Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED AUGUST 11, 2010 - PG&E Corp | form8k08112010.htm |

®

Goldman Sachs

Power and Utility Conference

August 12, 2010

Power and Utility Conference

August 12, 2010

PG&E

Corporation

Exhibit 99

This presentation contains management’s guidance for PG&E Corporation’s 2010 and 2011 earnings per share from operations. These statements and

projections, as well as the underlying assumptions, are forward-looking statements that are based on current expectations which management believes are

reasonable. These statements and assumptions are necessarily subject to various risks and uncertainties, the realization or resolution of which may be outside

of management's control. Actual results may differ materially. Factors that could cause actual results to differ materially include:

projections, as well as the underlying assumptions, are forward-looking statements that are based on current expectations which management believes are

reasonable. These statements and assumptions are necessarily subject to various risks and uncertainties, the realization or resolution of which may be outside

of management's control. Actual results may differ materially. Factors that could cause actual results to differ materially include:

• the Utility’s ability to efficiently manage capital expenditures and its operating and maintenance expenses within authorized levels;

• the outcome of pending and future regulatory proceedings and whether the Utility is able to timely recover its costs through rates;

• the adequacy and price of electricity and natural gas supplies and whether the new day-ahead, hour-ahead, and realtime wholesale electricity markets

established by the California Independent System Operator (“CAISO”) will continue to function effectively, the extent to which the Utility can manage and respond

to the volatility of electricity and natural gas prices, and the ability of the Utility and its counterparties to post or return collateral;

established by the California Independent System Operator (“CAISO”) will continue to function effectively, the extent to which the Utility can manage and respond

to the volatility of electricity and natural gas prices, and the ability of the Utility and its counterparties to post or return collateral;

• explosions, fires, accidents, mechanical breakdowns, the disruption of information technology and systems, and similar events that may occur while operating

and maintaining an electric and natural gas system in a large service territory with varying geographic conditions that can cause unplanned outages, reduce

generating output, damage the Utility’s assets or operations, subject the Utility to third-party claims for property damage or personal injury, or result in the

imposition of civil, criminal, or regulatory fines or penalties on the Utility;

and maintaining an electric and natural gas system in a large service territory with varying geographic conditions that can cause unplanned outages, reduce

generating output, damage the Utility’s assets or operations, subject the Utility to third-party claims for property damage or personal injury, or result in the

imposition of civil, criminal, or regulatory fines or penalties on the Utility;

• the impact of storms, earthquakes, floods, drought, wildfires, disease, and similar natural disasters, or acts of terrorism or vandalism, that affect customer

demand or that damage or disrupt the facilities, operations, or information technology and systems owned by the Utility, its customers, or third parties on which

the Utility relies;

demand or that damage or disrupt the facilities, operations, or information technology and systems owned by the Utility, its customers, or third parties on which

the Utility relies;

• the potential impacts of climate change on the Utility’s electricity and natural gas businesses;

• changes in customer demand for electricity and natural gas resulting from unanticipated population growth or decline, general economic and financial market

conditions, changes in technology that include the development of alternative technologies that enable customers to increase their reliance on self-generation, or

other reasons;

conditions, changes in technology that include the development of alternative technologies that enable customers to increase their reliance on self-generation, or

other reasons;

• the occurrence of unplanned outages at the Utility’s two nuclear generating units at Diablo Canyon, the availability of nuclear fuel, the outcome of the Utility’s

application to renew the operating licenses for Diablo Canyon, and potential changes in laws or regulations promulgated by the NRC or environmental agencies

with respect to the storage of spent nuclear fuel, security, safety, or other matters associated with the operations at Diablo Canyon;

application to renew the operating licenses for Diablo Canyon, and potential changes in laws or regulations promulgated by the NRC or environmental agencies

with respect to the storage of spent nuclear fuel, security, safety, or other matters associated with the operations at Diablo Canyon;

