Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL FINANCIAL INC | d8k.htm |

| EX-99.1 - NEWS RELEASE, DATED SEPTEMBER 30, 2010, OF PRUDENTIAL FINANCIAL, INC. - PRUDENTIAL FINANCIAL INC | dex991.htm |

PRUDENTIAL FINANCIAL, INC.

PRUDENTIAL FINANCIAL, INC.

ACQUISITION OF STAR/EDISON

ACQUISITION OF STAR/EDISON

SEPTEMBER 30, 2010

SEPTEMBER 30, 2010

1

Exhibit 99.2 |

Attractive Financial Transaction

–

In-force business + cost synergies = attractive expected returns

–

Expected near-term accretion to earnings per share, growing as synergies

are realized

–

Meaningful contribution to Prudential’s ROE prospects

–

Strong expected cash flow and capital generation

Strategic Benefits for Prudential’s Japanese Insurance Business

–

Complementary distribution, well-suited to Prudential’s core protection

and retirement products

–

Increased scale supports efficient cost structure across Japanese businesses

–

Client base offers second-sale opportunities

Acquisition of Star/Edison

Acquisition of Star/Edison

Building on Success in a Market We Know Well

Building on Success in a Market We Know Well

2 |

Low

Execution Risk Low Execution Risk

•

Products compatible with Prudential’s established Japanese

insurance operations

•

Recent update of Prudential’s administrative platform facilitates

absorption of acquired business

•

Seasoned Prudential management team with strong business

combination track record in Japan: Kyoei/Gibraltar Life (2001);

Aoba Life (2004); Yamato Life (2009)

•

Expected returns primarily based on in-force business that has

persisted through financial crisis

3 |

Transaction Highlights

Transaction Highlights

•

Purchase price $4.8 billion; “net”

purchase price, approximately $4.2

billion

(1)

•

Expected financing: approximately $1.7 billion available capital, $1.3 billion

equity issuance, $1.2 billion debt

•

Acquired businesses to be adequately capitalized at closing,

consistent with “AA”

ratings targets

(2)

•

Expected pre-tax integration expenses, $500 million over 5 year

period to achieve targeted annual cost savings of $250 million after

integration completed

•

Minimal goodwill

•

Closing expected first quarter, 2011

4

1)

“Net”

purchase price reflects expected application of a portion of net assets acquired to

repay assumed debt. 2)

Based

on

approximately

$4.2

billion

“net”

