Attached files

| file | filename |

|---|---|

| EX-99.17 - Xtreme Link, Inc. | v196079_ex99-17.htm |

| EX-2.1 - Xtreme Link, Inc. | v196079_ex2-1.htm |

| EX-3.3 - Xtreme Link, Inc. | v196079_ex3-3.htm |

| EX-99.8 - Xtreme Link, Inc. | v196079_ex99-8.htm |

| EX-99.7 - Xtreme Link, Inc. | v196079_ex99-7.htm |

| EX-99.6 - Xtreme Link, Inc. | v196079_ex99-6.htm |

| EX-99.9 - Xtreme Link, Inc. | v196079_ex99-9.htm |

| EX-99.2 - Xtreme Link, Inc. | v196079_ex99-2.htm |

| EX-99.3 - Xtreme Link, Inc. | v196079_ex99-3.htm |

| EX-99.1 - Xtreme Link, Inc. | v196079_ex99-1.htm |

| EX-99.4 - Xtreme Link, Inc. | v196079_ex99-4.htm |

| EX-99.5 - Xtreme Link, Inc. | v196079_ex99-5.htm |

| EX-99.14 - Xtreme Link, Inc. | v196079_ex99-14.htm |

| EX-99.16 - Xtreme Link, Inc. | v196079_ex99-16.htm |

| EX-99.12 - Xtreme Link, Inc. | v196079_ex99-12.htm |

| EX-99.13 - Xtreme Link, Inc. | v196079_ex99-13.htm |

| EX-99.11 - Xtreme Link, Inc. | v196079_ex99-11.htm |

| EX-99.15 - Xtreme Link, Inc. | v196079_ex99-15.htm |

| EX-99.10 - Xtreme Link, Inc. | v196079_ex99-10.htm |

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported): September 7, 2010

XTREME

LINK, INC.

(Exact

name of small business issuer as specified in its charter)

|

NEVADA

|

333-148098

|

20-5240593

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File No.)

|

(IRS

Employee Identification

No.)

|

1

Xingqing Road, Cuiting Plaza, Suite 2201

Xi’an,

Shaanxi Province

People’s Republic of China

710032

(Address

of Principal Executive Offices)

(86)

29-83213199

(Issuer

Telephone number)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Forward

Looking Statements

This

Current Report on Form 8-K (“Form 8-K”) and other

reports filed by the Registrant from time to time with the Securities and

Exchange Commission (collectively the “Filings”) contain or

may contain forward looking statements and information that are based upon

beliefs of, and information currently available to, the Registrant’s management

as well as estimates and assumptions made by the Registrant’s management. When

used in the filings the words “anticipate”, “believe”, “estimate”, “expect”,

“future”, “intend”, “plan” or the negative of these terms and similar

expressions as they relate to the Registrant or the Registrant’s management

identify forward looking statements. Such statements reflect the current view of

the Registrant with respect to future events and are subject to risks,

uncertainties, assumptions and other factors (including the risks contained in

the section of this report entitled “Risk Factors”) relating to the Registrant’s

industry, the Registrant’s operations and results of operations and any

businesses that may be acquired by the Registrant. Should one or more of these

risks or uncertainties materialize, or should the underlying assumptions prove

incorrect, actual results may differ significantly from those anticipated,

believed, estimated, expected, intended or planned.

Although

the Registrant believes that the expectations reflected in the forward looking

statements are reasonable, the Registrant cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, the

Registrant does not intend to update any of the forward-looking statements to

conform these statements to actual results. The following discussion should be

read in conjunction with the Registrant’s pro forma financial statements and the

related notes filed with this Form 8-K.

Item 1.01 Entry

into a Material Definitive Agreement

As more

fully described in Item 2.01 below, on September 7, 2010, Xtreme Link, Inc.

(“the Registrant”), executed a share exchange agreement (the “Exchange

Agreement”) by and between Orient New Energy Investments Limited, a British

Virgin Islands investment holding company (“Orient”), and the holders of 100% of

Orient’s issued and outstanding capital stock (the “Orient Stockholders”), on

the one hand, and the Registrant and Hong Gao (“Ms. Gao”) on the other hand. A

copy of the Exchange Agreement executed by the parties is included as

Exhibit 2.1 and filed with this current report on Form 8-K.

Orient

owns 100% of Orient New Energy Holdings Limited, a Hong Kong investment holding

company (“Orient Hong Kong”), which in turn owns 100% of Orient New Energy Xi’an

Ltd., a limited liability company organized in the People’s Republic of China

(“PRC” or “China”) and a wholly foreign-owned enterprise under PRC laws

(“Orient Xi’an”). Orient Xi’an has entered into a series of contractual

arrangements with Xi’an Orient Petroleum Group Co., Ltd., a PRC limited

liability company (“Orient Petroleum”). The contractual arrangements are

discussed below in Item 2.01 under the section titled “Description of Business –

Relationships with Orient Petroleum and its Owners.”

At the

closing of the Exchange Agreement (the “Closing”), which occurred on September

7, 2010 (the “Closing Date”), the Registrant issued 27,100,000 shares of

its common stock to the Orient Stockholders in exchange for 100% of the capital

stock of Orient (the “Exchange”). Concurrently, Ms. Gao cancelled 13,250,000

shares of the Registrant’s common stock held by her, which constituted 82.04% of

the Registrant’s issued and outstanding common stock immediately prior to the

Closing. Immediately after the Closing, the Registrant had a total of 30,000,000

shares of common stock issued and outstanding, with the Orient Stockholders

owning approximately 90.33% in the aggregate, and the balance held by those who

held the Registrant’s common stock prior to the Closing. Prior to the Exchange,

the Registrant was a public reporting “shell company,” as defined in Rule 12b-2

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a

result of the Exchange, the Orient Stockholders became the Registrant’s

controlling shareholders and Orient became the Registrant’s wholly-owned

subsidiary, and the Registrant acceded to the businesses and operations of

Orient, which are conducted by Orient Petroleum in China. Throughout this Form

8-K, Orient, Orient Hong Kong, Orient Xi’an and Orient Petroleum are sometimes

collectively referred to as “Orient Petroleum Group.”

Terms

and Conditions of the Share Exchange Agreement

The

following is a brief description of the terms and conditions of the Agreement

that are material to the Registrant:

Issuance of Common

Stock. On the Closing Date, the Registrant shall issue 27,100,000

shares of its common stock to the Orient Stockholders in exchange for 100% of

the issued and outstanding capital stock of Orient.

Cancellation of Common

Stock. On the Closing Date, Ms. Gao shall return all of the shares of the

Registrant’s common stock held by her to the Registrant for

cancellation.

2

Change in Management.

In connection with the Exchange, and as more fully described in Item 5.02

below, Terry Hahn, the Registrant’s sole executive officer immediately

prior to the Exchange, shall resign, and Anping Yao shall be appointed as the

Registrant’s new chief executive officer, and Bin Fu shall be appointed as the

Registrant’s new chief financial officer and secretary, effective at the

Closing. Additionally, Mr. Hahn, as the Registrant’s sole director

immediately prior to the Exchange, shall resign from the Registrant’s board of

directors, and Anping Yao and Yan Tian shall be appointed to replace him,

effective at Closing, with Mr. Yao as chairman of the board of

directors.

