Attached files

| file | filename |

|---|---|

| EX-32.2 - ShengdaTech, Inc. | v196563_ex32-2.htm |

| EX-31.2 - ShengdaTech, Inc. | v196563_ex31-2.htm |

| EX-31.1 - ShengdaTech, Inc. | v196563_ex31-1.htm |

| EX-32.1 - ShengdaTech, Inc. | v196563_ex32-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 10-K

(Amendment

No. 2)

(Mark

One)

|

x

|

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended December 31, 2009

or

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

|

For the

transition period from __________ to __________

Commission file number:

01-31937

SHENGDATECH,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

26-2522031

|

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

(I.R.S.

Employer

Identification

No.)

|

Unit

2003, East Tower, Zhong Rong Heng Rui International Plaza,

620

Zhang Yang Road, Pudong District, Shanghai 200122

People's

Republic of China

(Address

of Principal Executive Offices)

86-21-58359979 (Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name, Former Address and Former Fiscal Year, If Changed Since Last

Report)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class:

|

Name

of Each Exchange on Which Registered

|

|

|

Common

Stock, par value $.00001

|

The

NASDAQ Global Select Market

|

Securities registered pursuant to

Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes þ No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer x

|

Non-accelerated

filer ¨

(Do

not check if a smaller

reporting

company)

|

Smaller

reporting company ¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act):

Yes ¨ No þ

The

aggregate market value of the 28,114,324 shares of voting and non-voting

common equity stock held by non-affiliates of the registrant was $105,428,715 as

of June 30, 2009, the last business day of the registrant’s most recently

completed second fiscal quarter, based on the last sale price of the

registrant’s common stock on such date of $3.75 per share, as reported by The

NASDAQ Stock Market, Inc.

As

of March 15, 2010, there were 54,202,036 shares of common stock of

ShengdaTech, Inc. outstanding.

Explanatory

Note

This

amendment no. 2 to the Company's Annual Report on Form 10-K for the year ended

December 31, 2009 is filed in response to comments in the letter dated August

11, 2010 received by the Company from the U.S. Securities and Exchange

Commission.

SHENGDATECH,

INC.

(A

Nevada Corporation)

TABLE

OF CONTENTS

|

Page

|

|||

|

PART

I

|

|||

|

Item

1

|

Business

|

3

|

|

|

Item

1A

|

Risk

Factors

|

12

|

|

|

Item

1B

|

Unresolved

Staff Comments

|

29

|

|

|

Item

2

|

Properties

|

29

|

|

|

Item

3

|

Legal

Proceedings

|

30

|

|

|

PART

II

|

|||

|

Item

5

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

30

|

|

|

Item

6

|

Selected

Financial Data

|

32

|

|

|

Item

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation

|

35

|

|

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

48

|

|

|

Item

8

|

Financial

Statements and Supplementary Data

|

49

|

|

|

Item

9

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

50

|

|

|

Item

9A

|

Controls

and Procedures

|

50

|

|

|

Item

9B

|

Other

Information

|

53

|

|

|

PART

III

|

|||

|

Item

10

|

Directors,

Executive Officers and Corporate Governance

|

53

|

|

|

Item

11

|

Executive

Compensation

|

57

|

|

|

Item

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

62

|

|

|

Item

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

62

|

|

|

Item

14

|

Principal

Accounting Fees and Services

|

63

|

|

|

PART

IV

|

|||

|

Item

15

|

Exhibits

and Financial Statement Schedules

|

63

|

-2-

PART

I

Item

1. Business

Overview

We are a

leading and fast growing Chinese manufacturer of specialty additives. Our nano

precipitated calcium carbonate (“NPCC”) products are used as functional

additives and fillers in a broad array of products due to their low cost

and the overall improved chemical and physical attributes they provide to end

products. As a market leader of high-grade NPCC products, we deploy

advanced processing technology to convert limestone into high quality NPCC

products, which are sold to our customers in the tire, polyvinyl chloride

(“PVC”) building materials, polypropylene (“PP”) building materials, ink, paint,

latex, adhesive, paper and polyethylene (“PE”) industries.

Prior to

November 2008, we also manufactured, marketed and sold coal-based chemical

products, namely, ammonium bicarbonate, liquid ammonia, methanol and melamine.

We marketed and sold coal-based chemical products mainly as chemical fertilizers

and raw materials for the production of organic and inorganic chemical products,

including formaldehyde and pesticides. On June 16, 2008, the Tai’an

City Government, as part of China’s strengthening of environmental law

enforcement reform, issued a notice directing Bangsheng Chemical

Facility, our coal-based chemical facility in Tai’an City, to cease

production due to the close proximity of our facility to residential and

non-manufacturing business properties. In accordance with the Tai’an

City Government’s notice, we ceased production at our Bangsheng Chemical

Facility on October 31, 2008. As a result, we recorded an impairment charge of

approximately $3.9 million for Bangsheng Chemical Facility equipment in the

fourth quarter of 2008. We do not believe there is additional impairment of

assets in 2009. In December 2009, the Company decided to discontinue our

operations at Bangsheng Chemical Facility and to sell all of its operating

assets and inventory. Although we discontinued the Bangsheng coal-based chemical

operations, the Company is currently seeking other strategic opportunities in

the chemical business.

Our

Reorganization and Corporation Structure

We were

organized as a Nevada corporation on May 11, 2001 under the name Zeolite

Exploration Company for the purpose of acquiring, exploring and developing

mineral properties. We conducted no material operations from the date of our

organization until March 2006. On March 31, 2006, we consummated a share

exchange pursuant to a Securities Purchase Agreement and Plan of Reorganization

with Faith Bloom Limited, a British Virgin Islands company, and its

stockholders. As a result of the share exchange, we acquired all of the issued

and outstanding capital stock of Faith Bloom in exchange for a total of

50,957,603 shares of our common stock. The share exchange is accounted for as a

recapitalization of Zeolite and resulted in a change in our fiscal year end from

July 31 to December 31. Faith Bloom Limited was deemed to be the accounting

acquiring entity in the share exchange and, accordingly, the financial

information included in this annual report reflects the operations of Faith

Bloom, as if Faith Bloom had acquired us.

Faith

Bloom was organized on November 15, 2005 for the purpose of acquiring from

Eastern Nanomaterials Pte. Ltd., a Singapore corporation, all of the capital

shares of Shandong Haize Nanomaterials Co., Ltd and Shandong Bangsheng Chemical

Co., Ltd., which are Chinese corporations engaged in the manufacture, marketing

and sales of a variety of NPCC products and coal-based chemicals for use in

various applications. On December 31, 2005, Faith Bloom acquired all of the

capital shares of Shandong Haize Nanomaterials Co., Ltd and Shandong Bangsheng

Chemical Co., Ltd.

