Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTEGRAL SYSTEMS INC /MD/ | d8k.htm |

AUGUST

2010 Exhibit 99.1 |

2

•

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act.

Such

forward-

looking

statements

include,

but

are

not

necessarily

limited

to,

our

anticipated

financial

performance,

business

prospects,

technological

developments,

new

products,

research

and development activities and similar statements concerning anticipated future events

and expectations that are not historical facts.

•

These forward-looking statements are based on current information and expectations. We

caution you that these statements are not guarantees of future performance and are

subject to numerous risks and uncertainties, including our reliance on contracts and

subcontracts funded by the U.S. government, intense competition in the ground systems

industry, the competitive bidding process to which our government and commercial

contracts are subject, our dependence on the satellite industry for most of our revenues,

rapid technological changes in the satellite industry, our acquisition strategy and

other risks and uncertainties noted in our Securities and Exchange Commission filings,

including our Annual Report on Form

10-K for the year ended September 25, 2009, and subsequent

filings.

We undertake no obligation to publicly update or revise any forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

INTEGRAL SYSTEMS

SAFE HARBOR |

3

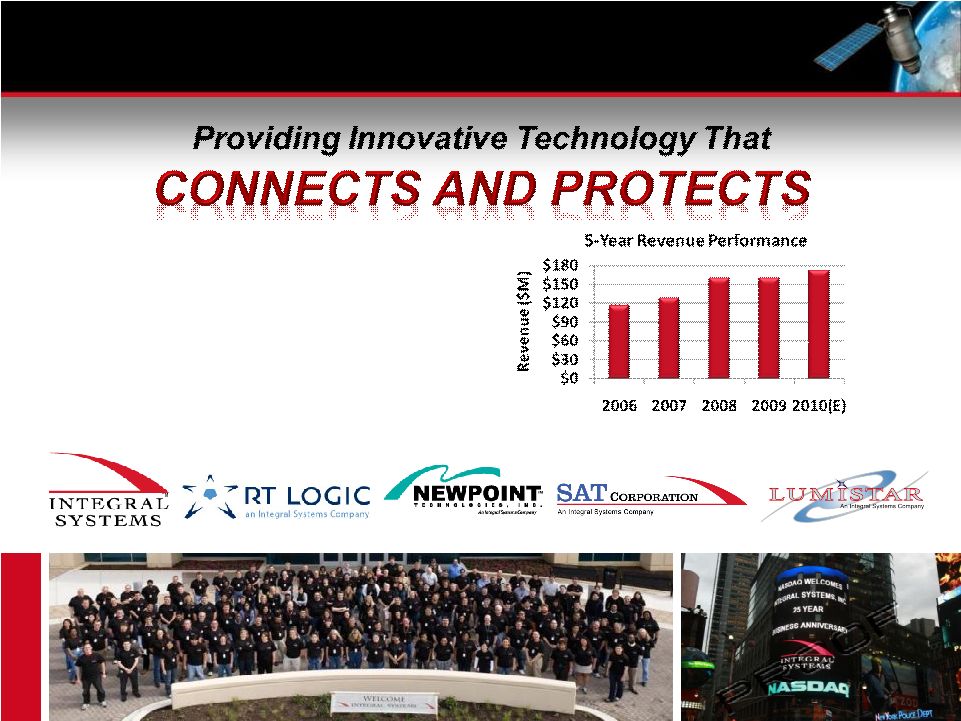

INTEGRAL SYSTEMS

AT A GLANCE

The Integral Systems Family of Solution Providers

•

NasdaqGS:

ISYS

•

Founded:

1982

•

Employees:

700 employees

•

Locations:

17 locations |

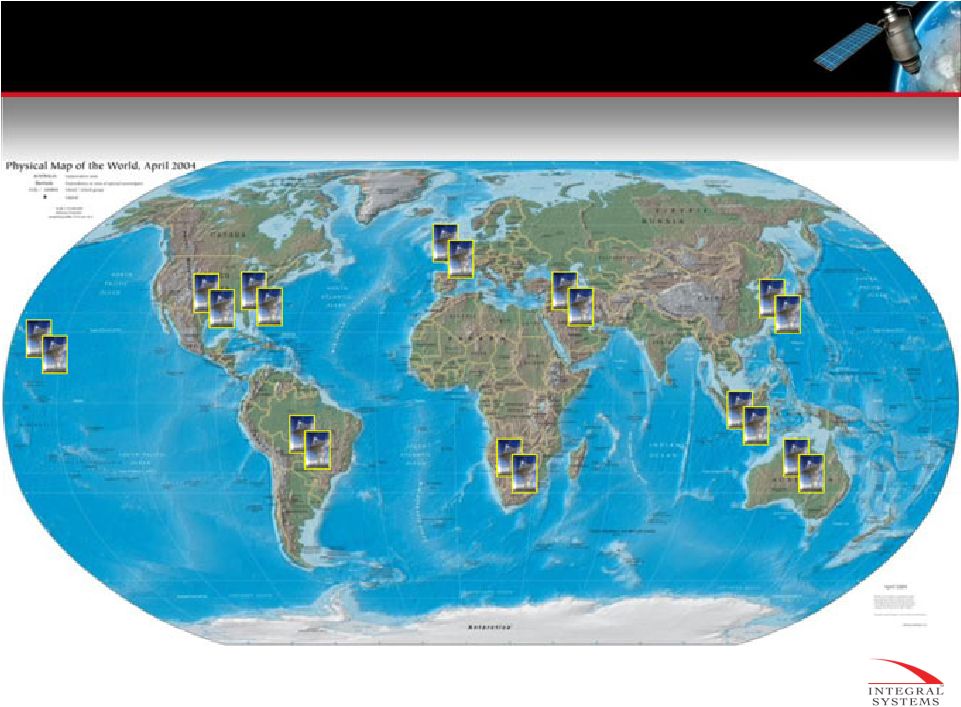

4

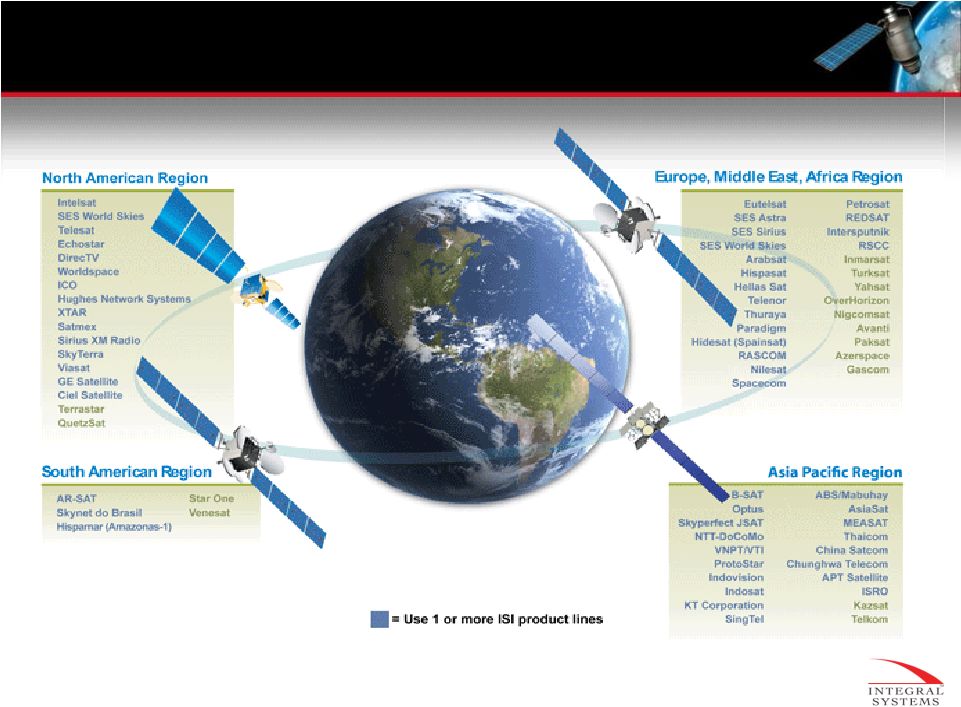

INTEGRAL SYSTEMS

DIVERSIFIED GLOBAL CUSTOMER BASE

A Leader in Our Industry:

•

U.S.

