Attached files

| file | filename |

|---|---|

| EX-5.1 - FORM OF OPINION OF SHUMAKER, LOOP & KENDRICK, LLP - QUALITY DISTRIBUTION INC | dex51.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - QUALITY DISTRIBUTION INC | dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 10, 2010

Registration No. 333-166407

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

QUALITY DISTRIBUTION, INC.

(Exact name of registrant as specified in charter)

| Florida | 4213 | 59-3239073 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4041 Park Oaks Blvd., Suite 200

Tampa, Florida 33610

(813) 630-5826

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jonathan C. Gold

Senior Vice President, General Counsel and Secretary

Quality Distribution, Inc.

4041 Park Oaks Blvd., Suite 200

Tampa, Florida 33610

(813) 630-5826

With copies to:

| Gregory Ezring, Esq. O’Melveny & Myers LLP 7 Times Square New York, New York 10036 (212) 326-2000 |

Michael Kaplan, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

(Name, address, including zip code, and telephone number, including area code, of agent for service of process)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

Title of each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, no par value per share |

$65,000,000 | $4,635 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The entire amount of the fee was previously paid by the Registrant. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 10, 2010

Shares

Quality Distribution, Inc.

Common Stock

We are selling all of the shares of common stock being offered hereby.

Our common stock is listed on The NASDAQ Global Market under the symbol “QLTY.” The last reported sale price on September 9, 2010 was $5.65 per share.

The underwriters have an option to purchase up to additional shares from us to cover over-allotments of shares. The underwriters can exercise this right at any time and from time to time, in whole or in part, within 30 days after the offering.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 16 of this prospectus.

| Price to Public |

Underwriting |

Proceeds

to | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

Delivery of the shares of common stock will be made on or about , 2010.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse RBC Capital Markets

BB&T Capital Markets Stephens Inc. Stifel Nicolaus Weisel

Cantor Fitzgerald & Co. Moelis & Company Ladenburg Thalmann & Co. Inc. Sterne Agee

The date of this prospectus is , 2010.

Table of Contents

Prospectus

| Page | ||

| ii | ||

| ii | ||

| 1 | ||

| 16 | ||

| 27 | ||

| 29 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 |

| Page | ||

| 68 | ||

| 71 | ||

| 75 | ||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES FOR NON-U.S. HOLDERS |

80 | |

| 83 | ||

| 86 | ||

| 87 | ||

| 87 | ||

| 87 | ||

| F-1 |

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the availability of, any other information that others may give you. You should not assume that the information contained in this prospectus is accurate as of any date other than the date of this prospectus or that information contained in any document incorporated or deemed to be incorporated by reference is accurate as of any date other than the date of that document.

The distribution of this prospectus in some jurisdictions may be restricted by law. Persons who receive this prospectus should inform themselves about and observe any such restrictions. This prospectus does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

Our logo and other trademarks mentioned in this prospectus or any document incorporated by reference herein are our property. Solely for convenience, our trademarks referred to in this prospectus are without the ® or ™ symbol, as applicable, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks. Other brand names or trademarks appearing in this prospectus or any document incorporated by reference herein are the property of the respective owners.

i

Table of Contents

In this prospectus, unless the context otherwise requires or indicates:

| • | the terms “our company,” “Quality Distribution,” “QDI,” “we,” “us” and “our” refer to Quality Distribution, Inc. and its consolidated subsidiaries and their predecessors; the term “QD LLC” refers to our wholly owned subsidiary, Quality Distribution, LLC, and its consolidated subsidiaries and their predecessors; and “QD Capital” means QD Capital Corporation, a Delaware corporation, our wholly owned subsidiary and, together with QD LLC, a co-issuer of the 9% Notes, the 2012 Notes, the 2013 Senior Notes and the 2013 PIK Notes. |

| • | “Apollo” means Apollo Management, L.P., together with its affiliates; |

| • | the “2012 Notes” means our outstanding Senior Floating Rate Notes due 2012, Series A; |

| • | the “9% Notes” means our outstanding 9% Senior Subordinated Notes due 2010; |

| • | the “2013 Senior Notes” means our outstanding 10% Senior Notes due 2013; |

| • | the “2013 PIK Notes” means our outstanding 11.75% Senior Subordinated PIK Notes due 2013; and |

| • | the “ABL Facility” means the asset-based revolving credit facility that we entered into on December 18, 2007, as it may be amended, modified, refinanced or replaced. |

Market and industry data and other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources, including Bulk Transporter’s Tank Truck Carrier 2009 Annual Gross Revenue Report and publications of the Association of American Railroads (“AAR”). Some data are also based on our good faith estimates, which are derived from our review of management’s knowledge of the industry and independent sources. Although we believe that this information is reliable, we cannot guarantee its accuracy and completeness, nor have we independently verified it. We also obtain certain other market share and industry data from internal company analyses and management estimates, and based on our knowledge of the industry. While we believe such internal company analyses and management estimates are reliable, no independent sources have verified such analyses and estimates. Although we are not aware of any misstatements regarding the market share and the industry data that we present in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and “Forward-Looking Statements and Certain Considerations.”

ii

Table of Contents

This summary may not contain all the information that may be important to you. You should read the entire prospectus and the documents incorporated and deemed to be incorporated by reference herein, including the financial statements and related notes, before making an investment decision. Unless otherwise expressly stated or the context otherwise requires, all information in this prospectus assumes that the over-allotment option granted to the underwriters is not exercised.

Our Company

We operate the largest chemical bulk tank truck network in North America through our wholly owned subsidiary, Quality Carriers, Inc. (“QCI”), and are also the largest provider of intermodal tank container and depot services in North America through our wholly owned subsidiary, Boasso America Corporation (“Boasso”). We service customers across North America through our asset-light network of 30 independent affiliates, 97 trucking terminals (91 of which are operated by independent affiliates), 8 intermodal tank depot services terminals and approximately 2,800 drivers (approximately 2,400 of whom work within our independent affiliate network). We also own approximately 5,000 tank or specialty trailers, the majority of which we lease to our independent affiliates to help facilitate our business. These trailers generally have long useful lives and we believe that increasing their utilization can significantly improve our operating income due to high operating leverage. Given the specialty nature of the services we provide and the size of our existing network, we believe there are significant barriers to entry to our industry.

In 2009, we generated operating revenue of $613.6 million, of which the bulk tank truck business accounted for $460.4 million or 75% and Boasso accounted for $79.5 million or 13%. The remaining $73.7 million consisted primarily of rental revenue and revenue from our tank wash business, which we sold during the fourth quarter of 2009. In the twelve-month period ended June 30, 2010, we generated operating revenue of $653.0 million, of which the bulk tank truck business accounted for $492.0 million or 75% and Boasso accounted for $91.2 million or 14%. The remaining $69.8 million consisted primarily of rental revenue and revenue from our tank wash business, which we sold in the fourth quarter of 2009.

Trucking

In our bulk tank truck business, we primarily transport a broad range of chemical products and provide our customers with logistics and other value-added services. We believe we have the leading market share (estimated at 14% in 2009) in the chemical and food grade bulk transportation market (which we estimated to be $4.0 billion in 2009). We are a core carrier for many of the major companies engaged in chemical processing including Ashland, BASF, Dow, DuPont, ExxonMobil, Georgia-Pacific, Honeywell, PPG Industries, Procter & Gamble, Sunoco and Unilever, and we provide services to most of the top 100 chemical producers with United States operations.

