Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 FOR OMNI VENTURES, INC. - Omni Ventures, Inc. | omniventuresexhibit.htm |

| EX-32.1 - EXHIBIT 32.1 FOR OMNI VENTURES, INC. - Omni Ventures, Inc. | omniventuresexhibit2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 10-Q

_____________________

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to______.

OMNI VENTURES, INC.

(Exact name of registrant as specified in the Charter)

|

KANSAS

|

333-156263

|

26-3404322

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File No.)

|

(IRS Employee Identification No.)

|

7500 College Blvd.,5th Floor, Overland Park, KS 66210

(Address of Principal Executive Offices) (Zip Code)

(913) 693-8073

(Registrants Telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

||||

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes o No x

The number of shares outstanding of the Registrant’s common stock as of June 30, 2010: 92,684,520 shares of common stock.

OMNI VENTURES, INC.

FORM 10-Q

June 30, 2010

TABLE OF CONTENTS

|

PART I— FINANCIAL INFORMATION

|

||

|

Item 1.

|

Financial Statements

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 4T.

|

Controls and Procedures

|

|

|

PART II— OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

|

|

Item 3.

|

Defaults Upon Senior Securities

|

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

|

|

Item 5.

|

Other Information

|

|

|

Item 6.

|

Exhibits

|

|

PART 1 - FINANCIAL INFORMATION

Item 1. Financial Statements

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

The information contained in Item 2 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

GENERAL

We were incorporated in August 2008 in the State of Kansas. From inception, our mission was to provide equity funding for commercial and recreational projects in the Mid-west and Western areas of the United States, with specialization in two different categories. One was apartment projects to house employees that work for gaming and supporting businesses. The other was recreational activities geared at family -oriented activities.

On March 3, 2010, we underwent a change of control and as a result, Mr. Daniel Reardon was voted in as our CEO, Chairman and Director, Mr. Neil Kleinman was voted in as President and Director and Mr. Lawrence Sands was voted in as Vice President, Secretary and Director.

Current management has continued our goal of establishing ourselves as a developer of residential and commercial real estate, concentrating in the areas of agricultural production in Southern and Central California, The company is seeking to expand into the fields of electronic payment processing, peer-to-peer payment and customer affinity marketing networks. The company has also been actively seeking a partner in the design, manufacture, branding and distribution of consumer goods. Our management believes investment in these types of projects appropriately addresses the market need regarding new economic realties.

The Company has already taken steps to achieve these goals. As reported in the Company’s 8-K as filed with the SEC on May 26, 2010, which report is incorporated by reference, the Company entered into a Vacant Land purchase agreement (the “Lompoc Agreement”), effective May 22, 2010 with James Alexander and the SB 246 & Cebada Group. Pursuant to the Land Purchase Agreement, the Company entered into a definitive agreement to purchase the property located at 3145 E. Highway 246, Lompoc, Santa Barbara, California. The Company plans to develop a vineyard and one respective structure on the property.

The Company’s obligation to close on the Property is subject to several conditions, including but not limited to settle of certain liens and claims against the Property and the receipt of an appraisal that the Property has a value of not less than $4,000,000.

The purchase price for the property is $3,750,000 and the Company is obligated to make an initial deposit of $112,500 or 3% of the purchase price to be put into an Escrow Account subject to certain terms and conditions of the Agreement. The balance of the purchase price will be due in 180 days.

The description and terms of the Purchase Agreement set forth herein is qualified in its entirety by the full text of the Purchase Agreement, which is filed as an exhibit to the 8-K previously filed.

PLAN OF OPERATION

Our operations will require outside capital to continue. . We believe we will be able to competitively market ourselves. All functions will be coordinated and managed by our Board, including marketing, finance, and operations.

We are currently negotiating with several real estate entities on various projects in the Western United States and have received positive input from them. We are actively developing our website, which will provide quick response for new customers. We anticipate to launch our website at the following URL: http://www.omve.net.

We have developed our engagement with several owners of real estate properties in the Central Coast of California as well as wine producers, brand developers and resellers in that area. We also entered into negotiations with several proprietors of premium brand consumer goods in the USA and in Europe with the purpose of integrating their brands into branding and distribution programs developed by our management.

