Attached files

Exhibit 10.5

Dated the 21 day of February 2006

(Linyi City Lanshanqu Guangxia Forestry Company Limited)

Ng Fuk Tang

and

Chine Victory Profit Limited

|

INVESTMENT ARRANGEMENT AGREEMENT

|

||

INDEX

|

1.

|

Definitions

|

1

|

|

2.

|

Capital Increase

|

2

|

|

3.

|

Guangxia Holding in Trust for CVP

|

2

|

|

4.

|

Guangxias Duties and Liabilities

|

3

|

|

5.

|

Arrangement Fee

|

3

|

|

6.

|

Representations and Warranties

|

4

|

|

7.

|

Events of Default

|

4

|

|

8.

|

Costs and Expenses

|

5

|

|

9.

|

Miscellaneous

|

6

|

|

10.

|

Governing Law and Jurisdiction

|

6

|

|

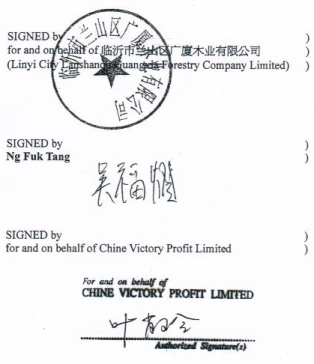

EXECUTION PAGE

|

8

|

|

|

THE SCHEDULE

|

9

|

|

THIS AGREEMENT is made on the 21st day of February 2006.

BETWEEN:

(Liny Guangsha Wood Industry Co., Ltd.), a company with limited liability incorporated in the PRC (Guangsba)

|

(1)

|

Ng Fuk Tang, holder of HKID, Identity Card No. V060151(9) (Mr Ng); and

|

|

(2)

|

Chine Victory Profit Limited, a company with limited liability incorporated in the British Virgin Islands whose registered office is at Sea Meadow House, Blackburne Highway, Road Town, Tortola, British Virgin Islands. (CVP).

|

WHEREAS:

|

(A)

|

Through the efforts of Mr Ng, CVP has agreed to provide the Increased Capital to the Target via Guangsha in the manner set out thereinafter.

|

|

(B)

|

CVP has agreed to pay an arrangement fee to Mr Ng.

|

NOW IT IS HEREBY AGREED as follows:

1. Definitions

|

1.1

|

In this Agreement (including the Recitals), unless the context requires otherwise, the following expressions shall have the meaning set out opposite them below:-

|

|

this Agreement

|

this agreement, as amended, supplemented or restated from time to time;

|

||

|

Business Day

|

a day (other than Saturday) on which banks generally are open for business in Hong Kong and the PRC;

|

||

|

Capital Increase

|

an increase in the registered capital of the Target by an amount equivalent to the Increased Capital;

|

||

|

Cash Capital

|

RMB4,480,000.00, being part of the Increased Capital;

|

||

|

HKS

|

Hong Kong Dollars, the lawful currency of Hong Kong;

|

||

|

Hong Kong

|

the Hong Kong Special Administrative Region of the PRC;

|

||

|

Increased Capital

|

RMB52,489,242.00;

|

||

|

Increased Capital Percentage

|

[74.9%] per cent;

|

||

|

Machinery

|

the machinery as set out in the Schedule;

|

||

|

PRC

|

the Peoples Republic of China;

|

||

|

RMB

|

Renminbi, the lawful currency of the PRC;

|

||

|

Stock Exchange

|

a recognisable stock exchange; and

|

||

|

Target

|

(Linyi Chan Tseng Wood Co.,) Ltd.), a company with limited liability incorporated in the PRC.

|

1

|

1.2

|

Expressions in the singular shall include the plural and expressions in a gender shall include every gender and references to persons shall include bodies corporate and unincorporate and vice versa.

|

|

1.3

|

References to any statute or statutory provision shall be construed as references to such statute or statutory provision as respectively amended or re-enacted or as their operation is modified by any other statute or statutory provision (whether before or after the date of this Agreement) and shall include any provisions of which they are re-enactments (whether with or without modification) and shall include subordinate legislation made under the relevant statute.