As a

result of the transactions described above, Shandong Haize Nanomaterials Co.,

Ltd and Shandong Bangsheng Chemical Co., Ltd. are wholly-owned subsidiaries of

Faith Bloom, and Faith Bloom is a wholly-owned subsidiary of Zeolite. On April

4, 2006, Faith Bloom formed a wholly-owned subsidiary in Shaanxi, China to run

the NPCC facility in Shaanxi Province. Effective January 3, 2007,

Zeolite changed its name to ShengdaTech, Inc. On July 1, 2008, Faith

Bloom formed a wholly-owned subsidiary in Zibo, Shandong Province to operate our

new NPCC facility in Zibo.

On

December 11 2009, Faith Bloom completed its acquisition of Anhui Chaodong

Nanomaterials Science and Technology Co., Ltd. (“Chaodong”), a company located

in Anhui province, to operate our new Anhui facility. The name of

Anhui Chaodong Nanomaterials Science and Technology Co. Ltd. was changed to

Anhui Yuanzhong Nanomaterials Co., Ltd. (“Anhui Yuanzhong”) in April

2010.

-3-

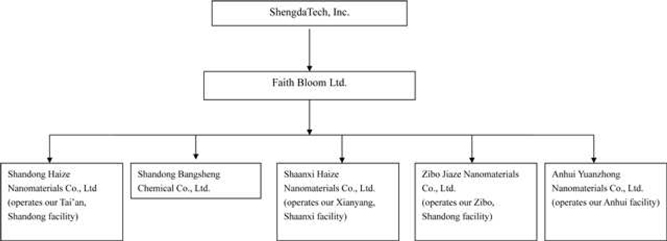

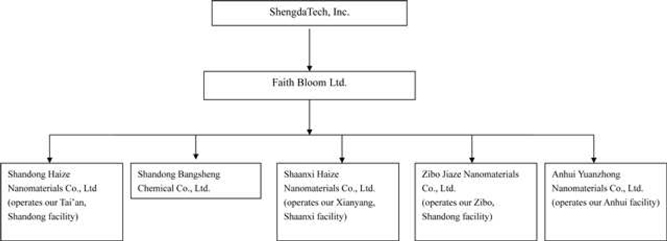

Our

corporate structure is depicted in the following chart:

Market

Opportunity

The

NPCC Markets in china

NPCC

refers to ultrafine nano precipitated calcium carbonate, a synthetic industrial

material made from limestone, which has an average particle diameter of less

than 100 nanometers or 0.1 micron. The nano particle is smaller than the

wavelength of visible light and provides characteristics such as narrow

distribution range of grain-size and improved decentrality, which make the

compounds suitable for many applications. In the filler and additive industry,

traditional fillers, including carbon blacks and precipitated calcium carbonate,

have been used for years as a means to reduce material costs by replacing a

portion of higher cost materials. The main functions of the traditional fillers

are to occupy the space and act as cheap diluents of more expensive materials.

Fillers play a major role in all types of polymers, such as thermoplastics,

rubbers and thermosets. NPCC is an emerging product in the functional filler and

additive industry with numerous possibilities of new applications, many of which

are yet to be developed. As functional additives, NPCC offers additional

benefits than traditional fillers. Due to its low cost and special chemical

properties, NPCC has been widely used in the rubber, plastic, paint, ink, paper

and adhesive manufacturing industries to improve product quality while

maintaining or reducing costs. It can be used solely as an additive which

contributes to the processing features of end products, or it can also be

applied together with other fillers such as precipitated calcium carbonate,

titanium oxide and silicon dioxide.

Compared

to traditional fillers, NPCC offers a broad range of advantages when used as

functional additives. These advantages include the following:

|

·

|

Enhanced performance of end

products, including but not limited to improved durability, increased

tensile strength, improved heat resistance and better stabilization;

and

|

|

·

|

Reduced product cost through

substitution of NPCC for more expensive

materials.

|

While

research into and manufacturing of NPCC in China began in the early 1980s, the

NPCC industry only recently experienced strong growth, resulting from increased

awareness of its ability to replace more expensive materials and its

functionality to enhance the performance of various end products. In China, NPCC

products are primarily used as functional additives in feedstock materials to

the automobile, construction and consumer sectors. Typical feedstock materials

that use NPCC include tires, PVC building materials, PP building

materials, ink, paint, latex, adhesives, paper and PE plastic

materials. We believe that the development of the plastics, rubber,

paper, construction coating and daily-use chemical industries in China will

increase demand for NPCC. With the maturity of the NPCC technology

and its expanded applications in China, we believe

that domestically produced NPCC with superior quality and steady

performance will gradually replace the market share of the imported

products of foreign competitors.

-4-

NPCC

products have been primarily used in the following industries:

Tire

and Rubber

NPCC,

when treated by a surface coating agent to improve compatibility, can fill the

spatial structure in rubber and enhance the properties of certain rubber

products, such as tires and latex. NPCC can be applied solely as an additive or

used together with other fillers such as precipitated calcium carbonate, clay

and carbon black to reduce expensive rubber content and to improve certain

properties of the rubber products. NPCC is a rubber strengthening additive that

can enhance the flexibility, break elongation, tear resistance, abrasion

resistance and anti-aging performance of rubber and the use of NPCC provides a

10-20% overall improvement in performance measured by increased traction wave

resistance, tear resistance, break elongation, tensile strength and aging

resistance. In addition, NPCC can also partially substitute for certain more

expensive materials such as carbon black and silicon dioxide, thus reducing the

overall cost of manufacturing without negative impact on reinforcing and

whitening features.

In 2009,

China has exceeded the United States and became the world’s largest automobile

consumption nation with annual sales of passenger cars of approximately 10.3

million units. Therefore, we expect NPCC products to

obtain a larger market share compared to traditional fillers in the rubber

and tire fields.

Plastic

Materials

Plastic

materials, including PVC, PE and PP, are a significant end market for NPCC

products. When modified with a surface coating agent, NPCC particles become

compatible with organic substances which facilitate their use as a functional

additive in plastic materials. Modified NPCC particles can be used in plastics

such as PVC building materials to increase their tensile strength, flexibility,

durability and heat resistance, to stabilize their dimensions and to improve

color fastness and glossiness. In addition, NPCC can be used as a substitute for

more expensive materials, such as silicon dioxide, which may considerably reduce

the total cost of the end products.

Paper

We

believe that China’s paper industry represents large untapped market

opportunities for domestic NPCC manufacturers. NPCC can be used as a functional

additive for newsprint paper, coating paper and specialty paper products. NPCC

can improve the glossiness, whiteness, opacity and printability of paper

products, while reducing the requirement for more expensive titanium dioxide or

kaolin. China’s paper industry is currently migrating from acid sizing to

alkaline sizing in terms of production process. We believe

this migration increases the market opportunity for NPCC, which can only be

applied in the alkaline sizing process.

