Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - bebe stores, inc. | a2200073zex-32_1.htm |

| EX-21.1 - EX-21.1 - bebe stores, inc. | a2200073zex-21_1.htm |

| EX-23.1 - EX-23.1 - bebe stores, inc. | a2200073zex-23_1.htm |

| EX-32.2 - EX-32.2 - bebe stores, inc. | a2200073zex-32_2.htm |

| EX-31.2 - EX-31.2 - bebe stores, inc. | a2200073zex-31_2.htm |

| EX-31.1 - EX-31.1 - bebe stores, inc. | a2200073zex-31_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended July 3, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number 0-24395

bebe stores, inc.

(Exact name of registrant as specified in its charter)

| California (State or Jurisdiction of Incorporation or Organization) |

94-2450490 (IRS Employer Identification Number) |

400 Valley Drive

Brisbane, California 94005

(Address of principal executive offices, including zip code)

Telephone:

(415) 715-3900

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $249,000,000 as of January 2, 2010, the last business day of the registrant's most recently completed second fiscal quarter, based upon the closing sale price per share of $6.25 of the registrant's Common Stock as reported on the Nasdaq National Market on such date. Shares of Common Stock held by each executive officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily conclusive for other purposes.

As of August 31, 2010, 86,150,881 shares of Common Stock, $0.001 per share par value, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive Proxy Statement for the 2010 Annual Meeting of Shareholders, to be filed with the Commission no later than 120 days after the end of the registrant's fiscal year covered by this Form 10-K.

The following discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as "expects," "anticipates," "intends," "plans," "believes," "estimates," "thinks" and similar expressions are forward-looking statements. Forward-looking statements include statements about our expected results of operations, capital expenditures and store openings and closings, as well as our plans regarding PH8 and our product developments. Although we believe that these statements are based on reasonable assumptions, we cannot assure you that our goals will be achieved. These forward-looking statements are made as of the date of this Form 10-K, and we assume no obligation to update or revise them or provide reasons why actual results may differ. Factors that might cause such a difference include, but are not limited to, our ability to respond to changing fashion trends, obtain raw materials and find manufacturing facilities, attract and retain key management personnel, develop new concepts, successfully open future stores, successfully manage our online business, maintain and protect information technology, respond effectively to competitive pressures in the apparel industry and adverse economic conditions and protect our intellectual property, as well as declines in comparable store sales performance, changes in the level of consumer spending or preferences in apparel and/or other factors discussed in "Risk Factors" and elsewhere in this Form 10-K.

General

We design, develop and produce a distinctive line of contemporary women's apparel and accessories. While we attract a broad audience, our target customer is an 21 to 34-year-old woman who seeks current fashion trends to suit her lifestyle. The "bebe look" appeals to a hip, sexy, sophisticated, body-conscious woman who takes pride in her appearance. The bebe customer expects value in the form of current fashion and high quality at a competitive price.

Our distinctive product offering includes a full range of separates, tops, dresses, active wear and accessories in the following lifestyle categories: career, evening, casual and active. We design and develop the majority of our merchandise in-house, which is manufactured to our specifications. The remainder is sourced directly from third-party manufacturers.

As of July 3, 2010, we marketed our products under the bebe, BEBE SPORT, bbsp, PH8 and 2b bebe brand names through our 297 retail stores, our on-line store at www.bebe.com, and our 49 international licensee operated stores and, pursuant to our product licensing, through certain select domestic and international retailers.

bebe. We were founded by Manny Mashouf, our Chief Executive Officer and Chairman of the Board. We opened our first store in San Francisco, California in 1976, which was also the year we incorporated in California. As of July 3, 2010, we operated 213 bebe stores in 36 states, Puerto Rico, the U.S. Virgin Islands and Canada. We also operate one bebe accessory store that features a limited assortment of bebe merchandise, including outwear, shoes and accessories.

PH8. We launched BEBE SPORT during fiscal 2003 to address the performance and active lifestyle needs of the bebe customer. In November 2009, we converted all of our BEBE SPORT storefronts to PH8 and began to offer BEBE SPORT product in bebe and 2b bebe stores in the 2009 holiday season. In addition, we changed our product offering in the PH8 stores to offer a selection of casual weekend apparel, work-out attire and accessories such as bags, shoes and various seasonal items under the new PH8 label. Due to the change in storefronts and product offering, we have excluded the new PH8 stores from comparable store sales as of November 2009. As of July 3, 2010, we operated 48 PH8 stores in 15 states and Canada. In the fourth quarter of fiscal 2010, we decided to discontinue

2

operations of our PH8 division, allowing us to focus our efforts on improving bebe sales and profitability as well as continuing to develop our 2b bebe business, including the possible conversion of up to 4 current PH8 stores to 2b bebe stores. We have begun to close or convert the PH8 stores in the first fiscal quarter of 2011 and will close or convert all 48 stores during fiscal 2011.

2b bebe. As of July 3, 2010, we operated 35 2b bebe stores in 12 states, the District of Columbia and Canada, 17 of which operate within a 2b bebe store design and 18 of which operate within an outlet store design. The stores operating within the 2b bebe store design sell bebe logo, 2b bebe merchandise and a small percentage of bebe retail markdowns. The stores operating in the outlet design with the name change sell bebe logo, 2b bebe merchandise and a large percentage of bebe retail markdowns.

On-line. bebe.com is an extension of the bebe store experience and provides a complete assortment of bebe, BEBE SPORT and 2b bebe merchandise. We also use it as a vehicle to communicate with our clients.

Operating Strategy

Our objective is to satisfy the fashion needs of the modern, sexy and sophisticated woman. The principal elements of our operating strategy to achieve this objective are as follows:

1. Provide distinctive fashion throughout a broad product line. Our designers and merchandisers are inspired by global fashion trends. They interpret contemporary designs, colors and fabrications into our products to address the lifestyle needs of our customer. Our in-house design team allows us to quickly react to fashion trends, bringing newness into the merchandise mix to complement our core assortment.

2. Vertically integrate design, production, merchandising and retail functions. Our vertical integration enables us to respond quickly to changing fashion trends, reduce risk of excess inventory and produce distinctive quality merchandise.

3. Manage merchandise mix. Our approach to merchandising and proactive inventory management is critical to our success. By actively monitoring sell-through rates and the mix of categories and products in our stores, we are able to respond to emerging trends in a timely manner, better maximizing sales opportunities and minimizing liabilities.

4. Control distribution of merchandise. We distribute our merchandise, other than licensed eyewear, footwear, fragrance and color products and international licensing, through company owned retail stores and an on-line store. This distribution strategy enables us to control pricing, flow of goods, visual presentation and customer experience. We seek to ensure brand equity through this exclusive distribution.

5. Enhance brand image. We attract customers through edgy, high-impact, visual advertising campaigns using print, outdoor, in-store, direct mail and e-mail communication vehicles. We also offer a line of merchandise branded with the distinctive bebe logo to increase brand awareness.

Stores and Expansion Opportunities

Based on the current retail environment, we will continue to develop international expansion opportunities for the bebe brand and will continue to test 2b bebe stores in new and existing domestic markets. Historically when selecting a specific site, we look for high traffic locations primarily in regional shopping centers and in freestanding street locations. We evaluate proposed sites based on the traffic pattern, co-tenancies, average sales per square foot achieved by neighboring stores, lease economics, demographic characteristics and other factors considered important regarding the specific location.

