Attached files

As filed with the U.S. Securities and Exchange Commission on September 22, 2010.

SEC FILE NO 333-167964

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA SHOUGUAN MINING CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

1000

(Primary Standard Industrial Classification Code Number)

27-2513824

(IRS Employer Identification No.)

6009 Yitian Road

New World Center Rm. 3207

Futian District, Shenzhen

People’s Republic of China

Telephone 0086-755-82520008

Facsimile 0086-755-82520156

(Address and telephone number of registrant’s principal executive offices)

__________________________

Law Office of Michael M. Kessler, P.C.

4900 Paloma Avenue

Carmichael, CA 95608

Telephone (916) 248-3666

Facsimile (916) 517-1449

(Name, address and telephone number of agent for service)

__________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

Large accelerated filer [ ] Accelerated Filer [ ] Non-accelerated filer [ ] Smaller reporting company [x]

|

CALCULATION OF REGISTRATION FEE

|

||||

|

Title of securities

|

Amount to be

|

Proposed maximum

|

Proposed maximum

|

Amount of

|

|

to be registered

|

Registered

|

offering price per share (2)

|

aggregate offering price (3)

|

registration fee (1)

|

|

Common stock

|

1,000,000Shares

|

$0.50

|

$500,000

|

$ 35.65

|

|

(1)

|

This is an initial offering and no current trading market exists for our common stock. The price paid for the currently issued and outstanding common stock was valued at $.50 per share.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457.

|

|

(3)

|

Our officers and directors intend to offer the shares to friends, family members and business acquaintances; we do not intend to engage the services of an underwriter to sell any of the shares. This will be an "all-or-none" offering, which means we will need to sell all of the shares before we can use any of the proceeds. We intend to establish a separate bank account where all proceeds from sales of shares will be deposited until the offering is sold out and the total offering amount of $500,000 is raised, at which time the funds will be transferred to our business account for use in our proposed business operations. In the event we do not sell all of the shares and raise all of the proceeds before the expiration date of the offering, all monies collected will be returned promptly to the subscribers, without deduction or interest.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such section 8(a), may determine.

|

1

China ShouGuan Mining Corporation

PROSPECTUS

1,000,000 Shares of Common Stock

$0.50 per share

-----------------------------------------------------------------------------

This is the initial offering of common stock of China ShouGuan Mining Corporation. No public market currently exists for our securities or the shares being offered. We are offering for sale a total of 1,000,000 shares of common stock on a "self-underwritten" basis, which means the shares will be offered and sold by our officers and directors, without any commissions being paid to them for any shares sold. We do not intend to engage the services of an underwriter to sell any of the shares and there is no guarantee we will be able to sell all of the shares being offered. The shares are being offered at a fixed price of $0.50 per share for a period not to exceed 180 days from the date of this Prospectus. There is no minimum number of shares required to be purchased. The offering will be an “all-or-none” offering, which means we will need to sell all of the shares before we can use any of the proceeds. We intend to establish a separate bank account, where all proceeds from sales of shares will be deposited until the offering is sold out and the total offering amount of $500,000 is raised, at which time the funds will be transferred to our business account for use in our business operations. In the event we do not sell all of the shares and raise all of the proceeds before the expiration date of the offering, all monies collected will be returned promptly to the subscribers, without deductions or interest.

China ShouGuan Mining Corporation is a mining company principally engaging in the project management of gold mining operations using the expertise and experience of its sophisticated management, advanced mining technologies, capital investment and consulting services.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS SECTION, BEGINNING ON PAGE 7.

Neither the U.S. Securities and Exchange Commission nor any state securities division has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Offering Price Per Share

|

Total Amount of Offering

|

Underwriting Commissions

|

Proceeds to us

|

|

|

Common Stock

|

$0.50

|

$500,000

|

$0.00

|

$500,000

|

This is a “best effort”, “all or none” offering and, as such, we will not be able to spend any of the proceeds unless and until all shares are sold and all proceeds are received. We intend to hold all monies collected for subscriptions in a separate bank account until the total amount of $500,000 has been received or until the 1,000,000 shares being offered have been sold. At that time, the funds will be transferred to our business account for use in the implementation of our business plans. In the event the offering is not sold out prior to the Expiration Date, all monies will be returned to investors, without interest or deduction.

Our securities are not currently listed on any exchange. Immediately following completion of this offering, we plan to contact a market maker to apply to have the shares listed and quoted on the OTC Electronic Bulletin Board (OTCBB); however, we cannot guarantee that our application will be accepted or approved. As of the date of this filing, there have been no discussions or understandings between us, or anyone acting on our behalf, with any market maker regarding participation in a future listing of our securities.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is _________________________.

