Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | d8k.htm |

September 14, 2010

Jamie Dimon, Chairman and Chief Executive Officer

Barclays Global Financial Services Conference

Exhibit 99.1 |

I.

Exceptional franchises

II.

Issues facing JPM, the industry and

global economy

III.

Key investor topics

Regulatory reform impact

–

Banking activity restrictions

–

Derivatives

Retail Financial Services

–

Credit trends

–

Mortgage repurchase risk

–

Regulatory reform impact–

Regulation E, debit interchange and

BCFP

Agenda

Fortress balance sheet

Capital generation

Basel III Capital proposals

Hierarchy of capital usage

Basel III Liquidity proposals

Interest rate positioning

IV.

Outlook

V.

Commitment to drive economic recovery

VI.

Summary

VII.

Appendix

1 |

JPM’s

fundamentals remain extremely strong

Excellent client franchises and businesses

Each standalone business has a top 1, 2 or 3 position

Unparalleled client relationships in 100+ countries

Culture

of

innovation;

new

products

and

programs

launched

during

crisis

Continued

investment

across

LOBs

driving

organic

growth

Consistent record of operating efficiency and delivering merger saves

Businesses stronger together than apart; additional revenue streams

generated Further strengthened balance sheet: Tier 1 Capital of $137B or

12.1%, Tier 1 Common at $108B or 9.6%

High quality capital and very high level of reserves ($36.7B), loan loss reserve

of 5.34%

Strong funding and liquidity profile: $888B deposits, 1.3x loan coverage

Strong and stable management team

Deep bench of talent; thoughtful succession planning

1

See note 3 on slide 52

2

See note 2 on slide 52

2

Excellent client

franchises and

businesses

Significant

earnings

power

Fortress

balance sheet

Strong

management

team

Robust technology infrastructure to serve clients

Benefits

from

diversification

–

funding,

capital,

lower

volatility

2

1 |

Agenda

Page

3

Exceptional franchises

3

Issues facing JPM, the industry and global economy

16

Key investor topics

21

Summary remarks

38

Appendix

42 |

Market leading exceptional franchises

ROE of 35% is best in peer group

Only bank in peer group with a loan-to-

deposit ratio under 100%

Strong deposit base will support NII

as the rate environment improves

Best

of

the

top

5

banks

71% of Chase clients use Chase for

their TS needs

87% of Chase clients say it is likely

they will continue doing business

with Chase

36% of Chase clients say they will

increase the amount of business

they award Chase going forward

1

Greenwich Research, 2009

2

Ernst & Young and Federal Reserve

3

Nilson

4

2Q10 Company reports

5

iMoney.net, June 2010

Pretax margin of 32% is second highest

and ROE of 24% is highest in peer

group

Long-term AUM net inflows of 14% over

last 12 months through June 2010,

higher than all peers reporting flows by

asset class

Leader in alternatives with $91B in

AUM

#1 Institutional Money Market Fund

Manager Worldwide

5

#1 Ultra-High-Net-Worth Private Bank

Globally

6

Leading International Asset Manager

#1 Asset Management Company in

Asia; Asset Management Company

of the Year

7

#1 Pan-European Fund

Management Firm

8

Best overall performing foreign

asset manager operating in China

9

ROE of 18% consistent with peer group

Top tier player in cash management,

processing a market leading average of

$3.1T in U.S. dollar transfers daily

#1 clearer of U.S. dollars in the world

and #1 Automated Clearing House for

originations

#1 Visa/ MasterCard Commercial,

Purchasing and Prepaid card issuer in

the U.S.

#2 in Assets under Custody with

$14.9T serviced

4

Top provider of custody services

leveraging significant scale and global

footprint

6

EuroMoney, February 2010

7

The Asset Magazine, 2009

8

Thomson Reuters, June 2010

9

PWC survey

4

Commercial

Banking

Treasury & Securities Services

Asset Management

2

3

1 |

Global Corporate Bank

Joint-Venture between IB and TSS to manage/better serve global corporate

banking relationships with ~2,300 of the world’s largest global

companies Significant TS international growth opportunity

Targeting ~10% international share of wallet by 2014

Material growth opportunity for IB and TSS

Opportunity

Expansion plans

Expand coverage/ footprint, extend more credit and increase product

capabilities

Extended footprint

Over 20+ branches and representative offices across EMEA, APAC and

LATAM

Nearly 500 front office employees

–

Nearly 200 Corporate Bankers and analysts, over 250 TS Sales,

Product Support Specialists, and Credit Officers

Approximately $50B+ in incremental lending over 5 years

Expansion of local treasury capabilities in 10 locations

Nearly $400mm additional investment targeted for key product gaps

5 |

IB

– AM

CB –

IB/TSS/AM

IB –

TSS

Significant competitive advantage created and benefit to franchise value from

cross-sell collaboration

Integrated IB/TSS/AM offering provided through CB

Bankers

Corporate Finance

FX/Derivatives

TS and Liquidity

Leverage new GCB/International capabilities for Mid-

Corp and Mid-Market clients

Liquidity solutions

Important cross-referrals between IM and WSS

(e.g., insurance companies, pension funds)

Global Corporate Bank: enhance international

capabilities to meet global clients needs

Integrated Prime Custody services for asset

managers and hedge funds

Joint FX offering sold through TSS and executed by

IB

Institutional AM:

Liquidity solutions

Long-term asset management

Retirement Plan Services

Private client access to IB product capabilities (e.g.,

trading desk, IPOs, research)

IB is an important source of referrals for the Private

Bank

AM –

TSS

Large-Corp, Financial Institutions and Private Clients

65% of Fortune 500 companies were simultaneously clients of IB, TSS and AM in

2009 Mid-Corporate / Middle Market Clients

80%+ CB clients used at least one TSS product in 2009

~25% CB clients used IB capabilities each year over the last 3 years

6 |

~25mm transactions done by CB clients in 2009 at

branches

~40% CB customers used a branch teller in

4Q09

CB has 2.7x greater revenue in high branch

density locations

Asset Management

Commercial Banking

Card Services

Retail branches are invaluable to the rest of our Franchise

Treasury & Securities Services

$8B of JPM investment products sold through

branches in 2009

$24B of JPM investment balance AUM comes

from the branch

~50% Private Wealth Management customers and

~30% PB customers used a branch teller in 4Q09

New offering for affluent RFS customers

Use of core banking services (e.g., deposits and

change orders)

Check Cashing Agreements: cashing of employee

payroll checks without a fee across Branch network

Chase At Work: better payroll management,

convenient banking & discounts to employees

7

~1.5mm cards sold through branches

~40% of RFS customers have a Card

relationship

Significant uplift (~10%+) in Card Services direct

mail production driven by local market presence

Integrated experience for Card branch clients |

JPM

Rank

Share%

2001

5

9.9

2002

7

9.2

2003

5

10.2

2004

7

8.4

2005

9

8.1

2006

8

7.6

2007

6

7.2

2008

5

8.6

2009

3

12.4

1H10

2

12.2

Market leading franchises –

Investment Bank

JPM

Rank

Share%

2001

7

5.3

2002

6

6.5

2003

3

9.2

2004

4

7.2

2005

4

7.7

2006

5

7.3

2007

2

9.5

2008

2

11.6

2009

1

11.6

1H10

1

8.1

Market leader for Global IB Fees, ranking #1 for the past two years

Improved Equity Underwriting rank from #7 in 2001 to #1 in 1H10

Ranked #1 2010 All-America Fixed Income Research team by

Institutional Investor magazine

55 ranked analysts –

up from 31 in 2002

Record number of coverage areas honored as best-in-class

Top 2 player in emerging markets over past 5 years

1

Material improvement in trading market share from 2005 to YTD 2010

Added Prime Brokerage and continue to build-out Commodities

1

Source: Coalition

2

Source:

Per

external

disclosure.

