Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | dex991.htm |

Q3 FY 2010 EARNINGS

August 18, 2010

Exhibit 99.2 |

| Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade’s Q3 Fiscal 2010 earnings presentation,

which includes prepared remarks, slides, and a press release detailing fiscal

third quarter 2010 financial results. The press release was issued shortly after 1:00 p.m. Pacific

time on August 18, 2010, via Business Wire and First Call. The press release, along

with these prepared comments and slides, has

been

made

available

on

Brocade’s

Investor

Relations

website

at

www.BRCD.com

and

has

been

furnished

to

the

SEC

on

Form 8-K.

©

2010 Brocade Communications Systems, Inc.

Page 1

of 42 |

| Cautionary Statements and Disclosures

This presentation includes forward-looking statements regarding

Brocade’s financial results, plans and business outlook as well as

worldwide IT spending, which are only predictions and involve risks and

uncertainties such that actual results may vary significantly. These and

other risks are set forth in more detail in our Form 10-Q for the

fiscal quarter ended May 1, 2010 and our Form 10-K for the fiscal

year ended October 31, 2009. These forward-looking statements reflect

beliefs, assumptions, outlook, estimates and predictions as of today, and

Brocade expressly assumes no obligation to update any such

forward-looking statements. In addition, this presentation includes

various third party estimates regarding the total available market and

other measures, which do not necessarily reflect the view of Brocade.

Further, Brocade does not guarantee the accuracy or reliability of any

such information or forecast. Certain

financial

information

is

presented

on

a

non-GAAP

basis.

The

most

directly

comparable

GAAP

information

and

a

reconciliation

between

the

non-GAAP

and

GAAP

figures

are

provided

in

the

accompanying

press

release,

which

has

been

furnished

to

the

SEC

on

Form

8-K

and

posted

on

Brocade’s

website,

and

is

included

in

the

appendix

to

this

presentation.

Please see risk factors on Forms 10-K and 10-Q filed with the SEC

|

| ©

2010 Brocade Communications Systems, Inc.

Page 2

of 42

*

*

* |

Agenda

Prepared comments followed by live Q&A call

Richard Deranleau

CFO

Mike Klayko

CEO |

| Today’s

prepared

comments

include

remarks

by

Mike

Klayko,

Brocade’s

CEO,

regarding

the

company’s

quarterly

results,

its

strategy

and

a

review

of

operations,

as

well

as

industry

trends

and

market/technology

drivers

related

to

its

business;

and

by

Richard

Deranleau,

Brocade’s

CFO,

who

will

provide

a

financial

review.

A

live

question-and-answer

conference

call

will

be

webcast

beginning

at

2:30

p.m.

Pacific

time

on

August

18

th

at

www.BRCD.com

and

will

be

archived

on

Brocade’s

Investor

Relations

website

for

approximately

12

months.

Participants

are

invited

to

submit

questions

via

email

at

ir@brocade.com

up

to

30

minutes

prior

to

the

conference

call

and

to

ask

live

questions

during the call.

©

2010 Brocade Communications Systems, Inc.

Page 3

of 42 |

Fiscal 2010: Q3 Earnings

Mike Klayko, CEO

*

*

* |

| Prepared comments provided by Mike Klayko, CEO

©

2010 Brocade Communications Systems, Inc.

Page 4

of 42 |

Q3 Executive Summary

Q3 Results

•

$503.5M revenues

•

$0.13 non-GAAP EPS*

Storage Area Networking (SAN)

•

Revenue performance ahead of

typical seasonality

•

SAN switch revenue grew 20%

Qtr./Qtr.

Ethernet

•

Sequential growth in EMEA, APAC,

and Americas (excluding Federal)

•

Federal up 15% Yr./Yr.

Solid performance across diversified business model

* Note: Non-GAAP, please see GAAP reconciliation in appendix

|

| Brocade reported Q3 revenues of $503.5M demonstrating the value of our

diversified business model across geographies, technology

segments

and

multiple

go-to-market

routes.

In

terms

of

business

segments,

we

performed

better-than-expected

in

storage

area

networking

(SAN)

with

switch

revenue

growing

double

digits

sequentially

in

what

is

typically

a

seasonally

challenging quarter. Our overall Ethernet business was slightly down sequentially

primarily due to softness in Japan and our Federal business, which was down

16% from a strong performance in Q2, while up 15% year-over-year.

There were a number of positive signs in our Ethernet business, as Americas

(excluding Federal), APAC and EMEA all grew sequentially. Another positive

sign comes from our net new Ethernet accounts which grew by 290 in Q3 10 and are beginning

to generate a larger portion of our revenues. These trends are noteworthy as they

indicate that our Ethernet business growth strategy is working in the areas

where we have focused our investments. I’ll cover our Ethernet business in greater detail in

the next two sections.

Other

key

Q3

financial

metrics

include

non-GAAP

EPS

(diluted)

of

$0.13

and

GAAP

EPS

(diluted)

of

$0.05,

for

the

quarter.

©

2010 Brocade Communications Systems, Inc.

Page 5

of 42 |

Ethernet Initiatives Update

Hiring Goals:

•

Recruited top talent from

networking industry

•

Met Q3 hiring goals for field and

inside sales

EMEA Leadership:

•

Alberto Soto

•

Former VP of EMEA at HP ProCurve

•

Significant channel and end-user

expertise

GSI:

•

Andy Vandeveld

•

Extensive IP networking experience

•

Led IBM alliance at major competitor |

| Looking in more detail at Brocade’s Ethernet business, we continued

to execute well on our key initiatives to accelerate end- user demand and

increased our account footprint and penetration with our robust portfolio of Ethernet products.

Key

highlights

this

quarter

include

our

ability

to

recruit

top

talent

from

the

networking

industry

and

reaching

our

hiring

goals

for

our field and inside sales teams for Q3. Because of their relevant networking

expertise and industry knowledge, these individuals have already had a

positive impact and are expected to ramp their productivity in subsequent quarters.

We are also adding top talent to deepen the strength of our executive bench. In

June, we announced that Alberto Soto, former VP and general manager of EMEA

for HP ProCurve, joined Brocade as head of our EMEA sales. We also added executive

talent

to

drive

our

Global

Systems

Integrator

(GSI)

strategy/business

with

the

addition

of

Andy

Vandeveld

who

has

extensive

experience in the networking industry. This is an increasingly strategic

route-to-market for Brocade as indicated by industry estimates

from

firms

such

as

IDC

who

predicts

that

spending

on

GSIs

will

exceed

$103

billion

USD

globally

in

this

year

alone.

