Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - AuraSound, Inc. | v197675_ex32.htm |

| EX-21 - EX-21 - AuraSound, Inc. | v197675_ex21.htm |

| EX-31.2 - EX-31.2 - AuraSound, Inc. | v197675_ex31-2.htm |

| EX-31.1 - EX-31.1 - AuraSound, Inc. | v197675_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10 -

K

|

x

|

ANNUAL

REPORT PURSUANT TO 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended June

30, 2010

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

For the

transition period from ________________________ to

_______________________

Commission

file number 005-80848

|

AuraSound,

Inc.

|

|

(Name

of small business issuer in its

charter)

|

|

Nevada

|

20-5573204

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

11839

East Smith Avenue

Santa

Fe Springs, California

|

90670

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Issuer's

telephone number: (562) 447-1780

Securities

registered under Section 12(b) of the Exchange Act: None

Securities

registered under Section 12(g) of the Exchange Act:

Common Stock, $.001 Par

Value

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. ¨ Yes x

No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. ¨ Yes x

No

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days. x

Yes ¨

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

¨ Yes ¨ No (The

registrant is not yet subject to this requirement.)

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated file or a smaller reporting

company.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated filer

¨

(Do not check if a smaller reporting company)

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No x

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold, or the average bid and asked price of such common equity, as of the last

business day of the registrant’s most recently completed second fiscal quarter.

As of December 31, 2009, after the 1 for 6 reverse split which was effective

November 17, 2009, the aggregate market value of the registrant’s voting and

non-voting common equity held by non-affiliates was approximately

$4,991,499.

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock, as of the latest practicable date. As of September

14, 2010, the issuer had 16,666,667 shares of its common stock,

$0.01 par value issued and outstanding.

Documents

incorporated by reference. List hereunder the following documents if

incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II,

etc.) into which the document is incorporated: (1) Any annual report

to security holders; (2) Any proxy or information statement; and (3) Any

prospectus filed pursuant to Rule 424(g) or (c) under the Securities Act of

1933. The listed documents should be clearly described for

identification purposes. None

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements. In addition,

from time to time, we or our representatives may make forward-looking statements

orally or in writing. We base these forward-looking statements on our

expectations and projections about future events, which we derive from the

information currently available to us. Such forward-looking statements relate to

future events or our future performance. You can identify forward-looking

statements by those that are not historical in nature, particularly those that

use terminology such as “may,” “should,” “expects,” “anticipates,”

“contemplates,” “estimates,” “believes,” “intends,” “plans,” “projected,”

“predicts,” “potential” or “continue” or the negative of these or similar terms.

In evaluating these forward-looking statements, you should consider various

factors, including those described in this report under the heading “Risk

Factors” beginning on page 9. These and other factors may cause our actual

results to differ materially from any forward-looking statements.

Forward-looking statements are only predictions. The forward-looking events

discussed in this report and other statements made from time to time by us or

our representatives may not occur, and actual events and results may differ

materially and are subject to risks, uncertainties and assumptions about

us.

We cannot

give any guarantee that these plans, intentions or expectations will be

achieved. The following is a list of important risks, uncertainties and

contingencies that could cause our actual results, performance or achievements

to be materially different from the forward-looking statements included in this

report:

|

|

·

|

our ability to finance our

operations on acceptable terms, either by raising capital through sales of

our securities, including the sale of convertible or other indebtedness,

or through strategic financing

partnerships;

|

|

|

·

|

our ability to retain members of

our management team and our

employees;

|

|

|

·

|

the success of our research and

development activities, the development of viable commercial products, and

the speed with which product launches and sales contracts may be

achieved;

|

|

|

·

|

our ability to develop and expand

our sales, marketing and distribution

capabilities;

|

|

|

·

|

our ability to upgrade our

technologies and products and to adapt to evolving

markets;

|

|

|

·

|

our ability to offer pricing for

products which is acceptable to customers;

and

|

|

|

·

|

competition that exists presently

or may arise in the future.

|

The

foregoing does not represent an exhaustive list of risks. Moreover, new risks

emerge from time to time and it is not possible for our management to predict

all risks, nor can we assess the impact of all risks on our business or the

extent to which any risk, or combination of risks, may cause actual results to

differ from those contained in any forward-looking statements. All

forward-looking statements included in this report are based on information

available to us on the date of this report. Except to the extent required by

applicable laws or rules, we undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new information,

future events or otherwise. All subsequent written and oral forward-looking

statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained throughout

this report.

PART

I

|

ITEM 1.

|

BUSINESS.

|

Overview

Our

business operations are conducted through our wholly-owned subsidiary,

AuraSound, Inc., a California corporation (referred to in this report as

“AuraSound”), which we acquired on June 7, 2007. Founded in 1987,

AuraSound develops, manufactures and markets premium audio products. AuraSound

specializes in the production of high sound pressure level (“SPL”), bass-rich,

low distortion sound from compact acoustic transducers (speakers). AuraSound has

invested in the development of innovative audio technologies for use in ultra

high end home and professional audio products. AuraSound has also expanded

its product line to include the micro-audio market. Specifically, AuraSound has

developed and is currently marketing undersized speakers that will deliver sound

quality to devices such as laptops, flat-panel televisions and displays that we

believe to be superior to the sound quality currently found in these

devices. During the year ended June 30, 2010, our operations in China

were conducted through Well-Tech International Co., a Hong Kong company owned by

Susanne Lee who is our office administrator in Hong Kong. Our

operations in Taiwan are conducted by AuraSound as a foreign corporation doing

business in Taiwan. Our home offices are located in Santa Fe Springs,

California.

Historically,

AuraSound has provided its products to the high end home and professional audio

markets. Products for this market start at $100 and reach upwards of $1,000.

Until recently, the extremely low annual unit sales volumes that characterize

the high end home and professional audio markets limited our ability to

accelerate our growth. However, successful development and customer acceptance

of our micro-audio product line has provided an opportunity for

accelerated growth with major electronics manufacturers. We are

currently delivering our micro-audio products to various OEM manufacturers

through Quanta , a leading private lable manufacturer of laptop computers, and

Compal, a leading manufacturer of notebooks and TVs. Our micro

speakers can now be found in products manufactured for HP, Sony and Toshiba, and

are being evaluated by Dell, LG, Sharp, and Acer. Quanta has become a strong

advocate for our micro-speaker technology in order to

reduce weight and improve sound quality in laptop computers. Because of the

manufacturing problems experienced by the Company, Quanta deferred certain

referrals until the Company could provide specific assurance that quality

control measures had been instituted to insure acceptable quality and timely

delivery of our products. Through our association with Guoguang

Electronic Co., Ltd. ("GGEC") the Company has provided such assurance and is

currently working with various Quanta customers on various current

and future products. Our backlog of orders as of June 30, 2010

totaled approximately $1,991,000.

