Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SCHLUMBERGER LIMITED/NV | d8k.htm |

Exhibit 99.1

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

Ladies and gentlemen, good afternoon. Let me thank Jim Crandell and Barclays Capital for the invitation to address this conference. For us it is particularly timely as we closed the Smith deal just 19 days ago. Today I would like to achieve four things.

First, an update on the macro-economic environment for both oil and gas together with some of the trends as we see them.

Second, how Schlumberger, with Smith, is placed to meet these trends and how we will maximize the synergies that we will extract from the merger.

Third, how we will report our results in the future with some insight on the accounting adjustments arising from the transaction. I will also give a short update on some events affecting the second half of 2010.

Finally, the future of Schlumberger as we see it going forward.

I’ll begin the macro view by saying that things have become somewhat clearer as the year has progressed. The recovery in world demand for oil has been reasonably robust, driven by non-OECD demand, and current supply forecasts for the coming year remain consistent with slowly increasing levels of exploration and production activity. On the other hand, natural gas economics have remained more challenging, as new supplies of LNG worldwide together with sustained production levels of unconventional gas in the United States continue to outstrip demand recovery.

1 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

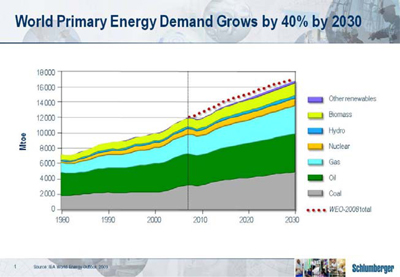

Longer term, the International Energy Agency tells us that world energy demand will grow by some 40% by 2030. They also tell us that hydrocarbon fuels will continue to dominate the global energy mix with coal, oil and natural gas supplying almost 80% of primary energy needs.

To enable such growth in oil and natural gas supplies, investment of some 350 billion dollars is estimated to be needed every year in upstream activity for the next twenty years. With the age of easy oil over, and the consequent higher costs of new supply, the challenges of matching supply and demand are not likely to decrease.

New regions are already characterizing the challenges of new supply with whole new provinces emerging. These include offshore Greenland, and central Sub-Saharan Africa. Extraordinary concentrations of activity exist in Brazil, North Africa, the North Sea, Southeast Asia, Western Siberia and the Caspian area. There is also growing interest in Eastern Siberia. Across these and other areas, including Iraq, the industry will be challenged by more remote operations, deeper waters, more difficult logistics, increasingly complex geological settings, and greater degrees of temperature and pressure. We will also be challenged by more difficult types of hydrocarbon.

We will face an increasingly harder task of turning resources into reserves, and reserves into production. At $70 plus per barrel, most oil resources except ultra deepwater, oil shales, oils in arctic areas and oils derived from various liquid conversions remain economic—although I would add that the additional control and oversight that deepwater operations in general can now expect following the Gulf of Mexico accident will undoubtedly add cost.

2 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

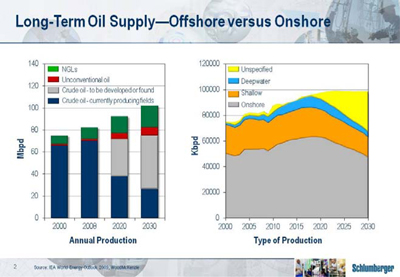

To illustrate the size of the task ahead, you only have to look at future oil production forecasts. The IEA estimates that approximately half of the conventional oil production needed by the end of the next decade has yet to be developed or found. By 2030 that figure may have increased to approximately two thirds.

Offshore activities—and deepwater operations in particular—merit significant attention. In the last ten years, more than half of all new oil and gas reserves discovered worldwide were discovered offshore. Partly as a result, offshore oil production is expected to be supplying approximately one third of the world’s needs late in the next decade. And within that same period, deepwater production will increase steadily to about one third of offshore supply, corresponding to approximately 10% of global oil supply.

