Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - BPZ RESOURCES, INC. | a10-15663_28k.htm |

| EX-99.1 - EX-99.1 - BPZ RESOURCES, INC. | a10-15663_2ex99d1.htm |

Exhibit 99.2

|

|

Annual Shareholders Meeting August 13, 2010 1 BPZ Energy: Exploration & Development |

|

|

Call to Order and Welcoming Remarks Applicability of Agenda and Rules Statement of Mailing of Notice and Materials Available to Shareholders Introduction of Inspector Determination of Quorum Opening of Polls Voting on Proposals Election of Class III Directors Amend the BPZ Resources, Inc. 2007 Long-Term Incentive Compensation Plan to allow for an additional amount of securities to be made available for incentive awards Approve the issuance of common stock upon conversion of our 6.5% Convertible Notes due 2015 if the conversion requires issuance of shares in excess of the New York Stock Exchange limits for share issuances without shareholder approval Selection of Company’s independent public accountants Closing of Polls Report of Voting Results Other Matters and Adjournment of Formal Business Management’s Reports Shareholders’ Remarks and Questions 2 |

|

|

3 Manolo Zúñiga President and CEO |

|

|

4 This Press Release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.These forward looking statements are based on our current expectations about our company, our properties, our estimates of required capital expenditures and our industry. You can identify these forward-looking statements when you see us using words such as "expect," "will", "anticipate," "indicate," "estimate," "believes," "plans" and other similar expressions. These forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward looking statements. Such uncertainties include the success of our project financing efforts, accuracy of well test results, well refurbishment efforts, successful production of indicated reserves, satisfaction of well test period requirements, successful installation of required permanent processing facilities, receipt of all required permits, and the successful management of our capital expenditures, and other normal business risks. We undertake no obligation to publicly update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. We caution you not to place undue reliance on those statements. The U.S. Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only “reserves” that a company anticipates to be economically producible by application of development projects to known accumulations, and there exists or is a reasonable expectation there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. We are prohibited from disclosing estimates of oil and gas resources that do not constitute “reserves” in our SEC filings. We may use certain terms in this press release or our related earnings call, such as “oil in place,” “oil zones,” and “oil sands,” which imply the existence of quantities of resources which the SEC guidelines strictly prohibit U.S. publicly registered companies from including in reported reserves in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our SEC filings, available from us at 580 Westlake Park Blvd., Suite 525, Houston, Texas 77079; Telephone: (281) 556-6200. These filings can also be obtained from the SEC via the internet at www.sec.gov. |

|

|

Migrated to New York Stock Exchange Reserve Growth of 119% ( YE 2009 vs. YE 2008) 27.5 Mmbo Proved Oil in Corvina 10.0 Mmbo Proved Oil in Albacora Exploration Success at Albacora A-14XD online and testing with EWT through mid January 2011 Corvina’s Appraisal Continues/Reduced Drilling Costs BPZ Marine Receives Certification to the ISO 9001 and 14001 Quality and Environmental Management Standards Raised Capital for Exploration and Development $88 million in equity $171 million in convertible notes 5 |

|

|

Dr. Fernando Zúñiga y Rivero Dr. Zúñiga y Rivero has over 60 years of experience in the energy industry with a particular focus on Peru. Manolo Zúñiga Mr. Zúñiga-Pflücker is a petroleum engineer with 25 plus years in the international oil and gas business. Gordon Gray Mr. Gray has owned and operated oil production and oil field service businesses for over 30 years. John J. Lendrum III Mr. Lendrum brings over 25 years experience in the oil and gas industry and heads the Company’s audit committee. Dennis Strauch Mr. Strauch has over 30 years experience in the oil and gas industry and chairs the compensation committee. James Taylor (February 2010) Brings 47 years of industry experience including serving as Executive Vice President of Occidental Oil and Gas. Stephen Beasley (February 2010) Brings over 30 years experience with extensive experience as President of the El Paso Pipeline Group. 6 |

|

|

Richard Spies, Chief Operating Officer Over 30 years experience in large scale projects with major oil and gas operators Amoco, Pan American Energy (a BP subsidiary), and BP Russia. Frederic Briens, Chief of Strategy and Technology Brings over 20 years experience in international projects with major and independent oil companies and was instrumental in bringing BPZ to early oil testing phase. Cesar Ortega, VP Operations, Peru Over 25 years experience, most recently with BP Americas Inc. in large scale on and offshore oil and gas projects. Herb Mills, Director Gas to Power Came to BPZ from Duke Energy International with over 20 years experience developing projects in Latin America. Reynaldo Llosa, Strategic Contracts Manager, Peru Brings over 25 years experience from Schlumberger where he managed drilling projects in Latin America as well as other international markets. 7 |