Our goal

is to rapidly expand our sales pipeline by expanding our customer base to

include additional OEM electronics manufacturers in existing product

categories.

SUBSEQUENT EVENTS

Asset Purchase Agreement and

Ancillary Agreements

On July

10, 2010,we entered into an Asset Purchase Agreement (the “Asset Purchase

Agreement”) with ASI Holdings Limited, a Hong Kong corporation (“ASI Holdings”),

and its wholly-owned subsidiary ASI Audio Technologies, LLC, an Arizona limited

liability company (“ASI Arizona”), pursuant to which AuraSound agreed to acquire

substantially all of the business assets and certain liabilities of ASI Holdings

and ASI Arizona (the “ASI Transaction”), in consideration of the issuance to the

shareholders of ASI Holdings of an aggregate of 5,988,005 shares (the “ASI

Transaction Shares”) of unregistered common stock of AuraSound (“Common Stock”),

and 5 year warrants to purchase an aggregate of 3,000,000 shares of Common Stock

(“Warrant Shares”) at an exercise price of $1.00 per share (collectively, the

“ASI Warrant”). Pursuant to the Asset Purchase Agreement, AuraSound

has agreed to assume approximately $10,154,745 in liabilities of ASI Holdings

and ASI Arizona, primarily consisting of trade payables. See the

Current Reports on Form 8-K which we filed on July 10, 2010 and July 31, 2010

for more details regarding the ASI Transaction.

ASI is a

global provider of audio products, in particular, sound bars for applications in

home entertainment.

Securities Purchase

Agreement

On July

10, 2010, we entered into and consummated a Securities Purchase Agreement (the

“SPA”) with GGEC America, Inc., a California corporation (“GGEC America”), and

its parent, GGEC, the primary manufacturer of our speaker drivers and

products. Pursuant to the SPA, AuraSound sold and issued to GGEC

America (i) 6,000,000 shares of unregistered Common Stock, which, following the

consummation of the SPA, constituted approximately 55% of AuraSound’s issued and

outstanding shares of Common Stock, (ii) a 3 year warrant to purchase

6,000,000 shares of Common Stock at an exercise price of $1.00 per

share, and (iii) a 3 year warrant to purchase 2,317,265 shares of Common Stock

at an exercise price of $0.75 per share; for an aggregate purchase price of US

$3,000,000 (the “GGEC Transaction”). GGEC America paid the purchase

price for the shares and warrants by cancelling $3,000,000 of indebtedness owed

by AuraSound to GGEC America and GGEC. In addition, pursuant to the

SPA, AuraSound issued 3 year warrants to a total of 5 officers, employees and

consultants of AuraSound and GGEC America to purchase a total of 380,000 shares

of Common Stock at an exercise price of $0.75 per share (the “Service

Warrants”). Arthur Liu, AuraSound’s former Chief Executive Officer

and former Chairman of the Board, received 200,000 of the Service Warrants and

Donald North, AuraSound’s Vice President – Engineering, received 100,000 of the

Service Warrants. The warrants to be issued to GGEC and the 5

officers, employees and consultants of AuraSound and GGEC America are

exercisable for cash only and will not be exercisable until AuraSound has

increased its authorized Common Stock to a number sufficient to allow their full

exercise. See the Current Report on form 8-K which we filed on July

10, 2010 for more details regarding these transactions.

3

Debt Conversion

Agreement

On July

10, 2010, AuraSound entered into and consummated an Agreement to Convert Debt

(the “Debt Conversion Agreement”) with Inseat Solutions, LLC (“Inseat”), a

California limited liability company controlled by Arthur Liu, AuraSound’s

former Chief Executive Officer and former Chief Financial

Officer. Pursuant to the Debt Conversion Agreement, AuraSound issued

326,173 shares of unregistered Common Stock and a 5 year warrant to purchase

2,243,724 shares of Common Stock at an exercise price of $0.50 per share (the

“Inseat Warrant”), in consideration of the cancellation of $1,957,040 of

indebtedness owed by AuraSound to Inseat. The Inseat Warrant is

exercisable for cash only and will not become exercisable until AuraSound has

increased its authorized Common Stock to a number sufficient to enable the full

exercise of all of AuraSound’s outstanding convertible securities, including the

Inseat Warrant. See the Current Report on Form 8-K which we filed on

July 10, 2010 for more details regarding the Debt Conversion

Agreement.

Please

see the discussion titled “Liquidity and Capital Resources” in Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations.”

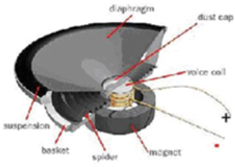

Technology

During

the year ended June 30, 2010, the majority of our revenue came from sales of

speakers for notebook computers and TV embedded speakers. Because of

the characteristics and specifications of such speakers, these applications

utilize custom designs of traditional topologies. In a traditional

speaker design, a speaker’s voice coil moves up and down in a piston like manner

as a result of motion generated by opposing magnetic fields created when

positive and negative electric charges are administered to the magnets in a

speaker. The up and down motion of the voice coil vibrates the diaphragm, which

then creates sound waves by vibrating the surrounding air.

The voice

coil length, magnet design and the quality of the material in the speaker

influence the quality of the sound that is produced. Speaker quality is

generally assessed based on four criteria:

|

1.

|

Sound

pressure level (SPL) - measure of pressure of a noise

(volume)

|

|

|

2.

|

Excursion

- the linear movement range of a speaker

|

|

|

3.

|

Frequency

range - the range from the lowest note to the highest note that a speaker

can reproduce

|

|

|

4.

|

Distortion

- the presence of unwanted noise that was not present in the original

sound signal

|

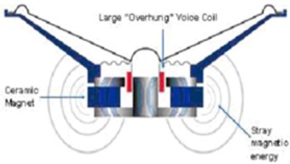

Conventional

Speaker Design

Example

of voice coil and magnetic design

4

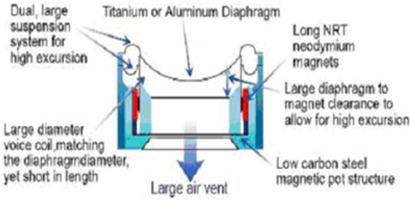

Whisper

Technology

For

certain applications, AuraSound utilizes its patented Whisper technology which

is a specialized application of the NRT transducer design for small, high power

drivers. The technology is fully scalable from speakers smaller than 1” to

larger 3”, 200W drivers and was designed to specifically address the severe

performance limitations of conventional micro-audio products.

In those

applications which are able to utilize AuraSound’s patented Whisper driver, the

use of this driver addresses some quality and range issues which are inherent in

traditional small speaker designs by utilizing an NRT-like design with the

following features:

Extended

Low Frequency Response - Whisper drivers create more bass by utilizing a high

excursion design due to a short voice coil in a long magnetic gap (underhung

magnet structure) and large suspension elements to allow movement.

