Attached files

| file | filename |

|---|---|

| EX-32.1 - Puda Coal, Inc. | v194089_ex32-1.htm |

| EX-31.2 - Puda Coal, Inc. | v194089_ex31-2.htm |

| EX-31.1 - Puda Coal, Inc. | v194089_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

l0-Q

(Mark

One)

|

x

|

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

quarterly period ended June 30, 2010

|

o

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE

ACT

|

For the

transition period from __________to _________

Commission

file number 333-85306

|

PUDA

COAL, INC.

|

||

|

(Exact

name of registrant as specified in its charter)

|

||

|

Delaware

|

65-1129912

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer

Identification

No.)

|

|

|

426

Xuefu Street, Taiyuan, Shanxi Province, The People’s Republic of

China

|

030006

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

|

011

86 351 228 1302

|

|

(Registrant’s

telephone number, including area code)

|

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer x (Do not check if

a smaller reporting company)

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No x

As of the

latest practicable date, August 10, 2010, the issuer had 20,284,737 shares of

common stock outstanding.

TABLE

OF CONTENTS

|

Page

|

||||

|

PART

I. FINANCIAL INFORMATION

|

||||

|

Item

1. Financial Statements

|

||||

|

Consolidated

Balance Sheets as of June 30, 2010 (unaudited)

and

December 31, 2009

|

3–4 | |||

|

Unaudited

Consolidated Statements of Operations for the three and six

months

ended June 30, 2010 and 2009

|

5 | |||

|

Unaudited

Consolidated Statements of Cash Flows for the six

months

ended June 30, 2010 and 2009

|

6 | |||

|

Notes

to Unaudited Consolidated Financial Statements

|

7–36 | |||

|

Item

2. Management’s Discussion and Analysis of Financial

Condition

and

Results of Operations

|

37–44 | |||

|

Item

3. Quantitative and Qualitative Disclosures about Market

Risk

|

44–45 | |||

|

Item

4. Controls and Procedures

|

45 | |||

|

PART

II. OTHER INFORMATION

|

||||

|

Item

1A. Risk Factors

|

46 | |||

|

Item

6. Exhibits

|

48 | |||

|

Signatures

|

49 | |||

|

Certifications

|

||||

2

PART

I. FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

PUDA

COAL, INC.

CONSOLIDATED

BALANCE SHEETS

June

30, 2010 and December 31, 2009

(In

thousands of United States dollars)

|

Note(s)

|

June

30,

2010

|

December

31,

2009

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

ASSETS

|

||||||||||||

|

CURRENT

ASSETS

|

||||||||||||

|

Cash

and cash equivalents

|

19

|

$ | 70,339 | $ | 19,918 | |||||||

|

Accounts

receivable

|

34,505 | 25,340 | ||||||||||

|

Advances

to suppliers

|

||||||||||||

|

-

Related parties

|

3 | 1,088 | 1,020 | |||||||||

|

-

Third parties

|

4,294 | 3,552 | ||||||||||

|

Inventories

|

4 | 15,582 | 22,531 | |||||||||

|

Total

current assets

|

125,808 | 72,361 | ||||||||||

|

PREPAYMENTS

|

- | 6,259 | ||||||||||

|

PROPERTY,

PLANT, EQUIPMENT AND MINING ASSETS

|

5 | 55,109 | 13,986 | |||||||||

|

INTANGIBLE

ASSETS

|

6 | 3,927 | 3,945 | |||||||||

|

INVESTMENT,

AT COST

|

7 | 14,746 | 14,650 | |||||||||

|

TOTAL

ASSETS

|

$ | 199,590 | $ | 111,201 | ||||||||

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

CURRENT

LIABILITIES

|

||||||||||||

|

Current

portion of long-term debt

|

||||||||||||

|

-

Related party

|

3, 9 | $ | 1,300 | $ | 1,300 | |||||||

|

Accounts

payable

|

7,180 | 4,839 | ||||||||||

|

Other

payables

|

||||||||||||

|

-

Related parties

|

3 | 929 | 1,031 | |||||||||

|

-

Third parties

|

2,705 | 2,650 | ||||||||||

|

Assets

acquisition price payable

|

8 | 8,399 | - | |||||||||

|

Accrued

expenses

|

702 | 1,076 | ||||||||||

|

Income

taxes payable

|

2,749 | 1,091 | ||||||||||

|

VAT

payable

|

1,397 | 1,135 | ||||||||||

|

Derivative

warrants

|

10, 20 | 2,464 | 7,620 | |||||||||

|

Total

current liabilities

|

27,825 | 20,742 | ||||||||||

|

LONG-TERM

LIABILITIES

|

||||||||||||

|

Long-term

debt

|

||||||||||||

|

-

Related party

|

3, 9 | 41,241 | 6,500 | |||||||||

|

Total liabilities

|

69,066 | 27,242 | ||||||||||

3

PUDA

COAL, INC.

CONSOLIDATED

BALANCE SHEETS (Continued)

June

30, 2010 and December 31, 2009

(In

thousands of United States dollars)

|

Note(s)

|

June

30,

2010

|

December

31,

2009

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

COMMITMENTS

AND CONTINGENCIES

|

11 | |||||||||||

|

STOCKHOLDERS’

EQUITY

|

||||||||||||

|

Preferred

stock, authorized 5,000,000 shares, par

value

$0.01, issued and outstanding None

|

- | - | ||||||||||

|

Common

stock, authorized 150,000,000 shares,

par

value $0.001, issued and outstanding

20,257,665 (2009:

15,828,863)

|

12 | 20 | 15 | |||||||||

|

Paid-in

capital

|

12 | 66,967 | 35,212 | |||||||||

|

Statutory

surplus reserve fund

|

1,366 | 1,366 | ||||||||||

|

Retained

earnings

|

51,330 | 37,233 | ||||||||||

|

Accumulated

other comprehensive income

|

10,841 | 10,133 | ||||||||||

|

Total

stockholders’ equity

|

130,524 | 83,959 | ||||||||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS’

EQUITY

|

$ | 199,590 | $ | 111,201 | ||||||||

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

4

PUDA

COAL, INC.

UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS

For

the three and six months ended June 30, 2010 and 2009

(In

thousands of United States dollars, except per share data)

|

Note(s)

|

Three

months ended

June

30, 2010

|

Three

months ended

June

30, 2009

|

Six

months ended

June

30, 2010

|

Six

months ended

June

30, 2009

|

||||||||||||||||

|

NET

REVENUE

|

$ | 82,319 | $ | 47,990 | 144,290 | 97,711 | ||||||||||||||

|

COST

OF REVENUE

|

70,246 | 44,388 | 121,943 | 90,238 | ||||||||||||||||

|

GROSS

PROFIT

|

12,073 | 3,602 | 22,347 | 7,473 | ||||||||||||||||

|

OPERATING

EXPENSES

|

||||||||||||||||||||

|

Selling

expenses

|

850 | 533 | 1,488 | 1,110 | ||||||||||||||||

|

General

and administrative expenses

|

804 | 404 | 1,362 | 745 | ||||||||||||||||

|

TOTAL

OPERATING EXPENSES

|

1,654 | 937 | 2,850 | 1,855 | ||||||||||||||||

|

INCOME

FROM OPERATIONS

|

10,419 | 2,665 | 19,497 | 5,618 | ||||||||||||||||

|

INTEREST

INCOME

|

61 | 23 | 83 | 56 | ||||||||||||||||

|

INTEREST

EXPENSE

|

13 | (432 | ) | (132 | ) | (549 | ) | (269 | ) | |||||||||||

|

DERIVATIVE

UNREALIZED FAIR VALUE

GAIN/(LOSS)

