Attached files

| file | filename |

|---|---|

| EX-23.1 - Bohai Pharmaceuticals Group, Inc. | v193404_ex23-1.htm |

As

filed with the Securities and Exchange Commission on August 12, 2010

Registration

No. 333-165149

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

(Amendment

No. 5)

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Bohai

Pharmaceuticals Group, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

2834

|

98-0588402

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

No.)

|

c/o

Yantai Bohai Pharmaceuticals Group Co. Ltd.

No.

9 Daxin Road, Zhifu District

Yantai,

Shandong Province, China 264000

+86

(535)-685-7928

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive offices)

Mr.

Hongwei Qu

President

and Chief Executive Officer

Bohai

Pharmaceuticals Group, Inc.

c/o

Yantai Bohai Pharmaceuticals Group Co. Ltd.

No.

9 Daxin Road, Zhifu District

Yantai,

Shandong Province, China 264000

+86

(535)-685-7928

(Name,

address including zip code, and telephone number, including area code, of agent

for service)

Copies

to:

Barry

I. Grossman, Esq.

Lawrence

A. Rosenbloom, Esq.

Ellenoff

Grossman & Schole LLP

150

East 42nd Street, 11th Floor

New

York, NY 10017

212-370-1300

212-370-7889

(fax)

Registrant’s

telephone number: +86 (535)-685-7928

APPROXIMATE

DATE OF PROPOSED SALE TO PUBLIC: From time to time after this

Registration

Statement becomes effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box: ¨

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the oearlier effective

registration statement for the same offering.

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective oregistration statement

for the same offering.

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective oregistration statement

for the same offering.

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

(Do

not check if a smaller reporting company)

|

CALCULATION

OF REGISTRATION FEE

|

Title of each class of securities

to be registered

|

Amount to be

registered(1)

|

Proposed

maximum

offering

price per

unit

|

Proposed

maximum

aggregate

offering

price

|

Amount of

registration fee

|

|||||||||||

|

common

stock, par value $0.001 per share, offered by certain selling stockholders

|

7,032,529 shares

|

$ | 1.00 | (2) | $ | 7,032,529 | $ | 499.10 | * | ||||||

|

common

stock, par value $0.001 per share, underlying the principal of convertible

notes held by certain selling stockholders (1)

|

6,000,000 shares

|

(3) | $ | 2.00 | $ | 12,000,000 | $ | 855.60 | * | ||||||

|

common

stock, par value $0.001 per share, underlying the interest of convertible

notes held by certain selling stockholders (1)

|

690,000

shares

|

(4) | $ | 2.00 | $ | 1,380,000 | $ | 98.40 | * | ||||||

|

common

stock, par value $0.001 per share, underlying warrants held by certain

selling stockholders (1)

|

6,000,000 shares

|

(5) | $ | 2.40 | $ | 14,400,000 | $ | 1,026.72 | * | ||||||

|

common

stock, par value $0.001 per share, underlying placement agent warrants

held by certain selling stockholders

|

600,000 shares

|

(6) | $ | 2.40 | $ | 1,440,000 | $ | 102.67 | * | ||||||

|

TOTAL

|

20,322,529 shares

|

$ | 36,252,529 | $ | 2,680.89 | ||||||||||

|

*

|

Previously

paid.

|

|

(1)

|

Pursuant

to Rule 416 of the Securities Act of 1933, also registered hereby are such

additional and indeterminable number of shares as may be issuable due to

adjustments for changes resulting from stock dividends, stock splits and

similar changes as well as anti-dilution provisions applicable to the

notes and warrants.

|

|

(2)

|

Estimated

pursuant to Rule 457(f)(2) under the Securities Act of 1933 solely for the

purpose of calculating the amount of the registration fee, based on the

book value of such securities received by the Company in the Share

Exchange.

|

|

(3)

|

The

6,000,000 shares of common stock are being registered for resale by

certain selling stockholders named in this registration statement, which

shares are issuable by the registrant upon the conversion of the principal

amount of the registrant’s 8% Convertible Notes due January 5, 2012.

|

|

(4)

|

The 690,000 shares of common stock are being registered for resale by certain selling stockholders named in this registration statement, which shares are potentially issuable by the registrant upon the conversion of the interest accrued under the registrant’s 8% Convertible Notes due January 5, 2012. |

|

(5)

|

The

6,000,000 shares of common stock are being registered for resale by

certain selling stockholders named in this registration statement, which

shares are issuable by the registrant upon the exercise of the

registrant’s common stock purchase warrants issued on January 5, 2010.

|

|

(6)

|

The

600,000 shares of common stock are being registered for resale by certain

selling stockholders named in this registration statement, which shares

are issuable by the registrant upon the exercise of the placement agent

warrants issued on January 5, 2010.

|

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Securities and Exchange Commission, acting

pursuant to Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. We

may not sell these securities until the registration statement filed with the

Securities and Exchange Commission (“SEC”) is effective. This

prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

|

Preliminary

Prospectus

|

Subject

to Completion, dated August 12, 2010

|

20,322,529

Shares of

Common

Stock

This

prospectus relates to the sale of up to a total of 20,322,529 shares of common

stock of Bohai Pharmaceuticals Group, Inc., a Nevada corporation, that may be

sold from time to time by the selling stockholders named in this prospectus and

their successors and assigns. The shares of common stock subject to

this prospectus include: (i) 5,482,529 shares of common stock issued in

connection with our January 5, 2010 share exchange transaction and 1,550,000

other shares of restricted common stock; (ii) 6,690,000 shares issuable upon

conversion by certain selling stockholders of the principal and interest

underlying our 8% Convertible Notes due January 5, 2012, which we refer to

herein as the Notes; (iii) 6,000,000 shares issuable upon the exercise by

certain selling stockholders of our common stock purchase warrants issued on

January 5, 2010, which we refer to herein as the Warrants; and (iv) 600,000

shares upon issuable upon the exercise by certain selling stockholders of

placement agents’ warrants issued on January 5, 2010, which we refer to herein

as the Placement Agent Warrants. The securities offered for resale

hereby were issued to the applicable selling stockholders in private placement

or other exempt transactions completed prior to the filing of the registration

statement of which this prospectus is a part.

The

selling stockholders may sell all or a portion of their shares through public or

private transactions at prevailing market prices or at privately negotiated

prices. Information regarding the selling stockholders and the times

and manner in which they may offer and sell the shares under this prospectus is

provided under “Selling Stockholders” and “Plan of Distribution” in this

prospectus. We have agreed to pay all the costs and expenses of this

registration.

We will

not receive any of the proceeds from the sale of shares by the selling

stockholders. We may receive proceeds upon exercise of Warrants or

the Placement Agent Warrants, and any proceeds we receive will be used for

general corporate purposes and for working capital.

