Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED MAY 31, 2010 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission file number: 001-34372

SABA SOFTWARE, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 94-3267638 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) | |

| 2400 Bridge Parkway Redwood Shores, California |

94065-1166 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(650) 581-2500

(Registrant’s Telephone Number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| (Title of Each Class) |

(Name of Each Exchange on Which Registered) | |

| Common Stock, par value $0.001 per share | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) | |

| Preferred Stock Purchase Rights | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-Accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of November 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $104,946,956 (based on a closing sale price of $4.21 per share as reported for the Nasdaq Global Market). Shares of common stock beneficially held by each executive officer and director and by each person who beneficially owns 5% or more of the outstanding common stock have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock, $0.001 par value per share, outstanding as of July 31, 2010 was 28,174,855.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Stockholders to be held on November 17, 2010 are incorporated by reference in Part III of this Form 10-K to the extent stated herein. Except as expressly incorporated by reference, the registrant’s Proxy Statement shall not be deemed to be a part of this Form 10-K.

Table of Contents

FISCAL YEAR 2010

FORM 10-K

ANNUAL REPORT

| Page | ||||

| 1 | ||||

| Item 1 |

2 | |||

| Item 1A |

14 | |||

| Item 1B |

27 | |||

| Item 2 |

27 | |||

| Item 3 |

28 | |||

| Item 4 |

31 | |||

| Item 5 |

32 | |||

| Item 6 |

35 | |||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

35 | ||

| Item 7A |

52 | |||

| Item 8 |

53 | |||

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

83 | ||

| Item 9A |

83 | |||

| Item 9B |

84 | |||

| Item 10 |

85 | |||

| Item 11 |

85 | |||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

85 | ||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

85 | ||

| Item 14 |

86 | |||

| Item 15 |

87 | |||

| 88 | ||||

| 90 | ||||

Table of Contents

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

For purposes of this Annual Report on Form 10-K, the terms “Saba”, “the Company”, “we”, “us” and “our” refer to Saba Software, Inc. and its consolidated subsidiaries (unless the context indicates otherwise). This Annual Report on Form 10-K and certain information incorporated herein by reference contain “forward-looking statements” within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements contained in this Annual Report on Form 10-K other than statements of historical fact are “forward-looking statements” for purposes of these provisions, including any statements of plans and objectives for future operations and any statement of assumptions underlying any of the foregoing. Statements that include the use of terminology such as “may,” “will,” “expects,” “believes,” “plans,” “estimates,” “potential,” or “continue,” or the negative thereof or other comparable terminology are forward-looking statements. Forward-looking statements include, without limitation:

(i) in Item 1: “Business”, statements regarding our belief that we are uniquely positioned to provide a solution that supports and enables the people-driven enterprise; our belief that there are four distinct markets that are converging to solve the challenge of becoming a people-driven enterprise; competition; our belief that we offer the most comprehensive and flexible people systems platform; our belief regarding the principal competitive features affecting our market; our belief that we are the leader in our market space; registration of trademarks; and our belief and intention regarding litigation to which we are subject;

(ii) in Item 1A: “Risk Factors”, statements regarding the possibility of future losses; our expectation that we will continue to incur non-cash expenses relating to the amortization of purchased intangible assets; our belief that quarter-to-quarter comparisons of our revenues and operating results are not necessarily meaningful and should not be relied upon as indicators of future performance; maintaining and strengthening relationships with strategic partners; our anticipation that revenues from the Saba People Suite, as well as related services will constitute substantially all of our revenue for the foreseeable future; the likelihood significant fluctuations in our operating results; our plan to expand sales coverage and marketing support; our plan to continue to expand and ramp our direct sales force; our intention to continue to expand our international presence; the expectation that the intensity of competition and the pace of change will increase in the future which is likely to result in price reductions, reduced gross margins and loss of market share; our belief and intention regarding litigation to which we are subject; periodically acquiring complementary businesses or technologies; regularly releasing new products and new versions of existing products; and issuance of a reexamination certificate canceling certain patent claims;

(iii) in Item 2: “Properties”, statements regarding the adequacy of our existing facilities to meet anticipated needs for the foreseeable future;

(iv) in Item 3: “Legal Proceedings”, statements regarding the financial impact of any proposed settlements; our intention to dispute claims against us; and the merits of claims against us;

(v) in Item 5: “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities”, statements regarding our intention to retain our future earnings; and share repurchases pursuant to our share repurchase program, as well as our intention to finance any such share repurchases with funds from operations;

(vi) in Item 7: “Management’s Discussion and Analysis of Financial Condition and Results of Operations:, statements regarding our belief that subscription revenue will grow steadily for the foreseeable future; our anticipation that a substantial majority of our customers will renew their annual contracts; our anticipation that we will continue to add new subscription customers; our anticipation that we will continue to experience long sales cycles; our anticipation of an increase in sales and marketing expenses in fiscal 2011, which we anticipate to be primarily related to headcount additions as we continue to expand our sales and marketing functions; the table summarizing our contractual obligations at May 31, 2010; the sufficiency of our available cash resources and cash flows generated from revenues to meet our presently anticipated working capital, capital expense and business expansion requirements for at least the next twelve months;

1

Table of Contents

the adequacy of tax provisions related to the examination of certain of our tax returns; our estimate of future forfeiture rates in stock-based compensation and our anticipation to not pay dividends in the foreseeable future;

(vii) in Item 7A: “Quantitative and Qualitative Disclosures About Market Risk”, statements regarding our exposure to interest rate risk and foreign currency risk; and the effects of future changes in interest rates and foreign currency rates;

(viii) in Item 8: “Financial Statements and Supplementary Data”, statements regarding our management’s belief that financial risks associated with cash, cash equivalents and accounts receivable are minimal; the financial impact of a proposed settlement; the merits of our litigation; statements regarding total expected future amortization related to intangible assets; our estimate of future forfeiture rates in our stock-based compensation plans; the anticipated adjustments to total unrecognized stock-based compensation, and the adequacy of tax provisions related to the examination of certain of our tax returns.

These forward-looking statements involve known and unknown risks and uncertainties. Our actual results may differ materially from those projected or assumed in such forward-looking statements. Among the factors that could cause actual results to differ materially are incorrect estimates or assumptions, unanticipated adverse results for pending litigation, contraction of the economy and world markets, lack of demand for information technologies from our customers, unanticipated need for capital for operations, lack of demand for our products, inability to introduce new products, unanticipated difficulties relating to the Saba products, unanticipated decrease in demand for our products and services, unanticipated changes in domestic and foreign tax regulations and the factors detailed under the heading “Risk Factors” in Item 1A of this Annual Report on Form 10-K. All forward-looking statements and risk factors included in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement or risk factor.

