Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2010

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period for , 2010

Commission File No. 001-34793

LONGWEI PETROLEUM

INVESTMENT HOLDING LIMITED

(Name of small business issuer in its charter)

|

Colorado

|

84-1536518

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

No. 30 Guanghau Street, Xiaojingyu Xiang, Wan Bailin District, Taiyuan City,

Shanxi Province, China

|

030024

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(727) 641-1357

(Registrant’s telephone number, including area code)

|

Securities registered under Section 12(b) of the Exchange Act:

|

||

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

|

Common Stock, no par value

|

NYSE Amex LLC

|

|

|

Securities registered under Section 12(g) of the Exchange Act: Common Stock, no par value per share.

|

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

Revenues for year ended June 30, 2010: $343,249,462

The aggregate market value of the registrant’s voting common stock held by non-affiliates as of June 30, 2010 based upon the closing price reported for such date on the OTC Bulletin Board was US $46,067,745.

As of September 28, 2010 the registrant had 93,266,981 shares of its common stock issued and outstanding.

Documents Incorporated by Reference: None.

1

TABLE OF CONTENTS

|

PAGE

|

||||

|

PART I

|

||||

|

ITEM 1.

|

Business

|

3 | ||

|

ITEM 1A.

|

Risk Factors

|

12 | ||

|

ITEM 2.

|

Properties

|

19 | ||

|

ITEM 3.

|

Legal Proceedings

|

20 | ||

|

ITEM 4.

|

Removed and Reserved

|

20 | ||

|

PART II

|

||||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

20 | ||

|

ITEM 6.

|

Selected Financial Data

|

25 | ||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

25 | ||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

30 | ||

|

ITEM 8.

|

Consolidated Financial Statements

|

31 | ||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

33 | ||

|

ITEM 9A(T).

|

Controls and Procedures

|

33 | ||

|

ITEM 9B.

|

Other Information

|

34 | ||

|

PART III

|

||||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

34 | ||

|

ITEM 11.

|

Executive Compensation

|

37 | ||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

39 | ||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

40 | ||

|

ITEM 14.

|

Principal Accounting Fees and Services

|

40 | ||

|

PART IV

|

||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

41 | ||

|

SIGNATURES

|

43 |

2

ITEM 1. BUSINESS

Overview

Longwei Petroleum Investment Holding Limited (the “Company”) is an energy company engaged in the wholesale distribution of finished petroleum products in the People’s Republic of China (the “PRC”). The Company’s oil and gas operations consist of transporting, storage and selling finished petroleum products, entirely in the PRC. The Company purchases diesel, gasoline, fuel oil and solvents (the “Products”) from various petroleum refineries in the PRC. The Company’s headquarters are located in Taiyuan City, Shanxi Province (“Taiyuan”). The Company has a storage capacity for its Products of 120,000 metric tons located at its fuel depot storage facilities in Taiyuan and in Gujiao, Shanxi (“Gujiao”), 50,000 metric tons and 70,000 metric tons of capacity respectively at each location. The Gujiao facility was acquired in January of 2009 and commenced operations in January of 2010. The Company is 1 of 3 licensed intermediaries in Taiyuan and the sole licensed intermediary in Gujiao that operates its own large scale storage tanks. The Company has the necessary licenses to operate and sell Products not only in Shanxi but throughout the entire PRC. The Company seeks to earn profits by selling its Products at competitive prices with timely delivery to coal mining operations, power supply customers, large-scale gas stations and small, independent gas stations. The Company also earns revenue under an agency fee by acting as a purchasing agent for other intermediaries in Shanxi, and through limited sales of diesel and gasoline at two retail gas stations, each located at the Company’s facilities. The sales price and the cost basis of the Company’s products are largely dependent on regulations and price control measures instituted and controlled by the PRC government as well as the price of crude oil. The price of crude oil is subject to fluctuation due to a variety of factors, all of which are beyond the Company’s control.

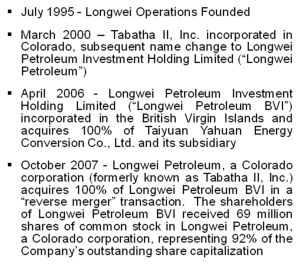

The Company was incorporated under the laws of the State of Colorado on March 17, 2000 as Tabatha II, Inc. On October 12, 2007, the Company changed its name to Longwei Petroleum Investment Holding Limited.

For the year ended June 30, 2010, we reported revenues of approximately $343.2 million, an increase of 74% from revenues of approximately $196.8 million reported for the year ended June 30, 2009. We continue to expand our customer base and distribution platform.

A summary of our operating results and select balance sheet data for the years ended June 30, 2010 through 2006 are as follows:

|

Select Historical Financial Data for the Years Ended June 30, 2010 - 2006

|

|||||

|

(Amounts in $USD Millions)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|

Revenues

|

$343.2

|

$196.8

|

$143.8

|

$93.8

|

$93.1

|

|

Annual Revenue Growth

|

74%

|

37%

|

53%

|

1%

|

128%

|

|

Net Income

|

$50.2

|

$21.8

|

$20.7

|

$12.0

|

$14.7

|

|

Annual Net Income Growth

|

130%

|

5%

|

73%

|

(18%)

|

78%

|

|

Total Assets

|

$187.6

|

$120.1

|

$93.4

|

$60.7

|

$53.3

|

|

Total Liabilities

|

$ 9.7

|

$ 5.2

|

$ 4.9

|

$ 3.0

|

$10.1

|

|

Total Shareholder’s Equity

|

$177.9

|

$114.9

|

$88.5

|

$57.7

|

$43.2

|

Customers

The Company sells its Products directly to commercial, industrial, retail and wholesale customers throughout Shanxi from its two fuel depot storage facilities. We enter into supply contracts with our wholesale customers and require the customers to purchase a minimum amount of specified oil products at market price during each period of the contract. Payments are due upon receipt of the products. Customers may take delivery of their purchases at our depots or pay us to deliver to their location.

Our primary customers are industrial users including coal mining operations and power generation plants, which use diesel, gasoline, fuel oil and solvents. Both sectors are expected to experience significant growth in late 2010 and 2011, which the Company anticipates will further drive demand for its Products. Power demand and power generating capacity in the PRC are on a growth rate to double by 2020 according to Liu Zhenya, president of the State Grid Corp of China from the China Knowledge article, “China’s Electricity Demand to Double by 2020,” dated May 22, 2009. In the Reuters article, “China’s Shanxi Province to Grow Coal Output 30% in 2010,” Reuters, March 8, 2010, the Shanxi Party Secretary, Zhang Baoshum stated he expects coal output in Shanxi Province, historically the country’s leading coal producing region, to rise by up to 30% this year. Industrial customers accounted for approximately 55% and 45% of our revenues for the years ended June 30, 2010 and 2009, respectively.