Extended

High Frequency Response - Whisper drivers provide extended high frequency

response by minimizing moving mass and driver inductance by utilizing a short

voice coil.

Higher

Power Handling and SPL - Whisper drivers maximize power handling and SPL by

utilizing a long excursion, larger diameter, underhung voice coil, providing a

maximum level of excursion and good thermal dissipation to eliminate heat and

allow more power input.

Easy

Product Integration and Low Resonance Frequency - Whisper drivers utilize an

innovative rear venting design which eliminates trapped air and allows for

increased SPL with minimal distortion and does not require the area around the

driver to be kept open.

AuraSound

Whisper Speaker Design

Products

Whisper

Micro-Audio Products

|

We

provide standardized and custom developed micro-audio speakers ranging in

size from less than 1” to 3”. Our Whisper speakers can be easily

integrated into various products that require compact and light, high

performance speakers. We believe that our Whisper products have a

significant competitive advantage over other micro speakers that are based

upon conventional design parameters. We believe that our micro OEM

speakers are not only lighter and more compact than any other loudspeaker

currently available in their class, but that they are also more powerful

and provide significantly improved frequency response at the same price

point as competitive technologies. In addition, we believe that our

Whisper products provide significant advantages for integration in

electronics products relative to competing products as a result of their

favorable venting characteristics and natural ability to minimize

electronic interference that results from stray magnetic flux.

|

|

5

Speaker

Component Products

|

We

provide standardized and custom design drivers based upon NRT technology

to leading ultra-high end home audio manufacturers including such notable

names as McIntosh and MDesign. We believe that our component loudspeaker

transducers are considered by many audio enthusiasts and specialty

loudspeaker manufacturers to be the best available. We produce components

ranging from less than 1” to 18” and 800 Watts. From the miniature

NSW1Cougar to the enormous NS18 woofer to the low profile NSFB woofer, all

feature our patented NRT magnet structure for maximum fidelity with

life-like dynamics and minimal distortion.

|

|

Home

and Pro Audio Products

We

believe that our home audio systems are elegantly designed and provide a

dynamic acoustic experience. The home audio line features three series,

the Whisper Ensemble, the Baby Grand and the Concert Series, all of which

utilize the NRT and/or Whisper platforms. The Whisper Ensemble is an ultra

compact home theater system that maintains the quality and performance of

a larger speaker system. The Baby Grand is the mid sized system and has

excellent bandwidth, powerful dynamics and precise stereo imaging. The

Concert Series is the largest system, providing the greatest range, lowest

distortion and most bass while maintaining the same accurate spatial sound

field and focused coverage of the other systems. All three of the systems

have a sophisticated style with the cabinets having a beautiful black or

white high-gloss lacquer finish. Additionally, the grills are held in

place magnetically allowing the consumer the choice of displaying the

system with or without the grill.

|

|

|

Our

Pro Audio products are an extension of our component business and consist

primarily of the NRT 18-8 Subwoofer. The NRT 18-8 18" is an 800-Watt

high-output subwoofer with a high-temperature neodymium ring magnet,

unique magnet geometry with underhung 4" edgewound aluminum voice coil,

dual over-size spiders and tough epoxy cone. With a 20 - 200 Hz frequency

response the 18-8 delivers deeper bass, enhances overall performance and

is designed to move using a minimal amount of power, thereby maximizing

motor efficiency. The NRT 18-8 has appeared on-stage and on-tour with

artists such as Rod Stewart and features AuraSound's patented NRT

technology.

|

6

|

Automotive

Products

We

produce automotive competition-grade speaker and component systems. Our

automotive division designs and manufactures amplifiers, loudspeakers and

subwoofers. The subwoofer line features the NRT platform and is designed

for extremely low throw and high output, yielding unsurpassed linearity

and exceptionally low distortion. Our automotive loudspeakers, built with

coaxial high quality components, are available in a full range of products

from easy-to-install budget systems to top of the line competition grade

systems. The line is competitively priced and was designed with a new

industrial styling, a high level of performance and other unique features.

Our line of competition-grade amplifiers are built with performance

enhancing features that include gold-plated speaker and power connections,

modular internal design for improved separation and a high efficiency dual

heat sink which eliminates the need for noisy, power consuming fans.

|

|

|

Bass

Shaker Products

Our

Bass Shaker products are transducers that can be mounted to a fixed

surface to transmit vibration creating the “sensation of sound” or very

low bass, providing impact for music, sounds and special effects. The Bass

Shaker Plus and Bass Shaker add the impact of bass sub woofers without

excessive volume or the space required by traditional subwoofers. Our

technologically advanced design enhances the sound pressure levels so

there's no distortion while amplifying the bass energy delivered from the

stereo.

|

Research

and Development and Product Manufacturing

We employ

a skilled research and development team which is lead by the Vice President of

Engineering who is based in Santa Fe Springs, California and is responsible for

identifying and creating new products and applications along with improving and

enhancing existing products. Our research engineers and facilities

are located in both Santa Fe Springs, California and Taiwan. We added the

research and development team in Taiwan in order to be closer to our customer

base. During the twelve month period ended June 30, 2008, we had

three major vendors and experienced quality and delivery problems with two of

them, namely Grandford Holdings Ltd and ZYLUX Acoustic Corporation,

before entering into a three-year non-exclusive Manufacturing Agreement with

GGEC in December 2007. GGEC is currently the primary manufacturer of

AuraSound's proprietary audio products. Pursuant to the December 2007

agreement, GGEC was compensated for units manufactured and shipped in an amount

equal to the manufacturing cost (consisting of material cost, direct labor and

overhead equal to 100% of direct labor cost) plus forty percent of the profit

margin.

On July

30, 2010 we and GGEC entered into a new Manufacturing Agreement which supersedes

and replaces the Manufacturing Agreement dated December

2007. Pursuant to the new Manufacturing Agreement, we agreed to fully

disclose to GGEC and its personnel our processes, trade secrets, engineering,

design, operating information, technical information and other data (defined in

the Manufacturing Agreement as “Know-how”) relating to our products and, as

necessary to provide instruction to GGEC’s personnel in the methods and

techniques for manufacturing the products. We also granted to GGEC

the right to manufacture and package our products and to transfer this right to

its affiliates. GGEC agreed that any new inventions or related

products or processes which it may develop as a result of disclosure of the

Know-how shall be the property of AuraSound. GGEC also agreed that it

will not, without our written consent, sell or distribute the products or

manufacture or sell competing products to any current or named customers of the

Seller.

For the

manufacturing services performed pursuant to the Manufacturing Agreement, we

will pay to GGEC the cost of all materials required to build the products, labor

charges, finance charges, selling, general and administrative expenses, spoilage

charges and an amount of profit. We will also be required to pay the

costs of shipping the products and tooling charges for the improvement of

products or for the development of new products.