purchase

price. |

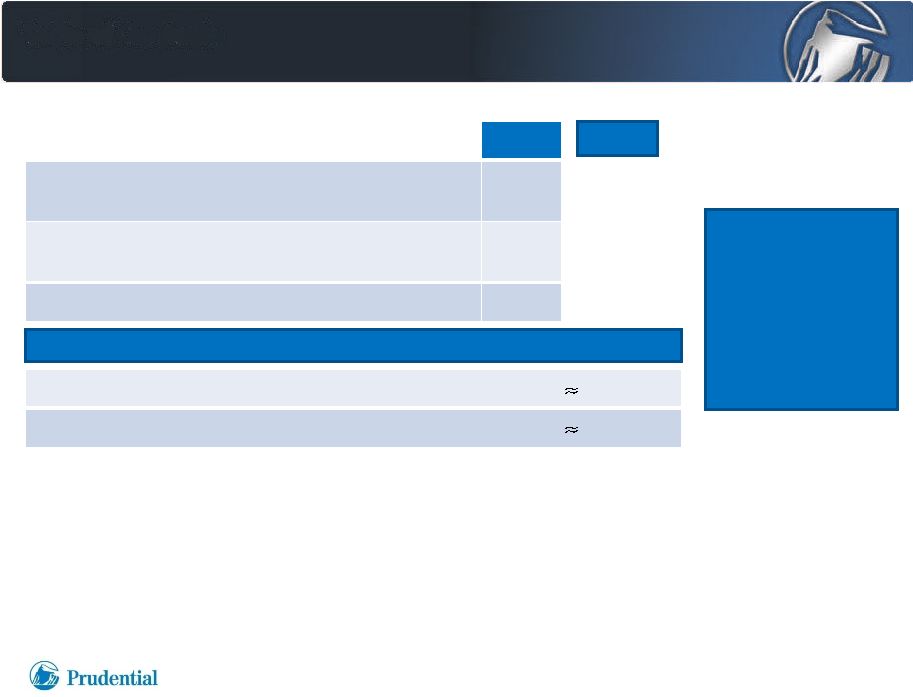

Expected Transaction Financing

Expected Transaction Financing

Available On-Balance-Sheet Capital

Available On-Balance-Sheet Capital

–

–

Parent company funds

Parent company funds

–

–

Capital resident in international units

Capital resident in international units

$1.7 billion

$1.7 billion

Common Equity

Common Equity

–

–

Public equity offering prior to closing

Public equity offering prior to closing

$1.3 billion

$1.3 billion

Debt Financing

Debt Financing

–

–

Long term senior notes of Prudential Financial, Inc.

Long term senior notes of Prudential Financial, Inc.

to be issued prior to closing

to be issued prior to closing

$1.2 billion

$1.2 billion

Total

Total

$4.2

$4.2

billion

billion

Ratio of Capital Debt

Ratio of Capital Debt

To Total Capitalization

To Total Capitalization

(1)

(1)

Actual

Actual

6/30/10

6/30/10

24.3%

24.3%

Pro-Forma with

Pro-Forma with

Expected Financing

Expected Financing

(2)

(2)

25.8%

25.8%

1)

For the Financial Services Businesses.

2)

Reflects repayment of third-party debt assumed in transaction.

5 |

Attractive Financial Returns

Attractive Financial Returns

Driven

Driven

by

by

In-Force

In-Force

Business

Business

and

and

Cost

Cost

Synergies

Synergies

(1)

(1)

6

1)

Amounts in millions except per share data.

2)

Excludes net realized capital gains and losses.

3)

Based on contribution of acquired businesses to after-tax adjusted operating

income of Financial Services Businesses before integration costs, net of

expected financing costs and impact of Prudential Common Stock issuance at $55.00

per share. 2009

2009

Star/Edison pre-tax operating income,

historical

basis

(2)

$900

Purchase accounting and other adjustments

(primarily reset of investment portfolio yield)

(500)

Pro-forma earnings base

$400

Approximately

30% of

Star/Edison

expense base,

realized over

3-5 year

period

Expected Cost

Synergies

$170 Expected Cost

Synergies

$170 Expected

EPS

Accretion

(3)

$.40

Expected

ROE

Accretion

(3)