|

|

8 Focus on Improving Operations |

|

|

Technologies Casing Drilling—First in Peru Annular Pressure While Drilling Compact Shuttle Logging Pipe Conveyed Logging Service Companies Schlumberger Weatherford Engineering & Construction Universal Pegasus Maintenance Wood Group 9 |

|

|

10 Improving Drilling Costs 136 Days Days to Drill & Complete 77 Days $11.6M Drilling Costs $8.3M First 5 Corvina Wells Last 3 Corvina Wells $9.2M Completion Costs/Testing ***CX11-23D not included $3.2M $28.3M Total Well Costs $13.8M |

|

|

11 “In Peru, Drilling & Measurements EcoScope logging-while-drilling technology successfully identified previously bypassed low resistivity pay zones in the BPZ Energy Corvina Field. In addition, Data & Consulting Services realtime monitoring and petrophysics interpretation helped BPZ Energy plan for future development in the area.” New Technologies Drive Success Press Release PARIS, July 23, 2010 Schlumberger |

|

|

12 Developing Our First Two Oil Fields |

|

|

13 Mmbo Albacora Reserves Estimated by Netherland Sewell & Associates, LLP 11.9 Mmbo 17 Mmbo 37.5 Mmbo 0 5 10 15 20 25 30 35 40 YE 2007 YE 2008 YE 2009 Corvina SEC Proved Oil Reserves—Corvina & Albacora |

|

|

14 NSAI Estimated 2007, 2008, 2009 OOIP and Reserves YE 2009 Includes Albacora 0 50 100 150 200 250 300 350 400 Potential Oil in Place 3P Reserves 2007 2008 2009 Potential Oil Reserves of 126.1 MMBO |

|

|

15 Taking Corvina to Commercial Production Drilling the CX11-23D well from the CX-11 platform Purchased reinjection equipment to transition to commercial production by November30 , 2010 Compression equipment enroute to Peru and all other equipment is in country |

|

|

16 Albacora Highlights Seven wells drilled to date (6 by other operators). 4 have produced oil including BPZ’s A-14XD 8-X-2 discovery well tested oil, gas and non-associated rich gas A-14XD well under production test (began Dec 2009), granted six month EWT through mid January 2011 Only one set of sands being addressed in the A-14XD with the potential to add additional pay Second BPZ well, A-17D, currently being tested and expect to be completed September 2010 |

|

|

Roadmap to 2012 Corvina Exit 2010 with production in the 4,000-5,000 BOPD range from Corvina Work-over some existing wells to optimize production Install new CX-15 platform by YE 2011 Albacora Drill A-18D with completion estimated in late November/early December, with six months of testing Exit 2010 with approximately 2,000-4,000 BOPD testing in Albacora Sign long-term oil sales agreement Continue drilling and appraising through 2011 Gas re-injection equipment planned for Albacora by YE 2011 Install new platform in 2012 TOTAL YEAR END PRODUCTION/TESTING OF APPROX. 6,000-9,000 BOPD 17 |

|

|

18 . . . our Corvina Gas Field |

|

|

19 Gas GIP (BCF) Reserves (BCF) RF (% GIP) 1P 250 195 78 2P 342 240 70 3P 342 270 79 West Corvina SPE Reserves (as of June 30, 2010) Reserves estimated by Netherland Sewell & Associates. These are estimates based on SPE rules set forth by the Society of Petroleum Engineers and are not reserves booked by the Securities and Exchange Commission. These reserves cannot be guaranteed. |

|

|

Critical Milestone for BPZ Energy’s Enterprise Value Supplies gas for CT Nueva Esperanza (135 MW power plant) Facilitates sale and booking of BPZ’s gas reserves Wells already drilled and ready to produce Corvina gas Provides Operational Enhancements Reduces BPZ’s annual unit production costs ($/boe) Provides flexibility for associated gas (sale versus reinjection) Gives BPZ outlet for testing of onshore gas wells Diversifies BPZ’s Business Power generation and gas pipeline infrastructure Source of stable cash flow / mitigates impact of oil price volatility Supplies Energy in a Growing Economy Supplies additional electricity to a growing power market Reliable power and natural gas supplies will attract industry to northern Peru 20 |

