Attached files

| file | filename |

|---|---|

| EX-5.1 - AMERICAN PACIFIC INVESTCORP LP | v194121_ex5-1.htm |

| EX-3.1 - AMERICAN PACIFIC INVESTCORP LP | v194121_ex3-1.htm |

| EX-3.3 - AMERICAN PACIFIC INVESTCORP LP | v194121_ex3-3.htm |

| EX-3.2 - AMERICAN PACIFIC INVESTCORP LP | v194121_ex3-2.htm |

| EX-23.1 - AMERICAN PACIFIC INVESTCORP LP | v194121_ex23-1.htm |

As

filed with the Securities and Exchange Commission on August 23,

2010

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO.1

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN

PACIFIC INVESTCORP LP

(Exact Name of Registrant As Specified

in Its Charter)

|

Delaware

(State

or Other Jurisdiction of

Incorporation

or

Organization) |

6500

(Primary

Standard Industrial

Classification

Code Number)

|

27-3175534

(I.R.S.

Employer

Identification

Number)

|

295

Madison Ave., 2nd Fl.

New York,

New York 10017

P: (212)

545-1100

F:

(212) 545-1355

(Address,

Including Zip Code, and Telephone Number,

Including

Area Code, of Registrants’ Principal Executive Offices)

Michael

Pilevsky

Seth

Pilevsky

Co-President

and Co-Chief Executive Officer

295 Madison Ave., 2nd Fl.

New

York, New York 10017

P:

(212) 545-1100

F:

(212) 545-1355

(Name,

Address, Including Zip Code, and Telephone Number,

Including

Area Code, of Agent for Service)

With copies to:

Sunny

J. Barkats, Esq.

JSBarkats PLLC

100

Church Street, 8th

Fl.

New York,

New York 10007

P: (646)

502-7001

F: (646)

607-5544

www.JSBarkats.com

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after this Registration Statement becomes

effective.

If

any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, check the following box. o

If

this Form is filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. o

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of "large accelerated filer," "accelerated filer," and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer x

(Do

not check if a

smaller

reporting company)

|

Smaller reporting company o

|

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to Be

Registered(1)

|

Proposed

Maximum

Offering Price

Per Common

unit |

Proposed

Maximum

Aggregate

Offering Price(1)

|

Amount of

Registration

Fee

|

||||||||||||

|

Common

units representing limited partner interests

|

$ | 187,000,000 | $ | 11.00 | $ | 187,000,000 | $ | 13,333.10 | ||||||||

(1) Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(o) for the direct offering.

The registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its

effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a),

may determine.

The

information in this preliminary prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission becomes effective. This preliminary

prospectus is not an offer to sell these securities and we are not

soliciting an offer to buy these securities in any jurisdiction where the offer

or sale is not permitted.

Subject to Completion,

Dated ___, 2010

PROSPECTUS

17,000,000

Common Units

Representing

Limited Partnership Interests

This is our initial public offering.

We are offering a maximum of 17,000,000 and a minimum of 8,555,556 common units

on a “self-underwritten” best efforts basis, an amount that our General Partner

(as defined hereafter,) has the unrestricted right to reject, limit or increase

. The officers and directors of American Pacific Investcorp, LP (the

“Company) intend to sell the common units described in this offering

directly. The intended methods of communication include, without

limitation, telephone and personal contact. For more information, see the

section titled “Plan of Distribution” herein. The proceeds from the sale of the

common units in this offering will be payable to the Company. This

offering will end 90 days after the effective date of the registration

statement, unless earlier terminated or extended in our sole and absolute

discretion.

We

intend to apply to list our common units on a U.S. national exchange including

but not limited to the Nasdaq Global Market under the symbol “APIC” if made

available to us.

Prior to this offering, there has

been no public market for our common units. We anticipate that the initial

public offering price will be between $9.00 and $11.00 per common unit agreed

upon according to a specific valuation undertaken by our management and

discussed hereafter in this prospectus.

This

investment involves a high degree of risk. You should purchase common units only

if you can afford a complete loss of your investment. You should consider the

risks which we have described in "Risk Factors" beginning on page 7 before

buying our common units.

These

risks include but are not limited to the following:

|

|

·

|

We

may not have sufficient cash to enable us to pay the minimum quarterly

distribution on our common units following establishment of cash reserves

and payment of costs and expenses, including reimbursement of expenses to

our General Partner;

|

|

|

·

|

Our

General Partner, which has sole responsibility for conducting our business

and managing our operations, and its affiliates may have conflicts of

interest with us and they may favor their own interests to the

detriment of us and our unit holders since the doctrine of corporate

opportunity does not apply;

|

|

|

·

|

Holders

of our common units have limited voting rights and are not entitled to

elect our General Partner or its directors, or to remove our General

Partner or its directors without the General Partner’s consent;

and

|

|

|

·

|

Unit

holders' share of our income will be taxable to them for U.S. federal

income tax purposes even if they do not receive any cash distributions

from us.

|

|

Per Common Unit

|

Total

|

|||||||

|

Maximum public

offering price

|

$ | $11.00 | $ | 187,000,000 | ||||

|

Proceeds,

before offering expenses, to us

|

$ | $ | 187,000,000 | |||||

The

information in this prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective or at all.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal

offense.

We expect to deliver the common

units to purchasers on or about 90 days after the effective date of the

registration.

TABLE

OF CONTENTS

|

Summary

|

Page

1

|

|

|

The

Offering

|

Page

1

|

|

|

Selected

Summary Financial Data

|

Page

5

|

|

|

Risk

Factors

|

Page

7

|

|

|

Use

of Proceeds

|

Page

21

|

|

|

Capitalization

|

Page

21

|

|

|

Dilution

|

Page

22

|

|

|

Cash

Distribution Policy and Restrictions on Distributions

|

Page

23

|

|

|

Plan

of Distribution

|

Page

25

|

|

|

Selected

Historical and Unaudited Pro Forma Financial and Operating

Data

|

Page

28

|

|

|

Management

Discussion & Analysis

|

Page

30

|

|

|

Business

Overview

|

Page

35

|

|

|

Management

|

Page

37

|

|

|

Executive

Compensation

|

Page

42

|

|

|

Certain

Relationships and related Party Transactions

|

Page

44

|

|

|

Conflicts

of Interests and Financial Duties

|

Page

45

|

|

|

Description

of Common Units

|

Page

46

|

|

|

The

Partnership Agreement

|

Page

47

|

|

|

Material

Tax Consequences

|

Page

52

|

You

should rely only on the information contained in this document or to which we

have referred you specifically. We have not authorized anyone to provide you

with any other information that maybe different. This document may only be used

where it is legal to sell securities. The information in this document may only

be accurate on the date of this document. This prospectus is not an

offer to sell or solicitation of an offer to buy our common units in any

circumstances under which the offer or solicitation is

unlawful.

i

FORWARD-LOOKING

INFORMATION

This

prospectus and the information incorporated herein by reference contains certain

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, many of which are beyond our ability to control

or predict. Forward-looking statements may be identified by words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

“will” or words of similar meaning and include, but are not limited to,

statements about the expected future business and financial performance of our

Company and our subsidiaries. Among these risks and uncertainties are risks

related to our real estate activities, including the extent of any tenant

bankruptcies and insolvencies and competition for residential and investment

properties; and other risks and uncertainties detailed from time to time in our

filings with the SEC. These risks include those set forth in the section of this

prospectus called “Risk Factors.”