2

|

TABLE OF CONTENTS

|

|

|

Page No.

|

|

|

SUMMARY OF PROSPECTUS

|

4

|

|

General Information about Our Company

|

4

|

|

The Offering

|

7

|

|

RISK FACTORS

|

7

|

|

RISKS ASSOCIATED WITH OUR COMPANY

|

7

|

|

RISKS RELATED TO DOING BUSINESS IN CHINA

|

11

|

|

RISKS ASSOCIATED WITH THIS OFFERING

|

13

|

|

USE OF PROCEEDS

|

14

|

|

DETERMINATION OF OFFERING PRICE

|

14

|

|

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

|

14

|

|

PLAN OF DISTRIBUTION

|

15

|

|

Offering will be Sold by Our Officers and Directors

|

15

|

|

Terms of the Offering

|

15

|

|

Deposit of Offering Proceeds

|

15

|

|

Procedures for and Requirements for Subscribing

|

15

|

|

DESCRIPTION OF SECURITIES

|

15

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

16

|

|

DESCRIPTION OF BUSINESS

|

16

|

|

DESCRIPTION OF PROPERTY

|

26

|

|

LEGAL PROCEEDINGS

|

26

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

26

|

|

FINANCIAL STATEMENTS

|

27

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

27

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

|

35

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

36

|

|

EXECUTIVE COMPENSATION

|

37

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

39

|

|

INDEMNIFICATION

|

40

|

|

AVAILABLE INFORMATION

|

40

|

3

SUMMARY OF PROSPECTUS

Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read the more detailed information contained in this prospectus, including our financial statements and related notes. Our business involves significant risks. You should carefully consider the information under the heading "Risk Factors" beginning on page 7 .

In this prospectus, unless the context otherwise denotes, references to “we,” “us,” “our,” “ShouGuan,” and “the Company” are to China ShouGuan Mining Corporation. “China” or “PRC” refers to the People’s Republic of China. “RMB” or “Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars” refers to the legal currency of the United States.

General Information about Our Company

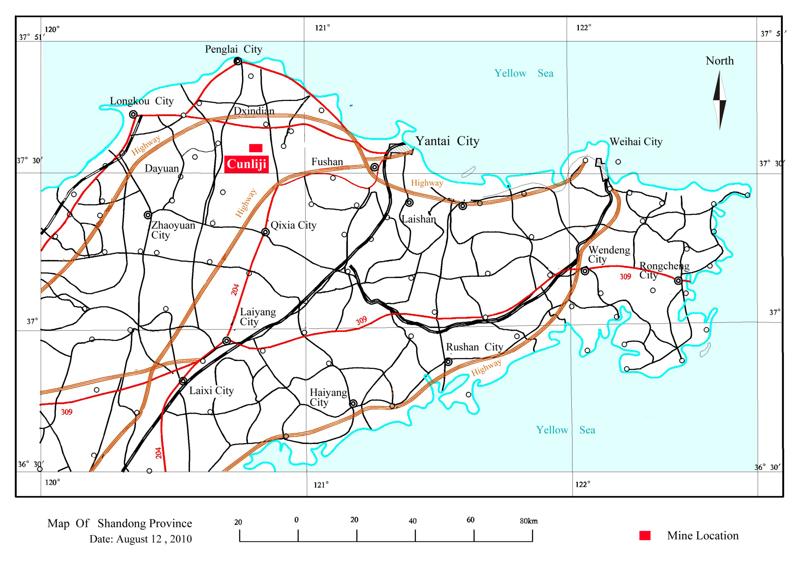

China ShouGuan Mining Corporation was incorporated in the State of Nevada on May 4, 2010. We are a holding company that conducts business operations in Shandong Province in the People’s Republic of China (PRC). On June 23, 2010, we entered into a stock exchange transaction with the shareholders of Bei Sheng Limited (“BSL”), whereby we issued 100,000,000 shares of common stock in exchange for 100% of the ownership interest in BSL, for the purpose of re-domiciling BSL as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the merger, we became the legal entity of BSL, while the business of BSL survives. Unless otherwise indicated, all references to the Company throughout this prospectus includes the operations of BSL and its subsidiaries and variable interest entities (“VIEs”).

We were founded by a number of business professionals and experts in China who specialize in mining technologies, mining resources management and financial and strategic management. Our primary focus is on acquiring existing gold mine projects in Shandong province of the PRC. These potential targets are mostly run with low productivity because of inadequate funds and primitive technologies. We plan to re-engineer and redevelop these gold mines through the transfer of advanced exploration and mining technologies, capital injection and effective management.

Our business model includes sourcing of early stage gold mines with good profit potential, conducting feasibility studies to identify suitable projects, leasing the suitable mining sites and facilities and managing the mining operations on these selected sites, with the goal of acquiring the mine if the operations prove to be satisfactory based on the review criteria set by our experienced management. In addition, we also provide consulting services in areas related to mine exploration and analysis to our clients on a project-by-project basis.

Revenues are derived from the sales of gold concentrates, the principal raw material used in gold smelting operation to produce gold. All mining operations are outsourced to independent third contractors and we only take possession of the gold concentrates when they are sold to smelters. At that time, the selling prices are determined from two factors, the amount of gold in the gold concentrates and the price of gold on the date of sale. The amount of gold in the gold concentrates is determined and agreed upon between the Company and the smelters and then the selling price is determined according to the official gold price at the time of sale as indicated by the Shanghai Gold Exchange (http://www.sge.sh), an entity governed by the PRC Government). On the consulting side, revenues are derived on a project-by-project basis and payment is collected as we complete our service as outlined in the scope of each individual project.

