Attached files

As filed with the Securities and Exchange Commission on August 31, 2010

Registration No. 333-130360

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

PRE-EFFECTIVE AMENDMENT NO. 7 TO FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Nuveen Diversified Commodity Fund

(Exact name of Registrant as specified in its charter)

| Delaware | 6799 | 20-6750075 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

333 West Wacker Drive

Chicago, Illinois 60606

(877) 827-5920

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Gifford R. Zimmerman

Nuveen Commodities Asset Management, LLC

Chief Administrative Officer

333 West Wacker Drive

Chicago, Illinois 60606

(877) 827-5920

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Donald S. Weiss, Esq. Stacy H. Winick, Esq. K&L Gates LLP 70 West Madison Street Chicago, Illinois 60602 (312) 372-1121 |

Leonard B. Mackey, Jr., Esq. David Yeres, Esq. Clifford Chance US LLP 31 West 52nd Street New York, New York 10019 (212) 878 - 8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer | ¨ |

| Non-accelerated filer (Do not check if a smaller reporting company) x | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price per Unit(1) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||||

| Common Units of Beneficial Interest (“Shares”) of Nuveen Diversified Commodity Fund |

10,000,000 Shares | $25.00 | $250,000,000 | $17,825 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | All fees have been previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus and disclosure document is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus and disclosure document is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated August 31, 2010

PROSPECTUS

Shares

Nuveen Diversified Commodity Fund

$25.00 per Share

The Nuveen Diversified Commodity Fund (the “Fund”) is a commodity pool. The Fund issues shares, which represent units of fractional undivided beneficial interest in and ownership of the Fund. The Fund’s investment objective is to generate higher risk-adjusted total return than leading commodity market benchmarks, specifically the Dow Jones-UBS Commodity Index® and the S&P GSCI® Commodity Index, and passively managed commodity funds. In pursuing its investment objective, the Fund will invest directly in a diversified portfolio of commodity futures and forward contracts to obtain broad exposure to all principal groups in the global commodity markets. The Fund is unleveraged, and the Fund’s commodity contract positions will be fully collateralized with cash equivalents and short-term, high grade debt securities. The Fund will also write commodity call options seeking to enhance the Fund’s risk-adjusted total return. The investment strategy the Fund intends to employ is discussed further starting on page 3. Nuveen Commodities Asset Management, LLC will be the manager of the Fund. Gresham Investment Management LLC will be responsible for investing the Fund’s assets in commodity futures and forward contracts and implementing the options strategy. Nuveen Asset Management, an affiliate of the manager, will be responsible for the Fund’s investments in debt securities used as collateral.

Investing in the Fund involves significant risks. See “Risk Factors” starting on page 17.

| • | Because the Fund has not commenced business, its shares have no history of public trading and the Fund does not have any performance history. |

| • | Fund shares are subject to investment risk, including the possible loss of the entire amount of your investment. |

| • | Investments in commodities have a high degree of price variability, and are subject to rapid and substantial price changes. |

| • | The Fund may not be able to achieve its investment objective. |

It is anticipated that the Fund’s shares will be approved for listing on the NYSE Amex, subject to notice of issuance, under the trading or “ticker” symbol “CFD.”

THE FUND IS NOT A MUTUAL FUND, A CLOSED-END FUND, OR ANY OTHER TYPE OF “INVESTMENT COMPANY” WITHIN THE MEANING OF THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED, AND IS NOT SUBJECT TO REGULATION THEREUNDER. THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together and both contain important information.

| Per Share |

Total(3) | |||

| Public offering price |

$25.000 | $ | ||

| Underwriting commissions(1) |

$1.125 | $ | ||

| Proceeds to the Fund(2) |

$23.875 | $ |

| (1) | Nuveen Commodities Asset Management, LLC (“NCAM”) (and not the Fund) has agreed to pay from its own assets additional compensation to Merrill Lynch, Pierce, Fenner & Smith Incorporated, and a structuring fee to each of UBS Securities LLC and Wells Fargo Securities, LLC and may also pay certain qualifying underwriters a structuring fee, a sales incentive fee or additional compensation in connection with the offering. See “Underwriting.” |

| (2) | After payment of expenses relating to issuance and distribution (other than underwriting commissions), proceeds to the Fund will be $ per share. Nuveen Investments, LLC has agreed to (i) reimburse all organization expenses of the Fund and (ii) pay the amount by which the Fund’s offering costs (other than commissions) exceed $.05 per common share. |

| (3) | The Fund has granted the underwriters an option to purchase up to additional shares at the public offering price less the Underwriting Commissions within 30 days from the date of this prospectus, solely to cover overallotments, if any. If such option is exercised in full, the total Public Offering Price, Underwriting Commissions, Estimated Offering Expenses and Proceeds to the Fund will be $ , $ , $ and $ , respectively. See “Underwriting.” |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2010.

BofA Merrill LynchUBS Investment BankWells Fargo SecuritiesNuveen Investments, LLC

Janney Montgomery ScottLadenburg Thalmann & Co. Inc.Maxim Group LLC

RBC Capital MarketsStifel Nicolaus Weisel

The date of this prospectus is , 2010.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL ON PAGE 15 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 13-14.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 17-26.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

OTHER REGULATORY NOTICES

THE BOOKS AND RECORDS OF THE FUND WILL BE MAINTAINED AT THE OFFICES OF NUVEEN COMMODITIES ASSET MANAGEMENT, LLC, OR ITS ADMINISTRATIVE AGENT AND WILL OTHERWISE BE MAINTAINED IN ACCORDANCE WITH THE RULES OF THE COMMODITY FUTURES TRADING COMMISSION.

THIS POOL HAS NOT COMMENCED TRADING AND DOES NOT HAVE ANY PERFORMANCE HISTORY.

NEITHER THIS POOL OPERATOR NOR ANY OF ITS TRADING PRINCIPALS HAS PREVIOUSLY OPERATED ANY OTHER POOLS OR TRADED ANY OTHER ACCOUNTS.

THE COMMODITY SUBADVISOR HAS PREVIOUSLY OPERATED A POOL AND TRADED OTHER ACCOUNTS.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS. THE FUND HAS NOT, AND THE UNDERWRITERS HAVE NOT, AUTHORIZED ANYONE TO PROVIDE YOU WITH DIFFERENT INFORMATION. IF ANYONE PROVIDES YOU WITH DIFFERENT OR INCONSISTENT INFORMATION, YOU SHOULD NOT RELY UPON IT. THE FUND IS NOT, AND THE UNDERWRITERS ARE NOT, MAKING AN OFFER OF THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER IS NOT PERMITTED. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROSPECTUS IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF THIS PROSPECTUS.

| Page | ||

| 1 | ||

| 13 | ||

| 15 | ||

| 16 | ||

| 16 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| Risk that the Fund’s Shares May Trade at a Discount to Net Asset Value |

