Attached files

Use these links to rapidly review the document

K-SEA TRANSPORTATION PARTNERS L.P. 2010 ANNUAL REPORT ON FORM 10-K TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended June 30, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number 001-31920

K-SEA TRANSPORTATION PARTNERS L.P.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

20-0194477 (I.R.S. Employer Identification No.) |

One Tower Center Boulevard, 17th Floor

East Brunswick, New Jersey 08816

(Address of principal executive offices and zip code)

(732) 565-3818

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Units | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's Common Units held by non-affiliates of the registrant was approximately $170.8 million as of December 31, 2009 based on $11.58 per Common Unit, the closing price of the Common Units on the New York Stock Exchange on such date.

At September 13, 2010, 19,127,411 Common Units were outstanding.

Documents Incorporated by Reference: None

K-SEA TRANSPORTATION PARTNERS L.P.

2010 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

i

Statements included in this report that are not historical facts are forward-looking statements. In addition, we may from time to time make other oral or written statements that are also forward-looking statements. Forward-looking statements may include words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "should" and other words and terms of similar meaning.

Forward-looking statements appear in a number of places in this report and include statements with respect to, among other things:

- •

- our business strategies and other plans and objectives for future operations;

- •

- our future revenues and expenses;

- •

- expected demand in the domestic tank vessel market in general and the demand for our tank vessels in particular;

- •

- expected decreases in the supply of domestic tank vessels;

- •

- planned capital expenditures and availability of capital resources to fund capital expenditures;

- •

- our expected cost of complying with the Oil Pollution Act of 1990 and other laws;

- •

- our plans for the retirement of tank vessels and the expected delivery and cost of newbuild vessels;

- •

- estimated future expenditures for drydocking and maintenance of our tank vessels' operating capacity;

- •

- the integration of acquisitions of tank barges and tugboats, including the timing, effects, benefits and costs thereof;

- •

- the likelihood that pipelines will be built that compete with us;

- •

- the effect of new or existing regulations or requirements on our financial position;

- •

- expectations regarding litigation;

- •

- the adequacy and availability of our insurance and the amount of any capital calls;

- •

- our future financial condition or results of operations;

- •

- our future compliance with financial covenants;

- •

- our ability to pay distributions; and

- •

- any other statements that are not historical facts.

These forward-looking statements are made based upon management's current plans, expectations, estimates, assumptions and beliefs concerning future events and, therefore, involve a number of risks and uncertainties. Forward-looking statements are not guarantees, and actual results could differ materially from those expressed or implied in the forward-looking statements. Please read "Item 1A. Risk Factors" for a list of important factors that could cause our actual results of operations or financial condition to differ from our expectations.

ii

ITEMS 1 and 2. BUSINESS and PROPERTIES.

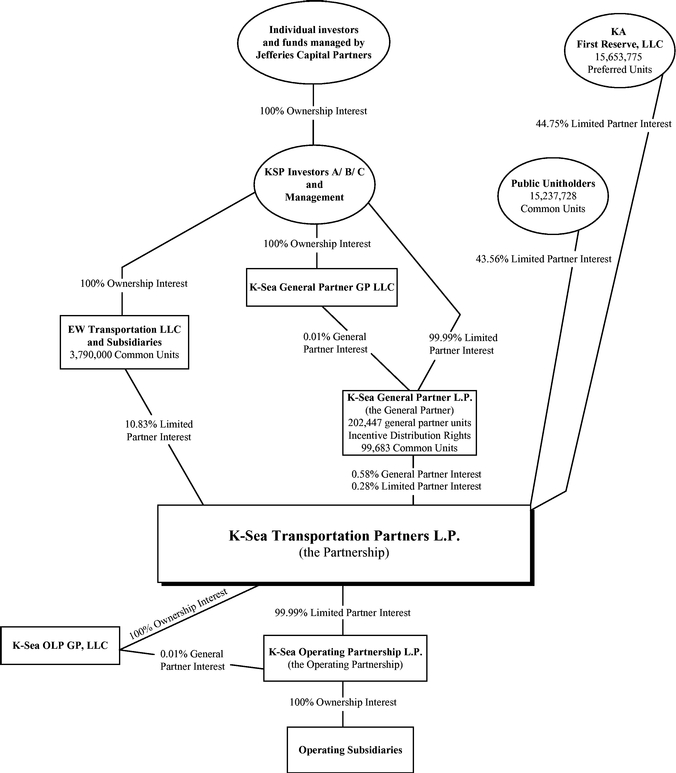

Our Partnership

K-Sea Transportation Partners LP is a publicly traded Delaware limited partnership. Our business activities are conducted through our subsidiary, K-Sea Operating Partnership L.P.; a Delaware limited partnership which we refer to as the operating partnership, and the subsidiaries of the operating partnership. Our general partner, K-Sea General Partner L.P., is a Delaware limited partnership whose general partner is K-Sea General Partner GP LLC, a Delaware limited liability company. K-Sea General Partner GP LLC has ultimate responsibility for managing our business. Our principal executive office is located at One Tower Center Boulevard, 17th Floor, East Brunswick, New Jersey 08816, and our telephone number at that address is (732) 565-3818.

We are a leading provider of marine transportation, distribution and logistics services for refined petroleum products in the United States. As of September 1, 2010, we operated a fleet of 65 tank barges and 66 tugboats that serves a wide range of customers, including major oil companies, oil traders and refiners. With approximately 4.2 million barrels of capacity, we believe we operate the largest coastwise tank barge fleet in the United States. As of September 1, 2010, approximately 90% of our barrel carrying capacity was double hulled. As of September 1, 2010, all of our tank vessels, except two, operated under the U.S. flag, and all but three were qualified to transport cargo between U.S. ports under the Jones Act, the federal statutes that restrict foreign owners from operating in the U.S. maritime transportation industry.

For the fiscal year ended June 30, 2010, our fleet transported approximately 129 million barrels of refined petroleum products for our customers, including BP, ConocoPhillips, ExxonMobil and Tesoro. These four customers have been doing business with us for approximately 19 years on average. We do not assume ownership of any of the products we transport. During fiscal 2010, we derived approximately 70% of our revenue from longer-term contracts that are generally for periods of one year or more.

Our Business Strategy

From our inception in 2003 through the third quarter of 2009, one of our primary strategies for increasing distributable cash flow to unitholders was the expansion of our fleet through strategic acquisitions and purchases of newly constructed vessels. From our initial public offering in January 2004 through September 30, 2009, we grew our fleet barrel-carrying capacity from 2.3 million barrels to 4.2 million barrels. As a result of the decline in refined product demand in the U.S. over the past 18 months and the resultant shift in the supply/demand balance of the tank vessels in our markets, we adjusted our business strategy to focus on improving our liquidity, reducing our outstanding debt and increasing our profitability of existing assets. We have improved our profitability by increasing utilization of our assets while controlling costs. We have improved our liquidity and reduced our outstanding debt by (i) reducing our capital expenditures, (ii) selling of non-core assets and (iii) raising equity from outside investors. During fiscal 2011, the key elements of our strategy will include the following:

- •

- Improve profitability. We intend to operate our fleet to enhance profitability by continuing our initiatives to maximize utilization by extending or expanding our revenue contract portfolio. We expect to continue this strategy by surveying the marketplace to identify and pursue new opportunities that extend our current customer commitments and expand our geographic presence and customer base and increase the end markets we serve. For example, we recently extended a contract to move ethanol on the West Coast and in September 2010 we chartered an 80,000-barrel barge for two years in the Caribbean.