In expanding and continuing to develop the company’s plan of operation, we have been actively seeking to expand into the various fields of electronic payment processing, peer-to-peer payment and customer affinity marketing networks and entered into negotiations with several companies in that industry with the purpose of merger and acquisition. The company has also been actively seeking a partner in the design, manufacture, branding and distribution of consumer goods.

Over the next year, our plan is to negotiate joint ventures and co-distribution agreements with several real estate development, wine-making and premium consumer goods brands marketing companies. We are also working on acquiring a portfolio of real estate properties, which will be developed for residential, commercial and agricultural production purposes. At this time negotiations on these projects are underway and response has been positive.

We have budgeted $300,000 over the next year for general expenses. This budget covers marketing and advertising expenses ($110,000), legal and consulting fees ($140,000), infrastructure fees ($20,000) and due diligence fees ($30,000).

We expect in the next year total cost of marketing and advertising to be in excess of $100,000. As projects come on line, we anticipate interest in our projects in other parts of the country and will be looking for joint venture partnerships for assistance in additional projects. We anticipate that new projects will offset any additional general and marketing costs.

At the end of the first 18 months, we plan to make an assessment on the first year and a half of operations. By that time, we anticipate having additional projects contracted for funding for the following year.

If we are unable to effectively market and fund these projects, we may have to suspend or cease our efforts. If we cease our previously stated efforts, we do not have plans to pursue other business opportunities

