Attached files

| file | filename |

|---|---|

| 8-K - GHN AGRISPAN 8-K - GHN Agrispan Holding Co | ghn_8k.htm |

| EX-10.3 - FORM OF CSPW - GHN Agrispan Holding Co | ghn_8k-ex1003.htm |

| EX-10.4 - FORM OF ESCROW AGREEMENT - GHN Agrispan Holding Co | ghn_8k-ex1004.htm |

| EX-10.1 - FORM OF SECURITIES PURCHASE AGREEMENT - GHN Agrispan Holding Co | ghn_8k-ex1001.htm |

| EX-10.2 - FORM OF REGISTRATION RIGHTS AGREEMENT - GHN Agrispan Holding Co | ghn_8k-ex1002.htm |

OF

RIGHTS, PREFERENCES, PRIVILEGES AND RESTRICTIONS

OF

SERIES A 10.0% CONVERTIBLE PREFERRED STOCK

OF

GHN AGRISPAN HOLDING COMPANY

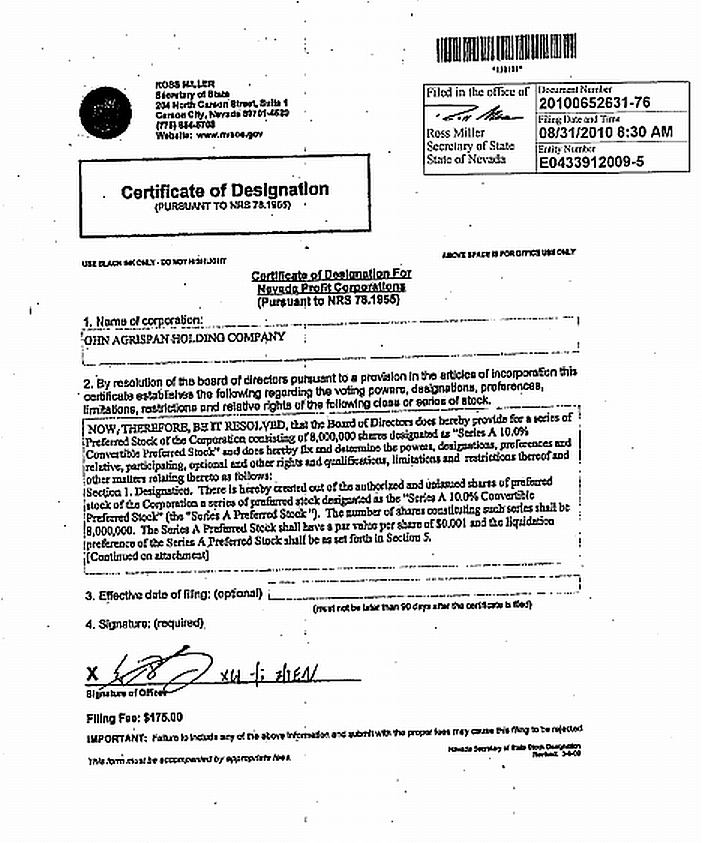

The undersigned officer of GHN Agrispan Holding Company, Inc., a corporation organized and existing under the Nevada Revised Statutes (the “Corporation”), does hereby certify:

That, pursuant to the authority conferred upon the Board of Directors of the Corporation by its Amended and Restated Articles of Incorporation and pursuant to the provisions of Section 78.195(5) of the Nevada Revised Statutes, the Board of Directors, by unanimous written consent, adopted the following recitals and resolution, which resolution remains in full force and effect on the date hereof:

WHEREAS, the Articles of Incorporation of the Corporation provides for a class of stock designated “Preferred Stock”;

WHEREAS, the Articles of Incorporation of the Corporation provides that such Preferred Stock may be issued from time to time in one or more series and authorizes the Board of Directors of the Corporation to fix by resolution the designations and the powers, preferences and relative, participating, optional and other special rights and qualifications, limitations and restrictions granted to or imposed upon any wholly unissued series of Preferred Stock and to fix the number of shares constituting any such series and the designation thereof; and

WHEREAS, it is the desire of the Board of Directors, pursuant to its authority as aforesaid, to fix and determine the powers, designations, preferences and relative, participating, optional and other rights and qualifications, limitations and restrictions thereof and other matters relating to a Series A Preferred Stock;

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for a series of Preferred Stock of the Corporation consisting of 8,000,000 shares designated as “Series A 10.0% Convertible Preferred Stock” and does hereby fix and determine the powers, designations, preferences and relative, participating, optional and other rights and qualifications, limitations and restrictions thereof and other matters relating thereto as follows:

Section 1. Designation. There is hereby created out of the authorized and unissued shares of preferred stock of the Corporation a series of preferred stock designated as the “Series A 10.0% Convertible Preferred Stock” (the “Series A Preferred Stock “). The number of shares constituting such series shall be 8,000,000. The Series A Preferred Stock shall have a par value per share of $0.001 and the liquidation preference of the Series A Preferred Stock shall be as set forth in Section 5.