©

2010 Brocade Communications Systems, Inc.

Page 6

of 42 |

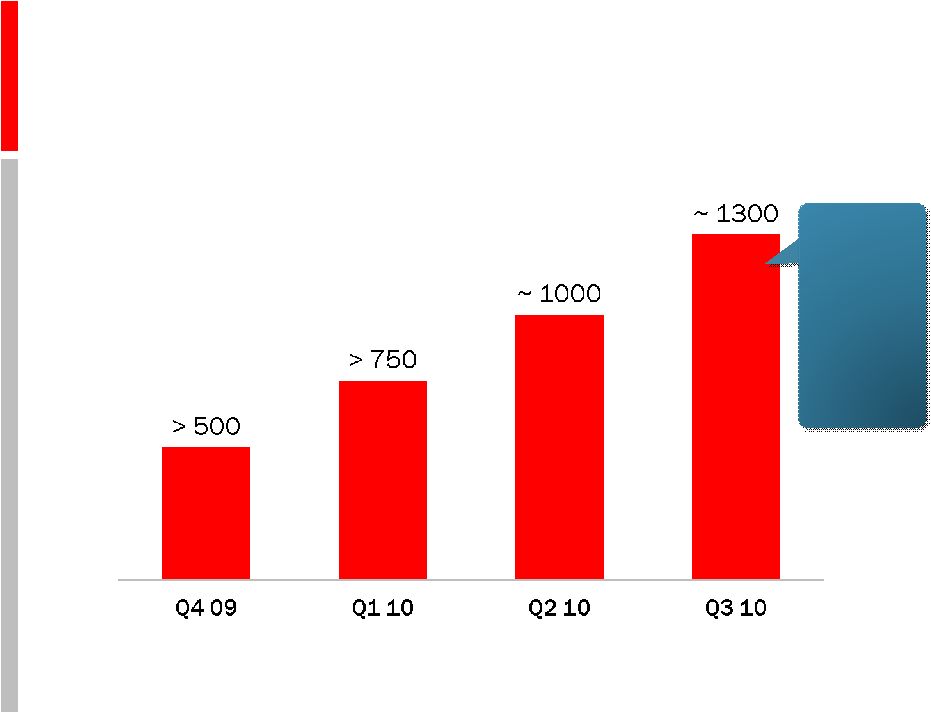

Ethernet Customer Account Penetration

Cumulative new Ethernet accounts

Highest

revenue

contribution

from new

accounts

since

Foundry

acquisition |

| We continue to make good headway in winning net-new enterprise

Ethernet accounts since the acquisition of Foundry. Exiting last quarter we

had a total of more than 1000 net new Ethernet customers. In Q3 we added 290 net-new accounts giving us a

running total of nearly 1300. These net-new accounts in Q3 contributed the

highest revenue than any other quarter since the acquisition of Foundry in Q1

09. Americas led the way in Q3 by adding 170 new accounts, which exceeded the entire worldwide

new accounts that were added in Q3 09. Additionally, we’re seeing other

positive trend lines in key metrics such as repeat purchases among new

accounts. In

addition,

as

of

Q3,

we

are

also

pleased

to

note

that

at

least

15%

of

the

Brocade

customers

in

the

Global

500/Fortune

1000

list purchased our Ethernet products in the last 18 months.

©

2010 Brocade Communications Systems, Inc.

Page 7

of 42 |

Technology Day 2010

Enthusiastic

response

to

Brocade

One

TM

and

innovations |

| We were also pleased with the enthusiastic response from customers,

partners, global press and analysts to the launch of Brocade

One™

and

our

next-generation

Ethernet

fabric

technology

strategy

at

our

Technology

Day

in

June.

Brocade

One

is

our

unifying network architecture and strategy designed to help customers transition

seamlessly to highly virtualized infrastructures where information and

services are available in the cloud. The positive response provides us with a growing confidence that

we

are

on

the

right

track

in

terms

of

our

overall

Ethernet

business

and

strategy.

Brocade

One

encompasses

our

core

value

propositions

we

believe

should

be

inherently

designed

into

networks:

unmatched

simplicity,

investment

protection,

non-stop

networking,

and

optimized

applications.

Leveraging

Brocade

One

are

the

innovations

we

unveiled

at

Technology

Day:

Virtual

Cluster

Switching

(VCS),

Virtualization

Access

Layer

(VAL)

and

Automated

Port

Profile

Migration

(AMPP).

These

highly

advanced,

foundational

technologies

will

make

Brocade

networks

simpler

to

operate

and

highly

tuned

to

perform

in

virtualized

data

center

environments.

There is no question that server virtualization is one of the most important and

transformational technologies in IT today. According to a recent customer

survey, virtualization is at the top of the list of network infrastructure investments, with close to

40% of customers citing that they would move more than half of their production

applications to virtual machines in the next 18 months.

©

2010 Brocade Communications Systems, Inc.

Page 8

of 42 |

Technology Day—Positive Reactions

Brocade One in the news

Long term, what Brocade was talking about

was where Cisco needs to get.

–Zeus Kerravala

”

“

Brocade Communications…

is promoting the concept of

a converged architecture for cloud-ready data centers.

–J. Bonasia

”

“

The network is the data center…

Brocade beat Juniper to the punch today.

–Craig Matsumoto

”

“

Brocade comes out of the networking shadows

and delivers a vision.

–Andre Kindness

“

” |

| Brocade One and these innovations align our technology strategies and

investments tightly with customer imperatives and key trends. In this slide

you can see some selected comments about our Technology Day announcements from press and

analysts.

©

2010 Brocade Communications Systems, Inc.

Page 9

of 42 |

Brocade 1020 CNA

Product Innovation and Recognition

Brocade One delivering leading products today

Rated Best

Performing CNA

Brocade DCX Backbone

8 Gb/sec 64-port FC Blade

MLX 8×10 GbE Blade

10 GbE Converged

Network Adapter

Brocade MLX |

| Brocade

One

not

only

serves

as

our

strategy

for

future

products,

it

is

also

core

to

the

products

we’re

delivering

today.

For

example,

in

Q3

we

extended

our

industry

leadership

in

terms

of

price/

performance

and

network

scalability

through

the

introduction

of

the

8-Port

10

Gigabit

Ethernet

Module

for

the

Brocade

NetIron

MLX

Series

for

both

our

data

center

and

service

provider customers. We have been pleased with the strong customer demand for these

new modules, an indication that many customers are upgrading their networks

to meet constantly increasing demands in terms of network traffic and bandwidth.

Had

it

not

been

for

supply

constraints

that

are

typical

of

new

product

introductions,

our

Ethernet

business

performance

would

have been stronger this quarter.

On

the

Fibre

Channel

side,

we

introduced

the

64-Port

8

Gigabit

Fibre

Channel

blade

for

the

Brocade

DCX

Backbone.

This

new

blade

offers

industry-leading

wire-speed

performance

and

density

to

address

increasing

traffic

in

service

provider

networks

and

booming

server

virtualization

adoption

in

data

centers.

And

it

reinforces

Brocade’s

commitment

to

non-stop

networking

while

also

preserving

customers’

investments

in

their

existing

infrastructures,

which

are

both

Brocade

One

principles.