3

In fiscal 2011, we plan to open 8 new stores and to relocate and expand 1 existing store. We also plan to close up to 49 stores, primarily related to the PH8 store closures discussed previously, resulting in net square footage reduction of approximately 11%.

bebe stores. During fiscal 2010, we opened 5 bebe stores and closed 3 bebe stores. Our bebe stores average 4,000 square feet and are primarily located in regional shopping malls and freestanding street locations. In addition, we operate 1 store that offers bebe accessories and limited apparel only. Our accessory store is approximately 2,300 square feet.

PH8 stores. During fiscal 2010, we opened 1 new store and closed 15 stores. Our PH8 stores average approximately 2,600 square feet and are primarily located in regional shopping malls. In the fourth quarter of fiscal 2010, we decided to discontinue operations of our PH8 division, allowing us to focus our efforts on improving bebe sales and profitability as well as continuing to develop our 2b bebe concept, including the possible conversion of up to 4 current PH8 stores to 2b bebe stores. We have begun to close or convert the PH8 stores in the first fiscal quarter of 2011 and all 48 stores will be closed or converted during fiscal 2011.

2b bebe stores. During fiscal 2010, we opened 2 new 2b bebe stores and closed one store. Our 2b bebe stores average 4,540 square feet and are primarily located in outlet malls. In fiscal 2011, we will continue to test 2b bebe stores in outlet centers and regional malls to access future growth opportunities.

Store Closures. We monitor the financial performance of our stores and have closed and will continue to close stores that we do not consider to be viable. Many of the store leases contain early termination options that allow us to close the stores in specified years if minimum sales levels are not achieved. During fiscal 2010, we closed 19 stores. In fiscal 2011, we plan to close up to 49 stores; 48 of which relate to the discontinuation of PH8 operations.

On-line store. In February 2006, we migrated to a third-party platform which has provided and continues to provide improved functionality. We recently implemented several enhancements that have improved the marketing to drive client acquisition and conversion. There are initiatives for fiscal 2011 and beyond to further enhance our shopping experience and integrate our webstore with retail stores and mobile applications. The bebe.com website is a source of testing new concepts, building a community with our clients as well as providing a comprehensive product offering. We are currently able to ship to customers in the United States, Canada, Puerto Rico, the U.S. Protectorates and internationally via our third-party provider, International Checkout.

International. As of July 3, 2010, we had 49 international stores operated by licensees in South East Asia, United Arab Emirates, Israel, Russia, Mexico and Turkey. Our international licensees purchase product from us to include in their licensed bebe stores; these stores are excluded from comparable store sales. As of July 3, 2010, wholesale revenue represented approximately 5% of total net sales. In fiscal 2011, we plan to expand from 49 to 63 licensee operated stores, which will include expansion into Qatar.

Merchandising

Our merchandising strategy is to provide current, timely fashions in a broad selection of categories to suit the lifestyle needs of our customers. We market all of our merchandise under the bebe, BEBE SPORT, PH8, bbsp and 2b bebe brand names. In some cases, we select merchandise directly from third-party manufacturers. We do not have long-term contracts with any third party-manufacturers, and we purchase all of the merchandise from manufacturers by purchase order.

Product Categories. Our distinctive product offering includes a full range of fashion separates, tops, dresses, active wear and accessories in the following lifestyle categories: career, evening, casual

4

and active. While each category's contribution as a percentage of total net sales varies seasonally, certain of the product classifications are represented throughout the year. We regularly evaluate existing categories for potential expansion opportunities. We have expanded accessories to include watches, sunglasses and an expanded shoe and handbag assortment.

In fiscal 2010, we had an eyewear license agreement in place for optical eyewear which represented less than 1% of our business in fiscal 2010. This eyewear license expired on June 30, 2010. Under the terms of this agreement, the licensee manufactured and distributed products branded with the bebe logo to be sold at bebe stores and selected retailers. In August 2010, we signed a new eyewear license agreement with Altair Eyewear, Inc., a subsidiary of Marchon, to manufacture and distribute products branded with the bebe logo to be sold at bebe stores and selected retailers. We expect product under this agreement to be featured in stores and other select retailers beginning in October 2010. In July 2008, we executed an agreement with Inter Parfums, Inc. to design, develop, manufacture, distribute, advertise and promote fragrance and color products using the bebe name. Product was available in our stores and other select retailers beginning in August 2009. In August 2009, we signed an agreement with Titan Industries to design, manufacture and distribute women's non-casual footwear. Products developed under this agreement were featured in stores and other select retailers in Spring 2010. In February 2009, we signed an agreement with Accessory Network Group to design, manufacture and distribute women's handbags and small leather goods. Products developed under this agreement are expected to be available in stores and other select retailers starting September 2010.

Product Development. Our product development process enables our merchants to make informed and timely decisions prior to making fabric or merchandise purchase commitments. Our speed to market strategy allows us to quickly react to emerging fashion trends and customer demand. An established timeline ensures an adequate flow of inventory into the stores. We make monthly commitments based on current sales and fashion trends. A detailed merchandising classification plan supports the product development process and includes sales, inventory and profitability targets. We regularly adjust the plan to meet inventory and sales targets.

Seasonality

Our business is seasonal in nature, with sales peaking during the second fiscal quarter, primarily during the holiday season in November and December. During fiscal 2010, 2009 and 2008, the second fiscal quarter accounted for approximately 30% of our net sales.

Marketing

We have developed our advertising and direct marketing initiatives to elevate brand awareness, increase customer acquisition and retention and support key growth strategies.

During fiscal 2010, our marketing expenditures were $23.9 million compared to $27.5 million in fiscal 2009. In fiscal 2011, we will reduce the spend in marketing overall with the exception of bebe.com eAdvertising and anticipate marketing expense to be approximately $24 million.

We continue to build brand awareness through targeted advertising campaigns that maintain a focus on core customers while adding new image building media strategies to further elevate the brand to "attainable luxury" status.

From time to time we will use an outside advertising agency to create edgy, high-impact, provocative ads which may be featured in leading fashion and lifestyle magazines. The images are also used for outdoor advertising, catalog, in-store visual presentation and on our website, bebe.com. We plan to continue to establish business relationships with models and celebrities who best represent the bebe brand image.

5

Our semi-annual collection preview events, where clients are invited to preview the latest collections, will be continued at lowered strategic importance in our stores. Additionally, we schedule events throughout the year in partnership with national and regional magazines to benefit non-profit organizations.

Store Operations

As of September 2010, our store operations are organized into four regions and 32 districts. Each region is managed by a zone or regional director, and each district is managed by a district manager. Our zone director is responsible for two regions, each regional director is typically responsible for six to ten districts and each district manager is typically responsible for seven to fifteen stores. Each store is typically staffed with three to five managers in addition to sales associates.

We seek to instill enthusiasm and dedication in our store management personnel and our sales associates through incentive programs and regular communication with the stores. Sales associates, excluding associates in outlet stores, receive commissions on sales with a guaranteed minimum hourly compensation. Store managers receive base compensation plus incentive compensation based on sales and inventory control. Our district managers receive base compensation plus incentive compensation based on sales and profitability benchmarks. Our regional managers and zone director participate in our management incentive program.

