Attached files

| file | filename |

|---|---|

| EX-32 - HUIHENG MEDICAL, INC. | v194766_ex32.htm |

| EX-31.1 - HUIHENG MEDICAL, INC. | v194766_ex31-1.htm |

| EX-31.2 - HUIHENG MEDICAL, INC. | v194766_ex31-2.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

x QUARTERLY REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

Quarterly Period Ended June 30, 2010

¨ TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from _____ to _____.

Commission File No.

333-132056

HUIHENG MEDICAL,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Nevada

|

20-4078899

|

|

|

(State

or Other Jurisdiction

Of

Incorporation or Organization)

|

(I.R.S.

Employer Identification

Number)

|

|

|

Huiheng Building, Gaoxin 7 Street

South,

Keyuannan Road, Nanshan

District,

Shenzhen Guangdong, P.R. China

518057

|

N/A

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code 86-755-25331366

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports); and (2) has been subject to such filing requirements for

the past 90 days.

|

Yes

¨ No

x

|

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

|

Yes

¨ No

¨

|

Indicate

by checkmark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-3 of the Exchange Act.

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

(Do

not check if a smaller reporting company)

|

|||

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

|

Yes

¨ No

x

|

As of

August 2, 2010, there were 13,935,290 shares of the issuer’s $0.001 par value

common stock issued and outstanding.

HUIHENG

MEDICAL, INC.

FORM

10-Q INDEX

|

Page

|

||

|

PART

I – FINANCIAL INFORMATION

|

||

|

Item

1. Financial Statements

|

||

|

Consolidated

Balance Sheets at June 30, 2010 (Unaudited) and December 31,

2009

|

1

|

|

|

Consolidated

Statements of Income for the Six Months Ended June 30, 2010 and 2009

(Unaudited)

|

2

|

|

|

Consolidated

Statements of Changes in Stockholders’ Equity and Other Comprehensive

Income for the Six Months Ended June 30, 2010 (Unaudited)

|

3

|

|

|

Consolidated

Statements of Cash Flows for the Six Months Ended June 30, 2010 and 2009

(Unaudited)

|

4

|

|

|

Notes

to the Consolidated Financial Statements (Unaudited)

|

5

|

|

|

Item

2. Management’s Discussion and Analysis of Financial Condition

and

Results of Operations

|

22

|

|

|

Item

3. Quantitative and Qualitative Disclosures About Market

Risk

|

29

|

|

|

Item

4T. Controls and Procedures

|

29

|

|

|

PART

II – OTHER INFORMATION

|

||

|

Item

1. Legal Proceedings

|

30

|

|

|

Item

1A. Risk Factors

|

30

|

|

|

Item

2. Unregistered Sales of Equity Securities and Use of

Proceeds

|

30

|

|

|

Item

3. Defaults Upon Senior Securities

|

30

|

|

|

Item

4. [Removed and Reserved]

|

30

|

|

|

Item

5. Other Information

|

30

|

|

|

Item

6. Exhibits

|

30

|

|

|

Signature

Page

|

|

32

|

In

this Quarterly Report on Form 10-Q, references to “dollars” and “$” are to

United States dollars and, unless the context otherwise requires, references to

“we,” “us”, “our” and the Company refer to Huiheng Medical, Inc. and its

consolidated subsidiaries.

This

Quarterly Report contains certain forward-looking statements. When

used in this Quarterly Report, statements which are not historical in nature,

including the words “anticipate,” “estimate,” “should,” “expect,” “believe,”

“intend,” “may,” “project,” “plan” or “continue,” and similar expressions are

intended to identify forward-looking statements. They also include

statements containing anticipated business developments, a projection of

revenues, earnings or losses, capital expenditures, dividends, capital structure

or other financial terms.

The

forward-looking statements in this Quarterly Report are based upon management’s

beliefs, assumptions and expectations of our future operations and economic

performance, taking into account the information currently available to

them. These statements are not statements of historical

fact. Forward-looking statements involve risks and uncertainties,

some of which are not currently known to us that may cause our actual

results, performance or financial condition to be materially different from the

expectations of future results, performance or financial condition we express or

imply in any forward-looking statements. These forward-looking

statements are based on our current plans and expectations and are subject

to a number of uncertainties and risks that could significantly affect current

plans and expectations and our future financial condition and

results.

We

undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise. In light of these risks, uncertainties and assumptions,

the forward-looking events discussed in this filing might not

occur. We qualify any and all of our forward-looking statements

entirely by these cautionary factors. As a consequence, current

plans, anticipated actions and future financial conditions and results may

differ from those expressed in any forward-looking statements made by or on our

behalf. You are cautioned not to unduly rely on such forward-looking

statements when evaluating the information presented

herein.

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

HUIHENG

MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

( IN US

DOLLARS)

|

June 30, 2010

(Unaudited)

|

December 31,

2009

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT

ASSETS:

|

||||||||

|

Cash

|

$ | 123,287 | $ | 84,962 | ||||

|

Accounts

receivable, net of allowance for doubtful accounts of $903,353 and

$897,319, as of June 30, 2010 and December 31, 2009,

respectively

|

17,177,023 | 16,499,819 | ||||||

|

Prepaid

expenses

|

3,347,364 | 3,058,465 | ||||||

|

Other

receivables, net of allowance for doubtful accounts of $737,311 and

$732,386 as of June 30, 2010 and December 31, 2009,

respectively

|

296,976 | 248,790 | ||||||

|

Inventories

|

1,900,727 | 1,359,900 | ||||||

|

Total

Current Assets

|

22,845,377 | 21,251,936 | ||||||

|

INVESTMENT

IN AFFILIATE

|

88,190 | 43,152 | ||||||

|

PROPERTY,

PLANT AND EQUIPMENT, net

|

2,450,569 | 2,520,787 | ||||||

|

LAND

USE RIGHT, NET

|

936,241 | 939,575 | ||||||

|

INTANGIBLE

ASSETS, NET

|

990,772 | 777,086 | ||||||

|

OTHER

RECEIVABLES, net of current portion

|

1,451,168 | 1,582,093 | ||||||

|

Total

Assets

|

$ | 28,762,317 | $ | 27,114,629 | ||||

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

||||||||

|

CURRENT

LIABILITIES:

|

||||||||

|

Accounts

payable

|

$ | 788,446 | $ | 844,539 | ||||

|

Amount

due to related parties

|

374,726 | 24,560 | ||||||

|

Income

tax payable

|

639,832 | 389,632 | ||||||

|

Accrued

liabilities and other payables

|

1,624,559 | 1,676,639 | ||||||

|

Total

Current Liabilities

|

3,427,563 | 2,935,370 | ||||||

|

STOCKHOLDERS’

EQUITY:

|

||||||||

|

Preferred

stock, $0.001 par value; 1,000,000 shares authorized; Designated 300,000

shares of Series A convertible preferred stock; 220,467 shares issued and

outstanding with liquidation preference of $8,267,513 at June 30,

2010 and December 31, 2009

|

220 | 220 | ||||||

|

Common

stock, $0.001 par value; 74,000,000 shares authorized; 23,635,290 shares

issued, 13,935,290 shares outstanding

|

23,635 | 23,635 | ||||||

|

Treasury

stock, 9,700,000 common shares, at cost

|

(9,700 | ) | (9,700 | ) | ||||

|

Additional

paid-in capital

|

7,498,086 | 7,498,086 | ||||||

|

Retained

earnings

|

14,937,078 | 13,799,481 | ||||||

|

Accumulated

other comprehensive income Foreign currency translation

gain

|

1,922,100 | 1,756,510 | ||||||

|

Non-controlling

interests

|

963,335 | 1,111,027 | ||||||

|

Total

Stockholders’ Equity

|

25,334,754 | 24,179,259 | ||||||

|

Total

Liabilities and Stockholders’ Equity

|

$ | 28,762,317 | $ | 27,114,629 | ||||

See

accompanying notes to the consolidated financial statements.