• whether the Utility earns incentive revenues or incurs obligations under incentive ratemaking mechanisms, such as the CPUC’s incentive ratemaking

mechanism relating to energy savings achieved through implementation of the utilities’ customer energy efficiency programs;

mechanism relating to energy savings achieved through implementation of the utilities’ customer energy efficiency programs;

• the impact of federal or state laws or regulations, or their interpretation, on energy policy and the regulation of utilities and their holding companies;

• whether the Utility can successfully implement its program to install advanced meters for its electric and natural gas customers and integrate the new meters

with its customer billing and other systems, the outcome of the independent investigation ordered by the CPUC and the California Legislature into customer

concerns about the new meters, and the ability of the Utility to implement various rate changes including “dynamic pricing” by offering electric rates that can

vary with the customer’s time of use and are more closely aligned with wholesale electricity prices;

with its customer billing and other systems, the outcome of the independent investigation ordered by the CPUC and the California Legislature into customer

concerns about the new meters, and the ability of the Utility to implement various rate changes including “dynamic pricing” by offering electric rates that can

vary with the customer’s time of use and are more closely aligned with wholesale electricity prices;

• how the CPUC interprets and enforces the financial and other conditions imposed on PG&E Corporation when it became the Utility’s holding company and the

extent to which the interpretation or enforcement of these conditions has a material impact on PG&E Corporation;

extent to which the interpretation or enforcement of these conditions has a material impact on PG&E Corporation;

• the outcome of litigation, including litigation involving the application of various California wage and hour laws, and the extent to which PG&E Corporation or

the Utility incurs costs and liabilities in connection with litigation that are not recoverable through rates, from insurance, or from other third parties;

the Utility incurs costs and liabilities in connection with litigation that are not recoverable through rates, from insurance, or from other third parties;

• the ability of PG&E Corporation, the Utility, and counterparties to access capital markets and other sources of credit in a timely manner on acceptable terms;

• the impact of environmental laws and regulations and the costs of compliance and remediation;

• the loss of customers due to various forms of bypass and competition, including municipalization of the Utility’s electric distribution facilities, increasing levels

of “direct access” by which consumers procure electricity from alternative energy providers, and implementation of “community choice aggregation,” which

permits cities and counties to purchase and sell electricity for their local residents and businesses;

of “direct access” by which consumers procure electricity from alternative energy providers, and implementation of “community choice aggregation,” which

permits cities and counties to purchase and sell electricity for their local residents and businesses;

• the outcome of federal or state tax audits and the impact of changes in federal or state tax laws, policies, or regulations; and

• other factors and risks discussed in PG&E Corporation and Pacific Gas and Electric Company’s 2009 Annual Report on Form 10-K and other reports filed with

the Securities and Exchange Commission.

the Securities and Exchange Commission.

Cautionary Language Regarding

Forward-Looking Statements

Forward-Looking Statements

2

3

Overview Page 4

Regulatory Update Page 8

Appendix Page 18

Table of Contents

4

• Provides energy to approximately 15 million people

• 70,000 square-mile service territory

• Four main operational units:

Electric and gas distribution

Electric transmission

Natural gas transmission

Electric procurement and owned generation

Pacific Gas and Electric Company

(PG&E)

(PG&E)

