Attached files

| file | filename |

|---|---|

| 8-K - ENDO PHARMACEUTICALS HOLDINGS INC. - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d8k.htm |

grow.

collaborate. innovate. thrive.

ENDO PHARMACEUTICALS

Bank of America Merrill Lynch Specialty Pharmaceuticals Conference

August 12, 2010

Exhibit 99.1 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

FORWARD LOOKING STATEMENT

2

This presentation contains forward-looking statements regarding, among other things, the proposed

business combination between Endo and Penwest, Endo’s and Penwest's financial position,

results of operations, market position, product development and business strategy, as well as

estimates of Endo’s future total revenues, future expenses, future net income and future earnings per

share. Statements including words such as “believes,” “expects,”

“anticipates,” “intends,” “estimates,” “plan,” “will,” “may” “intend,”

“guidance” or similar expressions are forward-looking statements. Because these

statements reflect our current views, expectations and beliefs concerning future events, these

forward-looking statements involve risks and uncertainties. Investors should note that many

factors could affect the proposed business combination of the companies, future financial results and could cause actual

results to differ materially from those expressed in forward-looking statements contained in this

presentation. These factors include, but are not limited to: the risk that the tender offer and

merger will not close, the risk that Endo’s business and/or Penwest's business will be

adversely impacted during the pendency of the tender offer and merger, the risk that the operations of the two companies will

not be integrated successfully, Endo’s ability to successfully develop, commercialize and market

new products; timing and results of pre-clinical or clinical trials on new products;

Endo’s ability to obtain regulatory approval of any of Endo’s pipeline products;

competition for the business of Endo’s branded and generic products, and in connection with its

acquisition of rights to intellectual property assets; market acceptance of our future

products; government regulation of the pharmaceutical industry; Endo’s dependence on

a small number of products; Endo’s dependence on outside manufacturers for the manufacture of a majority of its

products; Endo’s dependence on third parties to supply raw materials and to provide

services for certain core aspects of its business; new regulatory action or lawsuits relating

to Endo’s use of narcotics in most of its core products; Endo’s exposure to product

liability claims and product recalls and the possibility that they may not be able to adequately insure themselves; the

successful efforts of manufacturers of branded pharmaceuticals to use litigation and legislative and

regulatory efforts to limit the use of generics and certain other products; Endo’s ability

to successfully implement its acquisition and in-licensing strategy; regulatory or other

limits on the availability of controlled substances that constitute the active ingredients of some of its products and products in

development; the availability of third-party reimbursement for Endo’s products; the outcome

of any pending or future litigation or claims by third parties or the government, and the

performance of indemnitors with respect to claims for which Endo has been indemnified;

Endo’s dependence on sales to a limited number of large pharmacy chains and wholesale drug distributors for a large

portion of its total revenues; a determination by a regulatory agency that Endo is engaging or has

engaged in inappropriate sales or marketing activities, including promoting the

“off-label” use of its products, the risk that demand for and acceptance of Endo’s and

Penwest's products or services may be reduced; the risk of changes in governmental regulations; the

impact of economic conditions; the impact of competition and pricing and other risks and

uncertainties, including those detailed from time to time in the companies’ periodic

reports filed with the Securities and Exchange Commission, including current reports on Form 8-K, quarterly reports on Form

10-Q and annual reports on Form 10-K, particularly the discussion under the caption “RISK

FACTORS" in their annual reports on Form 10-K for the year ended December 31, 2009,

which were filed with the Securities and Exchange Commission. The forward- looking

statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate,

could cause our actual results to differ materially from expected and historical results. The

companies’ assume no obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or otherwise. |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

FORWARD LOOKING STATEMENT CONTINUED

Additional Information

The

tender

offer

described

in

this

document

has

not

yet

commenced.

At

the

time

the

tender

offer

is

commenced,

we

will

file

with

the

SEC

and

mail

to

Penwest’s

stockholders

a

tender

offer

statement

on

Schedule

TO

and

Penwest

will

file

with

the

SEC

and

mail

to

its

stockholders a tender offer solicitation/recommendation statement on Schedule

14D-9 in connection with the transaction. Investors and

Penwest

shareholders are strongly advised to read the tender offer statement (including

the offer to purchase, letter of transmittal and related tender offer

documents) and the related solicitation/recommendation statement on Schedule 14D-9 when they are available

because

they

contain

important

information.

