Attached files

| file | filename |

|---|---|

| EX-3.1 - ARTICLES OF INCORPORATION - Premier Brands, Inc. | tracksofts1100410ex31.htm |

| EX-5.1 - LEGAL OPINION WITH CONSENT - Premier Brands, Inc. | tracksofts1100410ex51.htm |

| EX-23.1 - CONSENT OF ACCOUNTANT - Premier Brands, Inc. | tracksofts1100410ex23.htm |

| EX-14.1 - CODE OF ETHICS - Premier Brands, Inc. | tracksofts1100410ex14.htm |

| EX-3.2 - BY-LAWS - Premier Brands, Inc. | tracksofts1100410ex32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TRACKSOFT SYSTEMS, INC

(Name of Small Business Issuer in its charter)

|

WYOMING

|

7372

|

27-2300669

|

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer ID No.)

|

2820 North Pinal Ave., Suite 12/292

Casa Grande, AZ 85222

520-424-5262

(Address and telephone number of principal executive offices)

InCorp Services, Inc.

2510 Warren Avenue, Cheyenne, WY 82001

Phone 800-246-2677

(Name, address and telephone number of agent for service)

Copies to:

Timothy S. Orr, Esq.

4328 West Hiawatha Drive, Suite 101

Spokane, WA 99205

Phone: (509) 462.2926 Fax: (509) 769.0303

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

1

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check one):

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company x

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount to

be registered

|

Proposed maximum

offering price per unit

|

Proposed maximum

aggregate offering price

|

Amount of

registration fee

|

||||

|

Common

|

5,000,000

|

$0.02 [1]

|

$100,000

|

$7.13 [2]

|

[1] No exchange or over-the-counter market exists for TrackSoft Systems, Inc’s. common stock. The offering price has been arbitrarily determined and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

[2] Fee calculated in accordance with Rule 457(o) of the Securities Act of 1933, as amended “Securities Act”. Estimated for the sole purpose of calculating the registration fee.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

Subject To Completion: Dated ______, 2010

TRACKSOFT SYSTEMS, INC.

5,000,000 shares of common stock, no minimum / 5,000,000 maximum Offered at $0.02 per share

|

Securities Being Offered by TrackSoft Systems, Inc.

|

TrackSoft Systems, Inc. is offering 5,000,000 shares at an offering price of $0.02 per share. There is currently no public market for the common stock

|

|

|

Minimum Number of Shares To Be Sold in This Offering

|

None

|

This is a "self-underwritten" public offering, with no minimum purchase requirement.

1. TrackSoft Systems, Inc. is not using an underwriter for this offering.

2. The offering expenses shown do not include legal, accounting, printing and related costs incurred in making this offering. TrackSoft Systems, Inc. will pay all such costs, which it believes to be $4,500.

3. There is no arrangement to place the proceeds from this offering in an escrow, trust or similar account.

|

|

Per Share

(Non Minimum)

|

If Maximum Sold by TrackSoft (5,000,000)

|

||||||

|

Price to Public

|

$

|

.02

|

$

|

.02

|

||||

|

Underwriting Discounts/Commissions

|

0.00

|

0.00

|

||||||

|

Proceeds to Registrant

|

$

|

0.02

|

$

|

100,000

|

||||

This offering involves a high degree of risk; see "Risk Factors" beginning on page 8 to read about factors you should consider before buying shares of the common stock.

TrackSoft Systems, Inc. is a development stage company and currently has no operations. There is a high degree of risk involved with any investment in the shares offered herein. You should only purchase shares if you can afford a loss of your entire investment. Our independent auditor has issued an audit opinion for TrackSoft Systems, Inc. which includes a statement expressing substantial doubt as to our ability to continue as a going concern. As of the date of this prospectus, our stock is presently not traded on any market or securities exchange. Further, there is no assurance that a trading market for our securities will ever develop.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission, nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is ______________, 2010

3

TABLE OF CONTENTS

|

|

Page

|

|

FORWARD-LOOKING STATEMENTS

|

6

|

|

SUMMARY INFORMATION

|

6

|

|

RISK FACTORS AND UNCERTAINTIES

|

8

|

|

USE OF PROCEEDS

|

14

|

|

DETERMINATION OF OFFERING PRICE

|

16

|

|

DILUTION

|

16

|

|

PLAN OF DISTRIBUTION

|

16

|

|

DESCRIPTION OF SECURITIES TO BE REGISTERED

|

17

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

18

|

|

DESCRIPTION OF THE BUSINESS

|

18

|

|

DESCRIPTION OF PROPERTY

|

23

|

|

LEGAL PROCEEDINGS

|

23

|

|

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDERMATTERS

|

24

|

|

FINANCIAL STATEMENTS

|

25

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

|

26

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

30

|

|

DIRECTORS, EXECUTIVE OFFICERS, AND CONTROL PERSONS

|

30

|

|

EXECUTIVE COMPENSATION

|

32

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

33

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

33

|

|

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

33

|

|

CORPORATE GOVERNANCE

|

34

|

|

THE SEC’S POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

34

|

|

TRANSFER AGENT AND REGISTRAR

|

34

|

|

LEGAL MATTERS

|

34

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

34

|

|

PART II – INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

II-1

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

II-1

|

|

RECENT SALES OF UNREGISTERED SECURITIES

|

II-2

|

|

EXHIBITS

|

II-2

|

|

UNDERTAKINGS

|

II-3

|

|

SIGNATURES

|

II-5

|

5

FORWARD-LOOKING STATEMENTS

This prospectus and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned software development, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements.

Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors and Uncertainties”, “Description of the Business” and “Management’s Discussion and Analysis” of this prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this prospectus by the foregoing cautionary statements.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from the information contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of when this prospectus is delivered or when any sale of our common stock occurs.

This summary does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the “Risk Factors and Uncertainties” section and our consolidated financial statements and the related notes before deciding to invest in shares of our common stock.

SUMMARY INFORMATION

The Offering

TrackSoft Systems, Inc.'s common stock is presently not traded on any market or securities exchange. 2,000,000 shares of restricted common stock are issued and outstanding as of the date of this prospectus.

6

TrackSoft is offering up to 5,000,000 shares of common stock at an offering price of $0.02 per share. There is currently no public market for the common stock. TrackSoft intends to apply to have the common stock quoted on the OTC Bulletin Board (OTCBB). Currently, there is no trading symbol assigned. TrackSoft’s Officer and Director own 2,000,000 shares of Restricted Common Stock. If TrackSoft is unable to sell its stock and raise money, TrackSoft’s business would fail as it would be unable to complete its business plan and any investment made into the Company would be lost in its entirety.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" on pages 8 - 14.