GGEC will

provide an office to host our engineering and support team. GGEC has

also agreed to provide the use of its audio testing facilities at no charge to

AuraSound. GGEC and AuraSound have also agreed to develop new

products that will be manufactured by GGEC and sold by AuraSound.

All of

our intellectual property, as well as our Know-how and any patents, design

rights, copyrights and other intellectual property rights that relate to special

tooling, continue to belong to AuraSound. All products made pursuant

to the Manufacturing Agreement will belong to AuraSound. GGEC agrees

that it will supply the products only to AuraSound or to customers specified by

AuraSound and agrees that it will not manufacture for our competitors products

that compete with the products that it manufactures for AuraSound. So

long as GGEC gives AuraSound prompt notice of any claim made or action

threatened or brought against GGEC, we agree to indemnify GGEC against any claim

of infringement of letters patent, registered design, trade mark or copyright by

the use or sale of the products manufactured by GGEC for AuraSound.

7

We

currently outsource all product manufacturing and some testing and development

functions to GGEC, including the sound bars manufactured for the newly acquired

ASI customers. The manufacturing campus of GGEC is located in Guangzhou, China

and consists of 1,200,000 square meters with more than 26 production lines. The

plant is also ISO-9001, ISO 14000, TS16949 and QS-9000 certified and contains

extensive research and development facilities; a full range of testing

facilities including China’s largest anechoic chamber used for loudspeaker

design; research labs for magnetics, cone materials, vibrations and speaker

systems design; an engineering library; office space; and a show room. The

facility also has extensive warehousing and full living accommodations for the

staff.

Market

Overview

A major

component of the consumer electronics market is the personal and professional

audio manufacturing industry, which is mature, fragmented and highly

competitive. Cutting edge technologies have a short life in an industry that is

defined by research and development. The audio industry is dominated by large

domestic and international manufacturers that include Harman International, Bose

Corporation, Polk Audio, Alpine Electronics, Sony Corporation, Boston Acoustics,

Altec Lansing Technologies, Kenwood Corp., LOUD Technologies, JBL Incorporated,

Panasonic Corporation, Pioneer, Rockford Corp. and Yamaha Corp. Additionally,

there are numerous small, niche companies that attract consumers based upon

specialty product offerings. Industry participants compete based on acoustic

quality, technology, price, reliability, brand recognition and

reputation.

Although

the audio industry as a whole is relatively mature and is dominated by large

players, the micro-audio segment remains a relatively new niche market. With the

continued release of innovative new products, the consumer electronics industry

has experienced steady growth for several years. There are many manufacturers,

large and small, domestic and international, which offer products that vary

widely in price and quality and are distributed through a variety of channels.

The primary industry growth drivers have been increased portability and

miniaturization, sophisticated technological innovations and a dramatic

reduction in market prices.

The rapid

consumer acceptance of flat-panel televisions and displays, laptop computers,

portable devices (such as portable DVD players, MP3 and portable music devices)

and mobile phones demonstrates the overwhelming consumer demand for sleeker and

increasingly more compact electronics. The slenderness and compactness of these

products requires ultra compact speakers and we believe that consumers are

increasingly expecting the audio performance of these products to be comparable

to their visual quality. Despite significant technological innovations in

laptops, portable music players and mobile phones, the auditory capabilities of

these devices has stagnated or been significantly reduced as a result of efforts

to minimize size to achieve increased portability. This reduction in audio

quality has occurred despite a massive increase in media usage, particularly

audio, on these devices. We believe that the micro-audio market currently lacks

a true leader with an economical, easy to integrate audio product capable of

delivering high quality acoustics in an ultra-compact format.

We

believe that the integration of high-level audio capabilities provides device

makers with an additional product differentiator, and that the expanding market

for miniature electronic devices will ultimately drive rapid growth in high

quality ultra compact speaker sales.

Competition

We

compete in the traditional audio and micro-audio market segments.

In the

traditional audio market we provide component speakers to ultra high-end

manufacturers and sell our own line of home and mobile audio products. Several

well established companies participate in the mid to high-end of the traditional

home and pro audio markets. Among these companies are Bose Corporation, Boston

Acoustics, Inc., Harman International Industries, Inc., Polk Audio, Inc., Alpine

Electronics, Inc., Bang & Olufsen Holding A/S and Clarion Co.

Ltd.

In the

micro-audio market we provide component speakers incorporating our Whisper

technology to OEM manufacturers of electronics such as laptop computers and

televisions and displays. Companies that have developed micro-audio products

include NXT, Plc, AAC Acoustic Technologies Holdings, Inc., Tymphany

Corporation, SLS International, Inc. and American Technology Corporation.

However, not all of these companies target the laptop computer or mobile device

markets.

The

markets for traditional audio and micro-audio speakers are competitive and

subject to continuous technological innovation. Our competitiveness depends on

our ability to offer high-quality products that meet our customers’ needs on a

timely basis. The principal competitive factors of our products are time to

market, price and breadth of product line. Many of our competitors have

significant advantages over us such as far greater name recognition and

financial resources than we have. With the acquisition of ASI, we expect that

our market share will expand significantly in certain segments of the audio and

micro-audio speaker markets, particularly in the market for home entertainment

audio systems such as sound bars.

Sales

and Marketing

Currently,

we continue to market and sell certain of our OEM products through a network of

our sales representatives located in Taiwan, China and the U.S. The

products formerly produced by ASI are end user

products which are marketed and sold as private label products for sale by

retail outlets and chain stores.

8

Customers

During

the fiscal year ended June 30, 2010, approximately 94% of our sales were made to

customers outside the United States. We are currently delivering our micro-audio

products to Quanta and Compal, and have been approved or are being evaluated for

new product lines by HP, Sony, Toshiba, Dell, LG, Sharp and Acer. We

believe that international sales will expand with the current focus on micro

devices and will represent an increasingly significant portion of our revenues

in the future. A significant portion of our revenues has historically been

attributed to a small number of customers and we expect that this may continue.

None of our customers have continuing obligations to purchase products from

us. During the 2011 fiscal year, we expect that approximately 80% of

the products formerly manufactured by ASI will be sold to customers in the

United States.

Intellectual

Property and Proprietary Rights

We try to

protect our intellectual property through existing laws and regulations and by

contractual restrictions. We rely upon trademark, patent and copyright law,

trade secret protection and confidentiality or license agreements with our

employees, customers, partners and others to help us protect our intellectual

property.

Prior to

the ASI Transaction, we had twenty one active US patents covering the design and

technical innovations found in our audio products and three patents pending

which relate to our innovative micro speaker design. As a result of

the ASI Transaction, we acquired the rights to another 14 patent applications

that are pending. Two of these patent applications are pending in the

United States, two of these patent applications are pending in Taiwan and

ten of these patent applications are pending in China. The granting of any

patent involves complex legal and factual questions. The scope of allowable

claims is often uncertain. As a result, we cannot be sure that any patent

application filed by us will result in a patent being issued, nor that any

patents issued will afford adequate protection against competitors with similar

technology, nor can we provide assurance that patents issued to us will not be

infringed upon or designed around by others.