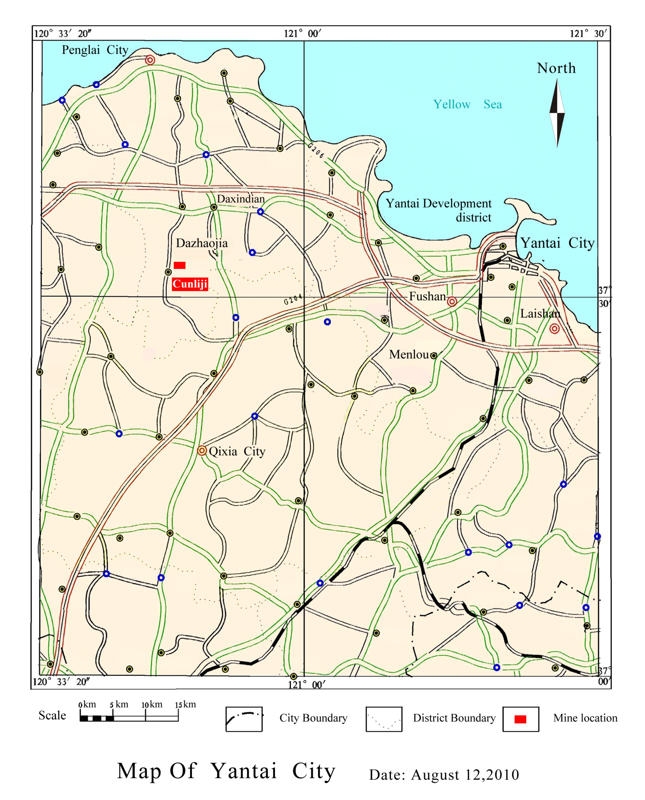

We target to grow proactively through continual sourcing of existing gold mines in the PRC and managing them. These projects will be executed by Bei Sheng Limited and its VIEs. Cunli Ji Gold Mine was the first project commenced in May 2009. To ensure all mines are legally and properly operated, all target gold mines are required to have full sets of government-approved licenses before effecting commencement of any business operations.

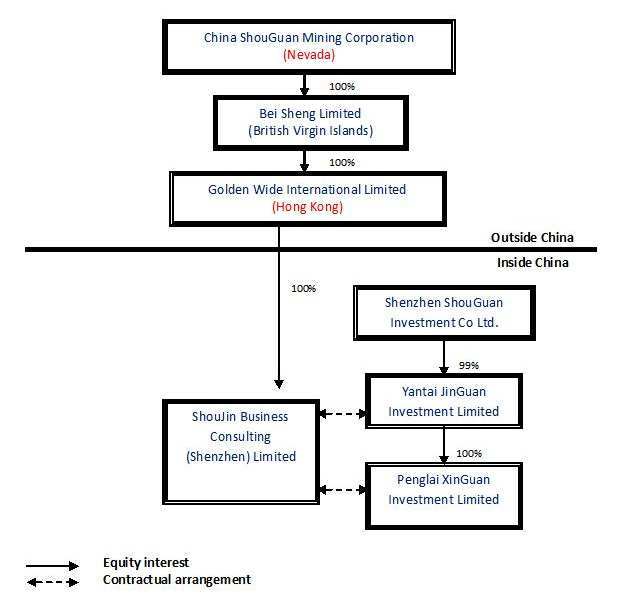

Corporate History and Structure

China ShouGuan Mining Corporation was incorporated in the State of Nevada on May 4, 2010. On May 27, 2010, Harry Orfanos, our original director and incorporator in the State of Nevada, resigned as our President and Chief Executive Officer and the Board of Directors appointed Mr. Feize Zhang to serve as our President, Treasurer, Chief Executive Officer and Director, Mr. Ming Cheung as Secretary, Chief Financial Officer and Director and Mr.Jingfeng Lv as Chief Technical Officer.

On June 23, 2010, we entered into a stock exchange transaction with the shareholders of Bei Sheng Limited (“BSL”), whereby we issued 100,000,000 shares of common stock in exchange for 100% of the ownership interest in BSL, for the purpose of re-domiciling BSL as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the merger, we became the legal entity of BSL, while the business of BSL survives. Unless otherwise indicated, all references to the Company throughout this prospectus includes the operations of BSL and its subsidiaries and variable interest entities (“VIEs”).

BSL was incorporated in the British Virgin Islands on December 17, 2009 as a limited liability company for the purpose of holding 100% equity interest in Golden Wide International Limited (“GWIL”).

GWIL was incorporated in the Hong Kong Special Administrative Region (“Hong Kong”) on June 18, 2009 as a limited liability company. GWIL formed Shoujin Business Consulting (Shenzhen) Limited (“SBCL”) as a wholly foreign-owned enterprise under the laws of the People’s Republic of China (the “PRC”) on April 23, 2010. SBCL is principally engaged in the business of providing consulting services in the PRC.

Shenzhen Shouguan Investment Co., Ltd (“SSIC”) is an investment holding company established in Shenzhen, on December 1, 2008. It is 70% owned by Mr. Feize Zhang, our Chairman and CEO, 20% owned by Mr. Jingfeng Lv, our Chief Technical Officer, and 10% owned by Mr. Jianxi Yang, a director of Yantai JinGuan Investment Limited, SSIC’s subsidiary.

4

Yantai JinGuan Investment Limited (“JinGuan”) was incorporated in Yantai, the PRC and is a subsidiary held 99% by SSIC.

Penglai XinGuan Investment Limited (“XinGuan”) was incorporated in Penglai, the PRC and is the wholly-owned subsidiary of JinGuan. XinGuan houses our licenses and operations in Penglai, the PRC.

