Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d8k.htm |

Barclays Capital CEO Energy-Power Conference

September 15, 2010

William

A.

Von

Hoene,

Jr.,

EVP

Finance

and

Legal

EXHIBIT 99.1 |

2

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, that are subject to risks

and uncertainties. The factors that could cause actual results to differ

materially from these forward-looking statements include those discussed

herein as well as those discussed in (1) Exelon’s 2009 Annual Report on

Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and

(c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2)

Exelon’s Second Quarter 2010 Quarterly Report on Form 10-Q in (a) Part II,

Other Information, ITEM 1A. Risk Factors, (b) Part 1, Financial

Information, ITEM 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations and (c) Part I , Financial Information,

ITEM 1. Financial Statements: Note 12 and (3) other factors discussed in

filings with the Securities and Exchange Commission (SEC) by Exelon

Corporation, Commonwealth Edison Company, PECO Energy Company and Exelon

Generation Company, LLC (Companies). Readers are cautioned not to place

undue reliance on these forward-looking statements, which apply only as of

the date of this presentation. None of the Companies undertakes any obligation to

publicly release any revision to its forward-looking statements to

reflect events or circumstances after the date of this presentation.

|

3

EPA Regulations –

Market Implications

Leading up to 2012 Compliance

Notes: Reliability Pricing Model (RPM) auctions take place annually in May.

For definition of the EPA regulations referred to on this slide, please see the EPA’s Terms of

Environment (http://www.epa.gov/OCEPAterms/). |

4

EPA Clean Air Standards Will Not Threaten

Electric System Reliability

(1) M.J. Bradley & Associates, LLC and Analysis Group. 2010. Ensuring

a Clean, Modern Electric Generating Fleet while Maintaining Electric System Reliability.

Proactive steps by EPA, the industry and other agencies will allow orderly plant

retirements without impacting system reliability

M.J. Bradley and Analysis Group report

(1)

in August 2010 concluded industry is

well-positioned to respond to proposed standards

•

System has >100 GWs of excess capacity

•

Regulators

have

tools

to

address

localized

reliability

concerns,

including

appropriate

price signals from capacity markets

•

Industry has proven track record of adding generation capacity and transmission

solutions

New clean air standards will help modernize US power generation

infrastructure •

Proven technologies for controls are commercially available: >50% of coal

units have installed controls demonstrating that compliance costs can be

managed •

Pollution-intensive plant retirements will create room for cleaner, more

efficient generation |

5

PJM RPM Capacity Prices and Auction ($MW-day)

74.75

134.46

174.29

110.00

143.90

0

500

1,000

1,500

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

0

100

200

300

PJM RPM Capacity Auction

Note: Data contained on this slide is rounded.

(1)

Weighted average $/MW-Day would apply if all generation cleared in the

highlighted zone. (2)

All

generation

values

are

approximate

and

not

inclusive

of

wholesale

transactions;

All

capacity

values

are

in

installed

capacity

terms

(summer

ratings)

located

in

the

areas.

(3)

Elwood

contract

expires

on

12/31/12

and

Kincaid

contract

expires

on

2/28/13.

(4)

Reflects

decision

in

December

2010

to

permanently

retire

Cromby

Station

and

Eddystone

Units

1&2

as

of

5/31/11.

None

of

these

933

MW

cleared

in

the

2011/2012

or

2012/2013

auctions.

RTO = Regional Transmission Organization; EMAAC =Eastern Mid-Atlantic Area

Council; MAAC = Mid-Atlantic Area Council Capacity by Region Eligible for

2014/15 RPM Base Residual Auction

(2)

7%

42%

51%

RTO

EMACC

MACC

8,700 MW

1,500 MW

10,300 MW

(4)

2013/14 RPM capacity prices result in a $400 million revenue increase to Exelon over

the prior auction; expect 2014/15 auction to result in blended prices at least

as high (3)

