Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INERGY HOLDINGS, L.P. | d8k.htm |

Tres

Palacios Natural Gas Storage

Acquisition Overview

September 7, 2010

Exhibit 99.1 |

2

Forward Looking Statements

NYSE: NRGY, NRGP

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 that are not limited to historical facts, but

reflect Inergy’s and Inergy Holdings’ current beliefs, expectations

or intentions regarding future events. Words such as “may,”

“will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,”

“believe,” “estimate,” “predict,”

“potential,” “pursue,” “target,” “continue,” and similar expressions are intended to identify such forward-

looking statements. These forward-looking statements include, without

limitation, Inergy’s and Holdings’ expectations with respect to the

synergies, costs and other anticipated financial impacts of the proposed

transaction; future financial and operating results of the combined

company; the combined company’s plans, objectives, expectations and

intentions with respect to the expectation that the closing conditions

will be satisfied and the Tres Palacios acquisition will close, the accretion expectations as a result of Tres Palacios, the availability

and timing of any expansion possibilities at Tres Palacios, the expectation that

the acquisition will be funded by a combination of debt and equity, the

impact on EBITDA, the anticipated future storage capacity at storage projects as well as future demand for such capacity and

the timing of the pending simplification transaction with Inergy Holdings,

L.P. All forward-looking statements involve significant risks, uncertainties and

assumptions that could cause actual results to differ materially from

those in the forward-looking statements, many of which are generally outside the control of Inergy and Holdings and are difficult to

predict. Examples of such risks, uncertainties and assumptions include,

but are not limited to, weather conditions that vary significantly from

historically normal conditions, the demand for high deliverability natural gas storage capacity in the Northeast and in Texas, the

general level of natural gas and other hydrocarbon product demand, the

availability of natural gas, the price of natural gas to the consumer

compared to the price of alternative and competing fuels, our ability to

successfully implement our business plan for midstream expansion, our

ability to generate available cash for distribution to unitholders, the outcome of certificate and rate decisions issued by the Federal

Energy Regulatory Commission, and the costs and effects of legal, regulatory,

and administrative proceedings against us or which may be brought against

us. Inergy and Inergy Holdings caution that the foregoing list of factors is not

exclusive. Additional information concerning these and other risk factors

is contained in Inergy’s and Inergy Holdings’ most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports

on Form 10-Q, recent Current Reports on Form 8-K and other SEC

filings. All subsequent written and oral forward-looking statements

concerning Inergy, Inergy Holdings, the proposed merger and related transactions

and the Tres Palacios acquisition or other matters and attributable to

Inergy or Inergy Holdings or any person acting on their behalf are expressly qualified in their entirety by the cautionary

statements above. Neither Inergy nor Inergy Holdings undertakes any

obligation to publicly update any of these forward-looking statements

to reflect events or circumstances that may arise after the date hereof. |

3

Transaction Summary

Inergy

has executed a definitive agreement to purchase Tres

Palacios Gas Storage LLC,

the owner of the Tres

Palacios natural gas storage facility located ~100 miles southwest

of Houston in Matagorda County, TX for $725 million (plus reimbursement of certain

capital expenditures and customary working capital adjustments)

High-deliverability salt dome natural gas storage asset located near

metropolitan demand markets of Houston and San Antonio and connected to 10

intrastate and interstate pipelines serving multiple U.S. demand

markets –

38.4 Bcf

of working gas capacity with planned expansion to 47.9 Bcf

Transaction positions Inergy

as the largest independent natural gas storage operator in

the U.S.

–

Total

combined

working

gas

capacity

of

~80

(a)

Bcf,

expandable

to

~100

Bcf

with

planned

expansion

projects

–

Significantly

expands

Inergy’s

existing

natural

gas

storage

operations

and

establishes

a

new

gas

storage

platform

for

future growth

–

Identified

expansion

opportunities

in

addition

to

current

Tres

Palacios

operations

Inergy

has secured committed financing to fund the transaction and expects to utilize a

combination of long-term debt and equity consistent with its goal of

maintaining a strong balance sheet

Transaction expected to create significant long-term strategic value and

provide Inergy unitholders

attractive economic returns

__________________

(a)

Pro forma for Seneca Lake and Tres

Palacios acquisitions. |

4

Transaction Benefits

__________________

(a)

Forecast run rate FY 2012 Adjusted EBITDA.

Significantly expands natural gas

storage operations

–

Creates largest independent natural gas storage operator

in the U.S. with ~80 Bcf

of working gas storage

capacity, expandable to ~100 Bcf

Establishes new midstream market

platform with additional growth

opportunities

Further strengthens and diversifies

cash flow profile

–

Pro forma adjusted EBITDA contribution from

midstream operations expected to be ~43% in FY 2011

and ~50% in FY 2012

Expected to be immediately accretive to

Inergy

unitholders

Transaction economics consistent with

expected returns outlined under

NRGY/NRGP merger

27.1

38.4

47.9

0

10

20

30

40

50

60

Current

Expected Q4 2010

Expected 2014

Tres Palacios Working Gas Capacity

Pro Forma Adjusted EBITDA

(a)