The following diagram illustrates our current corporate structure:

To satisfy the investment restrictions in the PRC mining business, the Company, through SBCL entered into and consummated certain contractual arrangements with SSIC, JinGuan and XinGuan. As a result of these contractual arrangements, which obligates SBCL to absorb the risk of loss from the activities of SSIC, JinGuan and XinGuan ,and enables SBCL to receive all of its expected residual returns, we account for SSIC, JinGuan and XinGuan ,and their subsidiaries, as a variable interest entity (“VIE”) under U.S. GAAP and we consolidate their results in our consolidated financial statements.

Since the Company, BSL, GWIL, SBCL and its VIE arrangement as SSIC were under common control with the same ultimate beneficial owners, who are officers and directors of the Company, the re-domiciling transaction and VIE arrangement was accounted for as a transfer of entities under common control and all disclosures referencing business operations of our VIEs were made throughout this prospectus as if the share exchange transaction had become effective as of the beginning of the first period presented, even though the Company was not yet incorporated in Nevada. As such, the Company, BSL and its subsidiaries and VIEs are hereinafter collectively referred to as the Company and all are consolidated in our financial statements.

Prior to acquisition of the Company shares, Mr. Zhang, Mr. Cheung and Mr. Lv were not affiliates of the Company. They were also not an affiliate of any of the Company’s shareholders.

5

Contractual Arrangements

Gold mining is a highly restricted industry in China. As such, it is extremely difficult for PRC gold mining companies to obtain government approval on having foreign ownership. Accordingly, BSL's PRC subsidiary, SBCL, which is considered foreign-invested, is currently ineligible to directly own the required exploration and mining licenses in China. Our exploration and mining business is currently provided through contractual arrangements with BSL and its VIEs in China, which are currently SSIC and its subsidiaries, JinGuan and XinGuan.

BSL's VIEs sell gold concentrates directly to our customers, which are typically the refinery plants in China. We have been and are expected to continue to be dependent on our VIEs to operate our exploration and mining business. SBCL has entered into contractual arrangements with our VIEs, which enable us to:

|

-

|

exercise effective control over the VIEs;

|

|

-

|

receive substantially all of the economic benefits from the VIEs; and

|

|

-

|

have an exclusive option to purchase all of the equity interests in the VIEs.

|

SBCL entered into a series of agreements (“VIE agreements”) among SSIC and the individual owners of SSIC, JinGuan and XinGuan; details of the VIE agreements are as follows:

|

1.

|

Exclusive Technical Service and Business Consulting Agreement, signed on May 15, 2010 - SBCL has the exclusive right to provide to SSIC, JinGuan and XinGuan, consulting services, including operational management, human resources management, research and development of the technologies related to the operations of SSIC, JinGuan and XinGuan. SSIC, JinGuan and XinGuan pay to SBCL annually consulting service fees in an amount equal to all of their revenue for such year. The Agreement runs for a 10-year term and is subject to automatic renewal for an additional 10 year term provided that no objection is made by both parties on the renewal.

|

|

2.

|

Exclusive Option Agreement - SBCL has the option to purchase all of the assets and ownership of SSIC, JinGuan and XinGuan at any time.

|

|

3.

|

Equity Pledge Agreement, signed on May 15, 2010 - SSIC, JinGuan and XinGuan agree to pledge their legal interests to SBCL as a security for the obligations under the Exclusive Technical Service and Business Consulting Agreement.

|

|

4.

|

Proxy Agreement - SSIC, JinGuan and XinGuan irrevocably grant and entrust SBCL the right to exercise its voting and other stockholder rights.

|

|

5.

|

Operating Agreement, signed on May 15, 2010 - SBCL agrees to participate in the operations of JinGuan and XinGuan in different aspects.

|

With the above agreements, SBCL demonstrates its ability to control SSIC, JinGuan and XinGuan as the primary beneficiaries and the operating results of the VIEs were included in the consolidated financial statements.

XinGuan commenced operations on our first mining project, the Cunli Ji Gold Mine, in May 2009. XinGuan directly holds title to Cunli Ji Gold Mine ("CJ Mine") and all regulatory and government operating licenses in China.

On May 4, 2009, the Company, through BSL and its VIE, Xinguan, e ntered into a Master Agreement, an Operating Lease Agreement and an Acquisition Agreement with Penglai City Gold Mining Holding Co. Limited (PCGM), an unrelated third party which is the legal owner and holds the PRC State license to the CunliJi Mine. The Master Agreement sets out the general terms of the Operating Lease Agreement and the Acquisition Agreement. Pursuant to the terms of the Operating Lease Agreement, XinGuan agrees to pay a monthly rent of $14,641 (RMB 100,000) for the right to lease and manage the gold mine for a term of 20 months, with a rental deposit of $2,925,174 (RMB 20 million). Pursuant to the temrs of the Acquisition Agreement, XinGuan agrees to acquire the gold mine for a purchase consideration of $5,089,803 if the following conditions are satisfied upon the expiration of the Operating Lease Agreement: 1) average daily ore production from the CunliJi Mine has reached production of 80 tons of ore or more for the year 2010, and 2) the CunliJi mine has obtained ISO (or equivalent) certification on or before January 3, 2011. Upon successful closing of the acquisition, the rental deposit would become part of the purchase consideration. If the mining operations do not meet the above production levels, the rental deposit will be refunded in full to XinGuan.

