Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - Emerald Oil, Inc. | a10-13086_110q.htm |

| EX-32.1 - EX-32.1 - Emerald Oil, Inc. | a10-13086_1ex32d1.htm |

| EX-31.2 - EX-31.2 - Emerald Oil, Inc. | a10-13086_1ex31d2.htm |

| EX-31.1 - EX-31.1 - Emerald Oil, Inc. | a10-13086_1ex31d1.htm |

Exhibit 10.1

EXPLORATION AND DEVELOPMENT AGREEMENT

WITH AREA OF MUTUAL INTEREST

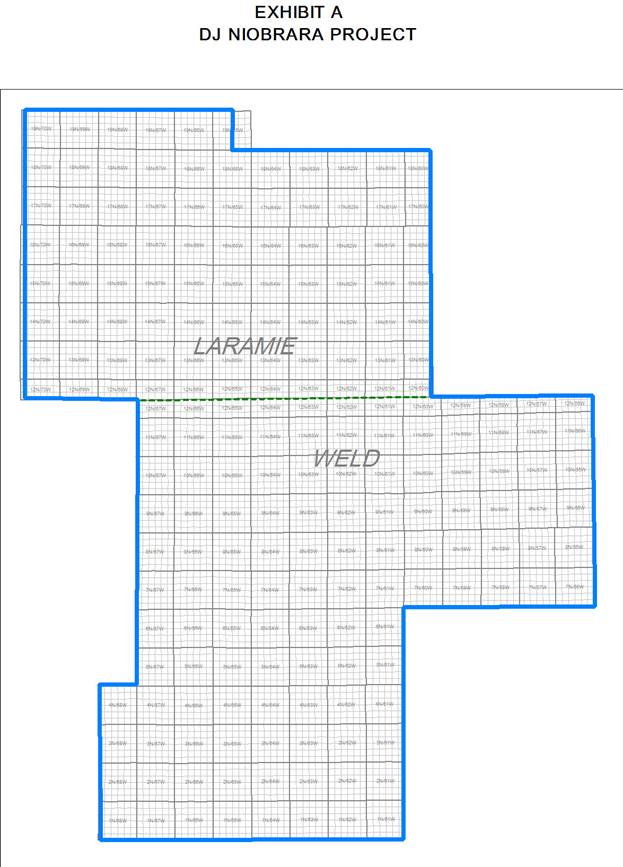

DJ NIOBRARA PROJECT

Weld County, Colorado

Laramie County, Wyoming

This EXPLORATION AND DEVELOPMENT AGREEMENT WITH AREA OF MUTUAL INTEREST (this “Agreement”), dated effective as of the 1st day of May, 2010 (the “Effective Date”), is by and between Slawson Exploration Company, Inc., a Kansas corporation, whose principal place of business is 727 North Waco, Suite 400, Wichita, Kansas, 67203 (hereafter “SECI”), and Voyager Oil & Gas, Inc., whose address is 2812 1st Ave. N., Suite 506, Billings, Montana, 59101 (hereafter “Participant”). SECI and Participant may be hereinafter collectively referred to as “Party” or “Parties.”

RECITALS

A. Whereas, SECI has acquired State of Colorado Oil and Gas leasehold interests covering 32,960 gross and net acres in lands located in Weld County, Colorado, within SECI’s DJ Niobrara Project. Such State of Colorado Oil and Gas Leases shall be hereafter referred to as “State Leases.” The area of SECI’s DJ Niobrara Project is depicted on Exhibit “A” attached hereto and covers all of Weld County, Colorado, and all of Laramie County, Wyoming, said area being hereafter referred to as the “Project Area.” A description of the State Leases is attached hereto as Exhibit “B.”

B. Whereas, the State Leases have expiration dates of November 15, 2010. The State of Colorado has agreed that SECI may extend the State Leases for an additional term of one year by: (1) drilling three horizontal Niobrara wells; (2) obtaining drilling permits on any other State Leases that SECI desires to extend; (3) drilling and setting surface casing with a drilling rig capable of drilling to a depth of 3,500 feet on each of the State Leases that SECI desires to extend; and (4) paying prior to November 15, 2010 a $10 per acre rental fee for each of the State Leases that SECI desires to extend.

C. Whereas, in order to extend the State Leases, SECI will, in most cases, be required to pay 100% of the costs to drill and set surface casing on wells where SECI does not own 100% of the spacing unit. Nonetheless, should these wells be drilled at a later date to a depth deeper than the surface casing, SECI will use its best efforts to recoup from any third party that participates in the drilling operations to deepen these wells, such third party’s share of costs to drill and set surface casing.

