock

CHINA

ELECTRONICS HOLDINGS, INC.

Common

Stock

PROSPECTUS

__________,

2010

The

information in this prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell

these securities and it is not soliciting offers to buy these securities in any

state where the offer is not permitted.

SUBJECT

TO COMPLETION, DATED OCTOBER 15,

2010

PRELIMINARY

PROSPECTUS

5,390,424

Shares

China

Electronics Holdings, Inc.

Common

Stock

This

prospectus relates to the resale by the Selling Stockholders of up to 5,390,424

shares of our Common Stock, $.0001 par value (“Common Stock”), including an

aggregate of 778,035 shares issued to 5 Selling

Stockholders pursuant to or in connection with a Share Exchange Agreement dated

as of July 9, 2010 (the “Share Exchange Agreement”), an aggregate of

1,628,572 shares of common stock issuable to 5 Selling Stockholders upon

exercise of warrants to purchase our Common Stock issued pursuant to the Share

Exchange Agreement, an aggregate of 1,989,211 shares of our Common

Stock issued to 105 Selling Stockholders issued in a

series of private placements (the “Private Placements”) pursuant to a

Subscription Agreement dated as of July 9, 2010 (the “Purchase Agreement”) and

an aggregate of 994,606 shares of common stock issuable to

105 Selling Stockholders upon exercise of warrants to purchase our

Common Stock issued in the Private Placements.

All of

such shares may be sold by the Selling Stockholders. It is anticipated that the

Selling Stockholders will sell these shares of Common Stock from time to time in

one or more transactions, in negotiated transactions or otherwise, at prevailing

market prices or at prices otherwise negotiated (see “Plan of Distribution”). We

will not receive any proceeds from the sales by the Selling

Stockholders. Under the terms of the warrants, cashless exercise is

permitted in certain circumstances. We will not receive any proceeds from any

cashless exercise of the warrants, but would receive the exercise price of

warrants exercised on a cash basis. We will pay all of the registration expenses

incurred in connection with this offering, but the Selling Stockholders will pay

any selling commissions, brokerage fees and related expenses.

There is

a limited market in our Common Stock. The shares are being offered by the

Selling Stockholders in anticipation of the continued development of a secondary

trading market in our Common Stock. We cannot give you any assurance that an

active trading market in our Common Stock will develop, or if an active market

does develop, that it will continue.

Our

Common Stock is listed on the OTC Bulletin Board and trades under the symbol

CEHD.OB. On October 14, 2010, the closing sale price of our Common

Stock was $3.80 per share.

Investing

in our Common Stock involves risks. See “Risk Factors”.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal

offense.

The date

of this prospectus is ______, 2010

TABLE OF

CONTENTS

|

Page

|

|

|

Prospectus Summary

|

1

|

|

Risk Factors

|

6

|

|

Special

Note Regarding Forward-Looking Statements

|

16

|

|

Use

of Proceeds

|

17

|

|

Market

for Common Equity and Related Stockholder Matters

|

17

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

18

|

|

Organizational

History of the Company and its Subsidiaries

|

23

|

|

Business

|

26

|

|

Description

of Property

|

31

|

|

Directors,

Executive Officers, Promoters and Control Persons

|

32

|

|

Transactions

With Related Persons, Promoters and Control Persons; Corporate

Governance

|

33

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

34

|

|

Selling

Stockholders

|

35

|

|

Description

of Securities

|

46

|

|

Shares Eligible for

Future Sale

|

49

|

|

Material

United States Federal Income Tax Considerations

|

50

|

|

Material

PRC Income Tax Considerations

|

54

|

|

Plan

of Distribution

|

56

|

|

Legal

Matters

|

58

|

|

Experts

|

58

|

|

Changes

in and Disagreements With Accountants

|

58

|

|

Where

You Can Find More Information

|

58

|

|

Index

to Consolidated Financial Statements

|

F-1

|

ABOUT

THIS PROSPECTUS

You should rely only on the information

contained in this prospectus and any free writing prospectus prepared by or on

behalf of us or to which we have referred you. We and the underwriter have not

authorized anyone to provide you with information that is different. This

document may only be used where it is legal to offer or sell these securities.

This prospectus does not constitute an offer to sell or the solicitation of an

offer to buy these securities in any jurisdiction in which such offer or

solicitation may not be legally made. If any other information or

representation is given or made, such information or representation may not be

relied upon as having been authorized by us or the underwriter, and neither we

nor the underwriter accepts any liability in relation thereto.

We obtained statistical data, market

data and other industry data and forecasts used throughout, or incorporated by

reference in, this prospectus from market research, publicly available

information and industry publications. Industry publications generally state

that they obtain their information from sources that they believe to be

reliable, but they do not guarantee the accuracy and completeness of the

information. Similarly, while we believe that the statistical data, industry

data and forecasts and market research are reliable, we have not independently

verified the data, and we do not make any representation as to the accuracy of

the information. We have not sought the consent of the sources to refer to their

reports appearing or incorporated by reference in this

prospectus.

PROSPECTUS

SUMMARY

This summary highlights information

contained elsewhere in this prospectus. This summary does not contain

all of the information you should consider before investing in our common stock.

You should read this entire prospectus carefully, especially the “Risk Factors”

section and our consolidated financial statements and the related notes

appearing at the end of this prospectus, before making an investment

decision. Unless the context otherwise requires, the "Company", "we,"

"us," and "our," refer to (i) China Electronics Holdings, Inc., a Nevada

corporation (“China Electronics”), (ii) China Electronic Holdings, Inc., a

Delaware corporation (“CEH Delaware”), and (iii) Lu’an Guoying Electronic Sales

Co., Ltd. , a wholly foreign enterprise (“WOFE”), under the laws of the People’s

Republic of China (“Guoying”).

Our

Business

Through our subsidiary, CEH Delaware,

we are engaged in the retail sale of consumer electronics and appliances in the

People’s Republic of China (the “PRC”), such as solar heaters, refrigerators,

air conditioners, televisions, and etc. We are targeting the rural market in

Anhui Province.

We started sales of home appliances and

electronics in 2001. During the fiscal year ended December 31, 2009 (“fiscal

2009”), approximately 66% of our revenues were from the sale of solar water

heaters, approximately 10.5% of our revenues were from the sale of

refrigerators and approximately 6.5% of our revenues were generated

from the sale of televisions. Approximately 69% of our net income for fiscal

2009 was from the sale of solar water heaters, approximately 12.7% of our 2009

net income was from the sale of refrigerators and approximately 8.0% of our 2009

net income was profit from sales of televisions.

