Attached files

| file | filename |

|---|---|

| EX-5 - EXHIBIT 5 - IDEANOMICS, INC. | ex5.htm |

| EX-3.1 - EXHIBIT 3.1 - IDEANOMICS, INC. | ex3_1.htm |

| EX-21.1 - EXHIBIT 21.1 - IDEANOMICS, INC. | ex21_1.htm |

| EX-23.1 - EXHIBIT 23.1 - IDEANOMICS, INC. | ex23_1.htm |

As filed with the Securities and Exchange Commission on October 7, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

CHINA BROADBAND, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

4841

|

20-1778374

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

27 Union Square, West Suite 502

New York, New York 10003

(303) 449-7733

(Address and telephone number of principal executive offices)

____________________________

Mr. Shane McMahon

27 Union Square, West Suite 502

New York, New York 10003

(303) 449-7733

Copies to:

Louis A. Bevilacqua, Esq.

Pillsbury Winthrop Shaw Pittman LLP

2300 N Street, N.W.

Washington, D.C. 20037

(202) 663-8000

(Names, addresses and telephone numbers of agents for service)

____________________________

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered(1)(3) | Proposed maximum offering price per unit (2) | Proposed maximum aggregate offering price (2) | Amount of registration fee |

|

Common Stock, $0.001 par value

|

62,500,000

|

$0.05

|

$3,125,000

|

$222.81

|

|

Common Stock, $0.001 par value, issuable upon exercise of warrants

|

62,500,000

|

$0.05

|

$3,125,000

|

$222.81

|

|

Common Stock, $0.001 par value, issuable upon exercise of placement agent warrants

|

4,018,000 | $0.05 | $200,900 | $14.32 |

|

TOTAL

|

129,018,000

|

$0.05

|

$6,450,900

|

$459.94

|

|

(1)

|

In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee, based on the average of the high and low prices reported on the OTCQB Market on September 23, 2010, except that with respect to the shares underlying the warrants, the fee is calculated pursuant to Rule 457(g).

|

|

(3)

|

Represents shares of the Registrant’s common stock being registered for resale that have been issued to the selling stockholders named in this registration statement.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to completion, dated October 7, 2010

CHINA BROADBAND, INC.

129,018,000 Shares of Common Stock

This prospectus relates to 129,018,000 shares of common stock of China Broadband, Inc. that may be sold from time to time by the selling stockholders named in this prospectus, which includes:

|

|

·

|

62,500,000 shares of common stock; and

|

|

|

·

|

66,518,000 shares of common stock issuable to the selling stockholders upon the exercise of warrants.

|

We will not receive any proceeds from sales by the selling stockholders.

Our common stock is quoted on the OTCQB inter-dealer electronic quotation and trading system maintained by Pink OTC Markets Inc. under the symbol “CBBD.” The closing bid price for our common stock on September 23, 2010 was $0.05 per share, as reported on the OTCQB.

Any participating broker-dealers and any selling stockholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 5 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010.

TABLE OF CONTENTS

|

1

|

|

|

5

|

|

|

17

|

|

|

17

|

|

|

17

|

|

|

17

|

|

|

18

|

|

|

33

|

|

|

35

|

|

|

42

|

|

|

42

|

|

|

42

|

|

|

45

|

|

|

47

|

|

|

49

|

|

|

50

|

|

|

50

|

|

|

53

|

|

|

57

|

|

|

58

|

|

|

59

|

|

|

59

|

|

|

59

|

You should only rely on the information contained in this prospectus. We have not, and the selling stockholders have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover, but the information may have changed since that date.

PROSPECTUS SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the financial statements, the notes thereto and matters set forth under “Risk Factors.”

Except as otherwise indicated by the context, references in this prospectus to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of China Broadband, Inc., a Nevada corporation, and its consolidated subsidiaries and variable interest entities.

In addition, unless the context otherwise requires and for the purposes of this prospectus only:

|

|

●

|

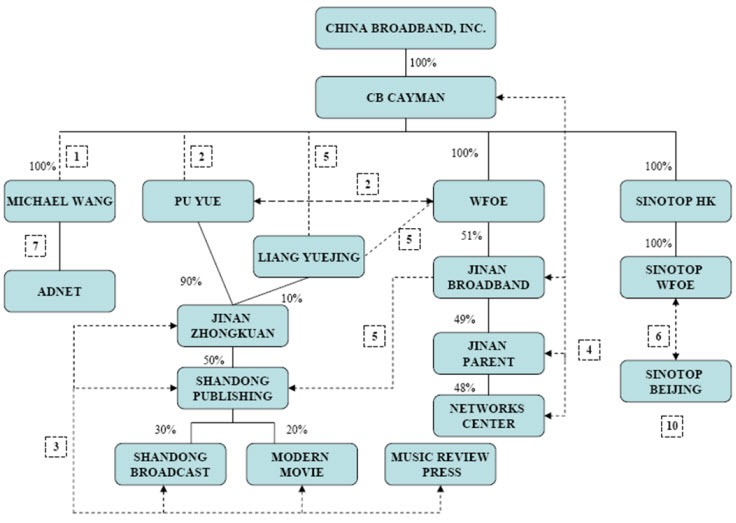

“AdNet” refers to Wanshi Wangjing Media Technologies (Beijing) Co., Ltd. (a/k/a Adnet Media Technologies (Beijing) Co., Ltd.), a PRC company controlled by CB Cayman through a contractual arrangement;

|

|

|

●

|

“CB Cayman” refers to our wholly-owned subsidiary China Broadband Ltd., a Cayman Islands company;

|

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

|

●

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

|

|

|

●

|

“Jinan Broadband” refers to Jinan Guangdian Jiahe Broadband Co., Ltd., a PRC joint venture owned 51% by WFOE and 49% by Jinan Parent;

|

|

|

●

|

“Jinan Parent” refers to Jinan Guangdian Jiahe Digital Television Co., Ltd., a PRC company;

|

|

|

●

|

“Jinan Zhongkuan” refers to Jinan Zhongkuan Dian Guang Information Technology Co., Ltd., a PRC company owned 90% by Pu Yue and 10% by Liang Yuejing, PRC individuals, and controlled by CB Cayman through contractual arrangements;

|

|

|

●

|

“Modern Movie” refers to Modern Movie and TV Biweekly Press, a PRC company;

|

|

|

●

|

“Networks Center” refers to Jinan Radio & Television Network;

|

|

|

●

|

“PRC,” “China,” and “Chinese,” refer to the People’s Republic of China;

|

|

|

●

|

“Renminbi” and “RMB” refer to the legal currency of China;

|

|

|

●

|

“SEC” refers to the Securities and Exchange Commission;

|

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended;

|

|

|

●

|

“Shandong Broadcast” refers to Shandong Broadcast & TV Weekly Press, a PRC company;

|

|

|

●

|

“Shandong Publishing” refers to Shandong Lushi Media Co., Ltd., a PRC company owned 50% by Jinan Zhongkuan, 30% by Shandong Broadcast and 20% by Modern Movie;

|

|

|

●

|

“Sinotop Beijing” refers to Beijing Sino Top Scope Technology Co., Ltd, a PRC company controlled by Sinotop HK through contractual arrangements;

|

|

|

●

|

“Sinotop HK” refers to Sinotop Group Limited, a Hong Kong company wholly-owned by CB Cayman;

|

|

|

●

|

“U.S. dollars,” “dollars,” “US$” and “$” refer to the legal currency of the United States;

|

|

|

●

|

“VIEs” refers to our variable interest entities, including Jinan Broadband, Shandong Publishing and Sinotop Beijing; and

|

|

|

●

|

“WFOE” refers to Beijing China Broadband Network Technology Co., Ltd., a PRC company wholly-owned by CB Cayman.

|

In this prospectus we are relying on and we refer to information and statistics regarding the media industry in China that we have obtained from various public sources. Any such information is publicly available for free and has not been specifically prepared for us for use or incorporation in this prospectus or otherwise.

The Company

Overview of our Business

We operate in the media segment, through our Chinese subsidiaries and VIEs, (1) a business which provides integrated value-added service solutions for the delivery of pay-per-view, or PPV, video-on-demand, or VOD, and enhanced premium content for cable providers, (2) a cable broadband business based in the Jinan region of China and (3) a television program guide, newspaper and magazine publishing business based in the Shandong region of China.

On July 30, 2010, we acquired Sinotop HK through our subsidiary CB Cayman. Through a VIE structure, which is a series of contractual arrangements, Sinotop HK controls Sinotop Beijing. Through Sinotop Beijing, a corporation established in the PRC which is a party to a joint venture with two other PRC companies, we provide integrated value-added service solutions for the delivery of PPV, VOD, and enhanced premium content for cable providers.

Through our VIE, Jinan Broadband, we provide cable and wireless broadband services, principally internet services, Internet Protocol Point wholesale services, related network equipment rental and sales, and fiber network construction and maintenance. Jinan Broadband’s revenue consists primarily of sales to our PRC-based internet consumers, cable modem consumers, business customers and other internet and cable services.

Through our VIE, Shandong Publishing, we operate our publishing business, which includes the distribution of periodicals, the publication of advertising, the organization of public relations events, the provision of information related services, copyright transactions, the production of audio and video products, and the provision of audio value added communication services. Shandong Publishing’s revenue consists primarily of sales of publications and advertising revenues.