Overview

We are the premier provider of people systems, which constitute a new class of business-critical software that combines enterprise learning, people management and collaboration technologies. Our people systems enable organizations to mobilize and engage their people to drive new strategies and initiatives, align and connect people to accelerate the flow of business, and cultivate, capture and share individual and collective knowhow to effectively compete and succeed. Our solutions are available both on-premise and in the cloud, and are underpinned by global services capabilities encompassing strategic consulting, comprehensive implementation and education services and worldwide support.

The Saba People System is transformative in nature, catalyzing dramatic change in how work gets done while fostering a people-driven culture. The Saba People System enables organizations to realize unique benefits, including the following:

| • | MOBILIZE—quickly identify and communicate new strategies or challenges and engage the right people to address them: |

| • | Rapidly form and re-form teams |

| • | Identify and build expertise and new processes |

| • | Continuously develop and re-skill people |

| • | Motivate and engage people by keeping them constantly connected and aware of new initiatives |

2

Table of Contents

| • | ACCELERATE—align and connect people to accelerate the flow of business: |

| • | Incent and reward people and teams around the right goals, ensuring that everyone is always aligned |

| • | Speed the flow of information to any person, anytime, anyplace, via multiple devices |

| • | Collect and disseminate continuous, real-time people feedback from across the organization |

| • | CULTIVATE—ignite, cultivate and capture the collective people knowhow: |

| • | Enable individuals and teams to create, track, distribute, consume, and rate knowhow |

| • | Harness ideas and expertise from the extended value chain |

| • | Institutionalize organizational wisdom and make it discoverable by anyone, anytime, anywhere on multiple devices |

We were incorporated in Delaware in April 1997 and are currently headquartered in Redwood Shores, California, with offices on five continents. Our Internet address is www.saba.com.

On the Investor Relations page of our web site www.saba.com/company/investor-relations, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission: our Annual Report on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The filings on our Investor Relations web page are available to be viewed free of charge. Information contained on our web site is not part of this Annual Report on Form 10-K or our other filings with the Securities and Exchange Commission. We assume no obligation to update or revise any forward-looking statements in this Annual Report on Form 10-K, whether as a result of new information, future events or otherwise, unless we are required to do so by law. A copy of this Annual Report on Form 10-K is available without charge upon written request to: Investor Relations, Saba Software, Inc., 2400 Bridge Parkway, Redwood Shores, California 94065.

Evolution of Our Market

Most of today’s human capital management systems were built to support static human resources processes and strategies, top down management, and a culture focused on operations and automation rather than people optimization. Sequential steps that were consistent and repeatable were the keys to successful execution. Many systems were built to support these processes on highly rigid, linear, transactional frameworks, making them poorly suited for dynamic people-focused strategies and a “networked” work style. Even newer SaaS-based talent management systems are typically built to support individual processes such as recruiting or performance management, and do not provide the holistic people view required of today’s human capital management systems.

The current business and economic climate continues to change with unprecedented speed and far-reaching impacts. Worldwide changes affecting organizations include:

| • | Globalization—new opportunities and challenges are arising from developing countries in a world that is more interconnected—where employees, suppliers, customers or partners cross borders. |

| • | Economic Uncertainty—economies have become permanently intertwined and the ongoing global financial crisis makes long term planning take a back seat to increasing restructuring and merger and acquisition activities. |

| • | Hyper-Competition—the ubiquity of the Internet means every competitor has global reach and can be a fast follower or has the means to invent new business models. |

| • | Technology Disruption—smart phones, the latest platform to invade the corporate world from the consumer world, are requiring companies to support multiple platforms simultaneously. |

3

Table of Contents

| • | Changing Workforce Dynamics—today’s workforce is more global, more mobile, more diverse and more technology savvy, which is forcing employers to rethink the way they attract, manage, retain and get the most out of their people. |

While these trends are changing organizations from the outside, the workforce is simultaneously evolving to change organizations from the inside. Organizations are adopting a modern and networked way of working, where the norms are transparency, concurrent projects with real-time updates, and continuously connected people, including customers, contractors and partners, who can operate successfully in a fluid and fast changing environment.

We believe that we are uniquely positioned to provide a solution that supports and enables the people-driven enterprise in this rapidly evolving business and economic climate. We believe that four distinct markets are converging to solve the challenge of becoming a people-driven enterprise:

| • | The Enterprise Learning Market: This market is comprised of software applications for the administration, documentation, tracking, and reporting of training programs, classroom and online events, e-learning programs, and training content. |

| • | The Enterprise Talent Management Market: This market is comprised of software applications for strategic talent management, including software applications for performance management, compensation management, talent acquisition and recruiting, training, career development, and succession planning. |

| • | The Enterprise Web Conferencing Market: This market is comprised of real-time collaboration tools that support interactions over a network between participants in multiple meeting formats. |

| • | The Enterprise Social Software Market: This market is comprised of social software used in business and commercial context, providing capabilities such as search, links, authoring, tags, recommendations, and content subscription. |

We call the combination of these four markets ‘People Systems’.

Our Solutions

Saba People Systems leverage over 13 years of industry experience in building world-class, people-driven software solutions. Saba People Systems embody a single unified platform, information model and process model, and include modern collaboration technologies in each application service. As a result, Saba People Systems deliver a consistent experience across all people actions and processes as well as offer major cost, upgrade, and speed-to-deployment advantages. Based on open standards, Saba People Systems allow simplified and flexible deployment, integration and personalization options.

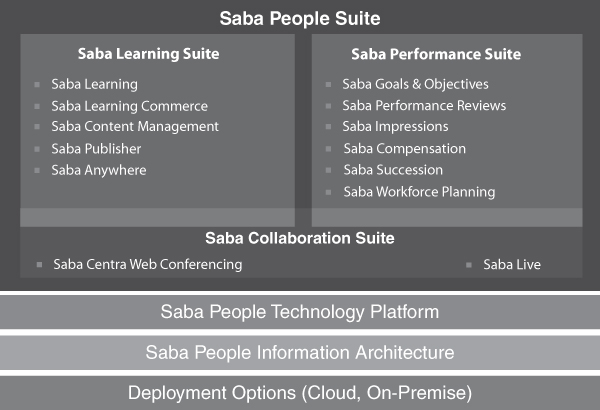

Saba People Systems are comprised of the Saba People Suite and global services capabilities encompassing strategic consulting, comprehensive implementation and education services, and worldwide support. The Saba People Suite includes products within the Saba Learning Suite, the Saba Performance Suite and the Saba Collaboration Suite. The Saba People Suite is available through both SaaS and on-premise delivery models.

4

Table of Contents

The key components of the Saba People Suite are illustrated in the following chart:

Saba Learning Suite

The Saba Learning Suite is a solution that provides comprehensive management systems for formal and informal learning so that organizations can identify, manage, develop, and measure the capabilities and knowhow of people throughout the organization and the supply chain, as well as empower employees to connect and contribute expertise.

