Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - Snowdon Resources CORP | exhibit31-1.htm |

| EX-32.1 - CERTIFICATION - Snowdon Resources CORP | exhibit32-1.htm |

| EX-10.8 - CORPORATE SUPPORT AGREEMENT - Snowdon Resources CORP | exhibit10-8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from __________ to __________

| Nevada | N/A |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Commission file number 000-52813

SNOWDON RESOURCES

CORPORATION

(Exact name of registrant as specified in its

charter)

| 789 West Pender Street, Suite 1010 | |

| Vancouver, British Columbia, Canada | V6C 1H2 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (604) 606-7979

Securities registered pursuant to Section 12(b) of the Exchange Act:

| None | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $0.00001 par value

(Title of

class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

Yes [ ] No [X]

Indicate by check mark whether the registrant(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] | |

| Non-accelerated Filer | [ ] | Smaller Reporting Company | [ X ] | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [X ] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $484,000 (based on a share price of $0.08, being the average bid and asked price on October 30, 2009)

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN

BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes [ ] No [ ]

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 16,050,000 common shares issued and outstanding as of August 10, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). N/A

2

TABLE OF CONTENTS

3

Forward Looking Statements.

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

- the uncertainty of future revenue and profitability based upon our current financial condition and history of losses;

- risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned projects;

- risks relating to the mining of uranium; and

- other risks and uncertainties related to our business strategy.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted

Accounting Principles. In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company” and “Snowdon” mean Snowdon Resources Corporation, unless the context clearly requires otherwise.

4

PART I

| ITEM 1. | DESCRIPTION OF BUSINESS |

General

We were incorporated on March 1, 2006 and our fiscal year end is April 30. Our administrative office is located at 789 West Pender Street, Suite 1010, Vancouver, British Columbia, Canada V6C 1H2, which is also our mailing address. Our telephone number is (604) 606-7979, and our registered statutory office is located at 311 South Division Street, Carson City, Nevada 89703.

We are an exploration stage mining company. We are in the business of exploration and development of uranium on our properties. Currently we hold title to twelve claims in Gila County, Arizona (the “CR Claims”) and have the right to receive certain royalties in respect of certain Arizona state leases and claims described below. We acquired five Gila County claims on April 1, 2006. The claims were re-staked in March, 2008 and increased to a total of twelve. Each claim measures 600 feet by 1,500 feet and covers 20 acres. Total land position is 240 acres.

In July, 2009, we entered into an debt settlement agreement with Eagle Hill Exploration Corporation and Eagle Hill Arizona Uranium LLC

(together the “Vendors”) to acquire the following five Arizona State leases (the “Leases”) and two additional claims in settlement of certain debt owed by the Vendors to Snowdon:

| Leases | ||||||

| Arizona | ||||||

| State | ||||||

| Section | Permit | Permit | ||||

| Number | Date | Number | County | Township | Range | Acres |

| 2 | 1 Jun 07 | 08-111685 | Coconino | 38N | 3W | 661.24 |

| 16 | 1 Jun 07 | 08-111687 | Mohave | 39N | 4W | 640.00 |

| 32 | 17 Nov 06 | 08-114280 | Mohave | 37N | 5W | 640.00 |

| 32e | 1 Jun 07 | 08-111686 | Mohave | 38N | 4W | 639.41 |

| 36 | 14 Dec 06 | 08-111148 | Mohave | 38N | 6W | 640.00 |

The two Arizona mining claims which we may acquire under the terms of the agreement dated July 20, 2009 are as follows:

| Date of | Coconino | BLM Serial | ||||

| Claim Name | Location | County No. | No. (AMC #) | Township | Range | Section |

| TR #20 | 19 Feb 08 | 3480264 | 392039 | 39N | 2W | 26 |

| TR #21 | 19 Feb 08 | 3480265 | 392040 | 39N | 2W | 26 |

As with our Gila County claims, the annual maintenance fee on these two additional claims is $140 each, due on or before September 1. As a condition of the debt settlement agreement we agreed to grant a 1% royalty interest in the claims and leases to the Vendors up to a limit of $400,000. On January 1, 2010 we entered into a mineral exploration and option agreement among the Vendors, Quaterra Alaska Inc. (“Quaterra”) and Limestone Resources LLC, pursuant to which the parties granted Quaterra an option to acquire a 100% interest to the following Arizona State leases (collectively the “Optioned Leases”): Nos. 08-111148, 08-111081, 08-111685, 08-111686, 08-111686, 08-111687 and 08-114280. As consideration for the exercise of the option, Quaterra agreed to pay the Arizona State Land Development fees on the Optioned Leases for a one year period and perform the required exploration work to maintain the leases in good standing. As a condition of the agreement, the parties agreed to grant the following royalties: (i) a royalty of 25% of any royalties paid to the State of Arizona in connection with any mineral production from the Optioned Leases to Snowdon (the “Snowdon Royalty”), (ii) a royalty of 20% of any proceeds received by Snowdon from the Snowdon Royalty less any royalty payments to the Vendors, and (iii) a 1% net smelter return royalty on the proceeds of the Snowdon Royalty payable to the Vendors.

Recent Corporate Developments

Since the commencement of our fourth quarter ended April 30, 2010, we experienced the following significant corporate developments:

| 1. |

On January 1, 2010 we entered into a mineral exploration and option agreement among the Eagle Hill Exploration Corporation and Eagle Hill Arizona Uranium LLC (together the “Vendors”), Quaterra Alaska Inc. (“Quaterra”) and Limestone Resources LLC, pursuant to which the parties granted Quaterra an option to acquire a 100% interest to the following Arizona State leases |

