Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

Copano’s expansions in the Eagle

Ford Shale, including a joint

venture with Kinder Morgan

Platts 5th Pipeline Development &

Expansion Conference

September 24, 2010

NASDAQ: CPNO

Disclaimer

This presentation includes “forward-looking statements,” as defined in the federal securities laws.

Statements that address activities, or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Statements that address activities, or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Important factors that could cause actual results to differ materially from those in the forward-looking

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

The volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production and producers’ ability to drill and successfully complete and attach new

natural gas supplies and the availability of downstream transportation systems and other facilities for

natural gas and NGLs; higher construction costs or project delays due to inflation, limited availability of

required resources, or the effects of environmental, legal or other uncertainties; general economic

conditions; the effects of government regulations and policies; and other financial, operational and legal

risks and uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with

the Securities and Exchange Commission.

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

The volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production and producers’ ability to drill and successfully complete and attach new

natural gas supplies and the availability of downstream transportation systems and other facilities for

natural gas and NGLs; higher construction costs or project delays due to inflation, limited availability of

required resources, or the effects of environmental, legal or other uncertainties; general economic

conditions; the effects of government regulations and policies; and other financial, operational and legal

risks and uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with

the Securities and Exchange Commission.

Copano undertakes no obligation to update any forward-looking statements, whether as a result of new

information or future events.

information or future events.

2

Introduction to Copano

Independent midstream company founded in 1992

■ Best in class service to customers

■ Entrepreneurial approach

■ Focus on long-term accretive growth

Provides midstream services in multiple producing areas through

three operating segments

three operating segments

■ Texas

● South Texas conventional and Eagle Ford Shale

● North Texas Barnett Shale Combo play

■ Central and Eastern Oklahoma

● Conventional, Hunton De-Watering play and Woodford Shale

■ Rocky Mountains

● Powder River Basin

3

Key Copano Metrics

Service throughput volumes approximate 1.8 Bcf/d of natural

gas(1)

gas(1)

Approximately 6,700 miles of active pipelines

8 natural gas processing plants with over 1.1 Bcf/d of combined

processing capacity

processing capacity

One NGL fractionation facility with total capacity of 22,000 Bbls/d

Equity market cap: $1.6 billion(2)

Enterprise value: $2.7 billion(3)

4

Based on 2Q 2010 results. Includes unconsolidated affiliates.

As of September 8, 2010.

As of September 8, 2010. Includes $300 million of convertible preferred equity issued to an affiliate of TPG Capital in July 2010.