Additionally, we received important third-party recognition for our 10 Gigabit

Ethernet Converged Network Adapters (CNAs), a critical component of our

end-to-end data center networking architecture. Specifically, IT Brand Pulse declared that the

Brocade CNAs

performed better and offered the easiest migration paths in real-world

applications and IT scenarios compared to every other major competitor in

existence today. ©

2010 Brocade Communications Systems, Inc.

Page 10

of 42 |

Brocade DCX–4S

Brocade Encryption Switch

Industry Recognition for Innovation

Brocade continues to show product leadership

Brocade NetIron CER 2000 Routers

Brocade FastIron Series Switches |

| Other third parties are taking note of Brocade’s product quality and

innovation. In Q3 Brocade products netted major industry awards from various

companies and publications including: •Communications

Solutions

Product

of

the

Year

Award

for

the

Brocade

NetIron

CER

2000

Routers

•Carrier

Infrastructure

Best

of

Show

Award

at

Interop

Tokyo

2010

also

for

the

Brocade

NetIron

CER

2000

Routers

•TMC

Unified

Communications

Excellence

Award

for

the

Brocade

FastIron

Series

Switches

•EMC

Partner

Solution

Award

for

Best

New

Offering

for

the

Brocade

Encryption

Switch

•Best

Of

Tech-Ed

2010

by

Windows

IT

Pro

and

SQL

Server

Magazines

for

the

Brocade

DCX-4S

These prestigious awards reflect Brocade’s customer-driven commitment to

developing higher performance, innovative solutions with the highest

standards of quality. ©

2010 Brocade Communications Systems, Inc.

Page 11

of 42 |

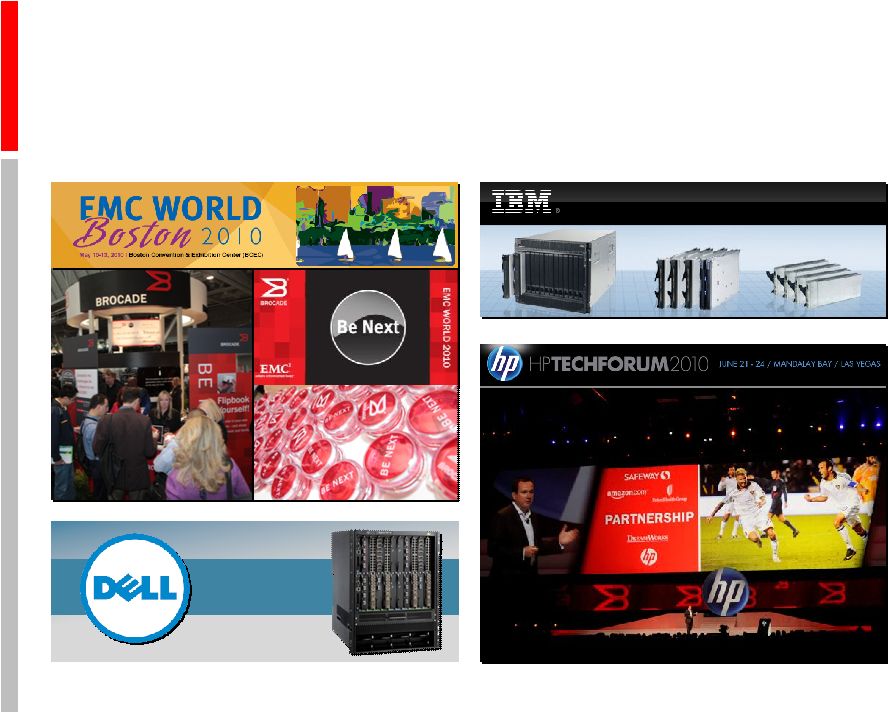

OEM Partner Momentum

Strengthening strategic relationships

System x

B-RX 16

B-RX 16 |

| In Q3 we continued to generate healthy momentum across several partner

categories, namely OEM, channel and solution partners. First,

an

update

at

two

important

OEM

events—EMC

World

in

May

and

HP

Technology

Forum

in

June.

What

a

difference

a

year

makes!

That was our theme coming out of this year’s EMC World, which may have been one

of the most productive EMC events for us in recent history. As we reported on

our Q2 conference call, EMC has become a reseller of our Ethernet switches and IP routers as part of tailored-

made EMC solutions such as remote backup, disaster recovery, virtualization and data

center consolidation. Brocade and EMC also announced “Be Next”, a

joint marketing campaign that defines how the two companies are collaborating to deliver private cloud

infrastructure.

We followed up EMC World with an equally successful engagement at HP Technology

Forum where we announced a new set of high- performance

Fibre

Channel

SAN

and

server

connectivity

solutions

designed

specifically

for

virtualized

data

center

environments.

The

extension

of

our

Fibre

Channel

portfolio

through

HP

was

significant

as

we

also

announced

that

the

two

companies

achieved

a

record-

breaking

milestone

by

shipping

over

7

million

HP

StorageWorks

B-series

Fibre

Channel

ports

to

date.

This

makes

HP

the

No.

1

OEM

for

Fibre

Channel in our 15-year history.

In

other

OEM

updates,

we

are

seeing

strong

traction

of

our

Fibre

Channel

host

bus

adapter

(HBA)

business

through

IBM

with

300%

growth sequentially. In Q3 IBM also qualified and launched a series of

top-of-rack Ethernet switches from Brocade optimized for its System

X (x86) enterprise servers. There is no question that we still have much to do in terms of growing the Ethernet business through

IBM.

But

we

remain

determined

in

continuing

to

develop

this

important

route-to-market

as

demonstrated

by

our

activities

this

quarter.

Moving

onto

Dell,

in

Q3

Dell

launched

a

factory-installed

version

of

the

Brocade

815

Fibre

Channel

HBA

offering

significant

pricing

advantages over competing products. Dell also is continuing to fill out its

portfolio of Dell-branded networking solutions from Brocade with

the

recent

addition

of

the

Brocade

BigIron

RX

16

Series

Switches.

We

are

pleased

with

the

results

to

date

of

the

Brocade/Dell

strategic

partnership

designed

to

offer

Dell

customers

end-to-end

computing,

networking

and

storage

solutions

through

Dell’s

global

sales

organization.

©

2010 Brocade Communications Systems, Inc.

Page 12

of 42 |

Channel and Solution Partner Momentum

Phase II

Tightly integrated network

security solutions delivered

via channel partners

Power 100: The Most Powerful

Women Of The Channel |

| We are also making good progress with channel partners, which include

distributors and value-added resellers (VARs). These partners are

important to our success especially for our Ethernet portfolio and we are pleased to announce that we added

another 24 global distributors and VARs to our Alliance Partner Network program this

quarter, adding to the 300+ partners in the program already. We also

announced a new set of technology-centric channel partner specializations that will help our

channel partners address growing customer demand for skilled expertise across a

broad range of networking technologies. This program is designed to reward

qualified partners, who will receive a number of benefits including dedicated pre-sales

support, access to seed units and proof-of-concept labs, opportunities for

special accreditation, and dedicated lead assignments. Finally, we were also

delighted that Barbara Spicek, Brocade’s VP of Worldwide Channels, was named by

Computer Reseller News as one of its “Power 100,”

the list of the 100 most powerful women in the channel business.