1

- •

- Continue to improve our balance sheet and financial flexibility with a goal of reinstating distributions on our common

units as soon as prudently advisable. We intend to continue to improve our balance sheet and financial flexibility. As of

June 30, 2010, we had approximately $382.9 million of indebtedness outstanding. As of September 10, 2010, after repayment of existing debt with the proceeds from the sale of

preferred units, net of estimated transaction related costs, and the proceeds from the sale of two tug boats and two double-hull barges, we had approximately $286.6 million of

indebtedness outstanding, and approximately $62.2 million of available capacity for additional borrowings and potential letters of credit under our revolving loan agreement. We intend to use

the proceeds from a sale of additional preferred units to further reduce indebtedness. In addition, we intend to continue to dispose of single hull and older double hull barges and excess tug boats in

an effort to decrease outstanding indebtedness and increase liquidity. We believe that availability under our revolving loan agreement and our ability to issue additional partnership units should

provide us with the financial flexibility to facilitate the execution of our business strategy. Any decision to resume cash distributions on our units and the amount of any such distributions will be

based on our determination that such distributions are sustainable based on current and expected distributable cash flow as well as our current and expected liquidity position. We will also consider

general economic conditions and our outlook for our business as we determine whether or not to pay any distributions. Recent amendments to our revolving loan agreement and a term loan facility

(collectively, the "Revolver and ATB Amendments") prohibit cash distributions prior to the end of the March 31, 2011 quarter and thereafter limit cash distributions to our unitholders to $0.45

per unit per quarter, provided that we maintain a minimum liquidity of $17.5 million. If these conditions are satisfied, we will be permitted to pay distributions if (a) the fixed charge

coverage ratio is at least 1.0 to 1.0 for two consecutive fiscal quarters prior to and after giving effect to such distributions; (b) the projected fixed charge coverage ratio is equal to or

greater than 1.0 to 1.0 for the next twelve months and is equal to or greater than 1.0 to 1.0 in three of four of those quarters; and (c) the total funded debt to EBITDA ratio is less than 5.0

to 1.0.

- •

- Maximize fleet utilization and improve productivity. The

interchangeability of our tank vessels and the critical mass of our fleet give us the flexibility to allocate the right vessel for the right cargo assignment on a timely basis. We intend to continue

improving our operational efficiency through the use of new technology and comprehensive training programs for new and existing employees. We also intend to minimize downtime by emphasizing efficient

scheduling and timely completion of planned and preventative maintenance.

- •

- Maintain safe, low-cost and efficient

operations. We believe we are a cost-efficient and reliable tank vessel operator. We intend to continue to reduce operating

costs through constant evaluation of each vessel's performance and concurrent adjustment of operating and chartering procedures to maximize each vessel's safety, availability and profitability.

Effective July 1, 2010, we implemented a new electronic management system, which we expect will improve operational efficiency. We also intend to continue to minimize costs through an active

preventative maintenance program both on-shore and at sea, employing qualified officers and crew and continually training our personnel to ensure safe and reliable vessel operations.

- •

- Balance our fleet deployment between longer-term contracts and shorter-term business in an effort to provide stable cash flows through business cycles, while preserving flexibility to respond to changing market conditions. During fiscal 2010, we derived approximately 70% of our revenue from time charters, consecutive voyage charters, contracts of affreightment, and bareboat charters, all of which are generally for periods of one year or more. We derived the remaining 30% of our revenue for fiscal 2010 from single voyage charters, which are generally priced at prevailing market rates. Vessels operating under voyage charters have the potential to generate decreased profit margins during periods of economic downturn and increased profit margins during periods

2

- •

- Attract and maintain customers by adhering to high standards of performance, reliability and safety. Customers place particular emphasis on efficient operations and strong environmental and safety records. We intend to continue building on our reputation for maintaining high standards of performance, reliability and safety, which we believe will enable us to attract increasingly selective customers.

of improved charter rates, while vessels operating on time charters or other longer term charters generally provide more predictable cash flow. Although we expect the percentage of our contracts with terms of one year or more to continue to decrease in the near future due to the economic downturn, we intend to pursue a strategy of emphasizing longer-term contracts, while preserving operational flexibility to take advantage of changing market conditions.

Recent Developments

During fiscal 2010, we adjusted our business strategy to focus on improving our liquidity, reducing debt and improving the profitability of our assets. We are successfully executing our plan as highlighted by the following accomplishments:

- •

- Sale of Preferred Units. On September 10, 2010, we

issued 15,653,775 Series A Preferred Units to KA First Reserve, LLC in exchange for approximately $85.0 million. In addition, KA First Reserve has agreed to purchase an additional

2,762,431 preferred units for approximately $15.0 million upon clearance of a Hart-Scott-Rodino review. The preferred units are convertible at any time into common units on a

one-for-one basis, subject to certain adjustments in the event of certain dilutive issuances of common units. The preferred units have a coupon of 13.5%, with

payment-in-kind distributions through the quarter ended June 30, 2012 or, if earlier, when we resume cash distributions on our common units. We have an option to force

the conversion of the preferred units after three years if (1) the price of our common units is 150% of the conversion price on average for 20 consecutive days on a volume-weighted basis, and

(2) the average daily trading volume of our common units for such 20 day period exceeds 50,000 common units. The preferred units were priced at $5.43 per unit, which represents a 10%

premium to the 5-day volume weighted average price of our common units as of August 26, 2010. We used the net proceeds from the sale of the preferred units to reduce outstanding

indebtedness and pay fees and expenses related to the transaction. Proceeds from the sale of the additional preferred units will also be used to reduce outstanding indebtedness.

- •

- Amended Credit Facility. On August 31, 2010, we amended ("Revolver Amendment") our revolving loan agreement (as amended, "Revolving Loan Agreement") to, among other things, (1) reduce the revolving lenders' commitments from $175.0 million to $115.0 million (subject to a maximum borrowing base equal to two-thirds of the orderly liquidation value of the vessel collateral), (2) amend the fixed charge coverage, total funded debt to EBITDA and asset coverage covenants, (3) maintain a July 1, 2012 maturity date, and (4) allow the payment of cash distributions subject to liquidity requirements and certain minimum financial ratios starting with the fiscal quarter ending March 31, 2011. The obligations under the Revolving Loan Agreement are collateralized by a first priority security interest, subject to permitted liens, on certain vessels having an orderly liquidation value equal to at least 1.50 times the amount of the aggregate obligations (including letters of credit) outstanding under the Revolving Loan Agreement. Borrowings under the Revolving Loan Agreement bear interest at a rate per annum equal, at our option, to (a) the greater of the prime rate, the federal funds rate plus 0.5% or the 30-day London Interbank Offered Rate ("LIBOR") plus 1%, plus a margin based upon the ratio of total funded debt to EBITDA of between 1.75% and 4.75%, or (b) the 30-day LIBOR, plus a margin based upon the ratio of total funded debt to EBITDA ranging from 2.75% to 5.75%.

3

- •

- Amended Term Loan Facility. Also on August 31,

2010, we entered into an amendment ("ATB Amendment") to a secured term loan credit facility ("Term Loan Agreement") in the amount of $57.6 million dated June 4, 2008, as amended ("ATB

Agreement"). The ATB Amendment, among other things, amended the financial covenants, LIBOR margins and limitations on distributions to conform to the financial covenants, LIBOR margins and limitations

on distributions in the Revolving Loan Agreement, as amended by the Revolver Amendment.

- •

- Sold Non-Core Assets. We sold

non-core assets with a carrying value of $7.0 million comprised primarily of single hull barges in the period January 1, 2009 through June 30, 2010 for

$9.0 million. In August 2010, we sold a recently completed 30,000-barrel new build double hull barge for $2.3 million. On September 10, 2010 we sold two tug boats and

two of our oldest double hull barges to an international buyer for $12.0 million. We have definitive agreements for the sale of (1) our waste water treatment facility in Virginia for

$5.1 million and (2) a single hull barge for $1.3 million. These transactions should close by the end of September 2010.

- •

- Reduced Vessel Operating and General and Administrative

Expenses. We reduced our vessel operating expenses to $138.1 million for the year ended June 30, 2010 from

$144.3 million for the year ended June 30, 2009 by reducing vessel crewing due to decreased utilization levels; and we reduced general and administrative expenses to $27.2 million

for the year ended June 30, 2010 from $29.8 million for the year ended June 30, 2009 by reducing staffing and controlling costs.

- •

- Reduced Capital Expenditures. We concluded our new building program in August 2010 with payments for two 30,000-barrel double hull tank barges aggregating approximately $5.5 million. Fiscal years 2010, 2009 and 2008 included capital expenditures for tank vessel construction of $37.7 million, $65.2 million and $52.0 million, respectively.