Item 2.01 Completion

of Acquisition or Disposition of Assets

On

September 7, 2010, the Registrant consummated the Exchange referenced in Item

1.01 of this Form 8-K, and acquired 100% of the capital stock of Orient. As a

result, the Registrant acquired control of the businesses and operations of

Orient Petroleum Group, which are conducted in China by Orient Petroleum and

controlled by Orient Xi’an through contractual arrangements between Orient Xi’an

and Orient Petroleum. The description of the material terms and conditions of

the Exchange Agreement as described in Item 1.01 above is incorporated herein by

reference.

The

Exchange Agreement and the transactions contemplated thereunder were approved by

the Registrant’s board of directors, as well as Orient’s board of directors and

the Orient Stockholders. Except for the Exchange Agreement and the transactions

contemplated thereunder, neither the Registrant nor its sole officer and

director serving immediately prior to the consummation of the Exchange had any

material relationship with Orient or any Orient Stockholder.

As a

result of the Exchange, the Registrant’s principal business is now that of

Orient Petroleum Group, as more fully described below. The information provided

hereinafter in this Item 2.01 with respect to Orient Petroleum Group is intended

to comply with the disclosure requirements of Form 10 prescribed under the

Exchange Act.

DESCRIPTION

OF BUSINESS

Except as

otherwise indicated by the context, references to “we”, “us” or “our”

hereinafter in this Form 8-K are to the combined business of Orient Petroleum

Group, except that references to “our common stock”, “our shares of common

stock” or “our capital stock” or similar terms shall refer to the common stock

of the Registrant.

Overview

Orient

Petroleum Group is engaged in two energy-related business segments in China, the

wholesale distribution of finished oil products and the operation of retail gas

stations. Our wholesale business currently covers eight provinces, and

includes gasoline, diesel and methanol gasoline supplied to us by various

petroleum distributors and refineries in Shaanxi Province. We maintain three

sales offices in Shaanxi Province where the majority of our current customers

are concentrated. We own one oil storage depot and lease another one, both

located in Xi’an, the capital of Shaanxi Province. We also have access to a

7-kilometer dedicated railway line at one of our depots, which connects to

state-owned railway. Tanker trucks deliver our products from our other depot

throughout Shaanxi Province and beyond. We are one of 19 non-state-owned

distributors in Shaanxi Province that are licensed to sell finished oil

products. We distributed 211,476.61 metric tons, 178,997.61 metric tons and

141,686.83 metric tons of finished oil products in our fiscal years ended March

31, 2010, 2009 and 2008, respectively, and 55,194.02 metric tons and 52,152.10

metric tons in the three months ended June 30, 2010 and 2009, respectively. We

plan to grow our wholesale business by expanding our distribution coverage of

both existing and new markets.

We are

also a retail distributor of all grades of gasoline and diesel, and currently

operate 13 retail gas stations in Shaanxi Province, the majority of which are

located in Xi’an. The average annual sales volume of each gas station is 3,153.8

metric tons for our fiscal year ended March 31, 2010, 2009 and 2008. We plan to

continue to expand our portfolio of retail gas stations through leasing

arrangements or acquisitions, and are continuously looking for high-traffic

locations within and outside of Xi’an.

Our net

sales and net income for the three months ended June 30, 2010 and 2009, and for

the years ended March 31, 2010, 2009 and 2008, are as follows (amounts in

million):

|

Three months ended

June 30,

|

Years ended

March 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

2008

|

||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||

|

Net

Sales

|

$ | 52.6 | $ | 39.3 | $ | 173.7 | $ | 142.6 | $ | 95.6 | ||||||||||

|

Net

Income

|

$ | 5.6 | $ | 3.5 | $ | 17.3 | $ | 9.9 | $ | 7.3 | ||||||||||

3

The

selling price and the cost basis of our products, however, are largely dependent

on the price of crude oil. The Chinese government has control on the sales price

of finished oil products and the price of crude oil.

Corporate

Organization

Orient is

an investment holding company established in British Virgin Islands on November

28, 2008. Other than holding 100% of the outstanding equity interests of Orient

Hong Kong, Orient has no separate operations of its own.

Orient

Hong Kong is an investment holding company established in Hong Kong Special

Administrative Region on March 12, 2009. Other than holding 100% of the

outstanding equity interests of Orient Xi’an, Orient Hong Kong has no separate

operations of its own.

Orient

Xi’an is a limited liability company organized in the PRC on July 30, 2010, with

registered capital of $16 million, 15% of which is required to be paid within 90

days from the date of organization and the balance of which is due within two

years from the issuance date of its business license. Because all of its

outstanding equity interests are held by Orient Hong Kong, Orient Xi’an is

deemed a wholly foreign owned enterprise, or WFOE, under applicable PRC law. The

principal purpose of Orient Xi’an is to manage, hold and own rights in and to

the businesses, operations and profits of Orient Petroleum, which it does

through a series of contractual arrangements.

Orient

Petroleum is a limited liability company organized in the PRC on December 4,

1996, with registered capital of 500,000 Renminbi (“RMB”). The registered

capital was subsequently increased, and is currently RMB 100 million, all of

which has been fully paid by its owners. Orient Petroleum has three equity

owners, including Anping Yao (92%), who has been appointed as the Registrant’s

chief executive officer and chairman of the board of directors in connection

with the Exchange referenced in Item 1.01 of this Form 8-K. All of our business

operations are conducted by Orient Petroleum, for which it has the necessary

licenses, permits and approvals.

Orient

Petroleum and its three owners entered into contractual arrangements with Orient

Xi’an on August 12, 2010. Concurrently, the owners entered into an entrustment

agreement and a call option agreement with Jia Rosales Yao, a Philippines

passport holder and the sole shareholder of Ultimate Sino Holdings Limited, a

British Virgin Islands company and the majority shareholder of Orient

(“Ultimate”). Through these two agreements, the owners acquired control of, and

have the right to acquire 100% ownership of Ultimate, thereby achieving indirect

control of Orient and establishing common control between Orient and Orient

Petroleum.

Contractual

Agreements with Orient Petroleum and its Owners

We do not

own any equity interests in Orient Petroleum, but control and receive the

economic benefits of its business operations through contractual arrangements.

According to the Catalogue for

the Guidance of Foreign Investment Industries jointly issued by State

Development and Reform Commission and Ministry of Commerce on October 31, 2007,

the wholesale of petroleum products and the operation of gas stations falls

within the category of restricted foreign investment industries, and a foreign

investor (including a WFOE) can only hold a minority ownership interest in a PRC

company engaged in wholesale of petroleum products or that has 30 or more gas

stations. In order to comply with such domestic ownership requirements, we have,

through Orient Xi’an, a series of exclusive contractual agreements with Orient

Petroleum and its owners (the “Owners”).

Through these contractual arrangements, we have the ability to, among other

things, substantially influence Orient Petroleum’s business operations, policies

and management and to approve all matters requiring owner approvals, and we have

the right to include 100% of the annual net income earned by Orient Petroleum as

part of our combined financial statements.

