Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - AMERALIA INC | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - AMERALIA INC | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERALIA INC | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERALIA INC | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM 10-K |

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2010

|

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

| Commission file number: 000-15474 |

NATURAL RESOURCES USA CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Utah

|

|

87-0403973

|

|

(State of other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

3200 County Road 31, Rifle, Colorado

|

|

81650

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| (720) 876-2373 |

| (Registrant’s Telephone Number, including Area Code) |

AmerAlia, Inc.

(Former name or former address, if changed since last report)

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Common Stock, $0.01 par value

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

Yes o No x

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

|

Yes o No x

|

|

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

|

|

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

|

|

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. o

|

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one): |

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-Accelerated Filer o

|

Smaller Reporting Company x

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

|

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $5,808,000 as of December 31, 2009, based on the last sale price on the OTCBB of $0.50.

|

|

The number of shares of the Registrant’s Common Stock, $0.01 par value, outstanding as of September 28, 2010 was 352,413,582.

|

Documents Incorporated By Reference

To the extent herein specifically referenced in Part III, portions of the Registrant’s Definitive Proxy Statement on Schedule 14A for the 2010 Annual Meeting of Shareholders. See Part III.

Cautionary Note RegardingForward Looking Statements

The information in this Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties regarding the intent, belief or current expectations of the Company, its directors or its officers. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks we outline from time to time in other reports we file with the Securities and Exchange Commission (the “SEC”) and under the heading “Risk Factors” in this Annual Report. These factors may cause our actual results to differ materially from any forward-looking statement. We disclaim any obligation to publicly update these forward-looking statements, or disclose any difference between our actual results and those reflected in these statements, except as required by law. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

We qualify all forward-looking statements in this Annual Report by the foregoing cautionary note.

Cautionary Note to US Investors

The SEC limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The reader is cautioned that the term "resource" is not recognized by SEC guidelines for disclosure of mineral properties.

Terminology

In this report “tons” means U.S. Short Tons unless otherwise specified.

|

Item

|

Page

|

||

| PART I | |||

|

1

|

3 | ||

| 4 | |||

|

Natural Soda Holdings & Natural Soda

|

|||

|

Restructuring Transactions

|

|||

| 6 | |||

| 6 | |||

| 9 | |||

| 13 | |||

| 18 | |||

|

1A

|

19 | ||

|

1B

|

22 | ||

|

2

|

23 | ||

|

3

|

24 | ||

|

4

|

|||

| PART II | |||

|

5

|

24 | ||

|

6

|

25 | ||

|

7

|

26 | ||

|

8

|

30 | ||

|

9

|

31 | ||

|

9A

|

31 | ||

|

9B

|

32 | ||

| PART III | |||

|

10

|

Directors, Executive Officers and Corporate Governance

|

||

|

11

|

Executive Compensation

|

||

|

12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

||

|

13

|

Certain Relationships and Related Transactions, and Director Independence

|

||

|

14

|

Principal Accountant Fees and Services

|

||

| PART IV | |||

|

15

|

33 | ||

| SIGNATURES | |||

PART I

|

DESCRIPTION OF BUSINESS

|

The terms “we,” “us,” “our,” “Natural Resources,” “AmerAlia” and the “Company” used in this Annual Report refer to Natural Resources USA Corporation, unless otherwise indicated.

Natural Resources USA Corporation was incorporated in Utah on June 7, 1983 as Computer Learning Software, Inc., renamed AmerAlia, Inc. in January 1984 and again renamed Natural Resources USA Corporation on September 14, 2010.

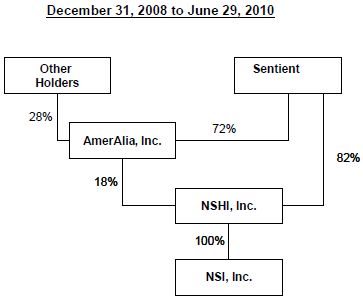

Our business is to identify and develop natural resource assets. Our wholly owned subsidiary, Natural Soda Holdings, Inc. (“Natural Soda Holdings” or ”NSHI”) and Natural Soda Holdings’ wholly-owned subsidiary, Natural Soda, Inc. (“Natural Soda” or ‘NSI”) own substantial natural sodium bicarbonate resources and water rights located in the State of Colorado, United States.

Previously, we owned 18% of Natural Soda Holdings, however, on June 30, 2010, we completed an exchange reorganization with Sentient, our major shareholder, whereby we acquired all the outstanding shares of Natural Soda Holdings in exchange for the issue of 286,119,886 shares of our common stock. Sentient now owns 94.8% of our shares.

Natural Soda owns various water rights in the Piceance Creek Basin in northwest Colorado, a part of the Colorado River drainage system. These various rights allow Natural Soda to draw up to a maximum of 108,812 acre feet (35.46 billion gallons) annually and to store up to 7,980 acre feet of water. Some of the water rights owned by Natural Soda are conditional rights and are subject to a requirement to demonstrate reasonable diligence. Every six years, Natural Soda must file an application to support its claim. In April 2010, the District Court in and for Water Division No 5 State of Colorado determined that Natural Soda had met the standard of Reasonable Diligence with respect to a portion of its conditional water rights and no further findings are required for a period of six years with respect those water rights. Natural Soda has filed additional applications for Findings of Reasonable Diligence with respect to other water rights and the applications are pending in the District Court in and for Water Division No. 6 State of Colorado.

Natural Soda Holdings and Natural Soda also own the largest Bureau of Land Management (“BLM”) leases in the Piceance Creek Basin which contains the largest known deposits of nahcolite, naturally occurring sodium bicarbonate, in the world. Natural Soda Holdings’ and Natural Soda’s leases are located near the depositional center of the Piceance Creek Basin where the nahcolite beds are thickest and most concentrated. Consequently, we believe these deposits are unique and capable of producing sodium bicarbonate and related sodium products for many generations.

Natural Soda Holdings first acquired its interest in a lease known as the Rock School lease in 1989. Natural Soda acquired its operating assets and sodium leases in 2003, an acquisition financed by loans from a trust and a fund (the “Sentient Entities”) managed by Sentient Asset Management, an international private equity group specializing in the development of natural resources (the “WRNM Acquisition”).

Natural Soda’s business is to produce and sell natural sodium bicarbonate, commonly known as baking soda, for use in a wide variety of products and activities. Natural Soda’s immediate objectives are, firstly, to be a low cost producer of sodium bicarbonate and to leverage that low cost advantage to achieve superior profit margins; and secondly, to profitably utilize its water assets.

Deposits of oil shale lie below, above and are interspersed within the nahcolite contained within the sodium leases. We do not have any rights to recover oil shale but Natural Soda Holdings has applied to the BLM for a Research, Development and Demonstration oil shale lease to explore possible recovery methods on 160 acres with a priority to develop a further 480 acres if the technology being developed proves to be successful and if acceptable lease terms are negotiated with the BLM. Shell Frontier Oil & Gas Co. (“Shell”) has three research, development and demonstration leases adjacent to Natural Soda’s sodium leases. A Shell fact sheet, “Shell Exploration & Production Technology - to secure our energy future – Mahogany Research Project” reports an estimated potential recovery rate of up to one million barrels of oil per surface acre. If we obtain the right to exploit all or part of this oil shale, we plan to independently determine possible recovery rates and attempt to develop an economically feasible plan to recover oil from the oil shale resource contained within the area where Natural Soda Holdings’ and Natural Soda’s sodium leases are located.

|

|

Figure 1: Natural Soda’s Plant Operations, Rifle, Colorado

|

OVERVIEW & HISTORY OF CORPORATE STRUCTURE

Prior to May 2007, we owned 100% of the outstanding common stock of Natural Soda Holdings, which in turn owned 100% of the outstanding common stock of Natural Soda, as shown below. Natural Soda is an operating company that produces and sells sodium bicarbonate (baking soda). Natural Soda has several active mineral leases, owns water rights and a sodium bicarbonate production facility in the Piceance Creek Basin area of Colorado.

