Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - GameFly Inc. | a2199913zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

GAMEFLY, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on September 9, 2010

Registration No. 333-164821

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GAMEFLY, INC.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7841 (Primary Standard Industrial Classification Code Number) |

04-3700336 (I.R.S. Employer Identification No.) |

GameFly, Inc.

5340 Alla Road, Suite 110

Los Angeles, CA 90066

(310) 664-6400

(Address, including zip code and telephone number, including

area code, of Registrant's principal executive offices)

David Hodess

President and Chief Executive Officer

GameFly, Inc.

5340 Alla Road, Suite 110

Los Angeles, CA 90066

(310) 664-6400

(Name, address, including zip code and telephone number, including

area code, of agent for service)

| Copies to | ||

Glen R. Van Ligten, Esq. Louis D. Soto, Esq. Orrick Herrington & Sutcliffe LLP 1000 Marsh Road Menlo Park, California 94025 Telephone: (650) 614-7400 Facsimile: (650) 614-7401 |

Mark Mihanovic, Esq. McDermott Will & Emery LLP 2049 Century Park East, 3800 Los Angeles, California 90067 Telephone: (310) 277-4110 Facsimile: (310) 277-4730 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable following the effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common Stock, $0.0001 par value per share |

$50,000,000 | $3,565(3) | ||

|

||||

- (1)

- Estimated

solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as

amended.

- (2)

- Includes

shares which the underwriters have the option to purchase to cover overallotments, if any.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated , 2010

PROSPECTUS

Shares

GameFly, Inc.

Common Stock

This is GameFly, Inc.'s initial public offering. We are selling shares of our common stock and the selling stockholders are selling shares of our common stock. We will not receive any proceeds from the sale of shares to be offered by the selling stockholders.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After we determine the public offering price, we expect that the shares will trade on the NASDAQ Global Market under the symbol "GFLY."

Investing in the common stock involves risks that are described in the "Risk Factors" section beginning on page 10 of this prospectus.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

| Public offering price | $ | $ | |||||

| Underwriting discount | $ | $ | |||||

| Proceeds, before expenses, to us | $ | $ | |||||

| Proceeds, before expenses, to the selling stockholders | $ | $ | |||||

The underwriters may also purchase up to an additional shares from us, and up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2010.

| BofA Merrill Lynch | Piper Jaffray |

| Cowen and Company | William Blair & Company |

The date of this prospectus is , 2010.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We and the selling stockholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since such date.

No action has been or will be taken in any jurisdiction by us or any underwriter that would permit a public offering of our common stock or the possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to this offering and sale of our common stock and the distribution of this prospectus outside the United States. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus to "dollars" and "$" are to U.S. dollars.

Market data used throughout this prospectus was obtained from internal surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Consultant surveys and industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness

i

of such information is not guaranteed. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys and market research, which we believe to be reliable, based upon our management's knowledge of the industry, have not been independently verified.

"GameFly," "Game Answers," "Cheat Freak," "FileShack," "ShackNews," "CheatServer" and "GameStrata" and their respective logos are our trademarks. Solely for convenience, we refer to our trademarks in this prospectus without the ™ and ® symbols, but such references are not intended to indicate, in any way, that we will not assert to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

ii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

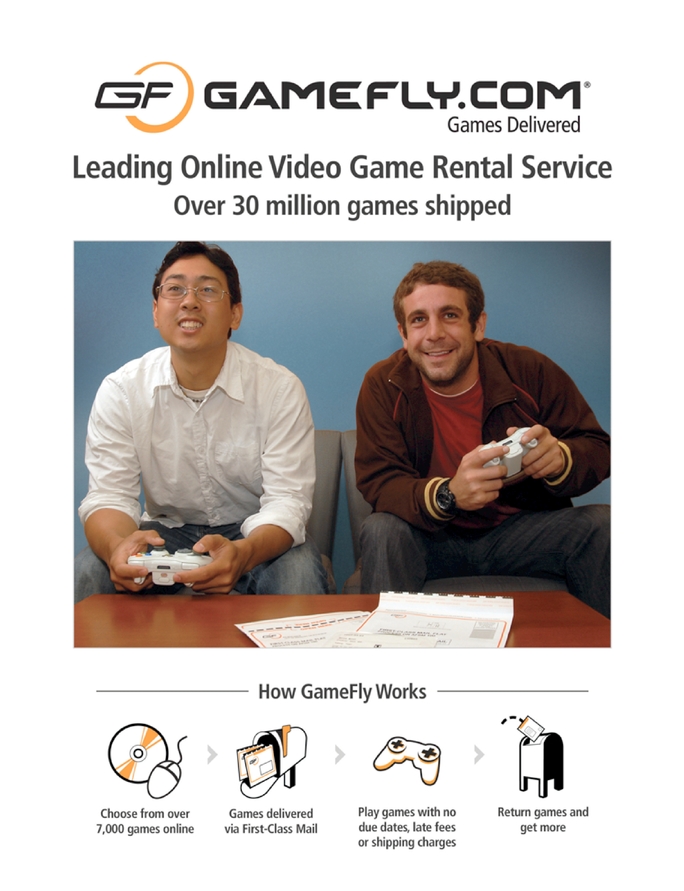

Our Company

We are a leading online video game rental subscription service with approximately 410,000 subscribers in the United States as of June 30, 2010. We provide our subscribers access to a comprehensive library of over 7,000 titles covering all major video game and handheld game consoles. We deliver video games to our subscribers via First-Class Mail. There are over 100 million people that play console video games in the United States, according to the 2009 Gamer Segmentation Report published by The NPD Group, or NPD. We believe that online rental subscriptions will constitute a growing percentage of total video game-related expenditures and that our subscription service presents a compelling alternative for video game players who have historically either purchased video games or rented them from traditional retailers.

Our subscription service has grown rapidly since its launch in 2002. We believe our growth has been driven by the compelling value proposition of our subscription model, extensive selection of titles, high level of customer service and effective marketing programs, as well as the increase in the installed base of video game consoles. We purchase nearly every new title upon its initial release in the United States. In addition, we continue to carry in our inventory approximately 92% of all titles that have been released across multiple generations of the major video game platforms since the inception of our company. As evidence of the demand for video games well after their initial release dates, approximately 50% of the video games rented through our subscription service during the 12 months ended June 30, 2010 consisted of titles at least six months old.