Our

common stock is listed for quotation on the Over-the-Counter Bulletin Board, or

OTCBB, under the symbol “BOPH”. There is very limited trading in our

common stock. On July 23, 2010, the most recent day that our stock

traded, the last reported price per share of our common stock was

$2.25. You are urged to obtain current market quotations of our

common stock before purchasing any of the shares being offered for sale pursuant

to this prospectus.

An

investment in our securities is highly speculative, involves a high degree of

risk and should be considered only by persons who can afford the loss of their

entire investment. See “Risk Factors” beginning on page 6 of this

prospectus.

Neither

the SEC nor any state securities commission has approved or disapproved of these

securities or passed upon the accuracy or adequacy of this

prospectus. Any representation to the contrary is a criminal

offense.

The date of this

prospectus is

[ ],

2010.

TABLE

OF CONTENTS

|

Page

|

|

|

Number

|

|

|

About

This Prospectus

|

-i-

|

|

Prospectus

Summary

|

1

|

|

Risk

Factors

|

6

|

|

Cautionary

Note Regarding Forward-Looking Statements

|

30

|

|

Use

of Proceeds

|

31

|

|

Determination

of Offering Price

|

31

|

|

Management’s

Discussion and Analysis of Financial Conditions and Results of Operations

|

32

|

|

Business

|

42

|

|

Management

|

59

|

|

Executive

Compensation

|

62

|

|

Certain

Relationships and Related Transactions

|

63

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

65

|

|

Description

of Securities

|

66

|

|

Selling

Stockholders

|

68

|

|

Plan

of Distribution

|

76

|

|

Market

for Common Equity and Related Stockholder Matters

|

79

|

|

Legal

Matters

|

79

|

|

Experts

|

79

|

|

Changes

In and Disagreements With Accountants on Accounting and Financial

Disclosure

|

80

|

|

Where

You Can Find More Information

|

80

|

|

Index

to Financial Statements

|

F-1

|

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement we filed with the

SEC. You should rely only on the information provided in this

prospectus and incorporated by reference in this prospectus. We have

not authorized anyone to provide you with information different from that

contained in or incorporated by reference into this prospectus. This

prospectus does not constitute an offer to sell or a solicitation of an offer to

buy any securities other than the common stock offered by this

prospectus. This prospectus does not constitute an offer to sell or a

solicitation of an offer to buy any common stock in any circumstances in which

such offer or solicitation is unlawful. The selling stockholders are

offering to sell, and seeking offers to buy, shares of common stock only in

jurisdictions where offers and sales are permitted.

Neither

the delivery of this prospectus nor any sale made in connection with this

prospectus shall, under any circumstances, create any implication that there has

been no change in our affairs since the date of this prospectus or that the

information contained by reference to this prospectus is correct as of any time

after its date. The information in this prospectus is accurate only

as of the date of this prospectus, regardless of the time of delivery of this

prospectus or of any sale of common stock. The rules of the SEC may

require us to update this prospectus in the future.

-i-

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained in this

prospectus. This summary does not contain all the information you

should consider before investing in the securities. Before making an

investment decision, you should read the entire prospectus carefully, including

the information set forth under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and

the financial statements and the notes to the financial statements included in

this prospectus.

As

used throughout this prospectus, the terms “BOPH”, “Company”, “we,” “us,” or

“our” refer to Bohai Pharmaceuticals Group, Inc., a Nevada corporation, together

with: (i) its wholly owned subsidiary, Chance High International Limited, a

British Virgin Islands company (“Chance High”); (ii) its indirect wholly foreign

owned subsidiary, Yantai Shencaojishi Pharmaceuticals Co., Ltd., a PRC company

(“WFOE”), and the WFOE’s variable interest entity, Yantai Bohai Pharmaceuticals

Group Co., Ltd., a PRC company (“Bohai”). In this prospectus, we

sometimes refer to BOPH, Chance High, WFOE and Bohai collectively as the

“Group.”

As

used in this prospectus, “China” or “the PRC” refers to the People’s Republic of

China.

Our

Company

We are

engaged in the production, manufacturing and distribution in China of herbal

pharmaceuticals based on traditional Chinese medicine, which we refer to herein

as Traditional Chinese Medicine or TCM. We are based in the city of

Yantai, Shandong Province, China and our operations are exclusively in

China.

Our

medicines address rheumatoid arthritis, viral infections, gynecological

diseases, cardio vascular issues and respiratory diseases. We

obtained Drug Approval Numbers for 29 varieties of traditional Chinese herbal

medicines in 2004 and currently produce 10 varieties of approved traditional

Chinese herbal medicines in seven delivery systems: tablets, granules, capsules,

syrup, concentrated powder, tincture and medicinal wine. Of these 10

products, 5 are prescription drugs and 5 are over the counter, or OTC,

products. In a significant development, on December 1, 2009, two of

our lead products, Tongbi Capsules and Tablets and Lung Nourishing Cream, became

eligible for reimbursement under China’s National Medical Insurance Program.

Background

and Key Events

We were

incorporated under the laws of the State of Nevada under the name Link Resources

Inc. on January 9, 2008. Our principal office was in Calgary,

Alberta, Canada. Prior to January 5, 2010, we were a public “shell”

company in the exploration stage since our formation and had not yet realized

any revenues. We entered into a Mineral Lease Agreement on April 1,

2008 for two mining claims in Pershing County, Nevada, in an area known as the

Goldbanks East Prospect. We terminated the lease on July 7,

2009.

Share

Exchange with Chance High

Pursuant

to the Share Exchange Agreement entered into on January 5, 2010 (the “Share

Exchange Agreement”), and related share exchange (the “Share Exchange”) by and

among us, Chance High, and the shareholders of Chance High (the “Chance High

Shareholders”), we acquired Chance High and its indirect, controlled subsidiary

Bohai, a Chinese company engaged the production, manufacturing and distribution

in China of herbal medicines, including capsules and other products, based on

Traditional Chinese Medicine. The closing of the Share Exchange (the

“Closing”) took place on January 5, 2010. As of the Closing, pursuant

to the terms of the Share Exchange Agreement, we acquired all of the outstanding

equity securities (the “Chance High Shares”) of Chance High from the Chance High

Shareholders, and the Chance High Shareholders transferred and contributed all

of their Chance High Shares to us. In exchange, we issued to Chance

High Shareholders an aggregate of 13,162,500 newly issued shares of our common

stock. Certain of the Chance High Shareholders are selling

stockholders hereunder.

1

In

addition, pursuant to the terms of the Share Exchange Agreement, Anthony

Zaradic, our former sole officer and director (“Zaradic”), cancelled a total of

1,500,000 shares of common stock owned by him. As a further condition

of the Share Exchange, effective as of January 5, 2010, Zaradic resigned from

all of his positions with our company and Hongwei Qu (“Qu”), the former

principal stockholder and Executive Director of Bohai, was appointed as our

President, Chief Executive Officer, Interim Chief Financial Officer, Treasurer

and Secretary and also, effective January 16, 2010, as our sole

director. In June 2010, Mr. Qu relinquished the positions of Interim

Chief Financial Officer, Treasurer and Secretary and we appointed Gene Hsiao as

our Chief Financial Officer. On July 12, 2010, we appointed three

independent directors to our board of directors.