Paints,

Ink and Adhesives

NPCC

products have a range of other applications in the construction and automotive

industries, including surface coatings, water-based and oil-based paints,

adhesives and sealants. NPCC has also been widely used as an additive in

oil-based printing inks. When used as a substitute of certain more expensive

materials such as titanium dioxide or kaolin, NPCC can reduce component cost as

well as maintain or reinforce the features of the end products.

-5-

Our

Business

NPCC Production

We

commenced our NPCC operations in 2001 with the installation of our first NPCC

production line, which had an annual production capacity of 10,000 metric tons,

in Tai’an, Shandong Province. As of December 2009, we have increased our total

annual NPCC production capacity to 250,000 metric tons. We believe that we are

currently the largest Chinese manufacturer of NPCC products in terms of net

sales for the year ended December 31, 2009.

In August

2009, we, through our wholly-owned subsidiary, Faith Bloom, entered into an

equity transfer agreement with Anhui Chaodong Cement Co., Ltd., a company

incorporated under the laws of the People’s Republic of China, pursuant to which

Faith Bloom acquired the entire equity of Chaodong, a PRC company and

wholly-owned subsidiary of Anhui Chaodong Cement Co., Ltd. Chaodong was an

inactive manufacturer of NPCC, and its assets include mining rights to reserves

of approximately 13.2 million metric tons of limestone and existing

buildings and equipment. The acquisition was approved by the Chinese government

in November 2009. Anhui Chaodong Cement Co., Ltd. and Chaodong were not

affiliates of our Company or any of our directors or officers. On

December 11, 2009, we completed our acquisition of Chaodong, which has an

annual production capacity of 10,000 metric tons. The name of Chaodong was

changed to Anhui Yuanzhong Nanomaterials Co., Ltd. in April 2010. Anhui

Yuanzhong, which operates our Anhui facility, started production in May

2010 after we completed certain repairs and maintenances of the acquired

facility and equipment and performed certain technological upgrades consistent

with our Zibo, Shandong facility.

In August

2009, we, through Faith Bloom Limited, entered into a project investment

agreement with the local government of Hanshan County, Anhui Province. Pursuant

to this agreement, we agreed to invest an aggregate amount of RMB

1,200 million (approximately $175.7 million) in several phases by 2013,

which includes an investment in a new NPCC project with an

annual capacity of 200,000 metric tons of NPCC per year and

the purchase of land-use rights for a total area of approximately 341,335 square

meters (approximately 84.35 acres). The local government also agreed to grant to

us exclusive mining rights to good quality limestone, and provide other

utilities and services for manufacturing purposes. We plan to utilize third

parties for mining or processing operations and do not plan to engage in any

mining or processing operations. In addition to this agreement, we also

agreed to purchase land-use rights for a total area of approximately 66,767

square meters (16.5 acres) from the local government of Hanshan County, Anhui

Province for Anhui Yuanzhong. These agreements are investment plans and are not

contractually binding until key elements of contract terms such as transaction

prices and specific payment schedules are fully agreed upon, binding agreements

are executed, and approval from the relevant government agencies are

obtained.

The

following table exhibits all of our facilities with their respective annual

production capacities and production volume of NPCC for the last three

years.

|

2007

|

2008

|

2009

|

||||||||||||

|

Tai’an,

Shandong facility

|

Production

Capacity (metric tons)

as

of December 31

|

30,000

|

30,000

|

30,000

|

||||||||||

|

Annual

Output (metric tons)

|

34,259

|

34,070

|

33,538

|

|||||||||||

|

Xianyang,

Shaanxi facility

|

Production

Capacity (metric tons)

as

of December 31

|

100,000

|

160,000

|

160,000

|

||||||||||

|

Annual

Output (metric tons)

|

87,652

|

147,935

|

163,294

|

|||||||||||

|

Zibo,

Shandong facility

|

Production

Capacity (metric tons)

as

of December 31

|

-

|

-

|

60,000

|

||||||||||

|

Annual

Output (metric tons)

|

-

|

-

|

13,350

|

|||||||||||

|

Total

|

Production

Capacity (metric tons)

as

of December 31

|

130,000

|

190,000

|

250,000

|

||||||||||

|

Annual

Output (metric tons)

|

121,911

|

182,004

|

210,181

|

|||||||||||

-6-

We

established a research and development center in Pudong, Shanghai, which is

dedicated to the research and development of NPCC applications. Our research and

development center has attracted NPCC researchers and scholars with advanced

degrees in chemistry and materials science who primarily focus on improving the

quality of our existing NPCC products and developing innovative NPCC products

for new applications. As an example, we developed new NPCC products for use in

the paper and PE industries and began receiving orders from paper manufacturers

in 2007 and from PE customers in February 2008. In addition, we expect to begin

selling our newly developed NPCC products to the asphalt and PVC plastic glove

markets in the near future. Currently, our product is undergoing trials with a

number of potential asphalt industry customers.

We

currently sell our NPCC products in Shandong Province, the Yangtze River Delta

and other parts of China through resident sales representatives.

Internationally, in 2009, we targeted five countries for our product export:

Singapore, Thailand, South Korea, Malaysia and India. International sales

accounted for approximately 0.4%, 9.6%, and 7.1% of our total NPCC net sales in

2007, 2008, and 2009, respectively. In July 2009, we established a new

international sales team at our headquarters in Shanghai, China. In January

2010, we strengthened our international sales and marketing efforts by

appointing Mr. Gary Cao, who has over 12 years of experience as a sales and

marketing director for leading chemical companies in China and the Asia Pacific

region, as our new international marketing director. We believe international

sales and marketing will make more contribution to our business as the worldwide

economy recovers.

Revenue

and Net Income from Continuing Operations

Our

revenue and net income from continuing operations have increased steadily since

2006. In 2009, our revenue was $102.1 million and our net income from continuing

operations was $23.6 million.

Our

Products

Our key

applications for our NPCC products and their respective end markets are as

follows:

|

NPCC Applications

|

|

Primary Use

|

|

Rubber

|

Additive

for tires

|

|

|

Plastic

|

Additive

for PVC building materials and PE

|

|

|

Paint

and ink

|

Additive

for ink and water-based and oil-based paints

|

|

|

Latex

|

Additive

for latex gloves

|

|

|

Adhesive

|

Additive

for high-grade silicone adhesive and polysulfide

sealant

|

|

|

Paper

|

Additive

for coating

paper

|

Our NPCC

business focuses on the production of high-quality and low-cost NPCC

products. Our NPCC business has strong positions in the tire and PVC

building materials markets, and has expanded into the ink, paint, latex and

adhesives markets. To further diversify our customer base, we plan to gain share

in the paper and PE markets, which are currently relatively underserved by

the NPCC industry.

We have

established effective quality assurance systems for our NPCC products. Our

Tai’an, Shandong facility has been ISO 9001-certified since 2003 and our NPCC

products were awarded “Shandong Top Brand” at the end of 2006.

Our Xianyang, Shaanxi facility has been ISO

9001-certificated since 2007.