Our subscription service allows subscribers to have one or more video games out concurrently with no due dates, late fees or shipping charges for a fixed monthly fee. Subscribers select titles on our website, www.gamefly.com, receive video games via First-Class Mail and return them to us at their convenience using our prepaid mailers. Subscribers also have the option to purchase a video game they are currently renting through our "Keep" feature. Unless a subscriber decides to "Keep" a game, the subscriber can hold the game for as long as the subscriber desires without any obligation to purchase the game or pay any late fee or shipping charges. We offer our "Keep" feature for most of our newly released video games in our library. Upon confirmation that a video game has been returned or that a subscriber has elected to "Keep" a video game, we mail the next available game in a subscriber's GameQ, a subscriber's personal wish list of titles. We believe a significant value we offer to our subscribers is the ability to rent video games before they buy them. According to our August 2009 survey of subscribers, "try before you buy" ranks as the most important feature of the GameFly service. In addition to selling video games through our "Keep" feature, we also sell new and previously rented video games to our subscribers and others through www.gamefly.com.

To complement our subscription service and video game sales, we operate a network of advertising-supported websites that provide video game content and information. Our network of websites currently attracts approximately 4.4 million monthly unique visitors, most of whom are not subscribers. We focus on providing these visitors with video game-specific content to enhance their video game experience, which we believe increases our subscriber satisfaction and enables us to attract new subscribers. We have attracted advertisers who seek to reach the 18-34-year-old male demographic.

Our subscriber base increased from approximately 74,000 as of March 31, 2005 to approximately 410,000 as of June 30, 2010. Our revenues increased from $15.8 million in the fiscal year

1

ended March 31, 2005 to $101.5 million in the fiscal year ended March 31, 2010. In the fiscal year ended March 31, 2010, rental revenues constituted 98% of our revenues and advertising and other revenues constituted 2% of our revenues. Our net income decreased from $4.1 million in the fiscal year ended March 31, 2009 to $0.5 million in the fiscal year ended March 31, 2010 primarily due to an income tax benefit of $3.8 million in fiscal 2009 resulting primarily from the reversal of our valuation allowance for our deferred tax assets.

Industry Overview

There are over 100 million people that play console video games in the United States, according to the 2009 Gamer Segmentation Report published by NPD. International Data Corporation, or IDC, estimates that there were approximately 200 million installed video game consoles (including handheld units) in North America at the end of 2009, a number that is estimated by IDC to increase to almost 260 million by the end of 2013. According to IDC, the installed base of Sony PlayStation 3, Microsoft Xbox 360 and Nintendo Wii video game consoles is expected to grow from over 44 million consoles in 2008 to approximately 131 million consoles in 2013. According to the Newzoo Games Market Report published by Newzoo BV, revenues from sales of new and used console video game software in 2009, including games for handheld units, represented 60% of the total United States video game software market, including PC, casual/social, massive multiplayer online and mobile games. According to a 2009 survey conducted by Frank N. Magid Associates, console gaming and Internet usage are the top two leisure activities for males in the United States between the ages of 18 and 34. North American video game hardware and software sales surpassed $29 billion in 2008 and are projected to grow at a rate of approximately 8% annually to $43 billion in 2013, according to IDC. Sales of video game software constituted approximately $20 billion, or 68%, of this market in 2008.

Subscriber Benefits

Our solution provides the following benefits to our subscribers:

- •

- Value. We offer our video game rental service on a

subscription basis, significantly reducing the consumer's up-front cost associated with buying a new game. Through our subscription plans, subscribers can have one or more titles out

concurrently with no due dates, late fees or shipping charges, for prices starting at $15.95 per month, which is significantly less than the suggested retail price of a newly released video game.

Using our service, a subscriber can try a video game for as long as he or she desires and then choose to return or purchase it. Our average subscriber rents approximately 22 video games per year from

us at a cost less than the purchase price of five new video games at an average price of $60.

- •

- Wide selection. We offer over 7,000 video game titles for

Microsoft's Xbox 360 and Xbox, Sony's PlayStation 3, PlayStation 2 and PSP, and Nintendo's Wii, GameCube, DS and Game Boy Advance consoles. Our library contains numerous copies of popular new

releases, as well as many older "back-catalog" games that are generally less accessible in most video game rental and retail stores. We believe we are one of the few rental providers of

console games that offers a broad selection of titles for previous generation platforms, giving us an advantage over traditional retailers and expanding our addressable market. Many of our subscribers

play video games well after they have been released, leading us to believe that the availability of "back-catalog" games is an important differentiator of our service.

- •

- Convenience. Subscribers can easily select titles by building and modifying their GameQ, a personalized wish list or queue, of video game titles on our website. We create a unique experience for subscribers by personalizing our website to each subscriber's console type and selection history. Once selected, titles are sent to subscribers' homes through the U.S. Postal Service and returned to us in prepaid mailers. Subscribers also have the option to purchase a video game that they are currently renting through our "Keep" feature. Upon confirmation

2

that a title has been returned or that a subscriber has elected to "Keep" a video game, we automatically mail the next available game in his or her GameQ.

Strategy

Our objective is to extend our position as a leading online video game rental subscription service and to become a premier provider of video game content and information. In order to achieve our objective, we intend to:

- •

- Capitalize on a large and underpenetrated market. We

believe there is a large and untapped customer base for our subscription service and that an increased investment in marketing will allow us to further penetrate this market. According to the 2009

Gamer Segmentation Report published by NPD, there are over 100 million people who play console video games in the United States. There are two distinct segments within this market that we

intend to target to drive our business:

- •

- Core customers. According to our August 2009 survey of

subscribers, approximately 64% of our subscribers fall into the 18-34-year-old male demographic. According to NPD, there are more than 21 million console video game players in this

segment. With our low 1% penetration rate, we believe that this segment continues to represent a large addressable market for our subscription service.

- •

- Families. A small portion of our subscribers are families.

As a result of the introduction of new video games and video game consoles that appeal to families, such as the Nintendo Wii, we believe that this segment of the market is emerging as a potentially

large subscriber base for us. To date, a relatively small portion of our marketing spending has been targeted toward families. We intend to increase our marketing expenditures targeted at this group.

- •

- Further improve the subscriber experience. We regularly

add new features to make it easier for our subscribers to use our service. For example, we recently introduced our GameCenter application on the iPhone, which allows our subscribers to update their

GameQ and access relevant video game-related content and information on their iPhones. We have also updated our e-commerce capability to enable visitors to purchase multiple new and

previously rented video games in a single transaction. To help ensure our subscribers receive video games quickly, we utilize proprietary technology to manage the process and distribution of

approximately 49,000 video games per day from our distribution centers. Our software automates the process of tracking and routing titles to and from each of our distribution centers and allocates

order responsibilities among them. We regularly monitor, test and seek to improve the efficiency of our distribution, processing and inventory management systems. We intend to add additional

distribution centers to enhance the efficiency of our distribution network and to decrease the delivery time of video games to our subscribers.