Under these circumstances, the challenges to which technology must respond are two-fold. First, offshore operating costs are high—particularly so in deepwater—and we will need technology that can mitigate both technical and economic risk. Second, the complexities of deepwater operations require sophisticated measurement and modeling to ensure that the right well is drilled, and the right information collected. This is becoming more and more a matter of integration across previously discrete technologies.

3 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

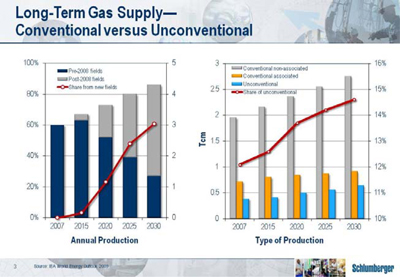

Natural gas resources show similar trends over the same time period with much of the gas needed by 2030 coming from fields on production since only 2008. As for oil, considerable conventional resources exist, but the vast majority of the world’s natural gas resources are in fact unconventional—trapped in shales, low-permeability reservoirs, and coalbed methane formations. And although these resources represent only 12% of today’s total production, that proportion will increase as consumption accelerates and conventional reservoirs deplete.

Among the world’s unconventional gas reserves, the growth in shale gas production has been the most dramatic. This has been driven by the success of new technologies that maximize contact between the shale formation and the wellbore completion. Development has been led by the United States where shale gas provided only 6% of total consumption in 2008—a figure that is expected to quadruple to 24% by 2035.

Elsewhere, shale gas development is less advanced and market prices and project costs will dictate whether, when and where such production will expand. Significant resources undoubtedly exist, but we should not underestimate the challenge—drilling and producing shale gas wells in central Europe will be very different from doing so in the southern United States for financial, logistical, social and regulatory reasons.

4 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

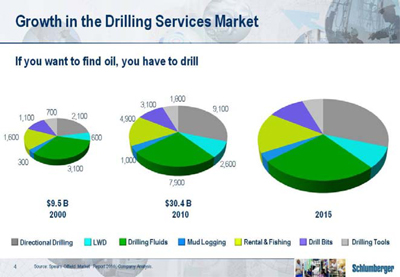

Given this context, in addition to investment in new technology, it is becoming increasingly apparent that the old adage of the oil industry holds truer than ever. If you want to find oil you have to drill. And if you want to produce unconventional gas it is even truer.

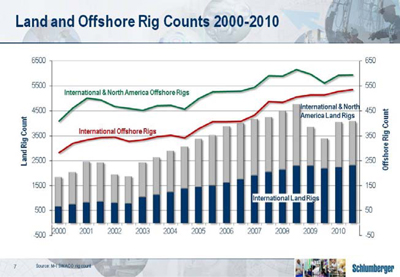

The increase in drilling services revenues since 2000 is quite remarkable, clearly reflecting the need for increased drilling intensity to sustain oil and gas production even after inflation effects. This matches our long running thesis that the lack of industry investment in the 1990s and early 2000s has finally caught up with us. The boom period from 2003 to 2008 only scratched the surface of the problem. As we pointed out in 2008, to recover additional hydrocarbon, drilling intensity and complexity have to increase to stem decline rates, produce the more complex deepwater reserves, and recover unconventional gas.

At the same time differing hydrocarbon types require greater degrees of technology—both to improve the reliability of operations and to reduce overall finding and development costs. These technologies fall into three primary areas.

5 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

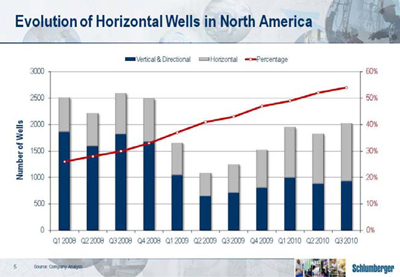

First are the technologies required to help recover unconventional gases and unconventional oils. We need such technologies for better extraction, lower cost and smaller environmental footprint. The dramatic change in the North American land rig count from vertical to horizontal over a very short period of time demonstrates the extent to which this change is already underway.