|

10, 14 | 1,337 | (121 | ) | 130 | (113 | ) | |||||||||||||

|

INCOME

BEFORE INCOME TAXES

|

11,385 | 2,435 | 19,161 | 5,292 | ||||||||||||||||

|

TAXATION

|

15 | (2,732 | ) | (706 | ) | (5,064 | ) | (1,447 | ) | |||||||||||

|

NET

INCOME

|

8,653 | 1,729 | 14,097 | 3,845 | ||||||||||||||||

|

OTHER

COMPREHENSIVE INCOME

|

||||||||||||||||||||

|

Foreign

currency translation adjustment

|

794 | (30 | ) | 708 | (196 | ) | ||||||||||||||

|

COMPREHENSIVE

INCOME

|

$ | 9,447 | $ | 1,699 | $ | 14,805 | $ | 3,649 | ||||||||||||

|

EARNINGS

PER SHARE - BASIC

|

$ | 0.44 | $ | 0.11 | $ | 0.75 | $ | 0.25 | ||||||||||||

|

-

DILUTED

|

$ | 0.36 | $ | 0.11 | $ | 0.72 | $ | 0.25 | ||||||||||||

|

WEIGHTED

AVERAGE NUMBER OF SHARES

OUTSTANDING

|

||||||||||||||||||||

|

- BASIC

|

16 | 19,812,130 | 15,353,176 | 18,830,771 | 15,343,482 | |||||||||||||||

|

-

DILUTED

|

16 | 20,360,158 | 15,370,319 | 19,378,799 | 15,360,625 | |||||||||||||||

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

5

|

PUDA

COAL, INC.

|

UNAUDITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For

the six months ended June 30, 2010 and 2009

(In

thousands of United States dollars)

|

Six

months ended June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net

income

|

$ | 14,097 | $ | 3,845 | ||||

|

Adjustments

to reconcile net income to net cash provided by operating

activities

|

||||||||

|

Amortization

of land-use rights

|

44 | 44 | ||||||

|

Depreciation

|

845 | 839 | ||||||

|

Allowance

for doubtful debts

|

- | 41 | ||||||

|

Derivative

unrealized fair value (gain)/loss

|

(130 | ) | 113 | |||||

|

Stock

compensation

|

393 | 33 | ||||||

|

Issue

of common stock/warrants to directors

|

- | 86 | ||||||

|

Changes

in operating assets and liabilities:

|

||||||||

|

Increase

in accounts receivable

|

(8,941 | ) | (13,620 | ) | ||||

|

Decrease

in other receivables

|

- | 7 | ||||||

|

(Increase)/decrease

in advances to suppliers

|

(775 | ) | 2,563 | |||||

|

Decrease/(increase

) in inventories

|

7,051 | (5,309 | ) | |||||

|

Increase

in accounts payable

|

2,294 | 1,377 | ||||||

|

Decrease

in accrued expenses

|

(295 | ) | (235 | ) | ||||

|

Decrease

in other payables

|

(69 | ) | (313 | ) | ||||

|

Increase/(decrease)

in income tax payable

|

1,640 | (612 | ) | |||||

|

Increase/(decrease)

in VAT payable

|

253 | (1,511 | ) | |||||

|

Net

cash provided by/(used in) operating activities

|

16,407 | (12,652 | ) | |||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Purchase

of mining rights and mining assets

|

(27,219 | ) | - | |||||

|

Prepayment

for equity purchase of coal mine

|

- | (8,781 | ) | |||||

|

Net

cash used in investing activities

|

(27,219 | ) | (8,781 | ) | ||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Exercise

of warrants

|

4,679 | - | ||||||

|

Issue

of common shares

|

14,538 | - | ||||||

|

Increase

in registered capital of Shanxi Coal

|

7,041 | - | ||||||

|

Borrowings

from related party

|

35,391 | - | ||||||

|

Repayment

of long-term debt

|

(650 | ) | (650 | ) | ||||

|

Net

cash provided by/(used in) financing activities

|

60,999 | (650 | ) | |||||

|

Effect

of exchange rate changes on cash

|

234 | (173 | ) | |||||

|

Net

increase/(decrease) in cash and cash equivalents

|

50,421 | (22,256 | ) | |||||

|

Cash

and cash equivalents at beginning of period

|

19,918 | 39,108 | ||||||

|

Cash

and cash equivalents at end of period

|

$ | 70,339 | $ | 16,852 | ||||

|

Supplementary

cash flow information

|

||||||||

|

Cash

paid during the period for:

|

||||||||

|

Interest

|

$ | 303 | $ | 269 | ||||

|

Income

taxes

|

$ | 3,424 | $ | 2,058 | ||||

|

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

|

6

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1.

The Company

Puda

Coal, Inc. (formerly Purezza Group, Inc.)(the “Company” or “Puda”) is a

corporation organized under Delaware Law and headquartered in Shanxi Province,

China. The Company was originally incorporated on August 9, 2001 in

Florida.

On July

15, 2005, the Company acquired all the outstanding capital stock and ownership

interests of Puda Investment Holding Limited (“BVI”) and BVI became a

wholly-owned subsidiary of the Company. In exchange, Puda issued to

the BVI members 1,000,000 shares of its Series A convertible preferred stock,

par value $0.01 per share, of the Company, which are convertible into

678,500,000 shares of Puda’s common stock. The purchase agreement provided that

the preferred shares would immediately and automatically be converted into

shares of Puda’s common stock (the “Mandatory Conversion”), following an

increase in the number of authorized shares of Puda’s common stock from

100,000,000 to 150,000,000, and a 10 to 1 reverse stock split of Puda’s

outstanding common stock (the “10-to-1 Reverse Split”). On

August 2, 2005, the authorized number of shares of common stock of the Company

was increased from 100,000,000 shares to 150,000,000 shares. On

September 8, 2005, Puda completed the 10-to-1 Reverse Split.

Effective

on July 30, 2009 (the “Effective Date”), the Company completed a reincorporation

from a Florida corporation to a Delaware corporation. Each issued and

outstanding share of common stock, par value $0.001 per share, of the

Florida-incorporated Company was automatically converted into 0.142857 issued

and outstanding share of common stock, par value $0.001 per share, of the

Delaware-incorporated Company (the “7-to-1 Share Conversion”). No

fractional shares were or will be issued in connection with the conversion;

instead, the Company rounded up the fractional share to the nearest whole

number. Any common shares exercised from the warrants or stock options which

were issued before the Effective Date were also subject to the conversion ratio

of 7 to 1. The total number of authorized shares of common stock and preferred

stock did not change as a result of the conversion. Although the

7-to-1 Share Conversion occurred on July 30, 2009, it was retroactively

reflected in the consolidated financial statements as if the reverse split was

effective from January 1, 2009.

BVI is an

International Business Company incorporated in the British Virgin Islands on

August 19, 2004 and it has a registered capital of $50,000. BVI has

not had any operating activities since its inception on August 19,

2004.

BVI, in

turn, owns all of the registered capital of Shanxi Putai Resources Limited

(formerly, Taiyuan Putai Business Consulting Co., Ltd.) (“Putai”), a wholly

foreign owned enterprise (“WFOE”) registered under the wholly foreign-owned

enterprises laws of the People’s Republic of China (“PRC”). Putai was

incorporated on November 5, 2004 and has a registered capital of

$20,000. Putai owns 90% of Shanxi Puda Coal Group Co., Ltd.