5

|

(collectively the “Optioned Leases”): Nos. 08-111148, 08-111081, 08-111685, 08-111686, 08-111686, 08-111687 and 08- 114280. As consideration for the exercise of the option, Quaterra agreed to pay the Arizona State Land Development fees on the Optioned Leases for a one year period and perform the required exploration work to maintain the leases in good standing. As a condition of the agreement, the parties agreed to grant the following royalties: (i) a royalty of 25% of any royalties paid to the State of Arizona in connection with any mineral production from the Optioned Leases to Snowdon (the “Snowdon Royalty”), (ii) a royalty of 20% of any proceeds received by Snowdon from the Snowdon Royalty less any royalty payments to the Vendors, and (iii) a 1% net smelter return royalty on the proceeds of the Snowdon Royalty payable to the Vendors. | ||

| 2. |

In February, 2010, the parties agreed to terminate the public relations agreement between Snowdon and Vorticom Inc. whereby Vorticom agreed to serve as public relations counsel for Snowdon beginning December 1, 2009 for a twelve month period. As consideration for the services, the Company had agreed to issue 250,000 restricted shares of common stock and pay a cash fee of $4,000 per month, and $500 monthly for media monitoring and live media database. The Company paid a total of $9,000 up to the date of termination of the contract. No further funds are owed and the Company issued the 250,000 shares to Vorticom pursuant to Rule 506 of Regulation D on the basis that the company represented that they were an accredited investor. | |

| 3. |

Effective March 31, 2010 Terence Schorn has resigned as a Director of the Company. There were no disagreements between Mr. Schorn and the Company relating to the Company’s policies, procedures or practices. | |

| 4. |

On April 1, 2010, the Company executed an amendment agreement for office space and administrative support services with a privately held company controlled by a significant shareholder, effective April 1, 2010 for a term of three years at a rate of CDN$7,500 per month plus applicable taxes, and 300,000 shares of restricted common stock of the Company (issued May 3, 2010). The sole director and officer of Snowdon is also a director and shareholder of the private company. | |

| 5. |

In July, 2010 we entered into a letter of intent with a private an arms length company for the acquisition of six patent applications and related intellectual property for the processing and upgrading of heavy crude oil. Under the terms agreed to in the letter of intent, Snowdon may acquire the intellectual property in consideration of the issuance of up to 3,000,000 shares of common stock of Snowdon, together with up to 7,062,250 additional shares of common stock upon the achievement of certain milestones by the Company. The letter of intent is subject to a number of conditions including, among other things, the satisfactory completion of the parties due diligence, completing a financing in the minimum amount of CDN$1,000,000. and the entry into a definitive agreement between the parties with the customary representations and warranties by the parties. There is no assurance that the transaction will be completed as planned or at all. An independent third party owns additional related oil and gas technology and Snowdon has been negotiating for the acquisition of such technology. There is no assurance that Snowdon will complete the acquisition of the additional technology. If the transaction completes, Snowdon intends to expand its business operations to include activities relating to the processing and upgrading of heavy crude oil and expects to continue with its mineral exploration activities on its uranium properties. |

Status of Our Proposed Exploration Program

The exploration program for our CR claims is now on hold, pending improved conditions for fundraising in the equity markets. We have had to temporarily cease exploration program expenditures on those properties until there is greater certainty in our view that our cash reserves can be replenished through further equity offerings.

We have completed the Radon survey on our CR claims. The Radon survey was more extensive than originally contemplated and allowed us to replace certain previously planned exploration steps. Those were, establishing a survey grid, geological mapping of the rock structures, soil sampling and analysis, a radiometric survey, and a magnetometer survey. Total survey and claim related expenditures to April 30, 2010 were $90,388.

At present, our property should be considered undeveloped raw land. Work to date has included the staking of twelve contiguous lode claims, the required filing with both county and federal agencies and the radon survey together with related fieldwork and consulting. Maintenance fees due to the BLM totaling $1,680 for the CR claims as noted above are due on or before September 1 every year. The Use of Proceeds for Drilling and Development were originally estimated at a combined total of $309,570. Total Development expenditures to April 30, 2010 were $37,262.

The following is our original plan and milestones for exploration of the CR claims. When sufficient funds are available for further exploration work on the CR claims, we will need to take into account the recommendations of Dr. Wenrich and Dr. Reimer with respect to the initial drilling locations and the need for additional data, possibly including groundwater testing. An entirely different type of drilling program (e.g. more widespread, shallow drilling) than that proposed in item 2 below could result. This would essentially change the current plan for Phase 2 in its entirety.

6

CR Claims Exploration Plan - Phase 2 (Now deferred and subject to re-evaluation)

| 1. |

We intend to submit a Plan of Operation to the Tonto National Forest Service to conduct a drill program. Approval can take up to six months. |

| 2. |

If our submission is approved, we will proceed with a reverse circulation drilling program at the locations recommended in the Radon survey report. This program will consist of 4 vertical holes drilled to a depth of 300 feet. The cost is estimated to be approximately $25,000 and the time involved is estimated to be 10 days. |

| 3. |

As the drill holes are completed, a radiometric, down-hole probe will be immediately inserted in the holes to measure gamma ray counts. Cost is estimated to be approximately $6,000. |

| 4. |

Administration and supervision by the field geologist during the drilling program and for the radiometric measurements is estimated to cost approximately $10,000. |

| 5. |

Reclamation work cost is estimated to be approximately $10,000 and time involved is estimated to be 4 days. A refundable bond payment for reclamation work will need to be posted and is expected to be approximately $15,000. |

The BLM regulations provide for three types of operations on public lands: 1. Casual Use level, 2. Notice level and 3. Plan of Operation level.

1. Casual Use means activities ordinarily resulting in no or negligible disturbance of the public lands or resources. Casual Use operations involve simple prospecting with hand tools such as picks, shovels, and metal detectors. Small-scale mining devices such as dry washers having engines with less than 10 brake-horsepower are allowed, provided they are fed using only hand tools. Casual Use level operations are not required to file an application to conduct activities or post a financial guarantee.

2. Notice level operations include only exploration activities in which five or less acres of disturbance are proposed. Presently, all Notice Level operations require a written notice and must be bonded for all activities other than reclamation.

3. Plans of Operation activities include all mining and processing (regardless of the size of the proposed disturbance), plus all other activities exceeding five acres of proposed public land disturbance.

Operators are encouraged to conduct a thorough inventory of the claim to determine the full extent of any existing disturbance and to meet with field office personnel at the site before developing an estimate. The inventory should include photographs taken "before" and "after" any mining activity.