|

|

1.4

|

References to Clauses and Schedules are to clauses of and schedules to this Agreement.

|

|

1.5

|

The headings used in this Agreement are inserted for convenience only and shall not affect its construction or interpretation.

|

|

1.6

|

The Schedule shall form part of this Agreement.

|

|

1.7

|

An undertaking by a party not to do any act or thing shall be deemed to include an undertaking not to permit or suffer the doing of such act or thing.

|

|

1.8

|

Where in this Agreement any liability is undertaken by two or more persons the liability of each of them shall be joint and several.

|

|

1.9

|

The expressions Guaagsha, Mr Ng and CVP shall, where the context permits, include their respective successors, personal representatives and permitted assigns.

|

|

2.

|

Capital Increase

|

|

2.1

|

Through the efforts of Mr Ng, CVP has agreed to provide (he Increased Capital to the Target via Guangxia subject to the terms and conditions herein.

|

|

2.2

|

Upon the approval being granted by the relevant authorities to the Capital Increase of the Target, Guangxia shall contribute the Machinery and deposit the Cash Capital into the foreign currency capital account of the Target and both Guangxia and the Target shall procure the verification of the Capital Increase, the completion of the formalities of the Capital Increase and the issuance of the new business licence and other documents reflecting the Capital Increase.

|

|

3.

|

Guangxia Holding in Trust for CVP

|

|

3.1

|

Guangxia shall hold the Increased Capital and all rights, benefits and privileges attaching thereto or arising therefrom on trust and as nominee for CVP absolutely.

|

2

|

3.2

|

Guangxia shall not transfer, assign, sell or otherwise dispose of the Increased Capital without the prior written consent of CVP and shall exercise all rights, benefits and privileges attaching to and arising from the Increased Capital as CVP may direct from time to time.

|

|

|

3.3

|

Guangxia shall pay to CVP the Increased Capital Percentage of any dividend, distribution or money payable by the Target to Guangxia as soon as practical after any such payment is received by Guangxia and, pending any such payment to CVP, Guangxia shall hold the same in trust for CVP.

|

|

|

3.4

|

All payments by Guangxia to CVP hereunder and all votes at any shareholders meeting of the Target shall be made in accordance with CVPs instructions which shall from time to time be given to Guangxia.

|

|

|

3.5

|

If Guangxia makes any payment to CVP in the belief that the Target has paid to Guangxia the amount thereof, by a certificate issued by Guangxia to CVP (such certificate to be, in the absence of any manifest error, conclusive and binding on CVP) that the Target has not, in fact, paid to Guangxia such amount, CVP shall, on demand, repay such amount to Guangxia.

|

|

|

3.6

|

If at any time after Guangxia made any payment to CVP, such payment is for any reason whatsoever reduced, rescinded, set aside or otherwise required to be repaid by Guangxia, by a certificate issued by Guangxia to CVP setting out such payment or, as the case may be, the amount reduced together with such further sums as being necessary to reimburse it for all its costs, charges and expenses incurred as a result of or in connection with such payment or in funding such payment (such certificate to be, in the absence of any manifest error, conclusive and binding on CVP), CVP shall forthwith on demand repay such payment or, as the case may be, the amount reduced to Guangxia together with such further sums.

|

|

|

3.7

|

CVP shall indemnify Guangxia and keep Guangxia indemnified now and in the future from any expenses, costs, actions, proceedings, claims, damages and demands whatsoever arising out of or in respect of the Increased Capital.

|

|

|

4.

|

Guangxias Duties and Liabilities

|

|

|

In respect of its duties and functions hereunder, Guangxia will to the extent that it may do so without violating any duty of confidentiality:

|

||

|

(a)

|

notify CVP of all payments made hereunder;

|

|

|

(b)

|

furnish to CVP, as CVP may reasonably request, copies of such documents that CVP may from time to time receive hereunder or otherwise, but Guangxia shall assume no responsibility with respect to the authenticity, validity, accuracy or completeness thereof; and

|

|

|

(c)

|

use all reasonable endeavours to give CVP notice of the occurrence of any Event of Default of which Guangxia shall have actual knowledge.