We acquired AdNet, a company which provided internet content in cafes, during the first half of 2009. Due to the shift of our business model to the PPV and VOD business, as of December 31, 2009, we permanently suspended the day-to-day operations of AdNet. We have maintained our technology and other assets of AdNet for future use in our new pay-per-view business.

See “Corporate History and Structure” later in this prospectus for additional information on our VIE structures.

Our Industry

Until 2005, there were over 2,000 independent cable operators in the PRC. While PRC’s State Administration of Radio, Film, and Television, or SARFT, has advocated for national consolidation of cable networks, the consolidation has primarily occurred at the provincial level. The 30 provinces are highly variable in their consolidation efforts and processes.

SARFT has taken various steps to implement a separation scheme to achieve economies of scale in the value-added service and cable operation sector. First, SARFT has been separating cable network assets from broadcasting assets and currently allows state-owned-enterprises to hold up to 49% in the cable network infrastructure assets. Second, SARFT is separating the value-added services segment from the network infrastructure which tends to increase private investments.

Due to its highly-regulated nature, we believe that the radio and broadcasting industry does not have the same financial resources as the deregulated telecom industry in China, and that the priorities and goals of this industry are different from the telecom industry.

We believe that SARFT and its broadcasters are currently focusing on increasing subscription revenues by converting Chinese television viewers from “analog” service to “digital” (pay TV) service. The digitalization efforts include providing set-top-boxes free of charge as part of a digital television service bundling initiative. Due to the lack of financial resources, we believe that the rollout of cable broadband services and other value-added services has moved lower on SARFT’s priority list.

Our Growth Strategy

We intend to implement the following strategic plans to take advantage of industry opportunities and expand our business:

|

|

●

|

Pay-Per-View and Video-On-Demand Services. Through our recently announced acquisition of Sinotop HK, and its VIE, Sinotop Beijing, which is a party to a joint venture consisting of partnerships with two major PRC companies, we have received an exclusive and national license to deploy PPV/VOD services onto cable TV networks throughout China. Currently we have access to the largest movie library in China and we plan to acquire content from entertainment companies and studios in the U.S. and other parts of the world to deliver an integrated solution for enhanced premium content through cable providers. There are over 170 million cable television households in China and we plan to capitalize on the revenue opportunities as the government continues to mandate the switch from analog to digital cable by 2015.

|

|

|

●

|

Focus on Additional Delivery Platforms. Once we build an extensive entertainment content library and establish our reputation within the cable television industry, we plan to expand the distribution of our content over multiple delivery platforms including internet, mobile, IPTV and satellite to expand out product offerings and diversifying our revenue streams.

|

|

|

●

|

Deployment of Value-added Services. To augment our product offerings and create other revenue sources, we work with strategic partners to deploy value-added services to our cable broadband customers. Value-added services will become a focus of revenue generation.

|

Our Corporate History

China Broadband, Inc., our parent holding company, was formed in the State of Nevada on October 22, 2004, pursuant to a reorganization of a California entity formed in 1988. Prior to January 2007, we were a blank check shell company.

On January 23, 2007, we acquired CB Cayman, which at the time was a party to the cooperation agreement with our PRC based WFOE, in a reverse acquisition transaction.

All of our business operations are conducted through our Chinese subsidiaries and VIEs, as described under “Corporate History and Structure” below.

Office Location

The address of our principal executive office is 27 Union Square, West Suite 502, New York, New York 10003 and our telephone number is (303) 449-7733. We maintain a website at www.chinabroadband.tv.

The Offering

|

Common stock offered by selling stockholders

|

129,018,000 shares (consisting of 62,500,000 shares of common stock and 66,518,000 shares of common stock issuable upon the exercise of warrants. This number represents 65.5% of our current outstanding common stock (1)

|

|

|

Common stock outstanding before the offering

|

190,769,563 shares.

|

|

|

Common stock outstanding after the offering

|

190,769,563 shares.

|

|

|

Offering Price

|

The selling stockholders will determine at what price they may sell the offered shares, and such sales may be made at prevailing market prices or at privately negotiated prices.

|

|

|

Proceeds to us

|

All of the shares of common stock being offered under this prospectus are being offered and sold by the selling stockholders. Accordingly, although we may receive proceeds from time to time from the exercise of warrants by some of the selling stockholders, we will not receive any proceeds from the resale of the shares by the selling security holders.

|

|

|

Risk Factors

|

See “Risk Factors” beginning on page 5 of this prospectus and the risk factors set forth in our annual report on Form 10-K for the year ended December 31, 2009, for a discussion of factors you should carefully consider before deciding to invest in our securities.

|

|

(1)

|

Based on 190,769,563 shares of common stock outstanding as of September 21, 2010.

|

Unless we specifically state otherwise, the share information in this prospectus excludes shares of our common stock issuable upon exercise of warrants or options outstanding as of September 17, 2010.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our auditors have expressed substantial doubt in their report on our financial statements about our ability to continue as a going concern.