Intellectual

Property

We

jointly own a patent with Tsinghua University for an advanced NPCC particle

production technology based on membrane-dispersion techniques. This patent

was granted by the State Intellectual Property Office of the PRC

in November 2007 and will expire on September 9, 2025.

We also

utilize a proprietary technique for NPCC chemical modification to tailor our

NPCC particles to the end product.

We

utilize a trademark for our NPCC products, which is licensed by our related

party and registered with the Trademark Office of the State Administration for

Industry and Commerce of China, relating to the Chinese words “盛科 (Shengke).”

As agreed to by our related party, we have rights to use this

trademark at no cost indefinitely.

-7-

Research

and Development

As

of December 31, 2009, we have 26 members in our research and

development team. Among them, 13 hold Ph.D. degrees, 13 hold Masters

degrees and most have worked in the NPCC research field for more than four

years. Mr. Xiaochuan Zhu, our Director of Research and Development, with more

than 10 years of experience, is leading our effort to develop and improve a

proprietary technology for modifying NPCC products. This new technology can

be used to modify the property of a specific NPCC product to fit a particular

end product and, in addition, improve the quality of such end product.

Recently, much progress has been made in the applications in paper, PE and

asphalt products. With this new technology, tires, PVC building materials,

paints, adhesives and paper of equal or better quality can be made at a lower

cost. We are also developing NPCC products for other applications, including

extensions of existed products and new products such as epoxy resin, cosmetics

and asphalt.

Our

research and development activities are a three-stage process. During the first

stage, we apply surface coating agents to NPCC according to different

pre-designed formulas for comparative studies. The modified NPCC is tested for

mass, size, oil absorbance and other traits to determine if it displays the

appropriate features. During the second stage, approximately two kilograms of

NPCC product is produced with lab equipment using a formula selected at the

first stage. The NPCC product produced is applied to an end product such as a

tire, paint or ink. The end product is then tested for a set of properties and

other parameters to determine if they meet expectations. If the formula is

successful at the second stage, it will be further tested. During the third

stage, several tons of the NPCC products are manufactured at a NPCC

facility using the formula that passed the second test and is sent to potential

customers for an industrial scale test. Our research and development staff is

dispatched to such customers’ sites to assist with the test.

We focus

on further developing and improving our core manufacturing technologies to

expand our product lines and reduce overall costs. In 2009, we completed sample

testing of our NPCC products with approximately 40 companies in various

industries, such as PVC, rubber, adhesive, latex and coating. As of December 31,

2009, we had 59 potential customers at various stages of our sample testing

process.

We had

previously entered into joint development agreements with Tsinghua University

and Qingdao University of Science and Technology to develop new NPCC

technologies. Under the agreement with Qingdao University of Science and

Technology, we have exclusive ownership to any technology developed. Under the

agreement with Tsinghua University, we jointly own any technology developed and

have an exclusive right to use such technology. Our joint development program

with Tsinghua University has produced a membrane-dispersion patent which was

granted by the Patent Office of the State Intellectual Property Office of China

in November 2007.

In

addition, we have adopted an advanced membrane-dispersion technology in the

production process at our Xianyang, Shaanxi facility and our Zibo, Shandong

facility with phase I capacity of 60,000 metric tons. This technology not only

reduces production cost, but also enables us to have better control of the size

and consistency of the nano-particles, which greatly improves our NPCC product

quality. Our research and development center in Pudong, Shanghai, China is our

base for training research and technical personnel and developing new

technologies. We believe that this research and development center is sufficient

to meet our current research and development needs and we are in a good position

to attract qualified research personnel at a reasonable cost. Thus, we are

currently conducting our research and development internally, and have

terminated our research and development cooperation with Tsinghua University and

Qingdao University of Science and Technology.

Sales

and Marketing

Our sales

team consists of 52 employees, 32 of which are devoted to domestic

sales and 20 of which are devoted to international sales. To expand

distribution channels and increase our market share, we will continue our

efforts on building our international sales team. We also plan to regularly

attend industry fairs and exhibitions to obtain the latest industry information.

We have become a member of www.alibaba.com.cn, the largest business-to-business

Internet portal in China.

-8-

Through

our sales and marketing efforts, we have established our leadership in the NPCC

industry in China, particularly for applications in the tire and PVC building

materials markets. We have successfully entered the oil-based paint and paper

industries. We are now actively marketing our NPCC products to major

international companies in the adhesive industry and our products in the asphalt

industry are under testing processes domestically. We plan to begin supplying

our products to certain major international companies in the adhesive industry

and to domestic asphalt manufacturers.

At

present, our NPCC products are primarily sold and marketed directly by our sales

and marketing staff. Our NPCC products are mainly sold in Shandong Province,

Yangtze River Delta and other parts of China. We are actively expanding our NPCC

marketing network into other parts of China and have resident sales

representatives in multiple locations in China including Shanghai, Xi’an, and

Dongying, Shandong Province. We have also successfully expanded into the

international market for NPCC. We have sold our NPCC products to a number of

Asian countries, including Singapore, Thailand, South Korea, Malaysia and India.

Additionally, our international sales department is actively testing our

products with customers in North America.

Raw

Materials

In 2009,

the cost of raw materials accounted for approximately 52.8% of our total

production cost. Anthracite, modification agents and limestone are the major raw

materials for producing NPCC products.

We have

multiple suppliers for all of our major raw materials, except for modification

agents. Soft coal and anthracite are in abundant supply in China with a large

number of suppliers. We are currently considering increasing the number of our

supplier partners for modification agents or potentially producing them

internally.

Given the

importance of certain key raw materials such as limestone to our business, we

obtained mining rights over high quality limestone in Shaanxi and Anhui

Provinces. All of our limestone reserves, 11.6 million metric tons in

Shaanxi Province and 13.2 million metric tons in Anhui Province, are proven

reserves. We are currently in negotiations with the government

regarding the price and payment terms for our mining rights for our Zibo,

Shandong facility. The Company plans to utilize third parties for

mining and processing operations and does not plan to engage in any mining

or processing operations. During 2009, 2008 and 2007, all of our limestone

was purchased from external sources and amounted to 376,707 metric tons, 311,253

metric tons and 223,803 metric tons, respectively.

For

production of NPCC, high quality limestone has both strict requirements in its

chemical content and certain requirements in its physical

properties. With regards to chemical composition, high calcium

carbonate content in the limestone is required, and at the same time, identified

detrimental impurity must be at a low enough level. Although high

calcium carbonate content in limestone is prevalent in nature, most of it

cannot be used to produce NPCC due to the levels of certain detrimental

impurities. We measure the required chemical content in percentages. Generally,

we consider the content percentage of various chemicals when measuring the

quality standard, such as the percentages of CaCO3, Fe2O3, Al2O3, MgO, and

other chemicals in the limestone.