We have

been advised by our PRC counsel, Allbright Law Offices in Shanghai, that the

contractual arrangements constitute valid and binding obligations of the parties

of such agreements. Each of the contractual arrangements and the rights and

obligations of the parties thereto are enforceable and valid in accordance with

the laws of the PRC. The contractual arrangements, as currently in effect, are

comprised of the following:

Consulting Services

Agreement. Pursuant to the consulting services agreement,

Orient Xi’an shall provide Orient Petroleum with general consulting services

relating to its business operations, human resources and business development on

an exclusive basis. Additionally, Orient Xi’an shall own any

intellectual property rights that are developed during the course of providing

these services. Orient Petroleum shall pay a quarterly consulting

service fee in RMB equal to its net income for such quarter to Orient

Xi’an. The consulting services agreement is in effect unless and

until terminated by written notice of either party in the event that: (a) the

other party causes a material breach of the agreement, provided that if the

breach does not relate to a financial obligation of the breaching party, that

party may attempt to remedy the breach within 14 days following the receipt of

the written notice; (b) the other party becomes bankrupt, insolvent, is the

subject of proceedings or arrangements for liquidation or dissolution, ceases to

carry on business, or becomes unable to pay its debts as they become due; (c)

Orient Xi’an terminates its operations; (d) Orient Petroleum’s business license

or any other approval for its business operations is terminated, cancelled or

revoked; or (e) circumstances arise which would materially and adversely affect

the performance or the objectives of the agreement. Additionally,

Orient Xi’an may terminate the agreement without cause.

4

Operating

Agreement. To ensure that Orient Petroleum is able to perform

its obligations under the consulting services agreement, the operating agreement

provides that Orient Petroleum may not engage in any transactions that could

materially affect its assets, liabilities, rights or operations without Orient

Xi’an’s prior consent, including without limitation, incurrence or assumption of

any indebtedness, sale or purchase of any assets or rights, incurrence of any

encumbrance on any of its assets or intellectual property rights in favor of a

third party or transfer of any agreements relating to its business operation to

any third party. Additionally, Orient Petroleum must abide by the corporate

policies set by Orient Xi’an in connection with its daily operations, financial

management and personnel, and the Owners must appoint Orient Xi’an’s nominees as

directors and senior executives of Orient Petroleum. Orient Petroleum also

agrees to pledge all of its assets to Orient Xi’an. In return, Orient Xi’an

agrees to guarantee Orient Petroleum’s contractual performance of their

agreements with any third party. The term of this agreement is 20 years unless

sooner terminated upon a 30-day written notice from Orient Xi’an or by any other

agreements reached by all parties. The term may be extended only upon

Orient Xi’an’s written confirmation prior to the expiration of the agreement,

with the extended term to be mutually agreed upon by the parties.

Equity Pledge

Agreement. To further guarantee Orient Petroleum’s performance

of its obligations under the consulting services agreement and to provide Orient

Xi’an with an additional enforcement mechanism of its rights thereunder, the

Owners agree, under the equity pledge agreement, to pledge all of their equity

interests in Orient Petroleum to Orient Xi’an. During the term of the agreement,

which shall expire two years from the fulfillment of Orient Petroleum’s

obligations under the consulting services agreement, Orient Xi’an shall be

entitled to all dividends declared on or paid to the pledged equity interests,

and the Owners shall not dispose of the pledged equity interests or take any

actions that would prejudice Orient Xi’an’s interest. Additionally, if Orient

Petroleum or the Owners breach their respective contractual obligations, Orient

Xi’an, as pledgee, shall be entitled to certain rights, including, but not

limited to, the right to vote with, control and sell the pledged equity

interests. The Owners also grant Orient Xi’an an irrevocable power of

attorney to carry out the security provisions of the equity pledge agreement, to

take effect automatically upon the occurrence of any event of default. Under

Article 226 of The

PRC Property Law, the

pledge of the pledged equity interests shall take effect upon registration of

the pledge with the relevant Administration for Industry and Commerce. Prior to

such registration, Orient Xi’an shall be entitled to enforce the terms of equity

pledge agreement under The PRC

Contract Law.

Voting Rights Proxy

Agreement. To facilitate Orient Xi’an’s exercise of its rights

under the operating agreement, the Owners irrevocably grant Orient Xi’an,

pursuant to the voting rights proxy agreement, the right to exercise all their

voting rights as owners of Orient Petroleum. This agreement may not

be terminated without the unanimous consent of all parties, except that Orient

Xi’an may terminate the agreement with or without cause upon 30-day written

notice to the Owners.

Option

Agreement. In the event PRC law should change in the future so

as to allow Orient Xi’an to hold Xi’an Petroleum’s equity interests directly,

Orient Xi’an shall be able to do so under the option agreement, pursuant to

which the Owners irrevocably grant Orient Xi’an or its designee an exclusive

option to purchase all or part of the equity interests in Orient Petroleum for

the cost of the Owners’ original contributions to Orient Petroleum’s registered

capital or the minimum amount of consideration permitted by applicable PRC

law. Orient Xi’an or its designee has sole discretion to decide when

to exercise the option, whether in part or in full. The term of this

agreement is ten years from August 9, 2010, and may be extended prior to its

expiration by written agreement of the parties.

As a

result of the foregoing contractual arrangements, we are considered the primary

beneficiary of Orient Petroleum. Accordingly, we combine its results, assets and

liabilities in our financial statements.

5

Post-Exchange

Corporate Structure

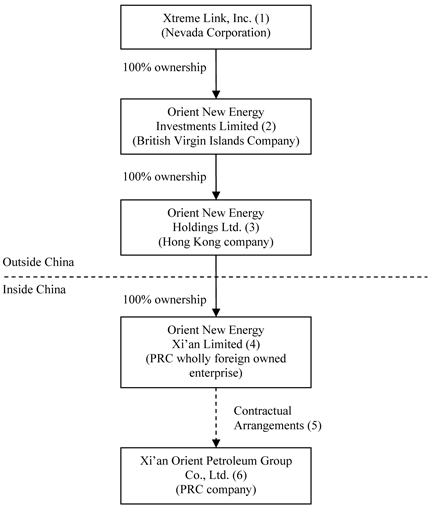

The

following diagram illustrates our corporate structure after the Closing of the

Exchange:

|

|

(1)

|

From

and after the Exchange, the management of the Registrant includes: Anping

Yao as chairman of the board of directors and chief executive officer, Bin

Fu as chief financial officer and secretary, and Yan Tian also as a

director.

|

|

|

(2)

|

The

management of Orient is comprised of Jia Rosales Yao as its

managing director. The Registrant is the sole shareholder of

Orient.

|

|

|

(3)

|

The

management of Orient Hong Kong is comprised of Jia Rosales Yao

as its managing director. Orient is the sole shareholder of Orient Hong

Kong.

|

|

|

(4)

|

The

management of Orient Xi’an is comprised of Anping Yao as its executive

director. Orient Hong Kong is the sole shareholder of Orient Xi’an, and as

such, Orient Xi’an is a wholly-foreign owned enterprise or

WFOE.

|

|

|

(5)

|

Orient

Xi’an controls Orient Petroleum through contractual arrangements,

including a consulting services agreement, operating agreement, equity

pledge agreement, voting rights proxy agreement and option

agreement.

|

|

|

(6)

|

The

management of Orient Petroleum includes: Anping Yao as chairman, Gongping

He as vice president of operations, Ruike Yuan as vice president of

administration, Xuewu Chen as vice president of sales, Na Li as vice

president of financial affairs, Yadong Ma as services manager and Yong

Yang as sales manager. As of the date of this current report: Mr. Yao,

Xi’an Sea Petroleum & Chemical Co., Ltd., and Songling Tian own 92%,

5% and 3% of Orient Petroleum,

respectively.

|

6

Our

Business Operations

Wholesale

Distribution of Finished Oil Products

We sell

on a wholesale basis finished oil products including gasoline, diesel and

methanol gasoline. Gasoline and diesel represent the majority of finished oil

products consumed, with automobiles as the most important driver of gasoline

consumption. Diesel and methanol gasoline are mainly used in agricultural

machines and other vehicles with the appropriate engines. Wholesale distribution

of finished oil products accounted for approximately 71.63% and 75.37% of our

net sales for the three months ended June 30, 2010 and 2009, respectively, and

approximately 72.89%, 76.48% and 76.19% of our net sales for fiscal years ended

March 31, 2010, 2009 and 2008, respectively.