Section 2. Ranking. The Series A Preferred Stock will, with respect to dividend rights and rights on liquidation, winding-up and dissolution, rank (i) on a parity with each class or series of Parity Securities (as defined below) established after the Effective Date by the Corporation and (ii) senior to the Corporation’s Common Stock and each other class or series of Junior Securities (as defined below) outstanding or established after the Effective Date by the Corporation. The Corporation has the right to authorize and/or issue additional shares or classes or series of Junior Securities without the consent of the Holders, but such consent is required for the authorization or issuance of Parity Securities pursuant to Section 9.

Section 3. Definitions. As used herein with respect to Series A Preferred Stock:

(a) “Articles of Incorporation” means the Corporation’s Amended and Restated Articles of Incorporation, as they may be amended or restated from time to time.

(b) “Business Day” means any day except Saturday, Sunday and any day on which banking institutions in the State of New York generally are authorized or required by law or other governmental actions to close.

(c) “Bylaws” means the bylaws of the Corporation, as they may be amended from time to time.

(d) “Certificate of Designation” means this Certificate of Designation relating to the Series A Preferred Stock, as it may be amended from time to time.

(e) “Change of Control” means any merger, consolidation, sale of stock or other business combination in which the Corporation is not the surviving entity or in which the stockholders of the Corporation prior to the transactions beneficially own less than 51% of the Corporation’s voting power after giving effect to such transaction.

(f) “Commission” means the Securities and Exchange Commission.

(g) “Common Stock” means the common stock, par value $0.001 per share, of the Corporation.

(h) “Conversion Rate” means, as of any given date, a number of shares of Common Stock equal to the quotient of (i) the Liquidation Amount divided by (ii) the Original Issue Price, as such rate may be adjusted from time to time pursuant to the terms of Section 8.

(i) “Dividend Rate” shall be equal to 10% per annum unless increased pursuant to Section 10(b).

(j) “Effective Date” means the date on which shares of the Series A Preferred Stock are first issued.

(k) “Holder” means the Person in whose name the shares of the Series A Preferred Stock are registered, which may be treated by the Corporation as the absolute owner of the shares of Series A Preferred Stock for the purpose of making payment and settling the related conversions and for all other purposes.

(l) “Investor Warrant” means the Warrants issued by the Corporation on the Effeictve Date to each Holder as of such date.

(m) “Junior Securities” means the Common Stock and any other class or series of stock or other equity securities of the Corporation (including warrants, options, or other rights to acquire such stock or other equity securities) the terms of which expressly provide that it ranks junior to the Series A Preferred Stock as to dividend rights, redemption rights and/or as to rights on liquidation, dissolution or winding up of the Corporation.

2

(n) “Liquidation Amount” means, with respect to a share of Series A Preferred Stock on any given date, the sum of (i) the Original Issue Price of such share plus (ii) all accrued and unpaid Dividends thereon (regardless of whether any dividends are actually declared) to, but excluding, such date.

(o) “Liquidation Event” means (i) any liquidation, dissolution or winding up of the Corporation; or (ii) a sale, lease or exchange of all or substantially all of the assets of the Corporation and its Subsidiaries, taken as a whole.

(p) “Original Issue Date” means the date on which all shares of Series A Preferred Stock are first issued. All shares of Series A Preferred Stock shall have the same Original Issue Date.

(q) “Original Issue Price” means $0.50 per share of Series A Preferred Stock.

(r) “Parity Securities” means any class or series of stock or other equity securities of the Corporation (including warrants, options, or other rights to acquire such stock or other equity securities) (other than Series A Preferred Stock) the terms of which do not expressly provide that such class or series will rank senior or junior to Series A Preferred Stock as to dividend rights and/or as to rights on liquidation, dissolution or winding up of the Corporation (in each case without regard to whether dividends accrue cumulatively or non-cumulatively).

(s) “Person” means an individual, partnership, corporation, limited liability company, association, trust, unincorporated organization or any other entity or organization, including a government or agency or political subdivision thereof.

(t) “Preferred Stock” means any and all series of preferred stock of the Corporation, including the Series A Preferred Stock.

(u) “Subsidiary” means, as to any particular parent corporation or organization, any other corporation or organization more than 50% of the outstanding Voting Stock of which is at the time directly or indirectly owned by such parent corporation or organization or by any one or more other entities which are themselves Subsidiaries of such parent corporation or organization. Unless otherwise expressly noted herein, the term “Subsidiary” means a Subsidiary of the Corporation or of any of its direct or indirect Subsidiaries.