We operate 3 company owned stores, all

of which are located in Lu’an City, Anhui Province. As of October 12, 2010, we

also operate 458 exclusive franchise stores and 600 non-exclusive franchise

stores, which are located in the rural areas around Lu’an. Approximately 3.3% of

our revenues for fiscal 2009 were from the company owned stores, approximately

88.9% of our 2009 revenues were from the exclusive franchise stores and

approximately 7.8% of our 2009 revenues were generated from the non-exclusive

franchise stores.

We purchase the consumer electronics

and appliances we sell directly from the manufacturers thereof or large

distributors. Currently, 30% of the products are supplied to us by large

distributors, mainly under the brand names Samsung and LG. Guoying is

the exclusive wholesaler in the Lu’an area for products under the brand names,

Sony, LG, Samsung, Shanghai Shangling, Chigo, Huayang and

Huangming. Guoying is the general sales agency of Sino-Japan Sanyo

electronic products, such as Sanyo TVs, air conditioners, washing machines and

micro-wave ovens. Guoying has teamed up with Huangming and Huayang,

the 2 largest manufacturers of solar thermal products in China, to be their

exclusive retail outlet in Lu’an, Anhui. Some of their energy efficient, “green”

products include: solar thermal water heaters, solar panels

(photovoltaic) and energy saving glass.

In addition to purchasing from the

manufacturers or distributors, we have refrigerators manufactured by an OEM

manufacturer under the Company’s own trademark “Guoying”. Guoying refrigerators

have “3C” quality national authentication certificates. During fiscal year 2009,

approximately 2 % of our 2009 revenues and 2.5% of our net income were from the

sale of Guoying brand refrigerators. In August 2007, Guoying entered into a 5

year OEM agreement with Shanghai Pengpai Electronic Co., Ltd. (“Pengpai”), under

which Pengpai will manufacture refrigerators for Guoying to sell under its own

trademark. Guoying sold a total of 30,000 refrigerators in 2007, 46,000 in 2008,

and 62,000 in 2009, and expects to sell 77,000 in 2010 and 100,000 in 2011, in

Anhui, Henan and Hubei provinces in the PRC. On October 2, 2006, Guoying entered

into a loan agreement with Pengpai where Guoying loaned to Pengpai a total of

RMB 80 million (approximately $ 11.76 million) from year 2006 to 2010. In

exchange, Pengpai sells refrigerators to Guoying at a discounted price. Pengpai

is required to repay the loan within 4 years, starting from October 2013. The

loan is secured by all the assets of Pengpai

1

Our

Industry

Approximately 56% of China’s population

still resides in rural areas of China, making rural residents the largest

consumer group in China. After many years of economic reforms, the average

income of people living in China's rural areas has gradually increased. The

rural market is largely untapped and has enormous potential for growth. The

rural consumer group has tremendous purchasing power and is increasing as the

Chinese government encourages rural communities to modernize.

There are several reasons for the

potential development of rural consumer electronics and appliances

market.

First, the central government has

decided to expand internal demand by increasing the income of the rural

population by reducing tax for farmers. The continuous improvements in the rural

power network, rural transportation, and rural communication make the rural

market extremely favorable for home appliances and electronics.

Second, the Chinese government has

initiated a rural home appliance and electronics rebate program, called “Rural

Consumer Electronics” plan. The plan provides that the maximum sales price of

electronics is fixed, at a price which is usually equal to or less than the

market price in urban areas of the same product. Meanwhile, rural consumers can

get a 13% government rebate on their purchases of electronics.

Third, the current consumer electronics

and appliances markets in big PRC cities like Beijing, Shanghai, and Shenzhen

are already saturated by an over abundance of competitors – leading to very lean

margins. Although some competitors have announced interest in the rural market,

none of the current competitors have established any significant presence in the

rural markets. Successful brand names typically established in cities are not an

indicator of automatic success in the rural. A majority of the population from

the rural market has not seen or heard of the retail chains that exist in the

cities.

Additionally,

the rural consumers have different tastes and values in making their purchases.

For example, when it comes to appliances, functionality to cost is the most

important factor in deciding which product to purchase. However, product colors

have a significant impact in decision making. Most rural consumers prefer

certain colors, such as red, over colors like black, silver, and white that are

successful in the city. As a result, much research has to be carried out to

fully understand the outlook of the rural consumer.

Guoying

is the first rural home appliance and electronics retailer in Anhui

Province.

Our

Principal Competitive Strengths

|

·

|

Rural market. We have

hundreds of franchise stores in rural markets, which are markets with high

potential margin, but which markets are ignored by the big retail chain

stores.

|

|

·

|

Flexibility. We are running 24/7

in making deliveries. After receiving an order, we can make delivery as

soon as within 2 hours. Huge state-owned retail stores, such as Guosheng,

usually take 2-3 days to deliver after receipt of

orders.

|

|

·

|

Sales Networking. We have 27

sales persons visiting the franchise stores each week, which serves to

keep a good relationship between Guoying and the

stores.

|

2

Our

Growth Strategies

|

·

|

Developing

Company-owned Stores. We will develop 6-7 company-owned stores in

Lu’an City with at least one store located in each major county of Lu’an

such as Shucheng, Huoshan, Huoqiu and Jinzhai. A 1000-square-meter

shopping mall will be established in Lu’an City in mid

2011.

|

|

·

|

Developing

Direct Sales. We plan to develop direct sales stores with total 600

direct stores in service by the end of 2011, over 20% of which will be

located in Henan and Hubei provinces. The area, delivery, service quality

of stores will be enhanced.

|

|

·

|

Developing

Franchise Stores. We will establish franchise stores in 2011 with

total of 700 franchise stores in service by the end of

2011.

|

|

·

|

Partnering

with well-known electric appliance manufactures. We will negotiate

with well-known brands for sales of products of theses brands. We

currently present and sell washing machines of Samsung and have achieved

successful progress for partnering with Samsung to sell refrigerators, air

conditioners and video-related products of Samsung. We are now in the

negotiating process with other famous electric appliance manufactures for

sales of their products.

|

|

·

|

Merger and

Acquisition. We also consider merger and acquisition opportunities

in 2011.