Company History

Unless otherwise indicated, any reference to TrackSoft or as “we”, “us”, or “our” refers to TrackSoft Systems, Inc. TrackSoft Systems, Inc. is a development stage company that was incorporated on March 30, 2010, under the laws of the State of Wyoming. Our fiscal year end is August 31. The principal offices are located at 2820 North Pinal Ave., Suite 12/292, Casa Grande, AZ 85222. The telephone number is (520) 424-5262 the fax number is (520) 374-2613.

Since becoming incorporated, TrackSoft has not made any significant purchases or sale of assets, nor has it been involved in any mergers, acquisitions or consolidations. TrackSoft has never declared bankruptcy, it has never been in receivership, and it has never been involved in any legal action or proceedings.

We are a development stage corporation. We intend to be in the business of software development related to construction project management use. We do not own any interest in any property. Currently, we have no further business planned if we are unable to develop our software and commercialize its use.

As of August 31, 2010, the date of company's last audited financial statements, TrackSoft has raised $5,000 through the sale of common stock. This sale was a purchase of 2,000,000 shares by the Company’s officer and director Matthew Howell.

TrackSoft’s current expenses from inception to August 31, 2010 were $750. This expense is relating to corporate start-up fees. The Company anticipates expense of $4,000 relating to bookkeeping/auditing fees for this filing. As of the date of this prospectus, we have not yet generated or realized any revenues from our business operations. The following financial information summarizes the more complete historical financial information as indicated on the audited financial statements of TrackSoft filed with this prospectus.

7

Management

Currently, TrackSoft has one Director, Matthew Howell and two Officers Matthew Howell and Phuthachak Muleethed. Our sole Director and Officers have assumed responsibility for all planning, development and operational duties, and will continue to do so throughout the beginning stages of the business plan. Other than the Officers/Director, there are no employees at the present time and there are no plans to hire employees during the next twelve months.

Summary of Financial Data

|

As of

August 31, 2010

|

||||

|

Revenues

|

$

|

0

|

||

|

Operating Expenses

|

$

|

750

|

||

|

Earnings (Loss)

|

$

|

(750

|

) | |

|

Total Assets

|

$

|

4,250

|

||

|

Working Capital

|

$

|

4,250

|

||

|

Shareholder’s Equity

|

$

|

4,250

|

||

RISK FACTORS AND UNCERTAINTIES

An investment in a development stage enterprise with no history of operations such as ours involves an unusually high amount of risk, unknown and known, present and potential, including, but not limited to the risks enumerated below.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Estimates of projected business operations and/ or plans are forward-looking statements inherently subject to error. Unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates.

RISKS RELATED TO OUR BUSINESS

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

Our business plan calls for ongoing expenses in connection with the marketing and development of construction software programs. We have not generated any revenue from operations to date.

8

At August 31, 2010, we had cash on hand of $4,250. Additional funding will be needed for business development, general administrative expenses and marketing costs.

In order to expand our business operations, we will need additional funding. If we are not able to raise the capital necessary to fund our business expansion objectives, we may have to delay the implementation of our business plan.

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of shares of common stock or advances from our directors and officers.

WE LACK AN OPERATING HISTORY AND HAVE NOT GENERATED ANY REVENUES OR PROFIT TO DATE. THERE IS NO ASSURANCE OUR FUTURE OPERATIONS WILL RESULT IN PROFITABLE REVENUES. IF WE CANNOT GENERATE SUFFICIENT REVENUES TO OPERATE PROFITABLY, WE MAY HAVE TO CEASE OPERATIONS.

We were incorporated on March 30, 2010. We have not started our proposed business operations or realized any revenues and we have been involved primarily in organizational activities. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to earn profit by marketing and developing educational software programs. We cannot guarantee that we will be successful in generating revenues and profit in the future. Failure to generate revenues and profit will cause us to suspend or cease operations.

IF WE FAIL TO FINALIZE THE DEVELOPMENT OF OUR PROPOSED SOFTWARE, WE WOULD HAVE TO CEASE OPERATIONS.

We have not begun the development of our proposed construction software to date. If we are unable to raise sufficient proceeds for the development of the software then we would likely be forced to cease operations. If we cease or suspend our business operations any investment made into the company would likely be lost in its entirety.

IF MATTHEW HOWELL, OUR PRINCIPAL OFFICER SHOULD RESIGN OR DIE, WE WILL NOT HAVE A CHIEF EXECUTIVE OFFICER. THIS COULD RESULT IN OUR OPERATIONS SUSPENDING, AND YOU COULD LOSE YOUR INVESTMENT.

We depend on the services of our principal officer and a director, Matthew Howell, for the future success of our business. The loss of the services of Mr. Howell could have an adverse effect on our business, financial condition and results of operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose your entire investment. We do not carry any key personnel life insurance policies on Mr. Howell and we do not have a contract for his services.

9

BECAUSE ARE OFFCIERS HAVE NO FORMAL TRAINING IN FINANCIAL ACCOUNTING AND MANAGEMENT FOR PUBLIC COMPANIES, IN THE FUTURE, THERE MAY NOT BE EFFECTIVE DISCLOSURE AND ACCOUNTING CONTROLS TO COMPLY WITH APPLICABLE LAWS AND REGULATIONS WHICH COULD RESULT IN FINES, PENALTIES AND ASSESSMENTS AGAINST US.

We have only two officers. Neither have formal training in financial accounting and management; however, they are responsible for our managerial and organizational structure, which will include preparation of disclosure and accounting controls. Mr. Howell has no formal training in financial accounting matters of public companies, he has been reviewing the financial statements that have been audited and reviewed by our auditors and included in this prospectus. When the disclosure and accounting controls referred to above are implemented, he will be responsible for the administration of them. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the SEC which ultimately could cause you to lose your investment, however, because of the small size of our expected operations, we believe that he will be able to monitor the controls he will have created and will be accurate in assembling and providing information to investors.

WE MAY HAVE DIFFICULTY ATTRACTING AND RETAINING SKILLED PERSONNEL. OUR FAILURE TO DO SO COULD CAUSE US TO GO OUT OF BUSINESS.

Our future success will depend in large part on our ability to attract and retain highly skilled management, sales, marketing, and finance and product development personnel. Competition for such personnel is intense, and there can be no assurance that we will be successful in attracting or retaining such personnel. Failure to attract and retain such personnel could have a material adverse effect on our operations and financial condition or cause us to go out of business.