Results of Operations

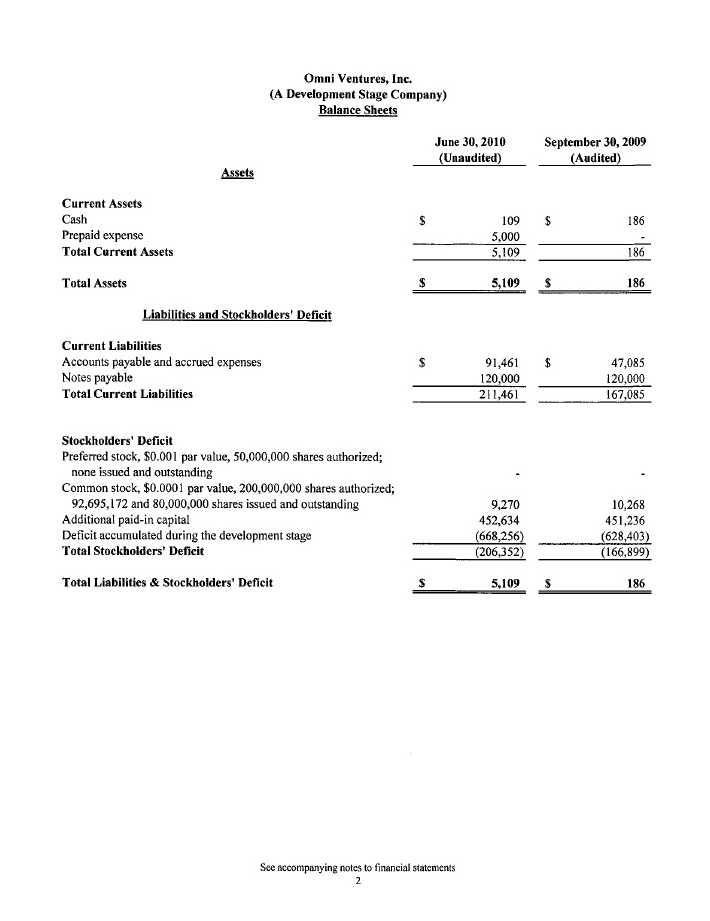

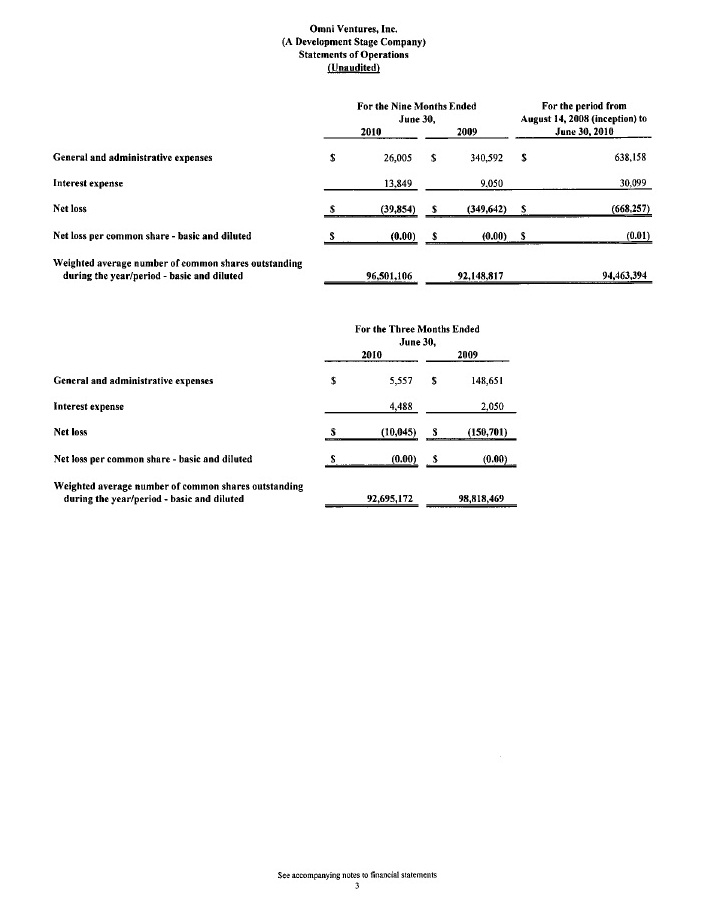

For the period from August 14, 2008 (inception) through June 30, 2010, we had no revenue and have a net loss of $668,257.

Capital Resources and Liquidity

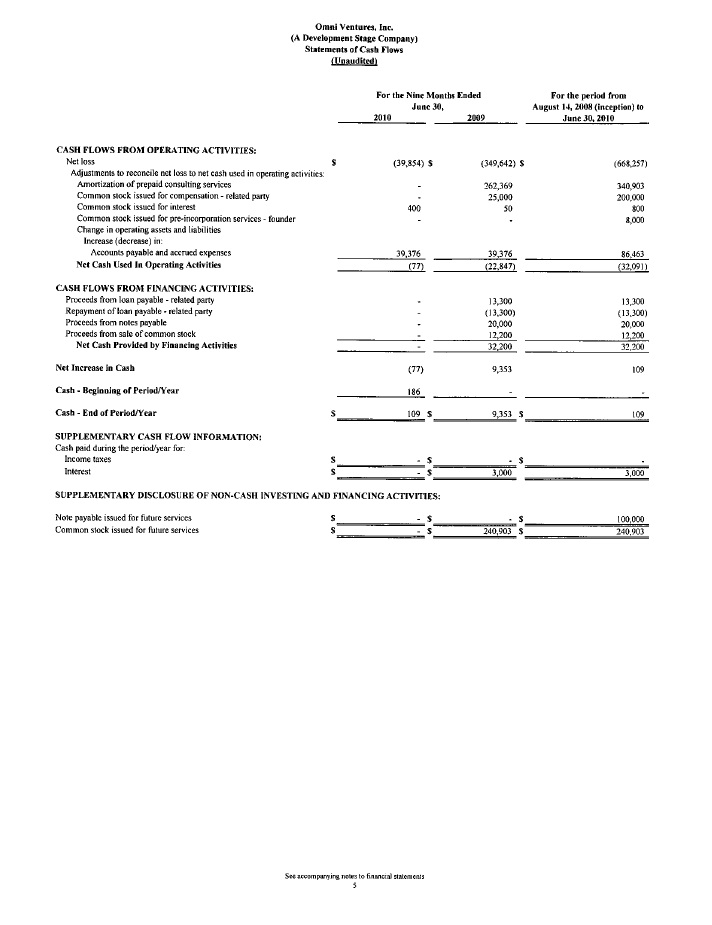

As of June 30, 2010, we had $109 in cash.