Those

risks are representative of factors that could affect the outcome of the

forward-looking statements. These and the other factors discussed elsewhere in

this prospectus and the documents incorporated by reference herein are not

necessarily all of the important factors that cause our results to differ

materially from those expressed in our forward-looking statements. We caution

you not to place undue reliance on these forward-looking statements, which

reflect our view only as of the respective dates of this prospectus and the

documents incorporated herein by reference or other dates which are specified in

those documents.

ii

SUMMARY

This summary highlights

information contained elsewhere in this prospectus. You should read the entire

prospectus carefully before investing in our common units. You should read "Risk

Factors" beginning on page 7 for information about critical risks that you

should consider before buying our common units.

References in this prospectus to

“American Pacific Investcorp LP," "we," "our," "us" or the “Company” or like

terms refer to us and our subsidiaries.

American

Pacific Investcorp LP is a master limited partnership formed in Delaware on July

2, 2010, (the “Company”); our General Partner is American Pacific Investcorp

Partner LP a Delaware limited partnership (the “General Partner”), and its

general partner is American Pacific Investcorp GP, LLC, a Delaware limited

liability company. Our officers and directors are directly employed by American

Pacific Investcorp Partner, LP. If the maximum offering closes, the General

Partner will own a non dilutive aggregate of 12% general partnership interest in

us. We are a growth-oriented Delaware limited partnership formed to, among

other things, (i) acquire, own and operate real estate property and related

assets, (ii) make or acquire loans secured by direct or indirect interests in

real property, and (iii) acquire and operate other ancillary non-primary

businesses as allowed under Section 7704 of the Internal Revenue Service

Code, in each case through ownership of one or more subsidiaries formed for such

purpose.

OUR

BUSINESS

Our

principal business is the acquisition, ownership, development, improvement,

leasing, management and disposition of a broad spectrum of real estate

properties, including but not limited to commercial buildings, retail centers,

office properties, residential properties, hotels and both residential and

commercial condominiums. We may also acquire or make loans secured directly

by real property or by ownership interests in real property. We may also

acquire and operate ancillary and/or non-primary businesses as allowed under

Section 7704 of the Internal Revenue Service Code. We have an

intentionally broad spectrum of assets that we intend to acquire because we

believe that a diversified portfolio avoids concentrations in any one industry

that may become subject to risk in the event of a downturn in that specific

industry, sector or subsector. With diversified assets, we believe that

the negative impact from sectors experiencing risk, downturn or significant

industry specific events, as is typical in economic cycles, may be ameliorated

or absorbed by unaffected sectors. We believe that this strategy

will produce more stable long term results as no one sector should have a major

impact on our portfolio as a whole. Further, our objective is to quickly

and strategically grow the Company by adding to our portfolio several hundred

million dollars of assets meeting our investment criteria.

Our

day to day operations include all aspects of property ownership, management and

strategic repositioning, tailored in each case to specific property needs and

targeted to enhance each property. In the event that we are able to

acquire a currently identified portfolio of approximately thirty

three (33) commercial office properties located in the state of Pennsylvania

(the “Pennsylvania Portfolio”), we thereafter intend to increase our holdings by

adding other properties with unrealized value on a going forward

basis. We intend to implement management and operational strategies that

we believe may increase the long term value of our portfolio. We will acquire

each asset and/or engage in each business through the use of one or more

subsidiaries owned in whole or in part by us.

We

seek specific opportunities to acquire, reposition and manage properties where

we believe we can achieve higher cash flows and capital appreciation as a result

of our specific expertise. We intend to utilize our considerable

experience in virtually all aspects of real estate development, operation and

lending to find the markets that we believe have favorable conditions to support

growth in occupancy and rental rates, and to find emerging markets that have not

yet reached full potential. Our initial focus will be in Pennsylvania,

where we have identified certain opportunities and where we believe we can

enhance the value of our properties through the execution of long term leases

with complimentary and synergistic users, through property refurbishment, and

strategic sales. However, we will not limit our efforts to any particular

individual geographic area, market or submarket as we may find other

opportunities in large metropolitan areas, suburban submarkets, smaller cities

or rural locations.

As

a master limited partnership, our primary business objective is to make

quarterly cash distributions to our unit holders at our minimum quarterly

distribution amount and, over time, increase our quarterly cash distributions.

Initially, in the event we do acquire the identified Pennsylvania Portfolio, we

intend to pay our common unit holders distributions of $0.1625 per common unit

per quarter, or $0.65 per common unit

annually.

THE

OFFERING

This

is a self-underwritten public offering pursuant to which we are offering our

common units for sale directly to the public. Our common units will be

offered on a best efforts basis, with a minimum purchase requirement of

8,555,556 common units. We do not intend to use an underwriter for this

offering, so there will not be any underwriting commissions or discounts.

Any funds raised from the offering will be held in escrow, with an

independent third party escrow, until the close of the

offering.

1

After

a thorough valuation our management anticipates to launch our initial public

offering based on a price between $9.00 and $11.00 per common unit. Such

price was determined based on the expectation of providing our

anticipated yield, to be between 6% and 6.5% per annum to

our unitholders. In the event that our common units maximum

offer is purchased, the gross proceeds to us before deducting

expenses of the offering will be up to $187,000,000; the expenses

associated with this offering are estimated to be approximately

of $13,300,000 or 7.1% of the gross proceeds. If the

minimum amount of our offered common units are purchased, the gross proceeds to

us before deducting expenses of the offering shall be of an aggregate

of $77,000,000; the expenses associated with this offering are

estimated to be $5,080,000 or 6.6%. The offering expenses consist of

offering placement costs, legal and accounting, and marketing Investor Relation

costs. If all of our offered common units are not purchased, the

percentage of offering expenses to gross proceeds may be higher.

We have set a minimum of 8,555,556 of our common units to be purchased in order

for this offering to close, as well as maximum number of 17,000,000 common units

to be purchased, with the ability of the board of directors to accept

over-subscriptions.

