Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - CHINA PEDIATRIC PHARMACEUTICALS, INC. | ex231.htm |

| EX-10.24 - EXHIBIT 10.24 - CHINA PEDIATRIC PHARMACEUTICALS, INC. | ex1024.htm |

As filed with the United States Securities and Exchange Commission on September 3, 2010

File No. 333-164562

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

AMENDMENT NO. 5

TO

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA PEDIATRIC PHARMACEUTICALS, INC.

Formerly Lid Hair Studios International, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

2834

|

20-271 8075

|

|

(State or other jurisdiction of

incorporation or organization)

|

(primary standard industrial

classification code number)

|

(I.R.S. Employer

Identification No.)

|

9th Floor, No. 29 Nanxin Street,

Xi’an, Shaanxi Province

P.R.C., 710004

86 29 8727 1818

(Address and telephone number of principal executive offices and principal place of business)

___________________

Copies to:

Marc J. Ross, Esq.

Jessica S. Yuan, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32 nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public : From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

¨

|

|

Accelerated Filer

|

¨

|

|

Non-Accelerated Filer

|

¨

|

Smaller Reporting Company

|

þ

|

1

Page 1

|

Title Of Each

Class of Securities

To be Registered

|

Amount To

Be Registered

|

Proposed

Maximum

Offering Price

Per Share(1)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee(3)

|

||||||||||||

|

Common stock, par value $0.001 per share (2)(3)

|

1,250,000

|

$

|

4.10

|

$

|

5,125,000

|

$

|

365.41

|

|||||||||

|

Common stock, par value $0.001 per share (2)(3)

|

1,250,000

|

$

|

4.10

|

$

|

5,125,000

|

$

|

365.41

|

|||||||||

|

Total

|

2,500,000

|

$

|

10,250,000

|

$

|

730.82

|

*

|

||||||||||

———————

(1) Estimated solely for purposes of calculating the registration fee. The registration fee is calculated pursuant to Rule 457(c). Our common stock is quoted under the symbol "CPDU.OB" on the Over-the-Counter Bulletin Board (“OTCBB”) administered by FINRA. As of January 28, 2010, the last reported high price was $4.10 per share and the last reported low price was $4.10 per share. The average of the high and low price was $4.10 per share. Accordingly, the registration fee is $730.82 based on $4.10 per share.

(2) An indeterminate number of additional shares of common stock shall be issuable pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions and in such an event the number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416 under the Securities Act.

(3) We are registering up to 2,500,000 shares of our common stock that we may issue upon the exercise of share purchase warrants.

*Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 3, 2010

PRELIMINARY PROSPECTUS

CHINA PEDIATRIC PHARMACEUTICALS, INC.

2,500,000 shares of common stock

This prospectus relates to the resale of up to 2,500,000 shares of our common stock, $0.001 par value per share, by certain of our stockholders. These persons, together with their transferees, are referred to throughout this prospectus as “selling stockholders.”

We issued all of the shares described above in private placement transactions completed prior to the filing of this registration statement.

The selling stockholders may offer to sell the shares of common stock being offered in this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices. Our common stock is quoted on the OTC Bulletin Board under the symbol "CPDU". On September 1, 2010 , the closing bid price for one share of our common stock on the OTC Bulletin Board was $4.75.

You should consider carefully the risk factors beginning on page 4 of this prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved of these securities or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is: *, 2010

3

Table of Contents

|

|

|

|

About this Prospectus

|

5 |

|

Cautionary Note Regarding Forward-Looking Statements and Other Information Contained in this Prospectus

|

6

|

|

Prospectus Summary

|

7

|

|

The Company

|

7

|

|

The Offering

|

8

|

|

Plan of Distribution

|

9

|

|

Risk Factors

|

9 |

|

Use of Proceeds

|

23

|

|

Dilution

|

23

|

|

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

|

23

|

|

Management’s Discussion and Analysis of Financial Conditions (MD&A)

|

25

|

|

Results of Operations

|

26

|

|

Critical Accounting Policies

|

30

|

|

Our Business

|

41

|

|

Corporate History

|

41

|

|

The Merger Transaction

|

41

|

|

Background of Shaanxi Jiali

|

41

|

|

Reorganization and Revised Structure

|

42

|

|

Our Business

|

44

|

|

Description of Property

|

56

|

|

Directors and Executive Officers , Promoters

|

57

|

|

Transactions with Related Persons, Promoters and Certain Control Persons

|

61

|

|

Executive Compensation

|

62

|

|

Security Ownership of Certain Beneficial Owners and Management

|

64

|

|

Selling Stockholders

|

65

|

|

Plan of Distribution

|

66

|

|

Description Of Securities

|

68

|

|

Legal Matters

|

70

|

|

Experts

|

70

|

|

Legal Proceedings

|

70

|

|

Changes in and Disagreements with Accountants

|

70

|

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

|

70

|

|

Where You Can Find More Information

|

71

|

|

Financial Statements

|

72

|

4

You should rely only on the information contained in the prospectus. We have not authorized anyone to provide you with information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than that contained in the prospectus. If any other information or representation is given or made, such information or representations may not be relied upon as having been authorized by us or any selling stockholder. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

When used in this prospectus, the terms:

|

●

|

“Asia Pharm,” refers to Asia Pharm Holdings, Inc., a British Virgin Islands Company

|

|

●

|

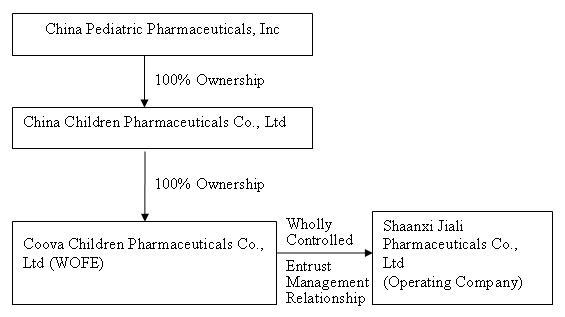

“China Pediatric,” “China Pediatric Pharmaceuticals,” “Lid Hair Studios International, Inc.,” “CPDU,” “LHSI,” the “Company,” “we,” “our” and “us” refers to China Pediatric Pharmaceuticals, Inc., formerly Lid Hair Studios International, Inc. a Nevada corporation.