Sourcing, Quality Control and Distribution

All of our merchandise is marketed under the bebe, BEBE SPORT, PH8, bbsp and 2b bebe brand names. We design and develop the majority of our merchandise in-house, which is manufactured to our specifications or is sourced directly from third-party manufacturers. When we contract for merchandise production, the contractors produce garments based on designs, patterns and detailed specifications provided by us.

We use computer aided design systems to develop patterns and production markers as part of our product development process. We fit test sample garments before production to ensure patterns are accurate. We adhere to a strict formalized quality control program. Garments that do not pass inspection are returned to the manufacturer for rework or accepted at reduced prices for sale in our outlet stores.

The majority of our merchandise is received, inspected, processed, warehoused and distributed through our distribution center located in Benicia, California. Details about each receipt are supplied to merchandise planners who determine how the product should be distributed among the stores, based on current inventory levels, sales trends and specific product characteristics. Advance shipping notices are electronically communicated to the stores and any goods not shipped are stored for replenishment purposes. Merchandise typically is shipped to the stores two times per week using common carriers.

Competition

The retail and apparel industries are highly competitive and are characterized by low barriers to entry. We expect competition in our markets to increase. The primary competitive factors in our markets are: brand name recognition, product styling, product quality, product presentation, product pricing, store ambiance, customer service and convenience.

Intellectual Property and Proprietary Rights

We have registrations, or applications have been filed and are pending, with the United States Patent and Trademark Office ("USPTO") and/or with certain foreign registries in many of our core

6

classifications (including stores, clothing, jewelry, eyewear, fragrance and bags) for the following marks: bebe, BEBE SPORT, bbsp, 2b bebe and PH8.

Information Services and Technology

We are committed to utilizing technology to enhance our competitive position. Our information systems provide data to the entire enterprise to help improve efficiency, visibility, and actionable decision making. The core business systems, which consist of both purchased and internally developed software, are accessed over a company-wide network providing employees with access to key business applications.

Our investments in information systems for fiscal 2010 continued to focus on our stores, supply chain, central corporate systems and infrastructure. We completed the roll out of a new point of sale ("POS") system to all stores that has resulted in significant efficiency improvements for our stores and corporate offices. We also completed improvements in merchandise ordering and planning processes by fully integrating our supply chain system. In fiscal 2011, we will continue to make improvements to our POS system, improve our inventory optimization capability across channels and increase our collaboration capabilities and integration with our global vendors to deliver further efficiencies to our supply chain.

For central corporate systems, we delivered a new VoIP phone system, a new helpdesk system, made progress on our paperless efforts, delivered further efficiencies to our finance group and improved our disaster recovery capabilities.

Employees

As of July 3, 2010, we had 3,772 employees, of whom 367 were employed at the corporate offices in Brisbane, the Los Angeles design studio and production facility and Benicia distribution center. The remaining 3,405 employees were employed in store operations. There were 1,398 full-time employees and 2,374 employed on a part-time basis. This is a decrease of approximately 5% as compared to the prior fiscal year end. In addition, our employees are not represented by any labor union, and we believe our relationship with our employees is good.

Available Information

We make available on our website, www.bebe.com, under "Investor Relations," free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the U.S. Securities and Exchange Commission ("SEC").

Our Code of Business Conduct and Ethics, Policy for Reporting Violations and Complaints, Corporate Governance Principles and Practices for the Board of Directors, and Board of Directors' Committee Charters are also available on our website, under "Corporate Governance."

7

EXECUTIVE OFFICERS AND DIRECTORS OF THE REGISTRANT

Executive Officers and Directors

The following table sets forth certain information with respect to our executive officers and directors as of September 1, 2010:

Name

|

Age | Position | |||

|---|---|---|---|---|---|

| Manny Mashouf(1) | 72 | Chairman of the Board and Chief Executive Officer | |||

| Barbara Bass(3)*(4) | 59 | Director | |||

| Cynthia Cohen(2)(3)(4)* | 57 | Director | |||

| Corrado Federico(2)(3)(4) | 69 | Director | |||

| Caden Wang(2)*(4) | 58 | Director | |||

| Emilia Fabricant(1) | 44 | President of bebe stores, inc. | |||

| Walter Parks(1) | 51 | Chief Operating Officer and Chief Financial Officer | |||

| Kathleen Fong-Lee(1) | 60 | Chief Merchandising Officer | |||

| Susan Powers(1) | 52 | Senior Vice President of Stores | |||

| Lawrence Smith(1) | 44 | Senior Vice President, General Counsel | |||

| Liyuan Woo(1) | 38 | Principal Accounting Officer and Vice President Corporate Controller | |||

- (1)

- Executive

Officer.

- (2)

- Member,

Audit Committee.

- (3)

- Member,

Compensation and Management Development Committee.

- (4)

- Member,

Nominating and Corporate Governance Committee.

- (*)

- Chairman of the Committee

Manny Mashouf founded bebe stores, inc. and has served as Chairman of the Board since our incorporation in 1976. Mr. Mashouf served as our Chief Executive Officer from 1976 to February 2004 and again from January 2009 to present. Mr. Mashouf is the uncle of Hamid Mashouf, Vice President of Information Systems and Technology.

Barbara Bass has served as a director since February 1997. Ms. Bass also currently serves on the boards of directors of Starbucks Corporation and DFS Group Limited. Since 1993, Ms. Bass has served as the President of the Gerson Bakar Foundation and is the Chief Executive Officer of the Achieve Foundation. From 1989 to 1992, Ms. Bass served as President and Chief Executive Officer of the Emporium Weinstock Division of Carter Hawley Hale Stores, Inc., a department store chain.

Cynthia R. Cohen has served as a director since December 2003 and Lead Independent Director since January 2009. She also currently serves on the boards of directors of Steiner Leisure Ltd. and Equity One, Inc., as well as several privately held companies. Ms. Cohen serves on the Executive Advisory Board for the Center for Retailing Education and Research at the University of Florida and is founder and President of Strategic Mindshare, a strategy consulting firm. Prior to founding Strategic Mindshare in 1990, she was a Partner in Management Consulting with Deloitte & Touche LLP.

Corrado Federico has served as a director since November 1996. From approximately 1997 through 2008, Mr. Federico served on the Board of Directors for Hot Topic, a publicly traded company. Mr. Federico was President of Solaris Properties until December 2008 and has served as the President of Corado, Inc., a land development firm, since 1991. From 1986 to 1991, Mr. Federico held the position of President and Chief Executive Officer of Esprit de Corp, Inc., a wholesaler and retailer of junior and children's apparel, footwear and accessories.

8

Caden Wang has served as a director since October 2003. Since 2005, Mr. Wang has also served on the board of directors of Leapfrog Enterprises, Inc. From 1999 to 2001, Mr. Wang served as Executive Vice President and Chief Financial Officer of LVMH Selective Retailing Group, which included international retail holdings such as DFS, Sephora and Miami Cruiseline Services. Mr. Wang previously served on the board of directors of Fossil, Inc. and as Chief Financial Officer for travel retailer DFS and retail companies Gumps and Cost Plus.