If an operator constructs access or uses an existing access way for an operation and would object to BLM blocking, removing, or claiming that access, then the operator must post a financial guarantee that covers the reclamation of the access.

Concurrence by the BLM for occupancy is required whenever residential occupancy is proposed or when fences, gates, or signs will be used to restrict public access or when structures that could be used for shelter are placed on a claim. It is the claimant's responsibility to prepare a complete notice or plan of operators.

Mining Claims On State Land

The Arizona law authorizing location of claims on State Lands was repealed in 1998. Acquisition of mineral rights on Arizona trust land can only be accomplished by application for a prospecting permit, mineral lease, or lease of common variety materials.

We believe that we are in compliance with all laws and will continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect our business operations.

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We anticipate that we will be able to secure all necessary permits for exploration and, if development is warranted on the property, file final plans of operation before we start any mining operations. At this point, a permit from the BLM would be required. Also, we would be required to comply with the laws of the state of Arizona and federal regulations.

7

Cost of Compliance With Environmental Laws

We anticipate that:

- no water will be discharged into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation;

- no endangered species will be disturbed;.

- restoration of the disturbed land will be completed according to law; and

- all holes, pits and shafts will be sealed upon abandonment of the property.

It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect" of compliance with environmental regulations in the State of Arizona is returning the surface to its previous condition upon abandonment of the property. We will only be using "non-intrusive" exploration techniques and will not leave any indication that a sample was taken from the area.

Intellectual Property

We do not currently own any intellectual property.

Employees and Employment Agreements

At present, we have no full-time employees. Our officers and directors are part-time.

Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Our officers and directors handle much of our administrative duties, delegating and managing those where possible through personnel of Sweetwater Capital Corporation.

ITEM 1A. RISK FACTORS

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease operations.

We were incorporated in March 1, 2006 and we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $679,118. Our ability to achieve and maintain profitability and positive cash flow is dependent upon;

- our ability to locate a profitable mineral property;

- our ability to generate revenues; and

- our ability to reduce exploration costs.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. As a result, we may not generate revenues in the future. Failure to generate revenues will cause us to suspend or cease operations.

We currently do not generate revenues, and as a result, we face a high risk of business failure.

We have not generated any revenues to date. In order to generate revenues, we will incur substantial expenses in the evaluation and development of our properties. We therefore expect to incur significant losses into the foreseeable future. If we are unable to generate significant revenues from our activities, our entire business may fail. There is no history upon which to base any assumption as to the likelihood that we will be successful in our plan of operation, and we can provide no assurance to investors that we will generate any operating revenues or achieve profitable operations.

Because the probability of an individual prospect ever having reserves is extremely remote any funds spent on exploration will probably be lost.

8

The probability of an individual prospect ever having reserves is extremely remote. In all probability the property does not contain any reserves. As such, any funds spent on exploration will probably be lost which result in a loss of your investment.

We have no history of mineral production or mining operations.

We have never had uranium producing properties. There is no assurance that commercial quantities of uranium will be discovered, nor is there any assurance that our exploration program thereon will yield positive results. Even if commercial quantities of uranium are discovered, there can be no assurance that any of our property will ever be brought to a stage where uranium resources can profitably be produced therefrom. Factors which may limit our ability to produce uranium resources from our properties include, but are not limited to, the spot price of uranium, availability of additional capital and financing and the nature of any mineral deposits. We do not have a history of mining operations and there is no assurance that we will produce revenue, operate profitably or provide a return on investment in the future.

We rely on our management team, outside contractors, experts and other advisors and the loss of any of them, if they cannot be replaced, could have a material adverse effect on our business and financial performance.

The success of our operations and activities is dependent to a significant extent on the efforts and abilities of our small senior management team, as well as outside contractors, experts and other advisors. In making an investment in our securities, you must be willing to rely to a significant extent on management's discretion and judgment, as well as the expertise and competence of outside contractors, experts and other advisors that we hire to advise us. The loss of one or more member of senior management, key employees or contractors, if not replaced, could materially adversely affect our operations and financial performance.

Because we are small and do not have any ore reserves or much capital, we may have to limit our exploration activity which may result in a loss of your investment.

Because we are small and do not have ore reserves or much capital, we must limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing ore body may go undiscovered. Without an ore body, we cannot generate revenues and you will lose your investment.

Because our officers and directors have other outside business activities and will each only be devoting 25% of their time or approximately ten hours per week each to our operations, our operations may be sporadic which may result in periodic interruptions or suspensions of exploration.

Because our officers and directors, have other outside business activities and will each only be devoting 25% of their time or ten hours each per week to our operations, our operations may be sporadic and occur at times which are convenient to our officers and directors. As a result, exploration of the property may be periodically interrupted or suspended.

The marketability of uranium is subject to numerous factors beyond our control.

The price of uranium may experience volatile and significant price movements over short periods of time. Factors that impact on the price of uranium include demand for nuclear power, political and economic conditions in uranium-producing and consuming nations, reprocessing of spent fuel and re-enrichment of depleted uranium tails or waste, sales of excess civilian and military inventories (including from dismantling nuclear weapons) by governments and industry participants and products levels and costs of production. These factors could negatively impact the price for uranium and lower uranium prices would negatively impact our future profitability. We do not have a hedging policy to protect us from a decline in uranium pricing and have no intention to establish one while we are in the exploratory phases of our operations. In addition, we may not have the ability to purchase hedging instruments in the future. Hedging instruments may also not protect us adequately from fluctuations in the market price of uranium.

There are a limited number of customers available in our target market.

A small number of electric utilities worldwide buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in demand by electric utilities for newly-produced uranium would adversely affect our business.

Our expected costs may be greater than we anticipate.

The capital expenditures and time required to develop new mines or other projects are considerable and changes in costs or construction schedules can affect project economics. Thus, it is possible that actual costs and economic returns may differ materially from our best estimates, or that we could fail to obtain satisfactory resolution of fiscal or tax matters or government approvals necessary for the development or operation of the project, in which case the project may not proceed, either on its original timing, or at all. It is not unusual in the mining industry for new mining operations to experience unexpected problems during the start-up phase, resulting in delays, and to require more capital than anticipated. These delays and additional costs could have a material adverse impact on our future cash flows, earnings, results of operations and financial condition.