3

Large-scale gas stations accounted for approximately 35% and 45% of our revenues for the years ended June 30, 2010 and 2009, respectively. These customers primarily buy diesel and gasoline. While sales volume to these customers was up in 2010 with the growing demand of new automobiles on the roads in the PRC, as a percentage of total revenues sales were down because of the larger increase in sales to the Company’s industrial customers. The new Gujiao facility is strategically located to serve a number of our larger industrial customers.

Our third largest group of customers consists of small, independent gas stations. These gas stations accounted for approximately 10% of our revenues for both the year ended June 30, 2010 and 2009, respectively. These gas stations buy gasoline and diesel. These customers depend on our timely delivery and customer service compared to the larger state-owned enterprises.

|

Percentage of Revenue by Customer Class

|

||

|

Customers

|

2010

|

2009

|

|

Industrial Users – Coal Operations & Power Generation

|

55%

|

45%

|

|

Large-Scale Gas Stations

|

35%

|

45%

|

|

Small, Independent Gas Stations

|

10%

|

10%

|

No customers accounted for more than 10% of our total revenues or accounts receivable for the year ended June 30, 2010.

Products

We purchase diesel, gasoline, fuel oil and solvents from various petroleum refineries in the PRC. We have historically sold large quantities of diesel and gasoline products and have a large and expanding supply chain in place. We do not generally modify the Products prior to sale. However, in some scenarios the Company will further blend or modify its Products upon the request of its customers.

Our percentage of total revenue and average profit margins by product category for years ended June 30, 2010 and 2009 are provided below:

|

Product Percentage of Total Revenue and Average Profit Margin by Product Line

|

||||

|

2010

|

2009

|

|||

|

Product

|

% Revenue

|

Avg. Profit Margin

|

% Revenue

|

Avg. Profit Margin

|

|

Diesel

|

44%

|

15%

|

47%

|

12%

|

|

Gasoline

|

47%

|

16%

|

41%

|

17%

|

|

Fuel Oil

|

2%

|

23%

|

3%

|

12%

|

|

Solvents

|

2%

|

21%

|

3%

|

19%

|

|

Agency Fees *

|

5%

|

100%

|

6%

|

79%

|

*The agency fee is a commission paid by intermediaries to purchase petroleum products directly from refineries using the Company’s licenses. Prior to the year ended June 30, 2010 the Company also incurred the cost of transporting the petroleum product under this arrangement, but has stopped this practice.

Facilities & Storage

The Company’s oil and gas operations consist of transporting, storage and selling finished petroleum products from its two fuel storage depots. The Company’s headquarters is located in Taiyuan, Shanxi. The Company has a total storage capacity for its Products of 120,000 metric tons located at its fuel depot storage facilities in Taiyuan and in Gujiao, Shanxi; 50,000 metric tons and 70,000 metric tons capacity respectively at each location. The Company has operated from its Taiyuan location since 1995 and the Gujiao facility was acquired in January 2009. The Company began to operate and generate revenues from its Gujiao location in October, 2009, commencing full operations in January, 2010. The Company is 1 of 3 licensed intermediaries in Taiyuan and the sole licensed intermediary in Gujiao that operates its own large scale storage tanks. The Company is 1 of 17 licensed intermediaries in Shanxi. The Company’s storage tanks have the largest storage capacity of any private enterprise in Shanxi. Both facilities are strategically located in close proximity to the Company’s largest customers to ensure timely delivery of Products.

The Company has its own enterprise resource planning (ERP) computer system that manages and monitors the inflow and outflow of the Products at its locations. The system ties into the Company’s inventory accounting system to monitor and manage inventory levels and automatically updates on a real-time basis.

Taiyuan, Shanxi

The Company’s headquarters are located at its operations in Taiyuan. This facility has a total of 14 storage tanks with a capacity to store approximately 50,000 metric tons of Products. We maintain delivery and distribution platforms, including a dedicated rail spur and a vehicle loading and unloading fuel depot station at this facility. The Company owns and maintains all assets at this facility. All of our revenues earned during the year ended June 30, 2009 were earned through this facility. The revenue contribution from this facility for the year ended June 30, 2010 was approximately $269 million.

4

Gujiao, Shanxi

In July, 2007 the Company made an initial deposit of approximately $9.2 million on a $30.0 million purchase contract with Shanxi Heitan Zhingyou Petrochemical Co., Ltd. for a second facility in Gujiao. The Company acquired control of the facility on January 22, 2009 and on June 30, 2009, the Company made the final payment on the purchase contract for approximately $7.1 million. The Company retrofitted the existing storage tanks and built a new office and customer service center at the location. The Gujiao Facility has a total of 8 storage tanks with a capacity to store approximately 70,000 metric tons of our Products. We also have 4 tar storage tanks with a capacity of 40,000 metric tons. We will maintain delivery and distribution platforms, including a dedicated rail spur and a vehicle loading and unloading station at this facility. The Company owns and maintains all assets at this facility. The revenue contribution from this facility for the year ended June 30, 2010 was approximately $74 million.

Shanxi Market

| The Company’s operations are all primarily concentrated in the central Shanxi Province. Shanxi is the leading coal producing region in the PRC. The region is mountainous and has no pipelines or refineries within the province. The province is dependent on the timely delivery of petroleum products to support its growing industrial and consumer base. Taiyuan is the capital of Shanxi Province.

Coal production in the PRC is estimated by the United States Department of Energy (“US DOE”) to double its capacity by 2030. The Shanxi provincial government has embarked on a program to consolidate its coal mining and support operations. The Company believes this is advantageous to the growth of its business model.