D. Whereas, Participant desires to participate with SECI in the leasing, evaluation, drilling, and development of the Project Area pursuant to the provisions of this Agreement and the agreements by which SECI acquires leasehold contracts within the Project Area.

AGREEMENT

NOW THEREFORE, the Parties hereto, for the mutual promises contained herein and other good and valuable consideration, the sufficiency of which is hereby acknowledged, do hereby contract and agree as follows:

ARTICLE 1.

Participation Interest

a. By execution of this Agreement and payment of funds as set forth in Article 2.a. below, Participant shall own a 50% interest in the State Leases. Participant shall also have the right to acquire a 30% interest in leases and lands (other than the State Leases) that are acquired by the Parties in the Project Area, subject to the terms of this Agreement. Participant agrees to pay its proportionate share of all reasonable actual costs incurred in the Project Area pursuant to the terms set out herein. Participant agrees that any interest acquired from SECI by Participant shall be subject to the terms of the State Leases and any other leases, options, and other agreements by which those leasehold interests are acquired in the Project Area by the Parties.

Participant shall be assigned and delivered proportionately reduced 79.5% net revenue interest leases in the State Leases.

As to lands not covered by the State Leases in which SECI owns an interest, Participant shall have a first right of refusal to acquire additional interests (other than the 30% interest refusal above) from SECI in the event that SECI elects to sell additional working interest in the Project Area. In the event SECI elects to sell additional interest in the Project Area, SECI shall give Participant written notice of the terms of the sale and Participant shall have fifteen (15) days after receipt of such notice in which to make an election to acquire such additional working interest from SECI under the terms of the sale. Failure by Participant to give written notice to SECI within the 15-day period shall be deemed an election by Participant to not acquire the additional working interest. This first right of refusal shall not apply to any working interest that SECI may transfer to Slawson family members or other companies that are owned by SECI or Slawson family members.

ARTICLE 2.

Leasehold Expenses

a. Participant shall pay SECI on or before June 23, 2010 the sum of seven million, five hundred thousand dollars ($7,500,000.00) for costs associated with acquiring the State Leases.

b. After the drilling of the first three horizontal Niobrara wells described in Article 3 below, Participant shall pay SECI the sum of $500.00 per net acre owned by Participant in the drillsite spacing unit on such State Leases within ten (10) days after the date that SECI commences operations to drill to deeper depths.

c. After the drilling of the first three horizontal Niobrara wells, as to any well drilled below the depth of surface casing that includes leases other than State Leases, Participant shall pay SECI the sum of $250.00 per net acre then owned by Participant in the drillsite spacing unit in such other leases within ten (10) days after the date that SECI commences operations to drill to deeper depths.

d. Should SECI acquire leasehold interests in the AMI (as defined in Article 14) through a land trade, such as drilling a well for a third party where a third party only retains an overriding royalty interest, that does not include the payment of funds by SECI to earn such leasehold interests, it shall be deemed that the acreage so earned shall have a value of $500.00 per net acre and Participant shall pay SECI the sum of $500.00 per net mineral acre acquired by Participant in such leasehold earned by SECI. As to any lands earned through a farmin where a third party retains the right to receive a backin working interest after payout of a well, Participant shall not be subject to a leasehold payment, but will be entitled to its proportionate share of such leasehold earned. Participant shall pay SECI within ten (10) days after the date that the leasehold is earned by SECI.

e. As to subsequent acquisitions of leasehold interests acquired pursuant to the terms of this Agreement, other than leasehold acquired under the terms of Article 2.d., Participant shall pay 50% of all the costs to acquire such leasehold interest, including brokerage fees, for a 30% interest in such acquired leasehold interests. Participant shall remit payment for such leasehold within ten (10) days from the date of invoice therefor. Failure to remit payment within said ten (10) days shall be deemed an election not to participate in the leasehold acquisition.

ARTICLE 3.

Participation Terms

a. Three (3) Horizontal Niobrara Wells. SECI has proposed the drilling of three (3) horizontal Niobrara wells to be located on the State Leases that have full interest in the 640-acre spacing unit for each well. It is anticipated that the first well will spud on July 1, 2010, with the remaining two wells to be drilled back to back after the first well. Participant agrees to participate in all costs to drill, equip, complete, test, and plug each of the initial three (3) horizontal Niobrara wells with its 50% working interest

and agrees to sign and return a copy of SECI’s Authority for Expenditure (“AFE”) prior to the drilling of each well. Participant will pay all AFE costs for each well on an at-cost basis no later than two (2) business days following the actual spud date of the well. SECI is subject to a non-performance payment of $400,000.00, to a third party, for each of the three wells that are not drilled. SECI agrees to use best efforts to drill each of the three wells. If for any reason all three wells are not drilled, Participant shall be obligated to pay 50% of the performance penalty for any of the three wells not drilled.