(formerly, Shanxi Puda Resources Co. Ltd.)(“Shanxi Coal”), a company with

limited liability established under the laws of the PRC.

7

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1.

The Company (continued)

Shanxi

Coal was established on June 7, 1995. Shanxi Coal mainly processes

and washes raw coal and sells from its plants in Shanxi Province, high-quality,

low sulfur refined coal for industrial clients mainly in Central and Northern

China. In September, 2009, the Shanxi provincial government appointed

Shanxi Coal as a consolidator of eight coal mines in Pinglu County, Shanxi

Province. In March 2010, Shanxi Coal received an approval from the Shanxi

provincial government to acquire and consolidate four additional coking coal

mines in Huozhou County, Shanxi Province. As of June 30, 2010, Shanxi Coal has

completed the acquisition of two coal mines in Pinglu County (see Note 5). The

initial registered capital of Shanxi Coal was RMB 22.5 million ($2,717,000)

which was increased to RMB 500 million ($73,129,000) in May 2010, as a result of

the new guidelines enacted by the Shanxi provincial government, that require the

registered paid-in-capital of coal mine consolidators to be at least RMB 200

million. The owners of Shanxi Coal were Putai (90%), Mr. Ming Zhao

(8%) and Mr. Yao Zhao (2%). In May 2010, Mr. Yao Zhao transferred his

2% ownership to Mr. Ming Zhao. Mr. Ming Zhao is the chairman and was

the president and chief executive officer of Puda until his resignation on June

25, 2008. Mr. Yao Zhao was the chief operating officer of Puda until

his resignation became effective on November 20, 2006. Mr. Ming Zhao and Mr. Yao

Zhao are brothers.

As of

June 30, 2010, the percentages owned by Mr. Ming Zhao and Mr. Yao Zhao in the

companies are as follows:

|

|

·

|

Puda

Coal, Inc.: Mr. Ming Zhao (approximately 37%); Mr. Yao Zhao (approximately

9%) held directly.

|

|

|

·

|

Puda

Investment Holding Limited: Mr. Ming Zhao (approximately 37%); Mr. Yao

Zhao (approximately 9%) held indirectly through

Puda.

|

|

|

·

|

Shanxi

Putai Resources Limited: Mr. Ming Zhao (approximately 37%); Mr. Yao Zhao

(approximately 9%) held indirectly through Puda and

BVI.

|

|

|

·

|

Shanxi

Puda Coal Group Co., Ltd.: Mr. Ming Zhao (10%) held directly, Mr. Ming

Zhao (approximately 33%) held indirectly through Puda, BVI and

Putai.

|

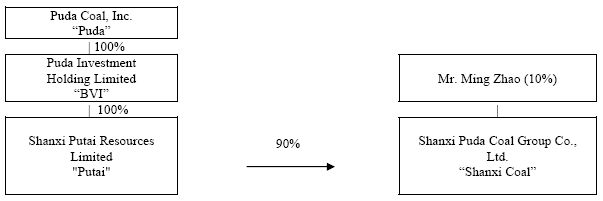

After the

above reorganization and as of June 30, 2010, the organizational structure is as

follows:

8

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies

(a)

Basis of Presentation and Consolidation

The

unaudited consolidated financial statements include Puda (Registrant and Legal

Parent), BVI, Putai and Shanxi Coal (Operating Company), collectively referred

to as “the Group”. Intercompany items have been eliminated.

The

accompanying unaudited consolidated financial statements as of June 30, 2010 and

for the thee and six month periods ended June 30, 2010 and 2009 have been

prepared in accordance with generally accepted accounting principles for interim

financial information and with the instructions to Form 10-Q and of Regulation

S-X. Certain information and footnote disclosures normally included

in financial statements prepared in accordance with accounting principles

generally accepted in the United States have been condensed or omitted pursuant

to the Securities and Exchange Commission’s rules and regulations. In the opinion of

management, these unaudited consolidated interim financial statements include

all adjustments and disclosures considered necessary to a fair statement of the

results for the interim periods presented. All adjustments are of a

normal recurring nature. The results of operations for the six months

ended June 30, 2010 are not necessarily indicative of the results for the full

fiscal year ending December 31, 2010. The unaudited consolidated

interim financial statements should be read in conjunction with the Company’s

audited consolidated financial statements and notes thereto for the year ended

December 31, 2009 as reported in Form 10-K.

(b)

Use of Estimates

In

preparing consolidated financial statements in conformity with accounting

principles generally accepted in the United States, management is required to

make estimates and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date

of the consolidated financial statements and revenues and expenses during the

reported periods. Significant estimates include depreciation and allowance for

doubtful accounts receivable. Actual results could differ from those

estimates.

(c)

Cash and Cash Equivalents

The Group

considers all highly liquid investments with original maturities of three months

or less at the time of purchase to be cash equivalents. As of June 30, 2010 and

December 31, 2009, the Group did not have any cash equivalents.

(d)

Allowance for Doubtful Accounts

The Group

recognizes an allowance for doubtful accounts to ensure accounts receivable are

not overstated due to uncollectability. An allowance for doubtful accounts is

maintained for all customers based on a variety of factors, including the length

of time the receivables are past due, significant one-time events and historical

experience. An additional reserve for individual accounts is recorded when the

Group becomes aware of a customer’s inability to meet its financial obligations,

such as in the case of bankruptcy filings or deterioration in the customer’s

operating results or financial position. If circumstances related to customers

change, estimates of the recoverability of receivables would be further

adjusted.

(e)

Inventories

Inventories

are comprised of raw materials and finished goods and are stated at the lower of

cost or market value. Substantially all inventory costs are determined using the

weighted average basis. Costs of finished goods include direct labor, direct

materials, and production overhead before the goods are ready for

sale.

9

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(f)

Property, Plant, Equipment and Mining Assets, Net

Property,

plant and equipment are stated at cost. Depreciation is provided principally by

use of the straight-line method over the useful lives of the related assets.

Expenditures for maintenance and repairs, which do not improve or extend the

expected useful lives of the assets, are expensed to operations while major

repairs are capitalized.

Management

considers that the Group has a 10% residual value for buildings, and a 5%

residual value for other property, plant and equipment. The estimated useful

lives are as follows:

|

Buildings

and facilities

|

20

years

|

|

Machinery

and equipment

|

10

years

|

|

Motor

vehicles

|

10

years

|

|

Office

equipment and others

|

10

years

|

Mine

works and reconstruction costs are capitalized and amortized by the units of

production method over estimated total recoverable proven and probable

reserves.

Amortization

of mining rights is provided by the units of production method over estimated

total recoverable proven and probable reserves.

The gain

or loss on disposal of property, plant and equipment is the difference between

the net sales proceeds and the carrying amount of the relevant assets, and, if

any, is recognized in the consolidated statement of operations.

(g)

Land-use Rights and Amortization

Land-use

rights are stated at cost, less amortization. Amortization of land-use rights is

calculated on the straight-line method, based on the period over which the right

is granted by the relevant authorities in Shanxi Province, PRC.