|

3

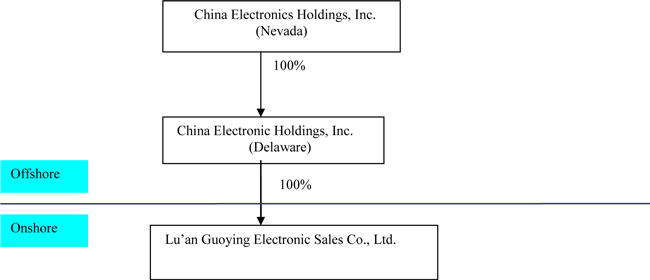

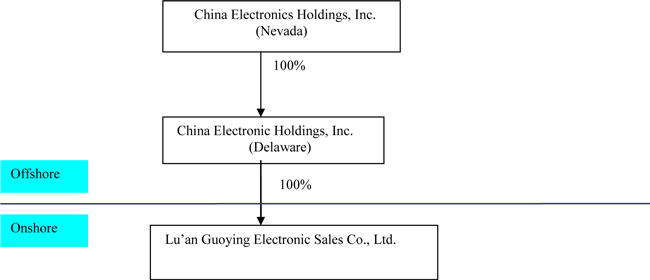

Our

Corporate Structure

Our current structure is

set forth in the diagram below:

Company

Information

Our

principal executive offices are located at Building 3, Binhe District, Longhe

East Road, Lu’an City, Anhui Province, PRC 237000, and our telephone number is

011-86-564-3224888.

THE

OFFERING

On July 15, 2010 we entered into and

consummated the Share Exchange Agreement, dated as of July 9, 2010 with certain

of the Selling Stockholders. Pursuant to the Share Exchange Agreement, on July

15, 2010, 10 former stockholders of our subsidiary, CEH Delaware, transferred to

us 100% of the outstanding shares of common stock and preferred stock and 100%

of the warrants to purchase common stock of CEH Delaware held by them, in

exchange for an aggregate of 13,785,902 newly issued shares of our Common Stock

and warrants to purchase an aggregate of 1,628,572 shares of our Common

Stock.

On July 15, 2010 we also

consummated the first of the Private Placements made pursuant to the Purchase

Agreement with certain of the Selling Stockholders. Additional

Private Placements were consummated on July 26, 2010 and August 17, 2010. In the

Private Placements we issued to Selling Stockholders for an aggregate gross

purchase price of $ 5,251,548 an aggregate of (a) 1,989,211 shares of our Common

Stock, (b) three year warrants (“Series C Warrants”) to purchase an aggregate of

497,303 shares of our Common Stock for $3.70 per share and (c) three year

warrants (“Series D Warrants”) to purchase an aggregate of 497,303 shares of our

Common Stock for $4.75 per share.

4

This prospectus relates to the resale

of the 5,390,424 shares of our Common Stock issued to the Selling Stockholders

and issuable to the Selling Stockholders upon exercise of all of the warrants

referred to in the preceding paragraphs.

|

Issuer

|

China

Electronics Holdings, Inc.

|

|

|

Common

Stock outstanding prior to the Offering

|

16,775,113

shares

|

|

|

Common

Stock offered by the Selling Stockholders

|

5,390,424

shares

|

|

|

Total

shares of Common Stock to be outstanding after the Offering assuming

exercise of all outstanding warrants

|

19,398,291

shares

|

|

|

Use

of Proceeds

|

We

will not receive any proceeds from the sale of the shares of Common

Stock.

|

|

|

Our

OTC Bulletin Board Trading Symbol

|

CEHD.OB

|

|

|

Risk

Factors

|

You

should read the “Risk Factors” section of this prospectus for a discussion

of factors to consider carefully before deciding to invest in shares of

our Common

Stock.

|

The

number of shares of our Common Stock to be outstanding after this offering is

based on 16,775,113 shares of our Common Stock outstanding as of

October 12, 2010, and gives effect to the issuance of an aggregate of

2,623,178 shares of Common Stock to the Selling Stockholders upon exercise of

warrants to purchase our Common Stock held by them.

SUMMARY

CONSOLIDATED FINANCIAL DATA

The

following tables summarize our consolidated financial data for the periods

presented. You should read these tables together with the consolidated financial

statements and related notes appearing at the end of this prospectus, as well as

“Capitalization,” “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and the other financial information included

elsewhere in this prospectus. We have derived the consolidated statement of

operations data for the six months ended June 30, 2010 and 2009 from our

unaudited consolidated financial statements included in this

prospectus. Our historical results are not necessarily indicative of

the results to be expected in any future period.

5

|

|

Six months

ended June 30, 2010

|

Six months

ended June 30, 2009

|

||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Net

Revenue

|

$ | 55,785,305 | $ | 11,565,688 | ||||

|

Cost

of goods sold

|

45,598,608 | 9,784,586 | ||||||

|

Gross

profit

|

10,186,697 | 1,781,102 | ||||||

|

Operating

expenses:

|

||||||||

|

Selling

expenses

|

793,606 | 25,075 | ||||||

|

General

and administrative expenses

|

44,672 | 31,413 | ||||||

|

Total

operating expenses

|

838,278 | 56,489 | ||||||

|

Net

Operating income

|

9,348,419 | 1,724,613 | ||||||

|

Other

income (expenses):

|

||||||||

|

Financial

income (expense)

|

(1,176 | ) | 576 | |||||

|

Total

other income (expense)

|

(1,176 | ) | 576 | |||||

|

Net

income before income taxes

|

9,347,243 | 1,725,189 | ||||||

|

Income

taxes

|

952 | 1,323 | ||||||

|

Net

income

|

$ | 9,346,292 | $ | 1,723,866 | ||||

|

Foreign

currency translation adjustment

|

102,033 | 33,402 | ||||||

|

Comprehensive

income

|

$ | 9,448,324 | 1,757,269 | |||||

|

Earnings

per share - basic

|

$ | 0.67 | $ | 0.13 | ||||

|

Earnings

per share - diluted

|

$ | 0.63 | $ | 0.13 | ||||

|

Weighted

average shares outstanding -basic

|

14,035,369 | 13,213,268 | ||||||

|

Weighted

average shares outstanding - diluted

|

14,807,691 | 13,213,268 | ||||||

Balance

Sheet Data:

|

|

|

June 30, 2010

|

|

|

December 31, 2009

|

|

||

|

|

|

(Unaudited)

|

|

|

(Audited)

