Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GRAHAM PACKAGING HOLDINGS CO | d8k.htm |

Exhibit 99.1

Transaction overview

On August 9, 2010, Graham Packaging Acquisition Corp., a Delaware corporation and a subsidiary of the Graham Packaging Holding Company L.P., entered into a Purchase Agreement to acquire all of the issued and outstanding common stock and unit interests of the Liquid Container Entities (“Liquid Container” or the “Target”). At the close of the Liquid Container acquisition (the “Acquisition”), Graham Packaging Acquisition Corp., or its wholly owned subsidiary and/or affiliate, will purchase issued and outstanding equity interests in Liquid Container for an aggregate purchase price of $568.0 million in cash, plus cash on hand and minus certain indebtedness. In connection with and at the time of the closing of the Acquisition, the Company intends to repay existing indebtedness of Liquid Container, including accrued interest, then outstanding.

In addition to the proposed Acquisition, Graham Packaging Company, L.P. (“Graham” or the “Company”) is also seeking to refinance the existing $563 million Term Loan B due 2011 and amend various provisions to the existing senior secured credit agreement (the “Amendment”)

In support of the Acquisition, Graham has engaged Deutsche Bank Securities Inc. (“DBSI”) and Citigroup (“Citi”) to act as Joint Lead Arrangers and Joint Bookrunners and Goldman Sachs (“Goldman”) to act as Co-Manager.

The Acquisition will be financed through:

| • | $350 million of Term Loan D |

| • | $250 million senior unsecured debt |

1

Sources and uses and pro forma capitalization

The estimated sources and uses of funds at closing of the Acquisition and Amendment are as follows:

| ($ in millions) | ||||||||

| Sources of funds |

Uses of funds | |||||||

| New term loan D |

$ | 350.0 | Purchase Liquid Container equity(a) |

$ | 568.0 | |||

| Existing Term Loan B |

563.1 | Extend existing term loan B |

563.1 | |||||

| Senior unsecured debt |

250.0 | Fees, expenses & OID |

33.4 | |||||

| Cash from Balance Sheet |

1.4 | |||||||

| Total sources of funds |

$ | 1,164.5 | Total uses of funds |

$ | 1,164.5 | |||

The Company’s estimated pro forma 6/30/10 capitalization and credit statistics at the closing of the transaction are as follows:

| Pro forma capitalization | |||||||||||||||

| Status Quo | Adj. | Pro Forma | Multiple of | ||||||||||||

| 6/30/2010 | + | - | 6/30/2010 | 6/30/10 EBITDA(b) | |||||||||||

| Cash |

$ | 136.1 | ($ | 1.4 | ) | $ | 134.7 | ||||||||

| Revolving facility |

$ | 0.0 | $ | 0.0 | 0.0x | ||||||||||

| Term Loan B |

563.1 | (563.1 | ) | 0.0 | 0.0x | ||||||||||

| Term Loan C |

1,038.1 | 1,038.1 | 1.8x | ||||||||||||

| New Term Loan D(c) |

0.0 | 913.1 | 913.1 | 1.6x | |||||||||||

| Capital Leases and other |

29.6 | 29.6 | 0.1x | ||||||||||||

| Total secured debt |

$ | 1,630.8 | $ | 1,980.8 | 3.4x | ||||||||||

| Existing senior notes |

253.4 | 253.4 | 0.4x | ||||||||||||

| Senior unsecured debt |

0.0 | 250.0 | 250.0 | 0.4x | |||||||||||

| Total senior debt |

$ | 1,884.2 | 2,484.2 | 4.3x | |||||||||||

| Senior subordinated notes |

375.0 | 375.0 | 0.7x | ||||||||||||

| Total debt |

$ | 2,259.2 | $ | 2,859.2 | 5.0x | ||||||||||

| Graham Packaging market capitalization(d) |

720.0 | 720.0 | 1.3x | ||||||||||||

| Total capitalization |

$ | 2,979.2 | $ | 3,579.2 | 6.2x | ||||||||||

| Operating metrics |

|||||||||||||||

| PF EBITDA(b) |

$ | 574.6 | |||||||||||||

| Cash interest expense |

220.8 | ||||||||||||||

| Capital expenditures |

173.3 | ||||||||||||||

| Credit statistics |

|||||||||||||||

| EBITDA / Cash interest expense |

2.6x | ||||||||||||||

| (EBITDA-Capex) / Cash interest expense |

1.8x | ||||||||||||||

| (a) | Acquisition price on a debt/cash free basis; Liquid Container has outstanding debt facilities which will be repaid at closing. |