(h) Investment

The Group

accounts for its equity investment, for which it does not possess the ability to

exercise significant influence using the cost method under ASC 325

“Investments”. Significant influence generally does not exist if the

ownership interest in the voting stock of the investee is less than 20% and the

Group does not take part in the operational management of the

investee. Under the cost method of accounting, investments are

carried at cost and are adjusted only for other-than-temporary declines in

realizable value and additional investments. When the decline is

determined to be other-than-temporary, the cost basis for the investment is

reduced and a loss is realized in the consolidated statement of operations in

the period in which it occurs. When the decline is determined to be temporary,

the unrealized losses are included in the shareholders' equity section in the

consolidated balance sheets. The Group makes such determination based

upon a number of factors, including financial condition, operating results,

sales forecasts and earnings growth of the investee, broad economic factors

impacting the investee’s industry, and the Group's intent and ability to retain

the investment over a period of time, which is sufficient to allow for any

recovery in market value. Under the cost method of accounting,

dividend received is recognized as income (see Note 7).

10

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(i)

Impairment of Long-Lived Assets

In

accordance with ASC 360 "Property, Plant, and Equipment", the Group evaluates

its long-lived assets to determine whether later events and circumstances

warrant revised estimates of useful lives or a reduction in carrying value due

to impairment. If indicators of impairment exist and if the value of the assets

is impaired, an impairment loss would be recognized.

(j)

Derivative Financial Instruments

Derivative

financial instruments are accounted for under ASC 815 “Derivatives and

Hedging”. Under ASC 815, all derivative instruments are recorded on

the balance sheet as assets or liabilities and measured at fair

value. Changes in the fair value of derivative instruments are

recorded in current earnings.

(k)

Income Taxes

The Group

accounts for income taxes under ASC 740 "Income Taxes". Under ASC

740, deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statements

carrying amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. Under

ASC 740, the effect on deferred tax assets and liabilities of a change in tax

rates is recognized in income in the period that includes the enactment

date. The Group reviewed the differences between the tax bases

under PRC tax laws and financial reporting under US GAAP, and no material

differences were found, thus, there were no deferred tax assets or liabilities

as of June 30, 2010 and December 31, 2009.

ASC 740

clarifies the accounting for uncertainty in income taxes recognized in an

enterprise’s financial statements and it prescribes a recognition threshold and

measurement attributable for the financial statements recognition and

measurement of a tax position taken or expected to be taken in a tax return. ASC

740 also provides guidance on derecognizing, classification, interest and

penalties, accounting in interim periods, disclosures and transitions. Interest

and penalties from tax assessments, if any, are included in general and

administrative expenses in the consolidated statements of

operations.

The Group

recognizes that virtually all tax positions in the PRC are not free of some

degree of uncertainty due to tax law and policy changes by the PRC government.

However, the Group cannot reasonably quantify political risk factors and thus

must depend on guidance issued by current PRC government officials.

Based on

all known facts and circumstances and current tax law, the Group believes that

the total amount of unrecognized tax benefits as of June 30, 2010 is not

material to its results of operations, financial condition or cash flows. The

Group also believes that the total amount of unrecognized tax benefits as of

June 30, 2010, if recognized, would not have a material effect on its effective

tax rate. The Group further believes that there are no tax positions for which

it is reasonably possible, based on current Chinese tax law and policy, that the

unrecognized tax benefits will significantly increase or decrease over the next

12 months producing, individually or in the aggregate, a material effect on the

Group’s results of operations, financial condition or cash flows.

11

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(k)

Income Taxes (continued)

Under

current PRC tax laws, 10% withholding tax is imposed in respect to distributions

paid to foreign owners. As the Group has no intention to pay

dividends in the foreseeable future, no withholding tax on undistributed

earnings has been accrued as of June 30, 2010.

Under

current PRC tax laws, no tax is imposed in respect to distributions paid to

owners except for individual income tax.

(l)

Revenue Recognition

Revenue

from goods sold is recognized when (i) persuasive evidence of an arrangement

exists, which is generally represented by a contract with the buyer; (ii) title

has passed to the buyer, which generally is at the time of delivery; (iii) the

price is agreed with the buyer; and (iv) collectability is reasonably

assured.

Net

revenue represents the invoiced value of products, less returns and discounts

and net of VAT.

(m)

Foreign Currency Transactions

The

reporting currency of the Group is the U.S. dollar. Shanxi Coal uses

its local currency, Renminbi, as its functional currency. Results of operations

and cash flow are translated at average exchange rates during the period, and

assets and liabilities are translated at the end of period exchange

rates. Translation adjustments resulting from this process are

included in accumulated other comprehensive income in stockholders’

equity. Transaction gains and losses that arise from exchange rate

fluctuations from transactions denominated in a currency other than the

functional currency are included in the results of operations as incurred. These

amounts are not material to the consolidated financial statements for the three

and six months ended June 30, 2010 and 2009.

The PRC

government imposes significant exchange restrictions on fund transfers out of

the PRC that are not related to business operations. These restrictions have not

had a material impact on the Group because it has not engaged in any significant

transactions that are subject to the restrictions.

(n)

Fair Value of Financial Instruments

ASC 825

“Financial Instruments”, requires disclosing fair value to the extent

practicable for financial instruments that are recognized or unrecognized in the

balance sheets. The fair value of the financial instruments disclosed

herein is not necessarily representative of the amount that could be realized or

settled, nor does the fair value amount consider the tax consequences of

realization or settlement.

For

certain financial instruments, including cash, accounts, related party and other

receivables, accounts payable, other payables and accrued expenses, it was

assumed that the carrying amounts approximate fair value because of the near

term maturities of such obligations. For long-term debt, the carrying amount is

assumed to approximate fair value based on the current rates at which the Group

could borrow funds with similar remaining maturities.

12

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(o)

Earnings Per Share

Basic

earnings per share is computed by dividing the earnings for the period by the

weighted average number of common shares outstanding for the

period. Diluted earnings per share reflects the potential dilution of

securities by including other potential common stock equivalents, including

stock options and warrants, in the weighted average number of common shares

outstanding for the period, if dilutive.

(p)

Accumulated Other Comprehensive Income

Accumulated

other comprehensive income represents the change in equity of the Group during

the periods presented from foreign currency translation

adjustments.

(q)

Share-Based Compensation Expense

ASC 718

“Compensation-Stock Compensation”, requires the measurement and recognition of

compensation expense for all share-based payment awards made to employees and

directors including employee stock options and employee stock purchases based on

estimated fair values. ASC 718 requires companies to estimate the

fair value of share-based payment awards on the date of grant using an

option-pricing model. The value of awards that are ultimately expected to vest

is recognized as expense over the requisite service periods in the Group’s

consolidated statements of operations.

(r)

Asset Retirement Obligations

Under the

Shanxi Province local rules and regulations, the Group is required to make

payments for restoration, rehabilitation or environmental protection of the land

after the underground sites have been mined. Such costs are recognized in the

period in which the obligation is identified and is charged as an expense in

proportion to the coal extracted. No such costs were recognized

in the six months ended June 30, 2010 as the coal mine operations have not

started.

(s)

Reclassifications

Certain

reclassifications have been made to prior period balances in order to conform to

the current period’s presentation.

13

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3.

Related Party Transactions

As of

June 30, 2010 and December 31, 2009, the Group had the following amounts due

from/to related parties:

|

June 30,

2010

|

December

31,

2009

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Advance

to Shanxi Liulin Jucai Coal Industry Co., Limited

(“Jucai

Coal”), a related company with a common owner

|

$ | 1,088 | $ | 1,020 | ||||

|

Other

payable to Shanxi Puda Resources Group Limited

(“Resources

Group”), a related company with common owners

|

$ | 800 | $ | 795 | ||||

|

Other

payable to Mr. Ming Zhao, chairman and shareholder of

Puda

|

129 | - | ||||||

|

Other

payable to Mr. Yao Zhao, shareholder of Puda

|

- | 236 | ||||||

| $ | 929 | $ | 1,031 | |||||

|

Loan

payable to Resources Group

|

||||||||

|

-current

portion

|

$ | 1,300 | $ | 1,300 | ||||

|

Loan

payable to Resources Group

|

||||||||

|

-long-term

portion

|

5,850 | 6,500 | ||||||

|

Loan

payable to Mr. Ming Zhao

|

35,391 | - | ||||||

| $ | 41,241 | $ | 6,500 | |||||

The

balances, except for the loans payable to Resources Group and Mr. Ming Zhao, are

unsecured, interest-free and there are no fixed terms for

repayment.

