Attached files

| file | filename |

|---|---|

| 8-K - Blue Gem Enterprise | bluegem8k091410.htm |

| EX-2.1 - Blue Gem Enterprise | ex2-1.htm |

| EX-3.5 - Blue Gem Enterprise | ex3-5.htm |

| EX-3.3 - Blue Gem Enterprise | ex3-3.htm |

| EX-3.2 - Blue Gem Enterprise | ex3-2.htm |

| EX-3.4 - Blue Gem Enterprise | ex3-4.htm |

| EX-10.1 - Blue Gem Enterprise | ex10-1.htm |

| EX-99.2 - Blue Gem Enterprise | ex99-2.htm |

| EX-10.2 - Blue Gem Enterprise | ex10-2.htm |

| EX-10.4 - Blue Gem Enterprise | ex10-4.htm |

| EX-10.5 - Blue Gem Enterprise | ex10-5.htm |

| EX-10.8 - Blue Gem Enterprise | ex10-8.htm |

| EX-10.6 - Blue Gem Enterprise | ex10-6.htm |

| EX-99.1 - Blue Gem Enterprise | ex99-1.htm |

| EX-10.7 - Blue Gem Enterprise | ex10-7.htm |

| EX-10.3 - Blue Gem Enterprise | ex10-3.htm |

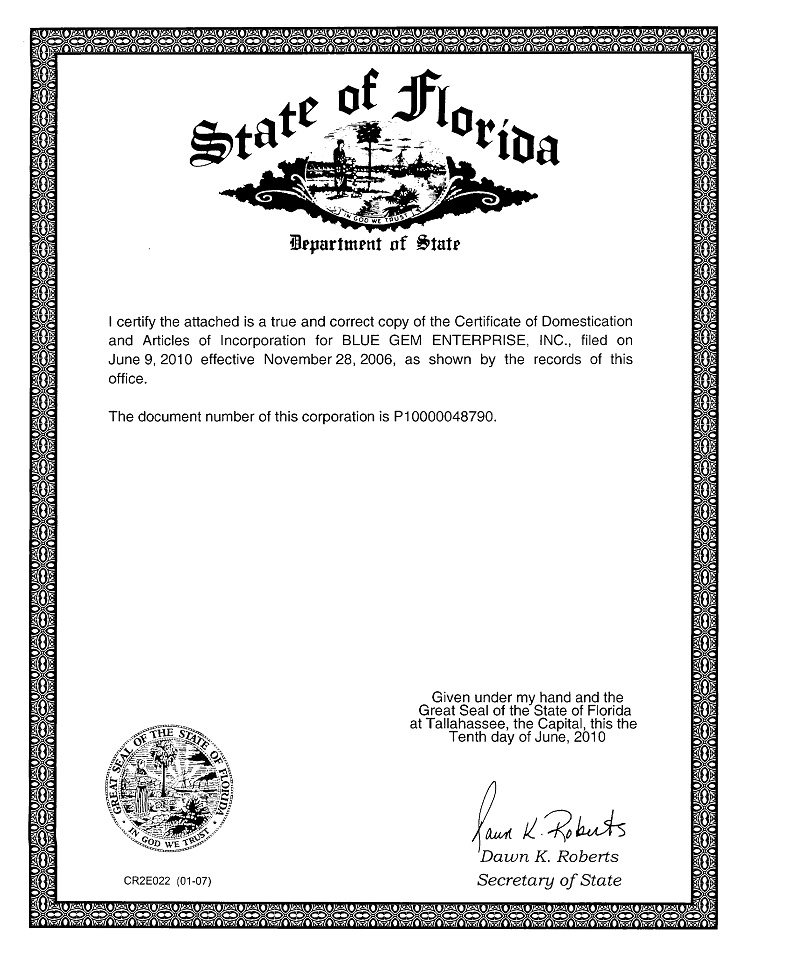

Exhibit 3.1

-2-

-3-

ARTICLES OF INCORPORATION

OF

BLUE GEM ENTERPRISE, INC.

(Continued from prior page)

ARTICLE VIII.

The total number of shares of stock that Blue Gem Enterprise, Inc. (the “Corporation”) shall have authority to issue is 210,000,000, consisting of 200,000,000 shares of common stock, par value $0.001 per share (“Common Stock”), and 10,000,000 shares of “blank check” preferred stock par value $0.001 per share (“Preferred Stock”).

Shares of Preferred Stock of the Corporation may be issued from time to time in one or more series, each of which shall have such distinctive designation or title as shall be determined by the Board of Directors of the Corporation (“Board of Directors”) prior to the issuance of any shares thereof. Preferred Stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof, as shall be stated in such resolution or resolutions providing for the issue of such class or series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then outstanding shares of the capital stock of the corporation entitled to vote generally in the election of the directors (the “Voting Stock”), voting together as a single class, without a separate vote of the holders of the Preferred Stock, or any series thereof, unless a vote of any such holders is required pursuant to any Preferred Stock Designation.

ARTICLE IX.

The number of directors of the Corporation may be increased or decreased in the manner provided in the Bylaws of the Corporation; provided, that the number of directors shall never be less than one. In the interim between elections of directors by stockholders entitled to vote, all vacancies, including vacancies caused by an increase in the number of directors and including vacancies resulting from the removal of directors by the stockholders entitled to vote which are not filled by said stockholders, may be filled by the remaining directors, though less than a quorum.

-4-

ARTICLE X.

No fully paid shares of any class of stock of the Corporation shall be subject to any further call or assessment in any manner or for any cause. The good faith determination of the Board of Directors of the Corporation shall be final as to the value received in consideration of the issuance of fully paid shares.

ARTICLE XI.

The Corporation shall have perpetual existence.

ARTICLE XII.

The holders of a majority of the outstanding shares of stock which have voting power shall constitute a quorum at a meeting of stockholders for the transaction of any business unless the action to be taken at the meeting shall require a greater proportion.

In furtherance and not in limitation of the powers conferred by statute, the Board of Directors is expressly authorized to fix the amount to be reserved as working capital over and above its paid-in capital stock, and to authorize and cause to be executed, mortgages and liens upon the real and personal property of the Corporation.

Any action required to be taken at any annual or special meeting of stockholders of the Corporation or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing setting forth the action so taken, shall have been signed by the holder or holders of a sufficient number of voting shares to take action with respect to the action that is the subject of the consent. Delivery made to the Corporation's registered office shall be by hand or by certified or registered mail, return receipt requested.

ARTICLE XIII.

The personal liability of the directors of the Corporation is hereby eliminated to the fullest extent permitted by Florida law, as the same may be amended and supplemented.

ARTICLE XIV.

The Corporation shall, to the fullest extent permitted by Florida law, as the same may be amended and supplemented, indemnify any and all persons whom it shall have power to indemnify under said Law from and against any and all of the expenses, liabilities, or other matters referred to in or covered by said Law, and the indemnification provided for herein shall not be deemed exclusive of any other rights to which those indemnified may be entitled under any Bylaw, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office, and shall continue as to a person who has ceased to be a director, officer, employee, or agent and shall inure to the benefit of the heirs, executors, and administrators of such a person.

-5-

ARTICLE XV.

The Corporation reserves the right to amend, alter, change, or repeal any provision contained in these Articles of Incorporation in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation.

ARTICLE XVI.

Shareholders of the Corporation shall not have cumulative voting rights nor preemptive rights.

-6-