Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - MAGNUM HUNTER RESOURCES CORP | magnum_8k-090910.htm |

Exhibit 99.1

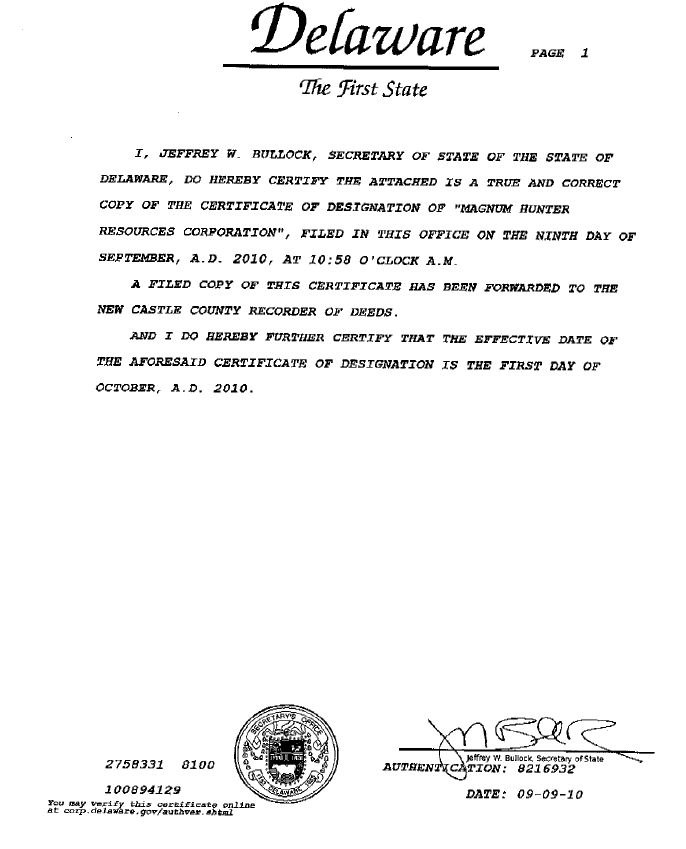

CERTIFICATE OF AMENDMENT OF

CERTIFICATE OF DESIGNATION OF RIGHTS AND PREFERENCES

10.25% SERIES C CUMULATIVE PERPETUAL PREFERRED STOCK

(Pursuant to Section 151 of the General Corporation Law of the State of Delaware)

Magnum Hunter Resources Corporation, a corporation organized and existing under the General Corporation Law of the State of Delaware, in accordance with Section 151 of the Delaware General Corporation Law, does hereby certify that:

1. The name of the corporation is Magnum Hunter Resources Corporation (formerly known as Petro Resources Corporation and Kid Critter U.S.A., Inc., the “Corporation”).

2. The original Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on June 4, 1997.

3. The original Certificate of Designation of Rights and Preferences 10.25% Series C Cumulative Perpetual Preferred Stock for the Corporation was filed with the Secretary of State of Delaware on December 10, 2009 as amended on August 5, 2010, (the “Certificate of Designation”).

4. Pursuant to the authority conferred upon the Board of Directors of the Corporation by the Certificate of Incorporation of the Corporation, as amended (the "Certificate of Incorporation"), and pursuant to the provisions of Sections 103 and 151(g) of the General Corporation Law of the State of Delaware, said Board of Directors by unanimous written consent dated August 12, 2010, adopted a resolution amending the Certificate of Designation of the Corporation's 10.25% Series C Cumulative Perpetual Preferred Stock, which resolution is as follows:

NOW, THEREFORE, BE IT RESOLVED that, pursuant to the authority vested in the Board of Directors by the Corporation’s Certificate of Incorporation, the Board of Directors does hereby amend the Certificate of Designation, effective as of October 1, 2010, as follows (collectively, the “Amendment”):

The definition of “Dividend Periods” in Section 2 of the Certificate of Designation is hereby amended and restated to read in its entirety as follows:

“Dividend Periods” shall mean monthly dividend periods commencing on January 1, February 1, March 1, April 1, May 1, June 1, July 1, August 1, September 1, October 1, November 1 and December 1 of each year and ending on and including the day preceding the first day of the next succeeding Dividend Period (provided, however, that any Dividend Period during which any Series C Preferred Shares shall be redeemed pursuant to Section 5 shall end on and include the Call Date only with respect to the Series C Preferred Shares being redeemed).