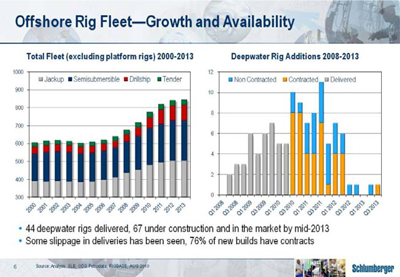

Second we need new technology to lower technical and economic risk and increase operational performance in the recovery of conventional hydrocarbons from the world’s remaining under-explored or undeveloped areas. In addition, the move to more harsh and hostile environments will also require development of appropriate, fit-for-purpose technologies. The rapid growth in offshore new builds, particularly in deepwater, illustrates the need to address these frontier areas. Exploration and development drilling offshore are therefore expected to grow.

6 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

The third area for technology development concerns reserves already in production. Prolonging their exploitation and increasing their recovery represents a significant opportunity and it is here that increased drilling intensity is likely to make the biggest difference in the short to medium term. The rehabilitation of the productive capacity in Iraq is an example that implies higher rig counts and this pattern is likely to be increasingly seen around the world.

You could be thinking that I am making a pitch for investment in the rig companies and it is true that many of them will do well. However, drilling rigs largely remain a commodity with their embodied technology mostly available from third-party suppliers. On the other hand, the needed downhole services, coupled with geological knowledge and the engineering of the drilling process, are much more technology intensive and are closer to our core skill sets.

It is the technology needs for the market opportunities that I have just discussed that have led us to the acquisition of Smith.

7 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

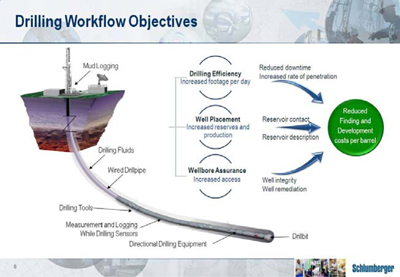

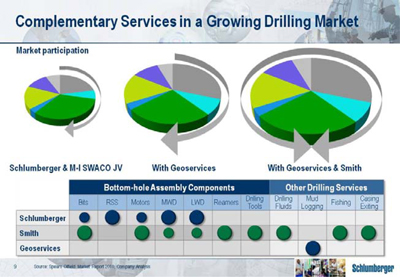

We believe that the combination of our own leading positions in directional drilling, measurement-while-drilling and logging-while-drilling with Smith’s positions in drill bits, drilling tools and drilling fluids through M-I SWACO together with our joint venture with National Oilwell Varco for wired drillpipe will allow us to help customers with three key objectives.

The first is drilling efficiency—measured by faster rates of penetration and reduced non-productive time. The second is well placement—for increased reservoir contact in the optimal part of the reservoir using technologies such as geosteering. The third objective is wellbore assurance. It’s all very well being able to drill the well faster and put it in the best place, but the wellbore must provide access from the surface to the reservoir for the life of the well.

In engineering this combination, we believe that value will be created through integration of equipment, services, processes and people while increased performance will result from the integration of the drilling systems technologies themselves. What makes this even more attractive is our expectation that we will be doing this in a growing market.

Indeed, even within the context of the limited information exchange that we had been able to pursue until the merger closed, the integration teams from both companies were able to identify large revenue synergies both in the short and longer term.

To illustrate this in another way, let me go back to the size of the drilling services market.

8 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

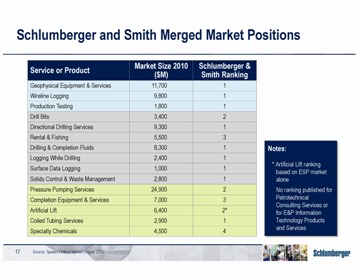

Until the acquisitions of Smith and Geoservices, Schlumberger participated in about only 48% of this market through our activity in Drilling and Measurements, and our 40% ownership of M-I SWACO. Following the acquisitions, Schlumberger now participates in the whole market and has created the opportunity to provide value through system performance and interoperability across different elements of the bottom-hole assembly and the drillstring.

