Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - MxEnergy Holdings Inc | a10-18479_1ex32.htm |

| EX-31.1 - EX-31.1 - MxEnergy Holdings Inc | a10-18479_1ex31d1.htm |

| EX-31.2 - EX-31.2 - MxEnergy Holdings Inc | a10-18479_1ex31d2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2010

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 333-138425

MXENERGY HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

20-2930908 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer Identification No.) |

|

Incorporation or Organization) |

|

|

|

|

|

|

|

595 Summer Street, Suite 300 |

|

|

|

Stamford, Connecticut |

|

06901 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(203) 356-1318

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 under the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant: Not applicable. The registrant has no publicly traded equity securities.

As of August 31, 2010, there were 33,710,902 shares of the Registrant’s Class A Common Stock (par value $0.01 per share), 4,002,290 shares of the Registrant’s Class B Common Stock (par value $0.01 per share) and 16,438,669 shares of the Registrant’s Class C Common Stock (par value $0.01 per share) outstanding.

Documents incorporated by reference: None

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment”) amends and restates in its entirety the Registrant’s Annual Report on Form 10-K for the fiscal year ended June 30, 2010 as originally filed with the Securities and Exchange Commission on September 28, 2010 (the “Original Filing”). This Amendment is being filed to correct an inadvertent clerical error in the Item 6 table which provides a reconciliation of Adjusted EBITDA to net cash provided by (used in) operating activities that appears on page 32 herein.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the certifications required pursuant to the rules promulgated under the Exchange Act, as adopted pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, which were included as exhibits to the Original Filing, have been restated and re-executed as of the date of this Amendment and are included as Exhibits 31.1, 31.2 and 32 hereto.

This Amendment has no effect on the Registrant’s consolidated financial statements. Except as described above, this Amendment does not amend, update or change any other items or disclosures contained in the Original Filing or otherwise reflect events that occurred subsequent to the filing of the Original Filing.

MXENERGY HOLDINGS INC.

ANNUAL REPORT ON FORM 10-K/A

FOR THE FISCAL YEAR ENDED JUNE 30, 2010

|

Item |

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

||

|

|

18 |

||

|

|

28 |

||

|

|

28 |

||

|

|

28 |

||

|

|

28 |

||

|

|

|

|

|

|

|

|

|

|

|

|

29 |

||

|

|

30 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

35 |

|

|

|

61 |

||

|

|

64 |

||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

113 |

|

|

|

113 |

||

|

|

115 |

||

|

|

|

|

|

|

|

|

|

|

|

|

116 |

||

|

|

121 |

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

|

138 |

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

141 |

|

|

|

145 |

||

|

|

|

|

|

|

|

|

|

|

|

|

146 |

||

|

|

|

|

|

|

|

147 |

||

Cautionary Note Regarding Forward-Looking Statements

Some statements in this Annual Report on Form 10-K (the “Annual Report”) are known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions and other statements contained in the Annual Report that are not historical facts and may relate to, among other things:

· future performance generally;

· our business goals, strategy, plans, objectives and intentions;

· our post-acquisition integration of acquired businesses;

· expectations concerning future operations, margins, profitability, attrition, bad debts, expenses, interest rates, liquidity and capital resources; and

· expectations regarding the effectiveness of our hedging practices and the performance of suppliers, pipelines and transmission companies, storage operators, independent system operators, financial hedge providers, banks providing working capital and other counterparties supplying, transporting, and storing physical commodity.

When used in this Annual Report on Form 10-K, the words “may,” “will,” “should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “predicts,” “estimates,” “potential,” “continue,” “projected” and similar expressions are generally intended to identify forward-looking statements, although the absence of such a word does not mean that such statement is not a forward-looking statement.

Forward-looking statements are subject to risks, uncertainties, and assumptions about us and our operations that are subject to change based on various important factors, some of which are beyond our control. The following factors, as well as the factors identified in “Risk Factors,” among others, could cause our financial performance to differ significantly from the goals, plans, objectives, intentions and expectations expressed in our forward-looking statements:

· failures in our risk management policies and hedging procedures;

· shortfalls in marketing or unusual customer attrition that result in our purchases exceeding our supply commitments;

· unavailability or lack of reliability in monthly settlement index prices;

· changes in the forward prices of natural gas and electricity;

· insufficient liquidity to properly implement our hedging strategy or manage commodity supply;

· changes in weather patterns from historical norms that affect customer consumption patterns;

· failure of our customers to pay their bills or our failure to maintain adequate billing and collection procedures;

· failure of LDCs (as defined herein) to pay amounts owed to us when due;

· failure to collect imbalance receivables;

· inaccuracy of data in our billing systems;

· disruptions in local transportation and transmission facilities;

· changes in regulations that affect our ability to use marketing channels;

· changes in statutes or regulations that affect growth and commodity, operating or financing costs or otherwise impact our profitability;

· investigations by any state utility commissions, state attorneys general or federal agencies that could result in fines, sanctions or damage to our reputation;

· failure to properly manage our growth;

· the loss of key members of management or failure to retain employees;

· changes in general economic conditions;

· competition from utilities and other marketers;

· malfunctions in computer hardware or software or in database management systems or power systems, due to mechanical or human error, that result in billing errors or problems with collections, reconciliation, accounting or risk management;

· natural disasters, including hurricanes; and

· our reliance on energy infrastructure and transportation within the United States and Canada.

Therefore, we caution you not to place undue reliance on any forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report on Form 10-K to conform these statements to actual results. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

Definitions

References in this Annual Report to “Holdings” refer to MXenergy Holdings Inc., a Delaware corporation. References to “the Company,” “we,” “us,” “our,” or similar terms refer to Holdings together with its consolidated subsidiaries.

References to “MMBtu” refer to a million British thermal units, a standard unit of heating equivalent measure for natural gas. A unit of heat equal to 1,000,000 Btus, or 1 MMBtu, is the thermal equivalent of approximately 1,000 cubic feet of natural gas. One billion cubic feet, or BCF, of gas is approximately 1,000,000 MMBtus.

References to “MWhr” refer to megawatt hours, each representing 1 million watt hours or a thousand kilowatt hours, which is the amount of electric energy produced or consumed in a period of time.

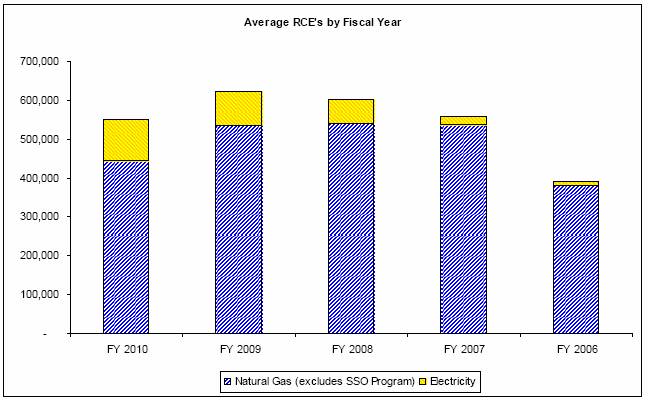

References to “RCEs” refer to residential customer equivalents, each of which represents a natural gas customer with a standard consumption of 100 MMBtus per year or an electricity customer with a standard consumption of 10 MWhrs per year. These quantities, which are used for convenience, represent the approximate amount of natural gas or power used by a typical household in some parts of the country.