9

We are dependent upon continued public acceptance of nuclear energy.

Because of unique political, technological and environmental factors that affect the nuclear industry, the industry is subject to public opinion risks which could have an adverse impact on the demand for nuclear power and increase the regulation of the nuclear power industry. An accident at a nuclear reactor anywhere in the world could impact the continuing acceptance of nuclear energy and the future prospects for nuclear generation, which may have a material adverse effect on our business.

We are subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products from our mining activities.

All phases of our operations are subject to environmental regulation in the jurisdictions in which we operate. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our operations. Environmental hazards may exist on the properties which are unknown to us at present and which have been caused by previous or existing owners or operators of the properties.

We are subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products from our mining activities. Reclamation costs are uncertain and planned expenditures estimated by management may differ from the actual expenditures required. The payment of any liabilities or the costs that we may incur to remedy environmental impacts would reduce funds otherwise available to us for operations. We might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential financial exposure to us may be significant. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal or waste products occurring from exploration and production) as it is not generally available at what we believe to be a reasonable price.

Our business could be adversely affected if we fail to comply with extensive government regulations or fail to obtain, renew or comply with necessary licenses and permits.

Our mineral exploration and planned development activities are subject to various laws governing prospecting, mining, development, production, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although we believe our exploration and development activities are currently carried out in accordance with all applicable laws, rules and regulations, no assurance can be given that new laws, rules and regulations will not be enacted or that existing laws, rules and regulations will not be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on our business and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties. Many of our mineral rights and interests are subject to government approvals, licenses and permits. Obtaining necessary permits and licenses can be a complex, time consuming process and we cannot be certain that we will be able to obtain all required permits on acceptable terms, in a timely manner or at all. The costs and delays associated with obtaining necessary permits and complying with these permits and applicable laws and regulations could stop, delay or restrict us from proceeding with the development of an exploration project or the development and operation of a mine. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of applicable governments or governmental officials. No assurance can be given that we will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are required and not obtained, we may be curtailed or prohibited from continuing or proceeding with planned exploration or development of mineral properties. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Our future prospects may be affected by political decisions about the uranium market.

There can be no assurance that the United States or other government will not enact legislation restricting to whom we can sell uranium or that the United States or other government will not increase the supply of uranium by decommissioning nuclear weapons.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Any reduction in our ability to raise equity capital in the future could have a significant negative effect on our business plans and our ability to develop new products. If our stock price declines, we may not be able to raise additional capital sufficient to acquire new business.

10

Because we do not intend to pay any cash dividends on our shares of common stock in the near future, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

Trading of our stock may be restricted by the SEC’s “Penny Stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to person other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and sales person compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Since our shares are thinly traded, and trading on the OTC Bulletin Board may be limited and sporadic because it is not an exchange, stockholders may have difficulty reselling their shares or liquidating their investments.

Our shares of common stock are currently listed for public trading on the Pink OTC Markets Inc. The trading price of our shares of common stock has been subject to wide fluctuations. Trading prices of our shares of common stock may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by shares of our common stock will be matched or maintained. These broad market and industry factors may adversely affect the market price of the shares of our common stock, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management's attention and resources.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

Not applicable.

11

| ITEM 2. | PROPERTIES. |

Our administrative office is located at 789 West Pender Street, Suite 1010, Vancouver, British Columbia, Canada V6C 1H2, which is also our mailing address. Our telephone number is (604) 606-7979, and our registered statutory office is located at 311 South Division Street, Carson City, Nevada 89703. Our office location is provided under the terms of our agreement with Sweetwater Capital Corporation pursuant to which we pay $7,500 per month for rental of our office space and certain office related services including use of computers, professional services such as bookkeeping, office services and use of other office equipment. We believe our current premises are adequate for our current operations and we do not anticipate that we will require any additional premises in the foreseeable future.

We are an exploration stage mining company. We are in the business of exploration and development of uranium on our properties. Currently we hold title to twelve claims in Gila County, Arizona (the “CR Claims”) and have the right to receive certain royalties in respect of certain Arizona state leases and claims described below. We acquired five Gila County claims on April 1, 2006. The claims were re-staked in March, 2008 and increased to a total of twelve. Each claim measures 600 feet by 1,500 feet and covers 20 acres. Total land position is 240 acres.

Claims

The following is a list of the claims which we currently own, as filed with Bureau of Land Management, hereinafter the “BLM,” showing the claim number, name of claims, date of location and date of expiration for claims. All of these claims are located in Gila County, Arizona.

| BLM Serial | |||

| No. (AMC #) | Claim Name | Date of Location | Date of Expiration |

| 390227 | CR # 1 | February 28, 2008 | September 1, 2009 |

| 390228 | CR # 2 | February 28, 2008 | September 1, 2009 |

| 390229 | CR # 3 | February 28, 2008 | September 1, 2009 |

| 390230 | CR # 4 | February 28, 2008 | September 1, 2009 |

| 390231 | CR # 5 | February 28, 2008 | September 1, 2009 |

| 390232 | CR # 6 | February 28, 2008 | September 1, 2009 |

| 390233 | CR # 7 | February 28, 2008 | September 1, 2009 |

| 390234 | CR # 8 | February 28, 2008 | September 1, 2009 |

| 390235 | CR # 9 | February 28, 2008 | September 1, 2009 |

| 390236 | CR # 10 | February 28, 2008 | September 1, 2009 |

| 390237 | CR # 11 | February 28, 2008 | September 1, 2009 |

| 390238 | CR # 12 | February 28, 2008 | September 1, 2009 |

In order to keep claims in good standing, a claim maintenance fee in the amount of US$140 per claim must be paid by to the BLM each year on or before September 1 and there is no grace period. We will not cause the claims to expire as a result of not paying the required maintenance fees, provided that mineralized material is found. In the event that our exploration program does not locate mineralization of interest, we will allow claims to expire and cease operations related to those claims. In July, 2009, we entered into an debt settlement agreement with Eagle Hill Exploration Corporation and Eagle Hill Arizona Uranium LLC (together the “Vendors”) to acquire the following five Arizona State leases (the “Leases”) and two additional claims in settlement of certain debt owed by the Vendors to Snowdon:

| Leases | ||||||

| Arizona | ||||||

| State | ||||||

| Section | Permit | Permit | ||||

| Number | Date | Number | County | Township | Range | Acres |

| 2 | 1 Jun 07 | 08-111685 | Coconino | 38N | 3W | 661.24 |

| 16 | 1 Jun 07 | 08-111687 | Mohave | 39N | 4W | 640.00 |

| 32 | 17 Nov 06 | 08-114280 | Mohave | 37N | 5W | 640.00 |

| 32e | 1 Jun 07 | 08-111686 | Mohave | 38N | 4W | 639.41 |

| 36 | 14 Dec 06 | 08-111148 | Mohave | 38N | 6W | 640.00 |

The two Arizona mining claims which we may acquire under the terms of the agreement dated July 20, 2009 are as follows:

12

| Date of | Coconino | BLM Serial | ||||

| Claim Name | Location | County No. | No. (AMC #) | Township | Range | Section |

| TR #20 | 19 Feb 08 | 3480264 | 392039 | 39N | 2W | 26 |

| TR #21 | 19 Feb 08 | 3480265 | 392040 | 39N | 2W | 26 |

As with our Gila County claims, the annual maintenance fee on these two additional claims is $140 each, due on or before September 1. As a condition of the debt settlement agreement we agreed to grant a 1% royalty interest in the claims and leases to the Vendors up to a limit of $400,000. On January 1, 2010 we entered into a mineral exploration and option agreement among the Vendors, Quaterra Alaska Inc. (“Quaterra”) and Limestone Resources LLC, pursuant to which the parties granted Quaterra an option to acquire a 100% interest to the following Arizona State leases (collectively the “Optioned Leases”): Nos. 08-111148, 08-111081, 08-111685, 08-111686, 08-111686, 08-111687 and 08-114280. As consideration for the exercise of the option, Quaterra agreed to pay the Arizona State Land Development fees on the Optioned Leases for a one year period and perform the required exploration work to maintain the leases in good standing. As a condition of the agreement, the parties agreed to grant the following royalties: (i) a royalty of 25% of any royalties paid to the State of Arizona in connection with any mineral production from the Optioned Leases to Snowdon (the “Snowdon Royalty”), (ii) a royalty of 20% of any proceeds received by Snowdon from the Snowdon Royalty less any royalty payments to the Vendors, and (iii) a 1% net smelter return royalty on the proceeds of the Snowdon Royalty payable to the Vendors.

History of Previous Work

To date, the only evidence to indicate previous work includes shallow prospects and cuts. Several roads and clearings may have been part of exploratory drilling efforts, however this has not been confirmed. Available literature does indicate that anomalous radioactivity was recognized in the immediate vicinity during the course of regional stream sediment surveys and airborne radiometric work conducted by the Atomic Energy Commission and/or Department of Energy, in the time period between the 1950 to late 1970. A thorough study of all references related to the CR property has not been attempted.

Radon Survey

The possibility of using radon measurement as a uranium prospecting technique was first suggested in 1927. Radon, being a noble gas does not combine with other element which facilitates its free migration through pore spaces in rock and soil and its dispersion over considerable distances by groundwater and surface water. Radon occurs naturally as three isotopes with mass numbers 222, 220, and 219 which are member of the 238U, 232Th and 235U decay series. After formation by radioactive decay, a radon atom diffuses through the enclosing mineral and diffuses through the ground air or groundwater present in pore spaces. In arid areas with little or no topsoil there is almost complete continuity between ground and atmospheric air and comes under the influence of meteorological variables. Low barometric pressure and strong winds tend to draw ground air out of the pore spaces and fractures of the near surface layers, thus reducing the radon concentration within them causing an upward movement of gas from depth. Calm conditions on the other hand reduce the rate of radon escape to atmosphere and result in a build up within the ground. Rainfall also restricts the upward flow of radon but has varying effects depending upon the soil profiles. Where soil is absent the rain water penetrates deeply and seals off the pore spaces in depth, producing a temporary reduction in near surface radon concentration. It is therefore emphasized that radon prospecting is part of a dynamic system depending upon a number of variables and the interpretation of the data must consider all the radon characteristics and geological environment of the survey area.

A radon survey was completed for Snowdon Resources Corporation on the CR Mineral Claims during June, 2008 by GeoXplor Corp., under the supervision of John Rud, Geologist, M.Sc. The theory of GeoXplor Corp’s radon soil surveys are based on the element radon which is a radioactive daughter product of uranium decay. Radon is produced by the radioactive decay of radium, a product of uranium and thorium decay in rocks and soils. The magnitude of a radon anomaly associated with a parent concentration of uranium will be due to the size and grade of the parent body. The radon survey utilizes a system that measures the radon by an ion chamber with electrically charged Teflon, called an electret, located inside an electrically conducting plastic chamber of known air volume. The electrets serve as a source of high voltage needed for the chamber to operate as an ion chamber. It also serves as a sensor for the measurement of ionization in air. The ions produced inside the sensitive volume of the chamber are collected by the electrets causing a depletion of charge. The measurement of the depleted charge during the exposure period is a measure of integrated ionization during the measurement period. The electrets charge is read before and after the exposure using a specially built non-contact electret voltage reader.

The CR mineral claim uranium radon survey consisted of 645 stations with 585 filtered radon readings. The mean value was 11.61 dV with a midrange reading of 17.98 dV. The gridding was completed by Kriging on a point basis with a standard deviation of 4.92 dV. The grid consisted of 10 lines on 100 meter spacing with station readings on 20 meter intervals for a lineal distance of 12,000 meters that covered an area of 1.08 square kilometers.

The conclusions of the Radon survey was that the CR mineral claims are underlain by a red to purple fine grained sandstone and gray limestone and dolomite of the Horquilla Formation. Available literature indicates that anomalous radioactivity in the immediate vicinity of the CR claims was reported by the Atomic Energy Commission, Department of Energy and Arizona Bureau of Geology Publications.