Our independent affiliates generally own or lease their terminals, employ drivers and manage independent owner-operators, pay all tractor operating expenses, lease trailers from us and provide national network capacity. Each affiliate is an independent company that generally has an exclusive contract with us to operate under the Quality Carriers® mark and receive a percentage of gross revenues collected on each shipment they transport. We in turn provide various services to the independent affiliates, including working capital, back office and sales support, technology support, insurance and cash flow management and regulatory compliance oversight. Typically, we receive 15% of the revenue (excluding fuel surcharges) generated by the independent affiliates and we also lease our trailers to the independent affiliates (generating additional revenue above our typical 15% revenue share), who have significant contractual limitations on their ability to lease or purchase trailers from

1

Table of Contents

sources other than us. We view the trailer leasing business as attractive given the low upfront costs, long useful life, limited maintenance and attractive return on investment. Due to several factors, including our ownership of the customer contracts and relationships, the presence of non-compete agreements with the independent affiliates, and our ownership of the trailers, our relationships with the independent affiliates tend to be long-term in nature, with minimal voluntary turnover.

Twenty-seven out of our 30 independent affiliates have been associated with us for more than five years and we derived approximately 77%, 90% and 94% of our operating revenue in 2009, the twelve-month period ended June 30, 2010 and the six-month period ended June 30, 2010, respectively, from independent affiliate operations. We believe that the greater proportion of operating revenue derived from independent affiliate operations during the six-month period ended June 30, 2010 (the first six-month period following the sale of our tank wash business in the fourth quarter of 2009) is likely to be indicative of the proportion of operating revenue derived from independent affiliate operations in the future. This affiliate-based model is an asset-light, variable-cost based model that enables us to leverage our independent affiliates and better serve customers while minimizing fixed costs and maximizing shareholder value. We believe this asset-light business model will enable us to benefit from an economic recovery without incurring substantial capital expenditures.

Our well-established coast-to-coast geographic footprint and our proximity to major chemical production facilities and ports afford us certain advantages that many of our smaller competitors lack. These advantages include the ability to dedicate significant capacity with prompt response times to customers across all of North America, enhanced lane density and efficiencies in driver recruiting.

Our transportation revenue is a function of the volume of shipments by the bulk chemical industry, prices, the average number of miles driven per load, our market share and the allocation of shipments between tank truck transportation and other modes of transportation such as rail. The volume of shipments of chemical products is, in turn, affected by many diverse industries and end-use markets, including consumer and industrial products, paints and coatings, paper and packaging, agriculture and food products, and tends to vary with changing economic conditions. We have recently experienced some year-over-year volume improvements and believe this trend could continue as the economy recovers. For the year-to-date period through August 27, 2010, chemical freight car loads reported by the Association of American Railroads (“AAR”), which we consider to be a key metric indicating the level of chemical transportation activity, is up 10.2% year-on-year over the comparable period.

Container Services

Boasso is the largest North American provider of ISO (International Organization for Standardization) tank container transportation and depot services, with eight terminals located in the eastern half of the United States. In addition to intermodal ISO tank transportation services, Boasso provides tank cleaning, heating, testing, maintenance and storage services to customers. Boasso provides local and over-the-road trucking primarily within proximity of the port cities where its depots are located and also sells equipment that its customers use for portable alternative storage or office space.

Demand for ISO tank containers is driven by the volume of imports and exports of chemicals through United States ports. Boasso’s revenues are accordingly impacted by this import/export volume, in particular the number and volume of shipments through ports at which Boasso has terminals, as well as by Boasso’s market share. Economic conditions and differences among the laws and currencies of nations may impact the volume of shipments as well. We believe this business will continue to benefit from the trend towards globalization of petrochemical production, leading to greater quantities of chemicals being imported into North America.

2

Table of Contents

Recent Strategic Initiatives

During the recent economic slowdown, we implemented several important initiatives designed to enhance our operating flexibility and improve our competitive positioning. As a result, we believe we are well-placed to take advantage of opportunities as the economy recovers and volumes in our industry rebound. These initiatives are summarized below:

| • | Simplification of business model and transition to asset-light independent affiliate network. We transitioned the majority of our company-operated terminals to affiliates, resulting in a highly variable cost structure with relatively minimal capital investment requirements. Our trucking terminals are currently 94% affiliate-operated, compared with 45% as of December 31, 2007. We also moved towards a smaller number of stronger independent affiliates leading to a simpler, more efficient business model with improved customer service. |

| • | Implemented $45 million cost saving programs. During 2008 and 2009, we embarked on a major initiative achieving $45 million in cost savings through reductions in overhead expenses, headcount reductions (including as a result of transitioning company-operated terminals to affiliates), closure of selected facilities, and fuel purchase discounts, among other areas. These savings have been fully implemented and achieved, leading to improved competitive positioning and a more favorable and flexible cost structure. For instance, we reduced corporate headcount by 34%, while our total number of employees decreased by 58%. We also consolidated and rationalized under-performing terminals, reducing total number of terminals by 38% from 169 to 105, while transitioning most of the business from these under-performing terminals to our remaining terminals. We believe that as we grow our business, we will be able to retain a substantial majority of the benefits from our cost savings initiatives, which we believe will lead to increased margins. |

| • | Divestiture of non-core tank wash business. In October 2009, we sold our tank wash business for $13.0 million. The business was non-core to us and the sale enabled us to deploy our resources more efficiently and focus on growing the core transport business. We believe the changes in our business activities as a result of the sale of the tank wash business will reduce our environmental compliance costs going forward. |

| • | Extension of debt maturities. In October 2009, we completed exchange and tender offers for our 9% Notes, which are due in 2010, and our 2012 Notes, extending our principal near-term debt maturities to 2013. The transaction allowed us to leave in place our existing lower cost debt under our ABL Facility with the flexibility of a capital structure that has no maintenance covenants so long as borrowing availability under our ABL Facility exceeds $20 million. At June 30, 2010, we had $47.8 million of borrowing availability under our ABL Facility. |

| • | Increased focus on cash flow generation. As a result of our shift to a more asset-light independent affiliate network, we believe we have created a more cash-efficient business model. With minimal maintenance capital investment requirements, estimated at approximately 1% of sales, we believe our business model allows for significant cash flow generation. As a result of this increased focus on cash flow generation, in the twelve-month period ended June 30, 2010 our net cash provided by operating activities was $11.1 million and Free Cash Flow (as defined below) was $8.7 million. |

3

Table of Contents

Our Competitive Strengths

We believe the following competitive strengths will enable us to sustain our market leadership and continue to grow our business:

Largest Tank Truck Network in a Fragmented Industry

We operate the largest tank truck network in North America with a 14% share of the highly fragmented $4.0 billion for-hire chemical and food grade bulk transport market, in each case estimated by us based on figures contained in Bulk Transporter’s Tank Truck Carrier 2009 Annual Gross Revenue Report. We believe our unique large nationwide network covers all major North American chemical shippers and enables us to serve customers with both international and national requirements better than competitors, the majority of which are regionally focused. Our size allows us, our independent affiliates and our independent owner-operators to benefit from economies of scale in the purchasing of supplies and services, including fuel, tires and insurance coverage. We believe our greater network density allows us to create efficiencies by increasing utilization through reduced “empty miles” with more opportunities to generate backhaul loads.