References to “LDC” refer to a local distribution company, or utility, that provides the distribution infrastructure to supply natural gas and electricity to our customers. In some cases, LDCs also provide billing services and guarantee customer accounts receivable within various markets that we serve.

References to “customers” refer to individual accounts served by us. An individual or business with multiple accounts will be counted multiple times in our tabulation of customers. An individual or business may be counted as a single customer despite having multiple meters in a single location. A governmental entity or LDC may be counted as a single customer despite representing an aggregation of multiple consumers of natural gas or electricity within a geographic service area under the terms of specific service agreements. Prospective customers that have initiated new service from us are not included in our customer portfolio until we have completed all required processing steps, including credit verification and sharing of appropriate information with the respective LDC. Customers that have initiated the process for termination of their service are included in our customer portfolio until the termination has been properly processed and coordinated with the LDC.

Company Overview, History and Development

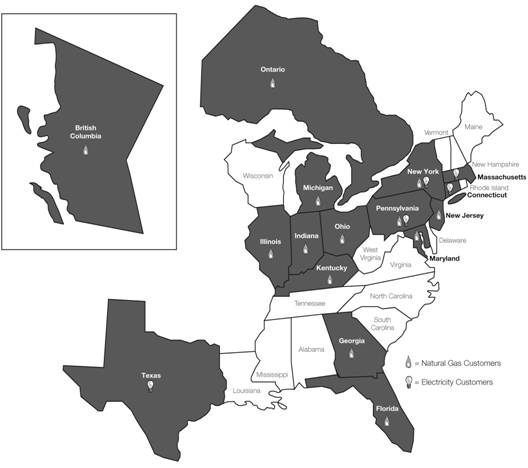

The Company was founded and incorporated in the state of Delaware in 1999. Headquartered in Stamford, Connecticut, we are an independent energy provider of retail natural gas and electric power to residential and commercial customers in deregulated markets in the U.S. and Canada. We are one of a number of retail energy marketers in the growing deregulated market. We currently serve natural gas and electricity customers located in 41 market areas across 14 states in the U.S. and in the provinces of Ontario and British Columbia in Canada.

The following map reflects the states in the U.S. and the Canadian provinces where we have natural gas and electricity customers as of June 30, 2010.

Recent Developments

Equity and Debt Restructuring

A sharp drop in natural gas market prices during the six months ended December 31, 2008 resulted in a significant reduction in the available borrowing base under the Company’s revolving credit facility (the “Revolving Credit Facility”). The reduced borrowing base strained the Company’s ability to post letters of credit as collateral with suppliers and hedge providers, caused defaults of certain financial covenants included in the agreement that governed the Revolving Credit Facility, prompted downgrades in the Company’s ratings from credit rating agencies and ultimately resulted in the Company obtaining material waivers of, and amendments to, the agreement that governed the Revolving Credit Facility and the Company’s principal commodity hedge facility (the “Hedge Facility”). Such amendments had material direct impacts on the Company’s liquidity position and operations during fiscal year 2009 and the first three months of fiscal year 2010, including requiring that the Company seek a new facility to replace the Revolving Credit Facility and the Hedge Facility.

On September 22, 2009, the Company completed an equity and debt restructuring, which included various transactions (the “Restructuring”). The Restructuring included a debt exchange transaction that was accounted for as a troubled-debt restructuring in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and therefore did not result in any gain or loss recorded in the consolidated statements of operations. The Company also entered into two master supply and hedge agreements with Sempra Energy Trading LLC (“RBS Sempra”) (the “ISDA Master Agreements” and collectively, the “Commodity Supply Facility”) to replace the Revolving Credit Facility and Hedge Facility. The transactions consummated in connection with the Restructuring had material impacts on various asset, liability and stockholders’ equity accounts during the quarter ended September 30, 2009, as summarized in the following table.

|

|

|

Balance at |

|

Restructuring |

|

Other |

|

Balance at |

|

||||

|

|

|

(in thousands) |

|

||||||||||

|

Selected asset accounts: |

|

|

|

|

|

|

|

|

|

||||

|

Cash and cash equivalents |

|

$ |

23,266 |

|

$ |

(2,375 |

) |

$ |

(17,385 |

) |

$ |

3,506 |

|

|

Restricted cash |

|

75,368 |

|

(75,000 |

) |

1,133 |

|

1,501 |

|

||||

|

Accounts receivable — RBS Sempra |

|

— |

|

17,948 |

|

(6,072 |

) |

11,876 |

|

||||

|

Fixed Rate Notes Escrow Account |

|

— |

|

8,977 |

|

— |

|

8,977 |

|

||||

|

Deferred debt issue costs |

|

4,475 |

|

15,083 |

|

(3,546 |

) |

16,012 |

|

||||

|

Net impact on selected asset accounts |

|

$ |

103,109 |

|

$ |

(35,367 |

) |

$ |

(25,870 |

) |

$ |

41,872 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Selected Liability and stockholders’ equity accounts: |

|

|

|

|

|

|

|

|

|

||||

|

Liabilities: |

|

|

|

|

|

|

|

|

|

||||

|

Bridge Financing Loans payable |

|

$ |

5,400 |

|

$ |

(5,400 |

) |

$ |

— |

|

$ |

— |

|

|

Denham Credit Facility |

|

12,000 |

|

(12,000 |

) |

— |

|

— |

|

||||

|

Long-term debt: |

|

|

|

|

|

|

|

|

|

||||

|

Fixed Rate Notes due 2014 |

|

— |

|

49,951 |

|

79 |

|

50,030 |

|

||||

|

Floating Rate Notes due 2011 |

|

163,476 |

|

(158,787 |

) |

1,665 |

|

6,354 |

|

||||

|

Net impact on selected liability accounts |

|

180,876 |

|

(126,236 |

) |

1,744 |

|

56,384 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Redeemable convertible preferred stock |

|

54,632 |

|

(54,632 |

) |

— |

|

— |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

||||

|

Common stock |

|

47 |

|

496 |

|

— |

|

543 |

|

||||

|

Additional paid in capital |

|

18,275 |

|

119,080 |

|

(117 |

) |

137,238 |

|

||||

|

Accumulated deficit |

|

(90,469 |

) |

25,925 |

|

(10,236 |

) |

(74,780 |

) |

||||

|

Net impact on selected stockholders’ equity accounts |

|

(72,147 |

) |

145,501 |

|

(10,353 |

) |

63,001 |

|

||||

|

Net impact on selected liability and stockholders’ equity accounts |

|

$ |

163,361 |

|

$ |

(35,367 |

) |

$ |

(8,609 |

) |

$ |

119,385 |

|

Material impacts of the Restructuring are further described in the “Balance Sheet Overview” section within Item 7 of this Annual Report. As a result of the Restructuring, we significantly decreased our outstanding debt obligations, which resulted in lower debt service requirements for fiscal year 2010 and future years. In addition, the Revolving Credit Facility and Hedge Facility were replaced by the Commodity Supply Facility, which provides us with a stable source of liquidity through August 2012 with an investment grade counterparty. Overall, the transactions consummated in the Restructuring improved our liquidity position, improved our financial and operational flexibility and allowed us to compete more effectively within the markets that we serve.

