Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d8k.htm |

GeoResources, Inc

Corporate Profile

August 2010

Exhibit 99.1 |

2

Forward-Looking Statements

Information herein contains forward-looking statements that involve significant

risks and uncertainties, including our need to replace production and

acquire or develop additional oil and gas reserves, intense competition in

the oil and gas industry,

our

dependence

on

our

management,

volatile

oil

and

gas

prices

and

costs, with hedging activities and uncertainties of our oil and gas estimates of

proved reserves and reserve potential, all of which may be

substantial. In addition,

all

statements

or

estimates

made

by

the

Company,

other

than

statements of historical fact, related to matters that may or will occur in the

future are forward-looking statements.

Readers are encouraged to read our December 31, 2009 Annual Report on

Form 10-K and Form 10-K/A and any and all of our other documents filed with

the SEC regarding information about GeoResources

for meaningful cautionary

language in respect of the forward-looking statements herein. Interested

persons are able to obtain free copies of filings containing information

about GeoResources, without charge, at the SEC’s

Internet site (http://www.sec.gov).

There is no duty to update the statements herein. |

3

Additional Disclosures |

4

Key Investment Highlights

Value Creation

Attractive Value Proposition

Trading at a significant discount to NAV

Experienced Management and Technical Staff with Large Ownership

Stake

Board and management own or control approximately 36% of the Company

Successful track record of creating value and liquidity for shareholders

Strong Asset Base

Strategically located

Geographically diverse

Balanced oil vs. gas

High level of operating control

Strong Financial Position

Significant cash flow

Moderate leverage |

5

Key Investment Highlights

Value Creation

Oil Weighted Asset Base

Reserves 56% Oil

Production 54% Oil

Significant Bakken Exposure

24,000 net operated acres

13,000 net non-op acres

37,000 TOTAL ACRES

Other Significant Growth Opportunities

Low risk development drilling

Higher impact exploration upside

Continually Expanding Acreage |

6

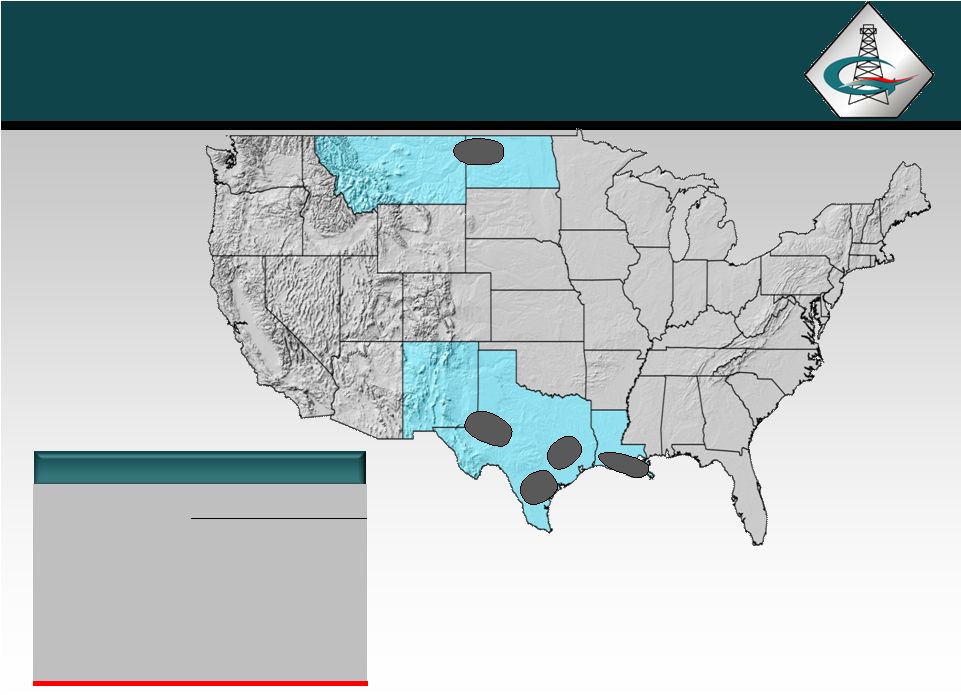

Company Overview

(1)

Represents the Company’s average production rate YTD June 30,

2010. (2)

Acreage information estimated as of June 30, 2010.

(3)

Map depicts focus areas and excludes minor value properties.

.

6

Company Highlights

Direct

Direct +

Ownership

Partnership

Proved Reserves (MMBOE)

24.0

25.6

Oil

56%

53%

Proved Developed

73%

74%

PV 10% (millions)

$384

$401

Production (BOEpd)

(1)

5,158

5,643

Oil

54%

50%

Operated

80%

80%

Gross Acreage

(2)

526,374

526,374

Net Acreage

(2)

239,770

246,168 |

7

Value-Driven Growth Strategy

Asset

Rationalization

Selectively divest assets to upgrade portfolio.

Focus on maximizing IRR for investors.

Cost Control

Operate as efficiently as possible by focusing on minimizing development,

production, and G&A expenses.

Pursue promoted partner positions to reduce costs and generate operating

fees.

Generate new exploration prospects.

Solicit partners on a promoted basis to reduce risk and enhance returns.

Exploration

Acquire operated properties with existing production, development

opportunities, and exploration potential.

Acquisitions

Development

and

Exploitation

Focus on areas with development and exploration upside.

Implement re-engineering and development programs to extend field life,

increase proved reserves, lower unit operating costs, and enhance economics.

|

8

Management History

2004-

2007

Southern Bay Energy, LLC

Gulf Coast, Permian Basin

REVERSE MERGED INTO

GEORESOURCES, INC.

2000-2007

Chandler Energy, LLC

Williston Basin, Rockies

ACQUIRED BY

GEORESOURCES, INC.

1988-2000

Chandler Company

Rockies, Williston Basin

MERGED INTO

SHENANDOAH THEN SOLD

TO QUESTAR

1992-1996

Hampton Resources Corp

Gulf Coast

SOLD TO BELLWETHER

EXPLORATION

Preferred investors –

30% IRR

Initial investors –

7x return

1997-2001

Texoil Inc.

Gulf Coast, Permian Basin

SOLD TO OCEAN ENERGY

Preferred investors –

2.5x return

Follow-on investors –

3x return

Initial investors –

10x return

2001-2004

AROC Inc.

Gulf Coast, Permian Basin, Mid-Con.

DISTRESSED ENTITY LIQUIDATED

FOR BENEFIT OF INITIAL

SHAREHOLDERS

Preferred investors –

17% IRR

Initial investors –

4x return

Track record of profitability and liquidity

Extensive industry and financial relationships

Significant technical and financial experience

Long-term repeat shareholders

Cohesive management and technical staff

Team has been together for up to 20

years through multiple entities |

9

Net Asset Value

Net Asset Value

(1)

Nymex

strip pricing at June 30, 2010.