These

documents

will

be

available

at

no

charge

on

the

SEC’s

website

at

www.sec.gov.

A

copy

of

the

solicitation/recommendation

statement

on

Schedule

14D-9

may

also

be

obtained

free

of

charge

from

Penwest's

website

at

www.penwest.com

or

by

directing

a

request

to

Penwest

at

2981

Route

22,

Patterson,

New

York

12563,

Attn:

Frank

Muscolo.

In

addition,

a

copy

of

the

offer

to

purchase,

letter

of

transmittal

and

certain

other

related

tender

offer

documents

may

be

obtained

free

of

charge from Endo’s website at www.endo.com

or by directing a request to Endo at www.endo.com, or Endo Pharmaceuticals, 100

Endo Boulevard, Chadds

Ford, PA 19317, Attn: Corporate Secretary’s Office.

3 |

grow. collaborate. innovate. thrive.

ENDO PHARMACEUTICALS

I.

Our Business

II.

Executing Strategy for Growth

III.

Penwest

Acquisition

IV.

HealthTronics

Acquisition

V.

Financial Outlook

4 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

STRONG OPERATING PERFORMANCE

17% 3-YEAR CAGR FOR REVENUE*

5 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

STRONG CORE BUSINESS SUPPORTING GROWTH

6 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

STRONG CORE BUSINESS SUPPORTING GROWTH

7

LIDODERM®

key component of our core business

Strong source of operating cash flow

Stable TRx

trends

10-year Commercial launch anniversary in September 2009

Differentiated product profile provides unique offering for HCPs

and patients

suffering from PHN

Improved PHN physician targeting for more efficient utilization

of resources

Solid managed care contract positioning for 2010

Opportunities in second half with formulary position

|

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

LONG-ACTING OPIOID FRANCHISE

Opana®

ER

Settlement with generic companies provides for 2013 entry on primary

dosage forms.

28% TRx

growth YOY in Q2 2010

Gaining share; Growing source of cash flow.