SBA

Region

III

Contractor

of

the

Year,

2009

•

Washington

Post

Top

200

Companies,

2009 |

5

INTEGRAL SYSTEMS

MARKET LEADER IN COMMERCIAL SPACE CONTROL |

6

Enterprise Network Management

•

Communications Infrastructure Management (Newpoint Compass)

•

Remote Site Monitoring (Newpoint Mercury)

Signal Processing & Data Communications

•

Software-Defined Front-End Systems (RT Logic)

•

SATCOM-On-The-Move (SATCOM Solutions)

Communications Information Assurance

•

Interference Detection; RF Monitoring; Digital Signal Processing

•

Spectrum Monitoring (SigMon), Interference Geolocation (satID)

Services

•

Satellite Communications Network Operations (SATCOM NetOps)

•

Subscription Services

INTEGRAL SYSTEMS

MARKET SEGMENTS |

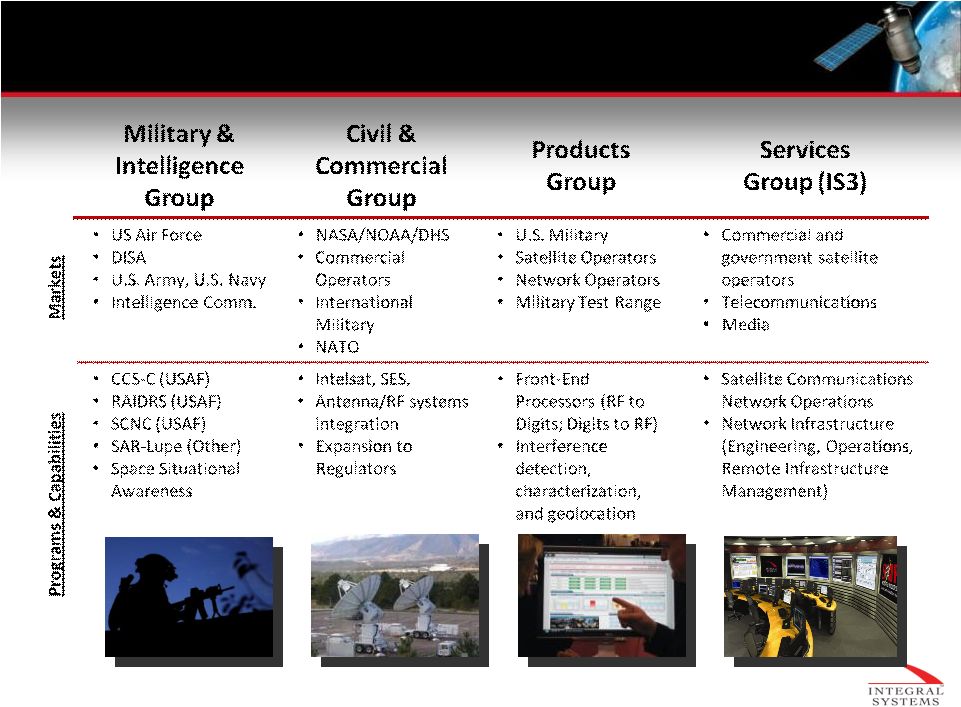

7

INTEGRAL SYSTEMS

ALIGNED OPERATIONS |

8

X, Ku, and Ka Band Micro Terminals

•

Smaller, Lighter, More Power Efficient SATCOM Terminals

•

Enable SATCOM-on-the-Move for Military, Special Operations,

National Guard, Government Agencies

SATCOM Solid State Power Amplifiers (SSPA)