On June 18, 2010, XinGuan paid an additional amount of $1,187,272 to PCGM as an additional rental deposit on the same terms as the original agreement. The additional deposit would become part of the purchase consideration upon successful closing of the acquisition or will be refunded in full if the mining operations to not meet the production levels set forth in the agreement.

The following contractual agreements were entered into with unrelated third parties with regard to the operation of the CJ Mine:

The following contractual agreements were entered into with unrelated third parties with regard to the operation of the CJ Mine:

|

1.

|

Master Agreement signed on May 4, 2009 between XinGuan and Penglai City Gold Mining Holding Co. Ltd. - Sets out the general terms of the Operating Lease Agreement and the Acquisition Agreement.

|

|

4.

|

Construction Project Agreement, signed on September 1, 2009 between XinGuan and Jinhai Mine Underground Engineering Limited.

|

|

5.

|

Gold Concentrate Processing Agreement, signed on July 1, 2009 between XinGuan and Shandong Humon Smelting Co., Ltd.

|

6

The Offering

Following is a brief summary of this offering. Please see the Plan of Distribution section for a more detailed description of the terms of the offering.

|

Securities Being Offered:

|

1,000,000 shares of common stock, par value $0.0001.

|

||

|

Offering Price per Share:

|

$ .50

|

||

|

Offering Period:

|

The shares are being offered for a period not to exceed 180 days.

|

||

|

Net Proceeds to Our Company:

|

$500,000

|

||

|

Use of Proceeds:

|

We intend to use the proceeds to expand our business operations.

|

||

|

Number of Shares Outstanding Before the Offering:

|

100,000,000

|

||

|

Number of Shares Outstanding After the Offering:

|

101,000,000

|

Our officers, directors, control persons and/or affiliates do not intend to purchase any shares in this offering.

RISK FACTORS

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. Following are what we believe are all of the material risks involved if you decide to purchase shares in this offering.

RISKS ASSOCIATED WITH OUR COMPANY:

We have a history of operating losses and negative cash flow and we anticipate that we will need to raise additional funds to finance operations.

We have a short history of operating losses and negative cash flow. We have incurred recurring net losses, including net losses from continuing operations of $677,942 in fiscal 2009. We used $3,205,922 of our cash for continuing operating activities during fiscal 2009.

We expect to continue to make significant expenditures and incur substantial expenses as we continue our mining operation efforts and develop facilities to expand the mining production capacity for our current property. As a result, we expect to continue to incur significant losses as we execute our strategies and may never achieve or maintain profitability. We believe that we have a long-term strategy in place that will allow us to operate profitably in the future. However, if we fail to execute our strategy or if there is a change in gold or other prices for the minerals we extract or market conditions or any other assumptions we used in formulating our business strategy, our long-term strategy may not be successful and we may not be able to achieve and maintain profitability. As a result, investors could lose confidence in our company and the value of our common stock, which could cause our stock price to decline and negatively affect our ability to raise additional capital. Although our current operating plan anticipates increased revenues and improved profit margins over the next two years, we expect to incur operating losses for the foreseeable future.

We have funded our operations primarily with proceeds from public and private offerings of our common stock and secured and unsecured debt instruments. We cannot provide any assurances that we will be able to secure additional funding from public or private offerings on terms acceptable to us, if at all. Our inability to achieve our current operating plan or raise capital to cover any potential shortfall would have a material adverse affect on our ability to meet our obligations as they become due without substantial disposition of assets or other similar actions outside the ordinary course of business. If we are not able to secure additional funding if and when needed, we would be forced to curtail our operations or take other action in order to continue to operate. These and other factors raise substantial doubt by our auditors about our ability to continue as a going concern.

7

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Messrs. Feize Zhang, our principal executive officer, Ming Cheung, our principal financial officer and JingFeng Lv, our chief technical officer, have extensive contacts and experience in the gold exploration and natural resource industry in China and we are dependent upon their abilities and services to develop and market our business. They are responsible for overseeing all of our day-to-day business operations in the PRC of our operating company, BSL, and its subsidiaries and VIEs, including the mining operations and negotiations for the sales of any gold concentrates extracted. We may not be able to retain these executive officers/managers for any given period of time. The loss of their services could have a material adverse effect upon our business operations, financial condition and results of operations. In addition, we must attract, recruit and retain a sizeable workforce of technically competent employees in the PRC to run our mining operations . Our ability to effectively implement our proposed business strategies and expand our operations will depend upon the successful recruitment and retention of additional highly skilled and experienced management and other key personnel in the PRC . If we cannot maintain highly experienced and skilled management teams, our business could fail and you could lose any investment you make in our shares.

Since our business consists of managing gold mining projects, the drop in the price of gold would negatively impact our asset values, cash flows, potential revenues and profits.

We plan to pursue opportunities in properties with gold mineralized material or reserves with exploration potential. The price that we pay to lease these properties will be influenced, in large part, by the price of gold at the time of the leasing agreements. Our potential future revenues are expected to be derived from the production and sale of gold from these properties, or from the sale of some of these properties. The value of any gold reserves or other mineralized materials, and the value of any potential mineral production will vary in direct proportion to changes in those mineral prices. The price of gold has fluctuated widely as a result of numerous factors beyond our control. The effect of these factors on the price of gold and other minerals, and therefore the economic viability of any of our projects, cannot accurately be predicted. Any drop in the price of gold and other minerals we may produce would negatively affect our asset values, cash flows and potential revenues and profits.