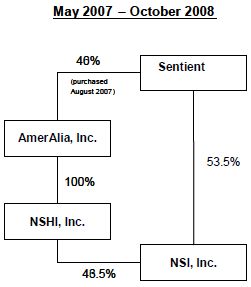

In 2003, the Sentient Entities provided Natural Soda Holdings with short-term debt financing which was refinanced on a long term basis in 2004. In May 2007, the Sentient Entities converted a portion of the debt owed by Natural Soda Holdings and Natural Soda into a 53.5% equity interest in Natural Soda. In August 2007, the Sentient Entities purchased approximately 46% of the equity in AmerAlia from a major shareholder of AmerAlia, and also acquired additional debt obligations of AmerAlia from the same major shareholder. These events are reflected in the ownership structure shown below.

As part of a restructuring transaction in October 2008:

|

|

·

|

the Sentient Entities transferred their various interests to Sentient;

|

|

|

·

|

Natural Soda became a wholly-owned subsidiary of Natural Soda Holdings;

|

|

|

·

|

Sentient converted its loans to Natural Soda Holdings into Natural Soda Holdings equity and AmerAlia’s ownership in Natural Soda Holdings was reduced from 100% to 18%; and

|

|

|

·

|

Sentient converted its loans to AmerAlia into additional common stock of AmerAlia.

|

This reorganization resulted in the ownership structure shown below.

In connection with this restructuring, AmerAlia also received approximately $10 million in cash, settled approximately $12 million of debt, terminated indemnification rights relating to the extinguishment of an AmerAlia $9.9 million bank loan and extinguished other obligations in exchange for the issue of 48,961,439 shares of its common stock.

Finally, as discussed above, on June 30, 2010, we issued 286,119,886 shares of our common stock to Sentient in exchange for the 82% of Natural Soda Holdings it held with the following resulting structure shown below.

In anticipation of this reorganization, the board of directors at a meeting on June 21, 2010, following the Annual Meeting of Shareholders, elected Alan De’ath, Paul-Henri Couture and Michel Marier as directors of the Company. In addition, it introduced some changes to the Company’s management structure. Whilst remaining Chief Executive Officer, Bill Gunn ceased to be the President of the Company and while Robert van Mourik remains as Chief Financial Officer, Treasurer and Secretary, he ceased to be Executive Vice President. Bradley F Bunnett, who is already President of Natural Soda Holdings and Natural Soda, was appointed to the positions of President and Chief Operating Officer of the Company.

Finally, on September 13, 2010 at a Special Meeting of the Shareholders, the shareholders approved the amendment of the articles of incorporation to change the name of the Company to Natural Resources USA Corporation.

|

1.

|

Sodium Leases

|

Sodium Leases and Operations

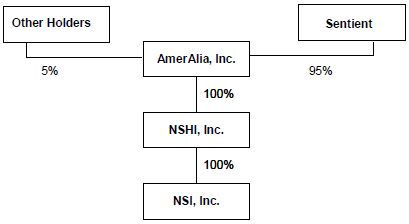

Nahcolite, a naturally occurring mineral form of sodium bicarbonate, is only known to exist in large quantities in the Piceance Creek Basin in northwest Colorado. Access to these deposits is governed by the BLM, a part of the Department of Interior, which has granted some leases to allow recovery of the sodium bicarbonate. Natural Soda owns four sodium leases, collectively known as the Wolf Ridge Mining Unit, and Natural Soda Holdings owns the adjoining Rock School lease.

The geology of the Piceance Creek Basin has been described and discussed in two reports. In March 1983, Rex D. Cole, Ph.D. Consulting Geologist, Grand Junction, Colorado, issued a report “Geologic Framework of Federal Sodium Lease C-0118326, Piceance Creek Basin, Colorado”. On Page 3 of “Summary and Conclusions” the report states “Total nahcolite resources for the lease area are between 6 and 8 billion tons.” The lease to which Cole refers (C-0118326) is the Wolf Ridge lease, one of the four leases comprising the Wolf Ridge Mining Unit being mined by Natural Soda; therefore, Natural Soda’s holdings extend beyond the particular lease to which Cole refers.

A second report by Cole, Daub & Weston entitled “Review of Geology, Mineral Resources, and Ground-Water Hydrology of the Green River Formation, North-Central Piceance Creek Basin, Colorado” was published by the Grand Junction Geological Society, Grand Junction, Colorado, in 1995. The authors state “…subsequent drilling established that the world’s largest deposits of naturally occurring sodium bicarbonate (nahcolite) are present in the Piceance Creek Basin” and “…the estimated in-situ resources of nahcolite and dawsonite are placed at 29 and 19 billion tons, respectively”. A more recent USGS Nahcolite and Dawsonite Piceance Creek Basin resource estimate in 2009 placed the nahcolite at 43.3 billion short tons. However, Natural Soda Holdings’ and Natural Soda’s leases only cover a portion of this area.

We are engaged in a program to further define the nahcolite resources adjacent to our current production cavities and processing plant. To this end we have in the period June to August, 2010 drilled three exploration wells to determine the nature and extent of the nahcolite contained within the Boies Bed, the particular bed from which we are currently producing. We intend to drill further exploration wells in the future to further determine the Boies Bed and other nahcolite beds that lie below the Boies Bed. This exploration program will require the issuance of further permits from the BLM which may impose conditions that cannot currently be predicted or determined. Based on recent drilling, we believe that we will have sufficient nahcolite available to us for the foreseeable future.

|

|

Figure 2: NSHI’s and NSI’s Sodium Leases are located

about 54 miles northwest of Rifle, Colorado

|

We first acquired an interest in the Rock School lease in Rio Blanco County, Colorado in 1989 and subsequently acquired it in 1992. We have never produced sodium bicarbonate from the Rock School lease which is now owned by Natural Soda Holdings and remains an untapped asset.

Natural Soda Holdings’ and Natural Soda’s leases are located near the depositional center of the Piceance Creek Basin where the nahcolite beds are thickest with the highest concentration of nahcolite. The Wolf Ridge Mining Unit leases issued to Natural Soda cover a total of 8,223 acres. When combined with the Rock School lease issued to Natural Soda Holdings, the leases cover a total of 9,543 acres.

Each of the four Wolf Ridge leases and the Rock School lease was renewed effective July 1, 2001 for a ten year term with a preferential right to subsequent renewals provided that sodium is being produced in paying quantities. Under the unit agreement, production in paying quantities from one lease is sufficient to extend all four Wolf Ridge leases. The leases bear a production royalty payable to the federal government of 2.0% of the gross value of the production exiting the processing plant. Each of these leases contains covenants to protect the in situ oil shale, water, and historical resources. We believe BLM general practice is that the conduct of Natural Soda Holdings and Natural Soda’s activities will be sufficient to enable lease renewals with the BLM. However, there can be no assurance that the conduct of such activities or additional development will be sufficient for the BLM to grant further lease renewals

