Attached files

Exhibit 99.2

CHINE VICTORY PROFIT LIMITED

CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2010

(Stated in US dollars)

CHINE VICTORY PROFIT LIMITED

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

CONTENTS

| Page(s) | ||

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

2

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

3-4

|

|

|

CONDENDSED CONSOLIDATED STATEMENTS OF INCOME

|

5

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

6

|

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

7-24

|

|

1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Stockholders of Chine Victory Profit Limited

We have reviewed the accompanying consolidated balance sheets of Chine Victory Profit Limited as of June 30, 2010, and the related statements of income, stockholders’ equity and cash flows for the period from April 1, 2010 to June 30, 2010. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with auditing standards generally accepted in the Public Company Accounting Oversight Board in the United States of America. A review is substantially less in scope than an examination, the objective of which is the expression of an opinion on management’s assumptions, the adjustments and the application of those adjustments to historical financial information. Accordingly, we do not express such an opinion.

Based on our review, nothing came to our attention that caused us to believe that management’s assumptions do not provide a reasonable basis for presenting the condensed consolidated financial statements for the period from April 1, 2010 to June 30, 2010.

Parker Randall CF (H.K.) CPA Limited

Certified Public Accountants

Hong Kong

Date 19 AUG 2010

2

CHINE VICTORY PROFIT LIMITED

CONSOLIDATED BALANCE SHEET

AS AT JUNE 30, 2010

(Stated in US dollars)

|

Notes

|

As of

June 30,

2010

|

As of

March 31,

2010

|

||||||||||

| (Unaudited) | (Audited) | |||||||||||

|

ASSETS

|

||||||||||||

|

Current assets

|

||||||||||||

|

Cash and cash equivalents

|

$ | 1,906,916 | $ | 5,195,664 | ||||||||

|

Accounts receivable, net

|

3 | 19,641,346 | 8,340,879 | |||||||||

|

Inventories

|

4 | 8,089,040 | 6,605,953 | |||||||||

|

Advances to suppliers

|

5,788,794 | 5,670,022 | ||||||||||

|

Other receivables

|

5 | 13,978 | 3,500 | |||||||||

|

Prepaid expenses

|

5,137 | 5,912 | ||||||||||

|

Total current assets

|

35,445,211 | 25,821,930 | ||||||||||

|

Plant and equipment, net

|

6 | 4,401,870 | 4,607,728 | |||||||||

|

TOTAL ASSETS

|

39,847,081 | 30,429,658 | ||||||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

Current liabilities

|

||||||||||||

|

Accounts payable

|

7,669,057 | 1,431,331 | ||||||||||

|

Accrued liabilities

|

7 | 193,267 | 171,279 | |||||||||

|

Advance from customers

|

35,053 | 8,167 | ||||||||||

|

Other payables

|

8 | 61,793 | 62,341 | |||||||||

|

Tax payable

|

9 | 11,673 | 5,549 | |||||||||

|

Total current liabilities

|

7,970,843 | 1,678,667 | ||||||||||

|

TOTAL LIABILITIES

|

7,970,843 | 1,678,667 | ||||||||||

|

COMMITMENT AND CONTINGENCIES

|

15 | |||||||||||

3

CHINE VICTORY PROFIT LIMITED

CONSOLIDATED BALANCE SHEET

AS AT JUNE 30, 2010

(Stated in US dollars)

|

Notes

|

As of

June 30,

2010

|

As of

March 31,

2010

|

||||||||||

|

|

(Unaudited) | (Audited) | ||||||||||

| STOCKHOLDERS’ EQUITY | ||||||||||||

|

Common equity

|

10 | $ | 20,000 | $ | 20,000 | |||||||

|

Statutory reserve

|

2(q ) | 127,572 | 127,572 | |||||||||

|

Accumulated other comprehensive income

|

1,261,516 | 1,541,461 | ||||||||||

|

Retained earnings

|

30,467,150 | 27,088,958 | ||||||||||

| 31,876,238 | 28,750,991 | |||||||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