|

|

||

|

Cash

and cash

equivalents

|

$

|

155,529

|

$

|

64,736

|

||||

|

Trade

accounts receivable, net

|

$

|

22,289,993

|

$

|

6,295,375

|

||||

|

Advance

to Suppliers

|

$

|

2,972,207

|

$

|

-

|

||||

|

Inventories,

net

|

$

|

3,473,699

|

992,090

|

|||||

|

Property

and equipment, net

|

$

|

9,798

|

$

|

11,733

|

||||

|

Other receivables - Long

term

|

$

|

2,091,660

|

$

|

12,831,849

|

||||

|

Total

assets

|

$

|

30,992,886

|

$

|

20,195,783

|

||||

|

Total

current

liabilities

|

$

|

2,683,309

|

$

|

14,174,389

|

||||

|

Total

stockholders' equity

|

$

|

28,309,577

|

$

|

6,021,394

|

||||

|

Total

liabilities and stockholders’ equity

|

$

|

30,992,886

|

$

|

20,195,783

|

||||

RISK

FACTORS

An

investment in our Common Stock involves a high degree of risk. You should

carefully consider the risks described below, together with all of the other

information included in this prospectus, before making an investment decision.

If any of the following risks actually occurs, our business, financial condition

or results of operations could suffer. In that case, the trading price of our

common stock could decline, and you may lose all or part of your

investment.

6

RISKS

RELATED TO OUR BUSINESS

We

may not be able to effectively control and manage our growth, and a failure to

do so could adversely affect our operations and financial

condition.

We plan

to expand our company-owned stores. Planned expenditures for the stores are

$8-10 million. Even if we are able to secure the funds necessary to implement

these expenditures (of which there is no assurance), we will face management,

resource and other challenges in expanding our current facilities, integrating

acquired assets or businesses with our own, and managing expanding product

offerings. Failure to effectively deal with increased demands on our resources

could interrupt or adversely affect our operations and cause production

backlogs, longer product development time frames and administrative

inefficiencies. Other challenges involved with expansion, acquisitions and

operation include:

|

●

|

unanticipated

costs;

|

|

●

|

the

diversion of management’s attention from other business

concerns;

|

|

●

|

potential

adverse effects on existing business relationships with suppliers and

customers;

|

|

●

|

obtaining

sufficient working capital to support

expansion;

|

|

●

|

expanding

our product offerings and maintaining the high quality of our

products;

|

|

●

|

maintaining

adequate control of our expenses and accounting

systems;

|

|

●

|

successfully

integrating any future acquisitions;

and

|

|

●

|

anticipating

and adapting to changing conditions in the electronics retail industry,

whether from changes in government regulations, mergers and acquisitions

involving our competitors, technological developments or other economic,

competitive or market dynamics.

|

Even if

we do obtain benefits of expansion in the form of increased sales, there may be

a lag between the time when the expenses associated with an expansion or

acquisition are incurred and the time when we recognize such benefits, which

would affect our earnings.

We

may not be able to hire and retain qualified personnel to support our growth and

if we are unable to retain or hire such personnel in the future, our ability to

implement our business objectives could be limited. Difficulties with hiring,

employee training and other labor issues could disrupt our

operations.

Our

operations depend on the work of our sales persons and other employees. We may

not be able to retain those employees, successfully hire and train new employees

or integrate new employees into the programs and policies of the Company. Any

such difficulties would reduce our operating efficiency and increase our costs

of operations, and could harm our overall financial condition.

If one or

more of our senior executives or other key personnel are unable or unwilling to

continue in their present positions, we may not be able to replace them within a

reasonable time, and our business may be disrupted and our financial condition

and results of operations may be materially and adversely affected. Competition

for senior management and personnel is intense, the pool of qualified candidates

is very limited, and we may not be able to retain the services of our senior

executives or senior personnel, or attract and retain high-quality senior

executives or senior personnel in the future. This failure could limit our

future growth and reduce the value of our common stock.

7

The

consumer electronics and appliances retail industry in the PRC is becoming

increasingly competitive and, unless we are able to compete effectively with

competitor retailers, our profits could suffer.

The

consumer electronics and appliances retail industry in the PRC is highly and

increasingly competitive. Giant national retailers such as Suning Appliance and

Guomei Appliance have expanded, and local and regional competition has grown.

Some of these companies have substantially greater financial, marketing,

personnel and other resources than we do.

Our

competitors could adapt more quickly than we do to evolving consumer preferences

or market trends, have more success than we do in their marketing efforts,

control supply costs and operating expenses more effectively than we do, or do a

better job than we do in formulating and executing expansion plans. Increased

competition may also lead to price wars, counterfeit products or negative brand

advertising, all of which may adversely affect our market share and profit

margins. Expansion of large retailers into new locations may limit the locations

into which we may profitably expand. To the extent that our competitors are able

to take advantage of any of these factors, our competitive position and

operating results may suffer.

Because

we face intense competition, we must anticipate and quickly respond to changing

consumer demands more effectively than our competitors. In order to succeed in

implementing our business plan, we must achieve and maintain favorable

recognition of our private label brands, effectively market our products to

consumers, competitively price our products, and maintain and enhance a

perception of value for consumers. We must also source and distribute our

merchandise efficiently. Failure to accomplish these objectives could impair our

ability to compete successfully and adversely affect our growth and

profitability.

Our

limited operating history makes it difficult to evaluate our future prospects

and results of operations; our business could fail, and you could lose some or

all of your investment.

We have a

limited operating history and the PRC consumer electronics and appliances retail

industry is young and continually growing. Accordingly, you should consider our

future prospects in light of the risks and uncertainties experienced by

early-stage companies in evolving markets. Some of these risks and uncertainties

relate to our ability to:

|

§

|

Offer new products to attract and

retain a larger customer

base;

|

|

§

|

Respond to competitive and

changing market conditions;

|

|

§

|

Maintain effective control of our

costs and expenses;

|

|

§

|

Attract additional customers and

increase spending per

customer;

|

|

§

|

Increase awareness of our brand

and continue to develop customer

loyalty;

|

|

§

|

Attract, retain and motivate

qualified personnel;

|

|

§

|

Raise sufficient capital to

sustain and execute our expansion

plan;

|

|

§

|

Respond to changes in our

regulatory environment;

|

|

§

|

Manage risks associated with

intellectual property rights;

and

|

|

§

|

Foresee and understand long-term

trends.

|

Because

we are a relatively new company, we may not be experienced enough to address all

the risks in our business or in our expansion plan. If we are unsuccessful in

addressing any of these risks and uncertainties, our business may

fail.

8

Economic

conditions that affect consumer spending could limit our sales and increase our

costs.