Ohio SSO Program

In April 2010, we began delivering natural gas to an LDC in Ohio as part of a new Standard Service Offer program (the “SSO Program”). Under the SSO Program, for the twelve-month period from April 1, 2010 through March 31, 2011, we will receive a NYMEX-referenced price plus a price adjustment for natural gas delivered by the LDC to its customers who are eligible to participate in the SSO Program. We expect that our gross profit per MMBtu sold to the LDC will be lower under the SSO Program than the gross profit that we normally experience from our direct retail energy customers. From April 1 through June 30, 2010, we delivered approximately 1.6 million MMBtus of natural gas to the LDC under the SSO Program. As of June 30, 2010, based upon estimates received directly from the LDC, we expect that the customers assigned to us as a participant in the SSO Program will consume approximately 9.7 million MMBtus of natural gas annually, the majority of which will occur during the upcoming winter heating season.

Information Regarding Our Business Segments

Sales of natural gas and electricity are summarized in the following table. The sales amounts in the table are intended to provide an indication of operational growth within the segments, and are not necessarily indicative of similar growth in gross profit or net income. Refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” located elsewhere in this Annual Report for commentary regarding gross profit and other components of net income.

|

|

|

Fiscal Year Ended June 30, |

|

|||||||||||||

|

|

|

2010 |

|

2009 |

|

2008 |

|

|||||||||

|

|

|

Sales |

|

% of |

|

Sales |

|

% of |

|

Sales |

|

% of |

|

|||

|

|

|

($ in thousands) |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Natural gas |

|

$ |

457,909 |

|

82 |

|

$ |

670,584 |

|

85 |

|

$ |

669,522 |

|

89 |

|

|

Electricity |

|

103,297 |

|

18 |

|

119,196 |

|

15 |

|

82,761 |

|

11 |

|

|||

|

Total sales |

|

$ |

561,206 |

|

100 |

|

$ |

789,780 |

|

100 |

|

$ |

752,283 |

|

100 |

|

Additional information regarding our business segments can be found in Note 23 of the audited consolidated financial statements, included in Item 8 of this Annual Report.

Our Products

We sell natural gas and electricity at variable or market-based prices that, in most cases, change monthly or at fixed prices for a forward term that generally does not exceed two years. In the case of variable sales contracts as well as most mid-market commercial sales, we purchase natural gas or electricity at the time of sale. In the case of fixed price retail customers, we purchase natural gas and electricity in advance of sales. Costs are marked up with a reasonable profit margin.

For fixed price sales contracts, the cost of the commodity is hedged in the forward markets with financial swaps and physical forward contracts that settle monthly. Physical natural gas and electricity is then purchased at the time such swap contracts settle. We regularly calculate the amount of the commodity required to meet our expected customer deliveries and balance this against the quantity hedged or purchased for such customers. Differences between expected customer deliveries and commodity purchases are managed by adjusting natural gas deliveries from storage and buying any shortfall or selling any excess in the market.

We market variations of two basic products:

· Fixed price contracts — Generally with terms of up to two years for natural gas and electricity, fixed rate products provide consumers with price protection against fluctuations in natural gas and electricity prices. In marketing this product, we do not promise savings as a consumer could pay more if prices offered by a local utility or other competitor, which are based on variable market conditions, fall during the term of the fixed rate contract.

We have a risk management policy that is intended to reduce our financial exposure related to changes in the price of natural gas and electricity. Under this policy, our objective is to hedge a minimum of 100% of the anticipated natural gas and electricity commodity purchases required to meet expected customer demand for all accounts served under fixed price contracts. Any difference between actual consumption and our purchased commodity volume results in pricing risk for the month.

· Variable price contracts — Variable price products generally are priced competitively with the price offered by the region’s incumbent utility and/or other local competitors (the “price to compare” or “PTC”). Our variable rate product is similar to utility variable rate pricing. By using alternative supply arrangements, we are sometimes able to supply customers with the commodity at a price lower than the utility’s tariff pricing due to the utility’s prior period cost recovery charges, fixed term transportation costs and/or hedging strategy. We do not guarantee to customers that our price will be below the PTC.

We generally do not hedge to protect against price volatility associated with deliveries under variable rate natural gas and electricity contracts because our variable price is set ahead of the month of commodity flow, which ensures a direct correlation between our cost for commodity delivered and the price charged to the customer. However, we do hedge natural gas inventory purchased during the summer to ensure that the value of storage inventory is correlated to the market price of natural gas when it is withdrawn during the winter months. Any difference between actual consumption and our purchased commodity volume results in pricing risk for the month.

The natural gas and electricity sold is metered and delivered to customers by LDCs. Except in our Georgia natural gas and Texas electricity markets and for certain of our commercial customers, LDCs generally provide billing and collection services on our behalf for residential and small commercial customers. In the case of our Georgia and Texas retail markets, we bill and collect directly from customers the price of delivered commodity plus the charges associated with the local utility’s distribution costs, the latter of which is remitted to such utility.

Our Customer Portfolio

Our customer base consists of residential and small and mid-market commercial customers. We have limited exposure to high concentrations of sales volumes to individual customers. From April 1 through June 30, 2010, we delivered approximately 1.6 million MMBtus of natural gas to the LDC under the SSO Program, which represented approximately 3.6% of our total natural gas sales volume for fiscal year 2010. For fiscal years 2009 and 2008, no single natural gas customer accounted for more than 3% of our total natural gas sales volume.

The following graph illustrates changes in our average RCE count for fiscal years 2006 through 2010.

The reduction in average natural gas RCEs during fiscal year 2010 resulted primarily from liquidity-related limitations placed on our ability to obtain new customers and to retain existing customers and from high credit-related attrition in certain of our markets. Volatility in natural gas prices negatively impacted our liquidity position and resulted in amendments to our Revolving Credit Facility, which placed formal constraints on the term and type of contracts that we could offer to new customers and to existing customers who informed us of their intent to terminate their contract before its termination date. In order to conserve cash, we also reduced direct mail marketing and advertising expenditures and scaled back our use of certain sales channels during fiscal year 2009 and the first quarter of fiscal year 2010, which had a negative impact on brand awareness and our ability to acquire new customers.

Deteriorating economic conditions during fiscal year 2009 resulted in credit-related attrition that was higher than historical levels. Refer to “Retaining and Winning Back Customers” below for additional commentary regarding customer attrition.