Competitive Advantage

Although barriers to entry in our industry are high due to stringent licensing requirements and the need for significant storage capacity, we face competition from both state-owned and non-state-owned companies based in Shanxi Province and elsewhere that engage in the wholesale distribution of finished petroleum products. In addition to state-owned petroleum enterprises such as China Petroleum & Chemical Corporation, also known as “SINOPEC” and PetroChina Company Limited, there are currently 15 non-state-owned enterprises (including the Company) in Shanxi Province licensed to distribute finished oil products. Many of these non-state owned enterprises may have exclusive supply and purchase arrangements with suppliers as a result of long-term relationships.

|

|

We believe we have the following advantages over our competitors:

|

●

|

Mature operational infrastructure. During the past 16 years, we have built up our operational infrastructure, including extensive distribution channels, two petroleum storage depots and convenient access to strategic railway lines. We also have the required licenses to conduct our wholesale distribution business, which are becoming increasingly difficult for new entrants to our industry to obtain due to the provincial government’s emphasis on consolidation and larger storage capacity by participants.

|

|

●

|

Established customer relationships. We have been in the wholesale finished oil business for over 16 years operating in the same region on a direct sales relationship with our customers. We focus on customer satisfaction and believe that we have consistently provided high quality products and services to our customers. The key competitive advantages we offer to our customers is proximity for timely delivery and flexible customer service to meet their product volume demands. We cannot offer significant discounts to our customers as the price of our products is primarily predetermined by market price and subject to regulatory price caps. However, customers who purchase large quantities of Products may be given priority of supply in case of shortages.

|

|

●

|

Stable supply sources. We have good, long-term relationships with our refinery suppliers, some of which are private enterprises and some are large state-owned enterprises. We also maintain significant advances on account with suppliers to ensure our own timely delivery and preferential pricing based on market movements.

|

|

●

|

Railway access. We benefit from our dedicated rail spurs that connect our storage depots to the main railway line to create efficient inflow and outflow of products. Our rail spur loading facilities can process up to 8 tanker railcars at one time. Our ERP system automatically measures all flow through our system and maintains our inventory accounting system.

|

|

●

|

Storage capacity. We have a total fuel depot storage capacity of 120,000 metric tons (approximately 880,000 barrels of oil). Aside from large upfront capital requirements, new entrants to this industry must also have significant storage capacity to be able to compete, which is a barrier to entry for new competitors. |

5

The Company’s Products vary by product density; therefore the capacity will vary depending on the inventory product mix. Below is a calculation based on the maximum capacity of each product individually as though it was the only product stored in inventory.

(1) Total Diesel Capacity – 37 million gallons (diesel density = 0.85kg/L)

(a) 1,000kg x 1L/0.85kg = 1,176 L

(b) 1 US gallon = 3.7854 L

(c) 1,176 L / 3.7854 = 310 gallons

(d) 120,000mt x 310 gallons = 37 million gallons diesel

(2) Total Gasoline Capacity – 43 million gallons (gasoline density = 0.74kg/L)

(a) 1,000kg x 1L/0.74kg = 1,351 L

(b) 1 US gallon = 3.7854 L

(c) 1,351 L / 3.7854 = 357 gallons

(d) 120,000mt x 357 gallons = 43 million gallons gasoline

(3) Fuel Oil Capacity – 35 million gallons (fuel oil density = 0.90kg/L)

(a) 1,000kg x 1L/0.90kg = 1,111 L

(b) 1 US gallon = 3.7854 L

(c) 1,111 L / 3.7854 = 294 gallons

(d) 120,000mt x 294 gallons = 35 million gallons fuel oil

(4) Solvent Capacity – mixture varies between gasoline and diesel, but assumes similar density to diesel

Below are the Product levels of inventory at year ended June 30, 2010 listed in metric tons and US gallon equivalents:

|

Inventory Level as of June 30, 2010

|

|||||

|

Product Inventory

|

Metric Tons (mt)

|

US Gallons (Millions)

|

($USD Millions)

|

||

|

Diesel

|

26,430

|

8.2M gallons

|

$19.8

|

||

|

Gasoline

|

16,246

|

5.8M gallons

|

$12.5

|

||

|

Fuel Oil

|

1,540

|

0.5M gallons

|

$ 0.8

|

||

|

Solvents

|

1,110

|

0.3M gallons

|

$ 0.6

|

||

|

TOTAL INVENTORY

|

45,326

|

14.8M gallons

|

$33.7

|

||

Based on the year end June 30, 2010 inventory product mix the Company held 45,326 mt of Product on-hand or 38% of its total capacity of 120,000 mt valued at $33,744,911.

The Company’s storage capacity allows management to adjust inventory levels based on the anticipated movement of industry pricing and acts as a hedge on pricing levels. Utilizing our excess storage capacity allows us flexibility to take advantage of pricing, supply and demand fluctuations within the marketplace. All petroleum products are imported to Shanxi from other provinces within the PRC. The Company’s supplier advance balance with refineries allows us to lock-in supply so that we can react quickly to purchases based on the timing of the PRC pricing levels adjustments.

The Company’s inventory turnover for the year ended June 30, 2010 is approximately 30 days. The Company is continually working to improve its inventory turnover, which expands sales capacity based on increased inventory movement.

Operating Licenses

We hold two distinct licenses for the wholesale distribution of petroleum products in the PRC. The Certificate for Wholesale Distribution of Finished Oil (the “Wholesale License”) is a license granted by the PRC central government. The Wholesale License allows us to sell our products to wholesale customers and other users of gasoline, diesel and solvents, and must be renewed every 5 years. We hold this license at the discretion of the PRC government. We also hold a Dangerous Chemical Distribution License (the “DCD License”) that allows us and our personnel to handle and transport gasoline and diesel oil. The DCD License must be renewed every 3 years. The Constitution of the PRC states that all mineral and oil resources belong to the State. Therefore, without these licenses, we would not be able to sell our products.

In addition to business licenses issued by the Municipal Administration for Industry and Commerce, our two retail gas stations hold a renewable Operating License for Hazardous Chemicals (the “Hazardous Chemical License”) and a renewable Operating License for Retail Sale of Finished Oil (the “Retail License”) that allows us to sell gasoline, diesel and solvents. Both licenses are subject to annual inspections - the Hazardous Chemical License by the provincial Administration of Work Safety and the Retail License by the provincial Department of Commerce - and failure to pass the annual inspection may lead to their revocations.

6

Suppliers

The Company purchases diesel, gasoline, fuel oil, solvents, kerosene and other additives directly from refineries in the PRC. The Company has long-term, established relationships with these suppliers. The Company’s advances to suppliers account represent cash paid in advance for purchases of inventory from suppliers. The Company locks in availability and pricing with suppliers in advance by using the Company’s cash resources. The Company expects to maintain this level of supplier advances in the future to ensure that the Company has access to adequate supplies and timely shipments to act as a hedge based on the movement of industry pricing. The deposits are held by the Company’s refinery partners to ensure that the delivery of inventory to the Company is made in a timely manner. The Company attempts to maintain a significant balance on account with refinery partners with the expectation of receiving preferential pricing and delivery from the refinery partners. The Company does not foresee any potential loss with regard to these advances as a result of the suppliers being large enterprises that have significant controls placed upon them by PRC regulation. The Company has not had to make any historical adjustments to these accounts for any deficiencies or negative impact related to the Company’s suppliers.