Emilia Fabricant joined bebe in August 2010 and currently serves as President, bebe stores, inc. From May to August 2010, Ms. Fabricant served as President of Destination Maternity Corporation. Ms. Fabricant served as President and Chief Merchandising Officer at Charlotte Russe from November 2008 to October 2009. From March 2007 to November 2008, Ms. Fabricant served as President of babystyle. From 2001 until 2007, Ms. Fabricant served as Founder and Chief Executive Officer of Cadeau Maternity. From 2000 to 2001, Ms. Fabricant served as President, Sales and Product Development at Katayone Adeli. From 1998 to 2000 Ms. Fabricant served as Senior Vice President, Divisional Merchandise Manager for Barneys New York, and in various other positions since joining that company in 1990.

Walter Parks has served as Chief Operating Officer since September 2006 and Chief Financial Officer since December 2003. From 2001 to 2003, Mr. Parks served as Executive Vice President and Chief Administrative Officer of Wet Seal, Inc. From 1999 to 2001, Mr. Parks served as the Executive Vice President and Chief Administrative Officer of Restoration Hardware, Inc. From 1997 to 1999, Mr. Parks served as Chief Financial Officer and Treasurer for Ann Taylor Stores Corporation, and in various other positions since joining that company in 1988.

Kathleen Fong-Lee has served as Chief Merchandising Officer since June 2009. From January 2007 to June 2009, Ms. Fong-Lee served as Senior Vice President of Merchandising at Forever 21. During 2006, Ms. Fong-Lee served as a consultant for various retailers. Ms. Fong-Lee served as Vice President of Merchandising for Gymboree Corporation from 2003 to 2005 and as General Merchandising Manager at bebe Stores, Inc. from 2000 to 2003.

Susan Powers has served as Senior Vice President of Stores since April 2007. From 2005 to 2007, Ms. Powers served as Vice President of Store Operations for Chico's FAS, Inc. From 2002 to 2005, Ms. Powers served as Vice President of Stores for The Wet Seal, Inc. From 1999 to 2002, Ms. Powers served as Vice President of Stores for BCBG Max Azria.

Lawrence Smith has served as Senior Vice President, General Counsel since August 2009 and as Vice President, General Counsel since October 2004. Prior to joining bebe stores, inc., Mr. Smith served as Vice President, General Counsel for The Wet Seal, Inc. from January 2002 to October 2004. From January 1996 to January 2002, Mr. Smith served as Vice President, General Counsel for BCBG Max Azria.

Liyuan Woo joined bebe in August 2010 and currently serves as Principal Accounting Officer and Vice President Corporate Controller. Prior to joining bebe, Ms. Woo held a Senior Manager position with the accounting firm Deloitte & Touche, LLP in its M&A Transaction Services Group from October 2004 through July 2010. Ms. Woo is a Certified Public Accountant.

9

Our past performance may not be a reliable indicator of future performance because actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed below. In addition, historical trends should not be used to anticipate results or trends in future periods.

Factors that might cause our actual results to differ materially from the forward-looking statements discussed elsewhere in this report, as well as affect our ability to achieve our financial and other goals, include, but are not limited to, the following:

1. General economic conditions, including increases in energy and commodity prices, that are largely out of our control may adversely affect our financial condition and results of operations. We are sensitive to changes in general economic conditions, both nationally and locally. Recessionary economic cycles, higher interest rates, higher fuel and other energy costs, inflation, deflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could adversely affect the demand for products we sell in our stores. In addition, the recent turmoil in the financial markets may have an adverse effect on the U.S. and world economy, which could negatively impact consumer spending patterns. We cannot assure you that government responses to the disruptions in the financial markets will restore consumer confidence.

Furthermore, we could experience reduced traffic in our stores or limitations on the prices we can charge for our products, either of which could reduce our sales and profit margins and have a material adverse effect on our financial condition and results of operations. Also, economic factors such as those listed above and increased transportation costs, inflation, higher costs of labor, insurance and healthcare, and changes in other laws and regulations may increase our cost of sales and our operating, selling, general and administrative expenses, and otherwise adversely affect our financial condition and results of operations.

2. We face significant competition in the retail and apparel industry, which could harm our sales and profitability. The retail and apparel industries are highly competitive and are characterized by low barriers to entry. We expect competition in our markets to increase. The primary competitive factors in our markets are: brand name recognition, sourcing, product styling, quality, presentation and pricing, timeliness of product development and delivery, store ambiance, customer service and convenience. We compete with traditional department stores, specialty store retailers, lower price point retailers, business to consumer websites, off-price retailers and direct marketers for, among other things, raw materials, market share, retail space, finished goods, sourcing and personnel. Because many of these competitors are larger and have substantially greater financial, distribution and marketing resources than we do or maintain comparatively lower cost of operations, we may lack the resources to adequately compete with them. If we fail to remain competitive in any way, it could harm our business, financial condition and results of operations.

3. The success of our business depends in large part on our ability to identify fashion trends as well as to react to changing customer demand in a timely manner. Consequently, we depend in part upon the customer response to the creative efforts of our merchandising, design and marketing teams and their ability to anticipate trends and fashions that will appeal to our consumer base. If we miscalculate our customers' product preferences or the demand for our products, we may be faced with excess inventory. Historically, this type of occurrence has resulted in excess fabric for some products and markdowns and/or write-offs, which has impaired our profitability, and may do so in the future. Similarly, any failure on our part to anticipate, identify and respond effectively to changing customer demands and fashion trends will adversely affect our sales. In addition, from time to time, we may pursue new concepts, and if the new concepts are not successful, our financial condition may be harmed.

10

4. We cannot assure that future store openings will be successful and new store openings may impact existing stores. We expect to open approximately 8 stores in fiscal 2011. In the past, we have closed stores as a result of poor performance, and we cannot assure that the stores that we plan to open in fiscal 2011, or any other stores that we might open in the future, will be successful or that our overall operating profit will increase as a result of opening these stores. During fiscal 2010, we closed 19 stores, and during fiscal 2011, we anticipate closing up to 49 stores, primarily related to the PH8 store closures discussed previously. Most of our new store openings in fiscal 2011 will be in existing markets. These openings may affect the existing stores' net sales and profitability. Our failure to predict accurately the demographic or retail environment at any future store location could have a material adverse effect on our business, financial condition and results of operations.

Our ability to effectively obtain real estate to open new stores depends upon the availability of real estate that meets our criteria, including traffic, square footage, co-tenancies, average sales per square foot, lease economics, demographics, and other factors, and our ability to negotiate terms that meet our financial targets. In addition, we must be able to effectively renew our existing store leases. Failure to secure real estate locations adequate to meet annual targets as well as effectively managing the profitability of our existing fleet of stores could have a material adverse effect on our business, financial condition and results of operations.

5. Our sales, margins and operating results are subject to seasonal and quarterly fluctuations. Our business varies with general seasonal trends that are characteristic of the retail and apparel industries, such as the timing of seasonal wholesale shipments and other events affecting retail sales. As a result, our stores typically generate a higher percentage of our annual net sales and profitability in the second quarter of our fiscal year (which includes the holiday selling season) compared to other quarters.