In terms

of the physical properties, we utilize two measures: the whiteness of the

limestone (with over 90% of calcium) and that the limestone does not

disintegrate when it is calcinated under high temperatures. Our

whiteness test requirement is a measurement of the chemical purity of calcium

carbonate.The Company’s policies limit the purchase of limestone to limestone

that fulfills the Company’s criteria described above.

Supplier

Management System

Although

most of our key raw materials are widely available in China, the price for

certain raw materials such as coal has been fluctuating greatly in the past few

years, which has affected our profit margin. We have adopted measures to reduce

risks in raw material supply costs, including establishing long-term

relationships with suppliers and diversifying supply

sources.

-9-

Purchasing

Procedures with View to Quality and Stability of Suppliers

Purchasing

activities are conducted in accordance with our standard purchasing procedures.

Potential suppliers are provided with our quality standards for the raw material

and are invited to make initial offers, which are compared objectively according

to relevant quality guidelines. After validating various suppliers’ services and

capabilities for quality and stable supply, we select the qualified supplier

with the lowest price. Our finance department has also established an oversight

process by appointing individuals to conduct independent market research of key

raw material prices periodically. We have implemented a standard procedure to

insure that all purchasing requirements are strictly adhered to.

We

generally use either cash payment or on credit for payment to suppliers of our

raw materials. Credit payments have terms of 30 to 90 days. We enter

into contracts with all long-term suppliers of raw materials.

Regardless of payment terms, payments are not made until our purchasing

procedures are completed.

Major

Suppliers

The table

below lists our major suppliers for the year ended December 31,

2009.

Major

Suppliers for NPCC Business

|

Suppliers

|

|

Amount

Purchased in

2009

(USD

million)

|

|

|

% of Total

Purchases

in

2009

|

|

||||

|

Xintai

Liantai Material Co., Ltd

|

Anthracite

|

4.46

|

8.42

|

%

|

||||||

|

Xianyang

Chuangfa Trading Co., Ltd.

|

Anthracite

and soft coal

|

8.63

|

16.30

|

%

|

||||||

|

Qingdao

Siwei Chemical Co. Ltd.

|

Modification

agent

|

6.93

|

13.09

|

%

|

||||||

|

Qianxian

Tianhe Mining Industry LLC

|

Limestone

and soft coal

|

5.38

|

10.16

|

%

|

||||||

|

Total

|

47.97

|

%

|

||||||||

Our

Major Customers

We sell

our NPCC products to customers in the tire, PVC building materials, ink, paint,

latex, adhesive, paper and PE industries. Our customers are mainly

located in Shandong Province, the Yangtze River Delta and other parts of China.

Most of our top NPCC customers are large-scale manufacturers of tires and PVC

building materials.

For the

year ended December 31, 2009, sales to our top five NPCC customers collectively

accounted for 10.5% of total NPCC sales. For the same period, approximately 7.0%

of our NPCC sales were contributed by overseas markets.

Major

Customers of our NPCC Products

|

Name

|

Industry

|

|

Amount

of

Sale in

2009

(USD

million)

|

|

|

Percentage of

Total Sales

|

|

|||

|

Triangle

Tire Co., Ltd.

|

Tire

|

2.12

|

2.08

|

%

|

||||||

|

Zhaoyuan

Liao Rubber Products Co., Ltd.

|

Tire

|

2.25

|

2.21

|

%

|

||||||

|

Qingdao

Doublestar Tire Industrial Co., Ltd.

|

Tire

|

2.18

|

2.14

|

%

|

||||||

|

Zhenjiang

Suhui Latex Production Co., Ltd.

|

Tire

|

1.83

|

1.78

|

%

|

||||||

|

Shengtai

Group Co., Ltd.

|

Tire

|

1.75

|

1.70

|

%

|

||||||

|

Total

|

10.13

|

9.91

|

%

|

|||||||

|

|

||||||||||

|

Dalian

Jinyuan Building Materials & Plastics Co., Ltd.

|

PVC

|

2.17

|

2.13

|

%

|

||||||

|

Shandong Ruifeng

Chemical Co., Ltd.

|

PVC

|

2.00

|

1.96

|

%

|

||||||

|

Tangshan Jiaji

Composite Pipe Corp. Ltd.

|

PVC

|

1.70

|

1.67

|

%

|

||||||

|

Cangzhou

Cangjing Chemical Co., Ltd.

|

PVC

|

1.65

|

1.62

|

%

|

||||||

|

Total

|

7.52

|

7.38

|

%

|

|||||||

-10-

Competition

We are

subject to intense competition. Some of our competitors have greater financial

resources, larger size, and better established market recognition in both

domestic and international markets than us.

For our

NPCC products, we compete based upon proprietary technologies, manufacturing

capacity, product quality, production cost and ability to produce a diverse

range of products. Our competitors include NPCC manufacturers both within China

and around the world.

We also

face competition from certain well-established foreign chemical companies,

including Imperial Chemical Industries Limited (ICI), Solvay S.A., Minerals

Technologies Inc., and Shiraishi Calcium Kaisha Ltd. For example, competition

for our NPCC products in the paper and ink industries primarily comes from

Japanese manufacturers such as Shiraishi Calcium Kaisha, which sells to Chinese

automobile paint makers and Japanese ink makers in China.

Regulation

In China,

waste gas and water discharges in our manufacturing processes are regulated and

must meet certain standards under China’s environmental laws and regulations.

The local branch of the Ministry of Environmental Protection of the

People’s Republic of China samples and tests our gas and water discharge

regularly. The specifications of these discharges must be consistent with the

regulations for industrial waste water and gas and relevant laws and standards,

including the Water Pollution Discharge Standard for the Synthetic Ammonia

Industry issued by the Ministry of Environmental Protection of the People’s

Republic of China. Our NPCC facilities are not required to obtain Production

Safety Licenses.

Pursuant

to the Environment Impact Assessment Law, which came into effect on September 1,

2003, the construction or expansion of our NPCC facilities is subject to

environment impact assessment procedures conducted by local environmental

protection authorities in China, including the acceptance of environment impact

assessment reports of each project by the environmental protection authorities.

As of December 31, 2009, we have a total annual production capacity of 250,000

tons of NPCC, and we have passed environment impact assessment for 190,000

metric tons of NPCC production capacity. The remaining capacity has not yet

passed the assessment and is expected to pass the assessment by the end of

September 2010. The local environmental regulatory department in Qian County,

where our Xianyang, Shaanxi facility is located, has orally advised us that

we may continue to produce NPCC during the process of passing the

environmental impact assessment, and we therefore believe that the temporary

non-compliance with the Environment Impact Assessment Law will not have and has

not had in the past material effects on our capital expenditures, earnings, and

competitive position. However, if the environmental regulatory department in

Xianyang or at a higher level determines that we are not compliant with the

Environment Impact Assessment Law, we may be subject to fines or other legal

sanctions. Although we have not been punished by any environmental regulatory

department as of December 31, 2010, we cannot assure you that the government

will take the same position in future.