Built to support the people processes of the world’s most demanding organizations, this easy-to-use system serves to drive new revenues, create strategic alignment, and mobilize people across the global ecosystem of our customers’ employees, customers, partners, and suppliers. The Saba Learning Suite uses innovative technologies and mobile access to generate user engagement through mobility, ubiquity, and immediacy.

The Saba Learning Suite includes the following applications:

| • | Saba Learning. Enables organizations to deliver and manage critical knowledge and skills to improve productivity and achieve business results; supports certifications with multiple learning pathways; provides flexible audit trails; and supports e-signatures to meet a wide variety of stringent regulatory requirements |

| • | Saba Learning Commerce. Provides support for optimized pricing, discounting schemes, marketing campaigns, branded certification programs, bundled training units and a variety of convenient payment methods for education businesses |

| • | Saba Content Management. Helps organizations capture, consolidate, organize, manage, share and reuse all types of learning content through a learning object repository and automated content and project-management processes |

5

Table of Contents

| • | Saba Publisher. Allows users to create new courses, or repurpose courses, and publish them in HTML or standard learning formats, such as AICC or SCORM, quickly and efficiently |

| • | Saba Anywhere. Provides a mobile platform that lets people take their learning on the go by downloading, viewing, and interacting with standards-based courseware and knowledge content anywhere, anytime, regardless of network connectivity |

Saba Performance Suite

The Saba Performance Suite enables organizations to continuously align individuals’ activities with key organizational goals, collect real-time performance feedback from the social network and establish a relevant performance review process that clarifies expectations, measures results, increases accountability, and identifies actionable improvements. The Saba Performance Suite enables organizations to establish a performance process that is proactive, collaborative and relevant for each individual employee. In addition, the Saba Performance Suite embeds a number of collaborative tools to foster connections with mentors and experts and enables cross-functional alignment of goals and activities.

The Saba Performance Suite includes the following applications:

| • | Saba Performance Reviews. Establishes a strategic, relevant performance review process that allows multiple raters to provide feedback on individualized goals and competencies to improve the speed, quality, and relevance of performance feedback. |

| • | Saba Goals & Objectives. Provides real-time views into an organization’s progress against goals and plans, allowing it to easily make adjustments to respond to changing requirements. |

| • | Saba Impressions. Delivers real-time feedback from the social network that is critical to rapid performance improvement. |

| • | Saba Workforce Planning. Provides organizations with the visibility needed to proactively plan their future workforce, increase overall agility and reduce risk. |

| • | Saba Succession. Focuses on the identification and development of key employees to mitigate the risks that occur when talent leaves the company. |

| • | Saba Compensation. Empowers managers with measures of employee success from various talent processes, both formal and informal, so that money is spent where it is needed most, and includes capabilities to support base and variable compensation plan design, compensation eligibility, and compensation allocation. |

Saba Collaboration Suite

The recently announced Saba Collaboration Suite is designed to be a uniquely integrated solution that combines enterprise-class web conferencing and real-time communication with cutting-edge business networking capabilities to enrich the learning and performance business processes in the enterprise and to power real-time communication with presence, instant messaging, video-enabled channels, VoIP-enabled online meetings, and web conferences.

The Saba Collaboration Suite will include Saba Centra Web Conferencing, a Saba product that is currently available, and Saba Live, a new Saba product that is currently scheduled for general availability in the second half of calendar year 2010. Accordingly, the full Saba Collaboration Suite will be available upon general availability of Saba Live.

Saba Centra Web Conferencing.

Saba Centra Web Conferencing enables online virtual learning, training and meetings. Organizations can capture and share knowledge and exchange information with customers, partners, prospects and

6

Table of Contents

employees around the world in real-time. Saba Centra Web Conferencing helps organizations increase productivity and efficiency by helping to incorporate learning and knowledge transfer into business processes. It works with Windows, Apple Macintosh and Linux platforms and accelerates mission-critical initiatives that involve learning, training and general web conferencing. Saba Centra is also available with a rich participant interface on the Apple iPhone.

Saba Centra Web Conferencing includes the following key features:

| • | Saba Centra Meeting. Helps eliminate the difficulties of complex meeting coordination and the time and expense of business travel. |

| • | Saba Centra Webinars. Equips the organization with an efficient and cost-effective way to reach and engage large audiences quickly. |

| • | Saba Centra Classroom. Enables live, interactive education sessions across many locations. |

Saba Centra Web Conferencing is integrated with the Saba Learning Suite to provide seamless access to blended learning programs, knowledge assets and important documents. Using Saba Centra together with the Saba Learning Suite makes it easy for organizations to capture knowledge from subject matter experts and share that information with a single click. Powerful, unified search enables users to search across all formal and informal learning content. Saba Centra Web Conferencing is available on any PC, Mac, or Linux desktop with a very lightweight Web Access client that works across all major browsers. Saba Centra Web Conferencing is also available with a rich participant interface on your Apple iPhone.

Saba Live. Saba Live is designed to be an enterprise business networking solution that will include powerful Web 2.0 social tools integrated with presence, instant messaging, and real-time meetings powered by Saba Centra Web Conferencing.

Saba Live is designed to integrate a rich person profile, competency-driven expertise, Twitter-like performance feedback, blended learning, secure groups and workplace analytics. The Saba Collaboration Suite is intended to extend the functionality of Saba Live by integrating the full functionality of Saba Centra Web Conferencing, including enterprise-class training, webinars and online meetings.

Saba Services

We offer a comprehensive set of services to assist in the successful implementation and optimized use of our products. Saba has a highly trained and experienced services staff to support our customers around the world, with over 50% of our consultants based outside of North America. Our global services organization supports multiple offerings, including the following services:

| • | Implementation and Consulting Services |

Saba’s Unified People Management Deployment Framework covers the entire customer lifecycle from initial business case assessment through ongoing application success measurement and provides a flexible, yet repeatable model for supporting successful design, deployment and support of Saba solutions. Our implementation and consulting services include the following specific services:

| • | Strategic Services. Saba Strategic Services are designed to enable organizations to effectively link people-driven strategies to business strategies. Offerings include developing new people-driven strategies, change management and governance, developing and deploying competency models, measurement and evaluation strategies, as well as content integration and deployment. |

| • | Consulting Services. Our consulting services include definition of business objectives, design of phased plans for achieving these objectives, technical solution specifications, establishment of implementation timelines and resource requirements, installation of Saba solutions, systems configuration, data loading, custom report and notification design, website development, enterprise system integration and post-implementation assessment. |

7

Table of Contents

| • | Implementation Services—Our implementation services include modular ‘QuickStart’ packages, configured integration frameworks, upgrade assistance and footprint expansion. |

| • | Application Management Services—Our application management services include system administration, functional help desk offerings, system optimization, and health checks and success criteria measurement. |

| • | Education Services. We provide a broad range of education services in a variety of formats, including instructor-led training and web and technology-based training. Course curricula, designed to enable customers to fully exploit the value of Saba solutions, include product training, project team training and technology training. |

| • | Customer Support |

Our support services are designed to ensure that our customers have the latest available technology and access to the assistance necessary for their on-going success with our products. Saba’s commitment to customer care extends far beyond basic issue resolution. Saba offers a full range of customer support options including dedicated account managers, 24x7 phone support, online support and access to customer communities for knowledge and best practice sharing.