b. Drilling and Setting Surface Casing. As to any well that is drilled prior to November 15, 2010 to a depth to set surface casing on State Leases for the purpose of receiving a one year extension to the term of such lease, Participant agrees to participate in all costs to drill and set surface casing and all costs to plug each well with a 50% working interest. SECI will provide Participant with an informational AFE showing the estimated costs through the setting of surface casing. Participant will pay such AFE costs for each well on an at-cost basis no later than two (2) business days following the actual spud date of the well. It is understood that SECI and Participant may be required to pay 100% of the cost to drill and set surface casing on some wells in order to obtain a one-year extension on State Leases even though the Parties may not own 100% of the spacing unit. SECI will use its best efforts to recoup payment from a third party at any time for the setting of surface casing and if payment is received, SECI shall credit Participant with 50% of the funds received by such third party.

c. Election to Not Participate in Drilling on State Leases. Should either SECI or Participant elect to or be deemed to not participate in the deepening of a well on State Leases after surface casing has been set, the Party electing not to participate shall forfeit all of its interest in any section located within two (2) miles of the section line for the applicable spacing unit, except that no forfeiture shall occur as to lands within a spacing unit in which State Leases are located, and in which such Party has participated in a well beyond the setting of surface casing. The forfeiting party shall not receive any refund of costs associated with the forfeited leases or well costs.

ARTICLE 4.

Geophysical and Geological Data

Participant shall own in proportion to its share of interest in the Project Area, and shall have access to review, all geophysical and exploration data acquired by SECI within the Project Area. Participant will participate and pay its proportionate share of costs plus 10% on any newly acquired seismic in the Project Area acquired by SECI or a third party, up to a maximum aggregate amount of $3,000,000.00. Participant must consent or agree to the acquisition of any seismic costs in excess of $3,000,000.00. Participant agrees to pay SECI within ten (10) days after receipt of an invoice for such costs.

ARTICLE 5.

Other Costs

As to all other costs not covered in the preceding paragraphs, Participant shall pay, on an at cost basis, its Participation Interest share of all other reasonable actual third party costs incurred in the Project Area, or chargeable under the applicable Joint Operating Agreement to operations in which Participant elects to participate, or in which Participant is obligated to participate by execution hereof, pursuant to the provisions of this Agreement.

ARTICLE 6.

Assignment of Leasehold Interest

SECI shall assign to Participant its Participation Interest in the lease(s) comprising the spacing unit for the applicable wells in each instance no later than sixty (60) days following the rig release date; provided, however, that in the event Participant is required under the terms of its senior lending facility to assign such rights to such lender, such assignment shall be made as soon as reasonably practicable but no sooner than thirty (30) days following the rig release date. On the second anniversary of the date of this Agreement, SECI shall assign to Participant its

Participation Interest in all of the lease(s) depicted on Exhibit “B” that are still in effect, to the extent not previously assigned to Participant.

ARTICLE 7.

Drilling Proposals on Lands Other Than on the State Leases

a. SECI will develop a drilling program for the identified well site(s), focusing on a logical development of the Project Area. SECI will generally be responsible for initiating well proposals to Participant and other parties participating; however, either Party that owns an interest in the State Leases or the other leases may recommend the drilling of a well. If SECI receives a well recommendation from Participant relative to a proposed location and SECI does not initiate a well proposal comparable to that received from Participant for circulation to all participants within thirty (30) days of receipt of Participant’s drilling recommendation, then Participant may initiate a proposal relative to such proposed site. Any such well shall be governed by this agreement and references herein to “Participant” and “SECI” shall refer to SECI and Participant, respectively.

b. A well shall be proposed by the Parties by mailing to all working interest owners a proposal identifying the location of the well to be drilled, the objective(s) to be tested and an AFE. Parties receiving this well proposal will have twenty (20) days from the date of receipt to elect to either: (1) participate as to their working interest in the proposed drilling venture; or (2) elect not to participate in the proposed drilling venture. Elections shall be made in writing to the Party proposing the well. Failure to timely elect shall be deemed to constitute an election not to participate in the proposed drilling venture. Any Party electing not to participate in the well shall forfeit all rights in any section located within one (1) mile of the section line for the applicable spacing unit. The non-participating party shall reassign to the participating party all such leasehold working interest that it owns in the section or spacing unit, as appropriate, at no cost to the participating party. Notwithstanding the foregoing, however, in order for any such forfeiture to occur and be binding on the non-participating party, a rig capable of drilling the well to total depth must commence drilling the well within a period of ninety (90) days after the date of the expiration of the election period. The non-participating party shall not be required to relinquish lands that are included in a spacing unit for a well in which that party participated, nor any area that is part of a spacing unit for a well which is then drilling and in which that party is participating. Participation elections in subsequent wells within an established spacing unit shall be subject to the non-consent provisions of the applicable Joint Operating Agreement.

c. For each well in the Project Area in which Participant elects to participate or is required to participate by execution hereof, Participant shall pay its proportionate share of all AFE costs and any other well-specific project costs on an at-cost basis no later than two (2) business days following the actual spud date of a well.