Employees

As of

December 31, 2009, we employed 1,063 full-time employees. Of our total

employees, 10.5% are management personnel, 3.6% are sales staff members and 2.4%

are R&D staff members. We believe that we maintain a satisfactory working

relationship with our employees, and we have not experienced any significant

labor disputes or any difficulty in recruiting staff for our

operations.

As

required by applicable Chinese law, we have entered into employment contracts,

which include confidentiality and non-compete provisions prohibiting employees

from disclosing our trade secrets or using trade secrets for purposes other than

benefiting us, with all employees.

-11-

Our

employees in China participate in a state pension program organized by Chinese

municipal and provincial governments. We are required to contribute to the

program at the rate of 20% of the average monthly salary of our employees. In

addition, we are required by Chinese law to cover employees in China with other

types of social insurance. Our total contribution may amount to as much as 30%

or more of the average employee monthly salary. We have purchased social

insurance for all of our employees who voluntarily participate in the social

insurance program. Social insurance expenses were approximately $347,287 and

$567,741 for 2009 and 2008, respectively.

Pursuant

to Chinese laws, our Chinese subsidiaries are required to establish housing

accumulation funds for their employees and to contribute to the funds at a

certain percentage of the monthly salary of each employee. Failure to comply

with such obligation may subject our Chinese subsidiaries to fines not exceeding

approximately $7,200 for each subsidiary. We have established housing

accumulation funds for our qualified employees since December

2008.

Additional

Information

Our

Internet address is www.shengdatechinc.com. We make available, free of charge,

through our Internet address our annual report on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed

or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as

reasonably practicable after we electronically file such material with, or

furnish it to, the SEC.

Item

1A. Risk Factors

Cautionary

Statement Regarding Future Results, Forward-Looking Information And Certain

Important Factors

In this

report we make, and from time to time we otherwise make, written and oral

statements regarding our business and prospects, such as projections of future

performance, statements of management’s plans and objectives, forecasts of

market trends, and other matters that are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Statements containing the words or phrases

“will likely result,” “are expected to,” “will continue,” “is anticipated,”

“estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,”

“target,” “goal,” “plans,” “objective,” “should” or similar expressions identify

forward-looking statements, which may appear in documents, reports, filings with

the Securities and Exchange Commission, news releases, written or oral

presentations made by officers or other representatives made by us to analysts,

stockholders, investors, news organizations and others, and discussions with

management and other of our representatives. For such statements, we claim the

protection of the safe harbor for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995.

Our

future results, including results related to forward-looking statements, involve

a number of risks and uncertainties. No assurance can be given that the results

reflected in any forward-looking statements will be achieved. Any

forward-looking statement speaks only as of the date on which such statement is

made. Our forward-looking statements are based upon assumptions that are

sometimes based upon estimates, data, communications and other information from

suppliers, government agencies and other sources that may be subject to

revision. Except as required by law, we do not undertake any obligation to

update or keep current either (i) any forward-looking statement to reflect

events or circumstances arising after the date of such statement, or (ii) the

important factors that could cause our future results to differ materially from

historical results or trends, results anticipated or planned by us, or which are

reflected from time to time in any forward-looking statement.

In

addition to other matters identified or described by us from time to time in

filings with the SEC, there are several important factors that could cause our

future results to differ materially from historical results or trends, results

anticipated or planned by us, or results that are reflected from time to time in

any forward-looking statement, include the following:

-12-

Risks Related To Our Business and

Operations

Subsequent to the

cease of production of our coal-based chemical production facility on October

31, 2008, we generate all of our net sales from our NPCC products and

a reduction in net sales from our NPCC products would cause

our net sales to decline and could materially harm our

business. After we ceased production at our Bangsheng Chemical Facility

on October 31, 2008 in compliance with the directive from the Tai’an City

Government, we no longer generate net sales from the sale of

coal-based chemical products and derive all of our net sales from the

sale of our NPCC products. As of December 31, 2009, the Bangsheng coal-based

chemical operations have been discontinued. For the year ended December 31,

2009, our sales of NPCC products were approximately $102.1 million, or 99.7% of

our total net sales and the remaining 0.3% or $295,899 was

generated from sales of coal inventory of Bangsheng Chemaical Facility.

Going forward, continued market acceptance of our NPCC products will remain

important to our success, and a reduction in revenue from the sale of our NPCC

products will materially harm our business, financial condition and results of

operations.

We may not be

able to maintain our competitive advantage in NPCC technology.

At present, we are the largest manufacturer of NPCC products in China in terms

of production capacity. Our competitive edge depends heavily on the new

technology employed in our NPCC manufacturing process. We adopted the ultra

gravity precipitation technology in the manufacturing process in our Tai’an,

Shandong facility. In our Xianyang, Shaanxi facility and Zibo,

Shandong facility, we deployed the membrane-dispersion technology co-developed

and co-owned with Tsinghua University. We currently have the exclusive

right to use this technology. At this time, other than maintaining

our own research and development center in Shanghai, we are not working in

partnership with any universities or research institutions. The

growth of our business and development of new technology may require that we

seek external collaborative partners for research and development. We

cannot assure you that we will be able to enter into agreements with

collaborative partners on terms acceptable to us, if any at all. In

addition, if more advanced technology is developed for the manufacturing of NPCC

by our competitors, we may lose our competitive advantage and our results of

operations may be adversely affected.

Our failure to

develop and introduce new NPCC products could reduce our sales or market

share. We rely on our research and development team

develop and improve technologies for NPCC production. Our research

and development team developed a technology used to modify the property of

a specific NPCC product to fit a particular end product and, in addition,

improve the property of such end product. However, research and

development activities are inherently uncertain, and we might encounter

practical difficulties in commercializing our research results. A

variety of competing NPCC products that our competitors may develop could prove

to be more cost-effective and have better performance than our NPCC

products. Therefore, our research and development efforts may be

rendered obsolete by the technological advances of our

competitors. Our failure to develop and introduce new NPCC products

could render our products uncompetitive or obsolete, and result in a decline in

our sales or market share.

Our NPCC products

have limited applications. We may not be able to increase the range of

applications of our NPCC products. Presently, our existing

NPCC products are used as functional additives for tire, PVC building

materials, PP building materials, ink, paint, latex, adhesive, paper and PE

products. Our products, therefore, depend heavily on a limited number

of industries. Our growth potential may be limited if we cannot

expand the markets for our existing NPCC products or develop new products for

other industries. Although we have increased our research and

development efforts to expand the range of applications of our NPCC products,

there is no assurance that we will succeed in our efforts.

We may not be

able to continue to produce high-quality NPCC products, which may negatively

impact our business. We believe that the quality of our NPCC

products is critical to our success. We maintain quality control

standard procedures and expect our employees to strictly comply with these

procedures. We also apply a distribution control system in NPCC

production to ensure process control and stability. Any quality

problems with our products due to any reason such as the failure to

implement our quality control and distribution control systems, delays in

shipments, cancellations of orders or customer returns and

complaints, could harm our reputation. In addition, we purchase

raw materials such as limestone and modification agents from third-party

suppliers. We may be unable to exercise the same degree of quality

control over these third-party production facilities as we can over our own

facilities. Any quality problems associated with the raw materials

produced by these third-party producers or suspension of the supply of

high-quality raw materials may adversely affect our reputation and cause a

decrease in sales of our products and a loss of market share.