Global

markets

represents

JPM’s

share of top 10 competitors. 2006 to 1H10 represents

current pro-forma competitor set; 2001 to 2005 represents competitors as

reported 3

Source: Dealogic

Global Equity & Equity-related

Global Markets

2002

2003

2004

2005

2006

2007

2008

2009

2010

Equity

US

10

8

9

7

6

3

2

2

NA

Europe

9

8

9

10

10

8

8

3

2

Fixed Income

US

2

3

2

2

2

3

2

2

1

Europe

4

1

1

1

2

2

2

NA

NA

Institutional Investor Research Analyst Rankings

8

3

2 |

Rank

1989

1999

2009

1

Merrill Lynch

Salomon Smith Barney

JPMorgan

2

Goldman Sachs

Merrill Lynch

Bank of America Merrill Lynch

3

First Boston

Goldman Sachs

Citi

4

Salomon

Morgan Stanley

Barclays

5

Morgan Stanley

Lehman Brothers

Goldman Sachs

6

Shearson Lehman

Credit Suisse

Morgan Stanley

7

Drexel

JPMorgan

Deutsche Bank

8

Bear Stearns

Bear Stearns

Credit Suisse

9

Prudential Securities

Donald Lufkin & Jenrette

UBS

10

Kidder Peabody

Chase

Royal Bank of Scotland

Market leading franchises –

Investment Bank

US Equity, Equity-related and Debt

JPM has built outstanding underwriting and advisory franchises in the last 10

years Source: Thomson Reuters. Data as of 8/31/10. Ranking based on $ volume

Note:

Light

gray

font

designates

firms

that

no

longer

exist,

red

font indicates non-US based firms

Competition from international firms has strengthened significantly

Based on market capitalization, US firms represent 11 of top 50 financial

institutions for YTD 2010 vs. 44 in 1989

US banking system is far less concentrated than other countries

Banks represent only a third of the credit lent or financed in the US vs.

two-thirds in Europe 9 |

Added

over

13,000

Personal

Bankers

since

2005

-

annual growth rate

of 26%; 14% organic

Branch

network

of

5,159

up

2,518

branches

from

2005

-

annual growth

rate of 16%; 5% organic

Added

8,342

ATMs

since

2005

-

annual growth rate of 18%; 12%

organic

Market leading franchises –

Retail Banking competitive position

2009

net

income

$3.9B

-

up 24% annually since 2005; 15% organic

10

Net income

Branch / ATM

distribution

Strong organic growth consistently year after year and lift from WaMu

acquisition |

Active

online

customers

of

16.6mm+

-

annual

growth

rate

of

42%

since

2006

3.7mm+

households

with

active

online

bill

pay

-

annual

growth

rate

of

46%; 30% organic

385mm

electronic

alerts

sent

to

customers

in

2009

-

~doubling

year

over

year

Strong

checking

account

growth

-

28%

annually

since

2005;

12%

organic

Average

deposits

of

$336B

-

annual

growth

rate

of

16%

since

2005;

7%

organic

Total

households

served

of

22.8mm,

up

13.6mm

since

2007

-

annual

growth rate of 38%; 9% organic

11mm+

households

with

direct

deposit

-

annual

growth

rate

of

34%

since 2007; 16% organic

18mm+

households

with

debit

cards

-

annual

growth

rate

of

40%

since

2007; 19% organic

Market leading franchises –

Retail Banking competitive position (cont.’d.)

11

Serving our

customers

Innovation —

Online &

Mobile

Banking

Strong organic growth consistently year after year and lift from WaMu

acquisition |

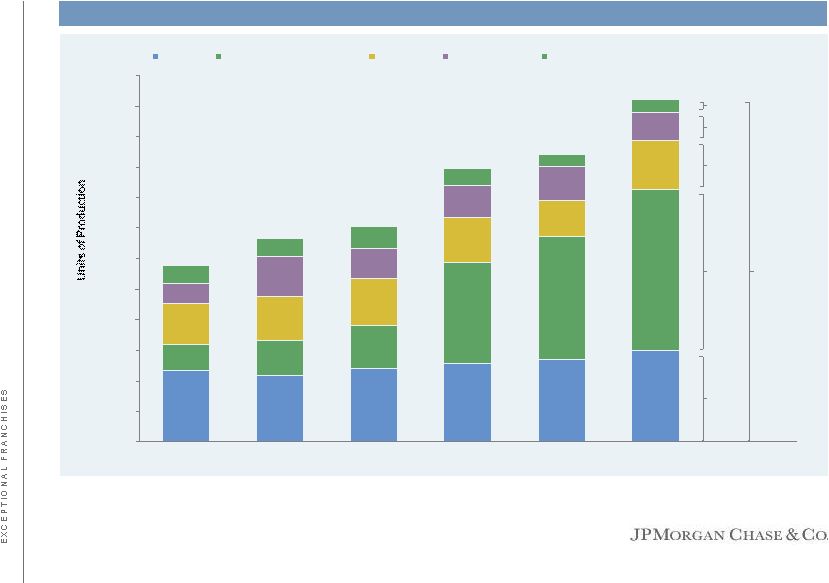

0

100

200

300

400

500

600

700

800

900

1,000

1,100

1,200

2Q05

2Q06

2Q07

2Q08

2Q09

2Q10

DDAs

Convenience Products

Savings

Credit Cards

Investments & Loans

Sales

Production

(in

units)

per

branch

–

hChase

Sales production has increased steadily over the past six years…

2Q10 vs. 2Q05

% Change

94%

(28)%

41%

17%

525%

28%

Convenience

products

include

Direct

Deposit,

Online

Bill

Pay,

Business

Online

Banking,

and

Fee-Based

Debit

Card

Sales

&

Upgrades.

Totals

exclude

instore

branches

12 |

Retail Financial Services –

factors impacting revenue and growth

Revenue currently adversely impacted by portfolio run-off and repurchase

expense Real Estate Portfolios expected to make a positive contribution to

earnings and capital over time as credit losses are reduced and significant

expense reductions are realized 2009

2010

2011

2012

2013

Balances

$270

$235

$200

$175

$150

Net interest income

6.6

5.5

4.5

4.0

3.5

Capital returned

—

—

1.0

1.0

1.0

Ultimately all of these factors will result in higher quality revenue and better

returns on capital

13

Real Estate portfolios —

simulated balance run-off & NII (Average balances, $ in billions)

Real Estate

portfolios

—

simulated

balance

run-off

&

NII

(Average

balances,

$

in

billions) |

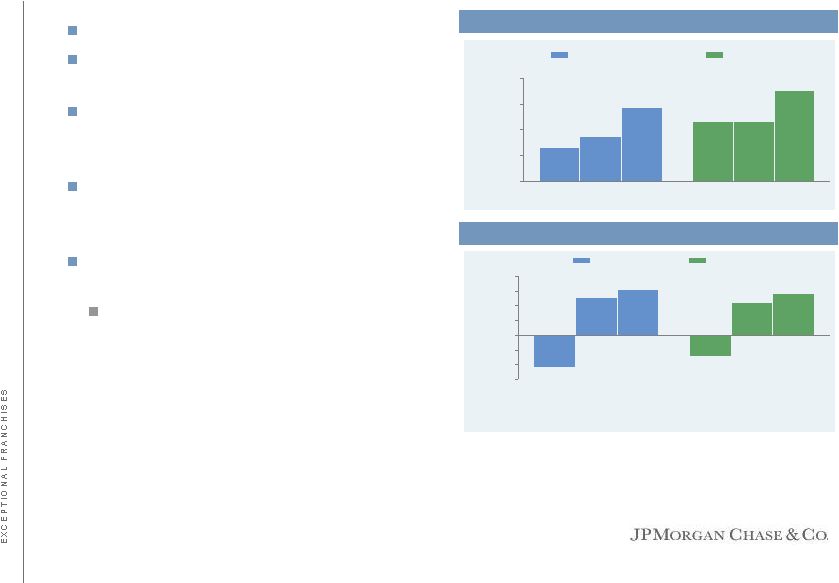

Market leading franchises —

Card Services

Annualized spend per open account –

AXP vs. Chase Affluent

Sales

growth

YoY

–

DFS

vs.

Chase

Brands

Mass

Affluent

Chase is #1 Visa credit card issuer

Over 50mm customers receive a credit card

statement from Chase each month

Our affluent portfolio, though far smaller,

exhibits higher spend per account behavior

relative to AXP US Card

Targeting Mass Affluent and business card

markets with Chase branded cards and

suite of products

Continue to invest in innovation and our

branded portfolio

Including Blueprint, Sapphire, Ink, Slate,

and Ultimate Rewards

$12,862

$13,503

$12,302

$11,320

$12,304

$11,711

$10,000

$11,000

$12,000

$13,000

$14,000

AXP US Card¹

Chase Affluent²

2Q09

1Q10

2Q10

2Q09

1Q10

2Q10

6.3%

5.7%

(2.8)%

(4.3)%

4.5%

5.2%

(6.0)%

(4.0)%

(2.0)%

0.0%

2.0%

4.0%

6.0%

8.0%

DFS³

Chase Mass Affluent

2Q09

1Q10

2Q10

2Q09

1Q10

2Q10

1

AXP open accounts represents ‘Basic Cards in Force’

2

Chase

Affluent

portfolio

includes

Cobrand

T&E

and

Branded

Affluent-HNW

portfolios

3

Discover’s portfolio includes mass affluent as well as affluent

customers Source: Earnings release, Internal Chase data

$21.5

$22.4

$22.9

$21.2

$19.8

$22.4

Sales in $B:

14 |

Card

Services

–

reduction

in

EOP

outstandings

–

lower

revenue,

higher

quality

WaMu

portfolio declined to $16B in 2Q10 from $20B at year-end 2009, expected to

decline to $10B by end of 2011

EOP outstandings

for Chase (excluding WaMu) are projected to decline by 15% or $21B

year-over- year in 2010

More than half of the decline in receivables is driven by conscious pullback in

balance transfer offers Expect underlying receivables growth in late 2010.

Overall receivables growth in 2011, reflecting a better mix of

customers Decline in receivables will free up capital and reserves

Reserve levels were down $1.5B last quarter, this will probably continue

Expect

Chase

losses

of

approximately

8.00%+/-

in

3Q10

vs.