Below is a list of suppliers that represented more than 10% of our purchases in years ended June 30, 2010 and 2009:

|

Suppliers

|

2010

% of Purchases

|

|

Guangzhou Tenghao Company

|

17%

|

|

Lanxin Petroleum Co., Ltd.

|

16%

|

|

Panjin Jinjiang Oil Company

|

14%

|

|

Yan Lian Industrial Group

|

13%

|

|

Tianjin Dagang Jinyu Industrial Co., Ltd.

|

12%

|

|

TOTAL

|

72%

|

|

Suppliers

|

2009

% of Purchases

|

|

Yan Lian Industrial Group

|

19%

|

|

Alashankou Dachen Co, Ltd.

|

14%

|

|

Tuha Oil Exploring and Exploiting Headquarters

|

13%

|

|

Panjin Jinjiang Oil Company

|

11%

|

|

Tianjin Dagang Jinyu Industrial Co., Ltd.

|

11%

|

|

Xinyuan Company

|

11%

|

|

Lanxin Petroleum Co., Ltd.

|

10%

|

|

TOTAL

|

89%

|

While we are dependent on these suppliers for our finished petroleum products, we are always seeking to expand our supply sources and believe that we can find alternative suppliers with comparable terms within a reasonable amount of time without any significant disruption in our operations. Since inception, we have not experienced any difficulty in obtaining refined products in a timely manner.

Supplier Risks

The Company depends on suppliers, namely refineries, for inventory. The cost of inventory may fluctuate substantially and it is possible that our demand for inventory could not be met due to short supply, may be available from only one or a limited number of suppliers, or may only be available from foreign suppliers. Increased costs or difficulties in obtaining inventory in the requisite quantities, or at all, could have a material adverse effect on our results of operations. The credit crisis and rapidly escalating raw material costs across a variety of industries created additional risks for our supplier base. In the year ending June 30, 2010, the Company’s suppliers could face financial difficulties as a result of the global economic downturn. We actively monitor our suppliers' financial condition, and to date we have no knowledge of significant concerns with the financial stability of any of our major suppliers.

We are dependent upon the ability of refinery suppliers to meet product specifications, standards and delivery schedules at anticipated costs. While we maintain a qualification and performance surveillance system to control risk associated with this reliance on third parties, the failure of suppliers to meet commitments could adversely affect delivery schedules and profitability, while jeopardizing our ability to fulfill commitments to customers.

Research and Development

The Company expenses the cost of research and development as incurred. Research and development costs for the years ended June 30, 2010 and 2009 were not significant.

7

Intellectual Property

The company currently does not own any intellectual properties. We do however hold two primary licenses: (1) Finish Oil Wholesale Licenses, and (2) Dangerous Chemical Products Businesses Licenses. These two licenses were initially obtained when we began operations in 1995. These licenses do not appear on our balance sheets within the consolidated financial statements. However, the FO Licenses have a renewable 5 year term and the DGP Licenses have a renewable 3 year term. We consider these licenses to be extremely valuable and believe our operations would be severely impacted if these licenses were not adequately maintained.

Industry

The economic growth in the PRC is becoming increasingly dependent on meeting its rapidly growing demand for oil from both domestic supply and foreign imports. The PRC’s net crude imports in June 2010 totaled a record 22.1 million tons and imports are expected to make up roughly 55% of its total oil consumption by 2011 because domestic refineries cannot keep up with the demand (Bloomberg). The increasing demand for oil is not only attributable to increased vehicle usage in the world’s largest new automobile market, but also to industrial activity in the PRC’s fastest growing provinces, including Shanxi where we primarily operate. Coal mining operations and power generation represent two of the Company’s largest types of industrial customers, and both sectors are expected to experience significant growth in late 2010 and 2011 after recent industry consolidation.

The strong, sustained economic growth in the PRC recently surpassed Japan as the world’s second largest economy in terms of GDP. A recent report by the International Energy Agency named the PRC as the top global energy consumer, and according to www.platts.com, the PRC is the second largest oil consumer in the world.

Our operations are in Shanxi, which is a center of industrial operations and energy supply within the PRC. We believe our Taiyuan facility is well positioned to continue revenue growth. The Gujiao facility is located within a dense industrial geography and is expected to continue to generate strong revenue growth during its first year of operations and going forward. The two facilities have a combined storage capacity of 120,000 metric tons.

We believe there are two key market trends according to the Institute for the Analysis of Global Security that allow for substantial growth in the PRC over the next three to five years:

|

1.

|

Energy demand. Oil consumption in the PRC is growing at an annual rate of 7.5%. The PRC is now the top global energy consumer and growing. Over 20% of the PRC’s energy demand is satisfied by oil. We are located in a province without pipelines or refineries that requires significant transportation logistics and storage, which can be facilitated by the Company.

|

|

2.

|

Automobile ownership. Automobiles in the PRC are expected to grow at an annual rate of 19%, and the PRC is now the largest new automobile market in the world. From 1990 – 2010, 90 times more automobiles are on the road in the PRC, and by 2030 the PRC is expected to have as many automobiles on the road as the US. The Company has good supplier relationships with many of the major gasoline retailers in Shanxi.

|

Business Strategy

Internal Growth

The Company seeks organic growth by growing with our existing customer base and expanding our sales using our direct sales force and customer referrals. We continue to seek expansion of our customer base within Shanxi Province, and are focused on the development of our customer base at the Gujiao Facility. We also seek to continue to improve our inventory turnover.

Geographic Growth

The Company will continue to seek out additional facilities with the intention of acquiring facilities in the future that are accretive to earnings with a short payback period on investment. We have proven to be successful with our operations at the new Gujiao Facility. Future potential acquisitions will be contemplated by our management with the knowledge and understanding we have gained from operations and business development work completed at both the Taiyuan and Gujiao facilities. In general, we intend to review potential acquisitions of facilities that we believe will generate profits over the initial 3 year term for us that equals or exceeds the total purchase price of a new facility.

Vertical Expansion

The Company will continue to seek out opportunities to work more closely with its refinery partners to ensure timely and reliable delivery of supply. The Company may seek opportunities to improve its margins within the oil and gas business that are “upstream” – exploration and production or “downstream” – refining.