(v) “Trading Day” means (i) a day on which the Common Stock is traded on a Trading Market or (ii) if the Common Stock is not listed or quoted on any Trading Market, a day on which the Common Stock is quoted in the over-the-counter market as reported by the Pink Sheets LLC (or any similar organization or agency succeeding to its functions of reporting prices); provided, that in the event that the Common Stock is not listed or quoted as set forth in (i) or (ii) hereof, then Trading Day shall mean a Business Day.

(w) “Trading Market” means whichever of the New York Stock Exchange, the American Stock Exchange, the NASDAQ Global Select Market, the NASDAQ Global Market, the NASDAQ Capital Market or OTC Bulletin Board on which the Common Stock is listed or quoted for trading on the date in question.

(x) “Voting Stock” of any Person means capital stock or other equity interests of any class or classes (however designated) having ordinary power for the election of directors or other similar governing body of such Person, other than stock or other equity interests having such power only by reason of the happening of a contingency.

3

(y) “VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. New York City time to 4:02 p.m. New York City time); (b) if the Common Stock is not then listed or quoted for trading on a Trading Market and if prices for the Common Stock are then reported in the “Pink Sheets “ published by Pink Sheets, LLC (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported; or (c) in all other cases, the fair market value of a share of Common Stock as determined by a nationally recognized-independent appraiser selected in good faith by persons holding a majority of the principal amount of Series A Preferred Stock then outstanding..

Section 4. Dividends.

(a) General Obligation. Holders of Series A Preferred Stock shall be entitled to receive, on each share of Series A Preferred Stock out of funds legally available therefor, dividends (“Dividends”) on the Original Issue Price at the Dividend Rate. All such dividends shall begin to accrue from the Original Issue Date and shall accrue on a daily basis. Dividends shall be payable quarterly in arrears on last day of November, February, May and August of each year (each, a “Dividend Payment Date”), commencing on November 30, 2010. In the event that any Dividend Payment Date would otherwise fall on a day that is not a Business Day, the dividend payment date on that date will be postponed to the next day that is a Business Day and no additional dividends will accrue as a result of that postponement. Dividends shall be payable in cash on each Dividend Payment Date provided that, at the option of the Corporation, dividends may be paid in shares of Common Stock that have been registered with the Commission pursuant to an effective registration statement (“Dividend Shares”). In order to exercise its option to satisfy its obligation to make a Dividend by issuing Dividend Shares, the Corporation must, at least five (5) days prior to the applicable Dividend Payment Date, provide written notice (the "Dividend Notice") to each Holder indicating that the Corporation is electing to pay the Dividend in Dividend Shares. Dividends paid in Dividend Shares shall be paid in a number of fully paid and non-assessable shares (rounded up to the nearest whole share) of Common Stock equal to (i) the amount of interest payable divided by (ii) ninety percent (90%) of the average VWAP for the ten Trading Days prior to the Dividend Payment Date. If any Dividend Shares are to be issued on a Dividend Payment Date, then the Corporation shall, no later than the third Trading Day following the applicable Dividend Payment Date, issue and deliver to such Holder a certificate, registered in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder shall be entitled.

Dividends that are payable on Series A Preferred Stock shall be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of dividends payable on Series A Preferred Stock on any date prior to a Dividend Payment Date, and for the initial dividend payment, shall be computed on the basis of a 360-day year consisting of twelve 30-day months, and actual days elapsed.

The date on which the Corporation initially issues all of the shares of Series A Preferred Stock will be deemed to be the “Original Issue Date” for each share of Series A Preferred Stock regardless of the number of times transfer of such share is made on the stock records maintained by or for the Corporation and regardless of the number of certificates which may be issued to evidence such share.

Section 5. Liquidation.

(a) Preference. Upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, each holder of Series A Preferred Stock will be entitled to be paid, before any distribution or payment is made upon any Junior Securities, an amount in cash equal to the aggregate Liquidation Amount of all shares of Series A Preferred Stock.

4

(b) Insufficient Funds. If upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, the cash and other property available for distribution to the stockholders of the Corporation (the “Distributable Funds”) shall be insufficient to permit the payment to the holders of Series A Preferred Stock of the full preferential amount set forth in Section 5(a), then the Distributable Funds shall be distributed to the holders of Series A Preferred Stock, ratably in proportion to the number of shares of Series A Preferred Stock held by each such holder on the date of liquidation, dissolution or winding up of the Corporation.