Asset-Light Business Model

Our extensive use of independent affiliates and independent owner-operators results in a highly variable cost structure with relatively minimal capital investment requirements. Due to our recent transition to a predominantly affiliate-based business model, we expect our capital expenditures to generally amount to approximately 1% of operating revenues annually, compared to the industry average of more than 10% for truckload carrier companies. This model also contributes to the stability of our cash flow and margins and increases our return on capital. The independent affiliates are responsible for capital investments and most of the operating expenses related to the business they service, including the capital costs related to purchasing and maintaining tractors. Typically, independent affiliates purchase or lease tractors for their business directly from the manufacturers and lease trailers from us. Independent owner-operators are independent contractors who supply one or more tractors and drivers for our own or our independent affiliates’ use. As with independent affiliates, independent owner-operators are responsible for most of the operating expenses related to the business they service, including costs related to the acquisition and maintenance of tractors.

We prefer to own the trailers as they provide us with a stable source of lease income, as well as access to attractive capital through the ABL Facility. Through periodic maintenance, we are typically able to extend the useful lives of trailers beyond 15-20 years, leading to operational flexibility.

Core Carrier to Blue Chip Chemical Companies.

We provide services to most of the top 100 chemical producers with U.S. operations, including many Fortune 500 companies and other major companies engaged in chemical processing. Our key customers include Ashland, BASF, Dow, DuPont, ExxonMobil, Procter & Gamble and PPG Industries. In 2009, our top 10 customers accounted for approximately 34% of our trucking revenue, and none of our customers accounted for more than 9% of our trucking revenue in 2009. Our ability to maintain these business relationships reflects our service performance and commitment to safety and reliability. We have established long-term customer relationships with these clients, which help us attract and retain experienced independent affiliate terminal operators and drivers. Our team of national account vice presidents and directors have decades of experience in our industry, which we believe enables them to provide practical solutions to complex customer issues.

Exposure to High Growth International Market.

Through Boasso’s operations, we have significant exposure to high growth international markets. Boasso is the leading provider of ISO tank container over-the-road transportation and depot services in North America. The

4

Table of Contents

ISO tank container transportation market has experienced significant growth recently as international chemical trade has increased and chemical manufacturers move towards greater utilization of ISO tanks and standardized intermodal tank containers to efficiently transport their products around the world via sea, land and air. According to USA Trade® Online, in the ten years from 1999-2009, total chemical imports and exports grew at a 6.3% compound annual growth rate, and for the first six months of 2010, chemical import and export activity is up 18.4% year-over-year. Boasso’s tank container depots, which provide transportation, cleaning, heating, testing, maintenance and storage services, are located at or near ports in Chalmette, LA; Houston, TX; Newark, NJ; Charleston, SC; Chicago, IL; Detroit, MI and Jacksonville, FL.

Diverse Product End-Markets.

We serve customers in a number of different industries, whose products reach a diverse group of end-markets. Many of our customers’ major end-markets, such as refining and water treatment, energy, ink and agriculture typically have volumes that we believe are not highly correlated with economic cycles. In addition, our most recent affiliate addition expands our presence in the dry bulk shipping industry. We believe the diversity of our customer base, geography and end-markets provides a competitive advantage.

Stable Pricing Environment.

We believe yields in the bulk tank truck industry tend to be more stable than yields in the overall trucking industry. We believe the specialized nature of the bulk tank truck industry, including specifically-licensed drivers, specialized equipment, and more stringent safety requirements create barriers to entry which limit the more drastic swings in supply experienced by the broader trucking industry. Additionally, it is common practice in the bulk tank truck industry for customers to pay fuel surcharges, which enables trucking companies to recover fuel price increases from customers.

Safe and Efficient Operations

We have a strong emphasis on safety in our operations and have a relentless focus on improving productivity and efficiency. Over the past three years, we have reduced our Department of Transportation (“DOT”) accident rating from 0.7 to 0.5, which was approximately 30% below the national average of 0.7 in 2009. This proactive approach to safety has resulted in financial benefits by enabling us to reduce our insurance deductibles from $5 million to $2 million and obtain letter of credit reductions of $17 million in the past few years. In addition, our insurance costs have decreased from over $23 million in 2007 to approximately $14 million in 2009. Given the nature of the cargo we haul, which requires a high degree of careful handling, we believe that our strong focus on safety creates a competitive advantage for us. We believe we are well positioned to comply with the expected implementation of the Federal Motor Carrier Safety Administration’s (“FMCSA”) Compliance Safety Analysis (“CSA”) program, which will impose additional safety standards on the industry.

Strong Management Team with a Track Record of Success

Our management team, led by our Chief Executive Officer, Gary Enzor, successfully navigated our business through the recent economic slowdown, by implementing cost savings measures and by leading the transition to an affiliate-based network, among other initiatives. We also extended our principal debt maturities until mid-2013. As a result, we believe we are well positioned to benefit from an economic recovery. Mr. Enzor, as well as our President and Chief Operating Officer, Steve Attwood, and other senior managers have significant managerial and operational experience in our industry and have implemented various operational initiatives to improve productivity. Our management team has also demonstrated its ability to acquire and integrate assets, as well as divest non-core businesses, as evidenced by the acquisition of Boasso in December 2007 and the divestiture of the QSI tank wash business in October 2009.

5

Table of Contents

Our Growth Strategy

Building on the strengths mentioned above, we plan to grow our revenue and increase cash flow and profitability as follows:

Pursue Attractive Growth Opportunities

Grow Business with Blue Chip Customers

We plan to leverage our strong existing relationships with the major chemical shippers to increase our market share of these customers’ volumes. For example, in the past few years, due to our strong commitment to customer service, we have been the sole source provider for one major chemical shipper and have grown revenue from $1 million in 2004 to $16 million in 2009. In addition, we increased our revenue with another major chemical distributor from $3 million in 2004 to $22 million in 2009 by leveraging our national network, solutions approach and customer service. Through our dedicated salesforce, we maintain an active and robust pipeline of potential opportunities to grow our business. We believe our business model allows our existing infrastructure to absorb significant additional volume without the need for major capital expenditures.

Grow Through Acquisitions and New Affiliations

We have strong organizational competence which we believe will allow us to identify and evaluate potential opportunities to acquire assets and businesses and increase our affiliate network. We believe that the various services we provide to our independent affiliates, including working capital, back office and sales support, technology support, insurance and cash flow management and regulatory compliance oversight, make our platform attractive for our affiliates. We believe we can make selective, highly accretive add-on acquisitions on an opportunistic basis to supplement our existing core business. For example, in 2007, we acquired Boasso, the largest North American provider of ISO intermodal tank container transportation and depot services. In addition to acquiring companies, we are able to grow externally by bringing new affiliates onto our platform. For example, on May 1, 2010, we added F.T. Silfies, a dry bulk carrier with annual revenues of approximately $20 million, primarily servicing the east coast markets, to our affiliate network. We are currently analyzing several opportunities and plan to continue to utilize acquisitions and affiliate additions to bolster our growth.