13

The Radon Survey defined several radon anomalies in the southern region of the CR mineral claim radon survey grid. The anomalies have a southeast trend which coincides with the regional trend of the uranium enriched channels in the nearby Promontory Butte/Mogollon Rim area. Field verification of the radon anomalies was completed by utilizing a RS230 Spectrometer which indicated gamma reading of 200 cps (2X background) in the area of the defined radon anomalies.

Recommendations were made to complete the following drill holes to determine the size, depth and grade of the uranium channel mineralization. The recommended drill holes to complete the first phase of a drilling program were as follows:

| Drill Hole | UTM East | UTM North |

| DH #1 | 503600 | 94600 |

| DH #2 | 503950 | 94500 |

| DH #3 | 503440 | 94400 |

| DH #4 | 503360 | 94300 |

A subsequent report prepared for us by Dr. Karen Wenrich recommends that any drilling should not be centered on the above sites, which were Radon anomalies, surmising that the source of the Radon is displaced from the anomaly. Reimer discusses both shallow and deeper drilling and recommends that the results of any first drilling should guide subsequent drilling, as opposed to committing a drilling program to the four sites noted above. He also recommends testing groundwater for radon, to help determine sites for additional drilling. He concludes by stating “Using geologic and hydrologic information, it may be possible to estimate the distance of displacement of the central anomaly. In any case, further studies should be flexible in modifying the location of sampling as new data become available.”

The recommendations of Wenrich and Reimer suggest that further fieldwork and sampling is necessary prior to deciding on the type and the location of an initial drilling phase. However, current economic conditions and the opportunity to acquire the rights to certain additional properties in two nearby Arizona counties has led us to re-evaluate and postpone further work on the CR claims.

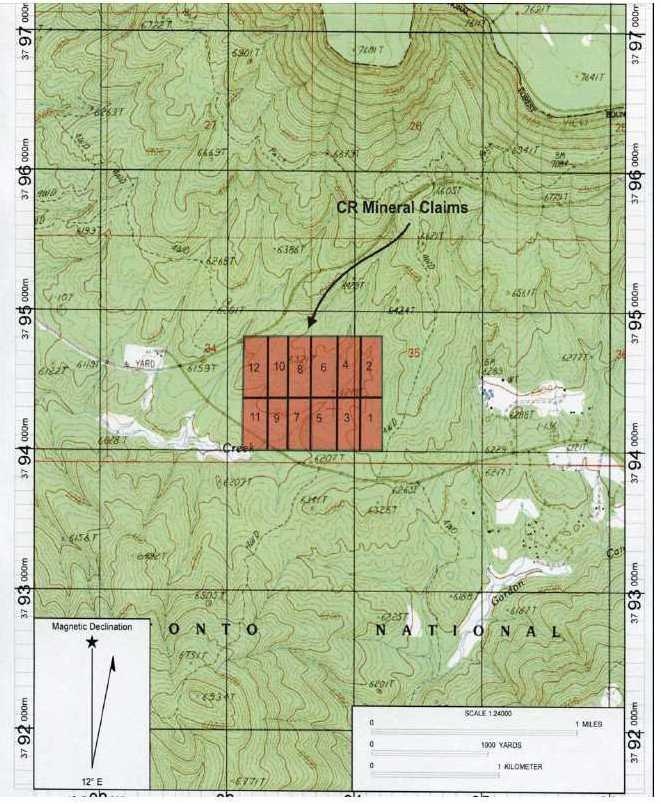

Location and Access

The twelve CR Mineral Claims are located approximately 30 miles east of Payson, Arizona in Township 11 north, Range 13 East, sections 34 & 35, Gila County, Arizona. The Claim Block is situated within the Mogollon Slope region on the southwestern edge of the Colorado Plateau geologic province in the east-central Arizona region. The edge of the physiographic Colorado Plateau is a dissected scarp known as the Mogollon Rim. The Mogollon Rim is both a structurally and topographically high which creates a regional drainage divide. The waters to the north traverse to the Colorado River and the waters to the south flow to the Gila River system. Elevations on the property range from about 6,200 to 6,450 feet.

The CR claims may be accessed from Payson, Arizona by traveling east on Arizona State highway 260 for approximately 30 miles to the Colcord Road junction, then travel about 1 mile southeast on Colcord Road to the claim boundary. There are several dirt roads that traverse the property in a northerly direction.

The terrain on the property is moderate with south dipping slopes and pine trees as the predominant vegetation. The property is typically snow free which provides a 12 month work season. The claims are outlined on the following topographical and geological maps of the area.

14

Location of CR Mineral Claims

15

Property Geology

The CR Claim block is underlain by the Pennsylvanian Horquilla Formation which is a carbonate sequence that forms ledges and slopes. The strata within the Horquilla consist of cyclically interbedded fossiliferous limestone and minor terrigenous mudstone and siltstone. The Horquilla Formation began with the eastward transgression of the sea from the Cordilleran geosynclines into a restricted embayment. Thin sheets of gravel, composed of chert and flint pebbles, and in some instances contains brachiopods or other marine fossils was spread over the area followed by layer of mud, silt and carbonate deposits.

The Naco Group (uranium enriched) is predominately a marine sequence of interbedded limestones and shales that grades laterally in the Lower Supai Formation of Late Pennsylvanian–Early Permian age. It was deposited during a marine transgression over a karst surface developed on the Mississippian Redwall Limestone. There are three members in the Naco Group. The lowermost member is typically a basal reddish-brown cherty mudstone, siltstone, or conglomerate with the source of material from the solution of the Redwall Limestone and followed by stratified mudstone, siltstone and sandstone. The middle member consists of richly fossiliferous resistant limestone and interbedded with purple shales and siltstones. The upper member consists of a succession of reddish-brown clastics and interbedded limestone produced by the interfingering of marine units and continental margin and terrestrial redbeds of the south-eastward building of the Supai delta.