(c) Remaining Funds. If any of the Distributable Funds shall remain after the payment to the holders of Series A Preferred Stock of the full preferential amount set forth in Section 5(a), and the corresponding amounts payable with respect to any Parity Securities have been paid in full, then such remainder shall be distributed ratably to the holders of Junior Securities.

(d) Notice. The Corporation will mail written notice of any proposed liquidation, dissolution or winding up, not less than 30 days prior to approving any such action, to each record holder of Series A Preferred Stock.

(e) Certain Events. For purposes of this Section 5, (i) a Change in Control Event shall not constitute a liquidation, dissolution or winding up of the Corporation and (ii) a Liquidation Event shall constitute a liquidation, dissolution or winding up of the Corporation.

Section 6. Rights Upon a Change of Control.

(a) Redemption. In connection with the consummation of a Change in Control, each Holder shall have the right to cause the Corporation to redeem some or all of the shares of Series A Preferred Stock held by such Holder for, at such Holder’s election, either (i) an amount of cash equal to 120% of the then-effective Liquidation Amount or (ii) a number of shares of Common Stock equal to the quotient of (A) 120% of the then-effective Liquidation Amount divided by (B) the average closing price of the Common Stock on the Trading Market for the 10 Trading Days immediately prior to the fifth Trading Day prior to the closing date of the Change of Control.

The redemption price for any shares of Series A Preferred Stock shall be payable in immediately available funds or shares of fully paid and nonassessable shares of Common Stock, as the case may be, on the day prior to the closing date of the Change of Control to the Holder of such shares against surrender of the certificate(s) evidencing such shares to the Corporation or its agent. If the funds of the Corporation legally available for redemption of shares of Series A Preferred Stock are insufficient to redeem the total number of outstanding shares of Series A Preferred Stock that the Holder thereof elects to be redeemed for cash, those funds which are legally available shall be used to redeem the maximum possible number of shares of Series A Preferred Stock ratably among the Holders of the shares that elect to have shares redeemed based upon the aggregate number of shares of Series A Preferred Stock to be redeemed held by each such Holder. The balance of the shares of Series A Preferred Stock shall be redeemed for shares of Common Stock pursuant to clause (ii) of Section 6(a).

(b) Notice of Change in Control. The Corporation shall provide written notice (a “Change in Control Notice”) to each Holder of a Change of Control Event no later than the 15th Business Day prior to the anticipated closing date of the transaction. Each Change in Control Notice shall state: (1) the anticipated closing date of such transaction; and (2) the form and amount of consideration to be paid in the transaction. Each Holder must provide written notice (a “Response Notice”) to the Corporation on or prior to the fifth Business Day following receipt of the Change in Control Notice (the “Response Date”) informing the Corporation of its election pursuant to Section 6(a) to have the Corporation redeem some or all of the shares of Series A Preferred Stock held by such Holder.

5

(c) Effectiveness of Redemption. Upon payment of the full redemption price of a share of Series A Preferred Stock, such share shall no longer be deemed outstanding and all rights with respect to such share shall cease and terminate. If fewer than all the shares of Series A Preferred Stock represented by any certificate are redeemed, a new certificate shall be issued representing the unredeemed shares without charge to the Holder thereof.

(d) Status of Redeemed Shares. Shares of Series A Preferred Stock that are redeemed, repurchased or otherwise acquired by the Corporation shall revert to authorized but unissued shares of Preferred Stock (provided that any such cancelled shares of Series A Preferred Stock may be reissued only as shares of a series of Preferred Stock other than Series A Preferred Stock).

(e) Shares Not Redeemed. If any shares of Series A Preferred Stock are not redeemed by the Corporation pursuant to this Section 6 in connection with a Change in Control, then upon any subsequent conversion of such shares of Series A Preferred Stock, the Holder shall have the right to receive, for each share of Common Stock that would have been issuable upon such conversion absent such Change In Control, the same kind and amount of securities, cash or property as it would have been entitled to receive upon the occurrence of such Change of Control if it had been, immediately prior to such Change of Control, the holder of one share of Common Stock (the “Alternate Consideration”). For purposes of any such conversion, the determination of the Conversion Ratio shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Change in Control. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Change in Control, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any conversion of its shares of Series A Preferred Stock following such Change in Control. To the extent necessary to effectuate the foregoing provisions, any successor to the Corporation or surviving entity in such Change in Control shall file a new Certificate of Designation with the same terms and conditions and issue to the Holder new preferred stock consistent with the foregoing provisions and evidencing the Holder’s right to convert such preferred stock into Alternate Consideration. The terms of any agreement pursuant to which a Change in Control is effected shall include terms requiring any such successor or surviving entity to comply with the provisions of this paragraph (e) and insuring that this Series A Preferred Stock (or any such replacement security) will be similarly adjusted upon any subsequent transaction analogous to a Change in Control. Notwithstanding the foregoing or any other provisions of this Certificate of Designation, in the event that the agreement relating to a Change in Control provides for the conversion or exchange of the Series A Preferred Stock into equity or debt securities, cash or other consideration and the agreement is approved by the holders of a majority of the then-outstanding shares of Series A Preferred Stock, then the holders of the Series A Preferred Stock shall have only the rights set forth in such agreement.