Production Cavities and Solution Mining

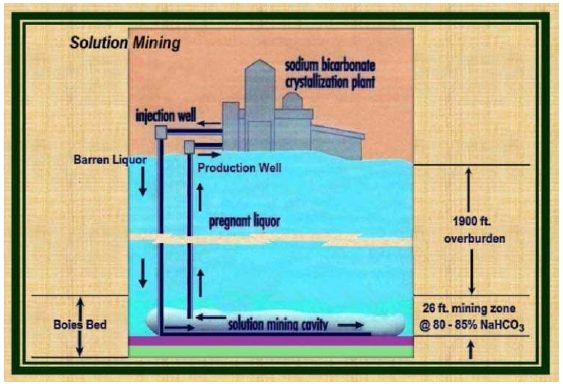

The Wolf Ridge leases contain the unique Boies Bed, which we believe is the richest and most economically recoverable bed of nahcolite in the Piceance Creek Basin. The Boies Bed contains an interval at an approximate depth of 1,900 feet that, while variable, averages approximately 26 feet thick with nahcolite constituting over 80% of the material in that interval. Solution mining requires pumping hot water into the nahcolite-bearing rock zone, the nahcolite dissolves and is pumped to the surface in near saturated solution known as pregnant liquor and brought into the plant for the sodium bicarbonate to be crystallized, dried, graded and bagged in 50 pound or 2,000 pound bags or stored for bulk sales. The remaining underground cavity comprises a honeycomb like rock rubble. The spent liquor is reheated and recycled underground to continue the solution mining process. The dried sodium bicarbonate is then screened and stored

|

|

Figure 3: Samples of nahcolite

|

Natural Soda’s operations to recover sodium products from these leases are governed by a BLM approved mine plan defining our cavity program to support our solution mining process. Natural Soda has invested $13,602,711 developing the well field and its cavities up to June 30, 2010. In the past, as the need for an additional cavity has arisen, Natural Soda has submitted applications for a new production well set in accordance with the approved mine plan, the drilling is then approved, and drilling commences. Once completed and after a period of consultation, the BLM authorizes the recovery of an amount of additional sodium bicarbonate. Consequently, Natural Soda has been able to maintain its operations. In early September 2009, Natural Soda completed a new cavity, 10H, and in late 2009 also completed another drilling program to establish another new well, 11H. Our investment in these two wells required approximately $1.19 million for exploration costs and $4.39 million in drilling costs. Together, these wells added 814,220 tons of recoverable product to our authorized recovery. The following table illustrates this process for the last five years:

|

Authorized Recovery (tons)

|

|||||||||

|

Year ending

|

Additions

|

Production

|

Balance

|

||||||

|

June 30, 2005

|

467,271 | ||||||||

|

June 30, 2006

|

- | (90,369) | 376,902 | ||||||

|

June 30, 2007

|

- | (98,145) | 278,757 | ||||||

|

June 30, 2008

|

150,000 | (100,189) | 328,568 | ||||||

|

June 30, 2009

|

(99,293) | 229,275 | |||||||

|

June 30, 2010

|

814,220 | (108,159) | 935,336 | ||||||

Along with these additional wells, Natural Soda has installed an additional pipeline and associated pumping facilities to carry the recovered liquor to the plant at a cost of approximately $1.45 million. This pipeline will support 10H, 11H and up to an additional eight future cavities.

These activities are part of an exploration and production cavity installation program which is expected to cost approximately $9 million over time. While Natural Soda is generating sufficient free cash flow to provide for most of this expenditure, Natural Soda needed additional financing to fund the initial investment. Consequently, we raised $4,510,000 from Sentient and utilized $990,000 from our reserves to provide Natural Soda Holdings with $5,500,000 to help fund these expansion plans.

|

|

Figure 4: A general illustration of the solution mining process

|

Products & Other Potential Uses

Sodium bicarbonate is used as a component in animal feed, human food, pharmaceutical and industrial applications, especially as an environmentally benign cleaning agent. Sodium bicarbonate can also be used as an agent for flue gas desulfurization, a market that may expand in the future.

Currently, the oil shale in the Piceance Creek Basin is the subject of considerable interest as a result of the increasing recognition of the need for the United States to become more self sufficient in energy and reduce its reliance on foreign energy sources. If that interest led to investment in developing the oil shale resource, Natural Soda’s proximity to the oil shale industry may allow it to benefit from any increased demand for its water or for additional sodium bicarbonate products such as those used in cleaning the environment.

Natural Soda’s business is to produce and sell natural sodium bicarbonate, commonly known as baking soda, for use in a wide variety of products and activities. Natural Soda is a wholly-owned subsidiary of Natural Soda Holdings.

The Sodium Bicarbonate Market

According to the 2006 Chemical Economics Handbook – SRI Consulting, the United States production of sodium bicarbonate in 2005 was 580,000 metric tons. Further, the Handbook reports “Apparent U.S. consumption of sodium bicarbonate increased from 331 thousand metric tons in 1989 to an estimated 534 metric tons in 2005, representing an average annual growth rate of 3.0%. Actual consumption growth is expected to average 2.1% per year through 2010, reaching a level of 576,000 metric tons.

In addition, the Handbook reports U.S. consumption of sodium bicarbonate by end user (thousands of metric tons) in 2005. For convenience, the equivalent U.S. Short Tons is also shown:

|

End User

|

Metric Tons (‘000)

|

Equivalent U.S. Short Tons (‘000)

|

||||

|

Food

|

192 | 212 | ||||

|

Animal Feed

|

131 | 144 | ||||

|

Pharmaceuticals and Personal Care

|

56 | 62 | ||||

|

Chemicals

|

55 | 61 | ||||

|

Cleaning Products

|

50 | 55 | ||||

|

Water Treatment

|

38 | 42 | ||||

|

Blast Media

|

21 | 23 | ||||

|

Fire Extinguishers

|

9 | 10 | ||||

|

Other

|

24 | 26 | ||||

|

Total

|

576 | 635 |

The market use is dominated by the food industry (baking soda) and animal nutrition (rumen buffer), accounting for a majority of the total market. The remaining market is split between a variety of uses from pharmaceuticals, personal care (toothpaste), deodorizers, industrial uses, cleaning products, chemical, blasting media, etc. Presently, Natural Soda’s share of the animal feed and food segments is in line with its share of industry production capacity, however, it is underrepresented in the specialty segments.

The Plant

The 26,500 square foot processing plant located on one of the Wolf Ridge leases consists of a single building with crystallizers, boilers, centrifuge, dryers and other equipment capable of producing various grades of sodium bicarbonate. The plant has a name plate capacity of 125,000 tons per year. In FY2009 it produced 97,729 tons for sale and in FY2010 it produced 108,159 tons for sale as a result of drilling programs completed during the year to obtain higher levels of production by drilling more cavities and further improving the efficiency and output of the surface plant and facilities. As a consequence of the improving levels of production that now match name plate capacity; we are uncertain as to its actual capacity.

Natural Soda would like to reengineer and expand the production capacity of the plant by a significant amount. It is currently developing designs for expansion and obtaining estimates of costs to aid in this evaluation.

There are also several other buildings associated with the plant - one building of approximately 50 feet in diameter used for bulk storage with a storage capacity of 3,000 tons - and three small sheds (lube storage shed, fire pump house shed and hazardous materials shed). The plant, the bulk storage facility and one of the sheds are of metal construction; the other two sheds are of wood construction, each on concrete pads.

There is no rail transportation to the plant. Product that is to be shipped by rail is transported by truck to a rail loading facility in Rifle, Colorado that is operated by a third party. Water for operations is available from water wells on Natural Soda’s property (see Water Rights below). Electric power and gas are provided by local suppliers.

|

||

|

Figure 5: A Finished Product Sample

|

Marketing Arrangements

Natural Soda sells animal feed grade product through five independent distributors. The largest of these is Bunnett & Company of Lago Vista, Texas which represents the largest part of our animal feed sales. The principal of Bunnett & Company is Bill Bunnett, father of Brad Bunnett who is a director of both NSHI and Natural Soda and President of the Company and also Natural Soda. The majority of Natural Soda’s industrial and United States pharmaceutical (“USP”) grade products is distributed by an agent, Vitusa Products, Inc. of Berkeley Heights, New Jersey. Sales distributed through Bunnett & Company accounted for 23% of Natural Soda’s sales revenues in the fiscal year ended June 30, 2010 and sales distributed through Vitusa Products accounted for 25% of our sales revenues during the same period. A third distributor, Agri Dealers, Inc. of Louisville, Kentucky, an animal feed distributor, accounted for 10% of Natural Soda’s sales revenues during the same period. There are no other significant marketing relationships that constitute more than 10% of our sales.

