Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Edgen Murray II, L.P. | d8k.htm |

*

*

*

Exhibit 99.1

************

*

*

*

*

* |

1

This

presentation

is

based

on

management’s

current

beliefs

and

assumptions,

which

in

turn

are

based

on

currently

available

information.

We

remind

you

that

there

are

risks

and

other

uncertainties

that

could

impact

our

future

operating

results

and

financial

condition

and

cause

our

actual

results

to

materially

differ

from

any

forward-looking

statements.

Our

SEC

filings

contain

information

on

risk

factors,

uncertainties

and

assumptions

that

could

cause

actual

results

to

differ

materially

from

our

current

expectations.

Special Notice Regarding Forward-Looking Statements |

2

Introductions-Today’s Presenters

Dan O’Leary –

President and CEO

David Laxton –

Executive Vice President and

CFO |

3

Business Overview

*

*

* |

4

Edgen

Murray Overview

Industrial

Distributor:

Specialty

steel

products

for

the

oil

and

gas,

power,

process,

petrochemical,

and

civil

construction

markets

25+

Year

Track

Record:

Formed

through

the

merger

of

Edgen

Corporation

and

U.K.

based

Murray

International

Metals

in

2005

Founded

in

1983,

Edgen

Corporation

was

a

supplier

of

premium

carbon

and

alloy

steel

products

in

the

Western

Hemisphere

Founded

in

1976,

Murray

International

Metals

provided

premium

steel

products

to

clients

in

Europe,

Middle

East

and

Asia

Global

Operations:

Managed

through

two

segments

Western

Hemisphere

(Americas)

and

Eastern

Hemisphere

(Europe/West

Africa,

Asia/Pacific,

and

the

Middle

East)

Over

14,000

SKU’s:

Including

highly-engineered

prime

carbon

or

alloy

steel

pipe,

pipe

components,

valves

and

high-grade

structural

sections

and

plate

Over

2,000

Customers

in

50

Countries:

Oil

and

gas:

upstream

(exploration

and

production),

midstream

(gathering,

pipeline

and

storage)

and

downstream

(refineries

and

processing)

Petrochemical

and

power

(hydrocarbon,

nuclear

and

renewable)

Other:

engineering,

procurement,

construction

and

civil

Diversified

Revenue

Base:

Both

project

and

MRO

revenues

MRO

orders

typically

account

for

30%

to

50%

of

our

sales

World

Class

Facilities

and

Technology

Platform

All

of

our

locations

are

either

certified

to

ISO

9001:2000

or

ISO

9001:2008

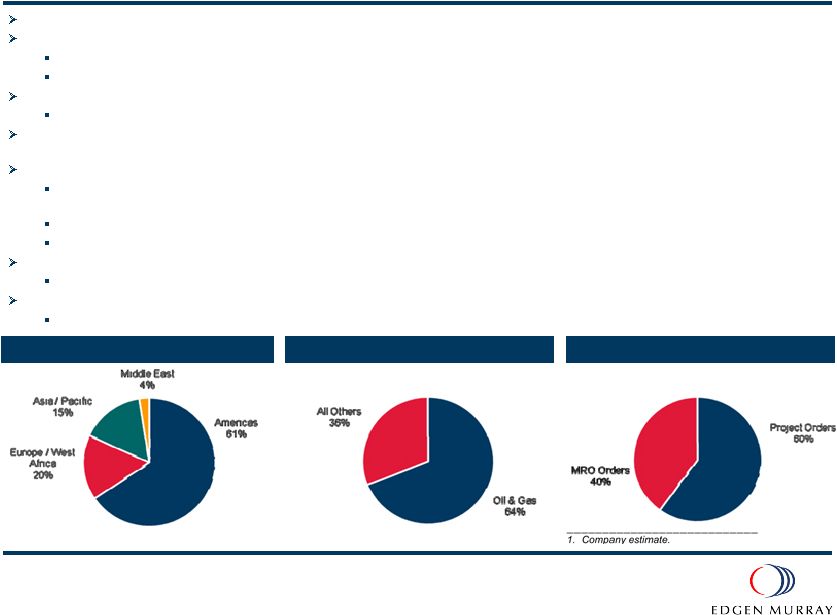

1H2010 Sales by End Market

1H2010 Sales by Segment

1H2010 Sales by Order Type

(1) |

5

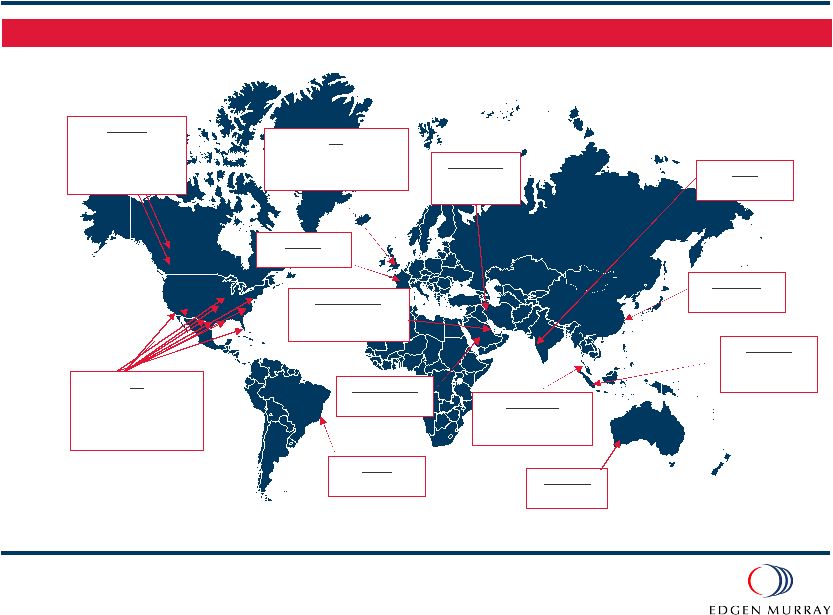

Global Distribution Network

Edgen Murray’s solution-driven approach meets customers’

needs on a global basis

UK

3 Sales Offices

2 Distribution Centers

(in 4 locations)

Azerbaijan

Stocking

Facility

Dubai, U.A.E.

Office /

Distribution Center

Singapore

Office /

Distribution Center

Australia

Sales Office

US

Corp. Headquarters

12 Sales Offices

13 Distribution Centers

(in 15 locations)

Canada

2 Sales Offices

2 Distribution

Centers (in 3

locations)

Saudi Arabia

Sales Office

Shanghai

Sales Office

Malaysia

Sales Office

India

Sales Office

Brazil

Sales Office

France

Sales Office |

6

End Market Exposure

Offshore rigs

Production facilities

Compression

Gathering

Processing

LNG

Transmission

Storage

Gas Distribution

Refining

Petrochemical

Mining

Upstream

Midstream

Downstream /

Process

Other

Infrastructure

Power Generation

Fossil

Nuclear

Renewables

Civil Infrastructure |

7

Specialized Product Portfolio

Edgen Murray is a single source for specialty carbon and alloy pipe, plate,

components, sections, and valves

Plate

Sections

Seamless Pipe

Welded Pipe

Full range

Carbon & Alloy

Fittings

Flanges

Full range of

thicknesses & process

treatments

Universal Beam / Column

Parallel Flange Channels

Rolled Steel Angle

Flat / Round / Square Bar

Hollow Sections

Full range of diameters and

gauges

Full range of diameters and

gauges

Valves

Specialty range including

ball, check, plug, butterfly

and needle

Components |

8

Unique Distribution Model

High volume network

End-to-end inventory management

Vendors

Value-Add

Customers

Value-Add

Edgen Murray creates substantial value for both vendors and customers

Provide global market

access

Sales and marketing

support for specialty

products

Consistent, high-

volume purchaser of

specialty products

Reduced investment in

working capital

Customer risk

management

Broad product

catalogue

Volume purchasing

power

Capable of supplying

large volume projects

and MRO requirements

Ability to provide global

logistical support and

procurement services

Sales force offers

technical expertise and

consultation |

9

Diversified, Global, Blue-Chip

Customer Base

Over 20 customers in 50 countries

Longstanding relationships

FY 2009 Top ten customers account for

26% of consolidated sales; six months

ended June 2010: 32%

Recognized leaders in their respective

industries

Large and well capitalized

Customers are driving spending

decisions

Customers participate in energy,

industrial and civil sectors

Strong mix of MRO and project orders

Selected Customers

Major /

National Oils

Engineering/

Construction

Power

Generation

Midstream

Refining/Petro

Mining |

10

Long-Term MRO Relationships…

MRO relationships provide increased base level performance during the

business cycle troughs

Diversity and depth of inventory along with strategic location of distribution

facilities enable us to meet customer demand for expedited delivery

Supply agreements with customers create predictable demand for certain

products at normal margins while allowing for profit opportunities on

ancillary products and services

Integrated computer systems allow for high volume order turns, accurate

order fulfillment and on-time performance

1H2010 MRO sales accounted for approximately 40% of our sales

|

11

…With Global Project Experience

We believe we are a critical supplier to clients operating in remote, challenging

regions Projects led by large, creditworthy sponsors

Complex projects in terms of size, scale and logistics

Provides significant potential for recurring revenue stream through MRO

opportunities Shell and Qatar Petroleum Pearl

GTL

Kinder Morgan Mid-Continent

Express

Motiva Crude Expansion

Intercostal Harvey Canal

Hurricane Protection

Ras Gas Barzan

Enbridge Southern Lights

Conoco Phillips Wood River

Expansion

Gulf Intercostal Waterway

Agip KCO (ENI subsidiary)