Through Saba’s online support portal, customers have access to documentation and a detailed knowledgebase to get to answers quickly and easily. As part of their relationship with Saba, customers also have access to an extensive array of resources that include Saba’s account management team, customer communities, and more. For our larger global customers, Saba also offers premium support offerings featuring tailored, flexible support solutions built to meet the customers’ specific business requirements. These services range from extending support access hours, upgrading SLAs, and dedicating resources that operate as a customer’s Saba team to proactively ensure success and business continuity.

Our Customers

Our customers include a wide spectrum of large, global enterprises and mid-size organizations for both private and public organizations. For each of the years ended May 31, 2010, 2009 and 2008, no single customer accounted for more than 10 percent of our total revenues. Based on total revenues, our customers are also leaders in their industries and their regions and represent many of the largest companies in the world.

Sales and Marketing

We sell our products to organizations through a worldwide direct sales force, combined with a global network of alliance and channel partners. Our direct sales efforts target large enterprises, including Global 2000 businesses, mid-size organizations, and government entities. Our channel sales efforts involve value-added resellers around the globe, as well as systems-integrator relationships. As of May 31, 2010, we had 118 sales and marketing employees in the United States, Australia, Canada, France, Germany, India, Japan, and UK. We incurred $33.4 million, $26.4 million and $36.6 million in sales and marketing expenses for the years ended May 31, 2010, 2009 and 2008, respectively.

We focus our marketing efforts on extending our market leadership, establishing market positioning, generating sales leads, supporting sales efforts, creating awareness of our solutions in the market and establishing strong brand awareness. Our marketing activities include public relations, analyst relations, direct marketing, industry trade shows, online marketing, seminar programs, and customer community building, as well as strategic relationships with third party content and community providers.

Alliances

Saba’s partnering strategy is to extend value to its customer base and the market by teaming up with the best-in-class global alliances and channel partners keenly focused on delivering superior results and customer satisfaction.

8

Table of Contents

The targeted nature of our partner program enables us to help partners better capture the momentum of the growing people systems marketplace. Through our partnership program, Saba and its partners leverage their collective strengths to offer integrated solutions that measure performance and improve profitability.

We have strategic alliance agreements with key global and regional value-added software resellers representing our solutions around the world, including IBM, HP and CAE. We also partner with global and regional consulting firms who act as advisors, systems integrators, and implementation partners for our solutions. These alliances and the associated training of qualified personnel in these organizations greatly increase the number of sales representatives and consulting professionals trained to implement our solutions.

We also have relationships with packaged content providers, custom content developers, and content authoring and learning delivery tool providers in order to increase the range of content offerings available to our customers. The Saba Content Alliance Program helps our content partners create and deliver learning content for use in conjunction with Saba solutions through the support of industry standards applicable to a broad variety of media formats, including Web-based training, computer-based training, video and asynchronous and synchronous delivery, as well as through the support of traditional forms of learning such as instructor-led classes, seminars, and workshops. In support of this program, we also operate a content developers’ resource center and testing lab that provides our content partners with direct access to our systems for standards compliance testing.

Technology

Product Architecture

Our proven product architecture coupled with our development processes facilitates the rapid development, deployment and configuration of enterprise scale solutions for people management. Our platforms use the latest industry standards and technologies including J2EE, J2ME, AJAX, web services, virtualization, and learning industry standards to deliver innovative, configurable features for our OnPremise and SaaS customers. Our solutions fully support cloud-based deployments.

We continue to provide a fully J2EE-compliant application platform. This helps accelerate application development by leveraging the transaction management, persistence management and resource pooling capabilities of standard J2EE application servers so that application developers can focus on building business logic and user interfaces. During the course of fiscal year 2010, we fully migrated to the AGILE development methodology with all programs now being delivered under this framework.

Key features of the Saba platform are described below:

| • | Open and Standards Based. The core Saba architecture is based on a current reference J2EE implementation. We leverage third-party, industry-leading and standards-based platforms wherever possible. To offer our customers maximum choice, we support a wide number of J2EE application servers (including JBoss, Websphere and Weblogic), database platforms (including Oracle, IBM DB2 and Microsoft SQL Server) and operating systems (including Linux, Windows, AIX, and HP-UX). Our architecture supports both OnPremise and cloud-based deployments, allowing us to provide the broadest possible choice to our customers. |

| • | Security. Saba solutions offer highly secure environments through which organizations manage their people management processes. A granular security model supports the highly complex business structures and processes used by our customers and can be easily configured to meet their needs. Our security implementation has been subject to rigorous validation by a number of customers and third parties. |

| • | Scalability. Saba offers a highly scalable solution able to meet the needs of many thousands of concurrent users both OnPremise and in the cloud. Scalability is accomplished through a variety of techniques including clustering, distributed caching, virtualization, session failover management and off-line |

9

Table of Contents

| processing for asynchronous processes. We maintain a dedicated performance lab which works with our internal development teams and with our customers to ensure that our solutions meet the complex and varying usage demands that are placed on them. |

| • | Configurability and Extensibility. The Saba platform offers a highly configurable application environment. Business processes, system features and user experiences can be easily configured to meet the needs of our diverse customer base. Where more complex requirements exist, the Saba platform provides a complete set of development tools and Application Programming Interface (“API”) which can be used to extend system functionality. |

| • | Integration Ready. Saba solutions are deployed in complex IT ecosystems where integrations with other systems are commonly required. We provide for such integrations by delivering open and standards based solutions, based on common technologies such as J2EE, SAML, XML, SOAP and JAAS. In addition, we provide a series of documented Web Services and APIs to facilitate tight data and application integration. |

| • | Compelling User Experiences. The Saba solution provides a variety of user experiences through standard web browsers via embedded portlets, online and offline clients and through integrations with other business applications such as Microsoft Outlook, Lotus Notes and the WebSphere Portal infrastructure. This allows users to use Saba wherever they work. We make extensive use of rich internet application technologies (such as AJAX, CSS, Javascript, Flash, and high quality VOIP) to deliver more engaging and intuitive user experiences. |

| • | Learning Standards. We continue to be active participants in the main learning standards bodies including ADL, IMS and AICC. We also continue to ensure our solutions are compliant with the most current versions of the standards delivered by these organizations. |

| • | Multiple language support. Saba’s platform is fully internationalized and is, therefore, independent of any particular language, script, culture, and coded character set. We currently provide a number of localized versions of our solutions and support over 26 languages. |

Research and Development

Our research and development operations are organized around software platform and applications development initiatives. These two development activities share resources and collaborate on design and development. Core teams are responsible for platform and infrastructure development, application development, user interface and application design, enterprise connectivity, internet applications and design, quality assurance, documentation and release management. As of May 31, 2010, we had 167 research and development employees in the United States and India. We incurred $17.8 million, $17.4 million and $16.5 million in research and development expenses for the years ended May 31, 2010, 2009 and 2008, respectively.