Government

Regulation

In the

United States, our products must comply with various regulations and standards

defined by the Federal Communications Commission and the Consumer Products

Safety Commission. Internationally, our products may be required to comply with

regulations or standards established by authorities in the countries into which

we sell our products, as well as various multinational or extranational bodies.

The European Union, or EU, has issued a directive on the restriction of certain

hazardous substances in electronic and electrical equipment, known as RoHs, and

has enacted the Waste Electrical and Electronic Equipment directive, or WEEE,

applicable to persons who import electrical or electronic equipment into Europe.

Although neither of these directives is currently applicable to our products,

both are expected to become effective and at that time they will apply to our

products. We are currently implementing measures to comply with each of these

directives as individual EU nations adopt their implementation guidelines.

Although we believe our products are currently in compliance with domestic and

international standards and regulations in countries to which we export, we can

offer no assurances that our existing and future product offerings will remain

compliant with evolving standards and regulations.

Investing

in our common stock involves a high degree of risk. You should

carefully consider the risks and uncertainties described below before you

purchase any of our common stock. These risks and uncertainties are

not the only ones we face. Unknown additional risks and

uncertainties, or ones that we currently consider immaterial, may also impair

our business operations. If any of these risks or uncertainties

actually occur, our business, financial condition or results of operations could

be materially adversely affected. In this event you could lose all or

part of your investment.

We

had a net loss of $2,238,947 for the fiscal year ended June 30,

2010. We have never been profitable and we may not be profitable in

the future. If we do not become profitable, the value of your

investment could be adversely affected or you could lose your

investment.

Our

independent auditor has noted in its report concerning our financial statements

as of June 30, 2010 that we have incurred substantial losses and had negative

cash flow in operating activities for the last two fiscal years, which, along

with our accumulated deficit of $37,838,789, raises substantial doubt about our

ability to continue as a going concern.

We

sustained a net loss of $2,238,947 for the fiscal year ended June 30,

2010. We cannot assure you that we will generate sufficient cash flow

to meet our obligations or achieve operating profits in the

future. If we do not become profitable, the value of your investment

could be adversely affected or you could lose your investment.

9

On

July 31, 2010 we acquired ASI Holdings Limited. We cannot guarantee

that we will be able to successfully integrate ASI’s operations or that our

business and results of operations will improve as a result of this

acquisition.

On July

31, 2010 we acquired ASI Holdings Limited in exchange for 5,988,005 shares of

our common stock and a warrant to purchase 3,000,000 shares of our common stock

and the assumption of $10,154,745 in debt consisting primarily of trade

payables. This acquisition is likely to place a strain on our

management and administrative resources, infrastructure and systems and require

us to make significant outlays of capital. These measures are time

consuming, will increase management’s responsibilities and will divert

management’s attention from our day-to-day operations. We cannot

guarantee that we will be able to successfully integrate ASI’s operations with

our operations. Even if we are successful in integrating the

operations of the businesses, there is no guarantee that our business and

results of operations will improve as a result of this acquisition.

We

experience variability in quarterly operating results because our sales are

seasonal. Because of this, our quarterly operating results will not

provide you with a reliable indicator of our future operating

results.

Our

operating results tend to vary from quarter to quarter because our sales are

seasonal. Revenue in each quarter is substantially dependent on

orders received within that quarter. Conversely, our expenditures are

based on investment plans and estimates of future revenues. We may,

therefore, be unable to quickly reduce spending if revenues decline in a given

quarter. As a result, operating results for such quarters would be

adversely impaired. Results of operations for any one quarter are not

necessarily indicative of results for any future period. Other

factors which may cause quarterly results to fluctuate or to be adversely

impacted include:

|

|

·

|

increased competition in niche

markets;

|

|

|

·

|

new product announcements by our

competitors;

|

|

|

·

|

product releases and pricing

changes by us or our

competitors;

|

|

|

·

|

market acceptance or delays in

the introduction of new

products;

|

|

|

·

|

production

constraints;

|

|

|

·

|

the timing of significant

orders;

|

|

|

·

|

customers’ budgets;

and

|

|

|

·

|

foreign currency exchange

rates.

|

Because

our quarterly operating results are unpredictable, they will not provide you

with a reliable indicator of our future operating results.

We

will need to raise additional capital in order to implement our long-term

business plan. We have no assurance that money will be available to

us when we need it. If money is not available to us when we need it,

we may be required to curtail or alter our long term business strategy or delay

capital expenditures.

Our

ability to implement our long-term strategy, which is to expand our operations

in order to meet expected demand for micro speakers, largely depends on our

access to capital. To implement our long-term strategy, we plan to

make ongoing expenditures for the expansion and improvement of our micro speaker

product lines and the promotion of our products with manufacturers of computers,

cell phones, home entertainment systems and iPods. We may also wish

to make expenditures to acquire other businesses which provide similar products

or products which can be marketed to our existing customer base. To date, we have

financed our operations primarily through sales of equity and

loans. If we were to attempt to expand our business at a faster pace

than currently contemplated, or if we were to identify an acquisition target, we

would need to raise additional capital through the sale of our equity securities

or debt instruments. However, additional capital may not be available

on terms acceptable to us. Our failure to obtain sufficient

additional capital could curtail or alter our long-term growth strategy or delay

needed capital expenditures.

Our

customers have many brands to choose from when they decide to order products. If

we cannot deliver products quickly and reliably, customers will order from a

competitor. We must stock enough inventory to fill orders promptly,

which increases our financing requirements and the risk of inventory

obsolescence. Competition may force us to shorten our product life

cycles and more rapidly introduce new and enhanced products. This,

too, could leave us with obsolete designs and inventory. If we do not

manage our inventory successfully, it could have a material adverse effect on

our results of operations.

If

the U.S. were to revoke NTR status for China, our results of operations could be

adversely affected.

Our

ability to import products from China at current tariff levels could be

materially and adversely affected if the “normal trade relations” (“NTR”,

formerly “most favored nation”) status the United States government has granted

to China for trade and tariff purposes is terminated. As a result of its NTR

status, China receives the same favorable tariff treatment that the United

States extends to its other “normal” trading partners. China’s NTR status,

coupled with its membership in the World Trade Organization, could eventually

reduce barriers to manufacturing products in and exporting products from China.

However, we cannot provide any assurance that China’s WTO membership or NTR

status will not change. If China were to lose its NTR status, the increase in

tariffs could adversely affect our results of operations.

10

Defects

in our products could reduce demand for our products and result in a loss of

sales, delay in market acceptance and injury to our reputation.

