Attached files

| file | filename |

|---|---|

| EX-21.1 - Shengkai Innovations, Inc. | v197555_ex21-1.htm |

| EX-23.1 - Shengkai Innovations, Inc. | v197555_ex23-1.htm |

| EX-23.2 - Shengkai Innovations, Inc. | v197555_ex23-2.htm |

| EX-31.1 - Shengkai Innovations, Inc. | v197555_ex31-1.htm |

| EX-32.2 - Shengkai Innovations, Inc. | v197555_ex32-2.htm |

| EX-31.2 - Shengkai Innovations, Inc. | v197555_ex31-2.htm |

| EX-32.1 - Shengkai Innovations, Inc. | v197555_ex32-1.htm |

| EX-10.25 - Shengkai Innovations, Inc. | v197555_ex10-25.htm |

| EX-10.24 - Shengkai Innovations, Inc. | v197555_ex10-24.htm |

| EX-10.27 - Shengkai Innovations, Inc. | v197555_ex10-27.htm |

| EX-10.28 - Shengkai Innovations, Inc. | v197555_ex10-28.htm |

| EX-10.26 - Shengkai Innovations, Inc. | v197555_ex10-26.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

|

S

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the fiscal year ended June 30, 2010

|

|

£

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the transition period from _____________ to ___________

|

Commission

file number: 001-34587

SHENGKAI

INNOVATIONS, INC.

(Exact

name of registrant as specified in its charter)

|

Florida

|

11-3737500

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer identification No.)

|

|

No.

27, Wang Gang Road,

Jin

Nan (Shuang Gang) Economic and Technology Development

Area

Tianjin,

People’s Republic of China

|

300350

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code + (86)

22-2858-8899

Securities

registered under Section 12(b) of the Exchange Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

|

N/A

|

N/A

|

Securities

registered pursuant to section 12(g) of the Act

Common Stock, par value

$0.001 per share

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

£ Yes S

No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act.

S

Yes £ No

Note – Checking the box above

will not relieve any registrant required to file reports pursuant to Section 13

or 15(d) of the Exchange Act from their obligations under those

Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. S Yes £

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). £

Yes £

No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. S

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer”,

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer £

|

Accelerated

filer £

|

|

Non-accelerated

filer £ (Do not

check if a smaller reporting company)

|

Smaller

reporting company S

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

£ Yes

S

No

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold, or the average bid and asked price of such common equity, as of the

last business day of the registrant’s most recently completed second fiscal

quarter.

Note – If a determination as

to whether a particular person or entity is an affiliate cannot be made without

involving unreasonable effort and expense, the aggregate market value of the

common stock held by non-affiliates may be calculated on the basis of

assumptions reasonable under the circumstances, provided that the assumptions

are set forth in this Form.

The

aggregate market value of the voting and non-voting common stock of the issuer

held by non-affiliates was approximately $27,874,375 based upon the closing

price of the common stock ($5.15) as quoted by NASDAQ on December 31,

2009.

APPLICABLE

ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act

of 1934 subsequent to the distribution of securities under a plan confirmed by a

court. ¨ Yes ¨ No

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock, as of the latest practicable date.

As of

September 20, 2010, there were 23,191,165 issued and outstanding shares of the

issuer’s common stock.

DOCUMENTS

INCORPORATED BY REFERENCE

List

hereunder the following documents if incorporated by reference and the Part of

the Form 10-K (e.g. Part I, Part II, etc.) into which the document is

incorporated: (1) Any annual report to security holders; (2) Any proxy or

information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or

(c) under the Securities Act of 1933. The listed documents should be clearly

described for identification purposes (e.g. annual report to security holders

for fiscal years ended December 24, 1980).

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements regarding our

business, financial condition, results of operations and prospects. Words such

as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates” and similar expressions or variations of such words are intended to

identify forward-looking statements, but are not deemed to represent an

all-inclusive means of identifying forward-looking statements as denoted in this

Annual Report on Form 10-K. Additionally, statements concerning future matters

are forward-looking statements.

Although

forward-looking statements in this Annual Report on Form 10-K reflect the good

faith judgment of our management, such statements can only be based on facts and

factors currently known by us. Consequently, forward-looking statements are

inherently subject to risks and uncertainties and actual results and outcomes

may differ materially from the results and outcomes discussed in or anticipated

by the forward-looking statements. Factors that could cause or contribute to

such differences in results and outcomes include, without limitation, those

specifically addressed under the headings “Risks Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations.” You

are urged not to place undue reliance on these forward-looking statements, which

speak only as of the date of this Annual Report on Form 10-K. We file reports

with the SEC. The SEC maintains a website (www.sec.gov) that contains reports,

proxy and information statements, and other information regarding issuers that

file electronically with the SEC, including us. You can also read and copy any

materials we file with the SEC at the SEC’s Public Reference Room at 100 F

Street, NE, Washington, DC 20549. You can obtain additional information about

the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330.

We

undertake no obligation to revise or update any forward-looking statements in

order to reflect any event or circumstance that may arise after the date of this

Annual Report on Form 10-K, except as required by law. Readers are urged to

carefully review and consider the various disclosures made throughout the

entirety of this Annual Report, which are designed to advise interested parties

of the risks and factors that may affect our business, financial condition,

results of operations and prospects.

Currency,

exchange rate, and “China” and other references

Unless

otherwise noted, all currency figures in this filing are in U.S. dollars.

References to "yuan" or "RMB" are to the Chinese yuan, which is also known as

the Renminbi. According to the currency exchange website www.xe.com, on

September 20, 2010, $1.00 was equivalent to 6.7169 yuan.

References

to “PRC” and “China” are to the People’s Republic of China.

References

to “Shengkai” are to Tianjin Shengkai Industrial Technology Development Co.

Ltd., a PRC company that we control.

Unless

otherwise specified or required by context, references to “Southern Sauce

Company, Inc.,” “we,” “the Company”, “our” and “us” refer collectively to (i)

Shengkai Innovations, Inc. (formerly known as “Southern Sauce Company, Inc.”),

(ii) the subsidiaries of the Company, Shen Kun International Limited, a British

Virgin Islands limited liability company (“Shen Kun”), Shengkai (Tianjin)

Limited, a wholly foreign-owned enterprise under the laws of the PRC (“SK

WFOE”), Shengkai (Tianjin) Trading Ltd., a wholly-owned subsidiary of SK WFOE

incorporated under the laws of the PRC, and (iii) Shengkai.

References

to Shengkai’s “registered capital” are to the equity of Shengkai, which under

PRC law is measured not in terms of shares owned but in terms of the amount of

capital that has been contributed to a company by a particular shareholder or

all shareholders. The portion of a limited liability company’s total capital

contributed by a particular shareholder represents that shareholder’s ownership

of the company, and the total amount of capital contributed by all shareholders

is the company’s total equity. Capital contributions are made to a company by

deposits into a dedicated account in the company’s name, which the company may

access in order to meet its financial needs. When a company’s accountant

certifies to PRC authorities that a capital contribution has been made and the

company has received the necessary government permission to increase its

contributed capital, the capital contribution is registered with regulatory

authorities and becomes a part of the company’s “registered

capital.”

2

SHENGKAI

INNOVATIONS, INC.