WE WILL NEED SIGNIFICANT CAPITAL REQUIREMENTS TO CARRY OUT OUR BUSINESS PLAN, AND WE WILL NOT BE ABLE TO FURTHER IMPLEMENT OUR BUSINESS STRATEGY UNLESS SUFFICIENT FUNDS ARE RAISED, WHICH COULD CAUSE US TO DISCONTINUE OUR OPERATIONS RESULTING IN A COMPLETE LOSS OF ANY INVESTMENT MADE INTO THE COMPANY.

We will require significant expenditures of capital in order to acquire and develop our planned operations. We estimate that we will require $100,000 to carry out our operations for the next 12 months. As of August 31, 2010, we had approximately $4,250 in cash assets. We plan to obtain the necessary funds through an equity offering. We may not be able to raise sufficient amounts from our planned source. In addition, if we drastically underestimate the total amount needed to fully implement our business plan, our ability to continue our business will be adversely affected.

Our ability to obtain additional financing is subject to a number of factors, including market conditions, investor acceptance of our business plan, and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable to us. If we are unable to raise additional financing, we will have to significantly reduce our spending, delay or cancel planned activities or substantially change our current corporate structure. In such an event, we intend to implement expense reduction plans in a timely manner. However, these actions would have material adverse effects on our business, revenues, operating results, and prospects, resulting in a possible failure of our business.

10

NON-ADOPTION OF SOFTWARE WITHIN THE CONSTRUCTION INDUSTRY WOULD CAUSE OUR BUSINESS TO FAIL.

Our proposed software products represent an efficient approach for project management within the construction industry. Our success depends substantially upon the widespread adoption of our proposed software within the construction industries. Since we have not developed our software to date, it is difficult for us to predict customer demand accurately. Investors should be aware that the failure of us to develop this software and promote it within the construction marketplace or a delay in the development -- whether due to technological, competitive or other reasons -- would severely limit the development of our business and adversely affect our ability to ever generate revenues in the future.

WE MAY BE SUSCEPTIBLE TO AN ADVERSE EFFECT ON OUR BUSINESS DUE TO THE CURRENT WORLDWIDE ECONOMIC CRISIS.

Our market and sales results could be greatly impacted by the current worldwide economic crisis, making it difficult to reach sales goals, as well as software and market development goals.

WE HAVE NO EXPERIENCE AS A PUBLIC COMPANY. OUR INABILITY TO SUCCESSFULLY OPERATE AS A PUBLIC COMPANY COULD CAUSE YOU TO LOSE YOUR ENTIRE INVESTMENT.

We have never operated as a public company. We have no experience in complying with the various rules and regulations, which are required of a public company. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required of a public company. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected. Our inability to operate as a public company could be the basis of your losing your entire investment.

RISKS RELATED TO OUR INDUSTRY

THE MARKET FOR SOFTWARE TOOLS WITHIN THE CONSTRUCTION INDUSTRY IS EXTREMELY FRAGMENTED AND COMPETITIVE AND WE MAY NOT BE ABLE TO COMPETE SUCCESSFULLY WITH OUR EXISTING COMPETITORS OR NEW ENTRANTS INTO THE MARKETS WE PLAN TO SERVE.

The market for construction software tools is fragmented and highly competitive. Increased competition may result in lost sales and may force us to lower prices. We expect that competition in this market will increase substantially in the future. There can be no assurance that we can maintain or improve our competitive position. Many of our current and potential competitors have longer operating histories, greater name recognition and greater financial, technical, sales, marketing, support and other resources than we do.

WE WILL HAVE A NEED FOR CONTINUAL INTRODUCTION OF NEW PRODUCTS AND TOOLS, AND UPDATES OF EXISTING PRODUCTS TO ADAPT TO FREQUENT CHANGES IN TECHNOLOGY. IF WE ARE UNABLE TO INTRODUCE NEW PRODUCTS, UPDATE EXISTING PRODUCTS OR ADAPT TO CHANGES IN TECHNOLOGY OUR BUSINESS COULD FAIL.

The market for construction software products is characterized by rapidly changing technologies. The continued growth in the use of software applications with the intense competition in its industry exacerbates these market characteristics.

11

Our future success will depend on our ability to adapt to rapidly changing technologies and customer demands by continually improving the features and performance of our products. We currently do not have any scheduled release of new products and features for commercial launch, it cannot be assured that we will ever have new products in the future or if we do the will be met with market acceptance. If we are unable to adapt to changing technologies, improve features of our current products or successful release our products, our business could fail and you could lose your entire investment.

WE ARE SUSCEPTIBLE TO UNDETECTED SOFTWARE ERRORS, OR “BUGS”, THAT COULD REDUCE REVENUE, MARKET SHARE, AND DEMAND FOR OUR PRODUCTS AND CAUSE OUR BUSINESS TO FAIL.

Product performance problems could result in lost or delayed revenue, loss of market share, failure to achieve market acceptance, diversion of development resources or injury to our reputation, any of which could have a material adverse effect on our business and financial performance. Software products such as ours may contain undetected errors, or bugs, which result in product failures or poor product performance. Our products may be particularly susceptible to bugs or performance degradation because of the emerging nature of Web-based technologies and the stress that may be placed on our products by the full deployment of our products to users. If these problems occur our business may fail.

WE ARE SUSCEPTIBLE TO CLAIMS OF INTELLECTUAL PROPERTY INFRINGEMENT. IF A CLAIM OF INFRINGEMENT IS SUCCESSFUL AGAINST US, OUR BUSINESS COULD FAIL.

If any of our products violate the proprietary rights of third parties, we may be required to reengineer our products or to obtain licenses to continue offering our products without substantial reengineering. Any efforts to reengineer our products or obtain licenses from third parties may not be successful and, in any case, could have a material adverse effect on our business and financial performance by substantially increasing our costs or potentially causing our business to fail.

RISKS RELATED TO OUR OFFERING

BECAUSE WE HAVE ONLY ONE OFFICER AND DIRECTOR WHO IS RESPONSIBLE FOR OUR MANAGERIAL AND ORGANIZATIONAL STRUCTURE, IN THE FUTURE, THERE MAY NOT BE EFFECTIVE DISCLOSURE AND ACCOUNTING CONTROLS TO COMPLY WITH APPLICABLE LAWS AND REGULATIONS WHICH COULD RESULT IN FINES, PENALTIES AND ASSESSMENTS AGAINST THE COMPANY.

We currently have only two officers and one director. Our two officers and sole director has the responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes-Oxley Act of 2002. When these controls are implemented, he will be responsible for the administration of the controls. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause the Company to be subject to sanctions and fines by the Securities Exchange.