Pending Acquisition of Penwest

for $5.00 per share

$0.05 accretive to adjusted diluted EPS in 2010

Advances our leadership and growth in pain management

NDA submission for new formulation of Oxymorphone

Long-acting Oxymorphone

designed to be crush-resistant

8 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

DEVELOPMENT PIPELINE

Phase I

Phase II

Phase III

NDA

Oxymorphone

Formulation designed to be crush-

resistant

FORTESTA™

2% Testosterone Gel

AVEED™

Long Acting Injectable

Testosterone

Urocidin™

Bladder Cancer

Octreotide

Implant

Acromegaly*

Axomadol

Moderate to moderately severe chronic pain

Octreotide

Implant

Carcinoid

Syndrome

Pending

Pending

* Granted orphan drug designation

9

Update Pending |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

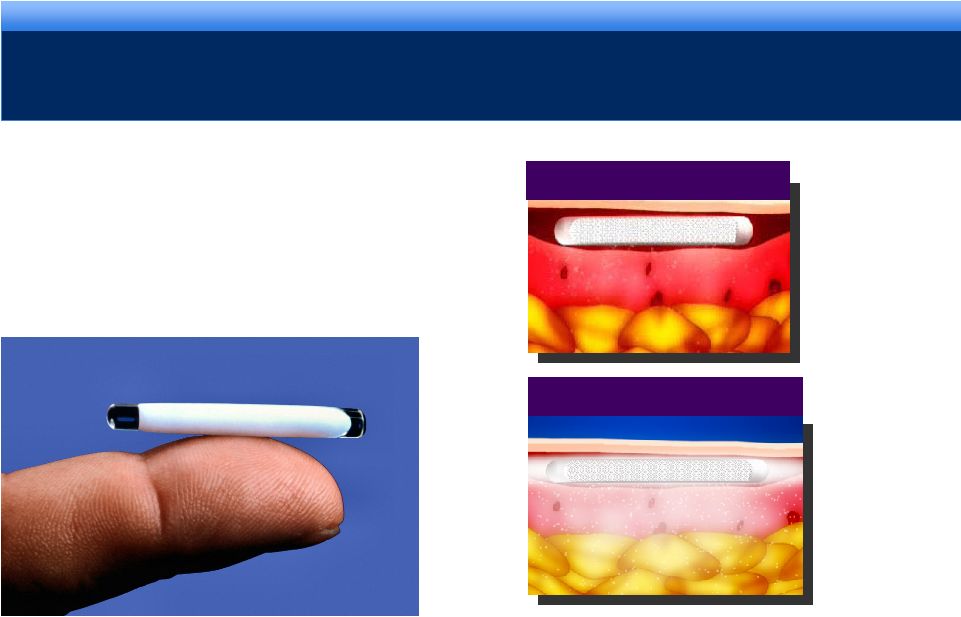

IMPLANT TECHNOLOGY

HYDRON®

DRUG DELIVERY TECHNOLOGY

10

IMPLANTATION

DISPERSION |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

SPECIALTY GENERICS DEVELOPMENT

11

~40 Projects

~40 Projects

25 Near-term*

25 Near-term*

12 Current

12 Current

ANDA

ANDA

reviews

reviews

*Near-term revenue 2010-2012

Approximately 40 projects under

development

14 Current ANDA submissions

12 with near-term launch targets

2 with long-term launch targets

Managing development for

sustainable growth

Potential efficiencies with branded

Rx business |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

12 |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

Enhance

Revenue

Growth

Through

Diversification

Sustainable, long-term growth

Diversified revenue stream

Enhanced product offerings in urology

Expand Urology Business

Elevates Endo’s leadership in urology

Expands Endo’s reach and relationships with key urology practices

Increase Shareholder Value

Accretive to adjusted earnings in 2010

Diversified revenue stream beyond pharmaceuticals

Enhanced offerings in urology

13

HEALTHTRONICS –

TRANSACTION RATIONALE |

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

Leading provider of urology services

Leader in lithotripsy, BPH laser and cryosurgery

Emerging urologic businesses in:

Anatomic pathology

Radiation therapy

Unique business relationship with 1/3 of urologists in U.S.

Total solution for the urology marketplace

Improve patient care

Enhance practice economics

14

HEALTHTRONICS –

CORPORATE OVERVIEW |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

ENDO’S CARE PATHWAY

15

Diagnostics

Drugs

Devices

Services

Pain

Bladder

Cancer

BPH

Prostate

Cancer

Endo with HealthTronics

will offer a full suite of products

and services as well as a direct channel to urologists

|

grow. collaborate. innovate. thrive.

©2010 Endo Pharmaceuticals Inc.

OUTLOOK

2010 Financial Guidance

Revenue range of $1.63B -

$1.68B

Adjusted diluted EPS range of $3.30 -

$3.35

Reported (GAAP) diluted EPS range of $1.89 -

$1.97

Flexible cost structure

Expect to generate $350 -

$400M in annual Operating Cash Flow this

year

16 |

grow. collaborate. innovate. thrive.

Endo Pharmaceuticals |

grow. collaborate. innovate. thrive.

RECONCILIATION OF NON-GAAP MEASURES

For an explanation of Endo’s reasons for using non-GAAP measures, see

Endo’s Current Report on Form 8-K filed today with the Securities

and Exchange Commission Reconciliation of Projected GAAP Diluted Earnings Per

Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending

December 31, 2010 Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$1.89

$1.97

Upfront and milestone-related payments to partners

$0.38

$0.33

Amortization of commercial intangible assets

$0.59

$0.59

Costs incurred in connection with continued efforts to enhance the cost

structure of the Company

$0.08

$0.08

Indevus

related costs and change in fair value of contingent

consideration

$0.01

$0.01

Impairment of indefinite-lived intangibles

$0.11

$0.11

Costs related to the acquisition of HealthTronics, Inc.

$0.30

$0.30

Costs related to the acquisition of Penwest

Pharmaceuticals Co.

$0.22

$0.22

Interest expense adjustment for ASC 470-20

and the amortization of

the premium on debt acquired from Indevus

$0.15

$0.15

Tax effect of pre-tax adjustments at the applicable tax rates

and

certain other expected cash tax savings as a result of the Indevus,

HealthTronics

and Penwest

acquisitions

($0.43)

($0.41)

Diluted adjusted income per common share guidance

$3.30

$3.35

The company's guidance is being issued based on certain assumptions

including: •Certain of the above amounts are based on estimates and

there can be no assurance that Endo will achieve these results

•Includes

all

completed

business

development

transactions

as

of

August

9,

2010

and

the

acquisition

of

Penwest

Pharmaceuticals

Co. |