Complex

components and assemblies used in our products may contain undetected defects

that are subsequently discovered at any point in the life of the

product. Defects in our products may result in a loss of sales, delay

in market acceptance, injury or other loss to customers, and injury to our

reputation and increased warranty or service costs.

Our

products could subject us to liability. Liability claims could have a

material adverse effect on our results of operations.

Some of

our products, such as amplifiers, speakers and our Bass Shaker devices are

electronically powered and carry a risk of electrical shock or fire. If our

products caused electrical shock or fire, the damaged party could bring claims

for property damage, physical injury or death. While the Company carries

insurance for these types of contingencies, these types of legal actions, if

threatened or brought, may be very costly to defend, may distract management’s

attention from operating our business and may result in large damage awards

which may exceed our coverage limits and could have a material adverse effect on

our results of operations.

During

the 2010 fiscal year, over four-fifths of our net sales were made to

customers that are located outside the United States. Any one of

several factors that affect overseas sales could adversely affect our results of

operations.

During

the year ended June 30, 2010, about 94% of our net sales were made to customers

outside the United States. Even though approximately 80% of ASI’s

products are sold in the United States, we believe that international

sales will continue to have a material impact on our revenues and

profitability. Our revenues from international sales may fluctuate

due to various factors, including:

|

|

·

|

changes in regulatory

requirements;

|

|

|

·

|

changes to tariffs and

taxes;

|

|

|

·

|

increases in freight costs, or

damage or loss in shipment;

|

|

|

·

|

difficulties in hiring and

managing foreign sales

personnel;

|

|

|

·

|

longer average payment cycles and

difficulty in collecting accounts

receivable;

|

|

|

·

|

fluctuations in foreign currency

exchange rates;

|

|

|

·

|

product safety and other

certification requirements;

and

|

|

|

·

|

political and economic

instability, wars and terrorist

activity.

|

If

international sales declined significantly or if any of the above factors

adversely impacted the revenues we earn from international sales, there may be a

material adverse effect on our results of operations.

In the sale of our micro-audio

products, we depend on

key customers, a small number of which account for a significant portion of our

revenue. The loss of one or more of these customers could have a

material adverse impact on our results of operations, liquidity and financial

condition.

In the

past, a significant portion of our revenue for micro-audio products was

attributed to a small number of customers and this may continue. We had three

major customers during the year ended June 30, 2010 which accounted for 85%

of our sales. We had two major customers during the year ended June

30, 2009 which accounted for 65% of our sales. The receivables due

from these customers as of June 30, 2010 and 2009 totaled $2,901,330 and

$718,582 respectively. Furthermore, none of our micro-audio customers

have continuing obligations to purchase products from us. If our relationships

with our largest customers deteriorated for any reason, we could lose a

substantial portion of our net sales revenues, which would have a material

adverse impact on our results of operations, liquidity and financial

condition.

Prior

to the ASI Transaction, we owned 21 active issued patents with three patents

pending and one trademark with three additional trademarks applied for, which we

believe are important to our business. In the ASI Transaction, we acquired

the rights to several patents pending in both the United States and China, and

the rights to two trademarks. While we try to protect our

intellectual property, if we are unable to do so our business could be

harmed.

We try to

protect our intellectual property in a number of different ways. We rely in part

on patent, trade secret, unfair competition and trademark law to protect our

rights to certain aspects of our products, including product designs,

proprietary manufacturing processes and technologies, product research and

concepts and recognized trademarks, all of which we believe are important to the

success of our products and our competitive position. There can be no assurance

that any of our pending patent or trademark applications will result in the

issuance of a registered patent or trademark, or that any patent or trademark

granted will be effective in thwarting competition or be held valid if

subsequently challenged. In addition, there can be no assurance that the actions

taken by us to protect our proprietary rights will be adequate to prevent

imitation of our products, that our proprietary information will not become

known to competitors, that we can meaningfully protect our rights to unpatented

proprietary information or that others will not independently develop

substantially equivalent or better products that do not infringe on our

intellectual property rights. We could be required to devote substantial

resources to enforce our patents and protect our intellectual property, which

could divert our resources and result in increased expenses. In addition, an

adverse determination in litigation could subject us to the loss of our rights

to a particular patent or other intellectual property, could require us to

obtain from or grant licenses to third parties, could prevent us from

manufacturing, selling or using certain aspects of our products or could subject

us to substantial liability, any of which could harm our business.

11

We may become subject to litigation

for infringing the intellectual property rights of others . Such actions could result

in a decrease in our operating income and cash flow and would harm our

business.

Others

may initiate claims against us for infringing on their intellectual property

rights. We may be subject to costly litigation relating to such infringement

claims and we may be required to pay compensatory and punitive damages or

license fees if we settle or are found culpable in such litigation. In addition,

we may be precluded from offering products that rely on intellectual property

that is found to have been infringed by us. We also may be required to cease

offering the affected products while a determination as to infringement is

considered. These developments could cause a decrease in our operating income

and reduce our available cash flow, which could harm our business.

The loss of the services of our key

employees, particularly the services rendered by Harald Weisshaupt, our Chief Executive Officer and Chief

Financial Officer, could harm our business

Our

success depends to a significant degree on the services rendered to us by our

key employees. If we fail to attract, train and retain sufficient

numbers of these qualified people, our prospects, business, financial condition

and results of operations will be materially and adversely affected. In

particular, we are heavily dependent on the continued services of Harald

Weisshaupt, our Chief Executive Officer and Chief Financial Officer, and the

other members of our senior management team. With the exception of Harald

Weisshaupt who has a one-year, renewable contract, we do not have long-term

employment agreements with any of the other members of our senior management

team, each of whom may voluntarily terminate his employment with us at any time.

With the exception of Mr. Weisshaupt, following any termination of employment,

these employees would not be subject to any non-competition covenants. The loss

of any key employee, including members of our senior management team, and our

inability to attract highly skilled personnel with sufficient experience in our

industry could harm our business.

We

have historically utilized a primary manufacturer to manufacture our products

and during the twelve months ended June 30, 2008 we experienced significant

negative issues with two successive suppliers. Any negative issues

with our current supplier could have a material adverse effect on our business

and operating results and would jeopardize our ability to timely meet customer

requirements, transition to a new vendor or become a multi-source

company. Our current supplier is GGEC.

Because

we have historically utilized a primary third party manufacturer to manufacture

our products, we have been totally dependent on that supplier to meet the

quality and volume requirements of our customers. Any continuing dependency on a

primary supplier will make us vulnerable to performance issues related to that

manufacturer, which could lead to customer dissatisfaction and a loss of current

and future business. This could have a material adverse affect our

business and operating results.

We

do not manufacture the products we sell. Instead, we rely on third

parties, and one supplier in particular, to manufacture the products to our

specifications. However, we have experienced problems with the

products manufactured by our suppliers. Too many defective products

could lead to customer dissatisfaction and a loss of business which would

materially adversely affect our business and operating results.