19 | |

| 19 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 33 | ||

| 41 | ||

| 42 | ||

| 42 | ||

| 45 | ||

| 46 | ||

| 46 | ||

| 46 | ||

| Conflicts Relating to the Manager and the Commodity Subadvisor |

47 | |

| 48 | ||

| 49 | ||

| 49 | ||

| 49 | ||

| 49 | ||

| 49 | ||

| 50 | ||

| 50 | ||

| 50 | ||

| 51 | ||

| 51 | ||

| 51 | ||

| 53 | ||

i

| Page | ||

| 54 | ||

| 55 | ||

| 57 | ||

| 57 | ||

| 57 | ||

| 58 | ||

| 58 | ||

| 59 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION |

60 | |

| 60 | ||

| 61 | ||

| 61 | ||

| 62 | ||

| 62 | ||

| 63 | ||

| THE SECURITIES DEPOSITORY; BOOK-ENTRY-ONLY SYSTEM; GLOBAL SECURITY |

63 | |

| 64 | ||

| 64 | ||

| 65 | ||

| 65 | ||

| 66 | ||

| 67 | ||

| Indemnification of the Manager |

67 | |

| 67 | ||

| 67 | ||

| 68 | ||

| 68 | ||

| 69 | ||

| 69 | ||

| 70 | ||

| 70 | ||

| 71 | ||

| 71 | ||

| 71 | ||

| 72 | ||

| 72 | ||

| 72 | ||

| 72 | ||

| 73 | ||

| 74 | ||

| 74 | ||

| 74 | ||

| 76 | ||

| 76 | ||

| 77 | ||

| 77 | ||

ii

| Page | ||

| 77 | ||

| 78 | ||

| 78 | ||

| 78 | ||

| 78 | ||

| 79 | ||

| 79 | ||

| Treatment of Securities Lending Transactions Involving Shares |

79 | |

| 79 | ||

| 80 | ||

| 80 | ||

| 80 | ||

| 81 | ||

| 82 | ||

| 83 | ||

| 83 | ||

| 83 | ||

| 85 | ||

| 85 | ||

| 91 | ||

| 92 | ||

| 103 | ||

| 106 | ||

| 107 | ||

This prospectus contains information you should consider when making an investment decision about the shares. You should rely only on the information contained or incorporated by reference in this prospectus. None of the Fund, the manager nor the underwriters have authorized any person to provide you with different information and, if anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not, the manager is not, and the underwriters are not making an offer to sell the shares in any jurisdiction where the offer or sale of the shares is not permitted. You should not assume that the information in this prospectus is current as of any date other than the date on the front page of this prospectus.

The current prospectus for the Fund, which may be updated from time to time pursuant to Securities and Exchange Commission and Commodity Futures Trading Commission requirements, is available at the Fund’s website (http://www.nuveen.com) as well as at the Securities and Exchange Commission’s website (http://www.sec.gov).

iii

NUVEEN DIVERSIFIED COMMODITY FUND

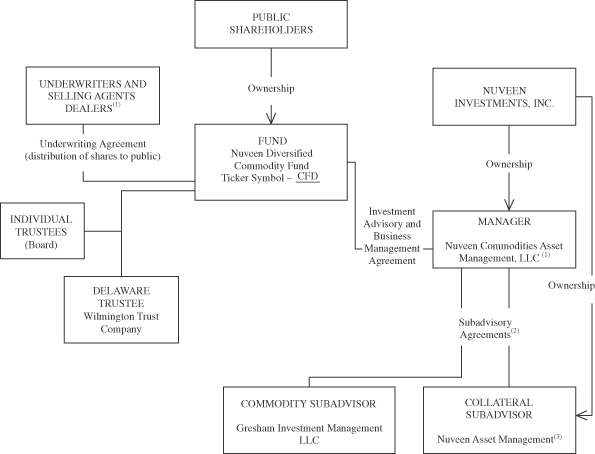

Principal Participants

| (1) | Nuveen Investments, LLC, a wholly owned subsidiary of Nuveen Investments, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, UBS Securities LLC and Wells Fargo Securities, LLC will act as Managing Underwriters and may engage dealers who are members of the Financial Industry Regulatory Authority to participate in the selling group. |

| (2) | Each of the subadvisory agreements are among the manager, the Fund and the respective subadvisor. |

| (3) | Nuveen Commodities Asset Management, LLC and Nuveen Asset Management are wholly owned subsidiaries of Nuveen Investments, Inc. Nuveen Commodities Asset Management, LLC also owns shares of the Fund. |

iv

This is only a summary. You should review the more detailed information contained elsewhere in this prospectus, including the Glossary appearing at the end of “Part Two: Statement of Additional Information,” which contains explanations of capitalized or other frequently used terms, to understand the offering fully.

| The Fund |

Nuveen Diversified Commodity Fund (the “Fund”) is a commodity pool. The Fund was organized as a statutory trust under Delaware law on December 7, 2005. The Fund will be operated pursuant to an Amended and Restated Trust Agreement (“Trust Agreement”), which is described under “Trust Agreement.” The Fund will be managed by Nuveen Commodities Asset Management, LLC (“NCAM” or the “manager”), a limited liability company which is registered as a commodity pool operator and commodity trading advisor with the Commodity Futures Trading Commission (the “CFTC”). The Fund issues shares, which represent units of fractional undivided beneficial interest in, and ownership of, the Fund. After the initial offering, the shares may be purchased and sold on the NYSE Amex. The principal offices of the Fund and the manager are each located at 333 West Wacker Drive, Chicago, Illinois 60606. The main telephone number of the Fund and the manager is (877) 827-5920. |

| Listing |

It is anticipated that the Fund’s shares will be approved for listing on the NYSE Amex, subject to notice of issuance, under the trading or “ticker” symbol “CFD.” Secondary market purchases and sales of shares will be subject to ordinary brokerage commissions and charges. |

| The Offering |

The Fund is offering shares at $25.00 per share through a group of underwriters led by Merrill Lynch, Pierce, Fenner & Smith Incorporated (“Merrill Lynch”), UBS Securities LLC, Wells Fargo Securities, LLC (“Wells Fargo”) and Nuveen Investments, LLC (“Nuveen”). Certain underwriters participating in this offering or their affiliates, including Merrill Lynch (which is a remote affiliate of NCAM, NAM (as defined below) and the Fund) and an affiliate of Wells Fargo, have an ownership interest in Nuveen Investments, Inc. (“Nuveen Investments”), the parent company of Nuveen, NCAM and Nuveen Asset Management (“NAM” or the “collateral subadvisor”). See “Management of the Fund.” Until the completion of this offering, no Fund shares will be outstanding (other than 840 shares owned by the manager). The offering price of $25.00 per share was determined on an arbitrary basis by the manager. You must purchase at least 100 shares in this offering. The Fund has given the underwriters an option to purchase up to additional shares to cover orders in excess of shares. See “Underwriting.” |

| Who May Want to Invest |

You should consider your investment goals, time horizons and risk tolerance before investing in the Fund. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. The Fund is designed as a long-term investment and not as a trading vehicle. This is the first actively managed fund to be listed on any NYSE Euronext group exchange that invests primarily in a diversified portfolio of commodity |

1

futures and options contracts. The Fund may be an appropriate investment for you if you are seeking:

| • | Exposure to commodity futures and forward contracts with an actively managed, diversified portfolio strategy; |

| • | The potential for regular monthly distributions; |

| • | The potential for attractive risk-adjusted returns as compared with passively managed commodity funds; |

| • | A fully collateralized and unleveraged commodity investment strategy; |

| • | Access to underlying investments that generally qualify as “Section 1256 Contracts” which generate gains (losses) that are characterized as 60% long-term capital gains (losses) and 40% short-term capital gains (losses); |