70

bps

2012

2012 |

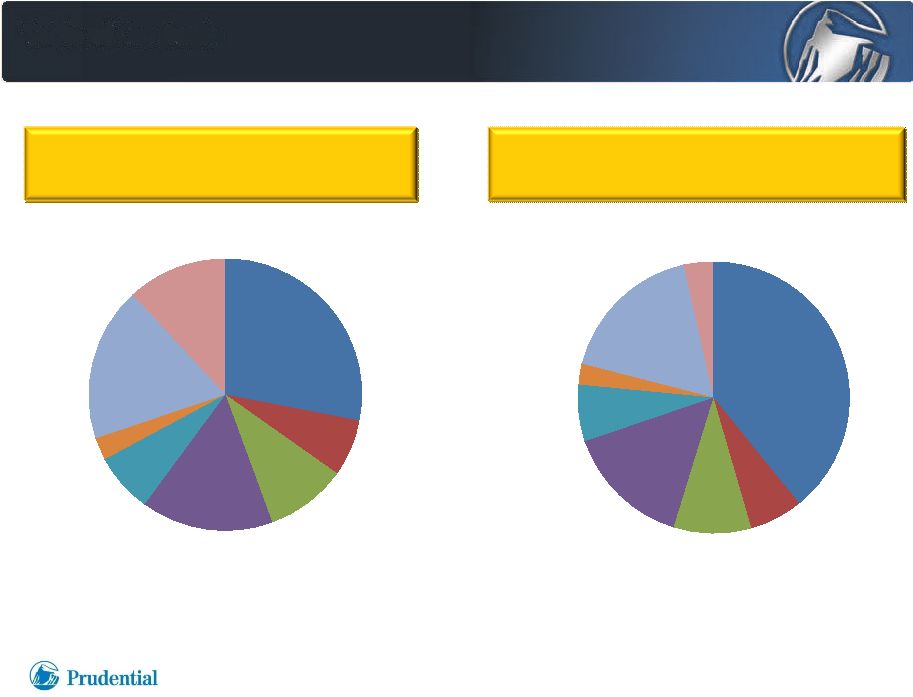

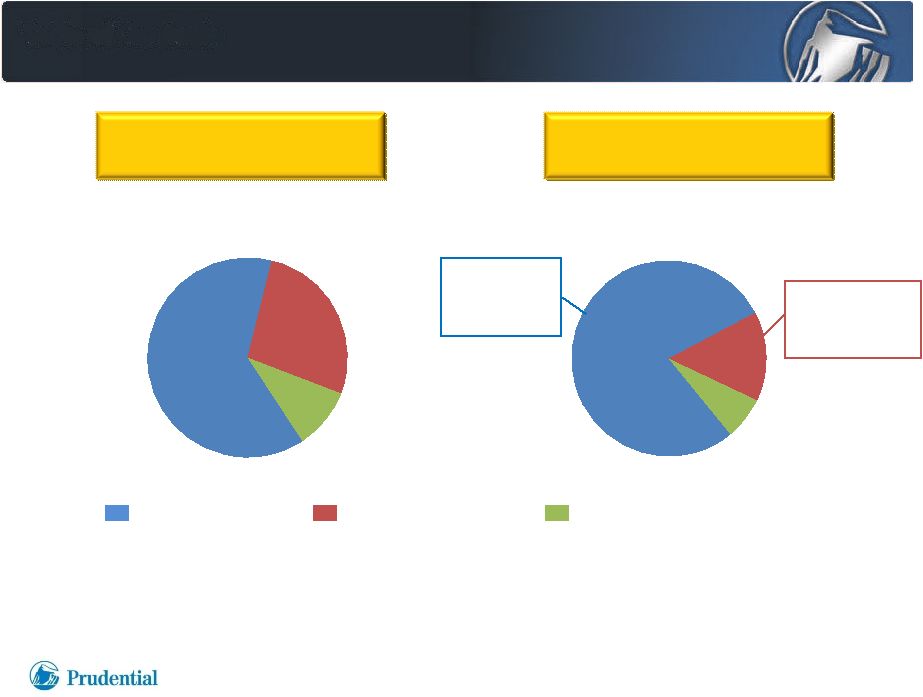

International

Insurance

39%

Group

Insurance

6%

Individual

Life

9%

Retirement

15%

Asset

Management

7%

International

Investments

2%

Individual

Annuities

18%

Corporate

and Other

4%

Transaction Effectively Deploys Capital and

Transaction Effectively Deploys Capital and

Strengthens Balanced Mix of Businesses

Strengthens Balanced Mix of Businesses

6/30/10 Actual

6/30/10 Actual

Attributed Equity $26.8 Billion

Attributed Equity $26.8 Billion

(1)

(1)

Pro-Forma Including Star/Edison,

Pro-Forma Including Star/Edison,

Attributed Equity $28.1 Billion

Attributed Equity $28.1 Billion

(1)(2)

(1)(2)

1)

For the Financial Services Businesses, excluding accumulated other comprehensive

income related to unrealized gains and losses on investments and pension /

postretirement benefits. 2)

Based on expected transaction financing.