|

|

With Its Own Management Team: BPZ is dedicated to developing a strong management team (Herb Mills, Director of Gas to Power) BPZ will use experienced local and international contractors to design, construct, and operate the facilities Project Description: 135 MW simple cycle power plant (3 x GE LM6000s) in northern Peru 10 mile gas pipeline from Corvina platform to CT Nueva Esperanza (24+ mmcfd) and other potential gas customers(up to 125 mmcfd) Schedule: Commercial operations – 2nd half of 2012 Estimated Capital Investment: $150MM (power plant - $130MM; pipeline delivery facilities - $20MM) plus 19% VAT Economics: Estimated gas demand from power plant: 24+mmcf per day Estimated potential realized price from sale of electricity: $5.00 – 6.00 per mcf 21 |

|

|

22 The Power Project Anchors our Gas Strategy |

|

|

23 Gas MGP Resources (BCF) + East Corvina Resources (BCF) = Total Resources (BCF) 1C 449.0 75.0 524.0 2C 1,079.0 315.0 1394.0 3C 1,814.0 435.0 2,249.0 Two Contingent Sources of Gas (as of June 30, 2010) Contingent resources estimated by Netherland Sewell & Associates. These are estimates based on SPE rules set forth by the Society of Petroleum Engineers and are not reserves booked by the Securities and Exchange Commission. These reserves are not yet published and cannot be guaranteed. Mancora Gas Play and East Corvina Field |

|

|

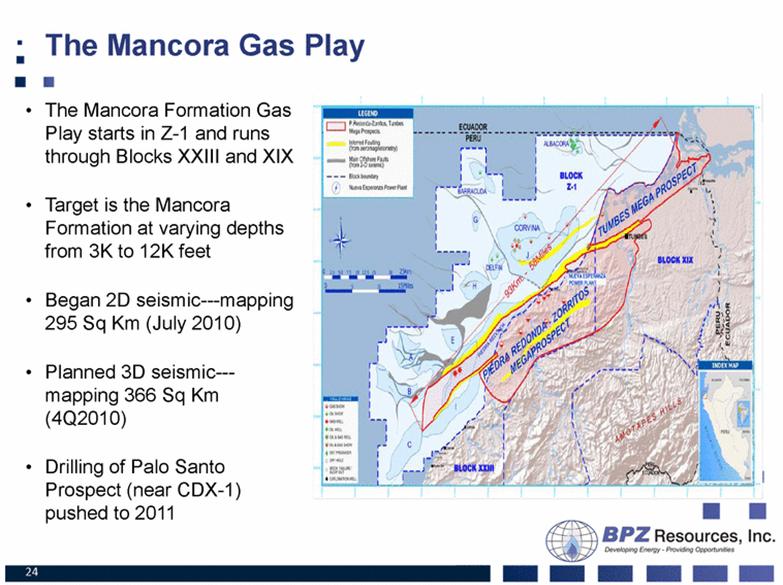

The Mancora Formation Gas Play starts in Z-1 and runs through Blocks XXIII and XIX Target is the Mancora Formation at varying depths from 3K to 12K feet Began 2D seismic---mapping 295 Sq Km (July 2010) Planned 3D seismic--- mapping 366 Sq Km (4Q2010) Drilling of Palo Santo Prospect (near CDX-1) pushed to 2011 24 |

|

|

25 Well History is On Our Side |

|

|

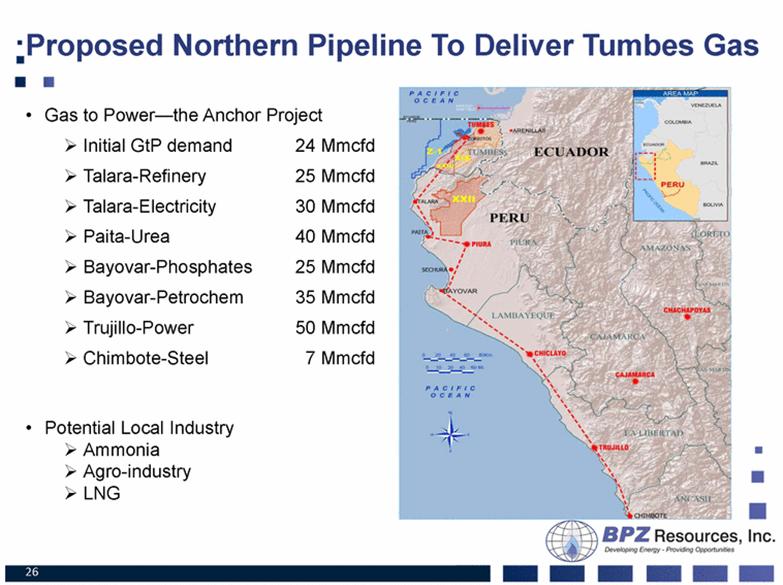

Gas to Power—the Anchor Project Initial GtP demand 24 Mmcfd Talara-Refinery 25 Mmcfd Talara-Electricity 30 Mmcfd Paita-Urea 40 Mmcfd Bayovar-Phosphates 25 Mmcfd Bayovar-Petrochem 35 Mmcfd Trujillo-Power 50 Mmcfd Chimbote-Steel 7 Mmcfd Potential Local Industry Ammonia Agro-industry LNG 26 |