FORM

10-K

For

the Fiscal Year Ended June 30, 2009

TABLE OF

CONTENTS

|

PAGE

|

||||

|

PART

I

|

||||

|

Item

1.

|

Business

|

4

|

||

|

Item

1A.

|

Risk

Factors

|

22

|

||

|

Item

1B.

|

Unresolved

Staff Comments

|

30

|

||

|

Item

2.

|

Properties

|

30

|

||

|

Item

3.

|

Legal

Proceedings

|

31

|

||

|

Item

4.

|

(Removed

and Reserved)

|

31

|

||

|

PART

II

|

||||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities

|

31

|

||

|

Item

6.

|

Selected

Financial Data

|

32

|

||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

33

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

39

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

39

|

||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

41

|

||

|

Item

9A.

|

Controls

and Procedures

|

41

|

||

|

Item

9B.

|

Other

Information

|

43

|

||

|

PART

III

|

||||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

44

|

||

|

Item

11.

|

Executive

Compensation

|

48

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Shareholder Matters

|

51

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

53

|

||

|

Item

14.

|

Principal

Accountant Fees and Services

|

54

|

||

|

PART

IV

|

||||

|

Item

15.

|

Exhibits

and Financial Statement Schedules

|

54

|

||

|

Signatures

|

58

|

3

PART

I

Item 1. Business.

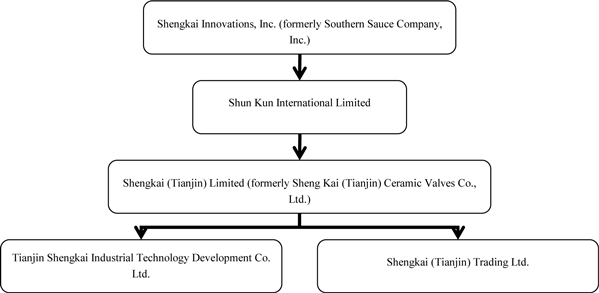

Corporate

History and Structure

We were

incorporated in Florida under the name Southern Sauce Company, Inc. on December

8, 2004. Our initial business plan was to establish a successful specialty

food business based on proprietary recipes for barbecue sauces and other

condiments for the retail market.

By a

Stock Purchase and Sale Agreement dated February 14, 2008, we experienced a

change in control whereby Vision Opportunity China LP and a number of other

investors acquired an aggregate of 2,575,000 shares of common stock from former

shareholders for a purchase price of $635,000. Upon this change in control, our

board of directors determined that the implementation of our business plan prior

to the change in control was no longer financially feasible, and we adopted an

acquisition strategy focused on pursuing growth by acquiring undervalued

businesses with a history of operating revenues. We utilized several criteria to

evaluate prospective acquisitions, including whether the business to be acquired

(1) was an established business with viable services or products, (2) had an

experienced and qualified management team, (3) had room for growth and/or

expansion into other markets, (4) was accretive to earnings, (5) offered the

opportunity to achieve and/or enhance profitability, and (6) increased

shareholder value.

Our board

of directors approved the Merger Agreement and Plan of Reorganization on May 30,

2008, and we entered into the Merger Agreement and Plan of Reorganization with

Shen Kun and all of the Shen Kun shareholders on June 9, 2008 as part of the

reverse merger transaction described in further detail below.

Immediately

following the reverse merger transaction, our corporate structure was as

follows:

Shen Kun

was incorporated under the laws of the British Virgin Islands on November 7,

2007, and Shen Kun formed SK WFOE under the name “Sheng Kai (Tianjin) Ceramic

Valves Co., Ltd.” as a wholly foreign-owned enterprise under the laws of the PRC

on April 9, 2008. SK WFOE was subsequently renamed as “Shengkai

(Tianjin) Limited” on April 15, 2010.

Shengkai,

our operating entity, was organized under the laws of the PRC in June 1994 under

the name Tianjin Shengkai Industrial Technology Development Company. Shengkai’s

business was formerly operated as a collective-owned enterprise. The business

was reorganized under the laws of the PRC as a limited liability company under

its current name, Tianjin Shengkai Industrial Technology Development Co., Ltd.

in April 1999.

4

Shengkai

(Tianjin) Trading Ltd., which is wholly-owned by SK WFOE, was organized as a

wholly foreign-owned enterprise under the laws of the PRC on June 25, 2010 with

a total registered capital of RMB500,000. Shengkai (Tianjin) Trading Ltd. is

primarily engaged in the international trading of non-valve products to better

serve the Company’s international customers.

Under the

laws of the PRC, certain restrictions are placed on round

trip investments, which are defined under PRC law as an acquisition of a

PRC entity by an offshore special purpose vehicle owned by one or more PRC

residents. As a result, SK WFOE entered into a series of agreements with

Shengkai which we believe give us effective control over the business of

Shengkai, the entity through which we now operate our business. These agreements

are described above in the section entitled “Contractual Agreements with

Shengkai.”

Our

executive offices are located at No. 27, Wang Gang Road, Jin Nan (Shuang Gang)

Economic and Technology Development Area, Tianjin, PRC 300350, and our telephone

number is (86) 22-2859-8899. Our website is www.shengkaiinnovations.com.

Information on our website or any other website is not a part of this

report.

Reverse

Merger and Private Placements

In June

and July 2008, we consummated a number of related transactions through which we

acquired control of Shengkai, a PRC-based company and consummated two private

placements for gross proceeds of $15 million and $5 million, respectively (the

“Private Placements”).

We

acquired control of Shengkai through two separate transactions: (i) a

restructuring transaction which granted control of Shengkai to another PRC

entity, SK WFOE, and (ii) a reverse merger transaction transferring control of

SK WFOE to the Company. We refer to the restructuring transaction and the

reverse merger transaction together as the “Reverse Merger.”

Restructuring Transaction:

Under the laws of the PRC, certain restrictions are placed on round

trip investments, which are defined under PRC law as an acquisition of a

PRC entity by an offshore special purpose vehicle owned by one or more PRC

residents. As a result, SK WFOE entered into a series of agreements with

Shengkai which we believe gives us effective control over the business of

Shengkai.

Reverse Merger Transaction:

In the reverse merger transaction, through our wholly-owned subsidiary

Shen Kun Acquisition Sub Limited, we acquired control of Shen Kun, a British

Virgin Islands company and the parent company of SK WFOE, by issuing to the Shen

Kun Shareholders 20,550,000 shares of our common stock, as consideration for all

of the outstanding capital stock of Shen Kun.

Private Placements : In

connection with the reverse merger transaction, on June 11, 2008 we sold to

Vision Opportunity China LP Units (the “Units”) for aggregate gross proceeds of

$15,000,000, at a price of $2.5357 per Unit (the “June 2008 Financing”). Each

Unit consists of one share of the Company’s Series A Convertible Preferred

Stock, par value $0.001 per share (the “Series A Preferred Stock”), convertible

into one share of common stock, par value $0.001 per share (the “common stock”),

and one Series A Warrant to purchase common stock equal to 120% of the number of

shares of common stock issuable upon conversion of the Series A Preferred Stock

(“Warrant”).

Additionally,

on July 18, 2008, we sold Units to Blue Ridge Investments, LLC for aggregate

gross proceeds of $5,000,000, at a price of $2.5357 per Unit (the “July 2008

Financing”). Each Unit consists of one share of Series A Preferred Stock,

convertible into one share of common stock, and one Warrant to purchase common

stock equal to 120% of the number of shares of common stock issuable upon

conversion of the Series A Preferred Stock.

A

detailed description of the agreements entered into in connection with the

Reverse Merger and Private Placements is provided below.