7

International

Insurance

28%

Group

Insurance

7%

Individual

Life

9%

Retirement

16%

Asset

Management

7%

International

Investments

3%

Individual

Annuities

18%

Corporate

and Other

12% |

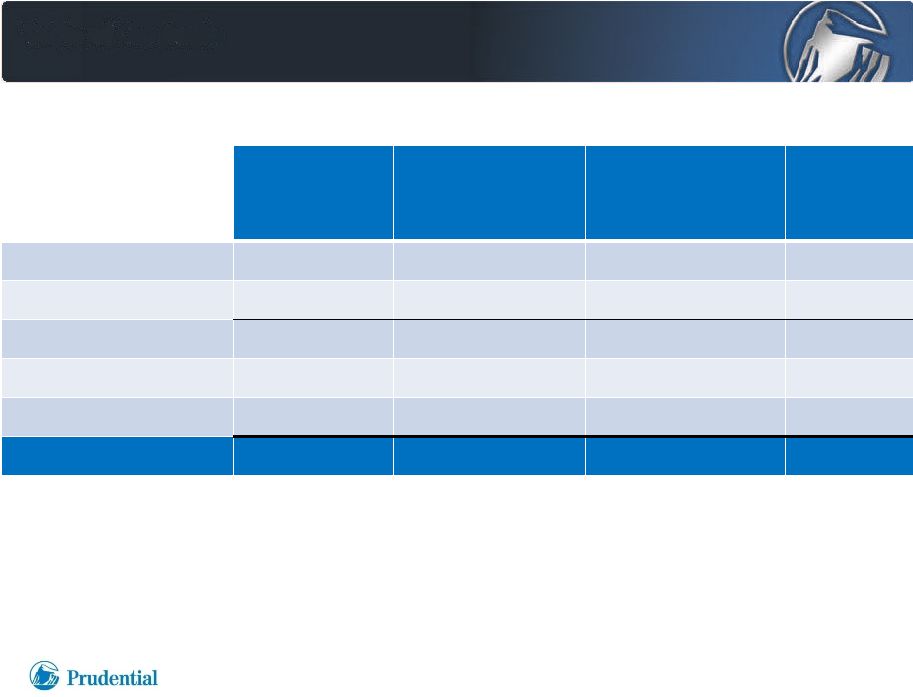

Building a Leading Foreign Life Insurer in Japan

Building a Leading Foreign Life Insurer in Japan

Assets

Assets

(1)(2)(3)

(1)(2)(3)

($ Billions)

($ Billions)

Face Amount

Face Amount

in-Force

in-Force

(2)(3)(4)(5)

(2)(3)(4)(5)

($ Billions)

($ Billions)

Insurance

Insurance

Revenues

Revenues

(1)(3)(6)

(1)(3)(6)

($ Millions)

($ Millions)

Captive

Captive

Agents

Agents

(2)

(2)

Star

$ 18.6

$ 76.3

$ 1,462

4,333

Edison

29.0

70.5

2,065

3,400

Combined

47.6

146.8

3,527

7,733

Gibraltar Life

45.4

219.7

2,939

6,101

Prudential of Japan

35.4

303.6

4,046

3,122

TOTAL

TOTAL

$128.4

$128.4

$670.1

$670.1

$10,512

$10,512

16,956

16,956

1)

Certain data based on one month reporting lag.

2)

As of June 30, 2010.

3)

Translated based on actual exchange rates.

4)

Face amount in-force for individual insurance only (excluding annuity).

5)

Source: Life Insurance Association of Japan

6)

Net premiums, policy charges and fee income for the year ended December 31, 2009.