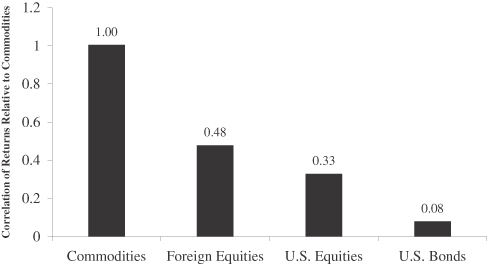

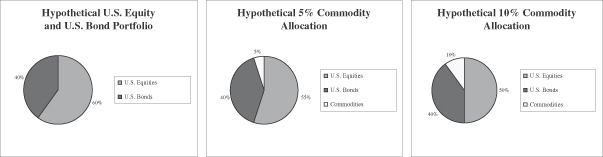

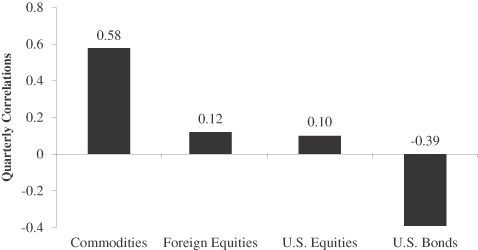

| • | A potentially more consistent hedge against inflation than U.S. equities, foreign equities or U.S. bonds; |

| • | Investment in an asset class with historically low correlations to equities and bonds; |

| • | Access to the commodity subadvisor’s commodity expertise and TAP® strategy (as described and defined below); and |

| • | The potential for daily liquidity afforded by listing on the NYSE Amex. |

However, keep in mind that you will need to assume the risks associated with an investment in the Fund. See “Risk Factors.”

| Investment Objective |

The Fund’s investment objective is to generate higher risk-adjusted total return than leading commodity market benchmarks, specifically the Dow Jones-UBS Commodity Index® (“DJ-UBSCI”) and the S&P GSCI® Commodity Index (“GSCI”), and passively managed commodity funds. Risk-adjusted total return refers to the income and capital appreciation generated by a portfolio (the combination of which equals its total return) per unit of risk taken, with such risk measured by the volatility of the portfolio’s total returns over a specific period of time. See “The Fund’s Investments” beginning on page 26 for a discussion of risk-adjusted total return. In pursuing its investment objective, the Fund will invest directly in a diversified portfolio of commodity futures and forward contracts to obtain broad exposure to all principal groups in the global commodity markets. The Fund’s investment strategy has three elements: |

| • | An actively managed portfolio of commodity futures and forward contracts utilizing the commodity subadvisor’s proprietary Tangible Asset Program®, referred to herein as “TAP ® ”; |

| • | An integrated program of writing commodity call options (the “options strategy”) designed to enhance risk-adjusted total return of the Fund’s commodity investments; and |

| • | A collateral portfolio of cash equivalents and short-term, high grade debt securities. |

2

The Fund’s strategy, which integrates TAP® and writing commodity call options, is referred to as TAP PLUSSM. The Fund cannot assure you that it will achieve its investment objective. The Fund’s risk-adjusted returns over any particular period may be positive or negative. See “Risk Factors” and “The Fund’s Investments.”

| Investment Strategy |

Commodity Investments. The manager has selected Gresham Investment Management LLC (“Gresham” or the “commodity subadvisor”) to manage the Fund’s commodities investment strategy and its options strategy. |

The commodity subadvisor will actively manage the Fund’s portfolio of commodity futures and forward contracts pursuant to TAP® , a fully collateralized, long-only rules-based commodity investment strategy. The Fund will invest in a diversified portfolio of commodity contracts with an aggregate notional value substantially equal to the net assets of the Fund. TAP® is designed to maintain consistent, fully collateralized exposure to commodities as an asset class. Gresham bases its investment decisions on three inputs: (i) systematic calculations of the values of global commodity production; (ii) total U.S. dollar trading volume on commodity futures and forwards exchanges; and (iii) global import/export trade values.

The specific commodities in which the Fund will invest, and the relative target weighting of those commodities, will be determined annually by the commodity subadvisor. The target weights are expected to remain unchanged until the next annual determination. The Fund’s portfolio concentration in any single commodity or commodity group will be limited in an attempt to moderate volatility. Initially, the Fund intends to limit the target weightings of each commodity group such that no group’s target weighting may constitute more than 35% of TAP®, no two groups’ combined target weightings may constitute more than 60% of TAP® and no single commodity’s target weighting can constitute more than 70% of its group. Under normal market circumstances, the commodity subadvisor avoids exercising discretion with respect to portfolio weights between such annual determinations. However, the actual portfolio weights may vary during the year and may in certain circumstances be rebalanced subject to TAP®’s rule-based procedures. Generally, the Fund expects to invest in short-term commodity futures and forward contracts with terms of one to three months but may invest in commodity contracts with terms of up to six months. See “Management of the Fund—Manager and Subadvisors—Commodity Subadvisor.”

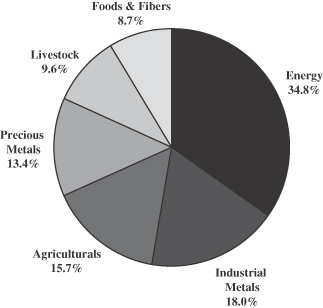

The Fund expects to make commodity investments in the six principal commodity groups in the global commodities markets:

| • | energy; |

| • | industrial metals; |

| • | agriculturals; |

| • | precious metals; |

| • | foods and fibers; and |

| • | livestock. |

3

See “The Fund’s Investments” on pages 26-31 for a list of commodity futures and forward contracts that the Fund may invest in and the exchanges on which they currently trade with the greatest dollar volume.

The Fund also may invest in other commodity contracts that are presently, or may hereafter become, the subject of commodity futures investing. Except for certain limitations described herein, there are no restrictions or limitations on the specific commodity investments in which the Fund may invest. See also pages 29 and 99 for actual weightings of the TAP® portfolio as of June 30, 2010.

TAP® is designed to maintain consistent exposure to a diversified portfolio of commodity futures and forwards over an extended period. To implement this feature of the Fund’s strategy, Gresham will regularly purchase and subsequently sell, i.e. “roll,” individual commodity futures and forward contracts throughout the year so as to maintain a fully invested position. As the commodity contracts near their expiration dates, Gresham will roll them over into new contracts. Gresham seeks to add value compared with leading commodity market benchmarks and passively managed commodity funds by actively managing the implementation of the rolls of the commodity contracts. As a result, the roll dates, terms and contract prices selected by Gresham may vary based upon Gresham’s judgment of the relative value of different contract terms. Gresham’s active management approach is market-driven and opportunistic and is intended to minimize market impact and avoid market congestion during certain days of the trading month.

The Fund’s investments in commodity futures and forward contracts and options on commodity futures and forward contracts generally will not require significant outlays of principal. Approximately 25% of the Fund’s assets will be initially committed as “initial” and “variation” margin to secure the long futures and forward contract positions. These assets will be placed in one or more commodity futures accounts maintained by the Fund at Barclays Capital Inc. (“BCI”), the Fund’s clearing broker, and will be held in cash or invested in U.S. Treasury bills and other direct or guaranteed debt obligations of the U.S. government maturing within less than one year at the time of investment. The remaining collateral (approximately 75%) will be held in a separate collateral investment account managed by NAM. See “Collateral Investments” on page 5.

The Fund expects that most of the commodity futures and options contracts acquired to facilitate implementing the investment strategy will be exchange listed and that generally they will qualify as “Section 1256 Contracts” for tax purposes. See “Federal Income Tax Considerations.”