(2)

At June 30, 2010, excluding derivative financial instruments.

(3)

Assumed $2,000 per net acre for Bakken

acreage plus book value at 6/30/10 for other areas.

(4)

June 30, 2010 balance plus July borrowings for acquisitions.

($ in millions)

PV-10

(1)

% of Total

Proved Reserves:

Proved Developed Producing

246.0

$

64.1%

Proved Developed Non-Producing

63.0

16.4%

Proved Undeveloped

74.8

19.5%

Total Proved PV-10 Value

383.8

$

100.0%

Plus:

Working Capital

(2)

18.4

$

Unproved Property

(3)

84.5

Partnership Value

16.8

Less:

Total Debt

(4)

(85.0)

Total Net Asset Value

418.5

$

Shares Outstanding (thousands)

19,713

Net Asset Value Per Share

21.23

$

June 30, 2010 |

10

Proved Reserves

Proved Reserves by Category

Proved Reserves by Area

Partnership

Proved

% of

Interests

Total Proved

% of Total

Area

MMBOE

Proved

MMBOE

MMBOE

Reserves

Central and South Texas

9.1

37.9%

1.5

10.6

41.4%

Williston

6.7

27.9%

0.0

6.7

26.2%

Louisiana

3.8

15.8%

0.0

3.8

14.8%

Other

4.4

18.4%

0.1

4.5

17.6%

Total

24.0

100.0%

1.6

25.6

100.0%

($ in millions)

Oil

Gas

Total

% of

Corporate Interests

MMBO

BCF

MMBOE

Total

PV-10

PDP

8.3

37.4

14.6

60.8%

$246.0

PDNP

2.1

5.4

3.0

12.5%

63.0

PUD

3.1

20.3

6.4

26.7%

74.8

Total Proved Corporate Interests

13.5

63.1

24.0

100.0%

383.8

Partnership Interests

0.1

9.1

1.6

16.8

Total Proved Corporate and Partnerships

13.6

72.2

25.6

$400.6 |

11

Selected Balance Sheet Data

Financial Summary

(1)

The above table does not include the balance sheet effects of hedge accounting for

derivative financial instruments which is required for financial statements

presented in accordance with generally accepted accounting principles. See the Company’s SEC filings for further

information.

(2)

June 30, 2010 was $69 million plus $16 million for July acquisitions.

($ & shares in millions)

June 30, 2010

Dec. 31, 2009

Dec. 31, 2008

Cash

15.9

$

12.7

$

14.0

$

Other Working Capital -

Net

(1)

2.5

$

3.3

$

(8.7)

$

Total Working Capital -

Net

(1)

18.4

$

16.0

$

5.3

$

Oil & Gas Assets (Successful Efforts)

262.2

$

248.4

$

181.6

$

Equity in Partnerships

2.7

$

3.5

$

3.3

$

Long-Term Debt

(2)

85.0

$

69.0

$

40.0

$

Common Stock and Additional Paid in Capital

147.6

$

147.2

$

112.7

$

Retained Earnings

41.3

$

30.8

$

21.0

$

Common Stock Outstanding

19.7

19.7

16.2 |

12

Financial Summary

Historical Operating Data

($ in millions except per share data)

YTD 2010

2nd Qtr. 2010

2009

2008

Key Data:

Average realized oil price ($/Bbl)

70.55

$

70.48

$

61.09

$

82.42

$

Avg. realized natural gas price ($/Mcf)

5.25

$

4.90

$

3.97

$

8.12

$

Oil production (MBbl)

504

255

851

743

Natural gas production (MMcf)

2,580

1,300

4,944

2,962

Total revenue

53.0

$

26.4

$

80.4

$

94.6

$

Net income before tax

17.2

$

7.3

$

14.8

$

21.3

$

Net income after tax

10.5

$

4.4

$

9.8

$

13.5

$

Net income per share (basic)

0.53

$

0.23

$

0.59

$

0.87

$

EBITDAX

35.6

$

17.7

$

48.2

$

54.2

$ |

13

Financial Summary

Historical Production Data

Historical Operating Netback Data

(1)

Represents severance tax expense and re-engineering and workover

expense.

YTD 2010

2nd

Qtr 2010

2009

2008

Oil Production (MBbls)

504

255

851

743

Gas Production (MMCF)

2,580

1,300

4,944

2,962

Total Production (Mboe)

934

472

1,675

1,237

Avg. Daily Production (Boe/d)

5,158

5,184

4,589

3,388

YTD 2010

2nd

Qtr 2010

2009

2008

($ per BOE)

Revenue

$56.72

$55.94

$48.01

$76.50

Less:

LOE

$10.94

11.00

$11.20

$18.53

G&A

4.13

4.32

5.07

5.80

Other Field Level Opex

(1)

4.10

3.80

3.84

8.92

Total Field Level Operating Costs

$19.17

$19.12

$20.11

$33.25

Field Level Operating Netback

$37.55

$36.82

$27.90

$43.25 |

14

Proved

Reserves

(MMBOE)

(2)

Average Daily Production (BOEpd)

Reserves and Production –

Direct Interests

(1)

Current Proved Reserves –

24.0 MMBOE

(1)

Excludes

partnership

interests.

(2)

2006

–

2009

proved

reserves

based

on

SEC

guidelines.