39,847,081 | 30,429,658 | ||||||||||

4

CHINE VICTORY PROFIT LIMITED

CONSOLIDATED STATMENT OF INCOME

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

(Unaudited)

|

Notes

|

Three months

ended

June 30,

2010

|

Three months

ended

June 30,

2009

|

||||||||||

|

Net sales

|

11 | $ | 13,812,520 | $ | 10,195,246 | |||||||

|

Cost of sales

|

(10,014,539 | ) | (7,395,963 | ) | ||||||||

|

Gross profit

|

3,797,981 | 2,799,283 | ||||||||||

|

Selling and distributing costs

|

(16,453 | ) | (270,676 | ) | ||||||||

|

Administrative and other operating costs

|

12 | (400,579 | ) | (39,038 | ) | |||||||

|

Financial costs

|

(1,475 | ) | (535 | ) | ||||||||

|

Income from operations

|

3,379,474 | 2,489,034 | ||||||||||

|

Other income, net

|

13 | — | 1,289 | |||||||||

|

Non-operating expenses, net

|

(173 | ) | (29 | ) | ||||||||

|

Income before taxes

|

3,379,301 | 2,490,294 | ||||||||||

|

Income tax

|

14 | (1,109 | ) | (2,681 | ) | |||||||

|

Net income

|

3,378,192 | 2,487,613 | ||||||||||

|

Other comprehensive income - Foreign currency translation adjustments

|

(252,945 | ) | 41,725 | |||||||||

|

Total comprehensive income

|

3,125,247 | 2,529,338 | ||||||||||

5

CHINE VICTORY PROFIT LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

(Unaudited)