Our

results of operations are sensitive to changes in overall economic conditions

that affect consumer spending, including discretionary spending. Inflation and

adverse changes to employment levels, business conditions, interest rates,

energy and fuel costs and tax rates can, in addition to causing the supply chain

cost challenges described above, reduce consumer spending and change consumer

purchasing habits.

We

rely on the performance of our sales persons and direct stores and franchise

stores managers for our sales, and should any or all of them perform poorly for

any reason, our sales results, reputation and competitive position would

suffer.

We sell

most of our products through our franchise stores, with our sales persons

visiting the stores each week. The store managers make the decision as to order

quantities and are responsible for the daily operation of the store. If factors

either in or out of a store manager’s control reduce a store’s business, the

individual store’s income could fall, which would negatively impact our

sales.

We

do not presently maintain product liability insurance or business interruption

insurance, and our property and equipment insurance does not cover the full

value of our property and equipment, which leaves us with exposure in the event

of loss or damage to our properties or claims filed against us.

We

currently do not carry any product liability or other similar insurance or

business interruption insurance. Unlike in the United States and many other

countries, product liability claims and lawsuits in the PRC are rare. Product

liability exposures and litigation, however, could become more commonplace in

the PRC. Moreover, we could have more product liability exposure and liability

as we expand our sales into international markets, like the United States, where

product liability claims are more prevalent.

We

may be required from time to time to recall products entirely or from specific

markets or batches. We do not maintain recall insurance. In the event we

do experience product liability claims or a product recall, or suffer from

natural or other unexpected disaster, business or government litigation, or any

uncovered risks of operation our financial condition and business operations

could be materially adversely affected.

We

may not have adequate or effective internal accounting controls.

The PRC has not adopted a Western style

of management and financial reporting concepts and practices. We may have

difficulty in hiring and retaining a sufficient number of qualified employees to

work in the PRC. As a result of these factors, we may experience difficulty in

establishing accounting and financial controls, collecting financial data,

budgeting, managing our funds and preparing financial statements, books of

account and corporate records and instituting business practices that meet

Western standards.

Our lack

of familiarity with Western practices generally and Section 404 specifically may

unduly divert management’s time and resources, which could have a material

adverse effect on our operating results. Further, if material weaknesses in our

internal controls over financial reporting are identified, this could result in

a loss of investor confidence in our financial reports, have an adverse effect

on our stock price and/or subject us to sanctions or investigation by regulatory

authorities.

Our

revenue will decrease if economical climate goes bad in China or if we are

significantly affected by financial crisis.

We are subject to the general changes

in economic conditions affecting many segments of the economy. Demand for

the electronics sold in our stores is typically affected by a number of economic

factors, including, but not limited to, the termination of “Rural

Consumer Electronics” in the rural regions or termination of other tax exemption

for the rural area.

9

Competition

in the retail electronics industry could adversely affect our results of

operations.

We operate in local and regional

markets in China, and many factors affect the competitive environments we face

in any particular market. These factors include the number of competitors in the

market, the pricing policies and financial strength of those competitors, the

total production capacity serving the market, the barriers to enter the market

and the proximity of natural resources, as well as general economic conditions

and demand for construction materials within the market. There is no assurance

that existing or new competitors may not receive contracts for which we compete

by reason of events and factors beyond our control.

Our

growth strategy is capital intensive; without additional capital on favorable

terms we may not accomplish our strategic plan.

Our expansion plans are premised upon

our raising sufficient capital. There can be no assurance that we will do so.

Our inability to raise sufficient capital or inability to raise capital on

acceptable terms to fund these new production plants would negatively impact our

projected revenues and our projected growth.

Long-term

collection of accounts receivable and potential bad debts may impose a threat to

our operations and expansion.

At certain times we may have a large

amount of accounts receivable, which account for over 72% of our total assets. A

substantial majority of our outstanding trade receivables are not secured by any

collateral or credit insurance. While we have procedures to monitor and limit

exposure to credit risk on our trade and non-trade receivables, there is no

assurance that such procedures will effectively limit our risks of bad debts and

avoid losses, which could have a material adverse effect on our financial

condition, operating results and business expansion.

We

depend heavily on key personnel, and turnover of key employees and senior

management could harm our business.

Our future business and results of

operations depend in significant part upon the continued contributions of our

key technical and senior management personnel, including Mr. Hailong Liu. They

also depend in significant part upon our ability to attract and retain

additional qualified management, technical, marketing and sales and support

personnel for our operations. If we lose a key employee, or if we are not

able to attract and retain skilled employees as needed, our business could

suffer. Significant turnover in our senior management could significantly

deplete our institutional knowledge held by our existing senior management team.

We depend on the skills and abilities of these key employees in managing

the technical, marketing and sales aspects of our business, any part of which

could be harmed by turnover in the future.

We

expect our sales revenues mainly be derived from our franchise stores and

direct stores as our customers a large drop of of these stores would reduce our

revenues and net income.

We believe

we are favorably diversifying our customer base to put less reliance on any one

customer; however, a drop of a large number of these stores at the same time

could materially decrease our revenues and net income.

We

depend heavily on large suppliers if we lose any of the largest suppliers could

harm our business.

The

top 10 major vendors accounted for 100% of the Company’s total purchases for the

six months ended June 30, 2010, with three major vendors, Shangdong Huangming

Solar Power Sales Co., Jiangsu Huayang Solar Power Sales Co. and Shangling

Refrigerator accounting for 52%, 20% and 10% of the total purchases. The top

five major vendors accounted for 100% of the Company’s total purchases for the

six months ended June 30, 2009, with three major vendors, Shangdong Huangming

Solar Power Sales Co. Hier Hefei Ririshun Sales Co., and Sanyo Electronics Co.

accounting for %, 51%, 36%and 6% and of the total purchases. Any drop off these

venders will significantly reduce our sales and income.

10

Our

continuing rapid expansion could significantly strain our resources, management

and operational infrastructure which could impair our ability to meet increased

demand for our products and hurt our business results.

To accommodate our anticipated growth

and to build additional facilities, we will need to expend capital resources and

dedicate personnel to implement and upgrade our accounting, operational and

internal management systems and enhance our record keeping and contract tracking

system. If we cannot successfully implement these measures efficiently and

cost-effectively, we will be unable to satisfy the demand for our products,

which will impair our revenue growth and hurt our overall financial

performance.

Certain

of our existing stockholders have substantial influence over our company, and

their interests may not be aligned with the interests of our other

stockholders.