1

HUIHENG

MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED)

(IN US

DOLLARS)

|

For

The Three Months Ended

|

For

The Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

REVENUES

|

$ | 1,436,905 | $ | 2,364,189 | $ | 2,837,758 | $ | 3,762,808 | ||||||||

|

COST

OF REVENUES

|

201,494 | 191,566 | 297,926 | 333,912 | ||||||||||||

|

GROSS

PROFIT

|

1,235,411 | 2,172,623 | 2,539,832 | 3,428,896 | ||||||||||||

|

OPERATING

EXPENSES:

|

||||||||||||||||

|

Sales

and marketing expenses

|

60,098 | 78,158 | 122,221 | 143,619 | ||||||||||||

|

General

and administrative expenses

|

654,069 | 566,197 | 1,149,817 | 1,434,853 | ||||||||||||

|

Research

and development costs

|

21,498 | 118,485 | 36,838 | 207,889 | ||||||||||||

|

Total

Operating Expenses

|

735,665 | 762,840 | 1,308,876 | 1,786,361 | ||||||||||||

|

OPERATING

INCOME

|

499,746 | 1,409,783 | 1,230,956 | 1,642,535 | ||||||||||||

|

OTHER

INCOME / (EXPENSES)

|

||||||||||||||||

|

Interest

income

|

61 | 59 | 104 | 175 | ||||||||||||

|

Gain

on business acquisition

|

21,508 | - | 21,508 | - | ||||||||||||

|

Equity

in income / (loss) of affiliate

|

55,042 | (10,851 | ) | 44,502 | 16,579 | |||||||||||

|

Total

Other Income / (Expenses)

|

76,611 | (10,792 | ) | 66,114 | 16,754 | |||||||||||

|

NET

INCOME BEFORE INCOME TAXES

|

576,357 | 1,398,991 | 1,297,070 | 1,659,289 | ||||||||||||

|

INCOME

TAXES

|

186,355 | 212,010 | 313,782 | 345,687 | ||||||||||||

|

NET

INCOME

|

390,002 | 1,186,981 | 983,288 | 1,313,602 | ||||||||||||

|

NET

LOSS ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

|

91,172 | 42,177 | 154,309 | 117,812 | ||||||||||||

|

NET

INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS

|

$ | 481,174 | $ | 1,229,158 | $ | 1,137,597 | $ | 1,431,414 | ||||||||

|

EARNINGS

PER SHARE

|

||||||||||||||||

|

-

Basic

|

$ | 0.03 | $ | 0.09 | $ | 0.08 | $ | 0.10 | ||||||||

|

-

Diluted

|

$ | 0.03 | $ | 0.08 | $ | 0.07 | $ | 0.09 | ||||||||

|

Weighted

Common Shares Outstanding

|

||||||||||||||||

|

-

Basic

|

13,935,290 | 13,914,282 | 13,935,290 | 13,910,800 | ||||||||||||

|

-

Diluted

|

16,251,113 | 16,251,113 | 16,251,113 | 16,251,113 | ||||||||||||

See

accompanying notes to the consolidated financial statements.

2

HUIHENG

MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY AND OTHER COMPREHENSIVE

INCOME

FOR THE

SIX MONTHS ENDED JUNE 30, 2010 (UNAUDITED)

(IN US

DOLLARS)

|

Series

A Preferred Stock

|

Common

Stock

|

Accumulated

|

||||||||||||||||||||||||||||||||||

|

Number

of

Shares

|

Amount

|

Number

of

Shares

|

Amount

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Other

Comprehensive

Income

|

Non-controlling

interests

|

Total

Stockholders’

Equity

|

||||||||||||||||||||||||||||

|

Balance,

December 31, 2009

|

220,467 | $ | 220 | 13,935,290 | $ | 13,935 | $ | 7,498,086 | $ | 13,799,481 | $ | 1,756,510 | $ | 1,111,027 | $ | 24,179,259 | ||||||||||||||||||||

|

Comprehensive

income:

|

||||||||||||||||||||||||||||||||||||

|

Net

income / (loss)

|

- | - | - | - | - | 1,137,597 | - | (154,309 | ) | 983,288 | ||||||||||||||||||||||||||

|

Foreign

currency translation gain

|

- | - | - | - | - | - | 165,590 | 6,617 | 172,207 | |||||||||||||||||||||||||||

|

Total

comprehensive income

|

- | - | - | - | - | - | - | - | 1,155,495 | |||||||||||||||||||||||||||

|

Balance,

June 30, 2010

|

220,467 | $ | 220 | 13,935,290 | $ | 13,935 | $ | 7,498,086 | $ | 14,937,078 | $ | 1,922,100 | $ | 963,335 | $ | 25,334,754 | ||||||||||||||||||||

See

accompanying notes to the consolidated financial

statements.

3

HUIHENG

MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

(IN US

DOLLARS)

|

For

The Six Months Ended

|

||||||||

|

June

30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Cash

flows from operating activities:

|

||||||||

|

Net

income

|

$ | 983,288 | $ | 1,313,602 | ||||

|

Adjustments

to reconcile net income to net cash used in operating

activities:

|

||||||||

|

Depreciation

of property, plant and equipment

|

121,526 | 122,540 | ||||||

|

Recovery

of bad debts

|

(731,989 | ) | ||||||

|

Amortization

of land use rights

|

9,599 | 7,984 | ||||||

|

Amortization

of intangible assets

|

41,310 | 41,230 | ||||||

|

Write

off of deferred offering costs

|

- | 460,209 | ||||||

|

Equity

in income of affiliate

|

(44,502 | ) | (16,579 | ) | ||||

|

Gain

on acquisition of subsidiary

|

(21,508 | ) | - | |||||

|

Changes

in assets and liabilities:

|

||||||||

|

Accounts

receivable

|

(677,204 | ) | (1,072,961 | ) | ||||

|

Prepaid

expenses

|

(288,899 | ) | (292,498 | ) | ||||

|

Other

receivables

|

82,739 | 265,603 | ||||||

|

Inventories

|

(540,827 | ) | (246,759 | ) | ||||

|

Accounts

payable

|

(56,093 | ) | (152,256 | ) | ||||

|

Income

tax payable

|

250,200 | 345,737 | ||||||

|

Accrued

liabilities and other payables

|

(52,080 | ) | (137,357 | ) | ||||

|

Net

cash used in operating activities

|

(192,451 | ) | (93,494 | ) | ||||

|

Cash

flows from investing activities:

|

||||||||

|

Capital

expenditures on addition of property, plant and equipment

|

(3,522 | ) | - | |||||

|

Advance

from related party

|

90,000 | |||||||

|

Repayment

of advances to related party

|

731,989 | |||||||

|

Payment

for land use right

|

- | (956,226 | ) | |||||

|

Net

cash provided by / (used in) investing activities

|

86,478 | (224,237 | ) | |||||

|

Net

decrease in cash

|

(105,973 | ) | (317,731 | ) | ||||

|

Effect

on change of exchange rates

|

144,298 | (22,216 | ) | |||||

|

Cash

as of January 1

|

84,962 | 1,019,176 | ||||||

|

Cash

as of June 30

|

$ | 123,287 | $ | 679,229 | ||||

|

Supplemental

disclosures of cash flow information:

|

||||||||

|

Cash

paid during the period for:

|

||||||||

|

Interest

paid

|

$ | - | $ | - | ||||

|

Income

tax paid

|

$ | 67,562 | $ | - | ||||

Acquisition

of subsidiary:

During

the period the group acquired subsidiary, Portola Medical, Inc., the fair value

of assets acquired and liabilities assumed were as follows:

|

Plant

and equipment

|

$ | 31,508 | ||

|

Intangible

assets

|

250,000 | |||

| 281,508 | ||||

|

Less:

Cash consideration paid

|

(260,000 | ) | ||

|

Gain

on acquisition of Portola Medical, Inc.

|

$ | 21,508 |

See

accompanying notes to the consolidated financial statements.

4

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

1 - ORGANIZATION AND OPERATIONS

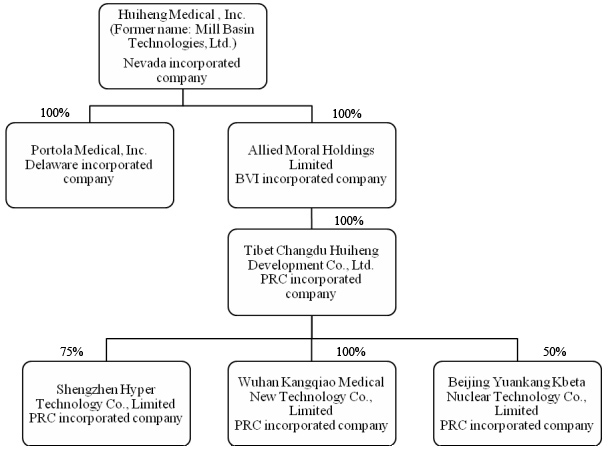

Huiheng

Medical, Inc. (“the Company” or “Huiheng”), formerly known as Mill Basin

Technologies, Limited (“Mill Basin”), is a China-based medical device company

that, through its subsidiaries, designs, develops and markets radiation therapy

systems used for the treatment of cancer. The Company is a Nevada

holding company and conducts all of its business through operating subsidiaries

in China.

Acquisition

of New Subsidiary

On June

7, 2010, the Company acquired a new wholly-owned subsidiary, Portola Medical,

Inc. with authorized 100 common shares with par value $0.01 per share which

registered capital of $1 in Delaware, USA, for the purpose of expanding the

product line.

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis

of Presentation

The

consolidated financial statements include all accounts of the Company and its

wholly-owned and majority-owned subsidiaries. All material

inter-company balances and transactions have been eliminated in

consolidation.

The

accompanying unaudited consolidated financial statements were prepared in

accordance with U.S. generally accepted accounting principles (“GAAP”) for

interim financial information and with the instructions to Form 10-Q and Article

10 of Regulation S-X. Accordingly, they may not include all of the information

and footnotes required by GAAP for complete consolidated financial statements.

All adjustments that are, in the opinion of management, of a normal recurring

nature and are necessary for a fair presentation of the consolidated financial

statements have been included. Nevertheless, these consolidated financial

statements should be read in conjunction with the Company’s audited consolidated

financial statements contained in its Annual Report on Form 10-K for the year

ended December 31, 2009 as filed with the Securities and Exchange Commission on

April 15, 2010. The results of operation for the six months ended June 30, 2010,

are not necessarily indicative of the results that may be expected for the

entire fiscal year or any other interim period.

The

Company’s common stock is listed on the Over-the-counter Bulletin Board

(“OTCBB”) market and traded under the symbol “HHGM”.

5

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies

Estimates

The

preparation of the financial statements in accordance with US GAAP requires

management of the Company to make a number of estimates and assumptions relating

to the reported amounts of assets and liabilities and the disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the years. Significant

items subject to such estimates and assumptions include the recoverability of

the carrying amount and the estimated useful lives of long-lived assets;

valuation allowances for receivables and realizable values for inventories.

Actual results could differ from those estimates in consolidation.

Accounts

receivable

Accounts

receivable are recorded at the invoiced amount, net of allowances for doubtful

accounts, sales returns, trade discounts and value added tax. The allowance for

doubtful accounts is the Company’s best estimate of the amount of probable

credit losses in the Company’s existing accounts

receivable. The Company performs ongoing credit evaluations of

its customers’ financial conditions. The Company provided an allowance of

$903,353 and $897,319 for doubtful accounts respectively as of June 30, 2010 and

December 31, 2009.

Outstanding

account balances are reviewed individually for collectability. Account balances

are charged off against the allowance after all means of collection have been

exhausted and the potential for recovery is considered remote.

Inventories

The

Company values inventories, consisting of work in process and raw materials, at

the lower of cost or market. Cost of material is determined on the

weighted average cost method. Cost of work in progress includes direct

materials, direct production cost and an allocated portion of production

overhead.

The final

steps of assembly of our products, including installation of radioactive service

materials, are completed at customer locations. Accordingly, the Company

generally does not carry finished goods (inventory held for sale in the ordinary

course of business) inventory.

Property,

plant and equipment

Property,

plant and equipment are recorded at cost less accumulated

depreciation. Expenditures for major additions and betterments are

capitalized. Maintenance and repairs are charged to general and

administrative expenses as incurred. Depreciation of property, plant and

equipment is computed by the straight-line method (after taking into account

their respective estimated residual values) over the assets estimated useful

lives ranging from three to twenty years. Building improvements are amortized on

a straight-line basis over the estimated useful life. Depreciation of property,

plant and equipment are stated at cost less accumulated

depreciation. Upon sale or retirement of property, plant and

equipment, the related cost and accumulated depreciation are removed from the

accounts and any gain or loss is reflected in operations. The estimated useful

lives of the assets are as follows:

|

Estimated Life

|

||

|

Building

improvements

|

3 to 5

|

|

|

Buildings

|

20

|

|

|

Production

equipment

|

3 to 5

|

|

|

Furniture

fixtures and office equipment

|

3 to 5

|

|

|

Motor

vehicles

|

|

5 to 10

|

6

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Land

use right

Land use

rights represent the prepayments for the use of the parcels of land in PRC where

the Company charged to expense over their respective lease periods of 50

years. According to the laws of the PRC, the government owns all of

the land in the PRC. Companies or individuals are authorized to possess and use

the land only through land use rights granted by the PRC government for a

certain period usually 50 years.

Intangible

assets

The

Company’s intangible assets include patent and pending patents

applications. The Company accounts for its intangible assets pursuant

to FASB ASC Subtopic 350-30, “General Intangibles Other Than Goodwill”. Under

ASC 350-30-35, intangibles with definite lives are amortized on a straight-line

basis over the lesser of their estimated useful lives or contractual terms.