|

Notes

|

Three months

ended

June 30,

2010

|

Three months

ended

June 30,

2009

|

||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Net income

|

$ | 3,378,192 | $ | 287,613 | ||||||||

|

Depreciation

|

6 | 165,662 | 165,007 | |||||||||

|

Increase in accounts receivable

|

(11,300,437 | ) | (407,460 | ) | ||||||||

|

Increase in inventories

|

(1,483,087 | ) | (256,621 | ) | ||||||||

|

Increase in advances to suppliers

|

(118,773 | ) | (1,230,015 | ) | ||||||||

|

Increase in other receivables

|

(5,232 | ) | ||||||||||

|

Decrease in prepaid expenses

|

775 | 2,920 | ||||||||||

|

Increase in accounts payable

|

6,237,726 | 22,346 | ||||||||||

|

Increase in customer deposits

|

26,886 | 31,233 | ||||||||||

|

Increase in tax payable

|

3,477 | 28,200 | ||||||||||

|

Increase in accrued expenses

|

13,577 | (64,463 | ) | |||||||||

|

Net cash (used in)/ provided by operating activities

|

(3,076,002 | ) | 773,528 | |||||||||

|

Cash flows from investing activities

|

||||||||||||

|

Purchase of plant and equipment

|

(637 | ) | (55,656 | ) | ||||||||

|

Net cash used in investing activities

|

(637 | ) | (55,656 | ) | ||||||||

|

Cash flows from financing activities

|

||||||||||||

|

Dividend paid

|

— | — | ||||||||||

|

Net cash used in financing activities

|

— | — | ||||||||||

|

Net (decrease)/ increase in cash and cash equivalents

|

(3,076,639 | ) | 717,872 | |||||||||

|

Effect of foreign currency translation on cash and

|

(212,109 | ) | (18,888 | ) | ||||||||

|

Cash and cash equivalents - beginning of period

|

5,195,664 | 904,247 | ||||||||||

|

Cash and cash equivalents - end of period

|

1,906,916 | 1,603,231 | ||||||||||

6

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

1. ORGANIZATION AND PRINCIPAL ACTIVITIES

|

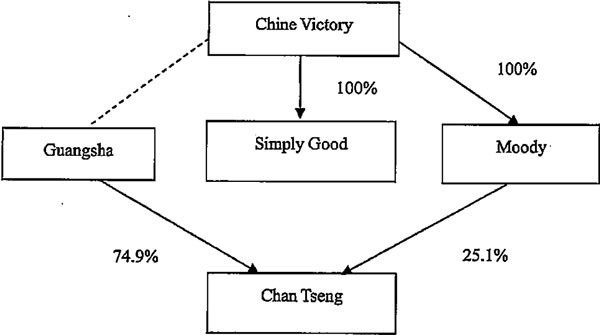

Chine Victory Profit Limited (the “Company” or “Chine Victory”) was incorporated in the British Virgin Islands on 13 May, 2004, under the International Business Companies Act, British “Virgin Islands. The Company is an investment holding company.

|

|

|

The Company acquired 100% of shareholding in Simply Good Limited (“Simply Good”) on 28 December, 2004, a company which was incorporated in the British Virgin Islands, under the International Business Companies Act, British “Virgin Islands. The principal activity of Simply Good is trading of wooden products.

|

|

|

The Company owns 100% of shareholding in Moody International Limited (“Moody”), a BVI incorporated company, on 6 March, 2006. Moody was incorporated on 19 January, 2006 under the International Business Companies Act, British “virgin Islands. The beneficiary owner of Moody is Chine Victory whereas Li Zhi Kang appears as nominee shareholder in registers of members. The principal activity of Moody is investment holding.

|

|

|

As on 21 March, 2006, Linyi Chan Tseng “Wood Company Limited (“Chan Tseng”), which was incorporated in PRC, 25.1% and 74.9% owned by Moody and Linyi Guangsha Wood Company Limited (“Guangsha”) respectively. Guangsha appears as one of the shareholder of Chan Tseng under the register of shareholders. Chine Victory has entrusted Guangsha to represent Chine “Victory to invest into Chan Tseng, which the beneficiary interest of Chan Tseng belongs to Chine Victory. The rights and obligations as shareholder of Chan Tseng have been vested to Chine “Victory. The principal activities of Chan Tseng is manufacturing and trading of plywood.

|

7

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

a) Method of Accounting

|

|

|

The Company maintains its general ledger and journals with the accrual method accounting for financial reporting purposes. The financial statements and notes are representations of management. Accounting policies adopted by the Company conform to generally accepted accounting principles in the United States of America and have been consistently applied in the presentation of financial statements, which are compiled on the accrual basis of accounting.

|

|

|

b) Basis of Presentation and Consolidation

|

|

|

The Company’s consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

|

|

|

This basis of accounting differs in certain material respects from that used for the preparation of the books of account of the Company’s principal subsidiaries, which are prepared in accordance with the accounting principles and the relevant financial regulations applicable to enterprises with limited liabilities established in the PRC (“PRC GAAP”), the accounting standards used in the places of their domicile. The accompanying consolidated financial statements reflect necessary adjustments not recorded in the books of account of the Company’s subsidiaries to present them in conformity with US GAAP.

|

|

|

c) Economic and Political Risks

|

|

|

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

|

|

|

d) Use of estimates’

|

|

|

In preparing of the financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting year. These accounts and estimates include, but are not limited to, the valuation of accounts receivable, inventories, deferred income taxes and the estimation on useful lives of plant and machinery. Actual results could differ from those estimates.

|

8

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

e) Cash and Cash Equivalents

|

|

|

The Company considers all cash and other highly liquid investments with initial maturities of three months or less to be cash equivalents. As of June 30, 2010 and March 31, 2010, there were no cash equivalents.

|

|

|

j) Accounts Receivable

|

|

|

Trade accounts receivable are recorded at the invoiced amount, net of allowances for doubtful accounts and sales returns.