8

Government Regulations

Finished Oil Distribution

Prior to 2006, significant gaps existed in the laws and regulations pertaining to the finished oil industry, and the relevant rules for this industry were, to some extent, inconsistent and subject to the discretion of the relevant government authorities.

In 2006, greater specificity was added to the rules for commercial activities in the finished oil industry with the enactment of the Measures on the Administration of the Finished Oil Market (promulgated on December 4, 2006 by the PRC Ministry of Commerce (“MOFCOM”) and effective as of January 1, 2007, (the “Measures”). This regulation provides comprehensive details on the finished oil wholesale and resale application procedures, qualification requirements, and rules for annual inspections. Enterprises (foreign or domestic-funded) meeting certain requirements can submit applications to the MOFCOM for a certificate of approval to conduct gasoline and diesel (including bio-diesel) wholesale, retail and storage businesses.

The first step required in applying to engage in the wholesale of finished oil is a preliminary examination by the provincial MOFCOM where the enterprise is located. Thereafter, the provincial MOFCOM will forward the application materials together with its opinions on the preliminary examination to the MOFCOM, which will then decide on whether to grant the Certificate of Approval for the Wholesale of Finished Oil.

An enterprise applying to engage in the finished oil wholesale business must, among other requirements, possess the following:

|

(i)

|

long-term and stable supply of finished oil;

|

|

(ii)

|

a legal entity with a registered capital of no less than RMB 30 million;

|

|

(iii)

|

a finished oil depot, which shall have a capacity not smaller than 10,000 m 3 (cubic meters), conforming to the local urban and rural planning requirements, and be approved by other relevant administrative departments (1 cubic meter is the equivalent of 1 metric ton of water at 4° Celsius); and

|

|

(iv)

|

Facilities for unloading finished oil such as conduit pipes, special railway lines, and transportation vehicles with a capacity of 10,000 metric tons or more to transport refined oil via rail, on the highway or over water to ports.

|

In practice, it has become increasingly difficult for enterprises (particularly foreign-funded enterprises) to meet the third requirement above. As both the number of available oil depots and state land and resources are reaching full capacity, it is becoming increasingly difficult to procure a finished oil depot with a capacity not smaller than 10,000 m 3.

The application procedure for the retail of finished oil is similar to that for wholesale except that the preliminary examination takes place at the administrative department for commerce at the municipal level, and the certificate of approval is issued at the provincial level.

An enterprise applying to engage in the finished oil retail business must, among other requirements, possess the following:

|

(i)

|

long-term and stable channels to finished oil supply and a supply agreement with an enterprise that has been qualified to engage in the wholesale business of finished oil for a period of three years or more in line with its business scale;

|

|

(ii)

|

qualified professional and technical personnel to handle inspections, metrology, storage and fire safety and the safe production of finished oil; and

|

|

(iii)

|

gas stations designed and built to comply with the relevant national standards and approved by the relevant administrative department.

|

|

Enterprises possessing certificates of approval are subject to annual inspection by the relevant provincial MOFCOM which will review:

|

|

(i)

|

the execution and performance of finished oil supply agreements;

|

|

(ii)

|

the operation results of the enterprise for the previous year;

|

|

(iii)

|

whether the enterprise and its supporting facilities are in compliance with the technical requirements under the Measures; and

|

|

(iv)

|

The current measures, among other measures, being taken by the enterprise regarding quality control, metrology, fire safety, security and environmental protection.

|

9

If we pass the annual inspection, the certificates of approval we hold will continue to be valid. An enterprise failing an annual inspection will be ordered to rectify all deficiencies within a certain time limit by the MOFCOM and/or its provincial branches. If such deficiencies have not been rectified within the specified time limit, its certificates of approval shall be revoked by the original issuing authority.

We currently are in full compliance with the Measures, and hold valid operating licenses to conduct our businesses. However, we cannot provide assurance that we will not fail to satisfy the above mentioned requirements in the future.

Pricing for Finished Oil

The PRC National Development and Reform Commission (“NDRC”) regulates domestic oil prices as part of its macro-management over the economy in order to control dramatic fluctuations in oil prices.

The Administrative Measures on Oil Prices ( trial implementation ), or the Price Measures, promulgated by the NDRC on May 7, 2009 stipulates that the NDRC will adjust domestic finished oil prices when the international market price for crude oil changes more than 4% over 22 consecutive working days. By contrast, crude oil prices are determined solely by enterprises engaging in this industry.

The NDRC adjusts domestic finished oil prices by modifying the retail price cap for gasoline and diesel in all provinces, autonomous regions, and directly administered municipalities. Thereafter, the administrative authorities at the provincial level adjust the wholesale price caps from the corresponding retail price caps. Where there are no specific contractual arrangements for a supplier’s delivery to a retailer, the wholesale price caps may be further deducted to take into account the retailer’s transportation cost among other expenses.

The Price Measures stipulate that the domestic finished oil prices shall be calculated according to the normal profit rate for refiners when the crude oil price on the international market is lower than $80 per barrel. When the international crude oil market price exceeds $130 per barrel, the NDRC will adopt certain fiscal and tax policies to ensure the continuing production and supply of refined oil products. Further, gasoline and diesel prices will only be increased slightly (if at all) in consideration of manufacturers and consumers, as well as the stability of the national economy.

The exact formula for calculating finished oil prices domestically has not been published. However, the NDRC has stated that such formula is based on the weighted average of the international market prices, together with the average domestic processing costs, taxes, fees incurred in distribution channels, and suitable profits for refiners. Moreover, the NDRC adjusts the cost index seasonally in accordance with the actual situation with respect to prices.

Environmental Protection

The relevant PRC governmental authorities set national and local environmental protection standards, as well as examine and issue approvals on environmental aspects of different stages of various projects. We are required to file an environmental impact statement, or in some cases, an environmental impact assessment outline, to obtain such approvals. The filing must demonstrate that the project in question conforms to applicable environmental standards. Generally speaking, environmental protection bureaus will issue approvals and permits for projects using modern pollution control measurement technology.

The PRC national and local environmental laws and regulations impose fees for the discharge of waste substances above prescribed levels, require the payment of fines for serious violations and provide that the PRC national and local governments may, at their own discretion, close or suspend any facility which fails to comply with orders requiring it to cease or improve operations causing environmental damage.

In accordance with the requirements of the environmental protection laws of the PRC, we have installed the necessary environmental protection equipment, adopted advanced environmental protection technologies, established responsibility systems for environmental protection, and reported to and registered with the relevant local environmental protection department.