Customers

We

currently have over 200 wholesale customers, among which more than 180 are

located within Shaanxi Province. For the three months ended June 30, 2010 and

2009, our top five wholesale customers collectively represented approximately

20.5% and 10.9% of our net sales, respectively. For fiscal years ended March 31,

2010, 2009 and 2008, our top five wholesale customers collectively represented

approximately 12.8%, 17.9% and 16.2% of our net sales, respectively. For

the three months ended June 30, 2010, one customer, Changzhi Zhengrui

Petro-Chemical Co., Ltd., accounted for 13% of our total sales.

We enter

into supply contracts with our wholesale customers that are typically between

one and three years in length and that require the customers to purchase a

minimum amount of specified oil products at market price during each year of the

contract. Payments are due upon order. Customers may take delivery of their

purchases at our depots or pay us to deliver them to their

locations.

Sales

and Marketing

Our

wholesale distribution network currently covers eight provinces, including

Shaanxi, Sichuan, Henan, Shanxi, Gansu, Inner Mongolia, Hubei and Ningxia. We

currently employ 18 full-time salespersons in three sales offices located in

Shaanxi Province. We chose the locations of our sales office locations based on

their proximities to the majority of our customers and suppliers. As our

business expands, we intend to further expand our sales network and develop more

sales channels. We plan to increase our sales volume through increasing our

distribution footprint in both existing and new market (such as increasing

the number of salespersons and establishing more regional sales

offices).

We do not

offer discounts to our customers as the price of our products is primarily

determined by market price and subject to price cap set by the provincial

government. However, customers who purchase a large amount of products

may enjoy the priority of supply from us in case of oil

shortage.

Competition

Although

barriers to entry in our industry are high due to stringent licensing

requirements and the need for significant storage capacity, we face competition

from both state-owned and non-state-owned companies based in Shaanxi Province

and elsewhere that engage in wholesale distribution of finished oil products. In

addition to state-owned petroleum enterprises such as China Petroleum &

Chemical Corporation, also known as “SINOPEC”

and PetroChina Company Limited, there are currently 19 non-state-owned

enterprises (including us) in Shaanxi Province licensed to distribute finished

oil products. Of the non-state-owned enterprises, seven of them currently

distribute finished oil products similar to ours, including Shaanxi Dongda

Petro-Chemical Co., Ltd., China Integrated Energy, Inc. and Shaanxi Zhonglian

Petroleum Co., Ltd. Many of our competitors may have greater financial

resources, sales resources, storage capacity and transportation capacity than we

do, and may have exclusive supply and purchase arrangements with suppliers as a

result of long-term relationships.

We

believe we have the following advantages over our competitors:

|

|

●

|

Mature

operational infrastructure. We were one of the first non-state-owned

enterprises to engage in the wholesale distribution of finished oil

products in Shaanxi Province. During the past 20 years, we have gradually

built up our operational infrastructure, including extensive distribution

channels, two oil storage depots and convenient access to strategic

railway lines. We also have the relevant licenses to conduct our wholesale

distribution business, which are becoming increasingly difficult for new

entrants to our industry to

obtain.

|

7

|

|

●

|

Established

customer relationships. We have been in the wholesale finished oil

business for almost 20 years since the incorporation of our predecessor

Xi’an Lianhu Petroleum Chemical Co., Ltd. in 1991. We focus on customer

satisfaction and believe that we have consistently provided high quality

products and services to our customers. With our business approach to

achieve a consistent increase of sales volume while improving our

administrative efficiency, we began referring our smaller customers to

purchase from our larger customers that we have established long-term

relationships with. As a result, our number of wholesale customers has

decreased from 448 in fiscal 2008 to 222 in fiscal 2010 while our sales

volume has increased over the same period of

time.

|

|

|

●

|

Stable

supply source. Shaanxi Yanchang Petroleum (Group) Co., Ltd. (“Yanchang

Group”), one of the four largest crude oil and gas exploration enterprises

in China with over 10 million metric tons of refinery capacity, is our

largest oil supplier. We also maintain good relationships with other

state-owned oil suppliers such as PetroChina and China National Offshore

Oil Corporation.

|

|

|

●

|

Railway

access. We benefit from our dedicated railway line connecting one of our

oil depots to Shaanxi Province’s main railway. We stopped using the

railway line for our other depot, however, because the loading capacity at

the depot does not meet current requirement of the PRC Ministry of

Railways. We are trying to obtain the necessary governmental approval to

use the railway line, but we cannot give assurance that such approval will

be issued.

|

|

|

●

|

Storage

capability. We have an aggregate oil depot storage capacity of 18,000 m

3

(approximately 4.8 million gallons). Aside from large upfront capital

requirements, new entrants to this industry must also have significant

storage capacity to be able to compete, which is a barrier to entry for

new competitors.

|

Operating

Licenses

We hold a

Certificate for Wholesale Distribution of Finished Oil (the “Wholesale

License”), granted by the PRC government. The Wholesale License

allows us to sell our products to wholesale customers and other users of

gasoline, kerosene and diesel, and must be renewed every 5 years. We

hold this license at the discretion of the PRC government. We also

hold a Dangerous Chemical Distribution License (the “DCD License”) that allows

us and our personnel to handle and transport gasoline and diesel oil. The

DCD License is renewable upon expiration. The Constitution of the PRC

states that all mineral and oil resources belong to the

State. Therefore, without these licenses, we would not be able to

sell our products.

Operation

of Retail Gas Stations

In

addition to our wholesale distribution of finished oil products, we also sell

gasoline and diesel directly to end users through the retail gas stations that

we operate.

We

currently operate 13 retail gas stations, 10 of which are located in

Xi’an and the other three are located in nearby municipalities. All stations

sell gasoline and diesel. Our customers include automobile, bus and truck

drivers. The number of employees at each gas station varies from 11 to 20.

We own two of the gas stations (excluding their related land use rights)

and operate the other 11 on 10-15 years renewable leases that also give us

full management and operational rights during their terms. Our lessors pay the

expenses in connection with land use rights and annual inspection of

operating licenses for the leased gas stations. The

operating licenses for two of the leased gas stations are transferred

to us during the duration of the leases, which we will transfer back to the

lessors upon termination of lease. Our gas stations are located at streets and

highways with heavy traffic volumes, and are open 24 hours a day. We also have

road tankers that transport products from our oil depot to our gas

stations.

Retail

gas sales at our gas stations accounted for approximately 28.61% and 24.80% of

our net sales for the three months ended June 30, 2010 and 2009, and

approximately 27.37%, 23.74% and 24.08% of our net sales for fiscal years ended

March 31, 2010, 2009 and 2008, respectively.

Competition

We face

competition from both state-owned and private retail gas station operators. Such

companies may have greater financial resources, sales resources, storage

capacity and transportation capacity than we do, and may have exclusive supply

and purchase arrangements with suppliers as a result of long-term relationships.