|

|

|

The Company recognizes an allowance for doubtful accounts to ensure accounts receivable are not overstated due to uncollectibility. An allowance for doubtful accounts is maintained for all customers based on a variety of factors, including the length of time the receivables are past due, significant one-time events and historical experience. An additional reserve for individual accounts is recorded when the Group becomes aware of a customer’s inability to meet its financial obligations, such as in the case of bankruptcy filings or deterioration in the customer’s operating results or financial position. If circumstances related to customers change, estimates of the recoverability of receivables would be further adjusted. Bad debt expenses are included in the general and administrative expenses.

|

|

|

Outstanding account balances are reviewed individually for collectibility. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. To date, the Company has not charged off any balances as it has yet to exhaust all means of collection. The Company does not have any off-balance-sheet credit exposure to its customers, except for outstanding bills receivable discounted with banks that are subject to recourse for non-payment.

|

|

|

g) Inventories

|

|

|

Inventories consisting of raw materials and finished goods are stated at the lower of weighted average cost or market value. Finished goods are comprised of direct materials, direct labor and an appropriate proportion of overhead.

|

|

|

h) Advances to Suppliers

|

|

|

Advances to suppliers represent the cash paid in advance for purchasing raw materials.

|

9

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30,2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

i) Long-Lived Assets

|

|

|

The Company adopted Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment or Disposal of Long-Live Assets” (“SFAS 144”), which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. The Company periodically evaluates the carrying value of long-lived assets to be held and used in accordance with SFAS 144. SFAS 144 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal. Based on its review, the Company believes that, as of June 30, 2010 and March 31, 2010, there was no significant impairments of its long-lived assets.

|

|

|

j) Plant and Equipment

|

|

|

Plant and equipment, other than construction in progress, are stated at cost less depreciation and amortization and accumulated impairment loss.

|

|

|

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straght-line method. Estimated useful lives of the plant and equipment are as follows:

|

|

Plant and machinery

|

10 years

|

||

|

Equipment & computers

|

5 years

|

|

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to income as incurred, whereas significant renewals and betterments are capitalized.

|

|

|

Management considers that we have no residual value for plant and equipment.

|

|

|

k) Construction in Progress

|

|

|

Construction in progress represents direct costs of construction or acquisition and design fees incurred. Capitalization of these costs ceases and the construction in progress is transferred to plant and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation is provided until it is completed and ready for intended use.

|

.

10

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

I) Fair value of Financial Instruments

|

|

|

SEAS No. 107, “Disclosures about Fair Values of Financial Instruments”, requires disclosing feir value to the extent practicable for financial instruments that are recognized or unrecognized in the balance sheet. The fair value of the financial instruments disclosed herein is not necessarily representative of the amount that could be realized or settled, nor does the fair value amount consider the tax consequences of realization or settlement.

|

|

|

The carrying values of the Group’s financial instruments, including cash and cash equivalents, restricted cash, accounts and other receivables, deposits, accounts and other payables approximate their fair values due to the short-term maturity of such instruments. The carrying amounts of borrowings approximate their fair values because the applicable interest rates approximate current market rates.

|

|

|

m) Foreign Currency Translation

|

|

|

The Company maintains its financial statements in the functional currency. The functional currency of the Company is the Rerrminbi (RMB). Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated. into the functional currency at the exchanges rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods.

|

|

|

For financial reporting purposes, the financial statements of the Company which are prepared using the functional currency have been translated into United States dollars. Assets and liabilities are translated at the exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates and stockholders’ equity is translated at historical exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign exchange adjustment to other comprehensive income, a component of stockholders’ equity.

|

|

30.6.2010

|

31.3.2010

|

||

|

Year end RMB : US$ exchange rate

|

6.7697

|

6.81612

|

|

|

Average yearly RMB : US$ exchange rate

|

6.82

|

6.81968

|

RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation.