Our auditors have included an explanatory paragraph in their report dated as of April 15, 2010 on our consolidated financial statements for the year ended December 31, 2009, indicating that there is substantial doubt regarding our ability to continue as a going concern. The financial statements included elsewhere in this prospectus do not include any adjustments to asset values or recorded liability amounts that might be necessary in the event we are unable to continue as a going concern. If we are in fact unable to continue as a going concern, our shareholders may lose their entire investment in our Company. We will therefore need immediate additional substantial capital in order to continue to operate.

Expansion of our business may put added pressure on our management and operational infrastructure impeding our ability to meet any potential increased demand for our services and possibly hurting our future operating results.

Our business plan is to significantly grow our operations to meet anticipated growth in demand for the services that we offer, and by the introduction of new goods or services. Growth in our businesses may place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

|

|

●

|

our ability to successfully and rapidly expand sales to potential new distributors in response to potentially increasing demand;

|

|

|

●

|

the costs associated with such growth, which are difficult to quantify, but could be significant; and

|

|

|

●

|

rapid technological change.

|

To accommodate any such growth and compete effectively, we may need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage our employees, and such funding may not be available in sufficient quantities, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

In order to comply with PRC regulatory requirements, we operate our businesses through companies with which we have contractual relationships but in which we do not have controlling ownership. If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

We do not have direct or indirect equity ownership of our VIEs, which collectively operate all our businesses in China. At the same time, however, we have entered into contractual arrangements with each of our VIEs and their individual owners pursuant to which we received an economic interest in, and exert a controlling influence over each of the VIEs, in a manner substantially similar to a controlling equity interest.

Although we believe that our current business operations are in compliance with the current laws in China, we cannot be sure that the PRC government would view our operating arrangements to be in compliance with PRC regulations that may be adopted in the future. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. As a result, our business in the PRC could be materially adversely affected.

We rely on contractual arrangements with our VIEs for our operations, which may not be as effective in providing control over these entities as direct ownership.

Our operations and financial results are dependent on our VIEs in which we have no equity ownership interest and must rely on contractual arrangements to control and operate the businesses of each of our VIEs. These contractual arrangements are not as effective in providing control over the VIEs as direct ownership. For example, one of the VIEs may be unwilling or unable to perform their contractual obligations under our commercial agreements. Consequently, we would not be able to conduct our operations in the manner currently planned. In addition, any of the VIEs may seek to renew their agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with substantial ability to control the VIEs, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate. In addition, if we are unable to renew these agreements on favorable terms when these agreements expire, or to enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase.

Our arrangements with our VIEs and their respective shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with our VIEs and their respective shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

The success of our business is dependent on our ability to retain our existing key employees and to add and retain senior officers to our management.

We depend on the services of our existing key employees, in particular, Mr. Shane McMahon, our Chairman and Chief Executive Officer, Mr. Marc Urbach, our President and Chief Financial Officer, Mr. Clive Ng, our Co-Chairman, and Mr. Weicheng Liu, a Senior Executive Officer. Our success will largely depend on our ability to retain these key employees and to attract and retain qualified senior and middle level managers to our management team. We have recruited executives and management in China to assist in our ability to manage the business and to recruit and oversee employees. While we believe we offer compensation packages that are consistent with market practice, we cannot be certain that we will be able to hire and retain sufficient personnel to support our business. In addition, severe capital constraints have limited our ability to attract specialized personnel. Moreover, our budget limitations will restrict our ability to hire qualified personnel. The loss of any of our key employees would significantly harm our business. We do not maintain key person life insurance on any of our employees.

Our officers and directors may allocate their time to other businesses, and are or may be affiliated with entities that may cause conflicts of interest.

Certain officers and all of our directors have the ability to allocate their time to other businesses and activities, thereby causing possible conflicts of interest in their determination as to how much time to devote to the affairs of our Company.

These individuals are engaged in several other business endeavors and will continue to be so involved from time to time, and are not obligated to devote any specific number of hours to our affairs. If other business affairs require them to devote more substantial amounts of time to such affairs, it could limit their ability to devote time to our affairs and could have a negative impact on our ongoing business. Certain of our officers and directors are now, and all of them may in the future become, affiliated with entities engaged in business activities similar to those intended to be conducted by us or otherwise, and accordingly, may have conflicts of interest in allocating their time and determining to which entity a particular investment or business opportunity should be presented. Moreover, in light of our officers’ and directors’ existing affiliations with other entities, they may have fiduciary obligations to present potential investment and business opportunities to those entities in addition to presenting them to us, which could cause additional conflicts of interest. While we do not believe that any of our officers or directors has a conflict of interest in terms of presenting to entities other than our investment and business opportunities that may be suitable for it, conflicts of interest may arise in the future in determining to which entity a particular business opportunity should be presented.