5

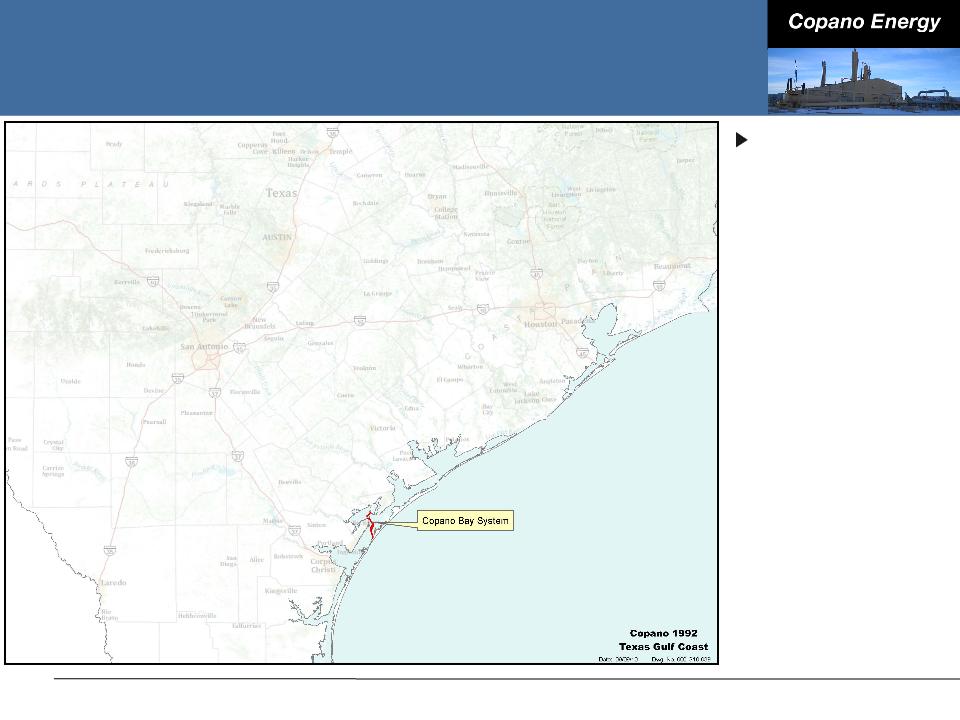

Copano in 1992

Copano began

with a 23-mile

pipeline in

Copano Bay in

1992

with a 23-mile

pipeline in

Copano Bay in

1992

Acquired and

extended

multiple

gathering

systems

extended

multiple

gathering

systems

Acquired

Houston Central

plant in 2001

Houston Central

plant in 2001

Developed

KMTP

relationship

KMTP

relationship

6

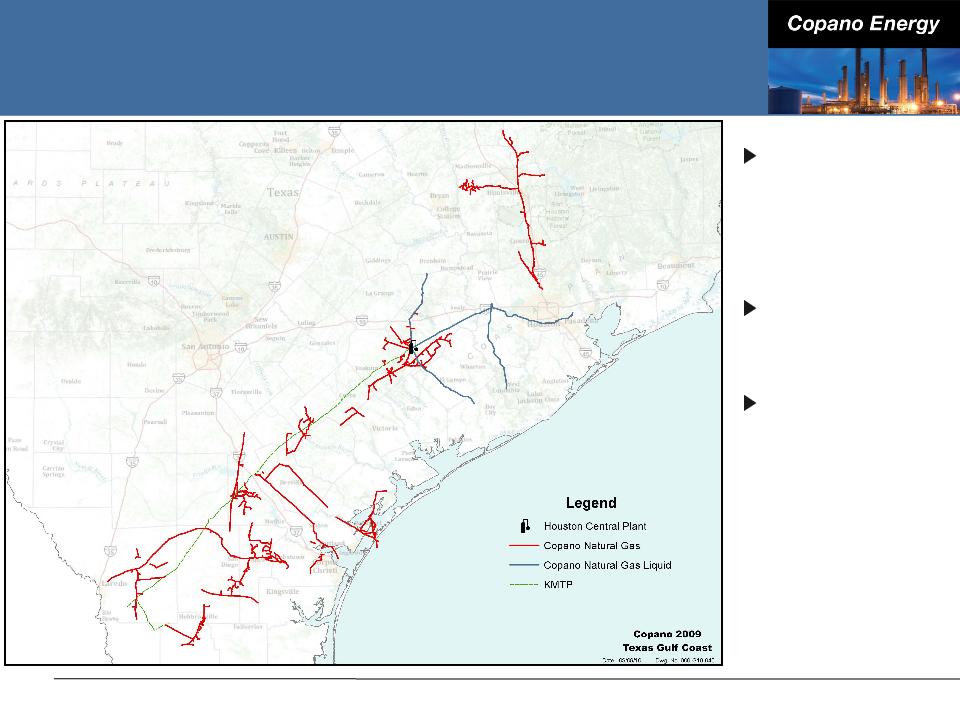

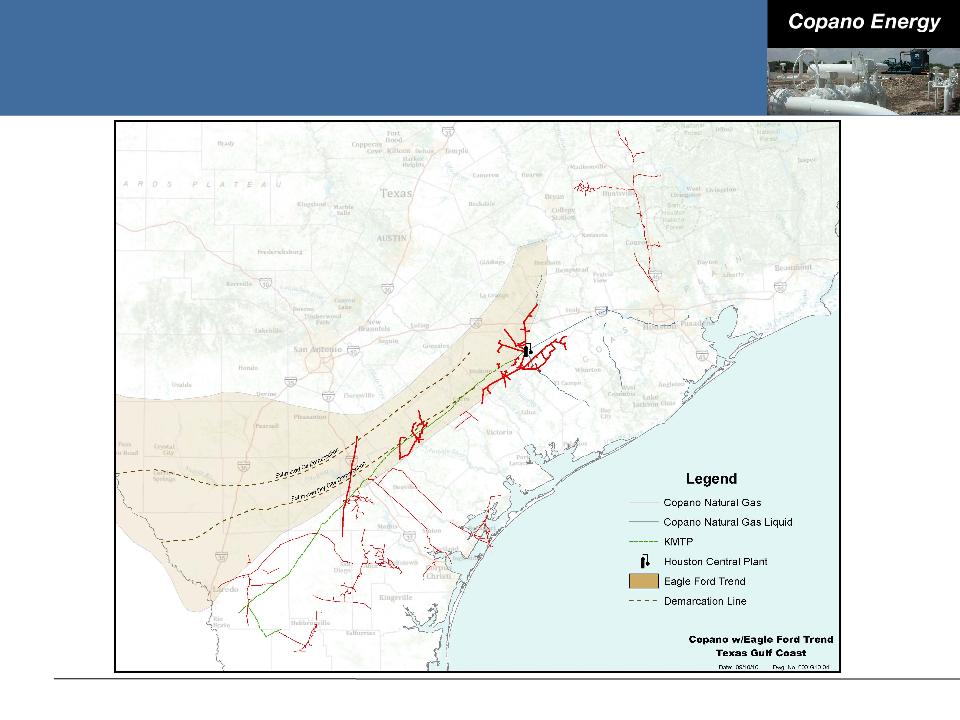

Copano Assets in South Texas - Pre-Eagle

Ford

Ford

Copano’s Houston Central Complex

700 MMcf/d of processing capacity

■ 200 MMcf/d of readily available expansion capacity

NGL fractionation and transportation

■ Newly commissioned 22,000 BPD fractionator (May 2010)

■ Ability to further expand fractionation facility

■ Over 250 miles of NGL pipelines provide access to markets

Multiple residue markets and close proximity to the Houston Ship

Channel provide better producer netback pricing

Channel provide better producer netback pricing

■ Access to Tennessee, Texas Eastern, HPL and KMTP

■ Ability to add additional interstate interconnects

7

8

Eagle Ford Shale Development

Eagle Ford Shale Advantages

Substantial infrastructure exists today

Rich gas and condensate/crude provide drilling incentive to producers

Lower break-even prices compared to most other shale and

conventional plays

conventional plays

Significant demand for natural gas and NGLs on the Texas Gulf Coast

Historically fewer land-related issues (leasing and ROW)

Lower construction costs relative to many other places (topography

and development)

and development)