PG&E SERVICE AREA

IN CALIFORNIA

IN CALIFORNIA

5

Excellent service at reasonable cost

Constructive regulatory environment

Investment in infrastructure-

providing solid, regulated growth

providing solid, regulated growth

Clean generation and world-class energy

efficiency programs

efficiency programs

Stable capital structure and return

Reliable, growing dividend

PCG Investment Case

6

Sustainable, comparable dividend

Payout ratio range of 50% - 70%

Dividend growth in line with EPS growth

Dividend Policy

7

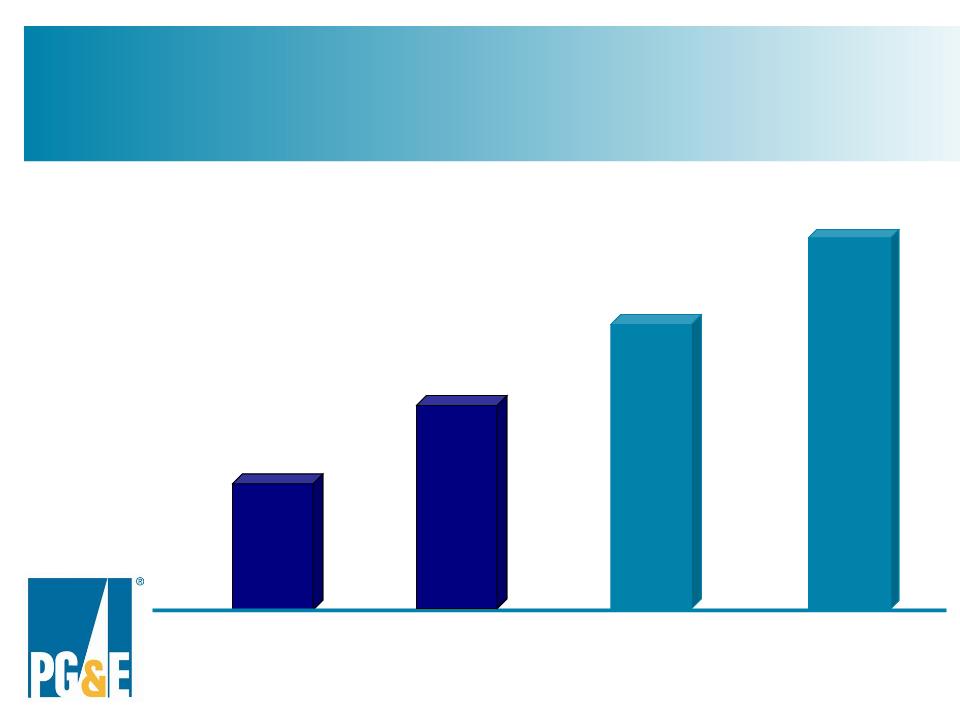

2011

EPS Guidance

$3.85

$3.85

2008

Actual

Actual

2010

$2.95

$2.95

$3.65

$3.65

Low

Low

High

High

Low

Low

High

High

$3.50

$3.50

$3.35

$3.35

Earnings per Share from Operations*

Earnings per Share from Operations*

2009

Actual

Actual

$3.21

$3.21

* Reg G reconciliation to GAAP for 2008 and 2009 EPS from Operations, and 2010-2011 EPS Guidance

available in Appendix and at www.pge-corp.com

available in Appendix and at www.pge-corp.com

®

Regulatory Update

9

2011 General Rate Case

Sets revenue requirements for Gas and Electric Distribution

and Electric Generation businesses for 2011 - 2013

and Electric Generation businesses for 2011 - 2013

Revenue Requirement Request: $6.7B

$1.1B increase

$2.7B average capital expenditures per year

Allows for necessary investments in energy infrastructure

to deliver energy safely and reliably to customers

to deliver energy safely and reliably to customers

Key capital projects will focus on:

• replacement of gas and electric systems that are at or near the end of their

useful lives

• replacement of aging generation infrastructure, hydro relicensing

requirements

requirements

• replacement of aging fleet, buildings and IT systems

10

Also requested a flexible attrition mechanism to adjust for:

• Labor costs

• Materials and services

• Capital investments

• Changes in franchise, payroll or other taxes

Based on the requested mechanism, attrition revenues are

currently forecasted to be $275M and $343M in 2012 and 2013

currently forecasted to be $275M and $343M in 2012 and 2013

Items not included in the 2011 GRC:

• SmartMeterTM and SmartMeterTM Upgrade programs

• PV Project, Cornerstone, Manzana, Diablo Relicensing

June - July

August - September

November

Hearings

Opening and

Reply Briefs

Reply Briefs

Proposed

Decision

Decision

New Rates

in Effect

in Effect

Jan 1 2011

December

Final

Decision

2011 General Rate Case

11

2011 Gas Transmission and

Storage Rate Case

Storage Rate Case

Sets revenue requirements, rates, terms and conditions for PG&E’s

Gas Transmission and Storage services for 2011 - 2014

Gas Transmission and Storage services for 2011 - 2014

Revenue Requirement Request: $529M

$67M increase over 2010 revenue requirement

$235M Capital Expenditures

Allows for upgrades to backbone transmission, local transmission,

and storage facilities, and maintenance of equipment

and storage facilities, and maintenance of equipment

Proposed attrition mechanism similar to General Rate Case

Conference held in July resulted in a proposed, multi-party settlement

The terms are confidential until the agreement is submitted to the

CPUC for approval

CPUC for approval

Final decision requested by Q4 2010

12

Request for revenue requirements to acquire, own, and operate

the 189 - 246MW Manzana wind project in the Tehachapi region

of Southern California

the 189 - 246MW Manzana wind project in the Tehachapi region

of Southern California

Request: $900M (all capital) at 246MW capacity

Manzana Wind Project would be designed, developed, and

constructed by Iberdrola Renewables, Inc.

constructed by Iberdrola Renewables, Inc.

• PG&E proposes to make progress payments throughout construction

and take full ownership at completion

and take full ownership at completion

• Final size of the project would depend upon permitting requirements,

completion of land rights acquisition and turbine supply

completion of land rights acquisition and turbine supply

• The proposed wind facility is targeted to be operational as early as

December 2011

December 2011

Final decision is requested by the end of 2010

Manzana Wind Project

13

Sets revenue requirements for PG&E’s Electric Transmission

business in 2011

business in 2011

Revenue Requirement Request: $1.026B

Capital Expenditures: $810M

If approved, revenues would provide for additional transmission

capacity and increased maintenance and replacement work on

our substations to improve overall reliability of our system

capacity and increased maintenance and replacement work on

our substations to improve overall reliability of our system

TO13 final decision expected by Q3 2011

FERC TO13 Filing

Request Settlement

TO 10 $760.5M $718M

TO 11 $845.0M $776M

TO 12 $946.0M $875M - Approved on 7/27/10

14

Cornerstone Reliability Program

Sets revenue requirements aimed at improving the reliability of

PG&E’s electric distribution system

PG&E’s electric distribution system

Approved Final Decision (6/24/10):

• $350M in reliability focused capital investments through 2013

• CPUC provided the opportunity for additional reliability investment

in 2014 GRC and subsequent general rate cases

in 2014 GRC and subsequent general rate cases

The primary focus of the program is:

Additional substation emergency capacity

Enhanced interconnectivity and automation

Reliability investments in rural areas

Recent Decisions

15

Solar PV Program

Sets revenue requirements to develop and own up to 250MW of PV

and sign PPAs for an additional 250MW of PV over a five year period

and sign PPAs for an additional 250MW of PV over a five year period

Approved Final Decision (4/22/10):