9.02%

in

2Q10

$123

$113

$116

$21

$10

$9

$0

$30

$60

$90

$120

$150

12/31/09

Est. 12/31/10

Est. 12/31/11

Core balances

Balance transfers

$144

$123

$125

15

Chase (excluding WaMu) EOP outstandings ($ in billions)

|

Agenda

Page

16

Issues facing JPM, the industry and global economy

16

Exceptional franchises

3

Key investor topics

21

Summary remarks

38

Appendix

42 |

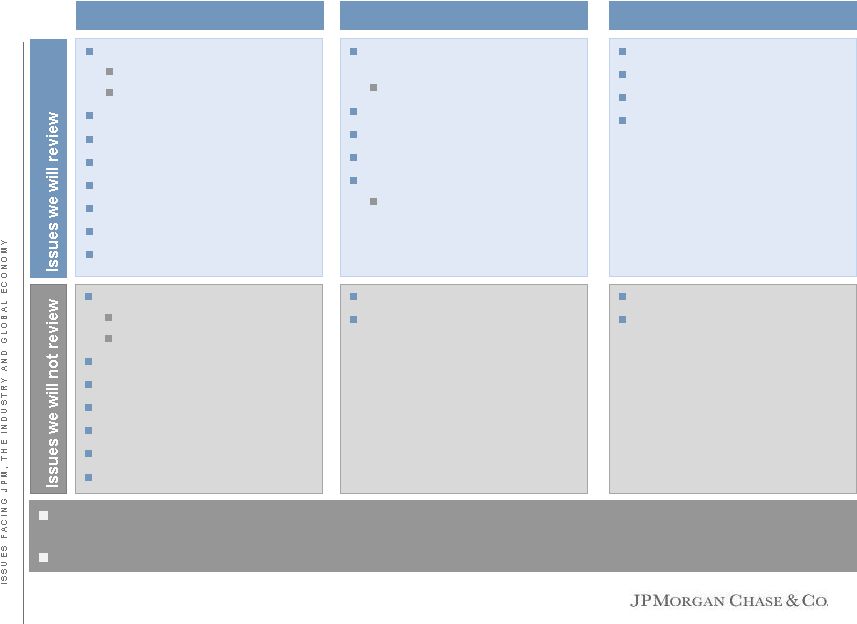

Industry is facing multiple regulatory, market and other issues

Ongoing issues in the mortgage

market

Home prices

Capital markets activity levels

Unemployment / economic growth

Low interest rate environment

Consumer and wholesale credit

Commercial real estate

Revenue growth opportunities

Portfolio run-off

International expansion

Global convergence

Regulation

Market

Other

Governance

Say-on-Pay

Proxy access

Living will

Compensation rules

Pre-emption

Bail-in and contingent capital

Bank taxes

FDIC assessment

Securitization

GSEs

and future structure

Healthcare

Litigation

JPM

will

continue

to

invest

in

its

businesses

and

expand

product

capabilities, to maintain best-in-class

franchises and drive organic growth

These issues will have a significant impact on the industry and markets

Capital, Liquidity, Basel III

Trust preferred securities

Dividend, stock buyback

Basel III

Derivatives

Volcker rule

Debit interchange

NSF/OD

Fair value accounting

Enhanced regulatory oversight

including Fed, FSA, BCFP, etc.

17 |

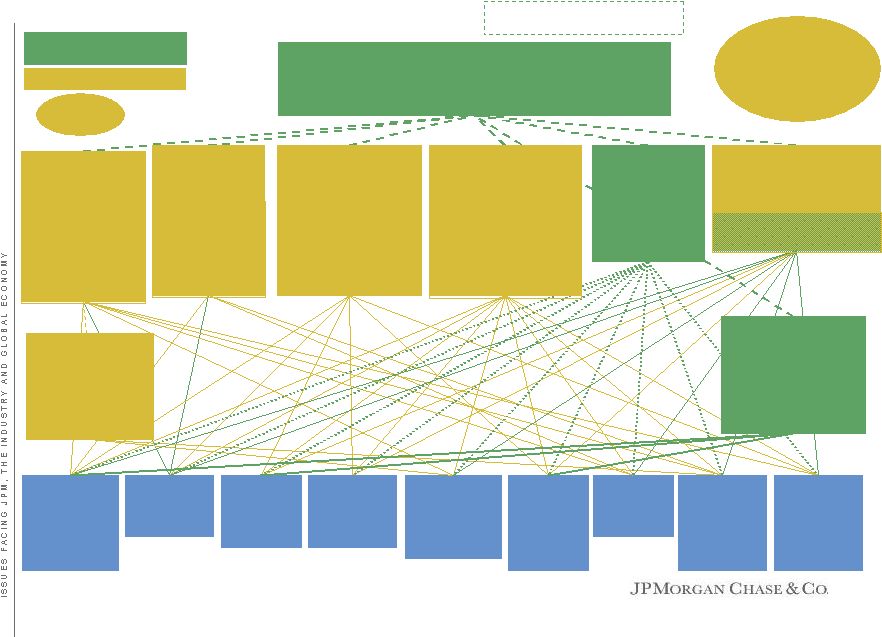

Investment

Advisory

Mutual and

money market

funds; wealth

management;

trust services

Consumer

Lending

Credit cards;

student and

auto loans

Commercial

Lending

Commercial and

industrial

lending

Broker-dealer

Institutional and

retail brokerage;

securities lending;

prime broker

services

Retail

Banking

Deposit

products;

mortgages

and home

equity

Payment and

Clearing

Systems

Payments

processing;

custody and

clearing

State Regulatory

Authorities and AG’s

Power to enforce rules

promulgated by Bureau

of Consumer Financial

Protection

Derivatives

Futures,

commodities

and derivatives

Alternative

Investments

Hedge funds;

private equity

Investment

Banking

Securities

underwriting;

M&A financial

advisory

services

Financial Stability Oversight Council

Identify risks to the financial stability of the U.S. from activities of large,

interconnected financial

companies.

Authority

to

gather

information

from

financial

institutions.

1

Make

recommendations to the Fed and other primary financial regulatory agencies

regarding heightened prudential standards.

OFAC /

FinCEN

CFTC

Market oversight and

enforcement

functions.

Authority over swaps,

swap dealers and

major swap

participants.

Regulates trading

markets, clearing

organizations and

intermediaries.

SEC

Regulates securities

exchanges; mutual

funds and investment

advisers. Examination

authority for broker-

dealers.

Authority over security-

based swaps, security-

based swap dealers and

major security-based

swap participants.

FDIC

Focus on protecting deposits

through insurance fund; safety and

soundness; manage bank

receiverships.

Examination authority.²

Orderly

liquidation of systemically important

financial institutions³.

Office of the Comptroller of

the Currency

Focus on safety and

soundness. Primary

regulator of national banks

and federal savings

associations. Examination

authority. Examines loan

portfolio, liquidity, internal

controls, risk management,

audit, compliance, foreign

branches.

Federal Reserve

Focus on safety and

soundness-Supervisor for bank

holding companies: monetary

policy; payment systems.

Supervisor for systemically

important financial institutions

and their subsidiaries.

Establish heightened prudential

standards on its own and based

on Council recommendations.

Examination authority.

FINRA

Regulates brokerage

firms and registered

securities

representatives. Writes

and enforces rules.

Examination authority

over securities firms.

Office of Financial

Research

Office within

Treasury, which may

collect data from

financial institutions

on behalf of Council.

No examination

authority.

Strengthened but not simplified

Green indicates new agency or

new powers and authority

Gold indicates old agency.

Dotted line indicates authority to request

information, but no examination authority.

Bureau of Consumer

Financial Protection

Focus on protecting

consumers in the financial

products and services

markets. Authority to write

rules, examine institutions

and enforcement. No

prudential mandate.

18

This chart assumes these activities are conducted in a systemically important bank holding company

(BHC) 1

The Council, through Office of Financial Research, may request reports from systemically important

BHCs 2

FDIC may conduct exams of systemically important BHCs for purposes of implementing its authority for

orderly liquidations, but may not examine those in generally sound condition

3

The Dodd-Frank Act expanded the FDIC’s authority when liquidating a financial institution to

include the bank holding company, not just entities that house FDIC-insured deposits

Note: Green lines from SEC and CFTC represent enhanced authority over existing relationships

|

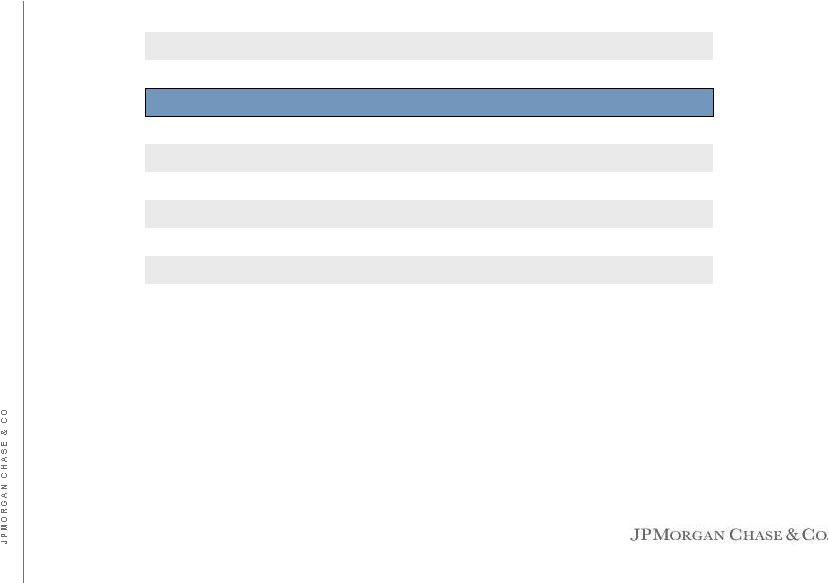

Multiple regulatory and market issues (and not just in U.S.)