| (b) | Based on PF 6/30/10 EBITDA of $574.6mm for the combined Graham and Liquid entity; includes $20mm of synergies. |

| (c) | Assumes full refinancing and conversion of Term Loan B into Term Loan D |

| (d) | Market cap of Graham as of 9/7/2010. |

Note: Excludes letters of credit.

2

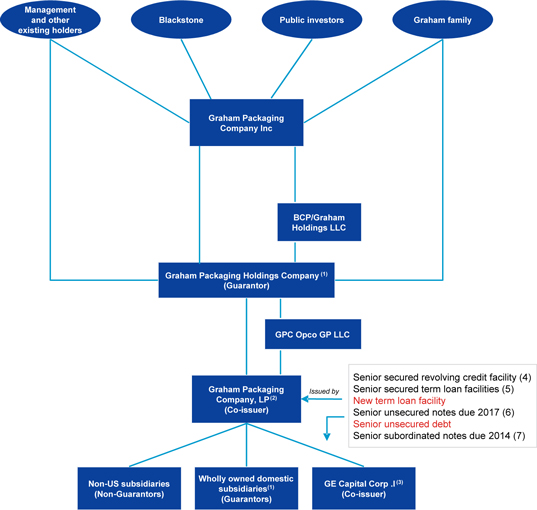

Ownership and Corporate Structure

The chart below illustrates the Company’s anticipated ownership and corporate structure immediately following the consummation of the acquisition. There are no significant changes to the corporate structure.

| (1) | Upon consummation of the transaction, Holdings (together with certain existing and future subsidiaries of the Operating Company, including Liquid Container and its subsidiaries, the “guarantors”) will guarantee the new Term Loan D, on a senior secured basis, and the senior debt on a senior unsecured basis. Holdings and the other guarantors also guarantee the existing senior notes on a senior unsecured basis, the existing senior subordinated notes on an unsecured senior subordinated basis and the senior secured credit agreement on a senior secured basis. As of June 30, 2010 the senior secured credit agreement consisted of (i) a $563.1 million senior secured term loan due October 7, 2011 (“Term Loan B”), which will be repaid in full in connection with the transaction, (ii) a $1,038.1 million senior secured term loan due April 5, 2014 (“Term Loan C”) ($1,022.8 million outstanding with a $15.3 million unamortized discount included as interest expense as Term Loan C matures), (iii) a $260.0 million senior secured revolving credit facility (“senior secured revolving credit facility) (of which $135.2 million of commitments will mature on October 7, 2010 and $124.8 million of commitments will mature on October 1, 2013) and, upon consummation of the transaction, (iv) a new $913.1 million senior secured term loan due six years from the closing date of the transaction (“Term Loan D”) ($904.0 outstanding on a pro forma basis after giving effect to the transaction with a $9.1 million unamortized discount to be included as interest expense as Term Loan D matures). |

| (2) | The Operating Company will be a borrower of the new Term Loan D and issuer of the senior unsecured debt. The Operating Company is also a co-borrower under the senior secured credit agreement and a co-issuer of the existing senior notes and the existing senior subordinated notes. |