Accordingly, the Company amortizes the patent over their remaining legal term of

20 years, on a straight-line basis.

Effective

January 1, 2010, the Company adopted the provisions in ASU 2010-06, “Fair Value

Measurements and Disclosures (ASC Topic 820): Improving Disclosures about Fair

Value Measurements, which requires new disclosures related to transfers in and

out of levels 1 and 2 and activity in level 3 fair value measurements, as well

as amends existing disclosure requirements on level of disaggregation and inputs

and valuation techniques. The adoption of the provisions in ASU 2010-06 did not

have a material impact on the Company’s consolidated financial

statements.

|

Estimated Life

|

||

|

Patented

technology

|

20

|

Investment

in affiliate

The

Company owns a 50% equity interest of Beijing Yuankang Kbeta Nuclear Technology

Company, Ltd (“Beijing Kbeta”) and accounts for the investment using the equity

method of accounting. The equity method is utilized as the Company has the

ability to exercise significant influence over the investee, but does not have a

controlling financial interest.

If

circumstances indicate that the carrying value of the Company’s investment in

Beijing Kbeta may not be recoverable, the Company would recognize an impairment

loss by writing down its investment to its estimated net realizable value if

management concludes such impairment is other than

temporary.

7

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Impairment

of long-lived assets

Long-lived

assets, which include tangible assets and intangible assets, are reviewed for

impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable.

Recoverability

of long-lived assets to be held and used is measured by a comparison of the

carrying amount of the asset to the estimated undiscounted future cash flows

expected to be generated by the asset. If the carrying amount of an asset

exceeds its estimated undiscounted future cash flows, an impairment charge is

recognized by the amount by which the carrying amount of the asset exceeds the

fair value of the asset. Assets to be disposed of, if any, are separately

presented in the balance sheet and reported at the lower of the carrying amount

or fair value less costs to sell, and are no longer depreciated. At

June 30, 2010 and 2009, the Company determined that there was no impairment of

value.

Fair

value of financial instruments

The fair

value of a financial instrument is the amount at which the instrument could be

exchanged in a current transaction between willing parties. The carrying amounts

of financial assets and liabilities, such as cash, accounts receivable, current

income tax assets, prepaid expenses and other current assets, accounts payable,

income taxes payable, accrued expenses and other current liabilities,

approximate their fair values because of the short maturity of these instruments

and market rates of interest.

Revenue

recognition

The

Company generates revenue primarily from sales of medical equipment and the sale

of maintenance and support services. Revenue is recognized as

follows:

|

(i)

|

Sales

of medical equipment

|

The

Company recognizes revenue when products are delivered and the customer takes

ownership and assumes risk of loss, collection of the relevant receivable is

probable, persuasive evidence of an arrangement exists and the sales price is

fixed or determinable. The sales price of the medical equipment includes the

training services, which generally take about 1 month. These services are

ancillary to the purchase of medical equipment by customers and are normally

considered by the customers to be an integral part of the acquired equipment. As

training services do not have separately determinable fair values, the Company

recognizes revenue for the entire arrangement upon customer acceptance, which

occurs after delivery and installation.

In the

PRC, value added tax (“VAT”) of 17% on invoiced amounts is collected in respect

of the sales of goods on behalf of tax authorities. The VAT collected is not

revenue of the Company; instead, the amount is recorded as a liability on the

balance sheet until such VAT is paid to the authorities.

Pursuant

to the laws and regulations of the PRC, Shenzhen Hyper is entitled to a refund

of VAT on the sales of self-developed software embedded in medical equipment.

The VAT refund represents the amount of VAT collected from customers and paid to

the authorities in excess of 3% of relevant sales. The amount of VAT refund is

calculated on a monthly basis. As the refund relates directly to the sale of

self-developed software that is embedded in the Company’s products, the Company

recognizes the VAT refund at the time the product is sold. The amount is

included in the line item “Revenues” in the consolidated statements of income

and is recorded on an accrual basis.

8

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Revenue

recognition (…/Cont’d)

The

medical equipment sold by the Company has embedded self-developed software which

can also be sold on a standalone basis.

|

(ii)

|

Provision

of maintenance and support services

|

The

Company also provides comprehensive post-sales services to certain distributors

for medical equipment used by hospitals. These contracts are negotiated and

signed independently and separately from the sales of medical equipments. In

accordance with the agreements, the Company provides comprehensive services

including replace of cobalt, additional training to users of the medical

equipment, maintenance of medical equipment, software upgrades and consulting.

Fees for these services are recognized over the life of the contract on a

monthly basis.

Government

subsidies

Pursuant

to the confirmation of tax position of Changdu Huiheng dated December 16, 2004

with No.173 issued by Tibet Finance Bureau, the profits tax payment of Changdu

Huiheng in excess of RMB 900,000 for a year will be refundable by Tibet Finance

Bureau. The 31% of business tax payment will be refundable by Tibet Finance

Bureau provided that the business tax payment exceeds RMB 1.0 million for a

year. The 38.75% of value added tax payment will be refundable by Tibet Finance

Bureau provided that the value added tax payment exceeds RMB 1.5 million for a

year. All tax incentive policies will be valid for five (5) years from the year

of commencement of tax refund, starting from September 2006.

Warranty

The

Company provides a product warranty to its customers to repair any product

defects that occur generally within twelve months from the date of sale. The

Company’s purchase contracts generally allow the customer to withhold up to 10%

of the total purchase price for the duration of the warranty period and included

in Accounts receivable. Based on the limited number of actual warranty claims

and the historically low cost of such repairs, the Company has not recognized a

liability for warranty claims, but rather recognizes such cost when product

repairs are made.

Research

and development costs

Research

and development costs are charged to expense as incurred. Research and

development costs mainly consist of remuneration for the research and

development staff and material costs for research and development. The Company

incurred $36,838 and $207,889 for the three months ended June 30, 2010 and 2009,

respectively.

9

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Income

taxes

The

Company accounts for income taxes under ASC 740 “Income Taxes”. Deferred income

tax assets and liabilities are determined based upon differences between the

financial reporting and tax bases of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences

are expected to reverse. Deferred tax assets are reduced by a valuation

allowance to the extent management concludes it is more likely than not that the

assets will not be realized. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is

recognized in the statements of operations in the period that includes the

enactment date.

During

2008, the Company adopted ASC740 “Income Taxes”, which prescribes a

more-likely-than-not threshold for financial statement recognition and

measurement of a tax position taken in the tax return. This interpretation also

provides guidance on de-recognition of income tax assets and liabilities,

classification of current and deferred income tax assets and liabilities,

accounting for interest and penalties associated with tax positions, accounting

for income taxes in interim periods and income tax disclosures.

Foreign

currency translation

Assets

and liabilities of foreign subsidiaries are translated at the rate of exchange

in effect on the balance sheet date; income and expenses are translated at the

average rate of exchange prevailing during the period. The related transaction

adjustments are reflected in “Accumulated other comprehensive income / (loss)”

in the equity section of our consolidated balance sheet.