We adhere to a well-defined and managed software development lifecycle model. This model, which makes increasing use of agile development practices, defines how we envision, plan, develop and test our products. It further defines the detailed phases of the project, the specific milestones to be achieved and the policies to be followed and documented. We continue to make extensive investments in the development tools and processes to support our development model.

We conduct our development efforts at multiple sites in the United States and India, which enables continuous development 24 hours per day.

Competition

The market for our products and services is intensely competitive, dynamic and subject to rapid change. The intensity of competition and the pace of change are expected to increase in the future. Competitors vary in size and in the scope and breadth of the products and services they offer. Although we believe that we offer the

10

Table of Contents

most comprehensive and flexible people systems we encounter competition with respect to different aspects of our solutions from a variety of sources including:

| • | companies that offer solutions that provide one or more applications within the people systems market, such as leaning management, performance management, talent management, compensation and recruiting, including SumTotal and Success Factors; |

| • | companies that offer collaboration solutions, such as Microsoft, Adobe, Cisco and Citrix; |

| • | enterprise software vendors that offer human resources information systems and employee relationship management systems with training and performance modules, such as SAP and Oracle; |

| • | potential customers’ internal development efforts; and |

| • | companies that operate internet-based marketplaces for the sale of online learning. |

We expect additional competition from other established and emerging companies as the market for people systems solutions continues to evolve. Increased competition is likely to result in price reductions, reduced gross margins and loss of market share, any one of which could seriously harm our business.

We believe the principal competitive features affecting our market include:

| • | breadth and depth of the solution; |

| • | a significant installed base of Global 2000 and government customers; |

| • | the ability to support all forms of content offerings; |

| • | the ability to meet the requirements of the world’s largest organizations, including support for global deployments; |

| • | the ability to support a broad range of extended-enterprise users, including employees, partners, customers and suppliers; |

| • | the ability to offer a choice of deployment options; |

| • | product quality and performance; |

| • | product features and functions; |

| • | customer service and support; |

| • | ease of implementation; |

| • | core technology; |

| • | price to performance ratio; and |

| • | partner ecosystem. |

Although we believe that we are a leader in our market space and that our solutions currently compete favorably with respect to these factors, our market is relatively new and is changing rapidly. We may not be able to maintain our competitive position against current and potential competitors, especially those with significantly greater financial, technical, service, support, marketing and other resources.

Proprietary Rights

Proprietary rights are important to our success and our competitive position. To protect our proprietary rights, we rely on copyright, trademark, patent and trade secret laws, confidentiality procedures and contractual provisions.

11

Table of Contents

We license our products and provide subscription services (which include license updates and product support, and cloud-based services) rather than sell our software license products and require our customers to enter into written agreements, which impose restrictions on the use, access, copying and disclosure of our software. In addition, we seek to avoid disclosure of our trade secrets through a number of means, including but not limited to, requiring those persons with access to our proprietary information to execute confidentiality agreements with us. These contractual provisions, however, may be unenforceable under the laws of some jurisdictions and foreign countries.

We seek to protect our software, documentation and other written materials under trade secret and copyright laws, which afford only limited protection. In addition, we have seven patents issued in the United States and multiple patent applications pending in the United States. We cannot be assured that any patents will be issued for any of the pending patent applications. Even for the issued patents, or any patent issued to us in the future, there can be no assurance that such patents (i) will protect our intellectual property, or (ii) will not be challenged by third parties. Furthermore, other parties may independently develop similar or competing technologies or design around any patents that may be issued to us. It is possible that any patent issued to us may not provide any competitive advantages, that we may not develop future proprietary products or technologies that are patentable, and that the patents of others may seriously limit our ability to do business. In this regard, we have not performed any comprehensive analysis of patents of others that may limit our ability to conduct our business.

We have obtained registration of various trademarks, including Saba and the Saba S-design logo, in the United States and in certain other countries. In addition, we have registration applications pending in various countries. We will continue to register additional trademarks as appropriate. There can be no assurance that we will be successful in obtaining registration of the trademarks for which we have applied. Even for any registered trademarks that we have obtained, or may obtain in the future, the trademarks may be successfully challenged by others or invalidated. If the applications are not approved because third parties own the trademarks, or if our registered trademarks are successfully challenged or invalidated, the use of the trademarks will be restricted unless we enter into arrangements with third parties that may be unavailable on commercially reasonable terms.

We cannot assure you that any of our proprietary rights with respect to our products or services will be viable or of value in the future since the validity, enforceability and type of protection of proprietary rights in Internet-related industries are uncertain and still evolving.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. Policing unauthorized use of our products is difficult, and while we are unable to determine the extent to which piracy of our software products exists, software piracy can be expected to be a persistent problem. In addition, the laws of some foreign countries do not protect proprietary rights to as great an extent as do the laws of the United States, and effective copyright, trademark and trade secret protection may not be available in those jurisdictions. Our means of protecting our proprietary rights may not be adequate to protect us from the infringement or misappropriation of such rights by others.

In recent years, there has been significant litigation in the United States involving patents and other intellectual property rights, particularly in the software and Internet-related industries.

On August 19, 2003, a complaint was filed against Centra and two other defendants by EdiSync Systems, LLC, in the United States District Court for the District of Colorado (No. 03-D-1587 (OES)) (the “Colorado District Court”). The complaint alleges infringement of two patents for a remote multiple user editing system and method and seeks permanent injunctive relief against continuing infringement, compensatory damages in an unspecified amount, and interest, costs and expenses associated with the litigation. Centra filed an answer to the complaint denying all of the allegations. Centra filed a request for reexamination of the patents at issue with the U.S. Patent and Trademark Office (the “Patent Office”). The re-examination request was accepted by the Patent Office and the Colorado District Court approved the parties’ motion to stay the court proceedings during the re-examination proceedings. A reexamination certificate has been issued for one of the patents that canceled all

12

Table of Contents

of the patent’s claims, thus rendering that patent of no further force or effect. The Patent Office issued a reexamination certificate for the other patent canceling all of the patent’s original claims and allowing certain newly-added claims. We have since filed a second reexamination request asking the Patent Office to reconsider the patentability of the newly-added claims in view of newly-discovered prior art and the Patent Office has granted that request. The Colorado District Court has again stayed the litigation pending the outcome of the second reexamination proceeding. We believe that we have meritorious defenses with respect to any future claims and intend to vigorously defend this action. However, due to the inherent uncertainties of litigation, we cannot accurately predict the ultimate outcome of the litigation. An unfavorable outcome of the litigation could materially and adversely affect our business, financial condition and results of operations.

