Attached files

| file | filename |

|---|---|

| EX-99.1 - TRANSCRIPT OF CONFERENCE CALL - MOSAIC CO | dex991.htm |

| 8-K - FORM 8-K - MOSAIC CO | d8k.htm |

The Mosaic Company

Jim Prokopanko, President and Chief Executive Officer

Larry Stranghoener, Executive VP and Chief Financial Officer

Mike Rahm, Vice President Market and Strategic Analysis

Christine Battist, Director -

Investor Relations

Earnings Conference Call -

1

st

Quarter Fiscal 2011

Tuesday, October 5, 2010

Exhibit 99.2 |

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and

operating results. Such statements are based upon the current beliefs

and expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties include

but are not limited to the predictability and volatility of, and customer

expectations about, agriculture, fertilizer, raw material, energy and

transportation markets that are subject to competitive and other pressures and economic and credit

market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international

trade risks; changes in government policy; changes in environmental and other

governmental regulation, including greenhouse gas regulation; further developments

in the lawsuit involving the federal wetlands permit for the extension of

the Company’s South Fort Meade, Florida, mine into Hardee County,

including orders, rulings, injunctions or other actions by the court or actions by

the plaintiffs, the Army Corps of Engineers or others in relation to the

lawsuit, or any actions the Company may identify and implement in an effort to

mitigate the effects of the lawsuit; other difficulties or delays in receiving, or

increased costs of, or revocation of, necessary governmental permits or

approvals; the effectiveness of the Company’s processes for managing its

strategic priorities; adverse weather conditions affecting operations in Central

Florida or the Gulf Coast of the United States, including potential

hurricanes or excess rainfall; actual costs of asset retirement, environmental

remediation, reclamation or other environmental regulation differing from

management’s current estimates; accidents and other disruptions

involving Mosaic’s operations, including brine inflows at its Esterhazy,

Saskatchewan potash mine and other potential mine fires, floods,

explosions, seismic events or releases of

hazardous or volatile chemicals, as well as other risks and uncertainties reported

from time to time in The Mosaic Company’s reports filed with the

Securities and Exchange Commission. Actual results may differ from those set

forth in the forward-looking statements.