The

average monthly exchange rates for period ended June 30, 2010 and the closing

rate as of June 30, 2010 were RMB 6.8189 and RMB 6.7814 to one USD,

respectively. The average monthly exchange rates for period ended June 30, 2009

and the closing rate as of June 30, 2009 were RMB 6.8322 and RMB 6.8307 to one

USD, respectively.

Stock

Option Plan

During

2009, the Company adopted a stock option plan (the “Plan”) for selected

employees, directors, consultants to promote the success of the Company’s

business by offering these individuals an opportunity to acquire a proprietary

interest in the Company. The Plan provides both for direct awards of

shares and for the granting of options to purchase shares as determined by the

Administrator at the time of the grant. The Plan replaces the

Company’s 2007 Share Plan which was never approved by the Company’s

shareholders. Under the Plan, 1,566,666 shares have been reserved for awards.

The number of shares reserved under the Plan is the same number that was

reserved under the Company’s 2007 Stock Option Plan.

Awards

under the Plan will be accounted for in accordance with ASC 718 “Stock

Compensation”.

10

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Other

comprehensive income

The

Company has adopted ASC 220 “Comprehensive Income”. This statement establishes

rules for the reporting of other comprehensive income and its

components. Other comprehensive income consists of net income and

foreign currency translation adjustments and is presented in the Consolidated

Statements of Income and the Consolidated Statement of Changes in Stockholders’

Equity.

Earnings

per share

The value

of basic earnings per share is computed on the basis of the weighted-average

number of shares of our common stock outstanding during the period. Diluted

earnings per share is computed on the basis of the weighted-average number of

shares of our common stock plus the effect of dilutive potential common shares

outstanding during the period using the if-converted method. Dilutive potential

common shares include Series A Convertible Preferred Stock.

The

following table sets forth the computation of basic and diluted net income per

common share:

|

For

the Six Months Ended June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Net

income per common share

|

$ | 1,137,597 | $ | 1,431,414 | ||||

|

Weighted

average outstanding shares of common stock

|

13,935,290 | 13,910,800 | ||||||

|

Dilutive

effect of Convertible Preferred Stock

|

2,315,823 | 2,340,313 | ||||||

|

Diluted

weighted average outstanding shares

|

16,251,113 | 16,251,113 | ||||||

|

Earnings

per common share:

|

||||||||

|

Basic

|

$ | 0.08 | $ | 0.10 | ||||

|

Diluted

|

$ | 0.07 | $ | 0.09 | ||||

For the

six months ended June 30, 2010 options to purchase 30,000 common shares were not

included in diluted earnings per share because the effect would be

anti-dilutive.

Commitments

and contingencies

Liabilities

for loss contingencies arising from claims, assessments, litigation, fines and

penalties and other sources are recorded when it is probable that a liability

has been incurred and the amount of the assessment can be reasonably

estimated.

Segment

reporting

ASC 280

“Segment Reporting”, establishes standards for reporting information on

operating segments in interim and annual financial statements. The

Company operates in two segments (i) selling the medical equipment and, (ii)

providing the consultancy, repairs and maintenance services for the

customers. The chief operating decision-makers review the Company’s

operation results on an aggregate basis and manage the operations as two

operating segments as disclosed in note 13.

11

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Summary

of significant accounting policies (…/Cont’d)

Financial

instruments with characteristics of both liabilities and equity

The

Company accounts for its Series A Preferred Stock in accordance with ASC 480

“Distinguishing Liabilities from Equity” and ASC 815 “Derivatives and

Hedging”. We

have determined that our Series A Preferred Stock is not mandatorily redeemable.

Accordingly, the Company accounts for the Preferred stock as permanent

equity.

Non-controlling

interest in consolidated financial statements

In

December 2007, the FASB issued authoritative guidance related to non-controlling

interests in consolidated financial statements, which was an amendment of ARB

No. 51. This guidance is set forth in Topic 810 in the Accounting Standards

Codification (ASC 810). ASC 810 establishes accounting and reporting standards

for the non-controlling interest in a subsidiary and for the deconsolidation of

a subsidiary. This accounting standard is effective for fiscal years beginning

after December 15, 2008. The Company adopted the presentation and disclosure

requirements of ASC 810 retrospectively to the December 31, 2008 financial

statements.

Fair

value measurements

ASC Topic

820, Fair Value Measurement and Disclosures, defines fair value as the exchange

price that would be received for an asset or paid to transfer a liability (an

exit price) in the principal or most advantageous market for the asset or

liability in an orderly transaction between market participants on the

measurement date. This topic also establishes a fair value hierarchy which

requires classification based on observable and unobservable inputs when

measuring fair value. There are three levels of inputs that may be used to

measure fair value:

|

Level

1 -

|

Quoted

prices in active markets for identical assets or

liabilities.

|

|

Level

2 -

|

Observable

inputs other than Level 1 prices such as quoted prices for similar assets

or liabilities; quoted prices in markets that are not active; or other

inputs that are observable or can be corroborated by observable market

data for substantially the full term of the assets or

liabilities.

|

|

Level

3 -

|

Unobservable

inputs that are supported by little or no market activity and that are

significant to the fair value of the assets or

liabilities.

|

Determining

which category an asset or liability falls within the hierarchy requires

significant judgment. The Company evaluates its hierarchy disclosures each

quarter.

The

carrying values of cash and cash equivalents, account receivable, and account

payable, approximate fair values due to their short maturities.

There was

no asset or liability measured at fair value on a non-recurring basis as of June

30, 2010 or 2009.

12

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(…/Cont’d)

Impact

of new accounting standards

We

describe below recent pronouncements that have had or may have a significant

effect on our financial statements. We do not discuss recent pronouncements that

are not anticipated to have an impact on or are unrelated to our financial

condition, results of operations, or disclosures.

In June

2009, the FASB issued Updates No. 2009-01, which establishes the FASB Accounting

Standards Codification TM (the Codification) as the source of authoritative

accounting principles recognized by the FASB to be applied by nongovernmental

entities in the preparation of financial statements in conformity with generally

accepted accounting principles (GAAP). The Codification is effective for interim

and annual periods ending after September 15, 2009. We adopted the Codification

when referring to GAAP in this quarterly report on Form 10-Q for the fiscal

period ending June 30, 2010. The adoption of the Codification did not have an

impact on our consolidated results.

The FASB

issued authoritative guidance related to subsequent events in May 2009, which

establishes general standards of accounting for and disclosure of events that

occur after the balance sheet date but before the financial statements are

issued or are available to be issued. This guidance is set forth in Topic 855 in

the Accounting Standards Codification (ASC 855). ASC 855 provides guidance on

the period after the balance sheet date during which management of a reporting

entity should evaluate events or transactions that may occur for potential

recognition or disclosure in the financial statements, the circumstances under

which an entity should recognize events or transactions occurring after the

balance sheet date in its financial statements and the disclosures that an

entity should make about events or transactions that occurred after the balance

sheet date. We adopted ASC 855 and its application had no impact on our

consolidated financial statements.

In

October 2009, the FASB issued authoritative guidance that amends existing

guidance for identifying separate deliverables in a revenue-generating

transaction where multiple deliverables exist, and provides guidance for

allocating and recognizing revenue based on those separate deliverables. The

guidance is expected to result in more multiple-deliverable arrangements being

separable than under current guidance and is required to be applied

prospectively to new or significantly modified revenue arrangements. This

guidance, for which the Company is currently assessing the impact on its

financial condition and results of operations, will become effective for the

Company on January 1, 2011.