• $1.45B (all capital) for the Utility-owned 250MW

• Authorized cost of service ratemaking treatment for the Utility-

owned portion

owned portion

• Included an incentive mechanism with 90/10 sharing between

customers and shareholders of the amount of total costs below a

certain threshold over the timeframe of project development

customers and shareholders of the amount of total costs below a

certain threshold over the timeframe of project development

Recent Decisions

16

Summer Rate Relief Program

As proposed by PG&E, the CPUC approved reducing overall rates by

$400M, a 3% decrease, effective June 1, 2010

$400M, a 3% decrease, effective June 1, 2010

For residential rates, reductions focused on highest rate tiers

• Substantially reduced rates in Tier 5 by 19.6%

and Tier 4 by 5.8%

• Moderately increased rates in Tier 3 by 1.8%

GRC Phase II filing recommends collapsing of

Tier 3, 4, and 5 into one Tier 3 rate

Tier 3, 4, and 5 into one Tier 3 rate

Recent Decisions

®

Appendix

18

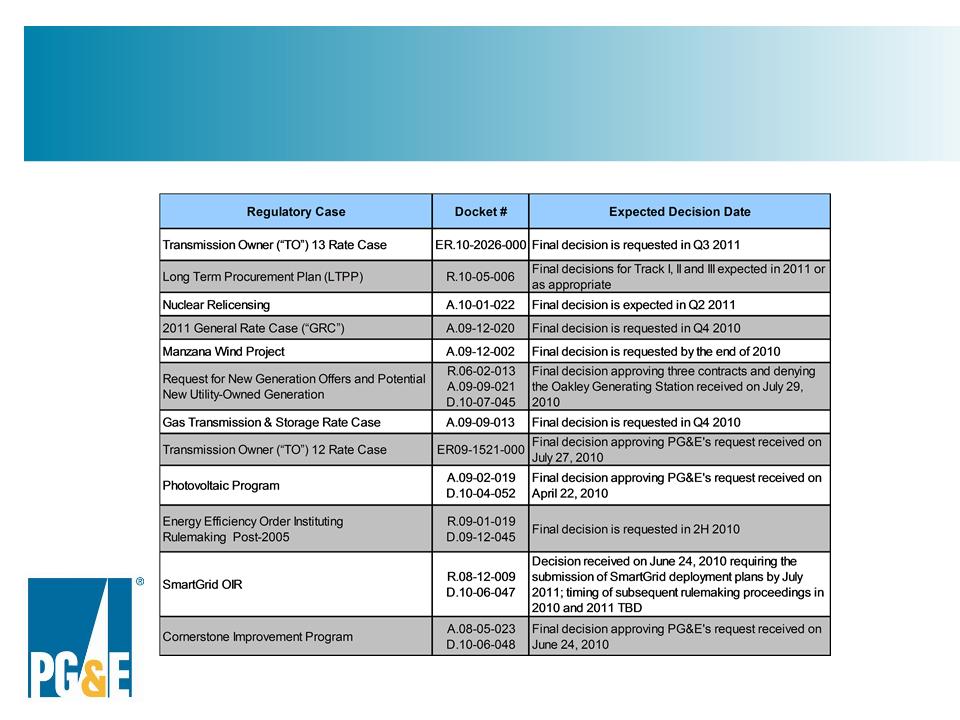

Key Regulatory Proceedings

19

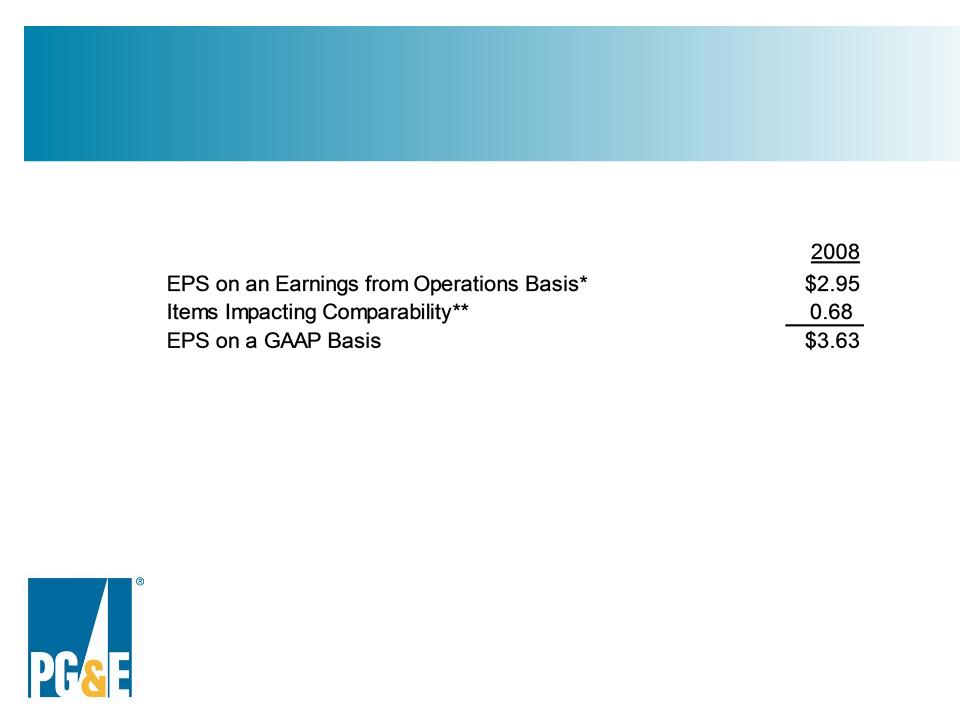

* Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to

compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal

course of operations.

compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal

course of operations.

** Items impacting comparability reconcile earnings from operations with consolidated net income as reported in accordance with

GAAP. For the three and twelve months ended December 31, 2008, PG&E Corporation recognized $257 million of net income

resulting from a settlement of tax audits for tax years 2001 through 2004. Of this amount, $154 million was related to PG&E

Corporation’s former subsidiary, National Energy & Gas Transmission, Inc., and was recorded as income from discontinued

operations

GAAP. For the three and twelve months ended December 31, 2008, PG&E Corporation recognized $257 million of net income

resulting from a settlement of tax audits for tax years 2001 through 2004. Of this amount, $154 million was related to PG&E

Corporation’s former subsidiary, National Energy & Gas Transmission, Inc., and was recorded as income from discontinued

operations

2008 EPS - Reg G Reconciliation

20

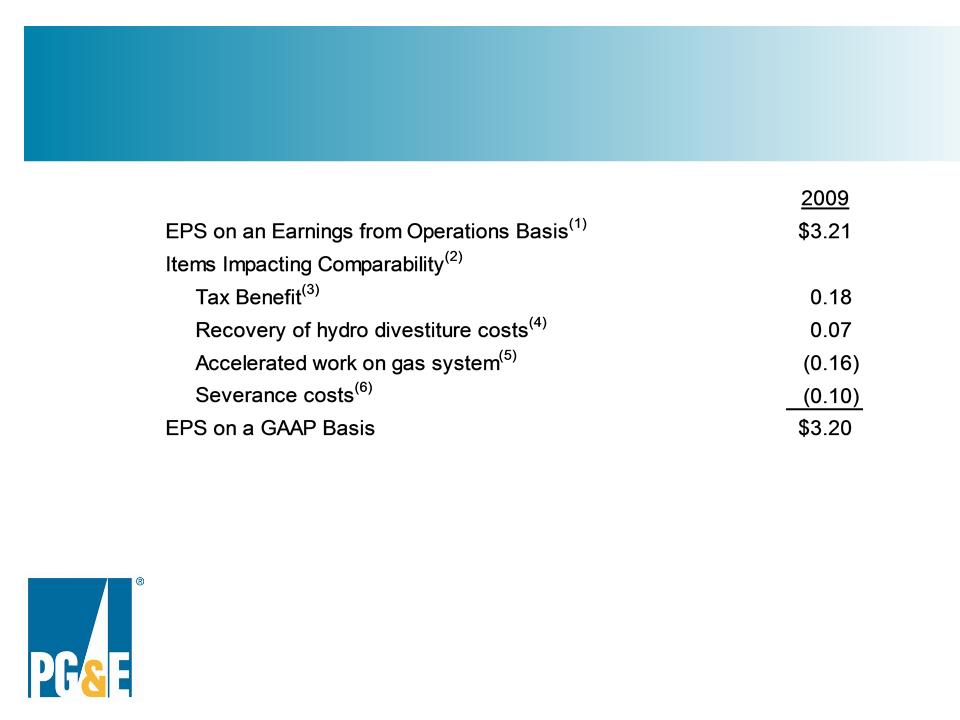

2009 EPS - Reg G Reconciliation

(1) Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to compare the

core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations.

core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations.