One of the reasons we are so confident of this is our 15-year experience in integrated project management. IPM has drilled a total of more than 4100 wells in the last six years in conditions varying from simple land wells to deepwater offshore at all ranges of pressure and temperature, and in all sorts of geological conditions. This vast accumulation of knowledge, coupled with our leadership in directional drilling, MWD and LWD has given us a clear vision of how to improve the drilling process. Furthermore, since 1985 we have continued to conduct research in this area at our Cambridge UK facility.

We now have, with Smith and Geoservices, all the parts necessary to develop the technology to the next level.

9 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

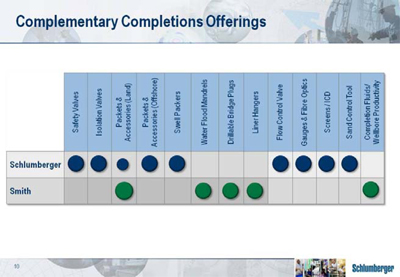

Smith brings us other benefits—notably in completions where Smith fills gaps in our own portfolio. This represents a real strategic fit where Schlumberger brings the international footprint and organization, while Smith brings the US land presence as well as an agile engineering capability.

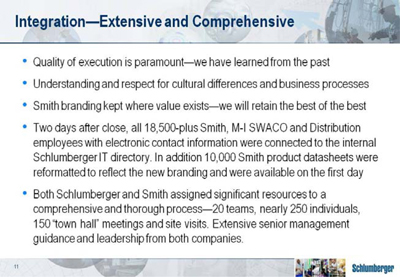

Let me now discuss the integration process which has been both extensive and comprehensive. The task is vast, and will evolve over the coming years. We are fully aware that success will depend on quality of execution and we have therefore established well-defined integration principles with significant resources devoted to the process.

10 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

We are very much aware of mistakes we have made in the past through failing to recognize the value of cultures and processes different to our own and through not making sufficient effort to accept and retain such differences. We have, therefore, made considerable effort to ensure that both employee populations understand and respect each other.

We are not systematically painting everything blue. We will maintain Smith branding where it has clear market value. We will retain the best of the best.

To demonstrate the energy and enthusiasm that has gone into integration planning, let me say that only two days after the deal closed, the 18,500-plus Smith, MI and distribution employees with active electronic contact information had been uploaded to the Schlumberger internal IT directory for seamless communication between the two companies at all levels. In addition, the database of 10,000 Smith product data sheets had been reformatted to be fully consistent with the new organization and was available to the sales force on the very first day after the close.

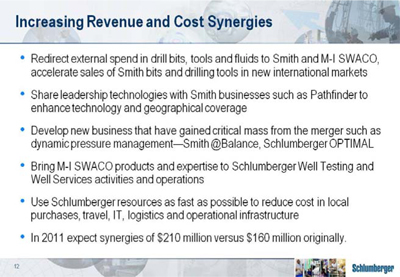

I would now like to address the synergies that we expect to realize from the merger—both from the standpoint of revenue and cost. Since the transaction was announced we have had some 250 Schlumberger and Smith people working on the integration. We have all been surprised by the upside to our original synergy numbers even before we could freely exchange information on certain aspects of the deal involving technology.

Many of the initial synergies will come through redirection of the current external spend of our IPM and Drilling and Measurements organizations in drill bits, tools and fluids to Smith and M-I SWACO. In logging-while-drilling, we will extend the Pathfinder offering by making our family of rotary steerable tools available to them. This is very important, as Pathfinder’s tool box gives us a service capability in the high volume land drilling

11 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

markets around the world that it is difficult to address with the existing Schlumberger Drilling & Measurements service range. We are extremely encouraged by the combination of Smith and Schlumberger capabilities in dynamic pressure management and we see immediate opportunities to expand this in international markets. Our international footprint will also allow us to expand the Smith Bits and Drilling Tools businesses into new markets at a pace and at a cost that Smith could not have achieved on their own. Indeed, we have plans ready to target the most promising markets.