•

Smaller, Lighter, More Power Efficient

•

Ku, Ka -Band 25W –

100W

•

Travelling Wave Tube Amplifier (TWTA) Replacement

Space Situational Awareness & Cyber Security

•

RF Interference, Detection, Geolocation & Cataloging

•

Cyber Enabled Products

•

Space Situational Awareness Architecture

INTEGRAL SYSTEMS

FUTURE GROWTH ENGINES |

9

Intelligence Programs

•

Satellite

Command

&

Control

(Market

Leader

for

Commercial

Geo

Operations)

•

SATCOM RFI Detection, Characterization, & Geolocation

•

SATCOM Data Link Information Assurance & Cyber Security

Unmanned Aerial Systems (UAS)

•

Common Data Link Test Sets –

We Are the Gold Standard

•

UAS Modems & Communication Systems

•

UAS Flight & Ground RF Interference (RFI) Detection &

Countermeasure Systems

Network Operations Services

•

Global Quality of Service, RFI Detection & Geolocation

Services for

Future COMSATCOM Services Acquisition (FCSA)

•

RFI, Geolocation, & Network Operations Outsourcing for SATCOM

Network Providers

•

SATCOM Data Link Information Assurance & Cyber Security

INTEGRAL SYSTEMS

FUTURE GROWTH ENGINES |

10

INTEGRAL SYSTEMS

GLOBAL SERVICES CAPABILITIES |

11

FINANCIAL OVERVIEW |

12

Significant Non-Recurring Expenses

•

Accounting

–

$2.7M Reserve Against DCAA Adjustments

•

Operating

Expenses:

Q3/YTD

–

Acquisition Integration Expenses: $600K/$1.8M

–

Legal Fees: $500K/$850K

–

Staff Reduction: $400K

–

Compliance Fees: $300K/$1.0M

Significant Other Expenses

•

P&L: Non-Cash Stock-Based Compensation

–

$600K/Q through Q411

•

Cash:

Real

Estate:

$1.2M/year

through

2015

–

Reserved through 6/2010

FY10 Investments

•

Integral

Systems

Service

Solutions

(IS3):

$2M

•

SATCOM

Solutions

R&D:

$750K

•

EPICOR

Material

Resource

Planning

System:

$1M

•

Product

Revamp

Newpoint

Technologies:

$300K

REVISED

FY10 GUIDANCE

Revenue

$170M -

$174M

Gross Profit Margin

37% -

39%

EBITDA

$9M -

$12M

Bookings

$170M -

$180M

INTEGRAL SYSTEMS

RECENT DEVELOPMENTS –

IMPACTS TO Q3 & FY10 |

13

INTEGRAL SYSTEMS

EBITDA RECONCILIATION

2010 FORECAST

VARIANCE

EBITDA (A)

EBITDA (E)

Q1

$

4.0 Total Q1

$

4.0 Q2

$

4.0 M&A -

CVG Integration

$

1.8 Total Q2

$

1.8

$

2.2 Q3

$

6.0 Rate Reserve

$

2.7 CVG Avtec Revenue Miss

$

4.6 CVG Avtec Direct Costs

$

(1.9) Legal Costs

$

0.5 Compliance Costs

$

0.2 Employee Severance

$

0.4 M&A -

CVG Integration

$

0.6 Gross Margin -

Civil, Lumistar

$

0.6 Total Q3

$

7.8

$

(1.8) Q4

$

8.0 CVG Avtec Revenue Reduction

$

2.0 CVG Avtec Direct Costs

$

(0.3) Compliance Costs

$

0.3 Total Q4

$

2.0

$

6.3 Total EBITDA (Variance)

$

22.0

$

11.6 Revised FY2010 EBITDA(E)

$

10.7 |

14

Key Opportunities

FY10 –

FY12

•

USAF Joint Space Operations Center Mission

Systems

(JSpOC

MS)

High

Accuracy

Catalog

•

USAF

RAIDRS

ECP-009

&

ECP-010

•

Special

Operations

(SOCOM)

Forces

Deployable

Nodelite

(SDN-Lite)

•

USN Military Sealift

Next Generation

Wideband

•

Future COMSATCOM Service Acquisition

(FCSA)