The

following is a summary of the terms of our offering of common

units.

|

Securities

|

Master

limited partnership interests known as common units.

|

|

|

Maximum

number of common units offered with the ability for our board of directors

to accept over subscriptions.

|

17,000,000

common units.

|

|

| Minimum number of common units offered. |

8,555,556

common

units

|

|

Use

of proceeds.

|

We

anticipate that the use of the net proceeds of approximately $173,700,000

(if the maximum number of common units are sold from this offering and

based on an assumed initial offering price of $11.00 per common unit)

after deducting offering expenses of approximately $13,300,000 for the

following purposes:

·

Acquisition

of the Pennsylvania Portfolio for an estimated purchase price of

$131,500,000 plus additional closing costs of approximately

$3,900,000.

· The

$3,900,000 closing cost shall be disbursed among the

following:

o

Real Estate Broker Fees

o

Acquisition Fees

o

Legal and Accounting

o

Third Party Costs

o

Transfer Taxes

o

Title Insurance

o

Miscellaneous Expenses

·

For

the first quarter that we are publicly traded, we will pay investors in

this offering a pro-rated distribution covering the period from the

completion of this offering through __________________, 2011 based on the

actual length of that period;

·

Pursuant

and subject to the requirements of our partnership agreement, we will

distribute net available cash after operating costs on a quarterly basis

as follows: 88% to the holders of common units and 12% to our

General Partner, until each common unit has received the minimum quarterly

distribution of $0.135 in the event that our units are priced at $9 per

unit or $0.1625 in the event our units are priced at $11 per unit

;

|

2

|

The

offering expenses of an aggregate of $13,300,000 shall be disbursed among

the main following:

·

Offering Placement Costs

·

Legal and Accounting

·

Marketing/Investor

Relations services

CAPITAL

EVENT:

Our

General Partner is entitled to 50% of the net proceeds, of any Capital

Event. The term “Capital Event” is defined as the sale of any asset

and/or its refinancing as well as the sale or liquidation of our Company

at a profit. A capital raise through issuance of additional common

units shall not be deemed a Capital Event. Therefore, in the event

of a sale of an asset, net proceeds, defined as the sale proceeds less all

costs directly associated with such sale, less the net carrying value of

the asset, defined as the historical cost plus capitalized improvements

less accumulated depreciation and amortization of the asset. Similarly in

the event of a refinancing of an asset, net proceeds shall be defined as

financing proceeds less all costs directly associated with said

refinancing. Notwithstanding, in the event of a financing, net proceeds

shall be distributed only if there is an increase in value, as evidenced

by an independent appraisal (or the then equivalent method for determining

value) between the net carrying value and the independently appraised

value of the asset. Additionally, the distribution of net proceeds shall

be limited to said increase in value.

INCENTIVE

DISTRIBUTION RIGHTS:

Our

General Partner may benefit from additional incentives in the event that a

cash distribution to our unit holders exceeds $0.135 or $0.1625 per common

unit in any quarter, Capital Events will never be taken into account when

calculating Incentive Distribution Rights. Our unit holders and our

General Partner will receive distributions according to the following

percentage allocations:

If

the cash distributions to unit holders are above $0.135 or

$0.1625 up to $____, then our General Partner will be

entitled to an additional 2% of that quarter’s distributable

income.

If

the cash distributions to unit holders are above

$___ up to

$___, then our General Partner will be entitled to an additional 5% of

that quarter’s distributable income.

If

the cash distributions to unit holders are above $___ up to $___, then our

General Partner will be entitled to an additional 7% of that quarter’s

distributable income.

·

These

percentage interests in the quarterly cash distribution for our General

Partner are exclusive of its non dilutive 12% minimum ownership and are

only an increase in the distribution rights rather than ownership

increases. We refer to the additional increasing distributions

of our General Partner as “Incentive Distribution

Rights”

·

It

is our belief that, based on our financial forecast and related

assumptions that we will have sufficient available cash to pay the minimum

quarterly distribution of $0.135 if our units are priced at $9 per unit or

$0.1625 if our units are priced at $11 per

unit.

|

||

|

Issuance

of Additional Common Units

|

·

Our

partnership agreement authorizes us to issue an unlimited number of

additional units without the approval of our unit holders, subject to the

approval of the board of

directors

|

3

|

Limited

voting rights

|

·

Our General Partner will manage and operate

us. Unlike the holders of common stock in a corporation, our

unit holders will have only limited voting rights on matters affecting our

business. For example, our unit holders will have no right to elect our

General Partner or its directors on an annual or other continuing basis.

Our General Partner may not be removed without such General Partner’s

consent.

|

|

Exchange

Listing

|

·

We

intend to apply to list our common units on a U.S. national exchange as

soon as practical such as the Nasdaq Global Market or any other national

exchange, under the symbol “APIC” if such

symbol is made available to us, or if not made available, then under

another

symbol.

|

Risk

Factors

An

investment in our common units involves risks. Those risks are described under

the caption “Risk Factors” beginning on page 7.

Acquisition

Activities

We

currently intend to use most of the proceeds of this offering to acquire an

unnamed but identified Pennsylvania Portfolio for an estimated purchase price

of $131,500,000 plus estimated closing costs of about

$3,900,000. The acquisition of the Pennsylvania Portfolio will be made by

LV Investcorp. L.P. (“LV Investcorp.”), a Delaware limited partnership owned by

us and by Pennsylvania Investcorp, LP and formed for the purpose of acquiring

the Pennsylvania Portfolio. We will own 99.99% of the partnership

interests in LV Investcorp LP as a limited partner, with Pennsylvania

Investcorp, LP owning 0.01% of the partnership interests as a general

partner. Pennsylvania Investcorp, LP will be owned by API GP 2 LLC, a

Delaware limited liability company owning 0.01% of the partnership interest

therein as a general partner, and by our General Partner owning 99.99% of the

partnership interest therein as a limited partner. API GP 2 LLC will be

wholly owned by American Pacific Investcorp GP, LLC. Our General

Partner intends to enter into a participation agreement with Pektor Holdings II

LLC pursuant to which Pektor Holdings II LLC will be entitled to half of all net

profits and distributions earned by the General Partner from its 12%

non-dilutive interest in us, with respect to assets acquired in Pennsylvania on

or before December 31, 2015. Pektor Holdings II, LLC

shall have no equity ownership in us, however, is free to acquire common units

upon the same terms as purchasers of common units hereunder. We will

continue identifying, evaluating, executing and integrating acquisitions of real

property across the United States. Other than as set forth in this prospectus,

we have not identified, or reached any agreements, commitments or understandings

for, any acquisitions. In

the event that we sell the minimum of 8,555,556 common units, we will likely

seek to secure a bridge loan or equity or other reasonable financial

arrangements in order to raise the necessary funds for the completion of the

acquisition of the Pennsylvania Portfolio. We believe that our

structure will allow us to compete in the real estate acquisition market in the

current economy.

Principal

Executive Offices

Our

principal executive offices are located at 295 Madison Ave., 2nd Fl., New York,

NY 10017. Our phone number is (212) 545-1100.