While many of the revenue synergies can be achieved in a short period of time, others will require technology “bridging” or new development and therefore take longer to bring to market.

Looking at M-I SWACO products and services, we see immediate increased scope for deployment of fracture stimulation flowback and well production testing through Schlumberger Well Testing and Well Services operations. This is in addition to the opportunity to provide an integrated completions service by combining M-I SWACO wellbore productivity products and services with Schlumberger Sand Management services.

On the cost side we are implementing rapidly a geographical alignment of the organizational structure in such a way as to allow the managers from both companies to identify and implement the appropriate cost synergies in the support structures. Apart from the initial obvious savings in corporate overhead we will have an ongoing program companywide to reduce the cost of support to the field operations. This will take years to complete but the initial gains will be large. Equally, we feel that we can realize quick wins in supply chain across a number of categories of spend and that longer term further opportunities will exist. A rationalization of facilities is another longer term gain with the initial emphasis being on administrative offices to facilitate cooperation between the two companies.

As a result of the work of the integration teams we have revised the synergy number we announced at the time of the deal. In 2011 we now expect approximately US $210 million against the US$ 160 million we originally announced.

As a result of the examples I have provided, coupled with the lengthy and detailed list of other synergies that our integration teams have identified, we believe the merger, while initially dilutive, will be breakeven on an earnings per share standpoint by the fourth quarter of 2011. This excludes the impacts of restructuring and integration costs, as well as one-off accounting charges associated with the merger. In 2012, we expect the transaction to be accretive to earnings per share.

12 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

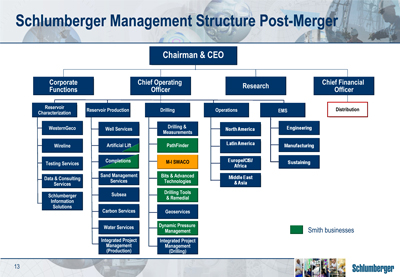

I will now turn to the high level organization of Schlumberger post the merger and how we intend to report the results in the future.

In recent years we have reported two segments, Oilfield Services and WesternGeco as well as the geographical areas. We have reached a point where our coverage of the different activities which make up exploration and production services is so broad that we are going to be changing the primary way in which we allocate resources and assess performance. As a result, effective the first quarter of 2011, we will move our primary reporting from geographical areas to product group segments. This change will give investors a better perspective on the different parts of our business. We will, of course continue to provide geographical information.

Let me now describe the three product groups.

First, the Reservoir Characterization Group. This will cover the principal product Technologies involved in the finding and defining of hydrocarbon deposits. These include WesternGeco, Wireline, Well Testing, Schlumberger Information Services, and Schlumberger Data & Consulting Services. All are leaders in their markets occupying a number one position according to Spears for directly comparable activities. I would point out that Spears do not publish figures for E&P software or consulting but we believe that we already lead those particular markets.

Second, the Drilling Group. This will comprise M-I SWACO, Drilling and Measurements, Pathfinder, Smith Bits and Advanced Drilling technologies, Drilling Tools and Remedial Services, Dynamic Pressure Management, and Geoservices mud logging. We will also report IPM Well Construction projects in this segment. Within the group, M-I SWACO, Drilling and Measurements and Geoservices occupy number one positions in their markets while Smith Bits is number two, and drilling tools number three. With the Schlumberger geographical footprint now available to these activities we expect to improve some of these positions.

13 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

The third group is the Reservoir Production Group. This includes our Well Services, Completions and Artificial Lift technologies, together with Sand Management, our nascent Subsea business and our Water and Carbon Services activities. In addition, the production activities of IPM will be reported with this group. Most of these activities are second or a close third in their Spears categories with some leaders such as Coiled Tubing Services. The combination of Schlumberger and Smith will now give additional impetus to our completions and artificial lift businesses.

We will report the combined results of all three product groups by Area in the format you are accustomed to. We will report the distribution businesses such as Wilson separately in order for you to be able to eliminate the margin effect of this business on the total of Schlumberger.

