Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Vantage Drilling CO | d8k.htm |

Oslo, Norway

Pareto Oil & Offshore Conference

September 1-2, 2010

Exhibit 99.1 |

Forward-Looking Statements

Some of the statements in this presentation constitute forward-looking

statements. Forward-looking statements relate to

expectations,

beliefs,

projections,

future

plans

and

strategies,

anticipated

events

or

trends

and

similar

expressions

concerning matters that are not historical facts. The forward looking

statements contained in this presentation involve risks and uncertainties as

well as statements as to: •

our limited operating history;

•

availability of investment opportunities;

•

general volatility of the market price of our securities;

•

changes in our business strategy;

•

our ability to consummate an appropriate investment opportunity within given time

constraints; •

availability of qualified personnel;

•

changes in our industry, interest rates, the debt securities markets or the

general economy; •

changes in governmental, tax and environmental regulations and similar

matters; •

changes in generally accepted accounting principles by standard-setting

bodies; and •

the degree and nature of our competition.

The forward-looking statements are based on our beliefs, assumptions and

expectations of our future performance, taking into account all information

currently available to us. These beliefs, assumptions and expectations can change as a result

of many possible events or factors, not all of which are known to us or are within

our control. If a change occurs, our business, financial condition,

liquidity and results of operations may vary materially from those expressed in our forward-

looking statements. |

Recent

Developments •

Acquired the 55% of Mandarin Drilling Company not previously owned,

bringing total ownership of Platinum Explorer drillship to 100%

•

Raised $1.0 Billion 11.5% Senior Secured Notes to fund the purchase of

Platinum Explorer and refinance existing debt; no debt matures prior to

2014

•

Signed Construction Management Agreement and Marketing Agreement

for Dalian Developer |

Corporate Overview

Symbol:

VTG (NYSE AMEX)

Location:

HQ –

Houston; Operations –

Singapore; Marketing -

Dubai

Market Cap:

$390 million

Book Value:

$773 million

Enterprise Value:

$1.5 billion

Employees:

> 700

Contract Backlog:

$3.8 billion

Owned Fleet:

4 Ultra-Premium Jackups

1 Ultra-Deepwater Drillship

Managed Fleet:

2 Ultra-Deepwater Semisubmersibles

2 Ultra-Deepwater Drillships |

•

Premium

high-specification

drilling

units,

including

four

jackup

rigs, three drillships

and two

semisubmersibles

•

Vantage’s modern rigs are capable of drilling to deeper depths and possess

enhanced operational efficiency and technical capabilities, resulting in

higher utilization, dayrates and margins

•

Total

costs

of

owned

fleet

of

four

jackups

and

the

Platinum

Explorer

drillship of approximately

$1.7 billion

•

Successful

track

record

of

managing,

constructing,

marketing

and

operating

offshore

drilling

units

•

In-house team of engineers and construction personnel overseeing complex

construction projects •

All jackups

delivered on budget and on time

•

Jackup

fleet has experienced approx. 99% of productive time for Vantage’s first 18

months in operation Level of efficiency is exceptional for

newly-constructed jackup rigs upon commencement of operations

•

Significant cash flow visibility

•

Owned fleet contract backlog of approximately $1.3 billion and managed fleet

contract backlog of approximately $2.5 billion as of March 31, 2010

Owned fleet counterparties include Pearl Energy, VAALCO Energy, Foxtrot

International, ENI, Nido Petroleum, Phu

Quy

(1)

and ONGC

Managed deepwater rigs counterparties include PEMEX and Petrobras

Company

Highlights

(1)

PVEP

Phu

Quy

Petroleum

Operating

Co.

Ltd.

is

a

joint

venture

interest

between

PetroVietnam

Exploration

Production

Corp.

and

Total

E&P

Vietnam.