Options Strategy. The Fund’s option strategy is designed to enhance risk-adjusted total return of the Fund’s commodity investments. Pursuant to the options strategy, the Fund, at Gresham’s discretion, will write (sell) exchange-traded commodity call options that may be up to 20% “out-of-the-money” on a continual basis on up to approximately 50% of the notional value of each of its commodity futures and forward contract positions that, in Gresham’s determination, have sufficient option trading volume and liquidity. A call option gives its owner (buyer) the right but not the obligation to buy

4

| the underlying futures contract at a particular price, known as the strike price, at anytime between the purchase date and the expiration date of the option. The person who writes (sells) the option to the buyer is thus required to fulfill the contractual obligation (by selling the underlying futures contract to the buyer at the strike price) should the option be exercised. If the option is covered, the writer (seller) has an offsetting futures position. Initially, the Fund expects to sell commodity call options on approximately 50% of the notional value of its commodity futures and forward contract positions. Generally, the Fund expects to write short-term commodity call options with terms of one to three months but may write commodity call options with terms up to one year. Subject to the foregoing limitations, the implementation of the options strategy will be within Gresham’s discretion. Over extended periods of time, the term and “out-of-the-moneyness” of the commodity options may vary significantly. |

The Fund also may write call options on baskets of commodities or on broad-based commodity indices, such as the DJ-UBSCI or the GSCI, whose prices are expected to closely correspond to at least a substantial portion of the commodity futures and forward contracts held by the Fund. Initially, the Fund does not intend to purchase commodity put options, but may do so in the future.

NCAM and the commodity subadvisor believe that the Fund’s options strategy can provide the potential for current gains from option premiums, which may meaningfully reduce return volatility. The goal is to enhance the Fund’s risk-adjusted total returns relative to the returns of leading commodity market benchmarks over extended periods of time. In up markets, the portion of the Fund on which call options have been sold will forego potential appreciation in the value of the underlying contracts to the extent the price of those contracts exceeds the exercise price of options written plus the premium collected by writing the call options. In flat or sideways markets, the portion of the Fund on which call options have been sold will generate current gains from the premium collected by writing the call options. In down markets, the Fund will experience declines in value of the underlying contracts to the extent that the amount of the decline in the value of the underlying contracts exceeds the option premium collected by writing the call options. There can be no assurance that the Fund’s options strategy will be successful. The Fund’s risk-adjusted returns over any particular period may be positive or negative. See “The Fund’s Investments—Overview of Investment Strategy.”

Collateral Investments. The Fund’s investments in commodity futures and forward contracts and options on commodity futures and forward contracts generally will not require significant outlays of principal. Approximately 25% of the Fund’s assets will be initially committed as “initial” and “variation” margin to secure the long futures and forward contract positions. These assets will be placed in one or more commodity futures accounts maintained by the Fund at BCI and will be held in cash or invested in U.S. Treasury bills and other direct or guaranteed debt obligations of the U.S. government maturing within less than one year at the time of investment. The remaining collateral (approximately 75%) will be held in a separate collateral investment account managed by NAM.

5

| The Fund’s assets held in the Fund’s separate collateral account will be invested in cash equivalents or short-term debt securities with final terms not exceeding one year at the time of investment. These collateral investments shall be rated at all times at the applicable highest short-term or long-term debt or deposit rating or money market fund rating as determined by at least one nationally recognized statistical rating organization (“NRSRO”) or, if unrated, shall be judged by NAM to be of comparable quality. These collateral investments will consist primarily of direct and guaranteed obligations of the U.S. Government and senior obligations of U.S. Government agencies and may also include, among others, money market funds and bank money market accounts invested in U.S. Government securities as well as repurchase agreements collateralized with U.S. Government securities. |

| Leverage. The Fund has no current intention to utilize leverage (except for borrowings for temporary or emergency purposes, as explained in more detail under “The Funds Investments” on page 27 and “Investment Policies of the Fund—Borrowings” on page 49). The Fund may not borrow in excess of 5% of its net assets. Borrowings by the Fund could cause tax-exempt investors to recognize unrelated business taxable income with respect to a portion of their income from the Fund. See “Federal Income Tax Considerations—Tax-Exempt Organizations.” |

Special Risk

| Considerations |

An investment in the Fund involves special risk considerations, which are summarized below. The Fund may not be able to achieve its investment objective. A more extensive discussion of these risks appears beginning on page 17. |

| • | The Fund has no history of operations. Therefore, there is no performance history for the Fund to serve as a basis for you to evaluate an investment in the Fund. The manager has not previously operated a commodity pool. While the commodity subadvisor has previously managed assets pursuant to TAP®, it has never employed TAP PLUSSM when managing assets for outside clients. |

| • | An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire amount that you invest. |

| • | Investments in commodity futures and forward contracts and options on commodity futures and forward contracts have a high degree of price variability and are subject to rapid and substantial price changes. The Fund could incur significant losses on its commodity investments. |

| • | The net asset value of each share will change as fluctuations occur in the market value of the Fund’s portfolio. Investors should be aware that the public trading price of a share may be different from the net asset value of a share. The price difference may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares may be related to, but are not identical to, the forces influencing the prices of the commodity contracts and other instruments held by the Fund at any point in time. |

| • | If the Fund experiences more losses than gains during the period you hold shares, you will experience a loss for the period even if the Fund’s historical performance is positive. |

6

| • | There can be no assurance that the Fund’s options strategy will be successful. The Fund intends to use options on commodity futures and forward contracts to enhance the Fund’s risk-adjusted total returns. The Fund may seek to protect its commodity futures and forward contracts positions in the event of a market decline in those positions by purchasing commodity put options that are “out-of-the money.” The Fund’s use of options, however, may not provide any, or only partial, protection for modest market declines. |

| • | As the writer of call options for which a premium is received, the Fund will forego the right to any appreciation in the value of each commodity futures or forward contract in its portfolio that effectively underlies a call option to the extent the value of the commodity futures or forward contract exceeds the exercise price of such option on or before the expiration date. |

| • | The return performance of the Fund’s commodity futures and forward contracts may not parallel the performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. |

| • | The investment decisions of the commodity subadvisor may be modified, and commodity contract positions held by the Fund may have to be liquidated at disadvantageous times or prices, to avoid exceeding regulatory “position limits”, potentially subjecting the Fund to substantial losses. |

| • | The CFTC has recently withdrawn relief previously granted to Gresham from position limits with respect to certain agricultural commodities (soybeans, corn and wheat) in which Gresham invests under TAP®. The CFTC is evaluating further changes to position limits for other commodities. Any such future changes could limit the Fund’s ability to implement its investment strategy. |

| • | The Fund is subject to numerous conflicts of interest, including those that arise because: |

| — | the Fund’s commodity subadvisor, commodity brokers and their principals and affiliates may execute trades in commodity futures and forward contracts and options on commodity futures and forward contracts for their own account and accounts of other customers that may compete with orders placed for the Fund; commodity contract positions established for the benefit of the Fund may be aggregated with the positions held by the commodity subadvisor, its principals or affiliates for their own account and the accounts of other customers for the purposes of determining “position limits”, and there can be no assurance that the commodity subadvisor will choose to liquidate the Fund’s positions in a proportionate manner in the event of mandatory liquidation of positions held by the commodity subadvisor (or its principals or affiliates) to comply with position limits or for other reasons; |

| — | the manager has less of an incentive to replace the collateral subadvisor because it is an affiliate of the manager; and |