(2) Items impacting comparability reconcile earnings from operations with consolidated net income as reported in accordance with GAAP.

(3) For the twelve months ended December 31, 2009, PG&E Corporation recognized $66 million, after-tax, for the interest and state tax

benefit associated with a federal tax refund, for 1998 and 1999.

benefit associated with a federal tax refund, for 1998 and 1999.

(5) For the twelve months ended December 31, 2009, PG&E Corporation incurred $59 million, after-tax of costs to perform accelerated

system-wide natural gas integrity surveys and associated remedial work.

system-wide natural gas integrity surveys and associated remedial work.

(4) For the twelve months ended December 31, 2009, PG&E Corporation recognized $28 million, after-tax, related to the CPUC's

authorization to recover costs previously incurred in connection with the Utility’s hydroelectric generation facilities.

authorization to recover costs previously incurred in connection with the Utility’s hydroelectric generation facilities.

(6) For the twelve months ended December 31, 2009, PG&E Corporation accrued $38 million, after-tax of severance costs related to the

elimination of approximately 2% percent of the Utility’s workforce.

elimination of approximately 2% percent of the Utility’s workforce.

21

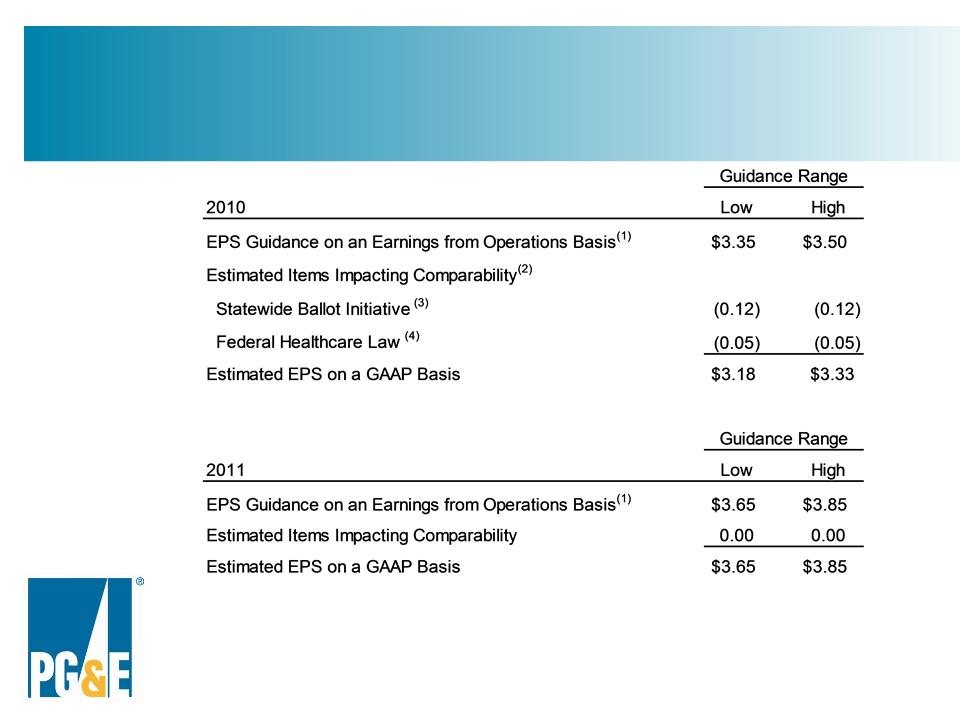

EPS Guidance - Reg G Reconciliation

|

(1) Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to

compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations. |

(2) Items impacting comparability reconcile earnings from operations with consolidated net income as reported in accordance with GAAP.

(3) Costs related to Proposition 16 - The Taxpayers' Right to Vote Act

(4) Reduction in the deferred tax asset corresponding to the loss of tax deductibility of Medicare Part D federal subsidies.