The

balance payable to Resources Group of $800,000 includes $901,000 of professional

and regulatory charges related to the public listing paid by Resources Group on

behalf of the Company, netted against other receivables of $101,000 due from

Resources Group.

In 2001,

Shanxi Coal entered into agreements with Resources Group to lease an office and

certain equipment. In the three months ended June 30, 2010 and 2009,

rental expenses paid to Resources Group were $40,000 and $40,000, respectively.

In the six months ended June 30, 2010 and 2009, rental expenses paid to

Resources Group were $80,000 and $79,000, respectively (see Note

11).

In the

three months ended June 30, 2010 and 2009, Shanxi Coal purchased raw coal from

Jucai Coal in the amounts of $6,972,000 and $3,514,000, respectively. In the six

months ended June 30, 2010 and 2009, Shanxi Coal purchased raw coal from Jucai

Coal in the amounts of $10,732,000 and $7,083,000, respectively.

14

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3.

Related Party Transactions (continued)

On

November 17, 2005, Shanxi Coal entered into a coal supply agreement with Jucai

Coal, pursuant to which Shanxi Coal has priority to Jucai Coal’s high grade

metallurgical coking coal supply over Jucai Coal’s other

customers. Under the terms of the agreement, Shanxi Coal receives a

discount of approximately RMB 30 (approximately $4) to RMB 50 (approximately $7)

per metric ton of coal from the price Jucai Coal charges to its other

customers.

On

November 17, 2005, Shanxi Coal entered into two conveyance agreements with

Resources Group. The two agreements transferred two new coal washing

plants, related land-use rights and coal washing equipment in Liulin County and

Zhongyang County, Shanxi Province. The Liulin County plant has an

annual clean coal washing capacity of 1.1 million metric tons while the

Zhongyang County plant has an annual clean coal washing capacity of 1.2 million

metric tons. The Liulin County plant started formal production in

December 2005. The Liulin County plant, land-use rights and related

equipment were purchased for a cost of $5,800,000. The Zhongyang

County plant started formal production at the end of March 2006. The

Zhongyang County plant, land-use rights and related equipment were purchased for

a cost of $7,200,000. Each conveyance agreement provides that the

purchase price paid by Shanxi Coal to Resources Group, which totals $13,000,000,

should be amortized over ten years from December 31, 2005 and bears interest at

a rate of 6% per annum payable quarterly. In the three months ended

June 30, 2010 and 2009, Shanxi Coal paid principal of $325,000 (2009: $325,000)

and interest of $112,000 (2009: $132,000) to Resources Group. In the

six months ended June 30, 2010 and 2009, Shanxi Coal paid principal of $650,000

(2009: $650,000) and interest of $229,000 (2009: $269,000) to Resources Group

Shanxi Coal pledged the land use rights, plant and equipment of the plants to

Resources Group until such time when the purchase price and interest thereupon

is fully paid by Shanxi Coal to Resources Group. If Shanxi Coal fails to

pay the principal or interest of the purchase price of the plants financed by

Resources Group in full when due, the properties acquired by Shanxi Coal, which

have been pledged to Resources Group as collateral, are revertible to Resources

Group (see Notes 5, 6 and 9).

On

December 11, 2009, Shanxi Coal entered into mining rights and mining assets

transfer agreements for the acquisition of two coal mines in Pinglu County,

Shanxi Province. Shanxi Coal’s obligation for payment under the

agreements is guaranteed by Mr. Ming Zhao (see Note 5).

On May 7,

2010, Putai and Mr. Ming Zhao signed a loan agreement, pursuant to which, Putai

borrowed from Mr. Ming Zhao RMB 240 million ($35,391,000) . The loan is

unsecured and bears a 6% annual interest rate, which is payable on a quarterly

basis, subject to certain adjustments to be agreed upon by the parties if such

adjustments are necessary in light of the official interest rate of the PRC, as

specified in the agreement.. The term of the loan is 18 months from May 7, 2010.

If Putai does not pay off the principal and interest of the loan on time in

accordance with the agreement, Mr. Ming Zhao may require Putai to pay off the

loan immediately and charge an additional 5% interest on the amount of loan that

is not paid off on time. In addition, if the interest rate under the

agreement is adjustable according to the agreement and Putai fails to pay

interest at the adjusted rate, Mr. Ming Zhao may require Putai to pay off the

loan immediately. The loan was used by Putai to increase the

registered paid-in capital of Shanxi Coal. In the three and six

months ended June 30, 2010, interest accrued on the loan amounted to

$320,000. As of June 30, 2010, Putai paid $191,000 and the balance of

interest payable of $129,000 was included in other payable (see Note

9).

15

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4.

Inventories

As of

June 30, 2010 and December 31, 2009, inventories consist of the

following:

|

June

30,

2010

|

December

31,

2009

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Raw

materials

|

$ | 4,983 | $ | 9,671 | ||||

|

Finished

goods

|

10,599 | 12,860 | ||||||

|

Total

|

$ | 15,582 | $ | 22,531 | ||||

There was

no allowance for losses on inventories as of June 30, 2010 and December 31,

2009.

5.

Property, Plant, Equipment and Mining Assets

As of

June 30, 2010 and December 31, 2009, property, plant and equipment consists of

the following:

|

June

30,

2010

|

December

31,

2009

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Cost:

|

||||||||

|

Buildings

and facilities

|

$ | 5,480 | $ | 3,899 | ||||

|

Machinery

equipment

|

18,650 | 15,682 | ||||||

|

Motor

vehicles

|

115 | 114 | ||||||

|

Office

equipment and others

|

35 | 35 | ||||||

|

Mine

works

|

7,869 | - | ||||||

|

Mining

rights

|

29,586 | - | ||||||

| 61,735 | 19,730 | |||||||

|

Accumulated

depreciation:

|

||||||||

|

Buildings

and facilities

|

742 | 650 | ||||||

|

Machinery

equipment

|

5,846 | 5,063 | ||||||

|

Motor

vehicles

|

29 | 24 | ||||||

|

Office

equipment and others

|

9 | 7 | ||||||

|

Mine

works

|

- | - | ||||||

|

Mining

rights

|

- | - | ||||||

| 6,626 | 5,744 | |||||||

|

Carrying

value:

|

||||||||

|

Buildings

and facilities

|

4,738 | 3,249 | ||||||

|

Machinery

equipment

|

12,804 | 10,619 | ||||||

|

Motor

vehicles

|

86 | 90 | ||||||

|

Office

equipment and others

|

26 | 28 | ||||||

|

Mine

works

|

7,869 | - | ||||||

|

Mining

rights

|

29,586 | - | ||||||

| $ | 55,109 | $ | 13,986 | |||||

16

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5.

Property, Plant, Equipment and Mining Assets (continued)

Shanxi

Coal pledged the Liulin and Zhongyang coal washing plants and related equipment

to Resources Group until such time when the purchase price and interest thereon

is fully paid by Shanxi Coal. If Shanxi Coal fails to pay the

principal and interest of the purchase prices of these two plants financed by

Resources Group in full when due, the properties acquired by Shanxi Coal, which

have been pledged to Resources Group as the collateral, are revertible to

Resources Group (see

Notes 3 and 9).