•

Army SMD

Wideband SATCOM Operations &

Technical Service (WSOTS)

•

Intelligence Community

INTEGRAL SYSTEMS

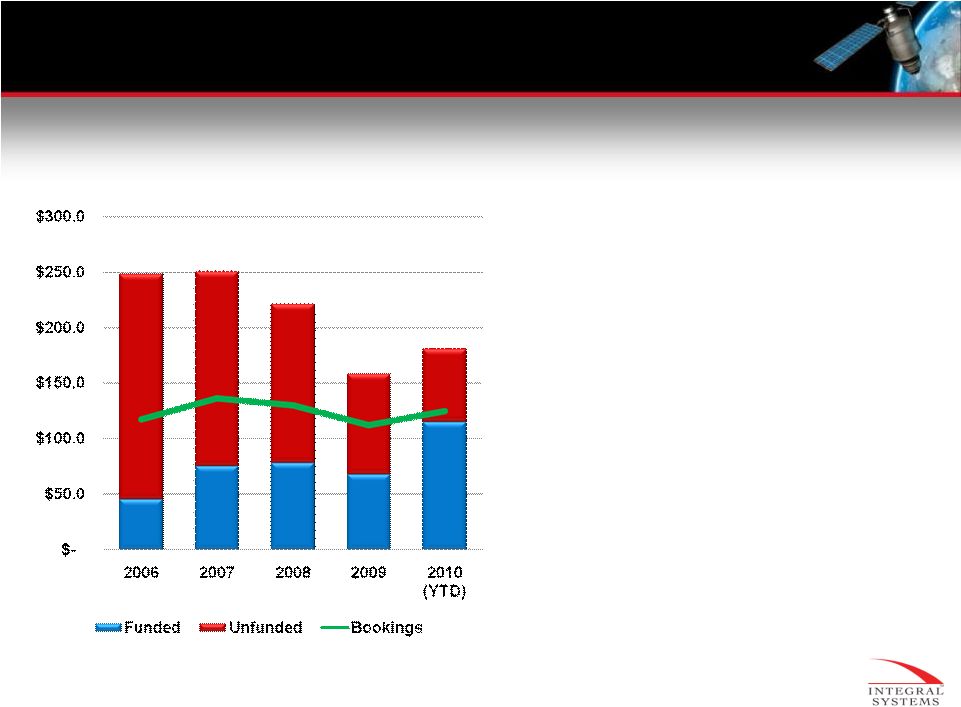

BOOKINGS, BACKLOG, AND PIPELINE

Information reflect Q3 results as reported 8/2/10 |

15

*BASED

UPON

Q3

FY

2010

RESULTS

DOES

NOT

ACCOUNT

FOR

INTERCOMPANY

ELIMINATION

**BASED UPON FY 2009 RESULTS DOES NOT ACCOUNT FOR INTERCOMPANY ELIMINATION

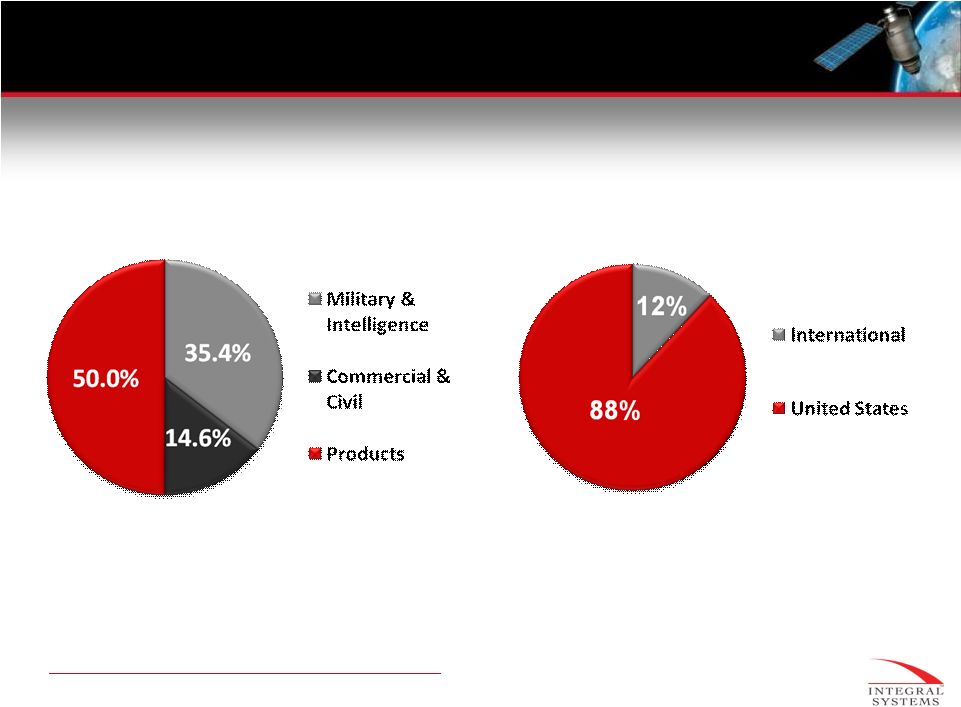

YTD FY10 SALES BY SEGMENT*

INTEGRAL SYSTEMS

YTD FY10 SALES

Information reflect Q3 results as reported 8/2/10