January

5, 2010 Private Placement and Related Agreements

Securities Purchase

Agreement. On January 5, 2010, we entered into a Securities

Purchase Agreement (the “Securities Purchase Agreement”) with certain accredited

investors, who are selling stockholders hereunder (the “Investors”) and Euro

Pacific Capital, Inc. (“Euro Pacific”), as representative of the Investors,

relating to a private placement by us of 6,000,000 units consisting of Notes and

Warrants, which we refer to herein as the private placement. The

consummation of the private placement resulted in gross proceeds to us of

$12,000,000 and net proceeds of approximately $9,700,000. Each unit

consisted of a $2.00 principal amount, two year convertible Note and a three

year Warrant to purchase one share of our common stock at $2.40 per share,

subject to certain conditions. Euro Pacific acted as the lead

placement agent and Chardan Capital Markets, LLC acted as co-placement agent of

the private placement.

Registration Rights

Agreement. In connection with the private placement, we

entered into Registration Rights Agreement (the “Registration Rights Agreement”)

with the Investors which sets forth the rights of the Investors to have the

shares of common stock underlying the Notes and Warrants issued in the private

placement registered with the Securities and Exchange Commission (“SEC”) for

public resale. The filing of the registration statement of which this

prospectus is a part is intended to satisfy certain of our obligations the

Registration Rights Agreement.

Securities Escrow

Agreement. Also in connection with the private placement, we

entered into a Securities Escrow Agreement (the “Securities Escrow Agreement”)

with Euro Pacific, as representative of the Investors, our principal

stockholder, Glory Period Limited, a British Virgin Islands company that we

refer to herein as Glory Period and which was the majority shareholder of Chance

High prior to the Share Exchange, and Escrow, LLC, as escrow agent (the “Escrow

Agent”). Pursuant to the Securities Escrow Agreement, Glory Period

has pledged and deposited a stock certificate representing 1 million shares of

our common stock (the “Escrow Shares”) into escrow in order to provide security

to the Investors in the event of an occurrence of an event of default under the

Notes. Upon the earlier to occur of the full repayment of all amounts

due to the Investors under the Notes or the conversion of fifty percent of the

principal face value of Notes into shares of common stock, the Investors’ rights

in and to the Escrow Shares shall terminate. Glory Period is

controlled by Qu through certain contractual relationships described elsewhere

in this prospectus.

2

Closing Escrow Agreement.

Pursuant to a Closing Escrow Agreement (the “Closing Escrow Agreement”)

that we entered into in connection with the private placement on December 10,

2009, we placed a total of $240,000 of proceeds from the private placement (the

“Holdback Amount”) with the Escrow Agent. The Holdback Amount

represents an amount sufficient to satisfy the payment to the Investors of one

quarterly interest payment due on the aggregate principal amount of all Notes

issued in the private placement. If, subject to certain conditions

and after applicable notice and cure periods, an event of default is declared by

Euro Pacific with respect to our failure to make a quarterly interest payment to

Investors, the Escrow Agent shall disburse such portion of the Holdback Amount

to the Investors, and we shall be obligated to deposit additional amounts equal

to the Holdback Amount with Escrow Agent. At such time as

seventy-five percent of the aggregate shares of common stock underlying the

Notes have been issued upon conversion of the Notes, all remaining funds of the

Holdback Amount shall promptly be disbursed to us.

Corporate

Name Change

On January 29, 2010, we entered into an

Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which we

merged with a newly formed, wholly owned subsidiary called Bohai Pharmaceuticals

Group, Inc., a Nevada corporation (“Merger Sub” and such merger transaction, the

“Merger”). Upon the consummation of the Merger, the separate

existence of Merger Sub ceased and our stockholders became stockholders of the

surviving company named Bohai Pharmaceuticals Group, Inc. As

permitted by Chapter 92A.180 of Nevada Revised Statutes, the sole purpose of the

Merger was to effect a change of our corporate name.

Change

of Our Independent Registered Accounting Firm

Effective

January 29, 2010, upon the approval of our board of directors, we dismissed John

Kinross-Kennedy as our independent registered public accountant and appointed

Parker Randall CF (H.K.) CPA Limited as our independent registered public

accounting firm

Corporate

Structure and Related Agreements

Our post

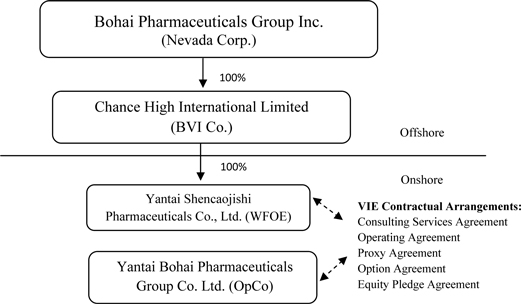

Share Exchange organization structure is summarized below:

3

Chance

High owns 100% of the issued and outstanding capital stock of the

WFOE. On December 7, 2009, the WFOE entered into a series of variable

interest entity contractual agreements (the “VIE Agreements”) with Bohai and its

three shareholders, which include Qu (our Chairman, President and Chief

Executive Officer, who owns 90% of Bohai’s shares) and two unaffiliated

parties. Pursuant to the VIE Agreements, WFOE does not directly own

the equity of our operating subsidiary, but rather effectively assumed

management of the business activities of Bohai and has the right to appoint all

executives and senior management and the members of the board of directors of

Bohai. The VIE Agreements are comprised of a series of agreements,

including a Consulting Services Agreement, Operating Agreement and Proxy

Agreement, through which WFOE has the right to advise, consult, manage and

operate Bohai for an annual fee in the amount of Bohai’s yearly net profits

after tax. Additionally, Bohai’s shareholders have pledged their

rights, titles and equity interest in Bohai as security for WFOE to collect

consulting and services fees provided to Bohai through an Equity Pledge

Agreement. In order to further reinforce WFOE’s rights to control and

operate Bohai, Bohai’s shareholders granted WFOE an exclusive right and option

to acquire all of their equity interests in Bohai through an Option

Agreement.

In

addition, on December 7, 2009, Mr. Qu entered into a call option agreement (the

“Call Option Agreement”) with Joshua Tan (“Tan”), the sole shareholder of Glory

Period. The Call Option Agreement became effective upon the closing

of the Share Exchange. Under the Call Option Agreement, Tan shall

transfer up to 100% shares of Glory Period within the next 3 years to Qu for

nominal consideration, which would give Qu indirect ownership of a significant

percentage of our common stock. The Call Option Agreement provides

that Tan shall not dispose any of the shares of Glory Period without Qu’s prior

written consent.

Following

the consummation of the Share Exchange, Glory Period holds 55% of the issued and

outstanding shares of our common stock (not taking into consideration the shares

of common stock underlying the Notes and Warrants issued in the private

placement). The shares of our common stock held by Glory Period are

not being offered for resale pursuant to this prospectus.