Premium Fleet

Proven Operational

Track

Record

Significant

Contract Coverage

with

High Quality

Counterparties |

Company Highlights (Cont’d)

Four

construction

management

arrangements

for

two

ultra-deepwater

drillships,

DragonQuest

and

Dalian

Developer,

as

well

as

two

6th

generation

semisubmersibles

Approximately $5.0 million of annual cash flow per contract during the

construction phase Management of drillship and semisubmersible operations

once in service Approximately $12.0 to $15.0 million per year per contract

for the duration of each contract Management team with extensive experience;

average of 28 years in the drilling industry Includes international and

domestic public company experience with industry-leading peers involving

numerous acquisitions and debt and equity financings

Experienced operating personnel already hired and crew member training ongoing for

Platinum

Explorer

Construction

Supervision and

Management

Arrangements

Experienced

Management and

Operational Team |

Fleet Overview

Owned Assets

Emerald Driller

Sapphire Driller

Aquamarine Driller

Topaz Driller

Platinum Explorer

•

Significant asset value of owned fleet

Managed Assets

SeaDragon

I

SeaDragon

II

Dalian Developer

DragonQuest |

Premium Newbuild

Fleet

•

Owned Fleet:

Four newbuild

ultra-premium high-specification Baker Marine Pacific Class 375 jackups

Platinum Explorer –

ultra-deepwater 12,000 ft. drillship (equipped for 10,000 ft.)

•

The drillship is currently being constructed by Daewoo Shipbuilding & Marine Engineering Co. Ltd.

(“DSME”) •

Managed Fleet:

One ultra-deepwater 12,000 ft. drillship (under construction at DSME Shipyard)

One multiservice drillship (under construction at Dalian Shipyard)

Two

Moss

Maritime

CS50

MkII

6th

generation

10,000

ft.

semisubmersibles

(under

construction

at

Jurong

Shipyard)

Fleet Construction Cost ~ $4.5 Billion

Drillships

–

One Owned, Two Managed

Semisubmersibles –

Two Managed

Jackups

–

Four Owned |

Worldwide Operations

Vantage Offices

Owned Rigs

Managed Rigs

Contract: PEMEX

Semi I

Mexico GOM

Contract: Petrobras

DragonQuest

U.S. GOM

Contract: ONGC

Platinum Explorer

India

Houston

Singapore

Dubai

Contract: Pearl

Emerald Driller

Thailand

Contract: Foxtrot

Sapphire Driller

Ivory Coast

Contract: VAALCO

Sapphire Driller

Gabon

Contract: Nido

Aquamarine Driller

Philippines

Contract: Phu Quy

(1)

Topaz Driller

Vietnam

Country of Operation

(1)

PVEP Phu Quy Petroleum Operating Co. Ltd. is a joint venture interest between

PetroVietnam Exploration Production Corp. and Total E&P Vietnam. |

Advantages of

Ultra-Premium Jackups The Baker Marine Pacific Class jackup

is capable of drilling in up to 375 feet of water and has a maximum

drilling depth of 30,000 feet

Dimensions

236’

x 224’

x 28’

208’

x 178’

x 23’

Water Depth (Max/Min)

375’

300’

Drilling Depth -

Ft

30,000

25,000

Cantilever Reach

75’

45’

Leg Length

506’

418’

Spudcan

Diameter

55.5’

48’

Variable Deck Load (Operating)

7,497 kips

4,000 kips

Accommodations (Persons)

120

66

•

Faster drilling times

•

Faster moving times

•

Increased volumes of consumable liquids

and drilling fluids

•

Reduced boat runs and non-productive

time

•

Improved pipe handling and offline

capability

•

Fast preloading time for all tanks

•

75’

x 30’

cantilever reach substantially

greater than the industry average

•

Pipe decks allow increased storage capacity

•

Premium drilling package:

•

3 x 2200HP mud pumps

•

Integrated diverter system

•

18 ¾

BOP handling system and 4 rams

•

High-capacity,

high

efficiency

–

5 x CAT

3516 B Diesel engines

Baker Marine Pacific Class 375

Standard 300’

Comparison of Vantage Ultra-Premium Jackup

to Standard Jackup

Increased Operational Efficiency and Improved Technical Capability |

Platinum Explorer

Construction Status

Platinum

Explorer

as

of

July

2010

Overall Construction Progress (July 2010)