FY 2009 SALES GEOGRAPHY** |

16

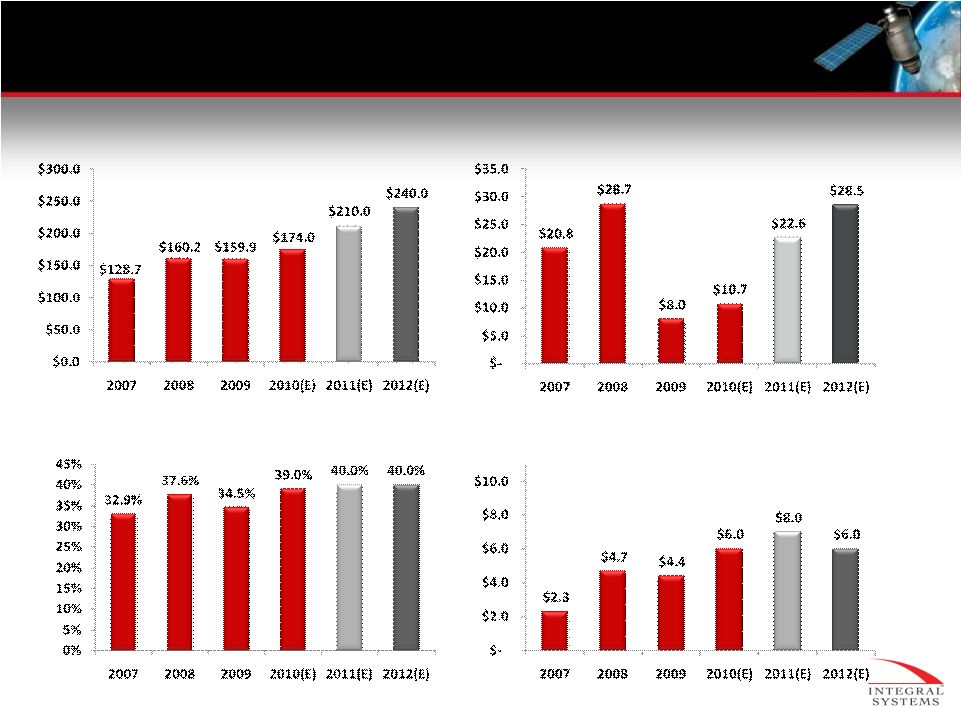

REVENUE

EBITDA

GROSS PROFIT MARGIN

CAPITAL EXPENDITURES

INTEGRAL SYSTEMS

FINANCIAL PERFORMANCE & EXPECTATIONS

Information reflect Q3 results as reported 8/2/10 |

17

INTEGRAL SYSTEMS

SUMMARY |

18

BACK UP

INTEGRAL SYSTEMS |

19

USE OF NON-GAAP FINANCIAL MEASURES

INTEGRAL SYSTEMS

EBITDA

(earnings

before

interest,

taxes,

depreciation

and

amortization)

is

a

non-GAAP

financial

measure

used

by

management

to

evaluate

operating

performance.