Dangerous Chemicals

PRC laws and regulations on dangerous chemicals require that a Dangerous Chemical Distribution License, or the DCD License, be obtained for all companies that handle and transport dangerous chemicals.

Foreign-invested Enterprises Engaging in Oil-related Businesses

Under the Catalogue of Industries for Guiding Foreign Investment, jointly promulgated by the MOFCOM and the NDRC on October 31, 2007 and effective as of December 1, 2007, each of the following falls within the restricted category for foreign investment: wholesale of oil products, the construction and operation of gas stations, and the production of liquid bio-fuels (i.e., fuel ethanol, biodiesel). Foreign investors can only engage in commercial activities involving liquid bio-fuels or retail distribution of finished oil (where the foreign investor possesses 30 or more gas stations or where it sells different brands of oil through different distributors) through a joint venture with a Chinese partner, and the Chinese partner must hold a controlling interest in the joint venture. As a result of these restrictions, all of our business operations are conducted by a domestic entity, Taiyuan Longwei Economy & Trading Co., Ltd.

10

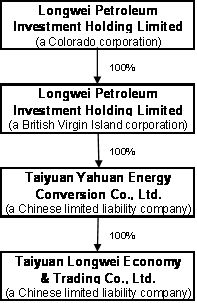

Corporate Structure

The Company began operations in July 1995 in the PRC. We were incorporated under the laws of the State of Colorado on March 17, 2000 as Tabatha II, Inc. On October 12, 2007, we changed our name to Longwei Petroleum Investment Holding Limited. On October 16, 2007, we entered into a Share Exchange Agreement and agreed to issue 69,000,000 shares of our common stock in exchange for 100% of the outstanding ownership units of Longwei Petroleum Investment Holding Limited (Longwei BVI), a British Virgin Islands entity. This transaction was accounted for as a reverse acquisition. Longwei Petroleum Investment Holding Limited, formerly known as Tabatha II, Inc., did not have any operations and majority-voting control was transferred to Longwei BVI. The transaction required a recapitalization of Longwei BVI. Since Longwei BVI acquired a controlling voting interest, it was deemed the accounting acquirer, while Longwei Petroleum Investment Holding Limited (formerly Tabatha II, Inc.) was deemed the legal acquirer.

|

|

Inflation

Inflationary factors such as increases in the cost of our Product and overhead costs may adversely affect our operating results. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net revenues if the selling prices of our products do not increase with these increased costs.

Foreign Currency Translation Adjustment

Our operating subsidiaries purchase all products and render services in the PRC, and receive payment from customers in the PRC using RMB as the functional currency. All of our customers and suppliers are located in the PRC. While our reporting currency is the US Dollar, all of our consolidated revenues and the majority of consolidated operating costs and expenses are denominated in RMB. Substantially all of our assets and liabilities are denominated in RMB. As a result, we are exposed to foreign exchange risk as our revenues and results of operations may be affected by fluctuations in the exchange rate between US Dollars and RMB. We have not entered into any hedging transactions in an effort to reduce our exposure to foreign exchange risk.

We incurred a foreign currency translation adjustment of $2,300,232 for the year ended June 30, 2010, as compared with the foreign currency translation adjustment of $1,371,603 for the year ended June 30, 2009. On July 21, 2005, China reformed its foreign currency exchange policy, revalued the RMB by 2.1 percent and allowed the RMB to appreciate as much as 0.3 percent per day against the U.S. dollar. We implemented exchange rates in translating RMB into US dollars in our financial statements for years ended June 30, 2010 and 2009, respectively. Assets and liabilities are translated at exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates for the periods presented and shareholders’ equity is translated at historical exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign currency translation adjustment to other comprehensive income, a component of stockholders’ equity. If the RMB appreciates against the U.S. dollar, revenue and expenses would be higher than they would have been if there were no fluctuations in the currencies. Conversely, if the RMB depreciates against the US dollar, revenue and expenses would be lower than they would have been if there were no fluctuations in the currencies.

11

Companies which operate petroleum and petrochemical businesses in China are subject to a variety of taxes, fees and royalties. Starting from January 1, 2008, the general enterprise income tax rate imposed on entities, other than certain enterprises defined in the new Enterprise Income Tax Law of the PRC, shall be 25%.

Our business is relatively stable and predictable and is not subject to changes in seasonality.

Employees

We currently have 75 employees, including our managers and officers. We expect that additional sales and material handling personnel will be required as the business expands. Our employees are interviewed and hired by our human resource department. We enter into employment agreements with terms of one to three years with employees at managerial and technical positions and short-term employment agreements with part-time or temporary employees such as transportation employees. We believe that our relationship with our employees is good. Management expects that our access to reasonably priced and competent labor will continue into the foreseeable future. Our employees are not represented by any union.

Environmental Matters

We believe that we are in compliance with present environmental protection requirements in all material respects. Our distribution processes generate noise, waste water, gaseous wastes, petrochemical wastes, and other industrial wastes. We have installed various types of anti-pollution equipment in our facilities to reduce, treat, and where feasible, recycle the wastes generated in our business. Our operations are subject to regulation and periodic monitoring by local environmental protection authorities.

Legal Proceedings

Other than routine litigation arising in the ordinary course of business that we do not expect, individually or in the aggregate, to have a material adverse effect on us, there is no currently pending legal proceeding and, as far as we are aware, no governmental authority is contemplating any proceeding to which we are a party or to which any of our properties is subject.

Corporate Information

Our principal executive office is No. 30 Guanghau Avenue, Wan Bailin District, Taiyuan City, Shanxi Province, China, PC 030024. Our main telephone number is (1) 727-641-1357 and our facsimile number is (1) 727-231-0944.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to the Company’s securities. The statements contained in or incorporated into this annual report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward looking statements. If any of the following risks actually occurs, the Company’s business, financial condition or results of operations could be harmed. In that case, the trading price of the Company’s common stock could decline, and you may lose all or part of your investment.

Risks Related to Business Operations

We may be unable to manage our growth.

We are planning for rapid growth and intend to aggressively expand operations. The growth in the size and geographic range of our business will place significant demands on management and our operating systems. Our ability to manage growth effectively will depend on our ability to attract additional management personnel; to develop and improve operating systems; to hire, train, and manage an employee base; and to maintain adequate service capacity. Additionally, the proposed expansion of operations may require hiring additional management personnel to oversee procurement duties. We will also be required to rapidly expand operating systems and processes in order to support the projected increase in product demand. There can be no assurance that we will be able to effectively manage growth and build the infrastructure necessary to achieve growth as management has forecasted.