Left axis

~$400M

Increase |

6

John Deere Renewable Wind Acquisition

735 operating MW of clean, renewable

energy, along with 230 MW in advanced

stages of development in Michigan

75% of the operating portfolio is contracted

Purchase price of $860 million plus an

option for $40 million upon commencement

of construction of the development projects

Attractive

economics

-

EPS

and

cash

flow

accretive

Acquisition positions Exelon as a large wind operator,

complementing its world-class nuclear fleet

TX, 26%

MO,

22%

MI, 17%

ID, 12%

MN,

11%

OR,

10%

KS, 2%

IL, 1%

Operating

Assets

–

Geographical

Distribution

Transaction Summary |

7

PECO –

Electric & Gas Distribution

Rate Case Settlements

Joint settlement filed with the PAPUC on August 31, 2010 for both electric and gas

rate cases

Settlements are subject to administrative law judges review and PAPUC approval by

mid-December 2010

$20 million

(46% of ask)

$225 million

(71% of ask)

Revenue Requirement Increase in

settlement

(1)

R-2010-2161592

R-2010-2161575

Docket #

<10%

(2)

Electric

~8%

2011 Distribution Price Increase as %

of Overall Customer Bill for Residential

customers

Gas

Rate Case Details

(1)

Settlements are “Black box”, meaning no details are provided for allowed

ROE, rate base or capital structure. (2)

Excluding Alternative Energy Portfolio Standards and default service surcharge.

Assumes results from final procurement in September 2010 are the same as May

2010 procurement. Note: Electric and gas rate case filings available on

Pennsylvania Public Utility Commission (PAPUC) website (www.puc.state.pa.us) or www.peco.com/know.

New rates scheduled to go into effect on January 1, 2011

|

8

ComEd Delivery Rate Case

Alternative Regulation (Alt Reg) Proposal

ComEd submitted an Alt Reg filing on August 31, 2010 proposing to recover the costs

of pre- approved projects outside of the traditional rate case

process •

9-month statutory process

$60 million proposal would create a collaborative framework for increased

investments in the future implementation of ICC-approved Smart Grid

investments Customer benefits include:

•

Assured

savings

to

customers

–

$2

million

on

capped

O&M

costs

for

program

costs

(excluding

CARE)

•

An incentive/penalty mechanism for performance above or under budget

Proposal would allow for accelerated modernization of the distribution system,

increased assistance to low-income households and the purchase of electric

vehicles $30

$15

Man-hole refurbishment and cable replacement

-

$10

Expanded

funding

for

low

income

CARE

programs

(1)

$5

-

Electric Vehicle Fleet Purchase

Capital

O&M

$ millions

(1)

CARE

=

Customers’

Affordable

Reliable

Energy.

Total

CARE

amount

for

two-year

proposal

is

$20

million. |

9

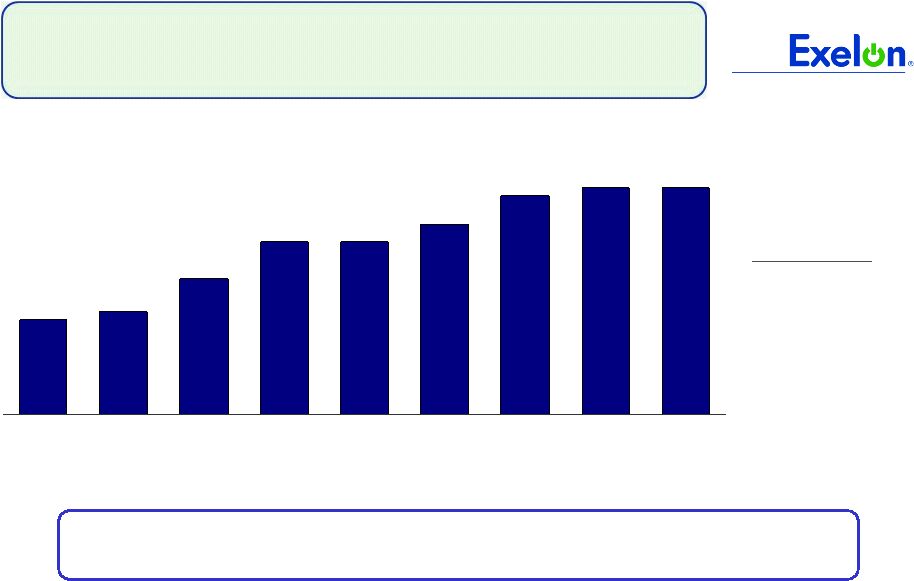

$2.03

$0.88

$0.96

$1.26

$1.60

$1.60

$1.76

$2.10

$2.10

2002

2003

2004

2005

2006

2007

2008

2009

2010E

Exelon’s Dividend Track Record

Note: Chart represents dividends per share paid by Exelon for 2002-2009 and

expected dividend for 2010, which is subject to Board approval. (1)

Dividend yield as of August 31, 2010. Competitive Integrated Yield average

includes AYE, CEG, EIX, ETR, FE, NEE, PPL, and PEG. Regulated Integrated

Yield average includes AEP, AEE, D, DTE, DUK, PCG, PGN, SO, WEC, and XEL.