Kashagan Field

Enbridge Alberta Clipper

Dow Hemlock Expansion

Koniambo Nickel Project

Total Usan Field

Energy Transfer Tiger,

Haynesville and Fayetteville

Express Pipelines

Exxon Baytown Cat Feed

Expansion

Alcan Grove Alumina Project

Sakhalin Energy Investment

Company Sakhalin II

Bechtel Transcanada Pipeline

PDVSA Refining, Morichal and

Punta de Mata

Olmsted Lock and Dam

Woodside Pluto Field

Southern Union Florida Gas

Phase 8

Origin Energy New Zealand Kupe

Gas Plant

Nooter/Eriksen HRSG

Chevron Platong Gas 2

EXCO Barnett Shale

Shell Argentina Proyecto

Reactivacion Del Coker

Prairie State Energy Campus

Shell Peregrino

Regency Gas Barnett Shale

ANCAP Argentina Expansion

Southwestern Electric Combined

Cycle Plant

Selected Projects |

12

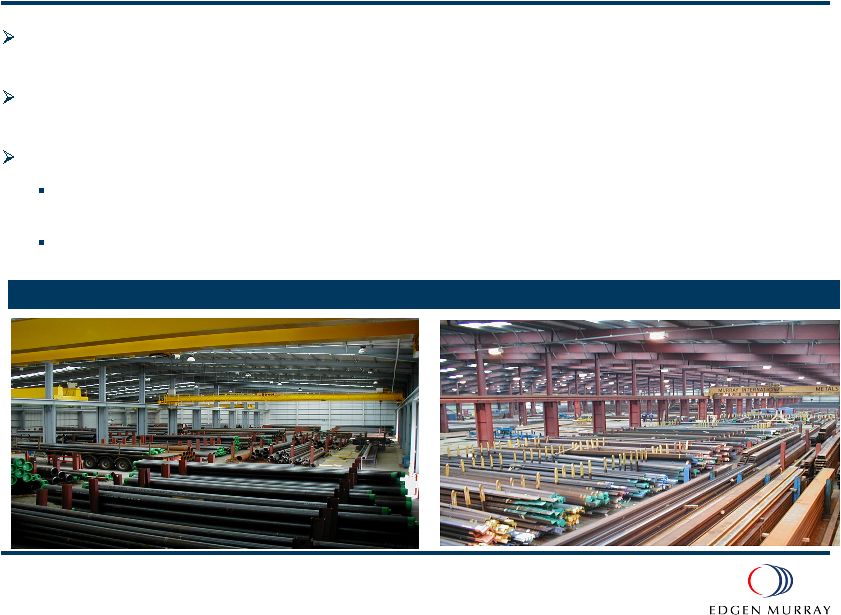

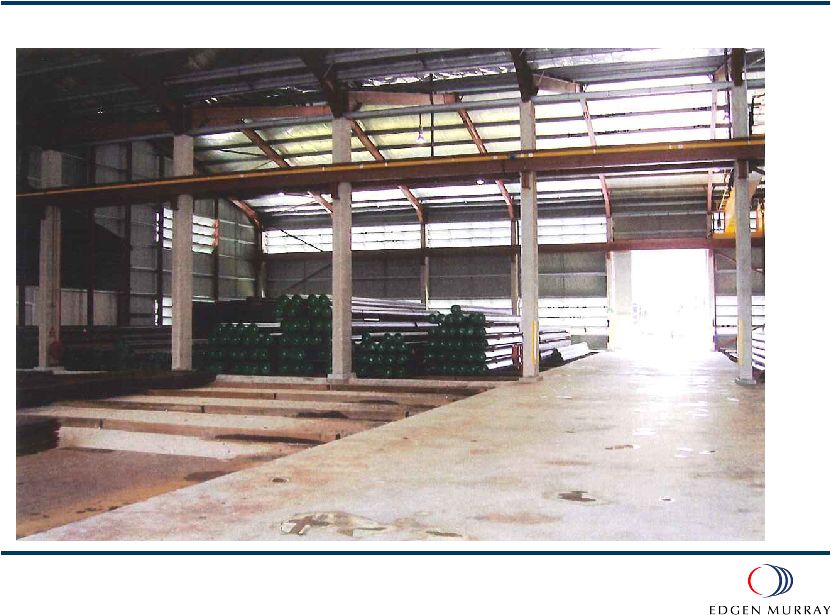

World Class Facilities Supported by

Advanced Information Technology Platform

Edgen

Murray maintains state of the art stocking and distribution facilities in the U.S.,