We also face competition from international energy companies such as Royal Dutch

Shell, which currently operates 41 gas stations in Shaanxi

Province.

We

believe we have the following advantages over our retail gas station

competitors:

|

|

●

|

Location

of gas stations. Our retail gas stations are geographically concentrated

so that we are able to oversee their daily operations, and in

high-trafficked areas for steady customer

source.

|

8

|

|

●

|

Flexible

pricing strategy. Although the prices of finished oil products are subject

to government control, we can adjust our retail pricing within the

government price limit based on supply and demand conditions as well as

the local economy.

|

Operating

Licenses

In

addition to business licenses issued by the municipal Administration for

Industry and Commerce, each of our retail gas station holds a renewable

Operating License for Hazardous Chemical (the “Hazardous Chemical License”) and

a renewable Operating License for Retail Sale of Finished Oil (the “Retail

License”) that allows us to sell gasoline, kerosene and diesel. Both licenses

are subject to annual inspections - the Hazardous Chemical License by the

provincial Administration of Work Safety and the Retail License by the

provincial Department of Commerce - and failure to pass the annual inspection

may lead to their revocations.

Suppliers

We

purchase gasoline, diesel, naphtha (primarily used as addictive for methanol),

methanol and gasoline addictives from various petroleum refineries and suppliers

in Shaanxi Province. We enter into one-year contracts with our suppliers

that require us to purchase a minimum amount of specified oil products at market

price during the year, which are delivered to our depots through ground

transportation. Our contracts with our suppliers also require payment before

delivery.

Our

largest suppliers for the year ended March 31, 2010, by product type, are as

follows:

|

Type of Product

|

Name of Supplier

|

% of Total Purchase

|

||||

|

Gasoline

|

Shaanxi

Yanchang Petroleum (Group) Co., Ltd.

|

57.38 | ||||

|

Diesel

|

Shaanxi

Yanchang Petroleum (Group) Co., Ltd.

|

57.38 | ||||

|

Naphtha

|

Huawei

Commerce Co., Ltd.

|

100.00 | ||||

|

Methanol

|

Yulin

Gas Chemical Co., Ltd.

|

100.00 | ||||

|

Gasoline

Addictives

|

Xi’an

Putian Petroleum Co., Ltd.

|

100.00 | ||||

While we

are dependent on these suppliers for our finished oil products, we are always

seeking other supply sources and believe that we can find alternative suppliers

with comparable terms within a reasonable amount of time without any significant

disruption in our operations.

Storage

We

currently use two oil storage depots, both located in Xi’an, which in the

aggregate have the capacity to store approximately 4.8 million gallons of

finished oil. We acquired one of the depots from a private petroleum company for

RMB 20.5 million in 2005. We lease the other depot for RMB 650,000 a year under

a 15-year renewable lease. Both depots are facilitated with oil tanks,

flow-lines, weighing machines and loading platforms. One of our oil storage

depots also has access to a 7-kilometer dedicated railway line which connects to

the main railway. Oil is currently delivered to and from the other depot by

tanker trucks.

Research

and Development

We are

currently researching and developing a methanol-based substitute for automobile

gasoline. However, we cannot provide assurance that this or any project that we

may conduct in the future will ultimately be successful or commercially viable.

Additionally, intellectual property rights and confidentiality protections in

China may not be as effective as in the United States or other countries, and we

cannot provide assurance that we will be able to meaningfully protect our rights

in connection with our research and development.

For the

years ended March 31, 2010, 2009 and 2008, we spent $29,473.31, $36,841.64 and

$22,104.98, respectively, for research and development. We did no

incur research and development expenses during the three months ended June

30, 2010 and 2009.

Intellectual

Properties

The

Company currently does not own any intellectual properties.

9

Government

Regulations

Finished

Oil Distribution

Prior to

2006, significant gaps existed in the laws and regulations pertaining to the

finished oil industry, and the relevant rules for this industry were, to some

extent, inconsistent and subject to the discretion of the relevant government

authorities.

In 2006,

greater specificity was added to the rules for commercial activities in the

finished oil industry with the enactment of the Measures on the Administration of

the Finished Oil Market (promulgated on December 4, 2006 by the PRC

Ministry of Commerce (“MOFCOM”) and effective as of January 1, 2007), or the

Measures. This regulation provides comprehensive details on the finished oil

wholesale and resale application procedures, qualification requirements, and

rules for annual inspections. Enterprises (foreign or domestic-funded) meeting

certain requirements can submit applications to the MOFCOM for a certificate of

approval to conduct gasoline and diesel (including bio-diesel) wholesale, retail

and storage businesses.

The first

step required in applying to engage in the wholesale of finished oil is a

preliminary examination by the provincial MOFCOM where the enterprise is

located. Thereafter, the provincial MOFCOM will forward the application

materials together with its opinions on the preliminary examination to the

MOFCOM, which will then decide on whether to grant the Certificate of Approval

for the Wholesale of Finished Oil.

An

enterprise applying to engage in the finished oil wholesale business must, among

other requirements, possess the following:

|

|

(i)

|

long-term and stable supply of

finished oil;

|

|

|

(ii)

|

a legal entity with a registered

capital of no less than RMB 30

million;

|

|

|

(iii)

|

a finished oil depot, which shall

have a capacity not smaller than 10,000 m 3 , conforming to the local

urban and rural planning requirements, and be approved by other relevant

administrative departments;

and

|

|

|

(iv)

|

Facilities

for unloading finished oil such as conduit pipes, special railway lines,

and transportation vehicles with a capacity of 10,000 metric tons or more

to transport refined oil on the highway or over water to

ports.

|

In

practice, it has become increasingly difficult for enterprises (particularly

foreign-funded enterprises) to meet the third requirement above. As both the

number of available oil depots and state land and resources are reaching full

capacity, it is becoming increasingly difficult to procure a finished oil depot

with a capacity not smaller than 10,000 m 3.

The

application procedure for the retail of finished oil is similar to that for

wholesale except that the preliminary examination takes place at the

administrative department for commerce at the municipal level, and the

certificate of approval is issued at the provincial level.

An

enterprise applying to engage in the finished oil retail business must, among

other requirements, possess the following:

|

|

(i)

|

long-term and stable channels to

finished oil supply and a supply agreement with an enterprise that has

been qualified to engage in the wholesale business of finished oil for a

period of three years or more in line with its business

scale;

|

|

|

(ii)

|

qualified professional and

technical personnel to handle inspections, metrology, storage and fire

safety and the safe production of finished oil;

and

|

|

|

(iii)

|

gas stations designed and built

to comply with the relevant national standards and approved by the

relevant administrative

department.

|

Enterprises

possessing certificates of approval are subject to annual inspection by the

relevant provincial MOFCOM which will review:

|

|

(i)

|

the execution and performance of

finished oil supply

agreements;

|

|

|

(ii)

|

the operation results of the

enterprise for the previous

year;

|

10

|

|

(iii)

|

whether the enterprise and its

supporting facilities are in compliance with the technical requirements

under the Measures; and

|

|

|

(iv)

|

The current measures, among other

measures, being taken by the enterprise regarding quality control,

metrology, fire safety, security and environmental

protection.

|

If we

pass the annual inspection, the certificates of approval we hold will continue

to be valid. An enterprise failing an annual inspection will be ordered to

rectify all deficiencies within a certain time limit by the MOFCOM and/or its

provincial branches. If such deficiencies have not been rectified within the

specified time limit, its certificates of approval shall be revoked by the

original issuing authority.