Section 7. Conversion Rights.

(a) Subject to and upon compliance with the provisions of this Section 7, a Holder of any shares of Series A Preferred Stock shall have the right, at its option, at any time prior to the ten-year anniversary of the Effective Date, to convert all or any portion of such Holder’s outstanding Series A Preferred Stock, subject to the conditions described below, into the number of fully paid and non-assessable shares of Common Stock at the then-effective Conversion Rate. Such Holder shall surrender to the Corporation such shares of Series A Preferred Stock to be converted in accordance with the provisions of Section 7(e). If any issued and outstanding shares of Series A Preferred Stock have not been converted prior to the ten-year anniversary of the Effective Date, such shares shall be automatically converted into shares of Common Stock at the then-effective Conversion Rate on the date of such ten-year anniversary.

6

(b) In connection with the conversion of any shares of Series A Preferred Stock, no fractional shares of Common Stock shall be issued, but the Corporation shall pay a cash adjustment in respect of any fractional interest in an amount equal to the fractional interest multiplied by the closing price on the most recent Trading Day. If more than one share of Series A Preferred Stock shall be surrendered for conversion by the same Holder at the same time, the number of full shares of Common Stock issuable on conversion of those shares of Series A Preferred Stock shall be computed on the basis of the total number of shares of Series A Preferred Stock so surrendered.

(c) Except as set forth in this Certificate of Designation, a Holder of Series A Preferred Stock is not entitled to any rights of a Holder of shares of Common Stock until that Holder has converted its Series A Preferred Stock, and only to the extent the Series A Preferred Stock are deemed to have been converted to shares of Common Stock in accordance with the provisions of this Section 7.

(d) The Corporation shall, prior to issuance of any shares of Series A Preferred Stock hereunder, and from time to time as may be necessary, reserve and keep available, free from preemptive rights, out of its authorized but unissued Common Stock, for the purpose of effecting the conversion of the shares of Series A Preferred Stock, such number of its duly authorized Common Stock as shall from time to time be sufficient to effect the conversion of all shares of Series A Preferred Stock then outstanding into such Common Stock at any time. The Corporation covenants that all shares of Common Stock which may be issued upon conversion of Series A Preferred Stock shall upon issue be fully paid and nonassessable and free from all liens and charges and, except as set forth in Section 7(e)(i), taxes with respect to the issue thereof. The Corporation further covenants that, if at any time the shares of Common Stock shall be listed on the New York Stock Exchange or any other national securities exchange or quoted on an automated quotation system, the Corporation shall, if permitted by the rules of such exchange or automated quotation system, list and keep listed or quoted, so long as the Common Stock shall be so listed or quoted on such exchange or automated quotation system, all Common Stock issuable upon conversion of the Series A Preferred Stock. Before the delivery of any securities that the Corporation shall be obligated to deliver upon conversion of the shares of Series A Preferred Stock, the Corporation shall comply with all applicable federal and state laws and regulations.

(e) The procedure to exercise the conversion right is set forth below:

(i) In order to convert shares of Series A Preferred Stock, a Holder must surrender to the Corporation at its principal office or at the office of the transfer agent of the Corporation, as may be designated by the Board of Directors, the certificate or certificates for the shares of Series A Preferred Stock to be converted accompanied by a written notice stating that the Holder of Series A Preferred Stock elects to convert all or a specified whole number of those shares in accordance with this Section 7(e) and specifying the name or names in which the Holder wishes the certificate or certificates for the shares of Common Stock to be issued (a “Conversion Notice”). In case the notice specifies that the shares of Common Stock are to be issued in a name or names other than that of the Holder of Series A Preferred Stock, the notice shall be accompanied by payment of all transfer taxes payable upon the issuance of shares of Common Stock in that name or names. Other than those transfer taxes payable pursuant to the preceding sentence, the Corporation shall pay any documentary, stamp or similar issue or transfer taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of the shares of Series A Preferred Stock.