3

| (3) | CapCo I will be a borrower of the New Term Loan D and issuer of the senior unsecured debt. CapCo I is also a co-borrower under the senior secured credit agreement and a co-issuer of the existing senior notes and the existing senior subordinated notes. |

| (4) | The senior secured revolving credit facility consists of a $260.0 million senior secured revolving credit facility, with $135.2 million of commitments (or 52% of total commitments) maturing on October 7, 2010, with the remaining $124.8 million of commitments maturing on October 1, 2013. As of June 30, 2010 on a pro forma basis for the transaction, $249.8 million was available for borrowing under this facility, after giving effect to $10.2 million of outstanding letters of credit. |

| (5) | The senior secured term loan facilities consist of (i) $1,038.1 million aggregate principal amount of Term Loan C due April 5, 2014 ($1,022.8 million outstanding as of June 30, 2010 with a $15.3 million unamortized discount included as interest expense as Term Loan C matures) and (ii) upon consummation of the transaction, the new $913.1 million aggregate principal amount Term Loan D due six years from the closing date of the transaction ($904.0 million outstanding with a $9.1 million unamortized discount to be included as interest expense as Term Loan D matures). |

| (6) | Consists of $253.4 million aggregate principal amount of 8.25% senior unsecured notes due 2017 (the “existing senior notes”) ($250.1 million outstanding as of June 30, 2010 with a $3.1 million unamortized discount included as interest expense as the existing senior notes mature). On July 2, 2010, the Company filed a registration statement with the SEC to exchange the senior notes for notes with substantially identical terms, except the new notes will be freely tradable. |

| (7) | Consists of $375.0 million aggregate principal amount of 9.875% senior subordinated unsecured notes due 2014 (the “existing senior subordinated notes” and, together with the existing senior notes, the “existing notes”). |

4

Corporate History and Information

The predecessor to Holdings, controlled by the predecessors of the Graham Family, was formed in the mid-1970s as a regional domestic custom plastic container supplier. Holdings was formed under the name “Sonoco Graham Company” on April 3, 1989, as a Pennsylvania limited partnership. It changed its name to “Graham Packaging Company” on March 28, 1991, and to “Graham Packaging Holdings Company” on February 2, 1998. The primary business activity of Holdings is its direct and indirect ownership of 100% of the partnership interests in the Operating Company. The Operating Company was formed under the name “Graham Packaging Holdings I, L.P.” on September 21, 1994, as a Delaware limited partnership, and changed its name to “Graham Packaging Company, L.P.” on February 2, 1998. On October 7, 2004, the Company acquired the blow molded plastic container business of Owens-Illinois, Inc. (“O-I Plastic”), which essentially doubled the size of the Company. The Company’s operations have included the operations of O-I Plastic since the acquisition date.

GPC was incorporated in Delaware under the name “BMP/Graham Holdings Corporation” on November 5, 1997 in connection with the recapitalization transaction in which Blackstone, management and other investors became the indirect holders of 85.0% of the partnership interests of Graham Packaging Holdings Company, which was completed on February 2, 1998. GPC is a holding company whose only material assets are the direct ownership of an 87.9% limited partnership interest in Holdings and 100% of the limited liability company interests of BCP/Graham Holdings L.L.C. (“BCP”), which holds a 2.9% general partnership interest in Graham Packaging Holdings Company. GPC changed its name to “Graham Packaging Company Inc.” on December 10, 2009. GPC completed the initial public offering of its common stock on February 17, 2010, in which it issued 16,666,667 common shares and raised net proceeds of approximately $147.9 million, including $3.0 million of expenses paid in the fourth quarter of 2009, and, on March 16 2010, GPC completed its sale of additional common shares offered to the underwriters in the IPO and received approximately $14.7 million in net proceeds. GPC’s common stock is listed on the New York Stock Exchange and is traded under the symbol “GRM.”

The Company’s principal executive offices are located at 2401 Pleasant Valley Road, York, Pennsylvania 17402, telephone (717) 849-8500. Holdings and GPC file annual, quarterly and current reports and other information with the SEC. Those filings with the SEC are, and will continue to be, available to the public on the SEC’s website at http://www.sec.gov and the corporate web site at http://www.grahampackaging.com. The information contained on the Company’s website or that can be accessed through the SEC website neither constitutes part of this offering memorandum nor is incorporated by reference herein.