- •

- Build our community. In addition to serving approximately

410,000 subscribers, our website www.gamefly.com attracts an average of 2.7 million monthly unique visitors. In order to build a community among

these visitors, we have developed and continue to add features and content that enable us and our community to post reviews, ratings and other video game-related content. We believe this

community enables us to engage with visitors, enhances loyalty and retention among our current subscribers and attracts new subscribers.

- •

- Expand GameFly Media. In addition to www.gamefly.com, we operate a network of additional video game-related websites including www.shacknews.com, www.fileshack.com, www.cheatfreak.com, www.consolecheatcodes.com, www.cheatserver.com, www.gameanswers.com and www.ponged.com. Our websites provide relevant content and information, such as industry-specific news, video game tips and cheat codes, screenshots and trailers of new titles,

3

- •

- Expand distribution and delivery channels. In November 2009, we started

selling new video games on our website and we intend to grow this service. We also intend to expand the channels through which we deliver video games to subscribers. For example, we are currently

piloting a kiosk program with two national retailers that enables consumers to rent or buy video games from kiosks located in retail outlets. We also intend to increase the number of games consumers

can play online and download from our network of websites, including www.ponged.com and www.fileshack.com.

- •

- Expand GameFly mobile presence. In September 2008, we enabled our subscribers to access www.gamefly.com from their mobile devices in order to search for video games and manage their GameQ. In October 2009, we launched our GameCenter application on the iPhone, and subsequently on other mobile devices, which allows our subscribers to manage their subscriptions and enables any visitor to easily access relevant video game-related content, news and information on their mobile devices. Since the launch of our GameCenter application, total monthly page views to our mobile website and application increased from 1.5 million in October 2009 to 11.3 million in June 2010. We intend to continue the development of our GameCenter applications in order to grow our advertising revenue, increase our subscriber base and lower our churn rate.

and game reviews and ratings to the video game community. Our websites are designed to enable our visitors to make informed decisions when purchasing or renting video games and enhance their overall video game experience. By developing or acquiring additional websites with video game-related content, we intend to grow our advertising revenue.

Risk Factors

Our business is subject to numerous risks and uncertainties, as discussed more fully in the section entitled "Risk Factors" beginning on page 10 of this prospectus, which you should read in its entirety. We generate substantially all of our revenue from subscriptions to our service. If our efforts to attract and retain subscribers are not successful, our revenues and business will be adversely affected. We must minimize the rate of loss of existing subscribers. If we experience excessive rates of subscriber churn or our subscribers switch their subscriptions to a lower cost plan, our revenues and business will be harmed. We face competitive pricing pressure and competition from companies with longer operating histories, larger customer bases, greater brand recognition and greater financial, marketing and other resources than we do. For example, Blockbuster, Inc. recently expanded its "Games by Mail" service to all customers that participate in its online movie rental service. There can be no assurance we will be able to compete effectively against these competitors.

Corporate Information

We were incorporated in the state of Delaware on April 15, 2002 under the name GameFly, Inc.

Our principal executive offices are located at 5340 Alla Road, Suite 110, Los Angeles, CA 90066 and our telephone number is (310) 664-6400. Our website address is www.gamefly.com. The information contained on our website is not part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only. Unless the context requires otherwise, in this prospectus the words "GameFly," "Company," "we," "our" and "us" refer to GameFly, Inc.

4

Common stock offered: |

|||

By GameFly, Inc. |

shares |

||

By the selling stockholders |

shares |

||

Total offering |

shares |

||

Common stock to be outstanding after this offering |

shares |

||

Overallotment option |

The underwriters have an option to purchase a maximum of additional shares of common stock from us and the selling stockholders to cover overallotments. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

||

Use of proceeds |

We expect the net proceeds to us from this offering, after expenses, to be approximately $ million based on an assumed initial public offering price of $ per share (the mid-point of the price range set forth on the cover page of this prospectus) and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, including working capital, sales and marketing activities, general and administrative matters and capital expenditures. We may also use a portion of the net proceeds to acquire or invest in complementary technologies, solutions or businesses or to obtain rights to such complementary technologies, solutions or businesses. There are no agreements, understandings or commitments with respect to any such acquisition or investment at this time. |

||

Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to shares offered by this prospectus for sale to some of our directors, officers, employees, distributors, dealers, business associates and related persons. If these persons purchase reserved shares, this will reduce the number of shares available for sale to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. |

||

Dividend policy |

We do not anticipate paying any dividends on our common stock in the foreseeable future. See "Dividend Policy." |

||

Risk factors |

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 10 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

||

Proposed NASDAQ Global Market symbol |

"GFLY" |

||

5

The number of shares of our common stock outstanding after this offering is based on 15,419,838 shares outstanding as of June 30, 2010, and excludes:

- •

- 4,452,614 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2010 to purchase

our common stock granted pursuant to the GameFly 2002 Stock Plan, as amended, or 2002 Stock Plan, at a weighted average exercise price of $2.64 per share;

- •

- 330,688 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2010 at a weighted

average exercise price of $2.37 per share;

- •

- an aggregate of 157,559 shares of common stock available for issuance as of June 30, 2010 under the 2002 Stock

Plan; and

- •

- 1,500,000 shares of common stock, subject to increase on an annual basis, reserved for issuance under our 2010 Omnibus Equity Incentive Plan, or 2010 Plan, which we plan to adopt in connection with this offering.

Except as otherwise indicated, information in this prospectus reflects or assumes the following:

- •

- that our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect at

or prior to completion of this offering, are in effect;

- •

- the automatic conversion of all of our outstanding preferred stock into an aggregate of 9,933,711 shares of common

stock upon completion of this offering;

- •

- no exercise of the underwriters' overallotment option to purchase up to additional shares of our common

stock; and

- •

- an initial public offering price of $ per share, the mid-point of the range set forth on the cover of this prospectus.

6

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize the consolidated financial data for our business. You should read this summary financial data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, all included elsewhere in this prospectus.

We derived the consolidated statements of operations data for the fiscal years ended March 31, 2008, 2009 and 2010 from our audited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated statements of operations data for the three months ended June 30, 2009 and 2010, and the unaudited consolidated balance sheet data as of June 30, 2010, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited information on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of the financial information set forth in those statements. Results for the three months ended June 30, 2010 are not necessarily indicative of the results to be expected for the fiscal year ending March 31, 2011. Our historical results are not necessarily indicative of the results to be expected in the future.