On November 19, 2007, a complaint was filed against us and ten other defendants by Gemini IP, LLC, in the United States District Court for the Eastern District of Texas (No. 07-CV-521) (the “Texas District Court”). The complaint alleges infringement of a patent directed to a method for processing client help requests using a computer network and seeks permanent injunctive relief against continuing infringement, compensatory damages in an unspecified amount, and interest, costs and expenses associated with the litigation. We filed an answer to the complaint denying all of the allegations. At our request, the United States Patent and Trademark Office (the “Patent Office”) has instituted reexamination proceedings against the asserted patent and the Texas District Court has stayed the action pending the outcome of those proceedings. On March 9, 2010, the Patent Office issued a Notice of Intent to Issue a Reexamination Certificate (NIRC). According to the NIRC, upon issuance of the Reexamination Certificate, all of the patent’s original claims that were asserted against us in the litigation will be cancelled and several new claims added during the reexamination proceeding will be deemed patentable. It’s presently unknown whether any of the newly-added claims will be asserted against us once the Reexamination Certificate issues. We believe that we have meritorious defenses with respect to the asserted patent and intend to vigorously defend this action. However, due to the inherent uncertainties of litigation, we cannot accurately predict the ultimate outcome of the litigation. An unfavorable outcome of the litigation could materially and adversely affect our business, financial condition and results of operations.

We could also become subject to additional intellectual property infringement claims as the number of our competitors grows and our products and services overlap with competitive offerings. Any of these claims, even if not meritorious, could be expensive to defend and could divert management’s attention from operating our company. If we become liable to third parties for infringing their intellectual property rights, we could be required to pay a substantial award of damages and to develop non-infringing technology, obtain a license or cease selling the products that contain the infringing intellectual property. We may be unable to develop non-infringing technology or obtain a license on commercially reasonable terms, if at all.

Employees

As of May 31, 2010, we had a total of 598 employees, including 167 in research and development, 118 in sales and marketing, 158 in services-related activities, 90 in operations and 65 in administration and finance. Of these employees, 319 were located in North America and 279 were located outside of North America. None of our employees is represented by a collective bargaining agreement, and we have not experienced any work stoppages. We consider our relations with our employees to be good. Our future success depends on our continuing ability to attract and retain highly qualified technical, sales and senior management personnel.

Our Executive Officers

Our current executive officers are listed below:

| Name | Office(s) | |

| Bobby Yazdani | Chairman and Chief Executive Officer | |

| William Slater | Chief Financial Officer | |

| Jeffrey T. Carr | President, Global Fields Operations | |

| Peter E. Williams III | Executive Vice President, Corporate Development and Secretary |

13

Table of Contents

Bobby Yazdani, 47, founded Saba, has been a Director of Saba since our inception in April 1997 and has served as Saba’s Chairman of the Board and Chief Executive Officer since September 2003. From February 2003 through September 2003, Mr. Yazdani served as Saba’s President and Chief Operating Officer. From April 1997 until February 2003, Mr. Yazdani served as Saba’s Chairman of the Board and from April 1997 until March 2002, Mr. Yazdani served as Chief Executive Officer. From 1988 until founding Saba, Mr. Yazdani served in various positions at Oracle, most recently as Senior Director. Mr. Yazdani holds a B.A. from the University of California, Berkeley.

William Slater, 58, has served as our Chief Financial Officer since December 2008. From August 2000 to September 2008, Mr. Slater served as Executive Vice President and Chief Financial Officer at Symmetricom, a provider of precise time and frequency technology. From August 1991to November 1999, Mr. Slater served as Executive Vice President and Chief Financial Officer at Computer Curriculum Corporation, an educational publisher and division of Viacom. Mr. Slater has also served as Vice President, Financial Planning, at Simon & Schuster and Vice President and Controller, Professional Products Group, for Revlon. Mr. Slater holds a BA from Queens College, City University of New York.

Jeffrey T. Carr, 51, has served as our President, Global Field Operations since April 2009. From 2004 to 2008, Mr. Carr served as a Corporate Officer and Executive Vice President with responsibility for sales, alliances and other areas at Taleo Corporation, a provider of on-demand talent management solutions. From 2001 to 2003, Mr. Carr served as Chief Executive Officer of Motiva Inc., a leader in the enterprise incentive management and compensation software industry. From 2000 to 2001, Mr. Carr served as President and COO of RightWorks Corporation, a leading provider of eProcurement and B2B enterprise business applications. From 1991 to 2000, Mr. Carr worked at PeopleSoft, Inc., a global enterprise software company, in a number of sales, general management and executive team roles, including Division President and Executive Vice President. From 1984 to 1990, Mr. Carr worked at Integral Systems, a leading provider of Human Resource Management and Financial enterprise application software, in sales and account management positions. Mr. Carr holds a BA from Miami University (Ohio) and studied in the MBA program at Xavier University (Ohio).

Peter E. Williams III, 48, has served as our Executive Vice President, Corporate Development since July 2007 and has served as our Secretary since our inception in April 1997. Mr. Williams served as our Chief Financial Officer from March 2004 to July 2007, and our Vice President, Corporate Development and General Counsel from October 1999 through March 2004. Mr. Williams was a partner at Morrison & Forester LLP, an international law firm, from January 1995 until March 2000. Mr. Williams holds B.A. degrees from the University of California, Los Angeles and a J.D. from Santa Clara University.

While we achieved profitability during fiscal year 2010, we may incur future losses and cannot assure you that we will sustain profitability on a consistent basis.

We cannot be certain that we will realize sufficient revenues to sustain profitability on a quarterly or annual basis, especially if our recurring subscription business grows faster than expected relative to license sales. In addition, in the future, we expect to continue to incur non-cash expenses relating to the amortization of purchased intangible assets that will contribute to our net losses, along with any potential goodwill impairment. As of May 31, 2010, we had $5.0 million of purchased intangible assets to be amortized as a result of our January 2006 acquisition of Centra Software, Inc. (“Centra”) and May 2005 acquisition of THINQ Learning Solutions, Inc. (“THINQ”) and our goodwill balance was $36.1 million. Further, starting with the first quarter of fiscal 2007, we were required to record as an expense charges related to all current outstanding and future grants of stock options in our reported results from operations in accordance with ASC 718-10 Compensation—Stock Compensation ,(formerly SFAS No.123 (revised 2004)), which was issued by the FASB in December 2004. These non-cash expenses have made it and will continue to make it significantly more difficult for us to continue to achieve profitability. We may not be able to sustain profitability on a consistent basis.