Because

we utilize third party manufacturers to manufacture our products, we may not

become aware of issues relating to quality or performance until the products

have been shipped. This has in the past, and may in the future,

result in high defect and rejection rates. We have in the past, and

we may in the future, be required to replace products, at our expense, that do

not pass our customers’ inspections. As a result of problems with our

products, we could be subject to lawsuits and lose future

business. Any problems that we have with defective products could

have a material adverse affect on our business and operating

results.

Product

technology evolves rapidly, making timely product innovation essential to

success in the marketplace. The introduction of products with improved

technologies or features may render our existing products obsolete and

unmarketable. If we cannot develop products in a timely manner in response to

industry changes, or if our products do not perform well, our business and

financial condition will be adversely affected.

If

our technologies, including the product technology that we acquired in the ASI

Transaction, is not accepted by the market, we may not achieve anticipated

revenue or profits.

Our

future financial performance as it relates to supplying audio devices will

depend on market acceptance of our product technology, including the product

technology we acquired in the ASI Transaction. If our technologies

and product lines do not gain sufficient positive market acceptance, we may not

achieve profitability.

12

We

are a small company and we do not represent a significant presence in the sound

enhancement products market. We are subject to intense

competition. We cannot assure you that we can compete

successfully.

The

market for sound enhancement products in general is intensely competitive and

sensitive to new product introductions or enhancements and marketing efforts by

our competitors. The market is affected by ongoing technological developments,

frequent new product announcements and introductions, evolving industry

standards and changing customer requirements. We face competition from a number

of well-known brands including Bose, NXT, and Bang & Olufsen. Many of our

competitors are substantially better capitalized and have substantially stronger

market presence than we have. Although we have attempted to design our home

audio systems to compete favorably with other products in the market, we may not

be able to establish and maintain our competitive position against current or

potential competitors. Competition may have the effect of reducing the prices we

can charge for our products, increasing marketing costs associated with

developing and maintaining our market niche, or reducing the demand for our

products. If we fail to compete successfully, either now or in the future, our

profitability and financial performance will likely be materially adversely

affected. We do not currently represent a significant presence in the sound

enhancement products market.

We

are susceptible to general economic conditions, and a downturn in our industry

or a reduction in spending by consumers could adversely affect our operating

results.

The

electronics industry in general has historically been characterized by a high

degree of volatility and is subject to substantial and unpredictable variations

resulting from changing business cycles. Our operating results will be subject

to fluctuations based on general economic conditions, in particular conditions

that impact discretionary consumer spending. As a result of the current downturn

in the U.S. economy, the audio products sector of the electronics industry may

experience a slowdown in sales, which would adversely impact our ability to

generate revenues and impact the results of our future operations.

Our

management owns or controls a significant number of the outstanding shares of

our common stock, which may be detrimental to our minority

stockholders.

As of the

date of this report, approximately 70% of our issued and outstanding common

stock is owned by 2 stockholders. See Item 12 titled “Security

Ownership of Certain Beneficial Owners and Management.” As a result

of this significant ownership of our common stock, these 2 stockholders will be

able to effectively control our affairs and business, including the election of

directors and, subject to certain limitations, approval or preclusion of

fundamental corporate transactions. This concentration of ownership

may be detrimental to the interests of our minority stockholders in that it

may:

|

|

|

·

|

limit our shareholders’ ability

to elect or remove

directors;

|

|

|

|

·

|

delay or prevent a change in

control;

|

|

|

|

·

|

impede a merger, consolidation,

take over or other transaction involving our company;

or

|

|

|

|

·

|

discourage a potential acquirer

from making a tender offer or otherwise attempting to obtain control of

our company.

|

There

is only a limited market for our common stock, which could cause our investors

to incur trading losses or prevent them from reselling their shares at or above

the price they paid for them, or from selling them at all.

Our

common stock is quoted on the Over-the-Counter Bulletin Board (OTCBB) under the

symbol “ARUZ.” On August 31, 2010, our common stock traded 300 shares

at a price of $2.75. Since then, our shares have not traded and there

can be no assurance that an active trading market will be developed or

maintained. See Item 5, “Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities.”

The OTCBB

is an unorganized, inter-dealer, over-the-counter market which provides

significantly less liquidity than NASDAQ or other national or regional

exchanges. Securities traded on the OTCBB are usually thinly traded,

highly volatile, have fewer market makers and are not followed by analysts.

The Securities and Exchange Commission’s order handling rules, which apply

to NASDAQ-listed securities, do not apply to securities quoted on the OTCBB.

Quotes for stocks included on the OTCBB are not listed in newspapers.

Consequently, prices for securities traded solely on the OTCBB may be

difficult to obtain and are frequent targets of fraud or market manipulation.

Dealers may dominate the market and set prices that are not based on

competitive forces. Individuals or groups may create fraudulent markets

and control the sudden, sharp increase of price and trading volume and the

equally sudden collapse of the market price for shares of our common stock.

Moreover, the dealer's spread (the difference between the bid and ask

prices) may be large and may result in substantial losses to the seller of

shares of our common stock on the OTCBB if the stock must be sold immediately

and may incur an immediate “paper” loss from the price spread.

Due to

the foregoing, demand for shares of our common stock on the OTCBB may be

decreased or eliminated and holders of our common stock may be unable to resell

their securities at or near their original acquisition price, or at any

price.

13

Investors

must contact a broker-dealer to trade OTCBB securities. As a result, you

may not be able to buy or sell our securities at the times you

wish.

Even

though our securities are quoted on the OTCBB, the OTCBB may not permit our

investors to sell securities when and in the manner that they wish.

Because there are no automated systems for negotiating trades on the

OTCBB, trades are conducted via telephone. In times of heavy market

volume, the limitations of this process may result in a significant increase in

the time it takes to execute investor orders. Therefore, when investors

place an order to buy or sell a specific number of shares at the current market

price it is possible for the price of a stock to go up or down significantly

during the lapse of time between placing a market order and its

execution.

Sales

of a substantial number of shares of our common stock may cause the price of our

common stock to decline.

If our

stockholders sell substantial amounts of our common stock in the public market,

including shares issued upon exercise of outstanding warrants, the market price

of our common stock could fall. These sales also may make it more

difficult for us to sell equity or equity-related securities in the future at a

time and price that we deem reasonable or appropriate.

Authorized

additional shares of our common stock available for issuance may dilute current

stockholders.

We are

authorized to issue 16,666,667 shares of our common stock and 3,333,333 shares

of our preferred stock. As of the date of this report, there are

16,666,667 shares of common stock issued and outstanding and no shares of

preferred stock issued or outstanding. However, the total number of shares

of our common stock outstanding does not include shares of our common stock

reserved in anticipation of the exercise of warrants. Further, in the

event that any additional financing should be in the form of, be convertible

into or exchanged for equity securities, investors may experience additional

dilution.