12

The strategy of acquiring complementary businesses and assets may fail which could reduce our ability to compete for customers.

As part of our business strategy, we have pursued, and intend to continue to pursue, selective strategic acquisitions of businesses, assets and technologies that complement our existing business. We intend to make other acquisitions in the future if suitable opportunities arise. Acquisitions involve uncertainties and risks, including:

|

•

|

potential ongoing financial obligations and unforeseen or hidden liabilities;

|

|

|

•

|

failure to achieve the intended objectives, benefits or revenue-enhancing opportunities;

|

|

|

•

|

costs and difficulties of integrating acquired businesses and managing a larger business; and

|

|

|

•

|

diversion of resources and management attention.

|

The failure to address these risks successfully may have a material adverse effect on our financial condition and results of operations. Any such acquisition may require a significant amount of capital investment, which would decrease the amount of cash available for working capital or capital expenditures. In addition, if we use our equity securities to pay for acquisitions, we may dilute the value of your shares. If we borrow funds to finance acquisitions, such debt instruments may contain restrictive covenants that could, among other things, restrict us from distributing dividends. Such acquisitions may also generate significant amortization expense related to intangible assets.

We depend on our key executives, and our business and growth may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our key executives. In particular, we are highly dependent upon Mr. Cai Yongjun, our chairman and chief executive officer, who has established relationships within the industries we operate. If we lose the services of one or more of our current management, we may not be able to replace them readily, if at all, with suitable or qualified candidates, and may incur additional expenses to recruit and retain new officers with industry experience similar to our current officers, which could severely disrupt our business and growth. In addition, if any of our executives joins a competitor or forms a competing company, we may lose some of our suppliers or customers. Furthermore, as we expect to continue to expand our operations and develop new products, we will need to continue attracting and retaining experienced management and key research and development personnel.

Competition for qualified candidates could cause us to offer higher compensation and other benefits in order to attract and retain them, which could have a material adverse effect on our financial condition and results of operations. We may also be unable to attract or retain the personnel necessary to achieve our business objectives, and any failure in this regard could severely disrupt our business and growth.

The current economic and credit environment could have an adverse effect on demand for certain of our products and services, which would in turn have a negative impact on our results of operations, our cash flows, our financial condition, our ability to borrow and our stock price.

Since late 2008, global market and economic conditions have been disrupted and volatile. Concerns over increased energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining residential real estate market in the U.S. have contributed to this increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil prices, declining business and consumer confidence and increased unemployment, have precipitated a global recession.

It is difficult to predict how long the current economic conditions will persist, whether they will deteriorate further, and which of our products, if not all of them, will be adversely affected. As a result, these conditions could adversely affect our financial condition and results of operations.

Our business will suffer if we cannot obtain, maintain or renew necessary permits or licenses.

All PRC enterprises engaging in the sale of finished oil products are required to obtain from various PRC governmental authorities certain permits and licenses, including, without limitation, the Certificate for Wholesale Distribution of Finished Oil and the Dangerous Chemical Distribution License. We have obtained permits and licenses required for the distribution of finished oil. Failure to obtain all necessary approvals/permits may subject us to various penalties, such as fines or being required to vacate from the facilities where we currently operate our business.

These permits and licenses are subject to periodic renewal and/or reassessment by the relevant PRC government authorities and the standards of compliance required in relation thereto may from time to time be subject to change. We intend to apply for renewal and/or reassessment of such permits and licenses when required by applicable laws and regulations, however, we cannot assure you that we can obtain, maintain or renew the permits and licenses or accomplish the reassessment of such permits and licenses in a timely manner. Any changes in compliance standards, or any new laws or regulations that may prohibit or render it more restrictive for us to conduct our business or increase our compliance costs may adversely affect our operations or profitability. Any failure by us to obtain, maintain or renew the licenses permits and approvals may have a material adverse effect on the operation of our business. In addition, we may not be able to carry on business without such permits and licenses being renewed and/or reassessed.

13

Power shortages, natural disasters, terrorist acts or other events could disrupt our operations and have a material adverse effect on our business, financial position or results of operations.

Our business could be materially and adversely affected by power shortages, natural disasters, terrorist attacks or other disruptive events in the PRC. For example, in early 2008, parts of the PRC were affected by severe snow storms that significantly impacted public transportation systems and the power supply in those areas. In May 2008, Sichuan Province in the PRC suffered a strong earthquake measuring approximately 8.0 on the Richter scale that caused widespread damage and casualties. The May 2008 Sichuan earthquake had a material adverse effect on the general economic conditions in the areas affected by the earthquake and severely affected the transportation systems in those areas. Any future natural disasters, terrorist attacks or other disruptive events in the PRC could cause a reduction in usage of or other severe disruptions to, public transportation systems and could have a material adverse effect on our business, financial position or results of operations.

If we require additional financing, we may not be able to find such financing on satisfactory terms or at all.

Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, future product opportunities with collaborators and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings or debt financings. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders’ interest in bankruptcy or liquidation.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

We currently consume a large amount of refined diesel and gasoline. While we try to adjust the sales price of the products to track international crude oil price fluctuations, our ability to pass on the increased cost resulting in diesel and gasoline price increases to our customers is dependent on international and domestic market conditions as well as the PRC government’s price control over refined petroleum products. For example, the international crude oil price reached its historically high level in July 2008, but we were not able to effectively pass the increased cost to our customers. Although the current price-setting mechanism for refined petroleum products in China allows the PRC government to adjust price in the PRC market when the average international crude oil price fluctuates beyond certain levels within a certain time period, the PRC government still retains discretion as to whether or when to adjust the refined petroleum products price. The PRC government will exercise certain price controls over refined petroleum products once international crude oil price experiences sustained growth or becomes significantly volatile. As a result, our results of operations and financial condition may be materially and adversely affected by the fluctuation of crude oil and refined petroleum product prices. Our operating results may fluctuate as a result of a number of factors, many of which are outside of our control, such as the price of crude oil. For these reasons, comparing operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of future performance. Quarterly and annual revenues, costs and expenses as a percentage of our revenues may be significantly different from our historical or projected rates. Operating results in future quarters may fall below expectations. Any of these events could cause the price of our common stock to fall.

We rely heavily on outside suppliers for products derived from crude oil and other raw materials, and may even experience disruption of our ability to obtain products refined from crude oil and other raw materials.