During fiscal year 2010, we experienced a more stable price environment and lower customer defaults as compared with the prior fiscal year. In addition, under the provisions of the Commodity Supply Facility, the constraints on our marketing and hedging activities have been removed, and we are able to offer a wider variety of natural gas and electricity products to current and potential customers using our traditional marketing channels. As a result, during the second and third quarters of fiscal year 2010, we experienced in-contract attrition in most of our natural gas and electricity markets that was lower than that experienced during fiscal year 2009 and the first quarter of fiscal year 2010, and we experienced customer growth in certain of our electricity markets.

Acquiring New Customers

As of June 30, 2010, most of our current customers have been acquired organically through an integrated marketing approach that consists of multiple combinations of direct marketing activities, such as door-to-door marketing, success-based and hourly telemarketing and direct mailings, and indirect marketing activities, which include traditional and online media, public

relations and local event participation. We are focused on growing our customer base while controlling customer acquisition costs. Our objective has been to maintain customer acquisition costs below 12 months of gross profit resulting in a pay back period of less than one year. As a result of our return to normal marketing activities, our total expenditures for acquiring customers, which includes amounts capitalized as customer acquisition costs and certain other marketing and advertising expenses, increased approximately 50% during fiscal year 2010, as compared with the prior fiscal year. Our cost to acquire customers approximated $100 per RCE for fiscal year 2010, which was consistent with the amount spent per RCE in the prior fiscal year.

In order to conserve cash, we significantly reduced direct mail marketing, advertising and overall marketing expenditures during fiscal year 2009, as compared to the prior fiscal year. We also scaled back our use of certain sales channels, which had a negative impact on brand awareness and new customer acquisitions during fiscal year 2009. During fiscal year 2010, as a result of the Restructuring, we are offering a wider variety of natural gas and electricity products to current and potential customers using our traditional marketing channels.

In addition to organic growth, we have historically followed a disciplined acquisition strategy, acquiring only businesses that meet certain criteria, including the following:

· the acquired operations must be consistent with our business objectives to build a profitable retail business;

· the customers of the acquired company must have been acquired by such company in a manner consistent with our marketing principles and values and in accordance with applicable laws and regulations;

· the operations of the acquired company can be integrated with existing internal systems and processes;

· the acquired customers are located in markets that facilitate risk management through transparent pricing and liquid instruments; and

· the acquisition can be supported by our financing capabilities.

Some of the companies we acquired were located in markets not previously served by us and therefore, provided us with new strategic marketing opportunities. We intend to continue this strategy when evaluating new acquisition opportunities. We completed 10 separate acquisitions since our inception in 1999, including the following acquisitions since 2005:

|

Acquisition Date |

|

Company / Business Acquired |

|

Number and |

|

|

|

|

|

|

|

|

|

November 2005 |

|

Castle Power LLC |

|

53,000 natural gas |

|

|

August 2006 |

|

Shell Energy Services Company L.L.C. (“SESCo”) |

|

315,000 natural gas |

|

|

May 2007 |

|

Vantage Power Services L.P. |

|

12,000 electricity |

|

|

January 2008 |

|

GasKey division of PS Energy Group, Inc. |

|

60,000 natural gas |

|

|

October 2008 |

|

Catalyst Natural Gas LLC |

|

38,000 natural gas |

|

On August 1, 2006, we acquired substantially all of the assets of SESCo, a wholly owned subsidiary of Shell Oil Company. As of August 1, 2006, SESCo supplied natural gas to approximately 315,000 RCEs in the deregulated markets of Georgia and Ohio. In addition to expanding our relationships with customers in two of our existing LDC markets in Ohio, the SESCo acquisition added Georgia to the list of states in which we operate. Georgia has been our largest natural gas market since the acquisition of SESCo.

Customer Retention and Attrition

To retain existing customers, we rely on a team of highly trained internal and external customer care representatives. Customers requesting cancellation of service are provided information on the volatility of commodity rates and encouraged to retain the benefits of long-term rate protection, if appropriate. If we receive notification from an LDC that a customer has cancelled or switched to another supplier, attempts to communicate with those customers are made through both mail and phone, encouraging the customer to reconsider his or her decision, reminding the customer of early-termination fees he or she may incur and, in some cases, offering a new rate plan.

Customer renewal and in-contract attrition percentages are summarized in the following tables.

|

|

|

Activity for Fiscal Year Ended |

|

||||

|

|

|

2010 |

|

2009 |

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

Customer renewal percentage (1) |

|

93 |

% |

84 |

% |

85 |

% |

|

In-contract attrition percentage (2) |

|

26 |

% |

34 |

% |

20 |

% |

(1) At the end of each customer contract term, customer contracts in most of our markets are renewed upon notification by the marketers unless the customer indicates otherwise. Customer renewal percentages in the table represent the percentage of customers who received such notification that ultimately continued their relationship with us.

(2) In-contract customer attrition percentage is defined as: (a) the percentage of loss of fixed rate customers after they have begun to receive natural gas or electricity from us but before their contract term officially expires; and (b) the percentage of loss of any variable rate customers, whose contracts generally do not have expiration dates.

Attrition data is calculated based upon actual customer level data. For analytical purposes, we assume that one RCE represents a natural gas customer with a standard consumption of 100 MMBtus per year, or an electricity customer with a standard consumption of 10 MWhr per year. However, each customer does not actually consume 100 MMBtu of natural gas or 10 MWhr of electricity. For example, one of our mid-market or large commercial customers may consume the equivalent of several hundred or even thousands of RCEs. Therefore, any reduction or increase in RCEs in any of our markets does not necessarily correlate directly with net customer attrition.

Fiscal year 2009 was an unusually challenging year for us with respect to customer retention and attrition. Our marketing activities and hedging capabilities were constrained under the Revolving Credit Facility and Hedge Facility, which severely limited our ability to offer desirable product options to existing or new customers. For instance, our ability to offer long-term fixed rate products to new and renewal customers was severely limited. This contributed to attrition generally, and particularly for various commercial customers, each of which represented a large number of RCEs per customer. Organic customer growth was also well below our historical levels due to these constraints.

Difficult economic conditions in many of our markets during fiscal year 2009 and the first three months of fiscal year 2010 resulted in credit-related attrition that was higher than historical levels. Credit-related attrition was particularly high in our Georgia natural gas market, partially due to expected credit quality issues within the portfolio of customers that we acquired from Catalyst Natural Gas LLC (“Catalyst”) in October 2008.

Volatile commodity prices during fiscal year 2009 caused many consumers of natural gas and electricity to migrate to market rates that were lower than their current rates. Since we were limited in our ability to offer new competitive rates to customers who indicated their intention to terminate their contract, many of our customers left us in favor of other retail marketers or their local utility.

During fiscal year 2010, we and our customers experienced a more stable price environment and lower customer defaults as compared with the prior year. In addition, under the provisions of the Commodity Supply Facility, the constraints on our marketing and hedging activities have been removed, and we are able to offer a wider variety of natural gas and electricity products to current and potential customers using our traditional marketing channels. As a result, during fiscal year 2010, we experienced lower in-contract attrition in most of our natural gas and electricity markets and customer growth in certain of our electricity markets.