On June

25, 2010, Shanxi Coal closed a mining right and mining assets transfer agreement

dated December 11, 2009 with Pinglu County Da Wa Coal Industry Co., Ltd. (“Da Wa

Coal”), pursuant to which Shanxi Coal purchased from Da Wa Coal all its tangible

assets and coal mining right with respect to a coal mine located in Pinglu

County, Shanxi Province of China. As consideration, Shanxi Coal

agreed to pay Da Wa Coal an aggregate purchase price of RMB 190 million

($28,018,000) in cash, of which RMB 46.6 million ($6.9 million) was for the

tangible assets and RMB 143.4 million ($21.1 million) was for the mining right.

Management estimates that the total proven and probable reserve of Da Wa Coal is

approximately 10.8 million metric tons by reference to the geological report

dated August 2007. The report was prepared by a geological firm hired

by the seller. We have hired an independent geological firm to

prepare an updated report which is now in progress. As of June 30,

2010, Shanxi Coal has paid RMB 152 million ($22,415,000). Shanxi Coal will pay

the remainder of the purchase price, RMB 38 million ($5,603,000) upon the one

year anniversary of completion of the transfer. Shanxi Coal’s

obligation for payment is guaranteed by Mr. Ming Zhao (see Note 8).

On June

25, 2010, Shanxi Coal closed a mining right and mining assets transfer agreement

dated December 11, 2009 with Pinglu County Guanyao Coal Industry Co., Ltd.

(“Guanyao Coal”), pursuant to which, Shanxi Coal purchased from Guanyao Coal all

its tangible assets and coal mining right with respect to a coal mine located in

Pinglu County, Shanxi Province of China. As consideration, Shanxi

Coal agreed to pay Guanyao Coal an aggregate purchase price of RMB 94.80 million

($13,979,000) in cash, of which RMB 37.6 million ($5.6 million) was for the

tangible assets and RMB 57.2 million ($8.4 million) was for the mining

right. Management estimates that the total proven and probable

reserve of Guanyao Coal is approximately 7.4 million metric tons by reference to

the geological report dated March 2007. The report was prepared by a

geological firm hired by the seller. We have hired an independent

geological firm to prepare an updated report which is now in progress. As of June 30, 2010,

Shanxi Coal has paid RMB 75.84 million ($11,183,000). Shanxi Coal

will pay the remainder of the purchase price, RMB 18.96 million ($2,796,000)

upon the one year anniversary of completion of the transfer. Shanxi Coal’s

obligation for payment is guaranteed by Mr. Ming Zhao (see Note

8).

17

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5.

Property, Plant, Equipment and Mining Assets (continued)

Da Wa

Coal and Guanyao Coal are both selling their coal mine assets and coal mining

rights to Shanxi Coal as a result of the Chinese government’s requirement to

close, consolidate and restructure smaller coal mines and the government’s

approval of Puda Coal as one of the few coal mine consolidators that have the

capacity to acquire and consolidate such coal mines. Da Wa Coal and

Guanyao Coal were closing their coal mine operations. Shanxi Coal is

merely acquiring the tangible assets and coal mining rights from them in their

liquidation process; Shanxi Coal is not acquiring or assuming any business,

customers, vendors, business partners, contracts, employees or goodwill from the

sellers, nor will Shanxi Coal assume any indebtedness or liabilities from them.

The Group accounted for these transactions as asset acquisitions. We

have completed the appraisals for the tangible assets but the appraisals of the

mining rights are still in progress. The valuations will be finalized within 12

months of the close of the acquisitions. When the valuations are

finalized, we will adjust the allocation of purchase price to individual

tangible assets and mining rights based on the relative fair

values. Depreciation on the tangible assets and amortization of

mining rights will not be started until the completion of the reconstruction

works, which are now in progress. The mining assets of Da Wa Coal

and Guanyao Coal will be eventually injected into two new companies, Shanxi

Pinglu Dajinhe Coal Co., Ltd. and Shanxi Pinglu Dajinhe Wujin Coal Co., Ltd,

respectively. The Shanxi government will approve the establishment

and registration of these two companies, which are wholly-owned subsidiaries of

Shanxi Coal, upon the completion of the reconstruction works. Shanxi

Coal was given transitional mining permits, which will expire in November

2011. After the establishment of the two new companies, the mining

permits will be renewed by Shanxi government. The property deeds for the

buildings will also be issued to the two companies.

Depreciation

expense for the three months ended June 30, 2010 and 2009 was $425,000 and

$420,000, respectively. Depreciation expense for the six months ended June 30,

2010 and 2009 was $845,000 and $839,000, respectively. In the

six months ended June 30, 2010 and 2009, the amount included in cost of sales

and general and administrative expenses was $829,000 (2009: $823,000) and

$16,000 (2009: $16,000), respectively.

There was

no impairment in the value of property, plant and equipment for the three and

six months ended June 30, 2010 and 2009.

6.

Intangible Assets

|

Land-use

rights

|

||||||||

|

June

30,

2010

|

December

31,

2009

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Cost

|

$ | 4,325 | $ | 4,297 | ||||

|

Accumulated

amortization

|

398 | 352 | ||||||

|

Carrying

value

|

$ | 3,927 | $ | 3,945 | ||||

Land-use

rights include $2,669,000 in Liulin County purchased from Resources Group, which

are located in Shanxi Province and are amortized over fifty years up to August

4, 2055, and $1,656,000 in Zhongyang County purchased from Resources Group,

which are located in Shanxi Province and are amortized over fifty years up to

May 20, 2055. Shanxi Coal pledged these land-use rights to Resources

Group until such time when the purchase price and interest thereon is fully paid

by Shanxi Coal (see Notes 3 and 9).

18

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6.

Intangible Assets (continued)

Amortization

expense for the three months ended June 30, 2010 and 2009 was $22,000 and

$23,000, respectively. Amortization expense for the six months ended

June 30, 2010 and 2009 was $44,000 and $44,000, respectively. The

estimated aggregate amortization expense for the five years ending December 31,

2010 (remaining six months), 2011, 2012, 2013 and 2014 amounts to approximately

$44,000, $88,000, $88,000, $88,000 and $88,000, respectively.

There was

no impairment in the value of intangible assets for the three and six months

ended June 30, 2010 and 2009.

7. Investment,

at Cost

On May

14, 2009, Shanxi Coal entered into an agreement of share transfer with two

unrelated individuals to purchase their equity, constituting 18% ownership, in

Shanxi Jianhe Coal Industry Limited Company (“Jianhe Coal”) for an aggregate

purchase price of $14,746,000. The governmental registration of the share

transfer was completed on December 3, 2009 and the purchase price was fully

paid. In addition, under the agreement, the individual, owning the

other 82% of Jianhe Coal, guaranteed Shanxi Coal first priority in the right to

purchase other shares of Jianhe Coal within the 24-month period following

execution of the agreement. Shanxi Coal will not take part in

the operational management of the coal mine but will be paid dividends

semiannually based on its 18% ownership in Jianhe Coal, and the dividends

declared each year will be no less than 80% of the annual net profits of Jianhe

Coal. No dividend was declared by Jianhe Coal for the six months

ended June 30, 2010.

The

investment was recorded at cost and there was no impairment in the value of

investment for the three and six months ended June 30, 2010 (see Note

2(h)).