We can not assure you that any conflicts will be resolved in our favor. These possible conflicts may inhibit the activities of such officers and directors in seeking acquisition candidates to expand the geographic reach of the Company or broaden its service offerings. For a complete description of our management’s other affiliations, see “Management’’ below. In any event, it cannot be predicted with any degree of certainty as to whether or not our officers or directors will have a conflict of interest with respect to a particular transaction as such determination would be dependent upon the specific facts and circumstances surrounding such transaction at the time.

We may be unable to compete successfully against new entrants and established industry competitors.

The Chinese market for Internet content and services is intensely competitive and rapidly changing. Barriers to entry are relatively minimal, and current and new competitors can launch new websites at a relatively low cost. Many companies offer competitive products or services including Chinese language-based Web search, retrieval and navigation services, wireless value-added services, online games and extensive Chinese language content, informational and community features and e-mail. In addition, as a consequence of China joining the World Trade Organization, the Chinese government has partially lifted restrictions on foreign-invested enterprises so that foreign investors may hold in the aggregate up to approximately 51% of the total equity ownership in any value-added telecommunications business, including an Internet business, in China.

Currently, our competition comes from standard “telephone” internet providers. Any of our present or future competitors may offer products and services that provide significant performance, price, creativity or other advantages over those offered by us and, therefore, achieve greater market acceptance than ours.

Because many of our existing competitors, as well as a number of potential competitors, have longer operating histories in the Internet market, greater name and brand recognition, better connections with the Chinese government, larger customer bases and databases and significantly greater financial, technical and marketing resources than we have, we cannot assure you that we will be able to compete successfully against our current or future competitors. Any increased competition could reduce page views, make it difficult for us to attract and retain users, reduce or eliminate our market share, lower our profit margins and reduce our revenues.

Unexpected network interruption caused by system failures may reduce user base and harm our reputation.

Both the continual and foremost accessibility of Internet service websites and the performance and reliability of our technical infrastructure are critical to our reputation and the ability of our Internet services to attract and retain users and advertisers. Any system failure or performance inadequacy that causes interruptions or delays in the availability of our services or increases the response time of our services could reduce user satisfaction and traffic, which would reduce the internet service appeal to users of “high speed” internet usage. As the number of users and traffic increase, we cannot assure you that we will be able to scale our systems proportionately. In addition, any system failures and electrical outages could materially and adversely impact our business.

Computer viruses may cause delays or interruptions on our systems and may reduce our customer base and harm our reputation.

Computer viruses may cause delays or other service interruptions on our systems. In addition, the inadvertent transmission of computer viruses could expose us to a material risk of loss or litigation and possible liability. We may be required to expend significant capital and other resources to protect our internet service against the threat of such computer viruses and to alleviate any problems. Moreover, if a computer virus affecting our system is highly publicized, our reputation could be materially damaged and customers may cancel our service.

If our providers of bandwidth and server custody service fail to provide these services, our business could be materially curtailed.

We rely on affiliates of Jinan Parent to provide us with bandwidth and server custody service for Internet users. If Jinan Parent or their affiliates fail to provide such services or raise prices for their services, we may not be able to find a reliable and cost-effective substitute provider on a timely basis or at all. If this happens, our business could be materially curtailed.

We face strong competition from both local and foreign competitors and increased competition could negatively affect our financial results.

Our magazines compete with a number of other magazine publishers. Both local and overseas publishers issue business related magazines in China, some of which may have substantially greater financial resources than us that may enhance their ability to compete in the publication of sales and marketing periodicals. In addition, we face broad competition for audiences and advertising revenue from other media companies that produce magazines, newspapers and online content. Overall competitive factors include product positioning, editorial quality, circulation, price and customer service. Competition for advertising dollars is primarily based on advertising rates, the nature and scope of readership, reader response to advertisers’ products and services and the effectiveness of the sales team. Increased competition could force us to lower our prices or offer services at a higher cost to us, which could reduce our operating income.

Since we publish our magazines in China, we are subject to the Chinese Advertising Law, which imposes upon us restrictions regarding the content of our publication and our ability, as a foreign corporation, to own media assets in China.

The advertising industry in China is governed by the Advertising Law which came into effect in February 1995. Advertisers, advertising operators and distributors, including entities such as ourselves, which engage in advertising activities are required to comply with applicable procedures and provisions under the Advertising Law. If our operations are determined to be in breach of the Advertising Law, penalties may be imposed which include fines, confiscation of advertising fees, orders to cease dissemination of the relevant advertisement and orders to publish an advertisement with corrective information.