|

|

|

5.

|

Arrangement Fee

|

|

|

In consideration of Mr Ng arranging for the Increased Capital from CVP to the Target via Guangxia, CVP shall pay one-tenth per cent. (0.1%) of an amount equal to the Increased Capital to Mr Ng as an arrangement fee within 3 Business Days after the signing of this Agreement

|

||

3

|

6.

|

Representations and Warranties

|

||

|

6.1

|

Each party hereby represents and warrants to the others as follows:

|

||

|

(a)

|

it (other than Mr Ng) is a company duly incorporated with limited liability and validly existing under the laws of its place of incorporation;

|

||

|

(b)

|

it or he has the power, authority and legal capacity to enter into this Agreement on the terms and conditions set out herein and to perform and observe its or his obligations hereunder;

|

||

|

(c)

|

its (other than MrNgs) execution, delivery and performance of this Agreement have been duly authorised by all necessary corporate action under all applicable laws and regulations; and

|

||

|

(d)

|

this Agreement constitutes valid and legally binding obligations of itself or himself in accordance with its terms.

|

||

|

7.

|

Events of Default

|

||

|

7.1

|

Each of the following events shall be an Event of Default:

|

||

|

(a)

|

if Guangxia or the Target fails to pay any dividend, distribution or money on the date on which the same is due and payable, or in the case of any sum expressed to be payable on demand, if Guangxia fails to pay forthwith upon any such demand;

|

||

|

(b)

|

if any certificate, representation, warranty or statement given or made or deemed to be made by Guangxia in this Agreement proves to have been untrue or inaccurate in any material respect;

|

||

|

(c)

|

if in respect of Guangxia or the Target:

|

||

|

(i)

|

any loan, guarantee, indemnity or other Indebtedness or any other obligation for borrowed money becomes or is declared or becomes capable (all grace periods, if any, having expired) of being declared due prematurely by reason of a default in its obligations in respect of the same;

|

||

|

(ii)

|

it fails to make any payment in respect of such loans, guarantee, indemnity or other indebtedness or obligation for borrowed money on the due date for such payment;

|

||

|

(iii)

|

the security for any such loans, guarantee, indemnity or other indebtedness or obligation for borrowed money becomes enforceable; or

|

||

|

(iv)

|

any judgment or order made against it is not satisfied or discharged within seven days;

|

||

|

(d)

|

if in respect of Guangxia or the Target:

|

||

4

|

(i)

|

any order is made by a competent court or other appropriate authority or any resolutions are passed for bankruptcy, liquidation, winding-up or dissolution or for the appointment of a liquidator, receiver, trustee or similar official of it or of all or a substantial part of its assets otherwise than for the purposes of amalgamation, merger or re-construction, the terms of which have previously been approved in writing by CVP;

|

||

|

(ii)

|

a distress or execution is levied or enforced upon or sued out against any of its chattels, properties or assets and is not discharged or stayed or contested in good faith by action within fifteen (15) days thereafter;

|

||

|

(iii)

|

it stops payment to creditors generally or is unable to pay its debts within the meaning of any applicable legislation relating to insolvency, bankruptcy, liquidation or winding up, or ceases or threatens to cease substantially to carry on business otherwise than for the purposes of amalgamation, merger or re-construction, the terms of which have been approved in writing by CVP; or

|

||

|

(e)

|

if it is or becomes impossible or unlawful in Hong Kong or elsewhere for any of the parties to fulfil any of its undertakings or obligations contained in this Agreement;

|

||

|

(f)

|

if a material adverse change occurs in the business, assets, general condition or prospects of Guangxia or the Target which could materially affect the ability of Guangxia to perform its obligations hereunder,

|

||

|

(g)

|

if the registered or the beneficial ownership (whether immediate or ultimate) of Guangxia or the Target at any time hereafter changes without the prior written consent of CVP;

|

||

|

(h)

|

if any licence, authorisation, consent, approval or registration necessary or desirable to enable Guangxia or the Target to comply with its obligations hereunder is revoked, withheld, materially modified or fails to be granted or perfected, or to remain in full force and effect; or

|

||

|

(i)

|

if any event occurs or circumstance arises which in the opinion of CVP is likely materially and adversely to affect the ability of Guangxia to perform and observe any or all of its obligation hereunder.