Topic & Section

Rulemaking

One-time Reports

/ Studies

Periodic Reports

TOTAL

Financial Stability (Title I)

35

8

5

48

Orderly Liquidation (Title II)

14

12

2

28

Private Fund Investment Advisers (Title IV)

14

5

2

21

Insurance (Title V)

8

2

3

13

Regulation of Bank Holding Companies, Savings & Loan Holding Companies and

Depository Institutions (excluding Volcker Rule) (Title VI)

9

3

0

12

Volcker Rule (Title VI – Section 619)

3

1

0

4

Derivatives (Title VII)

56

7

3

66

Payment, Clearing and Settlement Supervision (Title VIII)

6

1

0

7

Investor Protection and Regulatory Enforcement (Title IX – Subtitle A)

7

6

2

15

Credit Rating Agencies (Title IX – Subtitle C)

14

6

0

20

Asset-Backed Securitization (Title IX – Subtitle D)

7

2

0

9

Executive Compensation and Corporate Governance (Title IX – Subtitles E and G)

11

1

0

12

Municipal Securities (Title IX – Subtitle H)

6

4

0

10

Bureau of Consumer Financial Protection (Title X)

29

6

1

36

Mortgage Reform and Anti-Predatory Lending (Title XIV)

37

9

4

50

Miscellaneous – Titles III, XI, XII, XIII, XV and parts of Title IX

29

19

22

70

TOTAL

285

92

44

421

Source: Sullivan & Cromwell LLP

19

Dodd-Frank legislation rulemaking summary |

Although

regulatory

reform

will

potentially

have

a

significant

impact

on

our

businesses

and clients, we are convinced we can manage through the change and thrive

JPM remains supportive of safe and sound regulatory reform

Much

regulatory

reform

was

needed

–

financial

industry

and

global

economy

are

better

for

it. However, some was ill-conceived and there are unknown, unintended

consequences Industry

capital

and

liquidity

were

too

low

–

we

need

to

get

it

right

–

need

level

global

playing field

JPM has substantial franchise strength

Always continue to invest in our businesses

Extremely strong balance sheet

Continue to build our excellent client franchises

Always strive to maintain strong relationships with regulators

Committed to ensuring that the implementation of regulatory reform is done in a

way that is good for our clients and our company

Adding

people

to

75+

existing

work

streams

–

dedicated

to

implementing regulatory

reform

20 |

Agenda

Page

21

Key investor topics

21

Exceptional franchises

3

Issues facing JPM, the industry and global economy

16

Summary remarks

38

Appendix

42 |

Regulatory reform impact –

Banking activity restrictions (Volcker)

Law does not limit the growth of our client businesses, market-making activities

or ability to serve our clients

Can continue to sponsor client-only hedge funds (i.e., Highbridge)

3%

limitation

for

seed

capital

—

consistent with current practice

Can

continue

to

make

permissible

merchant

banking

investments

(through

OEP)

We will keep OEP and wind down third-party investments within regulatory

period Remaining

few

proprietary

trading

areas

will

be

transitioned

to

Asset

Management

—

de minimus

impact

22 |

Regulatory reform impact –

Derivatives

Always supported moving standardized and liquid swaps to clearinghouses

Revenue impact of $1B+/-, potentially positive offsets

May create significant liquidity and margin requirements for clients

Overall capital impact on dealers is unclear, but likely positive

Do not expect spread to change materially on liquid products

Critical that central clearinghouses are properly managed

Clearing and Swap Execution Facility (SEF)

Major

concern

is

that

we

can

properly

serve

clients

across

legal

entities

Creates significant operational work which will be done

Complicated regulation

Majority

of

derivatives

–

except commodities (other than metals), equity, and high yield and

certain

investment

grade

CDS

–

are not required to be moved

Possible capital requirements of $6B+/-, not incremental to the Firm

Final operational and legal structure has yet to be decided

Conduct certain activities in a non-bank subsidiary

23 |

Home

lending

credit

trends

–

Net credit losses and loan loss reserve levels

Current

loss

guidance

–

at

the

current

rate

of

delinquency

and

loss

severity,

quarterly

losses

could be:

Home equity $1B

Prime mortgage $400mm

Subprime mortgage $400mm

Rate

of

improvement

slowed

and

delinquencies

flattened

in

2Q10

–

July

and

August

remained flat to June

Home

Lending

reserves

for

the

nonpurchased

credit impaired portfolio at 2Q10 of $11.3B

Current loss guidance annualized of $7B +/-

Reserve level reflects significant uncertainty, allow for further stress

If delinquencies return to 2H09 levels with 10-15% incremental HPI decline

from here, losses

could

run

to

$8B

+/-

in 2011/2012

When roll rates and severities improve and uncertainty in the environment is

reduced, we will release reserves

In the purchased credit impaired portfolio lifetime losses plus additional

impairment through reserves are $33.4B

If

delinquencies

and

severities

remain

flat

-

additional impairment over the next two years

could be $3B+/-

If delinquencies return to 2H09 levels with 10-15% incremental HPI decline

from here - additional

impairment

over

the

next

two

years

could be $7B+/-

24 |

Home

lending

credit

trends

–

Net credit losses and loan loss reserve levels (cont.’d.)

Performance of loans modified after trial periods is still not certain as a large

number of these modifications were completed in the last six months

Early indications are that performance is better than that experienced on prior

modifications

Foreclosure

inventory

will

remain

at

current

elevated

levels

+/-

through

beginning of 2011 as

improvement in delinquencies is offset by new referrals, and then trend down

gradually through 2013; in turn REO inventory will increase through

2013 25 |

Repurchase demands elevated at $1B+ per quarter; demands driven by 2006-2008

vintages (~90%) and third-party originated (~40%)

Demands

lag

loans

reaching

90

DPD

by

12-20

months

-

delinquency

improvements

have

not

yet

flowed through to demand activity; demands expected to remain elevated well into

2011 Reserves of $2.0B ($2.3B firmwide) at June 30, 2010 for demands

presented and expected future demands

Key reserve assumptions include demand frequency, cure rate, loss severity and

third party recoveries; assumptions are reviewed and adjusted

quarterly based upon actual experience A 10% adverse change in all key

assumptions would increase repurchase liability by $1B +; a more severe

stress of 20% by $2-2.5B When demands and losses trend downwards, we

will release reserves Losses could approach $1.2B+/-

in 2010 and $1.0B+/-

in 2011

Repurchase risk

1

Heritage Chase only

26

Repurchase settlement experience and reserves ($ in millions)

2009

1

1Q10

2Q10

Repurchase settlements

$580

$238

$312

Reserve build

1,032

194

355

Total repurchase expense

1,612

432

667

EOP reserves

$1.4B

$2.0B |

Regulatory reform impact –

Reg

E, debit interchange and BCFP

All industries decide what to charge for services and what to provide for free

Pricing should be relative to the value provided, not just the costs incurred

Pricing of specific products and services need to cover broader fixed costs related

to servicing accounts and the relationship

Many services are free. Checking account customers receive the following free

services: debit cards, ATM access at Chase’s 15,500 ATMs, on-line

banking and on-line bill pay, access to Chase’s 5,100 branches,

and 100% fraud protection on debit transactions We

agree

that

merchants

should

have

the

option

to

accept/decline

a

form

of

payment

or

to

discount as they choose

However, the government should not be able to set pricing

Cash and checks are cheaper than debit and credit alternatives, but they are not

without cost Industry will inevitably reprice

as result of regulatory change:

Many products and services will no longer be free

Banks will exit certain customer relationships

The industry may reduce investment in distribution and innovation

We

will

work

with

the

BCFP

to

ensure

consumer

financial

products

are

transparent

and

fair.

However, consumers may be adversely affected by potential unintended consequences,

which could include reduced credit availability and increased costs

27 |

Fortress balance sheet as of 2Q10

Strong

capital

base

–

Tier

1

Common

of

$108B

or

9.6%

High quality capital and very high level of reserves ($36.7B), loan loss coverage

of 5.34% Large

deposit

base

–

~$900B.