Sherry Li is the owner of 11,556,288

shares of our Common Stock (approximately 68.9 % of the outstanding shares of

Common Stock as of October 12, 2010). As more particularly described in footnote

(3) and (4) to the table contained in “Security Ownership of Certain Beneficial

Owners and Management,” Ms. Li has granted options to our Chairman, Hailong Liu,

to purchase all 11,556,288 of her shares. As a result, Mr. Liu may have

significant influence over our business, including decisions regarding mergers,

consolidations and the sale of all or substantially all of our assets, election

of directors and other significant corporate actions. This concentration of

ownership may also have the effect of discouraging, delaying or preventing a

future change of control, which could deprive our stockholders of an opportunity

to receive a premium for their shares as part of a sale of our company and might

reduce the price of our shares.

Environmental

claims or failure to comply with any present or future environmental regulations

may require us to spend additional funds and may harm our results of

operations.

Our business is subject to

environmental, health and safety laws and regulations that affect our

operations, facilities and products in each of the jurisdictions in which we

operate. We believe that we are in compliance with all material environmental,

health and safety laws and regulations related to our products, operations and

business activities. Although we have not suffered material environmental claims

in the past, the failure to comply with any present or future regulations could

result in the assessment of damages or imposition of fines against us,

suspension of production, cessation of our operations or even criminal

sanctions. The enacting of new regulations could also require us to

acquire costly equipment or to incur other significant expenses.

Our

holding company structure may limit the payment of dividends.

We have no direct business operations,

other than our ownership of our subsidiaries. While we have no current

intention of paying dividends, should we decide in the future to do so, as a

holding company, our ability to pay dividends and meet other obligations depends

upon the receipt of dividends or other payments from our operating subsidiaries

and other holdings and investments. In addition, our operating

subsidiaries, from time to time, may be subject to restrictions on their ability

to make distributions to us, including as a result of restrictive covenants in

loan agreements, restrictions on the conversion of local currency into U.S.

dollars or other hard currency and other regulatory restrictions as discussed

below. If future dividends are paid in RMB, fluctuations in the exchange

rate for the conversion of RMB into U.S. dollars may reduce the amount received

by U.S. stockholders upon conversion of the dividend payment into U.S.

dollars.

Chinese regulations currently permit

the payment of dividends only out of accumulated profits as determined in

accordance with Chinese accounting standards and regulations. Our

subsidiaries in China are also required to set aside a portion of their after

tax profits according to Chinese accounting standards and regulations to fund

certain reserve funds. Currently, our subsidiary in China is the only

source of revenues or investment holdings for the payment of dividends. If

they do not accumulate sufficient profits under Chinese accounting standards and

regulations to first fund certain reserve funds as required by Chinese

accounting standards, we will be unable to pay any dividends.

11

RISKS

RELATED TO DOING BUSINESS IN CHINA

Risks

Related to Doing Business in the PRC

The Company faces the risk that

changes in the policies of the PRC government could have a significant impact

upon the business that the Company may be able to conduct in the PRC and the

profitability of such business.

The PRC economy is in a transition from

a planned economy to a market oriented economy subject to five-year and annual

plans adopted by the government that set national economic development goals.

Policies of the PRC government can have significant effects on the economic

conditions of the PRC. The PRC government has confirmed that economic

development will follow the model of a market economy. Under this direction, the

Company believes that the PRC will continue to strengthen its economic and

trading relationships with foreign countries and business development in the PRC

will follow market forces. While the Company believes that this trend will

continue, there can be no assurance that this will be the case. A change

in policies by the PRC government could adversely affect the Company’s interests

by, among other factors: changes in laws, regulations or the interpretation

thereof, confiscatory taxation, restrictions on currency conversion, imports or

sources of supplies, or the expropriation or nationalization of private

enterprises. Although the PRC government has been pursuing economic reform

policies for more than two decades, there is no assurance that the government

will continue to pursue such policies or that such policies may not be

significantly altered, especially in the event of a change in leadership, social

or political disruption, or other circumstances affecting the PRC political,

economic and social life.

The

PRC laws and regulations governing the Company’s current business operations are

sometimes vague and uncertain. Any changes in such PRC laws and regulations may

have a material and adverse effect on the Company’s business.

There are substantial uncertainties

regarding the interpretation and application of PRC laws and regulations,

including but not limited to the laws and regulations governing the Company’s

business, or the enforcement and performance of the Company’s arrangements with

customers in the event of the imposition of statutory liens, death, bankruptcy

and criminal proceedings. The Company and any future subsidiaries are considered

foreign persons or foreign funded enterprises under PRC laws, and as a result,

the Company is required to comply with PRC laws and regulations. These laws and

regulations are sometimes vague and may be subject to future changes, and their

official interpretation and enforcement may involve substantial

uncertainty.

The effectiveness of newly enacted

laws, regulations or amendments may be delayed, resulting in detrimental

reliance by foreign investors. New laws and regulations that affect existing and

proposed future businesses may also be applied retroactively. The Company cannot

predict what effect the interpretation of existing or new PRC laws or

regulations may have on the Company’s businesses.

A

slowdown or other adverse developments in the PRC economy may materially and

adversely affect the Company’s customers, demand for the Company’s products and

the Company’s business.

All of the Company’s operations are

conducted in the PRC and all of its revenue is generated from sales in the PRC.

Although the PRC economy has grown significantly in recent years, the Company

cannot assure investors that such growth will continue. A slowdown in overall

economic growth, an economic downturn or recession or other adverse economic

developments in the PRC could materially reduce the demand for our products and

materially and adversely affect the Company’s business.

Inflation

in the PRC could negatively affect our profitability and growth.

In recent years, the Chinese economy

has experienced periods of rapid expansion and highly fluctuating rates of

inflation. During the past ten years, the rate of inflation in China has

been as high as 20.7% and as low as -2.2%. These factors have led to the

adoption by the Chinese government, from time to time, of various corrective

measures designed to restrict the availability of credit or regulate growth and

contain inflation. High inflation may in the future cause the Chinese

government to impose controls on credit and/or prices, or to take other action,

which could inhibit economic activity in China, reduce demand, materially

increase our costs, and thereby harm the market for our products and our

Company.

12

Governmental

control of currency conversion may affect the value of an investment in the

Company and may limit our ability to receive and use our revenues

effectively.