7

| — | each of the manager and the subadvisors resolve conflicts of interest as they arise based on its judgment and analysis of the particular issue. There are no formal procedures to resolve conflicts of interest and as a result, the manager and/or the subadvisors could resolve a potential conflict in a manner that is not in the best interest of the Fund or its shareholders. |

| • | The Fund currently expects that up to 30% of its net assets invested in commodity futures and forward contracts and options on commodity futures and forward contracts may be in non-U.S. markets. Some non-U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. |

| • | Regardless of its investment performance, the Fund will incur fees and expenses, including brokerage and management fees. A management fee will be paid by the Fund even if the Fund experiences a net loss for the full year. To break even in one year on shares purchased in the offering, and assuming the Fund’s estimated net proceeds generate annual interest income of .15% (.14% of the estimated gross offering size), the Fund must earn profits other than from interest income of 6.31%. |

| • | The Fund may need to liquidate some of its investments in order to make distributions, and such liquidation could be at times or on terms different than those the Fund would otherwise select, which could have an adverse effect on the Fund’s results. |

| • | Unlike other Nuveen-sponsored funds, the Fund is not a mutual fund, a closed-end fund, or any other type of “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), and is not subject to regulation thereunder nor afforded the protections of the 1940 Act. As such, the Fund’s board does not have the scope of authority mandated to a board under the 1940 Act. Based on the Fund’s structure, its (i) potential for the realization of the greatest gains and (ii) exposure to the largest risk of loss will always be from its commodity investments and options strategy. |

| • | Shareholders will have no rights to participate in the Fund’s management other than the right in certain circumstances to remove or replace the manager. The individual Trustees will have very limited powers (specifically, to serve as the audit and nominating committees, and to terminate the manager for cause). The individual Trustees therefore will not have the control of the management and operation of the Fund that would be typical of the board of directors of a corporation. Therefore, Fund shareholders will have to rely on the judgment of the manager and the subadvisors to manage the Fund. |

| • | The Fund’s shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency. |

| • | In the event of deteriorating market conditions or other reasons, Nuveen Investments, NCAM, NAM and Gresham may need to implement cost reductions in the future which could make the retention of qualified and |

8

| experienced personnel more difficult and could lead to personnel turnover. |

| • | The Fund is dependent upon services and resources provided by its manager and collateral subadvisor (NCAM and NAM, respectively) and their parent, Nuveen Investments. Nuveen Investments has a substantial amount of indebtedness. Nuveen Investments, through its own business or the financial support of its affiliates, may not be able to generate sufficient cash flow from operations or ensure that future borrowings will be available in an amount sufficient to enable it to pay its indebtedness, with scheduled maturities beginning in 2013, or to fund its other liquidity needs. For additional information on NCAM, NAM and Nuveen Investments, see “Management of the Fund—Manager and Subadvisors—The Manager,” “—Collateral Subadvisor,” and “—Additional Information Related to NCAM, NAM and Nuveen Investments.” |

For additional risks, see “Risk Factors.”

| Trustees |

Wilmington Trust Company, a Delaware banking corporation, is the Delaware Trustee of the Fund, and as such will have very limited duties and liabilities to the Fund. The individual Trustees, all of whom will be unaffiliated with the manager, will fulfill those functions required under the NYSE Amex listing standards and certain other functions as set forth in the Trust Agreement. The Trust Agreement vests in the manager all authority (other than the limited requirements of the individual Trustees to serve on Fund board committees) to operate the business of the Fund and to be responsible for the conduct of the Fund’s commodity affairs. |

| Manager and Subadvisors |

Manager. Nuveen Commodities Asset Management, LLC, a Delaware limited liability company and wholly-owned subsidiary of Nuveen Investments organized on October 31, 2005, is the manager of the Fund and will be responsible for determining the Fund’s overall investment strategy and its implementation, including: |

| • | The selection and ongoing monitoring of the subadvisors; |

| • | Assessment of performance and potential needs to modify strategy or change subadvisors; |

| • | The determination of the Funds’ administrative policies; |

| • | The management of the Fund’s business affairs; and |

| • | The provision of certain clerical, bookkeeping and other administrative services. |

| The manager is registered with the CFTC as a commodity trading advisor (“CTA”) and a commodity pool operator (“CPO”) and is a member of the National Futures Association (“NFA”). The manager has no previous operating history or experience in operating a commodity pool. Neither the Fund nor the manager has established formal procedures to resolve potential conflicts of interest related to managing the investments and operations of the Fund. |

9

The commodity subadvisor and the collateral subadvisor are sometimes together referred to herein as the “subadvisors.”

| Commodity Subadvisor. Gresham Investment Management LLC, the commodity subadvisor, will manage the Fund’s commodity investment strategy and the options strategy. Gresham is a Delaware limited liability company, the successor to Gresham Investment Management, Inc., formed in July 1992. Gresham is registered with the CFTC as a CTA and a CPO and is a member of the NFA. Gresham also is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. As of June 30, 2010, Gresham had approximately $7.8 billion of client assets under management. Gresham’s senior portfolio management team has extensive investment experience trading commodities and have each been with Gresham and its predecessors for over 12 years. |

| Beginning in 1987, Dr. Henry Jarecki, the founder of Gresham, and Mr. Jonathan Spencer first managed the TAP® strategy in a proprietary family account. TAP® was first offered to outside clients beginning in September 2004, and Gresham continues to offer this investment strategy, among others, to outside clients. |

| Collateral Subadvisor. Nuveen Asset Management, the collateral subadvisor, an affiliate of the manager and a wholly-owned subsidiary of Nuveen Investments, will invest the Fund’s collateral in short-term, high grade debt securities. The collateral subadvisor is registered with the SEC as an investment adviser. As of June 30, 2010, NAM had approximately $82.6 billion of assets under management. Founded in 1898, Nuveen Investments and its affiliates had approximately $150 billion of assets under management as of June 30, 2010. |

| On November 13, 2007, Nuveen Investments was acquired by an investor group led by Madison Dearborn Partners, LLC, a private equity firm based in Chicago, Illinois (the “MDP Acquisition”). The investor group led by Madison Dearborn Partners, LLC includes affiliates of Merrill Lynch & Co., Inc., which has since been acquired by Bank of America Corporation (“Bank of America”), and an affiliate of Wells Fargo. As a result of the MDP Acquisition, Merrill Lynch & Co., Inc. currently owns a 32% non-voting equity stake in Nuveen Investments and holds two of ten seats on the board of directors of Nuveen Investments. An affiliate of Wells Fargo also owns an interest in Nuveen Investments. See “Management of the Fund—Manager and Subadvisors—Additional Information Related to NCAM, NAM and Nuveen Investments.” |

| The Fund is dependent upon services and resources provided by its manager and collateral subadvisor (NCAM and NAM, respectively) and their parent Nuveen Investments. Nuveen Investments significantly increased its level of debt in connection with the MDP Acquisition. As of June 30, 2010, Nuveen Investments had outstanding approximately $3.9 billion in aggregate principal amount of indebtedness, with approximately $360 million of available cash on hand. Nuveen Investments believes that monies generated from operations and cash on hand will be adequate to fund debt service requirements, capital expenditures and working capital requirements for the foreseeable future; |

10

| however, Nuveen Investments’ ability to continue to fund these items may be affected by general economic, financial, competitive, legislative, legal and regulatory factors and by its ability to refinance outstanding indebtedness with scheduled maturities beginning in 2013. The risks, uncertainties and other factors related to Nuveen Investments’ business, the effects of which may cause its assets under management, earnings, revenues, and/or profit margins to decline, are described in its filings with the SEC which are publicly available. |