Customer Contract Concentrations

We provide customers with a choice of natural gas and electricity products with alternative price structures that are designed to manage the risks of energy price volatility. The two basic alternative price structures are variable market-based pricing and fixed price forward contracts. Pricing and terms for these products are developed so that at any given time, potential customers can choose the product to meet their household or business needs. We attempt to be flexible and to respond quickly to market conditions to ensure that our products match consumer interests. Unlike competitors offering one product choice at a time, we simultaneously provide multiple product offerings. We also attempt to keep our product offerings simple in order to facilitate marketing to residential and small commercial customers.

As of June 30, 2010, 2009 and 2008, approximately 42%, 45% and 60%, respectively, of our natural gas customer portfolio had fixed rate contracts while the remaining 58%, 55% and 40%, respectively, had variable rate contracts. We have a risk management policy that is intended to reduce our financial exposure related to changes in the price of natural gas and electricity. Under this policy, our objective is to hedge a minimum of 100% of the anticipated natural gas commodity purchases required to meet expected customer demand for all accounts served under fixed price contracts. We also have a natural gas hedging facility that limits our exposure to mark-to-market margin payments. As of June 30, 2010, contracts with our fixed price natural gas customers have an average remaining life of approximately 5 months.

As of June 30, 2010, 2009 and 2008, approximately 70%, 36% and 36%, respectively, of our electricity customer portfolio had fixed rate contracts while the remaining 30%, 64% and 64%, respectively, had variable rate contracts. Although our objective is to economically hedge a minimum of 100% of anticipated electricity commodity purchases required to meet expected customer demand under fixed price contracts, there are certain ancillary and capacity costs that we are unable to hedge due to the term and the size of our electricity portfolio. In addition, since we cannot fully anticipate hourly spikes in demand for electricity during peak summer months, we may be unable to fully hedge commodity purchases necessary to meet such spikes in demand. Historically, our inability to economically hedge certain electricity commodity purchases and related costs has not had a material impact on our results of operations. As of June 30, 2010, contracts with our fixed price electricity customers have an average remaining life of approximately 6 months.

Geographic Market Concentrations

We believe that our diversified geographical coverage provides several benefits to us, including flexibility in product offerings and marketing campaigns, a broad demographic mix and diversified credit and regulatory exposure. Our multi-state approach allows us to:

· benefit from a diverse geographic stream of sales;

· lower the delivery risk associated with daily balancing gas markets;

· lower supply price risk and/or the risk of ancillary services events in a particular electricity market;

· achieve scalability from knowledge of multiple LDC programs and procedures;

· lower the risk of material impact from a regulatory change in a single jurisdiction;

· lower the risk of extreme regional weather patterns;

· lower the risk of material impact from regional economic downturns;

· improve inventory management opportunities across a diverse natural gas transportation and storage infrastructure; and

· capitalize on our regional supply and pricing knowledge.

RCEs by geographic area, excluding the SSO Program, are summarized in the following table.

|

|

|

RCEs at June 30, |

|

||||||||||

|

|

|

2010 |

|

2009 |

|

2008 |

|

||||||

|

|

|

No. |

|

% |

|

No. |

|

% |

|

No. |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Southern U.S. (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas |

|

150,000 |

|

|

|

197,000 |

|

|

|

241,000 |

|

|

|

|

Electricity |

|

27,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

|

|

|

|

|

177,000 |

|

29 |

% |

222,000 |

|

40 |

% |

266,000 |

|

38 |

% |

|

Northeastern U.S., Mid-Atlantic U.S. and Canada (2): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas |

|

144,000 |

|

|

|

138,000 |

|

|

|

156,000 |

|

|

|

|

Electricity |

|

146,000 |

|

|

|

50,000 |

|

|

|

73,000 |

|

|

|

|

|

|

290,000 |

|

48 |

% |

188,000 |

|

33 |

% |

229,000 |

|

33 |

% |

|

Midwestern U.S. (3): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas |

|

139,000 |

|

|

|

152,000 |

|

|

|

205,000 |

|

|

|

|

Electricity |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

139,000 |

|

23 |

% |

152,000 |

|

27 |

% |

205,000 |

|

29 |

% |

|

Total RCEs (4): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas |

|

433,000 |

|

|

|

487,000 |

|

|

|

602,000 |

|

|

|

|

Electricity |

|

173,000 |

|

|

|

75,000 |

|

|

|

98,000 |

|

|

|

|

Total |

|

606,000 |

|

100 |

% |

562,000 |

|

100 |

% |

700,000 |

|

100 |

% |

(1) Includes markets in Georgia, Texas and Florida.

(2) Includes markets in New York, New Jersey, Connecticut, Massachusetts, Pennsylvania, Maryland, Ontario and British Columbia.

(3) Includes markets in Ohio, Michigan, Indiana, Illinois and Kentucky.

(4) Excludes RCEs to be served in connection with the SSO Program in Ohio, pursuant to a one-year contract that expires March 31, 2011.

Our business platform is partly based on providing long-term, fixed rate price protection in contrast to variable rates offered by LDCs against which we compete in the markets that we serve. For the majority of fiscal year 2009, our financial and liquidity restrictions limited new and renewed contract terms to 12 months or less. Therefore, we were unable to fulfill consumer demand for longer-term products, losing growth and renewal opportunity to LDCs and competitors in many of our markets.

Southern U.S. markets — Total RCEs in our southern markets decreased 20% and 17% during fiscal years 2010 and 2009, respectively, mainly due to a decrease in our customer base in the Georgia natural gas market. In addition to the impact of liquidity constraints in Georgia, customer account terminations were also unusually high due to bad debt experience attributed to economic conditions, and to more stringent credit standards initiated during the year for new and renewable customer accounts. Liquidity and contract term limitations also impacted growth and renewals in our Texas electricity market.

Northeastern U.S., Mid-Atlantic U.S. and Canadian markets — Total RCEs within this region increased 54% during fiscal year 2010, primarily due to strong customer growth in various electricity markets. During fiscal year 2010, we focused on growth in our existing guaranteed electricity markets in order to improve the seasonal cash flow associated with the electricity business segment and reduce risks associated with commodity and geographic concentrations. In addition, actual electricity RCEs at June 30, 2010 include approximately 56,000 RCEs added as a result of our expansion into a new electricity market in Pennsylvania.

In April 2010, we obtained our electricity retail supplier license in the State of Maryland and began actively marketing in July to electricity customers within a Maryland service territory. Additionally, recently approved regulations in Maryland will require natural gas and electricity utilities to either guarantee supplier receivables or improve the way customer payments are allocated to suppliers. Within one of the two natural gas markets in Maryland where we currently operate, the LDC began guaranteeing the receivables of retail suppliers on July 15, 2010. We anticipate the other LDC market in Maryland will begin guaranteeing receivables sometime during fiscal year 2011.

Recent legislation in Massachusetts will require electricity LDCs to guarantee the accounts receivable of retail suppliers, although the time frame for this implementation is currently unknown. New initiatives that will increase the attractiveness of certain other northeastern electricity and natural gas markets also began to take effect early in fiscal year 2011.