14

Table of Contents

The recent recession and global economic crisis may impact our business, operating results or financial condition, including our revenue growth and profitability, which in turn could adversely affect our stock price.

The recent recession and global economic crisis caused a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, public sector deficits and extreme volatility in credit, equity and fixed income markets, which have contributed to diminished expectations for the global economy. These macroeconomic developments have negatively affected, and could continue to negatively affect, our business, operating results or financial condition which, in turn, could adversely affect our stock price. A general weakening of, and related declining corporate confidence in, the global economy or the curtailment in government or corporate spending could cause current or potential customers to reduce their IT budgets or be unable to fund software or services purchases, which could cause customers to delay, decrease or cancel purchases of our products and services or cause customers not to pay us or to delay paying us for previously-purchased products and services.

Fluctuations in our quarterly results could cause our stock price to experience significant fluctuations or declines.

Our operating results have varied significantly in the past and will likely fluctuate significantly in the future. Our quarterly operating results are particularly affected by the number of customers licensing our products during any quarter and the size of such licensing transactions. We have limited visibility into our future revenue, especially license revenue, which often has been heavily concentrated in the third month of each quarter. As a result, if we were to fail to close a sufficient number of transactions by the end of our quarter, particularly large license transactions, we would miss our revenue projections. If our plan to expand sales coverage and marketing support to align with key growth initiatives is not successful, we could miss our revenue and profit projections. In addition, our operating expenses are based in part on future revenue projections and are relatively fixed in the short-term. If we cannot meet our revenue projections, our business will be seriously harmed and net losses in a given quarter will be even larger than expected.

Other factors that could affect our quarterly operating results include:

| • | The demand for our products and professional services and our efficiency in rendering our professional services; |

| • | The variability in the mix of our revenues and bookings in any quarter; |

| • | The variability in the mix of the type of services delivered in any quarter and the extent to which third party contractors are used to provide such services; |

| • | The size and complexity of our license transactions and potential delays in recognizing revenue from license transactions; |

| • | The amount and timing of our operating expenses and capital expenditures; |

| • | The performance of our international business, which accounts for a substantial part of our consolidated revenues; and |

| • | Fluctuations in foreign currency exchange rates. |

Due to these and other factors, we believe that quarter-to-quarter comparisons of our revenues and operating results are not necessarily meaningful and should not be relied upon as indicators of future performance. It is possible that in some future quarter our operating results may be below the expectations of public market analysts or investors, which could cause the market price of our common stock to fall.

If we are unable to accurately forecast revenues, we may fail to meet stock analysts’ and investors’ expectations of our quarterly operating results, which could cause our stock price to decline.

We use a “pipeline” system, a common industry practice, to forecast sales and trends in our business. Our sales personnel monitor the status of all proposals, including the date when they estimate that a customer will

15

Table of Contents

make a purchase decision and the potential dollar amount of the sale. We aggregate these estimates periodically in order to generate a sales pipeline. We assess the pipeline at various points in time to look for trends in our business. While this pipeline analysis may provide us with some guidance in business planning and budgeting, these pipeline estimates are necessarily speculative and may not consistently correlate to revenues in a particular quarter or over a longer period of time, particularly in the recent global weak macroeconomic environment. Additionally, because we have historically recognized a substantial portion of our license revenues in the last month of each quarter and sometimes in the last few weeks of each quarter, we may not be able to adjust our cost structure in a timely manner in response to variations in the conversion of the sales pipeline into license revenues. Any change in the conversion rate of the pipeline into customer sales or in the pipeline itself could cause us to improperly budget for future expenses that are in line with our expected future revenues, which would adversely affect our operating margins and results of operations and could cause the price of our common stock to decline.

Failure to adequately expand and ramp our direct sales force will impede our growth.

We need to continue to increase and develop our sales and marketing infrastructure in order to grow our customer base and our business. We plan to continue to expand and ramp our direct sales force both domestically and internationally. Identifying and recruiting these people and training them in the use of our products require significant time, expense and attention. This expansion will require us to invest significant financial and other resources. Our business will be seriously harmed if our efforts to expand and ramp our direct sales force do not generate a corresponding significant increase in revenue. In particular, if we are unable to hire, develop and retain talented sales personnel or if new direct sales personnel are unable to achieve desired productivity levels in a reasonable period of time, whether due to the global economic slowdown or for other reasons, we may not be able to significantly increase our revenue and grow our business.

Our subscription business depends substantially on customers renewing their agreements with us. Any decline in our customer renewals would harm our future operating results.

In order for us to improve our operating results, it is important that our customers renew their agreements with us when the contract term expires. Our subscription customers have no obligation to renew their contracts, and we cannot assure you that customers will renew subscriptions at the same or higher level of service, if at all. During our fiscal years 2010, 2009 and 2008, 7%, 9% and 10% of our subscription business was not renewed, respectively. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our product offerings, pricing, the prices of competing products or services, completion of customer initiatives, mergers and acquisitions affecting our customer base, or reductions in our customers’ spending levels. If our subscription customers do not renew their contracts or renew on less favorable terms, our revenue may decline.

Because we generally recognize revenue from the sale of our subscription solutions ratably over the term of the offering period, a significant downturn in our subscription business may not be immediately reflected in our operating results.

We generally recognize subscription revenue over the terms of our customer agreements, which typically range from one to three years. As a result, most of our quarterly subscription revenue results from agreements entered into during previous quarters. A decline in new or renewed subscriptions in any one quarter may not impact our financial performance in that quarter, but will negatively affect our revenue in future quarters. If a number of contracts expire and are not renewed in the same quarter, our revenue could decline significantly in that quarter and in subsequent quarters. Accordingly, the effect of significant declines in sales and market acceptance of our solutions may not be reflected in our short-term results of operations, making our results less indicative of our future prospects. It is also difficult for us to rapidly increase our subscription revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable subscription term.

16

Table of Contents

If our efforts to attract new customers or to sell additional solutions to our existing customers are not successful, our revenue growth will be adversely affected.

To increase our revenue, we must continually add new customers and sell additional solutions to existing customers. If our existing and prospective customers do not perceive our solutions to be of sufficiently high value and quality, we may not be able to attract new customers or to increase sales to existing customers. Our ability to attract new customers and to sell new solutions to existing customers will depend in large part on the success of our sales and marketing efforts. However, our existing and prospective customers may not be familiar with some of our solutions, or may have traditionally used other products and services for some of their people management requirements. Our existing and prospective customers may develop their own solutions to address their people management requirements, purchase competitive product offerings or engage third-party providers of outsourced people management services.