PRC

Restructuring

The PRC

restructuring transaction was effected by the execution of five agreements

between SK WFOE, on the one hand, and Shengkai (and in some cases the

shareholders of Shengkai), on the other hand (the “PRC Restructuring

Agreements”). Under the laws of the PRC, certain restrictions are placed

on round trip investments, which are defined under PRC law as an

acquisition of a PRC entity by an offshore special purpose vehicle owned by one

or more PRC residents. To comply with these restrictions, in conjunction with

the reverse acquisition, we (via our wholly-owned subsidiary, SK WFOE) entered

into and consummated certain contractual arrangements with Shengkai and their

respective shareholders pursuant to which we provide these companies with

technology consulting and management services. Through these contractual

arrangements, we have the ability to substantially influence these companies’

daily operations and financial affairs, appoint their senior executives and

approve all matters requiring shareholder approval. As a result of these

contractual arrangements, which enable us to control Shengkai and operate our

business in the PRC through Shengkai, we are considered the primary beneficiary

of Shengkai.

On May

30, 2008, we entered into the following contractual arrangements, each of which

are enforceable and valid in accordance with the laws of the

PRC:

5

Consigned Management

Agreement

The

Consigned Management Agreement, among SK WFOE, Shengkai, and all of the

shareholders of Shengkai, provides that SK WFOE will provide financial,

business, technical and human resources management services to Shengkai that

will enable SK WFOE to control Shengkai’s operations, assets and cash flow, and

in exchange, Shengkai will pay a management fee to SK WFOE equal to 2% of

Shengkai’s annual revenue. The management fee for each year is due by January 31

of the following year. The term of the agreement is until SK WFOE acquires all

of the equity or assets of Shengkai.

Technology

Service Agreement

The

Technology Service Agreement, among SK WFOE, Shengkai, and all of the

shareholders of Shengkai, provides that SK WFOE will provide technology

services, including the selection and maintenance of Shengkai’s computer

hardware and software systems and training of Shengkai employees in the use of

those systems. SK WFOE will also provide research and development into new

formulations of ceramics and methods that will increase the toughness and

machinability of ceramics, raise manufacturing ceramic materials burn rate and

lower sintering temperature, and lower production costs. The agreement also

provides that SK WFOE will train Shengkai’s staff to increase productive use of

the new equipments and increase Shengkai’s overall production

capacity.

As

consideration for such services, Shengkai will pay a technology service fee to

SK WFOE equal to 1% of Shengkai’s annual revenue. The technology service fee for

each year is due by January 31 of the following year. The term of the agreement

is until SK WFOE acquires all of the equity or assets of Shengkai.

Loan Agreement

The Loan

Agreement, among SK WFOE and all of the shareholders of Shengkai, provides that

SK WFOE will make a loan in the aggregate principal amount of RMB49,000,000

(approximately $7,153,702) to the shareholders of Shengkai, each shareholder

receiving a share of the loan proceeds proportional to its shareholding in

Shengkai, and in exchange each shareholder agreed (i) to contribute all of its

proceeds from the loan to the registered capital of Shengkai in order to

increase the registered capital of Shengkai, (ii) to cause Shengkai to complete

the process of registering the increase in its registered capital with PRC

regulatory authorities within 30 days after receiving the loan, and (iii) to

pledge their equity to SK WFOE under the Equity Pledge Agreement described

below.

The loan

is repayable at the option of SK WFOE either in cash or by transfer of Shengkai

equity or all of its assets to SK WFOE. The loan does not bear interest, except

that if (x) SK WFOE is able to purchase the equity or assets of Shengkai, and

(y) the lowest allowable purchase price for that equity or those assets under

PRC law is greater than the principal amount of the loan, then, insofar as it is

allowable under PRC law, interest will be deemed to have accrued on the loan in

an amount equal to the difference between the lowest allowable purchase price

for Shengkai and the principal amount of the loan. The effect of this interest

provision is that, if and when permitted under PRC law, SK WFOE may acquire all

of the equity or assets of Shengkai by forgiving the loan, without making any

further payment.

If the

principal amount of the loan is greater than the lowest allowable purchase price

for the equity or assets of Shengkai under PRC law, then even though one might

expect that SK WFOE would be entitled to receive the difference between those

two amounts in repayment of the loan, Shengkai is not obligated to make such a

payment. The effect of this provision is that (insofar as allowable under PRC

law) Shengkai may satisfy its repayment obligations under the loan by

transferring all of its equity or assets to SK WFOE, without making any further

payment.

The Loan

Agreement also contains agreements from the shareholders of Shengkai that during

the term of the agreement, they will elect as directors of Shengkai only

candidates nominated by SK WFOE, and they will use their best efforts to ensure

that Shengkai does not take certain actions without the prior written consent of

SK WFOE, including (i) supplementing or amending its articles of association or

bylaws, (ii) changing its registered capital or shareholding structure, (iii)

transferring, mortgaging or disposing of any interests in its assets or income,

or encumbering its assets or income in a way that would affect SK WFOE’ security

interest, (iv) incurring or guaranteeing any debts not incurred in its normal

business operations, (v) entering into any material contract (exceeding RMB

3,000,000, or approximately $439,741, in value), unless it is necessary for the

company’s normal business operations; (vi) providing any loan or guarantee to

any third party; (vii) acquiring or consolidating with any third party, or

investing in any third party; and (viii) distributing any dividends to the

shareholders in any manner. In addition, the Loan Agreement provides that at SK

WFOE’ request, Shengkai will promptly distribute all distributable dividends to

the shareholders of Shengkai.

The funds

that SK WFOE used to make the loan came from the proceeds received by us, its

indirect parent company, in the Private Placements described in further detail

below.

6

Exclusive Purchase Option

Agreement

The

Exclusive Purchase Option Agreement, among SK WFOE, Shengkai, and all of the

shareholders of Shengkai, provides that Shengkai will grant SK WFOE an

irrevocable and exclusive right to purchase all or part of Shengkai’s assets,

and the shareholders of Shengkai will grant SK WFOE an irrevocable and exclusive

right to purchase all or part of their equity interests in Shengkai. Either

right may be exercised by SK WFOE in its sole discretion at any time that the

exercise would be permissible under PRC law, and the purchase price for SK WFOE’

acquisition of equity or assets will be the lowest price permissible under PRC

law. Shengkai and its shareholders are required to execute purchase agreements

and related documentation within 30 days of receiving notice from SK WFOE that

it intends to exercise its right to purchase.

The

Exclusive Purchase Option Agreement contains agreements from Shengkai and its

shareholders that they will refrain from taking actions, such as voting to

dissolve or declaring dividends, that could impair SK WFOE’s security interest

in the equity of Shengkai or reduce its value. These agreements are

substantially the same as those contained in the Loan Agreement described

above.

The

agreement will remain effective until SK WFOE or its designees have acquired

100% of the equity interests of Shengkai or substantially all of the assets of

Shengkai. The exclusive purchase options were granted under the agreement on May

30, 2008.

Equity

Pledge Agreement

The

Equity Pledge Agreement, among SK WFOE, Shengkai, and all of the shareholders of

Shengkai, provides that the shareholders of Shengkai will pledge all of their

equity interests in Shengkai to SK WFOE as a guarantee of the performance of the

shareholders’ obligations and Shengkai’s obligations under each of the other PRC

restructuring agreements. The Equity Pledge Agreement contains promises from

Shengkai and its shareholders that they will refrain from taking actions, such

as voting to dissolve or declaring dividends, that could impair SK WFOE’

security interest in the equity of Shengkai or reduce its value. These promises

are substantially the same as those contained in the Loan Agreement described

above.