-13-

Our NPCC business

depends significantly on the tire industry. If the composition of tires changes

and we fail to develop formulas that are applicable to a new composition, our

NPCC business could be harmed. In 2009, our NPCC business derived

approximately 34.3% of revenues from sales to tire manufacturers. If these

customers cease or decrease their orders of NPCC products from us, our NPCC

business could be adversely affected. In addition, our NPCC products can be used

in tire production to obtain desired properties since the current tire

composition allows for calcium carbonate as an additive. If the composition of

tires changes in the future, our NPCC products may not be compatible with the

change. As a result, our NPCC business could be adversely affected.

The United States

government’s increase in tariffs on tires imported from China may harm the

business of our customers, which would cause our revenue to decline and

materially and adversely affect our business. China’s accession to the

World Trade Organization (“WTO”) included transitional remedies to address

import surges into other countries leading to market disruption. In the United

States, the relevant safeguard provision was enacted as Section 421 of the Trade

Act of 1974. Section 421 permits US domestic industries and workers injured by

rapidly increasing imports from China to seek relief. Similar to other safeguard

provisions, a Section 421 investigation is initiated by the filing of a petition

with the United States International Trade Commission (“ITC”). On the basis of

information developed in an investigation, the ITC determined, pursuant to

section 421(b)(1) of the Trade Act of 1974, that certain passenger vehicle and

light truck tires from China are being imported into the United States in such

increased quantities or under such conditions as to cause or threaten to cause

market disruption to the domestic producers of like or directly competitive

products. On September 11, 2009, the United States government announced the

decision to grant relief in the form of increasing the tariffs on such

passenger vehicle and light truck tires from China for a three-year period

by 35% in year one, 30% in year two, and 25% in year three. The increase in

tariffs may harm the export business of our NPCC customers in the tire industry,

which would decrease demand for our NPCC products, cause our revenue to decline

and materially and adversely affect our business.

The Chinese

government is tightening its environmental laws and strengthening its

enforcement, which could adversely affect our business. With increased

environmental awareness among Chinese citizens, the Chinese government is

beginning to tighten environmental laws and regulations. The measures include

adopting new laws and regulations such as Urban and Rural Planning Law and

Regulation on National General Survey of Pollution Sources, and amending

existing laws and regulations such as Law of the PRC on the Prevention and

Control of Water Pollution. Some of these laws and regulations govern the level

of fees payable to government entities providing environmental protection

services and the prescribed standards relating to the discharge of solid or

liquid wastes and gases. Recently, the Chinese government has stepped up its

enforcement efforts due to the occurrence of several significant environmental

disasters. If we fail to comply with the PRC environmental protection laws and

regulations or if any new or revised environmental laws and regulations are

promulgated, we may have to increase capital investments to build or upgrade

environmental protection facilities or incur the risk of being subject to fines,

and, in either scenario, our business, results of operations and prospects may

be adversely affected.

Pursuant

to the Environment Impact Assessment Law, which came into effect on September 1,

2003, the construction or expansion of our NPCC facilities is subject to

environment impact assessment procedures by local environmental protection

authorities in China, including the acceptance of environment impact assessment

reports of each project by the environmental protection authorities. As of

December 31, 2009, we have a total annual production capacity of 250,000 tons of

NPCC, and we have passed environment impact assessment for 190,000 metric tons

NPCC production capacity. The remaining capacity has not yet passed the

assessment and is expected to pass the assessment by the end of September

2010. The local environmental regulatory department in Qian County, where our

Xianyang, Shaanxi facility is located, has orally advised us that we may

continue to produce NPCC during the process of passing the environmental impact

assessment, and we therefore believe that the temporary non-compliance with the

Environment Impact Assessment Law will not have and has not had in the past

material effects on our capital expenditures, earnings, and competitive

position. However, if the environmental regulatory department in Xianyang or at

a higher level determines that we are not compliant with the Environment Impact

Assessment Law, we may be subject to fines or other legal

sanctions.

-14-

We, our suppliers

and our customers are vulnerable to natural disasters which could severely

disrupt the normal operation of our business and adversely affect our business,

financial condition and operating results. We operate multiple facilities

and source products from companies that operate facilities, which may be damaged

or disrupted as a result of natural disasters such as earthquakes, floods, and

heavy rains, technical disruptions such as electricity or other power source

outage or other infrastructure breakdowns, computer outages and electronic

viruses. Such events may lead to the disruption of information systems and

telecommunication services for sustained periods. Such natural disasters also

may make it difficult or impossible for our employees to reach our business

locations. Damage or destruction that interrupts our provision of products could

adversely affect our reputation, our relationships with clients, or cause us to

incur substantial additional expenditure to repair or replace damaged equipment

or facilities. We may also be liable to our customers for disruption in service

resulting from such damage or destruction. Furthermore, the operations of our

suppliers could be subject to natural disasters and other business disruptions,

which could cause shortages and price increases in various materials essential

for the manufacturing of our products or result in shortage of our products. If

we are unable to procure an adequate supply of raw materials that are required

to manufacture our products, our revenue and operating results would be

adversely affected.

Our business,

financial condition and operating results depend on our customers’ future

success with their products, which may fail to achieve the results we and our

customers expect. Currently, we supply the tire, PVC building materials,

PP building materials, ink, paint, latex, adhesive, paper and PE industries with

our NPCC products. The potential for growth and success of our NPCC business

largely depends on our customers’ future success in their products. If our

customers are not successful in developing their products, their demand for our

NPCC products may decrease and our NPCC business may be adversely impacted as a

result.

The sales cycle

for our products is difficult to predict, which may make it difficult to plan

our expenses and forecast our operating results and could have an adverse effect

on our financial results and share price. If our sales cycle lengthens,

our quarterly operating results may become less predictable and more volatile.

Due to the relatively large size of some orders, a delayed sale could have a

material adverse effect on our quarterly revenue and operating results. If our

projected revenue does not meet our expectations, we are likely to experience a

shortfall in our operating profit relative to our expectations. As a result, we

believe that period-to-period comparisons of our historical results of

operations are not necessarily meaningful and that you should not rely on them

as an indication for future performance. It is also possible that our quarterly

results of operations may be below the expectations of public market analysts

and investors. If this occurs, the price of our common stock will likely

decrease.