7

(ii) As promptly as practicable after the surrender of the certificate or certificates for the shares of Series A Preferred Stock in accordance with Section 7(e)(i), the receipt of the Conversion Notice and payment of all required transfer taxes, if any, or the demonstration to the Corporation’s satisfaction that those taxes have been paid, the Corporation shall issue and shall deliver or cause to be issued and delivered to such Holder, or to such other person on such Holder’s written order, (a) certificates representing the number of validly issued, fully paid and non-assessable full shares of Common Stock to which the Holder of the Series A Preferred Stock being converted, or the Holder’s transferee, shall be entitled, (b) if less than the full number of Series A Preferred Stock evidenced by the surrendered certificate or certificates is being converted, a new certificate or certificates, of like tenor, for the number of shares of Series A Preferred Stock evidenced by the surrendered certificate or certificates, less the number of shares being converted, and (c) any fractional interest in respect of a share of Common Stock arising upon such conversion shall be settled as provided in Section 7(b).

(iii) Each conversion shall be deemed to have been made at the close of business on the date of giving the notice and of surrendering the certificate or certificates representing the shares of the Series A Preferred Stock to be converted so that the rights of the Holder thereof as to the Series A Preferred Stock being converted shall cease except for the right to receive the number of fully paid and non-assessable shares of Common Stock at the Conversion Rate (subject to adjustment in accordance with the provisions of Section 8), and, if applicable, the person entitled to receive shares of Common Stock shall be treated for all purposes as having become the record Holder of those shares of Common Stock at that time.

Section 8. Adjustment of Conversion Rate; Distributions.

(a) Stock Dividends and Distributions. If the Corporation shall, at any time or from time to time after the Effective Date while any shares of Series A Preferred Stock are outstanding, issue Common Stock as a dividend or distribution to all or substantially all of the holders of Common Stock, then the Conversion Rate in effect immediately prior to the close of business on the record date fixed for the determination of stockholders entitled to receive such dividend or distribution shall be adjusted by multiplying such Conversion Rate by a fraction:

(i) the numerator of which shall be the sum of (x) the total number of shares of Common Stock outstanding at the close of business on such Distribution Record Date and (y) the total number of shares of Common Stock constituting such dividend or other distribution; and

(ii) the denominator of which shall be the number of shares of Common Stock outstanding at the close of business on such Distribution Record Date.

An adjustment made pursuant to this Section 8(a) shall become effective immediately prior to the opening of business on the day following the Distribution Record Date fixed for such determination. If any dividend or distribution of the type described in this Section 8(a) is declared but not so paid or made, the Conversion Rate shall again be adjusted to the Conversion Rate which would then be in effect if such dividend or distribution had not been declared. “Distribution Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of stockholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board of Directors or by statute, contract or otherwise).

8

(b) Subdivisions, Combinations, Reclassifications and Splits. If the Corporation shall, at any time or from time to time after the Effective Date while any shares of Series A Preferred Stock are outstanding, subdivide, combine, reclassify or split its outstanding shares of Common Stock into a greater or lesser number of shares of Common Stock, the Conversion Rate in effect immediately prior to the opening of business on the day following the day upon which such subdivision, combination, reclassification or split becomes effective shall be adjusted by multiplying such Conversion Rate by a fraction:

(i) the numerator of which shall be the number of shares of Common Stock outstanding immediately prior to the opening of business on the day following the day such subdivision, combination, reclassification or split becomes effective; and

(ii) the denominator of which shall be the number of shares of Common Stock outstanding immediately prior to the opening of business on the day that such subdivision, combination, reclassification or split becomes effective.

An adjustment made pursuant to this Section 8(b) shall become effective immediately prior to the opening of business on the day following the day upon which such subdivision, reclassification, split or combination becomes effective.

(c) Issuances of Purchase Rights. If the Corporation shall, at any time or from time to time after the Effective Date while any shares of Series A Preferred Stock are outstanding, issue rights or warrants to all or substantially all holders of its outstanding Common Stock (including pursuant to an shareholder rights plan) entitling them to subscribe for or purchase Common Stock or securities convertible into or exchangeable or exercisable for Common Stock, the Holders of shares of Series A Preferred Stock shall be entitled receive such rights or warrants as though such Holders were the holders of the number of shares of Common Stock into which their shares of Series A Preferred Stock are convertible as of the record date fixed for the determination of the holders of Common Stock of this Corporation entitled to receive such distribution.