(3) 2008 Reserves reflect divestitures. (4) 7/1/10 strip prices based

on NYMEX strip of 6/30/10. |

15

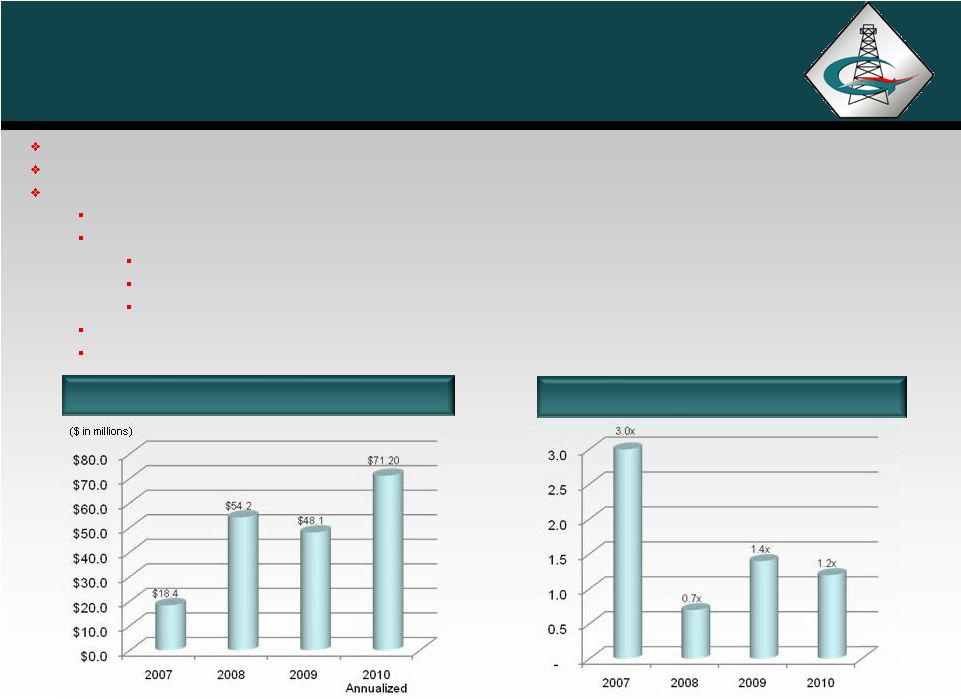

EBITDAX

Total Leverage

Can fund CapEx

without reliance on capital markets

Debt funding available for acquisitions

Conservative use of leverage to maintain strong balance sheet

$145 Million borrowing base

EBITDAX :

2

nd

Quarter

=

$17.7

Million

YTD 2010 = $35.6 Million

Annualized = $71.2 Million

Total debt of $85.0 million at June 30, 2010, pro-forma with

acquisition. Credit facility priced at LIBOR plus 2.25 –

3.00%

Strong Financial Position |

16

Hedging Strategy

Oil Hedges

GEOI uses commodity price risk management in order to execute its business plan

throughout commodity price cycles.

Overall, about 67% of production is hedged for 2010 and 58% is hedged for

2011. Natural

gas

hedges

include

hedge

volumes

intended

to

cover

GEOI’s

share

of

partnership

production.

Term of hedges is July 1, 2010 through December 31, 2012.

Natural Gas Hedges |

17

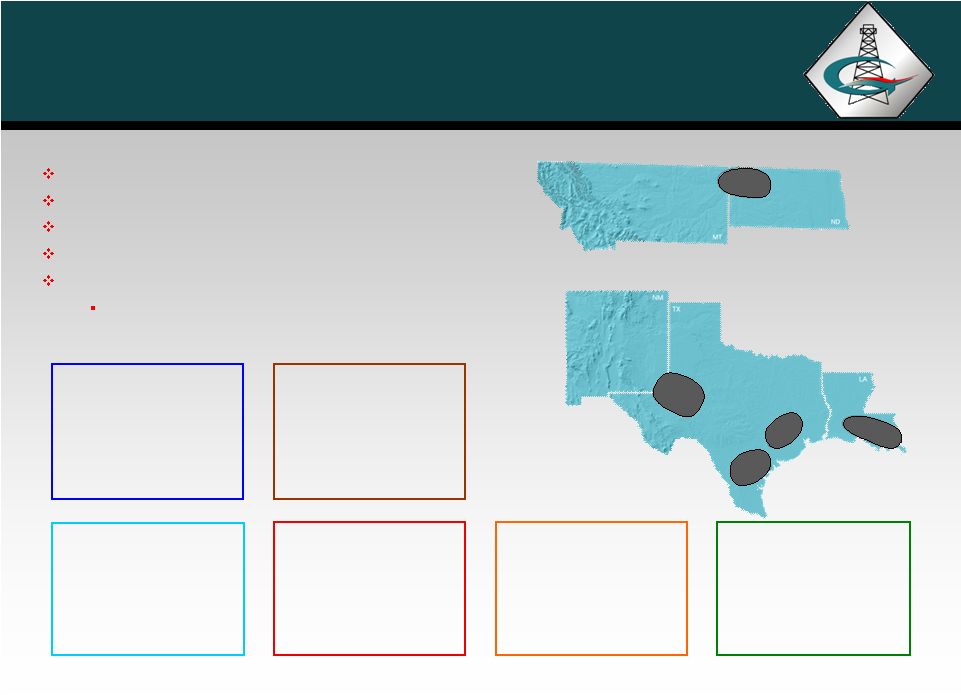

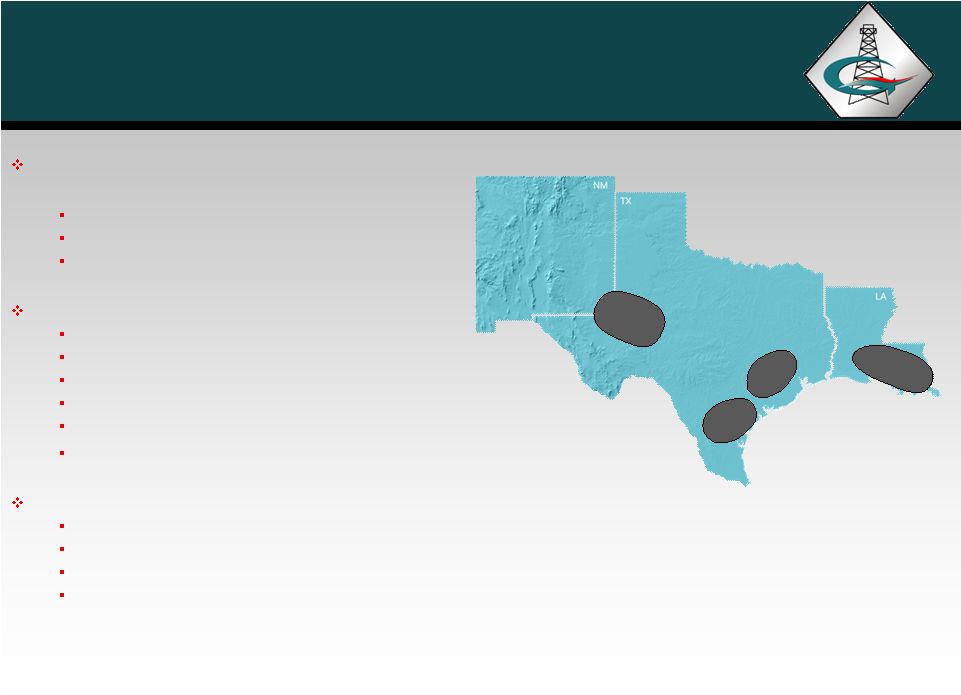

Southern Region

Accounts for approximately 71% of reserves and

70% of total production

High-impact exploration potential

Development and recompletion potential

Approximately 38% of proved reserves are oil

Successful Austin Chalk drilling program

Significant working interests plus partnership interests

Sixteen wells drilled with 100% success rate

68 producing wells

20 additional locations

Recent additional acreage acquisitions

Yegua, Eagle Ford and Georgetown potential

St. Martinville project to begin drilling in September 2010

Oil project supported by 3-D located in South Louisiana

Three new wells and one re-entry scheduled

Multiple stacked oil objectives above 7,000’