Under the

Equity Pledge Agreement, the shareholders of Shengkai have also agreed (i) to

cause Shengkai to have the pledge recorded at the appropriate office of the PRC

Bureau of Industry and Commerce, (ii) to deliver any dividends received from

Shengkai during the term of the agreement into an escrow account under the

supervision of SK WFOE, and (iii) to deliver Shengkai’s official shareholder

registry and certificate of equity contribution to SK WFOE. Additionally,

on July 3, 2008, a Supplementary Agreement to the Equity Pledge was executed to

authorize SK WFOE to fully and completely represent all shareholders of Shengkai

to exercise their shareholder's rights in Shengkai, including shareholders’

voting rights at shareholder meetings.

Completion of the PRC

Restructuring

The PRC

Restructuring Agreements were executed on May 30, 2008. As of June 30, 2009,

100% of the registered capital of SK WFOE had been contributed in accordance

with the PRC restructuring agreements.

As a

result of the consummation of the PRC Restructuring Agreements above, the

contributions of Shengkai’s registered capital, and therefore the ownership of

Shengkai, took the form represented in the table below:

|

Name of Shareholder

|

Amount of Contribution

(RMB)

|

Percent of Capital

Contribution

|

||||||

|

Wang Chen

|

45,689,600 | 71.39 | ||||||

|

Guo

Wei

|

8,531,200 | 13.33 | ||||||

|

Zhao

Yanqiu

|

4,192,000 | 6.55 | ||||||

|

Ji

Haihong

|

4,192,000 | 6.55 | ||||||

|

Zhang

Ying

|

307,200 | 0.48 | ||||||

|

Miao

Yang

|

307,200 | 0.48 | ||||||

|

Chen

Fang

|

307,200 | 0.48 | ||||||

|

Wu

Yanping

|

236,800 | 0.37 | ||||||

|

Liu

Naifan

|

236,800 | 0.37 | ||||||

|

Total

|

RMB | 64,000,000 | 100 | % | ||||

Reverse Merger

Transaction

On June

9, 2008, through our wholly-owned subsidiary Shen Kun Acquisition Sub Limited,

we entered into a Merger Agreement and Plan of Reorganization with (i) Shen Kun,

(ii) the owners of all of the outstanding voting stock of Shen Kun, and (iii)

our then-controlling shareholders, Vision Opportunity China LP, Castle Bison,

Inc., Martin Sumichrast, and Ralph Olson. The Shen Kun shareholders with whom we

consummated the merger included (i) the majority holder, Long Sunny Limited, a

British Virgin Islands company (which owned 84.72% of Shen Kun’s common stock),

a majority of the stock of which may be acquired in the future by our Chief

Executive Officer, Mr. Wang Chen, pursuant to a call option held by Mr. Wang,

(ii) five individual minority shareholders: Mr. Miao Yang, Ms. Zhang Ying, Ms.

Chen Fang, Mr. Wu Yanping, Mr. Liu Naifan (who collectively owned 2.18% of Shen

Kun’s common stock), and (iii) two entity minority shareholders, Groom Profit

Holdings Limited, a British Virgin Islands company (solely owned by Ms. Zhao

Yanqiu), and Right Idea Holdings Limited, a British Virgin Islands company

(solely owned by Ms. Ji Haihong) (who each owned 6.55% of Shen Kun’s common

stock, respectively).

7

Under the

terms of the Merger Agreement and Plan of Reorganization, we acquired control of

Shen Kun, a British Virgin Islands company and the parent company of SK WFOE, a

wholly foreign-owned entity organized under the laws of the PRC, by issuing

20,550,000 shares of common stock to the Shen Kun shareholders as merger

consideration for 100% of the common stock of Shen Kun. Immediately after the

closing of the Merger Agreement and Plan of Reorganization, we had a total of

22,112,500 shares of common stock outstanding, with the Shen Kun shareholders

(and their assignees) owning approximately 92.9% of our outstanding common stock

on a non-diluted basis. Shen Kun Acquisition Sub Limited was dissolved and Shen

Kun, the surviving entity, became our wholly-owned subsidiary.

Private Placement (June 2008

Financing)

In

connection with the consummation of the reverse merger transaction, on June 11,

2008 we consummated a financing for the sale of Units for the

aggregate gross proceeds of $15,000,000, at a price of $2.5357 per Unit

(“the June 2008 Financing”). Each Unit consists of one share of the Company’s

Series A Preferred Stock, convertible into one share of common stock, and one

Warrant equal to 120% of the number of shares of common stock issuable upon

conversion of the Series A Preferred Stock. The description of other material

terms and conditions of the June 2008 Financing are set forth

below.

Securities

Purchase Agreement

In

connection with the reverse merger transaction, on June 10, 2008 we entered into

and on June 11, 2008 consummated a Securities Purchase Agreement (the “June 2008

Purchase Agreement”) with certain Purchasers, namely Vision Opportunity China

LP, for the sale of Units at an aggregate purchase price of $15,000,000, each

unit consisting of one share of Series A Preferred Stock and one Warrant with an

exercise price of $3.52 per share, exercisable for a period of five years from

the closing date.

On June

11, 2008, the aggregate purchase price paid for the Units was $15,000,000 (the

“First Closing”). Pursuant to the June 2008 Purchase Agreement, on or before

June 30, 2008, we had the option to sell in a second closing an additional

number of Units for an aggregate price that was the difference between the gross

proceeds from the First Closing and $20,000,000 (the “Second

Closing”).

Each

share of Series A Preferred Stock is convertible, at the option of the holder,

into one share of our common stock, subject to certain limitations, conditions

and anti-dilutive adjustments, and to a 9.9% limitation on beneficial ownership

of stock. As such, the Series A Preferred Stock are convertible into an

aggregate of 5,915,526 shares of our common stock In the

event that the Company is unable to deliver the shares upon conversion while the

holder has transacted to sell such underlying shares to a third party, a holder

has the right to exercise certain buy-in rights, pursuant to which the Company

shall either (i) compensate the actual loss suffered by the holder in this

required transaction due to failure of delivery of common stock by the Company

(based on that (x) the amount of the total purchase price exceeds (y) the amount

obtained from the sale order), or either (i) reinstate the shares of the Series

A Preferred Stock that was intended to be converted, or (ii) deliver the number

of shares of common stock that should have been issued if the conversion had

been honored.

The

Warrants are exercisable in the aggregate for up to 7,098,632 shares of our

common stock, or 120% of the total number of shares of common stock issuable

upon conversion of the Series A Preferred Stock purchased by each Purchaser,

subject to a 9.9% limitation on beneficial ownership of common stock. The

Warrants are exercisable for a term of five years from June 10, 2008 and may be

exercised at any time after 18 months following June 10, 2008 if we do not have

an effective registration statement to cover the common stock underlying the

Warrants. In the event that the Company is unable to deliver the

shares upon conversion while the holder has transacted to sell such underlying

shares to a third party, a holder has the right to exercise certain buy-in

rights, pursuant to which the Company shall (i) compensate the actual loss

suffered by the holder in this required transaction due to failure of delivery

of common stock by the Company (based on that (x) the amount of the total

purchase price exceeds (y) the amount obtained from the sale order), and either

(i) reinstate the shares of the Series A Preferred Stock that was intended to be

converted, or (ii) deliver the number of shares of common stock that should have

been issued if the conversion had been honored.