Section 2 of the Certificate of Designation is hereby amended to add the following definitions:

“Quarterly Dividend Period” shall mean quarterly dividend periods commencing on January 1, April 1, July 1 and October 1 of each year and ending on and including the day preceding the first day of the next succeeding Quarterly Dividend Period.

A “Quarterly Dividend Default” shall occur if the Corporation fails to pay cash dividends on the Series C Preferred Shares in full for any Dividend Period within a Quarterly Dividend Period, provided that only one Quarterly Dividend Default may occur during each Quarterly Dividend Period and only four Quarterly Dividend Defaults may occur during any calendar year.

The third sentence in Section 3(a) of the Certificate of Designation is hereby amended and restated to read in its entirety as follows:

Such dividends shall accrue and accumulate on each issued and outstanding share of the Series C Preferred Shares on a daily basis from (but excluding) the original date of issuance of such share and shall be payable monthly in equal amounts in arrears on the last calendar day of each Dividend Period, beginning on October 31, 2010 (each such day being hereinafter called a “Dividend Payment Date”); provided that if any Dividend Payment Date is not a Business Day, then the dividend that would otherwise have been payable on such Dividend Payment Date may be paid on the next succeeding Business Day with the same force and effect as if paid on such Dividend Payment Date, and no interest or additional dividends or other sums shall accrue on the amount so payable from such Dividend Payment Date to such next succeeding Business Day.

The first paragraph in Section 3(b) of the Certificate of Designation is hereby amended and restated to read in its entirety as follows:

If at any time four Quarterly Dividend Defaults occur, whether consecutive or non-consecutive (a “Dividend Default”), then:

Section 3(b)(i) of the Certificate of Designation is hereby amended and restated to read in its entirety as follows:

(i) the Dividend Rate shall increase to the Penalty Rate, commencing on the first day after the Dividend Payment Date on which a Dividend Default occurs and for each subsequent Dividend Payment Date thereafter until such time as the Corporation has paid all accumulated accrued and unpaid dividends on the Series C Preferred Shares in full and has paid accrued dividends for all Dividend Periods during the two most recently completed Quarterly Dividend Periods in full in cash, at which time the Dividend Rate shall revert to the Stated Rate;

Section 3(b)(ii) of the Certificate of Designation is hereby amended and restated to read in its entirety as follows:

(ii) On the next Dividend Payment Date following the Dividend Payment Date on which a Dividend Default occurs, and continuing until such time as the Corporation has paid all accumulated accrued and unpaid dividends on the Series C Preferred Shares in full and has paid accrued dividends for all Dividend Periods during the two most recently completed Quarterly Dividend Periods in full in cash, the Corporation shall pay all dividends on the Series C Preferred Shares, including all accumulated accrued and unpaid dividends, on each Dividend Payment Date either in cash or, if not paid in cash, by issuing to the holders thereof (A) if the Common Shares are then subject to a National Market Listing, fully-tradable, registered Common Shares with a value equal to the amount of dividends being paid, calculated based on the then current Market Value of the Common Shares, plus cash in lieu of any fractional Common Share; or (B) if the Common Shares are not then subject to a National Market Listing, additional Series C Preferred Shares with a value equal to the amount of dividends being paid, calculated based on the stated $25.00 liquidation preference of the Series C Preferred Shares, plus cash in lieu of any fractional Series C Preferred Shares (and dividends on any such Series C Preferred Shares upon issuance shall accrue at the Penalty Rate and accumulate until such time as the Dividend Rate shall revert to the Stated Rate in accordance with subparagraph (i) of this paragraph (b));

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Corporation has caused this Amendment to the Certificate of Designation to be duly executed and acknowledged by Gary C. Evans its Chief Executive Officer as of this 8th day of September, 2010.

|

MAGNUM HUNTER RESOURCES CORPORATION

|

|

|

By: /s/ Gary C. Evans

|

|

|

Name: Gary C. Evans

|

|

|

Title: Chairman and Chief Executive Officer

|