Exelon

has

a

proven

track

record

of

maintaining

its

dividend

and

currently

offers one of the highest yields among its peers

Dividend Yield

(1)

Exelon: 5.2%

Competitive Integrateds: 4.5%

Regulated Integrateds: 4.8% |

10

Exelon Generation Hedging Disclosures

(As disclosed on July 22, 2010) |

11

Important Information

The following slides are intended to provide additional information regarding the hedging

program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon

Generation’s gross margin (operating revenues less purchased power and fuel expense). The

information on the following slides is not intended to represent earnings guidance or a forecast

of future events. In fact, many of the factors that ultimately will determine Exelon

Generation’s actual gross margin are based upon highly variable market factors outside of

our control. The information on the following slides is as of June 30, 2010. We

update this information on a quarterly basis.

Certain information on the following slides is based upon an internal simulation model that

incorporates assumptions regarding future market conditions, including power and commodity

prices, heat rates, and demand conditions, in addition to operating performance and dispatch

characteristics of our generating fleet. Our simulation model and the assumptions therein are

subject to change. For example, actual market conditions and the dispatch profile of our

generation fleet in future periods will likely differ – and may differ significantly –

from the assumptions underlying the simulation results included in the slides. In addition,

the forward- looking information included in the following slides will likely change over

time due to continued refinement of our simulation model and changes in our views on future