In the area of solution partners, in Q3 we announced the second phase of our

strategic partnership with McAfee that will help enable the two companies to

deliver a broad set of fully interoperable, simplified network-based security solutions through

channel partners by jointly offering comprehensive channel marketing and sales

enablement programs. We are also continuing to collaborate with our

virtualization solutions partners to enhance our existing networks for optimization in virtual

environments. The most tangible example of that is the introduction of the Brocade

Application Resource Broker for VMware and other virtualization platforms,

which provides visibility into application performance across the network and virtual

machine infrastructures and helps ensure application service level agreements (SLA)

are met dynamically. ©

2010 Brocade Communications Systems, Inc.

Page 13

of 42 |

Major Customers by Vertical

Brocade selling to the world’s best brands

Financial

Financial

Healthcare/

Healthcare/

Pharmaceuticals

Pharmaceuticals

Chemical

Chemical

Automotive

Automotive

Manufacturing/

Manufacturing/

Retail

Retail

Media &

Media &

Entertainment

Entertainment

Telecom

Telecom

Airlines

Airlines

Other

Other

Education

Education |

| Customers also are taking notice by standardizing their entire network

infrastructure using Brocade technologies. Highlights in Q3 include wins from

various higher education institutes who replaced their incumbent networking vendor with Brocade to take

advantage

of

higher

levels

of

reliability,

faster

ROI

and

better

support/service.

We

also

announced

that

a

number

of

service

providers turned to Brocade for similar reasons as these advantages in turn allow

them to offer advanced, differentiated

voice/video/data/mobility—otherwise

known

as

“Quad

Play”

services—to

their

customers

in

a

more

cost-effective

way.

We

offer

similar

benefits

and

advantages

to

all

customers

we

work

with

including

the

major,

global

brands

listed

in

this

slide.

©

2010 Brocade Communications Systems, Inc.

Page 14

of 42 |

Focus and Execution in a

Challenging Environment

•

Uncertainty in worldwide macro-

economic climate

•

Variable IT spending patterns

•

Increasingly competitive

Ethernet market

We will remain focused

and execute on our strategy |

| Of course we do face challenges, both within and outside our control,

such as the uncertainty in the worldwide macro- economic climate and its

impact on IT spending patterns globally. Changing forecasts from the industry research firms make

it difficult to accurately predict when customers will place purchase orders and can

affect inventory levels at our partners. Another

challenge

is

the

increasingly

competitive

landscape

in

the

Ethernet

market.

But

as

mentioned

earlier,

we

believe

that

the

diversification

of

our

business

model

helps

mitigate

some

of

these

challenges.

©

2010 Brocade Communications Systems, Inc.

Page 15

of 42 |

Q3 Summary

Q3 highlights include:

•

Better-than-expected performance in

our SAN business

•

Sequential growth in Americas, EMEA,

and APAC Ethernet business

•

Best quarter winning new Ethernet

accounts

•

Enthusiastic response for Brocade One

strategy and innovations at Tech Day

•

Industry-wide recognition for SAN and

Ethernet products |

| In summary, Brocade executed well during a challenging and highly

variable global market. Highlights in the quarter include:

•Better-than-expected performance in our SAN business driven by

strength in switch revenue, in the face of a typically seasonally soft

quarter •Sequential Ethernet revenue growth in 3 out of 4 geographies

(excluding Federal) •Our best quarter in winning net-new Ethernet

accounts with the highest revenue contribution in any quarter from those

accounts since the acquisition of Foundry

•Enthusiastic response from customers, partners, press and analysts on our

Brocade One strategy and innovations such as Brocade VCS, VAL, AMPP, etc.

•Wide industry recognition for both our SAN and Ethernet products,

demonstrating the competitively differentiated and advanced characteristics

of our portfolio ©

2010 Brocade Communications Systems, Inc.

Page 16

of 42 |

Analyst

Day 2010

Join us for Brocade Analyst Day 2010!

BROCADE ANALYST DAY 2010

When:

September 15, 2010

8:00 am–1:30 pm

Where:

Brocade Campus

130 Holger

Way

San Jose, CA 95134

Speakers:

Brocade executives Mike Klayko, CEO,

Richard Deranleau, CFO, and several others |

| We

now

turn

our

attention

to

Q4

in

order

to

deliver

a

strong

finish

to

fiscal

year

2010.

Looking

ahead,

we

have

confidence

in

the plans we have developed and the actions we are taking to drive our business

forward. We believe our sales and marketing strategies as well as our product

portfolio are aligned well with customer imperatives and will drive our long-term

success. We will be discussing these topics in greater detail at

our annual Analyst Day, which will be hosted at our new

campus and webcast on September 15. We hope to see you there.

©

2010 Brocade Communications Systems, Inc.

Page 17

of 42 |

Q3 FY 2010 Financials

Richard Deranleau, CFO |

| Prepared comments provided by Richard Deranleau, CFO

©

2010 Brocade Communications Systems, Inc.

Page 18

of 42 |

| Q3 Financial Highlights

Revenues

•

Q3 revenues $503.5M up 2% Yr./Yr.

•

SAN revenues up 4% Qtr./Qtr.

Profitability

•

Non-GAAP EPS* (diluted) of $0.13 up 8% Yr./Yr.

•

GAAP EPS (diluted) of $0.05 vs. ($0.06) in Q3 2009

Reducing debt

•

Additional $25M non-mandatory debt payments

•

Term loan below $400M at end of Q3 2010

* Note: Non-GAAP, please see GAAP reconciliation in appendix

|

| Brocade executed solidly in Q3, our softest seasonal quarter, and grew

revenues sequentially and 2.1% year-over-year. In Ethernet revenues,

the Americas (excluding Federal), APAC, and EMEA business regions all grew sequentially, with

weakness in Japan. As expected, our Federal Ethernet was down sequentially off a

very strong Q2 while up year-over-year. We

continued

to

manage

operating

expenses

below

our

long-term

model

while

making

significant

investments

in

our

Ethernet

sales

team.

Non-GAAP

earnings

per

share

on

a

diluted

basis,

were

$0.13

for

Q3.

I’ll

expand

on

all

these

points

in

my remarks today.

©

2010 Brocade Communications Systems, Inc.

Page 19

of 42 |

Key Financial Metrics

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Revenue

$493M

$522M

$539M

$501M

$504M

Sequential growth

(2.6)%

5.8%

3.4%

(7.1)%

.5%

Year-over-year growth

34.9%

30.9%

25.0%

(1.1)%

2.1%

Non-GAAP gross margin*

58.2%

59.5%

59.3%

56.7%

54.1%

Non-GAAP operating margin*

20.3%

22.7%

26.0%

20.5%

17.3%

Non-GAAP EPS*—diluted

$0.12

$0.15

$0.19

$0.13

$0.13

GAAP EPS—diluted**

($0.06)

$0.07

$0.11

$0.05

$0.05

* Note: Non-GAAP, please see GAAP reconciliation in appendix

** Note: Adjusted due to new accounting standards relating to convertible debt

instruments |

| Turning

first

to

revenues,

Q3

revenues

were

$503.5M

which

were

up

2.1%

year-over-year

and

up

slightly

over

Q2.

Q3

is

typically

our

seasonally

weakest

quarter

and,

as

a

comparison,

a

year

ago

Q2

09

to

Q3

09

was

down

2.6%.

Revenues

performed

in

the

range

of guidance we provided in our Q2 earnings call, which was flat to slightly up.