|

|

27 Low 3.14 Medium 6.14 High 18.16 MGP Prospective Resources (as of June 30, 2010) Gas in place estimated by Netherland Sewell & Associates. These are estimates based on SPE rules set forth by the Society of Petroleum Engineers and are not reserves booked by the Securities and Exchange Commission. These estimates cannot be guaranteed. |

|

|

28 Building a Balanced Asset Base . . . |

|

|

29 Delfin West Corvina Mero The Corvina Complex |

|

|

Drilling planned for first half 2011 Several mapped prospects based on 2007 2D seismic survey Targets are oil in Heath Formation and gas in Mancora Formation First well to begin appraisal of Mancora Gas play’s northern section The Pampa La Gallina prospect is approximately 5 miles from the future power plant site Three additional prospects/leads mapped Block XIX---Our First Onshore Prospect 30 |

|

|

31 Lead A Lead B PLG Prospect D Prospect Block XIX’s First Four Prospects |

|

|

Targeting oil and gas from Paleozoic up to Tertiary rock Multiple plays Planned 2D seismic---mapped 258 Sq Km 2 (4Q2010) Adjacent to existing proved oil and gas accumulations Oil production from Paleozoic formation in nearby Portachuelo, San Pedro (offshore), and La Isla oilfields Close proximity to Talara refinery and oil services, as well as deep water port in Paita Block XXII---Oil & Gas Prospects 32 |

|

|

33 Portachuelo San Pedro Looking for Oil in the Southern Block XXII |

|

|

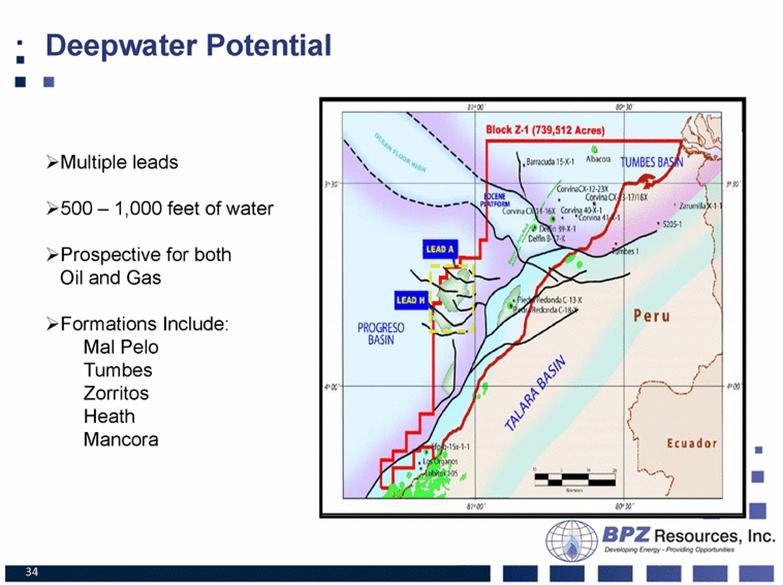

34 Multiple leads 500 – 1,000 feet of water Prospective for both Oil and Gas Formations Include: Mal Pelo Tumbes Zorritos Heath Mancora Deepwater Potential |

|

|

35 Corporate Social Responsibility |

|

|

36 The Social Investment in Our Children |

|

|

37 Development of Our Adolescents |

|

|

38 Providing Opportunities for Fishermen |

|

|

Share Count 115 Million Shares Outstanding 145 Million Shares Fully Diluted (includes Feb 2010 Convertible Notes due March 2015) Share Ownership: Management 15% Institutional Ownership 60% Largest Holders: International Finance Corporation Centennial Energy Partners Soros Fund Management SPO Partners Contact: Greg Smith, Director of Investor Relations and Corporate Communications greg_smith@bpzenergy.com Additional Information NYSE:BPZ 39 |

|

|

40 Thank You |