On

September 16, 2007, Shengkai entered into a Financial Consulting Agreement (the

“Mass Harmony Agreement”) with Mass Harmony Asset Management Limited (“Mass

Harmony”). Pursuant to the Mass Harmony Agreement, Mass Harmony received an

aggregate of 450,000 shares of common stock and 5% of the gross proceeds of the

June 2008 Financing in Warrants, equivalent to warrants exercisable in the

aggregate of up to 213,068 shares of our common stock. The services provided by

Mass Harmony under the Mass Harmony Agreement include performing initial due

diligence on Shengkai, preparing Shengkai’s business plan, and assisting in the

corporate restructuring and financial documentation.

8

Pursuant

to the Second Amendment to the June 2008 Purchase Agreement dated as of July 31,

2008, we are required to list and trade our shares of common stock on the Nasdaq

Capital Market, the Nasdaq Global Market, the American Stock Exchange or any

successor market thereto within eighteen (18) months of the First

Closing, or our principal shareholder, Li Shaoqing (the “Principal

Shareholder”), will be required to deliver to Vision Opportunity China LP an

aggregate of 750,000 shares of common stock.

The

Purchase Agreement also grants the following significant rights to Vision

Opportunity China LP and places the following significant restrictions and

obligations on us:

|

|

·

|

Subsequent

financing participation. For two years after the date on

which the initial registration statement to be filed by the Company under

the registration rights agreement described below is declared effective by

the Securities and Exchange Commission (“SEC”), Purchasers who continue to

hold Series A Preferred Stock have the right to participate in any

subsequent sale of securities by the Company in order to purchase up to

its pro rata portion of the total amount of securities sold in the

subsequent sale equal to the percentage of the total Series A Preferred

Stock issued in the June 2008

Financing.

|

|

|

·

|

Consent for

asset sale. We may

not sell all or a substantial portion of our assets, except to a

subsidiary, without the consent of the holders of a majority of the

then-outstanding Series A Preferred

Stock.

|

|

|

·

|

Chief

Financial Officer/Vice President of Investor Relations. As soon as possible after the

First Closing, we are required to use our best efforts to appoint an

individual who is fluent in English and acceptable to Vision Opportunity

China LP to serve as Chief Financial Officer and/or Vice President of

Investor Relations.

|

|

|

·

|

Investor

relations fund. We

must maintain an escrow account with $500,000 in connection with monies to

be used for investor and public relations services. The escrow account was

established through the Investor and Public Relations Escrow Agreement

described below and was funded at the Closing. Out of this amount,

$150,000 shall be released from escrow once we appoint a Chief Financial

Officer or Vice President of Investor Relations. An additional $150,000

will be released to us after we engage a new independent registered

accounting firm that is listed as one of the top 20 firms by stock market

client number as calculated by Hemscott Group Limited, a division of

Morningstar, Inc. As of June 30, 2010, all of the $500,000 had

been released back to the

Company.

|

|

|

·

|

U.S.

visitation. For as

long as Vision Opportunity China LP holds at least 5% of

the aggregate total number of shares of common stock and Shares (as

defined in the Purchase Agreement) of the Company on a fully-diluted

basis, the Company must provide for its management to visit the United

States at least twice each year to meet with potential

investors.

|

Securities

Escrow Agreement

On June

10, 2008 we entered into and on June 11, 2008 consummated a securities escrow

agreement with Vision Opportunity China LP, as representative of the Purchasers

under the June 2008 Purchase Agreement, the Principal Shareholder, and Loeb

& Loeb LLP, as escrow agent (the “Securities Escrow Agreement”). In the

Securities Escrow Agreement, as an inducement to the Purchasers to enter into

the June 2008 Purchase Agreement, the Principal Shareholder agreed to deliver an

aggregate of 5,915,526 shares of our common stock (the amount of common stock

underlying the Series A Preferred Stock) (the “Vision Escrow Shares”) to the

escrow agent for the benefit of the Purchasers, and to forfeit some or all of

those shares to the Purchasers in the event we fail to achieve certain financial

performance thresholds for the 12-month periods ending June 30, 2008 and June

30, 2009.

Pursuant

to the Second Amendment to the June 2008 Purchase Agreement and the First

Amendment to the June 2008 Securities Escrow Agreement, both dated as of July

31, 2008, if we fail to list our common stock on the Nasdaq Capital Market,

Nasdaq Global Market, American Stock Exchange or any successor market thereto

within eighteen (18) months of June 10, 2008, 750,000 shares of common

stock owned by Principal Shareholder will be distributed to Vision Opportunity

China LP.

As of

June 30, 2010, pursuant to the terms of the Securities Escrow Agreement,

all shares held in escrow had been released back to the Principal

Shareholder.

Investor

and Public Relations Escrow Agreement

On June

10, 2008 we entered into and on June 11, 2008 consummated an Investor and Public

Relations Agreement with Vision Opportunity China LP and Sichenzia Ross Friedman

Ference LLP, as escrow agent. Pursuant to the agreement, $500,000 of the

proceeds of the June 2008 Financing was deposited into an escrow account with

Sichenzia Ross Friedman LLP for use in investor and public relations services.

The escrow account was established through the Investor and Public Relations

Escrow Agreement described below and was funded at the closing. Out of this

amount, $150,000 shall be released from escrow once we appoint a Chief Financial

Officer or Vice President of Investor Relations. An additional $150,000 will be

released to us after we engage a new independent registered accounting firm that

is listed as one of the top 20 firms by stock market client number as calculated

by Hemscott Group Limited, a division of Morningstar, Inc. As of June

30, 2010, all of the $500,000 had been released back to the

Company.

9

Registration

Rights Agreement

On June

10, 2008 we entered into and on June 11, 2008 consummated a Registration Rights

Agreement with Vision Opportunity China LP (the “Vision RRA”), under which we

agreed to prepare and file with the SEC and maintain the effectiveness of a

“resale” registration statement pursuant to Rule 415 under the Securities Act

(“Rule 415”) providing for the resale of (i) all of the shares of common stock

issuable on conversion of the Series A Preferred Stock, (ii) all of the shares

of common stock issuable upon exercise of the Warrants, (iii) 1,304,750 shares

of common stock held by certain shareholders before the Reverse Merger

Transaction, (iv) all of the Vision Escrow Shares delivered to Vision

Opportunity China LP under the Securities Escrow Agreement described above, and

(v) all of the 750,000 shares of common stock that the Principal Shareholder

will be required to deliver to Vision Opportunity China LP in case the Company

does not meet the deadline for listing on a national securities

exchange.

Under the

terms of the Vision RRA, we are required to have a registration statement filed

with the SEC within 45 days after the earlier of the date of the Second Closing

or June 30, 2008, and declared effective by the SEC not later than November 27,

2008. We filed the registration statement on August 7, 2008, and it

was declared effective by the SEC on August 21, 2008.

We are

required to pay liquidated damages in an amount equal to 1 percent of Vision

Opportunity China LP’s initial acquisition of Series A Preferred Stock pursuant

to the June 2008 Purchase Agreement for each month past the relevant deadline

that the registration statement is not filed or not declared effective, for any

period that we fail to keep the registration statement effective, or for any

period that we cause our common stock to be delisted from the Over-the-Counter

Bulletin Board (or other principal exchange on which it is traded), up to a

maximum of 10 percent of the purchase amount of the Units. The number of shares

of Series A Preferred Stock issuable pursuant to the liquidated damages

provision is subject to reduction based on the maximum number of shares that can

be registered under Rule 415.