Enhance Independent Affiliate Trucking Operations

We have focused over the last two years and continue to focus on a less capital-intensive business model based on our 30 independent affiliates. We believe these actions reduce certain fixed costs and provide a more flexible, variable cost structure. In 2008 and 2009, we transitioned the majority of our company-operated terminals to independent affiliates. We also moved one-third of our sales representatives to the independent affiliates to better cover key regional accounts. As a result of these actions and the sale of our tank wash business, we generated approximately 90% and 94% of our revenue in the twelve-month period ended June 30, 2010 and the six-month period ended June 30, 2010, respectively, from independent affiliates. We believe that the greater proportion of operating revenue derived from independent affiliate operations during the six-month period ended June 30, 2010 (the first six-month period following the sale of our tank wash business in the fourth quarter of 2009) is likely to be indicative of the proportion of operating revenue derived from independent affiliate operations in the future. At the same time, due to our ownership of the customer contracts and relationships, presence of non-compete agreements with the independent affiliates, and our ownership of the trailers, our relationships with the independent affiliates tend to be long-term in nature, with minimal voluntary turnover. We also monitor volume performance of each affiliate on a regular basis to ensure operating performance is in line with management’s expectations. We work proactively with our affiliates to take corrective action or render assistance where appropriate and have certain contractual mechanisms in place to remedy sustained underperformance. We believe our selected independent affiliates are also generally well-financed and have the capacity to increase their revenue base while maintaining a high level of customer service.

6

Table of Contents

Focus on Driver Recruitment and Retention

We are committed to being a driver-focused company that provides both technical support and personal respect to these professionals. We believe we offer competitive compensation at a premium compared to most commercial driving opportunities. With an average haul length of 300 miles, the drivers are also generally home more frequently. Our driver organization contains field-based recruiters who augment the friendly, small business environment provided by our business model. As the overall economy improves, we believe our ability to attract drivers could prove to be a significant competitive advantage to us.

Increase Trailer Utilization

At June 30, 2010, we owned approximately 5,000 trailers, the majority of which we lease to affiliates. Trailer leasing is a key component of our business model. Through periodic maintenance, we are typically able to extend the useful lives of trailers beyond 15-20 years, leading to operational flexibility. Our independent affiliates have significant contractual limitations on their ability to lease or purchase trailers from sources other than us, helping ensure their continued utilization. Based on our current trailer fleet, we believe we have the ability to capture any additional business volume with minimal capital expenditures. To increase our trailer utilization, we also actively pursue opportunities to lease our trailers to third parties other than our independent affiliates. The operating leverage inherent in our business model allows a significant portion of any incremental revenue generated through increased trailer utilization to flow through to our operating income.

Increase Equity Returns Through Debt Paydown

We intend to use the net proceeds from this offering to repay certain of our existing indebtedness and to use cash generated from operations to further reduce our indebtedness as appropriate. Given our relatively low levels of maintenance capital expenditures, we believe that we will continue to generate significant free cash flow to continue to reduce our indebtedness and to make targeted acquisitions.

Our Industry

Trucking

The bulk tank truck market in North America includes all products shipped by bulk tank truck carriers and consists mainly of liquid and dry bulk chemicals (including plastics) and bulk dry and liquid food-grade products. We estimate, based on industry sources, that the highly fragmented North American for-hire segment of the bulk transport market generated revenues of approximately $5.3 billion in 2009. We specifically operate in the for-hire chemical and food grade bulk transport market (which we estimated to be $4.0 billion in 2009). We believe we have the leading market share (estimated at 14% in 2009) in this sector based on revenues. We operate the largest for-hire chemical bulk tank truck network in North America comprising terminals, tractors and trailers. We believe being a larger carrier facilitates customer service and lane density, and provides a more favorable cost structure. As such, we believe we are well-positioned to expand our business by increasing our market share.

The chemical bulk tank truck industry growth is generally dependent on volume growth in the industrial chemical industry, the rate at which chemical companies outsource their transportation needs, the overall capacity of the rail system and, in particular, the extent to which chemical companies make use of the rail system for their bulk chemical transportation needs.

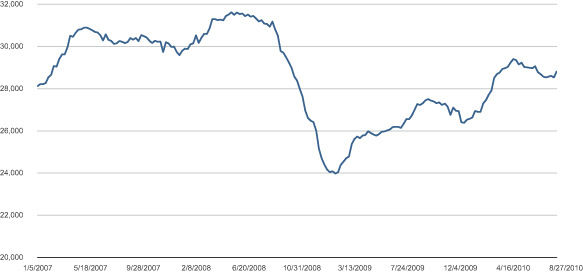

We consider U.S. rail carloads of chemicals (calculated using the data reported by AAR on a weekly basis) a key metric since we believe it has historically been indicative of transportation activity involving chemicals. As summarized in the chart below, this metric has been trending positively recently, posting 41 consecutive weeks of growth through August 27, 2010, which we believe can be considered a positive sign for our business prospects in this sector.

7

Table of Contents

Carloads of Chemicals on U.S. Railroads per Week

Source: Association of American Railroads (AAR).

Note: Data as of August 27, 2010.

We believe the most significant factors relevant to our future business growth are the ability to obtain additional business from existing customers, add new customers, improve the utilization of our trailer fleet and add and retain qualified drivers.

Our industry is characterized by high barriers to entry such as the time and cost required to develop the operational infrastructure necessary to handle sensitive chemical cargo, the financial and managerial resources required to recruit and train drivers, substantial industry regulatory requirements, strong customer relationships and the significant capital investments required to build a fleet of equipment and establish a network of terminals.

The tank truck business is competitive and fragmented. We compete primarily with other tank truck carriers and dedicated private fleets in various states within the United States and Canada. Competition from for-hire carriers is composed of fewer than ten large carriers, most of which have other businesses that do not compete with ours, and more than 200 smaller, primarily regional carriers. With respect to certain aspects of our business, we also compete with intermodal transportation and railroads. Intermodal transportation has increased in recent years. Competition for the bulk tank truck services is based primarily on rates and service. We believe that we enjoy significant competitive advantages over other tank truck carriers because of our asset-light model, variable cost structure, overall fleet size and national terminal network.

Container Services

We estimate that the North American ISO tank container transportation and depot services market generated revenues of approximately $230 million in 2009. The ISO tank container business generally provides services that facilitate the global movement of liquid and dry bulk chemicals, pharmaceuticals and food grade products.

The proliferation of global import/export of bulk liquid chemicals has driven the movement of basic manufacturing out of the United States and has resulted in an increase in chemical plant infrastructure to service these off-shore industries. Driven by this globalization, the ISO tank container market is a growing sector of the overall liquid bulk chemical transportation sector. Furthermore, chemical manufacturers have sought to efficiently transport their products by utilizing ISO tank containers. The resulting demand for distributors that

8

Table of Contents

can offer a broad range of services within the supply chain will drive future growth in this sector. We believe that Boasso will benefit from these trends because of its market leadership, experience and track record.

Boasso competes primarily with other national, regional and local tank truck carriers and dedicated private fleets as well as local and regional dry container transporters. Competition in our ISO container services business depends on which competitors have facilities that are proximate to the ports serviced by Boasso. Among competitors for a port location, competition is based primarily on rates and service.