Midwestern U.S. markets — Total RCEs in our Midwestern region, excluding RCEs expected to be served in connection with the SSO Program, decreased 9% and 26% during fiscal years 2010 and 2009, respectively, due primarily to competitive pressure and budgetary constraints placed on our sales and marketing team. The contract term limitations placed on us prior to the Restructuring also significantly impacted growth opportunities in the Michigan market.

In April 2010, we began delivering natural gas to an LDC in Ohio as a participant in the SSO Program. Under the SSO Program, we receive a NYMEX-referenced wholesale price plus a retail price adjustment for natural gas delivered by the LDC to its customers who remain eligible to participate in the SSO Program. As of June 30, 2010, based upon estimates received directly from the LDC, we expect that the customers assigned to us as a participant in the SSO Program will consume approximately 9.7 million MMBtus of natural gas annually.

Potential market growth opportunities — For fiscal year 2011, we will continue to explore expansion into LDC markets that are open to competition and appear to provide attractive growth potential. The decision to enter into new LDC territories will continue to be governed by several factors, including:

· compatibility with our existing operating systems and supply base;

· attractiveness of LDC program rules, such as billing options and guarantees of customer accounts receivable;

· competitive landscape;

· mass market consumption profiles;

· regulatory climate;

· market location and size; and

· our ability to provide value to customers.

Guaranteed and Non-Guaranteed Market Concentrations

We are exposed to direct credit risk associated with customer accounts receivable in eleven of the markets that we serve, where such receivables are not guaranteed by LDCs. For fiscal years 2010, 2009 and 2008, 51%, 55% and 56%, respectively, of our total sales of natural gas and electricity were within markets where LDCs do not guarantee customer accounts receivable. We refer to these markets as “non-guaranteed” markets. We maintain an allowance for doubtful accounts, which represents our estimate of potential credit losses associated with accounts receivables from customers within non-guaranteed markets. We record a provision for doubtful accounts based on historical loss experience within our markets and periodically assess the adequacy of the allowance for doubtful accounts through review of the aging of customer accounts receivable and general economic conditions in the markets that we serve.

Within thirty of the markets that we serve, we operate under a purchase of receivables program whereby all billed receivables are purchased by the LDC. We refer to these markets as “guaranteed” markets. For fiscal years 2010, 2009 and 2008, 49%, 45% and 44%, respectively, of our total sales of natural gas and electricity were within markets where LDCs guarantee customer accounts receivable at a weighted average discount rate of approximately 1%. Such discount is the cost of service to guarantee the customer accounts receivable. Within these markets, we are exposed only to the credit risk of the LDC, rather than that of our customers. We monitor the credit ratings of LDCs and the parent companies of LDCs that guarantee customer accounts receivable. We also periodically review payment history and financial information for LDCs to ensure that we identify and respond to any deteriorating trends. As of June 30, 2010, all of our customer accounts receivable in LDC-guaranteed markets were from LDCs with investment grade credit ratings.

In addition, in certain markets, we have commercial customers that have asked us to bill them directly for consumption of natural gas and electricity. For these customers, we bear credit risk associated with non-payment by the customer.

Commodity Supply and Pricing Risk Management

Natural Gas Supply

We buy natural gas in the wholesale market in time and location specific bulk quantities at fixed and indexed prices. Effective September 22, 2009, under the Commodity Supply Facility, we began purchasing natural gas supply from RBS Sempra, as our exclusive natural gas supplier. The Commodity Supply Facility also requires that we release natural gas transportation and storage capacity to RBS Sempra and for RBS Sempra to perform certain transportation and storage nominations. During fiscal year 2010, we released transportation and storage capacity in several markets to RBS Sempra according to a mutually acceptable schedule and in a manner intended to ensure an effective transition of these functions. In connection with the Commodity Supply Facility, we are obligated to reimburse RBS Sempra for various direct costs associated with transportation and storage capacity released to RBS Sempra by the Company.

We periodically adjust our portfolio of supply purchase and sales contracts, storage and transportation capacity based upon continual analysis of our forecasted load requirements to determine whether it would be more economical to utilize natural gas from storage or to purchase from the spot market, with consideration given to transportation costs and availability. Natural gas is delivered to the LDC city-gate or other specified delivery points where the LDC takes control of the natural gas and delivers it to individual customers’ locations of use, utilizing its extensive network of small diameter distribution pipe.

LDCs provide ancillary services such as billing, meter reading and balancing services. Because of this extensive transportation infrastructure and the services provided, LDC costs typically make up a significant portion of the end user’s utility bill.

Electricity Supply

We buy electricity in the wholesale market in time and location specific block and hourly shaped quantities at fixed and indexed prices. Effective September 22, 2009, under the Commodity Supply Facility, we began purchasing electricity from RBS Sempra, as our exclusive electricity supplier. The Commodity Supply Facility also requires that RBS Sempra perform certain load bidding and scheduling services on our behalf with the respective Independent System Operator (ISO) or Regional Transmission Organization (RTO) to the Company’s customers in each LDC. In connection with the Commodity Supply Facility, we are obligated to reimburse RBS Sempra for various direct costs associated with scheduling and balancing the Company’s supply to the ISOs and RTOs. ISOs and RTOs provide services such as transmission and load balancing, which comprise a relatively small portion of the end user’s utility bill in comparison with energy and capacity costs.

Commodity Pricing Risk Management

We have a risk management policy that is intended to reduce our financial exposure to changes in the prices of natural gas and electricity. Our objective under this policy is to economically hedge all anticipated natural gas and electricity commodity purchases required to meet expected customer demand for all accounts served under fixed price contracts. We typically contract for sufficient commodity volume to meet expected customer consumption assuming normal weather patterns. We may purchase additional commodity volumes for the summer in the case of electricity and for the winter in the case of natural gas in order to protect against a potential demand increase in peak seasons. As a result of the natural swing in customer consumption related to weather changes, we may have to buy or sell additional natural gas or electricity volume, which exposes us to additional price volatility. We utilize various hedging strategies in order to mitigate the risk associated with potential volumetric variability of our monthly deliveries for fixed priced customers.

We utilize the following instruments to offset price risk associated with volume commitments under fixed and variable price contracts where the price to the customer must be established ahead of the index settlement: (1) for natural gas: NYMEX-referenced gas swaps, basis swaps, physical commodity hedges, physical basis hedges and index options; and (2) for electricity: ISO zone specific swaps, basis swaps, physical commodity hedges, physical basis hedges and index options. We also utilize carbon dioxide offset credits and various renewable energy credits in order to meet regulatory requirements related to operating in electricity markets and our commitments from “green” product offers.

Refer to Item 7A of this Annual Report for additional commentary regarding commodity price risk management.

Seasonality of Operations

The majority of natural gas customer consumption occurs during the months of November through March. By contrast, electricity customer consumption peaks during the months of June through September. Because the natural gas business segment comprises such a large component of the Company’s overall business operations, operating results for the second and third fiscal quarters represent the vast majority of operating results for the Company’s full fiscal year.