Historically, the plant has shipped up to approximately 55% of its production as bulk product and the remainder as bagged product. Natural Soda packages product in various crystal sizes in 50 lb. bags, 2000 lb. “supersacks”, or in bulk and transports the product to its customers by truck or rail. Natural Soda sells most of its products throughout the United States, Canada and Mexico.

Natural Soda’s products have many uses and applications. They include sales to the animal feed, industrial, food and pharmaceutical grade markets. Sodium bicarbonate is used in baking products, personal care products including toothpaste and antacid remedies; household products including deodorizers, cleaning products, detergents, carpet cleaners, bath salts and cat litter. Sodium bicarbonate is also used in industrial situations such as leather tanning, fire extinguishers, blast media and waste water treatment.

Competitive Advantage

There are five other competitors in the sodium bicarbonate market according to the 2006 Chemical Economics Handbook – SRI Consulting. Natural Soda’s principal competitors are Church & Dwight, manufacturers of the Arm & Hammer brand; FMC Corporation and Solvay. Church & Dwight is by far the largest manufacturer in the United States and Natural Soda’s competitors have far greater financial resources than Natural Soda. Natural Soda is the only producer of sodium bicarbonate from nahcolite, the naturally occurring form of sodium bicarbonate. All other production of sodium bicarbonate utilizes trona, a mixed form of sodium bicarbonate and sodium carbonate, from Green River, Wyoming. An alternative method is to produce sodium carbonate synthetically from sodium chloride in an industrial plant. We believe that both these production methods are more expensive than the solution mining and simple re-crystallisation of sodium bicarbonate from naturally occurring nahcolite Natural Soda employs. We believe that Natural Soda is the lowest cash cost producer. Natural Soda competes on the basis of service and price.

In addition, there are significant barriers to overcome for competitors seeking to establish solution mining operations on BLM leases in the Piceance Creek Basin. The only other sodium leases issued by the BLM in the Piceance Creek Basin are the 4,956 acre Yankee Gulch lease, and the Nielsen-Juhann-Hogle lease covering 2,186 acres. The Nielsen-Juhann-Hogle lease has not been permitted and would require a public filing of a mining plan, an environmental impact study and a series of public meetings to secure extensive government approvals before it can be brought into production.

We believe that Natural Soda Holdings and Natural Soda have the largest available resource of nahcolite in the Piceance Creek Basin that is currently able to be mined.

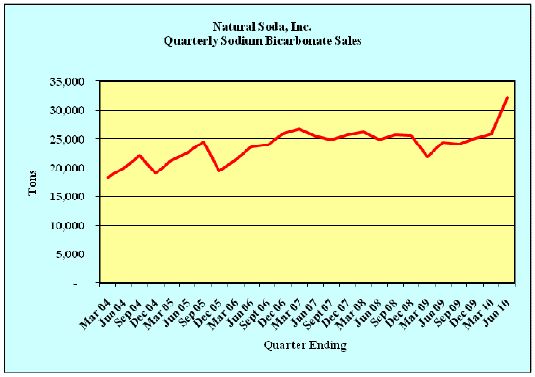

Sales and Revenue Performance

Fiscal year 2004 was the first complete fiscal year of Natural Soda’s ownership of its processing plant. Natural Soda’s annual sales in tonnages and gross revenues are shown in the following tables:

|

Fiscal

Year |

Sales (tons)

|

% Change

on prior FY |

||||||

|

2004

|

84,103 | |||||||

|

2005

|

85,038 | + 1.1 | ||||||

|

2006

|

88,910 | + 4.6 | ||||||

|

2007

|

101,970 | +14.7 | ||||||

|

2008

|

101,614 | - 0.4 | ||||||

|

2009

|

97,729 | -3.8 | ||||||

|

2010

|

107,179 | +9.7 | ||||||

|

Fiscal

Year |

Gross Revenues

($) |

% Change

on prior FY |

||||||

|

2004

|

12,609,041 | |||||||

|

2005

|

14,141,500 | + 12.2 | ||||||

|

2006

|

15,293,688 | + 8.1 | ||||||

|

2007

|

16,951,997 | + 10.8 | ||||||

|

2008

|

17,947,800 | + 5.9 | ||||||

|

2009

|

19,835,160 | + 10.5 | ||||||

|

2010

|

21,981,038 | +10.8 | ||||||

During 2010, the rate of sales increased during the later months of the year as a result of the increased production and supply capability. Natural Soda’s sales history is illustrated on a quarterly basis in the following graph.

Environmental Issues

The sodium bicarbonate production is licensed under the EPA and BLM as a zero water emission business. Natural Soda must not allow any water stream from the production process to enter the environment, except for water lost in the production cavities. All breaches must be reported.

Waste water streams are collected in two ponds where the water is evaporated and the residual salts collected for disposal by an approved method.

During our fiscal year ended June 30, 2010, Natural Soda did not allow any water stream to enter the environment and consequently no breaches were reported.

|

3.

|

Natural Soda’s Water Rights

|

General

Natural Soda owns numerous water rights in Northwestern Colorado in the Piceance Basin from the Piceance and Yellow Creeks and the Yellow River. Piceance and Yellow Creeks flow into the White River, which flows into the Green and Colorado Rivers. In addition, Natural Soda owns several well water rights and a judicially approved plan that incorporates well water rights, direct flow water rights and storage water rights into an integrated water supply system. One storage water right is diverted from the White River and is called Wolf Ridge Reservoir, and another storage water right is called Larson Reservoir, which is located at the headwaters of Piceance Creek.

The Colorado River Basin covers 244,000 square miles and provides water for 30 million people. The river has an average flow of around 14 million acre feet per year which occasionally increases to 18 million in wet years and decreases to about 12 million in dry years.

On the basis of the Colorado River Compact of 1922, the Colorado River Basin is divided into the Upper Colorado River Basin and Lower Colorado River Basin at Lee’s Ferry just below the confluence of the Paria River and the Colorado River near the Utah-Arizona border. The upper Basin and the lower Basin were each apportioned a consumptive use of 7.5 million acre feet of water annually, based on an assumption of 15 million acre feet of available water for the Colorado River. The assumption was demonstrated to be an overestimate and reduced to 12 million acre feet in a hydrologic study by the U.S. Bureau of Reclamation (CWCB 2004). In the Upper Colorado River Basin Compact of 1948, the water of the Upper Colorado River Basin was further allocated among the states of Arizona, Colorado, New Mexico, Utah, and Wyoming. Arizona has a fixed allocation of 50,000 acre feet annually. The remainder is shared by Colorado (51.75%), New Mexico (11.25%), Utah (23%), and Wyoming (14%).

By treaty, Mexico must receive 1.5 million acre feet of water annually. California has a right to a minimum of 4.4 million acre feet while the upper Basin where Natural Soda is located has an accumulated withdrawal allotment of around 3.6 million acre feet. The Central Arizona Project, a 335 mile canal and the largest water transfer system ever built, has the capacity to withdraw more than 2 million acre feet. State by State allotments are shown in the following table:

|

Water Allocation from The Colorado River System

|

||||

|

State

|

Allocation

(Acre Feet per year)

|

|||

|

California

|

4,400,000 | |||

|

Colorado

|

3,881,250 | |||

|

Arizona

|

2,800,000 | |||

|

Utah

|

1,725,000 | |||

|

Mexico

|

1,500,000 | |||

|

Wyoming

|

1,050,000 | |||

|

New Mexico

|

845,750 | |||

|

Nevada

|

300,000 | |||

| 16,502,000 | ||||

In Colorado the state requires that groundwater removed from an aquifer be augmented (i.e. replaced) from surface water sources. Thus, new groundwater pumping rights cannot be used for any length of time without an approved plan to augment the water removed from the groundwater wells.