We

currently are in full compliance with the Measures, and hold valid operating

licenses to conduct our businesses. However, we cannot provide assurance that we

will not fail to satisfy the above mentioned requirements in the

future.

Pricing

for Finished Oil

The PRC

National Development and Reform Commission (“NDRC”) regulates domestic oil

prices as part of its macro-management over the economy in order to control

dramatic fluctuations in oil prices.

The Administrative Measures on Oil

Prices ( trial implementation ),

or the Price Measures, promulgated by the NDRC on May 7, 2009 stipulates that

the NDRC will adjust domestic finished oil prices when the international market

price for crude oil changes more than four percent over 22 consecutive working

days. By contrast, crude oil prices are determined solely by enterprises

engaging in this industry.

The NDRC

adjusts domestic finished oil prices by modifying the retail price cap for

gasoline and diesel in all provinces, autonomous regions, and directly

administered municipalities. Thereafter, the administrative authorities at the

provincial level adjust the wholesale price caps by deducting RMB 30 per metric

ton from the corresponding retail price caps. Where there are no specific

contractual arrangements for a supplier’s delivery to a retailer, the wholesale

price caps may be further deducted to take into account the retailer’s

transportation cost among other expenses.

The Price

Measures stipulate

that the domestic finished oil prices shall be calculated according to the

normal profit rate for refiners when the crude oil price on the international

market is lower than $80 per barrel. When the international crude oil market

price exceeds $130 per barrel, the NDRC will adopt certain fiscal and tax

policies to ensure the continuing production and supply of refined oil products.

Further, gasoline and diesel prices will only be increased slightly (if at all)

in consideration of manufacturers and consumers, as well as the stability of the

national economy.

The exact

formula for calculating finished oil prices domestically has not been published.

However, the NDRC has stated that such formula is based on the weighted average

of the international market prices, together with the average domestic

processing costs, taxes, fees incurred in distribution channels, and suitable

profits for refiners. Moreover, the NDRC adjusts the cost index seasonally in

accordance with the actual situation with respect to prices.

According

to the Price Measures,

Shaanxi Province Price Control Administration shall be responsible for

setting the retail price cap of gasoline and diesel oil in Shaanxi Province. We

are allowed, subject to the retail price cap set by the provincial government,

to determine the retail price of gasoline and diesel products sold at our gas

stations.

Environmental

Protection

The

relevant PRC governmental authorities set national and local environmental

protection standards, as well as examine and issue approvals on environmental

aspects of different stages of various projects. We are required to file an

environmental impact statement, or in some cases, an environmental impact

assessment outline, to obtain such approvals. The filing must demonstrate that

the project in question conforms to applicable environmental standards.

Generally speaking, environmental protection bureaus will issue approvals and

permits for projects using modern pollution control measurement

technology.

The PRC

national and local environmental laws and regulations impose fees for the

discharge of waste substances above prescribed levels, require the payment of

fines for serious violations and provide that the PRC national and local

governments may, at their own discretion, close or suspend any facility which

fails to comply with orders requiring it to cease or improve operations causing

environmental damage.

11

In

accordance with the requirements of the environmental protection laws of the

PRC, we have installed the necessary environmental protection equipment, adopted

advanced environmental protection technologies, established responsibility

systems for environmental protection, and reported to and registered with the

relevant local environmental protection department.

Dangerous

Chemicals

PRC laws

and regulations on dangerous chemicals require that a Dangerous Chemical

Distribution License, or the DCD License, be obtained for all companies that

handle and transport dangerous chemicals. We obtained the DCD License in May 24,

2010, which will expire on December 31, 2012. It can thereafter be renewed upon

application.

Foreign-invested

Enterprises Engaging in Oil-related Businesses

Under

the Catalogue of

Industries for Guiding Foreign Investment, jointly promulgated by the

MOFCOM and the NDRC on October 31, 2007 and effective as of December 1, 2007,

each of the following falls within the restricted category for foreign

investment: wholesale of oil products, the construction and operation of gas

stations, and the production of liquid bio-fuels (i.e., fuel ethanol,

biodiesel). Foreign investors can only engage in commercial activities involving

liquid bio-fuels or retail distribution of finished oil (where the foreign

investor possesses 30 or more gas stations or where it sells different brands of

oil through different distributors) through a joint venture with a Chinese

partner, and the Chinese partner must hold a controlling interest in the joint

venture. As a result of these restrictions, all of our business operations are

conducted by a domestic entity, Orient Petroleum.

SAFE

Regulations Pertaining to Overseas-Listed Companies

Circular

75

The PRC

State Administration of Foreign Exchange (“SAFE”) issued the Circular on Issues Relevant to

Foreign Exchange Control with Respect to the Round-trip Investment of Funds

Raised by Domestic Residents Through Offshore Special Purpose Vehicles

(“Circular 75”), on October 21, 2005. Circular 75 requires PRC residents

and citizens to register with their local SAFE branches before establishing or

acquiring the control of any company outside of China by using domestic assets

or equities for the purpose of equity financing. PRC residents and citizens who

are stockholders of offshore special purpose companies established before

November 1, 2005 were required to conduct overseas investment registration with

the local SAFE branches before March 31, 2006. Further, PRC residents and

citizens must register all major changes relating to capitalization (including

overseas equity or convertible bonds financing) within 30 days upon the

occurrence of such changes.

On May

29, 2007, the SAFE issued the Notice on Operating Procedures for the

Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’

Corporate Financing and Roundtrip Investment Through Offshore Special Purpose

Vehicles (“Notice 106”). Notice 106 clarifies

some outstanding issues with respect to Circular 75, and adds various

implementing rules. Specifically, it provides for seven schedules to be

established by the SAFE in order to track registration requirements for offshore

fundraising and roundtrip investments.

Failure

to comply with the registration procedures set forth in Circular 75 and any

other rules and regulations may result in restrictions on the relevant PRC

subsidiary, including the payment of dividends and other distributions to its

offshore parent or affiliate and the capital inflow from the offshore entity.

Non-compliance may also subject relevant PRC residents to penalties under PRC

foreign exchange administration regulations, and may result in liability under

PRC law for foreign exchange evasion.

At

present, however, many key terms and provisions in Circular 75 continue to

remain unclear and without consistent official interpretations. In addition,

implementation by central and local SAFE branches has been inconsistent since

adoption of these regulations, which often results in substantial delays in

application review and processing.

It is

uncertain how our business operations or future strategy will be affected by the

interpretations and implementation of Circular 75. It is anticipated that its

application will continued to be subject to significant administrative

interpretation, and we will need to closely monitor how the relevant PRC

governmental bodies apply the rules to ensure that our domestic and offshore

activities continue to comply with PRC law. Given the uncertainties regarding

interpretation and application of the new rules, we may need to expend

significant time and resources to maintain compliance.

12

Dividend

Distribution

The

principal laws, rules and regulations governing dividends paid by our PRC

affiliated entities include the Company Law of the PRC (1993), as amended in

2005, Wholly Foreign Owned Enterprise Law (1986), as amended in 2000, and Wholly

Foreign Owned Enterprise Law Implementation Rules (1990), as amended in 2001.