market conditions. |

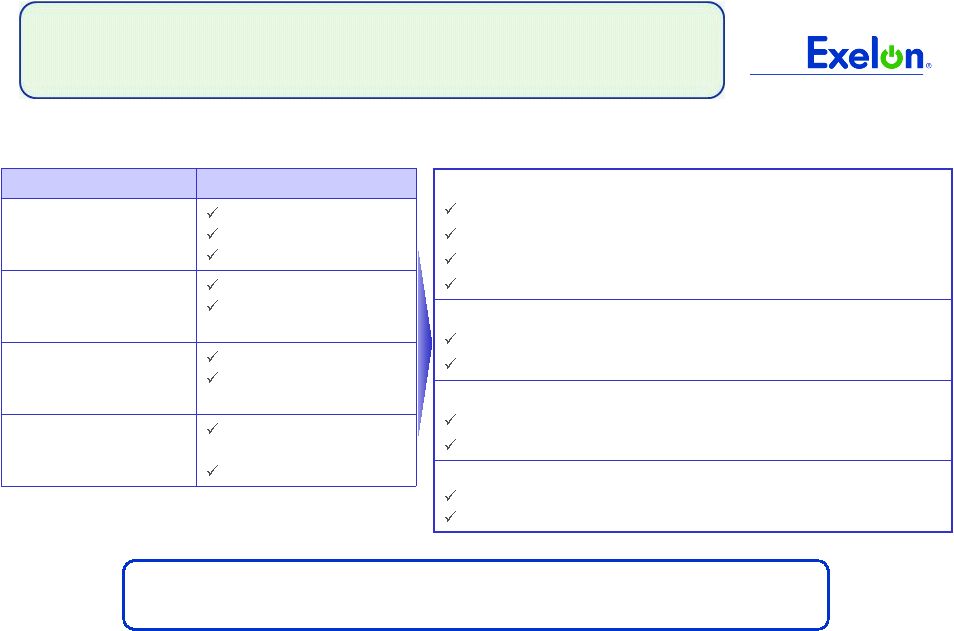

Portfolio Management Objective

Align Hedging Activities with Financial Commitments

Power Team utilizes several product types

and channels to market

•

Wholesale and retail sales

•

Block products

•

Load-following products

and load auctions

•

Put/call options

Exelon’s hedging program is designed to

protect the long-term value of our

generating fleet and maintain an

investment-grade balance sheet

•

Hedge enough commodity risk to meet future cash

requirements if prices drop

•

Consider: financing policy (credit rating objectives,

capital structure, liquidity); spending (capital and

O&M); shareholder value return policy

Consider market, credit, operational risk

Approach to managing volatility

•

Increase hedging as delivery approaches

•

Have enough supply to meet peak load

•

Purchase fossil fuels as power is sold

•

Choose hedging products based on generation

portfolio –

sell what we own

•

Heat rate options

•

Fuel products

•

Capacity

•

Renewable credits

% Hedged

High End of Profit

Low End of Profit

Open Generation

with LT Contracts

Portfolio

Optimization

Portfolio

Management

Portfolio Management Over Time

12 |

13

Percentage of Expected

Generation Hedged

•

How many equivalent MW have been

hedged at forward market prices; all hedge

products used are converted to an

equivalent average MW volume

•

Takes ALL

hedges into account whether

they are power sales or financial products

Equivalent MWs Sold

Expected Generation

=

Our normal practice is to hedge commodity risk on a ratable basis

over the three years leading to the spot market

•

Carry operational length into spot market to manage forced outage and

load-following risks

•

By

using

the

appropriate

product

mix,

expected

generation

hedged

approaches

the

mid-90s percentile as the delivery period approaches

•

Participation in larger procurement events, such as utility auctions, and some

flexibility in the timing of hedging may mean the hedge program is not

strictly ratable from quarter to quarter

Exelon Generation Hedging Program |

14

2010

2011

2012

Estimated Open Gross Margin ($ millions)

(1)(2)

$5,700

$5,300

$5,100

Open gross margin assumes all expected generation is

sold at the Reference Prices listed below

Reference Prices

(1)

Henry Hub Natural Gas ($/MMBtu)

NI-Hub ATC Energy Price ($/MWh)

PJM-W ATC Energy Price ($/MWh)

ERCOT

North

ATC

Spark

Spread

($/MWh)

(3)

$4.77

$33.17

$44.76

$1.28

$5.34

$32.63

$45.54

$(0.02)

$5.68

$34.22

$46.86

$0.53

Exelon Generation Open Gross Margin and

Reference Prices

(1)

Based on June 30, 2010 market conditions.

(2)

Gross margin is defined as operating revenues less fuel expense and purchased power

expense, excluding the impact of decommissioning and other incidental revenues. Open

gross margin is estimated based upon an internal model that is developed by

dispatching our expected generation to current market power and fossil fuel prices. Open gross margin

assumes

there

is

no

hedging

in

place

other

than

fixed

assumptions

for

capacity

cleared

in

the

RPM

auctions

and

uranium

costs

for

nuclear

power

plants.

Open

gross

margin

contains assumptions for other gross margin line items such as various ISO bill and

ancillary revenues and costs and PPA capacity revenues and payments. The estimation of open

gross margin incorporates management discretion and modeling assumptions that are

subject to change. (3)

ERCOT North ATC spark spread using Houston Ship Channel Gas, 7,200 heat rate, $2.50

variable O&M. |

15

2010

2011

2012

Expected Generation

(GWh)

(1)

167,500

163,000

162,600

Midwest

100,000

98,700

97,500

Mid-Atlantic

58,900

57,000

57,000

South

8,600

7,300

8,100

Percentage of Expected Generation Hedged

(2)

96-99%

86-89%

57-60%

Midwest

96-99

86-89

54-57

Mid-Atlantic

96-99

90-93

59-62

South

97-100

66-69

51-54

Effective Realized Energy Price

($/MWh)

(3)

Midwest

$46.00

$43.50

$44.50

Mid-Atlantic

$36.50

$57.50

$51.00

ERCOT North ATC Spark Spread

$0.00

$(2.00)

$(5.50)

Generation Profile

(1)

Expected generation represents the amount of energy estimated to be generated or purchased through

owned or contracted for capacity. Expected generation is based upon a simulated dispatch

model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products,

and options. Expected generation assumes 10 refueling outages in 2010 and 11 refueling outages

in 2011 and 2012 at Exelon-operated nuclear plants and Salem. Expected generation

assumes capacity factors of 94.1%, 93.2% and 92.9% in 2010, 2011 and 2012 at Exelon-operated nuclear plants. These estimates of expected

generation in 2011 and 2012 do not represent guidance or a forecast of future results as Exelon has

not completed its planning or optimization processes for those years. (2)

Percent of expected generation hedged is the amount of equivalent sales divided by the expected

generation. Includes all hedging products, such as wholesale and retail sales of power,

options, and swaps. Uses expected value on options. Reflects decision to permanently retire Cromby Station and Eddystone Units 1&2 as of May 31, 2011.