Our Industry

Introduction

Tank vessels, which include tank barges and tankers, are a critical link in the refined petroleum product distribution chain. Tank vessels transport gasoline, diesel fuel, heating oil, asphalt and other products from refineries and storage facilities to a variety of destinations, including other refineries, distribution terminals, power plants and ships.

Among the laws governing the domestic tank vessel industry is the one commonly referred to as the Jones Act, the federal statute that restricts foreign competition in the U.S. maritime transportation industry. Under the Jones Act, marine transportation of cargo between points in the United States, generally known as U.S. coastwise trade, is limited to U.S.-flag vessels that were built in the United States and are owned, manned and operated by U.S. citizens. As of September 1, 2010, all of our tank vessels, except two, operated under the U.S. flag, and all but three were qualified to transport cargo between U.S. ports under the Jones Act.

OPA 90 mandates, among other things, the phase-out of all single-hull tank vessels transporting petroleum and petroleum products in U.S. waters at varying times by January 1, 2015. The effect of this legislation has been, and is expected to continue to be, the replacement of domestic single-hulled tank vessel capacity with double-hulled newbuildings and retrofitting of existing single-hulled tank vessels. Weak demand in the market for single-hulled vessels has resulted in their effective obsolescence and early retirement.

The demand for domestic tank vessels is driven primarily by U.S. demand for refined petroleum products, which can be categorized as either clean oil products or black oil products. Clean oil products include motor gasoline, diesel fuel, heating oil, jet fuel and kerosene. Black oil products, which are what remain after clean oil products have been separated from crude oil, include residual fuel oil in the

4

refining process, asphalt, petrochemical feedstocks and bunker fuel. The demand for clean oil products is impacted by vehicle usage, air travel and prevailing weather conditions, while demand for black oil products varies depending on the type of product transported and other factors, such as oil refinery requirements and turnarounds, asphalt use, the use of residual fuel oil by electric utilities and bunker fuel consumption. The demand for residual fuel oil by electric utilities is influenced by the availability and price of alternative sources of energy, such as natural gas.

Transportation of Refined Petroleum Products

Refined petroleum products are transported by pipelines, water carriers, motor carriers and railroads. Tank vessels are used frequently to continue the transportation of refined petroleum products along the distribution chain after these products have first been transported by another method of transportation, such as a pipeline. For example, many areas have access to refined petroleum products only by using marine transportation as the last link in their distribution chain. In addition, tank vessel transportation is generally a more cost-effective and energy-efficient means of transporting bulk commodities such as refined petroleum products than transportation by rail car or truck. The carrying capacity of a 100,000-barrel tank barge is the equivalent of approximately 162 average-size rail tank cars and approximately 439 average-size tractor trailer tank trucks.

Types of Tank Vessels

The domestic tank vessel fleet consists of tankers, which have internal propulsion systems, and tank barges, which do not have internal propulsion systems and are instead pushed or towed by a tugboat. Tank barges generally move at slower speeds than comparably sized tankers, but are less expensive to build and operate. Although tank barge configuration varies, the bow and stern of most tank barges are square or sloped, with the stern of many tank barges having a notch of varying depth to permit pushing by a tugboat. While a larger tank vessel may be able to carry more cargo, some voyages require a tank vessel to go through a lock, bridge opening or narrow waterway, which limit the size of vessels that may be used. In addition, some loading and discharge facilities have physical limitations that prevent larger tank vessels from loading or discharging their cargo. Tank barges are often able to navigate the shallower waters of the inland waterway system and the waters along the coast. Tankers, however, are often confined to the deeper waters offshore due to their size.

Tank vessels can be categorized by:

- •

- Barrel-carrying Capacity—the number of barrels of refined

product that it takes to fill a vessel;

- •

- Gross Tonnage—the total volume capacity of the interior space

of a vessel, including non-cargo space, using a convention of 100 cubic feet per gross ton;

- •

- Net Tonnage—the volume capacity of a vessel determined by

subtracting the engine room, crew quarters, stores and navigation space from the gross tonnage using a convention of 100 cubic feet per net ton;

- •

- Deadweight Tonnage—the number of long-tons (2,240

pounds) of cargo that a vessel can transport. A deadweight ton is equivalent to approximately 6.5 to 7.5 barrels of capacity, depending on the specific gravity of the cargo. In this report, we have

assumed that a deadweight ton is equivalent to 7.0 barrels of capacity;

- •

- Hull Type—the body or framework of a vessel. Vessels can have

more than one hull, which means they have additional compartments between the cargo and the outside of the vessel. Typical vessels are single-hulled or double-hulled; and

- •

- Cargo—the type of commodity transported.

5

Tank vessels can also be categorized into the following fleets based on the primary waterway system typically navigated by the vessel:

- •

- Coastwise Fleet. The term coastwise fleet generally refers

to commercial vessels that transport goods in the following areas:

- •

- along the Atlantic, Gulf and Pacific coasts;

- •

- Alaska, Hawaii and other U.S. Pacific Islands, Venezuela; and

- •

- between the Atlantic or Gulf and Pacific coasts by way of the Panama Canal.

- •

- Inland Waterways Fleet. The term inland waterways fleet

generally refers to commercial vessels that transport goods on the navigable internal waterways of the Atlantic, Gulf and Pacific Coasts, and the Mississippi River System. The main arteries of the

inland waterways network for the mid-continent are the Mississippi and the Ohio Rivers. The inland waterways fleet consists primarily of tugboats and tank barges which typically have a

shallower depth. These tank barges are generally less costly than many tank barges operating in the coastwise fleet. The vessels comprising the inland waterways fleet are generally not built to

standards required for operation in coastal waters.

- •

- Great Lakes Fleet. The term Great Lakes fleet generally refers to commercial vessels normally navigating the waters among the U.S. Great Lakes ports and connecting waterways.

Tugboats

Tugboats are equipped to push, pull or tow tank barges alongside. The amount of horsepower required to handle a barge depends on a number of factors, including the size of the barge, the amount of product loaded, weather conditions and the waterways navigated. A typical tugboat is manned by six people: a captain, a mate, an engineer, an assistant engineer and two deckhands. These individuals perform the duties and tasks required to operate the tugboat, such as standing navigational watches, maintaining and repairing machinery, rigging and line-handling, and painting and other routine maintenance. A standard work schedule for a tugboat crew is 14 days on, 14 days off. While on duty, the crew members generally work two six-hour shifts each day.

Integrated Tug-Barge Units

Tugboats can also be integrated into a barge utilizing a notching system that connects the two vessels. An integrated tug-barge unit, or ITB, has certain advantages over other tug-barge combinations, including higher speed and better maneuverability. In addition, an ITB can operate in certain sea and weather conditions in which conventional tug-barge combinations cannot.

Articulated Tug-Barge Units

An articulated tug barge unit, or ATB, similar to ITBs, consist of a tugboat (which provides propulsion) and a cargo carrying barge using a coupling system that connects the two vessels. Unlike the rigid connection found on ITBs, an ATB uses a hinged connection. ATBs offer the additional advantage of substitutability, because the barge and tug may be decoupled. This offers operational and commercial flexibility, allowing the barge unit to be towed by a third party tug in certain situations.

Our Customers

We provide marine transportation services primarily to major oil companies, oil traders and refiners in the East, West and Gulf Coast regions of the United States, including Alaska and Hawaii. We monitor the supply and distribution patterns of our actual and prospective customers and focus our efforts on providing services that are responsive to the current and future needs of these customers.

6

The following chart sets forth our major customers and the number of years each of them has been a customer:

K-Sea Transportation Partners L.P.

Major Customers

Major Customers

|

Years as Customer |

|||

|---|---|---|---|---|

BP |

37 | |||

ConocoPhillips |

14 | |||

ExxonMobil |

14 | |||

Tesoro |

12 | |||

Our two largest customers in fiscal 2010, based on gross revenue, were ConocoPhillips and Tesoro, each of which accounted for more than 10% of our fiscal 2010 consolidated revenue. If we were to lose either of these customers or if either of them significantly reduced its use of our services, our business and operating results could be adversely affected.