Cash collected from natural gas customers peaks in the late winter and early spring of each calendar year, while cash collected from electricity customers peaks in the late summer and early fall. The Company utilizes a considerable amount of cash from operations to meet working capital requirements during the months of November through March of each fiscal year. In addition, the Company utilizes considerable cash to purchase natural gas inventories during the months of April through October.

Budget billing programs can reduce the seasonality of cash receipts, but they can also cause timing differences between the billing and collection of accounts receivable and the recording of revenues. The payment terms of LDCs also can cause timing differences between the billing and collection of accounts receivable and the recording of revenues.

Weather conditions have a significant impact on customer demand and market prices for natural gas and electricity. Customer demand exposes the Company to a high degree of seasonality in sales, cost of sales, billing and collection of customer accounts receivable, inventory requirements and cash flows.

The impact of rapidly rising or falling commodity prices also varies greatly depending on the period of time in which they occur during our fiscal year. Although commodity price movements can have material short-term impacts on monthly and

quarterly operating results, our economic hedging and contract pricing strategies may reduce the impact of such trends on operating results for a full fiscal year.

Industry Overview

Market Deregulation

In markets that are open to competitive choice of retail energy suppliers, our primary competition comes from utility-affiliated retail marketers, small to mid-size independent retail energy companies and default service with the incumbent utility. Competition is based primarily on product offerings, price and customer service.

Increasing our market share depends in part on our ability to convince customers to switch to our service. The local utilities and their affiliates have the advantage of long-standing relationships with their customers, and they may have longer operating histories, greater financial and other resources, and greater name recognition in their markets than we do. In addition, local utilities have been subject to many years of regulatory oversight and thus have significant experience regarding the regulators’ policy preferences, as well as a critical economic interest in the outcome of proceedings concerning their revenues and terms and conditions of service. The incumbents’ advantages in many markets are intended to be limited, however, by regulatory structures that, for example, prohibit incumbents from offering non-standard service and pricing structures, minimize the opportunity for the regulated business to subsidize the unregulated business and limit the ability of the utilities to solicit customers that have switched. In Georgia and Texas, however, the market is fully deregulated where the incumbent utilities no longer use a regulated benchmark price.

In many cases, LDCs actively support deregulation and have welcomed the entry of retail energy marketers. Regulated LDCs generally do not profit from commodity supplied to their customers; rather, their rate of return is based on their infrastructure assets or “rate base.” Accordingly, regulated LDCs charge consumers for commodity on a pass-through basis, and do not hedge their forward energy costs. By relieving LDCs of the need to engage in risk management, regulations permitting retail competition allows LDCs to focus on their core competency of local distribution, which typically constitutes a significant portion of most customers’ utility bills. Many LDCs assume customer bad debt exposure since this encourages more market entrants and supports continued deregulation. LDCs may recover the bad debt expense as part of their tariff rates. The interests of retail energy marketers and most LDCs are thus highly aligned, providing crucial support for continued deregulation, while increasing penetration of the retail energy marketer model. We have successfully forged strong relationships with many of the LDCs throughout our service territories.

Some of our competitors, including local utilities, have formed alliances and joint ventures in order to compete in the restructured retail electricity and natural gas industries. Many customers of these local utilities may decide to stay with their longtime energy provider if they have been satisfied with their service in the past. Therefore, it may be difficult for us to compete against local utilities and their affiliates.

Our retail energy sales depend upon our ability to identify and enter profitable, deregulated, retail energy markets, manage the cost of customer acquisitions, retain customers and attract new customers in our existing markets, and integrate acquired businesses successfully. The principal components of our strategy to compete in existing and new markets include:

· offering competitively priced products;

· maintaining prudent and proven hedging and risk management policies;

· building and maintaining an excellent commodity supply team;

· pursuing organic growth and opportunistic acquisitions;

· maintaining a low cost operating structure;

· upholding high customer service standards; and

· leveraging our investment in information systems.

Deregulated Natural Gas Industry

The Natural Gas Policy Act of 1978 took the first steps toward deregulating the natural gas market by instituting a scheme for the gradual removal of price ceilings at the wellhead. In 1985, the Federal Energy Regulatory Commission (“FERC”) issued Order 436, which changed how interstate pipelines were regulated. Essentially, this order allowed pipelines, on a voluntary basis, to offer transportation services to customers who requested them on a first-come, first-serve basis. The movement towards allowing pipeline customers a choice in the purchase of their natural gas and transportation arrangements became known as “open access,” and spurred the emergence of natural gas marketers.

While large commercial and industrial consumers have had the option of purchasing the natural gas commodity separately from natural gas suppliers for many years, state regulators and law makers have moved more slowly in implementing choice programs for residential and small-volume commercial customers.

According to the United States Energy Information Agency (“EIA”), as of December 2009, twenty-one states and the District of Columbia have legislation or programs in place that let residential consumers and other small-volume users purchase natural gas from someone other than their traditional utility company. As of December 2009, of the approximately 65.3 million residential natural gas customers in the U.S., nearly 35.0 million have access to choice programs, with approximately 5.1 million (or 14.7% of eligible customers) actually purchasing from residential marketers. State regulators continue to refine and evaluate existing programs in order to promote a competitive marketplace. The low penetration rate, coupled with the desire for a competitive marketplace, has created attractive growth opportunities for residential marketers such as us.

As of December 31, 2009, there were approximately 150 marketers licensed to serve residential natural gas customers, of which 110 were actively serving or enrolling customers. Marketers competing for the commercial and residential markets fall into three categories: utility affiliates, national marketers and niche marketers. The commitment of many of these marketers is often modest, confined to a limited geographic region, and supported by limited capital, personnel and operational infrastructure.

We focus on natural gas markets that are less susceptible to competitive pressures on profit margins and that lend themselves to mass-market techniques. The number of active competitive retail natural gas marketers ranges from 2 to 15 in most of the states that we serve, with as many as 60 in New York. In addition to all local utilities, we consider the main retail competitors within our natural gas markets to be Georgia Natural Gas, Direct Energy (an affiliate of UK based Centrica), Gas South, Vectren Source, IDT Energy, Dominion Retail Energy (a deregulated affiliate of Dominion Resources, Inc.), Just Energy and Interstate Gas Services.

Deregulated Electricity Industry

In 1978, Congress passed the Public Utility Regulatory Policies Act, which laid the groundwork for deregulation and competition by opening wholesale power markets to non-utility producers of electricity. In 1996, FERC Orders 888 and 889 required open and equal access to jurisdictional utilities’ transmission lines for all electricity producers, thus facilitating the states’ restructuring of the electric power industry by allowing customers direct access to retail power generation.

As a result of federal and state initiatives, the electric power industry in several states has changed from a structure characterized by highly regulated, vertically integrated local monopolies, which provide their customers with a comprehensive package of electricity services, to a deregulated structure. The deregulated structure includes independent power producers and unregulated owners of electricity generation, competitive providers like us who supply electricity to end-use customers, and utilities that continue to provide transmission or distribution services as common carriers.

According to the EIA, as of May 2010, 15 states and the District of Columbia operate retail markets in which customers may choose alternative electricity suppliers. For electricity, our primary retail competitors are ConEd Solutions, Direct Energy, StarTex Power, TXU Energy, Reliant Energy, Champion Energy Services and Dominion Retail Energy.