Additional shallow locations with significant gas objectives at

about 10,000’ |

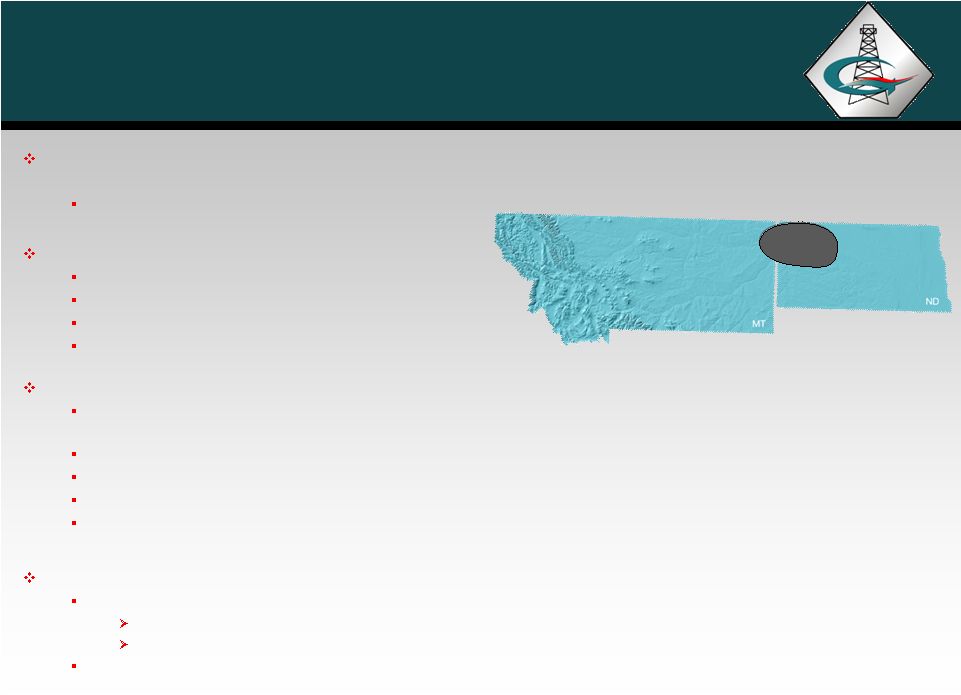

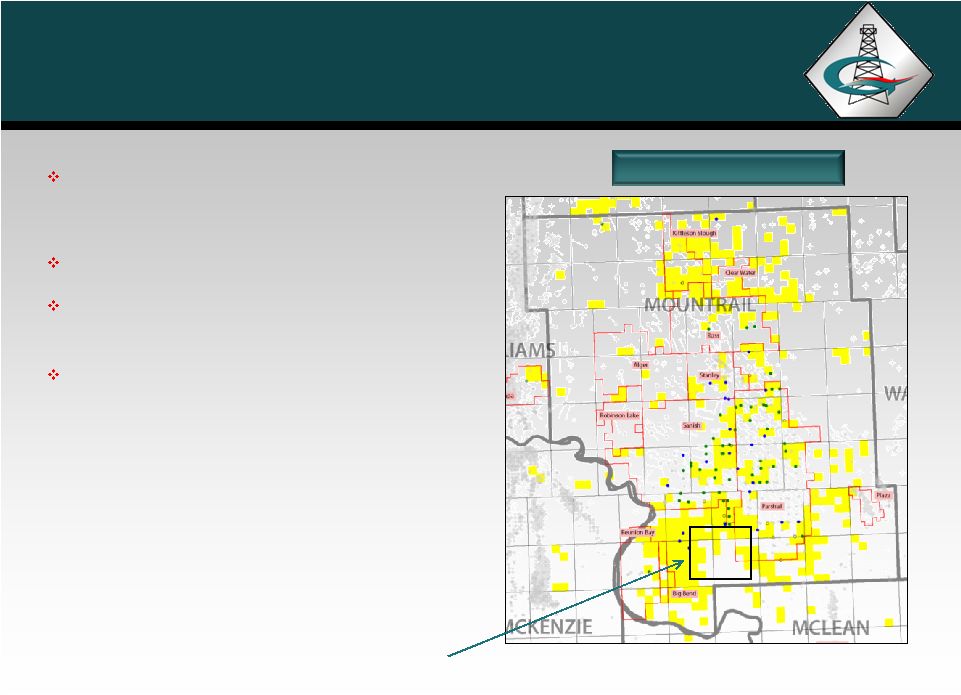

18

Northern Region

Accounts for approximately 29% of reserves and 30% of

total production

Approximately 93% of proved reserves are oil

Bakken Operated Joint Venture:

Acquired 50,000 net acres in Williams County, ND

Established development joint venture

Retained 47.5% WI (24,000 net acres) in AMI

Drilling scheduled to begin September 2010

Bakken Non-Operated Joint Venture:

10-18% WI in approximately 100,000 gross acres

(approximately 13,000 net acres)

Current four rig program

58 joint venture operated gross wells drilled

Acquired and/or participated in over 185 non-operated wells

Joint venture expects to drill 100 wells in the next 2 years

Williston Basin Other:

Starbuck & SW Starbuck waterflood installation completed in early 2008

& in early 2009 Initial response realized

Additional oil upside in horizontal and vertical infill locations within the unit

boundaries Proved undeveloped and non-proved oil drilling opportunities

within producing fields |

19

Southern Region

Project Inventory

Project Expansion with Success |

20

Capital Allocation and Budget

Project

Budgeted

Comments

$(Millions)