We believe that we will need additional funding to satisfy our cash requirements for the next twelve months. Completion of our plan of operation is subject to attaining adequate revenue. We cannot assure that additional financing will be available. In the absence of additional financing, we may be unable to proceed with our plan of operations.

We anticipate that our operational, and general and administrative expenses for the next 12 months will total approximately $300,000. We do not anticipate the purchase or sale of any significant equipment. We also do not expect any significant additions to the number of employees. The foregoing represents our best estimate of our cash needs based on current planning and business conditions. The exact allocation, purposes and timing of any monies raised in subsequent private financings may vary significantly depending upon the exact amount of funds raised and our progress with the execution of our business plan. We anticipate that depending on market conditions and our plan of operations, we may incur operating losses in the foreseeable future. Therefore, our auditors have raised substantial doubt about our ability to continue as a going concern.

Going Concern

As reflected in the accompanying financial statements, we have a net loss of X; and a working capital deficit of $206,353

We are in the development stage and have not yet generated any revenues. Our ability to continue as a going concern is dependent on Management's plans, which include potential asset acquisitions, mergers or business combinations with other entities, further implementation of its business plan and continuing to raise funds through debt or equity raises. The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements, an amendment of Accounting Research Bulletin No 51” (“SFAS 160”). SFAS 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, changes in a parent’s ownership of a noncontrolling interest, calculation and disclosure of the consolidated net income attributable to the parent and the noncontrolling interest, changes in a parent’s ownership interest while the parent retains its controlling financial interest and fair value measurement of any retained noncontrolling equity investment. SFAS 160 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early adoption is prohibited. The adoption of SFAS No. 160 did not have a material effect on the Company’s financial position, results of operations or cash flows.

In December 2007, the FASB issued SFAS 141R, “Business Combinations” (“SFAS 141R”), which replaces FASB SFAS 141, “Business Combinations”. This Statement retains the fundamental requirements in SFAS 141 that the acquisition method of accounting be used for all business combinations and for an acquirer to be identified for each business combination. SFAS 141R defines the acquirer as the entity that obtains control of one or more businesses in the business combination and establishes the acquisition date as the date that the acquirer achieves control. SFAS 141R will require an entity to record separately from the business combination the direct costs, where previously these costs were included in the total allocated cost of the acquisition. SFAS 141R will require an entity to recognize the assets acquired, liabilities assumed, and any non-controlling interest in the acquired at the acquisition date, at their fair values as of that date. This compares to the cost allocation method previously required by SFAS No. 141. SFAS 141R will require an entity to recognize as an asset or liability at fair value for certain contingencies, either contractual or non-contractual, if certain criteria are met. Finally, SFAS 141R will require an entity to recognize contingent consideration at the date of acquisition, based on the fair value at that date. This Statement will be effective for business combinations completed on or after the first annual reporting period beginning on or after December 15, 2008. Early adoption of this standard is not permitted and the standards are to be applied prospectively only. Upon adoption of this standard, there would be no impact to the Company’s results of operations and financial condition for acquisitions previously completed. The adoption of SFAS No. 141R did not have a material effect on the Company’s financial position, results of operations or cash flows.

In October 2008, the FASB issued FSP FAS 157-3, “Determining the Fair Value of a Financial Asset When the Market For That Asset Is Not Active” (“FSP FAS 157-3”), with an immediate effective date, including prior periods for which financial statements have not been issued. FSP FAS 157-3 amends FAS 157 to clarify the application of fair value in inactive markets and allows for the use of management’s internal assumptions about future cash flows with appropriately risk-adjusted discount rates when relevant observable market data does not exist. The objective of FAS 157 has not changed and continues to be the determination of the price that would be received in an orderly transaction that is not a forced liquidation or distressed sale at the measurement date. The adoption of FSP FAS 157-3 did not have a material effect on the Company’s financial position, results of operations or cash flows.