Pro forma basic net income (loss) per share has been calculated assuming the conversion of all outstanding shares of our preferred stock into 9,933,711 shares of common stock upon the completion of this offering. The balance sheet data as of June 30, 2010 is presented:

- •

- on an actual basis;

- •

- on a pro forma basis to reflect the automatic conversion of all outstanding shares of our preferred stock into 9,933,711

shares of common stock upon the completion of this offering; and

- •

- on a pro forma as adjusted basis to reflect the pro forma adjustments and the sale by us of shares of common stock offered by this prospectus at the initial public offering price of $ per share (the mid-point of the price range set forth on the cover page of this prospectus) after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

7

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2009 | 2010 | |||||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||||

Consolidated Statements of Operations: |

||||||||||||||||||

Revenues: |

||||||||||||||||||

Base subscription |

$ | 55,303 | $ | 71,756 | $ | 87,844 | $ | 20,723 | $ | 25,044 | ||||||||

Previously rented product |

9,171 | 10,786 | 11,111 | 2,452 | 2,735 | |||||||||||||

Total rental revenues |

64,474 | 82,542 | 98,955 | 23,175 | 27,779 | |||||||||||||

Advertising and other |

1,672 | 2,128 | 2,511 | 575 | 726 | |||||||||||||

Total revenues |

66,146 | 84,670 | 101,466 | 23,750 | 28,505 | |||||||||||||

Cost of revenues: |

||||||||||||||||||

Rental(1) |

36,658 | 45,140 | 53,561 | 11,121 | 13,584 | |||||||||||||

Advertising and other |

238 | 202 | 976 | 144 | 245 | |||||||||||||

Total cost of revenues |

36,896 | 45,342 | 54,537 | 11,265 | 13,829 | |||||||||||||

Gross profit |

29,250 | 39,328 | 46,929 | 12,485 | 14,676 | |||||||||||||

Operating expenses: |

||||||||||||||||||

Fulfillment(2) |

6,424 | 8,780 | 9,746 | 2,209 | 2,605 | |||||||||||||

Technology and development(2) |

3,636 | 6,542 | 7,409 | 1,823 | 2,032 | |||||||||||||

Marketing(2) |

13,526 | 17,521 | 19,105 | 4,157 | 4,438 | |||||||||||||

General and administrative(2) |

3,065 | 3,592 | 5,397 | 1,051 | 2,005 | |||||||||||||

Depreciation and amortization |

724 | 1,175 | 1,501 | 372 | 400 | |||||||||||||

Impairment of acquired website |

— | 668 | — | — | — | |||||||||||||

Impairment of goodwill |

— | 449 | 1,500 | — | — | |||||||||||||

Total operating expenses |

27,375 | 38,727 | 44,658 | 9,612 | 11,480 | |||||||||||||

Operating (loss) income |

1,875 | 601 | 2,271 | 2,873 | 3,196 | |||||||||||||

Other income (expense): |

||||||||||||||||||

Interest income |

199 | 68 | 7 | 3 | — | |||||||||||||

Interest expense |

(329 | ) | (225 | ) | (233 | ) | (74 | ) | (36 | ) | ||||||||

Change in fair value of warrants |

— | — | (648 | ) | (121 | ) | (5 | ) | ||||||||||

Other—net |

(57 | ) | (164 | ) | (28 | ) | (4 | ) | (12 | ) | ||||||||

Total other income (expense) |

(187 | ) | (321 | ) | (902 | ) | (196 | ) | (53 | ) | ||||||||

Income (loss) before income tax (provision) benefit |

1,688 | 280 | 1,369 | 2,677 | 3,143 | |||||||||||||

Income tax (provision) benefit |

(60 | ) | 3,780 | (916 | ) | (1,166 | ) | (1,550 | ) | |||||||||

Net income (loss) |

$ | 1,628 | $ | 4,060 | $ | 453 | $ | 1,511 | $ | 1,593 | ||||||||

Undistributed income attributable to preferred stockholders |

(1,628 | ) | (3,276 | ) | (453 | ) | (1,139 | ) | (1,178 | ) | ||||||||

Net income (loss) available to common stockholders |

$ | — | $ | 784 | $ | — | $ | 372 | $ | 415 | ||||||||

Net income (loss) per share: |

||||||||||||||||||

Basic |

$ | — | $ | 0.16 | $ | — | $ | 0.07 | $ | 0.08 | ||||||||

Diluted |

$ | — | $ | 0.10 | $ | — | $ | 0.05 | $ | 0.05 | ||||||||

Weighted average shares outstanding: |

||||||||||||||||||

Basic |

4,551,307 | 4,893,713 | 5,330,384 | 5,177,861 | 5,486,127 | |||||||||||||

Diluted |

4,551,307 | 7,824,282 | 8,433,383 | 8,077,741 | 8,772,593 | |||||||||||||

Pro forma net income (loss) per share (unaudited): |

||||||||||||||||||

Basic |

$ | 0.03 | $ | 0.10 | ||||||||||||||

Diluted |

$ | 0.02 | $ | 0.09 | ||||||||||||||

Pro forma weighted average shares outstanding used in calculating net income (loss) per share (unaudited): |

||||||||||||||||||

Basic |

15,226,293 | 15,419,838 | ||||||||||||||||

Diluted |

18,329,292 | 18,706,304 | ||||||||||||||||

8

- (1)

- Components of cost of rental are shown below:

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||

| |

(in thousands) |

|

|

||||||||||||||

Amortization of video game library |

$ | 11,817 | $ | 13,354 | $ | 20,286 | $ | 3,199 | $ | 5,536 | |||||||

Carrying value of previously rented products sold |

9,346 | 11,517 | 11,001 | 2,470 | 2,485 | ||||||||||||

Carrying value of lost and damaged games expensed |

6,186 | 5,981 | 5,462 | 1,521 | 1,142 | ||||||||||||

Shipping and handling, packaging, and other cost of rental |

9,309 | 14,288 | 16,812 | 3,931 | 4,421 | ||||||||||||

Total cost of rental |

$ | 36,658 | $ | 45,140 | $ | 53,561 | $ | 11,121 | $ | 13,584 | |||||||

- (2)

- Stock-based compensation, including the impact of warrants and options, included in the above line items:

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||

| |

(in thousands) |

|

|

||||||||||||||

Fulfillment |

$ | 69 | $ | 88 | $ | 74 | $ | 16 | $ | 21 | |||||||

Technology and development |

109 | 478 | 325 | 93 | 124 | ||||||||||||

Marketing |

82 | 165 | 901 | 156 | 54 | ||||||||||||

General and administrative |

82 | 109 | 264 | 24 | 188 | ||||||||||||

Total stock-based compensation expense |

$ | 342 | $ | 840 | $ | 1,564 | $ | 289 | $ | 387 | |||||||

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2009 | 2010 | |||||||||||

Other Data:(1) |

||||||||||||||||

Total subscribers(2) |

266,853 | 328,119 | 422,663 | 336,206 | 409,594 | |||||||||||

Gross additions |

393,063 | 531,949 | 635,536 | 139,285 | 152,179 | |||||||||||

Monthly churn |

7.3 | % | 7.7 | % | 7.8 | % | 8.2 | % | 8.3 | % | ||||||

Average monthly revenue per subscriber |

$ | 21.27 | $ | 21.03 | $ | 20.54 | $ | 20.80 | $ | 20.06 | ||||||

Subscriber acquisition cost |

$ | 29.93 | $ | 29.29 | $ | 26.18 | $ | 26.16 | $ | 25.41 | ||||||

- (1)

- The terms "total subscribers," "gross additions," "monthly churn," "subscriber acquisition cost" and "average monthly revenue per subscriber" are defined in the "Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics" section.