Current RMR discussions do not impact metrics presented in the hedging disclosure.

(3)

Effective realized energy price is representative of an all-in hedged price, on a per MWh basis,

at which expected generation has been hedged. It is developed by considering the energy

revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium

costs and RPM capacity revenue, but includes the mark-to-market value of capacity contracted

at prices other than RPM clearing prices including our load obligations. It can be

compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges.

|

16

Gross Margin Sensitivities with Existing Hedges ($ millions)

(1)

Henry Hub Natural Gas

+ $1/MMBtu

-

$1/MMBtu

NI-Hub ATC Energy Price

+$5/MWH

-$5/MWH

PJM-W ATC Energy Price

+$5/MWH

-$5/MWH

Nuclear Capacity Factor

+1% / -1%

2010

$20

$(15)

$10

$(5)

$5

$ -

+/-

$25

2011

$100

$(90)

$75

$(65)

$30

$(25)

+/-

$45

2012

$260

$(245)

$220

$(210)

$130

$(125)

+/-

$45

Exelon Generation Gross Margin Sensitivities

(with Existing Hedges)

(1)

Based on June 30, 2010 market conditions and hedged position. Gas price sensitivities are based on an

assumed gas-power relationship derived from an internal model that is updated

periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due

to correlation of the various assumptions, the hedged gross margin impact calculated by aggregating

individual sensitivities may not be equal to the hedged gross margin impact calculated when

correlations between the various assumptions are also considered. |

17

95% case

5% case

$6,600

$6,400

$5,100

$7,100

$6,500

$6,600

Exelon Generation Gross Margin Upside / Risk

(with Existing Hedges)

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2010

2011

2012

(1)

Represents an approximate range of expected gross margin, taking into account hedges in place, between

the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot

market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market

inputs, future transactions and potential modeling changes. These ranges of approximate gross margin

in 2011 and 2012 do not represent earnings guidance or a forecast of future results as Exelon

has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market

quotes for power, fuel, load following products, and options as of June 30, 2010.

|

18

Midwest

Mid-Atlantic

ERCOT

Step 1

Start

with

fleetwide

open

gross

margin

$5.70 billion

Step 2

Determine the mark-to-market value

of energy hedges

100,000GWh * 97% *

($46.00/MWh-$33.17/MWh)

= $1.24 billion

58,900GWh * 97% *

($36.50/MWh-$44.76/MWh)

= $(0.47 billion)

8,600GWh * 98% *

($0.00/MWh-$1.28/MWh)

= $(0.01) billion

Step 3

Estimate

hedged

gross

margin

by

adding open gross margin to mark-to-

market value of energy hedges

Open gross

margin: $5.70 billion

MTM value of energy

hedges: $1.24 billion + $(0.47 billion) + $(0.01) billion

Estimated hedged gross margin:

$6.46 billion

Illustrative Example

of Modeling Exelon Generation 2010 Gross Margin

(with Existing Hedges) |

19

19

Market Price Snapshot

Forward NYMEX Natural Gas

PJM-West and Ni-Hub On-Peak Forward Prices

PJM-West and Ni-Hub Wrap Forward Prices

2011

$4.64

2012 $5.26

Forward NYMEX Coal

2011

$66.50

2012

$74.59

2011 Ni-Hub $37.43

2012 Ni-Hub

$39.48

2012 PJM-West $49.82

2011 PJM-West

$47.47

2011 Ni-Hub

$24.48

2012 Ni-Hub

$25.97

2012 PJM-West

$36.76

2011 PJM-West

$35.09

35

40

45

50

55

60

65

70

75

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

20

25

30

35

40

45

50

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

50

55

60

65

70

75

80

85

90

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

Rolling

12

months,

as

of

September

8

th

,

2010.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily. |

20

20

Market Price Snapshot

2012

$9.14

2011

$9.04

2011

$40.93

2012

$46.82

2011

$4.53

2012

$5.13

Houston Ship Channel Natural Gas

Forward Prices

ERCOT North On-Peak Forward Prices

ERCOT North On-Peak v. Houston Ship Channel

Implied Heat Rate

2011

$5.76

2012

$7.34

ERCOT North On Peak Spark Spread

Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

8.0

8.2

8.4

8.6

8.8

9.0

9.2

9.4

9.6

9.8

10.0

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

5.5

6.5

7.5

8.5

9.5

10.5

11.5

12.5

13.5

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

40

45

50

55

60

65

70

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

Rolling

12

months,

as

of

September

8

th

,

2010.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily. |

21

Appendix |

22

John Deere Renewable Acquisition –

Transaction Summary

Components of purchase price

•

$860M for operating assets and advanced-stage Michigan development

projects •

Up to $40M in additional payments contingent on commencement of construction

on Michigan development projects

•

Equivalent to ~$1,000/KW

Financing

•

Exelon will fund transaction with Exelon Generation debt (no equity

issuance) •

Clean

capital

structure

with

no

tax

equity

and

project

debt

(1)

•

Ability to utilize production tax credits

735 MW operating portfolio spread across 36 projects located in eight states

•

75% of the operating portfolio is sold under long-term power purchase

arrangements

•

86% of contracted portfolio has PPAs through 2026 or beyond

1,468 MW in development pipeline

•

PPAs

have

already

been

executed

for

230

MW

in

Michigan

–

projects

expected

to

be operational in 2012-2013

Acquisition positions Exelon as a large wind operator, complementing its

world-class nuclear fleet

(1) Except for $1.8M loan from Illinois Finance Authority for AgriWind project in

IL |

23

John Deere Renewable Acquisition -

Strategic Rationale

Diversify with additional clean generation

•

JDR’s proven wind platform provides unique opportunity and entry point into

U.S. wind business

•

Provides diversity in geographic presence and generation type

•

Supports

Exelon

2020

by

adding

more

“clean”

generation

to

our

portfolio

and

positions us for potential federal renewable portfolio standard (RPS)

Contracted portfolio with option for future growth

•

75% of operating portfolio sold under long-term PPAs

•

1,468 additional MW in pipeline, of which 230 MW have executed PPAs

•

Only plan further development of contracted assets

Attractive economics and good fit

•

Purchase price compares favorably with other wind transactions

•

Disciplined investment approach aligned with Exelon’s approach

•

Addition of strong renewable energy development team

Acquisition further enhances Exelon’s strong environmental leadership and

provides future opportunities for incremental development

|

24

John Deere Renewable Acquisition -

Financials Are Attractive

EPS breakeven in 2011, accretive beginning in 2012

•

Assumes transaction is funded with 100% debt

EBITDA

run-rate

of

~$150M/year

including

PTCs

(1)

(including

Michigan

development

projects)

Free cash flow accretive by 2013

•

Includes estimated capex (before tax incentives) of $450-$500M in

2011-2012 for Michigan development projects

Expect transaction to have minimal impact on credit metrics

EPS Accretion / Dilution

0.0%

0.6%

1.5%

2011E

2012E

2013E

(1) Production Tax Credits |

25

25

John Deere Renewable Acquisition

Asset Profile –

Operating

The portfolio is largely made up of contracted operating assets

Geographic Distribution

TX, 26%

MO,

22%

MI, 17%

ID, 12%

MN,

11%

OR,

10%

KS, 2%

IL, 1%

Note:

There is ongoing litigation with Southwest Public Service related to PURPA

contracts which could impact the price at which the generation

from

these

units

is

sold.

Cracking

issues

experienced

by

Deere

on

certain

Suzlon

turbine

blades

have

been

addressed

to

our

satisfaction.

We

have

factored

both

items

into

our

valuation.

Project State

MW

# of Wind

Projects

Ownership

Placed in

Service

Date

PPA End

Date

Federal

Incentive

Off-Taker

Idaho

88.2

3

100%

2009/2010

2028/2030

ITC Grant

Idaho Power

Illinois

8.4

1

99%

2008

2018

PTC

Wabash Valley Power

Kansas

12.5

1

100%

2010

2030

PTC

Kansas Power Pool

Michigan

121.8

2

100%

2008

2018/2028

PTC

Wolverine Power Supply

/ Consumers Energy

Minnesota

77.7

9

94%-100%

2003/2008

2018/2028

PTC

Various

Missouri

162.5

4

99%-100%

2008

2027

PTC

Associated Electric /

MO Joint Municipal

Oregon

74.5

4

99%-100%

2009

2029

ITC Grant

PacifiCorp

Texas

189.8

12

100%

2006/2009

N/A

PTC

Southwest Public Service

Total

735.4

36 |

26

26

John Deere Renewable Acquisition

Asset Profile –

Development Pipeline

PPAs already executed for these

projects

Development pipeline includes

wind projects ranging from 20 MW

to 300 MW

Development of projects to be

considered on a case-by-case

basis

State

Project Name

MW

MI

Michigan Wind II

90

MI

Harvest II

59

MI

Blissfield (MW IV)