Estimates of mineral reserves and of mineralized material are inherently forward-looking statements, subject to error, which could force us to curtail or cease our business operations.

Estimates of mineral reserves and of mineralized materials are inherently forward-looking statements subject to error. Although estimates of proven and probable reserves are made based on a high degree of assurance in the estimates at the time the estimates are made, unforeseen events and uncontrollable factors can have significant adverse impacts on the estimates. Actual conditions inherently differ from estimates. The unforeseen adverse events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, fuel price increases, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be predicted.

|

·

|

Geologic Uncertainty and Inherent Variability: Estimated reserves and additional mineralized materials are generally derived from appropriately spaced drilling to provide a high degree of assurance in the continuity of the mineralization, however, there is generally variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There are also unknown geologic details that are not always identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining operations. Acceptance of these uncertainties is part of any mining operation.

|

|

·

|

Metal Price Variability: The prices for gold, silver, copper and other precious metals fluctuate in response to many factors beyond anyone's ability to predict. The prices used in making the reserve estimates are disclosed and differ from daily prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated reserve quantities, which are affected by a number of additional factors. For example, a ten percent (10%) change in price may have little impact on the estimated reserve quantities and affect only the resultant positive cash flow, or it may result in a significant change in the amount of reserves. Because mining occurs over a number of years, it may be prudent to continue mining for some period during which cash flows are temporarily negative for a variety of reasons, including a belief that the low price is temporary and/or the greater expense would be incurred in closing a property permanently.

|

|

·

|

Fuel Price Variability: The cost of fuel can be a major variable in the cost of mining; one that is not necessarily included in the contract mining prices obtained from mining contractors but is passed on to the overall cost of operation. Future fuel prices and their impact are difficult to predict, but could force us to curtail or cease our business operations.

|

|

·

|

Variations in Mining and Processing Parameters: The parameters used in estimating mining and processing efficiency are based on testing and experience with previous operations at the properties or on operations at similar properties. While the parameters used have a reasonable basis, various unforeseen conditions can occur that may materially affect the estimates. In particular, past operations indicate that care must be taken to ensure that proper ore grade control is employed and that proper steps are taken to ensure that the leaching operations are executed as planned. Mining contracts generally include clauses addressing these issues to help ensure planned requirements are met. Nevertheless, unforeseen difficulties may occur in our current or future operations, which would force us to curtail or cease our business operations.

|

8

|

·

|

Changes in Environmental and Mining Laws and Regulations: Our reserve estimates contain cost estimates based on compliance with current laws and regulations in the PRC which we believe we are currently in compliance with. While there are no currently known proposed changes in these laws or regulations, significant changes have affected past operations of mining companies in China and if additional changes do occur in the future, we may or may not be able to comply with them and continue our operations.

|

We may not be able to successfully compete with other mineral exploration and mining companies.

We compete with other mineral exploration and mining companies or individuals, including large, well established mining companies with substantial capabilities and financial resources in the PRC , to research and acquire rights to mineral properties containing gold and other minerals. There is a limited supply of desirable mineral lands available for claim staking, lease or other acquisition in the PRC. We don't know if we will be able to successfully acquire any prospective mineral properties against competitors with substantially greater financial resources than we have. If we cannot successfully acquire other mining properties to manage and explore and generally expand our business operations, our results of operations, financial condition and future revenues could be reduced and you could suffer a loss of any investment you make in our shares.

We are subject to the many risks of doing business internationally, including but not limited to the difficulty of enforcing liabilities in foreign jurisdictions.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors. An investor would have the ability to effect service of process in any action against the Company within the United States. In addition, we are registered as a foreign corporation doing business in Shandong Province, PRC, and as such, are subject to the local laws of Shandong Province governing an investors’ ability to bring actions in foreign courts and enforce liabilities against a foreign private issuer, or any person, based on U.S. federal securities laws. Generally, a final and conclusive judgment obtained by investors in U.S. courts would be recognized and enforceable against us in the Shandong Province courts having jurisdiction without re-examination of the merits of the case.

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

All of our current operations are conducted in the PRC and all of our directors and officers are nationals and residents of China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

All of our assets are located in China and all of our revenues are derived from our operations in China. As a result, any changes in the political climate and/or economic policies of the PRC government could have a significant impact upon our current and proposed future business operations in the PRC and our results of operations and financial condition.

Our business operations may be adversely affected by the current and future political and economic environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since the late1970s. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to successfully operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice, any of which could have an adverse effect on our results of operations and financial condition, resulting in a loss of any investment you make in our shares .

We are employing a VIE structure, which could materially adversely affect our business operations if current regulations change in the PRC regarding VIE’s.