Colorado operates under the “Prior Appropriation Doctrine” with respect to water rights. The Prior Appropriation Doctrine essentially provides that any person or entity that diverts water and applies the water to beneficial use before another person or entity has the first and prior right to divert water under the water right. The doctrine is also commonly known as the “First in Time – First in Right”. To the extent that a water right was appropriated prior to another water right, the Prior Appropriation Doctrine provides that a senior water right is entitled to be fully satisfied before the junior water right is allowed to take any water. The Colorado General Assembly requires the claimants of a water right to create documentary evidence by obtaining a decree from a court confirming the existence of the water right.

Natural Soda’s water rights were incorporated into a Decree entered by the District Court in and for Water Division No. 5 in Case No. 88CW420 on August 13, 1991 (the “Decree”). The Decree is crucial for continued operations of the sodium mining business. Natural Soda’s water rights were combined in the Decree to ensure the reliability of the water supply for mining operations. In addition, since all the water rights are under common ownership, the ability to maximize the use and value of the water rights is enhanced if the water rights could be used for any purpose associated with the mining operations or other purposes. Another factor leading to the inclusion of all the water rights in the Decree was that some of the water rights and facilities for the water rights had not been developed, and the conditional portion of the water rights could be maintained by legally integrating and attributing work on some of the water rights to other conditional water rights.

However, even though all of the water rights were integrated into the Decree, various water rights may be separated from the water supply required for mining operations. As discussed below, Natural Soda’s substitution and exchange rights and augmentation plan provide additional flexibility in how we can manage access to Natural Soda’s water rights.

|

|

Figure 6: Colorado River System

|

The Decree also includes a Water Court approved “plan for augmentation”. This is a plan that can considerably aid operational flexibility. Natural Soda’s augmentation plan includes rights under Colorado law of “substitution and exchange”. Substitution and exchange enables delivering water at one point on a stream and taking water out at another point on the stream. Water rights may be acquired to enable substitution and exchange. While this concept may not seem significant, “substitution and exchange” can save millions of dollars in dam and pipeline construction costs and pumping costs to a prospective purchaser who might otherwise have to bring water from a much greater distance than does Natural Soda.

For example, under the Decree, Natural Soda may deliver fully consumable agricultural water rights to Piceance Creek at its headwaters, and “substitute and exchange” this water depleted from Piceance Creek by the operation of its wells at the plant site. Natural Soda thereby avoids the necessity to pipe water from the headwaters of Piceance Creek to its operations. Further, because Piceance Creek is such a dry stream, the substitution and exchange ability is limited and at a premium. While someone else may acquire the right to operate a substitution and exchange on the two streams, that use would be subordinate to Natural Soda’s own substitution and exchange rights.

Under current operations, the water supply for the mining operations is provided by a single well owned by Natural Soda. The pumping of water from the well causes depletions to Piceance Creek and Yellow Creek. Colorado law requires that depletions to Piceance Creek and Yellow Creek must be replaced with other water from the same drainage system. The Decree provides that senior water rights on Piceance Creek are used to replace the depletions to Piceance Creek and part of the depletions to Yellow Creek. Hence in order to protect mining operations, it is necessary to maintain ownership of well water rights to supply mining operations and senior water rights to replace the depletions caused to Piceance Creek and Yellow Creek. Natural Soda has several different sources of water to replace the depletions to the streams. Currently, Natural Soda’s water requirements for its sodium operations are approximately 130 acre feet of water per year, which is currently withdrawn through the single well. The withdrawal of the approximately 130 acre feet of water per year results in a depletion to the Piceance Creek and Yellow Creek stream systems of less than two and one-half acre feet of water per year, which is replaced by Natural Soda’s senior surface water rights and storage water rights.

Some of the water rights owned by Natural Soda are conditional rights and are subject to a requirement to demonstrate reasonable diligence. Every six years Natural Soda must file an application to support its claim. . In March 2010, the District Court in and for Water Division No. 5 State of Colorado, a decree was entered finding that Natural Soda had exercised reasonable diligence in the development of the exchange water rights that were decree in Case No. 88CW420, and in April 2010, the same court entered decrees finding that Natural Soda had exercised reasonable diligence in the development of the Wolf Ridge Pumping Pipeline water right, the Wolf Ridge Reservoir water right, and five well water rights. As of June 30, 2010, Natural Soda has eight cases pending in the District Court in and for Water Division No. 6 State of Colorado for determination of reasonable diligence in the development of well water rights. In addition, Natural Soda has an application pending in the District Court in and for Water Division No. 5 State of Colorado for determination of an additional storage water right.

There are other factors independent of the Decree that enhance the value of Natural Soda’s water rights. First, no other large capacity plan for augmentation has been approved by the Water Court within the Piceance Creek Basin thereby providing Natural Soda a significant competitive advantage in the water supply available to its activities. There is also a value associated with having the augmentation plan approved and Natural Soda’s Decree completed. Litigation is always an uncertain venture, and any new augmentation plan application that is filed will be scrutinized by all the other water rights owners in the Piceance Creek and Yellow Creek drainages, including the major oil companies that have a presence in these Basins. Potential users of Natural Soda’s water rights may find that constructing a pipeline for delivery of water may be more reliable and cheaper than obtaining a judicially approved plan for augmentation.

Based on the judicial decrees that have been entered with respect to Natural Soda’s water rights, the total potential volume of the water rights exceeds more than 100,000 acre feet per year. We believe that these water rights can generate a future revenue stream and have increasing value, especially as any prospective development of the oil shale resources of the Piceance Creek Basin may require very large volumes of water. It is our objective to develop and further utilize the water rights Natural Soda owns.

Agreement with Shell Frontier Oil & Gas, Inc.

Natural Soda entered into a contract on January 29, 2007 with Shell, effective January 1, 2007, to sell up to 120 acre feet of water per year at a price equal to $8,146 per acre foot. Shell has been awarded three 160 acre oil shale research, design and development leases by the Bureau of Land Management contiguous with Natural Soda’s sodium leases. If Shell purchases any water, it will remove the water using water transport trucks or by constructing a pipeline at its own expense.

Natural Soda will provide water to Shell from one of its existing water wells. The water will be recovered from the geologic formation commonly known as the “A Groove” and the quality of the water shall be “as is” upon withdrawal from the geologic formation without any treatment by Natural Soda. The initial term of the agreement is five years and renewable thereafter with the purchase price adjusted according to a formula based on movement in the consumer price index. A condition of the agreement is that Natural Soda may sell water to other users provided that such delivery is subordinate to the delivery of water to Shell. Shell did not purchase any water during the year ended June 30, 2010.

The agreement will be extended automatically for successive periods of five years although Shell may elect to terminate the agreement by providing written notice prior to the end of the initial term or each subsequent renewal date. Similarly, Natural Soda can terminate the agreement by providing written notice on the same basis. In addition, the agreement terminates if Natural Soda ceases to have an interest in the sodium leases. See Item 3 “Legal Proceedings” for additional information.

Appraisals

While water rights are assets routinely bought and sold in the State of Colorado, the current value of Natural Soda's water rights is unknown.

A significant portion of the value of the Natural Soda water rights is associated with the supply of water to the sodium bicarbonate mining operations. As discussed above, the Natural Soda water rights may also be developed and used for other purposes. Such additional development and use will require permits and judicial proceedings regarding the water rights. Litigation is an uncertain venture and other entities may assert that the use of the Natural Soda water rights should be limited or restricted.