8 |

Business Integration Drives Cost Synergies

Business Integration Drives Cost Synergies

•

Expect to integrate Star and Edison businesses with Prudential’s

Japanese insurance operations by early 2012

•

Integration includes branch and back office consolidations,

migration to Prudential’s IT platform, rationalization of

administrative expenses

•

Expect pre-tax integration costs of approximately $500 million

over 5 year period, including approximately $400 million in

2011-2012

•

Expect annual cost savings of about $170 million by 2012,

$200 million by 2013, and $250 million after integration completed

9 |

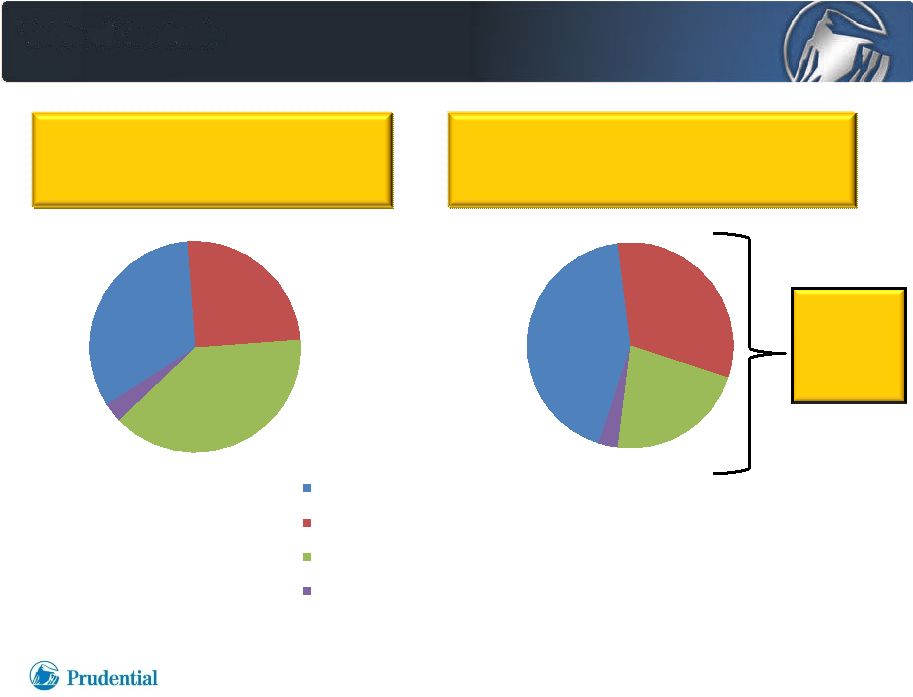

63%

27%

10%

78%

15%

7%

Diversified Distribution Channels

Diversified Distribution Channels

Star/Edison

Star/Edison

2009

2009

Sales

Sales

(1)

(1)

$599 million

$599 million

1)

Annualized new business premiums; foreign denominated activity translated to U.S.

dollars based on average exchange rates for periods indicated including 118

Japanese yen per U.S. dollar for 2007 and 94 Japanese yen per U.S. dollar for 2009; based on one-month reporting lag.

2)

As of June

30,

2010.

3)

Includes distribution through corporations and associations.

7,733

Captive

Agents

(2)

4,400

Independent

Agents

(2)

Star/Edison

Star/Edison

2007

2007

Sales

Sales

(1)

(1)

$708 million

$708 million

Captive

Agents Independent Agents

Banks

and

Other

Distribution

(3)

10 |

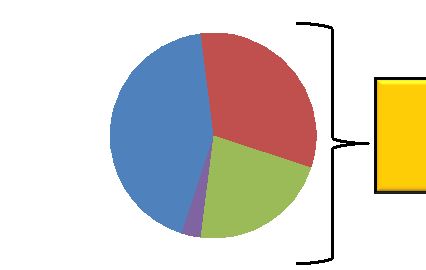

33%

25%

39%

3%

Life Insurance -

whole life, term, universal life

Third Sector -

primarily hospital daily benefits

Fixed Annuities

Group Life -

primarily term insurance

Product Mix Compatible with Prudential’s

Product Mix Compatible with Prudential’s

Emphasis on Protection and Retirement Markets

Emphasis on Protection and Retirement Markets

Star/Edison

In-Force Annualized

Premiums

(1)

As of December 31, 2009

Star/Edison

Star/Edison

Annualized New Business Premiums

Annualized New Business Premiums

Year

Year

ended

ended

December

December

31,

31,

2009

2009

(1)

(1)

1)

1)

Foreign denominated activity translated to U.S. dollars based on

average exchange rates, Japanese yen 94 per U.S. dollar; data based on

one-month reporting lag; percentage comprised of U.S. dollar business

estimated. 11

45%

45%

U.S.