The

registration rights agreement also provides for additional demand registration

rights in the event that Vision Opportunity China LP is unable to register all

of the registrable securities in the initial registration statement and grants

holders of registrable securities customary piggy back rights during any time

when there is not an effective registration statement providing for the resale

of the registrable securities.

The terms

of the Vision RRA are subject to a registration rights agreement that was

consummated on June 11, 2008 by and between the Company and certain shareholders

pre-existing the reverse merger (the “Shareholder RRA”). Under the terms of the

Shareholder RRA, the Company granted registration rights to certain shareholders

existing prior to the reverse merger transaction, by which the shareholders were

granted registration rights for the registration of an aggregate

of 1,304,750 shares of common stock. The shareholders will be entitled

to cash liquidated damages in the amount equal to .75% of the value of each

shareholder’s registrable securities (using a value of $2.54 per share to

calculate the amount of such shareholder’s registrable securities) on the date

that it fails to register the securities under the terms of the agreement and

for each calendar month or portion thereof until the failure is cured, up to a

maximum amount of 10% of the value of the shareholder’s securities (using a

value of $2.54 per share to calculate the amount of such shareholder’s

registrable securities).

Lock-Up

Agreement

On the

Closing Date, we entered into an agreement with various shareholders of Long

Sunny Limited and members of Shengkai’s management under which, in order to

induce the Company and the Purchasers to enter into the June 2008 Financing,

each of the seven shareholders and managers listed below agreed that (i) they

will not sell or transfer any shares of our common stock held as of the Closing

Date until at least 12 months after the effective date of the initial

registration statement to be filed under the Vision RRA described above, and

(ii) for an additional 24 months after the end of that 12 month period, it will

not sell or transfer more than one-twelfth of its total shares of that common

stock during any one month.

The

shareholders subject to the Lock-Up Agreement are:

|

|

·

|

Wang Chen, our

CEO.

|

|

|

·

|

Li

Shaoqing

|

|

|

·

|

Guo

Wei

|

|

|

·

|

Liu

Xiaoqian

|

|

|

·

|

He

Li

|

|

|

·

|

Ruan

Xiangyi

|

|

|

·

|

Li

Juan

|

10

Private Placement (July 2008

Financing)

On July

18, 2008, we sold to Blue Ridge Investment, LLC, Units for aggregate gross

proceeds of $5,000,000, at a price of $2.5357 per Unit (the “July 2008

Financing”). As in the June 2008 Financing, each Unit consists of one share of

Series A Preferred Stock, convertible into one share of common stock, and one

Warrant to purchase common stock equal to 120% of the number of shares of common

stock issuable upon conversion of the Series A Preferred Stock. The description

of other material terms and conditions of the July 2008 Financing are set forth

below.

Securities

Purchase Agreement

On July

18, 2008, we entered into and consummated a Securities Purchase Agreement (the

“July 2008 Purchase Agreement”) with Blue Ridge Investments, LLC for the sale of

Units at an aggregate purchase price of $5,000,000, each unit consisting of one

share of Series A Preferred Stock and one Warrant with an exercise price of

$3.52 per share, exercisable for a period of five years from

issuance.

Each

share of Series A Preferred Stock is convertible, at the option of the holder,

into one share of our common stock, subject to certain limitations, conditions

and anti-dilutive adjustments, and to a 9.9% limitation on beneficial ownership

of stock. As such, the Series A Preferred Stock are convertible into an

aggregate of 1,971,842 shares of our common stock. In the event that

the Company is unable to deliver the shares upon conversion while the holder has

transacted to sell such underlying shares to a third party, a holder has the

right to exercise certain buy-in rights, pursuant to which the Company shall

either (i) compensate the actual loss suffered by the holder in this required

transaction due to failure of delivery of common stock by the Company (based on

that (x) the amount of the total purchase price exceeds (y) the amount obtained

from the sale order), or either (i) reinstate the shares of the Series A

Preferred Stock that was intended to be converted, or (ii) deliver the number of

shares of common stock that should have been issued if the conversion had been

honored.

The

Warrants are exercisable in the aggregate for up to 2,366,211 shares of our

common stock, or 120% of the total number of shares of common stock issuable

upon conversion of the Series A Preferred Stock purchased by each Purchaser,

subject to a 9.9% limitation on beneficial ownership of common stock. The

Warrants are exercisable for a term of five years from July 18, 2008 and may be

exercised at any time after 18 months following July 18, 2008 if we do not have

an effective registration statement to cover the common stock underlying the

Warrants. In the event that the Company is unable to deliver the

shares upon conversion while the holder has transacted to sell such underlying

shares to a third party, a holder has the right to exercise certain buy-in

rights, pursuant to which the Company shall (i) compensate the actual loss

suffered by the holder in this required transaction due to failure of delivery

of common stock by the Company (based on that (x) the amount of the total

purchase price exceeds (y) the amount obtained from the sale order), and either

(i) reinstate the shares of the Series A Preferred Stock that was intended to be

converted, or (ii) deliver the number of shares of common stock that should have

been issued if the conversion had been honored.

Pursuant

to the Mass Harmony Agreement dated as of September 16, 2007, Mass Harmony also

received 5% of the gross proceeds of the July 2008 Financing in Warrants,

equivalent to warrants exercisable in the aggregate of up to 71,023 shares of

our common stock. The services provided by Mass Harmony under the Mass Harmony

Agreement include performing initial due diligence on Shengkai, preparing

Shengkai’s business plan, and assisting in the corporate restructuring and

financial documentation.

Pursuant

to the First Amendment to the July 2008 Purchase Agreement dated as of July 31,

2008, we are required to list and trade our shares of common stock on the Nasdaq

Capital Market, Nasdaq Global Market, American Stock Exchange or any successor

market thereto within eighteen (18) months of July 18, 2008, or the

Principal Shareholder, will be required to deliver to Blue Ridge Investments,

LLC an aggregate of 250,000 shares of common stock.

The July

2008 Purchase Agreement also grants the following significant rights to Blue

Ridge Investments, LLC and places the following significant restrictions and

obligations on us:

|

|

·

|

Subsequent

financing participation. For two years after the date on

which the initial registration statement to be filed by the Company under

the Registration Rights Agreement described below is declared effective by

the Securities and Exchange Commission (“SEC”), if Blue Ridge Investments,

LLC continues to hold Series A Preferred Stock, it shall have the right to

participate in any subsequent sale of securities by the Company in order

to purchase up to its pro rata portion of the total amount of securities

sold in the subsequent sale equal to the percentage of the total Series A

Preferred Stock issued in the July 2008

Financing.

|

|

|

·

|

Consent for

asset sale. We may

not sell all or a substantial portion of our assets, except to a

subsidiary, without the consent of the holders of a majority of the

then-outstanding Series A Preferred

Stock.

|

|

|

·

|

Chief

Financial Officer/Vice President of Investor Relations. As soon as possible after the

Closing Date, we are required to use our best efforts to appoint an

individual who is fluent in English and acceptable to Vision Opportunity

China LP and to Blue Ridge Investments, LLC to serve as Chief Financial

Officer and/or Vice President of Investor

Relations.