|

|

●

|

“China Children Pharmaceuticals” refers to our wholly owned subsidiary China Children Pharmaceuticals Co., Ltd., a limited liability company organized under the laws of the Hong Kong.

|

|

|

●

|

“Xi’an Coova” refers to Coova Children Pharmaceuticals Co. Ltd., which is a “wholly foreign-owned enterprise” (“WFOE”) under the laws of the People’s Republic of China.

|

|

●

|

“Shaanxi Jiali” refers to our variable interest entity (“VIE”), Shaanxi Jiali Pharmaceutical Co., Ltd. a company organized under the laws of the PRC that has entered into a series of agreements with Xi’an Coova that (i) give Xi’an Coova control over the board of directors, officers, operations and finances of China Children Pharmaceuticals; (ii) permit China Children Pharmaceuticals to be treated as a subsidiary of Xi’an Coova under the laws of the People’s Republic of China; and (iii) allow us to consolidate its financial statements under GAAP.

|

|

●

|

“China Children Shareholders” refers to the shareholders of China Children Pharmaceuticals who are also some of the shareholders of China Pediatric Pharmaceuticals.

|

|

●

|

“Yuan” or “RMB” refer to the Chinese yuan (also known as the Renminbi). According to the currency website xe.com, as of December 31, 2009, $1 = 6.828 yuan.

|

|

●

|

“PRC” or “China” refers to the People’s Republic of China.

|

|

●

|

“SFDA” refers to the PRC State Food and Drug Administration.

|

|

●

|

“OTC Bulletin Board” or the “OTCBB” refers to the Over-the-Counter Bulletin Board, an electronic quotation system for equity securities overseen by the Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers), which is accessible through its website at WWW.OTCBB.COM

|

5

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) projected sales, profitability, and cash flows, (b) growth strategies, (c) anticipated trends, (d) future financing plans and (e) anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipates,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Plan of Operation” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of the forward-looking statements in this prospectus may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in the prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

6

This summary highlights selected information contained elsewhere in this prospectus. It is not complete and does not contain all of the information that you should consider before investing in our common stock. To understand this offering fully, you should read the entire prospectus carefully, including “Risk Factors” and the Consolidated Financial Statements and the Related Notes.

Business Overview

Through our operating company, Shaanxi Jiali, we are a profitable, mid-sized Chinese pharmaceutical company that identifies, discovers, develops manufactures and distributes both prescription and over-the counter, including both conventional Western and Traditional Chinese Medicines (“TCMs”), for the treatment of some of the most common ailments and diseases, with pediatric medicine as its focus.

A TCM is understood in the PRC pharmaceutical industry to be a type of drug that is primarily composed of herbs and plants used in traditional Chinese medicinal preparations but, instead of being processed and applied using ancient traditional methods (such as a tea or decoction), is both produced and applied using modern methods and dosage forms. Unlike in conventional Western pharmaceuticals, where the active medicinal ingredients may be synthetically and chemically manufactured, the active substances in TCM products are usually derived from naturally-found plant and non-plant sources. TCMs are understood to be the modern form of traditional Chinese medicine whose remedies are based on Chinese instead of Western pharmacological principles. The PRC government recognizes and authorizes for production and sale two types of pharmaceuticals: Western-style chemically produced pharmaceuticals and TCMs. The former is denoted in the national pharmacological coding system with an “H,” and the latter is denoted with a “Z”.

Shaanxi Jiali has its own manufacturing facility located in Baoji, Shaanxi Province. Our manufacturing facility was issued a Good Manufacturing Practices (“GMP”) certification by the SFDA in 2004. We were awarded the National High-tech Enterprise Award by the Shaanxi Technology Administration in 2006. As a result of receiving the National High-tech Award, Shaanxi Jiali is entitled to the “Two exemption Three half” tax holiday based on the local government’s policy to encourage outside investment into the locality. According to PRC tax laws, “Two exemption Three half” policy means foreign investment enterprises including Shaanxi Jiali may enjoy an exemption from corporate income tax for 2 years starting from its first profitable year, followed by 3 years at a rate that is one half of the regular rate for corporate income tax.

We distribute our high value, branded medicines, both prescription and OTC, through exclusive territory agents who sell our products directly to local pharmacies who in turn sell them to their retail customers.

Currently we are looking to increase production capacity and look to do so year by year primarily through acquisitions. The PRC government has recently pushed for consolidation of the pharmaceutical industry. We have a good relationship with our local government who will help us to find, acquire and merge with other factories, however our development may be limited by our ability to find suitable acquisition targets.

For more information about our business you should read the section entitled “OUR BUSINESS”.

Our Corporate Information

We maintain our corporate headquarters at 9 th Floor, No. 29 Nanxin Street, Xi’an, Shaanxi Province, People’s Republic of China. Our telephone number is (86) 29-8727-1818 and our facsimile number is (86) 29-8727-1818-8003.