Our Vessels

Tank Vessel Fleet

At September 1, 2010, our fleet consisted of the following tank vessels:

K-Sea Transportation Partners L.P. Tank Vessel Fleet

Vessel(1)

|

Year Built |

Capacity (barrels) |

Gross Tons |

OPA 90 Phase-Out |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Double-Hull Barges |

|||||||||||||||

DBL 185 |

2009 | 185,000 | 13,895 | N.A. | |||||||||||

DBL 155(2) |

2004 | 165,882 | 12,152 | N.A. | |||||||||||

DBL 151 |

1981 | 150,000 | 8,710 | N.A. | |||||||||||

DBL 140 |

2000 | 140,000 | 10,303 | N.A. | |||||||||||

DBL 134(3) |

1994 | 134,000 | 9,514 | N.A. | |||||||||||

DBL 105(4)(7) |

2004 | 105,000 | 11,438 | N.A. | |||||||||||

DBL 101 |

2002 | 102,000 | 6,774 | N.A. | |||||||||||

DBL 102 |

2004 | 102,000 | 6,774 | N.A. | |||||||||||

DBL 103 |

2006 | 102,000 | 6,774 | N.A. | |||||||||||

DBL 104 |

2007 | 102,000 | 6,774 | N.A. | |||||||||||

DBL 106 |

2009 | 102,000 | 7,874 | N.A. | |||||||||||

Lemon Creek(5) |

1987 | 89,293 | 5,736 | N.A. | |||||||||||

Spring Creek(5)(8) |

1987 | 89,293 | 5,736 | N.A. | |||||||||||

Nale |

2007 | 86,000 | 6,508 | N.A. | |||||||||||

McCleary's Spirit(6)(8) |

2001 | 85,000 | 6,554 | N.A. | |||||||||||

Antares |

2004 | 84,000 | 5,855 | N.A. | |||||||||||

Deneb |

2006 | 84,000 | 5,855 | N.A. | |||||||||||

DBL 81 |

2003 | 82,000 | 5,667 | N.A. | |||||||||||

DBL 82 |

2003 | 82,000 | 5,667 | N.A. | |||||||||||

Capella(7) |

2002 | 81,751 | 5,159 | N.A. | |||||||||||

Leo |

2003 | 81,540 | 5,954 | N.A. | |||||||||||

Pacific |

1993 | 81,000 | 5,669 | N.A. | |||||||||||

Rigel |

1993 | 80,861 | 5,669 | N.A. | |||||||||||

Sasanoa |

2001 | 81,000 | 5,790 | N.A. | |||||||||||

DBL 78 |

2000 | 80,000 | 5,559 | N.A. | |||||||||||

7

Vessel(1)

|

Year Built |

Capacity (barrels) |

Gross Tons |

OPA 90 Phase-Out |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

DBL 77(7) |

2008 | 80,000 | 5,235 | N.A. | |||||||||||

DBL 76(7) |

2008 | 80,000 | 5,813 | N.A. | |||||||||||

DBL 79(7) |

2008 | 80,000 | 6,149 | N.A. | |||||||||||

DBL 70(9) |

1972 | 73,024 | 5,248 | N.A. | |||||||||||

Kays Point(7) |

1999 | 67,000 | 4,720 | N.A. | |||||||||||

Noa |

2002 | 67,000 | 4,826 | N.A. | |||||||||||

Cascades(7) |

1993 | 67,000 | 4,721 | N.A. | |||||||||||

Columbia(7) |

1993 | 58,000 | 4,286 | N.A. | |||||||||||

Na-Kao |

2005 | 52,000 | 4,076 | N.A. | |||||||||||

Ne'ena |

2004 | 52,000 | 4,076 | N.A. | |||||||||||

DBL 53(9) |

1965 | 53,000 | 4,543 | N.A. | |||||||||||

DBL 54 |

2009 | 50,000 | 4,276 | N.A. | |||||||||||

DBL 31 |

1999 | 30,000 | 2,146 | N.A. | |||||||||||

DBL 32 |

1999 | 30,000 | 2,146 | N.A. | |||||||||||

DBL 33 |

2010 | 30,000 | 1,754 | N.A. | |||||||||||

DBL 28 |

2006 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 29 |

2006 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 26 |

2006 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 27 |

2007 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 22 |

2007 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 23 |

2007 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 24(7) |

2007 | 28,000 | 2,146 | N.A. | |||||||||||

DBL 25(7) |

2007 | 28,000 | 2,146 | N.A. | |||||||||||

Puget Sounder |

1992 | 25,000 | 1,870 | N.A. | |||||||||||

DBL 20 |

1991 | 20,127 | 1,480 | N.A. | |||||||||||

DBL 16 |

1954 | 20,000 | 1,420 | N.A. | |||||||||||

DBL 17 |

1998 | 18,000 | 1,499 | N.A. | |||||||||||

DBL 18 |

1998 | 18,000 | 1,499 | N.A. | |||||||||||

DBL 19 |

1998 | 18,000 | 1,499 | N.A. | |||||||||||

DBL 10 |

1998 | 10,000 | 806 | N.A. | |||||||||||

Subtotal |

3,779,771 | 273,616 | |||||||||||||

Vessel(1)

|

Year Built |

Capacity (barrels) |

Gross Tons |

OPA 90 Phase-Out |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Single-Hull Barges |

|||||||||||||||

KTC 80 |

1981 | 82,878 | 4,576 | 2015 | |||||||||||

KTC 60 |

1980 | 61,638 | 3,824 | 2015 | |||||||||||

KTC 55 |

1972 | 53,012 | 3,113 | 2015 | |||||||||||

KTC 50 |

1974 | 54,716 | 3,367 | 2015 | |||||||||||

SCT 280(7) |

1977 | 48,000 | 3,081 | 2015 | |||||||||||

Washington(7) |

1980 | 32,000 | 2,062 | 2015 | |||||||||||

Wallabout Bay |

1986 | 28,330 | 1,687 | 2015 | |||||||||||

PM 230(7) |

1983 | 25,000 | 1,610 | 2015 | |||||||||||

SCT 180 |

1980 | 16,250 | 1,053 | 2015 | |||||||||||

SEA 76 |

1969 | 13,313 | 830 | 2015 | |||||||||||

Subtotal |

415,137 | 25,203 | |||||||||||||

Total Fleet |

4,194,908 | 298,819 | |||||||||||||

- (1)

- Excludes one potable water barge.

8

- (2)

- Built

in 1974; double-hulling was completed and the vessel redelivered in September 2004.

- (3)

- Built

in 1986 and rebuilt in 1994.

- (4)

- Built

in 1982 and rebuilt for petroleum transportation in 2004.

- (5)

- Vessel

not qualified for Jones Act trade due to foreign construction.

- (6)

- Built

in 1969 and rebuilt in 2001.

- (7)

- Chartered-in

vessel.

- (8)

- Vessel

not qualified for Jones Act trade due to foreign flag.

- (9)

- A definitive agreement has been signed to sell these vessels.

Articulated/Integrated Tug-Barge Units

As of September 1, 2010, we operated 25 ITBs and 1 ATB, which represented approximately 52% of the barrel-carrying capacity of our tank barge fleet.

Newbuildings

We expect to take delivery of a 50,000-barrel tank barge in the third quarter of fiscal 2011 under a lease from the shipyard. We took delivery of one 30,000-barrel tank barge in July 2010, the DBL 33; and one 33,000-barrel tank barge in August 2010, the DBL 34. These tank barges cost in the aggregate and after the addition of certain special equipment, approximately $6.6 million. We have a long term contract with a customer relating to the DBL 33. In August 2010, we sold the DBL 34 for $2.3 million, net of commission and escrow agent fees.

Tugboat Fleet

We use tugboats as the primary means of propelling our tank barge fleet. Therefore, we seek to maintain the proper balance between the number of tugboats and the number of tank barges in our fleet. This balance is influenced by a variety of factors, including the condition of the vessels in our fleet, the mix of our coastwise business and our local business and the level of longer-term contracts versus shorter-term business. We are also able to maintain a proper balance between tugboats and tank barges by analyzing the historical trading patterns of our customers and the nature of their cargoes. While a tank barge is unloading, we often dispatch its tugboat to perform other work.