81

Total

230

Projects to be developed by Exelon

Optional projects for development

Ohio

198

Michigan

40

Idaho

20

Texas

760

Maine

50

Colorado

40

Oregon

30

California

100

Total

1,238

Total

1,468 |

27

John Deere Renewable Acquisition

Regulatory Approval Process

FERC approval required

DOJ antitrust approval required under the Hart-Scott-Rodino Antitrust

Improvements Act

Other than Texas, no state approval is necessary

Expect to close transaction in fourth quarter of 2010; no material issues

expected |

28

111.91

148.80

102.04

191.32

174.29

110.00

16.46

133.37

139.73

27.73

226.15

245.00

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

RTO

MAAC + APS

MAAC

Eastern MAAC

Only shown

if cleared

at separate

price and

generation

is located

in that zone

(1)

PJM RPM Auction Results

Note: Data contained on this slide is rounded.

(1)

MAAC = Mid-Atlantic Area Council; APS = Allegheny Power System.

(2)

All generation values are approximate and not inclusive of wholesale

transactions. (3)

All capacity values are in installed capacity terms (summer ratings) located in the

areas. (4)

Obligation represents the remainder of the ComEd auction load that ends in May

2010. $134.46

1,500

8,700

(7)

10,300

(6)

Capacity

(3)

2013/2014

2009/2010

2010/2011

2011/2012

2012/2013

in MW

Capacity

(3)

Obligation

Capacity

(3)

Obligation

Capacity

(3)

Capacity

(3)

RTO

12,800

3,800 -

4,100

(5)

23,900

9,300 -

9,400

(4)

23,200

12,100

(6)

EMAAC

9,500

MAAC + APS

11,100

9,300 –

9,400

(5)

MAAC

1,500

Avg ($/MW-Day)

(8)

$143.90

$174.29

$110.00

$74.75

PJM RPM Auction ($MW-day)

(5)

Obligation consists of load obligations from PECO. PECO PPA expires December 2010.

(6)

Elwood contract expires on 12/31/12 and Kincaid contract expires on 2/28/13.

(7)

Reflects decision in December 2010 to permanently retire Cromby Station and Eddystone Units

1&2 as of 5/31/11. None of these 933 MW cleared in the 2011/2012 or 2012/2013 auctions.

(8)

Weighted average $/MW-Day would apply if all generation cleared in the highlighted zones.

Exelon Generation Eligible Capacity within PJM Reliability Pricing Model

|

29

ComEd Delivery Service

Rate Case Filing Summary

$396

Total

($2,337

million

revenue

requirement)

(6)

$45

Other adjustments

(5)

$22

Bad debt costs (resets base level of bad debt to 2009 test year)

$55

Pension

and

Post-retirement

health

care

expenses

(4)

$95

Capital Structure

(3)

: ROE –

11.50% /

Common

Equity

–

47.33%

/

ROR

–

8.99%

$179

(2)

Rate Base: $7,717 million

(1)

Requested Revenue

Increase

($ in millions)

Primary drivers of rate request are new plant investment, pension/retiree

health care and cost of capital

(1)

Filed

June

30,

2010

based

on

2009

test

year,

including

pro

forma

capital

additions

through

June

2011,

and

certain

other

2010

pro

forma adjustments. ICC Docket #: 10-0467,

http://www.icc.illinois.gov/docket/casedetails.aspx?no=10-0467. (2)

Includes increased depreciation expense.

(3)

Requested capital structure does not include goodwill; ICC docket 07-0566

allowed 10.3% ROE, 45.04% equity ratio and 8.36% ROR. ROE includes 0.40%

adder for energy efficiency incentive. (4)

Reflects 2010 expense levels, compared to 2007 expense levels allowed in last rate

case. (5)

Includes reductions to O&M and taxes other than income, offset by wage

increases, normalization of storm costs and the Illinois Electric

Distribution Tax, other O&M increases, and decreases in load.