Foreign Operations

Our foreign operations are located in Canada. Foreign operations comprised less than 1% of our consolidated total assets at June 30, 2010 and 2009 and less than 1% of our consolidated sales of natural gas and electricity for the fiscal years ended June 30, 2010 and 2009. Management believes that the financial and operational risks associated with our Canadian operations are immaterial.

Management Team and Employees

The members of our executive management team have extensive experience in energy risk management and retail marketing as well as in creating, developing and managing businesses and risk on behalf of major international corporations. The professional backgrounds of our executive management team are described in Item 10 of this Annual Report.

As of June 30, 2010, we had approximately 203 full-time equivalent employees in the United States and Canada. None of our employees are subject to a collective bargaining agreement, and we believe that our relationship with our employees is good.

Environmental Matters

We do not have physical custody or control of the natural gas provided to our customers, or any facilities used to produce or transport natural gas or electricity. Although we hold title to natural gas in interstate pipelines and storage tanks, we believe that the carriers have the liability risk associated with infrastructure failures that could cause environmental issues. Therefore, we do not believe that we have significant exposure to legal claims or other liabilities associated with

environmental concerns.

Where You Can Find More Information

Our filings with the SEC are available to the public over the Internet at the SEC’s website at www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Our filings with the SEC are also available under the SEC Filings section of our website, www.mxholdings.com, as soon as reasonably practicable after we electronically file such reports with the SEC. The information contained on this Internet site is not incorporated by reference in this Annual Report. You may also request a copy of these filings, at no cost, by writing to us at our corporate headquarters: MXenergy Holdings Inc., 595 Summer Street, Suite 300, Stamford, Connecticut 06901, Attention: Chief Financial Officer, or by calling us at (203) 356-1318.

The website at www.mxholdings.com contains information concerning Holdings and its subsidiaries. This website is separate from our consumer website, www.mxenergy.com. The information contained on our website and those of our subsidiaries is not incorporated by reference in this Annual Report.

Any of the following risks could have an adverse effect on our business, financial condition or results of operations. Additional risks or uncertainties not currently known to us may also arise in the future that could have an adverse effect on our business, financial condition or results of operations.

Risks Related to Our Business

Our risk management policies and hedging procedures may not mitigate risk as planned, and we may fail to fully or effectively hedge our commodity supply and price risk exposure against changes in consumption volumes or market rates.

To provide energy to our customers, we purchase the relevant commodity in the wholesale energy markets, which are often highly volatile. It is our policy to match estimated consumption by our customers by purchasing offsetting volumes of natural gas and electricity. To reduce our financial exposure related to commodity price fluctuations and changes in consumption volumes, we routinely enter into contracts to hedge our fixed price sale commitments, delivery requirements and inventory of natural gas, as well as fixed price sale commitments and line loss of electricity.

We have contractual obligations to many of our customers to provide full requirements service and as a result, our hedging procedures require constant monitoring and adjustment. Failure to continue to use valid assumptions may lead to inappropriate hedging positions. In addition, there are a number of factors that are beyond our control, such as risk of loss from counterparties’ nonperformance, volumetric risks related to customer demand and seasonal fluctuations. Although we purchase anticipatory hedges that represent volume we expect to sell to residential and small commercial customers for up to one month of projected marketing, we are exposed to the risk of a shortfall in marketing that could result in our purchases exceeding our supply commitments to those customers. We cannot fully protect ourselves against these factors and if our risk management policies are inadequate, this may have a detrimental effect on our business.

Actual customer attrition may exceed or be below expected attrition, which could result in a cost to cover previously purchased fixed price hedges and physical commodity supply or in incremental cost to source additional commodity supply.

Although our fixed price contracts with residential customers generally have terms of up to two years, those customers may terminate their contracts at any time for a termination fee that, in most cases, is relatively modest and does not bear any relation to our costs or lost profit with respect to the remainder of the contract. Most of our small and mid-market commercial customers cannot terminate their fixed price contracts without triggering a damages provision designed to cover costs related to the termination of those contracts. For larger commercial customers, we utilize various means to ensure that we recover our costs, including legal remedies if appropriate. We depend on our hedging strategies to cover the costs related to terminations by residential and small commercial customers. To hedge effectively against terminations, we must, at the inception of the contracts, attempt to accurately forecast the number of residential and small commercial customers that will terminate their contracts prior to the end of their term. If we experience a number of cancellations greater than originally forecasted or if we are not able to replace terminating customers with new customers, our financial results may be negatively impacted. Conversely, if forecasted attrition is higher than actual realized attrition, we are at risk for having to source additional hedges or supply at potentially higher market prices where no price increase can be passed on to customers through the duration of their contract terms.

Most of our financial swap agreements are settled against published index prices that could cease to be reliable or could become unavailable.

We hedge our forward natural gas exposures through a combination of physical supply purchases and financial swap agreements. Financial swap agreements may be settled against monthly New York Mercantile Exchange (“NYMEX”) settlement prices or against index prices published by various industry publications. NYMEX settlement prices could be affected by supply and demand factors at the Henry Hub delivery point of the contract that are not present elsewhere in the country. Accordingly, the NYMEX settlement prices may cease to accurately reflect the market price of natural gas. Likewise, index prices for market areas in which our customers are located, and which are contained in daily and monthly industry publications, are published based on private polling of industry participants and therefore may be distorted, deliberately or unintentionally, thereby ceasing to be an accurate gauge of market pricing in those areas.

In the event either NYMEX settlement prices or published index prices were to become unavailable or cease to be reliable, we and our counterparties could seek to find a replacement price that would more accurately or reliably reflect the market prices that we are hedging. However, there is no certainty that such efforts would be successful.

The accounting method utilized for our hedging activities results in volatility in our quarterly and annual financial results.

We engage in risk management activities related to our natural gas and electricity purchases in order to economically hedge our exposure to commodity price risk. Through the use of financial derivative and physical contracts, we attempt to balance our physical and financial purchases and sales commitments. We have not designated these derivative instruments as hedges for accounting purposes. Therefore, changes in the fair value of these instruments are recognized immediately in earnings. As a result of this accounting treatment, changes in the forward prices of natural gas and electricity cause volatility in our quarterly and annual earnings, which we are unable to fully estimate or predict.

We may not have sufficient liquidity or credit capacity to hedge market risks, to continue to grow our business, or to operate effectively.

Certain of our LDC, transportation and storage agreements require us to maintain restricted cash balances or letters of credit as collateral for the performance risk associated with the future delivery of natural gas. These collateral requirements may increase as our customer base grows or as a result of movements in the market prices of commodity. The effectiveness of our operations and future growth depends in part on the amount of cash and letters of credit available to enter into or maintain these contracts. Such liquidity requirements may be greater than we anticipate or are able to meet.

Despite our efforts to hedge risk and accurately forecast demand, our financial results are susceptible to changing weather conditions and commodity price fluctuations and therefore will fluctuate on a seasonal and quarterly basis.