Stable

source

of

funding

–

retail

and

wholesale

–

geographic

Low

reliance

on

short

term

unsecured

capital

markets

–

plenty

of

capacity

in

these

short-term

markets as well as long-term unsecured funding markets

Significant unused liquidity in the form of cash and high quality liquid

unencumbered collateral Loss

of

trust

preferred

securities

(~$21B)

regulatory

capital

credit

–

minimum

impact

on

JPM

–

unfair

to

many

US

banks

–

we

will

determine

what

to

do

when

we

see

final

rules

Wholesale

(Investment

Bank

and

Commercial

Banking)

credit

trends

have

improved

from

2009

peak

levels but remain above historical averages

Strong loan loss reserves -

allowance for loan losses of $4.8B

Net charge-off rate of 0.55%

Total net fair value assets of $777B

Level

1

and

2

assets

are

85%

of

total

assets

at

fair

value

–

actively

traded

in

liquid

markets

Level 3 assets represent 15% of total assets at fair value

Strong capital position today will be further strengthened by significant

earnings and need for lower reserve levels over time

28 |

Analyst

Projections "Stressed" Analyst Projections

2010

2011

2012

2013

2010

2011

2012

2013

Tier 1 Common (%)

10%

12%

13%

14%

10%

11%

11%

12%

Tier 1 Common ($)

$120

$130

$150

$170

$110

$120

$130

$140

Excess Tier 1 Common Over 8%

$25

$40

$60

$75

$20

$30

$40

$45

ROE

9%

11%

11%

12%

6%

7%

7%

8%

Allowance for Loan Loss

$35

$30

$20

$25

$35

$35

$35

$35

Dividend

$0.29

$0.74

$1.12

$1.33

$0.29

$0.74

$1.12

$1.33

We have significant capital generation

Illustrative “stress”

case based on analyst projections

$15.5

$19.0

$22.5

$24.5

~$15

~$14

~$12

~$10

2010

2011

2012

2013

Analyst Projections

"Stressed" Analyst Projections

¹

Analyst average includes 8 analysts through 2012; 2013 is composed of 3 analysts

plus I/B/E/S LTG projections for other 5 in 2013; Regulatory changes are assumed to be incorporated in the analyst projections. One analyst is excluded from 2013 Tier 1 Common average due

to assumption that JPM repurchases a significant amount of shares during the year;

ratios reflect Basel I through ‘12 & Basel III in ‘13 (~50bp impact); other capital deployment represents analyst average less 1 firm in ‘13 due to significant share repurchase. JPM does not

endorse these projections

²

“Stressed”

Analyst Projections incorporate JPM stressed scenario assumptions

³

Analyst projection of capital deployment through common dividends of $11.8B:

analyst average dividend of $0.29, $0.74, $1.12, $1.33 in ‘10, ‘11, ‘12 & ‘13, respectively (assumes 2013 payout constant to 2012)

Note: Basel I through 2012 and Basel III in 2013; Numbers rounded for presentation

purposes. Ratios and other calculations may not round perfectly Net

Income

Capital

Multiple stress scenarios are run on a regular basis. Highly stressed

scenario has Tier 1 Common of ~12% despite:

Peak unemployment of 12% in 4Q13

HPI peak-to-trough of 45% in 1Q12

Excess capital reduces ROEs

Equity markets bottom at 850 during 1H11 & remain

stagnant through 4Q13

Fed funds stay at 20bps through 4Q13

29

Analyst

and

“stressed”

analyst

projections

($

in

billions)

¹,²,³ |

Basel III capital summary as of 2Q10

Tougher capital standards (which we always believed in)

More restrictive capital definitions (e.g., deductions)

Higher risk-weighted assets (e.g., CVA, Market Risk)

Higher required capital

Basel I: 4% Tier 1 Common standard (SCAP)

Basel

III:

7%

Tier

1

Common

standard

1

9.6% JPM’s

2Q10 Tier 1 Common ratio under Basel I

Results

in

estimated

9%

2

Basel

III

Tier

1

Common

ratio

in

4Q11

after

taking

known actions

JPM will mostly manage to the new capital rules effective immediately

JPM does not need to or intend to issue common stock

JPM will probably not operate with an additional self-imposed buffer, as we

have in the past, because we believe the new capital requirements are

sufficient 1

Preliminary view (as of 9/12/10) of Basel III based on interpretation of current

rules/initial estimates. Subject to change as interpretation of Basel III rules is ongoing and dependant on guidance from

Basel/International regulators

²

Based on JPM and analyst projections (see page 29)

30

Tougher

standard and

higher

calibration

Estimated

impact on JPM

Current JPM

expectations |

Basel I 2Q10

Basel III 4Q10

Basel III 4Q11

JPM estimated capital levels under Basel III are well in excess of Basel I standards

Estimated projections as of 2Q10

$1.1

$1.5

Adjustments to RWA from 2Q10 Basel I to 4Q11

Basel III (+$400B):

Market risk impact (+$180B)

Risk weight 50/50 deductions at 1250% (+$140B)

CVA (+$60B)

Other (+$30B)

Known actions by 4Q11 to reduce Basel III RWA

(-$180B):

Market risk –

reduce IB & CIO positions (-$50B)

CVA –

reduction/ hedging of derivative positions

(-$20B)

RWA on 50/50 deductions; reduce IB/CIO

securitization (-$70B) exposure

Retail loan run-off (-$40B)

Other (-$5B)

Basel I 2Q10

Basel III 4Q10

Basel III 4Q11

Adjustments to Capital from 2Q10 Basel I to 4Q11

Basel III with known actions (-$0.5B):

Deduct net pension asset (-$2B)

Deduct PCCR (-$1B)

Deduct

DTA

from

NOL

carryforward-(-$0.5B)

Net Impact of adding back 50/50 deductions

(+$1B)

Add back of OCI balance (+$2B)

Includes estimated capital generation of $15B

based on average analyst projections¹

$108

$109

$1.4

$123

Includes known actions

Includes known actions

¹

Based on analyst projections of capital generation; see page 29

Note: Numbers rounded for presentation purposes. Ratios and other calculations may

not round perfectly 10%

7%

9%

Tier 1 Common Ratio

31

Capital ($ in billions)

RWA ($ in trillions) |

Hierarchy of capital usage

We intend to restore the dividend

Ultimately return to dividend payout ratio of 30-40% of normalized earnings

(pending tax rule changes)

Initial

increase

is

not

likely

to

hit

payout

ratio,

but

would

be

material

Subject to final analysis of Basel III in November and regulatory capital

adequacy Hopefully early 2011

Hierarchy of capital after restoration of dividend

Investing in organic growth

Stock buyback

–

Will be higher when stock price is lower

–

Will be lower when stock price is higher

–

Will be adjusted for other future opportunities

Acquisitions

32

We clearly have excess capital generation, which will be used to benefit

shareholders |

Implications

of

Basel

III

liquidity

proposal

–

Liquidity

Coverage

Ratio

53%

Liquid

Asset

Buffer

Net

Funding

Outflow

< 30

days

Items included in LCR

Comments

$72B:

Cash & Central Bank reserves

100% factor

$83B:

US Treasuries / Sovereigns

100% factor

$22B:

Agency / Agency MBS

85% factor

$7B:

Public fund deposits collateral

25% factor

$2B:

Eligible

Corp.

Securities

(

AA-

)

85% factor

$225B:

Deposits

(25% average factor)

$124B:

Non-Operational Deposits

75-100% factor

$101B:

Wholesale

Operational

&

Retail/SME Deposits –

5-25% factor

$100B:

Unfunded commitments

48% average factor

$89B:

Liquidity

Commitments

&

FI

Credit Commitments –

100% factor

$11B:

Wholesale

Credit

(ex

FI)

&

Retail

Commitment outflow –

5-10% factor

$31B:

Secured

funding

outflow

(Repo)

10% factor

($7B):

Other

funding

Inflows/Outflows²

0-100% factor

Example of items not included in LCR

Munis

Corp. securities below AA-

Sovereign guaranteed loans (i.e., EXIM)

Fed Discount Window Eligible loans

(~$80B)

JPM experienced net deposit inflows

Historic experience during the financial crisis¹

JPM experienced 6-8% drawdown on unfunded balances

We understand banks under stress would have

outflows / draw-downs; it is prudent to be prepared

33

186

349

Preliminary view of JPM Liquidity Coverage Ratio (LCR) -

Estimate based on 2Q10 balances for illustrative purposes ($B)

¹ Financial crisis occurred between late 2007 and mid 2009

²Includes impact of account payable/receivable, trading assets derivatives payable/receivable, and

other contractual payments <30 days Note: Preliminary view (as of 9/7/10) of JPM LCR ratio

based on interpretation of current rules/ initial estimates of 2Q10 asset buffer and net funding

outflow. Subject to change as interpretation of Basel III liquidity rules is ongoing and

dependant on guidance from Basel/International regulators

Numbers rounded for presentation purposes. Ratios and other calculations may not round perfectly

|

Business

evolution

Potential levers to meet proposed Basel III LCR requirements

Known actions:

Reduction

in

size

of

IB

(~$8B)

&

CIO

portfolios

(~$2B)

–

estimated

notional

impact

by

end of 2011

RFS

loan

run-off

(~$80B)

&

reduction

in

size

of

PE

(~$2B)

–

estimated

notional

impact

by end of 2013

Raise Unsecured Term Debt (e.g., term CP, CDs, and 1+ year notes)

Term-out existing Short-Term debt

Raise Secured Term Debt (e.g., FHLB, Auto and Card ABS)