IF WE COMPLETE A FINANCING THROUGH THE SALE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN THE FUTURE, THEN SHAREHOLDERS WILL EXPERIENCE DILUTION.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders.

12

This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

BECAUSE THERE IS NO PUBLIC TRADING MARKET FOR OUR COMMON STOCK, YOU MAY NOT BE ABLE TO RESELL YOUR STOCK.

There is currently no public trading market for our common stock. Therefore there is no central place, such as stock exchange or electronic trading system to resell your shares.

THERE IS CURRENTLY NO MARKET FOR TRACKSOFT’S COMMON STOCK, BUT IF A MARKET FOR OUR COMMON STOCK DOES DEVELOP, OUR STOCK PRICE MAY BE VOLITAL.

There is currently no market for TrackSoft's common stock and there is no assurance that a market will develop. If a market develops, it is anticipated that the market price of TrackSoft’s common stock will be subject to wide fluctuations in response to several factors including:

|

·

|

The ability to complete the development of TrackSoft’s anticipated software;

|

|

|

·

|

The market price of TrackSoft’s anticipates software; and

|

|

·

|

The ability to hire and retain competent personal in the future.

|

WHILE TRACKSOFT EXPECTS TO APPLY FOR LISTING ON THE OTC BULLETIN BOARD (OTCBB), WE MAY NOT BE APPROVED, AND EVEN IF APPROVED, WE MAY NOT BE APPROVED FOR TRADING ONT EH OTCBB; THEREFORE SHAREHOLDERS MAY NOT HAVE A MARKET TO SELL THEUR SHARES, WEITHER IN THE NEAR TERM OR LONG TERM.

We can provide no assurance to investors that our common stock will be traded on any exchange or electronic quotation service. While we expect to apply to the OTC Bulletin Board, we may not be approved to trade on the OTCBB, and we may not meet the requirements for listing on the OTCBB. If we do not meet the requirements of the OTCBB, our stock may then be traded on the "Pink Sheets," and the market for resale of our shares would decrease dramatically, if not be eliminated.

TRACKSOFT HAS LIMITED FINAINCIAL RESOURCES AT PRESENT, AND PROCEEDS FROM THE OFFERIGN MAY NOT BE USED TO FULLY DEVELOP ITS BUSINESS.

TrackSoft has limited financial resources at present; as of August 31, 2010 it had $4,250 of cash on hand. If it is unable to develop its business plan, it may be required to divert certain proceeds from the sale of TrackSoft’s stock to general administrative functions. If TrackSoft is required to divert some or all of proceeds from the sale of stock to areas that do not advance the business plan, it could adversely affect its ability to continue by restricting the Company's ability to become listed on the OTCBB; advertise and promote the Company and its products; travel to develop new marketing, business and customer relationships; and retaining and/or compensating professional advisors.

13

BECAUSE OUR SECURITIES ARE SUBJECT TO PENNY STOCK RULES, YOU MAY HAVE DIFFICULTY SELLING YOUR SHARES.

Our shares are penny stocks are covered by section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell the Company's securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker/dealer must make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

BECAUSE WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT FOR INVESTOR’S SUBSCRIPTIONS, IF WE FILED FOR BANKRUPTCY PROTECTION OR ARE FORCED INTO BANKRUPTCY, INVESTORS WILL LOSE THEIR ENTIRE INVESTMENT.

Invested funds for this offering will not be placed in an escrow or trust account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors and will not be used for the sourcing and sale of promotional products.

These risk factors, individually or occurring together, would likely have a substantially negative effect on TrackSoft’s business and would likely cause it to fail.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis - no minimum of shares must be sold in order for the offering to proceed. The offering price per share is $0.02. There is no assurance that we will raise the full $100,000.

14

The following table below sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100% of the securities offered for sale in this offering by the company. For further discussion see Plan of Operation.

|

If 25% of

|

If 50% of

|

If 75% of

|

If 100% of

|

|||||||||||||

|

Shares Sold

|

Shares Sold

|

Shares Sold

|

Shares Sold

|

|||||||||||||

|

GROSS PROCEEDS FROM THIS OFFERING

|

$

|

25,000

|

$

|

50,000

|

$

|

75,000

|

$

|

100,000

|

||||||||

|

Less: OFFERING EXPENSES

|

||||||||||||||||

|

SEC Filing Expenses

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

||||||||

|

Printing

|

$

|

500

|

$

|

500

|

$

|

500

|

$

|

500

|

||||||||

|

Transfer Agent

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

||||||||

|

SUB-TOTAL

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

||||||||

|

Less: PHASE I

|

||||||||||||||||

|

Webmaster Development(initial design)

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

||||||||

|

Website Construction (limited website)

|

$

|

1,000

|

$

|

2,000

|

$

|

3,000

|

$

|

4,000

|

||||||||

|

Hosting/Maintenance

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

||||||||

|

Integration(industry specific development)

|

$

|

10,000

|

$

|

13,500

|

$

|

26,000

|

$

|

36,000

|

||||||||

|

Travel

|

$

|

1,000

|

$

|

1,500

|

$

|

2,000

|

$

|

3,000

|

||||||||

|

SUB-TOTAL

|

$

|

17,000

|

$

|

22,000

|

36,000

|

$

|

48,000

|

|||||||||

|

|

||||||||||||||||

|

Less: PHASE II

|

||||||||||||||||

|

Internet tool Construction (functional web tool)

|

$

|

0

|

$

|

8,000

|

$

|

12,000

|

$

|

17,000

|

||||||||

|

Mobile Development (mobile device expansion)

|

$

|

0

|

$

|

5,000

|

$

|

8,000

|

$

|

10,000

|

||||||||

|

Implementation (field testing)

|

$

|

0

|

$

|

5,500

|

$

|

7,500

|

$

|

11,000

|

||||||||

|

SUB-TOTAL

|

$

|

0

|

$

|

18,500

|

$

|

27,500

|

$

|

38,000

|

||||||||

|

Less: ADMINISTRATION EXPENSES

|

||||||||||||||||

|

Office, Telephone, Internet

|

$

|

0

|

$

|

0

|

$

|

1,000

|

$

|

2,000

|

||||||||

|

Legal and Accounting

|

$

|

3,500

|

$

|

5,000

|

$

|

6,000

|

$

|

7,500

|

||||||||

|

SUB-TOTAL

|

$

|

3,500

|

$

|

5,000

|

$

|

7,000

|

$

|

9,500

|

||||||||

|

TOTALS

|

$

|

25,000

|

$

|

50,000

|

$

|

75,000

|

$

|

100,000

|

||||||||

The above figures represent only estimated costs.