Bakken

Operated

$6.7

5 wells per month

Non-Operated

10.3

3 wells

Rip-Rap

1.3

Initial well Montana

Giddings

5.3

2 wells

St. Martinville

4.2

4 wells

$27.8

Acreage/seismic

12.0

$39.8

Remainder of 2010

Project inventory allows flexibility

Weighted towards oil and liquids

Oil and gas projects in inventory

Exploration and development

projects in inventory

Held by long-term leases or

production

Current allocations favors lower-risk,

high cash flow oil projects

Will move between oil and gas as

prices and costs dictate

Capital Allocations |

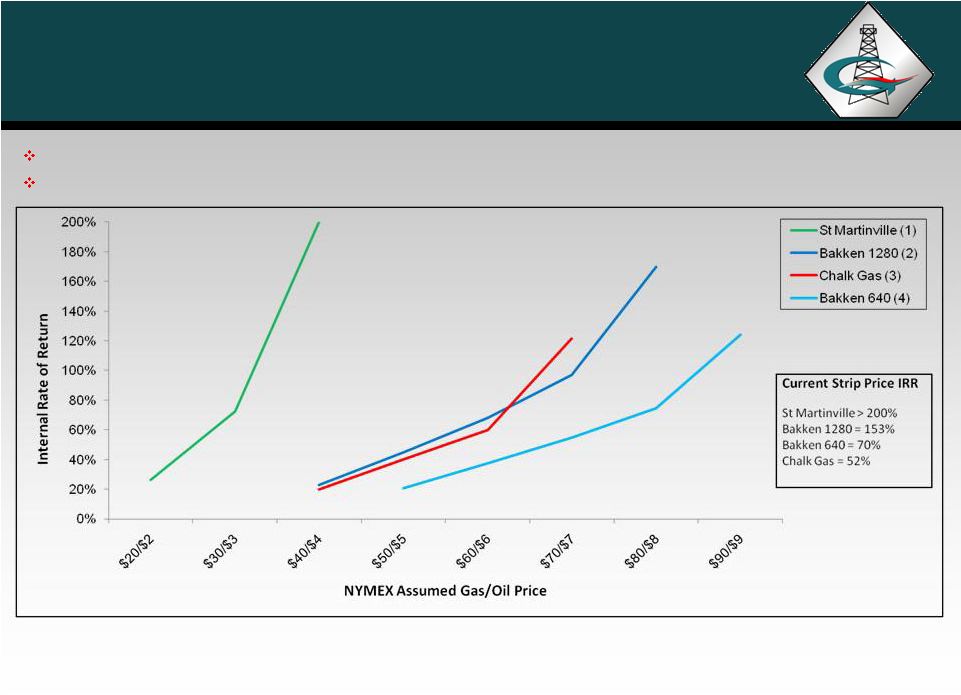

21

Type Well Economics

Diverse set of drilling opportunities provides for flexibility in changing

commodity price cycles Most

drilling

opportunities

remain

economic

in

the

current

price

environment

(1)

Well cost of $1.3 million and reserves of 250 MBO

(2)

Well cost of $6.2 million and reserves of 600 MBO

(3)

Well cost of $7.0 million and reserves of 6.5 BCF

(4)

Well cost of $5.2 million and reserves of 400 MBO. |

APPENDICES |

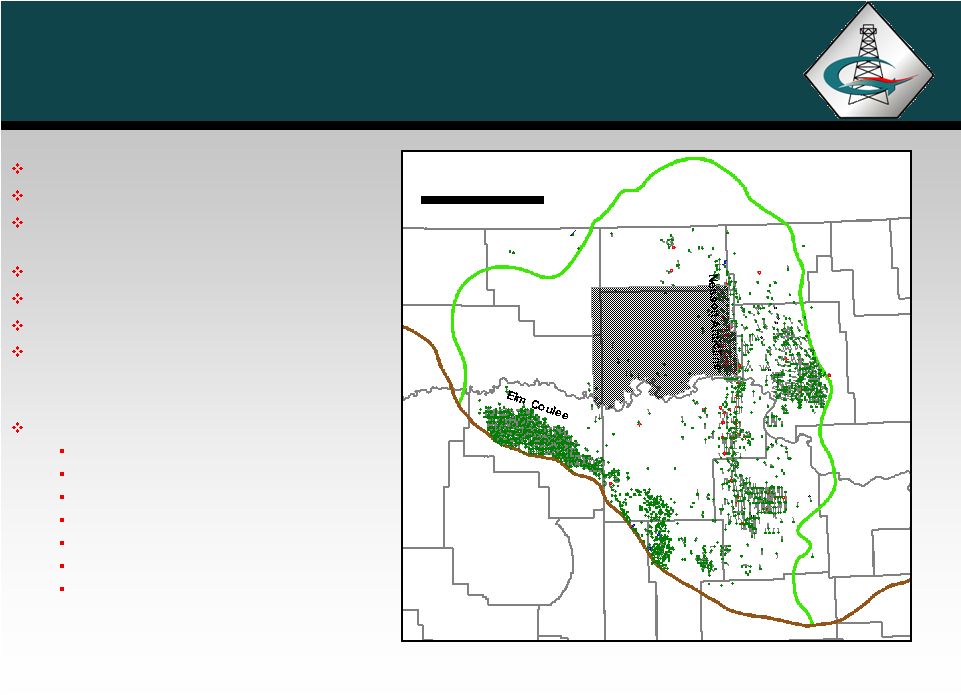

Bakken

Shale Operated Williams County, ND Joint Venture Acreage

Joint Venture controls 50,000 Net Acres

GEOI operated

Partner with Resolute Energy and Private

Independent

GEOI = 47.5% Working Interest

GEOI = 24,000 net acres

Continued leasing

Plan to drill at least 3 wells beginning in

September 2010

Operator Activity in Williams County

American (Hess)