Reduce

“illiquid”

assets

so

that

proceeds

can

count

towards

the

buffer

Consider profitability impact

Raise additional Retail deposits

Consider profitability impact

Reduce

Committed

Credit

and

Liquidity

Facilities

-

probably

done

through

pricing

Consider client impact

Reduce

wholesale

deposits

-

probably

done

through

pricing

Convert Financial Institution deposits to Term

Outflows

34

Buffer

Outflows |

Potential market pricing changes due to Basel III liquidity constraints

Due to

modest

ROEs

on

current

credit

pricing

and

higher

funding

costs,

client

pricing

expected

to

increase

Does not take into account potentially higher capital charges under Basel III or

funding costs if short- term funding supply constraints develop in

market Impact will be dramatically different by client and type of

product Annual pricing impact on client¹

-

Illustrative example ($ in 000’s)

1

Example is meant to be illustrative and based on hypothetical client experience,

which include assumptions on probability of draw and current/future upfront and arranger fees. Pricing increase over

current expected price to client, including arranger/other upfront fees is

amortized over the life of the facility (where applicable) ²

Assumes

JPM

ROE

and

capital

stay

constant;

Does

not

reflect

leverage

ratio

constraintthat

would likely lead to more severe price impact

Client

Characteristics of Facility

Actual Cost to Client

Incremental Funding Cost to

JPM to be LCR neutral ²

Large Corporate

A / A2

3 Year Revolver (CP Backstop)

$100mm JPM Exposure

$275

$800

35 |

Overall okay; but will cause some capital shortfall for banks

RWA needs to be done fairly across global banks

Basel III industry implications

Appropriate to do right; likely some changes to come

Either way JPM will be fine

Could create additional funding costs and pricing issues for clients

Role of banks likely reduced

Policy mismatch between LCR and money market industry, LCR and Interbank

lending

Basel III

Capital

Basel III

Liquidity

36 |

Firm

interest

rate

positioning

—

NIM

by

line

of

business

Increase from higher long-term rates due to increased value of deposits

Negatively impacted by higher short-term rate (flatter and stagflation)

scenarios Retail Financial

Services

Card Services

Commercial

Banking, TSS,

AM

Corporate

Firm benefits from immediate +100 bps parallel rate shock by +$947mm over the next

12 months Firm benefits from higher long term rates (steeper yield curve) and

slightly negative to rising short-term rates (flatter yield curve)

If rates remain where they are, NIM could be compressed

Benefit from higher long-term rates, adversely impacted by higher

short-term rates

Immediate ability to reposition, refinance, change size of investment

portfolio Modest benefit from rising short-term rates

Fairly neutral to higher long-term rates

If rates remain where they are, NIM could be modestly compressed

Generally benefits from rising short and/or low long-term rates

37 |

Agenda

Page

38

Summary remarks

38

Exceptional franchises

3

Issues facing JPM, the industry and global economy

16

Key investor topics

21

Appendix

42 |

Chase

and

WaMu

credit

losses

expected

to

continue

to

improve

Chase

losses

of

approximately

8.00%+/-

in

3Q10

vs.

9.02%

in

2Q10

Total net income impact from the CARD Act, including recent legislative reasonable

and proportional fee changes is $750mm+/-

65% of run-rate expected to be included in 3Q10 results vs. 25% in 2Q10

Outlook

Corporate quarterly net income expected to decline to $300mm+/-, subject to

the size and duration of the investment securities portfolio

Investment Bank

Trading environment has been stable

Card Services

Corporate

39 |

Commitment to drive economic recovery

Providing capital, financing and liquidity: annualized 1H10 of $1.4T,

up 3% and up 6% vs. 2009 and 2008, respectively

1H10 small business lending of $4.7B up 35% vs. 1H09

Remain committed to 2010 originations target of $10B for small

business lending

On track to hire 10K people in the US in 2010

40 |

Significant

earnings

power

JPM’s

fundamentals remain extremely strong

Excellent client franchises and businesses

Each standalone business has a top 1, 2 or 3 position

Unparalleled client relationships in 100+ countries

Culture

of

innovation;

new

products

and

programs

launched

during

crisis

Robust technology infrastructure to serve clients

Excellent

client

franchises and

businesses

Fortress

balance sheet

Continued

investment

across

LOBs

driving

organic

growth

Consistent record of operating efficiency and delivering merger saves

Businesses stronger together than apart; additional revenue streams

generated Further strengthened balance sheet: Tier 1 Capital of $137B or

12.1%, Tier 1 Common

1

at $108B or 9.6%

High quality capital and very high level of reserves ($36.7B), loan loss reserve

of 5.34%

2

Strong funding and liquidity profile: $888B deposits, 1.3x loan coverage

Benefits

from

diversification

–

funding,

capital,

lower

volatility

Strong

management

team

Strong and stable management team

Deep bench of talent; thoughtful succession planning

1

See note 3 on slide 52

2

See note 2 on slide 52

41 |

Agenda

Page

42

Appendix

42

Exceptional franchises

3

Issues facing JPM, the industry and global economy

16

Key investor topics

21

Summary remarks

38 |

Financial results

$O/(U)

1H10

1H09

1H09

Investment Bank

$3,852

$3,077

$775

Retail Financial Services

911

489

422

Card Services

40

(1,219)

1,259

Commercial Banking

1,083

706

377

Treasury & Securities Services

571

687

(116)

Asset Management

783

576

207

Corporate/Private Equity

881

546

335

Total Firm Net Income

$8,121

$4,862

$3,259

Firmwide

results ( $ in millions)

Net income by line of business ($ in millions)

1

Revenue is on a fully taxable-equivalent (FTE) basis. See note 1 on slide

52 2

Net income used to calculate the ratios for 1H09 excludes the one-time,

non-cash negative adjustment of $1.1B resulting from the repayment of

TARP preferred capital 3

See note 4 on slide 52

43

$O/(U)

1H10

1H09

1H09

Revenue (FTE)

1

$53,785

$54,631

($846)

Credit Costs

1

10,373

19,755

(9,381)

Expense

30,755

26,893

3,863

Reported Net Income

$8,121

$4,862

$3,259

Reported EPS

$1.83

$0.68

$1.15

ROE

2

10%

6%

ROTCE

2,3

15%

9% |

Market leading franchises –

Retail Banking growth drivers

Checking accounts (# in 000s)

25,712

10,839

9,995

24,499

8,793

26,351

2005

2006

2007

2008

2009

2Q10

CAGR 28% (hChase

12%)

Branches

5,159

2,641

5,474

3,079

3,152

5,154

2005

2006

2007

2008

2009

2Q10

Average deposits ($ in billions)

338

175

245

190

207

341

2005

2006

2007

2008

2009

2Q10

CAGR 16% (hChase

7%)

CAGR 16%

WaMu

WaMu

ATMs

15,654

7,312

15,424

8,506

9,186

15,406

2005

2006

2007

2008

2009

2Q10

CAGR 18%

hChase

hChase

44

Strong growth through organic expansion and WaMu

acquisition

|

5,760

17,391

7,414

8,409

18,357

Jan-07

Jan-08

Jan-09

Dec-09

Jun-10

Market leading franchises –

Retail Banking growth drivers

Households with direct deposit (# in 000’s)

4,240

10,860

4,926

5,852

11,364

Jan-07

Jan-08

Jan-09

Dec-09

Jun-10

Households with debit cards (# in 000’s)

CAGR 34% (hChase

16%)

CAGR 40% (hChase

19%)

WaMu

(data not available until 2009)

WaMu

(data not available until 2009)

Total households (# in 000s)

10,285

22,838

11,125

22,541

Jan-08

Jan-09

Dec-09

Jun-10

CAGR 38% (hChase

9%)

WaMu

(data not available until 2009)

Active online customers (# in 000s)

4,909

15,424

5,918

11,710

16,584

2006

2007

2008

2009

2Q10

CAGR 42%

hChase

hChase

hChase

45

Strong growth through organic expansion and WaMu

acquisition

|

1.7

3.0

1.9

2.2

3.9

2005

2006

2007

2008

2009

Market leading franchises –

Retail Banking growth drivers

Strong

growth

through

organic

expansion

and

WaMu

acquisition

20,170

7,067

15,825

7,573

9,650

17,991

2005

2006

2007

2008

2009

2Q10

CAGR 26%

Alerts (# in millions)

135.2

103.1

83.9

124.5

73.6

155.3

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

CAGR 82%

Households with active online bill pay (# in 000’s)

1,022

3,266

1,279

1,685

3,752

Jan-07

Jan-08

Jan-09

Dec-09

Jun-10

CAGR 46% (hChase

30%)

WaMu

(data not available until 2009)

CAGR

24% (hChase

15%)