Legal and accounting fees refer to the normal legal and accounting costs associated with filing this Registration Statement under the 1933 Act as amended and maintaining the status of a Reporting Company under the 1934 Act.

A total of $5,000 has been raised from the sale of stock to our sole Officer and Director - this stock is restricted and is not being registered in this offering. The offering expenses associated with this offering are believed to be $4,500. As of August 31, 2010, TrackSoft had a balance (less outstanding checks) of $4,250 in cash. One of the purposes of the offering is to create an equity market, which allows TrackSoft to more easily raise capital, since a publicly traded company has more flexibility in its financing offerings than one that does not.

15

DETERMINATION OF OFFERING PRICE

There is no established market for the Registrant's stock. TrackSoft’s offering price for shares sold pursuant to this offering is set at $0.02. Our existing shareholder, our Officer /Director, paid $0.0025 per share. The additional factors that were included in determining the sales price are the lack of liquidity (since there is no present market for TrackSoft’s stock) and the high level of risk considering the lack of operating history of TrackSoft.

DILUTION

"Dilution" represents the difference between the offering price of the shares of common stock and the net book value per share of common stock immediately after completion of the offering. "Net book value" is the amount that results from subtracting total liabilities from total assets. In this offering, the level of dilution is increased as a result of the relatively low book value of our issued and outstanding stock. Assuming all shares offered herein are sold, and given effect to the receipt of the maximum estimated proceeds of this offering from shareholders net of the offering expenses, our net book value will be $100,000 or $0.014 per share. Therefore, the purchasers of the common stock in this offering will incur an immediate dilution of approximately $0.006 per share while our present stockholders will receive an increase of $0.012 per share in the net tangible book value of the shares they hold. This will result in a 30% dilution for purchasers of stock in this offering.

The following table illustrates the dilution to the purchasers of the common stock in this offering. While this offering has no minimum, the table below includes an analysis of the dilution that will occur if only 25% of the shares are sold, as well as the dilution if all shares are sold:

|

25% of

|

Maximum

|

|||||||

|

Offering

|

Offering

|

|||||||

|

Offering Price Per Share

|

$

|

0.02

|

$

|

0.02

|

||||

|

Book Value Per Share Before the Offering

|

$

|

0.002

|

5

|

$

|

0.002

|

5

|

||

|

Book Value Per Share After the Offering

|

$

|

0.007

|

$

|

0.014

|

||||

|

Net Increase to Original Shareholders

|

$

|

0.005

|

$

|

0.012

|

||||

|

Decrease in Investment to New Shareholders

|

$

|

0.013

|

$

|

0.006

|

||||

|

Dilution to New Shareholders (%)

|

35

|

%

|

30

|

%

|

||||

PLAN OF DISTRIBUTION

The offering consists of a maximum number of 5,000,000 common shares being offered by TrackSoft at $.02 per share with no minimum offering requirement.

16

Company Offering

TrackSoft is offering for sale common stock. If TrackSoft is unable to sell its stock and raise money, it will not be able to complete its business plan and will fail.

There will be no underwriters used, no dealer's commissions, no finder's fees, and no passive market making for the shares being offered by TrackSoft. All of these shares will be issued to business associates, friends, and family of the management of the Company. The Officers, Matthew Howell and Phuthachak Muleethed, will not register as broker-dealers in connection with this offering. Neither will be deemed to be a broker pursuant to the safe harbor provisions of Rule 3a4-1 of the Securities and Exchange Act of 1934, since they are not subject to statutory disqualification, will not be compensated directly or indirectly from the sale of securities, is not an associated person of a broker or dealer, nor have they been so associated within the previous twelve months, and primarily performs substantial duties as Officers and Director that are not in connection with the sale of securities, and has not nor will not participate in the sale of securities more than once every twelve months.

Our Common Stock is currently considered a "penny stock" under federal securities laws (Penny Stock Reform Act, Securities Exchange Act Section 3a (51(A)) since its market price is below $5.00 per share. Penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell or recommend such shares to certain investors.

Broker-dealers who sell penny stock to certain types of investors are required to comply with the SEC's regulations concerning the transfer of penny stock. If an exemption is not available, these regulations require broker-dealers to: make a suitability determination prior to selling penny stock to the purchaser; receive the purchaser's written consent to the transaction; and, provide certain written disclosures to the purchaser. These rules may affect the ability of broker-dealers to make a market in, or trade our shares. In turn, this may make it very difficult for investors to resell those shares in the public market.

DESCRIPTION OF SECURITIES

General

The authorized capital stock consists of 50,000,000 shares of common stock at a par value of $0.001 per share. We plan to offer 5,000,000 common shares at a price of $0.02 per share. We will not sell any of the 5,000,000 common shares until the registration statement is deemed effective.

Common Stock

As of September 30, 2010, there are 2,000,000 shares of common stock issued and outstanding. 2,000,000 shares are held by our Officer / Director, Matthew Howell.

Holders of common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of common stock representing a majority of the voting power of TrackSoft’s capital stock issued and outstanding and entitled to vote represented in person or by proxy, are necessary to constitute a quorum at any meeting of company stockholders. A vote by the holders of a majority of the outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to the articles of incorporation.

17

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of the common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to the common stock.

Shareholders

Each shareholder has sole investment power and sole voting power over the shares owned by such shareholder.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Timothy S. Orr, Esquire, of Spokane, Washington, an independent legal counsel, has provided an opinion on the validity of TrackSoft Systems, Inc.’s issuance of common stock and is presented as an exhibit to this filing.