We may not be

able to achieve and maintain an effective system of internal control over

financial reporting, a failure of which may prevent us from accurately reporting

our financial results or detecting and preventing fraud. We are subject

to reporting obligations under the U.S. securities laws. We are required to

prepare a management report on our internal control over financial reporting

containing our management’s assessment of the effectiveness of our internal

control over financial reporting. In addition, our independent registered public

accounting firm must report on the effectiveness of our internal control over

financial reporting. Our management may conclude that our internal control over

our financial reporting is not effective. Moreover, even if our management

concludes that our internal control over financial reporting is effective, our

independent registered public accounting firm may conclude that our internal

control over financial reporting is not effective. Our reporting obligations as

a public company may place a significant strain on our management, operational

and financial resources and systems for the foreseeable future.

In May

2008, our consolidated financial statements for the year ended December 31, 2007

were restated to correct an overstatement of advances paid to suppliers and an

understatement of property and equipment. In January 2007, our consolidated

financial statements were restated to correct an overstatement of revenues and

selling expenses for the years ended December 31, 2003, 2004, and 2005. Also,

our December 31, 2003 consolidated financial statements were restated to correct

an overstatement of general and administrative expenses and an understatement of

cost of sales and selling expenses. Our restatements of our prior consolidated

financial statements may have exposed us to risks associated with litigation,

regulatory proceedings and government enforcement actions. We are unable to

predict what action, if any, the SEC or other regulatory bodies may pursue or

what consequences such an action may have on us. We are also unable to predict

the likelihood of or potential outcomes from litigation, other regulatory

proceedings or government enforcement actions, if any, relating to the need to

restate our historical consolidated financial statements. The resolution of

these matters could be time-consuming and expensive, and further distract

management from other business concerns and harm our business. Furthermore, if

we were subject to adverse findings in litigation, regulatory proceedings or

government enforcement actions, we could be required to pay damages or penalties

or have other remedies imposed, which could harm our business and financial

condition.

-15-

Although

the restatements we have made did not result in material changes to our

previously reported revenues and profits, our management determined that

certain material weaknesses existed in our internal control over financial

reporting as of December 31, 2008. Our management had continued to work on

taking remedial measures and determined that our internal control over financial

reporting was effective as of December 31, 2009. We, however, cannot assure you

that our financial statements will not be restated in a way that causes material

changes to our reported revenues and profits in the future.

We may not be

able to successfully carry out our strategic acquisition and investment

strategy. Our future success depends in part on our ability to make

strategic acquisitions and investments and failure to do so could have a

material adverse effect on our market penetration and revenue growth. We,

therefore, intend to make strategic acquisitions and investments in the chemical

business. We cannot assure you however that we will be able to successfully make

such strategic acquisitions and investments that will prove to be effective for

our business due to certain uncertainties such as delay in obtaining required

governmental approvals for making such strategic acquisitions.

Strategic

acquisitions and investments could subject us to a number of risks, including

risks associated with shared proprietary information and loss of control of

operations that are material to our business. Moreover, strategic acquisitions

and investments may be difficult to finance and/or expensive to fund and may

also be expensive to implement and subject us to the risk of non-performance by

a counterparty, which may in turn lead to monetary losses that materially and

adversely affect our business. Strategic acquisition and investment could also

divert our management’s attention as well as other resources away from our core

business. Finally, a full integration of the acquired companies into our

business may also prove to be difficult, which may hinder or delay our planned

growth.

The cost of our

raw materials fluctuates significantly, which may adversely impact our profit

margin and financial position. Raw materials that we use in the

manufacture of our NPCC products include limestone, anthracite and

modification agents, among which costs of anthracite represented 21.1% of the

cost of goods sold of our NPCC business in 2009. The costs of modification

agents and limestone represented 25.8% of the cost of goods sold of our

NPCC business in 2009. The prices of these materials are subject to market

forces beyond our control. In the last few years, coal prices have fluctuated

substantially. The price for coal may continue to increase in the future due to

the rapid development of the Chinese economy. If the price for coal

and other raw materials increases in the future, our profit margin

could decrease considerably.

We are dependent

on our suppliers for key materials such as limestone and modification agents. If

we cannot secure such raw materials from our suppliers, our business may be

adversely affected. We purchase raw materials from suppliers. We may

experience a shortage or interruption in the supply of our raw materials in the

future and if any such shortage or interruption occurs, our production

capabilities and results of operations could be materially adversely affected.

At the present time, we purchase our supply of modification agents used in NPCC

production exclusively from two suppliers. If these two suppliers are unwilling

or unable to provide us with the modification agent we require in sufficient

quantities and at acceptable prices, we would have to resort to our research and

development center or alternative suppliers for modification agent supply. We

cannot assure you that our research and development center would be able to make

modification agents in a timely manner and in sufficient quantities or that

alternative suppliers would be able to provide modification agents at

commercially acceptable prices, on satisfactory terms, in a timely manner, or at

all. Our inability to find or develop alternative sources could adversely affect

our business operations.

We extend

relatively long payment terms for accounts receivable for our NPCC business. If

any of our customers fails to pay us, our business may be adversely affected as

a result. As is customary in our industry in China, we extend relatively

long payment terms to our customers of up to 90 days. As a result of the size of

many of our orders, these extended terms may adversely affect our cash flow and

our ability to fund our operations from operating cash flow. Also, if our

customers place large orders for our products, requiring fast delivery, our

inventory and working capital may be impacted. If our customers experience sales

slowdowns or other issues, they may not pay us in a timely fashion, even on our

extended terms. The failure of our customers to pay us in a timely manner would

negatively affect our working capital, which could in turn adversely affect our

cash flow, revenues and operating results in subsequent

periods.

-16-

Expansion of our

business may put added pressure on our management and operational infrastructure

and we may not be able to meet increased demand for our NPCC products, adversely

affecting our operating results. Our business plan is to significantly

grow our operations to meet anticipated growth in demand for existing NPCC

products. Growth in our business may place a significant strain on our

personnel, management, financial systems and other resources. The evolution of

our business also presents numerous risks and challenges,

including:

|

·

|

the continued acceptance of our

NPCC products by the tire, PVC building materials and other

industries;

|

|

·

|

our ability to successfully and

rapidly expand sales to potential customers in response to potentially

increasing demand;

|

|

·

|

the cost associated with such

growth, which is difficult to quantify, but could be

significant;

|

|

·

|

rapid technological

changes;

|

|

·

|

continued R&D efforts;

and

|

|

·

|

the highly competitive nature of

the NPCC industry.

|

If we are

successful in achieving rapid market growth of our NPCC products, we will

be required to deliver large volumes of quality products to customers on a

timely basis at a reasonable cost to those customers. Meeting any such increased

demand will require us to expand our manufacturing facilities, to increase our

ability to purchase raw materials, to increase the size of our work force, to

expand our quality control capabilities and to increase our production scale.

Such demands would require more capital and working capital than we currently

have available. We cannot assure you that our current and planned operations,

personnel, systems, internal procedures and controls will be adequate to support

our future growth.

Our business

depends substantially on the continuing efforts of our executive officers,

research personnel and other key personnel, and our business may be severely