Brigham Exploration

Continental Resources

EOG

Oasis

Whiting

Exxon Mobil

CANADA

ND

MT

50 miles

Williams

County

Parshall

Sanish

23 |

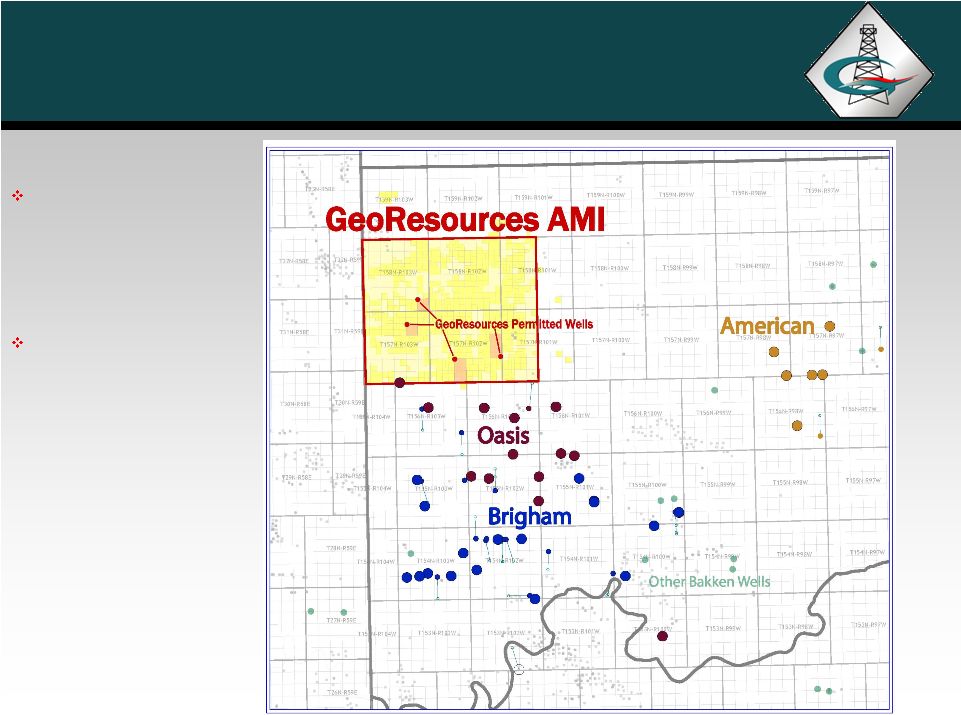

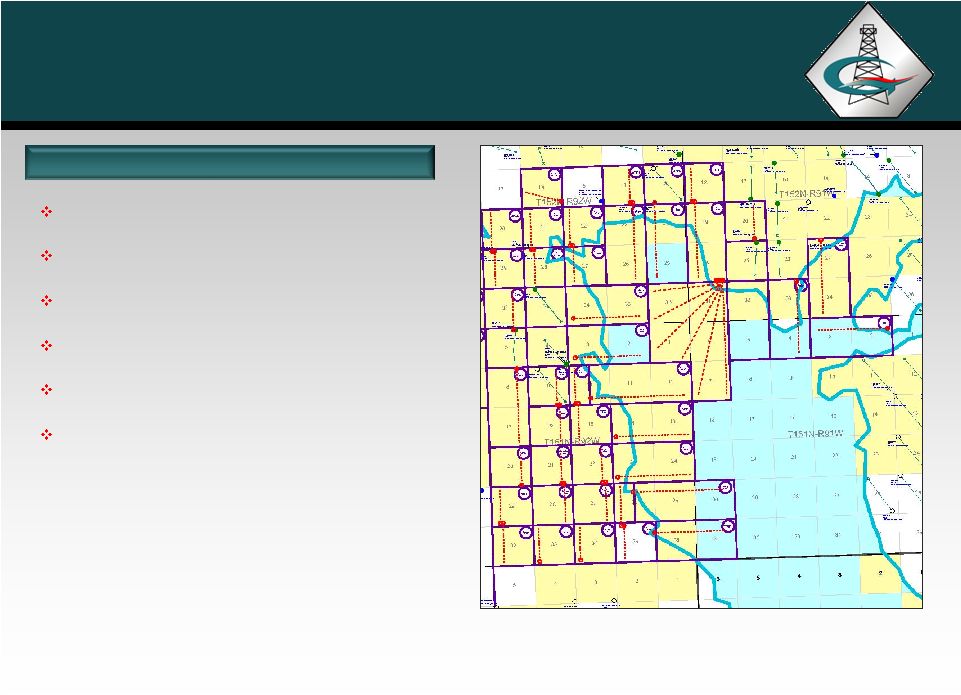

Bakken Shale Operated

Williams County, ND Joint Venture Acreage

24

5 southern offsets to

GEOI AMI have state-

reported initial rates

of 1,181-1,947 bopd

5 wells south of

GEOI AMI either

completing, drilling or

permitted |

25

Bakken Shale

Non-operated

Bakken Shale

Note: Yellow-highlighted areas represent the Company’s acreage

position. Working interests ranging from 10% to 18%

in 100,000 gross acres (approximately

13,000 net acres)

Four rigs running

Joint Venture has drilled 58 wells and

expects 100 wells in the next 24 months

Developing on 640 acre units as well as

1,280 acre and larger units

Detailed map on next slide |

26

Bakken Shale

Non-operated

Note: Yellow-highlighted areas represent the Company’s acreage

position. 640 and 1,280 acre units being drilled

Some larger units under the lake

Multiple wells from single drilling pad

Minimize facilities and roads

Maximize infrastructure

Minimize disturbance and the number of

locations

Van Hook Area |

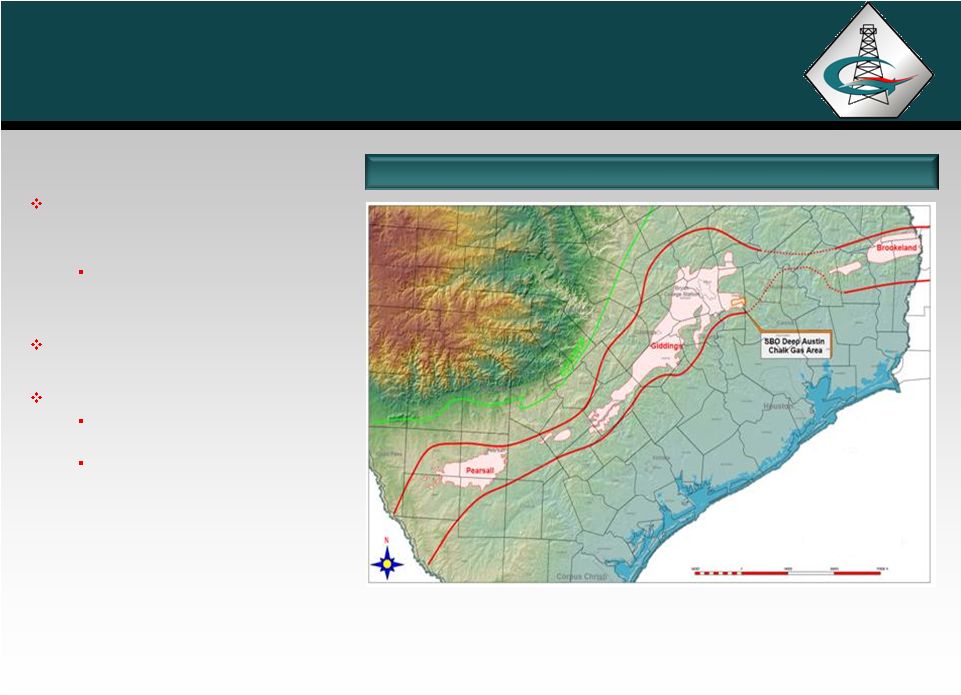

27

Giddings Field

Austin Chalk Play, Texas

Working interests range from

37% -

53% in 68,000 gross acres

(approximately 29,000 net acres)

20 additional gross drilling

locations (9.2 net wells)

16 wells drilled –

100% success

Additional upside includes:

Yegua, Eagle Ford and

Georgetown potential

Multiple wells with rate increase

potential from slick water

fracture stimulations |

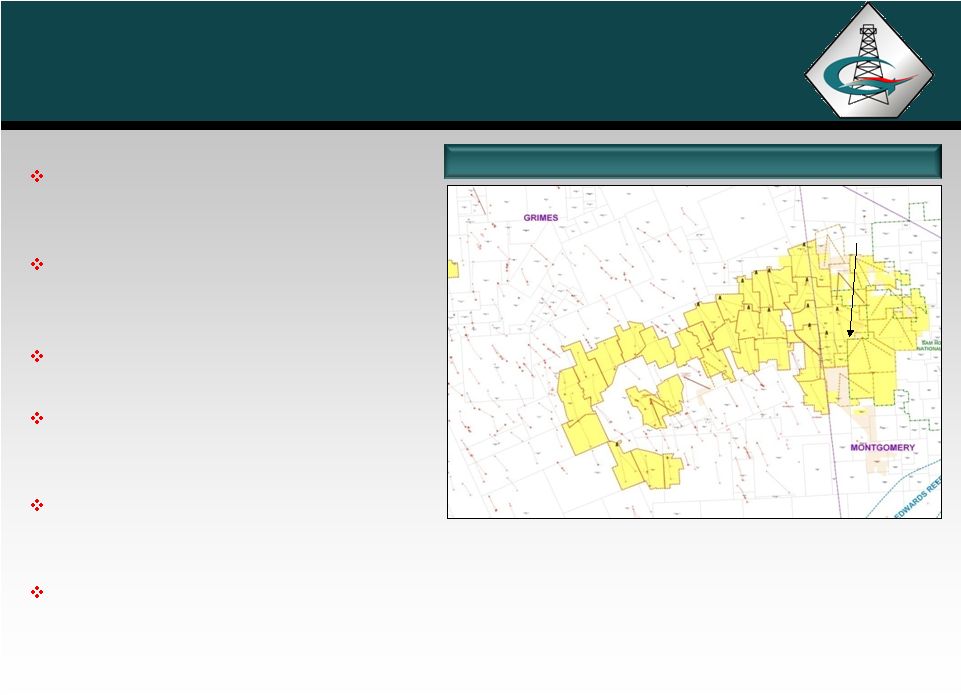

28

Grimes and Montgomery Counties, TX

Austin Chalk Development

Proved undeveloped and probable

horizontal locations

Longstreet 1H produced 1.0 BCFG in

67 days

Single and multiple laterals

Eastern Grimes / Western Montgomery

dry gas

Western Grimes gas with large volume

of liquids

Tight gas –

severance tax exemption

Longstreet 1H |

29

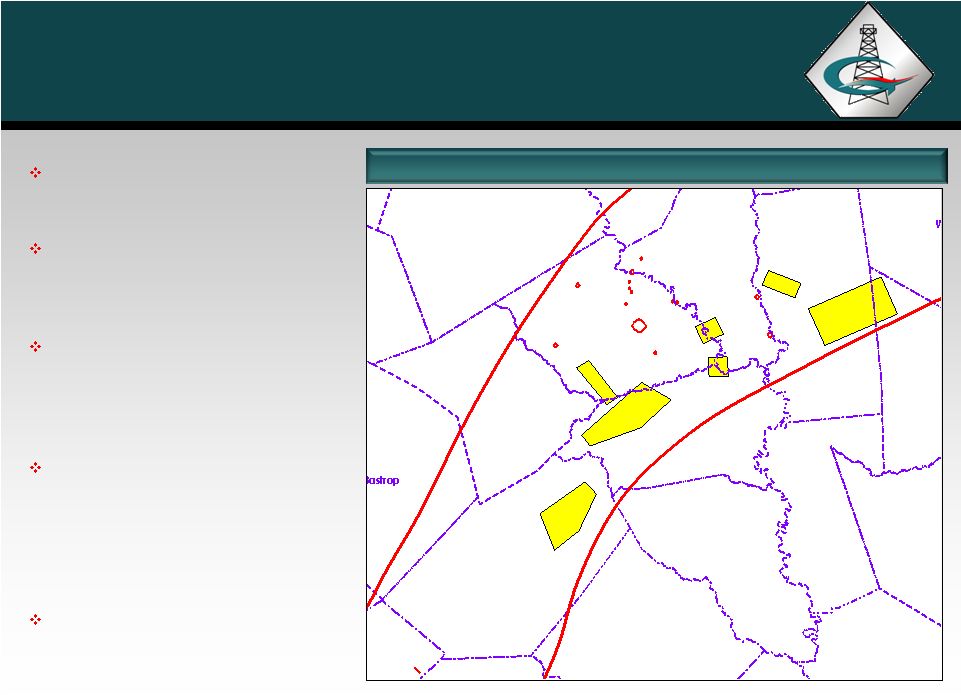

Recent Activity Map

Apache & Clayton Williams active

in Giddings Field

Apache drilled a combination of

vertical and horizontal wells with

older style completions

Our Brazos, Burleson, Fayette

and Washington County holdings

currently appear most prospective

for Eagle Ford

Eagle Ford

•

Early in development

•

Present over much larger

area than current

development

Recent initial rates by other

operators

from

234

–

492

BOPD

Central Texas Eagle Ford

APACHE

APACHE

APACHE

APACHE

APACHE

CWEI

CWEI

MAGNUM-HUNTER

Lee

Washington

Waller

Fayette

Austin

Colorado

Milam

Brazos

Grimes

Burleson |

30

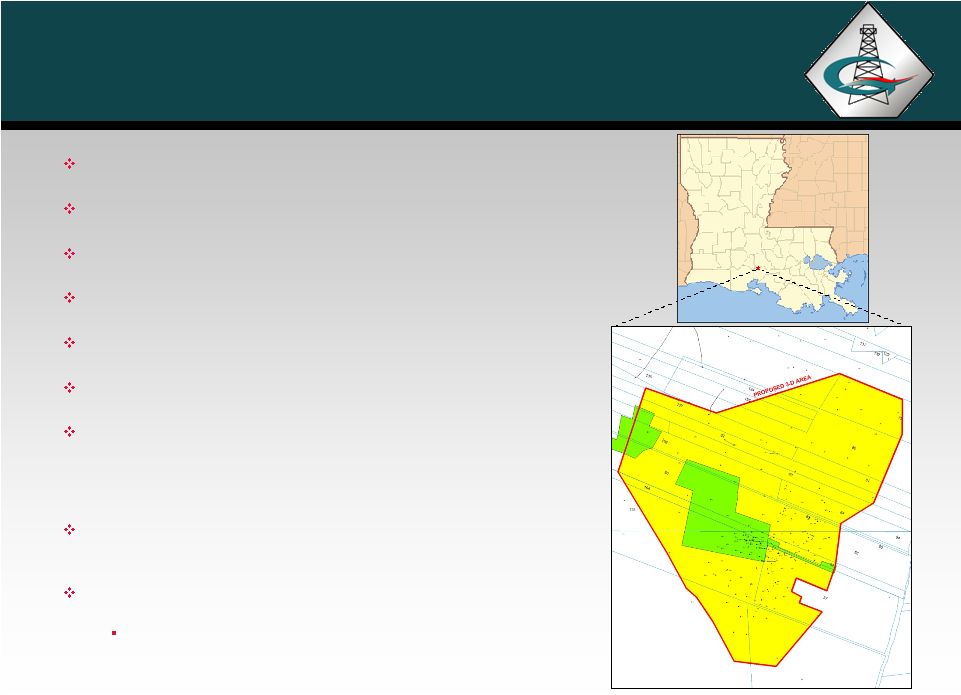

St. Martinville

St. Martinville

Recent

5.3

square

mile

“high

resolution”

3-D

survey

Intermediate depth salt dome

Average working interest 97% and average NRI 91%.