11

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

n) Revenue Recognition

|

|

|

Revenue from the sales of plywood is recognized on the transfer of risks and rewards of ownership, which generally coincides with the time when the goods are delivered to customers and the title has passed.

|

|

|

Net sales of products represent the invoiced value of goods, net of value added taxes (“VAT”), sales returns, trade discounts and allowances. The Company is subject to VAT which is levied on the majority of the products of Linyi at the rate of 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by the Company in addition to the invoiced value of purchases to the extent not refunded for export sales. Provision for sales returns are recorded as a reduction of revenue in the same period that revenue is recognized. The provision for sales returns, which is based on historical sales returns data, is the Company’s best estimate of the amounts of goods that will be returned from its customers.

|

|

|

o) Cost of revenues

|

|

|

Cost of revenues consists primarily of material costs, employee compensation, depreciation and related expenses, which are directly attributable to the production of products. Write-down of inventory to lower of weighted average cost or market value is also recorded in cost of revenues.

|

|

|

p) Income Taxes

|

|

|

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing, assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the consolidated statements of income and comprehensive income in the period that includes the enactment date.

|

.

12

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

q) Statutory reserves

|

|

|

Statutory reserves are referring to the amount appropriated from the net income in accordance with laws or regulations, which can be used to recover losses and increase capital, as approved, and are to be used to expand production or operations.

|

|

|

Statutory reserves consist of the following as of

|

|

As of

|

As of

|

||||||

|

June 30,

|

March 31,

|

||||||

|

2010

|

2010

|

||||||

|

(Unaudited

|

)

|

(Audited

|

)

|

||||

|

Enterprise reserve fund

|

$

|

127,572

|

$

|

127,572

|

|

r) Comprehensive Income

|

|

|

SFAS No. 130, “Reporting Comprehensive Income”, requires companies to classify items of other comprehensive income in a financial statement. Comprehensive income is defined as the change in equity of a business enterprise during a period from transactions and other events and circumstances from non-owner sources. The Company’s comprehensive net income is equal to its net income for all periods presented. The Company’s current component of other comprehensive income is the foreign currency translation adjustment.

|

|

|

s) Retirement benefits

|

|

|

Retirement benefits in the form of contributions under defined contribution retirement plans to the relevant authorities are charged to the statements of income as incurred.

|

|

|

t) Commitments and contingencies

|

|

|

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

|

13

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

u) Variable Interest Entities (“VIE”)

|

|

|

The Company conducts substantially all of the manufacturing of plywood through Chan Tseng. The Company has entrusted Guangsha to legally invest into the entity, which the beneficiary interest of Chan Tseng belongs to Chine “victory. The rights and obligations as shareholder of Chan Tseng have been vested to Chine “Victory.

|

|

|

Pursuant to certain contractual arrangements, Chan Tseng has been granted the financial support to their operation.

|

|

|

In December 2003, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 46, revised December 2003, “Consolidation of Variable Interest Entities, an interpretation of ARB No. 51” (“FIN46R”). FIN46R is intended to achieve more consistent application of consolidation policies to variable interest entities to improve comparability between enterprises engaged in similar activities even if some of those activities are conducted through variable interest entities. The Company has determined that it is the primary beneficiary of the Chan Tseng, which are VIE, and has consolidated them in its Consolidated Financial Statements. As a group, as of June 30 2010, the Chan Tseng had total assets of $11.48 million (primarily recorded in property, plant and equipment, accounts receivable and inventory) and total liabilities of $1.15 million respectively (primarily recorded in accounts payable).

|

|

|

v) Segment reporting

|

|

|

The Company uses the “management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker for making operatmg decisions and assessing performance as the source for detennining the Company’s reportable segments. Management, including the chief operating decision maker, reviews operating results solely by monthly revenue of plywood (but not by geographic area) and operating results of the Company and, as such, the Company has determined that the Company has one operating segment as defined by SFAS 131, “Disclosures about Segments of an Enterprise and Related Information”.