Our PPV and VOD business depends on third parties to provide the programming that we offer to subscribers in China, and if we are unable to secure access to this programming, we may be unable to attract subscribers.

Our PPV and VOD business depends on third parties to provide us with programming services which we would distribute to our subscribers in China. We plan to negotiate with various U.S. entertainment studios to secure access to programming content, however we may not be able to obtain access to the programming content on favorable terms or at all. If we are unable to successfully negotiate agreements for access to high quality programming content, we may not be able to attract subscribers for our service and our operating results would be negatively affected.

If we are unable to attract subscribers for our PPV and VOD services, or are unable to successfully negotiate agreements with cable television providers in China to deliver our programming content, our financial performance will be adversely affected.

At present, there is a limited market for PPV and VOD services in China, and there is no guarantee that a market will develop or that we will be able to attract subscribers to purchase our services. In addition, we rely on cable television providers to deliver our programming content to subscribers and we may not be able to negotiate agreements to deliver our programming content on favorable terms or at all. If we are unable to attract subscribers or successfully negotiate delivery agreements with cable television providers, our financial performance will be adversely affected.

We may be exposed to potential risks relating to our internal controls over financial reporting.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. Under current law, we were subject to these requirements beginning with our annual report for the fiscal year ended December 31, 2007. Our internal control over financial reporting and our disclosure controls and procedures have been ineffective, and failure to improve them could lead to future errors in our financial statements that could require a restatement or untimely filings, which could cause investors to lose confidence in our reported financial information, and a decline in our stock price.

We are constantly striving to establish and improve our business management and internal control over financial reporting to forecast, budget and allocate our funds. However, as a PRC company that has become a US public company, we face difficulties in hiring and retaining a sufficient number of qualified employees to achieve and maintain an effective system of internal control over financial reporting in a short period of time.

In connection with the preparation and audit of our 2009 financial statements and notes, we were informed by our auditor, UHY LLP, or UHY, of certain deficiencies in our internal controls that UHY considered to be material weaknesses. These deficiencies related to our financial closing procedures and errors in classification of warrants. After discussions between management, our audit committee and UHY, we concluded that the Company had not properly adopted FASB ASC Topic 815-40 (“Derivatives and Hedging: Contracts in Entity’s Own Equity”) and as a result had not reclassified warrants from equity to liabilities as of January 1, 2009. As a result of the change in accounting, the Company recognized a $512,000 charge for the year ended December 31, 2009.

Because of the above-referenced deficiencies and weaknesses in our disclosure controls and procedures and procedures and internal control over financial reporting, we may be unable to comply with the SOX 404 internal controls requirements. As a result of any deficiencies and weaknesses, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records, and instituting business practices that meet international standards, failure of which may prevent us from accurately reporting our financial results or detecting and preventing fraud.

RISKS RELATED TO DOING BUSINESS IN CHINA

Changes in China's political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

|

●

|

Level of government involvement in the economy;

|

|

●

|

Control of foreign exchange;

|

|

●

|

Methods of allocating resources;

|

|

●

|

Balance of payments position;

|

|

●

|

International trade restrictions; and

|

|

●

|

International conflict.

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

Increased government regulation of the telecommunications and Internet industries in China may result in the Chinese government requiring us to obtain additional licenses or other governmental approvals to conduct our business which, if unattainable, may restrict our operations.

The telecommunications industry is highly regulated by the Chinese government, the main relevant government authority being the Ministry of Information Industry, or MII. Prior to China’s entry into the World Trade Organization, the Chinese government generally prohibited foreign investors from taking any equity ownership in or operating any telecommunications business. Internet Content Provider, or ICP, services are classified as telecommunications value-added services and therefore fall within the scope of this prohibition. This prohibition was partially lifted following China’s entry into the World Trade Organization, allowing foreign investors to own interests in Chinese businesses. In addition, foreign and foreign invested enterprises are currently not able to apply for the required licenses for operating cable broadband services in China.

We cannot be certain that we will be granted any of the appropriate licenses, permits or clearance that we may need in the future. Moreover, we cannot be certain that any local or national ICP or telecommunications license requirements will not conflict with one another or that any given license will be deemed sufficient by the relevant governmental authorities for the provision of our services.