Nuveen, a registered broker-dealer affiliate of NAM that is involved in the offering of the Fund’s shares, has received notice of certain charges that may be brought against it by the Financial Industry Regulatory Authority (“FINRA”) in connection with the marketing of preferred shares of certain closed-end funds managed by NAM. See “Management of the Fund—Regulatory and Litigation.”

| Fees. The Fund has agreed to pay the manager an annual fee, payable monthly, in a maximum amount equal to 1.25% of the Fund’s average daily net assets, with lower fee levels for assets that exceed $500 million. The manager has agreed to pay, out of the fee it receives from the Fund, a fee to each of the commodity subadvisor and the collateral subadvisor for subadvisory services at the rates listed on page 41 of this prospectus. For more information on fees and expenses, see “Management of the Fund—Management Fees.” |

The address of Nuveen Commodities Asset Management, LLC is 333 West Wacker Drive, Chicago, Illinois 60606. Its telephone number is (877) 827-5920.

| Distributions |

Commencing with the Fund’s first distribution, the Fund intends to make regular monthly distributions to its shareholders (stated in terms of a fixed cents per share distribution rate) based on the past and projected performance of the Fund. However, the Fund has the discretion to withhold distributions, which could have the effect of increasing its management fees. Among other factors, the Fund will seek to establish a distribution rate that roughly corresponds to NCAM’s projections of the total return that could reasonably be expected to be generated by the Fund over an extended period of time. Each monthly distribution will not be solely dependent on the amount of income earned or capital gains realized by the Fund, and such distributions may from time to time represent a return of capital and may require that the Fund liquidate investments. As market conditions and portfolio performance may change, the rate of distributions on the shares and the Fund’s distribution policy could change. The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions, or may temporarily suspend or reduce distributions without a change in policy, at any time and may do so without prior notice to shareholders. |

Since the Fund expects to be classified as a partnership for tax purposes, shareholders will be allocated their pro-rata share of the Fund’s income, gains, losses, deductions and credits for purposes of computing their tax liability. The Fund anticipates it will make regular monthly distributions intended in part to provide shareholders with cash with which to fund potential tax liabilities on their proportionate share of income and gains

11

| earned by the Fund, although there can be no assurance that distributions for any period will correspond to such potential tax liabilities or share of income and gains for such period. |

| The Fund expects to receive substantially all of its current income and gains from the following sources: |

| • | Realized and unrealized net capital gains (both short-term and long-term) from commodity futures and forward contracts; |

| • | Realized and unrealized net capital gains (both short-term and long-term) from the options strategy; and |

| • | Interest income and/or capital gains received on collateral invested in high quality short-term debt securities, government securities and cash equivalents. |

The Fund expects to declare the initial distribution approximately 45 days, and to pay that distribution approximately 60 days, after the completion of this offering, depending on market conditions. For more information, see “Distributions.”

| Transfer Agent, Registrar and |

State Street Bank and Trust Company (“State Street”) will serve as transfer agent and registrar for the Fund’s shares and custodian for the assets of the Fund. BCI, the Fund’s clearing broker, also may serve as custodian for all or a portion of the Fund’s assets. |

| Break-Even Threshold |

Assuming an initial offering of $250 million, and assuming the Fund’s estimated net proceeds generate annual interest income of .15% (.14% of the estimated gross offering size), an investment of $2,500 must earn profits other than from interest income of $157.70 or 6.31% in order to “break-even” at the end of one year of the Fund’s operations. See “Break-Even Analysis.” |

| U.S. Federal Income Tax Aspects Subject to the discussion below in “Federal Income Tax Considerations,” the Fund will be classified as a partnership for U.S. federal income tax purposes. Accordingly, the Fund will not incur U.S. federal income tax liability; rather, each owner of the Fund’s shares will be required to take into account his or her allocable share of the Fund’s income, gain, loss, deduction and other items for the Fund’s taxable year ending with or within its taxable year. Fund shareholders will receive an Internal Revenue Service (“IRS”) Form 1065, Schedule K-1, which reports their allocable portion of such tax items. The Fund anticipates that shareholders will have access to their Schedule K-1 by the end of the first week of March in the following year. |

The Fund will invest primarily in exchange listed futures and options that generally qualify as Section 1256 Contracts which generate gains (losses) that are characterized as 60% long-term capital gains (losses) and 40% short-term capital gains (losses).

Please refer to the “Federal Income Tax Considerations” section below for information on the potential U.S. federal income tax consequences of the purchase, ownership and disposition of shares.

12

The following “break-even” table indicates the approximate dollar amount and percentage the Fund must earn after one year for investors who purchase shares in the initial offering to offset the costs applicable to an investment of $2,500 (the minimum investment on purchases in the initial offering). In the table below, expenses are based on estimated amounts for the Fund’s first year of operations, and assume the Fund’s estimated gross offering size is $250,000,000 with net proceeds of the offering (after Underwriting Commissions and Offering Expenses borne by the Fund) totaling $238,250,000. Expenses also assume the Fund’s leverage is equal to 0% of net assets. To break even from a purchase made in the initial offering, and assuming the Fund’s portfolio generate annual interest income of .15% (.14% of the estimated gross offering size), the Fund must earn profits other than from interest of 6.31% at the end of one year.

| Initial Offering

Purchases(1) |

||||||

| Dollar Amount |

Percentage |

|||||

| Underwriting Commissions |

$11,250,000 | 4.50 | % | |||

| Manager’s Management Fee(2) |

$2,978,125 | 1.19 | % | |||

| Brokerage Commissions and Fees(3) |

$428,850 | .17 | % | |||

| Transaction Fees(4) |

$119,125 | .05 | % | |||

| Offering Expenses(5) |

$500,000 | .20 | % | |||

| Operating Expenses(6) |

$851,605 | .34 | % | |||

| Total Fees |

$16,127,705 | 6.45 | % | |||

| Interest Income(7) |

$(357,375 | ) | (.14 | )% | ||

| 12 Month Break-Even Value on estimated Fund assets of $250 million |

$15,770,330 | 6.31 | % | |||

| 12 Month Break-Even Value on a $2,500 Investment |

$157.70 | |||||

| (1) | The expenses in connection with a minimum purchase of the Fund in the initial offering are calculated based on the net proceeds of the Fund ($238,250,000), with the exception of Underwriting Commissions and Offering Expenses, which are calculated based on the estimated gross offering size of $250,000,000. If the Fund’s estimated gross offering size was $100 million or $500 million, the 12 Month Break-Even Value on a $2,500 purchase made in the initial offering would be, respectively, 6.77% and 6.15%. Thus, the amount of profits the Fund must earn in order for investors to break even in the first year of operations is reduced as the assets of the Fund increase. |

| (2) | The Fund will pay the manager an annual fee, payable monthly, in a maximum amount equal to 1.25% of the Fund’s average daily net assets, from which the manager will pay maximum advisory fees to the commodity subadvisor and the collateral subadvisor of .35% and .30%, respectively. “Average daily net assets” means the total assets of the Fund, minus the sum of its accrued liabilities. |

| (3) | The dollar amounts shown are based on approximately 7,400 annual futures, forward and option contract transactions and an annual turnover rate of 725% (which is based on TAP® historical trading). Additionally, brokerage commissions for the Fund’s investments in both commodity futures and options contracts are approximately $5 per round turn. The total amount will vary based upon the frequency of the Fund’s commodity investments, the specific commodity futures, forward and option contracts purchased (or sold), and the volatility of the commodity futures, forward and options markets. |