5

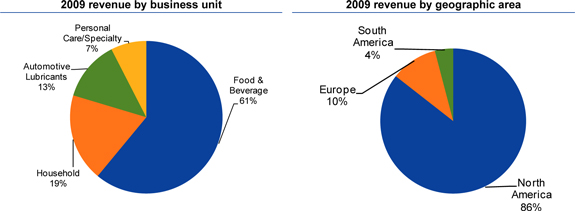

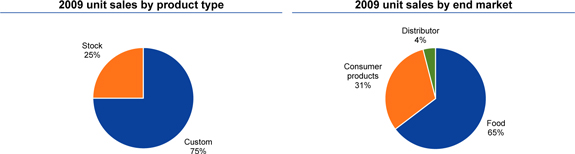

Graham Packaging overview

Graham Packaging Company is a worldwide leader in the design, manufacture and sale of value added, custom blow molded plastic containers for branded consumer products. The Company operates in product categories where customers and end users value the technology and innovation that custom plastic containers offer as an alternative to traditional packaging materials such as glass, metal and paperboard. Graham selectively pursues opportunities where they can leverage their technology portfolio to continue to drive the trend of conversion to plastic containers from other packaging materials. Customers include leading multi national and regional blue-chip consumer product companies that seek customized, sustainable plastic container solutions in diverse and stable end markets, such as the food and beverage and the household consumer products markets. Graham is well-positioned to meet the evolving needs of the Company’s customers who often use Graham’s technology to differentiate their products with value added design and performance characteristics such as smooth-wall panel-less bottles, unique pouring and dispensing features, multilayer bottles incorporating barrier technologies to extend shelf life, and ultra lightweight bottles with “hot-fill” capabilities that allow containers to be filled at high temperatures.

Graham believes it has the number one market share positions in North America for hot-fill juices, sports drinks/isotonics, yogurt drinks, liquid fabric care, dish detergents, hair care, skin care and certain other products. For the year ended December 31, 2009, approximately 90% of net sales from continuing operations were realized in these product categories. Graham does not participate in markets where technology is not a differentiating factor, such as the carbonated soft drink or bottled water markets.

Graham’s value added products are supported by more than 1,000 issued or pending patents. The Company strives to provide the highest quality products and services to their customers, while remaining focused on operational excellence and continuous improvement. These priorities help to reduce their customers’ costs, while also maximizing financial performance and cash flow. Graham supplies their customers through a network of 82 manufacturing facilities, approximately one-third of which are located on-site at their customers’ plants. The vast majority of Graham’s sales are made pursuant to long-term customer contracts that include the pass-through of the cost of plastic resin, as well as mechanisms for the pass-through of certain other manufacturing costs.

Collectively, Graham’s product portfolio, technologies, end markets and operations all contribute to their industry leading margins and strong cash flow.

6

For the twelve months ended June 30, 2010, on a pro forma basis giving effect to the acquisition of Liquid Container, the Company generated net sales of approximately $2,733.4 million and covenant compliance EBITDA of approximately $574.6