We rely exclusively on contractual arrangements with Jinan Parent and its approvals to operate as an ICP. We believe that our present operations are structured to comply with applicable Chinese law. However, many Chinese regulations are subject to extensive interpretive powers of governmental agencies and commissions. We cannot be certain that the Chinese government will not take action to prohibit or restrict our business activities. We are uncertain as to whether the Chinese government will reclassify our business as a media or retail company, due to our acceptance of fees for Internet advertising, online games and wireless value-added and other services as sources of revenues, or as a result of our current corporate structure. Such reclassification could subject us to penalties, fines or significant restrictions on our business. Future changes in Chinese government policies affecting the provision of information services, including the provision of online services, Internet access, e-commerce services and online advertising, may impose additional regulatory requirements on us or our service providers or otherwise harm our business.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our subsidiaries in the PRC. Our subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and all of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

You may have difficulty enforcing judgments against us.

Most of our assets are located outside of the United States and most of our current operations are conducted in the PRC. In addition, some of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors that are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Our counsel as to PRC law has advised us that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as -0.8% . These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our revenues will be settled in RMB and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB and between those currencies and other currencies in which our revenues may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC VIEs’ ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Substantially all of our revenues are earned by our PRC VIEs. However, PRC regulations restrict the ability of our PRC VIEs to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC VIEs only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC VIEs are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC generally accepted accounting principles to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of our PRC VIEs to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Because Our Assets Are Located In China, Any Dividends Of Proceeds From Liquidation Is Subject To The Approval Of The Relevant Chinese Government Agencies.

Our assets are located inside China. Under the laws governing foreign invested enterprises in China, dividends of proceeds from liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend of proceeds from liquidation is subject to both the relevant government agency’s approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of liquidation.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into PRC subsidiaries, limit our PRC subsidiary's ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; (3) covering the use of existing offshore entities for offshore financings; (4) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (5) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006. This date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We have asked our stockholders who are PRC residents, as defined in Circular 75, to register with the relevant branch of SAFE as currently required in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary. However, we cannot provide any assurances that they can obtain the above SAFE registrations required by Circular 75 and Notice 106. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries' ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 and Notice 106 by our PRC resident beneficial holders.

In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75 and Notice 106. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75 and Notice 106, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries' ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

The implementation of the new PRC employment contract law and increases in the labor costs in China may hurt our business and profitability.

We are primarily a service provider. A new employment contract law became effective on January 1, 2008 in China. It imposes more stringent requirements on employers in relation to entry into fixed-term employment contracts, recruitment of temporary employees and dismissal of employees. In addition, under the newly promulgated Regulations on Paid Annual Leave for Employees, which also became effective on January 1, 2008, employees who have worked continuously for more than one year are entitled to paid vacation ranging from 5 to 15 days, depending on the length of the employee’s service. Employees who waive such vacation entitlements at the request of the employer will be compensated for three times their normal daily salaries for each vacation day so waived. As a result of the new law and regulations, our labor costs may increase. There is no assurance that disputes, work stoppages or strikes will not arise in the future. Increases in the labor costs or future disputes with our employees could damage our business, financial condition or operating results.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation issued the Notice Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of de facto Management Bodies, or the Notice, further interpreting the application of the EIT Law and its implementation against non-Chinese enterprise or group controlled offshore entities. Pursuant to the Notice, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate chops, board and shareholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management often resident in China. A resident enterprise would be subject to an enterprise income tax rate of 25% on its worldwide income and its non-PRC stockholders would be subject to a withholding tax at a rate of 10% when dividends are paid to such non-PRC stockholders. However, it remains unclear as to whether the Notice is applicable to an offshore enterprise incorporated by a Chinese natural person. Nor are detailed measures on enforcement of PRC tax against non-domestically incorporated resident enterprises are available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

We may be deemed to be a resident enterprise by Chinese tax authorities. If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on financing proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2010 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

We May Be Classified As A Passive Foreign Investment Company, Which Could Result In Adverse U.S. Tax Consequences To U.S. Investors.

Based upon the nature of our income and assets, we may be classified as a passive foreign investment company, or PFIC, by the United States Internal Revenue Service for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences to you. For example, if we are a PFIC, our U.S. investors will become subject to increased tax liabilities under U.S. tax laws and regulations and will become subject to more burdensome reporting requirements. The determination of whether or not we are a PFIC is made on an annual basis, and those determinations depend on the composition of our income and assets, including goodwill, from time to time. We intend to operate our business so as to minimize the risk of PFIC treatment, however you should be aware that certain factors that could affect our classification as PFIC are out of our control. For example, the calculation of assets for purposes of the PFIC rules depends in large part upon the amount of our goodwill, which in turn is based, in part, on the then market value of our shares, which is subject to change. Similarly, the composition of our income and assets is affected by the extent to which we spend the cash we have raised on acquisitions and capital expenditures. In addition, the relevant authorities in this area are not clear and so we operate with less than clear guidance in our effort to minimize the risk of PFIC treatment. Therefore, we cannot be sure whether we are not and will not be a PFIC for the current or any future taxable year. In the event we are determined to be a PFIC, our stock may become less attractive to U.S. investors, which may negatively impact the price of our common stock.