We purchase a significant portion of our products from outside suppliers located in different provinces within the PRC. We are also aware that a large portion of our products originated in other countries. We are subject to the political, geographical and economic risks associated with these other provinces and perhaps even the countries where the products have originated. If one or more of our material supply contracts were terminated or disrupted due to any natural disasters or political events, it is possible that we would not be able to find sufficient alternative sources of supply in a timely manner or on commercially reasonable terms. As a result, our business and financial condition would be materially and adversely affected.

Our business faces operation risks and natural disasters that may cause significant property damages, personal injuries and interruption of operations, and we may not have sufficient insurance coverage for all potential financial losses incurred.

Transporting petroleum products involves a number of operating hazards. Significant operating hazards and natural disasters may cause interruption to business operations, property or environmental damages as well as personal injuries, and each of these incidents could have a material adverse effect on our financial condition and results of operations.

We do not yet maintain insurance coverage on our property, plant, equipment and inventory. However, preventative measures such as insurance may not be effective in any event and if we should acquire insurance coverage it may not be sufficient to cover all the financial losses caused by operation risks and potential natural disasters, among other risks. Losses incurred or payments required to be made by us due to operating hazards or natural disasters, which are not fully insured, may have a material adverse effect on our financial condition and results of operations.

We are dependent on third parties to transport our products, so their failure to transport the products could adversely affect our earnings, sales and geographic market.

We use third parties for the vast majority of our shipping and transportation needs. If these parties fail to deliver products in a timely fashion, including lack of available trucks or drivers, labor stoppages or if there is an increase in transportation costs, including increased fuel costs, it would have a material adverse effect on our earnings and could reduce our sales and geographic market.

14

We have limited business insurance coverage and potential liabilities could exceed our ability to pay them.

The insurance industry in the PRC is still at an early stage of development. Insurance companies in the PRC offer limited business insurance products. We do not have any business liability or disruption insurance coverage for our operations in the PRC. Any business disruption, litigation or natural disaster may result in substantial costs and the diversion of our resources.

Our common stock is classified as a “penny stock” as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00. Our common stock will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

We are subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our Common Stock, which in all likelihood would make it difficult for the Company’s stockholders to sell their securities.

Rule 3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a "penny stock," for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our common stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person's account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

|

·

|

the basis on which the broker or dealer made the suitability determination, and

|

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions.

Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our common stock. In addition, the liquidity for our common stock may decrease, with a corresponding decrease in the price of our common stock. Our common stock is subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their common stock.

The market for penny stock has experienced numerous frauds and abuses which could adversely impact subscribers of our stock.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

|

·

|

control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

|

·

|

manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

|

·

|

“boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

|

·

|

excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

|

|

·

|

wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

|

15

We believe that many of these abuses have occurred with respect to the promotion of low price stock companies that lacked experienced management, adequate financial resources, an adequate business plan and/or marketable and successful business or product.

We are controlled by the officers and directors of the Company.

Our officers, directors and principal stockholders and their affiliates own or control a majority of our outstanding common stock. As a result, these stockholders, if acting together, would be able to effectively control matters requiring approval by our stockholders, including the election of our Board of Directors.

Our certificate of incorporation limits the liability of members of the Board of Directors.

Our certificate of incorporation limits the personal liability of the director of the Company for monetary damages for breach of fiduciary duty as a director, subject to certain exceptions, to the fullest extent allowed. We are organized under Colorado law. Accordingly, except in limited circumstances, our directors will not be liable to our stockholders for breach of their fiduciary duties.

Provisions of our certificate of incorporation, bylaws and Colorado corporate law have anti-takeover effects.

Some provisions in our certificate of incorporation and bylaws could delay or prevent a change in control of us, even if that change might be beneficial to our stockholders. Our certificate of incorporation and bylaws contain provisions that might make acquiring control of us difficult, including provisions limiting rights to call special meetings of stockholders and regulating the ability of our stockholders to nominate directors for election at annual meetings of our stockholders. In addition, our board of directors has the authority, without further approval of our stockholders, to issue common stock having such rights, preferences and privileges as the board of directors may determine. Any such issuance of common stock could, under some circumstances, have the effect of delaying or preventing a change in control of us and might adversely affect the rights of holders of common stock.

In addition, we are subject to Colorado statutes regulating business combinations, takeovers and control share acquisitions, which might also hinder or delay a change in control of us. Anti-takeover provisions in our certificate of incorporation and bylaws, anti-takeover provisions that could be included in the common stock when issued and the Colorado statutes regulating business combinations, takeovers and control share acquisitions can depress the market price of our securities and can limit the stockholders’ ability to receive a premium on their shares by discouraging takeover and tender offer bids, even if such events could be viewed by our shareholders or others as beneficial transactions.

Our internal financial reporting procedures are still being developed. During the fiscal year ending June 30, 2011, the Company will need to allocate significant resources to meet applicable internal financial reporting standards.

We have adopted disclosure controls and procedures that are designed to ensure that information required to be disclosed by us in the reports that we submit under the Securities Exchange Act of 1934, as amended, are recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act are accumulated and communicated to management, including principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. We are taking steps to develop and adopt appropriate disclosure controls and procedures.

These efforts require significant time and resources. If we are unable to establish appropriate internal financial reporting controls and procedures, our reported financial information may be inaccurate and we will encounter difficulties in the audit or review of our consolidated financial statements by our independent auditors, which in turn may have material adverse effects on our ability to prepare consolidated financial statements in accordance with generally accepted accounting principles in the United States of America and to comply with SEC reporting obligations.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes Oxley Act of 2002 could prevent us from producing reliable financial reports or identifying fraud. In addition, current and potential stockholders could lose confidence in our financial reporting, which could have an adverse effect on our stock price.

We are subject to Section 404 of the Sarbanes-Oxley Act of 2002. Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud, and a lack of effective controls could preclude the Company from accomplishing these critical functions. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, in connection with, Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 5 (“AS 5”) which requires annual management assessments of the effectiveness of our internal controls over financial reporting. Although we intend to augment our internal control procedures and expand our accounting staff, there is no guarantee that this effort will be adequate.

16

During the course of testing, we may identify deficiencies which we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404 and AS5. In addition, if we fail to maintain the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain effective internal controls could cause us to face regulatory action and also cause investors to lose confidence in our reported financial information, either of which could have an adverse effect on our stock price.

Shareholders may have difficulty trading and obtaining quotations for our common stock.