- (2)

- At end of period.

| |

As of June 30, 2010 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma | Pro Forma As Adjusted |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 11,960 | $ | 11,960 | ||||||

Total assets |

40,139 | 40,139 | ||||||||

Long term debt (including current portion) |

3,409 | 3,409 | ||||||||

Convertible preferred stock |

21,787 | — | ||||||||

Total stockholders' equity |

19,614 | 19,614 | ||||||||

9

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus before deciding whether to purchase our stock. Our business, prospects, financial condition and operating results could be materially and adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in the prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock.

If our efforts to attract and retain subscribers are not successful, our revenues will be adversely affected.

We generate substantially all of our revenue from subscriptions to our service and we must continue to attract subscribers to our service. Our ability to attract subscribers will depend primarily on our ability to consistently provide our subscribers with a valuable and quality experience for selecting, playing, receiving and returning video games, including providing content and features to enhance our subscribers' selection and play. For example, if consumers do not perceive our subscription service to be valuable relative to the services of our competitors, if we fail to deliver video games in a timely manner or deliver damaged video games, if we do not regularly introduce new content and features, or if we introduce new content and features that are not favorably received by the market, we may not be able to attract or retain subscribers. If we do not handle subscriber complaints effectively, our brand and reputation may suffer, we may lose our subscribers' confidence, and they may choose not to renew their subscriptions. In addition, many of our subscribers originate from word-of-mouth advertising and are directly referred to our service from existing subscribers. If our efforts to satisfy our existing subscribers are not successful, we may not be able to attract new subscribers and, as a result, our business, financial condition and results of operations will be adversely affected.

If we experience excessive rates of subscriber churn or our subscribers switch their subscriptions to lower cost plans, our revenues and business will be harmed.

We must minimize the rate of loss of existing subscribers and continually add new subscribers both to replace subscribers who choose not to renew their subscriptions and to grow our business beyond our current subscriber base. We describe the percentage of subscribers who elect not to renew their subscriptions as subscriber "churn." Subscribers choose not to renew their subscriptions for many reasons, including a desire to reduce discretionary spending or a perception that they do not use the service sufficiently, the service is a poor value, competitive services provide a better value or experience, or subscriber service issues are not satisfactorily resolved. Subscribers may choose not to renew their subscription at any time prior to the renewal date. If we are unable to attract new subscribers in numbers greater than our subscriber churn, our subscriber base will decrease and our business, financial condition and results of operations will be adversely affected. In addition, from time to time, we have experienced increases in the number of subscribers who switch their subscriptions to lower cost plans. Even if we are successful in minimizing churn, if significant numbers of our existing subscribers switch their subscriptions to lower cost plans, our business, financial condition and results of operations will be adversely affected.

If our subscriber churn increases, we may be required to increase the rate at which we add new subscribers in order to maintain and grow our revenues. If excessive numbers of subscribers cancel our service or switch their subscriptions to lower cost plans, we may be required to incur significantly higher marketing and advertising expenses than we currently anticipate in order to offset this loss of revenue. A significant increase in our subscriber churn or in the number of subscribers who switch their subscriptions to lower cost plans would have an adverse effect on our business, financial condition and results of operations.

10

If we are unable to compete effectively or withstand competitive pricing pressures, our business will be materially and adversely affected.

The market for in-home video game entertainment is intensely competitive and subject to rapid change. Many of our competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. For example, we compete against large retailers, such as Amazon, eBay, Blockbuster, Best Buy, GameStop, Target and Walmart, and other competitors that offer video game sales or rentals through retail stores, online or both. Blockbuster and Netflix have online rental subscription services for movies that are similar in nature to our online video game rental subscription service. Netflix subscribers and participants in Blockbuster's By Mail and Total Access Programs can rent movie DVDs online and have the DVDs delivered to their homes via First-Class Mail. Blockbuster and Netflix each have a greater number of online subscribers for movies than we do for video games. Each also has a much larger network of distribution centers and, in the case of Blockbuster, stores across the United States from which they offer DVDs to their subscribers. As such, these companies have a large and established subscriber base to which they can offer additional subscription services, such as the online rental of video games. Blockbuster began its "Games by Mail" pilot program in 2009 to expand its online movie rental service to include video games for customers in Cleveland, Ohio and Seattle, Washington. Starting in August 2010 Blockbuster expanded its "Games by Mail" service to all customers that participate in its online movie rental service. Blockbuster currently charges its online customers a fee ranging from $8.99 to $16.99 to rent concurrently one to three video games or, at the customer's option, movies for an unlimited period. Under our subscription plans, which range in price from $15.95 to $36.95 per month, subscribers can rent one to four games concurrently for an unlimited period. Netflix may in the future decide to include video games in its service offering. In addition, Netflix has significantly greater financial resources than we do. Also, alternative channels for online entertainment such as social networking sites, virtual worlds and massively multiplayer online games are growing in popularity and new technologies for delivery of in-home video game entertainment, such as Internet delivery of video game content, continue to receive considerable media and investor attention. There can be no assurance that we will be able to compete effectively against these competitors or against alternative channels of online entertainment delivery. To remain competitive, we must continue to provide relevant content and enhance and improve the functionality and features of our products and services. If competitors introduce new solutions that incorporate new technologies, our existing products and services may become obsolete. Our future success will depend on, among other things, our ability to:

- •

- anticipate demand for new products and services;

- •

- enhance our existing solutions;

- •

- respond to technological advances on a cost-effective and timely basis; and

- •

- decrease prices in response to pricing pressures from our competitors.

Demand for our service is also sensitive to price. Many external factors, including our marketing and technology costs and our competitors' pricing and marketing strategies, can significantly affect our pricing strategies. Certain other online DVD rental subscription services receive rates and terms of service from the U.S. Postal Service which we believe enable them to incur lower costs for mailing DVDs to and from their subscribers than we incur and may potentially enable them to charge lower rates for comparable services than we charge for our services. In addition, our competitors may adopt aggressive pricing policies and devote substantially more resources to marketing, website and systems development than we do. There can be no assurance that we will be able to compete effectively against current or new competitors at our existing pricing levels or at lower price levels in the future. Furthermore, we may need to increase the level of service provided to our subscribers and/or incur significantly higher marketing expenditures than we currently anticipate, which would further impact our ability to respond to pricing pressures.