Mineralization

The origin of the uranium that occurs in the Colcord Road region are directly related to sandstone lenses of stream origin in beds of late Paleozoic age coincidental with the evolutionary development of land plants. The uranium deposits are tabular peneconcordant types that are enveloped in rock formations with reduced geochemical characteristics. The sandstone is pale gray and white and contains coalified plant fossils and finely disseminated pyrite. The associated mudstones are gray or green and also contain disseminated pyrite.

The uranium deposits are in the sandstone lenses interbedded with mudstone that formed in intermontane basins on broad alluvial plains or fans. The host sandstone ranges from fine to coarse grained and in places it is conglomeratic with a dominantly quartzose composition. The uranium beds have a gentle dip which may have resulted from either stream gradient or slight tectonic tilting. The uranium deposits formed at shallow or moderate depths. Within the Colcord Road area the peneconcordant uranium deposits are associated with plant debris and are light colored containing pyrite in shale (mudstone). The clastic rocks have been deposited in fluvial environments and are stratigraphically controlled. The mineralization is digenetic related to the migration of ground waters. The source of the uranium is believed to be the Precambrian rocks to the south. The uranium is associated with copper and not vanadium. The primary mineralization is characterized by metallic sulfides and uranium and in most instances it is a uraninite in coalified material.

The uranium mineralization in the Colcord Road area is estimated to occur about 700 feet above the Redwall Limestone. The uranium beds seem to be in one prominent zone of conglomerates and related cross-stratified sandstone and shales laced with carbonized and coalified plant debris within a fluvial complex. The fluvial complex displays a progressive northward shift of channel deposits with pebbles grading to inclined siltstones-claystones on the south sides of channels. Studies have shown the current within the stream channels was flowing in an easterly direction and are point-bar deposits. The channel complex is blanketed by a gray-green shale bed that contains abundant thin carbonized plant remains. The horizons are several feet thick and usually contain thin coaly units.

Uraninite, a variety of pitchblende, is the only uranium-bearing mineral reported in the area. The pitchblende occurs as sperulites and as a replacement of wood fragments. The uraninite occurs in concentrated layers and is disseminated in the fine-grained, gray siltstone and the limestone conglomerate. Drill results in the nearby Promontory Butte area indicate the uranium bearing minerals are concentrated in a horizon that includes the gray siltstone and the limestone conglomerate and appear to have a concordant 10 degree dip to the southeast. A large percentage of the uranium mineralization occurs as a direct replacement of wood fragments. In some instances, the pitchblende was deposited in a mamillary or nodular form around the periphery of existing crystals.

| ITEM 3. | LEGAL PROCEEDINGS |

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

| ITEM 4. | (Removed and Reserved) |

16

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our shares may be traded on the Bulletin Board operated by the Federal Industry Regulatory Authority under the symbol “SWDO.” The following table reflects the high and low bid information for our common stock obtained from the OTC Bulletin Board and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| High Bid | Low Bid | |||||

| 2010 | ||||||

| Fourth Quarter 2/01/10 to 4/30/10 | $ | 0.30 | $ | 0.10 | ||

| Third Quarter 11/01/09 to 1/31/10 | $ | 0.15 | $ | 0.07 | ||

| Second Quarter 8/01/09 to 10/31/09 | $ | 0.11 | $ | 0.07 | ||

| First Quarter 5/01/09 to 7/31/09 | $ | 0.11 | $ | 0.05 | ||

| 2009 | ||||||

| Fourth Quarter 2/01/09 to 4/30/09 | $ | 0.15 | $ | 0.05 | ||

| Third Quarter 11/01/08 to 1/31/09 | $ | 0.25 | $ | 0.02 | ||

| Second Quarter 8/01/08 to 10/31/08 | $ | 0.00 | $ | 0.00 | ||

| First Quarter 5/01/08 to 7/31/08 | $ | 0.00 | $ | 0.00 |

Holders of Record

There are twenty-four holders of record for our common stock as at August 12, 2010.

Transfer Agent

Our common shares are issued in registered form. Transfer Online Inc. of 512 SE Salmon Street, Portland OR, Fax: 503.227.6874, is the registrar and transfer agent for our common shares.

Dividends

We have not declared any cash dividends, nor do we have any plans to do so. Management anticipates that, for the foreseeable future, all available cash will be needed to fund our operations.

Recent Sales of Unregistered Securities

Other than as disclosed below, during the year ended April 30, 2010 we had no sales of unregistered securities.

On April 1, 2010, the Company executed an agreement for office space and administrative support services with a privately held company controlled by a significant shareholder, effective April 1, 2010 for a term of three years at a rate of CDN$7,500 per month plus applicable taxes, and 300,000 shares of restricted common stock of the Company (issued May 3, 2010). The shares were issued pursuant to Regulation S of the Securities Act of 1933 on the basis that the stockholder represented to us that they were not a “US person” as such term is defined in Regulation S.

On November 24, 2009, Snowdon Resources Corporation (“Snowdon”) entered into an agreement with Vorticom Inc. whereby Vorticom will serve as public relations counsel for Snowdon beginning December 1, 2009 for a twelve month period. As consideration for the services, the Company agreed to issue 250,000 restricted shares of common stock and pay a cash fee of $4,000 per month, and $500 monthly for media monitoring and live media database. In February, 2010, the parties agreed to terminate the public relations agreement between Snowdon and Vorticom Inc. whereby Vorticom agreed to serve as public relations counsel for Snowdon beginning December 1, 2009 for a twelve month period. As consideration for the services, the Company had agreed to issue 250,000 restricted shares of common stock and pay a cash fee of $4,000 per month, and $500 monthly for media monitoring and live media database. The Company paid a total of $9,000 up to the date of

17

termination of the contract. No further funds are owed and the Company issued the 250,000 shares to Vorticom pursuant to Rule 506 of Regulation D on the basis that the company represented that they were an accredited investor.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the NASD’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

The following table summarizes certain information regarding our equity compensation plan as at December 31, 2009:

Plan Category |

Number of Securities to

be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities

Remaining Available for Future Issuance Under Equity Compensation Plan |

Equity compensation plans approved by security holders |

Nil |

Nil |

Nil |

Equity compensation plans not approved by security holders |

Nil |

Nil |

10,000,000 |

Total |

Nil |

Nil |

10,000,000 |

We have an equity compensation plan under which our shares of common stock have been authorized for issuance to our officers, directors, employees, attorneys, accountants, consultants, or advisors, namely our 2008 Nonqualified Stock Option Plan. The plan provides for the issuance of stock options for services rendered to us. The board of directors is vested with the power to determine the terms and conditions of the options.