In addition, our comparable store sales have fluctuated significantly in the past, and we expect that they will continue to fluctuate in the future. A variety of factors affect comparable store sales, including fashion trends, competition, current economic conditions, the timing of release of new merchandise and promotional events, changes in our merchandise mix, the success of marketing programs and weather conditions. Our ability to deliver strong comparable store sales results and margins depends in large part on accurately forecasting demand and fashion trends, selecting effective marketing techniques, providing an appropriate mix of merchandise for our customer base, managing inventory effectively, and optimizing store performance by closing under-performing stores.

Such fluctuations may adversely affect the market price of our common stock.

6. We may be required to record losses in future quarters as a result of the decline in value of our investments in auction rates securities or as a result of a change in our ability to hold our investments in auction rate securities. We hold a variety of interest bearing ARS comprised of federally insured student loan backed securities and insured municipal authority bonds. These ARS investments are intended to provide liquidity via an auction process that resets the applicable interest rate at predetermined calendar intervals, allowing investors to either roll over their holdings or gain immediate liquidity by selling such interests at par. The recent uncertainties in the credit markets that began in February 2008 have affected our holdings in ARS investments and the majority of auctions for our investments in these securities have failed to settle on their respective settlement dates. Consequently, $95.6 million of our ARS are not currently liquid and we will not be able to access these funds until a future auction of these investments is successful or securities are purchased or redeemed outside of the auction process. Maturity dates for these ARS investments range from 2012 to 2044, with principal distributions occurring on certain securities prior to maturity.

The valuation of our investment portfolio is subject to uncertainties that are difficult to predict. Factors that may impact its valuation include changes to credit ratings of the securities as well as to the underlying assets supporting those securities, rates of default of the underlying assets, underlying

11

collateral value, discount rates and ongoing strength and quality of market credit and liquidity. If the current market conditions deteriorate further, or the anticipated recovery in market values does not occur, we may be required to record additional losses in other comprehensive income or losses in net income in future quarters.

7. Our success depends on our ability to attract and retain key employees in order to support our existing businesses and future expansion. From time to time we actively recruit qualified candidates to fill key executive positions from within our company. There is substantial competition for experienced personnel, which we expect will continue. We compete for experienced personnel with companies who have greater financial resources than we do. In the past, we have experienced significant turnover of our executive management team and retail store personnel. We are also exposed to employment practice litigation due to the large number of employees and high turnover of our sales associates. If we fail to attract, motivate and retain qualified personnel, it could harm our business and limit our ability to expand.

In addition, we depend upon the expertise and execution of our key employees, particularly: Manny Mashouf, our founder, Chief Executive Officer and Chairman of the Board of Directors; Emilia Fabricant, President; and Kathleen Fong-Lee, Chief Merchandising Officer. If we lose the services of Mr. Mashouf , Ms. Fabricant, Ms. Fong-Lee, or any key officers or employees, it could harm our business and results of operations.

8. Because Manny Mashouf beneficially owns a substantial portion of the outstanding shares, other shareholders may not be able to influence the direction the company takes. As of August 31, 2010, Manny Mashouf, our Chief Executive Officer and Chairman of the Board, beneficially owned approximately 53% of the outstanding shares of our common stock. As a result, he can control the election of directors and the outcome of all issues submitted to the shareholders. This may make it more difficult for a third party to acquire shares, may discourage acquisition bids, and could limit the price that certain investors might be willing to pay for shares of common stock. This concentration of stock ownership may have the effect of delaying, deferring or preventing a change in control of our company.

9. We rely on information technology, the disruption of which could adversely impact our business. We rely on various information systems to manage our operations and regularly make investments to upgrade, enhance or replace such systems. Any delays or difficulties in transitioning to these or other new systems, or in integrating these systems with our current systems, or any other disruptions affecting our information systems, could have a material adverse impact on our business. Any failure to maintain adequate system security controls to protect our computer assets and sensitive data, including client data, from unauthorized access, disclosure or use could also damage our reputation with our clients.

10. We are subject to risks associated with our on-line sales. We operate an on-line store at www.bebe.com to sell our merchandise, which we migrated to a third-party platform in February 2006. Although our on-line sales encompass a relatively small percentage of our total sales, our on-line operations are subject to numerous risks, including unanticipated operating problems, reliance on third-party computer hardware and software providers, system failures and the need to invest in additional computer systems. The on-line operations also involve other risks that could have an impact on our results of operations including but not limited to diversion of sales from our other stores, rapid technological change, liability for on-line content, credit card fraud and risks related to the failure of the computer systems that operate the website and its related support systems. In addition, with the migration to a third-party platform, we no longer have direct control of certain aspects of our on-line business. We cannot assure that our on-line store will continue to achieve sales and profitability growth or even remain at its current level.

12

11. Any serious disruption at our major facilities could have a harmful effect on our business. We currently operate a corporate office in Brisbane, California, a distribution facility in Benicia, California, and a design studio and production facility in Los Angeles, California. Any serious disruption at these facilities whether due to construction, relocation, fire, earthquake, terrorist acts or otherwise could harm our operations and could negatively affect our business and results of operations. Furthermore, we have little experience operating essential functions away from our main corporate offices and are uncertain what effect operating such satellite facilities might have on business, personnel and results of operations.

12. If we are unable to obtain raw materials or unable to find manufacturing facilities or our manufacturers perform unacceptably, our sales may be negatively affected and our financial condition may be harmed. We do not own any manufacturing facilities and therefore depend on contractors and third parties to manufacture our products. We place all of our orders for production of merchandise and raw materials by purchase order and do not have any long-term contracts with any manufacturer or supplier. If we fail to maintain favorable relationships with our manufacturers and suppliers or are unable to obtain sufficient quantities of quality raw materials on commercially reasonable terms, it could harm our business and results of operations. We cannot assure you that contractors and third-party manufacturers (1) will not supply similar products to our competitors, (2) will not stop supplying products to us completely or (3) will supply products in a timely manner. Untimely receipt of products may result in lower than anticipated sales and markdowns which would have a negative impact on earnings. Furthermore, we have received in the past, and may receive in the future, shipments of products from manufacturers that fail to conform to our quality control standards. In such event, unless we are able to obtain replacement products in a timely manner, we may lose sales. Certain of our third-party manufacturers store our raw materials. In the event our inventory was damaged or destroyed and we were unable to obtain replacement raw materials, our earnings could be negatively impacted.

13. Our business could be adversely impacted by unfavorable international political conditions. Due to our international operations, our sales and operating results are, and will continue to be, affected by international social, political, legal and economic conditions. In particular, our business could be adversely impacted by instability or changes resulting in the disruption of trade with the countries in which our contractors, suppliers or customers are located, significant fluctuations in the value of the dollar against foreign currencies or restrictions on the transfer of funds, or additional trade restrictions imposed by the United States and other foreign governments. Trade restrictions, including increased tariffs or quotas, embargoes and customs restrictions could increase the cost or reduce the supply of merchandise available to us and adversely affect our financial condition and results of operations. In addition, we purchase a substantial amount of our raw materials from China and our business and operating results may be affected by changes in the political, social or economic environment in China.