11

If we are unable to successfully compete with the programs, technologies, or pricing strategies of our current or future competitors, we may not be able to increase or maintain market share, revenues or profitability, and our business, financial condition and results of operations will be materially and adversely affected.

If digital download or other technologies are more widely adopted and supported as a method of content delivery or other forms of online entertainment continue to grow in popularity, our business could be adversely affected.

Our rental subscription service currently depends on the distribution of physical video game media such as discs and cartridges. Existing and new technologies are continually being developed to enable consumers to download video game content from the Internet to a game console or a computer. Any of these technologies could become an alternative method of game content delivery that is widely supported by video game publishers and adopted by consumers. In addition, massively multiplayer online games, virtual worlds and other online games such as those offered by social networks are becoming increasingly popular. We currently do not offer our subscribers the ability to digitally download video games to a game console and have no current plans to offer this capability to our subscribers. If these technologies are adopted more quickly than we anticipate or more quickly than Internet delivery offerings that we may provide in the future, other providers are better able to meet video game publisher and consumer needs and expectations, or these forms of online entertainment grow in popularity more quickly than we anticipate, our business, financial condition and results of operations could be adversely affected.

Our recent revenue growth rate may not be sustainable.

Our revenues increased in each of the fiscal years ended March 31, 2005 through March 31, 2010. However, the rate of our revenue growth declined during each of the fiscal years during this period and our revenue growth rate may continue to decline. We may not be able to sustain our historical revenue growth rate in future periods and you should not rely on the revenue growth of any prior quarterly or annual period as an indication of our future performance. If our future growth fails to meet investor or analyst expectations, it could have a negative effect on our stock price. If our growth rate were to decline significantly or become negative, it would adversely affect our business, financial condition and results of operations.

If our marketing and advertising efforts fail to generate additional revenues on a cost-effective basis, or if we are unable to manage our marketing and advertising expenses, our business will suffer.

We utilize a broad mix of marketing programs to promote our service to potential new subscribers. Significant increases in the pricing of one or more of our marketing and advertising channels would increase our marketing and advertising expense or cause us to choose less expensive but less effective marketing and advertising channels. As we implement new marketing and advertising strategies and phase out older strategies, we may need to expand into marketing and advertising channels with significantly higher costs than our current channels, which could adversely affect our profitability. Further, we may over time become disproportionately reliant on one channel or partner, which would limit our marketing and advertising flexibility and could increase our operating expenses. We may also incur marketing and advertising expenses significantly in advance of the time we anticipate recognizing revenue associated with such expenses, and our marketing and advertising expenditures may not result in increased revenue or generate sufficient levels of brand awareness. If we are unable to maintain our marketing and advertising channels on cost-effective terms or replace existing marketing and advertising channels with similarly effective channels, our marketing and advertising expenses could increase substantially, our subscriber levels could be adversely affected, and our business, financial condition and results of operations will suffer.

12

If we are unable to improve market recognition of and loyalty to our brands, or if our reputation were to be harmed, our business may be adversely affected.

We must continue to build and maintain strong brand identity. To succeed, we must continue to attract and retain a large number of subscribers who may have previously relied on other rental sources and persuade them to subscribe to our service. In addition, we compete for subscribers against other in-home entertainment brands which are well-established and have greater recognition than ours. We believe that the importance of brand loyalty will only increase in light of increasing competition, both for online subscription services and other means of distributing video game titles, such as digital download. From time to time, our subscribers express dissatisfaction with our service, including among other things, our inventory availability and shipping times. To the extent dissatisfaction with our service is widespread or not adequately addressed, our brand may be adversely impacted. Many of our subscribers are passionate about video games, and many of these subscribers may participate in blogs on this topic. If actions we take or changes we make to our service upset these subscribers, their blogging could negatively affect our brand and reputation. If we are unable to maintain and develop our brand and reputation, our business, financial condition and results of operations may be adversely affected.

If we do not acquire sufficient video game titles or manage our inventory efficiently, our subscriber satisfaction and results of operations may be adversely affected.

If we do not acquire sufficient video game titles, we may not appropriately satisfy subscriber demand, and our subscriber satisfaction and results of operations may be adversely affected. Conversely, if we attempt to mitigate this risk and, as a result, acquire more titles than needed to satisfy our subscriber demand, our inventory utilization would become less effective and our profitability would be adversely affected. Similarly, if we are unable to sell previously rented video games in a timely manner, and at prices that are acceptable to us, as part of our inventory management efforts, our profitability would be adversely affected. Additionally, market factors such as exclusive distribution arrangements may impact our ability to acquire appropriate quantities of certain titles.

Our operating results may fluctuate from quarter to quarter, which could make them difficult to predict.

Our quarterly operating results are tied to certain financial and operational metrics that have fluctuated in the past and may fluctuate significantly in the future. As a result, you should not rely upon our past quarterly operating results as indicators of future performance. Our operating results depend on numerous factors, many of which are outside of our control. In addition to the other risks described in this "Risk Factors" section, the following risks could cause our operating results to fluctuate:

- •

- our ability to retain existing subscribers and attract new subscribers;

- •

- timing and amount of costs of new and existing marketing and advertising efforts;

- •

- seasonal fluctuations in the number of our subscribers;

- •

- timing and amount of inventory purchases in connection with the holiday season and the release of major video game titles;

- •

- timing and amount of operating costs and capital expenditures relating to expansion of our business, operations and

infrastructure;

- •

- the cost and timing of the development and introduction of new product and service offerings by our competitors or by us;

- •

- downward pressure on the pricing of our subscriptions; and

- •

- system failures, security breaches or Internet downtime.

13

For these or other reasons, the results of any prior quarterly or annual periods should not be relied upon as indications of our future performance and our revenue and operating results in future quarters may differ materially from the expectations of management or investors.

Increases in the cost of delivering video games or other changes in U.S. Postal Service policies would adversely affect our profitability.

Increases in postal delivery rates or increases in the cost of fuel or other transportation costs related to the delivery of our video games would adversely affect our profitability if we elect not to raise our subscription fees to offset the increase. The U.S. Postal Service increased the rate for first class postage in May 2009 and is expected to raise rates again in subsequent years in accordance with the powers granted to it in connection with the 2006 postal reform legislation. In addition, the U.S. Postal Service continues to focus on plans to reduce its costs and make its service more efficient. If the U.S. Postal Service were to change any policies relative to the requirements of First-Class Mail, including changes in size, weight or machinability qualifications of our envelopes, such changes could result in increased shipping costs or higher breakage rates for our video games, and our gross margin could be adversely affected. Also, if the U.S. Postal Service reduces its available services, such as by closing facilities or discontinuing Saturday delivery service, our ability to timely deliver video games could be impacted, and our subscriber satisfaction could be adversely affected.