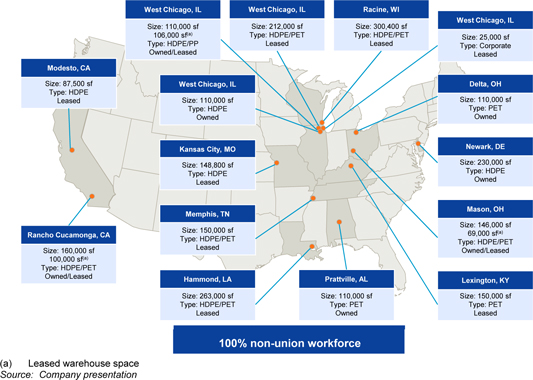

On August 9, 2010, Graham announced entry into an agreement to acquire Liquid Container, which Graham views as strategically important to the Company. Liquid Container is a custom blow-molded plastic container manufacturer based in West Chicago, Illinois, that primarily services food and household product categories. In the food category, Liquid Container produces packaging for peanut butter, mayonnaise, coffee, creamer, cooking oil, nuts, instant drink mixes, and other food items. The household category consists of containers for bleach, laundry detergent, spray cleaners, automotive cleaning products, drain cleaners, and other consumer-based household products. Liquid Container utilizes high density polyethylene (“HDPE”), polyethylene teraphthalate (“PET”), and polypropylene resins to manufacture their containers. Liquid Container employs approximately 1,000 employees in its 14 non-union plants located across the United States. Seven of the plants are “near sites,” operating within a few miles of their customers’ production facilities.

Historical financial results

Graham Packaging

Graham’s historical financial results for the fiscal years ended December 31, 2007 to 2009, and the twelve months ended June 30, 2010, are as follows:

| Graham summary historical financials |

||||||||||||||||

| ($ in millions) | Year ended December 31, | LTM | ||||||||||||||

| 2007 | 2008 | 2009 | 2010 | |||||||||||||

| Net Sales |

$ | 2,470.9 | $ | 2,559.0 | $ | 2,271.0 | $ | 2,361.9 | ||||||||

| % growth |

NA | 3.6 | % | (11.3 | %) | NA | ||||||||||

| Gross profit |

$ | 341.5 | $ | 375.7 | $ | 404.4 | $ | 421.1 | ||||||||

| % of net sales |

13.8 | % | 14.7 | % | 17.8 | % | 17.8 | % | ||||||||

| Adjusted EBITDA |

$ | 432.0 | $ | 452.8 | $ | 463.2 | $ | 475.1 | ||||||||

| % of net sales |

17.5 | % | 17.7 | % | 20.4 | % | 20.1 | % | ||||||||

| Covenant compliance adjusted EBITDA |

$ | 441.6 | $ | 462.8 | $ | 475.3 | $ | 485.9 | ||||||||

| % of net sales |

17.9 | % | 18.1 | % | 20.9 | % | 20.6 | % | ||||||||

| Capital expenditures |

$ | 153.4 | $ | 148.6 | $ | 146.0 | $ | 150.1 | ||||||||

| % of net sales |

6.2 | % | 5.8 | % | 6.4 | % | 6.4 | % | ||||||||

| Covenant compliance adjusted EBITDA - CapEx |

$ | 288.2 | $ | 314.2 | $ | 329.3 | $ | 335.8 | ||||||||

| % of net sales |

11.7 | % | 12.3 | % | 14.5 | % | 14.2 | % | ||||||||

7

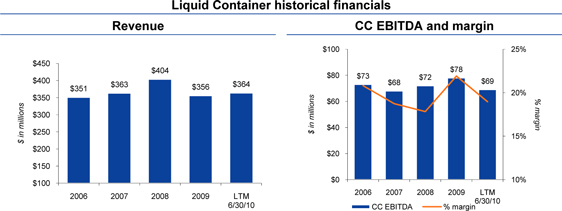

Liquid Container L.P.

Liquid Container’s historical financial results for the fiscal years ended December 31, 2007 to 2009, and the twelve months ended June 30, 2010, are as follows:

| Liquid Container summary historical financials |

||||||||||||||||

| ($ in millions)