Identification of Water Rights

Our water rights can be categorized and summarized as follows:

|

Water Flow Rights

|

Location

|

Flow Rate

(CFS)

|

Flow Rate

(acre ft/yr)

|

Percent of

Annual Flow

|

||||||

|

Direct pumping

|

13 wells on site

|

45.0 | 32,579 | 30% | ||||||

|

Direct Flow rights

|

Piceance Creek

|

5.3 | 3,837 | 3% | ||||||

|

River pumping

|

White River

|

100.0 | 72,397 | 67% | ||||||

|

Total flow

|

150.3 | 108,813 | 100% |

|

Water Storage

Right

|

Location

|

Volume

(acre feet)

|

Percent of

Storage

|

||||

|

Wolf Ridge Reservoir

|

White River

|

7,380 | 92% | ||||

|

Larson Reservoir

|

Piceance Creek headwaters

|

600 | 8% | ||||

|

Total flow

|

7,980 | 100% |

The projections of the flow rates for the water rights are predicated on the decrees that have been entered with respect to the water rights. Further judicial proceedings may modify the flow rates.

Direct Pumping Rights - Well Water

Natural Soda owns thirteen well water rights located adjacent to the sodium bicarbonate process plant as described in the Decree. These rights have priority dates from the 1970s so they are very “junior” water rights. Under Colorado law, the Well Water Rights cannot divert water without having a plan of augmentation approved by the Water Court. Natural Soda’s Decree includes a plan for augmentation authorizing, among other things, wells that have a hydraulic connection to the surface stream to pump water, provided that depletions to the surface stream caused by well pumping are augmented (i.e. replaced) with other water supplies. As discussed above, the Well Water Rights are included within the Decree.

Senior Direct Flow Water Rights in the Piceance Creek Basin

Natural Soda owns the following senior direct flow water rights:

|

Name

|

Appropriation Date

|

Decree Date

|

Flow Rate (CFS)

|

||

|

Morgan Ditch No. 1

|

April 15, 1883

|

April 28, 1890

|

1.00 | ||

|

Enlargement and Extension of Morgan Ditch No. 1

|

September 27, 1886

|

April 28, 1890

|

0.40 | ||

|

Morgan No. 2 Ditch

|

September 27, 1886

|

April 28, 1890

|

0.40 | ||

|

Home Supply Ditch

|

September 19, 1886

|

May 10, 1889

|

1.00 | ||

|

Larson Ditch

|

September 17, 1886

|

May 10, 1889

|

2.50 |

The direct flow water rights located adjacent to the Larson Reservoir on the upper reaches of Piceance Creek are among the most senior water rights in the Piceance Creek Basin. They were originally decreed for agricultural irrigation however the Water Court in its Decree changed the direct flow water rights for numerous purposes including commercial and industrial purposes. In addition, the Water Court imposed certain terms and conditions on the use of the water, including annual volumetric limitations on the use of the water rights. The average annual amount of water that may be diverted and consumed pursuant to the direct flow rights is approximately 234 acre feet.

Wolf Ridge Reservoir and Feed Pipeline Water Rights to the White River

The Wolf Ridge Reservoir and Wolf Ridge Feeder Pipeline water rights (“Wolf Ridge Water Rights”) were decreed in the 1970s. However, unlike the Well Water Rights that divert water from the aquifer tributary to Piceance Creek, the Wolf Ridge Water Rights are decreed for diversion of water primarily from the White River approximately 12 miles from the current sodium bicarbonate production operations. Piceance Creek has lower flows in the summer, but the White River is a much larger stream. Hence a 1970s water right diverting out of the White River is anticipated to have water available for diversion on a yearly basis. As discussed above, the Wolf Ridge Water Rights originally contemplated construction of a reservoir originally intended to be adjacent to the current sodium bicarbonate processing facility to contain a maximum of 7,379.70 acre feet. This reservoir could be fed by the Wolf Ridge feeder Pipeline at the rate of 100 CFS. (44,800 gallons per minute) and Natural Soda asserts that the total amount of water that could be delivered would be approximately 72,396 acre feet per year.

Larson Reservoir and Larson Reservoir Enlargement Water Rights

The Larson Reservoir located on the upper reaches of the Piceance Creek was originally decreed for 62 acre feet of water storage rights with an appropriation date of July 20, 1888 and a decree date of May 10, 1889. Hence it is a very “senior” water right. The Water Court Decree changed the uses of the Larson Reservoir Right to include industrial and commercial uses and allows the consumption of approximately 39 acre feet of fully consumable water per year.

The Decree also approved an additional water right referred to as the Larson Reservoir Enlargement Water Right. It has an appropriation date of April 5, 1988 and may store up to 600 acre feet of water, with the right to refill the Larson Reservoir with 600 acre feet of water per year. This has not been constructed but could be constructed on land entirely owned by Natural Soda. The Larson Reservoir Enlargement Water Right could only divert water during the early spring runoff period. Natural Soda intends to evaluate the possibility of reconstructing and enlarging the reservoir to provide for a greater storage capacity.

|

Oil Shale Potential

|

The Energy Policy Act of 2005 directed the Task Force on Strategic Unconventional Fuels to make recommendations and develop an integrated program to coordinate and accelerate the development of fuels from domestic unconventional fuels resources. The Task Force found in February, 2007:

“Global and domestic demand for crude oil and refined products continues to expand, driven by rapid economic growth in developing economies and domestic consumer habits. At the same time, finding and producing oil reserves to meet rising demand is increasingly difficult and costly. Companies are failing to replace produced reserves, shrinking the world’s conventional oil reserves base. Excess production capacity is also shrinking, reducing the ability to supply disruptions, increasing price volatility, and driving up prices. Domestic crude oil production is declining as demand rises, increasing our dependence on imports of oil and refined products……….Increasingly, oil and refined products must be imported from nations unfriendly to the United States or threatened by political instability, reducing the security and reliability of supplies critical to our economy, our military, and our national security.” (Page ES-1). “Oil shale is extremely well suited for producing premium quality refinery feedstocks for diesel and jet fuels. The manufacturing processes can also yield significant quantities of value-added chemical by-products…….America’s commercial quality oil shale resources exceed 2 trillion barrels, including about 1.5 trillion barrels of oil equivalent in high quality shales concentrated in the Green River Formation in Colorado, Utah and Wyoming.” (Page I-16).

The Cole report described on Page 5 of this Annual Report, states “Shale-Oil resources for the Saline zone under the lease are between 12 and 14 billion barrels.” The Saline zone sits under one of Natural Soda’s sodium bicarbonate leases from the BLM. We have not conducted any additional studies on oil shale on this specific lease nor the Rock School lease or the other Wolf Ridge leases.

In 2006, the BLM issued five oil shale research leases adjacent to Natural Soda’s sodium bicarbonate operations in accordance with its regulations at that time. Three of these leases were issued to Shell, as mentioned above. We believe that the US Government will evaluate the results achieved by existing holders of these research leases before any commercial leases will be issued.

We currently do not have the right to evaluate or extract oil shale and the Department of Interior does not have any current rules for applying for a lease to evaluate or extract oil shale, even on a research basis. In December, 2009, Natural Soda Holdings filed a Nomination for an Oil Shale Research, Development and Demonstration (R, D, and D) Lease, under the provisions of the “Notice of Potential for Oil Shale Development: Call for Nominations— Oil Shale Research, Development and Demonstration Program,” as detailed in the United States Government, Federal Register Vol. 74, No. 211, on Tuesday, November 3, 2009, Notices, Page 56867. At this time, we do not know whether an R, D and D Lease will be issued to Natural Soda Holdings or, if an R, D and D Lease is issued, whether production of oil shale will be economically viable.

EMPLOYEES

The Company’s day to-day business activities are managed by Bill H. Gunn, Chairman and CEO; Bradley F. Bunnett, President and COO; and Robert van Mourik, Chief Financial Officer, Secretary and Treasurer.

Natural Soda has 39 employees in production, sales & marketing, financial, environmental compliance and human resources roles.

|

RISK FACTORS

|

We have large accumulated losses, we may not maintain profitability and we require additional capital to expand our operations.

We have incurred substantial losses and used substantial cash to support our activities through the development stage, complete our acquisition of the assets, refurbish Natural Soda’s plant, expand Natural Soda’s cavities and our restructuring while sustaining our activities to date. Our accumulated losses were approximately $112 million at June 30, 2010. While our business was profitable in fiscal year 2010 we must continue to operate profitably or else ultimately we cannot remain in business.