Increases in payment processing fees or changes to operating rules that increase our costs would increase our operating expenses and adversely affect our business and results of operations, and the termination of our relationship with any major credit card company would have a material impact on our business.

Our subscribers pay for our subscription services using credit cards or debit cards. Our acceptance of these payment methods requires that we pay certain processing fees for each credit card or debit card transaction. From time to time, these fees may increase, either as a result of rate changes by the payment processing companies or as a result of a change in our business practices which increases the fees on a cost-per-transaction basis. Such increases would adversely affect our business and results of operations.

We are subject to rules, regulations and practices governing our accepted payment methods, which are predominately credit cards and debit cards. These rules, regulations and practices could change or be reinterpreted to make it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines or higher transaction fees or lose our ability to accept these payment methods. In addition, our credit card fees may be increased by credit card companies if our chargeback rate, or the rate of payment refunds, exceeds certain minimum thresholds. If we are unable to maintain our chargeback rate at acceptable levels, our credit card fees for chargeback transactions, or for all credit card transactions, may be further increased, and, if the problem significantly worsens, credit card companies may terminate their relationship with us. Any increases in our credit card fees could adversely affect our results of operations, particularly if we elect not to raise our subscription rates to offset the increase. The termination of our ability to process payments on any major credit or debit card would have a material impact on our ability to operate our business.

If the sales prices of video games to retail customers decrease or the number of video game consoles purchased by retail consumers declines, or video game publishers charge our subscribers additional fees to access online features of our games, our ability to attract and retain new subscribers would be adversely affected.

We believe that video game publishers have significant flexibility in pricing video games for retail sale. If the retail price of video games were to become significantly lower, customers may choose to purchase video games rather than subscribe to our service, which would adversely affect our business.

14

Video game publishers may charge our subscribers additional fees to access online features of games they rent from us. For example, EA Sports recently announced it will charge $9.99 to consumers using rented or used games to access online features, such as enhanced game content or multiplayer games. If more game publishers charge consumers of rented or used games additional fees to access online content or other privileges, our subscribers may decide to not use our service, which would adversely affect our business. The maintenance and growth of our subscriber base is dependent upon consumers continuing to purchase video game consoles as such purchases significantly drive the purchase and rental of video games. If there is a decline in the number of video game consoles purchased by consumers, our business, financial condition and results of operations would be adversely affected.

Any significant disruption in service on our websites or in our computer systems could materially and adversely affect our business.

Substantially all of our communications, network and computer hardware used to operate our websites are co-located at the facilities of a third-party provider in Irvine, California, our primary facility, and in Denver, Colorado, our secondary facility. We do not control the operation of these facilities. Hardware for our delivery systems is maintained in our shipping centers. Fires, floods, earthquakes, power losses, telecommunications failures, break-ins and similar events could damage these systems and hardware or cause them to fail completely. Our secondary facility in Denver, Colorado is not yet fully redundant. A disrupting event at the Irvine facility could result in downtime of our operations and could materially and adversely affect our business, financial condition and results of operations.

Subscribers and potential subscribers access our service through our primary website, www.gamefly.com, where the title selection process is integrated with our delivery processing systems and software. Our reputation and ability to attract, retain and serve our subscribers is dependent upon the reliable performance of our websites, our network infrastructure and fulfillment processes. Interruptions in these systems, or with the Internet in general, could make our service unavailable and hinder our ability to receive and fulfill title requests. Much of our software is proprietary, and we rely on the expertise of our engineering and software development teams for the continued performance of our software and computer systems. Service interruptions or errors in our software, which result in the unavailability or impair usability of our website, could diminish the overall attractiveness of our subscription service to existing and potential subscribers. Additionally, problems faced by our third-party Web hosting provider, with the telecommunications network providers with which it contracts or with the systems by which it allocates capacity among its customers, including us, could adversely impact the experience of our subscribers.

Our servers are also vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could lead to interruptions and delays in our service and operations as well as loss, misuse or theft of data. Any attempts by hackers to disrupt our website service or our internal systems, if successful, could harm our business, be expensive to remedy and damage our reputation. Our insurance does not cover expenses related to direct attacks on our website or internal systems. Efforts to prevent hackers from entering our computer systems are expensive to implement and may limit the functionality of our services. Any significant disruption to our website or internal computer systems could result in a loss of subscribers and materially and adversely affect our business, financial condition and results of operations.

In the event of an earthquake, other natural or man-made disaster or loss of power, our operations could be adversely affected.

Our executive offices are located in Los Angeles, California, our network and computer hardware used to operate our websites are hosted at co-location facilities in Irvine, California and

15

Denver, Colorado, and we have shipping centers located throughout the United States, including in earthquake and hurricane-sensitive areas. Our business and operations could be adversely affected in the event of these natural disasters as well as from electrical blackouts, fires, floods, power losses, telecommunications failures, break-ins or similar events. We may not be able to effectively shift our fulfillment and delivery operations to handle disruptions in service arising from these events. Because Irvine and Los Angeles, California, are located in an earthquake-sensitive area, we are particularly susceptible to the risk of damage to, or total destruction of, our executive offices and primary co-location facility. We are not insured against any losses or expenses that arise from a disruption to our business due to earthquakes and may not have adequate insurance to cover losses and expenses from other natural disasters.

We rely heavily on our technology to process deliveries and returns of our video games and to manage other aspects of our operations, and the failure of this technology to operate effectively could adversely affect our business.

We use complex proprietary and non-proprietary software technologies to process deliveries and returns of our video games and to manage other aspects of our operations. This technology is intended to allow our nationwide network of distribution centers to be operated on an integrated basis. We continually enhance or modify the technology used for our distribution operations. We cannot be sure that any enhancements or other modifications we make to our distribution operations will achieve the intended results or otherwise be of value to our subscribers. Future enhancements and modifications to our technology could consume considerable resources. If we are unable to maintain and enhance our technology to manage the processing of video games among our distribution centers in a timely and efficient manner, our ability to retain existing subscribers and to add new subscribers may be impaired.

If we experience delivery problems or if our subscribers or potential subscribers lose confidence in the U.S. Postal Service, we could lose subscribers, which would adversely affect our operating results.