The Company receives all of its

revenues in Renminbi, which is currently not a freely convertible currency. The

PRC government imposes controls on the convertibility of Renminbi into foreign

currencies and, in certain cases, the remittance of currency out of the PRC. Any

future restrictions on currency exchanges may limit our ability to use revenue

generated in Renminbi to fund any future business activities outside China or to

make dividend or other payments in U.S. dollars. Although the Chinese

government introduced regulations in 1996 to allow greater convertibility of the

Renminbi for current account transactions, significant restrictions still

remain, including primarily the restriction that foreign-invested enterprises

may only buy, sell or remit foreign currencies after providing valid commercial

documents, at those banks in China authorized to conduct foreign exchange

business. In addition, conversion of Renminbi for capital account items,

including direct investment and loans, is subject to governmental approval in

China, and companies are required to open and maintain separate foreign exchange

accounts for capital account items. We cannot be certain that the Chinese

regulatory authorities will not impose more stringent restrictions on the

convertibility of the Renminbi.

The

fluctuation of the Renminbi may materially and adversely affect investments in

the Company and the value of our securities.

The value of the Renminbi against the

U.S. dollar and other currencies may fluctuate and is affected by, among other

things, changes in the PRC’s political and economic conditions. As the Company

relies principally on revenues earned in the PRC, any significant revaluation of

the Renminbi may materially and adversely affect the Company’s cash flows,

revenues and financial condition, and the price of our common stock may be

harmed. For example, to the extent that the Company needs to convert U.S.

dollars it receives from an offering of its securities into Renminbi for the

Company’s operations, appreciation of the Renminbi against the U.S. dollar could

have a material adverse effect on the Company’s business, financial condition

and results of operations. Conversely, if the Company decides to convert its

Renminbi into U.S. dollars for the purpose of making payments for dividends on

its common stock or for other business purposes and the U.S. dollar appreciates

against the Renminbi, the U.S. dollar equivalent of the Renminbi that the

Company converts would be reduced. In addition, the depreciation of significant

U.S. dollar denominated assets could result in a charge to the Company’s income

statement and a reduction in the value of these assets.

PRC

regulations relating to the establishment of offshore special purpose companies

by PRC residents may subject our PRC resident shareholders to penalties and

limit our ability to inject capital into our PRC subsidiaries, limit our PRC

subsidiaries’ ability to distribute profits to us, or otherwise adversely affect

us.

On October 21, 2005, the PRC State

Administration of Foreign Exchange, referred to as SAFE, issued the

Notice on Issues Relating to the Administration of Foreign Exchange in

Fund-raising and Reverse Investment Activities of Domestic Residents Conducted

via Offshore Special Purpose Companies, or Notice 75, which became effective as

of November 1, 2005. According to Notice 75, prior registration with the local

SAFE branch is required for PRC residents to establish or to control an offshore

company for the purposes of financing such offshore company with assets or

equity interests in an onshore enterprise located in the PRC, or an offshore

special purpose company. An amendment to registration or filing with

the local SAFE branch by such PRC resident is also required for the injection of

equity interests or assets of an onshore enterprise in the offshore special

purpose company or overseas funds raised by such offshore company, or any other

material change involving a change in the capital of the offshore special

purpose company. Moreover, Notice 75 applies retroactively. As a result, PRC

residents who have established or acquired control of offshore special purpose

companies that have made onshore investments in the PRC in the past are required

to have completed the relevant registration procedures with the local SAFE

branch by March 31, 2006. To further clarify the implementation of Circular 75,

the SAFE issued Circular 106 on May 29, 2007. Under Circular 106, PRC

subsidiaries of an offshore special purpose company are required to coordinate

and supervise the filing of SAFE registrations by the offshore holding company’s

shareholders or beneficial owners who are PRC residents in a timely

manner.

13

Our current shareholders and/or

beneficial owners may fall within the ambit of the SAFE notice and be required

to register with the local SAFE branch as required under the SAFE notice. If so

required, and if such shareholders and/or beneficial owners fail to timely

register their SAFE registrations pursuant to the SAFE notice, or if future

shareholders and/or beneficial owners of our company who are PRC residents fail

to comply with the registration procedures set forth in the SAFE notice, this

may subject such shareholders, beneficial owners and/or our PRC subsidiaries to

fines and legal sanctions and may also limit our ability to contribute

additional capital into our PRC subsidiaries, limit our PRC subsidiaries’

ability to distribute dividends to our company, or otherwise adversely affect

our business.

We

may be exposed to liabilities under the Foreign Corrupt Practices Act, and any

determination that we violated the Foreign Corrupt Practices Act could hurt our

business.

Although we are currently not subject

to these regulations, we anticipate to become subject to the Foreign Corrupt

Practices Act, or FCPA, and other laws that prohibit improper payments or offers

of payments to foreign governments and their officials and political parties by

U.S. persons and issuers as defined by the statute for the purpose of obtaining

or retaining business. Our activities in China create the risk of unauthorized

payments or offers of payments by one of the employees, consultants, sales

agents or distributors of our Company, even though these parties are not always

subject to our control. It is our policy to implement safeguards to discourage

these practices by our employees. However, our existing safeguards and any

future improvements may prove to be less than effective, and the employees,

consultants, sales agents or distributors of our Company may engage in conduct

for which we might be held responsible. Violations of the FCPA may result in

severe criminal or civil sanctions, and we may be subject to other liabilities,

which could negatively affect our business, operating results and financial

condition.

Because

the Company’s principal assets are located outside of the United States and the

Company’s officers and directors reside outside of the United States, it may be

difficult for investors to enforce their rights in the U.S. based on U.S.

federal securities laws against the Company and the Company’s officers and

directors or to enforce U.S. court judgments against the Company or them in the

PRC.

The Company is located in the PRC and

substantially all of its assets are located outside of the United States; it may

therefore be difficult or impossible for investors in the United States to

enforce their legal rights based on the civil liability provisions of the U.S.

federal securities laws against the Company in the courts of either the U.S. or

the PRC and, even if civil judgments are obtained in U.S. courts, to enforce

such judgments in PRC courts. Further, it is unclear if extradition treaties now

in effect between the United States and the PRC would permit effective

enforcement against the Company or its officers and directors of criminal

penalties, under the U.S. federal securities laws or otherwise.

PRC

regulations also involve complex procedures for acquisitions conducted by

foreign investors that could make it more difficult for us to grow through

acquisitions.