Europe, Asia and the Middle East

All facilities are ISO certified and enable the Company to keep inventory in close

proximity to its customers

The Company operates on an advanced Oracle IT platform and product RFID

system In

the

process

of

fully

integrating

IT

system

between

operations

in

the

Western

and

Eastern

Hemispheres

to

allow

more

efficient

access

across

the

organization

Systems allow close coordination of management and reporting

Edgen

Murray Stocking and Distribution Facilities |

13

Management has a proven track record of success in the industry

Many years of industry experience

Experience across upstream and downstream end markets, as well

as in the manufacturing of the products the Company distributes

Extensive global experience with senior managers located in key

markets around the world

Management team owns approximately 26% of the Company (on a

fully diluted basis)

Capital markets proven

Experienced Management Team |

14

Our Corporate Strategy

Market:

Increase

the

size

of

our

addressable

market

and

our

overall

market

presence

Assets:

Leverage

our

investment

in

people,

locations,

inventory

and

systems

Supply:

Optimize

our

vendor

relationships,

purchasing

and

inventory

levels

Financial:

Manage

working

capital

to

maximize

cash

flow

from

operations

through

prudent

credit

analysis

and

aggressive

inventory

control

Leverage

our

sales

growth

through

selling,

general

and

administrative

expense

controls

Target

a

balanced

revenue

contribution

from

Eastern

and

Western

Hemispheres

Maintain

a

revenue

stream

balanced

between

project

business

and

recurring

MRO business

New

Opportunities:

Pursue

global

expansion,

emerging

segments,

strategic

investments,

specialty

product

additions

and

opportunistic

acquisitions

Eastern

Hemisphere:

Actively

farm

expanded

footprint

and

expand

alloy

product

sales

Western

Hemisphere:

Market

penetration

in

civil

construction

and

nuclear

power generation

Service:

Vigilant

client

coverage

in

an

effort

to

capitalize

on

deferred

maintenance

requirements

and

project

spending

pick-up |

15

Financial Overview

*

*

* |

16

Historical Summary Operating Performance

Cash

$918

$1,266

$773

$280

2007

2008

2009

1H-2010

$ millions

Total Revenue

Total Availability Under the ABL Revolver

$ millions

$ millions |

17

Challenging Market Conditions…

Generally sluggish worldwide economic recovery

Uncertainty regarding future demand for oil and

natural gas and impact on prices

Difficult project finance environment

Excess competitor inventories

Extreme price competition |

18

…But We Believe the Following are Attractive Long-Term Market

Dynamics

Increasing

global

demand

for

crude

oil

and

natural

gas

driven

by

population

growth

and

economic modernization

Conventional

producing

regions

confronting

rising

depletion

rates

and

geopolitical

instability

Producers

making

significant

capital

investments

in

new

/

remote

sources

of

supply

Unconventional

natural

gas

and

oil

resources

Off-shore

/

deepwater

oil

Unlocking

trapped

/

remote

gas

resources

New

production

infrastructure,

transmission

solutions

and

processing

capacity

required

Global

investment

in

power

generation

capacity

EIA

estimates

global

electricity

generation

will

increase

over

75%

by

2030

vs.

2006

Demand

for

renewable

projects

and

alternative

energy

resources

continues

to

increase

Growth

in

civil

construction

and

infrastructure

projects

Aging

infrastructure

and

massive

stimulus

packages

will

spur

global

spend |

19

We believe we are well positioned to capitalize on market

stabilization in 2010 and growth beyond

Global Distribution Network

Diversified, Blue Chip Customer Base

End Market Exposure

Unique Distribution Model

Highly Specialized Product Portfolio

Long-Term MRO Relationships

Global Project Experience

Liquidity Through the Cycle

Attractive Market Dynamics

Experienced Management Team

Strong Shareholder Support |

20

Plant Tour

*

*

*

*

*

*

* |

Houston, Texas

21 |

Houston, Texas

22 |

Houston, Texas

23 |

Houston, Texas

24 |

Houston, Texas

25 |

Edinburgh, Scotland

26 |

Edinburgh, Scotland

27 |

Edinburgh, Scotland

28 |

Dubai,

U.A.E. 29 |

Dubai,

U.A.E. 30 |

Singapore

31 |

Singapore

32 |

Singapore

33 |