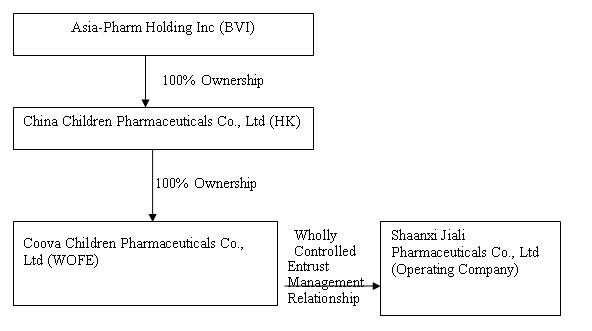

Background

On September 30, 2009, we acquired control of Shaanxi Jiali from Asia-Pharm through a “reverse merger” transaction, by which we acquired 100% of the equity interest in China Children Pharmaceuticals for 7,000,000 shares of common stock to the shareholders of Asia-Pharm. In connection with the share exchange agreement, our former controlling shareholder submitted 5,000,000 post-split shares of common stock of the Company for cancellation and forgave the outstanding shareholder’s loan to the Company in the amount of $86,173 in exchange for 100% of the issued and outstanding shares of Lid Hair Studios’ wholly-owned subsidiary, Belford Enterprises B.C. Ltd., d/b/a Lid Hair Studio. Through the reverse merger we ceased to be a shell company as that term is defined in Rule 12b-2 under the Securities Exchange Act of 1934 (the “Exchange Act”) and are now in the business of developing, manufacturing and distributing conventional medicines and TCMs in China primarily for pediatric use.

Lid Hair Studios International, Inc. was established on April 20, 2005 in the state of Nevada. On June 27, 2008, Asia-Pharm formed China Children Pharmaceuticals, a Hong Kong company, as its wholly-owned subsidiary. On July 25, 2008, China Children Pharmaceuticals formed Xi’an Coova, a limited liability company organized under the laws of the PRC,

7

as its wholly-owned subsidiary and WFOE under PRC law. On August 4, 2008, Xi’an Coova signed a management entrustment agreement with Shaanxi Jiali ("Shaanxi Jiali"), a pediatric pharmaceutical developer, manufacturer and marketer formed on July 1, 1998 under the laws of the PRC, and the shareholders of Xi’an Coova. Pursuant to that agreement, Xi’an Coova acts as the management company for Shaanxi Jiali, and Shaanxi Jiali conducts the principal operations of the business.

In summary, we have no equity ownership interest in Shaanxi Jiali; however, through Xi’an Coova, we are entitled to receive all of the profits of Shaanxi Jiali, and we are obligated to pay all of its debts. As a result we are allowed to consolidate the financial statements of Shaanxi Jiali under GAAP. When we sell our equity or borrow funds we expect the proceeds will be forwarded to Shaanxi Jiali and accounted for as a loan to Shaanxi Jiali and eliminated during consolidation. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Concurrent with the Share Exchange Agreement on September 30, 2009, we issued to certain consultants two year warrants to purchase an aggregate of 1,250,000 shares of our common stock at an exercise price of $3.00 per share with three year piggyback warrants to purchase an aggregate of 1,250,000 shares of our common stock at an exercise price of $5.00 per share (collectively, the “Warrants”). Pursuant to the terms of the Warrants, we agreed to register the shares of common stock issuable under the Warrants. We have filed the registration statement of which this prospectus forms a part in order to meet our obligations under those agreements. For more information about the reverse merger transaction and the issuance of the Warrants you should read the sections entitled “OUR BUSINESS – Corporate History,” “DESCRIPTION OF SECURITIES,” and “SELLING STOCKHOLDERS”.

|

Common stock outstanding

|

10,180,288 shares as of September 1, 2010.

|

|||

|

Common stock that may be offered by selling stockholders

|

Up to 2,500,000 shares.

|

|||

|

Total proceeds raised by offering

|

We will receive no proceeds from the resale of the common stock offered by the selling stockholders, but could receive up to $10,000,000 if all of the share purchase warrants held by the selling stockholders are exercised.

|

|||

|

Common Stock Outstanding after the offering

|

12,680,288

|

|||

|

Risk factors

|

There are significant risks involved in investing in our company. For a discussion of risk factors you should consider before buying our common stock, see “Risk Factors” beginning on page 5. These risk factors include:

·

● Various risks of doing business in China since all of our revenues are derived from operations of China Children Pharmaceuticals in China including changes in political and economics in China, changes in the laws of the People’s Republic of China, exchange rate issues, difficulty in establishing management, legal and financial controls;

·

● The risk of the loss of China Children Pharmaceuticals as our operating business;

|

|||

|

Risks associated with Shaanxi Jiali’s business, which include among other, competition, ability to manage growth, discovery and development of new products, need for additional capital to fund operations, dependence on key personnel, need for regulatory approval of products, need to obtain renewal of licenses to operate business, governmental price controls, products being replaced by newer products

Risk related to our common stock, which include but are not limited to the illiquidity of our stock price, need for internal controls, additional expenses due to regulatory requirements, penny stock regulations that will be applicable to our common stock.

|

||

|

Use of Proceeds

|

The shares of common stock offered hereby are being registered for the account of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of the common stock will go to the selling stockholders and we will not receive any proceeds from the resale of the common stock by the selling stockholders, although we could receive proceeds of up to $10,000,000 if all of the share purchase warrants are exercised. We will, however, incur all costs associated with this registration statement and prospectus.

|

8

This offering is not being underwritten. The selling stockholders directly, through agents designated by them from time to time or through brokers or dealers also to be designated, may sell their shares from time to time, in or through privately negotiated transactions, or in one or more transactions, including block transactions, on the OTC Bulletin Board or on any stock exchange on which the shares may be listed in the future pursuant to and in accordance with the applicable rules of such exchange or otherwise. The selling price of the shares may be at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices after the shares are quoted on the OTC Bulletin Board. To the extent required, the specific shares to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any such agent, broker or dealer and any applicable commission or discounts with respect to a particular offer will be described in an accompanying prospectus. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. We will keep this prospectus current until the expiration dates of the convertible securities, even if the convertible securities which underlie certain shares of our common stock subject to this prospectus are out of the money.