In order to comply with PRC regulatory requirements, we operate our businesses operations through companies in the PRC with which we have contractual relationships, but in which we do not have controlling ownership. We believe our current business operations are in compliance with the current laws in China, but we cannot be sure that the PRC government will continue to view our operating arrangements to be in compliance with PRC regulations if any new laws regarding operating through VIEs may be adopted in the future . If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

In addition, our Exclusive Option Agreement with SSIC, JinGuan and XinGuan and its shareholders gives our Chinese subsidiary, SBCL the option to purchase all or part of the equity interests in them. The option may not be exercised by SBCL if the exercise would violate any applicable laws and regulations in China or cause any license or permit held by, and necessary for the operation of SSIC, JinGuan and XinGuan, to be cancelled or invalidated. Under the laws of China, if a foreign entity, through a foreign investment company that it invests in, acquires a domestic related company, China’s regulations regarding mergers and acquisitions may technically apply to the transaction. If these regulations apply, an examination and approval of the transaction by China’s Ministry of Commerce (“MOFCOM”), or its local counterparts would be required. In addition, an appraisal of the equity interest or the assets to be acquired would also be mandatory. Since the scope of business activities (mining operations and consulting services), as defined in the business license of SBCL, does not involve the MOFCOM approval and monitoring, we do not believe at this time that an approval or an appraisal is required for SBCL to exercise its option to acquire SSIC, JinGuan and XinGuan. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the approval and appraisal requirement. If we are not able to purchase the equity of SSIC, JinGuan and XinGuan, then we will lose a substantial portion of our ability to control SSIC, JinGuan and XinGuan and our ability to ensure that SSIC, JinGuan and XinGuan will act in our interests. Our business in the PRC could be materially adversely affected if there are any changes to current regulations in the PRC which would affect our business operations and current business agreements with our PRC operating company and its subsidiaries and VIEs, resulting in a loss of any investment you make in our shares.

9

Our principal stockholder, who is also an officer and director of our Company, has conflicts of interest which may not always be resolved favorably to our Company and its stockholders.

We operate our businesses in China through SSIC, JinGuan and XinGuan. Our chairman, CEO and principal shareholder, Mr. Feize Zhang, owns 70% of the equity interest in SSIC. Conflicts of interests between his duties to us and to SSIC may arise. We cannot assure you that when conflicts of interest arise, he will act in the best interests of our Company or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

We could be subject to tax consequences in the PRC that could negatively impact our business operations, revenues and results of operations.

Our arrangements with SSIC, JinGuan and XinGuan and its shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses. We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with SSIC, JinGuan and XinGuan and its shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any, which could materially affect our financial condition and resulting revenues.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to 2010. We have no control over whether our employees or other agents will or will not engage in such conduct for which we might be held responsible . If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes, in which system-decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and/or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties that are unclear at this time . New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a “foreign persons” or “foreign funded” enterprise under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of any PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

|

·

|

levying fines;

|

|

·

|

revoking our business and other licenses;

|

|

·

|

requiring that we restructure our ownership or operations; and/or

|

|

·

|

requiring that we discontinue any portion or all of our business operations in the PRC.

|

Mining risks and insurance could negatively effect on our profitability.

The business of mining for gold and other metals is generally subject to a number of risks and hazards including environmental hazards, industrial accidents, labor disputes, unusual or unexpected geological conditions, pressures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. At the present time, we have in effect statutory required social insurance for all employees and mine workers and have obtained additional accidental insurance. There is currently no other insurance in place for the mining site and management and even if we were to purchase additional insurance , we can't be sure that such insurance would be available to us or that we could afford the premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. In addition , insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards which we may not be insured against, or which we may elect not to insure against, because of premium costs or other reasons. Any losses from any of these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations, which could negatively impact any investment you make in our shares.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

PRC companies have historically not adopted a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards for foreign subsidiaries. As a result, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This could result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

10

Changes in interest rates could negatively impact our results of operations, stockholders’ equity (deficit) and fair value of net assets.

Our investment activities and credit guarantee activities expose us to interest rate and other market risks. Changes in interest rates, up or down, could adversely affect our net interest yield. Although the yield we earn on our assets and our funding costs tend to move in the same direction in response to changes in interest rates, either can rise or fall faster than the other, causing our net interest yield to expand or compress. For example, due to the timing of maturities or rate reset dates on variable-rate instruments, when interest rates rise, our funding costs may rise faster than the yield we earn on our assets. This rate change could cause our net interest yield to compress until the effect of the increase is fully reflected in asset yields. Changes in the slope of the yield curve could also reduce our net interest yield.

Interest rates can fluctuate for a number of reasons, including changes in the fiscal and monetary policies of the federal government and its agencies, such as the Federal Reserve. Federal Reserve policies directly and indirectly influence the yield on our interest-earning assets and the cost of our interest-bearing liabilities. The availability of derivative financial instruments (such as options and interest rate and foreign currency swaps) from acceptable counterparties of the types and in the quantities needed could also affect our ability to effectively manage the risks related to our investment funding. Our strategies and efforts to manage our exposures to these risks may not be as effective as they have been in the past.

RISKS RELATED TO DOING BUSINESS IN CHINA:

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate all of our revenues in China. Accordingly, our business, financial condition, results of operations and future revenue prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

• the higher level of government involvement;

• the early stage of development of the market-oriented sector of the economy;

• the rapid growth rate;

• the higher level of control over foreign exchange; and

• the allocation of resources.

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of security and surveillance investments and expenditures in China, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business and prospects.

The PRC government exerts substantial influence over the manner in which we conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and any number of other unknown matters . We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions in China and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures. Any of these actions by the PRC government would severely and negatively impact our business operations and resulting revenues, which could result in a total loss of any investment you make in our shares.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

Most of our sales revenue and expenses are denominated in Renminbi. Under PRC law, the Renminbi is currently convertible under the "current account," which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, the PRC operating subsidiaries and VIEs of BSL may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC governmental authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in Renminbi, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in Renminbi to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if the PRC operating subsidiaries and/or VIEs of BSL borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries and/or VIEs by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or their respective local counterparts. These limitations could affect the PRC operating subsidiaries’ and/or VIEs’ ability to obtain foreign exchange through debt or equity financing, which could limit our business operations and impact our future revenues and financial condition.