U.S.

dollar

dollar

business

business

43%

32%

22%

3% |

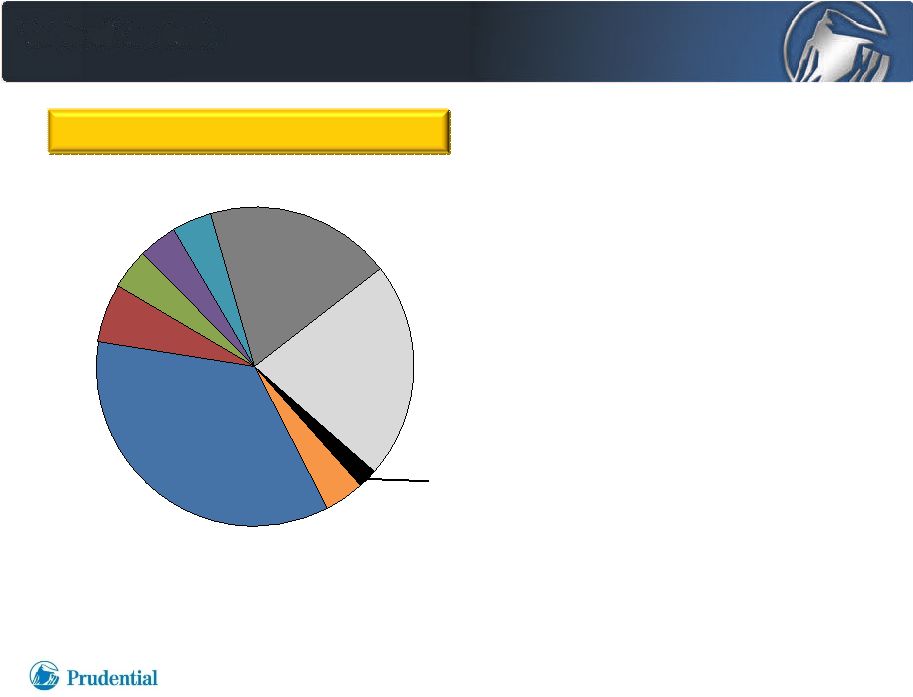

Star/Edison General Account Portfolio

Star/Edison General Account Portfolio

1)

As of June 30, 2010, at estimated market value.

2)

Securities not rated by either Moody’s or S&P have been classified as

below investment grade for purposes of this display. 3)

Based on bonds and structured products.

•

90% of fixed maturity investments

are

investment

grade

(2)(3)

•

72% of non-Japanese bonds

are U.S. Dollar denominated

•

Expect to migrate portfolio to

reduce exposure to structured

securities, real estate and equities

Non-

Japanese

Corporate

Bonds

35%

Structured

Products

6%

Equities 4%

Loans 4%

Real Estate

4%

Japanese

Corporate

Bonds

19%

Japanese

Government

Bonds

22%

Other

Japanese

Bonds 2%

Non-

Japanese

Gov't

&

Muni Bonds

4%

12

$41 billion General Account

$41 billion General Account

(1)

(1) |

Building on Success in a Market We Know Well

Building on Success in a Market We Know Well

•

Attractive

financial

and

strategic

transaction;

expected

returns

primarily

driven

by

in-force

business

and

cost

synergies

•

Low strategic and execution risk: compatible products; updated

Prudential systems facilitate integration; seasoned management team

with strong business combination track record

•

Effective deployment of capital enhances Prudential’s ROE prospects;

accretive to earnings per share

•

Expanded footprint in Japan: world’s second largest insurance market,

with substantial retirement market opportunity driven by demographics

and savings fund base

•

Distribution and client base deepen and extend growth opportunities

in Japanese life insurance market

13 |

Forward-Looking Statements

Forward-Looking Statements

Certain of the statements included in this presentation constitute

forward-looking statements within the meaning of the U. S. Private Securities

Litigation Reform Act of 1995. It is possible that actual results may differ

materially from any expectations or predictions expressed in this

presentation. Words such as “expects,”

“believes,”

“anticipates,”

“includes,”

“plans,”

“assumes,”

“estimates,”

“projects,”

“intends,”

“should,”

“will,”

“shall,”

or variations of such words are generally part of forward-looking

statements. Forward-looking statements are made based on

management’s current expectations and beliefs concerning future developments

and their potential effects upon Prudential Financial, Inc. and its

subsidiaries.