Pursuant to the Regulations on Mergers

and Acquisitions of Domestic Enterprises by Foreign Investors, effective as of

September 8, 2006 and revised as of June 22, 2009, additional procedures and

requirements were established that are expected to make merger and acquisition

activities in China by foreign investors more time-consuming and complex,

including requirements in some instances that the Ministry of Commerce of the

PRC (“MOFCOM”) be notified in advance of any change-of-control transaction in

which a foreign investor takes control of a PRC domestic enterprise, or that the

approval from MOFCOM be obtained in circumstances where overseas companies

established or controlled by PRC enterprises or residents acquire affiliated

domestic companies and special anti-monopoly submissions for parties meeting

certain reporting thresholds. We may grow our business in part by acquiring

other companies engaged in aquaculture in the PRC. Complying with the

requirements of the new regulations to complete such transactions could be

time-consuming, and any required approval processes, including approval from

MOFCOM, may delay or inhibit our ability to complete such transactions, which

could affect our ability to expand our business or maintain our market

share.

14

There

are substantial uncertainties regarding the interpretation and application of

PRC laws and regulations governing the validity and legality of call

options to purchase of our Common Stock which are held by our Chairman and

others and there can be no assurance that the call options held by such persons

are not in breach of such laws and regulations.

Under a call option agreement with

Hailong Liu our Chairman, Sherry Li, the holder of 11,556,288 shares of our

Common Stock, has granted to Mr. Liu an option to purchase all of such

11,556,288 shares held by her over the course of two years in installments upon

achievement of certain performance milestones by the Company. While we believe

that this arrangement shall not be governed by PRC laws and regulations and

therefore is not in breach of any PRC laws and regulations, there are

substantial uncertainties regarding the interpretation and application of

current or future PRC laws and regulations, including regulations governing the

validity and legality of such call options. Accordingly, we cannot assure you

that PRC government authorities will not ultimately take a view contrary to our

view. If such certain call option agreement is deemed to be governed by PRC laws

and regulations, our Chairman may be required to register with the local SAFE

branch for his overseas direct investment in the Company. Failure to make such

SAFE registration may subject our Chairman to fines and legal sanctions, and may

also limit his ability to receive dividends from our PRC subsidiaries and remit

his proceeds from their overseas investment into the PRC as a result of foreign

exchange control under PRC laws and regulations.

RISKS

RELATED TO THE MARKET FOR OUR STOCK

Our

common stock is quoted on the OTC Bulletin Board which may have an unfavorable

impact on our stock price and liquidity.

Our common stock is quoted on the

Over-the-Counter Bulletin Board (the “OTCBB”). The OTCBB is a

significantly more limited market than the New York Stock Exchange or NASDAQ.

The quotation of our shares on the OTCBB may result in a less liquid

market available for existing and potential stockholders to trade shares of our

common stock, could depress the trading price of our common stock, could cause

high volatility and price fluctuations, and could have a long-term adverse

impact on our ability to raise capital in the future.

There is currently limited trading

market for our common stock and we cannot ensure that one will ever develop or

be sustained.

There is currently limited trading

market on the OTCBB for our common stock, and there is no assurance that one

will develop or be sustained.

The

elimination of monetary liability against the Company’s directors and officers

under the Nevada law and the existence of indemnification rights to the

Company’s directors, officers and employees may result in substantial

expenditures by the Company and may discourage lawsuits against the Company’s

directors and officers.

Under Nevada law, a corporation may

indemnify its directors, officers, employees and agents under certain

circumstances, including indemnification of such persons against liability under

the Securities Act of 1933, as amended. In addition, a corporation may purchase

or maintain insurance on behalf of its directors, officers, employees or agents

for any liability incurred by him in such capacity, whether or not the

corporation has the authority to indemnify such person.

The effect of these provisions may be

to eliminate the rights of the Company and its stockholders (through

stockholder’s derivative suits on behalf of the Company) to recover

monetary damages against a director, officer, employee or agent for breach of

fiduciary duty. Insofar as indemnification for liabilities arising under the

Securities Act of 1933, as amended, may be provided for directors, officers,

employees, agents or persons controlling an issuer pursuant to the foregoing

provisions, the opinion of the Commission is that such indemnification is

against public policy as expressed in the Securities Act of 1933, as amended,

and is therefore unenforceable.

15

Shares

eligible for future sale may adversely affect the market price of our common

stock, as the future sale of a substantial amount of outstanding stock in the

public marketplace could reduce the price of our common stock.

As of October 12, 2010, there were

issued and outstanding (i) 16,775,113 shares of our Common

Stock,and (ii) immediately exercisable warrants to purchase an

aggregate of 2,862,571shares of our Common Stock. We currently have obligation

to register the resale of an aggregate of 2,623,178 shares of our Common Stock,

including shares issuable upon exercise of warrants. Future sales of substantial

amounts of our Common Stock in the trading market could adversely affect market

price of our Common Stock.

Provisions in our Articles of

Incorporation could prevent or delay stockholders’ attempts to replace or remove

current management or otherwise adversely affect the rights of the holders of

our common stock.

Under our

Articles of Incorporation, our Board of Directors is authorized to issue “blank

check” preferred stock, with designations, rights and preferences as they may

determine. Any shares of preferred stock that are issued are likely to have

priority over our common stock with respect to dividend or liquidation

rights. In the event of issuance, the preferred stock could be

utilized under certain circumstances as a method of discouraging, delaying or

preventing a change in control, which could have the effect of discouraging bids

to acquire us and thereby prevent shareholders from receiving the maximum value

for their shares. We have no present intention to issue any

additional shares of preferred stock in order to discourage or delay a change of

control or for any other reason. However, there can be no assurance

that preferred stock will not be issued at some time in the future.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains certain forward-looking statements (as such term is defined

in Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934), which are based on the beliefs of our

management as well as assumptions made by and information currently available to

our management. All statements other than statements of historical

facts contained in this prospectus, including statements regarding our future

results of operations and financial position, business strategy and plans and

objectives of management for future operations, are forward-looking

statements. In many cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar words.

These

forward-looking statements are only predictions. These statements

relate to future events or our future financial performance and involve known

and unknown risks, uncertainties and other important factors that may cause our

actual results, levels of activity, performance or achievements to materially

differ from any future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. We have

described in the “Risk Factors” section and elsewhere in this prospectus the

principal risks and uncertainties that we believe could cause actual results to

differ from these forward-looking statements. Because forward-looking

statements are inherently subject to risks and uncertainties, some of which

cannot be predicted or quantified, you should not rely on these forward-looking