9

At September 1, 2010, we operated the following tugboats:

K-Sea Transportation Partners L.P. Tugboat Fleet

Name(1)

|

Year Built | Horsepower | Dimensions | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Dublin Sea |

2009 | 11,800 | 131' × 44' × 22' | |||||||

Lincoln Sea |

2000 | 8,000 | 119' × 40' × 22' | |||||||

Rebel |

1975 | 7,200 | 150' × 46' × 22' | |||||||

Yankee |

1976 | 7,200 | 150' × 46' × 22' | |||||||

Jimmy Smith |

1976 | 7,200 | 150' × 40' × 22' | |||||||

Barents Sea |

1976 | 6,200 | 136' × 40' × 16' | |||||||

McKinley Sea |

1981 | 6,000 | 136' × 37' × 20' | |||||||

Bismarck Sea |

1978 | 5,750 | 136' × 37' × 20' | |||||||

Irish Sea |

1969 | 5,750 | 135' × 35' × 18' | |||||||

Sirius |

1974 | 5,750 | 135' × 38' × 19' | |||||||

Nakolo |

1974 | 5,750 | 125' × 38' × 14' | |||||||

El Lobo Grande |

1978 | 5,750 | 128' × 36' × 19' | |||||||

Nakoa |

1976 | 5,500 | 118' × 34' × 17' | |||||||

Volunteer |

1982 | 4,860 | 120' × 37' × 18' | |||||||

Adriatic Sea(2) |

2004 | 4,800 | 126' × 34' × 15' | |||||||

Java Sea(3) |

2005 | 4,800 | 119' × 34' × 15' | |||||||

Namahoe |

1997 | 4,400 | 105' × 34' × 16' | |||||||

Pacific Freedom(4) |

1998 | 4,500 | 120' × 31' × 15' | |||||||

Viking |

1972 | 4,300 | 133' × 34' × 18' | |||||||

Beaufort Sea |

1971 | 4,300 | 113' × 32' × 16' | |||||||

North Sea |

1982 | 4,200 | 126' × 34' × 16' | |||||||

Greenland Sea |

1990 | 4,200 | 117' × 34' × 17' | |||||||

Pacific Wolf |

1975 | 4,100 | 111' × 24' × 13' | |||||||

William J. Moore |

1970 | 4,000 | 135' × 35' × 20' | |||||||

Niolo |

1982 | 4,000 | 117' × 34' × 17' | |||||||

Nokea |

1975 | 4,000 | 105' × 30' × 14' | |||||||

Nunui |

1978 | 4,000 | 185' × 40' × 12' | |||||||

Tasman Sea |

1976 | 3,900 | 124' × 34' × 16' | |||||||

Norwegian Sea(5) |

2006 | 3,900 | 133' × 34' × 17' | |||||||

Sea Hawk(6) |

2006 | 3,900 | 112' × 32' × 15' | |||||||

John Brix(7) |

1999 | 3,900 | 141' × 35' × 8' | |||||||

Pacific Avenger |

1977 | 3,900 | 140' × 34' × 17' | |||||||

Altair |

1981 | 3,800 | 106' × 33' × 17' | |||||||

Kara Sea |

1974 | 3,520 | 111' × 32' × 14' | |||||||

Ross Sea |

2003 | 3,400 | 95' × 32' × 14' | |||||||

Solomon Sea |

1965 | 3,300 | 105' × 32' × 14' | |||||||

Coral Sea(10) |

1973 | 3,280 | 111' × 32' × 14' | |||||||

Nathan E. Stewart |

2001 | 3,200 | 95' × 32' × 14' | |||||||

Maryland |

1962 | 3,010 | 110' × 28' × 14' | |||||||

Baltic Sea(10) |

1973 | 3,000 | 101' × 30' × 13' | |||||||

Pacific Challenger |

1976 | 3,000 | 118' × 34' × 16' | |||||||

Paragon |

1978 | 3,000 | 99' × 32' × 15' | |||||||

Pacific Raven |

1970 | 3,000 | 112' × 31' × 14' | |||||||

Na Hoku |

1981 | 3,000 | 105' × 34' × 17' | |||||||

Nalani |

1981 | 3,000 | 105' × 34' × 17' | |||||||

Nohea |

1983 | 3,000 | 98' × 30' × 14' | |||||||

10

Name(1)

|

Year Built | Horsepower | Dimensions | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Pacific Pride(8) |

1989 | 2,500 | 84' × 28' × 13' | |||||||

Aegean Sea |

1978 | 2,400 | 85' × 24' × 10' | |||||||

Labrador Sea |

2002 | 2,400 | 82' × 26' × 12' | |||||||

Siberian Sea |

1980 | 2,400 | 85' × 24' × 10' | |||||||

Caribbean Sea |

1961 | 2,400 | 85' × 24' × 10' | |||||||

Bering Sea |

1975 | 2,250 | 105' × 29' × 13' | |||||||

Caspian Sea |

1981 | 2,000 | 65' × 24' × 9' | |||||||

Inland Sea |

2000 | 2,000 | 76' × 26' × 10' | |||||||

Pacific Patriot |

1981 | 2,000 | 77' × 27' × 12' | |||||||

Davis Sea |

1982 | 2,000 | 77' × 26' × 9' | |||||||

Pacific Eagle(9) |

2001 | 2,000 | 98' × 27' × 13' | |||||||

Tiger |

1966 | 2,000 | 88' × 27' × 12' | |||||||

Chukchi Sea |

1979 | 2,000 | 92' × 26' × 9' | |||||||

Houma |

1970 | 1,950 | 90' × 29' × 11' | |||||||

Timor Sea |

1960 | 1,920 | 80' × 24' × 10' | |||||||

Odin |

1982 | 1,860 | 72' × 28' × 12' | |||||||

Taurus |

1979 | 1,860 | 79' × 25' × 12' | |||||||

Falcon |

1978 | 1,800 | 80' × 25' × 12' | |||||||

Naupaka |

1983 | 1,800 | 75' × 26' × 10' | |||||||

Fidalgo |

1973 | 1,400 | 98' × 25' × 8' | |||||||

- (1)

- Excluding

certain workboats and other small vessels most of which are less than 1,000 HP.

- (2)

- Built

in 1978 and rebuilt in 2004.

- (3)

- Built

in 1981 and rebuilt in 2005.

- (4)

- Built

in 1969 and rebuilt in 1998.

- (5)

- Built

in 1976 and rebuilt in 2006.

- (6)

- Built

in 1978 and rebuilt in 2006.

- (7)

- Built

in 1963 and rebuilt in 1999.

- (8)

- Built

in 1976 and rebuilt in 1989.

- (9)

- Built

in 1966 and rebuilt in 1985 and 2001.

- (10)

- A definitive agreement has been signed to sell these vessels.

Bunkering

For over 30 years, we have specialized in the shipside delivery of fuel, known as bunkering, for the major and independent bunker suppliers in New York Harbor. We also provide bunkering services in Pennsylvania, Virginia and Hawaii. Demand for bunkering services is driven primarily by the number of ship arrivals. A ship's time in port generally is limited, and the cost of delaying sailing due to bunkering or other activities can be significant. Therefore, we continually strive to improve the level of service and on-time deliveries to our customers.

The majority of our bunker delivery tank vessels are equipped with advanced, whole-load sampling devices to provide the supplier and receiver a representative sample. Our bunker delivery tank barges are also equipped with extended booms for hose handling ease alongside ships, remote pump engine shut-offs, spill rails, spill containment equipment and supplies, VHF and UHF radio communication and fendering.

11

Preventative Maintenance

We have a computerized preventative maintenance program that tracks U.S. Coast Guard and American Bureau of Shipping inspection schedules and establishes a system for the reporting and handling of routine maintenance and repair.

Vessel captains submit monthly inspection reports, which are used to note conditions that may require maintenance or repair. Vessel superintendents are responsible for reviewing these reports, inspecting identified discrepancies, assigning a priority classification and generating work orders. Work orders establish job type, assign personnel responsible for the task and record target start and completion dates. Vessel superintendents inspect repairs completed by the crew, supervise outside contractors as needed and conduct quarterly inspections following the same criteria as the captains. Drills and training exercises are conducted in conjunction with these inspections, which are typically more comprehensive in scope. In addition, an operations duty officer is available on a 24-hour basis to handle any operational issues. The operations duty officer is prepared to respond on scene whenever required and is trained in technical repair issues, spill control and emergency response.