Obviously, these definitions are not all encompassing. Similar technologies are used in different operations. Just to take two examples, logging-while-drilling—a Drilling Group service—is used in reservoir characterization while cementing—a Production Group activity—is used during the drilling of the well. The groups, however, correspond to the organization of our customers’ workflows as far as possible.

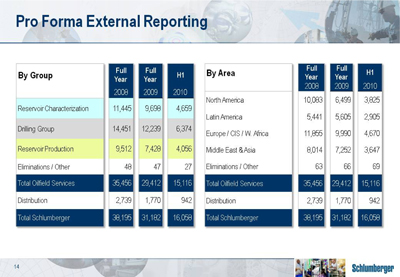

Just as an indicator of what this will mean, here is how the full years of 2008 and 2009, and the first half of 2010, would have looked like from a revenue perspective if we had reported through the groups, and had included Smith as well as Geoservices. The information is pro forma and unaudited, but serves as a useful guide as to where we will

14 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

take the business financial results in the coming years. In the coming months, we will be providing you with additional pro forma historical data, including pretax operating income on both a product group and geographic basis.

Meanwhile, and for the remainder of 2010, we will report our results in a manner consistent with our historical format and with the legacy Smith businesses, MI SWACO, Smith Oilfield and Distribution each represented as separate business segments. It is probably worth stating that our third-quarter results will only include one month of post-merger results because the merger closed at the very end of August. The impact on the third quarter from an operational results perspective will therefore be quite small.

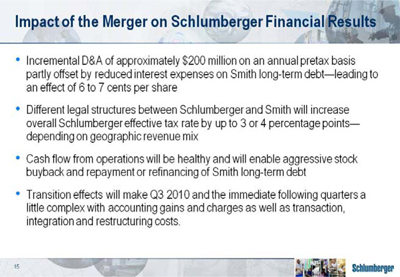

I will now touch on some additional implications of the merger that will impact our financial results in future periods.

We are still working through all of the purchase accounting, which is a complex task given the size of the transaction. However, based on where we are in the process today, we are estimating incremental depreciation and amortization expense associated with fair value adjustments to the acquired assets of approximately $200 million on an annual pretax basis. This increased depreciation and amortization expense will be offset in part by a reduction in interest expense of approximately $60 million as a result of fair value adjustments relating to Smith’s long-term fixed rate debt. With tax affecting these amounts at 35%, this nets out to approximately 6 to 7 cents per share on an annual basis. This EPS impact is basically in line with what we said when we announced the transaction, and what was reflected in the pro forma financial statements included in our registration statement that we filed with the SEC.

As you may be aware, Smith, being a US company, has a different legal structure to Schlumberger. As a result, the Schlumberger overall effective tax rate may increase by

15 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

as much as 3 to 4 percentage points through the merger. The exact amount of the increase will depend on a number of factors including the geographic mix of earnings in the merged company as well as the mix of earnings between the legacy Schlumberger and Smith operations.

The combined company will generate healthy cash flow from operations. We anticipate that our immediate priorities will be, from a cash flow perspective, to be aggressive and opportunistic with our stock buyback program as well as to repay or refinance the high-interest, long-term debt of Smith.

I would also like you to note that we expect our financial results for this quarter, and in the quarters immediately following the merger, to be a little messy. In the third quarter for example, under accounting rules, we are required to record a gain relating to our previously held 40% interest in the MI-SWACO. This gain will likely be around 1 billion dollars. We will also have charges relating to transaction costs, integration costs, restructuring costs and a number of one-off accounting-related charges that include impairments relating to certain assets which are no longer strategic, none of which are individually material. We will, of course, call out these items separately for you so that you can easily get to the underlying operational results.

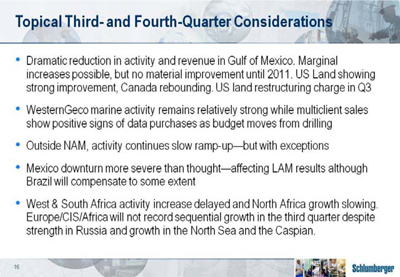

Before moving to the future of Schlumberger, let me turn to some topical events surrounding the third quarter and the remainder of 2010.