In

January 2010, the FASB issued authoritative guidance intended to improve

disclosures about fair value measurements. The guidance requires entities to

disclose significant transfers in and out of fair value hierarchy levels and the

reasons for the transfers and to present information about purchases, sales,

issuances and settlements separately in the reconciliation of fair value

measurements using significant unobservable inputs (Level 3). Additionally, the

guidance clarifies that a reporting entity should provide fair value

measurements for each class of assets and liabilities and disclose the inputs

and valuation techniques used for fair value measurements using significant

other observable inputs (Level 2) and significant unobservable inputs (Level 3).

This guidance is effective for interim and annual periods beginning after

December 15, 2009 except for the disclosures about purchases, sales, issuances

and settlements in the Level 3 reconciliation, which will be effective for

interim and annual periods beginning after December 15, 2010. As this guidance

provides only disclosure requirements, the adoption of this guidance will not

impact the Company’s financial condition or results of operations.

In April

2010, the FASB issued guidance on defining a milestone and determining when it

may be appropriate to apply the milestone method of revenue recognition for

research or development transactions. The guidance is effective on a prospective

basis for milestones achieved in fiscal years, and interim periods within those

years, beginning on or after June 15, 2010, with early adoption permitted. The

Company does not expect a material impact on its consolidated financial

statements upon the adoption of the new accounting standard.

Management

does not believe that any other recently issued, but not yet effective

accounting pronouncements, if adopted, would have a material effect on the

accompanying financial statements.

13

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

3 – INVENTORIES

Inventories

consisted of the following:

|

June

30, 2010

|

December

31, 2009

|

|||||||

|

Raw

materials

|

$ | 455,358 | $ | 281,112 | ||||

|

Work-in-progress

|

1,445,369 | 1,078,788 | ||||||

| $ | 1,900,727 | $ | 1,359,900 | |||||

Final

assembly of our products, including installation of radioactive source

materials, is conducted on site at our customers’ locations. Our products are

not considered to be finished good (available for sale in the normal course of

business) until such time as the source material is installed in the

units.

NOTE

4 – OTHER RECEIVABLES

Other

receivables, net, consisted of the following:

|

June

30, 2010

|

December

31, 2009

|

|||||||

|

Other

receivables

|

||||||||

|

-

current portion

|

||||||||

|

-

construction in progress paid on behalf of landlord (a)

|

||||||||

|

current

portion

|

$ | 157,814 | $ | 156,759 | ||||

| - loan or advance to staff for business travelling | 86,705 | 43,072 | ||||||

| - utilities and rental deposits | 1,961 | 1,948 | ||||||

| - prepaid expenses made by director | 2,949 | 2,930 | ||||||

| - others (net of allowance for doubtful accounts | ||||||||

|

of

$737,311 and $732,386)

|

47,547 | 44,081 | ||||||

|

Other

receivables – current portion

|

$ | 296,976 | $ | 248,790 | ||||

|

Other

receivables - Non-current portion

|

$ | 1,451,168 | $ | 1,582,093 | ||||

|

(a)

|

Under

the agreement signed with the landlord, Shenzhen OUR Technology Co., Ltd.,

Shenzhen Hyper will make payment for the construction in progress of the

building in advance on behalf the landlord. Meanwhile, Shenzhen Hyper

signed a rental agreement with the landlord to rent the building for 20

years at about US $23,500 (RMB160,000) per month. The balance of the

amount due from the landlord will be used to set off with the rental

expenses incurred by Shenzhen

Hyper.

|

14

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

5 – PROPERTY, PLANT AND EQUIPMENT

Property,

plant and equipment consisted of the following:

|

June

30, 2010

|

December

31, 2009

|

|||||||

|

Building

improvements

|

$ | 173,390 | $ | 172,232 | ||||

|

Buildings

|

2,323,067 | 2,307,550 | ||||||

|

Production

equipment

|

662,092 | 656,423 | ||||||

|

Furniture,

fixture and office equipment

|

403,113 | 366,868 | ||||||

|

Motor

vehicles

|

188,568 | 187,308 | ||||||

| 3,750,230 | 3,690,381 | |||||||

|

Less:

Accumulated depreciation

|

(1,299,661 | ) | (1,169,594 | ) | ||||

| $ | 2,450,569 | $ | 2,520,787 | |||||

Depreciation

expense is included in the consolidated statements of income. For the six months

ended June 30, 2010 and 2009, depreciation expenses were $121,526 and $122,540,

respectively.

NOTE

6 - LAND USE RIGHT

Land use

right consisted of the following:

|

June

30, 2010

|

December

31, 2009

|

|||||||

|

Land

use right

|

$ | 936,241 | $ | 939,575 | ||||

Land use

right represents prepaid lease payments to the Local Government for land use

right held for a period of 50 years from January 20, 2009 to December 26, 2058

in Wuhan, People’s Republic of China.

Land use

right is amortized using the straight-line method over the lease term of 50

years. The amortization expense for the six months ended June 30,

2010 and 2009 were $9,599 and $7,984, respectively.

15

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

7 – INTANGIBLE ASSETS

Intangible

assets, net consisted of the following:

|

June 30, 2010

|

December 31, 2009

|

|||||||

|

Patent

technology in Shenzhen Hyper (A)

|

$ | 1,474,622 | $ | 1,464,772 | ||||

|

Patent

technology in Portola Medical, Inc. (B)

|

250,000 | - | ||||||

|

Less:

Accumulated amortization

|

(733,850 | ) | (687,686 | ) | ||||

| $ | 990,772 | $ | 777,086 | |||||

(A)

Patent represents a patent technology for the production of a component of the

radiation treatment system. The patent was applied prior to its injection to

Shenzhen Hyper as a capital contribution. Pursuant to the patent certificate,

the patent was valid for 20 years from the application date, May 1999. Therefore

it was amortized over the rest of the valid patent period, which is the

estimated remaining useful life.

(B)

Patent acquired in Portola Medical, Inc. No amortization expense have been

charged since the amount is immaterial.

Patent

technology is utilized in the production of medical equipment and is amortized

over its estimated useful life.

Amortization

expenses were $41,310 and $41,230 for the six months ended June 30, 2010 and

2009 ($4,794 and $3,191 for the three months ended March 31, 2010 and 2009). The

expected amortization for the next five years and thereafter is as

follows:

|

Patent

technology

in

|

Patent

technology

in

|

|||||||||||

|

Portola

|

Shenzhen

|

|||||||||||

|

Medical,

Inc.

|

Hyper

|

Total

|

||||||||||

|

For

the twelve months ended June 30

|

||||||||||||

|

2011

|

$ | 12,500 | $ | 83,076 | $ | 95,576 | ||||||

|

2012

|

12,500 | 83,076 | 95,576 | |||||||||

|

2013

|

12,500 | 83,076 | 95,576 | |||||||||

|

2014

|

12,500 | 83,076 | 95,576 | |||||||||

|

2015

|

12,500 | 83,076 | 95,576 | |||||||||

|

Thereafter

|

187,500 | 325,392 | 512,892 | |||||||||

|

TOTAL

|

$ | 250,000 | $ | 740,772 | $ | 990,772 | ||||||

16

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

8 – ACCRUED LIABILITIES AND OTHER PAYABLES

Accrued

liabilities and other payables consisted of the following:

|

June 30, 2010

|

December 31,

2009

|

|||||||

|

Accrued

expenses

|

$ | 430,352 | $ | 365,923 | ||||

|

Accrued

payroll and welfare

|

190,268 | 188,125 | ||||||

|

Value

added tax, other taxes payable and surcharges

|

991,687 | 1,121,406 | ||||||

|

Customer

deposits

|

12,252 | 1,185 | ||||||

| $ | 1,624,559 | $ | 1,676,639 | |||||

NOTE

9 – NON-CONTROLLING INTEREST

Non-controlling

interest included in the Company’s balance sheets as of June 30, 2010 represent

25% equity interest in Shenzhen Hyper.