Under these laws and regulations, each of our combined PRC entities, including

wholly foreign owned enterprises, or WFOEs, and domestic companies in China may

pay dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition, each of

our combined PRC entities, including WFOEs and domestic companies, is required

to set aside at least 10% of its after-tax profit based on PRC accounting

standards each year to its statutory surplus reserve fund until the accumulative

amount of such reserve reaches 50% of its respective registered capital. These

reserves are not distributable as cash dividends. As of March 31, 2010, the

accumulated balance of our statutory reserve funds reserves amounted to RMB 31.9

million (approximately $4.4 million) and the accumulated profits of Orient

Petroleum that were available for dividend distribution amounted to RMB 77.1

million (approximately $ 9.1 million).

Taxation

Under the

PRC Enterprise Income Tax Law, or EIT Law, enterprises are classified as

resident enterprises and non-resident enterprises. An enterprise established

outside of China with its “de facto management bodies” located within China is

considered a “resident enterprise,” meaning that it can be treated in a manner

similar to a Chinese enterprise for enterprise income tax purposes. The

implementing rules of the EIT Law define “de facto management bodies” as a

managing body that in practice exercises “substantial and overall management and

control over the production and operations, personnel, accounting, and

properties” of the enterprise; however, it remains unclear whether the PRC tax

authorities would deem our managing body as being located within China. Due to

the short history of the EIT Law and lack of applicable legal precedents, the

PRC tax authorities determine the PRC tax resident treatment of entities

organized under the laws of foreign jurisdictions on a case-by-case

basis.

If the

PRC tax authorities determine that we are a “resident enterprise” for PRC

enterprise income tax purposes, a number of PRC tax consequences could follow.

First, we may be subject to enterprise income tax at a rate of 25% on our

respective worldwide taxable income, as well as PRC enterprise income tax

reporting obligations. Second, although the EIT Law provides that “dividends,

bonuses and other equity investment proceeds between qualified resident

enterprises” is exempted income, and the implementing rules of the EIT Law

refers to “dividends, bonuses and other equity investment proceeds between

qualified resident enterprises” as the investment proceeds obtained by a

resident enterprise from its direct investment in another resident enterprise,

it is still unclear whether the dividends we receive from Shaanxi Biostar

constitute “dividend between qualified resident enterprises” and consequently

are qualified for tax exemption.

Moreover,

the State Administration of Taxation issued a circular, or Circular 698, on

December 10, 2009, that reinforces taxation on transfer of non-listed shares by

non-resident enterprises through overseas holding vehicles. Circular 698 apply

retroactively and were deemed to be effective as of January

2008. Pursuant to Circular 698, where (i) a foreign investor who

indirectly holds equity interest in a PRC resident enterprise through an

offshore holding company indirectly transfers equity interests in a PRC resident

enterprise by selling the shares of the offshore holding company, and (ii) the

offshore holding company is located in a jurisdiction where the effective tax

rate is lower than 12.5% or where the offshore income of its residents is not

taxable, the foreign investor is required to provide the tax authority in charge

of that PRC resident enterprise with certain relevant information within 30 days

of the transfer. The tax authorities in charge will evaluate the offshore

transaction for tax purposes. In the event that the tax authorities determine

that such transfer is abusing forms of business organization and there is no

reasonable commercial purpose other than avoidance of PRC enterprise income tax,

the tax authorities will have the power to conduct a substance-over-form

re-assessment of the nature of the equity transfer. A reasonable commercial

purpose may be established when the overall offshore structure is set up to

comply with the requirements of supervising authorities of international capital

markets. If the State Administration of Taxation’s challenge of a transfer is

successful, they will deny the existence of the offshore holding company that is

used for tax planning purposes. Since Circular 698 has a short history, there is

uncertainty as to its application.

Seasonality

Our

business is relatively stable and predictable and is not subject to changes of

seasonality.

Employees

The

following table sets forth the number of our employees for each of our areas of

operations and as a percentage of our total workforce as of June 30,

2010.

13

|

Number of

Employees

|

% of Employees

|

|||||||

|

Management

& Administration

|

9 | 3.2 | % | |||||

|

Finance

& Accounting

|

12 | 4.3 | % | |||||

|

Sales

& Marketing

|

11 | 3.9 | % | |||||

|

Transportation

|

9 | 3.2 | % | |||||

|

Retail

Gas Stations

|

200 | 70.9 | % | |||||

|

Wholesale

Distribution

|

15 | 5.3 | % | |||||

|

Storage

|

21 | 7.4 | % | |||||

|

Research

and Development

|

5 | 1.8 | % | |||||

|

TOTAL

|

282 | 100.0 | % | |||||

Our

employees are interviewed and hired by our human resource department. We enter

into employment agreements with terms of one to three years with employees at

managerial and technical positions and short-term employment agreements with

part-time or temporary employees such as gas station employees. We believe that

our relationship with our employees is good. Management expects that our

access to reasonably priced and competent labor will continue into the

foreseeable future.

Environmental

Matters

We

believe that we are in compliance with present environmental protection

requirements in all material respects. Our production processes generate noise,

waste water, gaseous wastes and other industrial wastes. We have installed

various types of anti-pollution equipment in our facilities to reduce, treat,

and where feasible, recycle the wastes generated in our production process. Our

operations are subject to regulation and periodic monitoring by local

environmental protection authorities.

Corporate

Information

Our

principal executive office is located at 1 Xingqing Road, Cuiting Plaza, Suite

2201, Xi’an, Shaanxi Province, PRC 710032. Our main telephone number is (86)

29-83213199 and our facsimile number is (86) 29-83280286.

RISK

FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this Form 8-K before making an investment decision

with regard to our securities. The statements contained in or incorporated into

this Form 8-K that are not historic facts are forward-looking statements that

are subject to risks and uncertainties that could cause actual results to differ

materially from those set forth in or implied by forward-looking statements. If

any of the following events described in these risk factors actually occurs, our

business, financial condition or results of operations could be harmed. In that

case, the trading price of our common stock could decline, and you may lose all

or part of your investment.

Risks

Related to Our Business and Industry

We

rely on a limited number of third-party suppliers for our supply of finished oil

products and the loss of any such supplier, particularly our largest supplier,

could have a material adverse effect on our operations.

We are

dependent upon our relationships with third parties for our supply of finished

oil products. Our five largest suppliers provided 96.55%, 96.79% and 87.78% of

our finished oil requirements for fiscal years ended March 31, 2010, 2009 and

2008, respectively, with our largest supplier providing approximately 55.2%,

44.3% and 53.3%, respectively, in such periods. Should any of these suppliers,

and in particular our largest supplier, terminate their supply relationships

with us, fail to perform their obligations as agreed, or enter into the finished

oil products business in competition with us, we may be unable to procure

sufficient amounts of finished oil products to fulfill our demand. If we are

unable to obtain adequate quantities of finished oil products at economically

viable prices, our customers could seek to purchase products from other

suppliers, which could have a material adverse effect on our

revenues.

We

are highly dependent on the revenue contribution from our wholesale distribution

of finished oil. A reduction in sales from this segment would cause our revenues

to decline and materially harm our business.

We

currently derive a significant majority of our sales from our wholesale

distribution of finished oil products business segment, which accounted for

72.89%, 76.48% and 76.19% of our net sales in fiscal years ended March 31,

2010, 2009 and 2008, respectively. As a result, should there be an adverse

industry trend in the petroleum sector, our limited diversification could result

in our results of operations declining substantially and suffering

disproportionately compared to our competitors that have diversified their

revenue sources.

14

Our

ability to operate at a profit is partially dependent on market prices for

petroleum and diesel fuels, which are subject to government control in the PRC.