(d) Distributions of Assets. If the Corporation shall, at any time or from time to time after the Effective Date while any shares of Series A Preferred Stock are outstanding, by dividend or otherwise, distribute to all or substantially all of the holders of its outstanding shares of Common Stock (including any such distribution made in connection with a consolidation or merger in which the Corporation is the continuing corporation and the shares of Common Stock are not changed or exchanged), shares of its capital stock, evidences of the Corporation’s indebtedness or other assets or property, including securities (including capital stock of any subsidiary of the Corporation) but excluding (i) dividends or distributions of Common Stock referred to in Section 8(a), (ii) any rights or warrants referred to in Section 8(c), (iii) dividends and distributions paid exclusively in cash referred to in Section 4 and (iv) dividends and distributions of stock, securities or other property or assets (including cash) in connection with a Business Combination to which Section 9 applies (such capital stock, evidence of its indebtedness, other assets or property or securities being distributed hereinafter in this Section 8(d) called the “Distributed Assets”), then, in each such case, the Holders of shares of Series A Preferred Stock shall be entitled to receive such Distributed Assets as though such Holders were the holders of the number of shares of Common Stock into which their shares of Series A Preferred Stock are convertible as of the record date fixed for the determination of the holders of Common Stock of this Corporation entitled to receive such distribution.

9

(e) Whenever successive adjustments to the Conversion Rate are called for pursuant to this Section 8, such adjustments shall be made as may be necessary or appropriate to effectuate the intent of this Section 8 and to avoid unjust or inequitable results as determined in good faith by the Board of Directors. The Corporation shall be entitled to make such additional increases in the Conversion Rate, in addition to those required by Sections 8(a) and (b), if the Board of Directors determines that it is advisable in order that any dividend or distribution of Common Stock or subdivision, reclassification or combination of Common Stock or any event treated as such for United States federal income tax purposes, shall not be taxable to the holders of Common Stock for United States federal income tax purposes or to diminish any such tax.

(f) Whenever an adjustment in the Conversion Rate with respect to the Series A Preferred Stock is required, the Corporation shall promptly send to each Holder of Series A Preferred Stock a certificate of the Chief Financial Officer of the Corporation (or such person having similar responsibilities), stating the adjusted Conversion Rate determined as provided herein and setting forth in reasonable detail such facts as shall be necessary to show the reason for and the manner of computing such adjustment.

Section 9. Protective Provisions.

(a) So long as any shares of Series A Preferred Stock remain outstanding, the Corporation shall not, directly or indirectly (by amendment, merger, consolidation or otherwise) without first obtaining the approval (by vote at a meeting duly noticed and held or written consent) of the Holders of at least a majority of the then outstanding shares of Series A Preferred Stock:

(i) authorize, create or issue any additional equity securities that rank senior or pari passu to the Series A Preferred Stock (including, for the avoidance of doubt, authorization of additional shares of Series A Preferred Stock or authorized but unissued equity securities or equity securities held in treasury, that rank senior or pari passu to the Series A Preferred Stock), or reclassify Junior Securities to rank senior or pari passu to the Series A Preferred Stock in right of payment;

(ii) amend this Certificate of Designation, the Articles of Incorporation or Bylaws, in any such case, in a manner that would alter or change the powers, preferences, privileges or rights of the Series A Preferred Stock or adversely affect the rights, preferences or privileges of the Series A Preferred Stock;

(iii) consummate a Liquidation Event, unless a distribution of cash proceeds to the Holders of shares of Series A Preferred Stock in an aggregate amount equal to the Liquidation Amount occurs upon the consummation of such Liquidation Event;

(iv) declare or pay any dividends or distributions, whether in cash, stock or property, to the holders of Common Stock or other Junior Securities or Parity Securities of the Corporation; or

(v) redeem or repurchase any Common Stock or other Junior Securities or Parity Securities of the Corporation.

10

(b) For a period of two years following the Effective Date, the Corporation shall not issue any additional shares of Common Stock or any securities convertible into or exchangeable or exercisable for Common Stock, in any case at a price per share of Common Stock less than the Original Issue Price without first obtaining the approval (by vote at a meeting duly notice and held or written consent) of the Holders of at least a majority of the then outstanding shares of Series A Preferred Stock; provided, however, that the restriction contained in this Section 9(b) shall not apply to (i) the issuance and sale by the Corporation of shares of Common Stock or securities convertible into or exchangeable or exercisable for Common Stock issued as consideration for the acquisition of another company or business in which the shareholders of the Corporation do not have an ownership interest, and where the primary purpose is not to raise capital for the Corporation or any Subsidiary, which acquisition has been approved by the Board of Directors of the Corporation, (ii) the issuance of shares of Common Stock, stock options or restricted stock to directors, employees or consultants for compensatory purposes, where (A) such issuance has been approved by the Board of Directors of the Corporation and (B) the per share price of any shares of Common Stock, the value of any restricted shares, or the exercise price of any options is greater than or equal to $0.50 per share, (iii) the exercise or conversion of warrants, options or convertible instruments that are outstanding on the Original Issue Date pursuant to their terms as of such date or (iv) the issuance of shares of Common Stock in satisfaction of indebtedness of the Corporation or any of its Subsidiaries that is outstanding on the Original Issue Date.