There

can

be

no

assurance

that

future

developments

affecting

Prudential

Financial,

Inc.

and

its

subsidiaries

will

be

those

anticipated

by

management.

These

forward-looking

statements

are

not

a

guarantee

of

future

performance

and

involve

risks

and

uncertainties,

and

there

are

certain important factors that could cause actual results to differ, possibly

materially, from expectations or estimates reflected in such forward-

looking

statements,

including,

among

others:

(1)

general

economic,

market

and

political

conditions,

including

the

performance

and

fluctuations

of

fixed income, equity, real estate and other financial markets; (2) the availability

and cost of external financing for our operations, which has been

affected

by

the

stress

experienced

by

the

global

financial

markets;

(3)

interest

rate

fluctuations;

(4)

reestimates

of

our

reserves

for

future

policy

benefits and claims; (5)

differences between actual experience regarding mortality, morbidity, persistency,

surrender experience, interest rates or market

returns

and

the

assumptions

we

use

in

pricing

our

products,

establishing

liabilities

and

reserves

or

for

other

purposes;

(6)

changes

in

our

assumptions

related

to

deferred

policy

acquisition

costs,

valuation

of

business

acquired

or

goodwill;

(7)

changes

in

our

claims-paying

or

credit

ratings;

(8)

investment

losses,

defaults

and

counterparty

non-performance;

(9)

competition

in

our

product

lines

and

for

personnel;

(10)

changes

in

tax

law;

(11)

economic,

political,

currency

and

other

risks

relating

to

our

international

operations;

(12)

fluctuations

in

foreign

currency

exchange

rates

and

foreign

securities

markets;

(13)

regulatory

or

legislative

changes,

including

the

recently

enacted

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection Act; (14)

adverse determinations in litigation or regulatory matters and our exposure to

contingent liabilities, including in connection with our

divestiture

or

winding

down

of

businesses;

(15)

domestic

or

international

military

actions,

natural

or

man-made

disasters

including

terrorist

activities

or

pandemic

disease,

or

other

events

resulting

in

catastrophic

loss

of

life;

(16)

ineffectiveness

of

risk

management

policies

and

procedures

in

identifying,

monitoring

and

managing

risks;

(17)

effects

of

acquisitions,

divestitures

and

restructurings,

including

possible

difficulties

in

integrating

and

realizing

the

projected

results

of

acquisitions;

(18)

changes

in

statutory

or

U.S.

GAAP

accounting

principles,

practices

or

policies;

(19)

changes

in

assumptions

for

retirement

expense;

(20)

Prudential

Financial,

Inc.’s

primary

reliance,

as

a

holding

company,

on

dividends

or

distributions

from

its

subsidiaries

to

meet

debt

payment

obligations

and

the

ability

of

the

subsidiaries

to

pay

such

dividends

or

distributions

in

light

of

our

ratings

objectives

and/or

applicable

regulatory

restrictions;

and

(21)

risks

due

to

the

lack

of

legal

separation

between

our

Financial

Services

Businesses

and

our

Closed

Block

Business.

The

foregoing

risks

are

even

more

pronounced

in

severe

adverse

market

and

economic

conditions

such

as

those

that

began

in

the

second

half

of

2007

and

continued

into

2009.

Prudential

Financial,

Inc.

does

not

intend,

and

is

under

no

obligation,

to

update

any

particular

forward-looking

statement

included

in

this

presentation.

_______________________________________________________________________________

Prudential

Financial,

Inc.

of

the

United

States

is

not

affiliated

with

Prudential

PLC

which

is

headquartered

in

the

United

Kingdom.

14 |

This

presentation

includes

references

to

“adjusted

operating

income.”

Adjusted

operating

income

is

a

non-GAAP

measure

of

performance

of

our

Financial

Services

Businesses.