ARTICLE 8.

Proposals on State Lands

a. For each well that SECI proposes to deepen, SECI will mail to Participant a proposal identifying the location and objective(s) to be tested and an AFE. Participant will have twenty (20) days from the date of receipt to elect to either: (1) participate with its full working interest in the proposed operation, or (2) elect not to participate in the proposed operation. Failure to timely elect shall be deemed to constitute an election not to participate in the deepening of such well, and such non-participating party will be subject to the penalties set out in Article 3.b. herein.

ARTICLE 9.

Joint Operating Agreement

Except for participation elections and penalties resulting from those elections on wells which are specifically governed by this Agreement, the drilling of all jointly owned wells shall

be governed by the form of Joint Operating Agreement (“JOA”), attached hereto as Exhibit “C,” within the Project Area and shall cover the spacing unit in which each well is drilled. In the event of a conflict between the terms of this Agreement and the JOA, the terms of this Agreement shall prevail.

ARTICLE 10.

Funding Obligation — Well Costs

a. As to all wells drilled to a depth to set surface casing for the purpose of extending State Leases, and in which Participant has elected to participate in the deepening of such well, SECI shall provide Participant with written notice of the commencement of deepening of each well and notice of any required payment for AFE costs. Participant and SECI shall likewise be obligated to pay to SECI, or into a drilling contractor’s escrow account if required, their share of remaining AFE costs through completion no later than ten (10) days of receipt of notice or two (2) days following the commencement of deepening operations on any well, whichever is the latter. Failure to timely make payment within five (5) days following receipt of written notice of failure to make such payment may, at SECI’s option, be deemed to constitute a modification of Participant’s election, and Participant shall be deemed to have elected not to participate with respect to that operation in the applicable well.

As to all other wells drilled within the Project Area, Participant agrees to timely remit payment for all wells costs as required pursuant to the terms of this Agreement. Failure to timely make any such payment or to make payment within five (5) days following receipt of written notice of failure to make such payment shall constitute, at the SECI’s option, an election by Participant not to participate in the well. SECI, at its option, may either declare the Participant to be a non-participating party in the well or require payment of the amount due from Participant based upon the participation election previously made by Participant.

ARTICLE 11.

Net Revenue Interest

Participant shall acquire from SECI a net revenue interest in leasehold acquired in the Project Area equal to the net revenue interest acquired by SECI, less an overriding royalty interest of 3% of 8/8ths in favor of SECI, proportionately reduced to the interest acquired by Participant as to all leasehold other than State Leases which will be assigned to Participant at a proportionate 79.5% net revenue interest. Notwithstanding the foregoing, Participant shall not be delivered a net revenue interest lease less than 77% unless the net revenue interest received by SECI is less than 77%, then the net revenue interest delivered to Participant shall be that received by SECI.

ARTICLE 12.

Leasehold

SECI shall be responsible for acquiring leases by direct purchase and/or pursuant to option agreements or other contractual agreements. Upon completion of a well in which Participant has participated through completion, SECI shall assign to Participant its proportionate share of the lease(s) comprising the spacing unit for the applicable well. SECI shall be responsible for maintenance of leases within the Project Area and shall timely remit lease payments, rental and option extensions when due, and comply with the other obligations of the lease(s) and option agreements on behalf of Participant. SECI shall not be liable for either direct or consequential damages resulting from SECI’s failure to timely make lease payment, rental or extension payment absent a showing of negligence, willful misconduct or wanton disregard of responsibilities in the failure to make such payment. Participant agrees to bear its proportionate share of any such payment incurred by SECI on its behalf.

ARTICLE 13.

Billings

Except as otherwise provided above, billings attributable to Participant’s interest in leases and operated wells shall be billed and payable pursuant to the accounting provisions of the applicable JOA.

ARTICLE 14.

