Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d8k.htm |

| EX-99.1 - PRESS RELEASE - EXELON GENERATION CO LLC | dex991.htm |

Exelon’s Acquisition of John Deere Renewables

August 31, 2010

Exhibit 99.2 |

2

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, that are subject to risks

and uncertainties. The factors that could cause actual results to differ

materially from these forward-looking statements include those discussed

herein as well as those discussed in (1) Exelon’s 2009 Annual Report on Form

10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and

(c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Exelon’s

Second Quarter 2010 Quarterly Report on Form 10-Q in (a) Part II, Other

Information, ITEM 1A. Risk Factors, (b) Part 1, Financial Information,

ITEM 2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) Part I , Financial Information, ITEM 1. Financial

Statements: Note 12 and (3) other factors discussed in filings with the Securities

and Exchange Commission (SEC) by Exelon Corporation and Exelon Generation

Company, LLC (Companies). Readers are cautioned not to place undue reliance

on these forward-looking statements, which apply only

as

of

the

date

of

this

presentation.

None

of

the

Companies

undertakes

any

obligation

to

publicly

release

any

revision

to

its forward-looking statements to reflect events or circumstances after the

date of this presentation. |

3

Transaction Summary

Components of purchase price

•

$860M for operating assets and advanced-stage Michigan development

projects •

Up to $40M in additional payments contingent on commencement of construction

on Michigan development projects

•

Equivalent to ~$1,000/KW

Financing

•

Exelon will fund transaction with Exelon Generation debt (no equity

issuance) •

Clean

capital

structure

with

no

tax

equity

and

project

debt

(1)

•

Ability to utilize production tax credits

735 MW operating portfolio spread across 36 projects located in eight states

•

75% of the operating portfolio is sold under long-term power purchase

arrangements

•

86% of contracted portfolio has PPAs through 2026 or beyond

1,468 MW in development pipeline

•

PPAs

have

already

been

executed

for

230

MW

in

Michigan

–

projects

expected

to

be operational in 2012-2013

Acquisition positions Exelon as a large wind operator, complementing its

world-class nuclear fleet

(1) Except for $1.8M loan from Illinois Finance Authority for AgriWind project in

IL |

4

Strategic Rationale

Diversify with additional clean generation

•

JDR’s proven wind platform provides unique opportunity and entry point into

U.S. wind business

•

Provides diversity in geographic presence and generation type

•

Supports

Exelon

2020

by

adding

more

“clean”

generation

to

our

portfolio

and

positions us for potential federal RPS

Contracted portfolio with option for future growth

•

75% of operating portfolio sold under long-term PPAs

•

1,468 additional MW in pipeline, of which 230 MW have executed PPAs

•

Only plan further development of contracted assets

Attractive economics and good fit

•

Purchase price compares favorably with other wind transactions

•

Disciplined investment approach aligned with Exelon’s approach

•

Addition of strong renewable energy development team

Acquisition further enhances Exelon’s strong environmental leadership and

provides future opportunities for incremental development

|

5

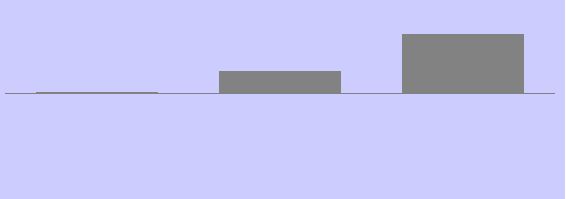

Financials Are Attractive

Economics for operating and advanced development portfolio are attractive

EPS breakeven in 2011, accretive beginning in 2012

•

Assumes transaction is funded with 100% debt

EBITDA

run-rate

of

~$150M/year

including

PTCs

(1)

(including

Michigan

development

projects)

Free cash flow accretive by 2013

•

Includes estimated capex (before tax incentives) of $450-$500M in

2011-2012 for Michigan development projects

Expect transaction to have minimal impact on credit metrics

EPS Accretion / Dilution

0.0%

0.6%

1.5%

2011E

2012E

2013E

(1)

Production Tax Credits |

6

6

Asset Profile –

Operating

The portfolio is largely made up of contracted operating assets

Geographic Distribution

TX, 26%

MO,

22%

MI, 17%

ID, 12%

MN,

11%

OR,

10%

KS, 2%

IL, 1%

Note:

There is ongoing litigation with Southwest Public Service related to PURPA

contracts which could impact the price at which the generation from these

units is sold. Cracking issues experienced by Deere on certain Suzlon

turbine blades have been addressed to our satisfaction.

We have factored both items into our valuation.

Project State

MW

# of Wind

Projects

Ownership

Placed in

Service

Date

PPA End

Date

Federal

Incentive

Off-Taker

Idaho

88.2

3

100%

2009/2010

2028/2030

ITC Grant

Idaho Power

Illinois

8.4

1

99%

2008

2018

PTC

Wabash Valley Power

Kansas

12.5

1

100%

2010

2030

PTC

Kansas Power Pool

Michigan

121.8

2

100%

2008

2018/2028

PTC

Wolverine Power Supply

/ Consumers Energy

Minnesota

77.7

9

94%-100%

2003/2008

2018/2028

PTC

Various

Missouri

162.5

4

99%-100%

2008

2027

PTC

Associated Electric /

MO Joint Municipal

Oregon

74.5

4

99%-100%

2009

2029

ITC Grant

PacifiCorp

Texas

189.8

12

100%

2006/2009

N/A

PTC

Southwest Public Service

Total

735.4

36 |

7

7

Asset Profile –

Pipeline

PPAs already executed for these

projects

Development pipeline includes

wind projects ranging from 20 MW

to 300 MW

Development of projects to be

considered on a case-by-case

basis

State

Project Name

MW

MI

Michigan Wind II

90

MI

Harvest II

59

MI

Blissfield (MW IV)

81

Total

230

Projects to be developed by Exelon

Optional projects for development

Ohio

198

Michigan

40

Idaho

20

Texas

760

Maine

50

Colorado

40

Oregon

30

California

100

Total

1,238

Total

1,468 |

8

Regulatory Approval Process

FERC approval required

DOJ antitrust approval required under the Hart-Scott-Rodino Antitrust

Improvements Act

Other than Texas, no state approval is necessary

Expect to close transaction in 4Q 2010; no material issues expected

|