In April 2009, the FASB issued FSP SFAS 157-4, “Determining Whether a Market Is Not Active and a Transaction Is Not Distressed,” which further clarifies the principles established by SFAS No. 157. The guidance is effective for the periods ending after June 15, 2009 with early adoption permitted for the periods ending after March 15, 2009. The adoption of FSP FAS 157-4 did not have a material effect on the Company’s financial position, results of operations, or cash flows.

In May 2009, the FASB issued SFAS No. 165 “Subsequent Events” (“SFAS 165”). SFAS 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. SFAS 165 sets forth (1) The period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements, (2) The circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements and (3) The disclosures that an entity should make about events or transactions that occurred after the balance sheet date. SFAS 165 is effective for interim or annual financial periods ending after June 15, 2009.

In June 2009, the FASB issued SFAS No. 166 “Accounting for Transfers of Financial Assets—an amendment of FASB Statement No. 140” (“SFAS 166”). SFAS 166 improves the relevance, representational faithfulness, and comparability of the information that a reporting entity provides in its financial statements about a transfer of financial assets; the effects of a transfer on its financial position, financial performance, and cash flows; and a transferor’s continuing involvement, if any, in transferred financial assets. SFAS 166 is effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period and for interim and annual reporting periods thereafter. The Company is evaluating the impact the adoption of SFAS 166 will have on its financial statements.

In June 2009, the FASB issued SFAS No. 167 “Amendments to FASB Interpretation No. 46(R)” (“SFAS 167”). SFAS 167 improves financial reporting by enterprises involved with variable interest entities and to address (1) the effects on certain provisions of FASB Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities”, as a result of the elimination of the qualifying special-purpose entity concept in SFAS 166 and (2) constituent concerns about the application of certain key provisions of Interpretation 46(R), including those in which the accounting and disclosures under the Interpretation do not always provide timely and useful information about an enterprise’s involvement in a variable interest entity. SFAS 167 is effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. The Company is evaluating the impact the adoption of SFAS 167 will have on its financial statements.

In June 2009, the FASB issued SFAS No. 168 “The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles—a replacement of FASB Statement No. 162”. The FASB Accounting Standards Codification (“Codification”) will be the single source of authoritative nongovernmental U.S. generally accepted accounting principles. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. SFAS 168 is effective for interim and annual periods ending after September 15, 2009. All existing accounting standards are superseded as described in SFAS 168. All other accounting literature not included in the Codification is nonauthoritative. The Codification is not expected to have a significant impact on the Company’s financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date and are not expected to have a material impact on the financial statements upon adoption.

Critical Accounting Policy

In December 2001, the SEC requested that all registrants discuss their most “critical accounting policies” in management’s discussion and analysis of financial condition and results of operations. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of the company’s financial condition and results and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Off Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

Item 3. Quantitative and Qualitative Disclosures About Market Risks

Not required for Smaller Reporting Companies.

Item 4T. Controls and Procedures

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (“Exchange Act”), the Company carried out an evaluation, with the participation of the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) (the Company’s principal financial and accounting officer), of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company’s CEO and CFO concluded that the Company’s disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Management’s Report on Internal Controls over Financial Reporting

Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of consolidated financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. There has been no change in the Company’s internal control over financial reporting during the quarter ended March 31, 2010 that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

The Company’s management, including the Company’s CEO and CFO, does not expect that the Company’s disclosure controls and procedures or the Company’s internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of the controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected.

Management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the company’s internal control over financial reporting was effective as of March 31, 2010.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

We are currently not involved in any litigation and there is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such.

Item 1A. Risk Factors

Not applicable because we are a smaller reporting company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

On November 18, 2009, the company issued 20,000 shares to two debt holders as interest payment on their loan. The Stock issued was valued by the debt holders at $400.00

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

Item 5. Other Information.

None.

Item 6. Exhibits and Reports of Form 8-K.

(a) Exhibits

31.1 Rule 13a-14(a)/ 15d-14(a) Certification of Chief Executive Officer and Chief Financial Officer

32.1 Section 1350 Certification of Chief Executive Officer and Chief Financial Officer

(b) Reports of Form 8-K

None.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Omni Ventures, Inc.

August 16, 2010 By: /s/Neil Kleinman

Neil Kleinman, President