Management

believes

that

the

presentation

of

EBITDA

helps

management

and

investors

to

make

a

meaningful

comparison

between

our

operating

results

and

those

of

other

companies,

as

well

as

providing

a

consistent

comparison

of

our

relative

historical

financial

performance.

The

presentation

of

this

non-GAAP

financial

measure

is

not

to

be

considered

in

isolation

or

as

a

substitute

for

our

financial

results

prepared

in

accordance

with

GAAP.

Below

are

reconciliations

of

fiscal

years

2007

-

2012

net

income

to

EBITDA:

2007

2008

2009

2010(E)

2011(E)

2012(E)

($ millions)

Net Income

$ 12.8

$ 18.2

$ 1.1

$ (1.2)

$ 4.1

$ 10.1

Other Income (Expense), net

$ (2.2)

$ (0.3)

$ 0.1

$ 0.9

$ 2.4

$ 1.2

Provision for Income Taxes

$ 6.3

$ 7.1

$ (1.0)

$ 1.1

$ 3.5

$ 5.0

Income From Operations

$ 16.9

$ 25.0

$ 0.2

$ 0.8

$ 10.0

$ 16.3

Non-Cash Stock Compensation

$ 0.9

$ 1.1

$ 3.5

$ 2.6

$ 2.3

$ 1.7

Depreciation and Amortization

$ 3.0

$ 2.6

$ 4.3

$ 7.3

$ 10.3

$ 10.5

EBITDA

$ 20.8

$ 28.7

$ 8.0

$ 10.7

$ 22.6

$ 28.5 |

20

USE OF NON-GAAP FINANCIAL MEASURES

INTEGRAL SYSTEMS

EBITDA

(earnings

before

interest,

taxes,

depreciation

and

amortization)

is

a

non-GAAP

financial

measure

used

by

management

to

evaluate

operating

performance.

Management

believes

that

the

presentation

of

EBITDA

helps

management

and

investors

to

make

a

meaningful

comparison

between

our

operating

results

and

those

of

other

companies,

as

well

as

providing

a

consistent

comparison

of

our

relative

historical

financial

performance.

The

presentation

of

this

non-GAAP

financial

measure

is

not

to

be

considered

in

isolation

or

as

a

substitute

for

our

financial

results

prepared

in

accordance

with

GAAP.

Below

is

a

reconciliation

for

the

first

three

quarters

of

fiscal

years

2010

and 2009 net

income

to

EBITDA:

Quarter Ended

December 25,

2009

Quarter Ended

March 26,

2010

Quarter Ended

June 25,

2010

Quarter Ended

December 26,

2008

Quarter Ended

March 27,

2009

Quarter Ended

June 26,

2009

($ millions)

Q1 2010

Q2 2010

Q3 2010

Q3 YTD 2010

Q1 2009

Q2 2009

Q3 2009

Q3 YTD 2009

Net Income (Loss)

1.2

0.1

(3.8)

(2.5)

1.0

2.7

(1.5)

2.2

Other income ( Expense)

0.2

(0.1)

(0.3)

(0.5)

0.0

0.0

(0.1)

(0.1)

Provision for income taxes

(Benefit)

0.6

0.3

(1.6)

(0.7)

0.3

1.5

(2.4)

(0.6)

Income from Operations

2.0

0.3

(5.1)

(2.7)

1.3

4.2

(3.8)

1.7

Stock-based compensation

0.6

0.6

0.9

2.1

1.0

0.6

1.0

2.6

Depreciation & Amortization

1.4

1.2

2.4

5.1

0.6

1.0

1.3

2.9

EBITDA

4.0

2.2

(1.8)

4.5

2.9

5.8

(1.5)

7.2 |