WaMu

Personal bankers

Net income ($ in billions)

hChase

hChase

46 |

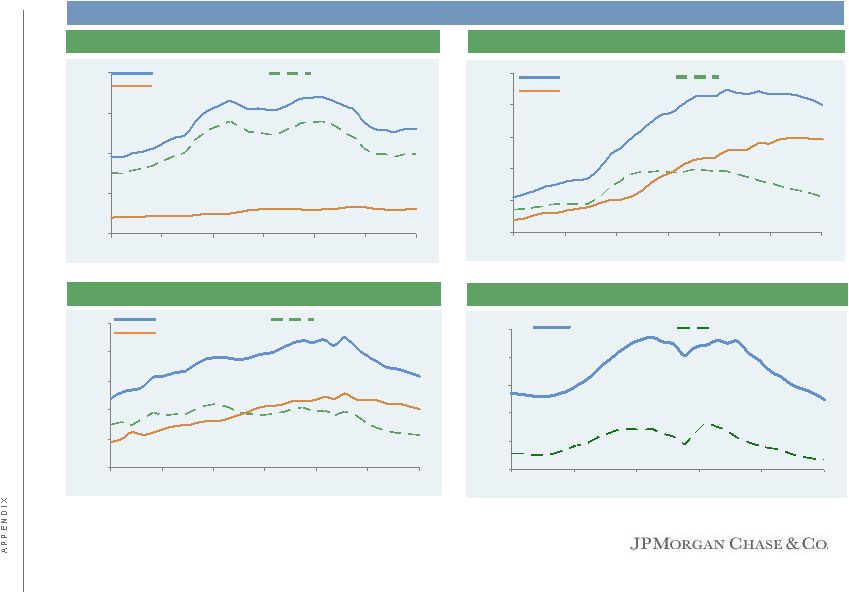

Consumer credit —

delinquency trends (Excl. purchased credit-impaired loans)

Note: Delinquencies prior to September 2008 are heritage Chase

Prime Mortgage excludes held-for-sale, Asset Management and Government

Insured loans 1

See note 1 on slide 52

2

“Payment holiday”

in 2Q09 impacted 30+ day and 30-89 day delinquency trends in 3Q09

$2,000

$3,300

$4,600

$5,900

$7,200

$8,500

Mar-08

Aug-08

Feb-09

Aug-09

Feb-10

Aug-10

30+ day delinquencies

30-89 day delinquencies

Card Services delinquency trend

1,2

—

Excl. WaMu

($ in millions)

Prime Mortgage delinquency trend ($ in millions)

Subprime Mortgage delinquency trend ($ in millions)

Home Equity delinquency trend ($ in millions)

$0

$1,000

$2,000

$3,000

$4,000

Mar-08

Jul-08

Dec-08

May-09

Oct-09

Mar-10

Aug-10

$0

$1,300

$2,600

$3,900

$5,200

$6,500

Mar-08

Jul-08

Dec-08

May-09

Oct-09

Mar-10

Aug-10

$0

$1,000

$2,000

$3,000

$4,000

$5,000

Mar-08

Jul-08

Dec-08

May-09

Oct-09

Mar-10

Aug-10

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

March 2008 –

August 2010

47 |

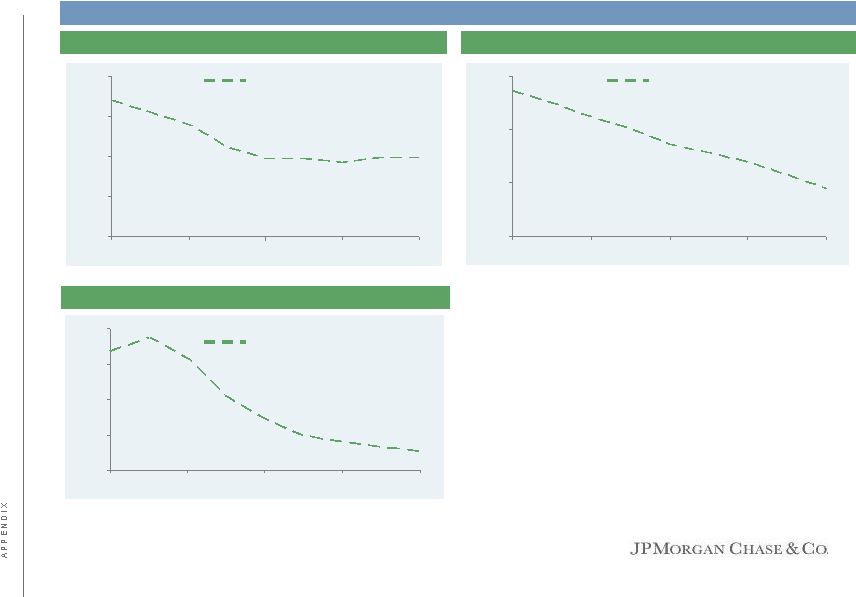

Consumer credit —

Home lending delinquency trends (Excl. purchased credit-impaired loans)

Prime Mortgage excludes held-for-sale, Asset Management and Government

Insured loans Prime Mortgage delinquency trend ($ in millions)

Subprime Mortgage delinquency trend ($ in millions)

Home Equity delinquency trend ($ in millions)

$1,000

$1,500

$2,000

$2,500

$3,000

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

$1,000

$1,500

$2,000

$2,500

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

$1,000

$1,250

$1,500

$1,750

$2,000

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

30 –

150 day delinquencies

30 –

150 day delinquencies

30 –

150 day delinquencies

December 2009 –

August 2010

48 |

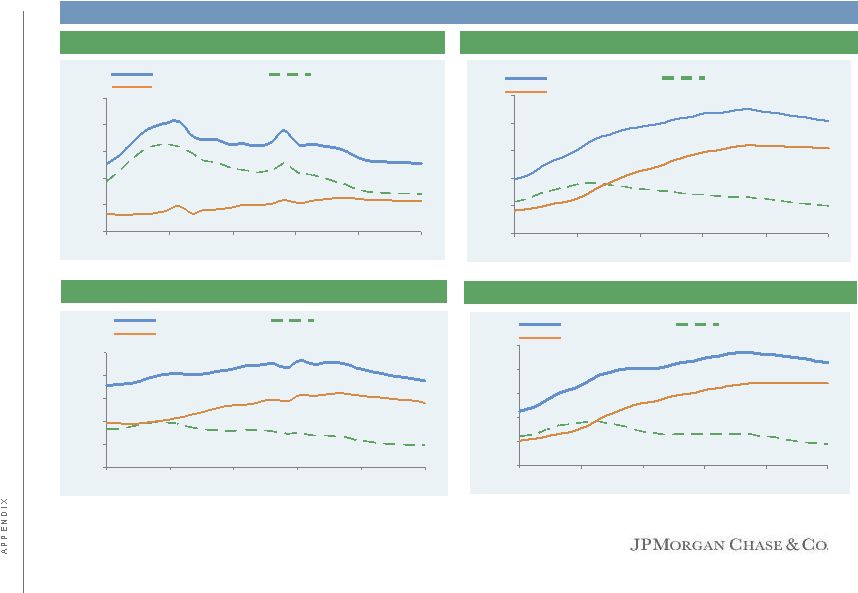

$0

$3,000

$6,000

$9,000

$12,000

$15,000

Sep-08

Jan-09

Jun-09

Oct-09

Mar-10

Aug-10

Consumer credit —

Home lending delinquency trends (Purchased credit-impaired loans)

Note: Credit Impaired delinquency is gross UPB. Prime Mortgage excludes

Government Insured loans Subprime Mortgage delinquency trend ($ in

millions) Home Equity delinquency trend ($ in millions)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

Sep-08

Jan-09

Jun-09

Oct-09

Mar-10

Aug-10

$0

$1,500

$3,000

$4,500

$6,000

$7,500

Sep-08

Jan-09

Jun-09

Oct-09

Mar-10

Aug-10

$0

$1,000

$2,000

$3,000

$4,000

$5,000

Sep-08

Jan-09

Jun-09

Oct-09

Mar-10

Aug-10

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

Option ARM delinquency trend ($ in millions)

30 –

150 day delinquencies

30+ day delinquencies

150+ day delinquencies

September 2008 –

August 2010

Prime Mortgage delinquency trend ($ in millions)

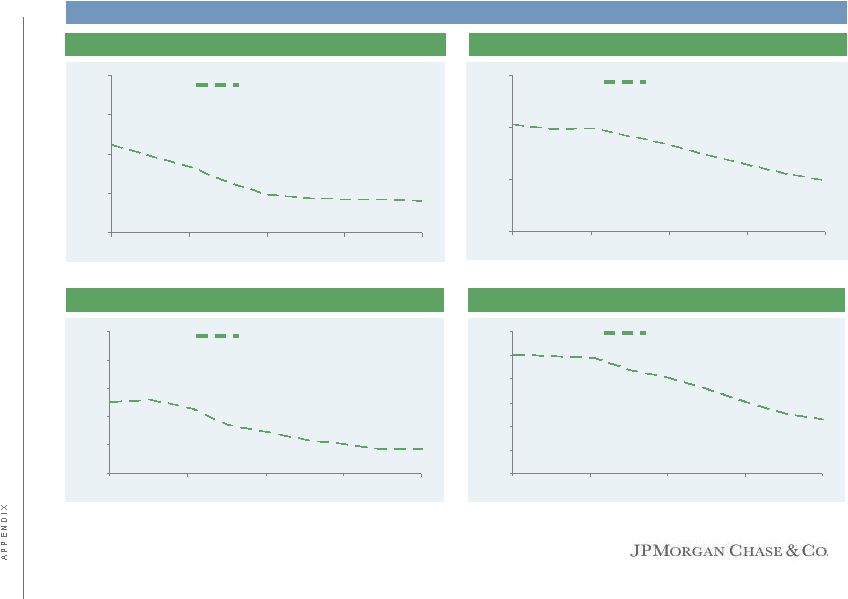

49 |

Note: Credit Impaired Delinquency is gross UPB. Prime Mortgage excludes Government