4

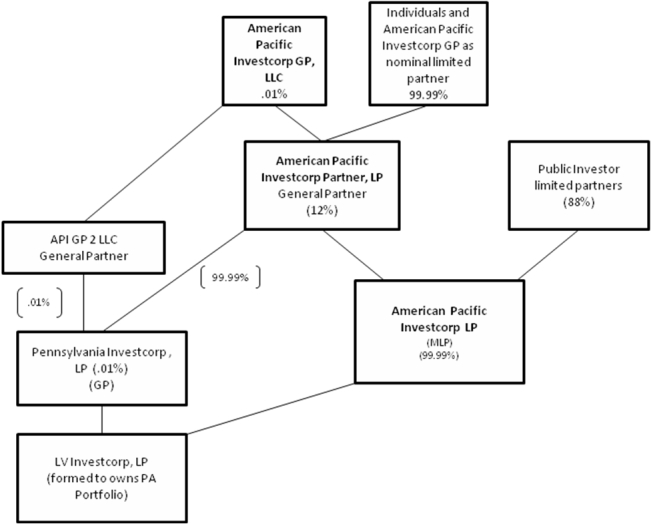

Organizational

Structure

The

following is a simplified diagram of our ownership structure after giving effect

to this offering and the related transactions.

SELECTED

SUMMARY FINANCIAL DATA

The

following tables show summary combined audited historical financial and

operating data of the Pennsylvania Portfolio and consolidated unaudited pro

forma financial and operating data for American Pacific Investcorp LP for the

periods and as of the dates presented, and should be read in conjunction with

the unaudited pro forma financial statements and related notes of American

Pacific Investcorp LP and the audited historical financial statements and

related notes of the targeted Pennsylvania Portfolio included elsewhere in this

prospectus.

Our

summary pro forma statement of income data for the years ended December 31,

2009 and the six months ended June 30, 2010 and summary pro forma balance sheet

data as of June 30, 2010 are derived from the unaudited pro forma financial data

of American Pacific Investcorp LP, which financial data is based on the

anticipated acquisition of the Pennsylvania Portfolio and is included elsewhere

in this prospectus. The pro forma adjustments have been prepared as if certain

transactions to be effected at the closing of this offering had taken place on

June 30, 2010, in the case of the pro forma balance sheet, and as of

January 1, 2009, in the case of the pro forma statement of income for the

year ended December 31, 2009 and for the six months ended June 30, 2010.

These transactions include:

5

|

·

|

The

proposed sale of 17,000,000 of our maximum common units offered

(representing limited partner interests) for an aggregate gross

proceeds of $187,000,000;

|

|

·

|

Our

acquisition of the Pennsylvania Portfolio for an estimated amount of

$131,500,000 not including the estimated acquisition closing costs.

|

The pro

forma financial data are not necessarily indicative of results of operations

that would have occurred had this acquisition been consummated at the beginning

of the periods presented or that might be attained in the

future.

|

Six Months Ended June 30,

|

||||||||||||

|

|

2010

|

2010

|

2009

|

|||||||||

|

|

Pro-forma

|

Historical

|

Historical

|

|||||||||

|

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||

|

Statement

of Income Data:

|

||||||||||||

|

Revenue

|

$ | 10,961,959 | $ | 10,961,959 | $ | 11,107,064 | ||||||

|

Operating

expenses

|

4,214,461 | 4,214,461 | 4,375,293 | |||||||||

|

Operating

income before depreciation, amortization and general and administrative

expenses

|

6,747,498 | $ | 6,747,498 | $ | 6,731,771 | |||||||

|

Depreciation

and amortization

|

1,351,650 | |||||||||||

|

General

and administrative (1)

|

606,000 | |||||||||||

|

Net

income

|

$ | 4,789,848 | ||||||||||

|

Net

income attributable to the General Partner

|

$ | 574,782 | ||||||||||

|

Net

income attributable to American Pacific Investcorp LP – Common Unit

Holders

|

$ | 4,215,066 | ||||||||||

|

Net

income per common unit (basic and diluted)

|

$ | 0.25 | ||||||||||

|

Balance Sheet Data: (Pro

forma)

|

||||||||||||

|

Real

estate assets

|

$ | 131,107,200 | ||||||||||

|

Total

assets

|

$ | 171,301,990 | ||||||||||

|

Total

liabilities

|

$ | 1,416,500 | ||||||||||

|

Total

equity

|

$ | 169,885,490 | ||||||||||

|

Other

Data:

|

||||||||||||

|

Cash

available for distribution to common unit holders (2)

|

$ | 5,322,251 | ||||||||||

|

Year Ended December 31,

|

||||||||||||||||

|

|

2009

|

2009

|

2008

|

2007

|

||||||||||||

|

|

Pro-forma

|

Historical

|

Historical

|

Historical

|

||||||||||||

|

|

(Unaudited)

|

|||||||||||||||

|

Statement

of Income Data:

|

||||||||||||||||

|

Revenue

|

$ | 21,928,560 | $ | 21,928,560 | $ | 21,799,223 | $ | 21,290,165 | ||||||||

|

Operating

expenses

|

8,099,425 | 8,099,425 | 8,041,722 | 7,703,872 | ||||||||||||

|

Operating

income before depreciation, amortization and general and administrative

expenses

|

13,829,135 | $ | 13,829,135 | $ | 13,757,501 | $ | 13,586,293 | |||||||||

|

Depreciation

and amortization

|

2,703,300 | |||||||||||||||

|

General

and administrative (1)

|

1,212,000 | |||||||||||||||

|

Net

income

|

$ | 9,913,835 | ||||||||||||||

|

Net

income attributable to the General Partner

|

$ | 1,189,660 | ||||||||||||||

|

Net

income attributable to American Pacific Investcorp LP

– Common Unit Holders

|

$ | 8,724,175 | ||||||||||||||

|

Net

income per common unit (basic and diluted)

|

$ | 0.51 | ||||||||||||||

|

Other

Data:

|

||||||||||||||||

|

Cash

available for distribution to common unit holders (2)

|

$ | 11,027,608 | ||||||||||||||

|

(1)

|

For

the purpose of calculating distributable income, general corporate

overhead expenses will be charged to the individual subsidiary real estate

holding entities (the Subsidiary) based upon each Subsidiary’s relative

contribution to operating income before depreciation, amortization and

general and administrative expenses.

|

| (2) |

Cash

available for distribution is calculated as the sum of the following; (i)

net operating income (ii) depreciation and amortization and (iii)

straight-line rental income adjustments.