NOTE

10 –AMOUNTS DUE TO RELATED PARTIES

A

summary of related party payables at June 30, 2010 (unaudited) and December 31,

2009 is as follows:

Amounts

due to related parties at June 30, 2010 and December 31, 2009 represents the

remaining balance due to Clear Honest International Limited which was former

shareholder of Allied Moral pursuant to the 2007 share redemption as well as

advances related to the acquisition of Changdu Huiheng.

In June

2010, cash consideration of $260,000 and relevant expenses of $30,000 for

acquiring the new subsidiary, Portola Medical, Inc., were paid in advance by the

Company’s Chairman, Hui Xiaobing.

NOTE 11 –STOCKHOLDERS’

EQUITY

(a) Capital

The

Company has authorized 74,000,000 shares of Common stock. As of June 30, 2010,

23,635,290 shares were issued and 13,935,290 shares were outstanding which is

net of 9,700,000 treasury shares contributed from Mill Basin’s

shareholders.

The

Company has authorized 1,000,000 shares of Preferred stock, with 300,000 shares

designated as Series A convertible preferred stock. As of June 30, 2010, 220,467

shares were issued and outstanding with a liquidation preference of

$8,267,513.

17

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

11 –STOCKHOLDERS’ EQUITY (…/Cont’d)

(b) Retained

Earnings

As of

June 30, 2010, the Company established and segregated in retained earnings an

aggregate amount for the Statutory Surplus Reserve and the Statutory Common

Welfare Fund of $1,310,516.

Statutory

surplus reserve

In

accordance with PRC Company Law, Changdu Huiheng is required to appropriate at

least 10% of the profit to the statutory surplus reserve. Appropriation to the

statutory surplus reserve by Changdu Huiheng is based on profits arrived at

under PRC accounting standards for business enterprises for each

year.

The

profit arrived at must be set off against any accumulated losses sustained by

Changdu Huiheng in prior years, before allocation is made to the statutory

surplus reserve. Appropriation to the statutory surplus reserve must be made

before distribution of dividends to owners. The appropriation is required until

the statutory surplus reserve reaches 50% of the equity. This statutory surplus

reserve is not distributable in the form of cash dividends.

NOTE

12 - PORTOLA MEDICAL, INC. ACQUISITION

The

Company entered into an Agreement to purchase all the common stock of Portola

Medical, Inc, dated May 7, 2010, from Three Arch Capital, L.P., TAC Associates,

L.P., Three Arch Partners IV, L.P., and Three Arch Associates IV,

L.P.

The

authorized capital stock of Portola Medical, Inc. consists of Common Stock, par

value $0.01 per share, of which 100 shares were issued and outstanding. Under

the terms of the Agreement, the Company acquired 100% of the common stock in

Portola Medical, Inc. at $2,600 per share and the total consideration is

$260,000.

The

following table presents the allocation of the purchase price to the assets

acquired and liabilities assumed, based on their fair values:

|

Property,

plant, and equipment

|

$ | 31,508 | ||

|

Intangible

assets

|

250,000 | |||

|

Total

asset acquired

|

281,508 | |||

|

Total

liabilities assumed

|

- | |||

|

Net

assets acquired

|

$ | 281,508 |

The net

assets acquired exceeded the purchase price by $21,508 which was recorded as a

gain on business acquisition. Included in the net assets acquired, $250,000

represents the cost of acquired intangible assets, which is made up of 8 patents

with 20-year useful life (Note 7).

18

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

13 - SEGMENT REPORTING

The Group

has two reportable segments: products and services.

The

following table presents information about the Company’s operating segments for

the six months ended June 30, 2010 and 2009:

|

June 30, 2010

|

June 30, 2009

|

|||||||

|

Revenues:

|

||||||||

|

Products

|

$ | - | $ | - | ||||

|

Services

|

2,808,195 | 3,030,253 | ||||||

|

Other

|

29,563 | 732,555 | ||||||

| $ | 2,837,758 | $ | 3,762,808 | |||||

|

June 30, 2010

|

June 30, 2009

|

|||||||

|

Operating

(loss) income:

|

||||||||

|

Products

|

$ | (59,784 | ) | $ | (104,768 | ) | ||

|

Services

|

2,514,768 | 2,750,627 | ||||||

|

Other

|

29,563 | 732,555 | ||||||

| 2,484,547 | 3,378,414 | |||||||

|

Corporate

expenses

|

(1,253,591 | ) | (1,735,879 | ) | ||||

|

Operating

income

|

$ | 1,230,956 | $ | 1,642,535 | ||||

Other

revenue consists principally of government financial subsidies to Changdu

Huiheng.

NOTE

14 – INCOME TAXES

Huiheng

Medical, Inc. is a non-operating holding company. All of the Company’s income

before income taxes and related tax expenses are from PRC sources. The Company’s

PRC subsidiaries file income tax returns under the Income Tax Law of the

People’s Republic of China concerning Foreign Investment Enterprises and Foreign

Enterprises and local income tax laws.

Income

tax expense for the three months ended June 30, 2010 and 2009 was $313,782 and

$345,687, respectively.

As

Changdu Huiheng, Huiheng’s subsidiary, is located in the western area in the PRC

and is within the industry specified by relevant laws and regulations of the

PRC, the tax rate applicable to Changdu Huiheng is 15% (2009: 12%).

Wuhan

Kangqiao is a high-tech enterprise with operations in an economic-technological

development area in the PRC. Therefore, the applicable tax rate is

25%.

Shenzhen

Hyper is a high-tech manufacturing company located in the Shenzhen special

economic region. Therefore, the applicable tax rate is also 15% (2009:18%).

According to local tax regulation, Shenzhen Hyper is entitled to a tax-free

period for the first two years, commencing from the first profit-making year and

a 50% reduction in state income tax rate for the next six years.

19

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

14 – INCOME TAXES (…/Cont’d)

A

reconciliation of the expected income tax expense to the actual income tax

expense for the period ended June 30, 2010 and 2009 are as follows:

|

Six Months Ended June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Income

before income taxes

|

$ | 1,297,070 | $ | 1,659,289 | ||||

|

Expected

PRC income tax expense at statutory tax rate of 25% (2009:

25%)

|

324,268 | 414,822 | ||||||

|

Non-deductible

expenses

|

1,434 | 39,891 | ||||||

|

Others

|

147,596 | 206,158 | ||||||

|

Tax

rate differences

|

(154,139 | ) | (315,184 | ) | ||||

|

Actual

income tax expense

|

$ | 319,159 | $ | 345,687 | ||||

The PRC

tax system is subject to substantial uncertainties and has been subject to

recently enacted changes. The interpretation and enforcement of which are also

uncertain. The Company remains open to examination by the major jurisdictions to

which the Company is subject to, in this case, the PRC tax

authorities.