Our Formation and Ownership

We were formed in 1994 as a holding company known as MTL Inc., which consummated its initial public offering on September 17, 1994. On June 9, 1998, MTL Inc. was recapitalized through a merger with a corporation controlled by Apollo Investment Fund III, L.P. As a result of the recapitalization, MTL Inc. became a private company. On August 28, 1998, we completed our acquisition of Chemical Leaman Corporation and its subsidiaries, or CLC. Through the 1998 acquisition, we combined two of the then-leading bulk transportation service providers, namely, Montgomery Tank Lines, Inc. and Chemical Leaman Tank Lines, Inc., under one operating company, Quality Carriers, Inc., or QCI. In 1999, we changed our name from “MTL Inc.” to “Quality Distribution, Inc.” On May 30, 2002, as part of a corporate reorganization, we transferred substantially all of our assets to QD LLC, consisting principally of the capital stock of our operating subsidiaries. On November 13, 2003, we consummated the initial public offering of 7,875,000 shares of our common stock. Boasso became our wholly owned subsidiary in December 2007, when we acquired all of its outstanding capital stock from a third party.

As of June 30, 2010, affiliates of Apollo owned or controlled approximately 48.9% of our common stock, or approximately 44.3% on a fully diluted basis. Following this offering, affiliates of Apollo will own approximately % of our common stock and approximately % on a fully diluted basis.

Corporate Information

Our company is a Florida corporation formed in 1994. Our principal executive offices are located at 4041 Park Oaks Blvd., Suite 200, Tampa, Florida, 33610, and our telephone number is (813) 630-5826. We are a holding company with no significant assets or operations other than the ownership of 100% of the membership units of QD LLC. Our website address is http://www.qualitydistribution.com. The contents of and information contained on our website do not form a part of and are not incorporated by reference into this prospectus.

9

Table of Contents

THE OFFERING

| Issuer |

Quality Distribution, Inc. |

| Common stock offered by us: |

shares |

| Common stock to be outstanding after the offering |

shares |

| Underwriters’ over-allotment option |

We have granted the underwriters an option to purchase up to shares of our common stock. If the underwriters exercise in full this right, we will have approximately shares of our common stock outstanding after this offering. |

| Use of proceeds |

We intend to use $15.0 million of the net proceeds from our sale of shares in this offering to repay outstanding borrowings under the ABL Facility (without reducing commitments). We intend to use the remainder of such proceeds to retire a portion of our outstanding notes, either through redemption at par, plus accrued and unpaid interest, or opportunistically at prices below par, through tender offers and/or open market repurchases. Pending such use of the remainder of the proceeds, we may temporarily further repay outstanding borrowings under the ABL Facility. See “Use of Proceeds.” |

| Dividend Policy |

We do not currently anticipate paying any dividends on our common stock in the foreseeable future. See “Dividend Policy.” |

| The NASDAQ Global Market symbol |

QLTY |

The last reported sale price on September 9, 2010 was $5.65 per share.

| Risk Factors |

You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading “Risk Factors” beginning on page 11, prior to purchasing the shares of common stock offered hereby. |

| Conflicts of interest |

Affiliates of Credit Suisse Securities (USA) LLC and BB&T Capital Markets, a division of Scott & Stringfellow, LLC, which are underwriters, are lenders under the ABL Facility and may receive more than five percent of the net proceeds of this offering as a result of our intention to repay outstanding borrowings under the ABL Facility. Thus, Credit Suisse Securities (USA) LLC and BB&T Capital Markets, a division of Scott & Stringfellow, LLC, may be deemed to have a “conflict of interest” under the applicable provisions of Rule 2720 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc. Accordingly, this offering will be made in compliance with the applicable provisions of Rule 2720 of the Conduct Rules. Rule 2720 currently requires that a “qualified independent underwriter” participate in the preparation of the registration statement and the prospectus and exercise the usual standards of due diligence in respect thereto. RBC Capital Markets Corporation is acting as the qualified independent underwriter. See “Conflicts of Interest.” |

10

Table of Contents

Unless otherwise indicated, all share information in this prospectus is based on the number of shares of common stock outstanding as of June 30, 2010 and excludes 3.1 million shares of common stock reserved for issuance under our stock option plans, 2.2 million outstanding stock options, 623,483 shares of unvested restricted stock and outstanding warrants representing 445,929 shares of common stock as of June 30, 2010.

Unless we specifically state otherwise, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

11

Table of Contents

SUMMARY FINANCIAL AND OTHER OPERATING DATA

The following table sets forth our summary historical financial information. The historical statement of operations data for the fiscal years ended December 31, 2009, 2008 and 2007 and the historical balance sheet data as of December 31, 2009 and 2008 are derived from, and should be read in conjunction with, our audited consolidated financial statements and related notes included elsewhere in this prospectus. The historical statement of operations data for the six months ended June 30, 2010 and June 30, 2009 and the historical balance sheet data as of June 30, 2010 and June 30, 2009 are derived from our unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the data for the period. The results of operations for the interim period are not necessarily indicative of the operating results for the entire year or any future period.

The summary historical financial data for the 12-month period ended June 30, 2010 was derived by (i) combining our historical consolidated statement of operations for fiscal 2009 with (ii) our historical consolidated statement of operations for the six months ended June 30, 2010 and (iii) subtracting our historical consolidated statement of operations for the six months ended June 30, 2009.

The information contained in this table should also be read in conjunction with “Capitalization,” “Selected Historical Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, |

Twelve Months Ended June 30, 2010 |

||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||

| Statement of Operations Data(1) |

||||||||||||||||||||||||||||

| Operating revenues |

$ | 613,609 | $ | 815,290 | $ | 751,558 | $ | 338,885 | $ | 299,518 | $ | 652,976 | ||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Purchased transportation |

373,539 | 466,823 | 471,531 | 233,975 | 170,876 | 436,638 | ||||||||||||||||||||||

| Depreciation and amortization |

20,218 | 21,002 | 17,544 | 8,310 | 10,639 | 17,889 | ||||||||||||||||||||||

| Impairment charge(2) |

148,630 | — | — | — | 148,630 | — | ||||||||||||||||||||||

| Other operating expenses |

186,398 | 294,487 | 238,630 | 76,693 | 106,611 | 156,480 | ||||||||||||||||||||||

| Operating (loss) income |

(115,176 | ) | 32,978 | 23,853 | 19,907 | (137,238 | ) | 41,969 | ||||||||||||||||||||

| Interest expense, net |

28,047 | 35,120 | 30,524 | 16,990 | 13,332 | 31,705 | ||||||||||||||||||||||

| Write-off of debt issuance costs |

20 | 283 | 2,031 | — | — | 20 | ||||||||||||||||||||||

| Gain on extinguishment of debt |

(1,870 | ) | (16,532 | ) | — | — | (675 | ) | (1,195 | ) | ||||||||||||||||||

| Other expense (income) |

1,912 | (2,945 | ) | 940 | 226 | (276 | ) | 2,414 | ||||||||||||||||||||

| (Loss) income before taxes |

(143,285 | ) | 17,052 | (9,642 | ) | 2,691 | (149,619 | ) | 9,025 | |||||||||||||||||||

| Provision for (benefit from) income taxes |

37,249 | 4,940 | (2,079 | ) | (163 | ) | 36,910 | 176 | ||||||||||||||||||||

| Net (loss) income |

$ | (180,534 | ) | $ | 12,112 | $ | (7,563 | ) | $ | 2,854 | $ | (186,529 | ) | $ | 8,849 | |||||||||||||

| Net (loss) income per common share: |

||||||||||||||||||||||||||||

| Basic |

$ | (9.28 | ) | $ | 0.63 | $ | (0.39 | ) | $ | 0.14 | $ | (9.65 | ) | 0.45 | ||||||||||||||

| Diluted |

(9.28 | ) | 0.62 | (0.39 | ) | 0.13 | (9.65 | ) | 0.42 | |||||||||||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