Net

operating income excludes gains and losses of real estate and other

assets, and other non-operating gains and

losses.

|

6

RISK

FACTORS

Limited partner interests are

inherently different from the capital stock of a corporation, although many of

the business risks to which we are subject are similar to those that would be

faced by a corporation engaged in a similar business. You should carefully

consider the following risk factors together with all of the other information

included in this prospectus in evaluating an investment in our common

units. The risks and uncertainties we describe are not the only ones

facing us. Additional risks and uncertainties not presently known to us or that

we currently deem immaterial may also impair our business or

operations.

If any of the following risks were

to occur, our business, financial condition, results of operations and cash

available for distribution could be materially adversely affected. In that case,

we might not be able to make distributions on our common units, the trading

price of our common units could decline, and you could lose all or part of your

investment.

7

Risks Relating to Our

Structure

We

intend to pay periodic distributions to the holders of our common units,

however, we are a holding company and substantially depend on the businesses of

our subsidiaries to satisfy our obligations.

We are

a holding company and will have no material assets other than the ownership

interests in our subsidiaries and will have no independent means of

generating income. Consequently, our cash flow and our ability to make

distributions with respect to common units likely will depend on the cash flow

of such subsidiaries and the payment of funds to us by such subsidiaries in the

form of dividends, distributions, loans or otherwise. The operating

results of our subsidiaries may not be sufficient to make distributions to us.

In addition, our subsidiaries are not obligated to make funds available to us

and distributions and intercompany transfers from our subsidiaries to us may be

restricted by applicable law or covenants contained in financing agreements and

other agreements to which these subsidiaries may be subject or enter into in the

future. The terms of any borrowings of our subsidiaries or other entities in

which we own equity may restrict dividends, distributions or loans to us. To the

degree any distributions and transfers are impaired or prohibited, our ability

to make distributions on our common units will be

limited.

We

are prohibited from making distributions to our common unit holders under

certain circumstances and the holders of our common units may be required to

return distributions that were made in violation of applicable law.

Under the

Delaware Limited Partnership Act, we may not make a distribution to a partner if

after the distribution all our liabilities, other than liabilities to partners

on account of their partnership interests and liabilities for which the recourse

of creditors is limited to specific property of the partnership, would exceed

the fair value of our assets. If we were to make such an impermissible

distribution, any limited partner who received a distribution and knew at the

time of the distribution that the distribution was in violation of the Delaware

Limited Partnership Act would be liable to us for the amount of the distribution

for three years.

Our

General Partner and our board of directors have the discretion to change our

distribution policy.

The

declaration and payment of any future distributions will be at the sole

discretion of our General Partner; however, it requires our board of director’s

approval to change our distribution policy. Our General Partner and

the board of directors will take into account general economic business

conditions, our strategic plans and prospects, our business and investment

opportunities, the proceeds, if any, from divestitures, our financial condition

and operating results, compensation expense, working capital requirements,

anticipated cash needs and the availability of adequate cash flow from the

operations of our subsidiaries, contractual restrictions and obligations,

restrictions contained in our financing arrangements, if any, our issuances of

additional equity or debt, legal, tax and regulatory restrictions, restrictions

or other implications on the payment of distributions by us to the holders of

our common units or by our subsidiaries to us and such other factors as our

General Partner and the board of directors that they may deem

relevant.

Our

partnership status could be changed by the Internal Revenue Service and we may

become taxable as a corporation.

We

believe that we are properly treated as a partnership for federal income tax

purposes. This allows us to pass through our income and deductions to our

partners. However, the Internal Revenue Service (IRS) could challenge our

partnership status and we could fail to qualify as a partnership for future

years. Qualification as a partnership involves the application of highly

technical and complex provisions of the Internal Revenue Code of 1986, as

amended. For example, a publicly traded partnership is generally taxable as a

corporation unless 90% or more of its gross income is “qualifying” income as

defined in Section 7704 of the Code. Our qualifying income includes,

without limitation, interest, dividends, real property rents, gains from the

sale or other disposition of real property, gain from the sale or other

disposition of capital assets held for the production of interest or dividends,

and certain other items. We intend to structure our business in a manner such

that at least 90% of our gross income will constitute qualifying income this

year and in the future. However, there can be no assurance that such structuring

will be effective in all events to avoid the receipt of more than 10% of

non-qualifying income, in which case we will have to pay U.S. Federal, state and

local income tax on our taxable income at the applicable tax rates and not have

the benefit of income, gains, losses, deductions or credits flowing through

them.

The cost

of paying Federal and possibly state and local income tax going forward could be

a significant liability and would reduce our funds available to make

distributions to holders of our common units, which could cause a

reduction in the value of our common units. Further, because of widespread

state budget deficits, several states are evaluating ways to subject

partnerships to entity level taxation through the imposition of state income,

franchise or other forms of taxation. To meet the qualifying income test we may

structure transactions in a manner which is less advantageous than if this were

not a consideration, or we may avoid otherwise economically desirable

transactions.

8

Our property taxes could increase due

to property tax rate changes or reassessment, which could adversely impact our

cash flows.

Even if

we qualify as a master limited partnership for federal income tax purposes, we

will be required to pay state and local taxes on our properties. The real

property taxes on our properties may increase as property tax rates change or as

our properties are assessed or reassessed by taxing authorities. If the

property taxes we pay increase, our ability to pay expected distributions to our

unit holders could be materially and adversely affected.

Permanent

changes in tax law could adversely affect us.

Changes

in tax law could adversely affect us. Legislation has been introduced in

Congress which, if enacted, could have a material adverse effect on us. The

proposals include legislation which would tax publicly traded partnerships, such

as us, as corporations. If such legislation were enacted it would materially

increase our taxes. As an alternative, we might be required to restructure our

operations, and possibly dispose of certain of our properties, in order to avoid

or mitigate the impact of any such legislation.

The

holders of our common units may be subject to state and local taxes and return

filing requirements as a result of owning our common units.

In

addition to U.S. Federal income taxes, holders of our common units may be

subject to other taxes, including state and local taxes, unincorporated business

taxes and estate, inheritance or intangible taxes that are imposed by the

various jurisdictions in which we do business or own property now or in the

future, even if the holders of our common units do not reside in any of those

jurisdictions. Holders of our common units may be required to file state and

local income tax returns and pay state and local income taxes in some or all of

these jurisdictions. Further, holders of our common units may be subject to

penalties for failure to comply with those requirements. In some instances we

may be required to pay composite or withholding taxes on behalf of non-resident

limited partners in some states, however, outside of these instances, it is the

responsibility of each unit holder to file all U.S. Federal, state and local tax

returns that may be required of such unit holder.

The

holders of our common units will be subject to U.S. federal income tax on their

share of our taxable income, regardless of whether they receive any cash

distributions, and may recognize income in excess of cash

distributions.

A U.S.

unit holder will be subject to U.S. Federal, state, local and possibly, in some

cases, foreign income taxation on its allocable share of our income, gain, loss,

deduction and credit (including its allocable share of those items of any entity

in which we invest that is treated as a partnership or is otherwise subject to

tax on a flow through basis), regardless of whether or when such unit holder

receives cash distributions.