14. If we are not able to protect our intellectual property our ability to capitalize on the value of our brand name may be impaired. Even though we take actions to establish, register and protect our trademarks and other proprietary rights, we cannot assure you that we will be successful or that others will not imitate our products or infringe upon our intellectual property rights. In addition, we cannot assure that others will not resist or seek to block the sale of our products as infringements of their trademark and proprietary rights.

We are seeking to register our trademarks domestically and internationally. Obstacles may exist that may prevent us from obtaining a trademark for the bebe, BEBE SPORT, bbsp, 2b bebe and PH8 names or related names. We may not be able to register certain trademarks, purchase the right or obtain a license to use these names or related names on commercially reasonable terms. If we fail to obtain trademark, ownership or license the requisite rights, it would limit our ability to expand. In some jurisdictions, despite successful registration of our trademarks, third parties may allege

13

infringement and bring actions against us. In addition, if our licensees fail to use our intellectual property correctly, the reputation and value associated with our trademarks may be diluted. Furthermore, if we do not demonstrate use of our trademarks, our trademark rights may lapse over time.

15. If an independent manufacturer violates labor or other laws, or is accused of violating any such laws, or if their labor practices diverge from those generally accepted as ethical, it could harm our business and brand image. While we maintain a policy to monitor the operations of our independent manufacturers by having an independent firm inspect these manufacturing sites, and all manufacturers are contractually required to comply with such labor practices, we cannot control the actions or the public's perceptions of such manufacturers, nor can we assure that these manufacturers will conduct their businesses using ethical or legal labor practices. Apparel companies, in certain conditions, may be held jointly liable for the wrongdoings of the manufacturers of their products. While we do not control our manufacturers' employment conditions or business practices, and the manufacturers act in their own interest, they may act in a manner that results in negative public perceptions of us and/or employee allegations or court determinations that we are jointly liable.

16. Failure to comply with Section 404 of the Sarbanes-Oxley Act of 2002 could negatively impact investor confidence. In order to meet the requirements of the Sarbanes-Oxley Act of 2002 in future periods, we must continuously document, test, monitor and enhance our internal control over financial reporting. We cannot assure that the periodic evaluation of our internal controls required by Section 404 of the Sarbanes-Oxley Act will not result in the identification of significant control deficiencies and/or material weaknesses. Failure to maintain the effectiveness of our internal control over financial reporting or to comply with the requirements of this Act could have a material adverse effect on our reputation, financial condition and market price of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

As of July 3, 2010, our 297 stores, all of which are leased, encompassed approximately 1,130,000 total square feet. The typical store lease is for a 10-year term and requires us to pay a base rent and a percentage rent if certain minimum sales levels are achieved. Many of the leases provide a lease termination option in specified years of the lease if certain minimum sales levels are not achieved. In addition, leases for store locations typically require us to pay property taxes, utilities, repairs and common area maintenance fees. Associated with our decision to discontinue our PH8 operations, beginning in the first quarter of fiscal 2011 we plan to close or convert our 48 PH8 stores which will result in a decrease in square footage of approximately 123,000 total square feet, or 11%.

Our main corporate headquarters are currently located in a facility in Brisbane, California. The Brisbane facility is approximately 35,000 square feet and houses administrative offices, planning operations and store support services. The lease expires in April 2014. We also lease a 144,000 square foot distribution center in Benicia, California. The lease expires in April 2013. In fiscal 2004, we acquired a 50,000 square foot design studio and production facility in Los Angeles, California that houses our design, merchandising and production activities. In December 2008 we acquired two condominium units in Los Angeles, California for use as short-term executive accommodations with a total approximate square footage of 3,400.

14

As of the date of this filing, we are involved in ongoing legal proceedings as described below.

A former employee sued us in a complaint filed July 27, 2006 in the Superior Court of California, San Mateo County (case No. CIV 456550) alleging a failure to pay all wages, failure to pay overtime wages, failure to pay minimum wages, failure to provide meal periods, violation of Labor Code §450, violation of Labor Code §2802 and California Code of Regulations §11040(9)(A), statutory wage violations (late payment of wages), unlawful business practices under Business and Professions Code §16720 and §17200, conversion of wages and violation of Civil Code §52.1. The plaintiff purports to bring the action also on behalf of current and former California bebe employees who are similarly situated. The lawsuit seeks compensatory, statutory, punitive, restitution and injunctive relief. The Court's previous stay has been lifted, discovery has commenced and a status conference is set for November 15, 2010.

We are also involved in various other legal proceedings arising in the normal course of business. None of these matters nor the matter listed above are expected, individually or in the aggregate, to have a material adverse effect on our business, financial condition or results of operations.

bebe intends to defend itself vigorously against each of these claims. However, the results of any litigation are inherently uncertain. bebe cannot assure you that it will be able to successfully defend itself in these lawsuits. Where required, and/or otherwise appropriate, we have recorded an estimate of potential liabilities that we believe is reasonable. Any estimates are revised as further information becomes available.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of our shareholders during the fourth quarter of fiscal 2010.

15

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the Nasdaq National Market under the symbol "BEBE." The following table sets forth the high and low sales prices of our common stock for each quarterly period within the two years ended July 3, 2010, as reported by Nasdaq:

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

Fiscal 2009 |

|||||||

First Quarter |

$ | 11.26 | $ | 8.56 | |||

Second Quarter |

9.07 | 4.57 | |||||

Third Quarter |

7.59 | 4.59 | |||||

Fourth Quarter |

9.50 | 6.40 | |||||

Fiscal 2010 |

|||||||

First Quarter |

$ | 8.65 | $ | 5.69 | |||

Second Quarter |

7.50 | 5.30 | |||||

Third Quarter |

9.66 | 5.92 | |||||

Fourth Quarter |

10.05 | 6.10 | |||||

In October 2008, our board of directors authorized a program to repurchase up to $30 million of our common stock. We intend, from time to time, as business conditions warrant, to purchase stock in the open market or through private transactions. Purchases may be increased, decreased or discontinued at any time without prior notice. The plan does not obligate us to purchase any specific number of shares and may be suspended at any time at management's discretion. In fiscal 2010 we repurchased approximately 0.7 million shares at an average price per share of $5.80 for an aggregate purchase price of $4.2 million. In the first fiscal quarter of 2011 we repurchased approximately 2.1 million shares at an average price per share of $5.84 and as of August 31, 2010 we had completed the maximum amount of repurchases approved under the plan.

As of August 31, 2010, the number of holders of record of our common stock was 79 and the number of beneficial holders of our common stock was approximately 8,000.

Declaration and payment of dividends is within the sole discretion of our Board of Directors, subject to limitations imposed by California law and compliance with our credit agreements and will depend on our earnings, capital requirements, financial condition and such other factors as the Board of Directors deems relevant. During fiscal 2009, we declared four quarterly dividends of $0.05 each per common share. During the first three quarters of fiscal 2010 we declared quarterly dividends of $0.025 each per common share. In the fourth quarter of fiscal 2010 we declared a dividend of $1.00 per common share.