SAN product revenues were up 3.9% sequentially driven by higher switch sales,

which were up 20% compared to Q2 10. Ethernet product revenues were down 4.7%

sequentially driven by lower Federal revenue, weakness in Japan which offset growth in the

Americas,

APAC,

and

EMEA

regions.

Additionally,

demand

for

our

8

x

10

Gig

blade

outpaced

supply

in

the

initial

launch

quarter.

As

Mike mentioned, we are pleased with the performance and growth in our new accounts,

specifically in the Americas, and we believe this is a positive indicator of

the investments we have made in our Ethernet Sales. Global Services revenues were down 2.5%

sequentially driven by lower support and professional services revenues. OEM

inventory levels were just slightly up sequentially, thus sell-in

and

sell-thru

were

essentially

the

same

in

Q3.

Based

on

forward

looking

demand,

our

partners’

weeks

on

hand

inventory

was

down

from

Q2

and

is

currently

just

slightly

more

than

2

weeks

of

supply.

Non-GAAP Gross Margins of 54.1% were down 260 basis points sequentially. The

decrease in gross margins was principally driven by the increase in

inventory reserve charges for our Ethernet products as we enter new product cycles, higher COGS spending

related to new product introductions and Ethernet investments, and selected sales

programs for new Ethernet products. Non-GAAP

Operating

Margins

were

17.3%.

The

sequential

reduction

in

Operating

Margin

is

principally

a

reflection

of

the

impact

of

lower gross margins. Non-GAAP Operating Expenses were up slightly as a

percentage of revenue to 36.8%, driven by our investments in Sales, but

still comfortably below our long-term model of 38–39%. In Q3, we

completed various tax audits with the US Federal Government and the State of California, which resulted in a more

favorable outcome than expected in our tax reserve position. Inclusive of these

discrete events, the Q3 10 effective non-GAAP tax expense was 0.2% and

effective GAAP tax benefit was negative 220%. Our non-GAAP EPS benefit

from the lower tax rate was $0.03 for the quarter. Looking to

the Balance Sheet, Brocade repaid $30.6M of our senior secured debt, of which $25.0M was in excess of the mandatory

amount due, bringing our acquisition term debt to below $400M. Total diluted shares

were relatively unchanged for Q3 at 482M shares.

This

includes

the

repurchase

of

$5M

of

stock

during

the

quarter.

©

2010 Brocade Communications Systems, Inc.

Page 20

of 42 |

Revenue: SAN, Ethernet, and Global Services |

| Turning

to

revenues

by

business

unit,

SAN

represented

58%

of

revenues

in

Q3

vs

56%

in

Q2.

Demand

for

Brocade’s

leading

SAN

products

remained

very

strong

in

Q3.

The

growth

in

Switch

revenues

was

driven

by

our

5300,

5100

and

300

product

families.

Based

on

our

internal

analysis,

we

believe

we

gained

share

in

Q3.

Our

revenue

that

we

identify

as

8

Gig

grew

from

78%

in

Q2

to

88%

in

Q3

for

Director

and

Switch

revenue.

As

of

Q3

10,

we

are essentially transitioned to 8 Gig.

SAN ASP sequential declines were in the low single digits.

Our Server product group, consisting of Embedded Switches, CNAs, HBAs, and

Mezzanine Cards, posted revenue of $39.6M which was up 26%

year-over-year and down 2% off our Q2. Embedded Switches were down 6% sequentially while the group

of CNAs, HBAs

and Mezzanine Cards were up 56% sequentially.

Our

Global

Services

business

represented

18%

of

revenues,

relatively

unchanged

vs

Q2.

Global

Services

revenue

was

down

2.2% year-over-year and was down 2.5% sequentially.

©

2010 Brocade Communications Systems, Inc.

Page 21

of 42 |

Total Ethernet Revenue

$148.5

$151.0

$124.6

$156.7

$149.5 |

| Looking at our Ethernet business, including hardware and

Ethernet-based support and services, Q3

10

revenues

of

$149.5M

represent

a

slight

growth

year-over-year

and

a

decline

of

4.7%

off

our

strong

Q2

10.

Our Ethernet product revenues were $122.1M in the quarter, an improvement of 2.5%

year-over-year and down 4.7% sequentially.

Ethernet

product

revenue

represented

24%

of

total

revenue

vs

26%

in

Q2.

The Ethernet business was mixed across our regions, with our Americas region showing

particular strength (excluding Federal), with weakness in Japan. We saw good

growth in our new accounts with both initial sales in the quarter as well as

new

customers

from

previous

quarters

returning

and

buying

again.

As

expected,

Federal

business

was

down

16%

off

a

strong

Q2. However, Federal business was still up 15% year-over-year,

showing continued growth in this sector. Ethernet

ASP

sequential

declines

were

in

the

low

to

mid-single

digits,

consistent

with

the

prior

quarter.

©

2010 Brocade Communications Systems, Inc.

Page 22

of 42 |

Revenue: 10% Customers,

Other OEM, Channel/Direct |

| In

Q3

Brocade

had

three

customers

that

had

revenues

greater

than

10%,

consistent

with

the

prior

quarter.

EMC,

IBM

and

HP

all contributed more than 10% of revenues individually. Collectively, our top 3 OEMs

contributed 44% of revenues in Q3, no change

vs.

Q2,

but

down

from

46%

in

the

year

ago

quarter.

Other

OEMs

represented

20%

of

revenues

in

Q3

vs.

19%

in

Q2.

Channel

and

Direct

were

36%

of

revenues

in

Q3

vs.

37%

in

Q2.

©

2010 Brocade Communications Systems, Inc.

Page 23

of 42 |

Domestic and International

Reported Revenue

Reported revenue on a ship-to basis |

| Turning to geography, as reported, on a ship-to basis, the US was

again strong this quarter and represented 64% of revenues in Q3, slightly

down from Q2 at 65%. On an estimated end-user

basis, adjusting for those partners who take delivery of internationally bound products in the US,

the US represented 45% of total revenues in Q3, unchanged compared to Q2.

©

2010 Brocade Communications Systems, Inc.

Page 24

of 42 |

Segment Revenues and

Gross Margin Snapshot

Q2 vs. Q3 revenue mix and non-GAAP* gross margin

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Q2 10

Q3 10

Revenues by Segment ($M)

Non-GAAP* Gross Margin

by Segment |

| Gross margins, on a non-GAAP basis, were 54.1%, which were down

approximately 260 basis points quarter-over-quarter and approximately

410 basis points year-over-year. Q3 SAN gross margins were 63.5%, down from 65.2% in Q2. The lower

SAN gross margins were driven by a higher mix of Switch vs

Director revenues in the quarter as well as increased COGS

spending related to new product introductions. The impact of lower SAN gross margins

on overall company gross margins was approximately 100 basis points in Q3.

This was partially offset by a favorable mix to SAN products at an overall company

level which increased overall margins by approximately 40 basis points.

Q3 Ethernet gross margins were 35.5% down from 43.5% in Q2. The lower

Ethernet gross margins were primarily driven by higher inventory reserve

charges and higher COGS spending related to new products and Ethernet investments in the

quarter. The inventory reserve charges are driven by excess inventory for Ethernet

products based on our new product introductions and current sales forecast.