We rely on key employees in Natural Resources and its subsidiaries to manage its operations and may have difficulty replacing them if they were to leave our employ.

We conduct our operations with a relatively small management team so the loss of an employee through an extended illness or resignation could adversely impact our capacity to successfully fulfill our obligations and thereby impact our sales, margins and operating profitability.

Natural Soda’s pricing of its products is determined in a competitive environment in which it is not generally able to lead prices.

Our industry is dominated by Church & Dwight, a long time manufacturer of the Arm & Hammer brand of baking soda and related products. Natural Soda’s major competitors also include FMC and Solvay, major corporations with considerable resources, marketing expertise and broader access to customers than we do. Consequently, if there is a price war with the major companies that dominate the industry Natural Soda’s margins and profitability may be threatened. In addition, Natural Soda’s business has high fixed costs. From time to time, Natural Soda may need to reduce prices for some of its products to respond to competitive and customer pressures and to maintain market share. Consequently, Natural Soda’s operating results may suffer.

The loss of any of Natural Soda’s principal customers could significantly lower its sales and profitability.

Natural Soda primarily sells its animal feed grade product through customers who act as distributors. The largest of these in tonnages and revenues is Bunnett & Company who account for the majority of Natural Soda’s animal feed sales. In addition, Natural Soda sells most of its higher grade products through Vitusa Products, Inc. of Berkeley Heights, New Jersey. Another customer, Agri Dealers, Inc., represented nearly 10% of Natural Soda’s sales and together these three constituted approximately 56% of Natural Soda’s sales through June 30, 2010 and about 63% of Natural Soda’s accounts receivable at June 30, 2010. Consequently, there is also a concentration of credit risk associated with the continuing successful performance of these customers. The loss of all or part of their business could be injurious to Natural Soda’s sales, margins and profitability.

Natural Soda may not be able to continue to recover sodium bicarbonate economically or at all from the cavities if there are failures in the underground operations.

Natural Soda recovers its sodium bicarbonate from cavities that are about 1,900 feet underground and does so by pumping hot water through a pipe into the cavity and then recovering the pregnant liquor through a recovery pipe that is about 8 inches in diameter. If portions of an underground cavity collapse or if there are blockages in the wells, Natural Soda’s ability to recover pregnant liquor can be severely affected. It is possible a well may become unusable so that Natural Soda would have to drill new a new cavity and associated injection and recovery wells at considerable expense and delays to its production. As continuity of production requires having operational cavities and as it can take some months to drill new cavities and bring them into production, failure of existing cavities can severely jeopardize Natural Soda’s production capability.

Natural Soda’s resource of naturally occurring sodium bicarbonate has a zone that contains some sodium chloride. The presence of too much sodium chloride in the pregnant liquor adversely impacts plant productivity and potentially may cause a reduction in the amount of sodium bicarbonate that might be recovered from a cavity.

This is a high fixed cost business and if there are underground production problems or if Natural Soda is unable to sell sufficient tonnages, the relatively high fixed operating costs applied to a low volume of sales may cause the operation to not be viable.

Increasing gas, power and fuel costs could erode Natural Soda’s profit margins and harm operating results.

Energy costs and transport costs represent a major component of Natural Soda’s cost structure. Because of our remote location, we are dependent on limited means of transportation to bring our products to market. It may be difficult to pass on increased costs to its customers so that Natural Soda’s profitability may be adversely impacted. This could harm Natural Soda’s financial condition and operating results.

Natural Soda’s operations are subject to a significant amount of regulatory scrutiny and regulation from federal and state authorities.

Natural Soda’s mining and processing operations operate under permits from several state and federal authorities, including the Environmental Protection Agency, the Bureau of Land Management, and the Colorado Division of Minerals and Geology. Failure to comply with government conditions and permitting requirements may cause these permits to be revoked with material and adverse effects on Natural Soda, Natural Soda Holdings and Natural Resources. If Natural Soda loses its permits, Natural Soda may have to cease operations while it seeks their renewal. If Natural Soda cannot renew its permits, it will be out of business. Natural Soda also requires BLM approval in accordance with Natural Soda’s approved mine plan to establish new cavities. If this approval is denied, then Natural Soda will lose its ability to recover sodium bicarbonate from the lease. In addition, regulatory authorities may suddenly impose additional compliance obligations which may cause closure of the plant if not met or may refuse to renew leases.

Natural Soda’s and Natural Soda Holdings’ sodium leases are due for renewal on June 30, 2011 and there is no assurance the BLM will renew any or all of the leases.

The sodium leases contain terms with which Natural Soda and Natural Soda Holdings must comply and the renewal of those leases is subject to the discretion of the Department of Interior, Bureau of Land Management. There is a risk the BLM will not renew the Rock School Lease. The loss of any of these leases could be injurious to Natural Soda’s or Natural Soda Holdings’ business and diminish shareholder value.

The oil shale industry has attempted to exploit oil shale commercially in the past and has been unable to do so in an economically feasible manner. Even if Natural Soda Holdings and/or Natural Soda obtain a research/commercial oil shale lease, the technology may not exist during the term of the lease to exploit oil shale in an economically feasible manner. If Natural Soda Holdings and Natural Soda are unable to exploit their potential oil shale leases the value of their assets would be materially and adversely affected.

In the past, the oil industry has attempted to exploit oil shale to produce commercial quantities of oil. Each time the industry has failed to develop technology that would allow it to produce commercial quantities of oil in an economically feasible manner.

Recently, large volatility in the price of oil has led the oil industry to rethink the economic feasibility for producing oil from oil shale. However, it is still uncertain whether production of oil from oil shale is economically viable even with significant increases in oil prices. It is also unclear whether new technologies would significantly decrease the cost of recovering oil from oil shale.

If Natural Soda Holdings or Natural Soda are unable to cost effectively exploit oil from oil shale, the value of any potential business opportunity or oil shale leases they may be able to obtain would be materially and adversely affected.

The current technology for production of oil from oil shale may require a significant amount of water.

The value of Natural Soda’s water rights is partly dependent on the development of commercial production of oil from oil shale on or near its properties. If such commercial oil shale market does not develop, the possible value of its water right assets may be materially and adversely affected. In addition, litigation regarding the water rights owned by Natural Soda may affect the ability of Natural Soda to fully develop all or a portion of the Natural Soda water rights.

Pursuant to our restructuring agreement with Sentient, Sentient has the option until October 31, 2011 to purchase and additional 5,500,000 shares of the Company’s common stock at $.36 per share to pay for AmerAlia indebtedness that was outstanding as of October 31, 2008. If Sentient exercises this option, the Company’s shareholders will have their ownership interest diluted.

In our restructuring transaction completed in October 2008, we were not able to repay all indebtedness of AmerAlia and Natural Soda Holdings owed to third parties. There are also potentially claims that we are unaware of currently. If any third party brings a claim prior to October 31, 2011 for amounts owed by the Company or Natural Soda Holdings prior to October 31, 2008, Sentient may exercise its option to purchase up to 5,500,000 shares at a purchase price of $.36 to provide the Company with the funds to pay such claim. If Sentient exercises this option, the percentage ownership of the Company held by its existing shareholders will be reduced.

Sentient owns more than 90% of our shares and can take complete control of the company.

Sentient currently owns nearly 95% of the issued and outstanding Common Shares. Accordingly, Sentient could unilaterally cause a “short form” merger, in which Utah law allows Sentient to force such a transaction without approval of non-Sentient shareholders. In a “short form” merger, a 90%-plus corporate shareholder forces out the remaining issued and outstanding shares for cash by operation of law, resulting in non-Sentient shareholders losing the potential future value of their Common Shares, if any. The cash-out value is set by the Directors but, pursuant to the Articles of Incorporation and Bylaws, Sentient would have the ability to control the composition of the Board through its stock ownership. Therefore, Sentient could not only force out the non-Sentient shareholders, but it could also effectively and unilaterally set the per share cash price received by each shareholder in such a transaction. If this occurs, the only recourse for shareholders will be to exercise dissenters’ rights pursuant to Utah law.