Source: DSME. |

Platinum Explorer

Path

Forward

Milestone Dates

•

September 2 –

Naming Ceremony

•

September 28 to October 23 –

Sea Trials

•

November 10 –

Rig Delivery

•

November 20-25 –

Arrive Singapore and load riser

•

December 15 –

Arrive East coast of India

•

December 31 –

On Contract with ONGC |

Semisubmersibles

•

Two 6th generation semisubmersibles

•

Moss Maritime CS50 MkII

Drilling depth of 40,000 feet

Operate in up to 10,000 feet of water

•

Construction

ongoing

at

Jurong

Shipyard

Pte

Ltd,

Singapore

Semi I: Delivery Q4 2010 (PEMEX

/ five years) Semi

II: Delivery Q3 2011 (Currently marketing)

•

Construction

Management

Contracts:

Approximately

$5.0

million

of

annual

cash

flow per contract during the construction phase

•

Operating Management Contracts:

Approximately

$12.0

–

$15.0

million

of

annual

cash

flow

per

rig

Structured as a combination of a fixed daily fee and a variable fee based on

dayrate

and annual cash flow |

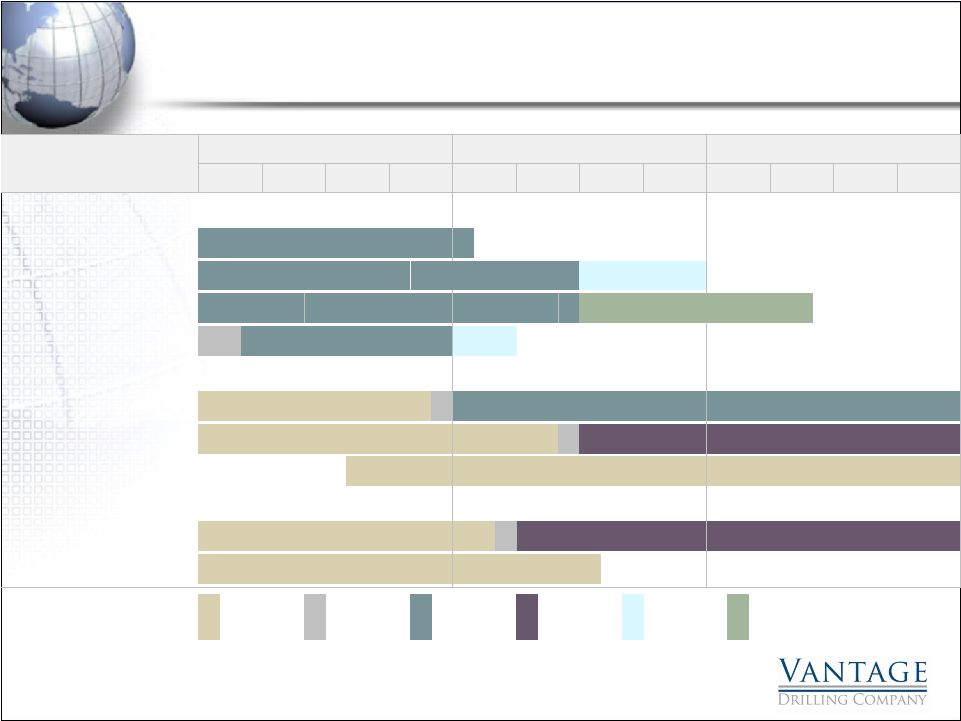

Fleet Status

– Average Drilling Revenue /

Day

(1)

5 years at $590,500

5 years at $503,000

Ownership

2010

2011

2012

Rig

%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Jackups

Emerald Driller

100%

2 yrs. at $171K

Sapphire Driller

100%

10 mos. at $115.5K

8 mos. at $120K

Aquamarine Driller

100%

5 mos. at $154.2K

2 yrs. at $120K

(2)