Executive

Offices

Our

executive office is located at No. 9 Daxin Road, Zhifu District, Yantai,

Shandong Province, P.R. China 264000. Our telephone number is

+86(535)-685-7928.

4

THE

OFFERING

|

Common

stock outstanding before the offering

|

16,500,000

|

|

|

Common

stock offered by selling stockholders

|

Up

to 20,322,529 shares of common stock held by the selling stockholders or

underlying securities held by the selling stockholders.

|

|

|

Common

stock to be outstanding after the offering

|

Up

to 28,850,000 shares, assuming full conversion or exercise of the Notes,

Warrants and Placement Agent Warrants.

|

|

|

OTBCC

Symbol

|

BOPH. No

active market for our common stock presently exists.

|

|

|

Use

of proceeds

|

We

will not receive any proceeds from the sale of the common stock offered

hereby. However, we may receive up to a maximum of $15.84

million of proceeds from the exercise of the warrants held by certain

selling stockholders, which proceeds we would expect to use for general

working capital. No assurances can be given, however, that all

or any portion of such warrants will ever be

exercised.

|

5

RISK

FACTORS

Our

business, operations and financial condition are subject to various significant

risks. Some of these risks are described below and you should take

these risks into account in making a decision to invest in our common

stock. If any of the following risks actually accurs, we may not be

able to conduct our business as currently planned and our financial condition

and operating results could be seriously harmed. In that case, the

market price of our common stock could decline and you could lose all or part of

your investment in our common stock.

Risks

Related to Our Business

Our

limited operating history may not serve as an adequate basis to judge our future

prospects and results of operations.

Our

limited operating history in the traditional Chinese herbal medicines industry

may not provide a meaningful basis for evaluating our business. Bohai

entered into its current line of business in September 2004. Although Bohai’s

revenues have grown rapidly since its inception, we cannot guarantee that we

will maintain profitability or that we will not incur net losses in the

future. We will continue to encounter risks and difficulties that

companies at a similar stage of development frequently experience, including the

potential failure to:

|

|

·

|

obtain

sufficient working capital to support our

expansion;

|

|

|

·

|

maintain

or protect our intellectual

property;

|

|

|

·

|

maintain

our proprietary technology;

|

|

|

·

|

expand

our product offerings and maintain the quality of our

products;

|

|

|

·

|

manage

our expanding operations and continue to fill customers’ orders on

time;

|

|

|

·

|

maintain

adequate control of our expenses allowing us to realize anticipated

revenue growth;

|

|

|

·

|

implement

our product development, marketing, sales and acquisition strategies and

adapt and modify them as

needed;

|

|

|

·

|

integrate

any future acquisitions; and

|

|

|

·

|

anticipate

and adapt to changing conditions in the Chinese herbal medicines industry

resulting from changes in government regulations, mergers and acquisitions

involving our competitors, technological developments and other

significant competitive and market

dynamics.

|

If we are

unable to address any or all of the foregoing risks, our business may be

materially and adversely affected.

6

We

will likely need to raise additional funds in the future to grow our business,

which funds may not be available on acceptable terms or at all, and, without

additional funds, we may not be able to maintain or expand our

business.

We expect

that the net proceeds from our January 2010 private placement, together with

cash generated from our operations, will be sufficient to fund our projected

operations for at least the next 12 months. It is likely however that

in the future we will require substantial funds in order to fund operating

expenses and growth plans to develop manufacturing, marketing and sales

capabilities and to cover public company costs. Without enough funds,

we may not be able to meet these goals. We may seek additional

funding through public or private financing or through collaborative

arrangements with strategic partners.

You

should also be aware that in the future:

|

|

·

|

We

cannot be certain that additional capital will be available on favorable

terms, if at all;

|

|

|

·

|

Any

available additional financing may not be adequate to meet our goals;

and

|

|

|

·

|

Any

equity financing would result in dilution to our

stockholders.

|

If we

cannot raise additional funds when needed, or on acceptable terms, we may not be

able to effectively execute our growth strategy, take advantage of future

opportunities, or respond to competitive pressures or unanticipated

requirements. In addition, we may be required to scale back or

discontinue our production and development program, or obtain funds through

strategic alliances that may require us to relinquish certain

rights.

We

have significant short-term debt obligations, which mature in less than one

year. Our inability to extend the maturities of, or to refinance,

this debt could result in defaults, and in certain instances, foreclosures on

our assets. Moreover, we may be unable to obtain financing to fund

ongoing operations and future growth.

We

currently depend on short-term bank loans and net revenues to meet our

short-term cash requirements. As of March 31, 2010, our total bank

debt outstanding was $4.38 million which carries maturity periods ranging from

six months to one year, while the short-term and revolving nature of these

credit facilities is common in China. The majority of this debt is

guaranteed by third-parties and our CEO, Mr. Qu, and a portion is secured by our

inventories and fixed assets. In China, short-term bank loans

generally mature in one year or less and contain no specific renewal

terms. However, it is customary practice for banks and borrowers to

negotiate roll-overs or renewals of short-term borrowings on an on-going basis

shortly before they mature. Although we have renewed our short-term

borrowings in the past, we cannot assure you that we will be able to renew these

loans in the future as they mature. If we are unable to obtain

renewals of these loans or sufficient alternative funding on reasonable terms

from banks or other parties, we will have to repay these borrowings with the

cash on our balance sheet or cash generated by our future operations, if

any.

Moreover,

we cannot assure you that our business will generate sufficient cash flow from

operations to repay these borrowings. Failure to obtain extensions of

the maturity dates of, or to refinance, these obligations or to obtain

additional equity financing to meet these debt obligations would result in an

event of default with respect to such obligations and could result in the

foreclosure on the collateral. The sale of such collateral at

foreclosure would significantly disrupt our ability to produce products for our

customers in the quantities required by customer orders or deliver products in a

timely fashion, which could significantly lower our revenues and

profitability.

7

In

addition, we may be exposed to changes in interest rates. If interest

rates increase substantially, our results of operations could be adversely

affected.

We

have not yet developed comprehensive independent corporate governance.

As of the

date of this prospectus, we have no audit, compensation, or nominating

committees of our board of directors and have not established formal corporate

governance procedures. A lack of independent controls over our

corporate affairs may result in potential or actual conflicts of interest

between Mr. Qu and our stockholders. We presently have no policy to

resolve such conflicts. The absence of customary standards of

corporate governance may leave our stockholders without protections against

interested director transactions, conflicts of interest, if any, and similar

matters and any potential investors may be reluctant to provide us with funds

necessary to expand our operations.

We

have been heavily dependent on sales of four key products.