|

14

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

3. ACCOUNTS RECEIVABLE, NET

Accounts receivable at June 30, 2010 and March 31, 2010 consist of the following:

|

As of 30.6.2010

|

As of 31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

Accounts receivable

|

$

|

19,641,346

|

$

|

8,340,879

|

|||

|

Less: Allowance for doubtful accounts

|

—

|

—

|

|||||

|

19,641,346

|

8,340,879

|

||||||

4. INVENTORIES

Inventories consist of the following as of

|

30.6.2010

|

31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

Raw materials

|

$

|

4,578,982

|

$

|

3,739,448

|

|||

|

Finished goods

|

3,510,058

|

2,866,505

|

|||||

|

8,089,040

|

6,605,953

|

||||||

Inventories consisting of raw materials and finished goods are stated at the lower of weighted average cost or market value. Raw materials are comprised of the wood and all materials used in the manufacturing process. Finished goods are comprised of direct materials, direct labor and an appropriate proportion of overhead.

The Company has not comprised the work-in-progress due to the short process of the plywood manufacturing.

15

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

5. OTHER RECEIVABLES

Other receivables consist of the following as of

|

30.6.2010

|

31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

Community insurance on behalf of employee

|

$

|

7,863

|

$

|

—

|

|||

|

Prepaid input VAT

|

6,115

|

—

|

|||||

|

Others

|

—

|

3,500

|

|||||

|

13,978

|

3,500

|

||||||

6. PLANT AND EQUIPMENT, NET

Plant and equipment consist of the following as of

|

30.6.2010

|

31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

At cost

|

|||||||

|

Plant and machinery

|

$

|

6,226,350

|

$

|

6,225,855

|

|||

|

Equipment & computers

|

97,164

|

97,307

|

|||||

|

Effect of foreign currency translation

|

(48,840

|

)

|

993,275

|

||||

|

6,274,674

|

7,316,437

|

||||||

|

Less: Accumulated depreciation

|

|||||||

|

Plant and machinery

|

1,853,787

|

2,538,780

|

|||||

|

Equipment & computers

|

27,320

|

28,122

|

|||||

|

Effect of foreign currency translation

|

(8,303

|

)

|

141,807

|

||||

|

1,872,804

|

2,708,709

|

||||||

|

Net value

|

|||||||

|

Plant and machinery

|

4,372,563

|

3,687,075

|

|||||

|

Equipment & computers

|

69,844

|

69,185

|

|||||

|

Effect of foreign currency translation

|

(40,537

|

)

|

851,468

|

||||

|

4,401,870

|

4,607,728

|

||||||

Depreciation expense for the three months ended June 30, 2010 and of the year ended March 31, 2010 were $165,662 and $730,253 respectively.

16

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

7. ACCRUED LIABILITIES

Accrued liabilities at June 30, 2010 and March 31, 2010 consist of the following:

|

As of 30.6.2010

|

As of 31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

Electricity, water and rental expenses

|

$

|

147,696

|

$

|

12,342

|

|||

|

Salaries, wages and community insurance

|

45,571

|

30,291

|

|||||

|

Rental expenses

|

—

|

119,386

|

|||||

|

Community insurance in PRC

|

—

|

9,260

|

|||||

|

193,267

|

171,279

|

||||||

8. OTHER PAYABLES

Other payables consist of the following as of

|

Note

|

30.6.2010

|

31.3.2010

|

||||||||

|

(Unaudited)

|

(Audited)

|

|||||||||

|

Amount due to a director

|

(a)

|

$

|

61,793

|

$

|

62,341

|

|||||

Note:

(a) The amounts due are unsecured, interest free, and have no fixed repayment terms.