If petroleum and diesel prices drop significantly, we may be unable to maintain

our current profitability.

Our

results of operations and financial condition are affected by the selling prices

of petroleum products, which are subject to state-imposed pricing control.

According to the Administrative Measures on Oil

Prices, Shaanxi

Province Price Control Administration is responsible for setting the retail

price cap of gasoline and diesel oil products sold in Shaanxi Province. We are

allowed, subject to the retail price cap set by the provincial government, to

determine the retail price of our products.

During

the years ended March 31, 2010, 2009 and 2008, our average selling prices for

gasoline were $846.73, $820.38 and $679.11 per metric ton, respectively. Our

average selling price for diesel were $802.07, $760.67 and $671.94 per metric

ton during the years ended March 31, 2010, 2009 and 2008.

Although

the current price-setting mechanism for refined petroleum products in China

allows the PRC government to adjust prices in the PRC market when the average

international crude oil price fluctuates beyond certain levels within a certain

time period, the PRC government still retains full discretion as to whether or

when to adjust the refined petroleum products price. The PRC government can also

be expected to exercise price control over refined petroleum products once

international crude oil price experiences sustained growth or become

significantly volatile. As a result, our results of operations and financial

condition may be materially and adversely affected by the fluctuation of market

prices of crude oil and refined petroleum products as well as the discretionary

actions of the PRC government.

We

face substantial competition in our wholesale distribution of finished

oil.

Although

barriers to entry in our industry are high due to stringent licensing

requirements and the need for significant storage capacity for products, we face

competition from both state-owned and non-state-owned companies based in Shaanxi

Province and elsewhere that engage in wholesale distribution of finished oil

products. In addition to state-owned petroleum enterprises such as SINOPEC and

PetroChina, there are currently 19 non-state-owned enterprises (including us) in

Shaanxi Province licensed to distribute finished oil products. Of the

non-state-owned enterprises, seven of them currently distribute finished oil

products similar to ours, including Shaanxi Dongda Petro-Chemical Co., Ltd.,

China Integrated Energy, Inc. and Shaanxi Zhonglian Petroleum Co., Ltd. Many of

our competitors may have greater financial resources, sales resources, storage

capacity and transportation capacity than we do, and may have exclusive supply

and purchase arrangements with suppliers as a result of long-term

relationships.

An

increase in competition arising from an increase in the number or size of

competitors in the wholesale distribution of finished oil may result in price

reductions, reduced gross profit margins, loss of our market share and departure

of key management personnel, any of which could adversely affect our financial

condition and profitability.

The

distribution of finished oil is primarily dependent on the sufficiency of

necessary infrastructure and access to means of transport, including rail

transportation, which may not be available on a cost-effective basis, if at

all.

Our

wholesale distribution of finished oil depends heavily on the availability of

infrastructure and means of transportation, including but not limited to

adequate highway or rail capacity, including sufficient numbers of dedicated

tanker trucks or cars and sufficient storage facilities.

15

Of

our two oil depots, only one currently has use of a dedicated railway

line connecting to the main railway in Shaanxi Province, which enables us to

distribute our products to customers within and outside Shaanxi Province. We

stopped using the railway line connecting the other depot because the loading

capacity of such depot does not meet the requirement of the Ministry of

Railways. We are now trying to get the governmental approval to use the railway

line, but we do not provide assurance that this approval will be

issued.

Our

gross margins in our wholesale distribution of finished oil products and in our

operation of retail gas station segments are principally dependent on the spread

between the average purchase price and the average selling price. If the average

purchase price increases and the average selling price of our products does not

similarly increase or if the average selling price of our products decreases and

the average purchase price does not similarly decrease, our margins will

decrease and results of operations will be harmed.

Our gross

margins in the wholesale distribution of finished oil products and in the

operation of retail gas stations depend principally on the spread between the

average purchase price and the average selling price we are able to realize for

our products. The spread between the average purchase price for petroleum and

the average selling price of our products has been relatively stable since 2007.

Prices for petroleum in the PRC are primarily influenced by the guidance prices

set by the National Development and Reform Commission, or the NDRC, and supply

and demand for petroleum-based fuel, rather than production costs. Any decrease

in the spread between the average purchase price and the prices we are able to

realize for our products, whether as a result of an increase in purchase prices

or policy determinations by the NDRC, would adversely affect our financial

performance and cash flows.

We

depend on our key executives, and our business and growth may be severely

disrupted if we lose their services.

Our

future success depends substantially on the continued services of our key

executives. In particular, we are highly dependent upon Mr. Anping Yao, our

chairman, chief executive officer and president, who has established

relationships within the industries we operate. If we lose the services of one

or more of our current management, we may not be able to replace them readily,

if at all, with suitable or qualified candidates, and may incur additional

expenses to recruit and retain new officers with industry experience similar to

our current officers, which could severely disrupt our business and growth. In

addition, if any of our executives joins a competitor or forms a competing

company, we may lose some of our suppliers or customers. Furthermore, as we

expect to continue to expand our operations and develop new products, we will

need to continue attracting and retaining experienced management and key

research and development personnel.

Competition

for qualified candidates could cause us to offer higher compensation and other

benefits in order to attract and retain them, which could have a material

adverse effect on our financial condition and results of operations. We may also

be unable to attract or retain the personnel necessary to achieve our business

objectives, and any failure in this regard could severely disrupt our business

and growth.

The

current economic and credit environment could have an adverse effect on demand

for certain of our products and services, which would in turn have a negative

impact on our results of operations, our cash flows, our financial condition,

our ability to borrow and our stock price.

Since

late 2008, global market and economic conditions have been disrupted and

volatile. Concerns over increased energy costs, geopolitical issues, the

availability and cost of credit, the U.S. mortgage market and a declining

residential real estate market in the U.S. have contributed to this increased

volatility and diminished expectations for the economy and the markets going

forward. These factors, combined with volatile oil prices, declining business

and consumer confidence and increased unemployment, have precipitated a global

recession.

It is

difficult to predict how long the current economic conditions will persist,

whether they will deteriorate further, and which of our products, if not all of

them, will be adversely affected. As a result, these conditions could adversely

affect our financial condition and results of operations.

Our

business will suffer if we cannot obtain, maintain or renew necessary permits or

licenses.

All PRC

enterprises engaging in the sale of finished oil products are required to obtain

from various PRC governmental authorities certain permits and licenses,

including, without limitation, the Certificate for Wholesale Distribution of

Finished Oil, the License for Retail Sale of Finished Oil and the Dangerous

Chemical Distribution License. We have obtained permits and licenses required

for the distribution of finished oil. Failure to obtain all necessary

approvals/permits may subject us to various penalties, such as fines or being

required to vacate from the facilities where we currently operate our

business.

16

These

permits and licenses are subject to periodic renewal and/or reassessment by the

relevant PRC government authorities and the standards of compliance required in

relation thereto may from time to time be subject to change. We intend to apply

for renewal and/or reassessment of such permits and licenses when required by

applicable laws and regulations, however, we cannot assure you that we can

obtain, maintain or renew the permits and licenses or accomplish the

reassessment of such permits and licenses in a timely manner. Any changes in

compliance standards, or any new laws or regulations that may prohibit or render

it more restrictive for us to conduct our business or increase our compliance

costs may adversely affect our operations or profitability. Any failure by us to

obtain, maintain or renew the licenses permits and approvals may have a material