Four of

our products, namely Tongbi Capsules, Tongbi Tablets, Lung Nourishing Cream and

Tongshangning Tablets represented approximately 22%, 16%, 26%, and 15%,

respectively, of total sales for the fiscal year ended June 30,

2009. We expect that a significant portion of our future revenue will

continue to be derived from sales of these four products. If one or

more of these products were to become subject to a problem such as loss of

Certificates of Protected Variety of Traditional Chinese Medicine, unexpected

side effects, regulatory proceedings, publicity adversely affecting user

confidence or pressure from competing products, or if a new, more effective

treatment should be introduced, the negative impact on our revenues could be

significant. We held the Certificates of Protected Variety of

Traditional Chinese Medicine (Grade Two) issued by State Food and Drug

Administration of China (“SFDA”) for Tongbi Capsules and Shangtongning Tablets

which gave exclusive or near-exclusive rights to manufacture and distribute

these two medicines. These certificates expired in September 2009 and

we have filed an application for extending the protection period on March 12,

2009 for Tongbi Capsules. We can not assure you that we will obtain

the approvals to renew the Certificate of Protected Variety of Traditional

Chinese Medicine and the loss of such protection will have a material adverse

effect on our revenues. If we are unable to obtain approvals, these

products can be manufactured and sold by other pharmaceutical manufacturers in

China once the relevant protection periods elapse, which would increase our

competition and potentially have an adverse effect on our sales.

We

may not be able to adequately protect our intellectual property, which could

cause us to be less competitive and negatively impact our business.

We regard

our trademarks, trade secrets, patents and similar intellectual property as

critical to our success. We hold the trademark “Xian Ge” registered

with the PRC Trademark Bureau under the State Administration for Industry and

Commerce with a valid term effective through February 23, 2013. We

have received a patent in the PRC for lung nourishing cream with its production

method for the treatment of Lung-qi Deficiency Cough and Chronic

Bronchitis. If we are unable to obtain or maintain registered

intellectual property protections for our proprietary products or methods, these

products or methods could be infringed upon, which could materially adversely

affect our business.

We rely

on trademark, patent and trade secret law, as well as confidentiality agreement

with certain of our employees to protect our proprietary rights. For

senior managers, we include a standard confidentiality clause into the

employment agreement to prevent them from disclosing the formula or processing

procedure to outside parties. No assurance can be given that our intellectual

property will not be challenged, invalidated, infringed or circumvented, or that

our intellectual property rights will provide competitive advantages to

us. Any material impairment of our intellectual property rights could

have a material adverse effect on our business.

8

The

availability of counterfeit versions of our products could adversely affect our

sales volume, revenue and profitability and brand value.

The

availability of sales of counterfeits of our products in China could adversely

impact our sales and potentially damage the value and reputation of our

brands. For example, we recently discovered evidence of a counterfeit

Tongbi Capsule sold in China which we believe infringes on our intellectual

property rights. We have addressed this situation with applicable PRC

authorities and do not believe it will adversely effect our company, but similar

situations may arise in the future which could adversely impact our sales,

profitability and brand value. Additionally, consumers who mistake

counterfeit Tongbi Capsules or counterfeits of our other products for our

products may attribute quality and efficacy deficiencies in the counterfeit

product to our brands and discontinue purchasing our brands, which would have an

adverse effect on our sales and profitability.

We

face competition in the pharmaceutical market in the PRC and such competition

could cause our sales revenue and profits to decline.

According

to SFDA in China, there were approximately 5,071 pharmaceutical manufacturing

companies in the PRC as of the end of June 2004, of which approximately 3,237

manufacturers obtained certificates of Good Manufacturing Practices

Certification (“GMP”). After GMP certification became a mandatory

requirement on July 1, 2004, approximately 1,834 pharmaceutical manufacturers

were forced to cease production. Only the 3,237 pharmaceutical

manufacturers with GMP certifications may continue their manufacturing

operations. As of the end of 2006, there were 4,682 enterprises

manufacturing medicines and formulation in China. The certificates,

permits, and licenses required for pharmaceutical operation in the PRC create a

potentially significant barrier for new competitors seeking entrance into the

market. Despite these obstacles, we face competitors that will

attempt to create, or are already marketing, products in the PRC that are

similar to ours. Many of our current and potential competitors have

significantly longer operating histories and significantly greater managerial,

financial, marketing, technical and other competitive resources, as well as

greater name recognition, than we do. These competitors may be able

to respond more quickly to new or changing opportunities and customer

requirements and may be able to undertake more extensive promotional activities,

offer more attractive terms to customers or adopt more aggressive pricing

policies. We cannot assure you that we will be able to compete

effectively with current or future competitors or that the competitive pressures

we face will not harm our business.

Our

business depends and will depend substantially on the continuing efforts of our

present and future executive officers, and our business may be severely

disrupted if we lose, are unable to obtain or unable to replace their

services.

Our

future prospects depend substantially on the continued services of our

President, Chief Executive Officer and Chairman of the Board, Mr.

Qu. We have no employment agreement with Mr. Qu and do not maintain

key man life insurance on Mr. Qu’s life. We also have other corporate

officers and key employees, and if Mr. Qu or one or more of our future executive

officers or key employees are unable or unwilling to continue in their

positions, we may not be able to replace them readily, if at

all. Therefore, our business may be severely disrupted, and we may

incur additional expenses to recruit and retain new officers. In

addition, if any of our executives joins a competitor or forms a competing

company, we may lose some of our customers.

9

Our

business and growth will suffer if we are unable to hire and retain key

personnel that are in high demand.

Our

future performance depends on our ability to attract and retain highly skilled

chemists, pharmaceutical engineers, technical, marketing and sales personnel,

especially qualified personnel for our operations in China. Qualified

individuals are in high demand in China, and there are insufficient experienced

personnel to fill the demand. Therefore, we may not be able to

attract or retain the personnel we need to succeed. Our business

development would be hindered if we lost the services of some key

personnel.

Our

business is highly dependent on continually developing or acquiring new and

advanced products, technologies, and processes and failure to do so may cause us

to lose our competitiveness in the pharmaceutical industry and may cause our

profits to decline.

To remain

competitive in the pharmaceutical industry, it is important to continually

develop new and advanced products, technologies and processes. There

is no assurance that our competitors’ new products, technologies and processes

will not render our company’s existing products obsolete or

non-competitive. Our company’s competitiveness in the pharmaceutical

market therefore relies upon our ability to enhance our current products,

introduce new products, and develop and implement new technologies and

processes. Our company’s failure to technologically evolve and/or

develop new or enhanced products may cause us to lose our competitiveness in the

pharmaceutical industry and may cause our profits to decline. It is

likely that our efforts to grow our products lines will be focused on

acquisitions of such products from third parties. There are many

risks attendant to the acquisition of assets or companies, including

availability, pricing, competition and, if acquisitions are consummate,

integration. If we are unable to so acquire and integrate new

products, our revenue and profitability may suffer.

Our

research and development may be costly and/or untimely, and there are no

assurances that our research and development will either be successful or

completed within the anticipated timeframe, if ever at all.