Midstream

~50%

Propane

~50% |

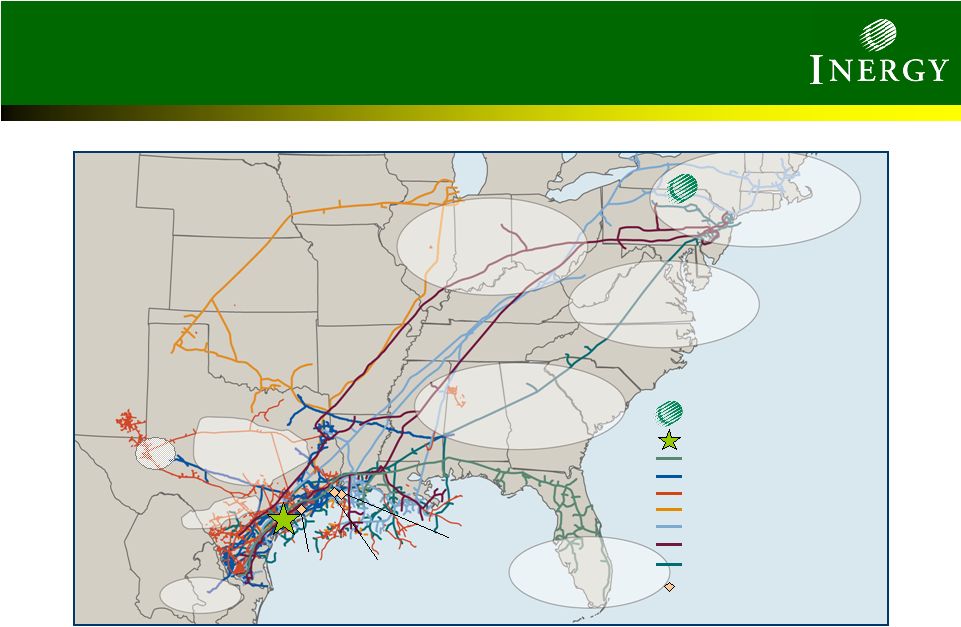

5

Pipeline

Interconnects

&

Markets

Served

Northeast

Midwest

Mid-Atlantic

Southeast

Florida

Barnett

Shale

Pemex

/ MGI

Eagle Ford Shale

Waha

Freeport

Sabine Pass

Golden Pass

Florida Gas Transmission Co

Natural Gas Pipeline Co

Tennessee Gas Pipeline Co

Texas Eastern Transmission LP

Transcontinental Gas Pipe Line

Kinder Morgan Intrastate System

Enterprise Intrastate System

Tres

Palacios Storage

LNG Terminal

Inergy

Northeast Storage Hub |

6

Tres

Palacios Asset Overview

27.1

Bcf

working

gas

capacity

currently

in

service

(Cavern

1

and

2)

Cavern

3

provides

additional

11.4

Bcf

of

working

gas

capacity

(expected

in-service

Sep-2010)

–

Cavern 3 substantially complete; FERC and TRC authorizations to place

in-service received –

$18 million incremental capex

(including base gas)

Cavern

4

provides

additional

9.5

Bcf

(expected

in-service

by

or

before

2014)

–

$67.5

million

incremental

capex

to

complete

(including

base

gas)

at

attractive

investment

returns

High deliverability characteristics (6+ turns)

–

Maximum

withdrawal

capacity

–

2.5

Bcf/day;

maximum

injection

capacity

–

1

Bcf/day

Compression

-

24,000

HP

existing

(48,000

HP

permitted)

–

40 mile, 24”

bi-directional header system is connected to 10 intrastate and interstate

pipelines serving Texas markets as well as U.S. markets in the

Northeast, Midwest, Southeast, Mid-Atlantic and Mexico

Rights to develop all caverns leached by Texas Brine on Markham salt dome

Five potential future additional interconnects

–

Trunkline, Crosstex, Gulf South, Dow Pipeline and KM Texas

Asset Characteristics

Future Growth Opportunities |

7

Commercial Opportunities

Tres

Palacios is strategically positioned to supply large daily needs of the Texas

gas-fired power generation market

Facility offers more interconnects than any competing storage asset in Texas

market –

Offers the ability to serve multiple demand markets in Texas as well as

Midwestern, Southeastern, Mid-Atlantic, Northeastern U.S. and

Mexico ~90%

of

existing

storage

capacity

under

firm

contracts–Inergy

expects

to

contract

100%

of

existing

and incremental storage capacity under firm storage contracts

Provides

ability

to

wheel

gas

between

pipeline

systems,

offering

customers

added

flexibility

Pooling point for Intercontinental Exchange (ICE); hub for Gulf Coast

Adjacent

to

Eagle

Ford

shale

and

connected

to

the

Perdido

gas

play;

access

to

LNG

regasification

plants and import pipelines

Creates synergy opportunities with Inergy’s

existing natural gas storage assets in the Northeast via

common connections to Tennessee Gas and Transcontinental Pipelines

–

Creditworthy

customer

base

has

significant

crossover

with

Inergy’s

Northeast

natural

gas

storage

facilities |

8

Tres Palacios Facilities Map |

9

Tres Palacios Storage Facility |

10

Committed to Generating Industry-Leading Returns to

Our Investors |