|

11

|

|

·

|

Investor

relations fund. We

must maintain an escrow account with $500,000 in connection with monies to

be used for investor and public relations services. The escrow account was

established through the Investor and Public Relations Escrow Agreement

entered into by and between the Company, Vision Opportunity China LP and

Sichenzia Ross Friedman Ference LLP, as escrow agent, dated as of June 10,

2008 and was funded on June 11, 2008. Out of this amount, $150,000 shall

be released from escrow once we appoint a Chief Financial Officer or Vice

President of Investor Relations. An additional $150,000 will be released

to us after we engage a new independent registered accounting firm that is

listed as one of the top 20 firms by stock market client number as

calculated by Hemscott Group Limited, a division of Morningstar,

Inc. As of June 30, 2010, all of the $500,000 had been released

back to the Company.

|

|

|

·

|

U.S.

visitation. For as

long as Vision Opportunity China LP or Blue Ridge Investments, LLC holds

at least 5% of the aggregate total number of shares of common

stock and Shares (as defined in the Purchase Agreement) of the

Company on a fully-diluted basis, the Company must provide for its

management to visit the United States at least 4 times each year to meet

with potential investors.

|

Securities

Escrow Agreement

On July

18, 2008, we consummated a securities escrow agreement with Blue Ridge

Investments, LLC, the Principal Shareholder, and Loeb & Loeb LLP, as escrow

agent (the “July 2008 Securities Escrow Agreement”). In the Securities Escrow

Agreement, as an inducement to Blue Ridge Investments, LLC to enter into the

July 2008 Purchase Agreement, the Principal Shareholder agreed to deliver an

aggregate of 1,971,842 shares of our common stock (the amount of common stock

underlying the Series A Preferred Stock) (the “Blue Ridge Escrow Shares”) to the

escrow agent for the benefit of Blue Ridge Investments, LLC, and to forfeit some

or all of those shares to Blue Ridge Investments, LLC in the event we fail to

achieve certain financial performance thresholds for the 12-month periods ending

June 30, 2008 (“2008”) and June 30, 2009 (“2009”).

Pursuant

to the First Amendment to the July 2008 Purchase Agreement and the First

Amendment to the July 2008 Securities Escrow Agreement, both dated as of July

31, 2008, if we fail to list our common stock on the Nasdaq Capital Market,

Nasdaq Global Market, American Stock Exchange or any successor market thereto

within 18 months of July 18, 2008, 250,000 shares of common stock owned by

Principal Shareholder will be distributed to Blue Ridge Investments,

LLC.

As of

June 30, 2010, pursuant to the terms of the Securities Escrow Agreement,

all shares held in escrow had been released back to the Principal

Shareholder.

Registration

Rights Agreement

On July

18, 2008 we entered into and consummated a Registration Rights Agreement with

Blue Ridge Investments, LLC (the “Blue Ridge RRA”), under which we agreed to

prepare and file with the SEC and maintain the effectiveness of a “resale”

registration statement pursuant to Rule 415 under the Securities Act (“Rule

415”) providing for the resale of: (i) all of the shares of common stock

issuable on conversion of the Series A Preferred Stock, (ii) all of the shares

of common stock issuable upon exercise of the Warrants, (iii) all of the Blue

Ridge Escrow Shares delivered to Blue Ridge Investments, LLC under the July 2008

Securities Escrow Agreement described above, and (iv) all of the 250,000 shares

of common stock that the Principal Shareholder will be required to deliver to

Blue Ridge Investments, LLC in case the Company does not meet the deadline for

listing on a national securities exchange.

Under the

terms of the Blue Ridge RRA, we are required to have a registration statement

filed with the SEC within 45 days after the date of the Closing Date, or

September 1, 2008, and declared effective by the SEC not later than December 15,

2008.

We are

required to pay liquidated damages to Blue Ridge Investments, LLC in an amount

equal to 1% of Blue Ridge Investments, LLC initial acquisition of Series A

Preferred Stock pursuant to the July 2008 Purchase Agreement for each month past

the relevant deadline that the registration statement is not filed or not

declared effective, for any period that we fail to keep the registration

statement effective, or for any period that we cause our common stock to be

delisted from the Over-the-Counter Bulletin Board (or other principal exchange

on which it is traded), up to a maximum of 10% of the purchase amount of the

Units. The number of shares of Series A Preferred Stock issuable pursuant to the

liquidated damages provision is subject to reduction based on the maximum number

of shares that can be registered under Rule 415.

The

registration rights agreement also provides for additional demand registration

rights in the event that Vision Opportunity China LP unable to register all of

the registrable securities in the initial registration statement and grants

holders of registrable securities customary piggy back rights during any time

when there is not an effective registration statement providing for the resale

of the registrable securities.

12

The terms

of the Blue Ridge RRA are subject to the Vision RRA described in the section

entitled “Private Placement (June 2008 Financing)” above. Under the terms of the

Vision RRA, we granted registration rights to Vision Opportunity China LP on

similar terms as Blue Ridge under the Registration Rights Agreement, except that

we are required to file a registration statement within 45 days after June 30,

2008, and such registration statement must be declared effective by the SEC not

later than November 27, 2008.

The terms

of the Blue Ridge RRA are also subject to the Shareholder RRA. Under the terms

of the Shareholder RRA, the Company granted registration rights to certain

shareholders existing prior to the reverse merger transaction, by which the

shareholders were granted registration rights for the registration of an

aggregate of 1,304,750 shares of common stock, as described in more

detail in the section entitled “Private Placement (June 2008 Financing)”

above.

Warrant Amendment

Agreement

On April

30, 2010, the Company entered into a Warrant Amendment agreement with each of

the holders of the Warrants in the June 2008 Financing and July 2008 Financing,

namely Vision Opportunity China, LP and Blue Ridge Investments, LLC, to amend

their respective warrants so as to replace certain down-round anti-dilution

protections with a provision to allow the Company to issue additional shares of

common stock or common stock equivalents at a price less than the conversion

price of the warrants with the consent of the majority holders of the

warrants.

Subsidiaries

As a

result of the Reverse Merger, Shen Kun and SK WFOE are our wholly-owned

subsidiaries. Shengkai, the entity through which we operate our business,

currently has no subsidiaries, either wholly-owned or

partially-owned.

Business

Overview

We

believe that Shengkai is the one of the few ceramic valve manufacturers in the

world with research and development, engineering, and production capacity for

structural ceramics and is the only valve manufacturer in China who is able to

produce large-sized ceramic valves with calibers of 150mm or more. Its product

categories include a broad range of valves in all industries that are sold

throughout China, to Europe, North America and other countries in the

Asia-Pacific region. Totaling over 400 customers, the company became a supplier

of China Petroleum & Chemical Corporation (“CPCC” or “Sinopec”) in 2005 and

a member of the PetroChina Co. Ltd. (“PetroChina”) supply network in 2006.

Shengkai is currently the only domestic ceramic valve manufacturer entering into

the CPCC and PetroChina supply system, after a six-year application

process.

Shengkai

develops ceramic products with more than 730 types and specifications in 34

series, under 9 categories. Of these, 22 national patents have been obtained for

its valve products. Shengkai’s product won the title of “National Key New

Product” four times from 1999-2003 and won a silver medal in the Shanghai

International Industry Fair in 2002. In 2003, Shengkai obtained API

authentication allowing export to North America and the Asia-Pacific region and

CE authentication allowing export to EU in 2003.

Presently,

the technology of other domestic and overseas industrial ceramic valves

manufacturers limits production to small-bore ball valves with pressure levels

below 2.5MPa. In contrast, Shengkai produces a variety of ceramics in every

category (gate valve, ball valve, back valve, adjustable valve, cut-off valve

and special valve) and produce more than 700 specifications that sustain a

maximum pressure level of 42MPa. The largest ceramic valve caliber produced by

Shengkai is 1,000mm. Currently, we believe that other manufacturers in the world

only produce ceramic ball valves and ceramic adjustable valves with 150mm

caliber or less.