The selling security holders and any other persons participating in the sale or distribution of the shares offered under this prospectus will be subject to applicable provisions of the Exchange Act, and the rules and regulations under that act, including Regulation M. These provisions may restrict activities of, and limit the timing of purchases and sales of any of the shares by, the selling security holders or any other person. Furthermore, under Regulation M, persons engaged in a distribution of securities are prohibited from simultaneously engaging in market making and other activities with respect to those securities for a specified period of time prior to the commencement of such distributions, subject to specified exceptions or exemptions. All of these limitations may affect the marketability of the shares.

We will not receive any proceeds from sales of shares by the selling stockholders. However, if any of the selling stockholders decide to exercise their Warrants, we will receive the net proceeds of the exercise of such security held by the selling stockholders. We intend to use any proceeds we receive from the exercise of the Warrants for working capital and other general corporate purposes. We cannot assure you that any of the Warrants will ever be exercised.

We will pay all expenses of registration incurred in connection with this offering (estimated to be $80,730), but the selling stockholders will pay all of the selling commissions, brokerage fees and related expenses.

The selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the distribution of any of the shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations .

Shaanxi Jiali commenced its current line of business operations on July 1, 1998 and received its Good Manufacturing Practices (“GMP”) certifications in November 2004. These certifications must be renewed every five years for Shaanxi Jiali to stay in business. We have applied for renewal of all of our necessary GMP certifications, underwent routine review and inspection, and have received approval for these renewals in April 2010, with the renewed GMP certificate expected to be issued in early July 2010. Notwithstanding the above, Shaanxi Jiali’s operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Shaanxi Jiali will maintain GMP approval for its products, maintain its profitability, or assure you that we will not incur net losses in the future. Pursuant to SFDA regulation, if there is a gap at any time in the validity of a company’s GMP certificate, it must suspend production or faces stiff fines and the risk that its authorization for production may be permanently revoked. We expect that Shaanxi Jiali’s operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

|

●

|

raise adequate capital for expansion and operations;

|

|

|

●

|

implement our business model and strategy and adapt and modify them as needed;

|

|

|

●

|

increase awareness of our brand name, protect our reputation and develop customer loyalty;

|

|

|

●

|

manage our expanding operations and service offerings, including the integration of any future acquisitions;

|

|

|

●

|

maintain adequate control of our expenses;

|

|

|

●

|

anticipate and adapt to changing conditions in the medical over the counter, pharmaceutical and nutritional supplement markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics

|

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

9

The loss of Shaanxi Jiali as our operating business would have a material adverse effect on our business and the price of our common stock.

We have no equity ownership interest in Shaanxi Jiali. Our ability to control Shaanxi Jiali and consolidate its financial results is through a series of contractual agreements between Shaanxi Jiali and our wholly-owned subsidiary Xi’an Coova. The management of Shaanxi Jiali is an affiliate of us and of Xi’an Coova and the stockholders of Shaanxi Jiali are also our shareholders. Thus the Management Entrustment Agreement was not entered into as a result of arms’ length negotiations because the parties to the agreement are under common control. Mr. Xia, our CEO and Chairman, holds approximately 35% of the shares of Shaanxi Jiali and approximately 26.82% of our common stock. The Management Entrustment Agreement may be terminated upon the termination of the business of Shaanxi Jiali or upon the date upon which Xi’an Coova completes the acquisition of Shaanxi Jiali. Any other termination would be a breach of the agreement. While the Company has been advised by its PRC counsel that the Management Entrustment Agreement is legal and enforceable under PRC law, these affiliates control the parties to the Management Entrustment Agreement and it could be possible for them to cause Shaanxi Jiali to breach the Management Entrustment Agreement and our unaffiliated investors would have little or no recourse because of the inherent difficulties in enforcing their rights since all our assets are located in the PRC. (See, Risk Factor “The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.”) In the event that management of Shaanxi Jiali decides to breach the Management Entrustment Agreement, the risk of loss of the affiliated shareholders of Shaanxi Jiali could be lower than unaffiliated investors and the interests of the management and shareholders of Shaanxi Jiali would be in conflict with the interest of our other stockholders.

Shaanxi Jiali’s failure to compete effectively may adversely affect our ability to generate revenue.

Shaanxi Jiali competes with other companies, many of whom are developing or can be expected to develop products similar to Shaanxi Jiali. Shaanxi Jiali’s market is a large market with many competitors. Many of its competitors are more established than Shaanxi Jiali is, and have significantly greater financial, technical, marketing and other resources than it presently possess. Some of Shaanxi Jiali’s competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that Shaanxi Jiali will be able to compete effectively with current or future competitors or that the competitive pressures it faces will not harm it business.

We may not be able to effectively control and manage the growth of Shaanxi Jiali.

If Shaanxi Jiali’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect its operations and cause delay in production and delivery of its pharmaceutical prescription, over the counter and medical nutrient products as well as administrative inefficiencies.

We may require additional financing in the future and a failure to obtain such required financing will inhibit Shaanxi Jiali’s ability to grow.