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax on NonResident Enterprises' Share Transfer, or Circular 698, that was released in December 2009 with retroactive effect from January 1, 2008.

The Chinese State Administration of Taxation released a circular on December 15, 2009 that addresses the transfer of shares by nonresident companies, generally referred to as Circular 698. Circular 698, which is effective retroactively to January 1, 2008, may have a significant impact on many companies that use offshore holding companies to invest in China. Circular 698, which provides parties with a short period of time to comply with its requirements, indirectly taxes foreign companies on gains derived from the indirect sale of a Chinese company. Where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise by selling the shares in an offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5% or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the tax authority in charge of that Chinese resident enterprise with the relevant information within 30 days of the transfers. Moreover, where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise through an abuse of form of organization and there are no reasonable commercial purposes such that the corporate income tax liability is avoided, the PRC tax authority will have the power to re-assess the nature of the equity transfer in accordance with PRC’s “substance-over-form” principle and deny the existence of the offshore holding company that is used for tax planning purposes. There is uncertainty as to the application of Circular 698. For example, while the term "indirectly transfer" is not defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. It is also unclear, in the event that an offshore holding company is treated as a domestically incorporated resident enterprise, whether Circular 698 would still be applicable to transfer of shares in such offshore holding company. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise. In addition, there are not any formal declarations with regard to how to decide “abuse of form of organization” and “reasonable commercial purpose,” which can be utilized by us to balance if our Company complies with the Circular 698. If Circular 698 is determined to be applicable to us based on the facts and circumstances around such share transfers, we may become at risk of being taxed under Circular 698 and we may be required to expend valuable resources to comply with Circular 698 or to establish that we should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption laws, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. We have operations, agreements with third parties, and make most of our sales in China. The PRC also strictly prohibits bribery of government officials. Our activities in China create the risk of unauthorized payments or offers of payments by the employees, consultants, sales agents, or distributors of our Company, even though they may not always be subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents, or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

RISKS RELATED TO THE MARKET FOR OUR STOCK

The market price of our common stock is volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock is volatile, and this volatility may continue. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. In addition to market and industry factors, the price and trading volume for our common stock may be highly volatile for specific business reasons. Factors such as variations in our revenues, earnings and cash flow, announcements of new investments, cooperation arrangements or acquisitions, and fluctuations in market prices for our products could cause the market price for our shares to change substantially.

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Moreover, the trading market for our common stock will be influenced by research or reports that industry or securities analysts publish about us or our business. If one or more analysts who cover us downgrade our common stock, the market price for our common stock would likely decline. If one or more of these analysts cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which, in turn, could cause the market price for our common stock or trading volume to decline.

Furthermore, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our company at a time when you want to sell your interest in us.

Although publicly traded, the trading market in our common stock has been substantially less liquid than the average trading market for a stock quoted on the Nasdaq Global Market and this low trading volume may adversely affect the price of our common stock.

Our common stock trades on the OTCQB market maintained by Pink OTC Markets Inc. The trading market in our common stock has been substantially less liquid than the average trading market for companies quoted on the Nasdaq Global Market. Although we believe that this offering will improve the liquidity for our common stock, there is no assurance that the offering will increase the volume of trading in our common stock. Limited trading volume will subject our shares of common stock to greater price volatility and may make it difficult for you to sell your shares of common stock at a price that is attractive to you.

Provisions in our articles of incorporation and bylaws or Nevada law might discourage, delay or prevent a change of control of us or changes in our management and, therefore depress the trading price of the common stock.

Our articles of incorporation authorize our board of directors to issue up to 50,000,000 shares of preferred stock. The preferred stock may be issued in one or more series, the terms of which may be determined at the time of issuance by the board of directors without further action by the stockholders. These terms may include preferences as to dividends and liquidation, conversion rights, redemption rights and sinking fund provisions. The issuance of any preferred stock could diminish the rights of holders of our common stock, and therefore could reduce the value of such common stock. In addition, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell assets to, a third party. The ability of our board of directors to issue preferred stock could make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change-in-control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.

In addition, Nevada corporate law and our articles of incorporation and bylaws contain certain other provisions that could discourage, delay or prevent a change in control of our Company or changes in its management that our stockholders may deem advantageous. These provisions:

|

|

●

|

deny holders of our common stock cumulative voting rights in the election of directors, meaning that stockholders owning a majority of our outstanding shares of common stock will be able to elect all of our directors;

|

|

|

●

|

require any stockholder wishing to properly bring a matter before a meeting of stockholders to comply with specified procedural and advance notice requirements; and

|

|

|

●

|

allow any vacancy on the board of directors, however the vacancy occurs, to be filled by the directors.

|

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.