AMI

An Area of Mutual Interest (AMI) shall be established within the boundaries of the Project Area. The AMI shall be for a period of three (3) years from the date of this Agreement. Subject only to the specific terms of this Agreement to the contrary, a Party acquiring an interest in leasehold within the boundary of the AMI and during its term shall be obligated to offer the leasehold to the other Party in the proportion that each Party owns in non state lands under this Agreement. The acquiring party shall give the non-acquiring Party written notice of all information relevant to the leasehold acquired. The non-acquiring Party shall have 20 days after receipt of notice from the acquiring Party to elect, in writing, to participate in such acquisition. Failure to make an election to participate in the acquisition within the twenty (20) day period shall be deemed an election to not participate in the acquisition. Should a Party elect not to take its proportionate share of a leasehold interest, the non-acquiring Party shall forfeit its right to participate in future leasehold acquisitions in all sections of land that fall within a 3-mile radius of the lands being acquired in such leasehold acquisition.

ARTICLE 15.

Term

The terms of this Agreement shall bind the Parties as to activities on the leasehold acquired pursuant to this Agreement for the term of each leasehold interest and any extension or renewal of each leasehold interest, or as to lands within a producing spacing unit for so long as an applicable JOA remains in effect within the boundaries of a spacing unit.

ARTICLE 16.

Notices

All notices required hereunder shall be considered given when delivered personally, or when received by e-mail, facsimile, or US Mail, properly addressed as follows:

|

SECI: |

|

Slawson Exploration Company, Inc. |

|

Address: |

|

727 North Waco, Suite 400 |

|

City, ST: |

|

Wichita, KS 67203 |

|

Phone: |

|

(316) 263-3201 |

|

Fax: |

|

(316) 268-0702 |

|

E-mail: |

|

cstokes@slawsoncompanies.com |

|

|

|

|

|

Participant: |

|

Voyager Oil & Gas, Inc. |

|

Address: |

|

2812 1st Ave. N., Suite 506 |

|

City, ST: |

|

Billings, MT 59101 |

|

Phone: |

|

(406) 245-4901 |

|

Fax: |

|

(406) 245-4914 |

|

E-mail: |

|

jr.reger@voyageroil.com |

|

|

|

mitch.thompson@voyageroil.com |

|

|

|

|

|

|

|

with a copy (which shall not constitute notice) to: |

|

|

|

|

|

|

|

Thomas F. Steichen |

|

|

|

Fredrikson & Byron, P.A. |

|

|

|

200 South Sixth Street |

|

|

|

Minneapolis, MN 55402 |

|

|

|

Fax: (612) 492-7077 |

|

|

|

tsteichen@fredlaw.com |

ARTICLE 17.

Nature of Agreement

The liabilities of the Parties shall be several and not joint or collective and each Party shall be responsible only for its share of the costs and liabilities incurred as provided hereunder. It is not the purpose or intention of this Agreement to create any partnership, mining partnership,

or association, and neither this Agreement nor the operations hereunder shall be construed or considered as creating any such legal relationship.

ARTICLE 18.

Marketing

SECI shall be responsible for marketing 100% of the production from the wells drilled pursuant to this Agreement, and shall account to Participant for its proportionate share thereof. Participant, however, shall have the right to take and market its production in kind, but in doing so shall also assume the obligations of disbursing revenue to royalty and any others burden to its interest.

ARTICLE 19.

Operations

SECI will be the operator of the Project Area, including drilling, completing and producing phases of spacing units. In the event multiple third party working interest owners exist in a proposed spacing unit for a well, Participant shall nominate SECI as operator for the spacing unit.

ARTICLE 20.

Miscellaneous Provisions

b. Entire Agreement, Amendment. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter hereof. There are no verbal understandings, agreements, representations or warranties which are not expressly set forth herein. This Agreement supersedes all prior agreements and understandings between the Parties, both written and oral. This Agreement may not be amended, modified, altered, or changed in any respect except in writing, signed by the Parties hereto.

c. Headings. The paragraph headings of this Agreement are inserted for convenience only, and should not be considered a part of this Agreement or used in its interpretation.

d. Jurisdiction. The Parties may only bring an action to resolve a dispute with respect to the subject matter hereof in the state or federal courts located in Denver County, Colorado. Said court shall have exclusive jurisdiction and each of the Parties submits to the sole jurisdiction of such court in any such action and waives all defenses relating to improper venue or personal jurisdiction.

e. No Consequential Damages. Neither Party shall be entitled to claim or recover from the other Party, and each Party hereby disclaims, releases and waives any claim against the other Party for any special, punitive, exemplary, indirect or consequential damages.

f. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the state of Colorado, except with respect to substantive oil and gas and real property matters which shall be governed and construed in accordance with the laws of the state of Colorado.