The impact of lower Ethernet gross margins on overall company gross margins was

approximately 200 basis points in Q3.

Based

on

our

new

forward-looking

forecast

and

the

remaining

Ethernet

inventory,

we

believe

the

impact

on

Ethernet

gross

margins

going

forward

in

Q4

10

and

beyond

will

be

considerably

less.

Global

Services

margins

were

relatively

flat

in

Q3

at

48.9%

vs

49.1%

in

Q2.

©

2010 Brocade Communications Systems, Inc.

Page 25

of 42 |

Pricing/Mix

Overhead

Inventory

Reserves

Ethernet Gross Margin Detail

Yr./Yr. bridge

(3.3%)

(3.8%)

(6.5% )

Q3 09

Q3 10

49.1%

35.5% |

| Ethernet product gross margins, on a non-GAAP basis, were 35.5% in

Q3. Ethernet gross margins are lower year-over-year primarily driven

by the inventory reserves taken in Q3 (3.3 pts), increased overhead allocations tied to new product ramp and

increased manufacturing focus (3.8 pts), and pricing/mix impact (6.5 pts).

©

2010 Brocade Communications Systems, Inc.

Page 26

of 42 |

Operating Expenses and Margins

Long-term model

operating margin

range: 20–23%

Non-GAAP* Operating Margins

Non-GAAP* Operating Expenses

as a Percentage of Revenues

Long-term model operating expense range: 38–39%

* Note: Non-GAAP, please see GAAP reconciliation in appendix

|

| While

increasing

our

investment

in

sales

headcount,

we

continued

to

focus

on

controlling

spending

in

non-sales

functional

areas.

On

a

non-GAAP

basis,

total

Operating

Expenses

were

36.8%

of

revenues

in

Q3

10

vs

36.2%

in

Q2

10.

Operating

expenses

were

better

than

our

long-term

target

model

of

38%

to

39%

of

revenues.

The

increase

in

operating

expenses

sequentially

reflects

the

investment

in

our

sales

organization.

Non-GAAP operating margins decreased on a sequential basis to 17.3% in Q3 from

Q2 margins of 20.5%, primarily due to our lower gross margins.

©

2010 Brocade Communications Systems, Inc.

Page 27

of 42 |

Balance Sheet and Cash Flow

Highlights as of July 31, 2010

Cash flows enable de-leveraging and reinvestment

* Note: Adjusted EBITDA is as defined in the term debt credit agreement

** Note: Giving effect to the McDATA convertible debt of $173M repaid on

February 16, 2010 Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Cash from operations

$16.6M

$155.3M

$69.1M

$67.7M

$55.3M

Campus capital expenditures

$25M

$28M

$31M

$42M

$24M

Operating capital expenditures

$20M

$17M

$17M

$20M

$23M

Free cash flow

($28M)

$110M

$22M

$6M

$9M

Cash, equivalents, and

short term investments

$250M

$339M

$328M**

$290M

$296M

Debt payments

$33.1M

$57.9M

$506.5M

$202.2M

$30.6M

Senior secured debt

$1.01B

$0.95B

$1.04B

$1.01B

$0.99B

Adjusted EBITDA*

$119.3M

$130.0M

$154.7M

$116.4M

$101.5M

Stock repurchase

–

–

–

$20M

$5M

Senior secured leverage ratio

1.94x

1.87x

1.99x

1.95x

1.97x

Covenant

2.3x

2.3x

2.5x

2.5x

2.5x

Fixed charge coverage ratio

2.2x

2.1x

2.0x

1.8x

1.7x

Covenant

1.25x

1.25x

1.25x

1.25x

1.25x |

| Cash from operations was $55.3M in Q3, which is typically a weaker

seasonal quarter for cash generation. Total Capital Expenditures in the

quarter were $47M, which is composed of $24M for the campus and $23M for

operations. Free Cash Flow was $9M in the quarter. With the completion of the

campus, we expect an incremental cash generation of approximately $125M in

FY2011 compared to FY2010 via savings from capital expenditures and rent expense.

Cash, equivalents and short-term investments grew to $296M, up from $290M in Q2.

In Q3, we reduced our debt principal by $30.6M including $25.0M in excess of

the mandatory payment. Adjusted EBITDA in the quarter was $101.5M, which was

down from the Q2 level of $116.4M. The

Senior

Secured

Leverage

Ratio

of

1.97x

and

the

Fixed

Charge

Coverage

Ratio

of

1.7x

are

both

within

the

covenant

requirements of our term credit agreement.

Brocade’s restructured debt allows us to repurchase stock. Brocade repurchased

$5M of stock in Q3 which was approximately 900k

shares.

Brocade

has

Board

authorization

to

repurchase

up

to

$389M

and

our

debt

covenants

allow

us

to

repurchase

up

to

$75M

if

our

Senior

Secured

Leverage

Ratio

is

below

2.

Brocade

will

continue

to

repurchase

stock

on

an

opportunistic

basis.

©

2010 Brocade Communications Systems, Inc.

Page 28

of 42 |

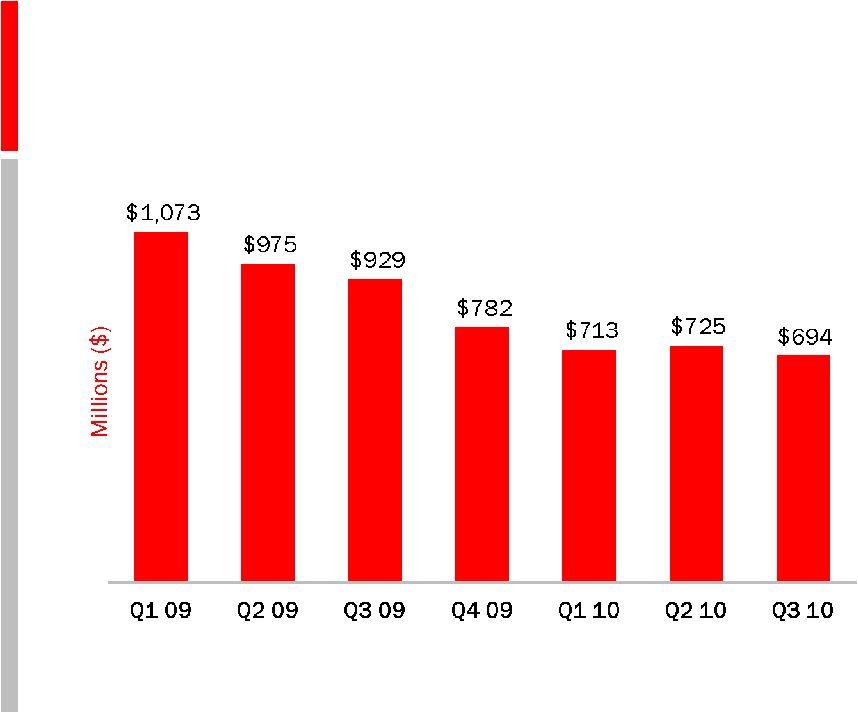

Net Debt:

Defined as Total Debt Less Total Cash

Reduction of $379M since Q1 2009 |

| Since acquiring Foundry last year, Brocade has steadily reduced Net Debt,

defined as Total Debt less Total Cash, Equivalents and Short-term

Investments. Net Debt has declined from $1,073M at the end of Q1 09 to $694M at the end of

Q3

10,

a

$379M

reduction.