|

Year ended December 31, | LTM | ||||||||||||||

| 2007 | 2008 | 2009 | June 30, 2010 |

|||||||||||||

| Net Sales |

$ | 362.8 | $ | 404.0 | $ | 355.5 | $ | 363.7 | ||||||||

| % growth |

3.5 | % | 11.4 | % | (12.0 | %) | NA | |||||||||

| Gross profit |

$ | 64.7 | $ | 65.8 | $ | 69.5 | $ | 60.8 | ||||||||

| % of net sales |

17.8 | % | 16.3 | % | 19.5 | % | 16.7 | % | ||||||||

| Adjusted EBITDA |

$ | 68.4 | $ | 71.4 | $ | 75.4 | $ | 67.4 | ||||||||

| % margin |

18.9 | % | 17.7 | % | 21.2 | % | 18.5 | % | ||||||||

| Covenant compliance adjusted EBITDA |

$ | 68.4 | $ | 72.4 | $ | 77.6 | $ | 68.8 | ||||||||

| % margin |

18.9 | % | 17.9 | % | 21.8 | % | 18.9 | % | ||||||||

| Capital expenditures |

$ | 29.7 | $ | 15.9 | $ | 20.0 | $ | 22.5 | ||||||||

| % of net sales |

8.2 | % | 3.9 | % | 5.6 | % | 6.2 | % | ||||||||

| Covenant compliance adjusted EBITDA - CapEx |

$ | 38.7 | $ | 56.5 | $ | 57.6 | $ | 46.3 | ||||||||

| % of net sales |

10.7 | % | 14.0 | % | 16.2 | % | 12.7 | % | ||||||||

8

Liquid Container L.P. overview

Liquid Container L.P. is a specialty rigid plastic container manufacturer serving large, growing markets with unique capabilities and a differentiated business strategy focused on complex, custom-designed packaging products. The Company designs and manufactures a wide range of specialty high density polyethylene (“HDPE”), polyethylene terephthalate (“PET”) and polypropylene (“PP”) blow molded containers primarily for the food and consumer products sectors.

Acquisition rationale

Liquid Container represents a strategically important acquisition for Graham as it expands customer reach within Graham’s existing end markets food and consumer products while providing additional technological capabilities and an expansion of Graham’s geographical reach.

Customer Expansion within Existing End Markets. The Acquisition will significantly increase the size and scope of Graham’s operations in particular in the food category (which represents 76% of Liquid Container’s unit sales volume) and provide considerable opportunities to convert new products to plastic containers. At the same, time Graham believes that the Liquid Container Acquisition will introduce the Company to new customers, in particular in the smaller-sized branded consumer products company space. Liquid Containers’ top five customers, who comprised approximately $186 million, or 52%, of their sales in 2009, purchased only $3 million from Graham, about 1% of 2009 net sales, providing Graham and Liquid with the opportunity to cross-sell to each other’s customers.

Access to New Technologies. Liquid Container has been a leader in custom blow molded plastic containers used in cold fill applications (peanut butter, mayonnaise, coffee, and creamer) as well as has new hot-fill technologies (ThermaSetTM), which complement Graham’s existing technologies, and which Graham believes can help drive new conversions. Additionally, Liquid Container’s process and operational expertise, combined with Graham’s, can create additional efficiencies across the combined manufacturing footprint.

9

Geographical Expansion. Liquid Container’s 14 plants are located in the U.S. and bring Graham additional manufacturing capacity in regions where Graham lacks a robust footprint. In particular, Liquid Container has two plants in California and three in the southern U.S., as well as some additional capacity on the East Coast that can provide a base for future production. While Liquid Container has been focused solely on the U.S. market, their key customers do have multinational presence. Graham believes there is an opportunity to service those customers’ international operations with their existing footprint, especially in Latin America.

Attractive Financial Profile similar to Graham Packaging. Liquid Container has strong, long-term customer relationships, serving consumer staple markets in the food and household categories. Similar to Graham, Liquid Container uses technology and operational excellence to serve their customer base with innovation and cost effective packaging solutions. Liquid Container has resin pass through mechanisms in the majority of their contracts, helping to further stabilize margins from resin commodity price swings. Liquid Container’s strong profit margins and disciplined capital spending have lead to strong cash flow generation.

10

Opportunity for Cost Savings. Graham believes the combined purchasing power can yield savings in resin, freight, energy, outside services, leased equipment, and miscellaneous raw materials such as packaging, pallets, shrink wrap, and spare parts. Graham also believes they can gain operating efficiencies at Liquid Container’s facilities by implementing projects from the Graham Performance System continuous improvement process. These projects range from energy and air compression audits to outside warehousing, material handling efficiencies, and line speed improvements. Additionally, Graham believes they can eliminate overlapping corporate functions and expenses.

11