Repriced

to Leading Market Rate

Topaz Driller

100%

10 mos. at $107.2K

Drillships

Platinum Explorer

100%

5 yrs. at $590.5K

DragonQuest

Managed

8 yrs. at $551.3K

(3)

Dalian Developer

Managed

Semisubmersibles

Semi I

Managed

5 yrs. at $503K

Semi II

Managed

Construction

Commissioning/

Working

Operating

Option

Extended

Management

Mobilization

(Owned Rigs)

(Management

Contract

Well Test

Contract

Contract)

Option

(1)

Average drilling revenue per day is based on the total estimated revenue

divided by the minimum number of days committed in a contract. Unless otherwise noted, the total revenue includes any

mobilization and demobilization fees and other contractual revenues

associated with the drilling services.

(2)

The contract is for drilling two wells plus extended well tests.

Estimated drilling time is one month per well and extended well tests could range from a few months to up to one year per well.

The first extended well tests period has been contracted through April

2011. (3)

The drilling revenue per day includes the achievement of the 12.5% bonus

opportunity, but excludes mobilization revenues and revenue escalations included in the contract. |

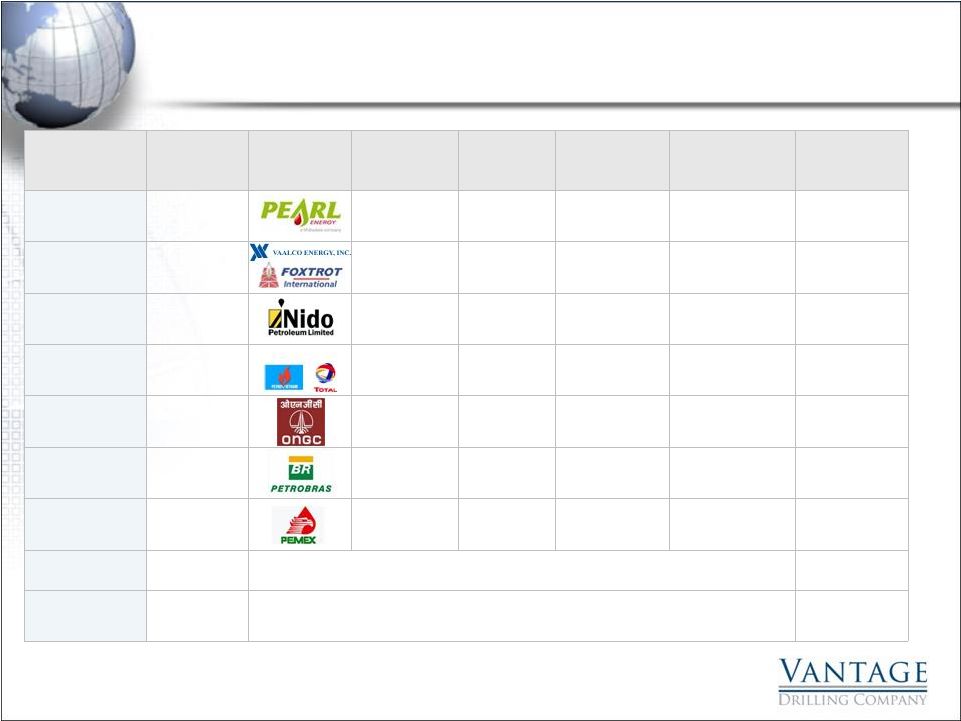

Vessel Name

Owned/

Managed

Contract Party

Contract Party

Credit Rating

(S&P/Moody’s)

Contract Length

Average Drilling

Revenue Per

Day

(1)

Contract Value

(Gross)

Operating

Management Fee

Emerald Driller

Owned

AA / Aa3

2 Years

$171,000

$126.5 million

N/A

Sapphire Driller

Owned

N/A

A-

/ BBB+

(2)

1) 5 months

2) 8 months

1) $115,500

2) $120,000

1) $17.2 million

2) $28.4 million

N/A

Aquamarine Driller

Owned

N/A

2 years

(3)

$120,000

$86.4 million

(3)

N/A

Topaz Driller

Owned

Phu

Quy

(4)