The continued growth of Shaanxi Jiali’s business may require additional funding from time to time, which we expect to raise in private placements of our equity or debt securities with accredited investors or by offering our securities for sale pursuant to an effective registration statement on a market where our common stock is traded. The proceeds of these funding would be forwarded to Shaanxi Jiali and accounted for as a loan to Shaanxi Jiali and eliminated during consolidation. The proceeds would be used for general corporate purposes of Shaanxi Jiali, which could include acquisitions, investments, repayment of debt and capital expenditures among other things. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Obtaining additional funding would be subject to a number of factors including market conditions, operating performance and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, terms and conditions of additional funding unattractive or unavailable to us. Our management believes that we currently have sufficient funds from working capital to meet our current operating costs over the next 12 months.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Shaanxi Jiali’s business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

10

We, through our subsidiaries/affiliated companies China Pediatric, Xi’an Coova or Shaanxi Jiali, may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiaries/affiliated companies China Children, Xi’an Coova or Shaanxi Jiali, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Shaanxi Jiali, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time Shaanxi Jiali reviews investments in new businesses and we, through our subsidiaries/affiliated companies China Children, Xi’an Coova or Shaanxi Jiali, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Shaanxi Jiali and accounted for as a loan to Shaanxi Jiali and eliminated during consolidation. In the event of any future acquisitions, we could:

|

●

|

issue equity securities which would dilute current stockholders’ percentage ownership;

|

|

|

●

|

incur substantial debt;

|

|

|

●

|

assume contingent liabilities; or

|

|

|

●

|

expend significant cash.

|

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if through our subsidiaries/affiliated companies, China Children, Xi’an Coova, or Shaanxi Jiali, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

|

●

|

difficulties in the assimilation of acquired operations, technologies and/or products;

|

|

|

●

|

unanticipated costs associated with the acquisition or investment transaction;

|

Standards for compliance with Section 404 of the Sarbanes-Oxley Act of 2002 are uncertain, and if we fail to comply in a timely manner, our business could be harmed and our stock price could decline.

We are constantly striving to improve our internal accounting controls. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of U.S. public companies’ internal control over financial reporting, and attestation of this assessment by their independent registered public accountants. While the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts smaller reporting companies with respect to the attestation by their independent registered public accountants as to our financial controls, this exception does not affect the requirement that we include a report of management on our intenal controls over financial reporting and will not affect the requirement to include the auditor's attestation if our public float exceeds $75 million and we cease to be smaller reporting company. Existing standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. While there has not been any detected significant deficiency or material weakness in our internal control and with respect to the assessment of the internal control for the year ended December 31, 2009, we cannot guarantee the implementation of controls and procedures in future years to be without any significant deficiency or material weakness.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and pharmaceutical factory operational expertise of key personnel. Jun Xia, our Chief Executive Officer and Chairman of the Board perform key functions in the operation of our and Shaanxi Jiali’s business. There can be no assurance that Shaanxi Jiali will be able to retain Mr. Xia after the term of their employment contracts expire. The loss of Mr. Xia could have a material adverse effect upon our business, financial condition, and results of operations. Shaanxi Jiali must attract, recruit and retain a sizeable workforce of technically competent employees. We do not carry key man life insurance for any of our key personnel or personnel nor do we foresee purchasing such insurance to protect against a loss of key personnel and the key personnel.

11

We are dependent upon the services of Mr. Xia for the continued growth and operation of our company because of his experience in the industry and his personal and business contacts in the PRC. Although we have entered into two-year employment agreements with Mr. Xia and we have no reason to believe that he will discontinue their services with the Company or Shaanxi Jiali, the interruption or loss of his services would adversely affect our ability to effectively run our business and pursue our business strategy as well as our results of operations.

We may not be able to hire and retain qualified personnel to support its growth and if it is unable to retain or hire these personnel in the future, its ability to improve its products and implement its business objectives could be adversely affected.

Competition for senior management and senior personnel in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition. We expect to hire additional sales and plant personnel throughout fiscal year 2010 in order to accommodate its growth.

If we fail to increase our brand recognition, we may face difficulty in obtaining new customers and business partners.

We believe that establishing, maintaining and enhancing our brand in a cost-effective manner is critical to achieving widespread acceptance of our current and future products and services and is an important element in our effort to increase our customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in our market develops. Some of our potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and ability to provide reliable and useful products and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition, would be materially adversely affected.

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

|

●

|

the costs of pharmaceutical products and development;

|

|

|

●

|

the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our products;

|

|

|

●

|

capital expenditure for equipment;

|

|

|

●

|

marketing and promotional activities and other costs;

|

|

|

●

|

changes in our pricing policies, suppliers and competitors;

|

|

|

●

|

the ability of our suppliers to provide products in a timely manner to their customers;

|

|

|

●

|

changes in operating expenses;

|

|

|

●

|

increased competition in the pharmaceutical markets; and

|

|

|

●

|

other general economic and seasonal factors.

|

We face risks related to product liability claims.

We presently do not maintain product liability insurance. We face the risk of loss because of adverse publicity associated with product liability lawsuits, whether or not such claims are valid. We may not be able to avoid such claims. Although product liability lawsuits in the PRC are rare, and we have not, to date, experienced significant failure of our products, there is no guarantee that we will not face such liability in the future. This liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on our business, financial condition and prospects.

We face marketing risks.

Newly developed drugs and technology may not be compatible with market needs. Because markets for drugs differentiate geographically inside the PRC, we must develop and manufacture our products to accurately target specific markets to ensure product sales. We have spent $16,616, $53,273 and $63,594 on market research during the years ended December 31, 2009, 2008 and 2007, which account for 0.1%, 0.3% and 0.5% of net sales respectively. If we fail to invest in extensive market research to understand the health needs of consumers in different geographic areas, we may face limited market acceptance of our products, which could have material adverse effect on our sales and earnings.

12

We face risks relating to difficulty in defending intellectual property rights from infringement.

Our success depends on protection of our current and future technology and products and our ability to defend our intellectual property rights. Shaanxi Jiali currently holds 2 patents and 9 trademarks and has filed for trademark protection for additional names and brands of its products sold in the PRC. We also have certain limited administrative SFDA protection for our non-patented products. However, it is possible for its competitors to develop similar competitive products even though we have taken steps to protect our intellectual property. If we fail to protect Shaanxi Jiali’s intellectual property adequately, competitors may manufacture and market products similar to Shaanxi Jiali.