The

“penny stock” rules could make selling our common stock more

difficult.

Our

common stock has a market price of less than $5.00 per share, therefore,

transactions in our common stock are subject to the “penny stock” rules

promulgated under the Securities Exchange Act of 1934, as

amended. Under these rules, broker-dealers who recommend such

securities to persons other than institutional accredited investors must: (i)

make a special written suitability determination for the purchaser; (ii) receive

the purchaser’s written agreement to a transaction prior to sale; (iii) provide

the purchaser with risk disclosure documents that identify certain risks

associated with investing in “penny stocks” and that describe the market for

these “penny stocks,” as well as a purchaser’s legal remedies; and (iv) obtain a

signed and dated acknowledgment from the purchaser demonstrating that the

purchaser has actually received the required risk disclosure document before a

transaction in “penny stock” can be completed. As a result,

broker-dealers may find it difficult to effect customer transactions, related

transaction costs will rise and trading activity in our securities may be

greatly reduced. As a result, the market price of our securities may

be depressed, and you may find it more difficult to sell our

securities.

You

should be aware that, according to the Securities and Exchange Commission, the

market for penny stocks has suffered in recent years from patterns of fraud and

abuse. Such patterns include:

|

|

·

|

Control of the market for the

security by one or a few broker-dealers that are often related to the

promoter or issuer;

|

|

|

·

|

Manipulation of prices through

prearranged matching of purchases and sales and false and misleading press

releases;

|

|

|

·

|

“Boiler room” practices involving

high pressure sales tactics and unrealistic price projections by

inexperienced sales persons;

|

|

|

·

|

Excessive and undisclosed bid-ask

differentials and markups by selling broker-dealers;

and

|

|

|

·

|

The wholesale dumping of the same

securities by promoters and broker-dealers after prices have been

manipulated to a desired level, along with the inevitable collapse of

those prices with consequent investor

losses.

|

We

do not intend to pay dividends in the foreseeable future. If you

require dividend income, you should not rely on an investment in our

company.

We have

never paid cash dividends and do not anticipate paying cash dividends in the

foreseeable future. Instead, we intend to retain future earnings, if

any, for reinvestment in our business and/or to fund future

acquisitions. If you require dividend income, you should not expect

to receive any cash dividends as a stockholder of our company.

|

ITEM

1B

|

UNRESOLVED

STAFF COMMENTS.

|

As a

smaller reporting company, we are not required to provide this

information.

14

|

ITEM 2.

|

PROPERTIES.

|

InSeat

Solutions, LLC, an entity under the control of our former Chairman and former

Chief Executive Officer, Mr. Arthur Liu, currently leases approximately 21,355

square feet of office, warehouse and technical research and development space

which is located at 11839 East Smith Avenue, Santa Fe Springs, California. The

current lease will expire on July 31, 2013. We share this space with

InSeat Solutions, LLC and we pay 23% of the rent commitment. We do

not have a written lease or rental agreement with InSeat Solutions, LLC and we

have no obligation in connection with our use of the premises other than the

payment of rent. For the fiscal year ended June 30, 2010, this amount

totaled $53,997 and we expect to pay at least this amount during the next fiscal

year. Our operations in Taiwan are conducted by AuraSound

as a foreign corporation doing business in Taiwan. We rent office

space in Taiwan on a month to month basis at a rental rate of $1,558 per month.

In the ASI Transaction, we assumed month- to- month obligations for offices in

Hong Kong, Shenzhen Province and Arizona.

Employees

As of the

date of this report, we employed 55 full-time employees and 7 consultants. Of

these, eight employees and one consultant were located in Taiwan, 26 employees

were located in Hong Kong and eight employees were located in Santa Fe Springs,

California, two were located in Arizona and eleven employees and six consultants

were located in Shenzhen, China. We also employ various engineering design and

financial consultants from time-to-time on an as needed basis. None of our

employees are covered by a collective bargaining agreement. We consider our

relationship with our employees to be good.

|

ITEM

3.

|

LEGAL

PROCEEDINGS.

|

|

ITEM

4.

|

REMOVED

AND RESERVED

|

15

PART

II

|

ITEM 5.

|

MARKET FOR

REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY

SECURITIES.

|

Market

information

Our

common stock is currently quoted on the OTCBB under the symbol

“ARUZ”.

The

following table sets forth, for the periods indicated, the high and low bid

information per share of our common stock as reported by the

OTCBB. These quotations reflect inter-dealer prices, without retail

mark-up, mark-down or commission and may not represent actual

transactions. The information below reflects the 1-for-6 reverse

stock split that was effected on November 17, 2009.

|

2010

|

Low Bid

|

High Bid

|

||||||

|

First

quarter ended September 30, 2009

|

$

|

.240

|

$

|

3.600

|

||||

|

Second

quarter to ended December 31, 2009

|

$

|

.150

|

$

|

2.050

|

||||

|

Third

quarter ended March 31, 2010

|

$

|

.950

|

$

|

2.010

|

||||

|

Fourth

quarter ended June 30, 2010

|

$

|

1.040

|

$

|

2.750

|

||||

|

2009

|

Low Bid

|

High Bid

|

||||||

|

First

quarter ended September 30, 2008

|

$

|

1.800

|

$

|

6.6

00

|

||||

|

Second

quarter to ended December 31, 2008

|

$

|

.006

|

$

|

3.060

|

||||

|

Third

quarter ended March 31, 2009

|

$

|

.120

|

$

|

.480

|

||||

|

Fourth

quarter ended June 30, 2009

|

$

|

.060

|

$

|

2.940

|

||||

Shareholders

As of

September 14, 2009, there were 144 record holders of our common stock. This does

not include an indeterminate number of stockholders whose shares are held by

brokers in street name.

Dividends

We have

never declared any cash dividends on our common stock and we do not anticipate

declaring a cash dividend in the foreseeable future. We intend to retain any

earnings which we may realize in the foreseeable future to finance our

operations. Future dividends, if any, will depend on earnings, financing

requirements and other factors.

Sales

of Unregistered Securities

Not

Applicable

Securities

Authorized for Issuance under Equity Compensation Plans

Equity

Compensation Plan Information

|

Plan Category

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

|

Weighted average exercise

price of outstanding

options warrants and rights

(b)

|

Number of securities

remaining available for

future issuance under the

equity compensation plan

(excluding securities

reflected in column (a)

(c)

|

|||||||||

|

Shareholder

Approved Equity Incentive Plan

|

0

|

N/A

|

8,421,591

|

|||||||||

(1) The

AuraSound, Inc. 2007 Equity Incentive Plan was adopted by our board of directors

on November 29, 2007 and approved by our stockholders on February 12,

2008. Pursuant to the terms of the plan, awards may be granted for

options (both incentive stock options and non-qualified stock options) and for

stock.

|

ITEM

6.

|