Faulted structural closures provide hydrocarbon traps

534 net acres of owned minerals (green)

2,585 net acres of HBP or leased (yellow)

Main objectives Miocene age, low risk, shallow, highly

productive

multi-sand,

oil,

from

3,000’

–

7,000’.

Over

50

individual sands productive in field with cumulative

shallow production of 15.2 MMBO and 16.6 BCFG

Most recent STD of Kansas #7 is 250 MBO with well

cost of $1.0 million.

Exploratory objectives in Discorbis

and Bol

perca

(gas

and condensate)

Discorbis

section

at

10,000’

produced

124

BCF

and 1.8 MMBO and is HBP.

LOUISIANA |

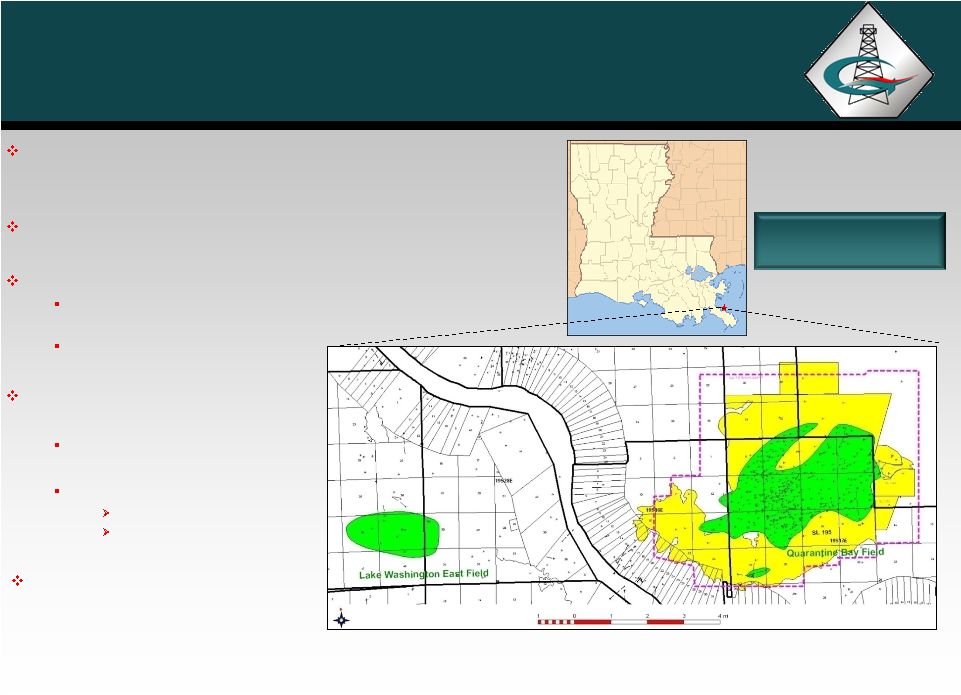

Quarantine Bay

Nearby Lake Washington East

which is an analogy for deep

production has produced 9 MMBO &

14 BCF from the Big Hum +-15,000’

31

LOUISIANA

Quarantine Bay

Field

GeoResources

has

a

7%

WI

above

10,500’

and

a

33%

WI

below 10,500’, in approximately 14,000 acres

Cumulative production = 180 MMBO and 285 BCF

Shallow zone potential (<10,500’):

Numerous behind pipe opportunities due to multiple stacked

sand reservoirs

Rate acceleration wells

Significant hi-potential exploration

deep potential:

Schlumberger reprocessed and

interpreted the 3-D seismic data

Prospect

Multiple objectives to 16,000’

Deeper objectives |

32

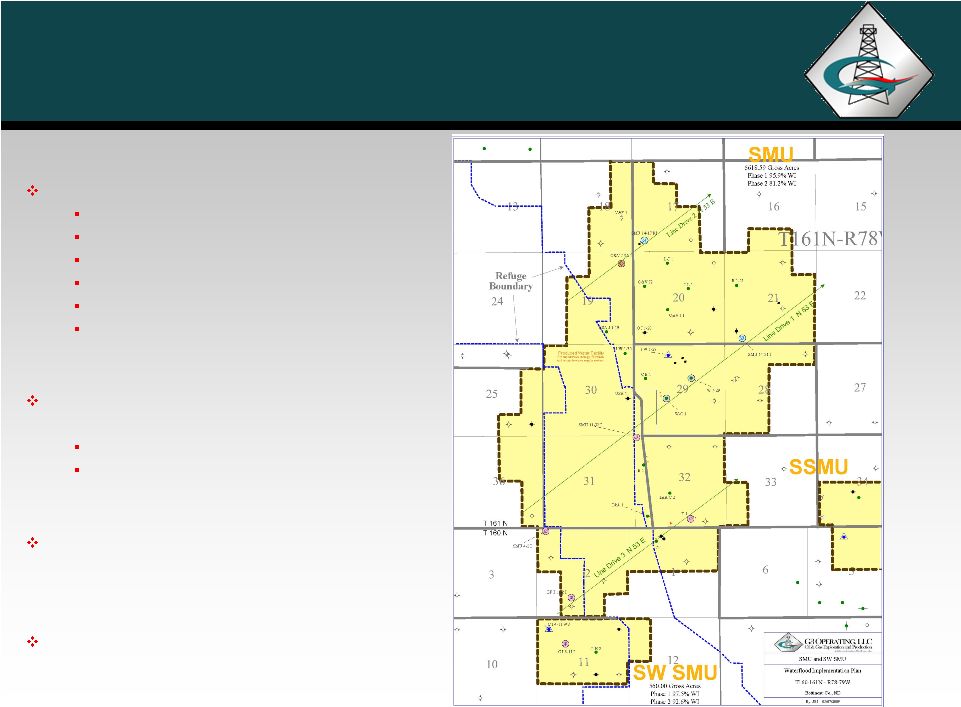

Starbuck and SW Starbuck Waterflood Units

Bottineau County, North Dakota

Starbuck Unit (6,618 acres, 96% WI)

Primary production 1.4 MMBO

Designed as line-drive waterflood

14 producers

6 injectors

One dedicated water supply well

One dedicated injection facility and one

shared facility with SSMU

SW Starbuck Unit (560 acres, 98% WI)

•

Primary production 170 MBO

Single producer/injector pair

Shared water supply well and injection facility

with larger Starbuck Unit

Additional vertical and horizontal wells

planned for both units as pressure response

and increased oil rate is achieved

Estimated additional reserves of 1.6 –

2.5

MMBO for both projects |