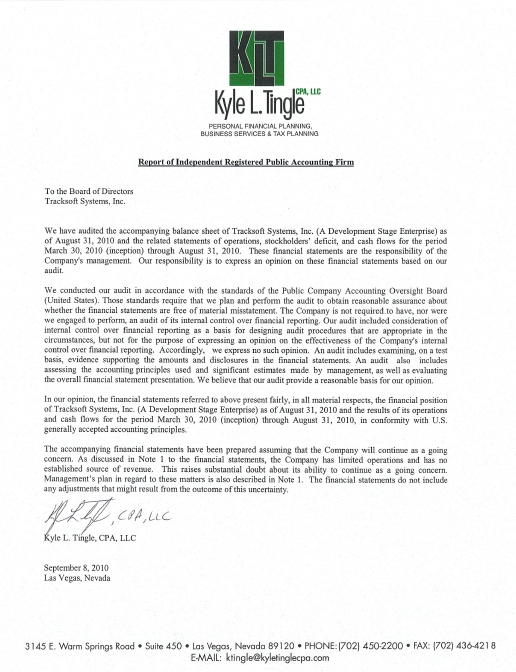

The financial statements included in this Prospectus and in the Registration Statement have been audited by Kyle Tingle, CPA, LLC, 3145 East Warm Springs Road, Suite 450, Las Vegas, NV 89120 to the extent and for the period set forth in their report (which contains an explanatory paragraph regarding TrackSoft’s ability to continue as a going concern) appearing elsewhere herein and in the Registration Statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

DESCRIPTION OF BUSINESS

History

TrackSoft Systems, Inc. was incorporated on March 30, 2010, in the state of Wyoming. TrackSoft has never declared bankruptcy, it has never been in receivership, and it has never been involved in any legal action or proceedings. Since becoming incorporated, TrackSoft has not made any significant purchase or sale of assets, nor has it been involved in any mergers, acquisitions or consolidations. TrackSoft is not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, since it has a specific business plan or purpose.

18

General

We intend to develop internet based software that will automate project management workflow allowing project managers, supervisors, coordinators, vendors and customers to view in real time the progress and specific scheduling of a multistage project. It will be completely internet based, which allows the intermediaries and customers to gain access to project documentation – on a secure internet location – anywhere/anytime. We believe this platform will be a significant benefit to operations by increasing productivity and improving profitability.

The Company plans to develop and market our software application to prospective industrial clientele, businesses and municipalities whom would benefit from tracking in real time the progress of their project.

We believe this application will be a significant advantage to project managers by:

|

-

|

Allowing vendors to view in real time the status of the project; specifically when they are scheduled to perform work and notify them of any modifications or delays in the scheduled work;

|

|

-

|

Allow the customers to view in real time the status of their project; specifically dates and times of the different phases of work to be completed and notifications of any modifications or delays; and

|

|

-

|

Provide the project manager a medium where they can update all involved parties on the status of the project in real time.

|

We believe by focusing on the status of the project in real time or as close to real time as possible will be advantages over other project management software applications, which generally are designed for accounting management of a project. We believe project managers will embrace the ability to have vendors and customers monitor the status of the project though an internet application and this platform will become increasingly popular taking into consideration individual’s desire for quick and reliable communication.

The systems primary function will be to improve the logistics of data management to a single point of reference. It is intended to eliminate verbal agreements and lengthy paper processing that slows production. Increasing production efficiencies also relates to savings in current production processes by reducing the quantity of on the job interactions.

Software Usability

We plan to develop the software to have specific access allowing both limited and full view of the project details depending on the users need and the parties’ status with the specific project.

Project managers would have full access to all jobs, phases, and supervisors inputs. This admission would allow viewing of comments, questions or disagreements that the customer, supervisor, or vendor may have.

Supervisors would have limited access, specific to their job(s). They would be capable of viewing comments or concerns that a customer or vendor may have, as well as all project information.

Vendors would only have access to their specific phase of the project. They may make or view comments or concerns that only supervisors and project managers can see.

19

Customers would only have access to their specific job. The customers would be able to have access to make comments for all intermediaries and all phases of the project, but would be limited to what comments they could view as it relates to their specific job.

Projected Process of Software Integration

We believe a case in point of the proposed integration of the software into a real world application would be as follows: After the sale of a job is made the sales associate would log on to the secure network via our proposed website at www.tracksoftsystems.com and records the sale thereby alerting all intermediaries of the purchase. The designated project manager would immediately confirm the supervisor(s) assigned to manage the job. Through the secure website, the supervisor would immediately input and process each vendor that would be used and notify them immediately of the request allowing a predetermined period of time for the vendor to confirm acceptance of the specific job within the project. During the entirety of the project, vendor(s) would have access through the software to post any questions or comments regarding the task and input immediately once the task was completed. This would then allow for all intermediaries to be alerted when each phase of the project was done, allowing the next phase to immediately respond with their job acceptance.

Timing for acceptance of each job/task by the vendors would be at the discretion of the project manager and would be posted within the request from the supervisor.

We believe integration of our proposed software would significantly decrease the amount of time required to complete a project, specifically by allowing streamline communications by all parties involved in the project.

Projected Project Systems Management Functionality

We plan to develop the software so users can easily view the progress and status of the project. We plan to utilize a “green light, yellow light, and red light” visual diagram of any given production whereby each job will list vendors and supervisors and display a current status message along with a corresponding color.

“Yellow Light” At phase 1 the initial color will show yellow meaning that the phase is not scheduled or confirmed by that phase’s vendor. The vendor creates an entry acknowledging the acceptance of the job and codes the box yellow signifying that it is scheduled but not completed.

“Green Light” Once the task is completed by the vendor they change the light to green signifying that the next phase is ready to be scheduled. The supervisor would be alerted and have access to keep the flow continual by signifying the next phase yellow with a message to please schedule.

“Red Light” If a problem occurs and the process is stopped then the color will be displayed as red by any individual with the exception of the customer. All “lighted boxed would be labeled with the most recent notes from the last intermediary on the job. The benefits for the supervisor is the ability to visual address red light problems first and reduce the time and effort to inform customers and vendors verbally of any status changes.

20

Projected Job Page Displays

Supervisors Page: We plan to develop the software in a manner where every job would have an access page to a printable copy of the work order and/or blueprint, a list of comments and concerns made throughout the process by each intermediary, status photos, and a map of the jobs location. We plan to have a street view map link for each project, which will be integrated into a map that can show pin point locations of all jobs. This will enable the supervisors to visual see the locations of all their jobs increasing productivity by reducing travel times. Supervisors will also have the ability to sort their index by vendors, jobs, or color codes. We believe this will be a great benefit to them by allowing for the ability to prioritize problems and address them more quickly which would increase customer service and reduce down time.

Vendor Page: The vendor page functionality would be similar to the supervisors’ page in that they would be able to view all their specific jobs and sort their information accordingly. This would provide the vendor(s) with the ability to prepare for upcoming assignments and to estimate more effectively completion times.

Customer Page: Customer pages would have the most limited access. These pages would only show the blueprint, and list of scheduled tasks. We believe this limited viewing would be adequate for customers by providing them information related to when and who will be working on their project.