13

| (4) | Transaction fees on the Fund’s collateral investments will vary based upon the frequency of the Fund’s investments in short-term, high-grade securities, the specific investments made, and the volatility of the fixed income markets. |

| (5) | Nuveen has agreed to pay Offering Expenses of the Fund (other than Underwriting Commissions) that exceed $.05 per share and to pay all organizational expenses of the Fund. Based on an estimated gross offering size of $250,000,000 (10,000,000 shares at a $25 share price), the Fund would pay a maximum of $500,000 of offering expenses and Nuveen would pay all offering expenses in excess of $500,000, which are currently estimated to be $1,785,000. |

| (6) | The Fund will pay all of its Operating Expenses, including, but not limited to, transfer agent fees, custodial fees, fees and expenses of the individual trustees, resident Delaware trustee fees, legal and accounting fees and expenses, tax preparation expenses, filing fees, printing and mailing and duplication costs. |

| (7) | Interest income for purposes of the break-even analysis currently is estimated to be earned at a rate of 0.15% based on the 3 month U.S. Treasury bill yield as of June 30, 2010. The interest earned on the Fund’s collateral investments in short-term, high grade debt securities may differ from the quoted Treasury bill rate. |

See “Fees and Expenses” at page 15.

14

The Fund will pay fees and expenses that must be offset by investment gains and interest income in order to avoid depletion of the Fund’s net assets. See “Management of the Fund—Management Fees.”

| Type of Fee or Expense |

Amount | |

| Manager’s Management Fees |

The Fund will pay the manager a maximum amount equal to 1.25% of average daily net assets, payable on a monthly basis. The fees paid by the Fund to the manager are subject to various breakpoints, as set forth on page 41. A break point means that if the value of investments held by the Fund achieves a specified level, the Fund will be eligible to pay the manager a reduced fee on that portion of the assets above that level (the “break point”). The manager will in turn pay Gresham, the commodity subadvisor, and NAM, the collateral subadvisor, maximum fees of .35% and .30%, respectively. There is no performance fee. | |

| Brokerage Commissions and Fees |

Brokerage commissions and transaction fees charged in connection with the Fund’s investment activity are estimated at .18% of net assets per year (includes markup and markdowns on fixed income trades, floor brokerage, NFA, exchange, clearing and give-up fees). On average, the total round-turn commission expected to be paid to the commodity broker is approximately $5. | |

| Offering Expenses |

The Fund will pay its offering expenses, including, but not limited to, legal and accounting fees and expenses, printing fees, fees and expenses of the Trustees, and various exchange and regulatory registration fees and expenses up to $.05 per share. Nuveen has agreed to pay offering expenses of the Fund (other than underwriting commissions) that exceed $.05 per share and to pay all organizational expenses of the Fund. The manager currently estimates that the aggregate amount of the offering expenses will be approximately $1.785 million. | |

| Operating Expenses |

The Fund will pay all of its routine operating, administrative and other ordinary expenses, including, but not limited to, transfer agent fees, fees and expenses of the Trustees, legal and accounting fees and expenses, tax preparation expenses, filing fees, printing and mailing and duplication costs. The manager currently estimates that the Fund’s routine ongoing expenses will be approximately .34% of net assets per year based on the Fund’s estimated size of $250 million. | |

| Extraordinary Fees and Expenses |

The Fund will pay all of its extraordinary fees and expenses, if any. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. | |

15

The manager will furnish you with annual reports as required by the rules and regulations of the SEC as well as with those reports required by the CFTC and the NFA, including, but not limited to, annual audited financial statements certified by an independent registered public accounting firm and any other reports required by any other governmental authority that has jurisdiction over the activities of the Fund. The Fund’s portfolio holdings will be disclosed on its website at http://www.nuveen.com on each business day that the NYSE Amex is open for trading. The Fund’s website is publicly available at no charge. This website disclosure of portfolio holdings and the Fund’s net asset value (as of the previous day’s close) will be made daily and will include, as applicable, the name and total value of each commodity investment and the total value of the collateral as represented by cash, cash equivalents and debt securities held in the Fund’s portfolio. The values of the Fund’s portfolio holdings will, in each case, be determined in accordance with the Fund’s valuation policies. Fund shareholders will be provided with appropriate information to permit them (on a timely basis) to file U.S. federal and state income tax returns with respect to their shares. The Fund will file a partnership return with the IRS and will transmit a Schedule K-1 to each shareholder reporting the shareholder’s allocable portion of relevant tax items of the Fund. The Fund anticipates that shareholders will have access to their Schedule K-1 by the end of the first week of March in the following year. See “Federal Income Tax Considerations—U.S. Shareholders—Tax Reporting by the Fund.”

Cautionary Note Regarding Forward-Looking Statements

This prospectus includes forward-looking statements that generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. These forward-looking statements are based on information currently available to the manager and subadvisors and are subject to a number of risks, uncertainties and other factors, both known, such as those described in “Risk Factors” and elsewhere in this prospectus, and unknown, that could cause the actual results, performance, prospects or opportunities of the Fund to differ materially from those expressed in, or implied by, these forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws or otherwise, the manager and the subadvisors undertake no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this prospectus, as a result of new information, future events or changed circumstances or for any other reason after the date of this prospectus.

16

Investing in the Fund’s shares involves a number of significant risks. Before you invest in the Fund’s shares, you should be aware of the various risks, including those described below. You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this prospectus, including the Fund’s financial statements and the related notes. Additional risks and uncertainties not presently known by the Fund or not presently deemed material by the Fund may also impair the Fund’s operations and performance. If any of the following events occur, the Fund’s performance could be materially and adversely affected. In such case, the Fund’s net asset value and the trading price of the Fund’s shares may decline and you may lose all or part of your investment.

An investment in the Fund involves a high degree of risk. You should not invest in shares unless you can afford to lose all of your investment.

Commodity Investment Strategy Risks

You may lose all of your investment. An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire amount that you invest. Your investment in the Fund’s shares represents an indirect investment in the commodity futures and forward contracts owned by the Fund, the prices of which can be volatile, particularly over short time periods. Investments in individual commodity futures and forward contracts historically have had a high degree of price variability and may be subject to rapid and substantial changes. The Fund could incur significant losses on its investments in those commodity futures and forward contracts. If the Fund experiences in the aggregate more losses than gains during the period you hold shares, you will experience a loss for the period even if the Fund’s historical performance is positive. Movements in commodity investment prices are outside of the Fund’s control and may not be anticipated by the commodity subadvisor. Price movements may be influenced by, among other things:

| • | governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; |

| • | weather and climate conditions; |

| • | changing supply and demand relationships; |

| • | changes in international balances of payments and trade; |

| • | U.S. and international rates of inflation; |

| • | currency devaluations and revaluations; |

| • | U.S. and international political and economic events; |

| • | changes in interest and foreign currency/exchange rates; |

| • | market liquidity; and |

| • | changes in philosophies and emotions of market participants. |

The changing interests of investors, hedgers and speculators in the commodity markets may influence whether futures prices are above or below the expected future spot price. In order to induce investors or speculators to take the corresponding long side of a futures contract, commodity producers must be willing to sell futures contracts at prices that are below the present value of expected future spot prices. Conversely, if the predominant participants in the futures market are the ultimate purchasers of the underlying commodity futures contracts in order to hedge against a rise in prices, then speculators should only take the short side of the futures contract if the futures price is greater than the present value of the expected future spot price of the commodity. This can have significant implications for the Fund when it is time to reinvest the proceeds from a maturing futures contract into a new futures contract. If the interests of investors, hedgers and speculators in futures

17

markets have shifted such that commodity purchasers are the predominant participants in the market, the Fund will be constrained to reinvest at higher futures prices which could have a negative effect on the Fund’s returns.