11

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into the operating PRC subsidiaries and/or VIEs of BSL, limit BSL's PRC subsidiaries’/VIEs’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued a public notice, the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE Notice, which requires PRC residents to register with the competent local SAFE branch before using onshore assets or equity interests held by them to establish offshore special purpose companies, or SPVs, for the purpose of overseas equity financing. Under the SAFE Notice, such PRC residents must also file amendments to their registration in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations. Moreover, if the SPVs were established and owned the onshore assets or equity interests before the implementation date of the SAFE Notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC resident stockholder of any SPV fails to make the required SAFE registration and amended registration, the PRC subsidiaries of that SPV may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV. Failure to comply with the SAFE registration and amendment requirements described above could also result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

Because of uncertainty over how the SAFE Notice will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, BSL's present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with the SAFE Notice by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by the SAFE Notice. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with the SAFE Notice, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit BSL's subsidiaries’/VIEs’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission or CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer,which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the Ministry of Commerce and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

In addition to the above risks, in many instances, we will seek to structure transactions in a manner that avoids the need to make applications or a series of applications with Chinese regulatory authorities under these new M&A regulations. If we fail to effectively structure an acquisition in a manner that avoids the need for such applications or if the Chinese government interprets the requirements of the new M&A regulations in a manner different from our understanding of such regulations, then acquisitions that we have effected may be unwound or subject to rescission. Also, if the Chinese government determines that our structure of any of our acquisitions does not comply with these new regulations, then we may also be subject to fines and penalties.

Under the New EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that the Company is a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from BSL's PRC subsidiaries/VIEs would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2008 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible. If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against any U.S. taxes we may owe.

12

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions and foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the revised policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the RMB appreciated more than 20% against the U.S. dollar over the following three years. Since July 2008, however, the RMB has traded within a narrow range against the U.S. dollar. It is difficult to predict how long the current situation may last and when and how the RMB exchange rates may change going forward.

Our revenues and costs are mostly denominated in RMB, while a significant portion of our financial assets are denominated in U.S. dollars. At the Cayman Islands holding company level, we rely entirely on dividends and other fees paid to us by our subsidiaries and consolidated affiliated entities in China. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditure more costly to us, to the extent that we need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into RMB, as RMB is our reporting currency. Conversely, a significant depreciation of the RMB against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our earnings, which in turn could adversely affect the price of our common stock.

We may be delayed by or unable to comply with government and environmental laws, rules and regulations related to our operations which could severely impact our business operations.

The mining industry is subject to extensive regulations by the PRC government. These regulations govern a wide range of areas, including, but not limited to, investments, exploration, production, mining rights, pricing, trading and investments. In addition, mine operations are subject to fees and taxes, as well as safety and environmental protection laws and regulations. Our proposed mineral exploration programs will be subject to all of these extensive laws, rules and regulations. Various governmental permits will be required prior to implementation of proposed exploration operations. We are not assured of receiving such permits as and when needed for operations, or at all. There is also no guarantee that new environmental or safety standards more stringent than those presently in effect will not be enacted in the future, which could negatively affect our exploration programs. Also, the industry often finds itself in conflict with the interests of private environmental groups which can have an adverse effect on the mining industry. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our time and costs of doing business and prevent us from carrying out our exploration programs. Please see the subsection entitled "Government and Industry Regulations" under the Description of Business section on page 28 for a more detailed description of the PRC rules and regulations our industry is subject to.

RISKS ASSOCIATED WITH THIS OFFERING:

Any future trading market in our shares will be regulated by Securities and Exchange Commission Rule 15g-9 which established the definition of a “penny stock.” The effective result being fewer purchasers qualified by their brokers to purchase our shares, and therefore a less liquid market for our investors to sell their shares.

The shares being offered are defined as a "penny stock" under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

We are selling this offering without an underwriter and may be unable to sell any shares. Unless we are successful in selling all of the shares and receiving all of the proceeds from this offering, we may have to seek alternative financing to implement our business plans and you would receive a return of your entire investment.

This offering is self-underwritten, which means th at we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through our officers and directors, who will receive no commissions. We will offer the shares to friends, relatives, acquaintances and business associates, however, there is no guarantee that we will be able to sell any of the shares.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.

There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following completion of this offering to apply to have the shares quoted on the OTC Electronic Bulletin Board (OTCBB); however, we cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. As of the date of this filing, there have been no discussions or understandings between China ShouGuan Mining Corporation or anyone acting on our behalf with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

You will incur immediate and substantial dilution of the price you pay for your shares.

Our existing stockholders acquired their shares at a cost of $0.004 per share, a cost per share substantially less than that which you will pay for the shares you purchase in this offering. Accordingly, any investment you make in the shares offered herein will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.50 you pay for them. Upon completion of the offering, the net tangible book value of your shares will be $.016 per share, $.484 per share less than what you paid for them.

13

Our officers and directors will continue to exercise significant control over our operations, which means as a minority shareholder, you would have no control over certain matters requiring stockholder approval that could affect your ability to ever resell any shares you purchase in this offering.