No

deferred tax liability has been provided as the amount involved is

immaterial.

NOTE

15 – CONCENTRATION OF CREDIT RISK

Customers’

concentrations

Customers

accounting for 10% or more of the Group’s net revenue as follows:

|

Six months ended June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

%

|

%

|

|||||||

|

Customer

A

|

53 | % | 53 | % | ||||

|

Customer

B

|

35 | % | 33 | % | ||||

|

Customer

C

|

11 | % | - | |||||

Three

customers accounted for 99% and three customers accounted for 93% of revenue for

the six months ended June 30, 2010 and 2009, respectively. These customers also

accounted for 84% and 77% of accounts receivable as of June 30, 2010 and 2009,

respectively. As a result, a termination in relationship with or a reduction in

orders from any of these customers could have a material impact on the Company’s

results of operations and financial condition.

Except as

disclosed above, no other single customer accounted for 10% or more of the

Group’s net revenue for the six months ended June 30, 2010 and

2009.

20

HUIHENG

MEDICAL, INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(IN US

DOLLARS)

NOTE

15 – CONCENTRATION OF CREDIT RISK (…/Cont’d)

Other

credit risks

As of

June 30, 2010, all of the Company’s cash and cash equivalents were held by major

financial institutions located in the PRC, none of which were insured or

collateralized. However, management believes those financial institutions are of

high credit quality and has assessed the loss arising from the non-insured cash

and cash equivalents from those financial institutions to be immaterial to the

consolidated financial statements. Therefore, no loss in respect of the cash and

cash equivalent were recognized as of June 30, 2010.

NOTE

16 - FOREIGN OPERATIONS

Operations

All of

the Company’s operations are carried out and substantially all of its assets are

located in the PRC. Accordingly, the Company’s business, financial condition and

results of operations may be influenced by the political, economic and legal

environments in the PRC. The Company’s business may be influenced by changes in

governmental policies with respect to laws and regulations, anti-inflationary

measures, currency fluctuation and remittances and methods of taxation, among

other things.

Dividends

and reserves

Under

laws of the PRC, net income after taxation can only be distributed as dividends

after appropriation has been made for the following: (i) cumulative prior years’

losses, if any; (ii) allocations to the “Statutory Surplus Reserve” of at least

10% of net income after tax, as determined under PRC accounting rules and

regulations, until the fund amounts to 50% of the Company’s equity; (iii)

allocations of 5-10% of income after tax, as determined under PRC accounting

rules and regulations, to the Company’s “Statutory Common Welfare Fund”, which

is established for the purpose of providing employee facilities and other

collective benefits to employees in China; and (iv) allocations to any

discretionary surplus reserve, if approved by equity owners.

NOTE

17 - OPERATING LEASE COMMITMENTS

As of

June 30, 2010, the total future minimum lease payments under non-cancellable

operating leases in respect of premises are $4.91 million (RMB33.28 million),

which was based on the closing rate as of June 30, 2010. The amounts payable are

as follows:

|

For

the twelve months ended June 30

|

||||

|

2011

|

$ | 275,189 | ||

|

2012

|

275,189 | |||

|

2013

|

275,189 | |||

|

2014

|

275,189 | |||

|

2015

|

275,189 | |||

|

Thereafter

|

3,531,596 | |||

|

TOTAL

|

$ | 4,907,541 | ||

21

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of

Operations

The

following discussion and analysis of our financial condition and results of

operations should be read in conjunction with our unaudited consolidated

financial statements and related notes appearing elsewhere in this Quarterly

Report. In addition to historical financial information, the

following discussion contains forward-looking statements that reflect our plans,

estimates and beliefs. Our actual results could differ materially

from those discussed in the forward-looking statements. Factors that

could cause or contribute to these differences include those discussed below and

elsewhere in this Quarterly Report. See also Risk Factors contained in our Form

10-K for the year ended December 31, 2009.

OVERVIEW

We

develop, design and sell precision radiotherapy equipment used for the treatment

of cancerous tumours. In addition to providing radiotherapy equipment, we also

offer our customers comprehensive post-sales services for our products as well

as products manufactured by others. These services include radioactive cobalt

source replacement and disposal, medical expert training, clinical trial

analysis, patient tumour treatment analysis, software upgrades and patient care

consulting. We currently have five products: the Super Gamma System (“SGS”), the

Body Gamma Treatment System (“BGTS”), OPEN Stereotactic Gamma-ray Radiotherapy

System, the Head Gamma Treatment System (“HGTS”) and a multileaf collimator

device (“MLC”) used in conjunction with a linear accelerator.

We

currently sell our products primarily to a small number of hospital equipment

investors in the People’s Republic of China (“PRC” or “China”), who install our

systems in hospitals or clinics. We also offer comprehensive

post-sales services for our medical equipment to our customers. The

service contracts are negotiated and signed independently and separately from

the sales of medical equipment. Our post-sales services include

radioactive cobalt source replacement and disposal, medical expert training,

clinical trial analysis, patient tumor treatment analysis, product maintenance,

software upgrades, and consulting.

Further,

we have sought to expand our product offering. Accordingly, we successfully

acquired Portola Medical, Inc., whose primary asset consists of its rights to

develop, manufacture and sell an adjustable Multi-Catheter Source Applicator

which is intended to provide brachytherapy when a physician chooses to deliver

intracavitary radiation to the surgical margins following lumpectomy of breast

cancer. We plan to market and sell this product in the United States

and in Asia.

In

addition, our research and development team is focused on developing and

producing technologically advanced radiotherapy and gamma treatment systems

(“GTS”) products. Currently, the focus of our research and

development efforts is on five main projects. The first project is

the development of next-generation SGS unit that will incorporate advanced

radiotherapy technologies through the addition of an Image Guided System

(“IGS”), which improves the targeting of the radiation beam through use of

computer-generated images, and a Respiration Tracking System (“RTS”), which

automatically adjusts the targeting of the radiation to compensate for the

patient’s breathing. The other major projects include the development

of an integrated linear accelerator (“LINAC”) and multileaf collimator unit,

another type of radiotherapy device that is used in less demanding applications,

an advanced magnetic resonance imaging (“MRI”) device and an industrial LINAC

unit used for, among other things, preserving food through

irradiation. These projects are in various stages of

development.

22

RESULTS

OF OPERATIONS

Comparison of three months

ended June 30, 2010 and 2009

The

following table sets forth certain information regarding our results of

operation.

|

Three Months Ended June 30

|

||||||||

|

2010

|

2009

|

|||||||

|

Statements

of Operations Data

|

||||||||

|

Revenues

|

$ | 1,436,905 | $ | 2,364,189 | ||||

|

Cost

of Revenues

|

201,494 | 191,566 | ||||||

|

Gross

Profit

|

1,235,411 | 2,172,623 | ||||||

|

Operating

Expenses

|

||||||||

|

Sales

and marketing expenses

|

60,098 | 78,158 | ||||||

|

General

and administrative expenses

|