The American Bureau of Shipping and the U.S. Coast Guard establish drydocking schedules. Typically, we drydock our vessels twice every five years. Prior to sending a vessel to a shipyard, we develop comprehensive work lists to ensure all required maintenance is completed. Repair facilities bid on these work lists, and jobs are awarded based on quality, price and time to complete. Vessels then report to a cleaning facility to prepare for shipyard. Once the vessel is gas-free a certified marine chemist issues paperwork certifying that no dangerous vapors are present. The vessel proceeds to the shipyard where the vessel superintendent and certain crewmembers assist in performing the maintenance and repair work. The planned maintenance period is considered complete when all work has been tested to the satisfaction of American Bureau of Shipping or U.S. Coast Guard inspectors or both.

Safety

General

We are committed to operating our vessels in a manner that protects the safety and health of our employees, the general public and the environment. Our primary goal is to minimize the number of safety- and health related accidents on our vessels and our property. Our primary concerns are to avoid personal injuries and to reduce occupational health hazards. We want to prevent accidents that may cause damage to our personnel, equipment or the environment, such as fire, collisions, petroleum spills and groundings of our vessels. In addition, we are committed to reducing overall emissions and waste generation from each of our facilities and vessels and to the safe management of associated cargo residues and cleaning wastes.

Our policy is to follow all laws and regulations as required, and we are actively participating with government, trade organizations and the public in creating responsible laws, regulations and standards to safeguard the workplace, the community and the environment. Our Operations Department is responsible for coordinating all facets of our health and safety program and identifying areas that may require special emphasis, including new initiatives that evolve within the industry. Our Human Resources Department is responsible for all training, whether conducted in-house or at a training facility. Supervisors are responsible for carrying out and monitoring compliance with all of the safety and health policies on their vessels.

Tank Barge Characteristics

To protect the environment, today's tank barge hulls are required not only to be leak-proof into the body of water in which they float but also to be vapor-tight to prevent the release of any fumes or

12

vapors into the atmosphere. Our tank barges that carry light products such as gasoline or naphtha have alarms that indicate when the tank is full (95% of capacity) and when it is overfull (98% of capacity). Each tank barge also has a vapor recovery system that connects the cargo tanks to the shore terminal via pipe and hose to return to the plant the vapors generated while loading.

The majority of our bunker delivery tank barges are equipped with advanced, whole-load sampling devices to provide the supplier and receiver a representative sample. Our bunker delivery tank barges are also equipped with extended booms for hose handling ease alongside ships, remote pump engine shut-offs, spill rails, spill containment equipment and supplies, VHF and UHF radio, satellite and internet communication.

Safety Management Systems

We belong and adhere to the recommendations of the American Waterways Operators ("AWO") Responsible Carrier Program. The program is designed as a framework for continuously improving the industry's and member companies' safety performance. The program complements and builds upon existing government regulations, requiring company safety and training standards that in many instances exceed those required by federal law or regulation.

Developed by the AWO, the Responsible Carrier Program incorporates best industry practices in three primary areas:

- •

- management and administration;

- •

- equipment and inspection; and

- •

- human factors.

The Responsible Carriers Program has been recognized by many groups, including the U.S. Coast Guard and shipper organizations. We are periodically audited by an AWO-certified auditor to verify compliance. We were audited in early 2010, and our Responsible Carrier Program certificate remains in effect until March 2013.

We are also certified to the standards of the International Safety Management, or ISM, system. The ISM standards were promulgated by the International Maritime Organization, or IMO, and have been adopted through treaty by many IMO member countries, including the United States. Although ISM is not required for coastal tug and barge operations, we have determined that an integrated safety management system including the ISM and Responsible Carriers Program standards promotes safer operations and provides us with necessary operational flexibility as we continue to grow.

Ship Management, Crewing and Employees

We maintain an experienced and highly qualified work force of shore based and seagoing personnel. As of June 30, 2010, we employed 865 persons, comprising 150 shore staff and 715 fleet personnel. Our tug and tanker captains are non-union management supervisors. Effective July 1, 2010, we renewed our collective bargaining agreement with our maritime union for one year, which covers certain of our seagoing personnel comprising 41% of our workforce. The collective bargaining agreement provides for wage increases, and requires us to make contributions to certain pension and other welfare programs. No unfunded pension liability exists under any of these programs. Our vessel employees are paid on a daily or hourly basis and typically work 14 days on and 14 days off. Our shore based personnel are generally salaried and most are located at our headquarters in East Brunswick, New Jersey or our facilities in Staten Island, New York; Seattle, Washington; Honolulu, Hawaii; Norfolk, Virginia and Philadelphia, Pennsylvania. We believe that our relations with our employees are satisfactory.

13

Our shore staff provides worldwide support for all aspects of our fleet and business operations, including sales and scheduling, crewing and human resources functions, engineering, compliance and technical management, financial, legal and insurance services, and information technology. A staff of dispatchers and schedulers maintain a 24-hour duty rotation to monitor communications and to coordinate fleet operations with our customers and terminals. Communication with our vessels is accomplished by various methods, including wireless data links, cellular telephone, VHF, UHF and HF radio.

Our crews regularly inspect each vessel, both at sea and in port, and perform most of the ordinary course maintenance. Our procedures call for a member of our shore based staff to inspect each vessel at least once each fiscal quarter, making specific notations and recommendations regarding the overall condition of the vessel, maintenance, safety and crew welfare. In addition, selected vessels are inspected each year by independent consultants. Most of the vessels that are on bareboat charters to third parties are managed and operated by the customer.

Classification, Inspection and Certification

Most of our coastwise vessels have been certified as being "in class" by the American Bureau of Shipping and, in the case of one vessel, by Lloyds of London. A vessel certified as being "in class" verifies that the vessel conforms to designated standards at a specified time. Other vessels, primarily in our West Coast operations, have the required "loadline" certification. The purpose of a "loadline" certification is to ensure that a ship is not overloaded and thus has sufficient reserve buoyancy. The American Bureau of Shipping is one of several internationally recognized classification societies that inspect vessels at regularly scheduled intervals to ensure compliance with American Bureau of Shipping classification rules and some applicable federal safety regulations. Most insurance underwriters require at least a "loadline" certification by a classification society before they will extend coverage to a coastwise vessel. The classification society certifies that the pertinent vessel has been built and maintained in accordance with the rules of the society and complies with applicable rules and regulations of the vessel's country of registry and the international conventions of which that country is a member. Inspections are conducted on the pertinent vessel by a surveyor of the classification society in three surveys of varying frequency and thoroughness: annual surveys each year, an intermediate survey every two to three years and a special survey every four to five years. As part of the intermediate survey, a vessel may be required to be drydocked every 24 to 30 months for inspection of its underwater parts and for any necessary repair work related to such inspection.

Our vessels are also inspected at periodic intervals by the U.S. Coast Guard to ensure compliance with Federal safety regulations. All of our tank vessels carry Certificates of Inspection issued by the U.S. Coast Guard.

Our vessels and shore side operations are also inspected and audited periodically by our customers, in some cases as a precondition to chartering our vessels. We maintain all necessary approvals required for our vessels to operate in their normal trades. We believe that the high quality of our vessels, our crews and our shore side staff are advantages when competing against other vessel operators for long-term business.

Insurance Program

We maintain insurance coverage consistent with industry practice that we believe is adequate to protect against the accident related risks involved in the conduct of our business and risks of liability for environmental damage and pollution. Nevertheless, we cannot provide assurance that all risks are adequately insured against, that any particular claims will be paid or that we will be able to procure adequate insurance coverage at commercially reasonable rates in the future.