Potential investors must be aware that as of the date of this prospectus we do not have any product available for commercial use or sale and have not developed any project management software. There is no guarantee or assurance that we will be able to develop our proposed software in the future. If we are unsuccessful in developing our proposed software in the future any investment made into the Company would be lost in its entirety. (See “Risk Factors”)

Marketing and Strategy

Target Market

Management believes that by equipping a project manager with the ability to maintain constant communication with selected individuals they will enhance the operating efficiency of the business. While we believe our proposed real time internet based software application could enhance the operations within many industries, the following business segments will be specifically targeted:

Home Builders: Home Builder project managers are constantly managing sub-contractors schedules. In addition with custom homes, clients want to be continually in the loop, this proposed application would allow them to view status 24/7 from anywhere.

Contractors: We believe Contractors would benefit by decreasing build time, reducing labor hours, minimizing consumable resource costs. Scheduling for subcontractors occurs the same day that the previous subcontractor completes their phase. Supervisors and other employees will spend less time traveling to and from jobs for onsite completion reporting. Consumable expenses like gasoline and equipment wear and tear are reduced because of limited visits. Customer quality is improved because customers can view the next expected phase instead of waiting a day or more for verbal confirmation of status from supervisors. All parties spend less time with undocumented verbal requests reducing labor hours.

21

Subcontractors: For example, landscapers could benefit by reducing consumable resource costs like gasoline and equipment wear and tear. The landscaper has a more accurate way to schedule jobs and track job performance. Job reports that previously were submitted at the close of the day now report instantly when the job is completed.

Municipalities: utilities workers and other municipalities could benefit by more effectively tracking the time spent on job. Real time job completion can allow addition jobs to be scheduled on the same day.

Management Companies: Real estate investors and managers can share information with their assistants and vendors to avoid schedule conflicts and to complete tasks more effectively and efficiently.

Field agents: Any individual that travels between multiple jobs throughout any given day can benefit by reducing travel times and consumable resources by having updated information at their fingertips.

Marketing

We are currently in the process of developing an Internet website, which will be used to present and offer our software application for sale to the consumer (www.tracksoftsystems.com). We plan to promote the website by conventional advertising and marketing. Marketing strategies will be designed to ultimately get consumers to our website. The Company plans to accomplish this through various means including, but not limited to, Internet advertising, implementing advertising and promotional campaigns addressed directly to project managers, specifically to industrial clientele, contractors, municipalities and individual customers. Management believes that direct marketing will provide an effective method for selling products and provide the capability to measure results of sales.

We expect that our key promotional activities will include:

|

•

|

attendance at industry trade shows and conventions;

|

||

|

|

•

|

print advertising in journals with specialized industry focus;

|

|

•

|

direct mail campaigns targeted to potential customers; and

|

|

•

|

web advertising, including supportive search engines and website and registration with appropriate sourcing entities;

|

It is important to note that we have not yet fully developed our website, and there can be no assurance that we will be able to implement any marketing campaigns and strategies successfully in the future.

Market and Industry Overview

A new adaptation of technology usually determines its own market size. The number of potential users of our proposed software application makes it difficult to quantify. We intend to pursue initial markets in the construction industries.

Competition

The software application markets are extremely competitive. Competitive factors in these industries include ease of use, quality, portability, versatility, reliability, accuracy, and cost.

22

Our primary competitors are expected to include companies with substantially greater financial, technological, marketing, personnel and research and development resources than we currently have. There are direct competitors with competitive technology and products in the project management software application markets for our proposed products. There can be no assurance that we will be able to compete successfully in this market. Further, there can be no assurance that existing and new companies will not enter the market space in the future, thereby limited our potential for success. See “Risk Factors.”

Our Competition

Similarly, in the software/technology industry, our competition includes many companies with significantly greater experience, larger client bases, and substantially greater financial resources. There are significant barriers to entry including large capital requirements and the recruitment and retention of qualified, experienced employees.

We cannot assure you that we will be able to compete in any of our business areas effectively with current or future competitors or that the competitive pressures faced by us will not have a material adverse effect on our business, financial condition and operating results.

Our Office

The principal offices are located at 2820 North Pinal Ave., Suite 12/292, Casa Grande, AZ 85222. The telephone number is (520) 424-5262 the fax number is (520) 374-2613.

Our Employees

Other than our officer and director, Matthew Howell and our officer, Phuthachak Muleethed we have no employees. Assuming financing can be obtained, management expects to hire additional staff and employees as necessary as implement of our business plan requires.

DESCRIPTION OF PROPERTY

The principal offices are located at 2820 North Pinal Ave., Suite 12/292, Casa Grande, AZ 85222. The telephone number is (520) 424-5262 the fax number is (520) 374-2613. TrackSoft’s management does not currently have policies regarding the acquisition or sale of real estate assets primarily for possible capital gain or primarily for income. TrackSoft does not presently hold any investments or interests in real estate, investments in real estate mortgages or securities of or interests in persons primarily engaged in real estate activities.

LEGAL PROCEEDINGS

TrackSoft Systems, Inc. is not currently a party to any legal proceedings. TrackSoft’s agent for service of process in Wyoming is: InCorp Services, 2510 Warren Avenue, Cheyenne, WY 82001—Phone 800-246-2677.

23

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

No Public Market for Common Stock

There is presently no public market for the common stock. TrackSoft anticipates applying for trading of the common stock on either the OTCBB upon the effectiveness of the registration statement of which this prospectus forms a part. However, TrackSoft can provide no assurance that the shares will be traded on the OTCBB or, if traded, that a public market will materialize.

Purchases of Equity Securities by the Small Business Issuer and Affiliates

There were no purchases of our equity securities by us or any of our affiliates during the year ended August 31, 2010 other than the purchase by Mr. Howell in May 2010 of 2,000,000 common shares for total consideration of $5,000.

Holders of the Common Stock

As of the date of this registration statement, TrackSoft had (1) registered shareholder. Matthew Howell, Officer and Director currently own 2,000,000 common shares, which represent 100% of the issued and outstanding common stock.

Dividend Policy

We anticipate that we will retain any earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any further determination to pay cash dividends will be at the discretion of our board of directors and will be dependent on the financial condition, operating results, capital requirements and other factors that our board deems relevant. We have never declared a dividend.

Equity Compensation Plan

To date, TrackSoft has no equity compensation plan, has not granted any stock options and has not granted registration rights to any person(s).

24

FINANCIAL STATEMENTS

TRACKSOFT SYSTEMS, INC.

(A Development Stage Enterprise)

Financial Statements

August 31, 2010

25

TRACKSOFT SYSTEMS, INC.