Presently, we sell our products mainly in PRC. To date, no trademark or patent filings have been made other than in PRC. To the extent that we market our products in other countries, we may have to take additional action to protect our intellectual property. The measures we take to protect our proprietary rights may be inadequate and we cannot give you any assurance that our competitors will not independently develop formulations and processes that are substantially equivalent or superior to our own or copy our products.

We expect to file additional patent applications seeking to protect newly developed technology and products in various countries, including the PRC. Some patent applications in the PRC are maintained in secrecy until the patent is issued. Because the publication of discoveries tends to follow their actual discovery by many months, we may not be the first to invent, or file patent applications on any of our discoveries. Patents may not be issued with respect to any of our patent applications and existing or future patents issued to or licensed by us may not provide competitive advantages for our products. Patents that are issued may be challenged, invalidated or circumvented by our competitors. Furthermore, our patent rights may not prevent our competitors from developing, using or commercializing products that are similar or functionally equivalent to our products.

Currently, the SFDA does not automatically stay drug registration approval upon initiation of an infringement lawsuit by a third party. At present, we must wait until a copycat manufacturer has received marketing approval from SFDA before we can bring an infringement lawsuit. Furthermore, PRC courts have been hesitant to issue preliminary injunctions to suspend sales until a final judgment is issued in the lawsuit. Our sales could be lowered were a competitor to infringe our intellectual property rights by marketing one or more versions of SFDA-approved drugs proprietary to us until we can curtail such infringement through legal action. Pursuing infringement lawsuits would require us to devote financial and management resources that could impact the results of our operations.

We also rely on trade secrets, non-patented proprietary expertise and continuing technological innovation that we shall seek to protect, in part, by entering into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements. Moreover, our trade secrets and proprietary technology may otherwise become known or be independently developed by our competitors. If patents are not issued with respect to products arising from research, we may not be able to maintain the confidentiality of information relating to these products.

We face risks relating to third parties that may claim that we infringe on their proprietary rights and may prevent us from manufacturing and selling certain of our products.

There has been substantial litigation in the pharmaceutical industry with respect to the manufacturing, use and sale of new products. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. We are not aware of any infringement claims that have been filed against us by third parties. However, we may be required to commence or defend against charges relating to the infringement of patents or proprietary rights. Any such litigation could:

|

●

|

require us to incur substantial expense, even if covered by insurance or are successful in the litigation;

|

|

|

●

|

require us to divert significant time and effort of our technical and management personnel;

|

|

|

●

|

result in the loss of our rights to develop or make certain products; and

|

|

|

●

|

require us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties.

|

Although intellectual property disputes within the pharmaceutical industry have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. These arrangements may be investigated by regulatory agencies and, if improper, may be invalidated. Furthermore, the required licenses may not be made available to us on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing and selling some of our products or increase our costs to market these products.

In addition, when seeking regulatory approval for some of our products, we may be required to certify to regulatory authorities, including the SFDA, that such products do not infringe upon third party patent rights. Filing a certification against a patent gives the patent holder the right to bring a patent infringement lawsuit against us. Any lawsuit would delay the receipt of regulatory approvals. A claim of infringement and the resulting delay could result in substantial expenses and even prevent us from manufacturing and selling certain of our products.

13

Our launch of a product prior to a final court decision or the expiration of a patent held by a third party may result in substantial damages to us. If we are found to infringe a patent held by a third party and become subject to such damages, these damages could have a material adverse effect on the results of our operations and financial condition.

Shaanxi Jiali is currently entitled to a beneficial tax exemption for a five year period; however, such tax exemption may be interpreted to be not in compliance with PRC tax laws in the future causing us to set aside certain contingency funds for dealing with potential retrospective tax liabilities.

Shaanxi Jiali is entitled to enjoy the “Two exemption Three half” tax holiday based on the local government’s policy to encourage outside investment into the locality. According to PRC tax laws, “Two exemption Three half” policy means foreign investment enterprises including Shaanxi Jiali may enjoy an exemption from corporate income tax for 2 years starting from its first profitable year, followed by 3 years at a rate that is one half of the regular rate for corporate income tax.

As to the tax treatment promised by local governments to purely domestic enterprises, i.e., Shaanxi Jiali, invested by non-local (but not foreign) investors under the so called preferential policy announced by local governments, our consultation with PRC certified public accountants and lawyers, is that the above policy is not compliant with the PRC laws. Even though such practice exists in many areas across the country, the policy faces the risk of being ruled illegal at any time for non-compliance with relevant laws. In this event, there is a risk that we might be assessed retrospective tax liabilities.

We face risks related to research and the ability to develop new drugs.

Our growth and survival depends on our ability to consistently discover, develop and commercialize new products and find new and improve on existing technology and platforms. During the year ended December 31, 2007, we spent $35,500 on research and development expenses, which amounted to 0.3% of our net sales. During the years ended December 31, 2009 and December 31, 2008, we have prepaid $955,900 and $808,800, respectively, of research and development expenses which amounted to 5.7% and 5.5%, respectively, of our net sales. We prepaid these expenses to Shaanxi Research Institution of Chinese Traditional Medicines (“SRICTM”), which develops certain drugs on our behalf. Should the applications for these drugs be rejected by the SFDA due to a technology-related error or any error of SRICTM, SRICTM is contractually obligated under Sections 5.3, 7.3 and 10.1 of the agreement to refund all fees already paid by the Company under the terms of the Medicine Research and Development Agreement and Supplemental Agreement of Medicine Research and Development Agreement. If we fail to make sufficient investments in research, be attentive to consumer needs or does not focus on the most advanced technology, our current and future products could be surpassed by more effective or advanced products of other companies.

Risk Related To the Pharmaceutical Industry

Our certificates, permits, and licenses related to our pharmaceutical operations are subject to governmental control and renewal and failure to obtain renewal will cause all or part of our operations to be terminated.