Safe Harbor Statement

Slide 2 |

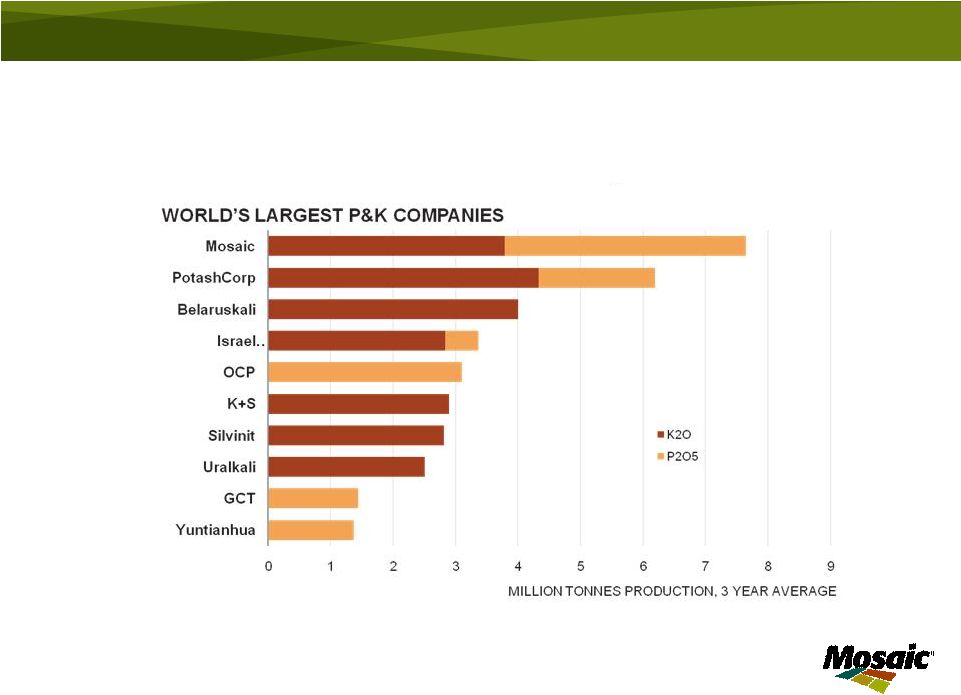

Leader in Potash and Phosphate

Slide 3

SOURCE: IFA, COMPANY REPORTS AND MOSAIC ESTIMATE

|

In

millions, except per share amounts Three Months Ended

August 31,

2010

2009

Net Sales

$2,188.3

$1,457.2

Gross Margin

$504.7

$222.2

% of net sales

23%

15%

Net Earnings

$297.7

$100.6

% of net sales

14%

7%

Diluted EPS

$0.67

$0.23

Effective Tax Rate

27%

25%

Cash Flow Provided by Operations

$556.2

$172.4

Cash and Cash Equivalents as of

August 31, 2010 & 2009

$2,362.7

$2,598.7

Financial Results

Slide 4 |

Phosphates Segment Highlights

Slide 5

Q1 FY11

Q4 FY10

Q1 FY10

IN MILLIONS, EXCEPT DAP PRICE

Net sales

$1,581.1

$1,187.9

$1,194.5

Gross Margin

$245.0

$306.6

$114.5

% of net sales

15%

26%

10%

Operating earnings

$178.0

$221.1

$46.5

Sales volumes

3.1

2.3

2.9

NA production volume

2.2

1.9

2.0

Ave DAP selling price

$431

$438

$278

First quarter year over year highlights:

•

Higher selling prices

•

Finished product operating rate 89%; however, reduced rock production at South

Fort Meade •

Strong sales volumes in North America & Brazil

•

Lean producer inventories |

Potash Segment Highlights

Slide 6

Q1 FY11

Q4 FY10

Q1 FY10

IN MILLIONS, EXCEPT MOP PRICE

Net sales

$621.9

$696.5

$333.3

Gross Margin

$256.7

$378.1

$124.6

% of net sales

41%

54%

37%

Operating earnings

$218.0

$346.9

$99.3

Sales volumes

1.7

1.8

0.8

Production volume

1.4

1.9

0.8

Ave MOP selling price

$331

$336

$354

First quarter year over year highlights:

•

Sales volume double last year

•

First quarter volumes in both years affected by seasonal turnarounds

•

Improved cost leverage due to increased production |

Execution of Strategic

Priorities

•

Investment in Miski Mayo

•

Closed Fosfertil sale

•

Grow value in Phosphates

–

Align distribution with production

–

Optimize production rates

–

Grow MicroEssentials®

•

Potash expansions continue on plan

–

New shaft at Esterhazy

Slide 7 |

Category

Guidance

Phosphates Market

Phosphates Segment

Extremely tight near term

Large domestic and international shipments

U.S. producer inventories extremely low

Q2 Sales volume 3.3 –

3.6 million tonnes

Q2

DAP

selling

price

$430

-

$460

per

tonne

Operating rate of 85 –

90%

Potash Market

Potash Segment

Surging shipments

North American producer inventories declined,

expected to stay low

Q2 Sales volume 1.6 –

1.9 million tonnes

Q2

MOP

selling

price

$310

-

$340

per

tonne

Operating rate of 80 –

85%

Canadian Resource Taxes and Royalties

$150 -

$200 million

SG&A

$360

–

$380

million

Capital Expenditures

$1.4 -

$1.6 billion

Effective Tax Rate*

Mid to upper 20 percent range

Financial Guidance –

Fiscal 2011

Slide 8

* Effective tax rate excludes items related to the Fosfertil sale. While the effect of the gain on

the sale on the Company’s provision for income taxes has not yet been finalized, it is

expected to increase income tax expense for the second quarter of fiscal 2011 but is expected to lower the effective

tax rate. |

South Fort Meade Update

Litigation status:

•

Awaiting decision from federal district court and

Eleventh Circuit on requested motions for

partial stay

•

Granted an expedited appeal of the preliminary

injunction by the Eleventh Circuit

Factors mitigating operational impact:

•

Utilizing phosphate rock on hand

•

Sourcing third party rock, including Miski Mayo

•

Maximizing existing mine production

•

Drawing down finished goods inventories

Slide 9 |

Market Outlook |

Developments in Ag Commodity Markets

Slide 11

Highlights:

•

Severe weather events: Russia, Saskatchewan, Europe, Pakistan, China,

Western Australia

•

U.S corn crop conditions

•

Other crop prices rally: cocoa, coffee, cotton, palm oil, and sugar

|

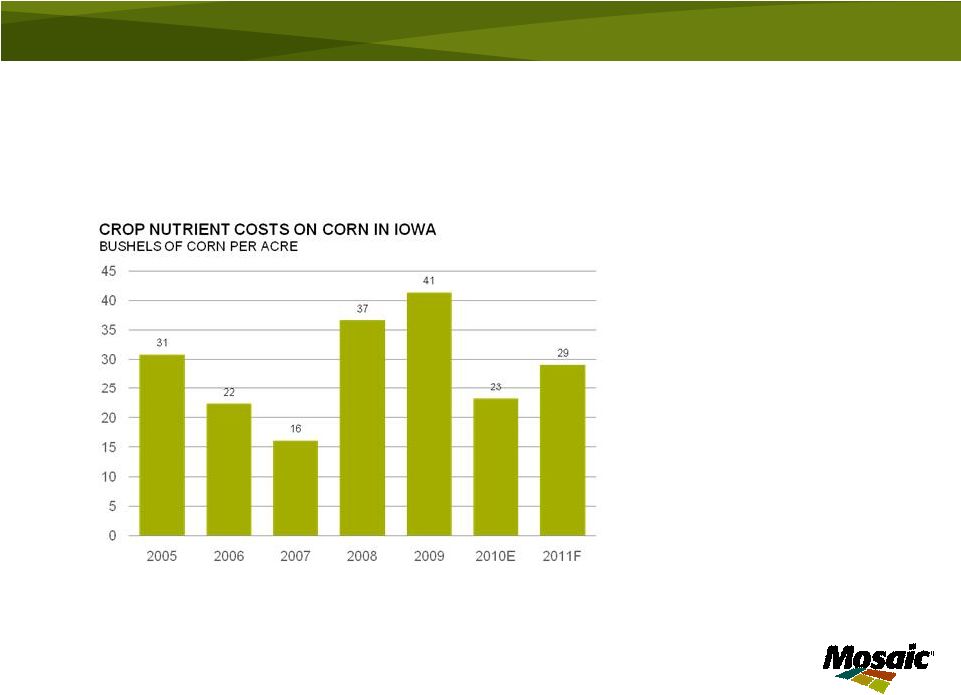

Healthy Farm Economics

Slide 12

•

Nutrient cost well within

historic norms

•

Record net farm income

in U.S.

•

Farm profitability at or

near records in key

markets around the world

IOWA HIGH YIELD FARM

SOURCE: IOWA STATE UNIVERSITY, USDA AND MOSAIC

|

Phosphate Demand at Record Levels

Import demand in growth

regions (million tonnes):

Brazil:

•2009

2.1

•2010F

2.5

•2011F

2.7 –

2.9

India:

•2009

6.6

•2010F

8.0

•2011F

7.5 –

8.0

13 |

Rebounding Potash Demand

14

Import demand in growth

regions (million tonnes):

Brazil:

•2009

3.4

•2010F

5.9

•2011F

6.2 –

6.5

China:

•2009

1.6

•2010F

5.0

•2011F

6.0 –

8.0

India

•2009

6.0

•2010F

6.0

•2011F

6.3 –

6.5 |

Supply Issues

•

Phosphate:

–

How much will Ma’aden produce in 2011?

–

Loss of Agrifos production

–

Raw material availability

–

Chinese exports

–

South Fort Meade resolution

•

Potash

–

Brownfield expansions required to keep up

with demand

Slide 15 |

Key Points

•

Strong quarterly results

•

Balanced nutrient portfolio

paying off

•

Positive market outlook

•

Executing our strategic

priorities

Slide 16 |

The Mosaic Company |