g. Severability. In the event any one or more of the provisions contained in this Agreement shall for any reason be declared to be invalid, illegal, unenforceable, or void in any respect, such declaration shall not have the effect of invalidating or voiding the remainder of this Agreement, and the parties hereto agree that the part or parts of this Agreement so held to be invalid, illegal, unenforceable, or void will be deemed to have been stricken herefrom and the remainder will have the same force and effectiveness as if such part had never been included herein.

h. Construction. The Parties acknowledge that each Party and its counsel have had the opportunity to review and negotiate the terms and conditions of this Agreement, and that the normal rule of construction to the effect that any ambiguities are to be construed against the drafting party shall not be employed in the interpretation of this Agreement or any exhibits or amendments hereto.

i. Counterparts. This Agreement may be executed in one or more counterparts and delivered via facsimile or e-mail, each of which shall be deemed an original, but all of which together shall constitute but one and the same instrument. Any signature delivered via facsimile or e-mail shall be deemed to be an original signature hereto.

j. Binding Effect. This Agreement shall inure to the benefit of and be binding upon not only the Parties hereto, but their respective heirs, successors, and assigns.

k. Prohibited Encumbrance.. If Participant, after receiving a recorded leasehold assignment, encumbers, hypothecates, mortgages, or pledges any or all interests so acquired from SECI, Participant nevertheless expressly agrees that SECI has a first and prior right of lien and offset against any revenues payable to Participant to the extent of any delinquent and unpaid expenses then and thereafter owed to SECI, and Participant expressly agrees that such first and prior right of lien and offset will be preserved in favor of SECI in any documents executed by Participant which create an encumbrance. .

l. Press Releases. SECI acknowledges that Participant will be required to publicly announce this Agreement and file a copy of this Agreement with the Unites States Securities and Exchange Commission. Participant and SECI agree to not release any press release on any well for a term of three (3) months following the date of completion of fracture stimulation of a well, unless required by applicable securities disclosure laws or regulations on the advice of legal counsel. Participant and SECI shall consult with each other with regard to all press releases and other announcements issued after the date of execution of this agreement and, except as may be required by applicable laws or the applicable rules of any governmental agency or stock exchange, Participant and SECI shall not issue any such press release or other publicity without the prior written consent of the other Party, which consent shall not be unreasonably withheld or delayed.

Executed effective as of the day and year first above written.

|

|

VOYAGER OIL & GAS, INC. |

||||||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

By: |

/s/ J.R. Reger |

|||||

|

|

|

|

|||||

|

|

Print Name: |

James R. (J.R.) Reger |

|||||

|

|

|

|

|||||

|

|

Print Title: |

CEO |

|||||

|

|

|

|

|||||

|

|

Date of Execution: |

June 23, 2010 |

|||||

|

|

|

|

|||||

|

|

|

||||||

|

|

SLAWSON EXPLORATION COMPANY, INC. |

||||||

|

|

|

||||||

|

|

|

|

|||||

|

|

By: |

/s/ Coni J. Stokes |

|||||

|

|

Coni J. Stokes, Vice President |

||||||

|

|

|

|

|||||

|

|

Date of Execution: |

June 22, 2010 |

|||||

EXHIBITS

|

Exhibit |

|

Description |

|

|

|

|

|

A |

|

Project Area |

|

|

|

|

|

B |

|

State Lease Descriptions |

|

|

|

|

|

C |

|

Joint Operating Agreement |

Exhibit “B”