Shaanxi Jiali is subject to various PRC laws and regulations pertaining to the pharmaceutical industry. Shaanxi Jiali has attained certificates, permits, and licenses required for the operation of a pharmaceutical enterprise and the manufacturing of pharmaceutical products in the PRC.

In 1998, the SFDA introduced the GMP Certificate in order to promote quality and safety of pharmaceutical production. The Good Manufacturing Practices were revised in July and October 2004. We and our competitors are required to meet GMP standards in order to continue manufacturing pharmaceutical products and health foods. For each new product, Shaanxi Jiali prepares documentation of pharmacological, toxicity, pharmacokinetics and drug metabolism studies in addition to providing samples of the drug. The documentation and samples are then submitted to provincial food and drug administration. This process typically takes approximately three months. After the documentation and samples have been approved by the provincial food and drug administration, the provincial administration submits the approved documentation and samples to the SFDA. The SFDA examines the documentation, tests the samples and presents the findings to the New Drug Examination Committee for approval. If the application is approved by the SFDA, the SFDA will issue a clinical trial license to the applicant for clinical trials. This clinical trial license approval typically takes one year, followed by approximately two years of trials, depending on the category and class of the new drug. The SFDA then examines the documentation from the trial and, if approved, issues the new drug license to the applicant. This process usually takes eight months. The entire process takes anywhere from three to four years.

Shaanxi Jiali initially obtained pharmaceutical products permits by submitting its manufacturing processes and product tests to the SFDA who verified that its production processes and products met the standards by onsite inspections, review of test results and a determination that the market was not saturated by its products. The production permits are permanent once issued as long as they are renewed by the expiration date. The GMP certificate is valid for a term of five years, and each must be renewed before its expiration, if applicable. Pursuant to SFDA regulation, if there is a gap at any time in the validity of a company’s GMP certificate, it must suspend production or face stiff fines and the risk that its authorization for production may be permanently revoked.

14

We manufacture and package our products at one factory in Baoji, Shaanxi Province, China. This facility is in compliance with Good Manufacturing Practice (GMP) standards and we received our initial GMP certificate on November 3, 2004. (Certificate No. Shaan F0076 for Baoji Production Base). The certificate remained valid until November 2, 2009. Our GMP certificate expired on November 2, 2009. It is not uncommon for companies in the pharmaceutical industry to suspend production while they are in application for a renewed permit in order to prepare for and accommodate GMP inspection. We applied to renew our GMP certificate prior to November 2, 2009, and as such we did not experience any penalties or delays in the processing of our application. Because, however, we experienced an increase in customer orders toward the end of the calendar year, we continued production until November 2, 2009 in order to meet all of our customers’ needs.

The SFDA generally takes about three to four months to review GMP renewal applications and as a result, we did not receive approval for the renewed certificate until April 2010. Between November 2009 and April 2010, while our application for renewal was being processed and our facilities underwent standard GMP review and inspection, we temporarily suspended production during the application period. During this time, we worked with our OEM partners to meet our manufacturing needs. We also experienced a lower demand for our products during this period due to China’s Spring Festival holiday in the month of February. As such, we continued to have sales between November 2009 and April 2010 even though we did not manufacture any products in-house and were able to use our OEM manufacturers to meet all of our customers’ needs. Since April 2010, when we were notified that the SFDA had approved our application, we have resumed regular production. We expect to officially receive our renewed certificate in early July 2010. However, we cannot guarantee that we will not experience interruptions or terminations in production in the future should our GMP certificate lapse.

According to Drug Administration Law of the PRC and its implementing rules, the SFDA approvals, including Pharmaceutical Manufacturing Permit and Drug Approval Numbers, may be suspended or revoked prior to the expiration date under circumstances that include:

|

●

|

producing counterfeit medicine;

|

|

|

●

|

producing inferior quality products;

|

|

|

●

|

failing to meet the drug GMP standards;

|

|

|

●

|

purchasing medical ingredients used in the production of products sources that do not have Pharmaceutical Manufacturing Permit or Pharmaceutical Trade Permit;

|

|

|

●

|

fraudulent reporting of results or product samples in application process;

|

|

|

●

|

failing to meet drug labeling and direction standards;

|

|

|

●

|

bribing doctors or hospital personnel to entice them to use products,

|

|

|

●

|

producing pharmaceuticals for use or resale by companies that are not approved by the SFDA, or

|

|

|

●

|

the approved drug has a serious side effect.

|

If our pharmaceutical products fail to receive regulatory approval or are severely limited in these products' scope of use, we may be unable to recoup considerable research and development expenditures.

Our research and development of pharmaceutical products is subject to the regulatory approval of the SFDA in the PRC. The regulatory approval procedure for pharmaceuticals can be quite lengthy, costly, and uncertain. Depending upon the discretion of the SFDA, the approval process may be significantly delayed by additional clinical testing and require the expenditure of resources not currently available; in such an event, it may be necessary for us to abandon our application. Even where approval of the product is granted, it may contain significant limitations in the form of narrow indications, warnings, precautions, or contra-indications with respect to conditions of use. If approval of our product is denied, abandoned, or severely limited in terms of the scope of products use, it may result in the inability to recoup considerable research and development expenditures. If we do not receive timely approval for any of these drugs, then production will be delayed and sales of the products cannot be planned for.

Price control regulations may decrease our profitability.

The laws of the PRC provide for the government to fix and adjust prices. The prices of certain medicines we distribute, including those listed in the Chinese government's catalogue of medications that are reimbursable under the PRC’s social insurance program, or the Insurance Catalogue, are subject to control by the relevant state or provincial price administration authorities. The PRC establishes price levels for products based on market conditions, average industry cost, supply and demand and social responsibility. In practice, price control with respect to these medicines sets a ceiling on their retail price. The actual price of such medicines set by manufacturers, wholesalers and retailers cannot historically exceed the price ceiling imposed by applicable government price control regulations. Although, as a general matter, government price control regulations have resulted in drug prices tending to decline over time, there has been no predictable pattern for such decreases.