A decline in the price of, or demand for, our products or our related services offerings, would seriously harm our revenues and operating margins.

We anticipate that revenues from the Saba People Suite as well as related services will constitute substantially all of our revenue for the foreseeable future. Consequently, a decline in the price of, or demand for, the Saba People Suite or failure to achieve broad market acceptance would seriously harm our business.

Our products have a long sales cycle, which increases the cost of completing sales and renders completion of sales less predictable.

Due to the expense, broad functionality, and company-wide deployment of our products, the period between our initial contact with a potential customer and the purchase of our products and services is often long. To successfully sell our products and services, we generally must educate our potential customers regarding the use and benefits of our products and services. We may commit a substantial amount of time and resources to potential customers without assurance that any sales will be completed or revenues generated. Many of our potential customers are large enterprises that generally take longer to make significant business decisions. Our public sector customers, in particular, are subject to extensive procurement procedures that require many reviews and approvals. Our typical sales cycle has been approximately six to 12 months, making it difficult to predict the quarter in which we may recognize revenue. The delay or failure to complete sales in a particular quarter could reduce our revenues in that quarter. If our sales cycle were to unexpectedly lengthen in general or for one or more large orders, it would adversely affect the timing of our revenues. If we were to experience a delay on a large license order, it could harm our ability to meet our forecasts for a given quarter.

We experience seasonality in our sales and expense, which could cause our operating results to fluctuate from quarter to quarter.

We experience quarterly seasonality in the demand for our products and services. For example, revenue has historically been lower in our first fiscal quarter while expenses have been higher than in the immediately preceding fourth fiscal quarter. Contributing to this seasonality is the timing of our first fiscal quarter that occurs during the summer months when general business activities slow down in a number of territories where we conduct our operations, particularly Europe. Our commission structure and other sales incentives also tend to result in fewer sales in the first fiscal quarter than in the fourth fiscal quarter. These seasonal variations in our revenue are likely to lead to fluctuations in our quarterly operating results.

Reductions in information technology spending could limit our ability to grow our business.

Our operating results may vary based on changes in the information technology spending of our clients. The revenue growth and profitability of our business depend on the overall demand for enterprise applications and services. We sell our solutions primarily to large organizations whose businesses fluctuate with general economic and business conditions. As a result, decreased demand for enterprise applications and services, and in particular

17

Table of Contents

people systems, caused by a weakening global economy may cause a decline in our revenue. Historically, economic downturns have resulted in overall reductions in corporate information technology spending. In particular, people software may be viewed by some of our existing and potential clients as a lower priority and may be among the first expenditures reduced as a result of unfavorable economic conditions. In the future, potential clients may decide to reduce their information technology budgets by deferring or reconsidering product purchases, which would negatively impact our operating results.

We rely on our relationships with our strategic partners. If we do not maintain and strengthen these relationships, our ability to generate revenue and control expenses could be adversely affected, which could cause a decline in the price of our common stock.

We believe that our ability to increase the sales of our products depends in part upon maintaining and strengthening relationships with our current strategic partners and any future strategic partners. In addition to our direct sales force, we rely on established relationships with a variety of strategic partners, such as systems integrators, resellers, business process outsourcing partners (BPOs), human resource outsourcing partners (HROs) and distributors, for marketing, selling, implementing, and supporting our products in the United States and internationally.

Our strategic partners offer products from several different companies, including, in some cases, products that compete with our products. We have limited control, if any, as to whether these strategic partners devote adequate resources to promoting, selling, and implementing our products as compared to our competitors’ products. We cannot guarantee that we will be able to strengthen our relationships with our strategic partners or that such relationships will be successful in generating additional revenue.

We may not be able to maintain our strategic partnerships or attract sufficient additional strategic partners, who have the ability to market our products effectively, are qualified to provide timely and cost-effective customer support and service, or have the technical expertise and personnel resources necessary to implement our products for our customers. In particular, if our strategic partners do not devote sufficient resources to implement our products, we may incur substantial additional costs associated with hiring and training additional qualified technical personnel to implement solutions for our customers in a timely manner. Furthermore, our relationships with our strategic partners may not generate enough revenue to offset the significant resources used to develop these relationships. If we are unable to leverage the strength of our strategic partnerships to generate additional revenues, our revenues and the price of our common stock could decline.

Implementation of accounting regulations and related interpretations and policies, particularly those related to revenue recognition, could cause us to defer recognition of revenue or recognize lower revenue or to report lower earnings per share.

While we believe that we are in compliance with ASC 985-605, Software Revenue Recognition, additional implementation guidelines, and changes in interpretations of such guidelines, could lead to unanticipated changes in our current revenue accounting practices that could cause us to defer the recognition of revenue to future periods or to recognize lower revenue. In addition, policies, guidelines and interpretations related to accounting for acquisitions, income taxes, facilities consolidation charges, allowance for doubtful accounts and other financial reporting matters require different judgments on complex matters that are often subject to multiple sources of authoritative guidance. To the extent that management’s judgment is incorrect, it could result in an adverse impact on our financial statements. Further, the factual complexities of applying these policies, guidelines and interpretations to specific transactions can lead to unanticipated changes in revenue recognition with respect to such transactions, which may affect our revenue and results of operations.

The loss of our senior executives and key personnel would likely cause our business to suffer.

Our ability to implement a successful long-term strategy, strengthen our competitive position, expand our customer base, and develop and support our products depends to a significant degree on the performance of the

18

Table of Contents

senior management team and other key employees. The loss of any of these individuals could harm our business. Our success will depend in part on our ability to attract and retain additional personnel with the highly specialized expertise necessary to generate revenue and to engineer, design and support our products and services. Like other technology companies, we face intense competition for qualified personnel. We may not be able to attract or retain such personnel.

Intense competition in our target market could impair our ability to grow and achieve profitability on a consistent basis.

The market for our products and services is intensely competitive, dynamic and subject to rapid technological change. The intensity of the competition and the pace of change are expected to increase in the future. Increased competition is likely to result in price reductions, reduced gross margins and loss of market share, any one of which could seriously harm our business. Competitors vary in size and in the scope and breadth of the products and services offered. We encounter competition with respect to different aspects of our solution from a variety of sources including:

| • | Companies that offer human capital management solutions that provide one or more applications within the HCM market, such as leaning management, performance management, talent management, compensation and recruiting, including SumTotal and Success Factors; |

| • | Companies that offer collaboration solutions, such as Microsoft, Adobe and Cisco; |

| • | Enterprise software vendors that offer human resources information systems and employee relationship management systems with training and performance modules, such as SAP and Oracle; |

| • | Potential customers’ internal development efforts; and |

| • | Companies that operate Internet-based marketplaces for the sale of on-line learning. |

We expect competition from a variety of companies.