14

Our hull and machinery insurance covers risks of actual or constructive loss from collision, tower's liabilities, fire, grounding and engine breakdown up to an agreed value per vessel. Our war-risks insurance covers risks of confiscation, seizure, capture, vandalism, sabotage and other war-related risks. While some tanker owners and operators obtain loss-of-hire insurance covering the loss of revenue during extended tanker off-hire periods, we do not have this type of coverage. We believe that this type of coverage is not economical and is of limited value to us. However, we evaluate the need for such coverage on an ongoing basis taking into account insurance market conditions and the employment of our vessels.

Our protection and indemnity insurance covers third-party liabilities and other related expenses from, among other things, injury or death of crew, passengers and other third parties, claims arising from collisions, damage to cargo, damage to third-party property, asbestos exposure and pollution arising from oil or other substances. Our current protection and indemnity insurance coverage for pollution is $1.0 billion per incident and is provided by West of England Ship Owners Insurance Services Ltd. ("West of England"), a mutual insurance association. West of England is a member of the International Group of protection and indemnity mutual assurance associations. The protection and indemnity associations that comprise the International Group insure approximately 90% of the world's commercial tonnage and have entered into a pooling agreement to reinsure each association's liabilities. Each protection and indemnity association has capped its exposure to this pooling agreement at approximately $6.9 billion per non-pollution incident. As a member of West of England, we are subject to calls payable to the association based on our claim records, as well as the claim records of all other members of the individual associations and members of West of England.

We are not currently the subject of any claims alleging exposure to asbestos or second-hand smoke, although such claims have been brought against our predecessors in the past and may be brought against us in the future. Our predecessor company, EW Transportation LLC, has contractually agreed to retain any such liabilities that occurred prior to our initial public offering in January 2004, will indemnify us for up to $10.0 million of such liabilities until January 2014, and will make available to us the benefit of certain indemnities it received in connection with the purchase of certain vessels. If, notwithstanding the foregoing, we are ultimately obligated to pay any asbestos related or similar claims for any reason, we believe that we or EW Transportation LLC would have adequate insurance coverage for periods after March 1986 to pay such claims. However, EW Transportation LLC and its predecessors may not have insurance coverage prior to March 1986. If we were subject to claims related to that period, including claims from current or former employees, EW Transportation LLC may not have insurance to pay the liabilities, if any, that could be imposed on us. If we had to pay claims solely out of our own funds, it could have a material adverse effect on our financial condition. Furthermore, any claims covered by insurance would be subject to deductibles, and because it is possible that a large number of claims could be brought, the aggregate amount of these deductibles could be material. Please read "Legal Proceedings" in Item 3 of this report.

We may not be able to obtain insurance coverage in the future to cover all risks inherent in our business, and insurance, if available, may be at rates that we do not consider commercially reasonable. In addition, as more single-hull vessels are retired from active service, insurers may be less willing to insure, and customers less willing to hire, single-hull vessels.

Competition

The domestic tank vessel industry is highly competitive. The Jones Act restricts U.S. point-to-point maritime shipping to vessels built in the United States, owned and operated by U.S. citizens and manned by U.S. crews. In our market areas, our primary direct competitors are the operators of U.S.-flag ocean-going tank barges and U.S.-flag refined petroleum product tankers, including the captive fleets of major oil companies.

15

In the voyage and short-term charter market, our vessels compete with all other vessels of a size and type required by a charterer that can be available at the date specified. In the voyage market, competition is based primarily on price and availability, although charterers have become more selective with respect to the quality of vessels they hire, with particular emphasis on factors such as age, double-hulls and the reliability and quality of operations. Increasingly, major charterers are demonstrating a preference for modern vessels based on concerns about the environmental risks associated with older vessels. Consequently, we believe that owners of large modern fleets have a competitive advantage over owners of older fleets.

U.S.-flag tank vessels also compete with petroleum product pipelines and are affected by the level of imports on foreign flag products carriers. The Colonial Pipeline system, which originates in Texas and terminates at New York Harbor, the Plantation Pipe Line system, which originates in Louisiana and terminates in Washington D.C., and smaller regional pipelines between Philadelphia and New York, carry refined petroleum products to the major storage and distribution facilities that we currently serve. We believe that high capital costs, tariff regulation and environmental considerations make it unlikely that a new refined product pipeline system will be built in our market areas in the near future. It is possible, however, that new pipeline segments, including pipeline segments that connect with existing pipeline systems, could be built or that existing pipelines could be converted to carry refined petroleum products. Either of these occurrences could have an adverse effect on our ability to compete in particular locations.

Regulation

Our operations are subject to significant federal, state and local regulation, including those described below.

Environmental

General. Government regulation significantly affects the ownership and operation of our tank vessels. Our tank vessels are subject to international conventions, federal, state and local laws and regulations relating to safety and health and environmental protection, including the generation, storage, handling, emission, transportation, and discharge of hazardous and non-hazardous materials. Although we believe that we are in substantial compliance with applicable environmental laws and regulations, we cannot predict the ultimate cost of complying with these requirements, or the impact of these requirements on the resale value or useful lives of our tank vessels. The recent trend in environmental legislation is toward stricter requirements, and this trend will likely continue. In addition, a future serious marine incident occurring in U.S. waters, or internationally, that results in significant oil pollution or causes significant environmental impact could result in additional legislation or regulation that could affect our profitability.

Various governmental and quasi-governmental agencies require us to obtain permits, licenses and certificates for the operation of our tank vessels. While we believe that we are in substantial compliance with applicable environmental laws and regulations and have all permits, licenses and certificates necessary for the conduct of our operations, frequently changing and increasingly stricter requirements, future non-compliance or failure to maintain necessary permits or approvals could require us to incur substantial costs or temporarily suspend operation of one or more of our tank vessels.

We maintain operating standards for all our tank vessels that emphasize operational safety, quality maintenance, continuous training of our crews and officers, care for the environment and compliance with U.S. regulations. Our tank vessels are subject to both scheduled and unscheduled inspections by a variety of governmental and private entities, each of which may have unique requirements. These

16

entities include the local port authorities (U.S. Coast Guard, harbor master or equivalent), classification societies, flag state administration and charterers, particularly terminal operators and oil companies.

Finally, we manage our exposure to losses from potential discharges of pollutants through the use of well maintained and well managed facilities, well maintained and well equipped vessels and safety and environmental programs, including a maritime compliance program and our insurance program. Moreover, we believe we will be able to accommodate reasonably foreseeable environmental regulatory changes. However, the risks of substantial costs, liabilities, and penalties are inherent in marine operations. As a result, there can be no assurance that any new regulations or requirements or any discharge of pollutants by us will not have a material adverse effect on us.

The Oil Pollution Act of 1990. The Oil Pollution Act of 1990, or OPA 90, affects all vessels trading in U.S. waters, including the exclusive economic zone extending 200 miles seaward. OPA 90 sets forth various technical and operating requirements for tank vessels operating in U.S. waters. Existing single-hull, double-sided and double-bottomed tank vessels are to be phased out of service at varying times based on their tonnage and age, with all such vessels being phased out by January 2015. As of September 1, 2010, we had 10 single-hulled tank vessels or approximately 10% of our barrel carrying capacity which will be precluded from transporting petroleum products as of January 1, 2015.

Under OPA 90, owners or operators of tank vessels and certain non-tank vessels operating in U.S. waters must file vessel spill response plans with the U.S. Coast Guard and operate in compliance with the plans. These vessel response plans must, among other things:

- •

- address a "worst case" scenario and identify and ensure, through contract or other approved means, the availability of

necessary private response resources;

- •

- describe crew training and drills; and

- •

- identify a qualified individual with specific authority and responsibility to implement removal actions in the event of an oil spill.

Our vessel response plans have been approved by the U.S. Coast Guard, and all of our tankermen have been trained to comply with OPA 90 requirements. In addition, we conduct regular oil-spill response drills in accordance with the guidelines set out in OPA 90. We believe that all of our vessels are in substantial compliance with OPA 90.