(6)

Net of Other Revenues.

Note: ROE = Return on Equity, ROR = Return on Rate Base, ICC = Illinois

Commerce Commission. |

30

3.82

4.73

7.44

7.03

0.73

0.73

0.65

0.60

ComEd Delivery Rate Case

Residential Rate Impacts 2010 to 2011

(1)

(1)

Reflects change in distribution rates only. Assumes Energy, Transmission and

all other components remain constant as of June 2010, except as noted

above. (2)

"All Other" includes impact of riders that are applicable to residential

bills. Unit rates: cents / kWh

All Other

(2)

Transmission

Energy

Distribution

Approximately

4% increase

July 1, 2010

July 1, 2011

Transmission: Subject to FERC

formula rate annual update

Comments

Energy: Reflects reduced PJM capacity

price that PJM has published for the

June

2011

–

May

2012

planning

period. Energy component may vary

Distribution: As proposed

12.63

13.09

Note: Amounts may not add due to rounding.

Proposed residential rate impact of 7% will be mitigated by impact

of lower capacity prices resulting in a net increase of 4%

|

31

ComEd Delivery Service Rate Case

Schedule

Delivery

Service

Rate

Case

Filed

–

June

30,

2010

Alt

Reg

Proposal

Filed

–

August

31,

2010

Intervenor

and

Rebuttal

Testimony

–

4Q

2010

Hearings –

January 2011

Administrative

Law

Judge

Order

–

March

31,

2011

Final

Order

Expected

–

May

2011

New

Rates

Effective

–

June

2011 |

32

PECO Procurement

(1)

See PECO Procurement website (http://www.pecoprocurement.com) for additional

details regarding PECO’s procurement plan and RFP results. (2)

Wholesale prices. No Small/Medium Commercial products were procured in the

June 2009 RFP. (3)

For Large C&I customers who have opted to participate in the 2011

fixed-priced full requirements product. Large Commercial and

Industrial Average

price

of

$77.55/MWh

(2)

100%

of

fixed-price

full

requirements

procured

in

May

’10

(3)

Medium Commercial

Sept

’09

/

May

’10

RFP

aggregate

result

$77.89/MWh

(2)

Remaining 42% of full requirements to be procured in Sep ‘10

Residential

June

’09

RFP

average

price

of

$88.61/MWh

(2)

Sept

’09

RFP

average

price

of

$79.96/MWh

(2)

May

‘10

RFP

average

price

of

$69.38/MWh

(2)

Remaining 28% of full requirements to be procured in Sep ‘10

Small Commercial

Sept

’09

/

May

’10

RFP

aggregate

result

$77.65/MWh

(2)

Remaining 40% of full requirements to be procured in Sep ‘10

85% full requirements

15% full requirements

spot

Medium Commercial

(peak demand >100

kW but <= 500 kW)

Fixed-priced full

requirements

(3)

Hourly full requirements

Large Commercial &

Industrial

(peak

demand >500 kW)

90% full requirements

10% full requirements

spot

75% full requirements

20% block energy

5% energy only spot

Products

Small Commercial

(peak demand <100

kW)

Residential

Customer Class

PECO

Procurement

Plan

(1)

2011 Supply Procured

Final RFP for 2011 supply to be held on September 20, 2010;

results will be public 30 days thereafter |

33

Exelon Investor Relations Contacts

Exelon Investor Relations

10 South Dearborn Street

Chicago, Illinois 60603

312-394-2345

312-394-4082 (Fax)

For copies of other presentations,

annual/quarterly reports, or to be added

to our email distribution list please

contact:

Martha Chavez, Executive Admin

Coordinator

312-394-4069

Martha.Chavez@ExelonCorp.com

Investor Relations Contacts:

Stacie Frank, Vice President

312-394-3094

Stacie.Frank@ExelonCorp.com

Melissa Sherrod, Director

312-394-8351

Melissa.Sherrod@ExelonCorp.com

Paul Mountain, Manager

312-394-2407

Paul.Mountain@ExelonCorp.com

Marybeth Flater, Manager

312-394-8354

Marybeth.Flater@ExelonCorp.com

Sandeep Menon, Principal Analyst

312-394-7279

Sandeep.Menon@ExelonCorp.com |