16

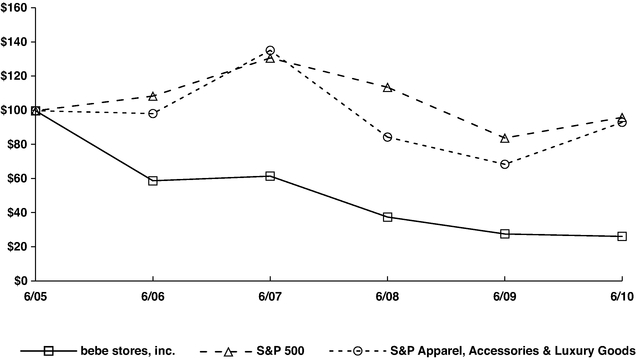

Stock Performance Graph

The graph below compares the percentage changes in our cumulative total shareholder return on our common stock for the five-year period ended July 3, 2010, with (i) the cumulative total return of the S & P 500 Index ("S & P 500") and (ii) the S & P Apparel, Accessories & Luxury Goods Index. The total shareholder return for our common stock assumes quarterly reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among bebe stores, inc., the S&P 500 Index

and the S&P Apparel, Accessories & Luxury Goods Index

- *

- $100

invested on 6/30/05 in stock or index, including reinvestment of dividends.

Fiscal year ending June 30.

Copyright© 2010 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

17

ITEM 6. SELECTED FINANCIAL DATA

Selected Financial and Operating Data

The following selected financial data is qualified by reference to, and should be read in conjunction with, our Consolidated Financial Statements and related Notes thereto and the other financial information appearing elsewhere in this report. These historical results are not necessarily indicative of results to be expected in the future.

| |

Fiscal Year Ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

July 3, 2010 |

July 4, 2009 |

July 5, 2008 |

July 7, 2007 |

July 1, 2006 |

||||||||||||

| |

(Dollars in thousands, except per share data) |

||||||||||||||||

Operating Results: |

|||||||||||||||||

Net sales |

$ | 508,968 | $ | 602,998 | $ | 687,622 | $ | 670,912 | $ | 579,073 | |||||||

Cost of sales, including production and occupancy |

311,061 | 359,805 | 372,209 | 349,095 | 292,592 | ||||||||||||

Gross margin |

197,907 | 243,193 | 315,413 | 321,817 | 286,481 | ||||||||||||

Selling, general and administrative expenses(1) |

209,012 | 233,309 | 236,044 | 216,560 | 181,986 | ||||||||||||

Income (loss) from operations |

(11,105 | ) | 9,884 | 79,369 | 105,257 | 104,495 | |||||||||||

Interest and other income, net |

3,158 | 6,672 | 16,396 | 13,120 | 10,408 | ||||||||||||

Income (loss) before income taxes |

(7,947 | ) | 16,556 | 95,765 | 118,377 | 114,903 | |||||||||||

Provision (benefit) for income taxes |

(2,782 | ) | 3,921 | 32,685 | 41,099 | 41,096 | |||||||||||

Net income (loss) |

$ | (5,165 | ) | $ | 12,635 | $ | 63,080 | $ | 77,278 | $ | 73,807 | ||||||

Basic income (loss) per share |

$ | (0.06 | ) | $ | 0.14 | $ | 0.70 | $ | 0.83 | $ | 0.81 | ||||||

Diluted income (loss) per share |

$ | (0.06 | ) | $ | 0.14 | $ | 0.69 | $ | 0.81 | $ | 0.79 | ||||||

Basic weighted average shares outstanding |

86,408 | 87,949 | 89,783 | 92,810 | 91,373 | ||||||||||||

Diluted weighted average shares outstanding |

86,408 | 88,179 | 91,089 | 94,973 | 93,795 | ||||||||||||

Statistics: |

|||||||||||||||||

Number of stores: |

|||||||||||||||||

Opened during period |

8 | 13 | 35 | 36 | 31 | ||||||||||||

Closed during the period |

19 | 8 | 5 | 5 | 3 | ||||||||||||

Open at end of period |

297 | 308 | 303 | 273 | 242 | ||||||||||||

Net sales per average store(2) |

$ | 1,580 | $ | 1,880 | $ | 2,344 | $ | 2,417 | $ | 2,437 | |||||||

Comparable store sales increase (decrease)(3) |

(17.1 | )% | (20.9 | )% | (7.6 | )% | 2.9 | % | 6.1 | % | |||||||

18

| |

As of | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

July 3, 2010 |

July 4, 2009 |

July 5, 2008 |

July 7, 2007 |

July 1, 2006 |

|||||||||||

| |

(Dollars in thousands, except per share data) |

|||||||||||||||

Balance Sheet Data: |

||||||||||||||||

Working capital |

$ | 178,479 | $ | 234,184 | $ | 137,381 | $ | 403,612 | $ | 330,269 | ||||||

Total assets |

551,893 | 571,455 | 597,763 | 607,028 | 500,909 | |||||||||||

Long-term debt, including current portion |

— | — | — | 260 | 509 | |||||||||||

Shareholders' equity |

369,055 | 459,495 | 485,885 | 504,590 | 408,224 | |||||||||||

Dividends declared per common share |

$ | 1.08 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.17 | ||||||

- (1)

- Net

of impairment charges for store assets of $8.0 million, $7.3 million, $0.8 million, $0 and $0.1 million in fiscal 2010,

2009, 2008, 2007 and 2006, respectively.

- (2)

- Based

on the sum of average monthly sales for the period.

- (3)

- Comparable store sales are calculated by including the net sales of stores that have been open at least one year. Therefore, a store is included in the comparable store sales base beginning with its thirteenth month. Stores that have been expanded or remodeled by 15 percent or more or have been permanently relocated are excluded from the comparable store sales base. In addition, comparable store sales are calculated using a same day sales comparison. On-line and international licensee store sales are not included in the comparable store sales calculation. Due to the change in storefronts and product offering, PH8 stores have been excluded from comparable store sales as of their open date in November of fiscal 2010.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the Consolidated Financial Statements and related Notes thereto included elsewhere in this report. The following Management's Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risks Factors" under Item 1A of this report.

Overview

We design, develop and produce a distinctive line of contemporary women's apparel and accessories under the bebe, BEBE SPORT, bbsp, PH8 and 2b bebe brand names. We operate stores in the United States, Puerto Rico, Virgin Islands and Canada. In addition we have an on-line store at www.bebe.com that ships to customers in the United States, Canada, Puerto Rico, the U.S. Protectorates and internationally via our third party provider, International Checkout. We also have international stores operated by licensees in South East Asia, United Arab Emirates, Israel, Russia, Mexico and Turkey. Our distinctive product offering includes a full range of separates, tops, dresses, active wear and accessories in the following lifestyle categories: career, evening, casual and active. We design and develop the majority of our merchandise in-house, which is manufactured to our specifications. The remainder is sourced directly from third-party manufacturers.

Fiscal 2010 financial highlights include the following:

- •

- Net sales for fiscal 2010 were $509.0 million, down 15.6% from $603.0 million for fiscal 2009. Comparable store sales for fiscal 2010 decreased 17.1% compared to a decrease of 20.9% in the previous fiscal year.

19

- •

- Gross margin for fiscal 2010 was 38.9% compared to 40.3% for fiscal 2009.