Colorado State Leases

|

|

|

Lessor |

|

Lease date |

|

Lease desc |

|

SEC |

|

TWN |

|

RNG |

|

Gross |

|

Surface |

|

Net acres |

|

Mineral |

|

Lessor Royalty |

|

Existing ORRI |

|

Expiration |

|

|

1 |

|

State of Colorado |

|

* |

|

N2SW:SESW:W2SE:SESE Section 5 |

|

5 |

|

9N |

|

62W |

|

240 |

|

240 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

2 |

|

State of Colorado |

|

* |

|

Lots 1-3 S2NE,NESE Section: 6 |

|

6 |

|

9N |

|

62W |

|

239.44 |

|

239.44 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

3 |

|

State of Colorado |

|

* |

|

NE:NESE Section: 8 |

|

8 |

|

9N |

|

62W |

|

200 |

|

200 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

4 |

|

State of Colorado |

|

* |

|

SW Section: 9 |

|

9 |

|

9N |

|

62W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

5 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

9N |

|

62W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

6 |

|

State of Colorado |

|

* |

|

Lots 2-4:E2SW:SWSE Section 18: Township: 9 |

|

18 |

|

9N |

|

62W |

|

243.64 |

|

243.64 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

7 |

|

State of Colorado |

|

* |

|

N2NE:NENW Section: 19 |

|

19 |

|

9N |

|

62W |

|

120 |

|

120 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

8 |

|

State of Colorado |

|

* |

|

W2NW:SENW:N2SW:SESW:S2SE:NWSE Section:20 |

|

20 |

|

9N |

|

62W |

|

360 |

|

360 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

9 |

|

State of Colorado |

|

* |

|

SWNE:NW:NESW:NWSE Section: 28 |

|

28 |

|

9N |

|

62W |

|

280 |

|

280 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

10 |

|

State of Colorado |

|

* |

|

N2NE Section: 29 |

|

29 |

|

9N |

|

62W |

|

80 |

|

80 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

11 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

9N |

|

62W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

12 |

|

State of Colorado |

|

* |

|

Lot 2 & 4:SENE:E2SE |

|

4 |

|

9N |

|

63W |

|

200.9 |

|

200.9 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

13 |

|

State of Colorado |

|

* |

|

NWNE:S2NE:NWSE |

|

10 |

|

9N |

|

63W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

14 |

|

State of Colorado |

|

* |

|

S2SE |

|

11 |

|

9N |

|

63W |

|

80 |

|

80 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

15 |

|

State of Colorado |

|

* |

|

N2:NESE |

|

13 |

|

9N |

|

63W |

|

360 |

|

360 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

16 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

9N |

|

63W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

17 |

|

State of Colorado |

|

* |

|

Lots 3 & 4:E2SW:SE |

|

18 |

|

9N |

|

63W |

|

321.37 |

|

321.37 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

18 |

|

State of Colorado |

|

* |

|

NW:E2SW:SE |

|

20 |

|

9N |

|

63W |

|

400 |

|

400 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

19 |

|

State of Colorado |

|

* |

|

S2NW:SW:W2SE |

|

28 |

|

9N |

|

63W |

|

320 |

|

320 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

20 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

9N |

|

63W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

21 |

|

State of Colorado |

|

* |

|

NWSW:S2S2 |

|

28 |

|

9N |

|

64W |

|

200 |

|

200 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

22 |

|

State of Colorado |

|

* |

|

NWSW:S2SW |

|

34 |

|

9N |

|

64W |

|

120 |

|

120 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

23 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

9N |

|

64W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

24 |

|

State of Colorado |

|

* |

|

SW:NESE:S2SE |

|

4 |

|

9N |

|

65W |

|

280 |

|

280 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

25 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

9N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

26 |

|

State of Colorado |

|

* |

|

Lot 1:SWNE:NENW:N2SE:SESE |

|

18 |

|

9N |

|

65W |

|

236.5 |

|

236.5 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

27 |

|

State of Colorado |

|

* |

|

E2 |

|

36 |

|

10N |

|

61W |

|

320 |

|

320 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

28 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

10N |

|

62W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

29 |

|

State of Colorado |

|

* |

|

Lots 1-4:E2SW |

|

31 |

|

10N |

|

62W |

|

234.44 |

|

234.44 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

30 |

|

State of Colorado |

|

* |

|

SWNE:NENW:SESE |

|

32 |

|

10N |

|

63W |

|

120 |

|

120 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

31 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

10N |

|

63W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

32 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

10N |

|

64W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

33 |

|

State of Colorado |

|

* |

|

Lot 1:SENE:E2SE |

|

6 |

|

10N |

|

65W |

|

161.12 |

|

161.12 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

34 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

10N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

35 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

10N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

36 |

|

State of Colorado |

|

* |

|

E2 |

|

14 |

|

11N |

|

65W |

|

320 |

|

320 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

37 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

11N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

38 |

|

State of Colorado |

|

* |

|

E2E2 |

|

30 |

|

11N |

|

65W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

39 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

11N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

40 |

|