|

||

|

7.2

|

Guangxia shall notify CVP forthwith in writing of any occurrence of an Event of Default or any event which, with the giving of notice under Clause 9.1 and/or lapse of time might constitute an Event of Default.

|

||

|

7.3

|

CVP may at any time after the happening of an Event of Default (whether or not any notice pursuant to Clause 9.1 above shall have been given by Guangxia), unless and until that Event of Default and any others shall have been fully remedied to the satisfaction of CVP, by written notice to Guangxia transfer the Increased Capital to a third party as may be nominated by CVP from time to time.

|

||

|

8.

|

Costs and Expenses

|

||

|

All expenses incurred by or on behalf of the parties, including all fees of agents, representatives, solicitors and accountants engaged by either of them in connection with the negotiation, preparation or execution of this Agreement, shall be borne solely by the party who incurred the liability.

|

|||

5

|

9.

|

Miscellaneous

|

|

All notice, demand or other communication so addressed to the relevant party shall be deemed to have been delivered (a) if given by hand, when actually delivered to the relevant address; (b) if given or made by fax, when despatched upon receipt by the sender of machine printed confirmed of receipt; or (c) if given or made by post (i) on the third (3rd) Business Day following the day of posting if sent locally unless actually received sooner, or (ii) on the seventh (7th) Business Day following the day of posting if sent overseas unless actually received sooner.

|

|

|

Ihe rights and remedies of the parties shall not be affected by any failure to exercise or delay in exercising any right or remedy or by the giving of any indulgence by any other party or by anything whatsoever except a specific waiver or release in writing and any such waiver or release shall not prejudice or affect any other righls or remedies of the patties. No single or partial exercise of any right or remedy shall prevent any further or other exercise thereof or the exercise of any other right or remedy.

|

|

|

This Agreement and the terms and provisions hereof may not be altered or amended except by writing signed by all parties.

|

|

|

Other than such disclosure as may be required by any Stock Exchange or any regulatory authority or as required by law. none of the parties hereto shall make any announcement or release or disclose any information concerning this Agreement or the transactions herein referred to or disclose the identity of the other party (save disclosure to its own professional advisers under a duty of confidentiality) without the written consent of the other party.

|

|

|

No party may assign its or his rights under this Agreement.

|

|

|

10.

|

Governing Law and Jurisdiction

|

|

This Agreement is governed by and shall be construed in all respects in accordance with the laws of Hong Kong.

|

|

|

Any dispute, controversy or claim arising out of or in connection with this Agreement, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration in Hong Kong in accordance with the rules of the International Chamber of Commerce (ICC) for the time being in force, which rules are deemed to be incorporated by reference in this clause. A party shall provide 14 days written notice prior to commencing any arbitration proceedings.

|

|

|

The tribunal to be appointed shall consist of three arbitrators with one arbitrator to be appointed by CVP and one arbitrator to be appointed by Guangxia. The two arbitrators thus appointed shall choose the third who will act as the presiding arbitrator of the tribunal. The presiding arbitrator shall be appointed by the Chairman or Secretary General of the ICC if the two arbitrators are unable to agree on the choice of presiding arbitrator within 30 days of their appointment.

|

|

|

The seat or legal place of arbitration shall be Hong Kong and the language to be used in the arbitral proceedings shall be English.

|

6

|

This Agreement may be executed in any number of counterparts each of which shall be binding on the party who shall have executed it but which shall together constitute but one agreement.

|

IN WITNESS whereof the parties hereto have hereunder set their respective hands the day and year first above written.

7

EXECUTION PAGE