We do not

presently rely on research and development activities as our business is focused

on expanding sales of our existing products. However, in the future,

the research and development of new products may play an important role for our

company. Development of new products requires significant research,

development and clinical testing efforts, and we currently have limited

resources to devote to and limited capabilities to conduct the development of

new products. We have only one full-time employee who is engaged in

research and development, so we mainly dependent on a third-party, Yantai

Tianzheng Medicine Research and Development Co., Ltd., to perform the limited

amount of research and development that we undertake. If research and

development activities become more important for us, and if we or third parties

that we retain are unable to perform research and development successfully, our

business and results of operations could be negatively impacted.

As of the

date of this prospectus, we have two products, namely Forsythia Capsule and Fern

Injection, under research and development. The research and

development of new products is costly and time consuming, and there are no

assurances that our research and development of new products will either be

successful or completed within the anticipated time frame, if ever at

all. There are also no assurances that if the product is developed,

that it will lead to actual commercialization and sales.

10

The

commercial performance of our products depends upon the degree of market

acceptance among the medical community and failure to attain market acceptance

among the medical community may have an adverse impact on our operations and

profitability.

The

commercial performance of our products depends upon the degree of market

acceptance among the medical community, such as hospitals and

physicians. Even if our products are approved by SFDA, and even if

our products are authorized to be eligible for reimbursement under Chinese

national medical insurance programs, there is no assurance that physicians will

prescribe or recommend our products to patients. Furthermore, a

product’s prevalence and use at hospitals may be contingent upon our

relationship with the medical community. The acceptance of our

products among the medical community may depend upon several factors, including

but not limited to, the product’s acceptance by physicians and patients as a

safe and effective treatment, cost effectiveness, potential advantages over

alternative treatments, and the prevalence and severity of side

effects. Failure to attain market acceptance among the medical

community may have an adverse impact on our operations and

profitability.

We

may not be able to obtain the regulatory approvals or clearances that are

necessary to commercialize our products.

The PRC

and other countries impose significant statutory and regulatory obligations upon

the manufacture and sale of pharmaceutical products. Each regulatory

authority typically has a lengthy approval process in which it examines

pre-clinical and clinical data and the facilities in which the product is

manufactured. Regulatory submissions must meet complex criteria to

demonstrate the safety and efficacy of the ultimate products. Addressing these

criteria requires considerable data collection, verification and analysis. We

may spend time and money preparing regulatory submissions or applications

without assurances as to whether they will be approved on a timely basis or at

all.

Our

product candidates, some of which are currently in the early stages of

development, will require significant additional development and pre-clinical

and clinical testing prior to their commercialization. These steps and the

process of obtaining required approvals and clearances can be costly and

time-consuming. If our potential products are not successfully developed, cannot

be proven to be safe and effective through clinical trials, or do not receive

applicable regulatory approvals and clearances, or if there are delays in the

process:

|

|

·

|

the

commercialization of our products could be adversely

affected;

|

|

|

·

|

any

competitive advantages of the products could be diminished;

and

|

|

|

·

|

revenues

or collaborative milestones from the products could be reduced or

delayed.

|

Governmental

and regulatory authorities may approve a product candidate for fewer indications

or narrower circumstances than requested or may condition approval on the

performance of post-marketing studies for a product candidate. Even if a product

receives regulatory approval and clearance, it may later exhibit adverse side

effects that limit or prevent its widespread use or that would force us to

withdraw the product from the market.

Any

marketed product and its manufacturer will continue to be subject to strict

regulation after approval. Results of post-marketing programs may limit or

expand the further marketing of products. Unforeseen problems with an approved

product or any violation of regulations could result in restrictions on the

product, including its withdrawal from the market and possible civil

actions.

11

In

manufacturing our products we will be required to comply with applicable good

manufacturing practices regulations, which include requirements relating to

quality control and quality assurance, as well as the maintenance of records and

documentation. If we cannot comply with regulatory requirements, including

applicable good manufacturing practice requirements, we may not be allowed to

develop or market the product candidates. If we or our manufacturers fail to

comply with applicable regulatory requirements at any stage during the

regulatory process, we may be subject to sanctions, including fines, product

recalls or seizures, injunctions, refusal of regulatory agencies to review

pending market approval applications or supplements to approve applications,

total or partial suspension of production, civil penalties, withdrawals of

previously approved marketing applications and criminal

prosecution.

Our

current and future products may have inadvertent and/or harmful side effects

which would expose us to the risks of litigation and a loss of

revenue.

All

medicines have certain side effects. Although all of our medicines

sold on market have passed proper testing and are approved by SFDA, the products

may still inadvertently adverse effects on the health of the consumers. If such

side effect is identified after marketing and sale of the products, the products

may be required to be withdrawn from the market, or have a change in labeling.

If a product liability claim is brought against us, it may, regardless of merit

or eventual outcome, result in damage to our reputation, breach of contracts

with consumers, decreased demand for our products, costly litigation and loss of

revenue.

Natural

disasters, weather conditions and other environmental factors affect our raw

material supply, and a reduction in the quality or quantity of our herb supplies

may have material adverse consequences on our financial results.

Our

business may be adversely affected by weather and environmental factors beyond

our control, such as natural disasters and adverse weather

conditions. The production of our products depends on the

availability of raw materials, a significant portion of which are herbs.

These herbs tend to be very sensitive crops, which can be readily damaged

by harsh weather, by disease, and by pests. If our suppliers’ crops are

destroyed by drought, flood, storm, blight, or the other woes of farming, we

will not be able to meet the demands of our customers, which will have a

material adverse effect on our business and financial condition and results.

Our

certificates, permits, and license are subject to governmental control and

renewal, and the failure to obtain renewal would cause all or part of our

operation to be suspended and have a material adverse effect on our financial

condition.

We are

subject to various PRC laws and regulations pertaining to the pharmaceutical

industry. We have obtained certain certificates, permits, and

licenses required for the operation of a pharmaceutical enterprise and the

manufacturing and distribution of pharmaceutical products in the

PRC. Some of the permits and license have expired or are about to

expire. We hold a Permit for the Production of Medicine (Lu

Zb20050330) issued by Shandong Branch of SFDA on January 1, 2006 which allows us

to engage in the production of tablets, capsules, granules, syrup, concentrated

decoctions, tincture (for oral use) and medical wine. Such permit

expires on December 31, 2010 and is material to our business. We also

hold a GMP Certificate (No. Lu K0587) issued by Shandong Branch of SFDA on June

18, 2009, the scope of inspection of which is tablets, capsules, granules,

syrup, concentrated decoctions, tincture and medical wine. Such

certificate expires on June, 14, 2014. The Permit for the Production

of Medicine and GMP certificates are each valid for a term of five years and

must be renewed before their expiration.