State of Colorado |

|

* |

|

Lots 1 & 2:S2N2:S2 (All) |

|

2 |

|

11N |

|

66W |

|

639.16 |

|

639.16 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

41 |

|

State of Colorado |

|

* |

|

Lots 1-4:S2NE:SENW:E2SW |

|

6 |

|

11N |

|

66W |

|

493.83 |

|

493.83 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

42 |

|

State of Colorado |

|

* |

|

NE:S2 |

|

8 |

|

11N |

|

66W |

|

480 |

|

480 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

43 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

11N |

|

66W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

44 |

|

State of Colorado |

|

* |

|

Lot 1:E2:E2NW |

|

18 |

|

11N |

|

66W |

|

480.6 |

|

480.6 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

45 |

|

State of Colorado |

|

* |

|

NE |

|

20 |

|

11N |

|

66W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

46 |

|

State of Colorado |

|

* |

|

E2NW:NWSE |

|

32 |

|

11N |

|

66W |

|

120 |

|

120 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

47 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

11N |

|

66W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

48 |

|

State of Colorado |

|

* |

|

Lots 1 & 2:S2N2:SW:N2SE |

|

2 |

|

11N |

|

67W |

|

559.76 |

|

559.76 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

49 |

|

State of Colorado |

|

* |

|

Lot 2:S2NW:SW |

|

4 |

|

11N |

|

67W |

|

322.93 |

|

322.93 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

50 |

|

State of Colorado |

|

* |

|

W2 of Lot 1:Lot 4:SWNE:E2SW:W2SE |

|

6 |

|

11N |

|

67W |

|

305.86 |

|

305.86 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

51 |

|

State of Colorado |

|

* |

|

E2 |

|

8 |

|

11N |

|

67W |

|

320 |

|

320 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

52 |

|

State of Colorado |

|

* |

|

All |

|

10 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

53 |

|

State of Colorado |

|

* |

|

All |

|

12 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

54 |

|

State of Colorado |

|

* |

|

All |

|

14 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

55 |

|

State of Colorado |

|

* |

|

All |

|

16 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

56 |

|

State of Colorado |

|

* |

|

Lots 1 & 2:E2:E2W2(All) |

|

18 |

|

11N |

|

67W |

|

608.2 |

|

608.2 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

57 |

|

State of Colorado |

|

* |

|

N2NE:SENE:NW:NESE |

|

22 |

|

11N |

|

67W |

|

320 |

|

320 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

58 |

|

State of Colorado |

|

* |

|

All |

|

24 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

59 |

|

State of Colorado |

|

* |

|

S2 of Lot1:Lot2:SESW:S2SE |

|

30 |

|

11N |

|

67W |

|

216.36 |

|

216.36 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

60 |

|

State of Colorado |

|

* |

|

SWNW:NWSW:S2SW |

|

32 |

|

11N |

|

67W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

61 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

11N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

62 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

12N |

|

64W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

63 |

|

State of Colorado |

|

* |

|

Lot 2:E2SW(SW) |

|

30 |

|

12N |

|

65W |

|

157.16 |

|

157.16 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

64 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

12N |

|

65W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

65 |

|

State of Colorado |

|

* |

|

Lots1-4:S2N2:S2 |

|

20 |

|

12N |

|

66W |

|

584.99 |

|

584.99 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

66 |

|

State of Colorado |

|

* |

|

W2W2 |

|

28 |

|

12N |

|

66W |

|

160 |

|

160 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

67 |

|

State of Colorado |

|

* |

|

Lots 1 & 2:E2W2:E2 |

|

30 |

|

12N |

|

66W |

|

651.24 |

|

651.24 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

68 |

|

State of Colorado |

|

* |

|

NW:S2 |

|

32 |

|

12N |

|

66W |

|

480 |

|

480 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

69 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

12N |

|

66W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

70 |

|

State of Colorado |

|

* |

|

Lot1:S2NE:NESW:NWSE |

|

20 |

|

12N |

|

67W |

|

176.5 |

|

176.5 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

71 |

|

State of Colorado |

|

* |

|

Lots 1-4:S2N2:N2SW:SWSW:SE |

|

22 |

|

12N |

|

67W |

|

498.36 |

|

498.36 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

72 |

|

State of Colorado |

|

* |

|

Lots 1-4:S2N2:S2 |

|

24 |

|

12N |

|

67W |

|

533.07 |

|

533.07 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

73 |

|

State of Colorado |

|

* |

|

All |

|

26 |

|

12N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

74 |

|

State of Colorado |

|

* |

|

All |

|

28 |

|

12N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

75 |

|

State of Colorado |

|

* |

|

Lots 1 & 2:E2:E2W2(All) |

|

30 |

|

12N |

|

67W |

|

615.44 |

|

615.44 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

76 |

|

State of Colorado |

|

* |

|

N2NE:SENE:NENW:S2SE |

|

32 |

|

12N |

|

67W |

|

240 |

|

240 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

77 |

|

State of Colorado |

|

* |

|

N2:SW |

|

34 |

|

12N |

|

67W |

|

480 |

|

480 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

78 |

|

State of Colorado |

|

* |

|

All |

|

36 |

|

12N |

|

67W |

|

640 |

|

640 |

|

* |

|

100.00 |

% |

12.50% |

|

5.00% |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

* Confidential treatment has been requested with respect to certain portions of this exhibit. Omitted portions have been filed separately with the Securities and Exchange Commission.