8. Assets

Acquisition Price Payable

The

amount represented the balance of the purchase price for Da Wa Coal of

$5,603,000 and Guanyao Coal of $2,796,000, which will be due on June 25, 2011,

one year anniversary of completion of the transfer (see Note

5).

9.

Long-term Debt

|

June

30,

2010

|

December

31,

2009

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Conveyance

loan

|

$ | 7,150 | $ | 7,800 | ||||

|

Loan

from Mr. Ming Zhao

|

35,391 | - | ||||||

| 42,541 | 7,800 | |||||||

|

Less:

current portion

|

(1,300 | ) | (1,300 | ) | ||||

|

Long-term

portion

|

$ | 41,241 | $ | 6,500 | ||||

19

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9.

Long-term Debt (continued)

The

conveyance loan is seller-financed, payable over ten years from December 31,

2005 and bears interest at a rate of 6% per annum, payable

quarterly. In the three months ended June 30, 2010 and 2009, Shanxi

Coal paid principal of $325,000 (2009: $325,000) and interest of $112,000 (2009:

$132,000) to Resources Group. In the six months ended June 30, 2010

and 2009, Shanxi Coal paid principal of $650,000 (2009: $650,000) and interest

of $229,000 (2009: $269,000) to Resources Group. Shanxi Coal pledged

the land-use rights and plant and equipment until such time when the purchase

price and interest thereon is fully paid by Shanxi Coal to Resources Group (see

Notes 3, 5 and 6).

The loan

from Mr. Ming Zhao is unsecured and bears a 6% annual interest rate, which is

payable on a quarterly basis. The term of the loan is 18 months from May 7,

2010. In the three and six months ended June 30, 2010, interest accrued on the

loan amounted to $320,000. As of June 30, 2010, Putai paid $191,000

and the balance of interest payable of $129,000 was included in other payable

(see Note 3).

The

future principal payments under the conveyance loan and the loan from Mr. Ming

Zhao as of June 30, 2010 are as follows:

|

Year Ending December

31,

|

$’000

|

|||

|

2010

(remaining six months)

|

$ | 650 | ||

|

2011

|

36,691 | |||

|

2012

|

1,300 | |||

|

2013

|

1,300 | |||

|

2014

|

1,300 | |||

|

Thereafter

|

1,300 | |||

| $ | 42,541 | |||

10. Derivative

Warrants

(a) On

November 18, 2005, the Company issued $12,500,000 8% unsecured convertible notes

due October 31, 2008 and related warrants to purchase shares of common stock of

the Company. The notes were convertible into common stock at $.50 per

share over the term of the debt. As of June 30, 2010, the notes with

an aggregate principal amount of $10,260,000 were converted into 2,931,429

shares (after adjusting for the 7-to-1 Share Conversion) of common stock, the

notes with an aggregate principal amount of $2,115,000 were redeemed upon

maturity, and the remaining notes with an aggregate principal amount of $125,000

will be paid off upon the receipt of the original notes from the

investors. The remaining notes with an aggregate principal amount of

$125,000 are included in other payables in the consolidated balance sheet as of

June 30, 2010. The related warrants to purchase 3,571,429 shares (after

adjusting for the 7-to-1 Share Conversion) of common stock, exercisable at $4.2

per share (after adjusting for the 7-to-1 Share Conversion), have a term of five

years from the date of issuance. As of June 30, 2010, 2,850,061

warrants (after adjusting for the 7-to-1 Share Conversion) were exercised into

2,850,061 shares (after adjusting for the 7-to-1 Share Conversion) of common

stock.

20

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

Investors

were given "full ratchet" anti-dilution protection under the warrants, meaning

that the exercise price under the warrants will be adjusted to the lowest per

share price for future issuances of Puda's common stock should such per share

price be lower than the exercise price of the warrants, with

carve-outs for (i) issuance of shares of common stock in connection with the

exercise of the warrants, or (ii) the issuance of common stock to employees or

directors pursuant to an equity incentive plan approved by Puda's

stockholders. The exercise price of the warrants is also subject to

proportional adjustments for issuance of shares as payment of dividends, stock

splits, and rights offerings to shareholders in conjunction with payment of cash

dividends. Investors were also given registration rights in connection with the

resale of the common stock underlying the warrants, on a registration statement

to be filed with the SEC. Puda may redeem all, but not less than all,

of the warrants at $0.001 per share subject to 30 business days’ prior notice to

the holders of the warrants, and provided that (i) a registration statement is

in effect covering the common stock underlying the warrants, (ii) the closing

bid price of the common stock of Puda exceeds $2.50 per share on an adjusted

basis for at least 20 consecutive trading days (prior to the adjustment for the

7-to-1 share conversion) and (iii) the average daily trading volume of the

common stock exceeds 50,000 shares per day during the same period.

The

warrants require the Company to register the resale of the shares of common

stock upon exercise of these securities. The warrants are

freestanding derivative financial instruments. The Group accounts for

the fair value of these outstanding warrants to purchase common stock in

accordance with ASC 815 “Derivatives and Hedging,” which requires the Group to

account for the warrants as derivatives. Since the effective

registration of the securities underlying the warrants is an event outside of

the control of the Company, pursuant to ASC 815, the Group recorded the fair

value of the warrants as liabilities. The Group is required to carry

these derivatives on its consolidated balance sheet at fair value and unrealized

changes in the values of these derivatives are reflected in the consolidated

statement of operations as “Derivative unrealized fair value

gain/(loss)”.

The

warrants are classified as a derivative liability because they embody an

obligation to issue a variable number of shares. This obligation is generated by

the Registration Rights described above. Warrants are being amortized

over the term of five years using the effective interest method up to October

31, 2010. Upon exercise, the pro rata percentage of the amount

actually exercised in relation to the total exercisable is multiplied by the

remaining derivative liability, and transferred to equity. The amount

of derivative warrants transferred to equity in the three months ended June 30,

2010 and 2009 was $3,002,000 and $nil, respectively. The amount of

derivative warrants transferred to equity in the six months ended June 30, 2010

and 2009 was $4,987,000 and $nil, respectively.

21

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

(b) In

conjunction with the issuance of the notes, the placement agent was issued five

year warrants, exercisable from November 18, 2005, to purchase 357,143 shares

(after adjusting for the 7-to-1 Share Conversion)of common stock of the Company

at an exercise price of $4.2 per share (after adjusting for the 7-to-1 Share

Conversion). The warrants issued to the placement agent have the same

terms and conditions as the warrants issued to the investors, including "full

ratchet" anti-dilution protection, proportional exercise price adjustments based

on issuances of stock as dividends and share splits, and Puda’s right to redeem

the warrants subject to an effective registration statement covering the

underlying shares of the placement agent’s warrant, and certain share price and

trading volume requirements. However, the warrants issued to the placement

agent, unlike the warrants issued to the investors, have a cashless exercise

feature. With a cashless exercise feature, the warrant holders have the option

to pay the exercise price of $4.2 (after adjusting for the 7-to-1 Share

Conversion) not in cash, but by reducing the number of common share issued to

them. As with the warrants related to the notes, the placement agent

warrants are classified as a derivative liability and are freestanding

derivative financial instruments and contain Registration Rights and Late Filing

Penalties identical to those held by the investors. These warrants

are being amortized over the term of five years using the effective interest

method. Upon exercise, the pro rata percentage of the amount actually

exercised in relation to the total exercisable is multiplied by the remaining

derivative liability, and transferred to equity. The amount of

derivative placement agent warrants transferred to equity in the three months

ended June 30, 2010 and 2009 was $19,000 and $nil, respectively. The

amount of derivative placement agent warrants transferred to equity in the six

months ended June 30, 2010 and 2009 was $39,000 and $nil,

respectively. As of June 30, 2010, 298,949 (after adjusting for the

7-to-1 Share Conversion) placement agent warrants were exercised and resulted in

the issuance of 215,238 shares (after adjusting for the 7-to-1 Share Conversion)

of common stock.