N/A

7 months

$107,200

$22.5 million

N/A

Platinum Explorer

Owned

N/A / A2

5 years

$590,500

$1.1 billion

N/A

DragonQuest

Managed

BBB-

/ A3

8 years

$551,300

$1.6 billion

$14.0-15.0

million annually

Semi I

Managed

BBB / Baa1

5 years

$503,000

$0.9 billion

$13.0-15.0

million annually

Semi II

Managed

N/A

Dalian Developer

Managed

N/A

Contract Overview and Customer Credit

Profile

(1)

Average drilling revenue per day is based on the total estimated revenue divided by the minimum number

of days committed in a contract. Unless otherwise noted, the total revenue includes any mobilization

and demobilization fees and other contractual revenues associated with the drilling services.

(2)

Foxtrot International is owned by Bouygues Group, which has an A- rating from S&P and BBB+

rating per Fitch. (3)

The contract is for drilling two wells plus extended well tests. Estimated drilling time is one month

per well and extended well tests could range from a few months to up to one year per well. The first extended

well tests period has been contracted through April 2011.

(4)

PVEP Phu Quy Petroleum Operating Co. Ltd. is a joint venture interest between PetroVietnam Exploration

Production Corp. and Total E&P Vietnam. |

Premium Asset

Advantage •

Premium jackups

(350’

+ IC rigs)

and ultra-deepwater floater

have historically maintained

significantly higher utilization

levels, particularly during

downturns in the energy industry

–

Operators demand newer, higher

specification rigs due to superior

operating performance, resulting in

lower maintenance downtimes,

improved safety and higher efficiency

•

A higher utilization level in the

international drilling market

continues to reflect a more

stable rig supply and demand

environment than the Gulf of

Mexico

•

Operators are willing to pay a

substantial

dayrate

premium

for

high-specification rigs

Global Jackup

Utilization

International vs. GOM Jackup

Utilization

Source: Riglogix; ODS-PetroData.

Historical Floater Dayrates

($Thousands)

Historical Floater Utilization |

Profile of Global Jackup

Fleet

•

Capabilities

and

age

–

The

current

worldwide

fleet

is

comprised

mostly

of

older,

inefficient

rigs

–

27% of today’s jackups

are mat-supported and/or have less than 200ft of water depth capability

–

71% of today’s jackups

are 25 years or older

–

As of July 2010 a total of 127 rigs were either ready stacked, cold stacked, or in

an accommodation mode without contract –

How many will not return to service?

•

Setting

up

cyclical

recovery

–

Reduction

in

the

overall

fleet

should

result

in

pricing

power

and

high

utilization levels early on during the recovery

•

Age

is

a

factor

–

Demand

is

increasing

for

high-specification

jackups.

Many

customers

are

implementing age restrictions and new high-specification characteristics

Source: Riglogix.

Global Jackup

Fleet Distribution

300'+ IC

117

300' IC

124

<250' IC

52

250' IC

65

300'+ IS

8

MC

44

<300' IS

17

MS

21

Heavy Weather

19

Age of Jackup Fleet

Water Depth (feet)

Age

Rigs

%

%

300+

200-299

<200

25 years or older

333

71%

64%

146

132

55

5 to 24 years

54

12%

10%

49

2

3

0 to 4 years

80

17%

15%

74

4

2

467

100%

269

138

60

2010 Deliveries

20

4%

14

4

2

2011 Deliveries

16

3%

16

0

0

2012 Deliveries

17

3%

16

1

0

520

100%

315

143

62 |

Profile of Global

Ultra-Deepwater Fleet •

The ultra-deepwater rig market maintains the most favorable long-term outlook driven by

recent discoveries in Brazil, West Africa, and the U.S. Gulf of Mexico

•

Ultra-deepwater rigs are capable of working in any water depth where operators are currently

likely to drill •

Can compete for any available work, while lower water depth drilling rigs have a more limited

market •

Projections

indicate

a

shortage

of

rigs

designed

for

the

4,000

–

6,000’

water

depth

range

which

will

likely

be filled by ultra-deepwater units

Floater Rig Supply By Type (# of Rigs)

Ultra-Deepwater Floaters By Operator

(1)

Source: Riglogix.