The

holders of our common units may not receive cash distributions equal to their

allocable share of our net taxable income. In addition, certain of our

holdings or entities treated as partnerships for U.S. Federal income tax

purposes may produce taxable income prior to the receipt of cash relating to

such income, and holders of our common units that are U.S. taxpayers will

be required to take such income into account in determining their taxable

income. In the event of an inadvertent termination of the partnership status for

which the IRS has granted limited relief, each holder of our common units may be

obligated to make such adjustments as the IRS may require to maintain our status

as a partnership. Such adjustments may require the holders of our common units

to recognize additional amounts in income during the years in which they hold

such units. In addition, because of our methods of allocating income and gain

among holders of our common units, you may be taxed on amounts that accrued

economically before you became a unit holder. Consequently, you may recognize

taxable income without receiving any cash.

In some

circumstances, under the U.S. Federal income tax rules affecting partners and

partnerships, the taxable gain or loss allocated to a unit holder may not

correspond to that unit holder’s share of the economic appreciation or

depreciation in the particular asset. This is primarily an issue of the timing

of the payment of tax, rather than a net increase in tax liability, because the

gain or loss allocation would generally be expected to be offset as a unit

holder sold units. Although

we expect that distributions we make should be sufficient to cover a holder's

tax liability in any given year that is attributable to its investment in us, no

assurances can be made that this will be the case. We will be under no

obligation to make any such distribution and, in certain circumstances, may not

be able to make any distributions or will only be able to make distributions in

amounts less than a holder's tax liability attributable to its investment in us.

Accordingly, each holder of common units should ensure that it has sufficient

cash flow from other sources to pay all tax liabilities.

9

Tax

gain or loss on disposition of our common units could be more or less than

expected.

In the

event of the sale of your common units, you will recognize a gain or loss equal

to the difference between the amount realized and your adjusted tax basis

allocated to those common units. Prior distributions to you in excess of the

total net taxable income allocated to you will have decreased the tax basis in

your common units. Therefore, such excess distributions will increase your

taxable gain, or decrease your taxable loss, when the common units are sold and

may result in a taxable gain even if the sale price is less than the original

cost. A portion of the amount realized, whether or not representing gain, may be

ordinary income to you.

A distribution in excess of our

current and accumulated earnings and profits may be considered a return of

capital and thus reduce the unit holder’s tax basis in their common

units.

All

distributions will be made at the discretion of the board of directors of our

General Partner and will depend on our earnings, our financial condition,

maintenance of our master limited partnership qualification and other factors as

our board of directors may deem relevant from time to time. If we decide to make

distributions in excess of our current and accumulated earnings and profits,

such distributions would generally be considered a return of capital for federal

income tax purposes to the extent of the holder’s adjusted tax basis in their

shares. A return of capital is not taxable, but it has the effect of reducing

the holder’s adjusted tax basis in its investment. If distributions exceed the

adjusted tax basis of a holder’s shares, they will be treated as gain from the

sale or exchange of such units. If we borrow to fund distributions, our future

interest costs would increase, thereby reducing our earnings and cash available

for distribution from what they otherwise would have been.

We

do not expect to be able to furnish to each unit holder specific tax information

within 90 days after the close of each calendar year, which means that

holders of common units who are U.S. taxpayers should anticipate the need to

file annually a request for an extension of the due date of their income tax

return.

As a

publicly traded partnership, our operating results, including distributions of

income, distributions, gains, losses or deductions, and adjustments to carrying

basis, will be reported on Schedule K-1 and distributed to each unit holder

annually. It may require longer than 90 days after the end of our fiscal

year to obtain the requisite information from all lower-tier entities so that

K-1s may be prepared for the unit holders. For this reason, holders of common

units who are U.S. taxpayers should anticipate the need to file annually with

the IRS (and certain states) a request for an extension past April 15 or

the otherwise applicable due date of their income tax return for the taxable

year.

Our

assets may be subject to impairment charges.

We

periodically evaluate our real estate investments and other assets for

impairment indicators. The judgment regarding the existence of impairment

indicators is based on factors such as market conditions, tenant performance and

legal structure. For example, the early termination of a lease by a tenant or

default by a borrower under a loan held by us may lead to an impairment charge.

If we determine that an impairment has occurred, we would be required to make an

adjustment to the net carrying value of the asset, which could have a material

adverse effect on our results of operations in the period in which the

impairment charge is recorded.

The

sale or exchange of 50% or more of our capital and profit interests will result

in the termination of our partnership for U.S. Federal income tax

purposes.

We will

be considered to have been terminated for U.S. federal income tax purposes if

there is a sale or exchange of 50% or more of the total interests in our capital

and profits within a 12-month period. A termination of our partnership would,

among other things, result in the closing of our taxable year for all unit

holders, and thus may impair your investment.

Bankruptcy

of our General Partner could place us into voluntary bankruptcy.

Our

General Partner has the power to put us into voluntary bankruptcy without

approval from common unit holders. Should our General

Partner experience financial stress and choose to file for bankruptcy

protection on its own behalf, it could potentially be in the interest of the

General Partner to also file a voluntary bankruptcy with respect to us, and to

petition the bankruptcy court to substantively consolidate the assets of both us

and the General Partner.

10

Since

we are a limited partnership, you may not be able to pursue legal claims against

us in U.S. federal courts.

We are a

limited partnership organized under the laws of the state of Delaware. Under the

federal rules of civil procedure, you may not be able to sue us in federal court

on claims other than those based solely on federal law because of lack of

complete diversity. Case law applying diversity jurisdiction deems us to have

the citizenship of each of our limited partners. Because we are a publicly

traded limited partnership, it may not be possible for you to attempt to sue us

in a federal court because we have citizenship in and operations in many states.

Accordingly, you will be limited to bringing any claims in state

court.

Our

common unit holders do not elect our General Partner or vote on our general

partner’s directors.

Our

common unit holders do not elect our General Partner or our board of directors

and, unlike the holders of common stock in a corporation, have only limited

voting rights on matters affecting our business and therefore limited ability to

influence decisions regarding our business. Furthermore, if our common unit

holders are dissatisfied with the performance of our General Partner or board,

they have no ability to remove our General Partner or board, with or without

cause.

Except

in limited circumstances, our General Partner has the power and authority to

conduct our business without unit holder approval.