19,449 | 19,379 | 19,336 | 19,880 | 19,331 | 19,668 | ||||||||||||||||||||||

| Diluted |

19,449 | 19,539 | 19,336 | 21,585 | 19,331 | 20,908 | ||||||||||||||||||||||

12

Table of Contents

| Year Ended December 31, | Six Months Ended June 30, |

Twelve Months Ended June 30, 2010 |

||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||

| Other Financial Data(1) |

||||||||||||||||||||||||||||

| Cash paid for interest |

$ | 22,704 | $ | 30,690 | $ | 28,850 | $ | 15,563 | $ | 12,620 | $ | 25,647 | ||||||||||||||||

| Net cash provided by operating activities |

39,756 | 19,593 | 14,052 | (6,134 | ) | 22,498 | 11,124 | |||||||||||||||||||||

| Net cash provided by (used in) investing activities |

9,577 | (8,524 | ) | (63,399 | ) | (2,366 | ) | (611 | ) | 7,822 | ||||||||||||||||||

| Net cash (used in) provided by financing activities |

(50,515 | ) | (13,485 | ) | 52,194 | 5,759 | (25,756 | ) | (19,000 | ) | ||||||||||||||||||

| Consolidated EBITDA(3) |

51,550 | 58,040 | 48,635 | 31,283 | 24,384 | 58,449 | ||||||||||||||||||||||

| Pro forma cash paid for interest(4) |

||||||||||||||||||||||||||||

| Ratio of pro forma Consolidated EBITDA (as defined) to pro forma cash paid for interest |

||||||||||||||||||||||||||||

| Free cash flow (as defined)(5) |

39,067 | 11,150 | 9,889 | (8,500 | ) | 21,887 | 8,680 | |||||||||||||||||||||

| Other Operating Data(1) |

||||||||||||||||||||||||||||

| Number of terminals at end of period |

108 | 149 | 169 | 105 | 139 | |||||||||||||||||||||||

| Number of trailers operated at end of period |

6,410 | 7,115 | 7,506 | 6,478 | 6,586 | |||||||||||||||||||||||

| Number of tractors operated at end of period |

2,839 | 3,224 | 3,927 | 3,031 | 3,036 | |||||||||||||||||||||||

| Transportation billed miles (in thousands) |

108,302 | 136,234 | 154,340 | 58,396 | 53,484 | 113,214 | ||||||||||||||||||||||

| Balance Sheet Data (at end of period)(1) |

||||||||||||||||||||||||||||

| Working capital |

$ | 19,016 | $ | 44,967 | $ | 67,093 | $ | 35,263 | $ | 32,388 | ||||||||||||||||||

| Total assets |

279,616 | 502,103 | 493,976 | 291,700 | 295,685 | |||||||||||||||||||||||

| Total indebtedness, including current maturities |

321,284 | 362,586 | 349,271 | 331,185 | 341,954 | |||||||||||||||||||||||

| Shareholders’ (deficit) equity |

(140,736 | ) | 31,020 | 27,300 | (136,138 | ) | (154,568 | ) | ||||||||||||||||||||

| (1) | On December 17, 2007, we acquired 100% of the stock of Boasso. The results of Boasso have been included in our results since the date of the acquisition. |

| (2) | The impairment charge resulted from an impairment analysis of goodwill and intangible assets performed during the quarter ended June 30, 2009. Refer to Note 12 to the consolidated financial statements for the fiscal year ended December 31, 2009 included elsewhere in this prospectus. |

| (3) | Consolidated EBITDA in this prospectus corresponds to “Consolidated EBITDA” in the indentures governing our 2013 Senior Notes and our 2013 PIK Notes. Consolidated EBITDA is defined in the indentures as the net income (loss) before interest expense, provision for (benefit from) income taxes, depreciation and amortization, adverse insurance claims development, refinancing costs, gain on early debt extinguishment which includes the write-off of deferred financing charges, costs related to unconsummated financial transactions, gain on pension settlement, gain on asset sales, restructuring costs which includes corporate office relocation costs, impairment of goodwill and intangibles and employee non-cash compensation. We believe that financial information based on United States generally accepted accounting principles (“GAAP”) for highly leveraged businesses, such as ours, should be supplemented by Consolidated EBITDA so that investors better understand our financial information in connection with their analysis of our business. Consolidated EBITDA is a component of the measure used by our management to facilitate internal comparisons to competitors’ results and the bulk transportation industry in general. This measure is especially important given the recent trends of increased merger and acquisition activity and financial restructurings within the industry, which has led to significant variations among companies with respect to capital structures and cost of capital (which affect interest expense) and differences in taxation and book depreciation of facilities and equipment (which affect relative depreciation expense), including significant differences in the depreciable lives of similar assets among various companies, as well as non-operating and one-time charges to earnings, such as the effect of debt restructurings. Accordingly, Consolidated EBITDA allows analysts, investors and other interested parties in the bulk transportation industry to facilitate company |

13

Table of Contents

| to company comparisons by eliminating some of the foregoing variations. Consolidated EBITDA as used in this prospectus may not, however, be directly comparable to similarly titled measures reported by other companies due to differences in accounting policies and items excluded or included in the adjustments, which limits its usefulness as a comparative measure. Consolidated EBITDA is not a measure of financial performance or liquidity under GAAP. Consolidated EBITDA should not be considered in isolation or as a substitute for consolidated statement of income and cash flow data prepared in accordance with GAAP as an indication of our operating performance or liquidity. |

The following table presents the calculation of Consolidated EBITDA for the periods presented:

| Year Ended December 31, | Six Months Ended June 30, | Twelve Months

Ended June 30, 2010 |

||||||||||||||||||||||||||

| (Dollars in thousands) | 2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||||||||||||||

| CONSOLIDATED EBITDA |

||||||||||||||||||||||||||||

| Net income (loss) |

$ | (180,534 | ) | $ | 12,112 | $ | (7,563 | ) | $ | 2,854 | $ | (186,529 | ) | $ | 8,849 | |||||||||||||

| Interest expense, net |

28,047 | 35,120 | 30,524 | 16,990 | 13,332 | 31,705 | ||||||||||||||||||||||

| Provision for (benefit from) income taxes |

37,249 | 4,940 | (2,079 | ) | (163 | ) | 36,910 | 176 | ||||||||||||||||||||

| Depreciation and amortization |

20,218 | 21,002 | 17,544 | 8,310 | 10,639 | 17,889 | ||||||||||||||||||||||

| EBITDA |

(95,020 | ) | 73,174 | 38,426 | 27,991 | (125,648 | ) | 58,619 | ||||||||||||||||||||