In the Gulf of Mexico the continuing effect of the US moratorium has led to a dramatic reduction in activity and revenue due to our high market share in deepwater. While some marginal increases are possible we do not see any material improvement until next year. In contrast, we have seen continued improvement in US Land activity and a strong rebound in Canada. As previously announced, we will take a restructuring charge for our US land organizational improvement initiatives in the quarter.

16 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

At WesternGeco, marine activity has remained relatively strong while multiclient shows positive signs that some customer budget has been diverted from drilling to seismic data purchases although we will only be able to confirm this in the fourth quarter.

Outside North America, activity has continued its slow ramp up with some notable exceptions. The downturn in project activity in Mexico has been more severe than we originally anticipated as customer budget problems have been compounded with security issues in the north. As a result the charge we will take for early termination of rig contracts and workforce reductions is likely to be larger than we originally anticipated. The overall effect on Latin America’s results in the quarter will be substantial even though improvements in Brazil will compensate to some extent.

In West and Southern Africa the activity increase is being somewhat delayed, and this, coupled with the reduction in exploration-linked revenues as more marginal prospects are drilled is slowing growth. Equally, administrative delays and budget reductions in North Africa are also slowing growth. As result, and despite a strong performance in Russia and improvements in the North Sea and the Caspian, the Europe, Africa, CIS area will not record sequential growth in the third quarter.

Overall in deepwater operations, the Macondo accident in the Gulf of Mexico has led operators to exercise increased caution before accepting drilling rigs as fit for purpose, and this has engendered delays in drilling programs. We have not, however, seen any programs canceled as a result of this.

In Middle East Asia the business remains strong with good results, particularly in Asia.

17 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

Let me now say a few words about the combined company. We are strongly placed in most of the market segments of the upstream oil and gas service sector. In most of what we do we are recognized as the number 1 or number 2 service provider. The combined company will have approximately 105,000 employees of 140 different nationalities working in over 80 countries. It is unusual for Schlumberger to make an investor presentation without dwelling at length on technology and I can assure you that we have not, in the midst of this merger, forgotten technology. Both Smith and Schlumberger have had strong research and development organizations and a reputation for technology. The combined company will spend somewhere between $900 million and $1 billion per year in research and engineering for new technology with unprecedented opportunities to integrate across different disciplines.

Ladies and gentlemen, what about the future?

Our mature infrastructure worldwide will allow us to be the low cost provider of support to our operations. After 12 years of a matrix geographical product segment organization, generations of managers who are accustomed to operating in a multi-segment, multifunction environment are increasingly finding ways to streamline and reduce our support costs. Our forty-year tradition of hiring where we work, and providing equal opportunity to all nationalities and genders will ensure a constant flow of operational and management talent.

We will remain vigilant that the combined company continues to operate safely and to the highest technical standards. We will continue to produce superior financial results and excess cash will be returned to shareholders through share repurchases and in the form of dividends where earnings warrant increases.

18 of 19

| BARCLAYS CAPITAL CEO ENERGY POWER CONFERENCE 2010 |

ANDREW GOULD |

However, perhaps the most important feature of the company as we go forward is that despite our size the opportunities to grow remain extraordinary. The market will move to increasingly complex projects both technically and logistically as well as to greater integration of all service lines. We are already seeing this in North America, and we have seen it in IPM well construction activity overseas for a number of years. We are ideally placed to address both these markets.

In our established businesses we will grow through the need to renew hydrocarbon resources in both oil and gas led by the need to drill more in all parts of the cycle, exploration, development and production enhancement. We will also grow, however, through the new products and services resulting from the synergies that this merger will allow us to achieve.

Finally, we will continue to grow all of our Product Groups through the introduction of new technology.

Ladies and gentlemen, this is a time to be extremely optimistic about the future of Schlumberger.

19 of 19