17

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

9. TAX PAYABLE

Tax payable consist of the following as of

|

30.6.2010

|

31.3.2010

|

||||||

|

(Unaudited)

|

(Audited)

|

||||||

|

Enterprise income tax in PRC

|

$

|

4,893

|

$

|

5,549

|

|||

|

Value added tax in PRC

|

6,780

|

—

|

|||||

|

11,673

|

5,549

|

||||||

10. COMMON EQUITY

Company equity as at June 30, 2010 and March 31, 2010 are as follows:

|

30.6.2010

|

31.3.2010

|

||||||

|

(Unaudited

|

)

|

(Audited

|

)

|

||||

|

Issued and fully paid:

|

|||||||

|

20,000 ordinary share at USD1.00 each

|

$

|

20,000

|

$ |

20,000

|

|||

11. BUSINESS SEGMENT

The Company operates in one segment and therefore does not provide additional disclosure relating to reporting segments.

The following table provides a breakdown of foreign sales by geographic area during the periods indicated:

|

Fiscal period ended

June 30, 2010

|

Fiscal period ended

June 30, 2009

|

||||||

|

PRC

|

$

|

13,740,600

|

$

|

10,180,296

|

|||

|

Other

|

71,920

|

14,950

|

|||||

|

Net Sale

|

13,812,520

|

10,195,246

|

|||||

18

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

12. ADMINISTRATIVE AND OTHER OPERATING COSTS

Details of administrative and other operating costs are summarized as follows:

|

Fiscal period ended

June 30, 2010

|

Fiscal period ended

June 30, 2009

|

||||||

|

Depreciation

|

$

|

44,064

|

$

|

4,835

|

|||

|

Entertainment

|

12,017

|

1,844

|

|||||

|

Insurance

|

12,001

|

2,814

|

|||||

|

Motor vehicle expenses

|

16,023

|

2,707

|

|||||

|

Office expenses

|

56,081

|

5,880

|

|||||

|

Travelling expenses

|

4,006

|

—

|

|||||

|

Staff salaries

|

120,174

|

14,447

|

|||||

|

Staff welfare

|

4,000

|

733

|

|||||

|

Others

|

132,213

|

5,778

|

|||||

|

400,579

|

39,038

|

||||||

13. OTHER INCOME, NET

Details of other income are summarized as follows:

|

Fiscal period ended

June 30, 2010

|

Fiscal period ended

June 30, 2009

|

||||||

|

Interest income received

|

$

|

—

|

$

|

1,289

|

|||

19

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

14. INCOME TAXES

BVI Tax

Simply Good Limited was incorporated in the BVI and, under the current laws of the BVI, is not subject to income taxes.

PRC Tax

Chan Tseng is operating in the PRC, and in accordance with the relevant tax laws and regulations of PRC, the corporation income tax rate is 33%. However, also in accordance with the relevant taxation laws in the PRC, from the time that a company has its first profitable tax year, a foreign investment company is exempt from corporate income tax for its first two years and is then entitled to a 50% tax reduction for the succeeding three years. The Company’s first profitable tax year was 2007. The Company will be levied at the 25% tax rate in March of 2011. Therefore, income tax for the period ended June 30, 2010 are as follows:

|

As of

30.6.2010

|

As of

30.6.2009

|

||||||

|

Income before tax

|

$

|

3,379,301

|

$

|

2,490,294

|

|||

|

Income tax

|

1,109

|

2,681

|

|||||

The deferred tax asset and liability has not been recognized because of the exemption for taxation and no valuation allowance to be established for the period ended June 30, 2010 and June 30, 2009.

20

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

|

15.

|

COMMITMENTS AND CONTINGENCIES

|

|

As of July 2006, the Company leased factory premises under the operating lease agreement expiring in 2014.

|

|

|

The future rninimurn lease payment Tinder the above-mentioned leases as of June 30,2010 is as follows:

|

|

Year

|

30.6.2010 | 30.6.2009 | ||||||

|

2010 to 2014

|

$ | 357,954 | $ | 452,752 |

|

As of June 30, 2010 the Company did not have any contingent liabilities.

|

|

|

16.