| Adverse insurance claims development |

— | — | 4,800 | — | — | |

— |

| ||||||||||||||||||||

| Refinancing costs |

2,323 | — | — | — | — | 2,323 | ||||||||||||||||||||||

| (Gain) loss on early debt extinguishment |

(1,850 | ) | (16,249 | ) | 2,031 | — | (675 | ) | (1,175 | ) | ||||||||||||||||||

| Costs related to unconsummated financial transactions |

— | — | 1,556 | — | — |

|

— |

| ||||||||||||||||||||

| Gain on pension settlement |

— | (3,410 | ) | — | — | — | — | |||||||||||||||||||||

| Gain on asset sales |

(7,130 | ) | (2,128 | ) | — | — | — | (7,130 | ) | |||||||||||||||||||

| Restructuring costs |

3,496 | 5,325 | 259 | 2,215 | 1,765 | 3,946 | ||||||||||||||||||||||

| Impairment of goodwill and intangibles |

148,630 | — | — | — | 148,630 | — | ||||||||||||||||||||||

| Employee non-cash compensation |

1,101 | 1,328 | 1,563 | 1,077 | 312 | 1,866 | ||||||||||||||||||||||

| Consolidated EBITDA |

$ | 51,550 | $ | 58,040 | $ | 48,635 | $ | 31,283 | $ | 24,384 | $ | 58,449 | ||||||||||||||||

| (4) | Pro forma cash paid for interest reflects adjustments to historic interest expense data to give effect to this offering and the application of the net proceeds as set forth in “Use of Proceeds” as if they occurred on January 1, 2009 using average interest rate calculations for the $15.0 million repayment of outstanding borrowings under the ABL Facility. |

| (5) | Free Cash Flow is used by management to evaluate the Company’s financial performance independent of cash used to maintain or expand its asset base. Net cash provided by operating activities is adjusted for capital expenditures net of proceeds from sales of property and equipment to arrive at Free Cash Flow. Free Cash Flow is not a measure of financial performance or liquidity under GAAP. Free Cash Flow should not be considered in isolation or as a substitute for the consolidated statement of income and cash flow data prepared in accordance with GAAP as an indication of the Company’s operating performance or liquidity. |

14

Table of Contents

The following table presents the calculation of Free Cash Flow for the periods presented:

| Year Ended December 31, | Six Months Ended June 30, | Twelve Months

Ended June 30, 2010 |

||||||||||||||||||||||||

| (Dollars in thousands) | 2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||||||||||||

| FREE CASH FLOW |

||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 39,756 | $ | 19,593 | $ | 14,052 | $ | (6,134 | ) | $ | 22,498 | $ | 11,124 | |||||||||||||

| Adjustments to cash from operating activities: |

||||||||||||||||||||||||||

| Net capital expenditures |

(689 | ) | (8,443 | ) | (4,163 | ) | (2,366 | ) | (611 | ) | (2,444 | ) | ||||||||||||||

| Free Cash Flow |

$ | 39,067 | $ | 11,150 | $ | 9,889 | $ | (8,500 | ) | $ | 21,887 | $ | 8,680 | |||||||||||||

15

Table of Contents

You should carefully consider the risks described below, in addition to the other information set forth or incorporated by reference in this prospectus, before investing in our common stock. Although the risks described below are all of the risks that we believe are material, they are not the only risks relating to our business. Additional risks and uncertainties not currently known to us or that we currently deem not to be material may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your investment.

Risks Related to Our Business

Our business is subject to general and industry specific economic factors that are largely out of our control and could affect our operations and profitability.

Our business is dependent on various economic factors over which we have little control, that include:

| • | the availability of qualified drivers; |

| • | access to the credit and capital markets; |

| • | changes in regulations concerning shipment and storage of material we transport and depot; |

| • | increases in fuel prices, taxes and tolls; |

| • | interest rate fluctuations; |

| • | excess capacity in the tank trucking industry; |

| • | changes in license and regulatory fees; |

| • | potential disruptions at U.S. ports of entry; |

| • | downturns in customers’ business cycles; and |

| • | reductions in customers’ shipping requirements. |

As a result, we may experience periods of overcapacity, declining prices, lower profit margins and less availability of cash in the future. We have a large number of customers in the chemical-processing and consumer-goods industries. If these customers experience fluctuations in their business activity due to an economic downturn, work stoppages or other industry conditions, the volume of freight transported by us or container services provided by us on behalf of those customers may decrease. The volume of shipments of chemical products is, in turn, affected by many other industries and end use markets, including consumer and industrial products, paints and coatings, paper and packaging, agriculture and food products, and tends to vary with changing economic conditions.

The trucking industry, in general, has experienced a slowdown due to lower demand resulting from slowing economic conditions through 2008 and 2009, which, to a certain extent, has continued thus far in 2010.

Our debt agreements contain restrictions that could limit our flexibility in operating our business.

Our ABL Facility and the indentures governing the 2013 Senior Notes and the 2013 PIK Notes contain covenants that limit or prohibit our ability, among other things, to:

| • | incur or guarantee additional indebtedness or issue certain preferred shares; |

| • | redeem, repurchase, make payments on or retire subordinated indebtedness or make other restricted payments; |

| • | make certain loans, acquisitions, capital expenditures or investments; |

| • | sell certain assets, including stock of our subsidiaries; |

16

Table of Contents

| • | enter into sale and leaseback transactions; |

| • | create or incur liens; |

| • | consolidate, merge, sell, transfer or otherwise dispose of all or substantially all of our assets; and |

| • | enter into certain transactions with our affiliates. |

These covenants may prohibit or impair us from taking actions that we believe are best for our business. Furthermore, under the ABL Facility we may be required to satisfy and maintain specified financial ratios. Our ability to meet those financial ratios can be affected by events beyond our control, and we may not meet those ratios. In addition, covenants in our debt agreements limit our use of proceeds from our ordinary operations and from extraordinary transactions. These limits may require us to apply proceeds in a certain manner or prohibit us from utilizing the proceeds in our operations or from prepaying or retiring indebtedness that we desire.

A failure to comply with any of the covenants contained in the ABL Facility or our other indebtedness could result in an event of default, which, if not cured or waived, could have a material adverse effect on our business, financial condition and results of operations. In the event of any default, the lenders of the defaulted indebtedness:

| • | will not be required to lend any additional amounts to us under the ABL Facility; |

| • | could elect to declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be due immediately and terminate all commitments to extend further credit; or |

| • | require us to apply all of our available cash to repay these borrowings. |

Such actions by the lenders could cause cross defaults under our other indebtedness. If we were unable to repay amounts under the ABL Facility, the lenders under the ABL Facility could proceed against the collateral granted to them to secure that indebtedness. If any of our indebtedness is accelerated, there can be no assurance that our assets would be sufficient to repay such indebtedness in full.

We have substantial indebtedness and may not be able to make required payments on our indebtedness.

At June 30, 2010, we had consolidated long-term indebtedness and capital lease obligations, including current maturities, of $331.2 million, most of which matures during the next five years. We must make regular payments under the ABL Facility and our capital leases, and semi-annual and quarterly interest payments under our outstanding notes. In addition, subject to certain conditions, we are required to make regular redemptions of our 2013 Senior Notes.