Under our

partnership agreement, our General Partner has full power and authority to do

all things on such terms as it determines to be necessary or appropriate to

conduct our business including, but not limited to, the following:

|

|

•

|

the

making of any expenditures, the lending or borrowing of money, the

assumption or guarantee of other contracting for, indebtedness and other

liabilities, the issuance of evidences of indebtedness, including

indebtedness that is convertible into our securities, and the incurring of

any other obligations;

|

|

|

•

|

The

acquisitions of loans or debt;

|

|

|

•

|

The

purchase, sale or other acquisition or disposition of any or all of our

assets, whether real property or

otherwise;

|

|

|

•

|

The making of any improvement

to or alterations of our real property

assets;

|

|

|

•

|

the

mortgage, pledge, encumbrance, transfer, sale, lease, hypothecation or

exchange of any or all of our assets;

|

|

|

•

|

the

negotiation, execution and performance of any contracts, conveyances or

other instruments;

|

|

|

•

|

the

distribution of our cash in

excess of operating

needs;

|

|

|

•

|

the

selection and dismissal of employees and agents, outside attorneys,

accountants, consultants and contractors and the determination of their

compensation and other terms of employment or hiring;

|

|

|

•

|

the

maintenance of insurance for our benefit and the benefit of our

partners;

|

|

|

•

|

the

formation of, or acquisition of an interest in, the contribution of

property to, and the making of loans to, any limited or general

partnership, joint venture, corporation, limited liability company or

other entity;

|

|

|

•

|

the

control of any matters affecting our rights and obligations, including the

bringing and defending of actions at law or in equity, otherwise engaging

in the conduct of litigation, arbitration or mediation and the incurring

of legal expense, the settlement of claims and

litigation;

|

|

|

•

|

the

indemnification of any person against liabilities and contingencies to the

extent permitted by law;

|

|

|

•

|

the

making of tax, regulatory and other filings, or the rendering of periodic

or other reports to governmental or other agencies having jurisdiction

over our business or assets; and

|

|

|

•

|

the

entering into of agreements with any of its affiliates to render services

to us or to itself in the discharge of its duties as our General

Partner.

|

|

|

•

|

The

exercise of remedies under leases, loans held by us and other remedies in

connection with transactions in which we are engaged, including without

limitation by instituting litigation or otherwise seeking judicial

intervention in any jurisdiction and venue of our

choosing.

|

11

Our

General Partner determines the amount and timing of asset purchases and sales,

capital expenditures, borrowings, issuances of additional partnership securities

and the creation, reduction or increase of reserves, each of which can affect

the amount of cash that is distributed to our unit holders.

The

amount of cash that is available for distribution to our unit holders is

affected by decisions of our General Partner regarding such matters including

but not limited to the following:

|

|

•

|

amount

and timing of asset purchases and

sales;

|

|

|

•

|

cash

expenditures for, and among other things, operating expenses (and whether

a capital expenditure is classified as a maintenance capital expenditure,

which reduces operating surplus, or an expansion capital expenditure,

which does not reduce operating

surplus);

|

|

|

•

|

borrowings;

|

|

|

•

|

activities

outside the ordinary course of

business

|

|

|

•

|

issuance

of additional units; and

|

|

|

•

|

the

creation, reduction, or increase of reserves in any

quarter.

|

In

addition, borrowings by us and our affiliates do not constitute a breach of any

duty owed by our General Partner and our board of directors to our

unit holders, including borrowings that have the purpose or effect of enabling

our General Partner

or its affiliates to receive incentive distribution rights. For example,

in the event we have not generated sufficient cash from our operations to pay

the minimum quarterly distribution on our common units, our partnership

agreement permits us to borrow funds, which would enable us to make this

distribution on all of our outstanding units.

The

control of our General Partner may be transferred to a third party without our

consent.

Our

General Partner may directly or indirectly sell, convey, pledge or otherwise

transfer its interest to a third party in a merger or consolidation or in a

sale or transfer of all or substantially all of its assets, in each case without

our consent or the consent of our common unit holders. Furthermore, ownership

interest in our General Partner or its constituent members may be directly or

indirectly sold, transferred, assigned, encumbered, hypothecated or pledged, in

whole or in part, without our approval.

A new

General Partner or new interest holders within the constituent members of the

General Partner may not be willing or able to acquire new properties and could

acquire properties that have investment objectives and governing terms that

differ materially from those of our current properties. A new owner could also

have a different investment philosophy, employ investment professionals who are

less experienced, be unsuccessful in identifying investment opportunities or

have a track record that is not as successful as our track record. If any of the

foregoing were to occur, we could experience difficulty in acquiring new

properties, and the value of our portfolio of properties, our business, our

results of operations and our financial condition could materially

suffer.

We

are a Delaware limited partnership, and there are certain provisions in our

limited partnership agreement regarding exculpation and indemnification of our

officers and directors that differ from the Delaware General Corporation Law in

a manner that may be less protective of the interests of our common unit

holders.

Our

limited partnership agreement provides that the directors and officers of our

General Partner do not have liability to us for acts or omissions. In contrast,

under the Delaware General Corporation Law, a corporation can only indemnify

directors and officers for acts or omissions if the director or officer acted in

good faith, in a manner he reasonably believed to be in the best interests of

the corporation and, in criminal action, if the officer or director had no

reasonable cause to believe his conduct was unlawful. Therefore, our limited

partnership agreement is less protective of the interests of our common unit

holders when compared to the Delaware General Corporation Law, insofar as it

relates to the exculpation and indemnification of our officers and

directors.

Our

General Partner is not required to have a majority of independent directors on

its board of directors.

Generally,

a public company must have a majority of independent board members as defined by

both the Securities and Exchange Commission and the Nasdaq Stock Exchange.

We, however, are considered a “controlled company,” which is a company of which

more than 50% of the voting power is held by an individual, a group or another

company within the meaning of the Nasdaq Stock Exchange rules. Since our

General Partner has full voting power, we are a “controlled company,” and may

elect to not comply with certain corporate governance requirements of the Nasdaq

Stock Exchange, including, without limitation:

|

·

|

the

requirement that a majority of our board of directors consist of

independent directors;

|

12

|

·

|

the

requirement that if we have a nominating/corporate governance committee,

it must be composed entirely of independent directors; and

|

|

·

|

the

requirement that if we have a compensation committee, it must be composed

entirely of independent directors.

|

Our board

is not currently, and in the future will not be, comprised of a majority of

independent directors. Accordingly, you will not have the same protections

afforded to stockholders of companies that are subject to all of the corporate

governance requirements of the Nasdaq Stock Exchange.

Our ability to sell equity to expand

our business will depend, in part, on the market price of our common units, and

our failure to meet market expectations with respect to our business could

negatively affect the market price of our common units and limit

our ability to sell equity.