This equity compensation plan was filed with the SEC on December 2, 2008 in a registration statement on Form S-8 (SEC file no. 333-155883) and registered 10,000,000 shares of common stock for sale thereunder. As of the date of this filing, no options have been granted and 10,000,000 options to acquire shares of common stock remain available for future issuance under this plan.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

| ITEM 6. | SELECTED FINANCIAL DATA. |

Not Applicable.

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion should be read in conjunction with our audited financial statements for the years ended April 30, 2010 and April 30, 2009 and the related notes that appear elsewhere in this Form 10-K. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this Form 10-K, particularly in the section entitled “Risk Factors”.

Our consolidated financial statements are prepared in accordance with United States generally accepted accounting principles.

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations. No revenues are anticipated until we can locate and begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on our property.

Our CR claims exploration program is presently on hold subject to a change in market conditions and additional financing. We anticipate that we are not going to buy or sell any plant or significant equipment during the next twelve months. We anticipate that will not buy any equipment until have located a body of ore and we have determined it is economical to extract the ore.

We do not intend to hire any employees at this time. All of the work on the properties will be conducted by unaffiliated, independent contractors. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Also, new equity financing could result in additional dilution to existing shareholders.

Results of Operations

We acquired one property containing five claims. We re-staked those claims in February, 2008 and added a further seven contiguous claims, for a total of twelve claims covering 240 acres. We have no revenue and have incurred a net loss from inception to April 30, 2010 of $657,260 as a result of staking costs, a mineral claim payment, exploration costs, consulting fees, accounting and legal expenses, and office and sundry costs.

RESULTS OF OPERATIONS

Our operating results for the years ended April 30, 2010 and 2009 are summarized as follows:

Year Ended April 30, 2010 |

Year Ended April 30, 2009 |

Percentage Increase/(Decrease) | |

| Revenue | - | - | N/A |

| Expenses | $ 377,329 | $ 193,686 | 195% |

| Basic and Diluted Loss Per Common Share | $ (0.03 ) | $ (0.01 ) | 200% |

| Net Income (loss) | $ (377,329 ) | $ (193,686 ) | 195% |

Revenues

We have had no operating revenues for the years ended April 30, 2010 and 2009. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

19

General and Administrative Expenses

The major components of our general and administrative expenses for the year are outlined in the table below:

| Year Ended April 30, | ||||||

| 2010 | 2009 | |||||

| Consulting fees | $ | 183,322 | $ | 42,000 | ||

| Foreign exchange (gain) loss | (1,352 | ) | 3,005 | |||

| Mineral property exploration costs | 4,053 | 77,595 | ||||

| Mineral property investigation costs | 20,260 | - | ||||

| Office and sundry | 64,475 | 32,696 | ||||

| Professional fees | 41,876 | 38,390 | ||||

| Research costs | 64,695 | - | ||||

| Total Expenses | $ | 377,329 | $ | 193,686 | ||

Our expenses for the fiscal year ended April 30, 2010 were $377,329, compared to $193,686 for the fiscal year ended April 30, 2009. The increase in our general and administrative expenses during the fiscal year ended April 30, 2010 was primarily due to an increase in consulting expenses associated with financing, strategic planning and business development advice and investor relations relating to ongoing business activities of the company and the pursuit of new opportunities for the company, and due to an increase in professional fees associated with the Company’s ongoing reporting obligations under the Securities Exchange Act of 1934. The increased consulting fees of the Company during the past fiscal year primarily related to the costs associated with the negotiation of the acquisition of certain technology for oil upgrading and other applications with Agosto Corporation Limited. These costs included the review and registration of various technology patents, the negotiation of terms for a proposed definitive agreement, due diligence reviews and tax advice (which resulted in increased professional fees) relating to the proposed acquisition.

Our cash decreased $247,374 primarily due to the increase in our expenses as described above. Amounts receivable decreased in 2009 there were outstanding advances in connection with the state leases and new claims to be acquired. In the 2010 fiscal year, outstanding receivables consist of payment of Goods and Services Taxes that are recoverable. Prepaid expenses had a minor increase from prepayment of consulting fees.

During the year ended April 30, 2010, the Company paid consulting fees and rent to a major shareholder and to two companies controlled by two major shareholders, one of whom is also a director and officer, in the amount of $127,880 (2009 - $67,375). The loan due to a company controlled by a director of $7,698 (2009 - $Nil) is unsecured with an annual interest rate of 8% with no specific terms of repayment. Amounts due to a major shareholder and to two companies controlled by two major shareholder, one of whom is also a director and officer, and included in accounts payable aggregate $23,000 (2009 - $Nil).

Liquidity and Capital Resources

As of the date of this report, we have not generated any revenues from our business operations. Our ability to generate adequate amounts of cash to meet our needs is entirely dependent on the issuance of shares, debt securities, or loans. As of April 30, 2010, our total assets were $23,120, and our total liabilities were $116,217. Cash requirements for the next twelve months, are estimated to be approximately $361,000. Accordingly, we do not have sufficient funds for planned operations and we will be required to raise additional funds for operations after that date. The audited financial statements accompanying this report have been prepared on a going concern basis, which implies that our company will continue to realize its assets and discharge its liabilities and commitments in the normal course of business. Our company has not generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of our company as a going concern is dependent upon the continued financial support from our shareholders, the ability of our company to obtain necessary equity financing to achieve our operating objectives, and the attainment of profitable operations.

These circumstances raise substantial doubt about our ability to continue as a going concern, as described in the explanatory paragraph to our independent auditors’ report on the April 30, 2010 and 2009 consolidated financial statements which are included with this annual report. The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty. The continuation of our business is dependent upon us raising additional financial support. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

20