Environmental Spill and Release Liability. OPA 90 and various state laws substantially increased over historic levels the statutory liability of owners and operators of vessels for the discharge or substantial threat of a discharge of oil and the resulting damages, both regarding the limits of liability and the scope of damages. OPA 90 imposes joint and several strict liability on responsible parties, including owners, operators and bareboat charterers, for all oil spill and containment and clean-up costs and other damages arising from spills attributable to their vessels. A complete defense is available only when the responsible party establishes that it exercised due care and took precautions against foreseeable acts or omissions of third parties and when the spill is caused solely by an act of God, act of war (including civil war and insurrection) or a third party other than an employee or agent or party in a contractual relationship with the responsible party. These limited defenses may be lost if the responsible party fails to report the incident or reasonably cooperate with the appropriate authorities or refuses to comply with an order concerning clean-up activities. Even if the spill is caused solely by a third party, the owner or operator must pay removal costs and damage claims and then seek reimbursement from the third party or the trust fund established under OPA 90. Finally, in certain circumstances involving oil spills, OPA 90 and other environmental laws may impose criminal liability and significant crimes and penalties on personnel and/or the corporate entity.

OPA 90 limits the liability of each responsible party for oil pollution from vessels, and these limits were increased substantially in 2006. The limits of liability are subject to periodic increases to account

17

for inflation, and the U.S. Coast Guard completed an adjustment for inflation by interim rule effective July 21, 2009. The limits for a tank vessel without a qualifying double hull are the greater of (1) $3,200 per gross ton or (2) $23,496,000 for a tank vessel of greater than 3,000 tons or $6,408,000 for a tank vessel of 3,000 gross tons or less. The limits for a tank vessel with a qualifying double hull are the greater of (1) $2,000 per gross ton or (2) $17,088,000 for a tank vessel of greater than 3,000 gross tons or $4,272,000 for a tank vessel of 3,000 gross tons or less. The limits for any vessel other than a tank vessel are the greater of $1,000 per gross ton or $854,000. These limits do not apply where, among other things, the spill is caused by gross negligence or willful misconduct of, or a violation of an applicable federal safety, construction or operating regulation by, a responsible party or its agent or employee or any person acting in a contractual relationship with a responsible party. In addition to removal costs, OPA 90 provides for recovery of damages, including:

- •

- natural resource damages and related assessment costs;

- •

- real and personal property damages;

- •

- net loss of taxes, royalties, rents, fees and other lost revenues;

- •

- net costs of public services necessitated by a spill response, such as protection from fire, safety or health hazards;

- •

- loss of profits or impairment of earning capacity due to the injury, destruction or loss of real property, personal

property or natural resources; and

- •

- loss of subsistence use of natural resources.

The Consolidated Land, Energy, and Aquatic Resources Act of 2010, or CLEAR Act, passed by the House of Representatives on July 30, 2010 would amend OPA 90 in various ways but does not materially affect the currently-effective liability caps for non-tank vessels set by the Coast Guard regulations. Legislation introduced by Senator Reid on July 28, 2010 would raise caps on liability for incidents involving vessels significantly. In its current form, Senator Reid's bill sets the limits for a tank vessel without a qualifying double hull at the greater of (1) $3,300 per gross ton or (2) $93,600,000. The proposed limits for a tank vessel with a qualifying double hull are the greater of (1) $1,900 per gross ton or (2) $16,000,000. Senator Reid's bill would also create subclasses of tank vessels with various liability limits within the caps outlined above. Depending on the outcome of these pending bills, or bills to similar effect, our costs of operation and/or potential liability exposure could be increased in the event of a release.

OPA 90 requires owners and operators of vessels operating in U.S. waters to establish and maintain with the U.S. Coast Guard evidence of their financial responsibility sufficient to meet their potential liabilities imposed by OPA 90. Under the regulations, we may provide evidence of insurance, a surety bond, a guarantee, letter of credit, qualification as a self-insurer or other evidence of financial responsibility. We have qualified as a self-insurer under the regulations and have received Certificates of Financial Responsibility from the U.S. Coast Guard for all of our vessels subject to this requirement.

OPA 90 expressly provides that individual states are entitled to enforce their own oil pollution liability laws, even if such laws are inconsistent with or imposing greater liability than OPA 90. There is no uniform liability scheme among the states. Some states have schemes similar to OPA 90 that limit liability to various amounts, some rely on common law fault-based remedies and others impose strict and/or unlimited liability on an owner or operator. Virtually all coastal states have enacted their own pollution prevention, liability and response laws, whether statutory or through court decisions, with many providing for some form of unlimited liability. We believe that the liability provisions of OPA 90 and similar state laws have greatly expanded potential liability in the event of an oil spill, even in instances where we did not cause the spill. Some states have also established their own requirements for financial responsibility. However, at least two states have repealed regulations concerning the

18

operation, manning, construction or design of tank vessels as a result of the U. S. Supreme Court's 2000 ruling in United States v. Locke ("Locke"). In Locke, the Court held that the regulation of maritime commerce is generally a federal responsibility because of the need for national and international uniformity.

Parties affected by oil pollution that do not fully recover from a responsible party may pursue relief from the Oil Spill Liability Trust Fund. Responsible parties may seek reimbursement from the fund for costs incurred that exceed the liability limits of OPA 90. In order to obtain reimbursement of excess costs, the responsible party must establish that it is entitled to a statutory limitation of liability as discussed above. If we are deemed a responsible party for an oil pollution incident and are ineligible for reimbursement of excess costs, the costs of responding to an oil pollution incident could have a material adverse effect on our results of operations, financial condition and cash flows. We presently maintain oil pollution liability insurance in an amount in excess of that required by OPA 90. Through West of England, our current coverage for oil pollution is $1 billion per incident. It is possible, however, that our liability for an oil pollution incident may be in excess of the insurance coverage we maintain.

We are also subject to potential liability arising under the U.S. Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, which applies to the discharge of hazardous substances, whether on land or at sea. Specifically, CERCLA provides for liability of owners and operators of vessels for cleanup and removal of hazardous substances. Liability under CERCLA for releases of hazardous substances from vessels is limited to the greater of $300 per gross ton or $5 million per incident unless attributable to willful misconduct or neglect, a violation of applicable standards or rules, or upon failure to provide reasonable cooperation and assistance. CERCLA liability for releases from facilities other than vessels is generally unlimited.

We are required to show proof of insurance, surety bond, self insurance or other evidence of financial responsibility to pay potential liabilities up to specified limits under both OPA 90 and CERCLA. We have satisfied these requirements and obtained a U.S. Coast Guard Certificate of Financial Responsibility for each of our tank vessels. OPA 90 and CERCLA each preserve the right to recover damages under other existing laws, including maritime tort law.

Changes in exposure to, or limits of, liability resulting from a change in law, such as that discussed above relating to the CLEAR Act, could also result in increased insurance cost or industry-wide changes in available insurance, either of which could increase our operating costs or potential liability.

Water. The federal Clean Water Act (CWA) imposes restrictions and strict controls on the discharge of pollutants into navigable waters, and such discharges generally require permits. The CWA provides for civil, criminal and administrative penalties for any unauthorized discharges and imposes substantial liability for the costs of removal, remediation and damages. State laws for the control of water pollution also provide varying civil, criminal and administrative penalties and liabilities in the case of a discharge of petroleum, its derivatives, hazardous substances, wastes and pollutants into state waters.

Other federal water quality statutes also potentially affect our operations. The Coastal Zone Management Act authorizes state implementation and development of programs of management measures for non-point source pollution to restore and protect coastal waters. The Nonindigenous Aquatic Nuisance Prevention and Control Act of 1990 and the National Invasive Species Act of 1996 authorize the U.S. Coast Guard to regulate the ballast water management practices of vessels operating in U.S. waters.

On July 23, 2008, the U.S. Ninth Circuit Court of Appeals affirmed the district court decision in Northwest Environmental Advocates v. EPA that vacated an Environmental Protection Agency's (EPA) regulation that exempted certain discharges of effluent from vessels, including discharges of ballast

19

water, from permitting requirements under the National Pollutant Discharge Elimination System (NPDES) program. In response to the court decision, EPA issued a General Permit for Discharges Incidental to the Normal Operation of a Vessel on December 18, 2008. The General Permit imposes effluent limitations on discharges from vessels and includes best management practice, inspection, reporting, and record-keeping requirements. We believe that any financial impacts resulting from the repeal of the permitting exemption for ballast water discharge and the resulting general permit for such discharges will not be material.