The

availability of equity capital to us will depend, in part, on the market price

of our common units which, in turn, will depend upon various market conditions

and other factors that will change from time to time,

including:

|

•

|

analyst

reports about us and the master limited partnership industry, the extent

of investor interest and our financial performance and that of our

tenants;

|

|

•

|

general

economic, credit market and real estate market

conditions

|

|

•

|

the

general reputation of master limited partnerships and the attractiveness

of their equity securities in comparison to other equity securities,

including securities issued by other real estate-based

companies;

|

|

•

|

general

units and bond market conditions, including changes in interest rates on

fixed income securities, which may lead prospective purchasers of our

common units to demand a higher annual yield from future

distributions;

|

|

•

|

our

ability to satisfy the distribution requirements applicable to master

limited partnerships;

|

|

•

|

a

failure to maintain or increase our cash distribution, which is dependent,

to a large part, upon increased revenue from additional

acquisitions and rental

increases; and

|

|

•

|

other

factors such as governmental regulatory action and changes in master

limited partnerships tax

laws.

|

Our

failure to meet the market’s expectation with regard to future earnings and cash

distributions would likely adversely affect the market price of our common units

and, as a result, the availability of equity capital to us.

We

will rely on external sources of capital to fund future capital needs, and if we

encounter difficulty in obtaining such capital, we may not be able to make

future acquisitions necessary to grow our business.

We

expect to rely on internal and external sources of capital, including

intercompany loans, debt and equity financing, to fund future capital needs.

However, the recent U.S. and global economic crisis has resulted in a

capital environment characterized by limited availability, increasing costs and

significant volatility. If we are unable to repay intercompany loans or unable

to obtain needed capital on satisfactory terms or at all, we may not be able to

make the investments needed to expand our business. Our access to capital will

depend upon a number of factors over which we have little or no control,

including general market conditions, the market’s perception of our current and

potential future earnings and cash distributions and the market price of the

shares of our common units. We may not be in a position to take advantage of

attractive investment opportunities for growth if we are unable to access the

capital markets on a timely basis or on favorable

terms;

We may be unable to complete

acquisitions that would grow our business, and even if consummated, we may fail to

successfully integrate and operate acquired

properties.

Our

growth strategy includes the disciplined acquisition of properties as

opportunities arise. Our ability to acquire properties on satisfactory terms and

successfully integrate and operate them is subject to the following significant

risks:

|

|

·

|

we

may be unable to acquire desired properties because of competition from

other real estate investors with more capital, including but not limited

to other master limited partnerships, publically traded

partnerships, real estate operating companies, REITs,

publically traded companies and investment funds, and such

competition may significantly increase the purchase price of a

desired property;

|

13

|

|

·

|

tenancies

in new acquisitions may terminate and vacancies may not be

filled.

|

|

·

|

the

process of acquiring or pursuing the acquisition of a new property may

divert the attention of our senior management team from our existing

business operations;

|

|

·

|

agreements

for the acquisition of properties are typically subject to customary

conditions to closing, including satisfactory completion of due diligence

investigations, and we may spend significant time and money on potential

acquisitions that we do not consummate because, among other things, due

diligence reveals unsatisfactory conditions based upon which purchases

would be declined or the sellers are unable to satisfy conditions to

closing;

|

|

·

|

we

may acquire properties without any recourse, or with only limited

recourse, for liabilities, whether known or unknown, such as clean-up of

environmental contamination, casualty, condemnation, claims by tenants,

vendors or other persons against the former owners of the properties and

claims for indemnification by general partners, directors, officers and

others indemnified by the former owners of the

properties;

|

|

·

|

we

may be unable to quickly and efficiently integrate new acquisitions,

particularly acquisitions of portfolios of properties, into our existing

operations; and

|

|

·

|

we

may need to spend more than budgeted amounts to make necessary

improvements or renovations to acquired

properties.

|

|

·

|

we may not locate

suitable assets for acquisition based on the costs or other factors unique

to potential real property

acquisitions.

|

With respect to loans that we may

make or have acquired, we may not be able to acquire the real property

collateral as a result of defenses that a borrower may successfully assert or as

a result of bankruptcy protection or other judicial remedies that a borrower may

invoke.

If we

cannot complete property acquisitions on favorable terms, or operate acquired

properties to meet our goals or expectations, our business, financial condition,

results of operations, cash flow, per unit trading price of our common units and

our ability to make distributions to our unit holders will be materially and

adversely affected.

We may be unable to successfully

expand our operations

into new markets.

If the

opportunity arises, we may explore acquisitions of properties in new markets.

Each of the risks applicable to our ability to acquire and successfully

integrate and operate properties in our current markets is also applicable to

our ability to acquire and successfully integrate and operate properties in new

markets. In addition to these risks, we may not possess the same level of

familiarity with the dynamics and market conditions of any new markets that we

may enter, which could adversely affect our ability to expand into or

operate in those markets. We may be unable to achieve a desired return on our

investments in new markets. If we are unsuccessful in expanding into new

markets, it could adversely affect our business, financial condition and results

of operations.

If we sell properties and provide

financing to purchasers, defaults by the purchasers would adversely affect our

cash flows.

If we

decide to sell any of our properties, we presently intend to use our best

efforts to sell them for cash. However, in some instances, we may sell our

properties by providing financing to purchasers. If we provide financing to

purchasers, we will bear the risk that the purchaser may default or invoke

chapter 11 bankruptcy protection in connection with which an automatic stay may

not be lifted, in each case which would negatively impact our cash distributions

to unit holders and result in litigation and related expenses to foreclose on

the property. Even in the absence of a purchaser default, the distribution of

the proceeds of sales to our unit holders, or their reinvestment in other

assets, will be delayed until the promissory notes or other property we may

accept upon a sale are actually paid, sold, foreclosed or

refinanced.

14

As

a result of being a public company, we must implement certain financial and

accounting systems, procedures and controls, which will increase our costs and

require substantial management time and attention.

As a

public company, we will incur significant legal, accounting and other expenses

that we would not incur as a private company, including costs associated with

public company reporting and corporate governance requirements under

the Sarbanes-Oxley Act of 2002. For example, in order to comply with such

reporting requirements, we must have a process for evaluating our internal

control systems in order to allow management to report on, and our independent

registered public accounting firm to attest to, our internal control over

financial reporting, as required by Section 404 of the Sarbanes-Oxley Act.

Effective internal and disclosure controls are necessary for us to provide

reliable financial reports and effectively prevent fraud and to operate

successfully as a public company. If we fail to implement proper overall

business controls, our results of operations could be harmed and to the extent

that any material weakness or significant deficiency exists in our consolidated

subsidiaries’ internal control over financial reporting, such material weakness

or significant deficiency may adversely affect our ability to provide timely and

reliable financial information necessary for the conduct of our business and

satisfaction of our reporting obligations under federal securities laws, which

could also affect our ability to list and remain listed on Nasdaq. In

addition, if we identify significant deficiencies or material weaknesses in our

internal control over financial reporting that we cannot remediate in a timely

manner, or if we are unable to receive an unqualified report from our

independent registered public accounting firm with respect to our internal

control over financial reporting, investors and others may lose confidence in

the reliability of our financial statements and the trading price of our common

units and our ability to obtain any necessary equity or debt financing could

suffer.

Furthermore,