We rely exclusively on the U.S. Postal Service to deliver video games from our shipping centers and to return them to us from our subscribers. We are subject to risks associated with using the public mail system to meet our shipping needs, including delays or disruptions caused by inclement weather, natural disasters, labor activism, health epidemics or bioterrorism. Our video games are also subject to risks of breakage and theft during our processing of shipments as well as during delivery and handling by the U.S. Postal Service. The risk of breakage is also impacted by the materials and methods used to manufacture video game discs and cartridges. If the companies manufacturing our video games use materials and methods more likely to break during delivery and handling or we fail to timely deliver video games to our subscribers, our subscribers could become dissatisfied and cancel our service, which would adversely affect our business, financial condition and results of operations. In addition, increased breakage and theft rates for our video games will decrease our profitability.

The loss of any of our key personnel, or our failure to attract, assimilate and retain other highly qualified personnel in the future, could harm our business.

We depend on the continued service and performance of our key personnel, including David Hodess, our President and Chief Executive Officer. We do not maintain key man insurance on any of our officers or key employees. We also do not have long-term employment agreements with any of our officers or key employees. In addition, much of our key technology and systems are custom-made for our business by our personnel. The loss of key personnel, including key members of our management team, as well as certain of our key marketing, sales, product development or technology personnel, could disrupt our operations and have an adverse effect on our ability to grow our business.

In addition, to execute our growth plan, we must attract and retain highly qualified personnel. Competition for these employees is intense, and we may not be successful in attracting and retaining

16

qualified personnel. We could also experience difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have. In addition, in making employment decisions, particularly in the Internet and high-technology industries, job candidates often consider the value of the stock options they are to receive in connection with their employment. Accounting principles generally accepted in the United States relating to the expensing of stock options may discourage us from granting the size or type of stock option awards that job candidates may require to join our company. If we fail to attract new personnel, or fail to retain and motivate our current personnel, our business and future growth prospects could be severely harmed.

If we are not able to manage our growth, our business could be adversely affected.

We have expanded rapidly since we launched our subscription service in 2002. Many of our systems and operational practices were implemented when we were at a smaller scale of operations. Our growth in operations has placed a strain on our management, administrative, technological, operational and financial infrastructure. Anticipated future growth, including growth related to the broadening of our service offering and the addition of new distribution centers, will continue to place similar strains on our personnel, technology and infrastructure. A sudden increase in the number of our subscribers and in the number of visitors to our websites could strain our capacity and result in website performance issues. Our success will depend largely upon our management team's ability to manage the expected growth of our operations and improving our operational, financial, technological and management controls and our reporting systems and procedures. Additional capital investments will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by offsetting expense reductions in the short term. If we fail to successfully manage our growth, it could adversely affect our business, financial condition and results of operations.

If we acquire any businesses or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value or have an adverse effect on our results of operations.

As part of our business strategy, we may engage in acquisitions of businesses or technologies to augment our organic or internal growth. While we have engaged in some acquisitions in the past, we do not have extensive experience with integrating and managing acquired businesses or assets. Acquisitions involve challenges and risks in negotiation, execution, valuation and integration. Moreover, we may not be able to find suitable acquisition opportunities on terms that are acceptable to us. Even if successfully negotiated, closed and integrated, certain acquisitions may not advance our business strategy, may fall short of expected return-on-investment targets or may fail. For example, we recently wrote off the goodwill and certain other intangible assets associated with GameStrata, Inc. ("GameStrata"), a company we acquired in October 2008. Any future acquisition could involve numerous risks including:

- •

- difficulty integrating the operations and products of the acquired business;

- •

- potential disruption of our ongoing business and distraction of management;

- •

- use of cash to fund the acquisition or for unanticipated expenses;

- •

- dilution to our current stockholders from the issuance of equity securities;

- •

- limited market experience in new businesses;

- •

- exposure to unknown liabilities, including litigation against the companies we may acquire;

- •

- potential loss of key employees or customers of the acquired company;

- •

- additional costs due to differences in culture, geographic locations and duplication of key talent; and

- •

- acquisition-related accounting charges affecting our balance sheet and operations.

17

In the event we enter into any acquisition agreements, closing of the transactions could be delayed or prevented by regulatory approval requirements, including antitrust review, or other conditions. We may not be successful in addressing these risks or any other problems encountered in connection with any attempted acquisitions, and we could assume the economic risks of such failed or unsuccessful acquisitions.

We are exposed to risks associated with credit card and payment fraud and with credit card processing, which could cause us to lose revenue.

Our subscribers use credit cards or debit cards to pay for our products and services. We have suffered losses, and may continue to suffer losses, as a result of fraudulent credit cards or other fraudulent payment data used on www.gamefly.com to obtain our subscription service and access to our video game inventory, as well as new and previously rented video games. For example, under current credit card practices, we may be liable for fraudulent credit card transactions if we do not obtain a cardholder's signature, a frequent practice in Internet sales. Currently, we do not carry insurance against the risk of fraudulent credit card transactions. We employ technology solutions to help us detect fraudulent transactions. However, the failure to detect or control payment fraud could cause us to lose revenue.

Our reputation and relationships with subscribers would be harmed if our subscriber data, particularly billing data, were to be accessed by unauthorized persons.

We maintain personal data regarding our subscribers, including names and mailing addresses. With respect to billing data, such as credit card numbers, we rely on licensed encryption and authentication technology to secure such information. If we, or our payment processing service, experience any unauthorized intrusion into our subscribers' data, current and potential subscribers may become unwilling to provide us with the information necessary for them to remain as or become subscribers, we could face legal claims, and our business could be adversely affected. Similarly, if a well-publicized breach of the consumer data security of any other major consumer website were to occur, there could be a general public loss of confidence in the use of the Internet for commerce transactions which could adversely affect our business, financial condition and results of operations.

We may seek additional capital and we cannot be certain that additional financing will be available.

From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other things, our development efforts, business plans, operating performance and condition of the capital markets. If we are unable to obtain adequate financing on terms satisfactory to us when we require it, our ability to service our outstanding indebtedness, to continue to support our business growth and to respond to business challenges could be significantly limited.

Changes in the economy could impact our business.

We provide an entertainment service and the success of our business depends to a significant extent upon discretionary consumer spending, which is subject to a number of factors, including general economic conditions, consumer confidence, employment levels, business conditions, interest rates, availability of credit, inflation and taxation. The United States remains in an economic downturn. Continued weak economic conditions and further adverse trends in any of these economic indicators may cause consumer spending to decline further, which could impact our business as subscribers choose either to leave our service or reduce their service levels. Also, efforts to attract new subscribers may be adversely impacted. In addition, media prices may increase in a period of economic growth, which could significantly increase our marketing and advertising expenses. As a result, our business, financial condition and results of operations may be significantly affected by changes in the economy generally.

18

A material weakness in our internal controls over financial reporting was identified in connection with our 2009 fiscal year audit, and if we fail to maintain an effective system of internal controls in the future, we may not be able to accurately report our financial results.