Our 2013 Senior Notes and 2013 PIK Notes issued in the quarter ended December 31, 2009 carry higher rates of interest and higher cash rates of interest than the notes for which they were exchanged. In addition, interest on amounts borrowed under our ABL Facility is variable and will increase as market rates of interest increase. Our higher interest expense may reduce our future profitability. Our future higher interest expense and future redemption obligations could have other important consequences with respect to our ability to manage our business successfully, including the following:

| • | it may make it more difficult for us to satisfy our obligations for our indebtedness, and any failure to comply with these obligations could result in an event of default; |

| • | using a portion of our cash flow to make interest or redemption payments on our indebtedness will reduce the availability of our cash flow to fund working capital, capital expenditures and other business activities; |

| • | it increases our vulnerability to adverse economic and industry conditions; |

| • | it limits our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

17

Table of Contents

| • | it may make us more vulnerable to further downturns in our business or the economy; and |

| • | it limits our ability to exploit business opportunities. |

The 9% Notes mature November 15, 2010. The ABL Facility matures June 18, 2013. However, the maturity date of the ABL Facility and our other debt maturing in 2013 may be accelerated if we default on our obligations. If the maturity of the ABL Facility and/or such other debt is accelerated, we do not believe that we will have sufficient cash on hand to repay the ABL Facility and/or such other debt or, unless conditions in the credit markets improve significantly, that we will be able to refinance the ABL Facility and/or such other debt on acceptable terms, or at all. The failure to repay or refinance the ABL Facility and/or such other debt at maturity will have a material adverse effect on our business and financial condition, would cause substantial liquidity problems and may result in the bankruptcy of us and/or our subsidiaries. Any actual or potential bankruptcy or liquidity crisis may materially harm our relationships with our customers, suppliers and affiliates.

Our ability to satisfy our interest, redemption and principal payment obligations will depend upon, among other things:

| • | our future financial and operating performance, which will be affected by many factors beyond our control; and |

| • | our future ability to borrow under the ABL Facility, the availability of which depends on, among other things, our complying with the covenants in the ABL Facility. |

We may not generate sufficient cash flow from operations, and we may not be able to draw under the ABL Facility, in an amount sufficient to fund our liquidity needs. If our cash flows and capital resources are insufficient to service our indebtedness or fund our operations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. If we are not able to refinance any of our indebtedness, sell assets or raise capital on commercially reasonable terms or at all or for sufficient proceeds, we could default on our obligations and impair our liquidity. Our inability to generate sufficient cash flow to satisfy our debt obligations or to refinance our obligations on commercially reasonable terms would have a material adverse effect on our business, financial condition, results of operations or cash flows.

Despite our substantial indebtedness, we may incur significantly more indebtedness, which could have a material adverse effect on our business, financial condition, results of operations or cash flows.

The ABL Facility and the indentures governing the 2013 Senior Notes and the 2013 PIK Notes contain restrictions on our ability to incur additional indebtedness. These restrictions are subject to a number of important qualifications and exceptions, and the indebtedness incurred in compliance with these restrictions could be substantial. Accordingly, we or our subsidiaries could incur significant additional indebtedness in the future. As of June 30, 2010, we had approximately $47.8 million available for additional borrowing under the ABL Facility, including a subfacility for letters of credit, and the covenants under our debt agreements would allow us to borrow a significant amount of additional indebtedness. Additional leverage could have a material adverse effect on our business, financial condition, results of operations or cash flows and could increase the risks described in “—Our debt agreements contain restrictions that could limit our flexibility in operating our business,” and “—We have substantial indebtedness and may not be able to make required payments on our indebtedness.”

The trucking industry is extremely competitive and fragmented.

The trucking industry is extremely competitive and fragmented. No single truckload carrier has a significant market share. We compete with many other truckload carriers of varying sizes, customers’ private fleets, and, to a lesser extent, with railroads, which may limit our growth opportunities and reduce profitability. Historically, competition has created downward pressure on the trucking industry’s pricing structure. Some trucking companies with which we compete have greater financial resources.

18

Table of Contents

We believe that the most significant competitive factor that impacts demand for our products is rates, and we may be forced to lower our rates based on our competitors’ pricing decisions, which would reduce our profitability. In fact, certain markets that we serve have experienced fierce price competition in recent years. This has been further magnified through the impact of the recent global economic recession as trucking companies have focused more on price to retain business and market share. With respect to certain aspects of our business, we also compete with intermodal transportation and railroads. Intermodal transportation has increased in recent years. Growth in such forms of transport could adversely affect our market share, net sales and profit margins. Competition from non-trucking modes of transportation and from intermodal transportation would likely increase if state or federal fuel taxes were to increase without a corresponding increase in taxes imposed upon other modes of transportation.

Additional trends include current and anticipated consolidation among our competitors which may cause us to lose market share as well as put downward pressure on pricing. Some of our competitors are larger, have greater financial resources and have less debt than we do. As a result, those competitors may be better able to withstand a change in conditions within our industry and in the economy as a whole. If we do not compete successfully, our operating margins, financial condition, cash flows and profitability could be adversely affected.

Our reliance upon affiliates and independent owner-operators could adversely affect our operations and profitability.

We rely heavily upon our independent affiliates and independent owner-operators to perform the services for which we contract with our customers. A reduction in the number of independent owner-operators, whether due to capital requirements related to the expense of obtaining, operating and maintaining equipment or for other reasons, could have a negative effect on our operations and profitability. Similarly the loss of one or more affiliates could adversely affect our profitability.

Contracts with affiliates are for various terms and contracts with independent owner-operators may be terminated by either party on short notice. Although affiliates and independent owner-operators are responsible for paying for their own equipment and other operating costs, significant increases in these costs could cause them to seek a higher percentage of the revenue generated if we are unable to increase our rates commensurately. A continued decline in the rates we pay to our affiliates and independent owner-operators could adversely affect our ability to retain our existing affiliates and independent owner-operators and attract new affiliates, independent owner-operators and drivers. Disagreements with affiliates or independent owner-operators as to payment or other terms, or the failure of a key affiliate to meet our contractual obligations or otherwise perform consistent with our requirements may require us to utilize alternative suppliers, in each case at potentially higher prices or with disruption of the services that we provide to our customers. If we fail to deliver loads on time or if the costs of our services increase, then our profitability and customer relationships could be harmed.

Although our affiliates and independent owner-operators have substantial contractual obligations to us, we do not control them. These affiliates and independent owner-operators typically utilize tractors and trailers bearing our tradenames and trademarks. To the extent that one of our affiliates or independent owner-operators are subject to negative publicity, it could reflect on us and have a material adverse effect on our business, brand, results of operations, cash flows or financial condition.

The loss of one or more significant customers may adversely affect our business.

We are dependent upon a limited number of large customers. Our top ten customers accounted for approximately 34% of our total revenues during 2009. The loss of one or more of our major customers, or a material reduction in the services we perform for such customers, may have a material adverse effect on our business, results of operations or financial condition.

19

Table of Contents

We are self-insured and have exposure to certain claims and are subject to the insurance marketplace, all of which could affect our profitability.

The primary accident risks associated with our business are:

| • | motor-vehicle related bodily injury and property damage; |

| • | workers’ compensation claims; |

| • | environmental pollution liability claims; |

| • | cargo loss and damage; and |

| • | general liability claims. |