Business

History

Shengkai

was established in June 1994 with registered capital of RMB310,000 and an

initial business scope covering the production and sales of spray mixtures and

ceramic valves. The stock ownership was jointly held by eight shareholders

including Wang Chen, the largest shareholder of the company.

In

October 1995, Shengkai increased its registered capital to RMB1 million through

capital and equity increase; Wang Chen contributed RMB810,000 and the remaining

shares were held by the other seven shareholders. In November 2000, the

registered capital increased to RMB15 million and the company’s business scope

was changed to the design, manufacturing and sales of ceramic valves,

manufacturing and sales of high-tech ceramic material, technical consultation

and service, and export of such products and related technologies.

Overview

of the Ceramic Valve Industry in China

At present, the world valve industry is in a position of stable

development. According to statistical data in “Industrial Valves: World Markets”

report published by the McIlvaine Company (the “McIlvaine Report”), as of 2008,

there are more than 50,000 valve manufacturers. Based on a 2008 Freedonia Group

Report, the worldwide industrial valve market is expected to increase 4.4%

annually through 2011 to $77.5 billion.

13

Since

reforming and opening its markets, China’s valve industry has developed rapidly.

According to the data from China Mechanical Electrical Data Online, at the end

of November 2008, the number of Chinese valve manufacturers was up to over

6,000, representing 8% of the world’s total suppliers; more than 1000 of them

have sales of over RMB5 million. According to statistical data from the China

Valve Industrial Association, gross industrial output value reached RMB114.74

billion in 2008, which increased 25.03% compared with the previous

year.

Market

dispersion is more pronounced in the valve industry than many other industries

and subjects to intense competition: according to a China Machinery Industry

Federation report, the top 15 of the world manufacturers had a sales volume less

than $8.93 billion in 2008 with a world market share of approximately 19%;

according to statistical data in “ Valve Communication” published by the China

Valve Industrial Association, the top 10 Chinese valve industry manufacturers

only had a sales volume of RMB6.34 billion, with a Chinese market share of less

than 5.5 percent.

Operations

of Shengkai

Shengkai

designs, manufactures and distributes ceramic valves in 34 series under 9

categories, covering almost every general type of valve available for industrial

use in the world. Shengkai’s valve sizes range from 32mm to 1000mm and can

withstand pressure up to 42MPa. The company provides a series of services

related to industrial ceramic valves, including manufacture, installation and

maintenance of general industrial ceramic valves, as well as the design and

manufacture of various non-standard ceramic valves as required by customers’

special operating conditions.

Production

is comprised of three processes: ceramic piece production, machine-work of

ceramic and metal components, and assembly. Currently, the total area of the

production plant is 22,000 m2, with

131 sets of machine tools, of which 40 sets are for ceramics, and 91 sets of

digitally controlled machine tools. Ceramic valve output in fiscal year 2010 was

14,376 sets.

Ceramics

are friable and non-plastic and, given that to-date we believe that there is no

special equipment available for ceramic processing in the world, as such not

only can be difficult to process but also have a limited field of application.

Shengkai has overcome these disadvantages by applying the following features to

its products:

|

·

|

adding zirconia to alumina

ceramics to increase toughness and resistance to

corrosion;

|

|

·

|

successfully using Martensite

transformation toughening technology to increase toughness and reduce

deformability; and

|

|

·

|

applying nano-sized powder

technology to improve toughness and other

features.

|

|

·

|

altering existing metal

processors so as to enable Shengkai to apply cold-working techniques to

its ceramic products.

|

Shengkai

has developed a solid solution and agent that lowers firing temperature and

enhances the homogeneous dispersion of ceramic pulp, applying the theories of

solid solution, chemical dispersion and the rational sintering temperature

curve. This technology effectively controls the contraction ratio during the

ceramic sintering process to greatly improve the rate of finished products.

Currently, the rate of sintered finished goods of various calibers of Shengkai’s

valve products has reached over 90%, and firing temperatures for Shengkai’s

products are 80°C-120°C lower than the world standard in the

industry.

Shengkai

has also developed various joint technologies under various temperatures, so as

to solve problems that arise from the combination of ceramics and metal with

different coefficients of thermal expansion and to ensure that the valves

produced are leak-proof. Shengkai mainly selects ceramic material of partially

stabilized zirconia (PSZ), tetragonal zirconia polycrystal (TZP),

zirconia-toughened alumina (ZTA) and zirconia toughened mullite

(ZTM).

We

believe that Shengkai's ability to produce a comprehensive category of

high-quality ceramic products, together with its self-developed ceramic

processor, leak-proof valve sealing technology and strong technology development

capacity, distinguish it from its domestic and international

competitors.

Products

Shengkai

mainly produces industrial ceramic valves with calibers up to 1,000mm in various

types and in different combinations of ceramic and metal coefficients, depending

on their use. Ceramic valves perform significantly better than metal valves due

to higher wear resistance, corrosion resistance, and high temperature

resistance. We estimate that the average service life of our ceramic valves are

at least 10 times of that of comparably-sized metal valves currently in the

market.

Customers

and Suppliers

Customers

For the

year ended June 30, 2010, Shengkai’s top 10 customers were as

follows:

14

Major

customers and sales amount for fiscal year 2010

|

Name

|

Amount (RMB)

|

|||

|

Changsha

Kaigao Valve Whole Set Co., Ltd.

|

14,817,952.95 | |||

|

Jiangxi

Xinghuo Machinery Company Changsha Branch

|

12,864,216.05 | |||

|

Changchun

Gaoneng Valve Co., Ltd.

|

10,057,417.93 | |||

|

Shandong

Keneng Power Chemical Equipment Sets Co., Ltd.

|

9,899,651.87 | |||

|

Jilin

Universal Valve Co., Ltd.

|

9,510,417.07 | |||

|

Xiamen

Sanhua Electrial Equipment Co., Ltd.

|

9,256,051.32 | |||

|

Inner

Mongolia DaiHai Electric Power Generation Co., Ltd

|

8,776,934.18 | |||

|

Lanzhou

High Pressure Valve Co., Ltd.

|

8,742,355.39 | |||

|

Zhejiang

Huanqiu Power Station Valve Co., Ltd., Changchun Branch

|

8,324,038.44 | |||

|

Shanghai

High & Medium Pressure Valves Co., Ltd., Hunan Branch

|

8,318,369.14 | |||

Our top

10 customers contributed approximately 27.17% of total sales in the fiscal year

ended June 30, 2010. No customer individually accounted for more than

4.0% of total sales.

For the

year ended June 30, 2009, Shengkai’s top 10 customers were as

follows:

Major

customers and sales amount for fiscal year 2009

|

Name

|

Amount (RMB)

|

|||

|

Lanzhou

High Pressure Valve Co., Ltd.

|

17,094,017.11 | |||

|

Jiangxi

Xinghuo Machinery Company Changsha Branch

|

14,110,848.77 | |||

|

Jiangxi

Hydropower Engineering Bureau

|

13,335,232.60 | |||

|

Shanghai

High & Medium Pressure Valves Co., Ltd Hunan Branch

|

13,241,741.26 | |||

|

Hunan

Yiyang Power Generating Co., Ltd.

|

10,513,373.94 | |||

|

Changsha

Kaigao Valve Whole Set Co., Ltd.

|

10,400,280.34 | |||

|