- •

- Selling, general and administrative expenses for the 2010 fiscal year were $209.0 million, down 10.4% from

$233.3 million for fiscal 2009.

- •

- Net loss for the fiscal year ended July 3, 2010 was $5.2 million, or a net loss of $0.06 per share on a

diluted basis, compared to net income of $12.6 million, or $0.14 per share on a diluted basis in the prior year.

- •

- Cash increased by $103.3 million during fiscal 2010, up from a decrease of $33.0 million for fiscal 2009.

Critical Accounting Policies

Management's Discussion and Analysis of Financial Condition and Results of Operations are based upon our consolidated financial statements, which have been prepared in conformity with accounting principles generally accepted in the United States of America.

The preparation of these financial statements requires the appropriate application of certain accounting policies, many of which require us to make estimates and assumptions about future events and their impact on amounts reported in our financial statements and related notes. Since future events and their impact cannot be determined with certainty, the actual results will inevitably differ from our estimates. Such differences could be material to the financial statements. We believe our application of accounting policies, and the estimates inherently required therein, are reasonable. These accounting policies and estimates are constantly reevaluated, and adjustments are made when facts and circumstances dictate a change. Our accounting policies are more fully described in Note 1 to our financial statements included in this report.

We have identified certain critical accounting policies, which are described below.

Revenue recognition. We recognize revenue at the time the products are received by the customers for store sales at the point at which the customer receives and pays for the merchandise at the register. For on-line sales, we recognize revenue at the time the customer receives the product. We estimate and defer revenue and the related product costs for shipments that are in transit to the customer. Customers typically receive goods within one week of shipment. We reflect amounts related to shipping billed to customers in net sales and the related costs in cost of goods sold. Sales tax collected from customers on retail sales are recorded net of retail sales at the time of the transaction.

We record a reserve for estimated product returns based on historical return trends. If actual returns are greater than those projected, we may include additional sales returns in the future. We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate our sales return reserve. However, if the actual rate of sales returns increases significantly, our operating results could be adversely affected. We have not made any material changes in the accounting methodology used to estimate future sales returns in the past three fiscal years.

Discounts offered to customers consist primarily of point of sale markdowns and are recorded at the time of the related sale as a reduction of revenue.

We include the value of points and rewards earned by our loyalty program members as a liability and a reduction of revenue at the time the points and rewards are earned based on historical conversion and redemption rates. We recognize the associated revenue when the rewards are redeemed or expire.

Gift certificates sold are carried as a liability and sales revenue is recognized when the gift certificate is redeemed. Similarly, customers may receive a store credit in exchange for returned goods.

20

Store credits are carried as a liability until redeemed. Unredeemed store credits and gift certificates are recognized as other income three and four years, respectively, after issuance, which is when management deems redemptions to be remote. In addition, we sell gift cards with no expiration dates to customers in our retail store locations, through our online stores, and through third parties. Sales revenue from gift cards is recognized when they are redeemed by the customer. In addition, we recognize income on unredeemed gift cards when we can determine that the likelihood of the gift card being redeemed is remote and there is no legal obligation to remit the unredeemed gift cards to relevant jurisdictions (gift card breakage). We determine gift card breakage income based on historical redemption patterns. We accumulated sufficient historical data to determine elapsed time for recording breakage income during the second quarter of fiscal 2010, which we estimate is four years. Gift card breakage is included as other income within selling, general and administrative expenses. We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate our breakage income. However, if the actual rate of redemption for gift certificates, store credits, and gift cards increases significantly, our operating results could be adversely affected.

We record royalty revenue from product licensees as the greater of the minimum amount guaranteed in the contract or amount sold.

We recognize wholesale licensee revenue from sale of product to international licensee operated bebe stores at the time the licensee receives shipment. We exclude these stores from comparable store sales.

Stock Based Compensation Stock-based awards to employees are recognized as compensation expense, based on the calculated fair value on the date of grant. We determine the fair value using the Black-Scholes option pricing model. This model requires subjective assumptions, which are affected by our stock price as well as assumptions regarding a number of complex and subjective variables. These variables include our expected stock price volatility over the term of the awards, actual and projected employee exercise behaviors, risk-free interest rate and expected dividends. As the stock-based compensation expense recognized on the consolidated statements of operations for fiscal 2010, 2009 and 2008 is based on awards ultimately expected to vest, such amount has been reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. Forfeitures were estimated based on our historical experience over the last ten years.

Inventories. We state inventories at the lower of weighted average cost or market. We determine market based on the estimated net realizable value, which is generally the merchandise selling price. To ensure that our raw material is properly valued, we age the fabric inventory and record a reserve in accordance with our established policy, which is based on historical experience. To ensure our finished goods inventory is properly valued, we review the age and turnover of our inventory and record an adjustment if the selling price is marked down below cost. These assumptions can have an impact on current and future operating results and financial position. We estimate and record shrinkage for the period between the last physical count and balance sheet date based on historic shrinkage trends.

Investments. We hold a variety of interest bearing auction rate securities ("ARS") consisting of federally insured student loan backed securities and insured municipal authority bonds. As of July 3, 2010, our ARS portfolio totaled approximately $95.6 million, net of a temporary impairment charge of $13.1 million, classified as available for sale securities. These ARS investments are intended to provide liquidity via an auction process that resets the applicable interest rate at predetermined calendar intervals, allowing investors to either roll over their holdings or gain immediate liquidity by selling such interests at par. The uncertainties in the credit markets that began in February 2008 have affected our holdings in ARS investments and auctions for our investments in these securities have failed to settle on their respective settlement dates. Historically the fair value of ARS investments had approximated

21

par value due to the frequent resets through the auction process. While we continue to earn interest on our ARS investments at the maximum contractual rate, these investments are not currently trading and therefore do not currently have a readily determinable market value. Accordingly, the estimated fair value of ARS no longer approximates par value. Consequently, the investments are not currently liquid, and we will not be able to access these funds until a future auction of these investments is successful, the issuer redeems the securities, or at maturity. Maturity dates for these ARS range from 2012 to 2044 with principal distributions occurring on certain securities prior to maturity.

We also hold short-term available for sale securities totaling $58.0 million at July 3, 2010 that consist of treasury bills and certificates of deposit.

We review our impairments in accordance with guidance issued by the FASB and SEC in order to determine the classification of the impairment as "temporary" or "other-than-temporary". A temporary impairment charge results in an unrealized loss being recorded in the other comprehensive income component of shareholders' equity. Such an unrealized loss does not affect net income for the applicable accounting period. An other-than-temporary impairment charge is recorded as a loss in the consolidated statement of operations and reduces net income for the applicable accounting period. When evaluating the investments for other-than-temporary impairment, we estimate the expected cash flows of the underlying collateral by reviewing factors such as the length of time and extent to which the fair value has been below cost basis, the financial condition of the issuer and any changes thereto, and our intent to sell, or whether it is more likely than not it will be required to sell, the investment before recovery of the investment's unamortized cost basis.

The valuation of our investment portfolio is subject to uncertainties that are difficult to predict. Factors that may impact our valuation include changes to credit ratings of the issuers of the securities as well as to the underlying assets supporting those securities, rates of default of the underlying assets, underlying collateral value, discount rates and ongoing strength and quality of market credit and liquidity.