22

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

(c) The

derivative warrants as of June 30, 2010 and December 31, 2009:

|

June

30,

2010

|

December

31,

2009

|

|||||||

|

$000

|

$000

|

|||||||

|

Amount

allocated to note warrants

|

$ | 6,363 | $ | 6,363 | ||||

|

Placement

agent warrants

|

5,625 | 5,625 | ||||||

|

Less:

amount transferred to equity upon exercise of note warrants

in

2006

|

(789 | ) | (789 | ) | ||||

|

Less:

amount transferred to equity upon exercise of placement

agent

warrants in 2006

|

(882 | ) | (882 | ) | ||||

|

Less:

amount transferred to equity upon exercise of note warrants

in

2007

|

(1,527 | ) | (1,527 | ) | ||||

|

Less:

amount transferred to equity upon exercise of placement

agent

warrants in 2007

|

(2,716 | ) | (2,716 | ) | ||||

|

Less:

change in fair value in 2005

|

(700 | ) | (700 | ) | ||||

|

Less:

change in fair value in 2006

|

(1,237 | ) | (1,237 | ) | ||||

|

Add:

change in fair value in 2007

|

343 | 343 | ||||||

|

Less:

change in fair value in 2008

|

(394 | ) | (394 | ) | ||||

|

Less:

amount transferred to equity upon exercise of note warrants

in

2009

|

(1,369 | ) | (1,369 | ) | ||||

|

Less:

amount transferred to equity upon exercise of placement

agent

warrants in 2009

|

(133 | ) | (133 | ) | ||||

|

Add:

change in fair value in 2009

|

5,036 | 5,036 | ||||||

|

Less:

amount transferred to equity upon exercise of note warrants

in

2010

|

(4,987 | ) | - | |||||

|

Less:

amount transferred to equity upon exercise of placement

agent

warrants in 2010

|

(39 | ) | - | |||||

|

Less:

change in fair value in 2010

|

(130 | ) | - | |||||

| $ | 2,464 | $ | 7,620 | |||||

23

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

The

following table shows (i) fair values of derivative instruments in our statement

of financial position as of June 30, 2010, and (ii) the effect of derivative

instruments on the statement of financial performance for the six months ended

June 30, 2010 in accordance with Accounting Standards Update (“ASU”) 2009-05

“Fair Value Measurements and Disclosure (Topic 820)”:

|

(i)

Fair values of derivative instruments

|

|||||

|

Liability

derivatives

|

|||||

|

June

30, 2010

|

|||||

|

Balance

sheet location

|

Fair

Value

|

||||

|

$000

|

|||||

|

Derivatives

not designated as hedging instruments

under

ASC 815

|

|||||

|

Derivative

warrants

|

Current

liabilities

|

$ | 2,464 | ||

|

Total

derivatives

|

$ | 2,464 | |||

|

(ii)

Effect of derivative instruments on the statement of

operations

|

|||||

|

Derivatives

not designated as hedging instruments

under ASC

815

|

|||||

|

Six

months ended June 30, 2010

|

|||||

|

Location

of gain recognized in income on derivatives

|

Amount

of gain recognized in income on derivatives

|

||||

|

$000

|

|||||

|

Derivative

warrants

|

Derivative unrealized

fair value gain

|

$ | 130 | ||

|

Total

|

$ | 130 | |||

24

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11.

Commitments and Contingencies

As of

June 30, 2010, the Group leased office premises under the operating lease

agreement expiring on December 31, 2013.

The

future minimum lease payments under the above-mentioned lease as of June 30,

2010 are as follows:

|

Year Ending December

31,

|

$’000

|

|||

|

2010

(remaining six months)

|

$ | 80 | ||

|

2011

|

160 | |||

|

2012

|

160 | |||

|

2013

|

160 | |||

| $ | 560 | |||

The above

future lease payments represent amounts payable to Resources Group (see Note

3).

In

September, 2009, the Shanxi provincial government appointed Shanxi Coal as a

consolidator of eight coal mines in Pinglu County. Shanxi Coal has the

government’s permission to acquire and consolidate the eight coal mines into

five, which could increase their total annual capacity from approximately 1.6

million to 3.6 million metric tons. As of June 30, 2010, Shanxi Coal

has completed the acquisitions of Da Wa Coal and Guanyao Coal (see Note 5) but

has not entered into any definitive agreements for the acquisition of the other

six coal mines.

In March

2010, Shanxi Coal received an approval from the Shanxi provincial government to

acquire and consolidate four additional coking coal mines in Huozhou County,

Shanxi Province, including Jianhe Coal. Shanxi Coal has the government’s

permission to acquire and consolidate the four coal mines into one, which could

increase the total annual capacity of target coal mines from current accumulated

720,000 metric tons to 900,000 metric tons per year. As of June 30,

2010, Shanxi Coal has acquired 18% equity ownership of Jianhe Coal (see Note 7)

but has not entered into any definitive agreements for the acquisition of the

other three coal mines.

As of

June 30, 2010 and December 31, 2009, the Group did not have any contingent

liabilities.

25

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12.

Common Stock and Paid-in Capital

|

Common

Stock

|

Paid-in

Capital

|

|||||||||||

|

No.

of shares

|

$000

|

$000

|

||||||||||

|

Balance, January

1, 2010

|

15,828,863 | $ | 15 | $ | 35,212 | |||||||

|

Issue

of shares to directors/employees

|

28,475 | - | 115 | |||||||||

|

Issue

of common shares

|

3,284,000 | 3 | 14,535 | |||||||||

|

Increase

in registered capital of Shanxi Coal

|

- | - | 7,041 | |||||||||

|

Exercise

of note warrants

|

1,110,128 | - | 4,663 | |||||||||

|

Derivative

note warrants transferred to equity upon exercise

|

- | 2 | 4,985 | |||||||||

|

Exercise

of placement agent warrants

|

6,199 | - | 16 | |||||||||

|

Derivative

placement agent warrants transferred to equity

upon

exercise

|

- | - | 39 | |||||||||

|

Stock-based

compensation

|

- | - | 361 | |||||||||

|

Balance,

June 30, 2010

|

20,257,665 | $ | 20 | $ | 66,967 | |||||||

On

February 18, 2010, the Company completed the offering and sale of 2,855,652

shares (the “Primary Shares”) of the Company’s common stock, par value $0.001

per share pursuant to an underwriting agreement with Brean Murray,

Carret & Co., LLC and Newbridge Securities Corporation (collectively, the

“Underwriters”) dated February 11, 2010. The Primary Shares were sold

to the public at a price of $4.75 per share. The Company granted the

Underwriters a 30-day option to purchase an aggregate of 428,348 additional

shares of common stock (the “Overallotment Shares”). On February 16,

2010, the Underwriters exercised the option in full. The offering of

the Overallotment Shares closed simultaneously with the closing of the offering

of the Primary Shares. The net proceeds to the Company were

$14,538,000 after deducting underwriting commissions and expenses associated

with the offering.

In May

2010, the registered capital of Shanxi Coal was increased from RMB 22.5 million

($2,717,000) to RMB 500 million ($73,129,000) as a result of the new guidelines