Insured loans Prime Mortgage delinquency trend ($ in millions)

Subprime Mortgage delinquency trend ($ in millions)

Home Equity delinquency trend ($ in millions)

$1,000

$1,500

$2,000

$2,500

$3,000

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

$1,000

$1,500

$2,000

$2,500

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

$750

$1,000

$1,250

$1,500

$1,750

$2,000

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

Option ARM delinquency trend ($ in millions)

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

Dec-09

Jan-10

Apr-10

Jun-10

Aug-10

30 –

150 day delinquencies

30 –

150 day delinquencies

30 –

150 day delinquencies

30 –

150 day delinquencies

Consumer credit —

Home lending delinquency trends (Purchased credit-impaired loans)

December 2009 –

August 2010

50 |

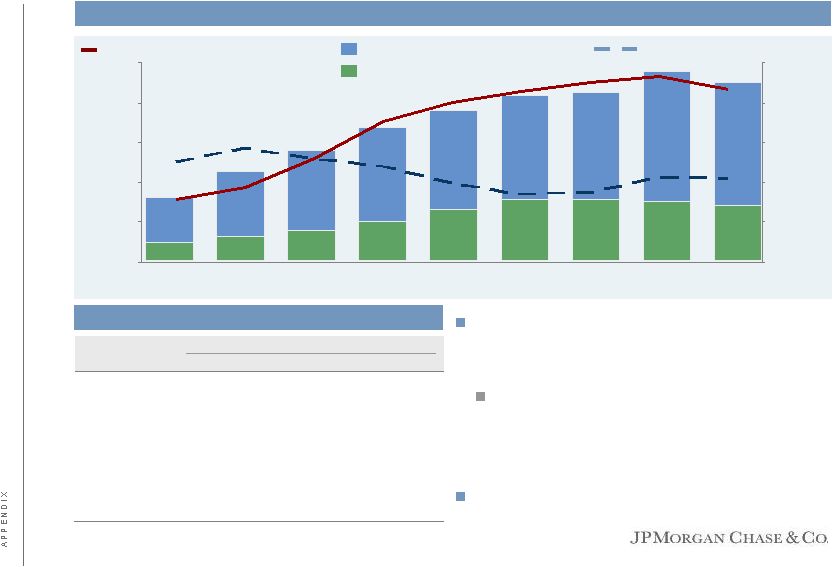

6,933

8,953

11,401

14,785

17,767

17,564

17,050

16,179

13,246

19,052

23,164

27,381

5,273

30,633

35,836

38,186

31,602

29,072

Coverage ratio remains strong

Loan Loss Reserve

Nonperforming Loans

Loan Loss Reserve/Total Loans

Loan Loss Reserve/NPLs

Peer comparison

1

See note 2 on slide 52

2

Peer average reflects equivalent metrics for key competitors. Peers are defined as

C, BAC and WFC. Consumer and wholesale peer average percentages reflected in

table differ from actual average percents due to peer loan disclosure

3

See note 1 on slide 52

($ in millions)

$35.8B of loan loss reserves in 2Q10, up

~$22.6B from $13.2B two years ago; loan

loss

coverage

ratio

of

5.34%

1

$7.5B (pretax) addition in allowance for

loan losses predominantly related to the

consolidation of credit card receivables in

1Q10

3

Strong coverage ratios compared to peers

51

2Q10

JPM

1

Peer

Avg.²

Consumer

LLR/Total Loans

6.88

%

5.75

%

LLR/NPLs

265

%

181

%

Wholesale

LLR/Total Loans

2.42

%

2.95

%

LLR/NPLs

97

%

63

%

Firmwide

LLR/Total Loans

5.34

%

4.87

%

LLR/NPLs

209

%

131

%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

0%

100%

200%

300%

400%

500%

1

1 |

Notes on non-GAAP financial measures

52

1.

In addition to analyzing the Firm’s results on a reported basis, management reviews the

Firm’s results and the results of the lines of business on a “managed” basis,

which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the

reported U.S. GAAP results and includes certain reclassifications to present total net revenue

for the Firm (and each of the business segments) on a FTE basis. Accordingly, revenue from tax-exempt securities and investments that receive

tax credits is presented in the managed results on a basis comparable to taxable securities and

investments. This non-GAAP financial measure allows management to assess the comparability

of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to these items is recorded within

income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole

or by the lines of business. Prior to January 1, 2010, the Firm’s managed-basis presentation also included certain

reclassification adjustments that assumed credit card loans securitized by CS remained on the

balance sheet. Effective January 1, 2010, the Firm adopted new accounting guidance that amended the accounting for the transfer of financial assets

and the consolidation of VIEs. Additionally, the new guidance required the Firm to consolidate its

Firm-sponsored credit card securitizations trusts. The income, expense and credit costs

associated with these securitization activities are now recorded in the 2010 Consolidated Statements of Income in the same classifications that were

previously used to report such items on a managed basis. As a result of the consolidation of the

credit card securitization trusts, reported and managed basis relating to credit card

securitizations are comparable for periods beginning after January 1, 2010. The presentation in 2009 of CS results on a managed basis assumed that credit card loans that had been

securitized and sold in accordance with U.S. GAAP remained on the Consolidated Balance Sheets,

and that the earnings on the securitized loans were classified in the same manner as the earnings on retained loans recorded on the

Consolidated Balance Sheets. JPMorgan Chase used the concept of managed basis to evaluate the credit

performance and overall financial performance of the entire managed credit card portfolio.

Operations were funded and decisions were made about allocating resources, such as employees and capital, based on managed financial

information. In addition, the same underwriting standards and ongoing risk monitoring are used for

both loans on the Consolidated Balance Sheets and securitized loans. Although securitizations

result in the sale of credit card receivables to a trust, JPMorgan Chase retains the ongoing customer relationships, as the customers may

continue to use their credit cards; accordingly, the customer’s credit performance affects both

the securitized loans and the loans retained on the Consolidated Balance Sheets. JPMorgan Chase

believed that this managed-basis information was useful to investors, as it enabled them to understand both the credit risks associated with the

loans reported on the Consolidated Balance Sheets and the Firm’s retained interests in

securitized loans 2.

The ratio for the allowance for loan losses to end-of-period loans excludes the following:

loans accounted for at fair value and loans held-for-sale; purchased credit-

impaired loans; the allowance for loan losses related to purchased credit-impaired loans; and,

loans from the Washington Mutual Master Trust, which were consolidated on the firm's balance

sheet at fair value during the second quarter of 2009. Additionally, Real Estate Portfolios net charge-off rates exclude the impact of purchased credit-

impaired loans. The allowance for loan losses related to the purchased credit-impaired portfolio

was $2.8 billion, $2.8 billion, $1.6 billion and $1.1 billion at June 30, 2010, March 31, 2010,

December 31, 2009 and September 30, 2009, respectively. No allowance for loan losses was recorded at or for any period prior to, June 30, 2009

related to these loans.

3.

Tier 1 Common Capital ("Tier 1 Common") is defined as Tier 1 capital less elements of capital

not in the form of common equity – such as qualifying perpetual preferred stock,

qualifying noncontrolling interest in subsidiaries and qualifying trust preferred capital debt securities. Tier 1 Common, a non-GAAP financial measure, is used by

banking regulators, investors and analysts to assess and compare the quality and composition of the

Firm’s capital with the capital of other financial services companies. The Firm uses Tier

1 Common along with the other capital measures to assess and monitor its capital position. 4.

Tangible Common Equity ("TCE") is calculated, for all purposes, as common stockholders equity

(i.e., total stockholders' equity less preferred stock) less identifiable intangible assets

(other than MSRs) and goodwill, net of related deferred tax liabilities. Return on tangible common equity, a non-GAAP financial ratio, measures the

Firm’s earnings as a percentage of TCE, and is in management’s view a meaningful measure to

assess the Firm’s use of equity. The TCE measures used in this presentation are not

necessarily comparable to similarly titled measures provided by other firms due to differences in calculation methodologies.

5.

Headcount-related expense includes salary and benefits (excluding performance-based

incentives), and other noncompensation costs related to employees. |

Forward-looking statements

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements are

based upon the current beliefs and expectations of JPMorgan Chase’s

management and are subject to significant risks and uncertainties. Actual

results may differ from those set forth in the forward-looking

statements. Factors that could cause JPMorgan Chase’s actual

results to differ materially from those described in the forward-looking

statements can be found in JPMorgan Chase’s Annual Report on Form 10-K for

the year ended December 31, 2009 and Quarterly Reports on Form 10-Q for

the quarters ended June 30, 2010 and March

31,

2010,

each

of

which

has

been

filed

with

the

Securities

and

Exchange

Commission

and

is

available

on

JPMorgan

Chase’s

website

(www.jpmorganchase.com)

and

on

the

Securities

and

Exchange

Commission’s

website

(www.sec.gov).

JPMorgan

Chase

does

not

undertake

to

update

the

forward-looking statements to reflect the impact of circumstances or events

that may arise after the date of the forward-looking statements.

53 |