12

We hold a

Drug Approval Number (“DAN”) for each of our products, and the valid terms of

such DANs have expired. We submitted the applications for

re-registration on June 29, 2007 which were accepted by SFDA, although the

approvals have not yet been granted. We have been advised that the

approval processes for these drugs have been started to be reviewed by the

Shandong Branch of SFDA. During the renewal period, we will be

permitted to continue manufacturing these drugs as if the renewals had been

approved. Our license to produce medical wine has a term valid

through December 31, 2010.

During

the application or renewal process for our licenses and permits, we will be

evaluated and re-evaluated by the appropriate governmental authorities and must

comply with the prevailing standards and regulations, which may change from time

to time. In the event that we are not able to obtain or renew

the certificates, permits and licenses, all or part of our operations may be

suspended by the government, which would have a material adverse effect on our

business and financial condition. Furthermore, if escalating

compliance costs associated with governmental standards and regulations restrict

or prohibit any part of our operations, it may adversely affect our results of

operations and profitability.

We held

the Certificates of Protected Variety of Traditional Chinese Medicine (Grade

Two) (the “Certificate of Protection”) issued by SFDA for two of our products,

Tongbi Capsules and Shangtongning Tablets. The protection periods for

both Tongbi Capsules and Shangtongning Tablets expired in September

2009. We have submitted application to extend the protection periods

for Tongbi Capsules to extend such protection period on March 12, 2009 and SFDA

has recently started its review process. We have decided not to

submit extension application of Shangtongning Tablets, because the SFDA will not

approve a Certificate of Protection for Shangtongning Tablets or any other

products that are currently produced by more than three manufacturers in China

according to applicable Chinese SFDA regulations. Our inability to regain the

Certificate of Protection for Tongbi Capsules, which is one of our leading

products, and the loss of the Certificate of Protection for our product

Shangttongning Tablets, may grant other manufactures the right to produce

similar products, which would result in the loss of competitive advantage and

could adversely impact our sales results.

Our

failure to fully comply with PRC labor laws, including laws relating to social

insurance, may expose us to potential liability and increased

costs.

Companies

operating in China must comply with a variety of labor laws, including certain

pension, health insurance, unemployment insurance and other welfare-oriented

payment obligations. Our failure to comply with these laws could have

a material adverse effect on our business. For example, we are

currently paying social insurance for our 105 full-time employees. We also

have 304 sales representatives that we believe we are not required to pay social

insurance for as these sales representatives are not legally employees of ours,

but are rather independent contractors. We have not paid social insurance

for 195 of our full-time employees whose personal identification files cannot be

transferred to us since they are not registered residents in Yantai, Shandong

Province, and as an alternative we have paid these employees compensations

included in their monthly salary with an amount equals to the amount of monthly

social insurance that we are required to pay and the employees could pay the

social insurance by themselves. We believe these employees have been

covered by social insurance and we are not required to make any contributions to

the government in addition to the amount we have paid to these

employees. However, our interpretation of these requirements may be

wrong, and the PRC regulatory authorities may not take the same view as we do on

this subject. If the PRC regulatory authorities take the view that we are

required to pay social insurance for our independent contractors or other

employees, our failure to make previous payments may be in violation of

applicable PRC labor laws and we cannot assure you that PRC governmental

authorities will not impose penalties on us for failure to comply. In

addition, in the event that any current or former employee files a complaint

with the PRC government, we may be subject to making up the social insurance

payment obligations as well as paying administrative fines. The total cost

of these payments and any related fines or penalties could be very significant

and could have a material adverse effect on our working

capital.

13

In

addition, the new PRC Labor Contract Law took effect January 1, 2008 and governs

standard terms and conditions for employment, including termination and lay-off

rights, contract requirements, compensation levels and consultation with labor

unions, among other topics. In addition, the law limits

non-competition agreements with senior management and other employees who have

access to confidential information to two years and imposes restrictions or

geographical limits. This new labor contract law will increase our

labor costs, which could adversely impact our results of

operations.

We

are subject to PRC government price control of drugs which may limit our

profitability and even cause us to stop manufacturing certain

products.

The State

Development and Reform Commission of the PRC (“SDRC”) and the price

administration bureaus of the relevant provinces of the PRC in which the

pharmaceutical products are manufactured are responsible for the retail price

control over our pharmaceutical products. The SDRC sets the price

ceilings for certain pharmaceutical products in the PRC. All of our products

except those under the protection periods are subject to such price controls as

of the date of this Memorandum and we prices our medicines well under

government-mandated caps. There is no assurance that whether our other products

will remain unaffected by the price control. Where our products are

subject to a price ceiling, we will need to adjust the product price to meet the

requirement and to accommodate for the pricing of competitors in the competition

for market shares. The price ceilings set by the SDRC may limit our

profitability, and in some instances, such as where the price ceiling is below

production costs, may cause us to stop manufacturing certain products which may

adversely affect our results of operations.

Because

we may not be able to obtain business insurance in the PRC, we may not be

protected from risks that are customarily covered by insurance in the United

States.

Business

insurance is not readily available in the PRC. To the extent that we

suffer a loss of a type which would normally be covered by insurance in the

United States, such as product liability and general liability insurance, we

would incur significant expenses in both defending any action and in paying any

claims that result from a settlement or judgment. We have not

obtained fire, casualty and theft insurance, and there is no insurance coverage

for our raw materials, goods and merchandise, furniture and buildings in

China. Any losses incurred by us will have to be borne by us without

any assistance, and we may not have sufficient capital to cover material damage

to, or the loss of, our production facility due to fire, severe weather, flood

or other cause, and such damage or loss would have a material adverse effect on

our financial condition, business and prospects.

We

may be subject to product liability claims, for which we have no

insurance.

We may

produce products which inadvertently have an adverse pharmaceutical effect on

the health of individuals. Existing laws and regulations in China do not

require us to maintain third party liability insurance to cover product

liability claims. However, if a product liability claim is brought against

us, it may, regardless of merit or eventual outcome, result in damage to our

reputation, breach of contracts with our customers, decreased demand for our

products, costly litigations, product recalls, loss of revenue, and our

inability to commercialize some products.

14

Our

indemnification obligations could adversely affect our business, financial

condition and results of operations.

Our

governing documents require us to indemnify our current and former directors,

officers, employees and agents against most actions of a civil, criminal,

administrative or investigative nature. Generally, we are required to

advance indemnification expenses prior to any final adjudication of an

individual’s culpability. The expense of indemnifying our current and

former directors, officers and employees and agents in their defense or related

expenses as a result of any actions related to the internal investigation and

financial restatement may be significant and in excess of any insurance coverage

we may have. As such, there is a risk that our indemnification

obligations could divert needed financial resources and may adversely affect our

business, financial condition and results of operations.

Potential

environmental liability could have a material adverse effect on our operations

and financial condition.