Our

term

debt

loan

balance

is

now

down

to

$381M.

©

2010 Brocade Communications Systems, Inc.

Page 29

of 42 |

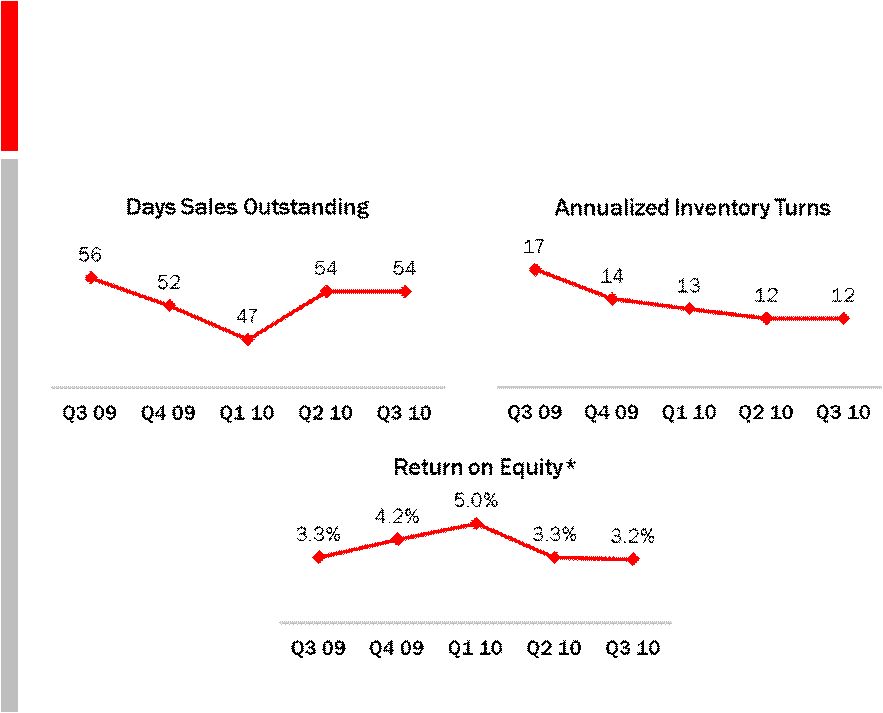

Selected Metrics

* Note: Return on Equity = Non-GAAP net income /total stockholders equity

Please see Non-GAAP reconciliation in appendix

|

| Days Sales Outstanding (DSO) was 54 days, unchanged from Q2. Inventories

turned 12 times, which were unchanged from Q2.

Return

on

Equity

was

3.2%,

essentially

flat

with

Q2.

©

2010 Brocade Communications Systems, Inc.

Page 30

of 42 |

| Q4/FY 2010 Planning Assumptions

IT market conditions

•

Macro economic challenges

•

Continued recovery in US but cautious regarding

international IT spending

ASP trends

•

Low single-digit declines in SAN pricing

•

Mid single-digit declines in Ethernet pricing

Taxes

•

Rates return to normal levels

OEM inventories

•

Expect to remain flat to slightly down |

| Now,

as

we

look

forward

to

Q4

10,

here

are

some

things

to

consider

in

developing

your

financial

models:

As Mike mentioned, we continue to see challenges in the macro economy, which could

negatively impact estimates for IT spending. We believe that the recovery in

the US will continue but are cautious about the IT spending environment in EMEA

and Japan.

We expect quarterly ASP declines in our SAN business to remain in the low-single

digits. ASP declines in our Ethernet business are expected to be in the

mid-single digits. From

a

tax

rate

perspective,

we

do

not

forecast

discrete

events

due

to

the

inherent

uncertainty

of

their

timing,

therefore

we

plan

for

our

tax

rate

to

return

to

normal

levels.

Regarding

OEM

inventory,

while

difficult

to

predict,

we

would

expect

OEM

inventory

levels

to

remain

flat

to

slightly

down

in

absolute

dollar

terms

as

we

head

into

our

seasonally

strong

quarter.

©

2010 Brocade Communications Systems, Inc.

Page 31

of 42 |

Q4/FY 2010 Financial Outlook

As of August 18, 2010

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Q4 2010

FY 2010

Revenue

$530M–$550M

$2.074B–$2.094B

Revenue growth

5%–9%

6%–7%

Non-GAAP gross margin*

56%–57%

56.6%–56.8%

Non-GAAP operating expenses*

36%–37%

35.5%–35.8%

Non-GAAP operating margin*

19%–21%

20.8%–21.3%

Non-GAAP tax rate*

~25%

~20%

Fully diluted shares outstanding

482M–487M

485M–487M

Non-GAAP EPS*

$0.12–$0.14

$0.57–$0.59

Operating cash flow

$80M–$90M

$272M–$282M

Operating capital expenditures

$20M–$25M

$80M–$85M

Campus capital expenditures

$28M

$124M

Free cash flow

$32M–$37M

$68M–$73M |

| Given these considerations, we expect:

•Q4 10 Revenue to be $530M to $550M, up 5% to 9% sequentially, which would

result in full fiscal year 2010 revenue growth of

6%

to

7%

year-over-year

($2.074B

to

$2.094B)

•Q4

10

Non-GAAP

gross

margins

to

be

56%

to

57%

and

for

the

full

year

to

be

56.6%

to 56.8%

•Q4

10

Non-GAAP

Operating

expenses

to

be

36%

to

37%

and

for

the

full

year

to

be

35.5%

to 35.8%

•Q4

10

Non-GAAP

Operating

margins

to

be

19%

to

21%

and

for

the

full

year

to

be

20.8%

to

21.3%,

which

is

in

Model

•Q4 10 Non-GAAP tax rate to be approximately 25% and full year tax rate to

be approximately 20% •Q4

10

Diluted

shares

outstanding

to

be

in

a

range

of

482M

to

487M

shares,

and

for

the

full

year

485M

to

487M

•Q4 10 Non-GAAP EPS to be in a range from 12 cents to 14 cents and full

year non-GAAP EPS to be in a range of 57 cents to 59 cents

•Q4 10 Operating Cash Flow of $80M to $90M and full year Operating Cash Flow

of $272M to $282M •Q4 10 Operational Capital Expenditures of $20M to

$25M and full year Operational Capital Expenditures of $80M to $85M •Q4

10 Campus Capital Expenditures of $28M and full year Campus Capital Expenditures of $124M

•Q4

10

Free

Cash

Flow

of

$32M

to

$37M

and

full

year

Free

Cash

Flow

of

$68M

to

$73M

©

2010 Brocade Communications Systems, Inc.

Page 32

of 42 |

Financial Summary

Richard Deranleau, CFO |

| To

summarize,

we

had

a

solid

Q3

and

are

committed

to

be

in

our

long-term

operating

margin

model

for

the

fiscal

year

2010.