Adjusted

operating

income

excludes

“Realized

investment

gains

(losses),

net,”

as

adjusted,

and

related

charges

and

adjustments.

A

significant

element

of

realized

investment

gains

and

losses

are

impairments

and

credit-related

and

interest

rate-related

gains

and

losses.

Impairments

and

losses

from

sales

of

credit-impaired

securities,

the

timing

of

which

depends

largely

on

market

credit

cycles,

can

vary

considerably

across

periods.

The

timing

of

other

sales

that

would

result

in

gains

or

losses,

such

as

interest

rate-related

gains

or

losses,

is

largely

subject

to

our

discretion

and

influenced

by

market

opportunities

as

well

as

our

tax

and

capital

profile.

Realized

investment

gains

(losses)

within

certain

of

our

businesses

for

which

such

gains

(losses)

are

a

principal

source

of

earnings,

and

those

associated

with

terminating

hedges

of

foreign

currency

earnings

and

current

period

yield

adjustments

are

included

in

adjusted

operating

income.

Realized

investment

gains

and

losses

from

products

that

are

free

standing

derivatives

or

contain

embedded

derivatives,

and

from

associated

derivative

portfolios

that

are

part

of

an

economic

hedging

program

related

to

the

risk

of

those

products,

are

included

in

adjusted

operating

income.

Adjusted

operating

income

excludes

gains

and

losses

from

changes

in

value

of

certain

assets

and

liabilities

related

to

foreign

currency

exchange

movements

that

have

been

economically

hedged,

as

well

as

gains

and

losses

on

certain

investments

that

are

classified

as

other

trading

account

assets

and

debt

that

is

carried

at

fair

value.

Adjusted

operating

income

also

excludes

investment

gains

and

losses

on

trading

account

assets

supporting

insurance

liabilities

and

changes

in

experience-rated

contractholder

liabilities

due

to

asset

value

changes,

because

these

recorded

changes

in

asset

and

liability

values

are

expected

to

ultimately

accrue

to

contractholders.

Trends

in

the

underlying

profitability

of

our

businesses

can

be

more

clearly

identified

without

the

fluctuating

effects

of

these

transactions.

In

addition,

adjusted

operating

income

excludes

the

results

of

divested

businesses,

which

are

not

relevant

to

our

ongoing

operations.

Discontinued

operations,

which

is

presented

as

a

separate

component

of

net

income

under

GAAP,

is

also

excluded

from

adjusted

operating

income.

We

believe

that

the

presentation

of

adjusted

operating

income

as

we

measure

it

for

management

purposes

enhances

understanding

of

the

results

of

operations

of

the

Financial

Services

Businesses

by

highlighting

the

results

from

ongoing

operations

and

the

underlying

profitability

of

our

businesses.

However,

adjusted

operating

income

is

not

a

substitute

for

income

determined

in

accordance

with

GAAP,

and

the

adjustments

made

to

derive

adjusted

operating

income

are

important

to

an

understanding

of

our

overall

results

of

operations.

For

additional

information

about

adjusted

operating

income

and

the

comparable

GAAP

measure

please

refer

to

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2009

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

June

30,

2010

located

on

the

Investor

Relations

website

at

www.investor.prudential.com.

Additional

historical

information

relating

to

the

Company’s

financial

performance,

including

its

second

quarter

2010

Quarterly

Financial

Supplement,

is

also

located

on

the

Investor

Relations

website.

The

information

referred

to

above

and

on

the

prior

page,

as

well

as

the

risks

of

our

businesses

described

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2009

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

June

30,

2010

should

be

considered

by

readers

when

reviewing

forward-looking

statements

contained

in

this

presentation.

Non–GAAP Measure

Non–GAAP Measure

15 |

PRUDENTIAL FINANCIAL, INC.

PRUDENTIAL FINANCIAL, INC.

ACQUISITION OF STAR/EDISON

ACQUISITION OF STAR/EDISON

SEPTEMBER 30, 2010

SEPTEMBER 30, 2010

16 |