In addition, Sentient can approve any shareholder action or block any shareholder action that it does not approve. Further, Sentient could replace our independent directors and nominate its representatives to the board of directors. This control could discourage others from initiating potential merger, takeover or other change of control transactions that may otherwise be beneficial to our business or holders of our common stock. In addition, the control that Sentient may exert over us, either directly or indirectly, could give rise to conflicts of interest issues.

The magnitude of the Sentient shareholding limits the size of the public float and the depth of the market for the buying and selling of our shares.

The number of shares of our company that are not owned by Sentient or other insiders is a small proportion of the total number of shares outstanding. Hence, our public float is small and our shares are thinly traded with prices volatile. If a large shareholder sought to sell shares through the market it could easily depress the market value of the shares.

We are currently engaged in litigation defending our water rights and our efforts to utilize our water rights could provoke further litigation.

We have water rights which represent a significant asset to us. Our water rights are based on a complex body of law. We are currently engaged in litigation defending our water rights and our efforts to utilize our water rights could provoke further litigation. If we are unsuccessful in defending our water rights, we could lose the rights to significant and valuable assets. In addition, if we lose our water rights we might have to pay a third party for the water necessary to run our operations, which would increase our expenses and could make our operations unprofitable.

Engaging in litigation is potentially an expensive undertaking with uncertain outcomes.

If we cease to be a “smaller reporting company” in future financial years, we will be required to obtain an auditor’s attestation on the effectiveness of our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002. Any adverse results from such attestation could result in a loss of investor confidence in our financial reports and have an adverse effect on the price of our Common Shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we have furnished a report by management on our internal control over financial reporting. Such report contains, among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective.

In future years, if we cease to be a “smaller reporting company” under the Securities and Exchange Act of 1934 we will be required to have our auditor provide an attestation report. If during the evaluation and testing process by our auditor, the auditor may identify one or more material weaknesses in our internal control over financial reporting, and then the auditor will be unable to attest that such internal control is effective. If our auditor is unable to attest that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on our common share price.

We will need to raise additional capital through the sale of our securities, resulting in dilution to the existing shareholders, and if such funding is not available, our operations would be adversely effected.

We do not have sufficient financial resources to undertake by ourselves all of our planned development programs. We have limited financial resources and have financed our operations primarily through investment from our majority shareholder. We will need to continue our reliance on the sale of our securities for future financing, resulting in potential dilution to existing shareholders. If adequate financing is not available, we may not be able to commence or continue with our development programs.

|

UNRESOLVED STAFF COMMENTS

|

We have held discussions with the SEC regarding Investment Company Act compliance and now that we own 100% of Natural Soda Holdings and Natural Soda we believe we are not required to register under the Investment Company Act.

|

PROPERTIES

|

Natural Resources’ only interests in property are through Natural Soda Holdings and Natural Soda.

Natural Soda is a lessee of United States Sodium Mineral Leases C-0118326, C-37474, C-0118327 and C-0119986 covering 8,223 acres and NSHI is a lessee of United States Sodium Lease No. C-0119985 covering 1,320 acres, all in Rio Blanco County, Colorado, USA. These are described more fully in Item 1. - "Business", above.

Natural Soda’s plant consists of a single building with boilers, centrifuge, and other equipment capable of producing various grades of sodium bicarbonate at approximately 100,000 tons per year. There are also several other buildings associated with the plant which are used for bulk storage (one building of approximately 50 feet in diameter with a storage capacity of 3,000 tons) and three small sheds (lube storage shed, fire pump house shed, and hazardous materials shed). The plant, the bulk storage facility and one of the sheds are of metal construction and the other two sheds are of wood construction, each on concrete pads. In management’s opinion, the plant facilities are adequately insured.

Natural Soda has real property owned in fee simple that is used for the existing water storage reservoir of about 35.8 acres, about 25 miles east of the plant. Natural Soda also leases a 21,517 square-foot warehouse in Rifle, Colorado, from an unaffiliated landlord.

|

LEGAL PROCEEDINGS

|

Natural Resources is not subject to any legal proceeding.

As discussed above, Natural Soda owns water rights located in the Piceance Creek, Yellow Creek and White River Basins within Colorado. Natural Soda is involved in several cases pending in the District Court in and for Water Division No. 5 and District Court in and for Water Division No. 6, State of Colorado (collectively referred to as “Water Court”). The proceedings in Water Court pertain to applications for water rights filed by Natural Soda and objections to water rights applications by third parties. In addition, under Colorado law, the owner of conditional water rights must periodically file an application for determination of reasonable diligence in the development of the conditional water rights. The proceedings pertaining to the conditional water right must be filed within six years following the determination by the Court regarding the prior proceeding, or the water right is considered abandoned.

As of June 30, 2010, Natural Soda is the applicant in the following cases pending in the Water Court:

|

|

·

|

Water Division No. 5: Case No. 1998CW315,

|

|

|

·

|

Water Division No. 6: Case Nos. 2010CW10, 2010CW11, 2010CW12, 2010CW13, 2010CW14, 2010CW32, 2010CW33 and 2010CW34.

|

As of June 30, 2010, Natural Soda has filed a statement of opposition in the following cases pending in Water Division No. 5; Case Numbers:

|

|

·

|

2003CW82–Exxon Mobile Corporation,

|

|

|

·

|

2003CW309–Encana Oil & Gas (USA), Inc.,

|

|

|

·

|

2003CW318–Encana Oil & Gas (USA), Inc.,

|

|

|

·

|

2004CW110–Shell Frontier Oil & Gas, Inc.,

|

|

|

·

|

2005CW285–Exxon Mobile Corporation,

|

|

|

·

|

2005CW294–Exxon Mobile Corporation,

|

|

|

·

|

2006CW263–Exxon Mobile Corporation,

|

|

|

·

|

2006CW265–Exxon Mobile Corporation,

|

|

|

·

|

2007CW242–Puckett Land Company,

|

|

|

·

|

2007CW253–XTO Energy Inc.,

|

|

|

·

|

2007CW254–Williams Production RMT Company,

|

|

|

·

|

2008CW182 - EnCana Oil and Gas (USA), Inc. and

|

|

|

·

|

2008CW199 – Exxon, 2008CW203 - Exxon.

|

Of the cases in which Natural Soda has filed a statement of opposition, the principal one is the objection to Shell Frontier Oil & Gas, Inc.’s application to move a water right from a tributary of the White River to a point on the White River lower down river than the off take point for Natural Soda’s White River direct pumping right. If Shell were to be successful in their application, it might adversely impact the value of our White River water rights. We intend to vigorously oppose this move.

|

ITEM 4.

|

[Removed and Reserved]

|

PART II

|

ITEM 5.

|

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information.

Our common stock is publicly traded under the symbol “AALA”. Since August 20, 2002, AmerAlia was listed on the OTC Bulletin Board until its shares were transferred to the over the counter market in late 2005. On May 18, 2009, AmerAlia regained its listing on the Bulletin Board. The highest, lowest and average closing prices for the Company's common stock as provided by an online service for the past two fiscal years up to June 30, 2010 are provided in the table below. These prices reflect inter-dealer prices and do not include allowance for retail mark-up or mark-down, commissions or other transaction costs.

|

For the Quarter Ended

|

Highest Price

For the Quarter ($) |

Lowest Price

For the Quarter ($) |

Average Reported

Last Sale Price ($) |

|||||||||

|

September 30, 2008

|

1.00 | 0.60 | 0.73 | |||||||||

|

December 31, 2008

|

0.87 | 0.30 | 0.57 | |||||||||