|

RELATED PARTY TRANSACTION

|

|

During the fiscal period, one of the subsidiaries, Simply Good, obtained supply of plywood through the production by a variable interest entity, Chan Tseng, and Chan Tseng agreed to produce plywood to Simply Good at zero cost.

|

21

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

17. RECENTLY ISSUED ACCOUNTING STANDARDS

|

In March 2008, the FASB issued SFAS No. 161, DISCLOSURES ABOUT DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES (an amendment to SFAS No. 133). This statement is effective for financial statements issued for fiscal year and interim periods beginning after November 15, 2008 and requires enhanced disclosures with respect to derivative and hedging activities. The Company will comply with the disclosure requirements of this statement if it utilizes derivative instruments or engages in hedging activities upon its effectiveness.

|

|

|

In April 2008, the FASB issued FASB Staff Position No. 142-3, DETERMINATION OF THE USEFUL LIFE OF INTANGIBLE ASSETS (“FSP No. 142-3”) to improve the consistency between the useful life of a recognized intangible asset (under SFAS No. 142) and the period of expected cash flows used to measure the fair value of the intangible asset (under SFAS No. 141 (R)). FSP No. 142-3 amends the factors to be considered when developing renewal or extension assumptions that are used to estimate an intangible asset’s useful life under SFAS No. 142. The guidance in the new staff position is to be applied prospectively to intangible assets acquired after December 31, 2008. In addition, FSP No.142-3 increases the disclosure requirements related to renewal or extension assumptions. The Company does not believe implementation of FSP No. 142-3 have a material impact on its financial statements.

|

|

|

In May 2008, the FASB issued statement No. 162, THE HIERARCHY OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLES. This statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States” (the GAAP hierarchy). This statement is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “the Meaning of Present Fairly in Conformity “With Generally Accepted Accounting Principles”.

|

22

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

17. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

|

In May 2008, the FASB issued FSP Accounting Principles Board (“APB”) 14-1 “Accounting for Convertible Debt instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement)” (“FSP APB 14-1”). FSP APB 14-1 requires the issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to separately account for the liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. FSP APB 14-1 is effective for fiscal years beginning after December 15, 2008 on a retroactive basis. As we do not have convertible debt at this time, we currently believe the adoption of FSP APB 14-1 will have no effect on our combined results of operations and financial condition.

|

|

|

In May 2008, the FASB issued Statement No. 163, ACCOUNTING FOR FINANCE GUARANTEE INSURANCE CONTRACTS - AN INTERPRETATION OF FASB STATEMENT NO. 60. The premium revenue recogmtion approach for a financial guarantee insurance contract links premium revenue recognition to the amount of insurance protection and the period in which it is provided. For purposes of this statement, the amount of insurance protection provided is assumed to be a function of the insured principal amount outstanding, since the premium received requires the insurance enterprise to stand ready to protect holders of an insured financial obligation from loss due to default over the period of the insured financial obligation. This Statement is effective for financial statements issued for fiscal years beginning after December 15,2008.

|

23

CHINE VICTORY PROFIT LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED JUNE 30, 2010

(Stated in US dollars)

17. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

|

In June 2008, the FA3B issued FASB Staff Position Emerging Issues Task Force (EITF) No. 03-6-1, DETERMINING WHETHER INSTRUMENTS GRANTED IN SHARE-BASED PAYMENT TRANSACTIONS ARE PARTICIPATING SECURITIES (“FSP EITF No. 03-6-1”)- Under FSP EITF No. 03-6-1, unvested share-based payment awards that contain rights to receive nonforfeitable dividends (whether paid or unpaid) are participating securities, and should be included in the two-class method of computing EPS. FSP EITF No. 03-6-1 is effective for fiscal years beginning after December 15, 2008, and interim periods within those years, and is not expected to have a significant impact on the Company’s financial statements.

|

|

|

None of the above new pronouncements has current application to the Company, but maybe applicable to the Company’s future financial reporting.

|

24