Regulatory environment is conducive to energy development

9

10

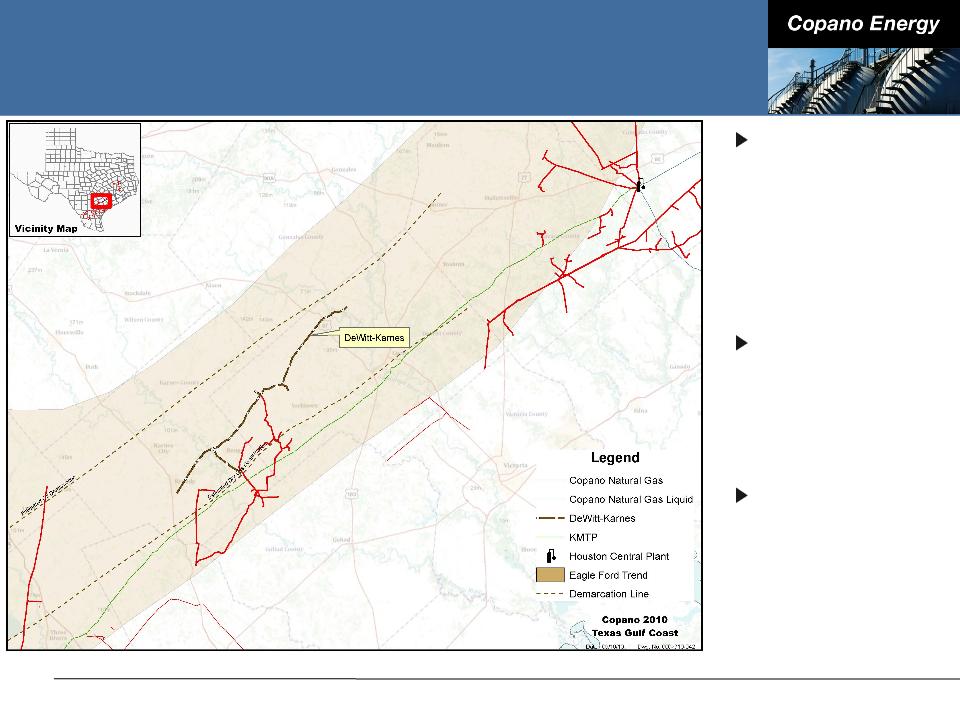

2010 - DeWitt-Karnes Header System

Built Dewitt

Karnes Header

(45 miles of 24”

pipeline)

Karnes Header

(45 miles of 24”

pipeline)

■ In-service

September

2010

September

2010

Services the

most prolific

rich gas window

of the Eagle

Ford Shale

most prolific

rich gas window

of the Eagle

Ford Shale

Access to

Houston Central

complex via

KMTP 30”

pipeline

Houston Central

complex via

KMTP 30”

pipeline

11

Why is the Joint Venture a Natural Fit?

Long-standing relationship between Copano and Kinder Morgan

Copano

■ Gathering and processing expertise

■ Available processing and fractionation capacity

■ Multiple market access for natural gas and NGLs

Kinder Morgan

■ Transmission expertise

■ Available pipeline capacity

■ Direct gas market access

Combined (Eagle Ford Gathering, LLC, a Kinder Morgan / Copano

joint venture)

joint venture)

■ Complementary assets offer comprehensive producer solution

■ Significant infrastructure currently available (lower barriers to entry)

■ Combined focus on customer service

12

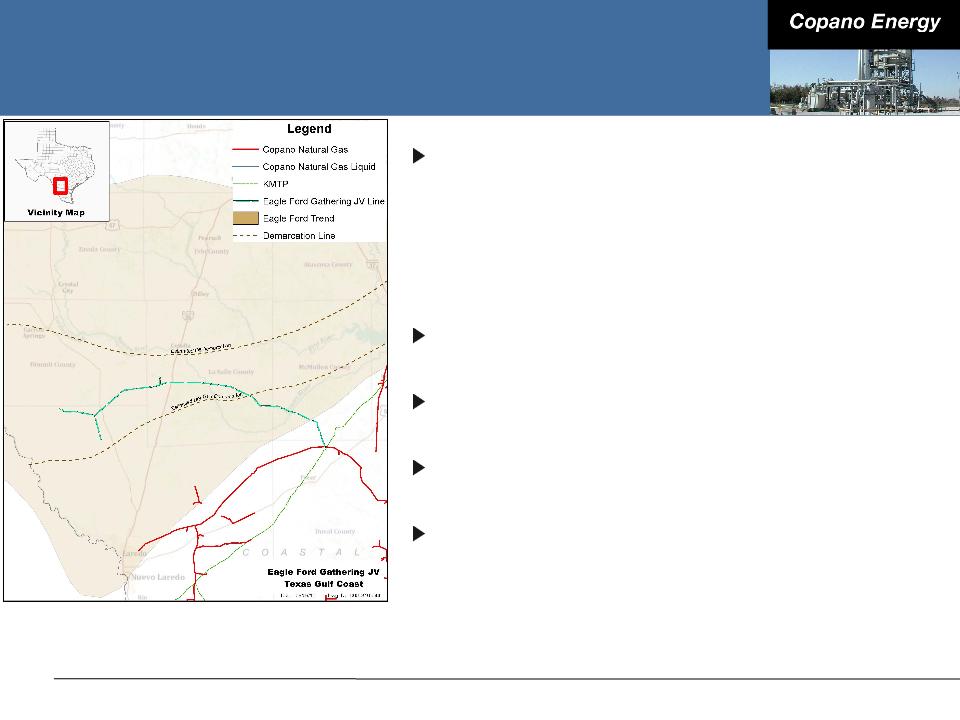

Eagle Ford Gathering, LLC

50/50 Kinder Morgan/Copano

■ Initial build-out of 85 miles of 24” and 30”

pipelines (expected completion: summer 2011)

pipelines (expected completion: summer 2011)