For the years ended December 31, 2009 and December 31, 2008, we have not had any products subject to specific pricing control and production and trading of none of our pharmaceutical products constitutes a monopoly. However, it is possible that our products may be subject to price control in the future. To the extent that our products are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and we may face no limitation on our costs. Further, if price controls affect both our revenue and costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

15

If the medicines we produce are replaced by other medicines or are removed from the PRC's insurance catalogue in the future, our revenue may suffer.

Under PRC regulations, patients purchasing medicine listed by the PRC's state and/or provincial governments in the Insurance Catalogue may be reimbursed, in part or in whole, by a social medicine fund. Accordingly, pharmaceutical distributors prefer to engage in the distribution of medicine listed in the Insurance Catalogue. Currently, our main prescription products are listed in the Insurance Catalogue. The content of the Insurance Catalogue is subject to change by the PRC Ministry of Labor and Social Security, and new medicine may be added to the Insurance Catalogue by provincial level authorities as part of their limited ability to change certain medicines listed in the Insurance Catalogue. If the medicine we produce are replaced by other medicines or removed from the Insurance Catalogue in the future, our revenue may suffer.

Adverse publicity associated with our products, ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The results of our operations may be significantly affected by the public's perception of our product and similar companies. This perception is dependent upon opinions concerning:

|

●

|

the safety and quality of our products and ingredients;

|

|

|

●

|

the safety and quality of similar products and ingredients distributed by other companies; and

|

|

|

●

|

our sales force.

|

Adverse publicity concerning any actual or purported failure to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing practices, or other aspects of our business, whether or not resulting in enforcement actions or the imposition of penalties, could have an adverse affect on our goodwill and could negatively affect our sales and ability to generate revenue.

In addition, our consumers' perception of the safety and quality of products and ingredients as well as similar products and ingredients distributed by other companies can be significantly influenced by media attention, publicized scientific research or findings, widespread product liability claims and other publicity concerning our products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity, whether or not accurate or resulting from consumers' use or misuse of our products, that associates consumption of our products or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of our or similar products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as to their use, could negatively impact our reputation or the market demand for our products.

If we fail to develop new products with high profit margins, and our high profit margin products are substituted by competitor's products, our gross and net profit margins will be adversely affected.

There is no assurance that we will be able to sustain our profit margins in the future. The pharmaceutical industry is very competitive, and there may be pressure to reduce sale prices of products without a corresponding decrease in the price of raw materials. In addition, the medical industry in the PRC is highly competitive and new products are constantly being introduced to the market. In order to increase our sales and expand our market share, we may be forced to reduce prices in the future, leading to a decrease in gross profit margin. The research and development of new products and technology is costly and time consuming, and there are no assurances that our research and development of new products will either be successful or completed within the anticipated timeframe, if ever at all. There is no assurance that our competitors' new products, technology, and processes will not render our existing products obsolete or non-competitive. To the extent that we fail to develop new products with high profit margins and our high profit margin products are substituted by competitors' products, our gross profit margins will be adversely affected.

The commercial success of our products depends upon the degree of market acceptance among the medical community and failure to attain market acceptance among the medical community may have an adverse impact on our operations and profitability.

The commercial success of our products depends upon the degree of market acceptance among the medical community, such as hospitals and physicians. Even if our products are approved by the SFDA, there is no assurance that physicians will prescribe or recommend our products to patients. Furthermore, a product's prevalence and use at hospitals may be contingent upon its relationship with the medical community, particularly products that are only available by medical prescription. The acceptance of our products among the medical community may depend upon several factors, including but not limited to, the product's acceptance by physicians and patients as a safe and effective treatment, cost effectiveness, potential advantages over alternative treatments, and the prevalence and severity of side effects. Failure to attain market acceptance among the medical community may have an adverse impact on our operations and profitability.

16

We enjoy certain preferential tax concessions and loss of these preferential tax concessions will cause its tax liabilities to increase and its profitability to decline.

Shaanxi Jiali enjoys preferential tax concessions in the PRC as a high-tech enterprise because of the research and development methodologies it employs to develop new products. Pursuant to the State Council's Regulations on Encouraging Investment in and Development, Shaanxi Jiali was granted a reduction in its income tax rate under which it paid no income taxes from January 1, 2006 to December 31, 2007 and had had an income tax rate of 15% since January 1, 2008 which is a 50% reduction on the current effective income tax rate. This favorable 50% tax exemption treatment will expire on December 31, 2010. There is no assurance that the preferential tax treatment in the PRC will remain unchanged and effective. Its tax liabilities will increase and its profits may accordingly decline if its reduced income tax rate is no longer applicable and/or the tax relief on investment in PRC is no longer available. Additionally, the PRC Enterprise Income Tax Law (the "EIT Law") was enacted on March 16, 2007. Under the EIT Law, effective January 1, 2008, the PRC will adopt a uniform tax rate of 25.0% for all enterprises (including foreign-invested enterprises) and cancel several tax incentives enjoyed by foreign-invested enterprises. However, for foreign-invested enterprises established before the promulgation of the EIT Law, a five-year transition period is provided during which reduced rates will apply but gradually be phased out. Since the PRC government has not announced implementation measures for the transitional policy with regards to such preferential tax rates, we cannot reasonably estimate the financial impact of the new tax law to Shaanxi Jiali at this time. Further, any future increase in the enterprise income tax rate applicable to it or other adverse tax treatments, such as the discontinuation of preferential tax treatments for high and new technology enterprises, would have a material adverse effect on its results of operations and financial condition.

Risks Related to Doing Business in the PRC

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business .

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the PRC’s Communist Party. The Chinese government exerts substantial influence and control over the manner in which we and it must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, particularly the pharmaceutical industry, through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.