As a

manufacturer, we are subject to various Chinese environmental laws and

regulations on air emission, waste water discharge, solid wastes and

noise. We are in the process of applying for Pollution Discharge

Permit, other than that we believe that our operations are in substantial

compliance with current environmental laws and regulations. We can not assure

you that we may not be able to comply with these regulations at all times as the

Chinese environmental legal regime is evolving and becoming more

stringent. Therefore, if the Chinese government imposes more

stringent regulations in future, we may have to incur additional and potentially

substantial costs and expenses in order to comply with new regulations, which

may negatively affect our results of operations. Furthermore, no

assurance can be given that all potential environmental liabilities have been

identified or properly quantified or that any prior owner, operator, or tenant

has not created an environmental condition unknown to us. If we fail

to comply with any of the present or future environmental regulations in any

material aspects, we may suffer from negative publicity and be subject to claims

for damages that may require us to pay substantial fines or have our operations

suspended or even be forced to cease operations.

Risks

Relating to the Our Corporate Structure

Our

corporate structure, in particular the VIE Agreements, are subject to

significant risks, as set forth in the following risk factors.

The

PRC government may determine that the VIE Agreements which we utilize to control

our operating subsidiary are not in compliance with applicable PRC laws, rules

and regulations and that they are therefore unenforceable.

In the

PRC it is widely understood that foreign invested enterprises are forbidden or

restricted to engage in certain businesses or industries which are sensitive to

the economy. As we intend to centralize our management and operation

in the PRC without being restricted to conduct certain business activities which

are important for our current or future business but are restricted or might be

restricted in the future, we believe our VIE Agreements will be essential for

our business operation. In order for WFOE to manage and operate our

business through Bohai in the PRC, the VIE Agreements were entered into under

which almost all the business activities of Bohai are managed and operated by

WFOE and almost all economic benefits and risks arising from the business of

Bohai are transferred to WFOE.

There are

risks involved with the operation of Bohai under the VIE

Agreements. We have been advised by PRC legal counsel that if the PRC

government determines the VIE Agreement used to control the operating company to

be unenforceable as they circumvent the PRC restrictions relating to foreign

investment restrictions, the relevant regulatory authorities would have broad

discretion in dealing with such breach, including:

15

|

|

·

|

imposing

economic penalties;

|

|

|

·

|

discontinuing

or restricting the operations of WFOE or

Bohai;

|

|

|

·

|

imposing

conditions or requirements in respect of the VIE Agreements with which

WFOE may not be able to comply;

|

|

|

·

|

requiring

us to restructure the relevant ownership structure or

operations;

|

|

|

·

|

taking

other regulatory or enforcement actions that could adversely affect our

business; and

|

|

|

·

|

revoking

the business license and/or the licenses or certificates of WFOE, and/or

voiding the VIE Agreements.

|

Any of

these actions could have a material adverse impact on our business, financial

condition and results of operations.

We

depend upon the VIE Agreements in conducting our production, manufacturing and

distribution of traditional Chinese herbal medicines in the PRC, which may not

be as effective as direct ownership.

We

conduct our production, manufacturing and distribution of traditional Chinese

herbal medicines in the PRC and generate the revenues through the VIE

Agreements. The VIE Agreements may not be as effective in providing

us with control over Bohai as direct ownership. The VIE Agreements

are governed by PRC laws and provide for the resolution of disputes through

arbitration proceedings pursuant to PRC laws. Accordingly, the VIE

Agreements will be interpreted in accordance with PRC laws. If Bohai

or its shareholders fail to perform the obligations under the VIE Agreements, we

may have to rely on legal remedies under PRC laws, including seeking specific

performance or injunctive relief, and claiming damages, and there is a risk that

we may be unable to obtain these remedies. The legal environment in

China is not as developed as in other jurisdictions. As a result,

uncertainties in the PRC legal system could limit our ability to enforce the VIE

Agreements.

The

pricing arrangement under the VIE Agreements may be challenged by the PRC tax

authorities.

We could

face adverse tax consequences if the PRC tax authorities determine that the VIE

Agreements were not entered into based on arm’s length

negotiations. If the PRC tax authorities determine that the VIE

Agreements were not entered into on an arm’s length basis, they may adjust the

income and expenses of our company for PRC tax purposes which could result in

higher tax liability.

We

rely on the approval certificates and business license held by Bohai and any

deterioration of the relationship between WFOE and Bohai could materially and

adversely affect the overall business operation of our company.

Pursuant

to the VIE Agreements, our production, manufacturing and distribution of

traditional Chinese herbal medicines in China is undertaken on the basis of the

approvals, certificates and business license as well as other requisite licenses

held by Bohai. There is no assurance that Bohai will be able to renew

its licenses or certificates when their terms expire with substantially similar

terms as the ones they currently hold.

16

Further,

our relationship with Bohai is governed by the VIE Agreements, which are

intended to provide us, through our indirect ownership of WFOE, with effective

control over the business operations of Bohai. However, the VIE

Agreements may not be effective in providing control over the applications for

and maintenance of the licenses required for our business

operations. Bohai could violate the VIE Agreements, go bankrupt,

suffer from difficulties in its business or otherwise become unable to perform

its obligations under the VIE Agreements and, as a result, our operations,

reputation, business and stock price could be severely harmed.

If

WFOE exercises the purchase options over Bohai’s equity pursuant to the VIE

Agreements, the payment of purchase prices could materially and adversely affect

the financial position of our company.

Under the

VIE Agreements, WFOE holds an option to purchase all or a portion of the equity

of Bohai at a price, pro rata in case of not all, based on the capital paid in

by the Bohai shareholders (namely, $2.94 million or RMB 20 million

). In the case that applicable PRC laws and regulations require an

appraisal of the equity interest or provide other restriction on the purchase

price, the purchase price shall be the lowest price permitted under the

applicable PRC laws and regulations. As Bohai is already a contractually

controlled affiliate to our company, WFOE’s purchase of Bohai’s equity would not

bring immediate benefits to our company and the exercise of the option and

payment of the purchase prices could adversely affect the financial position of

our company.

Risks

Associated With Doing Business in China

There

are substantial risks associated with doing business in China, some of which are

addressed in the following risk factors.

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

We are

dependent on our relationship with the local government in the province in which

we operate our business. The Chinese government has exercised and

continues to exercise substantial control over virtually every sector of the

Chinese economy through regulation and state ownership. Our ability

to operate in China may be harmed by changes in its laws and regulations,

including those relating to taxation, environmental regulations, land use

rights, property and other matters. The central or local governments

of in the PRC jurisdictions may impose new, stricter regulations or

interpretations of existing regulations that would require additional

expenditures and efforts on our part to ensure our compliance with such

regulations or interpretations. Accordingly, government actions in

the future, including any decision not to continue to support recent economic

reforms and to return to a more centrally planned economy or regional or local

variations in the implementation of economic policies, could have a significant

effect on economic conditions in China or particular regions thereof, and could

require us to divest ourselves of any interest we then hold in Chinese

properties.

Future

inflation in China may inhibit our ability to conduct business in China. In

recent years, the Chinese economy has experienced periods of rapid expansion and

high rates of inflation. Rapid economic growth can lead to growth in