■ Copano acts as operator and managing member

■ 520,000 MMBtu/d of capacity without

compression

compression

Kinder Morgan and Copano share

commercial development activities

commercial development activities

Kinder Morgan contributes 375,000

MMBtu/d of downstream pipeline capacity

MMBtu/d of downstream pipeline capacity

Copano contributes 375,000 MMBtu/d of

processing capacity

processing capacity

Entered into firm service agreement with

SM Energy, anchor tenant, for up to

200,000 MMBtu/d

SM Energy, anchor tenant, for up to

200,000 MMBtu/d

13

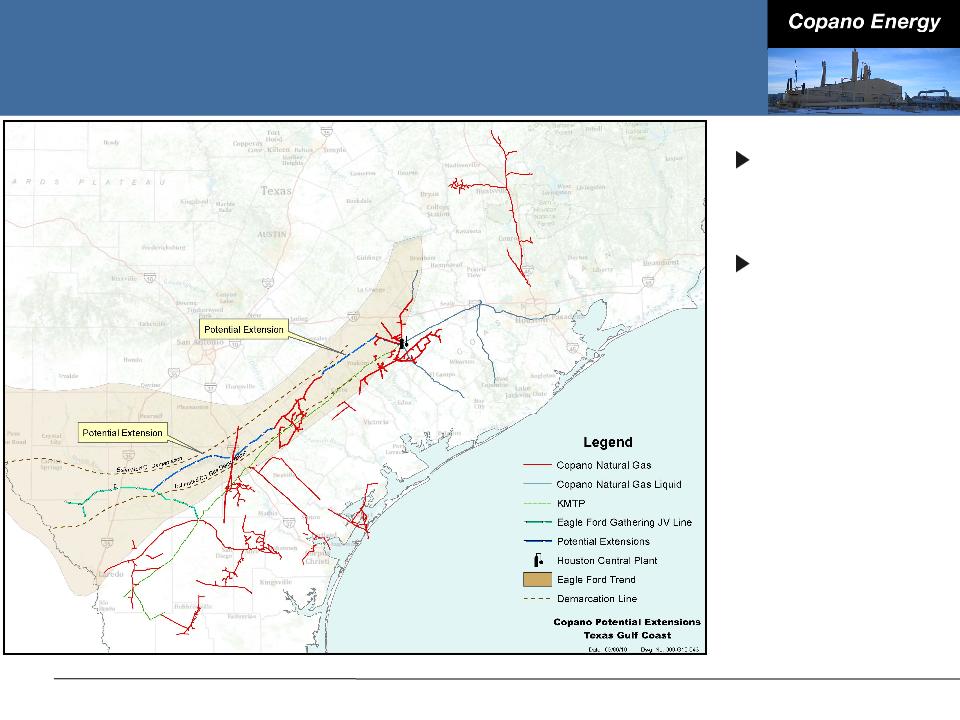

Potential Extensions - 2012 and beyond

Copano 24”

extensions (KM

loop to HCP)

extensions (KM

loop to HCP)

Possible

processing

expansion

processing

expansion

14

Eagle Ford Shale Expansion Summary

Integrated midstream solutions throughout the Eagle Ford trend

Immediately available capacity

Readily expandable infrastructure

Access to multiple markets for natural gas and NGLs

Contact Information

Jim Wade

Copano Energy - Texas

President

jim.wade@copanoenergy.com

Duane Kokinda

Kinder Morgan Texas Pipeline LLC

President

Duane.kokinda@kindermogan.com

15

Brian Eckhart

Copano Energy - Texas

Senior Vice President, Supply and

Transportation

brian.eckhart@copanoenergy.com

Bruce Boyd

Kinder Morgan Texas Pipeline LLC

Vice President - Gas Supply,

Processing

Bruce.boyd@kindermorgan.com