(A Development Stage Enterprise)

Financial Statements

August 31, 2010

CONTENTS

|

Page(s)

|

|||

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

||

|

Balance Sheet as of August 31, 2010

|

F-2

|

||

|

Statements of Operations for the period of March 30, 2010 to August 31, 2010 and March 30, 2010 (Inception) to August 31, 2010

|

F-3

|

||

|

Statement of Changes in Stockholder’s Equity cumulative from March 30, 2010 (inception) to August 31, 2010

|

F-4

|

||

|

Statements of Cash Flows for the period of March 30, 2010 to August 31, 2010 and March 30, 2010 (Inception) to August 31, 2010

|

F-5

|

||

|

Notes to the Financial Statements

|

F-6 - F-10

|

||

F-1

|

TRACKSOFT SYSTEMS, INC.

|

||||

|

(A Development Stage Enterprise)

|

||||

|

Balance Sheet

|

||||

|

August 31, 2010

|

||||

|

ASSETS

|

||||

|

Current assets

|

||||

|

Cash

|

$ | 4,250 | ||

|

Total current assets

|

4,250 | |||

|

Total assets

|

$ | 4,250 | ||

|

LIABILITIES AND STOCKHOLDER’S EQUITY

|

||||

|

Total liabilities

|

$ | - | ||

|

Stockholder’s Equity

|

||||

|

Common stock, $0.001 par value; 50,000,000 shares authorized; 2,000,000 issued and outstanding

|

2,000 | |||

|

Additional paid in capital

|

3,000 | |||

|

Deficit accumulated during the development stage

|

(750 | ) | ||

|

Total stockholder’s equity

|

4,250 | |||

|

Total liabilities and stockholder’s equity

|

$ | 4,250 | ||

|

See accompanying notes to financial statements.

|

||||

F-2

|

TRACKSOFT SYSTEMS, INC.

|

||||

|

(A Development Stage Enterprise)

|

||||

|

Statements of Operations

|

||||

|

Period of March 30, 2010 (Inception) to August 31, 2010

|

||||

|

Revenue

|

$ | - | ||

|

Expenses

|

||||

|

Professional fees

|

750 | |||

|

Total expenses

|

750 | |||

|

Net loss

|

$ | (750 | ) | |

|

Basic and diluted loss per common share

|

$ | (0.00 | ) | |

|

Weighted average shares outstanding

|

2,000,000 | |||

|

See accompanying notes to financial statements.

|

||||

F-3

|

TRACKSOFT SYSTEMS, INC.

|

||||||||||||||||||||

|

(A Development Stage Enterprise)

|

||||||||||||||||||||

|

Statement of Changes in Stockholder’s Equity

|

||||||||||||||||||||

|

For the Period of March 30, 2010 (Inception) to August 31, 2010

|

||||||||||||||||||||

|

Common Stock

|

Additional Paid-In Capital

|

Accumulated Deficit

|

Total

|

|||||||||||||||||

|

Shares

|

Amount

|

|||||||||||||||||||

|

Balance, March 30, 2010 (Inception)

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

Common stock issued for cash, April 19, 2010, $0.0025 per share

|

2,000,000 | 2,000 | 3,000 | - | 5,000 | |||||||||||||||

|

Net loss, period of March 30, 2010 (Inception) to August 31, 2010

|

- | - | - | (750 | ) | (750 | ) | |||||||||||||

|

Balance, August 31, 2010

|

2,000,000 | $ | 2,000 | $ | 3,000 | $ | (750 | ) | $ | 4,250 | ||||||||||

|

See accompanying notes to financial statements

|

||||||||||||||||||||

F-4

|

TRACKSOFT SYSTEMS, INC.

|

||||

|

(A Development Stage Enterprise)

|

||||

|

Statements of Cash Flows

|

||||

|

Period of March 30, 2010 (Inception) to August 31, 2010

|

||||

|

Cash flows from operating activities

|

||||

|

Net loss

|

$ | (750 | ) | |

|

Net cash used in operating activities

|

(750 | ) | ||

|

Net cash used in investing activities

|

- | |||

|

Cash flows from financing activities

|

||||

|

Proceeds from common stock issuances

|

5,000 | |||

|

Net cash provided by financing activities

|

5,000 | |||

|

Increase in cash

|

4,250 | |||

|

Cash at beginning of period

|

- | |||

|

Cash at end of period

|

$ | 4,250 | ||

|

Supplemental cash flow information

|

||||

|

Cash paid for interest

|

$ | - | ||

|

Cash paid for income taxes

|

$ | - | ||

|

See accompanying notes to financial statements.

|

||||

F-5

TRACKSOFT SYSTEMS, INC.

(A Development Stage Enterprise)

Notes to Financial Statements

August 31, 2010

Note 1 - Nature of Business

TrackSoft Systems, Inc. (“Company”) was organized on March 30, 2010 under the laws of the State of Wyoming for the purpose of developing a construction project management software package. The Company currently has no operations and, in accordance with ASC 915 “Development Stage Entities,” is considered a Development Stage Enterprise. The Company has been in the development stage since its formation and has not yet realized any revenues from its planned operations.

The Company has elected a fiscal year end of August 31.

Note 2 - Significant Accounting Policies

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash

For the Statements of Cash Flows, all highly liquid investments with maturity of three months or less are considered to be cash equivalents. There were no cash equivalents as of August 31, 2010.

Income taxes

The Company accounts for income taxes under ASC 740 "Income Taxes" which codified SFAS 109, "Accounting for Income Taxes" and FIN 48 “Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

Fair Value of Financial Instruments

The Company's financial instruments as defined by FASB ASC 825-10-50 include cash, trade accounts receivable, and accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short maturity of these financial instruments, approximates fair value at August 31, 2010.

F-6

TRACKSOFT SYSTEMS, INC.

(A Development Stage Enterprise)

Notes to Financial Statements

August 31, 2010

Note 2 - Significant Accounting Policies (continued)

FASB ASC 820 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. ASC 820 establishes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little or no market data, which requires the reporting entity to develop its own assumptions.

The Company does not have any assets or liabilities measured at fair value on a recurring basis at August 31, 2010. The Company did not have any fair value adjustments for assets and liabilities measured at fair value on a nonrecurring basis during the periods ended August 31, 2010.

Earnings Per Share Information

FASB ASC 260, “Earnings Per Share” provides for calculation of "basic" and "diluted" earnings per share. Basic earnings per share includes no dilution and is computed by dividing net income (loss) available to common shareholders by the weighted average common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of an entity similar to fully diluted earnings per share. Basic and diluted loss per share were the same, at the reporting dates, as there were no common stock equivalents outstanding.

Share Based Expenses