We

are

beginning

to

see

some

very

positive

results

in

our

Ethernet

go-to-market

strategy.

We

still

have

work

to

do

in

EMEA

and Japan and are conscious of a potentially tough IT spending environment in those

geographies. We continue to strengthen our balance sheet by reducing our debt

at a faster rate than outlined by our credit agreement. We

look

forward

to

answering

your

questions

in

the

Q&A

session

of

our

conference

call

and

seeing

you

at

our

Analyst

Day

on

September

15

th

in

San

Jose.

©

2010 Brocade Communications Systems, Inc.

Page 33

of 42 |

Live Q&A Call

August 18, 2010, 2:30PM Pacific Time

Richard

Deranleau

CFO

John McHugh

CMO

Ian Whiting

SVP WW Sales

Dave Stevens

CTO

Mike Klayko

CEO |

| Prepared comments provided by Rob Eggers, Investor Relations

That

concludes

Brocade’s

prepared

comments.

At

2:30

p.m.

Pacific

Time

on

August

18

th

Brocade

will

host

a

webcast

conference

call

at

www.BRCD.com

primarily

devoted

to

answering

questions

submitted

via

email

to

ir@brocade.com

and

taken

live

from

participants

via

telephone.

Thank

you

for

your

interest

in

Brocade.

©

2010 Brocade Communications Systems, Inc.

Page 34

of 42 |

Appendix and Reconciliations |

| *

*

©

2010 Brocade Communications Systems, Inc.

Page 35 of 42

*

* |

Non-GAAP*

Income

Statement

Comparison

* Note: Non-GAAP, please see GAAP reconciliation in

appendix |

| *

*

©

2010 Brocade Communications Systems, Inc.

Page 36 of 42

*

* |

Quarterly Net Income (Loss)

GAAP/Non-GAAP Reconciliation

* Adjusted as a result of adoption of new accounting standard relating to

convertible debt instruments (In Thousands)

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Net income (loss) on a GAAP basis*

(23,494)

32,101

51,095

22,380

21,961

Adjustments:

Legal fees associated with indemnification obligations

and other related expenses, net

(561)

(14,612)

301

277

(74)

Stock-based compensation expense

43,313

35,715

21,523

30,146

24,682

Amortization of intangible assets

35,002

34,950

34,902

30,657

30,657

Acquisition and integration costs

1,450

333

204

–

–

Loss on sale of property

–

–

8,783

(47)

–

Legal fees associated with certain pre-acquisition litigation

–

546

299

17

13

Provision for certain pre-acquisition litigation

–

14,335

–

–

1,604

Interest due to adoption of new standard*

2,030

2,085

2,142

348

–

Income tax effect of adjustments

(2,364)

(32,091)

(25,239)

(21,044)

(15,217)

Non-GAAP net income

55,376

73,362

94,010

62,734

63,626 |

| *

*

©

2010 Brocade Communications Systems, Inc.

Page 37 of 42

*

* |

Capital Expenditures

Cumulative campus spending: $278M to-date out of $316M* total

* Note: Excludes furniture and equipment leases of approximately

$14M

$14M

$14M

$13M

$16M

$20M

$17M

$17M

$20M

$23M

$80M

$23M

$22M

$25M

$28M

$31M

$42M

$24M

$28M

$20–

25M

$5M

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Forecast

FY 11 final campus expenditures will be approximately $11M for the year

|

| *

*

©

2010 Brocade Communications Systems, Inc.

Page 38 of 42

*

* |

Adjusted EBITDA and Sr. Secured Leverage Ratio

As defined in the term credit agreement

Consolidated Senior Secured Leverage Ratio

Q4 FY 2009

Q1 FY 2010

Q2 FY 2010

Q3 FY 2010

$ Thousand

Actual

Actual

Actual

Actual

Consolidated Net Income

$33,597

$51,095

$22,380

$21,961

plus

(i) Consolidated Interest Charges

$20,681

$22,073

$19,522

$22,061

(ii) Provision for Federal, state, local and foreign income taxes payable

$0

$1,277

$0

$0

(iii) Depreciation and amortization expense

$51,486

$51,012

$46,600

$50,493

(iv) Fees, costs and expenses incurred on or prior to the Acquisition Closing

Date in connection with the Acquisition and the financing thereof

–

–

–

$0

(v) Any cash restructuring charges and integration costs in connection with the

Acquisition, in an aggregate amount not to exceed $75,000,000

$333

$204

$0

$0

(vi) Non-cash restructuring charges incurred in connection with the

Transaction, all as approved by Arrangers

$2,097

$1,502

$1,084

$1,006

(vii) Other non-recurring expenses reducing such Consolidated Net Income

which do not represent a cash item in such period or any future period

(in each case of or by the Borrower and its Subsidiaries for such

Measurement Period) $0

$8,783

($47)

$0

(viii) Any non-cash charges for stock compensation expense in compliance

with FAS 123R and amortization of the fair value of unvested options

under the Acquired Business’ employee stock

option plan assumed by the Borrower

$35,714

$21,523

$30,146

$24,682

(ix)

Legal fees and expenses relating to the Borrower’s indemnification

obligations for the benefit of its former officers and directors in

connection with its historical stock option litigation $0

$250

724

376

minus

(i)

Federal, state, local and foreign income tax credits

($6,707)

$0

($840)

($15,096)

(ii)

All non-cash items increasing Consolidated Net Income (in each case of or

by the Borrower and its Subsidiaries for such Measurement Period)

($7,216)

($3,036)

($3,127)

($4,026)

Consolidated EBITDA

$129,985

$154,683

$116,442

$101,457

4 Quarter Trailing Consolidated EBITDA

$505,848

$523,861

$520,429

$502,567

Consolidated Senior Secured Debt

$948,028

$1,041,483

$1,015,957

$989,803

Consolidated

Senior

Secured

Leverage

Ratio

1.87

1.99

1.95

1.97 |

| *

*

©

2010 Brocade Communications Systems, Inc.

Page 39 of 42

*

* |

Q3 FY 2010 Cash and Debt Covenant

Adjusted EBITDA* Performance

(In Millions)

Strong Capital Structure

(In Millions)

Within Debt Covenant

Cash Balance**

(In Millions)

* Note: Adjusted EBITDA is as defined in the term debt credit

agreement ** Cash, equivalents and short term investments |

| *

*

*

*

©

2010 Brocade Communications Systems, Inc.

Page 40 of 42 |

2010 Share Repurchases

•

Company has remaining Board authorization of $389M

•

Brocade can repurchase an additional $75M under the terms of the

Term Debt Agreement if the Senior Secured Leverage Ratio is under 2.0

Amount

Shares

Q2 2010 Share repurchases

$20M

3.5M

Q3 2010 Share repurchases

$5M

0.9M

Total repurchases in 2010

$25M

4.4M |

| *

*

*

*

©

2010 Brocade Communications Systems, Inc.

Page 41 of 42 |

Thank You

www.BRCD.com |

| *

*

*

*

©

2010 Brocade Communications Systems, Inc.

Page 42 of 42 |