(1)

Ultra-Deepwater (>7,500 ft) drillships

and semisubmersibles currently in operation.

(2)

Other operators with 1 rig each include: Det

Norske Oljeselskap, Murphy, Taylor, Woodside, PEMEX, Tullow, ExxonMobil, Husky, Repsol, Cairn Energy

and ONGC for a total of 11 rigs.

(3)

Other operators with 2 rigs each include: BHP Billiton, Noble Energy, Marathon, Nexen, ENI and Devon

Energy for a total of 12 rigs. |

Financial Overview

Pro Forma Capitalization

($Millions)

Actual

As Adjusted

Unrestricted Cash

18.4

$

118.2

$

Restricted Cash

27.2

545.3

Accounts receivable

59.2

59.2

Inventory

14.4

14.4

Other current assets

3.9

3.9

123.1

741.0

Property and equipment, net

888.7

1,159.8

Investment in affiliate

129.1

(0.0)

Other assets

27.6

44.0

1,168.5

$

1,944.8

$

Accounts payable & accrued

45.1

$

45.1

$

Short-term debt

2.6

2.6

Current maturities long-term debt

16.0

-

63.7

47.7

Long-term debt

364.2

1,127.8

Deferred income taxes

0.1

0.1

Shareholders Equity:

Paid in capital

779.4

833.7

Retained earnings

(38.2)

(63.8)

Other comprehensive loss

(0.7)

(0.7)

Total equity

740.5

769.2

1,168.5

$

1,944.8

$

Outstanding shares

236.8

289.1

Book value per share

3.13

$

2.66

$

As of June 30, 2010 |

Financial Overview

Historical Financial Information

($ Millions) |

Financial Overview

Run-Rate Financial Potential of Vantage Owned Assets

($Millions, except dayrates)

Illustrative Range of Run-Rate Financial Potential

•

Rig-Level EBITDA excludes

income from management

fees and unallocated

corporate SG&A (estimated

at $17-$20 million per year)

(1)

Calculations of rig-level EBITDA incorporate management's assumption of 90% utilization/efficiency

of jackups, which reflects industry standard productive times on high-specification

jackups. Utilization/efficiency of drillship assumed to be 97%, which management believes is a

reasonable assumption for a newbuild vessel in its first full year of operations. Rig-level EBITDA attributable to jackups

reflects operating expense assumption based on Vantage’s jackups that operated for the full first

quarter of 2010. |

Significant

Upside Valuation Potential EBITDA

Today’s

Peer Avg.

5.5x

6.5x

Historical

Peer Avg.

11.6x

$275 million

$1.43

$2.40

$7.26

$300 million

$1.91

$2.95

$8.26

$350 million

$3.11

$4.08

$10.28

Implied Values –

EV/EBITDA

Source: Credit Suisse

Price to Book Value

Commencement of Platinum Explorer

expected to be a catalyst event to unlock value. |

Appendix

Reconciliation of Net Income (Loss) to Adjusted EBITDA

($Millions)

3/31/2009

6/30/2009

9/30/2009

12/31/2009

3/31/2010

6/30/2010

Net Income (Loss)

2.4

$

4.0

$

6.8

$

(4.3)

$

6.0

$

(7.0)

$

Interest Expense, Net

0.7

1.3

1.9

4.2

8.0

13.3

Income Tax Provision (Benefit)

0.6

0.9

1.1

(0.6)

2.3

8.4

Depreciation

1.7

2.1

3.2

4.3

7.5

8.4

EBITDA

5.4

$

8.3

$

13.0

$

3.6

$

23.8

$

23.1

$

Share-Based Compensation Expense

1.1

1.2

1.2

1.4

1.5

1.5

Adjusted EBITDA

6.5

$

9.5

$

14.2

$

5.0

$

25.3

$

24.6

$

Fiscal Quarter Ended, |