Regulatory developments could significantly and adversely affect the Fund. Commodity markets are subject to comprehensive statutes, regulations and margin requirements. Recent legislation has created a new multi-tiered structure of exchanges in the U.S. subject to varying degrees of regulation, and rules and interpretations regarding various aspects of this regulatory structure have only recently been finalized. Traditional futures exchanges, which are called designated contract markets, are subject to more streamlined and flexible core principles rather than the prior statutory and regulatory mandates. However, with respect to these traditional futures exchanges, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily limits and the suspension of trading. Any of these actions, if taken, could adversely affect the returns of the Fund by limiting or precluding investment decisions the Fund might otherwise make. The regulation of commodity transactions in the U.S. is a rapidly changing area of law and is subject to ongoing modification by government and judicial action. In addition, various national governments have expressed concern regarding the disruptive effects of speculative trading in the currency markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on the Fund is impossible to predict, but could be substantial and adverse to the Fund.

Changing Regulatory Environment. The CFTC has recently withdrawn relief previously granted to Gresham concerning position limits with respect to certain agricultural commodities (soybeans, corn and wheat) in which Gresham invests under TAP®. The effect of such withdrawal is that, beginning January 15, 2010, Gresham became subject to the same position limit rules as other investors. Gresham has taken steps to mitigate the potential risks associated with becoming subject to such limits (including expanding the number of exchanges on which it trades). However, the CFTC has recently announced a proposal to set aggregate position limits on contracts in certain energy commodities, irrespective of the exchange on which a contract is traded, which would adversely impact the effectiveness of the mitigating efforts of the commodity subadvisor. Any position limits established by the CFTC or the exchanges may in the future restrict the full implementation of the Fund’s investment strategy and result in substantial losses on your investment.

Any deflation or reduced inflation may negatively affect the expected future spot price of underlying commodities. Deflation or a reduced rate of inflation may result in a decrease in the future spot price of the underlying commodities, negatively affecting the Fund’s profitability and resulting in potential losses. In addition, reduced economic growth may lead to reduced demand for the underlying commodities and put downward pressure on the future spot prices, adversely affecting the Fund’s operations and profitability. Although the manager and the commodity subadvisor believe that the Fund’s options strategy can provide the potential for current gains from option premiums, in up markets, the Fund will forego potential appreciation in the value of the underlying contracts to the extent the price of those contracts exceeds the exercise price of options written by the Fund plus the premium collected by writing the call options. There can be no assurance that the Fund’s options strategy will be successful.

There can be no assurance that the Fund’s options strategy will be successful. The Fund intends to use options on commodity futures and forward contracts to enhance the Fund’s risk-adjusted total returns. The Fund may seek to protect its commodity futures and forward contracts positions in the event of a market decline in those positions by purchasing commodity put options that are “out-of-the money.” The Fund’s use of options, however, may not provide any, or only partial, protection for modest market declines.

In addition, the return performance of the Fund’s commodity futures and forward contracts may not parallel the performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. Investing in options is volatile and requires an accurate assessment of the market and the underlying instrument. Factors such as increased or reduced volatility, limited

18

dollar value traded and timing of placing and executing orders may preclude the Fund from achieving the desired results of the options strategy and could affect the Fund’s ability to generate income and gains and limit losses.

The Fund may forego price appreciation above the option exercise price on up to approximately 50% of its commodity futures and forward contracts as a result of writing “out-of-the-money” commodity call options. The Fund will write commodity call options with terms up to one year that may be up to 20% “out-of-the-money” on a continual basis on up to approximately 50% of the notional value of each of its commodity futures and forward contract positions that, in Gresham’s determination, have sufficient option trading volume and liquidity. Initially, the Fund expects to sell commodity call options on approximately 50% of the notional value of its commodity futures and forward contract positions. As the writer of a call option, the Fund sells, in exchange for receipt of a premium, the right to any appreciation in the value of the futures or forward contract over a fixed price on or before a certain date in the future. Accordingly, the Fund is effectively limiting its potential for appreciation to the amount the option is “out-of-the-money” during the term of the option on up to approximately 50% of the notional value of its portfolio invested in commodity futures and forward contract positions.

The Fund may incur put premium costs without benefiting from its investment in commodity put options. Initially, the Fund does not intend to purchase put options and therefore will not incur put premium costs. In the future, however, the Fund may purchase commodity put options on all or substantially all of the notional value of its commodity futures and forward contract positions. As a holder of a put option, the Fund, in exchange for payment of a premium, has the right to receive from the seller of the commodity put option, if the current price is lower than the exercise price, the difference between the put exercise price and the current price of the underlying commodity futures or forward contract on or before a specified date (in the case of “American-style” options, on or before the date of exercise or, in the case of “European-style” options, at the exercise date). If the price of the commodity futures or forward contract is greater than the exercise price of the put option upon expiration, then the Fund will have incurred the cost of the option but not have received any benefit from its purchase. In addition, because the Fund generally will purchase commodity put options that are substantially “out-of-the-money,” the Fund will not be protected against, and will bear the loss associated with, a market decline down to the exercise price of the option.

Risk that the Fund’s Shares May Trade at a Discount to Net Asset Value

There is a risk that the Fund’s shares may trade at prices other than the Fund’s net asset value per share. The net asset value of each share will change as fluctuations occur in the market value of the Fund’s portfolio. Investors should be aware that the public trading price of a share may be different from the net asset value of a share. The price difference may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares may be related to, but are not identical to, the forces influencing the prices of the commodity futures and forward contracts and other instruments held by the Fund at any point in time.

Risks Related to an Exchange Listing

The Exchange may halt trading in the shares which would adversely impact your ability to sell shares. It is anticipated that the Fund’s shares will be approved for listing on the NYSE Amex, subject to notice of issuance, under the market symbol CFD. Trading in shares may be halted due to market conditions or, in light of the NYSE Amex rules and procedures, for reasons that, in the view of the NYSE Amex, make trading in shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to “circuit breaker” rules that require trading to be halted for a specified period based on a specified market decline. There can be no assurance that the requirements necessary to maintain the listing of the shares will continue to be met or will remain unchanged.

The lack of an active trading market for shares may result in losses on your investment at the time of disposition of your shares. Although it is anticipated that the Fund’s shares will be approved for listing on the NYSE Amex, subject to notice of issuance, there can be no guarantee that an active trading market for the shares

19

will develop or be maintained. If you need to sell your shares at a time when no active market for them exists, the price you receive for your shares, assuming that you are able to sell them, likely will be lower than that you would receive if an active market did exist.

Gresham will be using a strategy for the Fund that differs from the strategy on which its historical performance record is based. Gresham’s historical performance record (set forth under the caption “Gresham Performance Record”) reflects the use of TAP®, not TAP PLUSSM. Gresham has not previously employed TAP PLUSSM (TAP® plus the options strategy) for the accounts of clients and, as a result, its historical performance record is not based on an investment approach that is identical to the investment approach to be used for the Fund. TAP PLUSSM is designed to enhance the Fund’s risk-adjusted total returns, which may have the effect of limiting the level of gains or losses that the Fund otherwise would achieve. Therefore, Gresham’s historical performance record for TAP® is not as relevant to investors in the Fund as it would be if Gresham were using only TAP® in investing for the Fund.