Section 10. Events of Noncompliance.

(a) Definition. An “Event of Noncompliance” shall be deemed to have occurred if:

(i) the Corporation fails to make any redemption payment with respect to the Series A Preferred Stock which it is obligated to make hereunder, whether or not such payment is legally permissible or is prohibited by any agreement to which the Corporation is subject;

(ii) the Corporation breaches or otherwise fails to perform or observe any other covenant or agreement set forth herein; or

(iii) the Corporation makes an assignment for the benefit of creditors or admits in writing its inability to pay its debts generally as they become due; or an order, judgment or decree is entered adjudicating the Corporation bankrupt or insolvent; or any order for relief with respect to the Corporation is entered under the Federal Bankruptcy Code; or the Corporation petitions or applies to any tribunal for the appointment of a custodian, trustee, receiver or liquidator of the Corporation or of any substantial part of the assets of the Corporation, or commences any proceeding relating to the Corporation under any bankruptcy, reorganization, arrangement, insolvency, readjustment of debt, dissolution or liquidation law of any jurisdiction; or any such petition or application is filed, or any such proceeding is commenced, against the Corporation and either (a) the Corporation by any act indicates its approval thereof, consent thereto or acquiescence therein or (b) such petition, application or proceeding is not dismissed within 60 days.

(b) Consequences of Events of Noncompliance.

(i) If an Event of Noncompliance has occurred and continues without waiver or cure for a period of 30 days, the Dividend Rate on the Series A Preferred Stock shall increase immediately by an increment of two percentage point(s). Thereafter, until such time as no Event of Noncompliance exists, the Dividend Rate shall increase automatically at the end of each succeeding 180-day period by an additional increment of two percentage point(s). Any increase of the Dividend Rate resulting from the operation of this paragraph shall terminate as of the close of business on the date on which no Event of Noncompliance exists, subject to subsequent increases pursuant to this paragraph.

11

(ii) If any Event of Noncompliance exists, each Holder of Series A Preferred Stock shall also have any other rights which such Holder is entitled to under any contract or agreement at any time and any other rights which such Holder may have pursuant to applicable law.

Section 11. Miscellaneous.

(a) Registration of Transfer. The Corporation will keep at its principal office a register for the registration of Series A Preferred Stock. Upon the surrender of any certificate representing Series A Preferred Stock at such place, the Corporation will, at the request of the record Holder of such certificate, execute and deliver (at the Corporation’s expense) a new certificate or certificates in exchange therefor representing in the aggregate the number of shares of Series A Preferred Stock represented by the surrendered certificate. Each such new certificate will be registered in such name and will represent such number of shares of Series A Preferred Stock as is requested by the Holder of the surrendered certificate and will be substantially identical in form to the surrendered certificate.

(b) Replacement. Upon receipt of an affidavit of the registered Holder of the loss, theft, destruction or mutilation of any certificate evidencing Series A Preferred Stock, and in the case of any such loss, theft or destruction, upon receipt of indemnity of such Holder or, in the case of any such mutilation upon surrender of such certificate, the Corporation will (at its expense) execute and deliver in lieu of such certificate a new certificate of like kind representing the number of shares of Series A Preferred Stock represented by such lost, stolen, destroyed or mutilated certificate and dated the date of such lost, stolen, destroyed or mutilated certificate.

(c) Amendment and Waiver. No amendment, modification or waiver will be binding or effective with respect to any provision of this Certificate of Designation without the prior written consent, or the affirmative vote at a duly noticed and held meeting, of the Holders of at least a majority of the shares of the Series A Preferred Stock outstanding at the time such action is taken; provided, that no such amendment, modification or waiver can alter or change the powers, preferences or special rights of the Series A Preferred Stock so as to affect the Holders thereof adversely without the prior written consent of each such Holder.

(d) Notices. Except as otherwise expressly provided, all notices referred to herein will be in writing and will be delivered personally or mailed certified mail, return receipt requested, postage prepaid or delivered by overnight courier service and will be deemed to have been given upon delivery, if delivered personally, three days after mailing it, if mailed, or one business day after timely delivery to the courier, if delivered by overnight courier service (a) to the Corporation, at its principal executive offices and (b) to any stockholder, at such Holder’s address as it appears in the stock records of the Corporation (unless otherwise indicated in a notice given by such Holder in accordance with this paragraph (d)).

[The remainder of this page is intentionally left blank.]

12

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Designation to be executed by its duly authorized officer this __ day of _________, 2010.

|

GHN AGRISPAN HOLDING COMPANY

|

|||

|

|

By:

|

/s/ | |

| Name | |||

| Title | |||